“In a stunning development, the original DTS proposals to FHFA in May of 2021 were soundly rejected by many housing advocates such as the Lincoln Institute, the National Housing Conference, and National Community Stabilization Act.” So wrote Raymond Leech for MHVillage’s MHInsider. Leech added that “They [nonprofit housing advocates] told FHFA to hit “pause” as they did not believe the proposals met the spirit of the DTS commitment.” Editorially, MHProNews might say “so far, so good” about those quoted lines. But what is obviously missing from those lines in the MHInsider is what our publication previously observed about at that time. Namely, why didn’t the Manufactured Housing Institute (MHI) weigh in along with those other “housing advocates” to cause FHFA to get Fannie Mae and Freddie Mac to implement the “Duty to Serve” (DTS) manufactured housing mandates in their respective plans proposed at that time with the FHFA for more affordable manufactured home chattel lending? That failure of MHI to join their effort was and arguably remains “stunning.” For years, MHI has apparently reveled in being part of housing coalitions. Which begs the question. Why didn’t MHI join hands in 2022 with the Lincoln Institute, the National Housing Conference (NHC), ROC USA, Prosperity Now, Next Step, and others – which included organizations that MHI has clear ties with? Given that MHI formally claimed that they were “disappointed” that the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac had not “carried through” on their plans to “resume purchases of chattel manufactured homes,” shouldn’t MHI have then logically joined the appeal to FHFA alongside those twenty other nonprofits?

That opening segment of this preface outlined several apparent incongruities in the 5.15.2023 column by Leech for MHVillage’s so-called MHInsider. Others as or more “stunning” and consequential elements will be explored in this evidence-based report, analysis, and manufactured housing industry expert commentary.

MHProNews reached out to Leech about his latest column in the MHInsider. Leech sent several responses via email that are included herein, further below.

Additionally, MHProNews reached out to Patrick Revere and Darren Krolewski at MHVillage/MHInsider for comment on specific aspects of this article and how it relates to key industry topics and some of their prior ‘reporting’ and commentaries.

Based on a written admission by Leech, one might wonder – are the Manufactured Housing Institute (MHI) connected MHInsider attempting to not fully inform the industry’s members on what they admit are critical issues for a more robust future of manufactured housing? Specifically, how did the editor and publisher of the Leech article allow it to be published without corrections?

For publications that adhere to or claim to care about accuracy, the Society of Professional Journalists (SPJ) provides a written statement in their code of ethical conduct that establishes a useful metric for what should occur when errors are made.

Key aspects of the initial inquiries to Leech, Revere, and Krolewski included the following:

- 1) Are you familiar with the Manufactured Housing Improvement Act (MHIA) of 2000 and what is commonly referred to in manufactured home circles as the MHIA’s enhanced preemption provision?

- 2) You mentioned zoning as a barrier to more manufactured housing sales and cited Tim Williams at 21st Mortgage Corporation and his linked comments. Are you aware of any published concerns about Williams, 21st, and their role in manufactured housing underperformance in the 21st century?

Leech responded to those inquiries, as well as others, as will be shown verbatim further below. In fairness, he’s to be editorially commended for what were reasonably prompt responses.

That said, Leech said in one of his follow ups: “I checked with my editor at MH Insider and said he had nothing more to add to my answers.”

While manufactured housing’s plunge in production is accelerating, the National Association of Home Builders (NAHB) is reporting increased permits and homebuilding for April 2023. Some of their tweets below indicate why manufactured housing reasonably ought to be doing much better. But with MHI “endorsed” and linked MHVillage’s MHInsider, it seems that their leadership appears to be willing to stand on claims that could connect the factual dots for professionals and researchers that explain why manufactured housing ought to be selling and producing more homes. A variety of legal and ethical questions tied to MHI arise as a result of MHInsider’s unwillingness to correct the record with respect to Leech’s viewpoints.

To frame the discussion, these tweets/retweets by NAHB are useful.

“We desperately need new inventory,” @NAHBhome‘s @dietz_econ says. “The level of resale inventory for single-family homes right now is less than a three-month supply. There are actually more realtors in the country than there are single-family homes available for sale.” pic.twitter.com/w6M7jT5cth

— Yahoo Finance (@YahooFinance) May 17, 2023

More on the housing starts data released today: A lack of existing inventory and stabilizing mortgage rates helped push single-family home production up to the highest rate thus far in 2023. https://t.co/oLF8Cck5lt | #realestate #economy

— NAHB 🏠 (@NAHBhome) May 17, 2023

HMI and starts data showing stability. Single-family permits up 3% in Apr, increased every month of 2023. Number of single-family homes under construction at 698k, down 16% from peak in May `22. Number of apts under construction at 977k, largest since Sept `73. @NAHBhome

— Robert Dietz (@dietz_econ) May 17, 2023

So, while NAHB states their far more costly single-family housing starts have increased in every month in 2023; even in the face of higher interest rates and higher housing prices than mainstream manufactured housing. Meanwhile, manufactured housing’s decline is accelerating in 2023 and is now in two full quarters of falling production? Where are those facts found in the reporting by Leech in what might be construed as an op-ed on MHInsider?

Note in fairness that Leech’s initial reply may suggests he may have been willing to make adjustments in what was published. That said, Leech said via email: “I checked with my editor at MH Insider and said he had nothing more to add to my answers.” Meaning, the leadership at MHInsider made a decision to ‘stand pat’ on his article. That is contrary to what the Society of Professional Journalists (SPJ) should occur when an error is identified. See the attached and what the SPJ states ought to occur when published errors are found.

Such details matter, but the big picture is this.

While acknowledging that zoning and finance issues are “vital” Leech – apparently with MHInsider’s editor’s blessings – said: “Affordable housing is a critical issue because the country is millions of units short of demand. This being the case, there is growing consensus that business may expand compared to site-built homes.” But as this preface has documented with facts vs. a nebulous ‘consensus,’ site-built housing is growing in this same rising interest rate environment. Meanwhile, unlike growth in site-built housing sales, manufactured housing is in a well-documented six-month slump.

- Sentiments and “consensus” are not in alignment with the nettlesome facts.

- To be clear, zoning/placement barriers and affordable financing are of “vital” importance, that’s true enough.

- But if critical details are missing, then what MHInsider is telling their readers provided under the heading of “Market Trends & Insights” is questionable if not harmful if it is being relied upon by their readers. As the tweets from NAHB and other aspects linked from this preface demonstrates, there are serious questions about those supposed “trends” and “insights.”

With this preface, having advised MHInsider that this report will make extensive use of their content is pending, this fact check, analysis and expert commentary will include the following elements.

- Part I. Raymond Leech’s article: “The Vital Need for Chattel Lending” (again, the headline statement may be true enough, but as the maxim says, the ‘devil is in the details.’)

- Part II. Leech’s article referenced: “21st Mortgage President/CEO Talks Lending Trends in Manufactured Housing.” Perhaps Leech should be thanked for resurrecting that article, in the light of what has been learned and revealed since.

- Part III. Leech referenced and authored: “Fannie Mae and Freddie Mac Duty To Serve Plans.” Note Leech told MHProNews that he worked for Fannie Mae on their manufactured home lending programs there. That keen disclosure is not obvious in the latest report published by MHInsider, but is alluded to in the bio that is part of his prior post with them. Why did the MHInsider editor change that disclosure in Leech’s prior bio? [See that in what follows in Part I and III, below].

- Part IV. Additional Facts, Analysis, and Expert Commentary. That includes why Leech’s use of the term “stunning” is relevant, though perhaps not in the sense that his article was published.

- Part V – the Daily Business News on MHProNews graphical macro- and MHVille stocks and market moving headlines.

Part I: The Vital Need for Chattel Lending

By Contributed Content May 15, 2023

Personal Property Loans Are Increasingly Viable, Yet No More Attainable [MHProNews note: true enough, but perhaps not in the same sense MHInsider published under “Market Trends & Insights”]

By Raymond Leech

As the spring selling season hits its high point the housing market continues to face challenges. Higher interest rates are slowing sales, which is the intent, of course. However, the continued lack of affordable housing amid talk of a recession may turn away buyers to a degree that our current housing infrastructure may barely be able to handle.

Still, the manufactured housing industry may be a bright spot in the market.

Affordable housing is a critical issue because the country is millions of units short of demand. This being the case, there is growing consensus that business may expand compared to site-built homes.

Currently, the percentage of manufactured homes to site-built housing is about 10 percent. But there is some thought that percentage could increase this year, one driver being that the interest rates for chattel lending — a personal property loan often used for manufactured homes — is within two points of conventional mortgage rates, making the factory-built homes more competitive in the marketplace. In past years, the spread has been double that, or more.

Regarding the supply of manufactured homes, there is also good news. Industry experts say that the previous backlog has been drastically reduced in nearly every market. HUD Code homes can be purchased and delivered in a few months.

Barriers To More Business

Hurdles remain when it comes to expanding growth for manufactured home units.

Tim Williams, the CEO of 21st Mortgage, said the biggest barrier of all to more manufactured home business is zoning issues. He noted that in Knoxville, Tenn., the home to his firm and Clayton Homes, local zoning laws prevent a manufactured housing unit from being set in the city. But, as Tim notes, it is a complicated issue.

But suppose someone had their home on a three-acre property and wanted to place a manufactured home on the property for their elderly parents to reside in. This scenario raises issues in the eyes of a lender. First, the home would be considered an investment property, and it is not attached to the real estate. To finance this unit requires a personal property or chattel loan. There are some lenders that may approve this transaction, but not many. And right now, there is no secondary market for chattel loans.

Status of Chattel Financing

There may be changes to the chattel loan situation within a few years. Freddie Mac is exploring purchasing chattel loans as part of the Duty To Serve goals, updated last year. In the plan, Freddie Mac committed to purchasing from 1,500 to 2,500 chattel loans in 2024. They plan to complete a feasibility assessment of the requirements and processes needed to support chattel loan purchase, including underwriting, pricing, consumer protection, valuation and risk management. The big challenges they noted are a lack of lender standardization, no standard underwriting practices, and no consistent approach to assessing property values.

Accessory Dwelling Units and MH

In some areas of the country, especially California where there is a huge shortage of affordable housing, some jurisdictions are permitting accessory dwelling units or ADUs on a property. These are small independent living spaces that can be part of the home structure, for example, a mother-in-law suite over a garage, or independent of the main structure, such a small cottage on the property. Since these are attached to the property, they can be financed through a cash out refinance with funds used to build the unit and tying it to the owner-occupied property.

The good news for MH is that Freddie Mac will purchase a mortgage secured by a 1-, 2- or 3-unit property that has a manufactured home ADU that meets the Guide requirements for both the manufactured home and the ADU. So, in some areas of the country, there may be an opportunity for MH business in these situations.

As noted, 2023 could be a turbulent year in the housing industry. But there are hopeful signs that MH will continue to grow and make progress in addressing the affordable housing crisis in our country. ##

Part I.a – Some MHProNews observations on the above.

- Quoting Leech/MHInsider: “But there are hopeful signs that MH will continue to grow and make progress in addressing the affordable housing crisis in our country.” Where are those signs? As the MHProNews preface above made clear with evidence supplied by NAHB, IBTS for HUD, the Manufactured Housing Association for Regulatory Reform (MHARR), and other sources, manufactured housing is sliding while conventional housing is recovering despite higher prices and payments.

- MHProNews reported on the Freddie Mac-ADU issue. While Leech is arguably correct that a solid understanding of ADUs and DADUs do point toward manufactured housing potential, the reality is that the industry is nevertheless in a 6 month slide.

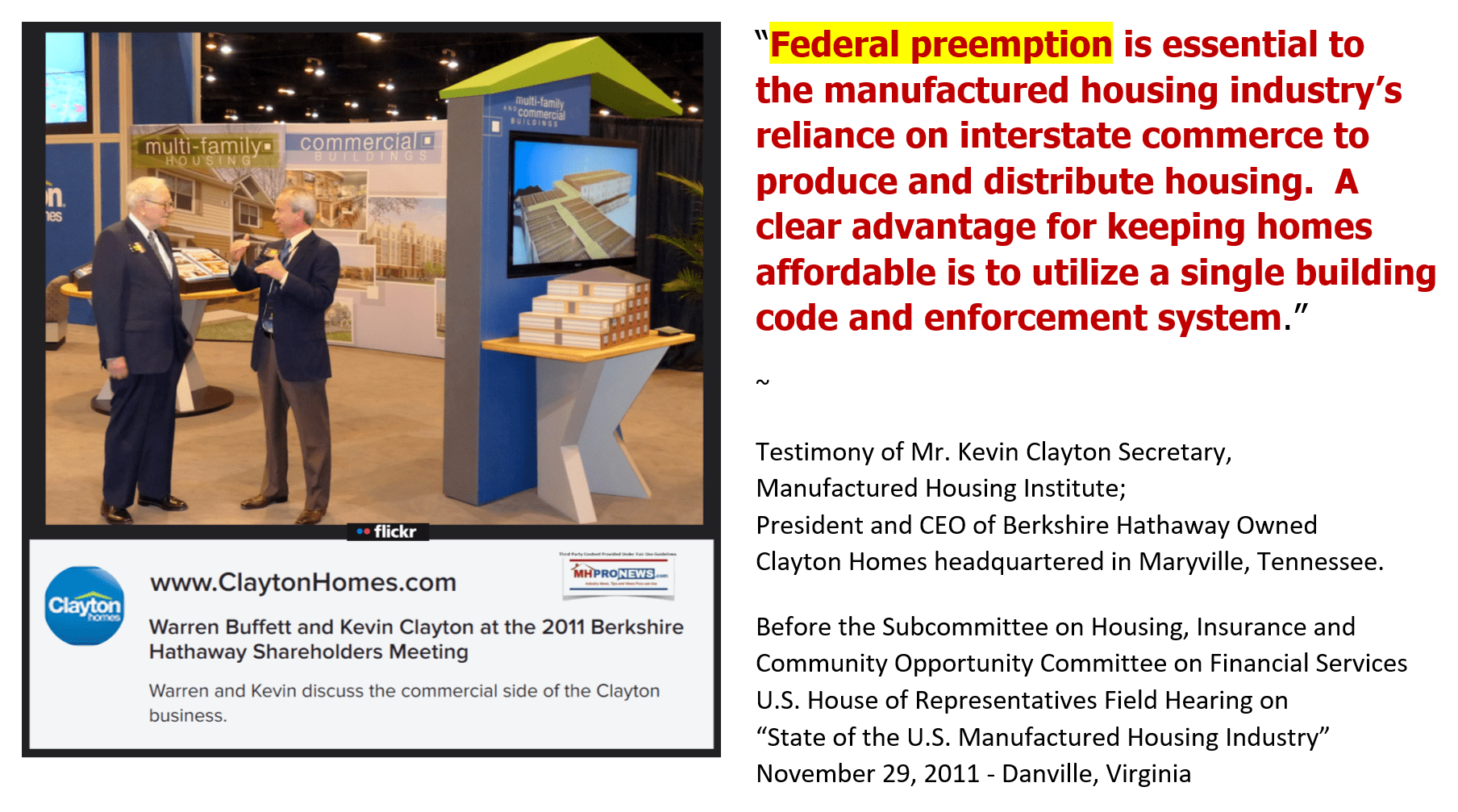

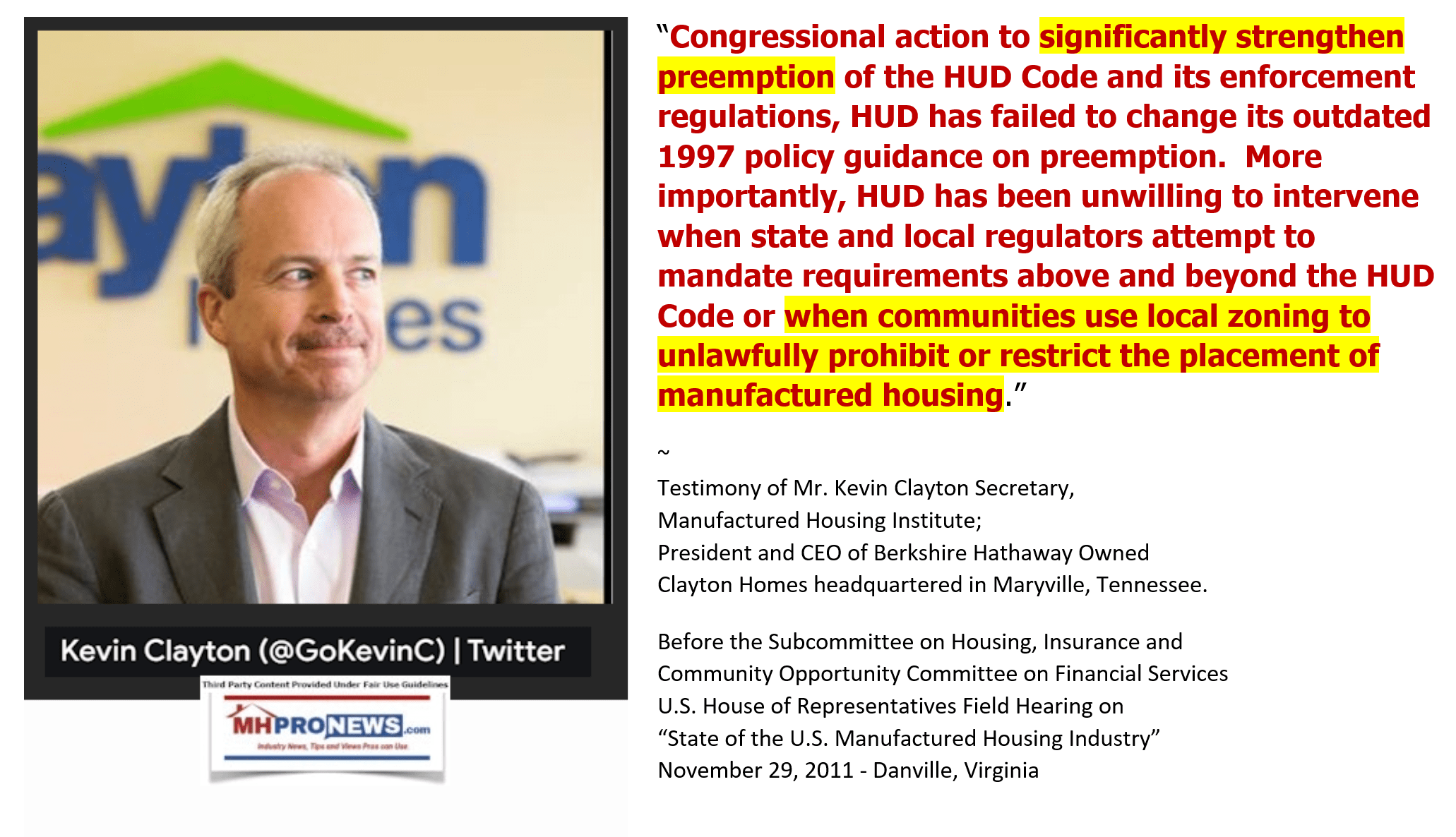

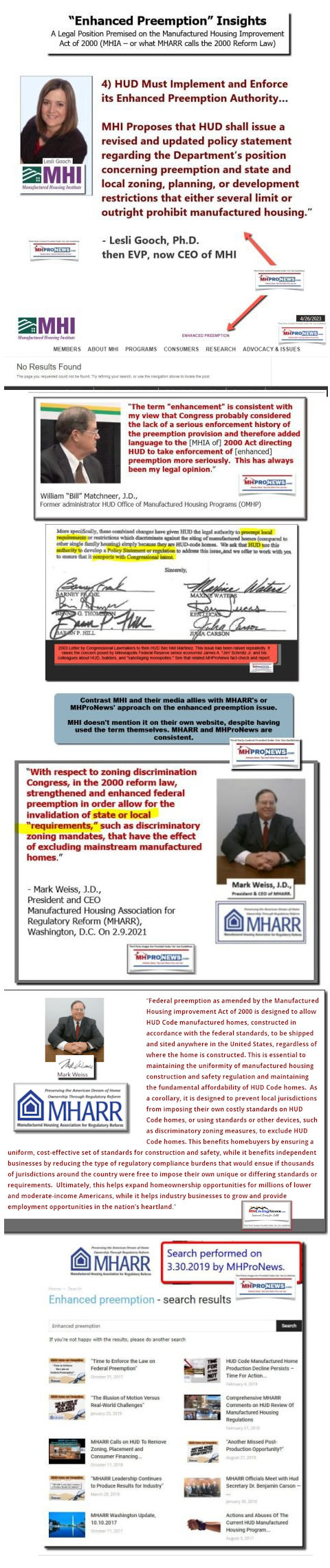

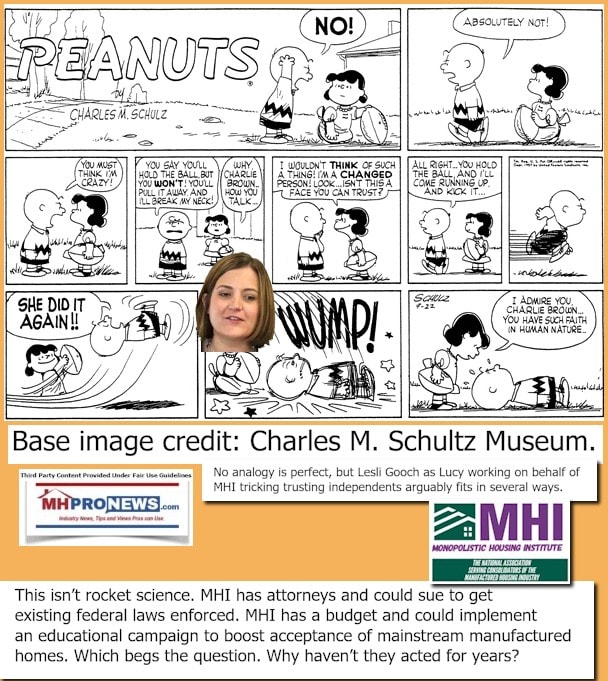

- Quoting: “Tim Williams, the CEO of 21st Mortgage, said the biggest barrier of all to more manufactured home business is zoning issues.” But that begs the question. Why hasn’t the Manufactured Housing Institute, or Clayton Homes/Berkshire Hathaway – if necessary – sued to get the industry’s rights under the Manufactured Housing Improvement Act enforced? Clayton CEO Kevin Clayton asserted it, as did MHI’s Lesli Gooch. Their words and the behaviors appear to have a serious disconnect, which is explored further below in Part IV. The job of those MHI corporate-staff leaders should not be limited to mere complaints. Rather, they should legally act as necessary to overcome the barriers they described.

- More analysis on the above, including Leeches remarks and admissions to MHProNews in Part IV, below.

Part II – Leech referenced: “21st Mortgage President/CEO Talks Lending Trends in Manufactured Housing.”

By Patrick Revere -October 9, 2019

Head of Industry’s Largest Lender Optimistic in Face of Change’

Tim Williams is the president and CEO of 21st Mortgage, the largest lender for manufactured homes in the United States. A conservative estimate of 21st Mortgage’s market share is 25 percent.

Compared against total shipment data published by MHI, the volume of home loans levied by 21st equals about 15 percent. Subtract from those same shipment totals the number of FEMA homes, cash sales and loans originated in-house by Clayton Retailers, and the 21st Mortgage market share may be as high as 30 percent.

So, as a matter of understanding the pulse of the lending side of the manufactured housing business, talking to Williams, with his 45 years of MH lending experience, should be viewed as the pinnacle of insight.

A former executive vice president of Clayton Homes and the president of Vanderbilt Mortgage between 1974 and 1995, Williams has led 21st through tremendous growth in recent years. The Knoxville, Tenn.-based lender originates about $1.3 billion in home loans each year, and currently services more than 180,000 mortgages valued at greater than $9 billion.

Let’s Talk About the Opportunities

During a recent conversation with The MHInsider, Williams was asked about challenges in the industry. His response was to immediately talk about opportunity, which in his world always takes precedence over challenges and obstacles.

“The opportunity is really in the product some of the manufacturers are promoting,” Williams said, referring to what many are calling the ‘New Class’ of manufactured homes, which have characteristics that allow them to sit beside site-built homes and be treated as such in appraisal and lending.

Differentiating From ‘Traditional Lenders’

“The traditional mortgage lenders can’t very well manage that product,” Williams said. “Their cost to originate is so very high. Many of them are $8,000 to originate a loan, and that amount cannot be put into a GSE pool and it cannot be passed forward.

“If you can’t pass on that cost, how are they going to finance that new home mortgage that the GSEs (Fannie and Freddie) both want to advance in the $150,000 area?” he said. “We’re better able to serve that market because our origination structure relies heavily on the retailer relationship to bring costs down.”

Traditional lenders cannot operate in the same way, because they don’t have a retail environment for their homes, much less the relationships within the retail environment.

Among the largest operators lending for manufactured homes — 21st, Triad, and Credit Human, for example — none of them are lenders focused on being backed by government-sponsored entities.

“Traditional GSE lenders do not originate many manufactured home loans, because they only do GSE-conforming product. So if the borrower, the house, or site for the house doesn’t fit in the Fannie Mae or Freddie Mac box, then those lenders don’t offer an alternative,” Williams said. “Whereas us traditional manufactured home lenders have alternatives, but we must get qualified to participate with the GSE in order to support the ‘New House’ with lower rates and longer terms that are only available through the GSEs.

“And you still have to be profitable,” he added. “You have to cover costs, which are not $8,000 but are more than a chattel loan… you need to be able to build in a profit.”

What About the Resale Value?

People who sell manufactured homes, and manufactured home buyers themselves, often are questioned about how factory-built homes retain value. There’s skepticism, and misinformation, about an individual manufactured home as an investment. This persists despite a recent pilot report held within FHFA’s quarterly Home Price Index summary that suggests manufactured homes appreciate in a fashion that is very similar to site-built homes.

True, the general public is less inclined than housing professionals to refer to the quarterly HPI report. Yet, Williams points to a couple of specific ways manufactured home buyers proceed that may hinder home value appreciation.

Circumstances Around Home Sale Financing

It has very little to do with the product, and more to do with where the home is placed.

“Fortunately, we have about 40 percent of our customers who buy a home and do it without paying for the land. The downside is you can have a difficult time selling the home,” he said. “If they put it on a private site, like family land, and then they try to sell it, maybe there’s no one to live there… or no one in the family or on the property wants anyone else living there.”

There could be debt on the farm, multiple owners who disagree about what to do with the property, or other legal claims that get in the way of a sale on the independently owned home.

“That happens every day, over and over,” Williams said. “ And I get it, because it’s happened to me.”

Many years ago, Williams made a significant investment in expanding and improving a small home on his family’s property. And he had to walk away from the investment for many years, until the deed holder was ready to hand over the property.

“It’s a great advantage to not have to pay for land,” Williams said. “But it can be difficult to sell when the homeowner needs a change.”

And moving even a single-section home adds another $3,500 in costs to a re-sell. A multi-section home can cost $10,000 to move.

The resale of a home, in terms of demand for the dwelling where it sits, along with potential moving costs, should be put on the list of items a buyer considers, even if the retailers or lenders risk losing the occasional sale.

Manufactured Homes in Residential Neighborhoods

Williams again uses an example from his daily life to illustrate the complexities of integrating manufactured housing throughout the market in a way that can boost the annual percentage of home starts well beyond the 10 percent ceiling manufactured housing professionals have experienced.

“I am optimistic about the new product,” Williams said. “I’m optimistic about manufactured homes getting into better communities where they can sit right beside conventional housing.

“You really expect it to be a better house, and we have a great opportunity to help deliver that,” he said. “Manufacturers have done a great job over the recent years building a better product.”

‘If you can do it anywhere, you should be able to do it here’

“That said, we really do have to start breaking down some zoning barriers,” he said.

Most cities in the U.S. make little if any room for manufactured homes, and many explicitly zone to keep manufactured homes out.

“In Knox County, Tennessee, the birthplace of Clayton, the largest builder of manufactured homes, and backed by Berkshire Hathaway and Warren Buffett, and we can’t get a manufactured home in the city of Knoxville?” Williams said. “If you can do it anywhere, you should be able to do it here. And we haven’t.

“Until we get really good at building homes that are certain to be accepted by not just consumers, but by their neighbors, we won’t get the results we want,” he said. “And that takes time.”

Beyond zoning for an individual manufactured home, the city of Knoxville hasn’t approved a new manufactured home community since the 1980s. Knoxville is not alone. About 313 new manufactured home communities have been built nationwide since 2002, according to information from the industry leader in data, Datacomp.

The 2,645 new communities built during the prior 15 years, including 395 communities built during 1986-87 alone, show the stark contrast between then and now. With that, it’s easy to understand why affordable housing advocates are concerned.

“We’re reaching a saturation point on communities — mobile home parks — where we will start getting some brand-new communities,” Williams said. “It has to happen, or shipments will hurt. There’s only so much of a market for homes on private land.”

What Else Will the Future Hold?

The market is good, so the alarm bells that may sound when Williams says the word “flat” should be taken in stride.

He said 21st Mortgage is able to originate every loan it sees that can be profitably originated. Business lingo might rephrase that to say: They’re not leaving any money on the table. The business is right-sized and sailing forward.

However, the U.S. is in the midst — or potentially in the latter stages — of the largest market expansion in modern history.

It’s one that can’t last.

The market will shrink, which hopefully will qualify as something less than a recession, great or not.

“Our default rate is artificially low,” Williams said. “I suspect many lenders would agree with that. Owners who default are facing the death of a spouse, serious illness or divorce. Typically, unemployment counts for about 30 percent of defaults. But that’s not happening right now, because employment is so high. Anyone who wants a job has one.”

Williams asserts that some lenders will move forward with loans that work today but will be difficult to maintain as the market corrects. Whether confidence is placed on the artificially low default rate or thinning margins, something is sure to give in months or years to come.

“You have to plan for it. And you can’t hedge for it, either,” he said. “You’d be wrong if you make that bet.” ##

Part II. a. MHProNews initial analysis in brief. Several red flags emerge from the above. For instance.

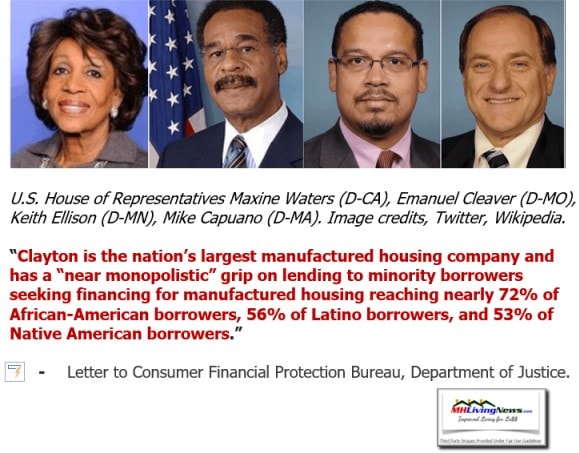

- Why didn’t Revere ask, or Williams clearly state, that 21st dominates manufactured housing lending? That is per Consumer Financial Protection Bureau (CFPB) data (see graphic here, more details here).

- Why didn’t Williams mention the Manufactured Housing Improvement Act of 2000 (MHIA), which Kevin Clayton referred to in remarks to Congress? After all, 21st and Clayton are both owned by Berkshire Hathaway (BRK).

- Or consider how Clayton Homes’ attorney – and prior MHI chairman – Tom Hodges amplified Kevin’s remarks to Congress?

- Additionally, note how Williams’ words pointed to hope for the new class of homes as much as to the roadblocks for what MHARR has aptly started calling mainstream manufactured homes. Williams stated that beyond their own firm originating loans on the new class of homes that MHI later rebranded as CrossMods would be difficult for others to do. More on that and other issues from Part II about Williams from MHInsider above is found in Part IV below.

Part III. Fannie Mae and Freddie Mac Duty To Serve Plans

By Contributed Content September 16, 2022

Is There Any Good News About Purchasing Chattel Loans on Manufactured Homes? Maybe

By Raymond Leech

As we all know, manufactured housing is one of the best sources of affordable housing available today and makes up to 10 percent of all of the nation’s housing stock. With the severe housing shortage in this country, estimated to be close to four million units by Freddie Mac, manufactured homes are valuable in closing this gap. But a large percentage of loans used to purchase these homes are chattel loans or personal property loans, and the conventional mortgage marketplace does not support chattel loans. This results in financing that has higher interest rates over shorter terms, and fewer consumer protections.

While Cascade Financial has been successful in creating a few securitizations in recent years, there are currently no other major investors that purchase or securitize chattel loans for manufactured housing. And the two Government-Sponsored Enterprises (GSEs), Fannie Mae and Freddie Mac, do not have policies or products in place to purchase them either.

But that could be changing.

What Are the Enterprises Doing on Chattel?

In April of this year, the Federal Housing Finance Agency (FHFA) released the Duty To Serve plans of Fannie Mae and Freddie Mac. Duty To Serve is a commitment by FHFA through Fannie Mae and Freddie Mac to provide financing in three key underserved markets: manufactured housing, rural housing, and affordable housing preservation.

DTS commenced in 2016 and the first plans were announced in 2018. A new plan is announced every three years. The one released in April is for 2022 through 2024.

But the 2022 plans got off to a rocky start, and one of the reasons is both GSEs had nothing to address support for chattel loans.

In a stunning development, the original DTS proposals to FHFA in May of 2021 were soundly rejected by many housing advocates such as the Lincoln Institute, the National Housing Conference, and National Community Stabilization Act. They told FHFA to hit “pause” as they did not believe the proposals met the spirit of the DTS commitment.

The advocates were upset that both GSEs were ending their plans to explore purchasing chattel loans, and disappointed in the goal levels set for rural, affordable housing preservation, and manufactured housing. FHFA listened and told Fannie Mae and Freddie Mac in January of this year to go back to the drawing board. And they did, and the new proposals were accepted in April.

But even with the improved proposals and more robust goals, do not expect significant changes regarding chattel financing in the next few years. However, there are some things happening.

Freddie Mac Duty to Serve Plans

In their April DTS plan, Freddie Mac announced a definite focus and goals for chattel loans in the next few years.

Freddie Mac committed to purchasing from 1,500 to 2,500 chattel loans as part of their DTS goals in 2024. Over the next two years, their plan is to complete a feasibility assessment of the requirements and processes needed to support chattel loan purchase, including underwriting, pricing, consumer protection, valuation, and risk management.

And if they are successful, they want to obtain FHFA approval to move forward with a loan option that could be introduced in 2024. The big challenges they point out are a lack of lender standardization, no standard underwriting practices, and no consistent approach to assessing property values.

Freddie Mac announced a focus on MH homes in Native American and Alaskan American communities, which have complicated land ownership rules due to trust or tribal issues. They also are working on efforts with nonprofit developers to expand the availability of manufactured housing. Additionally, they are focusing on expanding their outreach and loan purchases in resident-owned communities (ROCs) and nonprofit developer communities.

Fannie Mae Duty to Serve Plans

Fannie Mae’s plan does not include any specific goals for chattel financing by 2024. But they are still interested in exploring this area.

“We continue to work with our regulator (FHFA) to understand safety and soundness considerations and the viability of a chattel loan pilot program,” Fannie Mae said in a published statement.

So based on this, Fannie Mae may offer the chattel loan product via a pilot. Typically, pilots are done with selected lenders in specific markets. And pilots can be up to one or two years in length. So do not expect a chattel loan product available nationwide to lenders from Fannie Mae for several years at least.

Fannie Mae’s plan also includes efforts to develop products and strategies to purchase more loans in manufactured home communities. These communities feature homes built in factories and delivered to the community where residents own homes and lease the land from a community owner. They also announced that all loans in these communities must have 100 percent tenant site lease protections in place.

In addition, Fannie Mae announced that they are exploring how to purchase more loans from MHCs to finance rental units, and also allow residents who rent MH units to report their rental payment data to credit bureaus to help build up their credit profiles.

Some Good News

The good news for the manufactured housing industry is that both Fannie and Freddie are increasingly committed to the purchase of more conventional loans related to MH titled as real property, with Freddie planning to purchase from 5,800 to 7,500 loans each in the next three years and Fannie planning to purchase at least 9,300 loans annually in the next three years.

So, in summary, housing advocates were able to steer both Fannie Mae and Freddie Mac toward more robust efforts and goals in the manufactured housing marketplace. Freddie Mac is taking the lead on chattel financing efforts, and typically, once one GSE adopts a program or product, the other one will follow. This will be an interesting effort to examine during the next few years, and hopefully we will see progress down the road.

About the Author

Raymond Leech has worked in the mortgage industry for the past thirty years, first with Fannie Mae and more recently, with Fairway Independent Mortgage Corporation. He has developed and managed construction and renovation mortgage products, but also worked on FHFA Duty To Serve efforts involving manufactured housing, rural, and affordable housing efforts. ##

Part III. A. According to his LinkedIn profile, Leech has gone from Fannie Mae, to Fairway Independent Mortgage Corporation, to Berkshire Bank. When asked about some of his experiences and insights into Fannie Mae and Berkshire Bank, Leech replied to MHProNews via email that: “Hi Tony. I am not comfortable continuing this conversation. Good luck with your article.” More in Part IV, below.

Part IV. Useful, Bad, and Ugly Insights on the Above – A Case Study in Paltering, Posturing, Promotion, and Propaganda in Manufactured Housing?

More from Leech and About MHInsider, Williams, MHI et al.

1. To recap the inquiries sent to Leech (and MHInsider’s Revere and Krowelski), MHProNews asked in part:

- 1) Are you familiar with the Manufactured Housing Improvement Act (MHIA) of 2000 and what is commonly referred to in manufactured home circles as the MHIA’s enhanced preemption provision?

- 2) You mentioned zoning as a barrier to more manufactured housing sales and cited Tim Williams at 21st Mortgage Corporation and his linked comments. Are you aware of any published concerns about Williams, 21st, and their role in manufactured housing underperformance in the 21st century?

Leech sent the following to MHProNews as first in a series of responses.

Hi. Let me discuss your query with my editor at MH Insider. But I can tell you that I am not aware of MHIA of 2000 issue or whether there are any published concerns about Mr. Williams. I only spoke with him once.Thanks.Ray

MHProNews’ Kovach said in response:

I appreciate your candor. Prior to writing for MHInsider, may I ask how much experience you have in manufactured housing? LMK, we plan to publish on this tomorrow. Thank you.

Leech responded as follows. Quoting:

- HI. I worked at Fannie Mae for many years and worked on MH issues while there.

Helpful. A few more inquiries, please. Does Berkshire Hathaway have any stake in Berkshire Bank?

- Hi Tony. I am not comfortable continuing this conversation. Good luck with your article.

Let’s recap the above from Leech. He said he worked for years at Fannie Mae, which his LinkedIn profile on this date indicates was some 29 years all told. That would take his time at Fannie Mae back to the era when Berkshire Hathaway reportedly held stock in that firm.

Leech became “not comfortable” talking about the history of the GSEs above and after being asked: “Does Berkshire Hathaway have any stake in Berkshire Bank?”

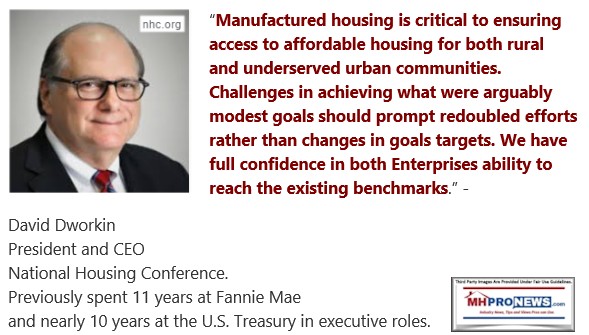

Leech made the point that Cascade Financial successfully securitized some manufactured housing loans. Cascade is a tiny fraction of the size of Fannie Mae or Freddie Mac. Doesn’t that clearly suggest that the two GSEs could successfully help originate and securitize loans too? To shed more light on that, consider what ex-Fannie Mae executive and current NHC President David Dworkin said about the GSEs capabilities.

1. What made Leech nervous or “not comfortable” is a matter of speculation. But he apparently did not want to comment about whatever he knows about the history of manufactured home chattel lending, Fannie, Freddie, and Warren Buffett led Berkshire Hathaway.

2. Who contacted whom with respect to these articles by Leech for MHInsider is currently unknown. Also unknown is to what extent MHInsider (and/or MHI or MHI tied corporate interests?) leadership wanted to – or did – influence Leech’s content. That said, Leech said he reached out to his “editor” at MHInsider. The editor reportedly did not feel any need to change any of his content. One must keep in mind that MHProNews’ also reached out directly to MHInsider’s Revere and Krolewski. So, to some extent, an evidence-based argument can be made that MHInsider made the decision that they would stand on what was published by Leech. That’s relevant to their published remarks found at this link here.

3. In an entirely different class, and highly relevant, are the flashback look at what Williams told the MHInsider, and the MHInsider’s ducking of known controversies involving Williams, 21st, and purported antitrust violations. (Click to see document.)

4. More specifically, Williams, Clayton, and MHI appear to be adept at paltering, posturing, and a clever deployment of what could be described as propaganda. It is beyond absurd for Williams to say with a presumably straight face that Clayton is unable to get HUD Code manufactured homes placed in Knoxville, TN. Leech admitted to having no knowledge about the MHIA and its enhanced preemption provision. That’s plausible. But it is difficult to imagine that Williams is ignorant of what Clayton, Gooch, or others have said about the common understanding of federal preemption and manufactured housing. Indeed, this writer knows with certainty that Williams at least postured understanding because he smilingly replied to a question from this writer at an MHI meeting that asked: why isn’t MHI suing to enforce its rights under federal law on issues like the MHIA and enhanced preemption? Williams said that may be necessary someday. That indicated knowledge. Furthermore, it would be Clayton attorney Tom Hodges’ job to know, and he should know what his boss Kevin Clayton said about federal preemption. Both Hodges and Williams have served as MHI chairmen.

5. So, there are an array of reasons to think that when Williams made those remarks reported by Revere in the apparently MHI-linked MHInsider, that Williams knew he was omitting a critical part of the conversation of zoning barriers. Are there barriers? Entirely plausible. But equally plausible is that Clayton Homes could SUE Knoxville, or any other jurisdiction, for their failure to honor the MHIA’s “enhanced preemption” provision that Kevin Clayton claimed to Congress that MHI desired to see enforced.

6. Williams, Clayton and Hodges all apparently know about “enhanced preemption” for manufactured housing that could overcome zoning and placement barriers, based on remarks cited herein. Leech said he knows nothing about it. After reading this carefully, he should see why his column is contradicted by evidence that Williams, Krolewski, and Revere should all know about.

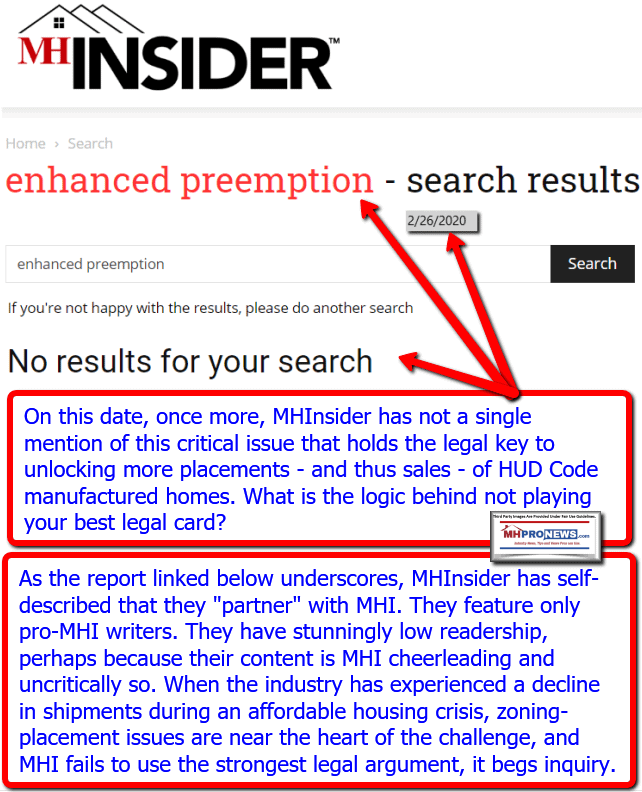

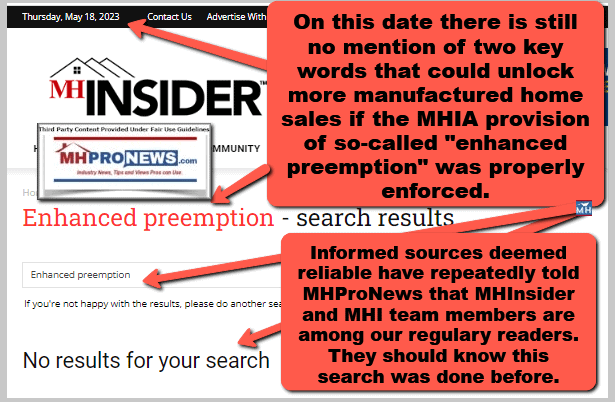

7. That said, why does MHInsider fail to have any articles that mention that topic that Clayton, Hodges, Williams, and Gooch are all apparently aware of? Haven’t they repeatedly said wording similar to what follows? Specifically, that they “make every effort to ensure that the information in this issue was correct before publication” – seriously? How could they make “every effort” and then fail to provide ANY verbiage that clearly identifies those two nearly magic words: “enhanced preemption.” Those words could unlock the barriers to local zoning and placement, IF they were being properly enforced. Yet, MHInsider – and Leech – are writing about how to do more sales while being ignorant of and/or avoiding a use of the very provisions of law that could make it possible?! Even Williams said in the above that zoning barriers are the biggest hurdle for the industry’s growth potential!

First this next flashback insights…

…then the same search on this date. Same result.

8. Consider this pull quote by Williams, in the light of the above. “We’re reaching a saturation point on communities — mobile home parks — where we will start getting some brand-new communities,” Williams said. “It has to happen, or shipments will hurt. There’s only so much of a market for homes on private land.” (emphasis added by MHProNews). Well, Williams hit on an issue asked MHI members by MHProNews at the MHI Winter Meeting in 2017. That apparently was verboten for this writer to ask, while it is okay for Williams to say it? Pardon me? Where is outside MHI attorney David Goch and his apparently inaccurate remarks on that, quoted below? Wasn’t Goch apparently lying when he wrote those words?

9. There IS a “VITAL NEED” for chattel lending in manufactured housing. The Leech/MHInsider’s headline happens to be correct about that statement. But that is how paltering is done. Paltering routinely leads with a remark that gets the reader ‘nodding’ in agreement. Once a propagandist gets some measure of buy-in, then the mix of half-truths, lies, manipulation, etc. can begin. That said, what Leech – and MHInsider – apparently don’t know and/or do not want to say in their published remarks how the status quo is apparently part of the Buffett moat operating in manufactured housing. There have been YEARS of promises and teases by MHI and their dominating brands in the 21st century, and where are the results? How much more Peanuts-like slapstick cartoonish Charlie Brown and Lucy-like analogies do they want to deploy?

How many times can MHI and/or their leading brands play the promises, promises game about finance, zoning

or marketing/education that boosts manufactured housing without delivering any results game?

Proverbial shades of Peanuts’ Charlie Brown, Lucy and the football. The football are the

the stand in for the Clayton-21st backed MHI’s teases and promises.

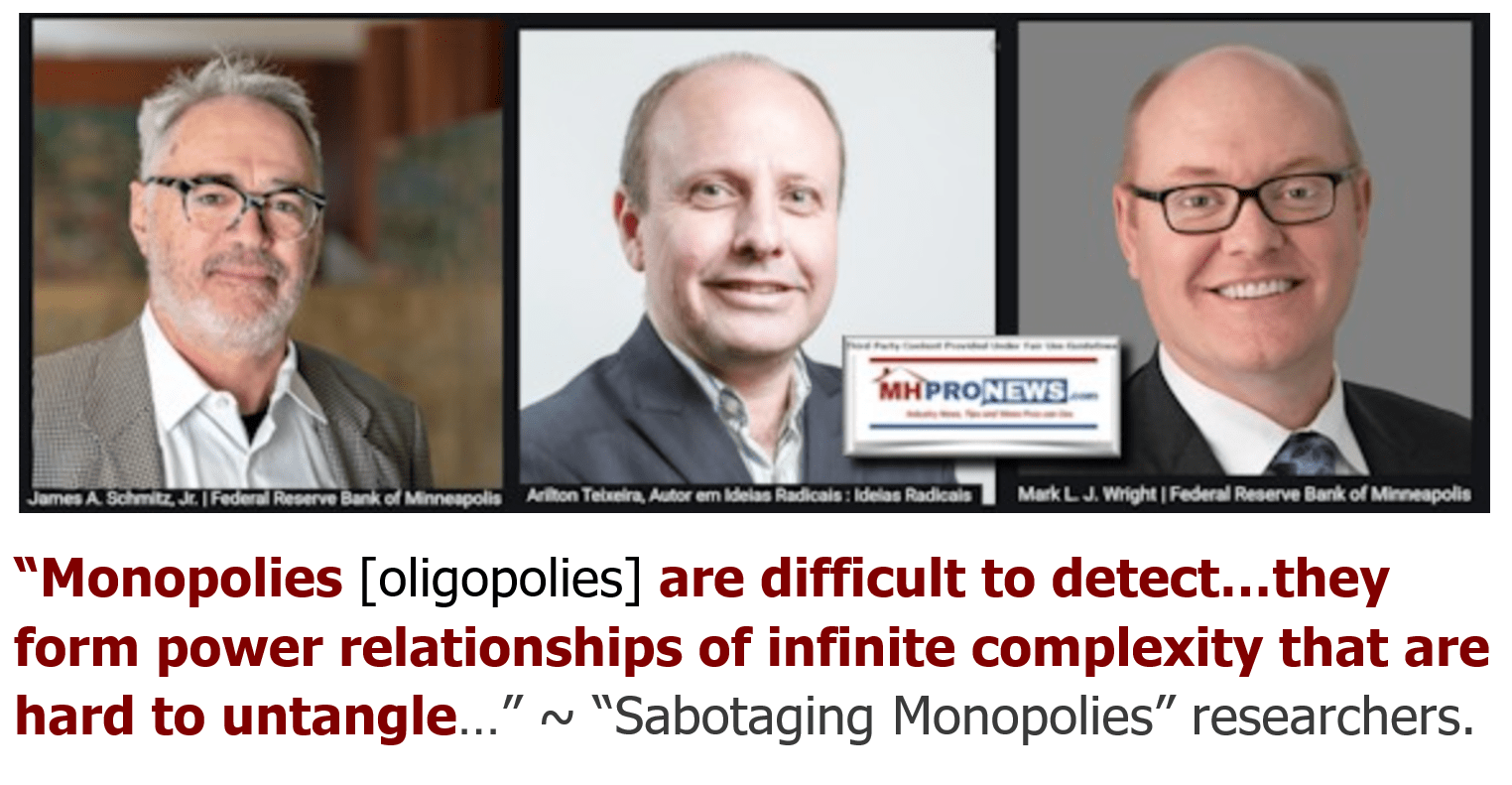

10. MHARR’s president and CEO, attorney Mark Weiss in an exclusive interview with MHProNews made the evidence-based case that the industry has been subjected to a “shell game.” A shell game is a cheap form of a confidence job (con job).

11. More specifically, Kevin Clayton said they planned to make it difficult for their competitors. That’s believable. Minneapolis Federal Reserve researchers studying manufactured housing have said that ‘sabotaging monopoly’ tactics have been deployed. When asked about that a Berkshire board member, Clayton, 21st, and MHI leaders have remained silent – no comments. Knudson Law’s Samuel “Sam” Strommen was sharper and more specific in that he named Berkshire Hathaway, Clayton Homes, MHI and others among their major brands in accusing them of “felony” monopoly practices. If so, that’s potentially prison time and/or the potential for large fines.

12. In addition to efforts to shine light on manufactured housing underperformance revealed by third-party credible researchers like those referenced in the above, Schmitz has since begun teaching graduate students about his research results. In his presentation he said the quote below his presentation on manufactured housing link.

13. Much of the rest of the above from MHInsider in Parts I, II, and III are a mix of truth, half-truth, paltering, deception, misdirection, and coverups of reality. It is a proverbial tangled web that is difficult to untangle, but like the classic poetic lines, they are apparently provided by MHInsider with the aim of deception. There are several mainstream media reports, some examples shown below, that outline how “the moat” operates and that may specifically name Clayton Homes and their lending. So, why is it that MHInsider or others in MHVille ‘trade media’ dodge these troubling topics? In fairness, it is unclear to what extent Leech may be a useful pawn and/or if he is an active participant in this deception and misdirection manipulation scheme?

14. Democratic lawmakers have called out Clayton Homes and their associated lending by name.

15. To be clear, there is plenty of paltering and posturing occurring in the U.S.A. On the Democratic side of the 2024 presidential nomination process, candidate Robert F. Kennedy Jr., J.D., has openly declared that a key part of his governing plan would be to expose and end the corrupt merger of corporate and governmental power. Kennedy is a veteran of numerous successful lawsuits against corporate interests. It is entirely possible that if he prevailed, he would launch antitrust efforts against firms such as Berkshire Hathaway. In a few weeks, Kennedy’s polling has reportedly gone from 10 to 21 percent among potential Democratic primary voters. The public is to some degree learning that corporate media and big corporations are not to be trusted.

16. It isn’t just Democrats who have antitrust concerns. In response to an inquiry in a crowded room by MHProNews at an AMAC.us national event, Donald J. Trump Jr. said that antitrust issues are the number 2 or number 3 issue top issue harming Americans.

17. MHProNews has previously reported on several insider remarks from those who worked with a GSE. The entire CrossMods fiasco is once again illustrated in part by remarks by Williams in the ‘interview’ shown above by Revere, which was referenced by Leech, and published by MHI linked MHInsider. An entire article could be written about just that aspect of Williams’ remarks. Here’s a tip for anyone that wants to seriously research why manufactured housing is underperforming. Dig into one of the key issues that face the industry. It could be zoning/placement barriers. It could be financing constraints. It could be the lack of proper education/marketing by MHI. Gather up scores of statements and reports. See how self-contradictory over time MHI’s claims and behaviors have been. An example of that is found linked below.

18. To be clear, it isn’t that MHInsider – per known evidence – is well read. It apparently isn’t. This scene below has been repeated at several trade shows, per photographic evidence.

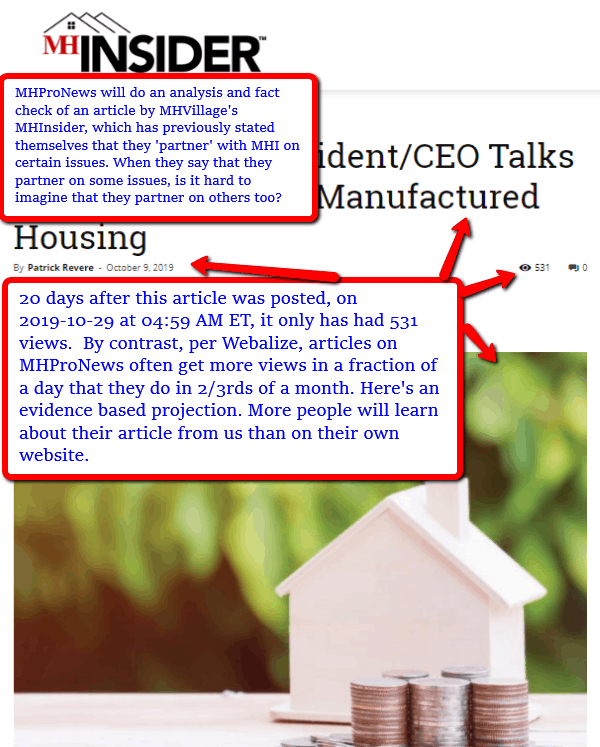

19. Ironically, the very story that Leech referenced is the one in the screen capture below. Sometime after that prior expose by MHProNews of MHInsider, the later disabled their pageview function. Apparently, the number of pageviews were so low that it was embarrassing to their highly suspect claims of being the best in manufactured housing news. They obviously are not.

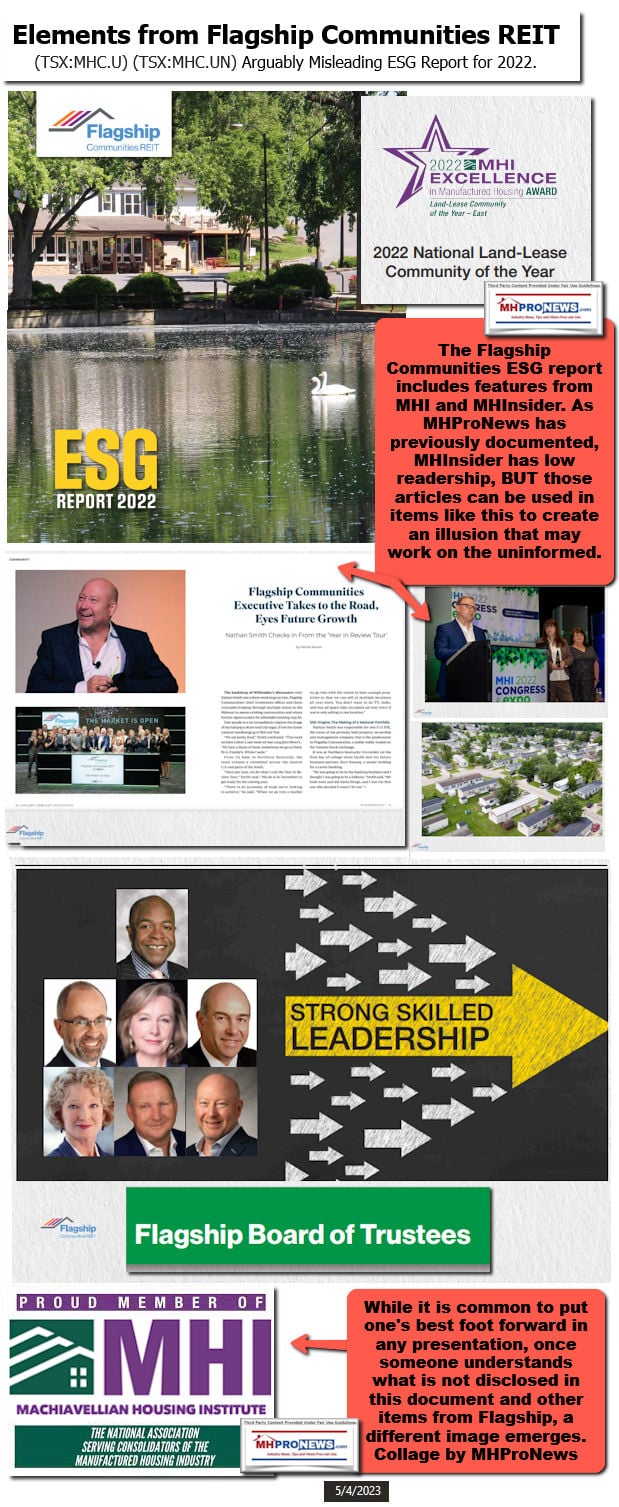

20. The screen capture above was previously published by MHProNews. As noted, it happens to be a fact check of the same article that Leech referred to in Part I above. MHInsider’s traffic is apparently low. But that doesn’t mean that why that say is insignificant. One of the apparent purposes of the publication seems to be for marketing messages that may not otherwise get published. Consider the example below from controversial MHI member Flagship Communities. MHI “award-winning” Flagship is rated a D- by the Better Business Bureau. The article with the photo of Nathan Smith, about half way down the collage that follows is from MHInsider.

21. Put differently, even with light traffic, the image and insights above reveal that MHInsider can be (mis)used as a tool for corporate pitches to investors and/or consumers. If a reader of such content does not scrutinize the claims, slick MHInsider may look like an authentic trade publication as opposed to being a paltering, posturing, propaganda medium.

22. There are numerous things that public officials can and should probe in manufactured housing for apparently corrupt and possibly illegal practices. MHInsider is seemingly one of them. That’s not said because they are a rival. Frankly, as is illustrated above by their low viewership, the odds are excellent that more people will read what they published here on MHProNews than have read their content on their own website. If there was good competitors that do a similar job of attempting to hold wrongdoers in manufactured housing accountable, it could elevate the manufactured home profession. By contrast, the reverse is also true. Poor or unethical competitors can diminish a profession. Ironically, the Krolewski of yesteryear made similar arguments.

There are pages that could be written about the problems in the reports linked above that Leech and MHInsider advanced. This is sufficient for now. But MHProNews and/or MHLivingNews will plan to do a follow up with these articles to show how ironically Williams et al have boxed themselves into a corner by their own prior remarks on a range of topics mentioned in those three posts on MHInsider.

That said, there is plenty for serious researchers, attorneys, and public officials to probe. Because apparent market manipulation methods are being exposed.

Leech may have inadvertently been caught up in this scheme, that is not clear at this time. But what MHProNews/MHLivingNews has been carefully documenting is that an increasing number of attorneys are exploring the industry. While they may miss the mark on some points, they are hitting the proverbial bulls eye on others.

So, someone at MHInsider was apparently happy to use Leech’s narratives in this vexing fashion (see Part I, II, III above) to advance the agenda of their corporate allies, MHI, and their corporate masters. To those with the eyes to see the truth instead of clever deceptions, the ties between MHI and MHInsider’s are seemingly a part of a disgusting and disgraceful pattern. The apparent motivation? There are some who have openly stated that they essentially want to keep manufactured housing artificially small. Their goal? To consolidate the industry in a relatively few brands.

The common feature of all of the above firms? They routine have ties to MHI. The truth is hiding in plain sight. However, it is covered in a complex pattern of deception and misdirection.

Now that MHARR has thankfully helped leverage MHI into a lawsuit that at least postures working on the industry’s behalf, the remaining questions include when will MHI sue to get DTS and the MHIA of 2000’s “enhanced preemption provisions enforced? If not for MHARR and a relative handful of souls willing to steadily fight back against this pattern, would there be any independents left in MHVille in production or retail? Alternative realities are difficult to assess, but in brief, it’s doubtful. Kudos to those who have fought the good fight for the future of MHVille. ##

PS:

For those in MHVille who may try to console themselves for their respective role in what has been happening in the 21st century who may think that no one reads long articles anymore, the evidence from 2022 says otherwise. MHProNews’ third-party metrics reflected millions of visits. Each visit yielded an impressive 10.75 page views per visitor. That is about 3 times the engagement rate that CNN or Fox News has, again, per third-party research.

It is ironically, Tim Williams, Darren Krolewski, and others who have praised our efforts over the years to expose the truth and the road ahead.

People are thirsting for the truth. They want the evidence. While not all will read articles that are thousands of words long, one of the hottest articles on Time Magazine post 2020 was some 6000 words in length. People will read when they feel motivated to learn what they want to know. Because the circumstances of MHVille make very little sense UNLESS someone grasps the operating evidence-based thesis of MHProNews/MHLivingNews. Namely, that the manufactured home industry is being cunningly consolidated by underperformance while posturing the opposite.

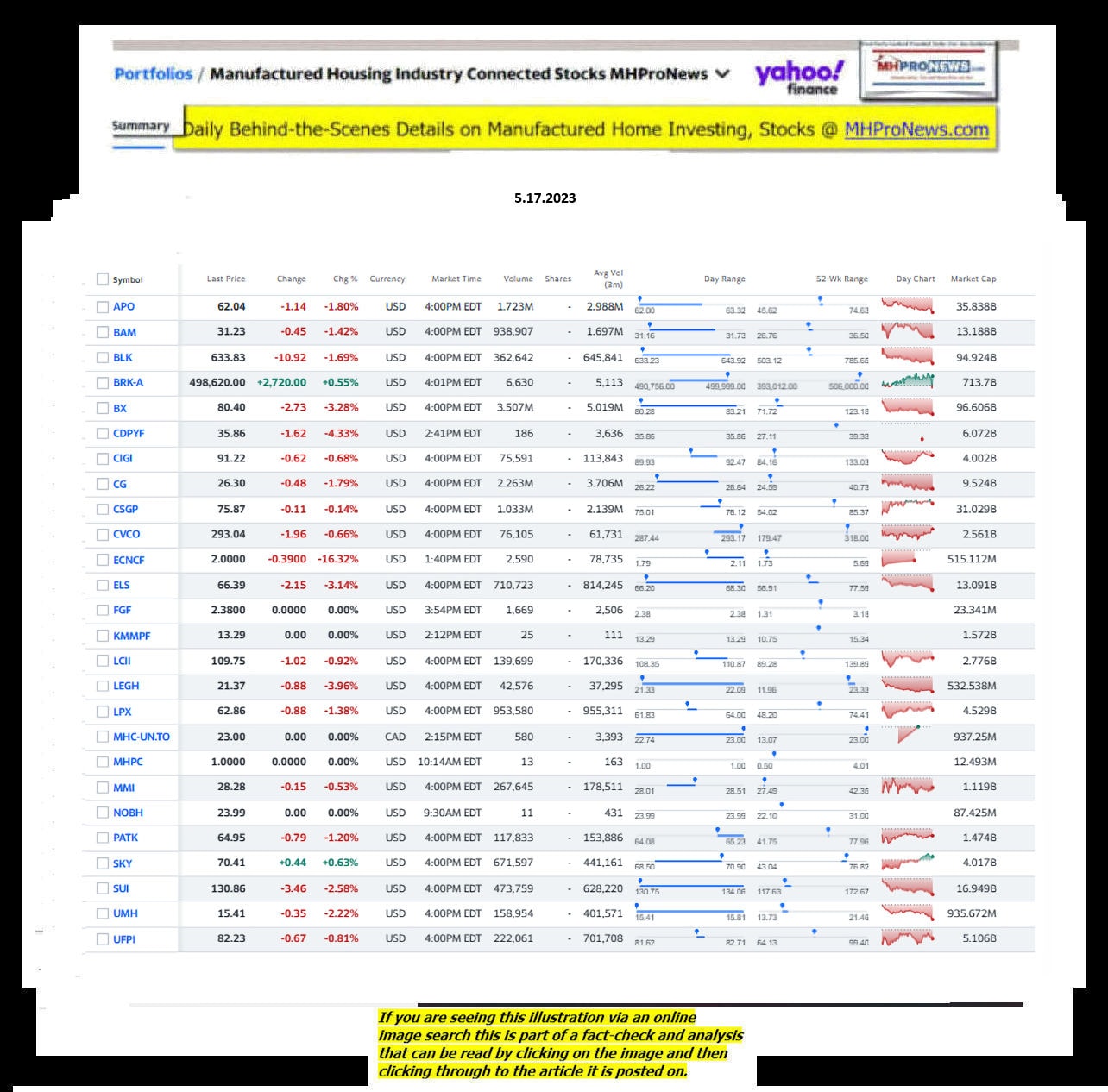

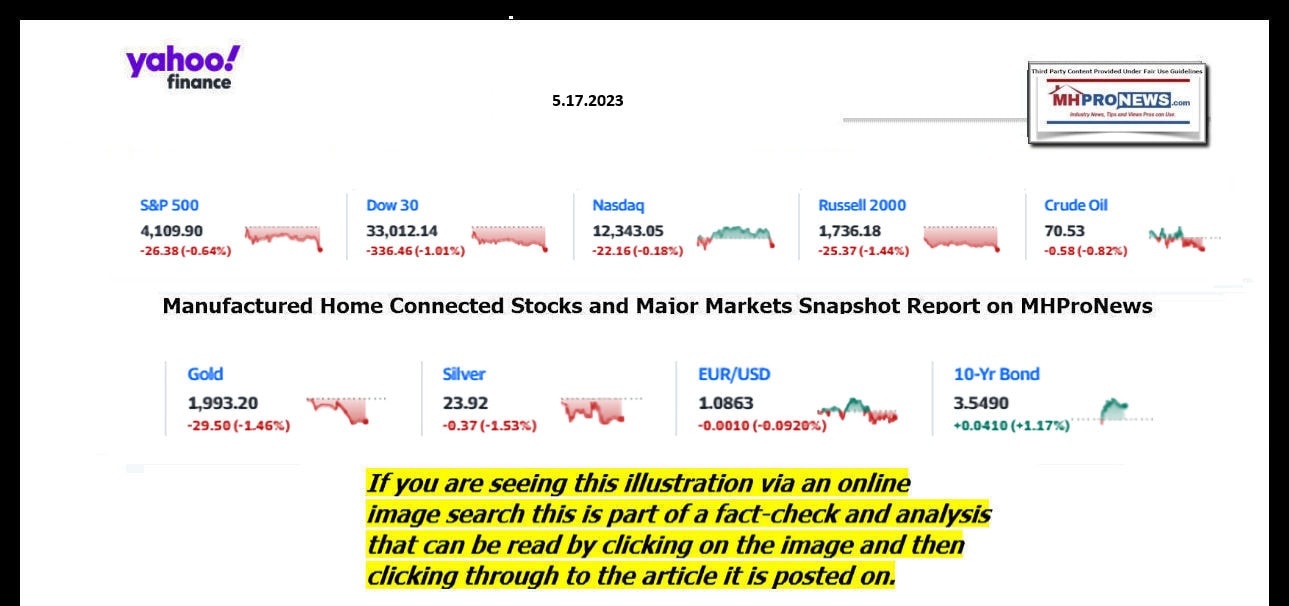

Part V – Daily Business News on MHProNews Markets and Headline News Segment

The modifications of our prior Daily Business News on MHProNews format of the recap of yesterday evening’s market report are provided below. It still includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines. The macro market moves graphics will provide context and comparisons for those invested in or tracking manufactured housing connected equities.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 5.17.2023

- Enough with the debt ceiling

- All it does is wreak havoc. It’s time to take this political football off the field

- Elizabeth Holmes must report to prison by May 30

- Want a free 55-inch TV? The catch: Nonstop ads, less privacy

- Hertz apologizes after refusing rental to Puerto Rican

- Are you worried about the US defaulting on its debt?

- Bank CEOs huddle with Schumer on the debt ceiling

- Kraft Heinz wants you to mix flavors in your ketchup

- Regional bank stocks soar after Western Alliance says deposits are growing

- Uber will now let teens ride in cars alone

- Elon Musk claims George Soros ‘hates humanity.’ The ADL says Musk’s attacks ‘will embolden extremists’

- How the CEO behind ChatGPT won over Congress

- Kaitlan Collins to anchor new 9 pm show on CNN

- Target flashes a recession warning: Shoppers are buying fewer clothes and more necessities

- New home construction rose in April after a dip in March

- How to protect your investments in the debt ceiling standoff

- Perdue made its own beer for ‘beer can chicken’

- A new CEO won’t fix Twitter’s biggest problem

- Oxford University wipes the Sackler name from its buildings

- Oscar Mayer’s Wienermobile is getting a new name

- What caused regional banks to fail? Senators blame excessive CEO pay

- Stellantis says UK car factories will close if Brexit deal isn’t changed

- Australian gold miner Newcrest backs Newmont’s $17.8 billion offer

- Use it or lose it: Google says it will delete inactive accounts

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Headlines from right-of-center Newsmax 5.17.2023

- State Dept. Offers to Let Lawmaker View Key Afghan Document

- Michael McCaul threatened earlier this week hold Secretary of State Antony Blinken in contempt of Congress if he did not turn over the so-called dissent cable. It was not immediately clear if this new offer would appease the Republican lawmaker, who is trying to get at the root causes of American troops’ chaotic withdrawal from Afghanistan. [Full Story]

- House GOP Lawmaker Readies Contempt Charge for Blinken

- State Dept Again Misses Afghanistan Cable Deadline

- Newsmax TV

- Murphy: Testimony Shows Capitol Police Failures

- Gidley: Removal of IRS Investigators of Hunter ‘Stinks’ | video

- Tuberville: ‘Cartels Are Running Our Borders’ | video

- Paul: Russiagate Hoaxers Should Go to ‘Prison’ | video

- Franklin Graham: Biden Ignoring ‘Major Crisis’ at Border | video

- Whitaker: Durham Details ‘Outrageous Moment’ in History | video

- Mark Meadows: Durham Could Cost FBI a New HQ | video

- Bondi: ‘Damaged’ FBI Agents Owe Targets’ Legal Fees | video

- Fry: Durham Proves Govt Weaponized | video

- NIH Cuts US Funds for COVID-Tied China Lab

- The National Institute of Health has removed China’s Wuhan Institute of Virology, the facility long suspected of being the origin of the COVID-19 pandemic, from the labs where U.S. money can be used to fund testing on animals, according to an update to the agency’s funding list…. [Full Story] | video

- Rubio Releases Report on COVID Origins

- DeSantis Official Refutes Trump Campaign Claim

- Florida GOP Gov. Ron DeSantis is not officially in the 2024 GOP [Full Story] | video

- Wall Street Rallies on Debt Ceiling Optimism

- U.S. stocks rose sharply Wednesday, fueled by optimism over a [Full Story]

- Jordan, Turner Seek CIA Info on Laptop Letter

- House Judiciary Chairman Jim Jordan, R-Ohio, and Permanent Select [Full Story]

- Hunter Biden Reportedly Lobbied on Behalf of Corrupt Romanian National

- Report: IRS Removes Entire Team Probing Hunter Biden

- Gidley to Newsmax: Removal of IRS Investigators of Hunter ‘Stinks’ |video

- Donalds to Newsmax: Biden Move on Hunter Investigation ‘Reeks of Obstruction’ |video

- Answers Demanded After IRS Whistleblower Reassigned

- House Ways and Means Committee chairman Jason Smith, R-Mo., is [Full Story]

- Trump to Newsmax: Durham Report ‘Great Vindication’

- The Durham Report came too late, but it was not too little in the way [Full Story]

- Durham Report: FBI Had No ‘Actual Evidence,’ Relied on Trump Opponents

- Devin Nunes to Newsmax: Durham Report Should ‘Scare Living Hell Out of Everyone’ |video

- Flynn: Durham Calls Out Probe That Never Should Have Been

- Durham Report Discredits Collusion Claims by Democrats |video

- MTG Introduces Impeachment Articles Against FBI’s Wray

- Dems Call Abortion Access a Promise: ‘You’re Safe Here’

- Access to abortion is essentially locked down in Illinois. But [Full Story]

- Smears of Supreme Court Conservatives a ‘Hail Mary’

- A recent multi-front effort to smear and delegitimize the [Full Story] | Platinum Article

- State Dept. Offers to Let GOP Lawmaker View Afghan Dissent Cable

- The State Department offered Wednesday to let the Republican chairman [Full Story]

- Ukraine Denies Russia Destroyed Patriot Missile System

- Ukraine denied on Wednesday that a Russian hypersonic missile had [Full Story]

- Ukraine Black Sea Grain Deal Extended 2 Months

- African Nations to Send Peace Mission to Ukraine, Russia

- G-7 Leaders Likely to Focus on the war in Ukraine and Tensions in Asia at Summit in Hiroshima

- Russia’s Threat to Exit Ukraine Grain Deal Adds Risk to Global Food Security

- SKorea’s President Vows to Expand Nonlethal Aid to Kyiv

- Biden Off to Japan for G-7: ‘Work to Do’ on Global Stage

- President Joe Biden said there’s “work to do” on the global stage as [Full Story]

- Israel’s Herzog Urges Progress in Judicial Reform Talks

- With judicial reform negotiations resuming following the end of [Full Story]

- Near Space Could Be Next Battleground for US, Rivals

- Geopolitical analysts say that China is preparing for future wars to [Full Story] | Platinum Article

- FedEx Express Pilots Vote in Support of Strike

- Pilots of FedEx Express, a unit of FedEx Corp., have voted [Full Story]

- BP to Pay Record $40M to Settle Air Pollution Charges

- A subsidiary of BP plc will pay a record-setting $40 million penalty [Full Story]

- US Single-Family Homebuilding, Permits Rise

- U.S. single-family homebuilding increased in April, but data for the [Full Story]

- Newsmax Beat CNN in Prime Time Friday

- Newsmax is crushing the competition and last Friday became the [Full Story]

- Trump: CNN Wants to Fire Licht After Town Hall Ratings Boon |video

- Trump: Newsmax ‘Really Going Up Like a Rocket Ship’ |video

- Poll: Fed to Keep Rates Untouched, Default Risk High

- The U.S. Federal Reserve will hold its key interest rate steady this [Full Story]

- Study: New Treatment Halts Dementia Progression

- Scientists have discovered that sodium selenate could be the magic [Full Story]

- Gallup: Just 1 in 5 Think Buying a Home a Good Idea

- Americans have had a big change of heart about buying a home in the [Full Story]

- US Urges ‘Restraint’ Ahead of Jerusalem Flag March in Old City

- With the annual Jerusalem Day Flag March set for Thursday, U.S. State [Full Story]

- Grand Jury Indicts Man in 4 University of Idaho Stabbing Deaths

- A grand jury has indicted a man who was already charged in the [Full Story]

- Pope Takes Cellphone Call During General Audience

- The Vatican’s Wednesday general audiences are often chances for [Full Story]

- WHO Warns Against Using AI in Healthcare

- The World Health Organization called for caution on Tuesday in using [Full Story]

- DOJ Watchdog: US Attorney in Mass. Tried to Influence DA Election

- The top federal prosecutor in Massachusetts, who has announced her [Full Story]

- Trump Slams ‘Impotent’ Barr After Durham Report

- Former President Donald Trump lashed out at former Attorney General [Full Story]

- Top Pentagon Policymaker Kahl Stepping Down

- Colin Kahl, the Pentagon’s top policymaker, is planning to leave his [Full Story]

- DeSantis Signs Measure Banning Gender Treatments for Kids

- Florida Republican Gov. Ron DeSantis signed a bill into law Wednesday [Full Story]

- DeSantis, ‘Cronies’ Accused of Intimidating Lawmakers

- The Trump campaign fired its latest salvo before Florida GOP Gov. Ron [Full Story] | video

- US Power Grids Vulnerable to Extreme Heat This Summer

- Large parts of the United States and some areas in Canada, home to [Full Story]

- Gallup: 17 Percent of Adults Being Treated for Depression

- According to a recentGallup survey, clinical depression rates in [Full Story]

- Finance

- Gallup: Just 1 in 5 Think Buying a Home a Good Idea

- Americans have had a big change of heart about buying a home in the past year, with a record low of just 21% saying now is a good time to buy a home, a new Gallup poll shows…. [Full Story]

- Judd Dunning: Americans Don’t Want to Fail and They Want Trump Back to Lead

- Elizabeth Holmes to Begin 11-Year Prison Term May 30

- Steve Cohen ‘Pretty Bullish’ on Markets Because of AI

- Lauren Fix, The Car Coach: The 2023 Toyota Highlander Might Beat the KIA Telluride

- Health

- Scientists Find Gene Protective Against Alzheimer’s

- Researchers have discovered a genetic mutation that should actively protect people from Alzheimer’s, thanks to a man belonging to a Colombian family known to be susceptible to the degenerative brain disease. Based on his family’s genetics, this unnamed patient should have…… [Full Story]

- FDA Flags Safety Risks of Fatty Liver Treatment

- Swallowable Gastric Balloon Effective for Weight Loss

- Early Blood Test Determines Cause of Pregnancy Loss

- Infertility is Common, Insurance Coverage Limited

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

2022 was a tough year for many stocks. Unfortunately, that pattern held true for manufactured home industry (MHVille) connected stocks too.

See the facts, linked below.

====================================

Updated

-

-

- NOTE 1: The 3rd chart above of manufactured housing connected equities includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry finance lender.

- NOTE 2: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE 3: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

- Note 4: some recent or related reports to the REITs, stocks, and other equities named above follow in the reports linked below.

-

2023 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

- Manufactured housing, production, factories, retail, dealers, manufactured home, communities, passive mobile home park investing, suppliers, brokers, finance, financial services, macro-markets, manufactured housing stocks, Manufactured Home Communities Real Estate Investment Trusts, MHC REITs.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.