Yahoo News had the ominous headline: “BlackRock — the world’s largest asset manager — says central banks are ‘deliberately’ causing recessions and warns of a downturn unlike any other.” BlackRock has investments in manufactured housing, as regular and detail minded readers of MHProNews know. Yahoo News is referring to a research document published by BlackRock that opens with this notion: “The Great Moderation, the four-decade period of largely stable activity and inflation, is behind us. The new regime of greater macro and market volatility is playing out. A recession is foretold; central banks are on course to overtighten policy as they seek to tame inflation.” That will be Part I (A) of today’s report, which will be followed by Part I (B) that includes some linked information and analysis in brief. Part II will be the media release from Cavco Industries (CVCO) about their most recent quarterly results. Part II (A) will include the vast majority of their release and will be followed in Part II (B) with a brief analysis and commentary that includes linked information. Part III of today’s report will be the manufactured housing connected stocks and Real Estate Investment Trusts (REITs) updates for manufactured home community equities. Part III also includes our signature left (CNN) and right (Newsmax) ‘market moving’ news headlines recap. In a matter of moments, insights on key macro topics and a review of manufactured home stocks can be accomplished.

Part I (A)

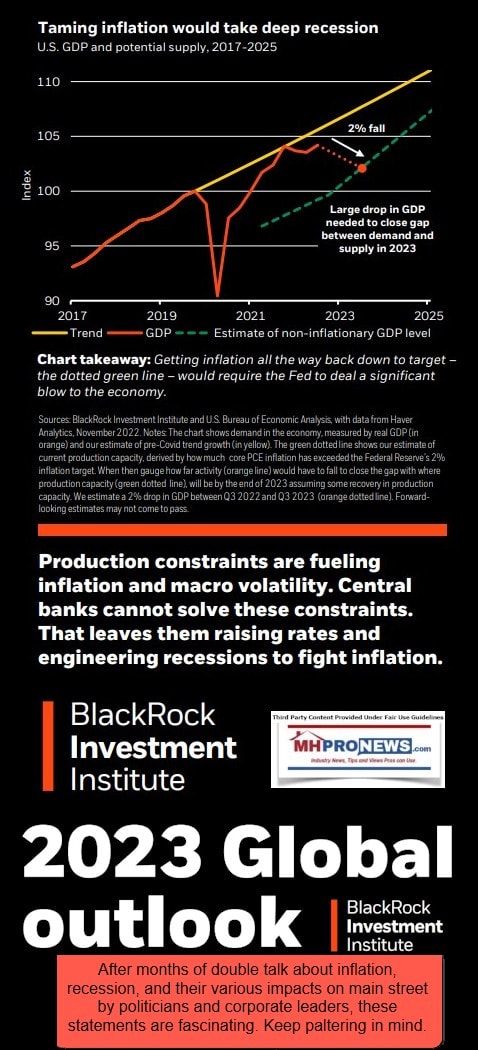

From the BlackRock BII White Paper document for 2023 are these statements.

“We laid out in our 2022 midyear outlook why we had entered a new regime – and are seeing it play out in persistent inflation and output volatility, central banks pushing policy rates up to levels that damage economic activity, rising bond yields and ongoing pressure on risk assets.

Central bankers won’t ride to the rescue when growth slows in this new regime, contrary to what investors have come to expect. They are deliberately causing recessions by overtightening policy to try to rein in inflation. That makes recession foretold. We see central banks eventually backing off from rate hikes as the economic damage becomes reality. We expect inflation to cool but stay persistently higher than central bank targets of 2%.

What matters most, we think, is how much of the economic damage is already reflected in market pricing. This is why pricing the damage is our first 2023 investment theme.” Their entire report BlackRock Investment Institute (BII) ‘white paper’ is linked here.

Per Yahoo News: “BlackRock — the world’s largest asset manager — says central banks are ‘deliberately’ causing recessions and warns of a downturn unlike any other” are the following statements regarding the BlackRock 2023 outlook report. Notice: in reporting these items, it must not be presumed that MHProNews is endorsing BlackRock as an investment or their statements. These insights and views shown are those of the party reporting them. That said, per Yahoo News is the following.

“Recession is foretold as central banks race to try to tame inflation,” BlackRock’s team of strategists write in their 2023 Global Outlook.

In fact, the strategists believe that central banks are “deliberately causing recessions by overtightening policy” in an effort to bring price levels under control.

In the past, when the economy entered a downturn, the Fed typically stepped in to help. But due to the cause of this projected recession, BlackRock says we can’t count on the central bank.

“Central bankers won’t ride to the rescue when growth slows in this new regime, contrary to what investors have come to expect.” ##

Part I (B) Additional Information with MHProNews Analysis and Commentary

In the Private Equity Stakeholders Project report entitled “PRIVATE EQUITY GIANTS CONVERGE ON MANUFACTURED HOMES” which had the subtitle: “How private equity is manufacturing homelessness & communities are fighting back” is this pull quote: “Vanguard Group, Fidelity, Blackrock, and Cohen & Steers are Equity Lifestyle Properties’ largest investors.132”

Benzinga, citing the SEC “SCHEDULE 13G” on 12.31.2022 pointed to BlackRock’s ongoing stake in Equity LifeStyle Properties (ELS).

BlackRock, per PiOnline on 10.13.2022, said that they had assets under management (AUM) of: “Specifically, AUM totaled about $7.96 trillion at the end of the third quarter of 2022, down from about $9.46 trillion at the end of the year” 2021. That’s an apparent decline of $1.5 trillion dollars in asset value for the private equity giant. To compare that to Clayton Homes parent company, Berkshire Hathaway (BRK), “Berkshire Hathaway total assets for the quarter ending September 30, 2022 were $902.296B, a 2.01% decline year-over-year” per MacroTrends. So, BlackRock is over 8 times the total assets of Berkshire.

BlackRock is one of the private equity giants that ‘red state’ attorneys general and other state officials have targeted for probes or a pull-back on investing in it, due to their ESG and generally left-leaning stance. See the reports linked further below.

A BlackRock executive are among the several hundred firms involved in the Civic Alliance nonprofit’s various initiatives, per reports from sources that include left-leaning CNN. “Hundreds of prominent executives from high-profile companies, including Amazon, Google, BlackRock and Starbucks, signed a statement that opposes discriminatory legislation that makes voting harder.”

Warren E. Buffett is another one of the letter’s signatories. So is Michael Bloomberg and other notables. That Civic Alliance organized letter they signed onto – plus the various signatories and corporate interests named that were involved – are linked here.

While it sounds grand that they are ‘for democracy’ – and claim to support the “Black Economic Alliance,” these often left-leaning corporate leaders ought to be quizzed on how that so-called ‘support’ plays out in the real world. The Civic Alliance broadly was a de facto supporter for the Biden White House residency.

BlackRock, Berkshire Hathaway, longtime Buffett ally in business, politics and philanthro-feudalism William “Bill” Gates III, are also among scores of corporate interests that support the World Economic Forum (WEF). See Civic Alliance and WEF business ties in the document linked here. Note that list is per those organizations, so it isn’t speculative.

Some have hyped these individuals, corporate, and nonprofits interests as a type of contemporary neo-feudalistic ‘shadow government.’ What is certain is that they demonstrably wield an outside sized influence on national and even international politics, and thus economic trends. They further wield an outsized influence on media, big tech, and a range of ‘information’ sources, as the WND op-ed by Kovach linked here documented and unpacked. See the linked reports to learn more.

Cavco Industries Reports Fiscal 2023 Third Quarter Results and Provides Business Updates

Cavco Industries, Inc.

Thu, February 2, 2023 at 4:05 PM EST

Cavco Industries, Inc.

Third Quarter Highlights

- Net revenue increased to $501 million, or 16.0%, compared to $432 million in the third quarter of the prior year.

- Income before income taxes increased to $76 million, or 29%, compared to $59 million in the prior year period.

- Gross profit as a percentage of Net revenue was 26.4%, with Factory-built housing gross profit as a percentage of Net revenue at 25.5%.

- Net income per diluted share attributable to Cavco common stockholders totaled $6.66 compared to $8.57 in the prior year quarter. The prior year period includes a $3.23 per share favorable benefit from energy efficient home tax credits, which included catch up credits for homes sold between 2018 through 2021.

- Backlogs were $427 millionat the end of the quarter, down $224 million sequentially from three months prior.

- Stock repurchases were $34 million, with $73 million repurchased fiscal year to date.

- Operations commenced at our manufacturing facility in Hamlet, North Carolina.

Commenting on the quarter, President and Chief Executive Officer Bill Boor said, “Our team continues to deliver outstanding performance despite rising interest rates, high inflation and uncertainty in the general economy. The market has clearly shifted over the past few quarters, but our manufacturing and retail operators are doing what they do best — staying nimble, keeping costs as variable as possible to tightly manage margins and maintaining strong teams ready for the inevitable return to an under-supplied market.”

He continued, “Our balance sheet remains strong with over $280 million in cash after the acquisition of Solitaire Homes, which closed subsequent to quarter end on January 3rd. We remain focused on providing quality affordable homes, and we are well positioned to continue growing and helping more families achieve the dream of home ownership.”

Financial Results

| Three Months Ended | ||||||||||||||

| ($ in thousands, except revenue per home sold) | December 31, 2022 |

January 1, 2022 |

Change | |||||||||||

| Net revenue | ||||||||||||||

| Factory-built housing | $ | 481,193 | $ | 413,590 | $ | 67,603 | 16.3 | % | ||||||

| Financial services | 19,410 | 18,124 | 1,286 | 7.1 | % | |||||||||

| $ | 500,603 | $ | 431,714 | $ | 68,889 | 16.0 | % | |||||||

| Factory-built modules sold | 7,544 | 7,645 | (101 | ) | (1.3 | )% | ||||||||

| Factory-built homes sold (consisting of one or more modules) | 4,442 | 4,424 | 18 | 0.4 | % | |||||||||

| Net factory-built housing revenue per home sold | $ | 108,328 | $ | 93,488 | $ | 14,840 | 15.9 | % | ||||||

| Nine Months Ended | ||||||||||||||

| ($ in thousands, except revenue per home sold) | December 31, 2022 |

January 1, 2022 |

Change | |||||||||||

| Net revenue | ||||||||||||||

| Factory-built housing | $ | 1,613,392 | $ | 1,067,967 | $ | 545,425 | 51.1 | % | ||||||

| Financial services | 52,941 | 53,712 | (771 | ) | (1.4 | )% | ||||||||

| $ | 1,666,333 | $ | 1,121,679 | $ | 544,654 | 48.6 | % | |||||||

| Factory-built modules sold | 25,649 | 20,219 | 5,430 | 26.9 | % | |||||||||

| Factory-built homes sold (consisting of one or more modules) | 14,899 | 11,721 | 3,178 | 27.1 | % | |||||||||

| Net factory-built housing revenue per home sold | $ | 108,289 | $ | 91,116 | $ | 17,173 | 18.8 | % | ||||||

- In the factory-built housing segment, the increase in Net revenue for both the three and nine months was due to higher home sales volume and higher home selling prices.

- Financial services segment Net revenue increased for the three months from more insurance policies in force in the current period. For the nine months, Net revenue decreased modestly related to the market performance of the equity securities in the insurance subsidiary’s portfolio during the current period and lower interest income earned on the acquired consumer loan portfolios that continue to amortize as expected. These items were partially offset by more insurance policies in force in the current year compared to the prior year.

| Three Months Ended | ||||||||||||||

| ($ in thousands) | December 31, 2022 |

January 1, 2022 |

Change | |||||||||||

| Gross Profit | ||||||||||||||

| Factory-built housing | $ | 122,923 | $ | 104,119 | $ | 18,804 | 18.1 | % | ||||||

| Financial services | 9,045 | 11,089 | (2,044 | ) | (18.4 | )% | ||||||||

| $ | 131,968 | $ | 115,208 | $ | 16,760 | 14.5 | % | |||||||

| Gross profit as % of Net revenue | ||||||||||||||

| Consolidated | 26.4 | % | 26.7 | % | N/A | (0.3 | )% | |||||||

| Factory-built housing | 25.5 | % | 25.2 | % | N/A | 0.3 | % | |||||||

| Financial services | 46.6 | % | 61.2 | % | N/A | (14.6 | )% | |||||||

| Selling, general and administrative expenses | ||||||||||||||

| Factory-built housing | $ | 54,127 | $ | 55,735 | $ | (1,608 | ) | (2.9 | )% | |||||

| Financial services | 4,777 | 4,587 | 190 | 4.1 | % | |||||||||

| $ | 58,904 | $ | 60,322 | $ | (1,418 | ) | (2.4 | )% | ||||||

| Income from Operations | ||||||||||||||

| Factory-built housing | $ | 68,796 | $ | 48,384 | $ | 20,412 | 42.2 | % | ||||||

| Financial services | 4,268 | 6,502 | (2,234 | ) | (34.4 | )% | ||||||||

| $ | 73,064 | $ | 54,886 | $ | 18,178 | 33.1 | % | |||||||

| Nine Months Ended | ||||||||||||||

| ($ in thousands) | December 31, 2022 |

January 1, 2022 |

Change | |||||||||||

| Gross Profit | ||||||||||||||

| Factory-built housing | $ | 412,174 | $ | 252,691 | $ | 159,483 | 63.1 | % | ||||||

| Financial services | 22,117 | 26,458 | (4,341 | ) | (16.4 | )% | ||||||||

| $ | 434,291 | $ | 279,149 | $ | 155,142 | 55.6 | % | |||||||

| Gross profit as % of Net revenue | ||||||||||||||

| Consolidated | 26.1 | % | 24.9 | % | N/A | 1.2 | % | |||||||

| Factory-built housing | 25.5 | % | 23.7 | % | N/A | 1.8 | % | |||||||

| Financial services | 41.8 | % | 49.3 | % | N/A | (7.5 | )% | |||||||

| Selling, general and administrative expenses | ||||||||||||||

| Factory-built housing | $ | 176,690 | $ | 131,579 | $ | 45,111 | 34.3 | % | ||||||

| Financial services | 15,244 | 14,947 | 297 | 2.0 | % | |||||||||

| $ | 191,934 | $ | 146,526 | $ | 45,408 | 31.0 | % | |||||||

| Income from Operations | ||||||||||||||

| Factory-built housing | $ | 235,484 | $ | 121,112 | $ | 114,372 | 94.4 | % | ||||||

| Financial services | 6,873 | 11,511 | (4,638 | ) | (40.3 | )% | ||||||||

| $ | 242,357 | $ | 132,623 | $ | 109,734 | 82.7 | % | |||||||

- In the factory-built housing segment, the gross profit percentage and total Gross profit for both the three and nine months increased from higher home sales prices.

- In the financial services segment, Gross profit and Income from operations for the three and nine months were negatively affected by higher insurance claims from Arizona and North Texas weather related events compared to the same period last year.

- Selling, general and administrative expenses for the three months decreased as the prior year quarter included higher contractor fees related to the claiming of the energy efficient home credits. This was partially offset by higher incentive compensation on improved earnings. For the nine months, Selling, general and administrative expenses increased from higher compensation on improved earnings and higher legal and professional fees.

| Three Months Ended | ||||||||||||||

| ($ in thousands, except per share amounts) | December 31, 2022 |

January 1, 2022 |

Change | |||||||||||

| Net Income attributable to Cavco common stockholders | $ | 59,524 | $ | 79,419 | $ | (19,895 | ) | (25.1 | )% | |||||

| Diluted net income per share | $ | 6.66 | $ | 8.57 | $ | (1.91 | ) | (22.3 | )% | |||||

| Nine Months Ended | ||||||||||||||

| ($ in thousands, except per share amounts) | December 31, 2022 |

January 1, 2022 |

Change | |||||||||||

| Net Income attributable to Cavco common stockholders | $ | 193,242 | $ | 144,075 | $ | 49,167 | 34.1 | % | ||||||

| Diluted net income per share | $ | 21.55 | $ | 15.54 | $ | 6.01 | 38.7 | % | ||||||

- For the three and nine months ended January 1, 2022, income taxes resulted in a benefit of $20.7 million and $0.9 million, respectively, due to $34.4 million of net tax credits related to the construction and sale of energy efficient homes in the calendar years 2018 through 2021. The current year periods include $2.4 million and $5.1 million, respectively, for homes sold during calendar year 2022 as the program was extended in the Consolidated Appropriations Act of 2021.

Items ancillary to our core operations had the following impact on the results of operations:

| Three Months Ended | Nine Months Ended | ||||||||||||||

| ($ in millions) | December 31, 2022 |

January 1, 2022 |

December 31, 2022 |

January 1, 2022 |

|||||||||||

| Net revenue | |||||||||||||||

| Unrealized gains (losses) recognized during the period on securities held in the financial services segment | $ | 0.7 | $ | 0.5 | $ | (0.5 | ) | $ | 0.4 | ||||||

| Selling, general and administrative expenses | |||||||||||||||

| Expenses incurred in engaging third-party consultants in relation to the non-recurring energy efficient home tax credits | (0.6 | ) | (5.8 | ) | (5.1 | ) | (6.2 | ) | |||||||

| Legal and other expense related to the SEC inquiry, net of recovery | (0.8 | ) | (0.6 | ) | (3.6 | ) | (1.2 | ) | |||||||

| Acquisition related deal costs | (0.5 | ) | — | (0.6 | ) | (2.4 | ) | ||||||||

| Other income, net | |||||||||||||||

| Corporate unrealized (losses) gains recognized during the period on securities held | (0.1 | ) | 2.3 | (1.2 | ) | 4.0 | |||||||||

| Gain on consolidation of equity method investment | — | — | — | 3.3 | |||||||||||

| Income tax (expense) benefit | |||||||||||||||

| Energy efficient home tax credits, net | 2.4 | 34.4 | 5.1 | 34.4 | |||||||||||

| Tax benefits from stock option exercises | 0.4 | 0.6 | 0.4 | 1.3 | |||||||||||

Housing Demand and Production Updates

Our backlog at December 31, 2022 was $427 million compared to $651 million last quarter, a decrease of $224 million or 34%. This was largely due to lower home order rates net of cancellations. Order rates are down from the extreme highs we saw during the summer of 2020 to the summer of 2021. For the third fiscal quarter of 2023, our capacity utilization was approximately 65% over all available production days, but was approximately 80% excluding market and weather driven downtime.

Acquisition of Solitaire Homes

As announced on January 3, 2023, we completed the acquisition of the business of Solitaire Homes, including its four manufacturing facilities, twenty-two retail locations and its dedicated transportation operations. The addition of Solitaire Homes strengthens our position in the Southwest, with high quality products that complement our existing home offerings. The purchase price totaled $93 million, before certain customary adjustments, and was funded with cash on hand.

Conference Call Details

Cavco’s management will hold a conference call to review these results tomorrow, February 3, 2023, at 1:00 p.m. (Eastern Time). Interested parties can access a live webcast of the conference call on the Internet at https://investor.cavco.com or via telephone. To participate by phone, please register here to receive the dial in number and your PIN. An archive of the webcast and presentation will be available for 90 days at https://investor.cavco.com.

About Cavco

Cavco Industries, Inc., headquartered in Phoenix, Arizona, designs and produces factory-built housing products primarily distributed through a network of independent and Company-owned retailers. We are one of the largest producers of manufactured and modular homes in the United States, based on reported wholesale shipments. Our products are marketed under a variety of brand names including Cavco, Fleetwood, Palm Harbor, Nationwide, Fairmont, Friendship, Chariot Eagle, Destiny, Commodore, Colony, Pennwest, R-Anell, Manorwood, MidCountry and Solitaire. We are also a leading producer of park model RVs, vacation cabins and factory-built commercial structures. Cavco’s finance subsidiary, CountryPlace Mortgage, is an approved Fannie Mae and Freddie Mac seller/servicer and a Ginnie Mae mortgage-backed securities issuer that offers conforming mortgages, non-conforming mortgages and home-only loans to purchasers of factory-built homes. Our insurance subsidiary, Standard Casualty, provides property and casualty insurance to owners of manufactured homes.

Forward-Looking Statements

Certain statements contained in this release are forward-looking statements. In general, all statements that are not historical in nature are forward-looking. Forward-looking statements are typically included, for example, in discussions regarding the manufactured housing industry; our financial performance and operating results; and the expected effect of certain risks and uncertainties on our business, financial condition and results of operations. All forward-looking statements are subject to risks and uncertainties, many of which are beyond our control. As a result, our actual results or performance may differ materially from anticipated results or performance. Factors that could cause such differences to occur include, but are not limited to: the impact of local or national emergencies including the COVID-19 pandemic, including such impacts from state and federal regulatory action that restricts our ability to operate our business in the ordinary course and impacts on (i) customer demand and the availability of financing for our products, (ii) our supply chain and the availability of raw materials for the manufacture of our products, (iii) the availability of labor and the health and safety of our workforce and (iv) our liquidity and access to the capital markets; labor shortages and the pricing and availability of transportation or raw materials; increased health and safety incidents; our ability to negotiate reasonable collective bargaining agreements with the unions representing certain employees; increases in the rate of cancellations of home sales orders; our ability to successfully integrate past acquisitions or future acquisitions; involvement in vertically integrated lines of business, including manufactured housing consumer finance, commercial finance and insurance; information technology failures or cyber incidents; our ability to maintain the security of personally identifiable information of our customers, suppliers and employees; our participation in certain financing programs for the purchase of our products by industry distributors and consumers, which may expose us to additional risk of credit loss; our exposure to significant warranty and construction defect claims; our exposure to claims and liabilities relating to products supplied to the Company or work done by subcontractors; our contingent repurchase obligations related to wholesale financing provided to industry distributors; a write-off of all or part of our goodwill; our ability to maintain relationships with independent distributors; our business and operations being concentrated in certain geographic regions; taxation authorities initiating or successfully asserting tax positions which are contrary to ours; governmental and regulatory disruption, including prolonged delays by Congress and the President to approve budgets or continuing appropriations resolutions to facilitate the operation of the federal government; curtailment of available financing from home-only lenders and increased lending regulations; the effect of increasing interest rates on our customer’s ability to finance home purchases; availability of wholesale financing and limited floor plan lenders; market forces, rising interest rates and housing demand fluctuations; the cyclical and seasonal nature of our business; competition; general deterioration in economic conditions and turmoil in the financial markets; unfavorable zoning ordinances; extensive regulation affecting the production and sale of manufactured housing; potential financial impact on the Company from the recently settled regulatory action by the SEC against the Company, including potential higher insurance costs as a result of such action, potential reputational damage that the Company may suffer and the Company’s potential ongoing indemnification obligations related to ongoing litigation not involving the Company; losses not covered by our director and officer insurance, which may be large, adversely impacting financial performance; loss of any of our executive officers; liquidity and ability to raise capital may be limited; and organizational document provisions delaying or making a change in control more difficult; together with all of the other risks described in our filings with the SEC. Readers are specifically referred to the Risk Factors described in Item 1A of the Company’s Annual Report on Form 10-K for the year ended April 2, 2022 as may be updated from time to time in future filings on Form 10-Q and other reports filed by the Company pursuant to the Securities Exchange Act of 1934, which identify important risks that could cause actual results to differ from those contained in the forward-looking statements. Cavco expressly disclaims any obligation to update any forward-looking statements contained in this release, whether as a result of new information, future events or otherwise, as required by law. Investors should not place undue reliance on any such forward-looking statements.

CAVCO INDUSTRIES, INC.

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except per share amounts)

| December 31, 2022 |

April 2, 2022 |

||||||

| ASSETS | (Unaudited) | ||||||

| Current assets | |||||||

| Cash and cash equivalents | $ | 376,148 | $ | 244,150 | |||

| Restricted cash, current | 9,911 | 14,849 | |||||

| Accounts receivable, net | 80,062 | 96,052 | |||||

| Short-term investments | 16,607 | 20,086 | |||||

| Current portion of consumer loans receivable, net | 13,763 | 20,639 | |||||

| Current portion of commercial loans receivable, net | 33,899 | 32,272 | |||||

| Current portion of commercial loans receivable from affiliates, net | 298 | 372 | |||||

| Inventories | 215,458 | 243,971 | |||||

| Prepaid expenses and other current assets | 86,408 | 71,726 | |||||

| Total current assets | 832,554 | 744,117 | |||||

| Restricted cash | 335 | 335 | |||||

| Investments | 21,822 | 34,933 | |||||

| Consumer loans receivable, net | 26,903 | 29,245 | |||||

| Commercial loans receivable, net | 40,727 | 33,708 | |||||

| Commercial loans receivable from affiliates, net | 3,049 | 2,214 | |||||

| Property, plant and equipment, net | 194,329 | 164,016 | |||||

| Goodwill | 100,577 | 100,993 | |||||

| Other intangibles, net | 26,948 | 28,459 | |||||

| Operating lease right-of-use assets | 17,230 | 16,952 | |||||

| Total assets | $ | 1,264,474 | $ | 1,154,972 | |||

| LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST, AND STOCKHOLDERS’ EQUITY | |||||||

| Current liabilities | |||||||

| Accounts payable | $ | 26,788 | $ | 43,082 | |||

| Accrued expenses and other current liabilities | 251,635 | 251,088 | |||||

| Total current liabilities | 278,423 | 294,170 | |||||

| Operating lease liabilities | 13,058 | 13,158 | |||||

| Other liabilities | 7,898 | 10,836 | |||||

| Deferred income taxes | 8,663 | 5,528 | |||||

| Redeemable noncontrolling interest | 932 | 825 | |||||

| Stockholders’ equity | |||||||

| Preferred stock, $0.01 par value; 1,000,000 shares authorized; No shares issued or outstanding | — | — | |||||

| Common stock, $0.01 par value; 40,000,000 shares authorized; Issued 9,319,700 and 9,292,278 shares, respectively | 93 | 93 | |||||

| Treasury stock, at cost; 556,344 and 241,773 shares, respectively | (134,270 | ) | (61,040 | ) | |||

| Additional paid-in capital | 268,423 | 263,049 | |||||

| Retained earnings | 821,998 | 628,756 | |||||

| Accumulated other comprehensive loss | (744 | ) | (403 | ) | |||

| Total stockholders’ equity | 955,500 | 830,455 | |||||

| Total liabilities, redeemable noncontrolling interest and stockholders’ equity | $ | 1,264,474 | $ | 1,154,972 | |||

CAVCO INDUSTRIES, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per share amounts)

(Unaudited)

| Three Months Ended | Nine Months Ended | ||||||||||||||

| December 31, 2022 |

January 1, 2022 |

December 31, 2022 |

January 1, 2022 |

||||||||||||

| Net revenue | $ | 500,603 | $ | 431,714 | $ | 1,666,333 | $ | 1,121,679 | |||||||

| Cost of sales | 368,635 | 316,506 | 1,232,042 | 842,530 | |||||||||||

| Gross profit | 131,968 | 115,208 | 434,291 | 279,149 | |||||||||||

| Selling, general and administrative expenses | 58,904 | 60,322 | 191,934 | 146,526 | |||||||||||

| Income from operations | 73,064 | 54,886 | 242,357 | 132,623 | |||||||||||

| Interest expense | (216 | ) | (209 | ) | (610 | ) | (576 | ) | |||||||

| Other income, net | 3,233 | 4,258 | 6,455 | 11,387 | |||||||||||

| Income before income taxes | 76,081 | 58,935 | 248,202 | 143,434 | |||||||||||

| Income tax (expense) benefit | (16,492 | ) | 20,680 | (54,721 | ) | 910 | |||||||||

| Net income | 59,589 | 79,615 | 193,481 | 144,344 | |||||||||||

| Less: net income attributable to redeemable noncontrolling interest | 65 | 196 | 239 | 269 | |||||||||||

| Net income attributable to Cavco common stockholders | $ | 59,524 | $ | 79,419 | $ | 193,242 | $ | 144,075 | |||||||

| Net income per share attributable to Cavco common stockholders | |||||||||||||||

| Basic | $ | 6.71 | $ | 8.66 | $ | 21.72 | $ | 15.68 | |||||||

| Diluted | $ | 6.66 | $ | 8.57 | $ | 21.55 | $ | 15.54 | |||||||

| Weighted average shares outstanding | |||||||||||||||

| Basic | 8,870,565 | 9,174,224 | 8,897,405 | 9,187,828 | |||||||||||

| Diluted | 8,936,075 | 9,270,438 | 8,969,104 | 9,270,855 | |||||||||||

CAVCO INDUSTRIES, INC.

OTHER OPERATING DATA

(Dollars in thousands)

(Unaudited)

| Three Months Ended | Nine Months Ended | ||||||||||||||

| December 31, 2022 |

January 1, 2022 |

December 31, 2022 |

January 1, 2022 |

||||||||||||

| Capital expenditures | $ | 7,662 | $ | 4,267 | $ | 40,850 | $ | 8,938 | |||||||

| Depreciation | $ | 3,389 | $ | 3,037 | $ | 10,663 | $ | 5,888 | |||||||

| Amortization of other intangibles | $ | 501 | $ | 523 | $ | 1,511 | $ | 862 | |||||||

Their contact information is omitted.

Part II (B) Additional Information with More MHProNews Analysis and Commentary

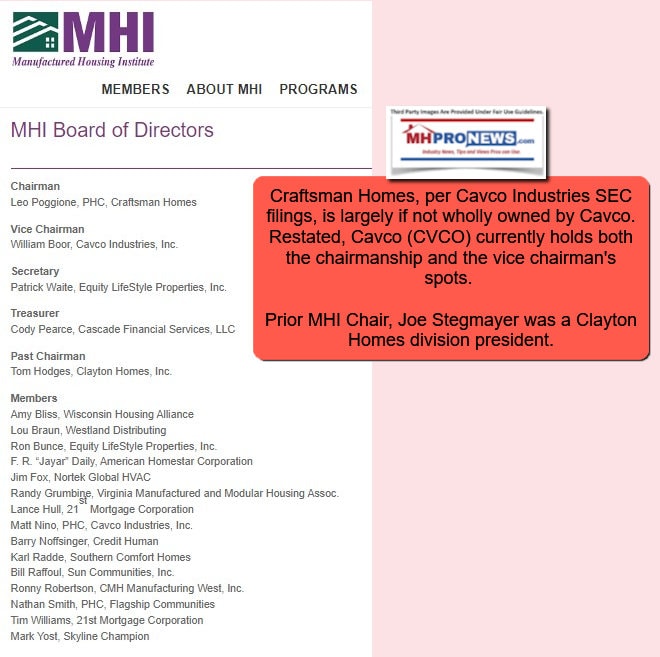

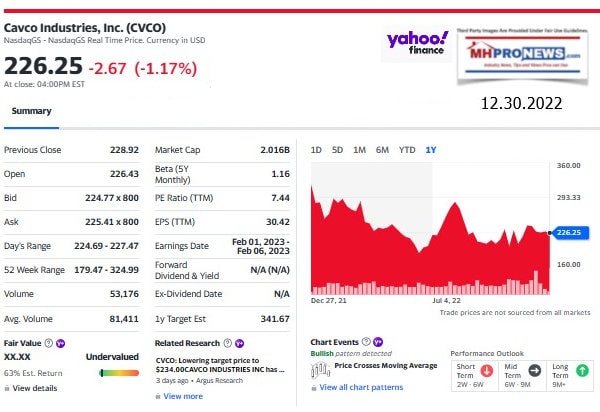

For an operation a fraction of the size of Clayton Homes and their related lending (21st Mortgage Corporation and Vanderbilt Mortgage and Finance (VMF), Cavco has played an outsized role at MHI for a number of years. They essentially hold not one, but two Manufactured Housing Institute (MHI) executive committee seats, per a look at the MHI base document shown below. The MHI chairman, Leo Poggione firm – Craftsman Homes – is essentially a Cavco subsidiary. Note that the first 5 posts named are the so-called MHI Executive Committee.

The MHI vice chairman, William “Bill” Boor is the top dog at Cavco Industries following the fall of Joseph “Joe” Stegmayer in the wake of the Securities and Exchange Commission (SEC) probe and suit that Cavco recently settled. Manufactured housing ought to be soaring, per the facts and their common-sense implications detailed in the reports linked below. For example, mortgage giant Freddie Mac fresh research found in the report posted below states that some 25 million renters are “mortgage ready” and are living in “MH friendly” zones.

That being so, why did the manufactured housing downturn that MHProNews began reporting two months ago continue on for its third month, per the latest data shown below?

As the ‘first look’ at the data report linked above indicates, manufactured housing closed up for the year, but down in the last 3 months. Furthermore, December 2022 data shows a stunning slump in HUD Code manufactured home sales.

Cavco, and other prominent MHI members, must shoulder their respective part of the blame for that outrageous outcome. More on this will be part of a planned report for Sunday 2.5.2023 and Monday 2.6.2023. Watch for them. Until then, check out the prior reports for additional factual, evidence-based, and commonsense takeaways from the facts presented, which routinely include the sources being critiqued.

The comment below by an MHI member executive. Overlook our typos and grammatical glitches,

and you’ll walk away with information you won’t find at any one source anywhere in MHVille.

Perhaps the quality of the data, evidence, MHVille expert analysis and commentary is what

makes and keeps us the runaway #1 trade media serving manufactured housing.

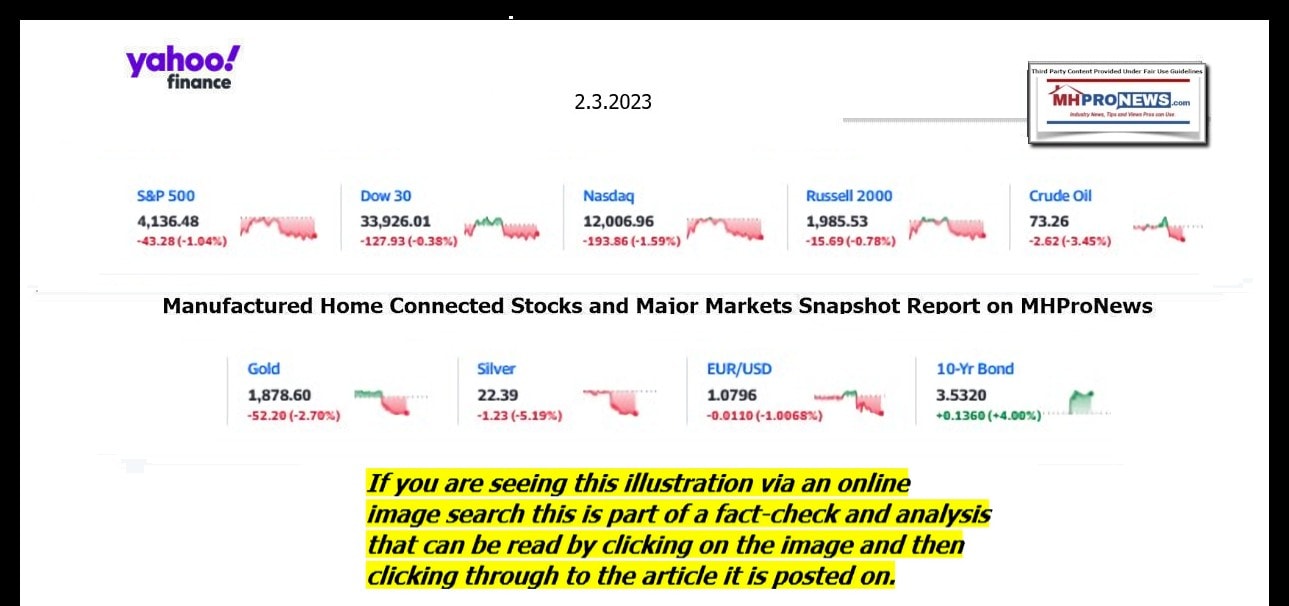

Part III. Daily Business News on MHProNews Markets Segment

The modifications of our prior Daily Business News on MHProNews format of the recap of yesterday evening’s market report are provided below. It still includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines. The macro market moves graphics will provide context and comparisons for those invested in or tracking manufactured housing connected equities.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 2.3.2023

- Jobs shocker

- Construction workers work on a building in Philadelphia, Wednesday, Dec. 21, 2022.

- Recession who? 3 key takeaways from the jaw-dropping January jobs report that bested economists’ expectations

- Astonishingly strong US jobs report sends stocks wavering

- The US economy added a whopping 517,000 jobs in January

- Why Twitter users are upset about the platform’s latest change

- Ford is getting back into Formula 1 racing to help sell EVs

- Offices are more than 50% filled for the first time since the pandemic started

- Adani market rout deepens as uproar brings Indian parliament to a halt

- Activision Blizzard settles SEC charges for $35 million

- Is the Fed ignoring long Covid in its inflation fight?

- Adani will ask Big 4 accounting firm for a ‘general audit,’ says TotalEnergies

- A U.S. flag is seen outside the New York Stock Exchange on January 26.

- LIVE UPDATES

- Latest jobs report shows even more growth than you think

- Hong Kong and Macao will fully reopen borders with mainland China

- ‘It turned bad in an instant’: CNN crew has close call in Ukraine as Russian missiles pummel their location

- Republicans are lashing out at DirecTV for supposedly ‘censoring’ conservative voices. Here’s what’s really going on

- Greenpeace activists scale Shell oil platform in the Atlantic Ocean as company announces record profits

- Meta wowed Wall Street, but investors remain skeptical about tech

- Mortgage rates fall for fourth week in a row

- ECB and Bank of England fight inflation with sharp interest rate hikes

- ‘The Daily Show’s’ Roy Wood Jr. selected as White House Correspondents’ Dinner entertainer

- Why a tiny American firm is taking aim at an Indian conglomerate

- A first generation iPhone going up for auction hopes to fetch $50,000

- Gautam Adani fails to calm investors as market wipeout hits $100 billion

- Blackouts and soaring prices: Pakistan’s economy is on the brink

- What to look for in Friday’s jobs report

- Shell profits double to record $40 billion

Notice: the graphic below can be expanded to a larger size.

See instructions below graphic, or click and follow the prompts.

Headlines from right-of-center Newsmax 2.3.2023

- ‘Gang of Eight’ Staff Briefed on China’s Mysterious Balloon

- Staff for the top congressional leaders from both parties were given a classified briefing Thursday on the Chinese balloon discovered floating above the U.S., says an NBC News report. [Full Story]

- Related Stories

- Pentagon Rejects China’s Claims That Balloon Is Not Spying

- KT McFarland to Newsmax: China Timed Balloon ‘Perfectly’

- US Pulls Plug on Blinken’s China Trip Over Spy Balloon

- Trump: ‘Shoot Down’ China’s Balloon

- Fred Fleitz to Newsmax: China Testing Biden With Spy Balloon

- DirecTV Censors Newsmax

- Michael Savage: DirecTV Shows Media’s ‘Sovietization’ | video

- Asa Hutchinson Urges Oversight for Firms Like DirecTV | video

- NYC Council’s GOP Delegation Speaks Out for Newsmax

- McCarthy: Hearings Will Cast ‘Sunlight’ on Censorship

- Texas AG: AT&T May Regret Viewer Discrimination | video

- Hannity Tweets Jon Voight’s Defense of Newsmax | video

- Morris and Sorbo: ‘Heartened’ by DirecTV Cancellations | video

- Jon Voight: ‘Speak Up’ Against DirecTV’s Censorship | video

- Op-Ed: Why Deplatforming Matters

- Fallon: Texans ‘Furious’ Over DirecTV’s Censorship | video

- Ted Cruz, Key Sens Demand DirecTV Answer for Action

- Dennis Prager: ‘Just Cancel DirecTV’ | video

- More Stories on AT&T DirecTV Censorship

- Newsmax TV

- Asa Hutchinson: Send ‘Strongest Message’ on China Balloon

- Asa Hutchinson: Send ‘Strongest Message’ on China Balloon | video

- Perry: Omar Ousted From Committee for National Security

- KT McFarland: China Timed Balloon ‘Perfectly’ | video

- Fallon: Biden’s Border Actions ‘Like a Clown Show’ | video

- Fred Fleitz: China Testing Biden With Spy Balloon | video

- Blaine Holt: China Balloon ‘Breach of Our National Security’ | video

- McCormick: Delay Ending COVID Emergency About Money, Power | video

- Van Drew: Ouster Shouldn’t Surprise Omar | video

- More Newsmax TV

- Newsfront

- Nearly 600,000 Migrants Released Into US Without Court Date

- Nearly 600,000 migrants who have crossed into the United States since 2021 have been released without being given a court date or even being charged, according to NBC News…. [Full Story]

- Schmitt Announces He’s Backing Trump in ’24

- Eric Schmitt, R-Mo., vowed to “support” former President Donald [Full Story]

- Wall Street Ends Down After Stunning Jobs Growth

- Major U.S. stock indexes ended lower Friday after surprisingly strong [Full Story]

- Calls to End Objective Journalism Are ‘Problematic’

- The re-emergence of “advocacy journalism” has coincided with a steady [Full Story] | Platinum Article

- Expert: Spy Balloon Could Be Dry Run to Deliver Nuclear EMP Device

- The high-altitude Chinese surveillance balloon that is traveling [Full Story]

- Interstate Migration Making Regions Redder, Bluer

- activists and political consultants are telling Bongino and Kaufman [Full Story] | Platinum Article

- DeSantis Complaint Accuses Venues of Sexual Behavior With Kids Present

- Florida’s Department of Business and Professional Regulation, under [Full Story]

- Germany Confirms Approval of Leopard 1 Tank Deliveries to Ukraine

- Germany has approved the export of Leopard 1 battle tanks to Ukraine [Full Story]

- Related

- Ukraine May Also Get Old Leopard 1 Tanks from German Stocks

- White House: Allow Russians in Olympics Under Neutral Flag

- White House Denies Ukraine Land Offered to Russia for Peace

- Putin Threatens West With Nukes, Teases Close Access to ‘Nuclear Football’

- GOP Rep. Spartz Not Seeking Reelection

- Victoria Spartz, R-Ind., will not run for “any office,” [Full Story]

- Report: Penn Successfully Lobbied DOJ to End China Initiative

- The University of Pennsylvania in 2022 successfully lobbied the [Full Story]

- US-China Relations Fray Over Suspected Spy Balloon

- The U.S. was tracking a suspected Chinese surveillance balloon [Full Story]

- Related

- Trump: ‘Shoot Down’ China’s Balloon

- Blaine Holt to Newsmax: China Balloon ‘Breach of Our National Security’ |video

- China Claims Balloon Is Meteorological Research Airship That Strayed

- With Rare China Trip, Blinken Aims to Steady Rocky Relationship

- CIA Chief Warns Against Underestimating Xi’s Ambitions Toward Taiwan

- Pentagon: Chinese Spy Balloon Spotted Over Western US

- Mother Pressing Charges Against Students Who Beat Her Kids on School Bus

- A Florida mother is pressing charges against the students who beat [Full Story]

- Power Prices Spike in Northeast as Arctic Blast Arrives

- Wholesale power prices jumped in the U.S. Northeast, with spot prices [Full Story]

- Rasmussen Poll: More Than Half Say Biden Shouldn’t Run in 2024

- A majority, 56% of likely voters, say President Joe Biden should not [Full Story]

- Man Charged With Attempted Firebombing of NJ Synagogue

- A 26-year-old man was arrested Wednesday in connection with the [Full Story]

- 9/10 Millennials Fail This Vintage Items Quiz

- Endeared

- Merck’s COVID Pill Linked to New Virus Mutations

- New research reveals that Merck & Co.’s popular antiviral drug, [Full Story]

- Unemployment Hits Half-Century Low as US Adds 517K Jobs

- America’s employers added a robust 517,000 jobs in January, a [Full Story]

- Musk Makes Surprise Appearance as Tesla Tweet Trial Wraps

- A high-profile trial focused on a 2018 tweet about the financing for [Full Story]

- NBC: Staff for ‘Gang of Eight’ Briefed About China Balloon

- Staff for the top congressional leaders from both parties were given [Full Story]

- Marjorie Taylor Greene to AOC: You ‘Lie About Me’

- Marjorie Taylor Greene, R-Ga., accused Rep. Alexandria [Full Story]

- Clyburn Urging Dems to Compromise on Police Reform

- Tim Scott, R-S.C., and Rep. James Clyburn, D-S.C., are in [Full Story] | video

- Sinema Faces Ethics Complaint Over Use of Staff

- Activist groups are calling on the Senate Ethics Committee to [Full Story]

- Secretary of State Blinken’s China Visit Postponed Over Spy Balloon

- Secretary of State Antony Blinken has postponed his planned trip to [Full Story]

- Trump: ‘Shoot Down’ China’s Balloon

- Former President Donald Trump called for the U.S. to shoot down a [Full Story]

- US Looks to Deter China With Philippines Pact

- President Joe Biden is aiming to deter China by expanding the U.S. [Full Story]

- Bill Gates on Musk Mars Plan: Not a Good Use of Money

- Bill Gates says SpaceX CEO Elon Musk’s goal of colonizing Mars isn’t [Full Story]

- NYC Council’s GOP Delegation Speaks Out for Newsmax

- New York City Council Republicans Friday came out in support of [Full Story]

- Kari Lake ‘Listening’ in Meeting With GOP Senate Group

- Former Arizona GOP gubernatorial candidate Kari Lake continues to [Full Story]

- Fed Likely to Lift Rates Above 5 Percent After Jobs Report

- The Federal Reserve is likely to deliver at least two more [Full Story]

- Buttigieg ‘Not Planning on Going Anywhere’

- Transportation Secretary Pete Buttigieg is getting questions about [Full Story]

- Trump Slams McCarthy Over Ashli Babbitt Comments

- Former President Donald Trump, proclaiming Ashli Babbitt was [Full Story]

- Best Car Insurance for Seniors Living in Florida

- Insured Smarter

- More Newsfront

- Finance

- US Credit Card Debt Jumps 18.5% to $930.6 Billion

- Americans’ total credit card debt reached a record $930.6 billion in the fourth quarter, up 18.5% from a year earlier, according to TransUnion, with much of that increase due to inflation…. [Full Story]

- Lauren Fix, The Car Coach: Global Elites’ Goal Is to Eliminate ALL Personal Cars

- Biden Hails Jobs Report, Waves Off Inflation

- Google, Apple, Amazon Give Investors Reason to Fret

- Twitter to Share Ad Revenue With Some Content Creators

- More Finance

- Health

- This Positive Habit Relieves Stress and Helps Your Heart

- New study findings reveal that practicing gratitude helps you process the psychological stresses of daily life. The researchers from the Universities of Maynooth and Limerick in Ireland also found that a more thankful worldview promotes better cardiovascular…… [Full Story]

- Study: Check-in Phone Calls Boost Survival in Heart Failure Patients

- New School Meals Proposal to Limit Sugar for First Time

- Health Benefits of an Insulin-Resistance Diet

- More Women Advised to Remove Fallopian Tubes to Prevent Ovarian Cancer

Notice: the graphic below can be expanded to a larger size.

See instructions below graphic, or click and follow the prompts.

====================================

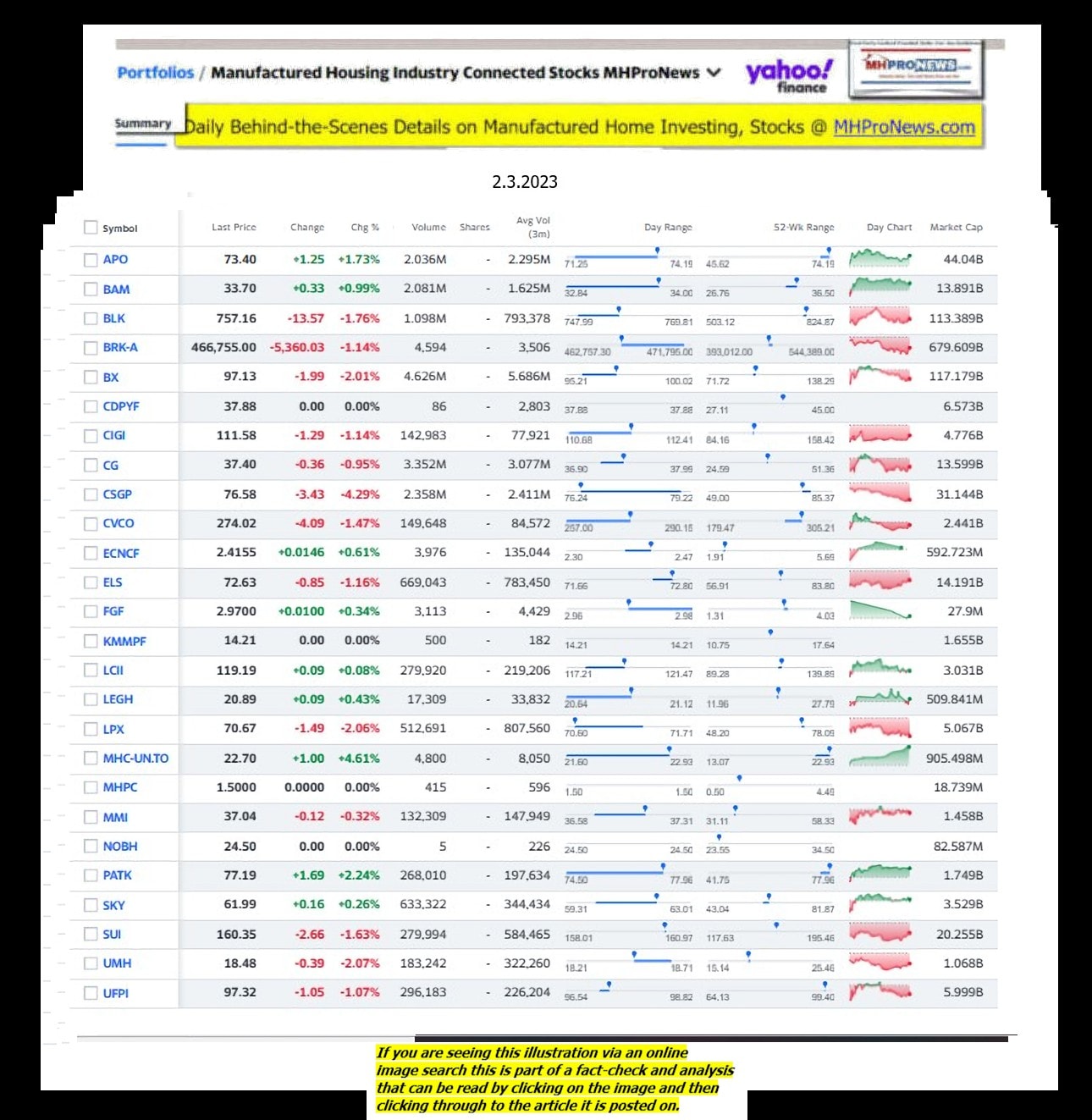

Updated

-

-

- NOTE 1: The 3rd chart above of manufactured housing connected equities includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry finance lender.

- NOTE 2: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE 3: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

- Note 4: some recent or related reports to the REITs, stocks, and other equities named above follow in the reports linked below.

-

2023 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.