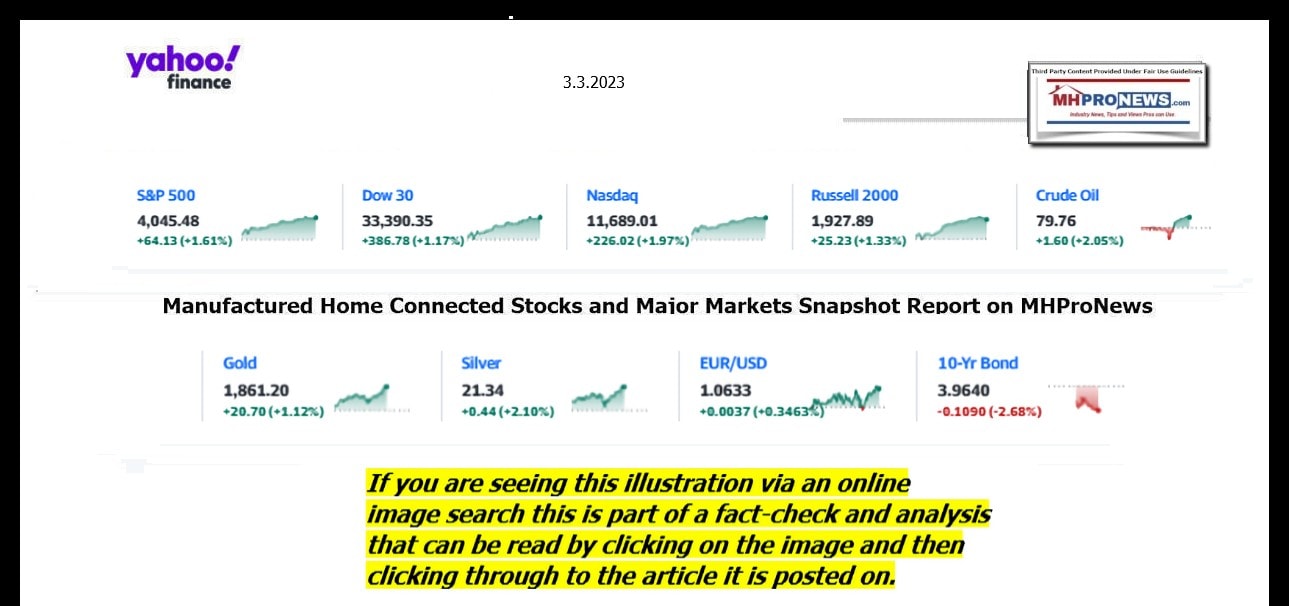

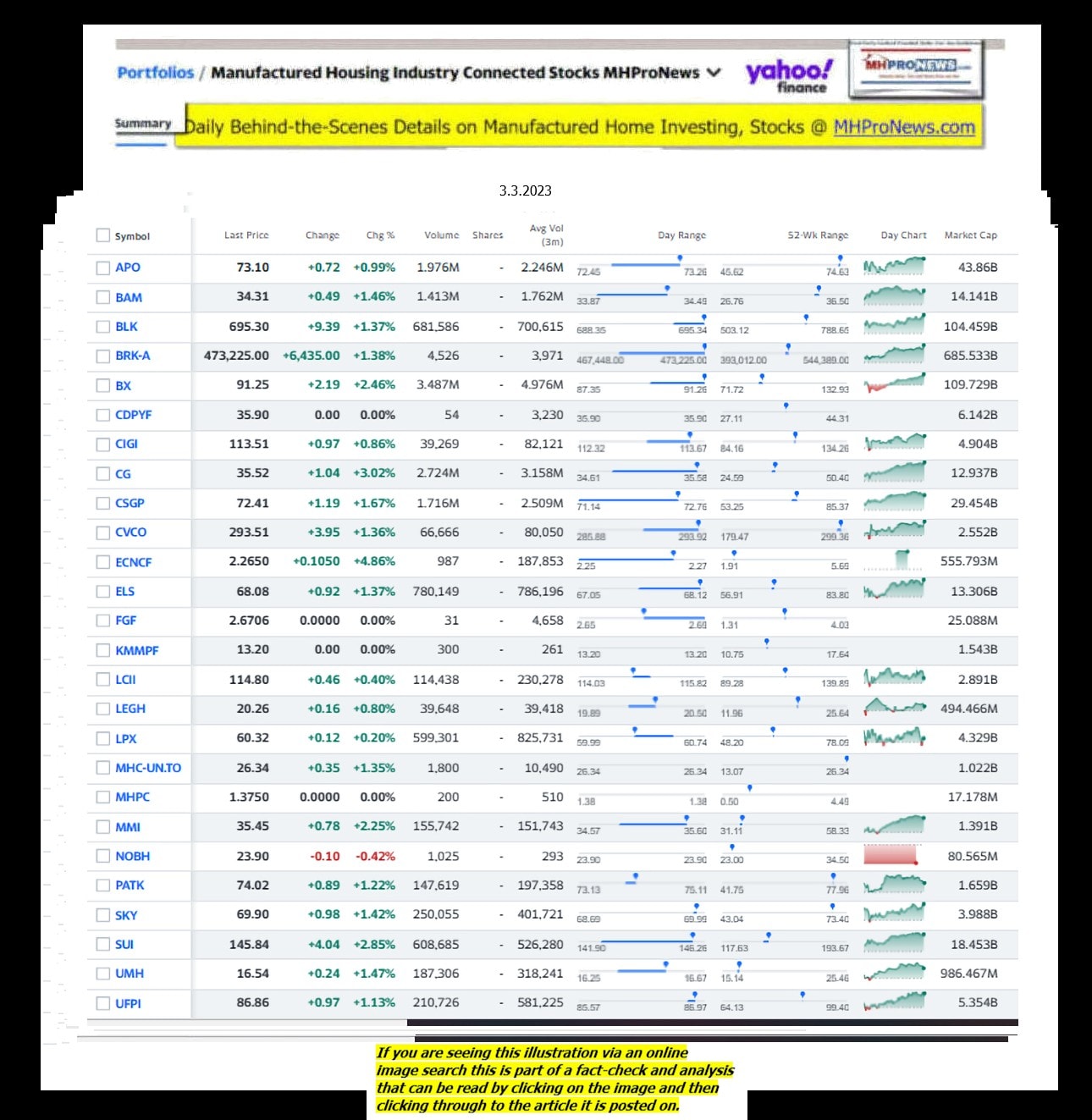

Manufactured Housing Institute (MHI) board member Sun Communities’ (SUI) Q4 and year end 2022 report and data figures are in. Their official statements are found herein in Part I A and B of today’s report. Part I A includes Sun’s official press release. Part I B includes Sun’s earnings call transcript, according to Reuters. Part II will include Additional Information with more MHProNews Analysis and Commentary in Brief. Financial and investment news website, Simply Wall Street reported their topline bullets on Sun Communities (SUI) as follows.

Sun Communities (NYSE:SUI) Full Year 2022 Results

Key Financial Results

- Revenue: US$2.97b (up 32% from FY 2021).

- Net income: US$242.0m (down 36% from FY 2021).

- Profit margin: 8.1% (down from 17% in FY 2021).

- EPS: US$2.01 (down from US$3.36 in FY 2021).

Sun released their Fourth (4th) Quarter 2022 and full year 2022 results and 2023 guidance via GlobeNewswire as follows. Note: highlighting in what follows is added by MHProNews. There are several reasons for highlighting, but one example will help illustrate the point.

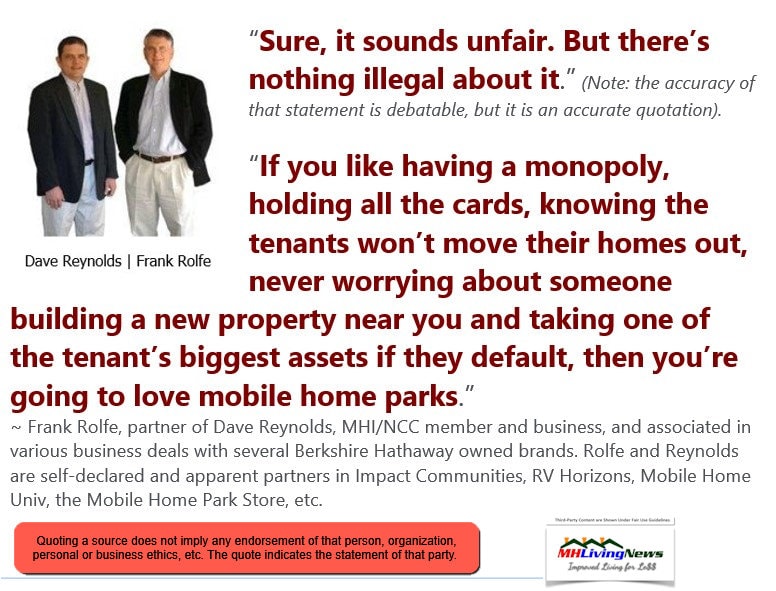

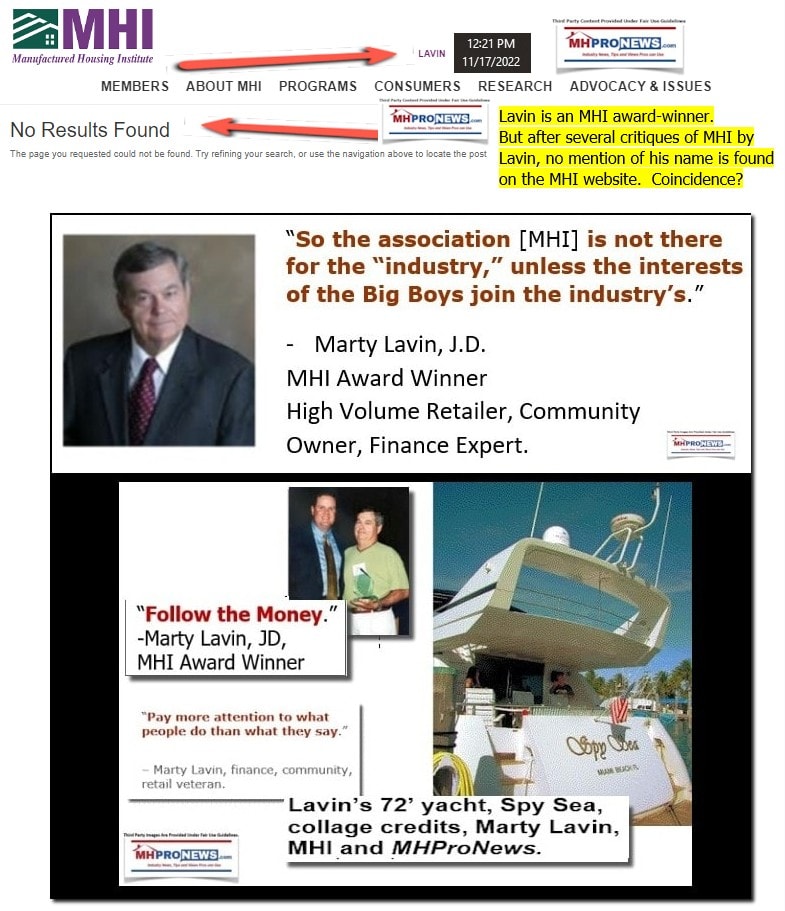

Conflicting Public Stances

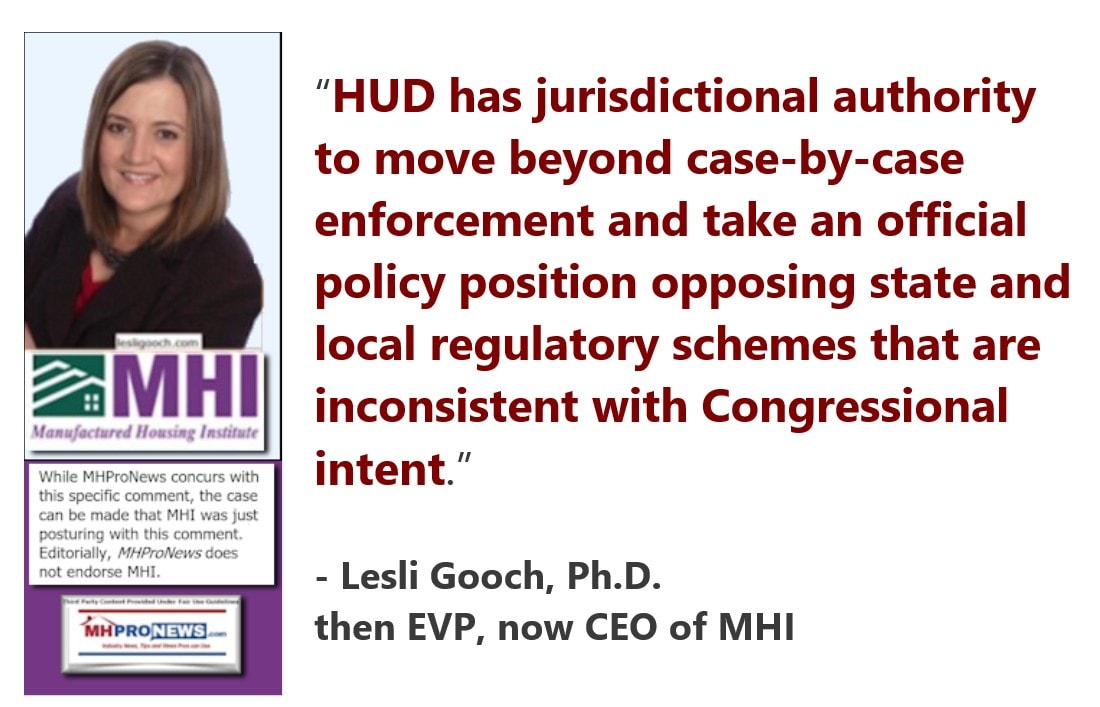

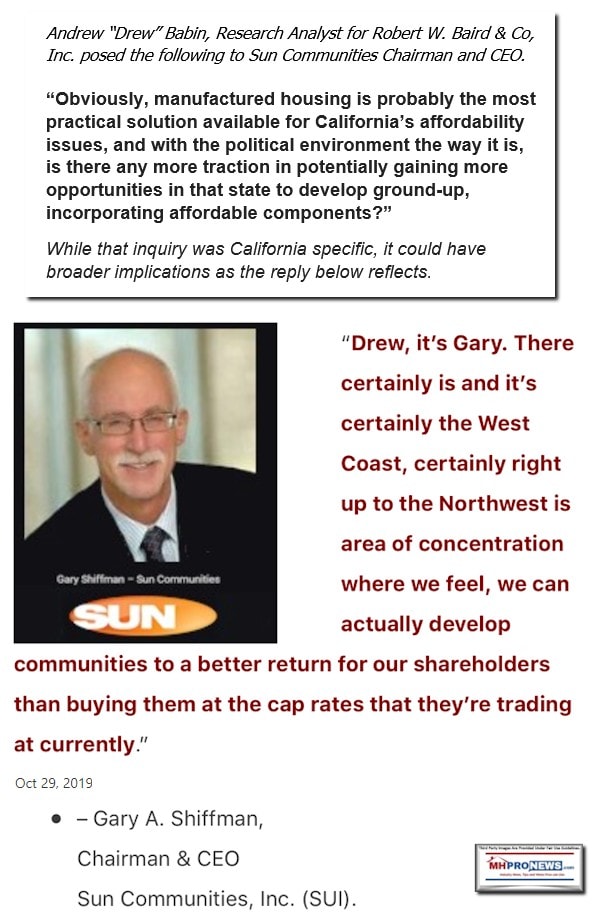

Despite MHI’s VP turned CEO Lesli Gooch’s claim that they want to see the Manufactured Housing Improvement Act of 2000’s (MHIA) “enhanced preemption” provision enforced, by definition, if HUD actually began enforcing that provision and/or local jurisdictions began honoring that part of federal law, then the example from CA indicates that developing and new site placements should dramatically improve. That said, by way of contrast, note this remark by Sun Communities’ Gary A. Shiffman, Chairman and CEO, which is among those highlighted below. “The resilient demand for our manufactured housing…combined with the limited supply…are the foundations of our business model, which generates positive results throughout economic cycles…”

So, when beyond the previously linked remark that MHI’s CEO Lesli Gooch claimed the following in a lightly read comments letter, it would apparently be contrary to Shiffman’s statement about one of the key “foundations” of Sun’s business model. Put simply, Gooch apparently seems to be paltering. There may come a time when MHI will want to vigorously seek to enforce enhanced preemption under the MHIA. But that day has apparently not yet arrived, because there is no known evidence that they or MHI member Sun has sued to get the law enforced.

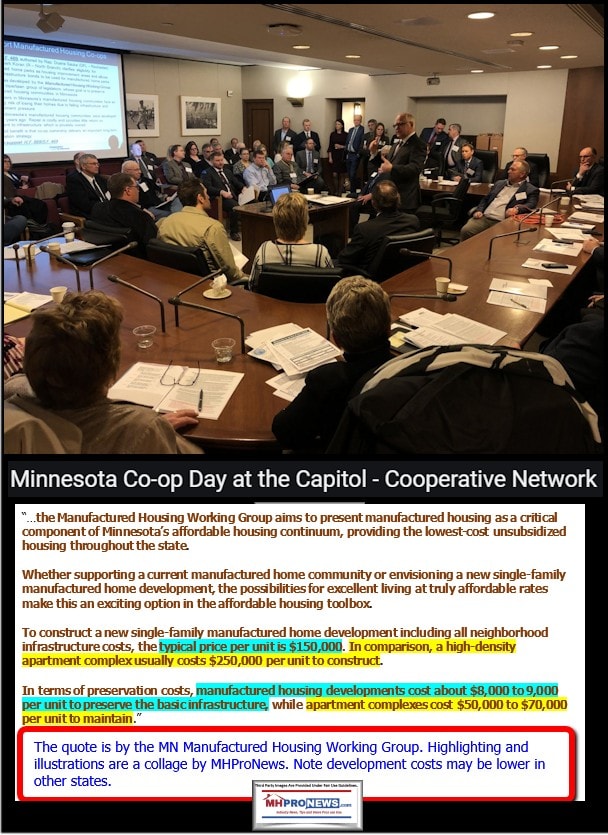

But there is one more related item that knowledge of Sun’s remarks reflects. Shiffman himself said that there are times it is more cost effective to develop than to purchase an existing manufactured home community. That would be particularly so when cap rates are compressed due to scarcity and demand.

Thus, it appears that it is not only MHI’s Gooch who is paltering. As the expert editorial analysis herein, including in Part II of this article, Sun’s CEO and chairman Shiffman likewise appears to be into the wink and a nod paltering game.

There are ripples of ramifications from such an understanding because Shiffman and Gooch both have fiduciary duties and other legal responsibilities to shareholders and those members or others which authentically desire robust growth. While throttling sales and private lot placements and developing may appear to benefit Sun short term, the case can be made that it will harm the interests of independent retailers and producers of HUD Code manufactured homes. Because this troubling and costly trend has been developing for years, it is no surprise that the numbers of retailers and producers that Congress was told that in the 21st century literally thousands of once profitable businesses being lost.

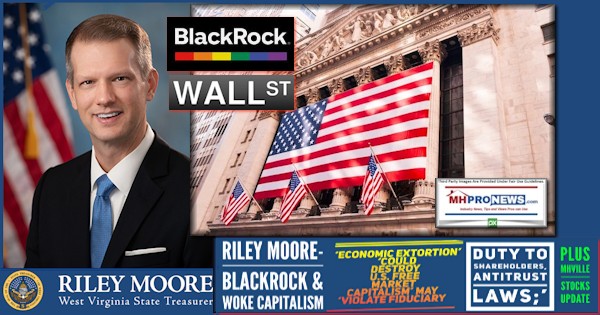

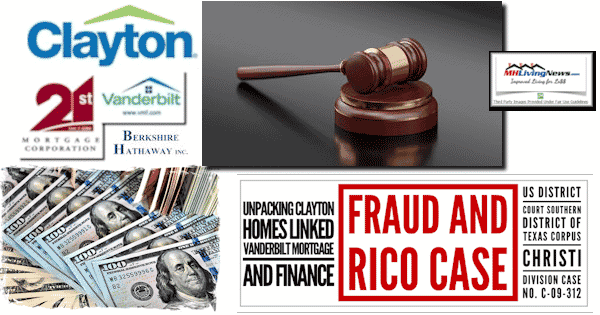

Given that notable legal actions have occurred relative to shareholders and/or stakeholders engaging contingency attorneys because their best interests are not being properly pursued, liability as well as possible federal law violations begin to emerge when specific remarks by MHI members, relevant facts and legalities are laid out like puzzle pieces waiting to be fitted together. While the SEC’s legal action against MHI member Cavco Industries (CVCO) began during the Trump Administration, there are reasons to think that Trump Admin II could be just over the horizon. Hypothesizing legal actions brought against Sun for such arguably avoidable causes of action would obviously have various avenues of defense for the firm. That noted, there appears to be a significant number of winks, nods, and carefully coded comments expressed by Sun and others in MHVille who routinely happen to be MHI members.

So, Sun, Cavco, and other larger consolidating MHI members often seem to fit that paltering, posturing mode that could raise serious civil and possible criminal legal issues for their firm? According to third-party legal and other credible research, the answer to that scenario appears to be “yes.”

Note that in the remarks and cited data below, Sun’s velocity for adding new sites has slowed significantly in 2022 vs. 2021. In fairness, this is not only true of Sun, but it appears to be occurring among some other MHI member consolidators too. MHProNews plans a report in the near term that reflects another REIT that could be setting themselves up for legal liability for similar reasons to those outlined herein. Collusion and market manipulation are not legal. That may shed light for those with eyes to see on why manufactured housing is underperforming during an affordable housing crisis.

Against that factual, evidence-based, and industry expert views backdrop, what follows is from Sun’s media release, with highlighting added by MHProNews.

Part 1 A

Sun Communities, Inc. Reports 2022 Fourth Quarter and Full Year Results; Provides 2023 Guidance and Increases Annual Distribution Rate for 2023

February 22, 2023 16:41 ET | Source: Sun Communities, Inc.

Net Income per Diluted Share of $0.04 and $2.00 for the Quarter and Year End, Respectively

Core FFO(1) per Share of $1.33 and $7.35 for the Quarter and Year End,

Respectively, Increased 1.5% and 12.9% over the 2021 Periods

Strong Demand and Accretive Investments Drive Continued Solid Performance

Record Volume of Transient-to-Annual RV Conversions Propel Record Gains in Revenue Producing Sites

Establishing Guidance for 2023

Expecting Total Same Property NOI(1)(2) Growth of 4.9% – 5.9%

Increasing Annual Distribution by 5.7% in 2023, to $3.72 per share

Southfield, MI, Feb. 22, 2023 (GLOBE NEWSWIRE) — Sun Communities, Inc. (NYSE: SUI) (the “Company” or “SUI”), a real estate investment trust (“REIT”) that owns and operates, or has an interest in, manufactured housing (“MH”) and recreational vehicle (“RV”) communities and marinas (collectively, the “properties”), today reported its fourth quarter and full-year results for 2022.

Financial Results for the Quarter and Year Ended December 31, 2022

- For the quarter ended December 31, 2022, net income attributable to common shareholders was $4.7 million, or $0.04 per diluted share, compared to net income attributable to common shareholders of $12.9 million, or $0.11 per diluted share, for the same period in 2021.

- For the year ended December 31, 2022, net income attributable to common shareholders was $242.0 million, or $2.00 per diluted share, compared to net income attributable to common shareholders of $380.2 million, or $3.36 per diluted share, for the same period in 2021.

Non-GAAP Financial Measures

- Core Funds from Operations (“Core FFO”)(1) for the quarter and year ended December 31, 2022, was $1.33 per common share and dilutive convertible securities (“Share”) and $7.35 per Share, respectively, representing 1.5% and 12.9% increases as compared to the corresponding periods in 2021.

- Constant Currency Core Funds from Operations (“Constant Currency Core FFO”)(1) for the quarter and year ended December 31, 2022, was $1.34 per Share and $7.44 per Share, respectively.

- Same Property Net Operating Income (“NOI”)(1)(2) for MH and RV properties increased by 4.4% and 5.4% for the quarter and year ended December 31, 2022, respectively, as compared to the corresponding periods in 2021. For the Company’s Marina properties, Same Property NOI(1) increased by 10.4% and 7.7% for the quarter and year ended December 31, 2022, respectively, as compared to the corresponding periods in 2021.

“We are pleased to report another year of strong performance and earnings growth. The resilient demand for our manufactured housing, RV and marina properties, combined with the limited supply for each, are the foundations of our business model, which generates positive results throughout economic cycles,” said Gary A. Shiffman, Chairman and CEO. “We delivered a record number of revenue producing sites in 2022, primarily driven by record conversions to annual leases at our RV communities, and we have nearly 16,200 sites in our portfolio available for development. We are optimistic in our outlook for 2023, supported by our healthy rental rate increases in our MH, annual RV and Marina properties. We will be disciplined in terms of capital deployment, pursuing selective acquisition opportunities while continuing to leverage our development platform to create new supply to meet the strong demand and deliver value for our shareholders.”

OPERATING HIGHLIGHTS

Portfolio Occupancy

- Total MH and annual RV occupancy (excluding UK Operations) was 96.8% at December 31, 2022, as compared to 97.4% at December 31, 2021.

- Revenue Producing Sites Gains – During the quarter ended December 31, 2022, the number of MH and annual RV revenue producing sites increased by 613 sites, as compared to an increase of 810 sites during the corresponding period in 2021. During the year ended December 31, 2022, MH and annual RV revenue producing sites increased by 2,922 sites, a 17.7% increase over the 2,483 sites gained during 2021.

- Transient-to-annual RV site conversions totaled a record 2,257 sites in 2022, and accounted for 77.2% of 2022’s revenue producing site gains.

Same Property Results(2)

- MH and RV – For the 421 MH and RV properties owned and operated by the Company since at least January 1, 2021, the following table reflects the percentage changes, both in total and by segment, for the quarter and year ended December 31, 2022:

| Quarter Ended December 31, 2022 | ||||||||

| Total MH and RV Same Property(2) |

MH Same Property(2) |

RV Same Property(2) |

||||||

| Revenue | 4.9 | % | 4.7 | % | 5.3 | % | ||

| Expense | 5.8 | % | 12.0 | % | (0.9) % | |||

| NOI(1) | 4.4 | % | 2.2 | % | 11.8 | % | ||

| Year Ended December 31, 2022 | ||||||||

| Total MH and RV Same Property(2) | MH Same Property(2) |

RV Same Property(2) |

||||||

| Revenue | 5.7 | % | 4.5 | % | 7.6 | % | ||

| Expense | 6.2 | % | 8.1 | % | 4.2 | % | ||

| NOI(1) | 5.4 | % | 3.3 | % | 10.3 | % | ||

Same Property adjusted blended occupancy(3) increased to 98.6% at December 31, 2022, from 96.8% at December 31, 2021, an increase of 180 basis points.

- Marina – For the 101 Marina properties owned and operated by the Company since at least January 1, 2021, the following table reflects the percentage increases for the quarter and year ended December 31, 2022:

| Quarter Ended December 31, 2022 | Year Ended December 31, 2022 | ||||

| Revenue | 8.2 | % | 7.0 | % | |

| Expense | 4.2 | % | 5.8 | % | |

| NOI(1) | 10.4 | % | 7.7 | % | |

UK Operations Results

During 2022, the Company expanded its MH segment into the United Kingdom (“UK”) with the acquisition of Park Holidays, the second largest owner and operator of holiday parks in the UK. UK Operations contributed $23.3 million of NOI(1) in the quarter ended December 31, 2022, and contributed $128.3 million of NOI(1) in the period from date of acquisition to December 31, 2022. On a constant currency basis, UK Operations contributed $27.0 million of NOI(1) in the quarter ended December 31, 2022, and contributed $143.9 million of NOI(1) in the period from date of acquisition to December 31, 2022. Refer to page 13 for additional information regarding UK operating results.

Hurricane Ian Update

As previously announced, the Company’s properties in Florida sustained damage from Hurricane Ian in September 2022. Complete asset impairments occurred at three communities in the Fort Myers area, which will require redevelopment. Charges, net of expected insurance recoveries, of $17.3 million were recognized as “Catastrophic event-related charges, net” in the Consolidated Statements of Operations for the year ended December 31, 2022. After quarter end, the Company received a reimbursement from its insurer for $3.5 million related to losses from debris and tree removal, common area repairs and flooding damage.

The foregoing estimates are based on current information available, and the Company continues to assess these estimates. The actual final impairment, insurance recoveries and net charges could vary from these estimates. Any changes to these estimates will be recognized in the period(s) in which they are determined.

INVESTMENT ACTIVITY

Acquisitions

Acquisitions totaled $66.7 million during the quarter ended December 31, 2022, including one MH community, one RV community and two marinas in the United States and one MH community in the UK. Refer to page 17 for additional detail on acquisitions and dispositions.

Development and Expansion Activities

During the year ended December 31, 2022, the Company:

- Acquired six land parcels located in the United States and UK for the potential development of over 1,300 sites, for an aggregate purchase price of $26.2 million.

- Constructed over 270 sites in the fourth quarter, bringing the total for the year to more than 840 sites at six ground-up development properties. This includes over 445 sites at two development properties acquired in the second quarter.

- Expanded existing communities by nearly 980 sites, bringing the total for the year to nearly 1,160 sites at 11 expansion properties.

BALANCE SHEET, CAPITAL MARKETS ACTIVITY AND OTHER ITEMS

Debt

As of December 31, 2022, the Company had $7.2 billion in debt outstanding with a weighted average interest rate of 3.8% and a weighted average maturity of 7.4 years. At December 31, 2022, the Company’s net debt to trailing twelve-month Recurring EBITDA(1) ratio was 6.0 times.

During and subsequent to the quarter ended December 31, 2022, the Company completed previously announced secured financings on 23 properties that raised proceeds of $311.0 million. The loans mature between February 13, 2026 and December 15, 2029 and have fixed interest rates of 4.5% to 5.0%. The Company used the proceeds to repay borrowings outstanding under its senior credit facility.

Subsequent to the quarter ended December 31, 2022, the Company issued $400.0 million of senior unsecured notes with an interest rate of 5.7% and a 10-year term. The Company used net proceeds of $395.3 million, to repay borrowings outstanding under its unsecured revolving line of credit.

2023 Distributions

The Company’s Board of Directors has approved setting the 2023 annual distribution rate at $3.72 per common share and unit, an increase of $0.20, or 5.7%, over the current annual dividend rate of $3.52 per common share and unit for 2022. This increase will begin with the first quarter distribution to be paid in April 2023. While the Board of Directors has adopted the new annual distribution policy, the amount of each quarterly distribution on the Company’s common stock will be subject to approval by the Board of Directors.

2023 GUIDANCE

Establishing Full-Year and First Quarter 2023 Guidance

The Company is establishing full-year and first quarter 2023 guidance for diluted EPS and Core FFO(1) per Share as follows:

| Reconciliation of Diluted EPS to Core FFO(1) per Share | First Quarter Ending March 31, 2023 |

Full-Year Ending December 31, 2023 |

||||||||||||||

| Low | High | Low | High | |||||||||||||

| Diluted EPS | $ | (0.03 | ) | $ | 0.02 | $ | 2.50 | $ | 2.70 | |||||||

| Depreciation and amortization | 1.24 | 1.24 | 5.02 | 5.02 | ||||||||||||

| Gain on sale of assets | (0.07 | ) | (0.07 | ) | (0.32 | ) | (0.32 | ) | ||||||||

| FFO(1) per Share | $ | 1.14 | $ | 1.19 | $ | 7.20 | $ | 7.40 | ||||||||

| Business combination expense and other acquisition related costs | 0.01 | 0.01 | 0.03 | 0.03 | ||||||||||||

| Other adjustments(a) | — | — | (0.01 | ) | (0.01 | ) | ||||||||||

| Core FFO(1)(b) per Share | $ | 1.15 | $ | 1.20 | $ | 7.22 | $ | 7.42 | ||||||||

(a) Other adjustments include the same categories presented in the table that reconciles Net income attributable to SUI common shareholders to FFO on page 6.

(b) The Company’s initial guidance translates forecasted results from operations in Canada, Australia and the UK using the relevant exchange rates in effect on December 31, 2022, which are provided in the 2023 Guidance Assumptions for Consolidated Portfolio table.

| 2023 Guidance Assumptions for Consolidated Portfolio | ||||

| Expected % | ||||

| Total Expected NOI(1) from Real Property: | Change in 2023 | |||

| Revenues | ||||

| Real property (excluding transient) | 9.8% – 10.2% | |||

| Real property (transient) | 0.9% – 2.1% | |||

| Revenues from real property | 8.1% – 8.7% | |||

| Total property operating expenses | 13.5% – 13.9% | |||

| Total NOI(1) from real property | 4.5% – 5.7% | |||

| Expected Ranges: | (in millions) | |||

| Service, retail, dining and entertainment NOI(1) | $49.5 – $52.1 | |||

| Interest income, brokerage commissions and other revenues, net | $82.6 – $84.8 | |||

| General and administrative expenses | $256.5 – $261.6 | |||

| UK Operations: | ||||

| NOI(1) from real property and home sales(a) | $155.5 – $165.1 | |||

| Other MH / RV Operational Guidance – North America: | # of sites | |||

| Increase in revenue producing sites | 2,800 – 3,100 | |||

| Vacant site additions from expansions and ground-up developments | 1,000 – 1,300 | |||

| Exchange rates in effect at: | December 31, 2022 | |||

| U.S. Dollar (“USD”) / Pound Sterling (“GBP”) | 1.21 | |||

| USD / Canadian Dollar (“CAD”) | 0.74 | |||

| USD / Australian Dollar (“AUS”) | 0.68 | |||

(a) UK NOI(1) from real property is included in Total NOI(1) from real property.

The Company expects total Same Property NOI(1) to increase 4.9% – 5.9% during the year ending December 31, 2023, inclusive of 3.3% – 4.4% total Same Property NOI(1) growth during the first quarter ending March 31, 2023.

| 2023 Guidance Assumptions for Same Property(1)(a) Portfolio | FY 2022 (in millions) |

Expected % Change in 2023 |

|||

| MH NOI(1) (289 properties) | $ | 570.3 | 4.2% – 5.0% | ||

| RV NOI(1) (163 properties) | $ | 281.0 | 5.1% – 6.4% | ||

| Marina NOI(1) (120 properties) | $ | 217.0 | 6.3% – 7.7% | ||

| Total Same Property Portfolio (572 properties) | |||||

| Income from real property(b) | $ | 1,608.9 | 6.6% – 7.0% | ||

| Total property operating expenses(b)(c) | $ | 540.6 | 9.1% – 10.0% | ||

| NOI(1) | $ | 1,068.3 | 4.9% – 5.9% | ||

| 2023 Average Rental Rate Increases: | Guidance(d) | ||||

| MH | 6.2% – 6.4% | ||||

| Annual RV | 7.7% – 7.9% | ||||

| Marina | 7.3% – 7.6% | ||||

| MH – UK Operations | 7.2% – 7.4% | ||||

(a) The amounts in the table reflect constant currency, as Canadian currency figures included within the 2022 actual amounts have been translated at the assumed exchange rate used for 2023 guidance.

(b) Total Same Property results net $101.3 million and $105.5 million of utility revenue against the related utility expense in property operating expenses for 2022 actual results and 2023 guidance, respectively.

(c) FY 2022 results exclude $1.3 million of expense incurred at recently acquired properties in order to bring them up to the Company’s operating standards. The improvements included items such as tree trimming and painting costs that do not meet the Company’s capitalization policy.

(d) Rental rate guidance for 2023 is unchanged from the ranges provided by the Company in its third quarter 2022 supplemental information package.

| Seasonality | 1Q23 | 2Q23 | 3Q23 | 4Q23 | ||||||||

| Same Property NOI(1) | ||||||||||||

| MH | 25 | % | 25 | % | 25 | % | 25 | % | ||||

| RV | 15 | % | 26 | % | 42 | % | 17 | % | ||||

| Marina | 19 | % | 27 | % | 30 | % | 24 | % | ||||

| Total Same Property | 21 | % | 26 | % | 30 | % | 23 | % | ||||

| NOI(1) from UK Operations | 16 | % | 29 | % | 38 | % | 17 | % | ||||

| Consolidated EBITDA(1) | 19 | % | 27 | % | 33 | % | 21 | % | ||||

| Core FFO(1) per Share | 16 | % | 27 | % | 36 | % | 21 | % | ||||

The estimates and assumptions presented above represent a range of possible outcomes and may differ materially from actual results. These estimates include contributions from all acquisitions, dispositions and capital markets activity completed through February 22, 2023, and the effect of a property disposition under contract expected to close in March 2023. These estimates exclude all other prospective acquisitions, dispositions and capital markets activity. The estimates and assumptions are forward-looking based on the Company’s current assessment of economic and market conditions and are subject to the other risks outlined below under the caption Cautionary Statement Regarding Forward-Looking Statements.

EARNINGS CONFERENCE CALL

A conference call to discuss fourth quarter results will be held on Thursday, February 23, 2023 at 11:00 A.M. (ET). To participate, call toll-free at (877) 407-9039. Callers outside the U.S. or Canada can access the call at (201) 689-8470. A replay will be available following the call through March 9, 2023 and can be accessed toll-free by calling (844) 512-2921 or (412) 317-6671. The Conference ID number for the call and the replay is 13734720. The conference call will be available live on the Company’s website located at www.suncommunities.com. The replay will also be available on the website.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release contains various “forward-looking statements” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Company intends that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this document that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intends,” “intend,” “intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” “guidance,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. These forward-looking statements reflect the Company’s current views with respect to future events and financial performance, but involve known and unknown risks and uncertainties, both general and specific to the matters discussed in this document, some of which are beyond the Company’s control. These risks and uncertainties may cause the Company’s actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks described under “Risk Factors” contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and in the Company’s other filings with the Securities and Exchange Commission from time to time, such risks, uncertainties and other factors include but are not limited to:

- Outbreaks of disease and related restrictions on business operations;

- Changes in general economic conditions, including inflation, deflation and energy costs, the real estate industry and the markets within which the Company operates;

- Difficulties in the Company’s ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully;

- The Company’s liquidity and refinancing demands;

- The Company’s ability to obtain or refinance maturing debt;

- The Company’s ability to maintain compliance with covenants contained in its debt facilities and its unsecured notes;

- Availability of capital;

- Changes in foreign currency exchange rates, including between the U.S. dollar and each of the Canadian dollar, Australian dollar and Pound sterling;

- The Company’s ability to maintain rental rates and occupancy levels;

- The Company’s ability to maintain effective internal control over financial reporting and disclosure controls and procedures;

- Increases in interest rates and operating costs, including insurance premiums and real estate taxes;

- Risks related to natural disasters such as hurricanes, earthquakes, floods, droughts and wildfires;

- General volatility of the capital markets and the market price of shares of the Company’s capital stock;

- The Company’s ability to maintain its status as a REIT;

- Changes in real estate and zoning laws and regulations;

- Legislative or regulatory changes, including changes to laws governing the taxation of REITs;

- Litigation, judgments or settlements;

- Competitive market forces;

- The ability of purchasers of manufactured homes and boats to obtain financing; and

- The level of repossessions by manufactured home and boat lenders.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. The Company undertakes no obligation to publicly update or revise any forward-looking statements included or incorporated by reference into this document, whether as a result of new information, future events, changes in the Company’s expectations or otherwise, except as required by law.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to the Company or persons acting on the Company’s behalf are qualified in their entirety by these cautionary statements.

Company Overview and Investor Information

The Company

Established in 1975, Sun Communities, Inc. became a publicly owned corporation in December 1993. The Company is a fully integrated REIT listed on the New York Stock Exchange under the symbol: SUI. As of December 31, 2022, the Company owned, operated, or had an interest in a portfolio of 669 developed MH, RV and Marina properties comprising over 179,700 developed sites and approximately 47,800 wet slips and dry storage spaces in the United States, the United Kingdom and Canada.

For more information about the Company, please visit www.suncommunities.com.

| Company Contacts | |

| Management: | Investor Relations: |

|

Sara Ismail, Vice President |

|

(248) 208-2500 |

|

investorrelations@suncommunities.com |

| Corporate Debt Ratings | |

| Moody’s | S&P: |

| Baa3 | Stable | BBB | Stable |

| Equity Research Coverage | ||||

| Bank of America Merrill Lynch | Joshua Dennerlein | joshua.dennerlein@bofa.com | ||

| Barclays | Anthony Powell | anthony.powell@barclays.com | ||

| BMO Capital Markets | John Kim | jp.kim@bmo.com | ||

| Citi Research | Nicholas Joseph | nicholas.joseph@citi.com | ||

| Evercore ISI | Samir Khanal | samir.khanal@evercoreisi.com | ||

| Steve Sakwa | steve.sakwa@evercoreisi.com | |||

| Green Street Advisors | John Pawlowski | jpawlowski@greenstreetadvisors.com | ||

| JMP Securities | Aaron Hecht | ahecht@jmpsecurities.com | ||

| RBC Capital Markets | Brad Heffern | brad.heffern@rbccm.com | ||

| Robert W. Baird & Co. | Wesley Golladay | wgolladay@rwbaird.com | ||

| Truist Securities | Anthony Hau | anthony.hau@truist.com | ||

| UBS | Michael Goldsmith | michael.goldsmith@ubs.com | ||

| Wolfe Research | Andrew Rosivach | arosivach@wolferesearch.com | ||

| Keegan Carl | kcarl@wolferesearch.com |

Financial and Operating Highlights

(amounts in millions, except for *)

| Quarter Ended | ||||||||||||||

| 12/31/2022 | 9/30/2022 | 6/30/2022 | 3/31/2022 | 12/31/2021 | ||||||||||

| Financial Information | ||||||||||||||

| Basic Earnings per share (“EPS”)* | $ | 0.04 | $ | 1.32 | $ | 0.61 | $ | 0.01 | $ | 0.11 | ||||

| Diluted EPS* | $ | 0.04 | $ | 1.32 | $ | 0.61 | $ | 0.01 | $ | 0.11 | ||||

| Cash distributions declared per common share* | $ | 0.88 | $ | 0.88 | $ | 0.88 | $ | 0.88 | $ | 0.83 | ||||

| FFO(1)(4) per Share* | $ | 1.02 | $ | 2.54 | $ | 1.95 | $ | 1.28 | $ | 1.28 | ||||

| Core FFO(1)(4) per Share* | $ | 1.33 | $ | 2.65 | $ | 2.02 | $ | 1.34 | $ | 1.31 | ||||

| Constant Currency Core FFO(1)(4) per Share* | $ | 1.34 | $ | 2.71 | $ | 2.04 | $ | 1.34 | $ | 1.31 | ||||

| Recurring EBITDA(1) | $ | 236.3 | $ | 408.1 | $ | 328.4 | $ | 221.0 | $ | 208.6 | ||||

| Recurring EBITDA(1) (TTM) / Interest | 5.2x | 5.7x | 5.9x | 6.2x | 6.2x | |||||||||

| Balance Sheet | ||||||||||||||

| Total assets | $ | 17,084.2 | $ | 16,484.6 | $ | 16,397.8 | $ | 13,914.2 | $ | 13,494.1 | ||||

| Total debt | $ | 7,197.2 | $ | 6,711.0 | $ | 6,930.9 | $ | 6,076.5 | $ | 5,671.8 | ||||

| Total liabilities | $ | 8,992.8 | $ | 8,354.6 | $ | 8,566.3 | $ | 6,980.7 | $ | 6,474.6 | ||||

| Operating Information* | ||||||||||||||

| Properties | ||||||||||||||

| MH | 353 | 350 | 349 | 293 | 292 | |||||||||

| RV | 182 | 181 | 182 | 182 | 185 | |||||||||

| Marina | 134 | 131 | 130 | 128 | 125 | |||||||||

| Total | 669 | 662 | 661 | 603 | 602 | |||||||||

| United States and Canada | ||||||||||||||

| Manufactured home sites | 99,977 | 99,428 | 99,185 | 98,279 | 98,621 | |||||||||

| Annual RV sites | 30,333 | 32,026 | 31,768 | 31,121 | 30,540 | |||||||||

| Transient RV sites | 28,038 | 27,945 | 28,682 | 29,267 | 29,847 | |||||||||

| Total sites | 158,348 | 159,399 | 159,635 | 158,667 | 159,008 | |||||||||

| Marina wet slips and dry storage spaces(a) | 47,823 | 46,185 | 45,905 | 45,725 | 45,155 | |||||||||

| MH occupancy | 95.9 | % | 96.2 | % | 96.3 | % | 96.7 | % | 96.6 | % | ||||

| Annual RV occupancy | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||

| Blended MH and annual RV occupancy | 96.8 | % | 97.1 | % | 97.2 | % | 97.5 | % | 97.4 | % | ||||

| United Kingdom | ||||||||||||||

| Manufactured home sites | 18,227 | 17,733 | 17,112 | 616 | N/A | |||||||||

| Transient RV sites | 3,143 | 3,203 | 3,306 | — | N/A | |||||||||

| Total sites | 21,370 | 20,936 | 20,418 | 616 | — | |||||||||

| MH occupancy | 89.0 | % | 91.7 | % | 91.4 | % | 94.8 | % | N/A | |||||

| MH and RV Revenue Producing Site Net Gains(5)* (excluding UK Operations) |

|||||||||

| MH net leased sites | 346 | 122 | 132 | 65 | 321 | ||||

| RV net leased sites | 267 | 567 | 818 | 605 | 489 | ||||

| Total net leased sites | 613 | 689 | 950 | 670 | 810 |

(a) Total wet slips and dry storage spaces are adjusted each quarter based on site configuration and usability.

Portfolio Overview as of December 31, 2022

| MH & RV Properties | |||||||||||||

| Properties | MH & Annual RV | RV Transient Sites | Total MH and RV Sites | Sites for Development(b) | |||||||||

| Location | Sites | Occupancy %(a) | |||||||||||

| Florida | 129 | 39,618 | 97.4 | % | 4,660 | 44,278 | 3,539 | ||||||

| Michigan | 84 | 32,471 | 96.7 | % | 749 | 33,220 | 1,337 | ||||||

| California | 37 | 6,861 | 98.6 | % | 1,936 | 8,797 | 942 | ||||||

| Texas | 31 | 8,778 | 94.3 | % | 2,566 | 11,344 | 2,015 | ||||||

| Ontario, Canada | 16 | 4,611 | 100.0 | % | 628 | 5,239 | 1,473 | ||||||

| Connecticut | 16 | 1,907 | 93.4 | % | 98 | 2,005 | — | ||||||

| Maine | 16 | 2,548 | 95.1 | % | 1,108 | 3,656 | 202 | ||||||

| Arizona | 13 | 4,537 | 91.3 | % | 986 | 5,523 | 6 | ||||||

| Indiana | 12 | 3,155 | 96.6 | % | 1,023 | 4,178 | 177 | ||||||

| New Jersey | 11 | 2,817 | 100.0 | % | 1,225 | 4,042 | 262 | ||||||

| Colorado | 11 | 2,799 | 88.2 | % | 987 | 3,786 | 1,493 | ||||||

| Virginia | 10 | 1,286 | 99.8 | % | 2,163 | 3,449 | 752 | ||||||

| New York | 10 | 1,497 | 98.5 | % | 1,443 | 2,940 | 778 | ||||||

| New Hampshire | 10 | 1,728 | 100.0 | % | 652 | 2,380 | 111 | ||||||

| Other | 74 | 15,697 | 97.9 | % | 7,814 | 23,511 | 1,220 | ||||||

| North America Total | 480 | 130,310 | 96.8 | % | 28,038 | 158,348 | 14,307 | ||||||

| United Kingdom | 55 | 18,227 | 89.0 | % | 3,143 | 21,370 | 1,888 | ||||||

| Total | 535 | 148,537 | 95.9 | % | 31,181 | 179,718 | 16,195 | ||||||

(a) As of December 31, 2022, total portfolio MH occupancy was 94.8% inclusive of the impact of over 2,300 recently constructed but vacant MH expansion sites, and annual RV occupancy was 100.0%.

(b) Total sites for development were comprised of 54% for expansion, 25% for greenfield development and 21% for redevelopment.

| Marina | ||||||||

| Properties | Wet Slips and Dry Storage Spaces | |||||||

| Location | ||||||||

| Florida | 21 | 5,054 | ||||||

| Rhode Island | 12 | 3,421 | ||||||

| Connecticut | 11 | 3,325 | ||||||

| California | 11 | 5,705 | ||||||

| New York | 9 | 3,018 | ||||||

| Maryland | 9 | 2,632 | ||||||

| Massachusetts | 9 | 2,520 | ||||||

| Other | 52 | 22,148 | ||||||

| Total | 134 | 47,823 | ||||||

| Properties | Sites, Wet Slips and Dry Storage Spaces | |||||||

| Total Portfolio | 669 | 227,541 |

Consolidated Balance Sheets

(amounts in millions)

| December 31, 2022 | December 31, 2021 | ||||||

| Assets | |||||||

| Land | $ | 4,322.3 | $ | 2,556.3 | |||

| Land improvements and buildings | 10,903.4 | 9,958.3 | |||||

| Rental homes and improvements | 645.2 | 591.7 | |||||

| Furniture, fixtures and equipment | 839.0 | 656.4 | |||||

| Investment property | 16,709.9 | 13,762.7 | |||||

| Accumulated depreciation | (2,738.9 | ) | (2,337.2 | ) | |||

| Investment property, net | 13,971.0 | 11,425.5 | |||||

| Cash, cash equivalents and restricted cash | 90.4 | 78.2 | |||||

| Marketable securities | 127.3 | 186.9 | |||||

| Inventory of manufactured homes | 202.7 | 51.1 | |||||

| Notes and other receivables, net | 617.3 | 469.6 | |||||

| Goodwill | 1,018.4 | 495.4 | |||||

| Other intangible assets, net | 402.0 | 306.8 | |||||

| Other assets, net | 655.1 | 480.6 | |||||

| Total Assets | $ | 17,084.2 | $ | 13,494.1 | |||

| Liabilities | |||||||

| Secured debt | $ | 3,217.8 | $ | 3,380.7 | |||

| Unsecured debt | 3,979.4 | 2,291.1 | |||||

| Distributions payable | 111.3 | 98.4 | |||||

| Advanced reservation deposits and rent | 352.1 | 242.8 | |||||

| Accrued expenses and accounts payable | 396.3 | 237.5 | |||||

| Other liabilities | 935.9 | 224.1 | |||||

| Total Liabilities | 8,992.8 | 6,474.6 | |||||

| Commitments and contingencies | |||||||

| Temporary equity | 202.9 | 288.9 | |||||

| Shareholders’ Equity | |||||||

| Common stock | 1.2 | 1.2 | |||||

| Additional paid-in capital | 9,549.7 | 8,175.6 | |||||

| Accumulated other comprehensive income / (loss) | (9.9 | ) | 3.1 | ||||

| Distributions in excess of accumulated earnings | (1,731.2 | ) | (1,556.0 | ) | |||

| Total SUI shareholders’ equity | 7,809.8 | 6,623.9 | |||||

| Noncontrolling interests | |||||||

| Common and preferred OP units | 78.7 | 86.8 | |||||

| Consolidated entities | — | 19.9 | |||||

| Total noncontrolling interests | 78.7 | 106.7 | |||||

| Total Shareholders’ Equity | 7,888.5 | 6,730.6 | |||||

| Total Liabilities, Temporary Equity and Shareholders’ Equity | $ | 17,084.2 | $ | 13,494.1 | |||

Consolidated Statements of Operations

(amounts in millions, except for per share amounts)

| Three Months Ended | Year Ended | ||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | % Change | December 31, 2022 | December 31, 2021 | % Change | ||||||||||||||||

| Revenues | |||||||||||||||||||||

| Real property (excluding transient) | $ | 390.8 | $ | 338.5 | 15.5 | % | $ | 1,548.9 | $ | 1,316.8 | 17.6 | % | |||||||||

| Real property – transient | 49.8 | 45.8 | 8.7 | % | 353.3 | 281.4 | 25.6 | % | |||||||||||||

| Home sales | 107.7 | 65.1 | 65.4 | % | 465.8 | 280.2 | 66.2 | % | |||||||||||||

| Service, retail, dining and entertainment | 108.6 | 80.3 | 35.2 | % | 531.6 | 351.8 | 51.1 | % | |||||||||||||

| Interest | 9.9 | 4.2 | 135.7 | % | 35.2 | 12.2 | 188.5 | % | |||||||||||||

| Brokerage commissions and other, net | 7.5 | 8.5 | (11.8) % | 34.9 | 30.2 | 15.6 | % | ||||||||||||||

| Total Revenues | 674.3 | 542.4 | 24.3 | % | 2,969.7 | 2,272.6 | 30.7 | % | |||||||||||||

| Expenses | |||||||||||||||||||||

| Property operating and maintenance | 155.4 | 125.6 | 23.7 | % | 624.6 | 500.8 | 24.7 | % | |||||||||||||

| Real estate tax | 27.4 | 24.4 | 12.3 | % | 110.6 | 94.8 | 16.7 | % | |||||||||||||

| Home costs and selling | 76.0 | 48.9 | 55.4 | % | 311.2 | 205.8 | 51.2 | % | |||||||||||||

| Service, retail, dining and entertainment | 109.4 | 80.3 | 36.2 | % | 472.7 | 307.9 | 53.5 | % | |||||||||||||

| General and administrative | 69.8 | 54.6 | 27.8 | % | 256.8 | 181.3 | 41.6 | % | |||||||||||||

| Catastrophic event-related charges, net | 5.2 | (0.9 | ) | N/M | 17.5 | 2.2 | N/M | ||||||||||||||

| Business combinations | 0.8 | 0.4 | 100.0 | % | 24.7 | 1.4 | N/M | ||||||||||||||

| Depreciation and amortization | 154.8 | 144.6 | 7.1 | % | 604.8 | 522.7 | 15.7 | % | |||||||||||||

| Loss on extinguishment of debt | — | — | N/A | 4.4 | 8.1 | (45.7) % | |||||||||||||||

| Interest | 67.6 | 42.4 | 59.4 | % | 229.8 | 158.6 | 44.9 | % | |||||||||||||

| Interest on mandatorily redeemable preferred OP units / equity | 1.1 | 1.1 | — | % | 4.2 | 4.2 | — | % | |||||||||||||

| Total Expenses | 667.5 | 521.4 | 28.0 | % | 2,661.3 | 1,987.8 | 33.9 | % | |||||||||||||

| Income Before Other Items | 6.8 | 21.0 | (67.6) % | 308.4 | 284.8 | 8.3 | % | ||||||||||||||

| Gain / (loss) on remeasurement of marketable securities | 20.6 | (9.7 | ) | N/M | (53.4 | ) | 33.5 | N/M | |||||||||||||

| Gain / (loss) on foreign currency exchanges | (16.3 | ) | 3.4 | N/M | 5.4 | (3.7 | ) | N/M | |||||||||||||

| Gain / (loss) on dispositions of properties | (0.3 | ) | — | N/A | 12.2 | 108.1 | (88.7) % | ||||||||||||||

| Other expense, net(6) | (4.7 | ) | (2.1 | ) | (123.8) % | (2.1 | ) | (12.1 | ) | (82.6) % | |||||||||||

| Gain / (loss) on remeasurement of notes receivable | (0.9 | ) | 0.1 | N/M | (0.8 | ) | 0.7 | N/M | |||||||||||||

| Income / (loss) from nonconsolidated affiliates | (0.9 | ) | 1.1 | N/M | 2.9 | 4.0 | (27.5) % | ||||||||||||||

| Loss on remeasurement of investment in nonconsolidated affiliates | (2.8 | ) | (0.1 | ) | N/M | (2.7 | ) | (0.2 | ) | N/M | |||||||||||

| Current tax benefit / (expense) | 2.2 | 0.2 | N/M | (10.3 | ) | (1.2 | ) | (758.3) % | |||||||||||||

| Deferred tax benefit / (expense) | 0.3 | 1.0 | (70.0) % | 4.2 | (0.1 | ) | N/M | ||||||||||||||

| Net Income | 4.0 | 14.9 | (73.2) % | 263.8 | 413.8 | (36.2) % | |||||||||||||||

| Less: Preferred return to preferred OP units / equity interests | 2.4 | 3.1 | (22.6) % | 11.0 | 12.1 | (9.1) % | |||||||||||||||

| Less: Income / (loss) attributable to noncontrolling interests | (3.1 | ) | (1.1 | ) | (181.8) % | 10.8 | 21.5 | (49.8) % | |||||||||||||

| Net Income Attributable to SUI Common Shareholders | $ | 4.7 | $ | 12.9 | (63.6) % | $ | 242.0 | $ | 380.2 | (36.3) % | |||||||||||

| Weighted average common shares outstanding – basic(7) | 123.1 | 115.2 | 6.9 | % | 120.2 | 112.6 | 6.7 | % | |||||||||||||

| Weighted average common shares outstanding – diluted(4)(7) | 125.8 | 115.7 | 8.7 | % | 122.9 | 115.1 | 6.8 | % | |||||||||||||

| Basic EPS | $ | 0.04 | $ | 0.11 | (63.6) % | $ | 2.00 | $ | 3.36 | (40.5) % | |||||||||||

| Diluted EPS(4) | $ | 0.04 | $ | 0.11 | (63.6) % | $ | 2.00 | $ | 3.36 | (40.5) % | |||||||||||

N/M = Percentage change is not meaningful.

N/A = Percentage change is not applicable.

Reconciliation of Net Income Attributable to SUI Common Shareholders to FFO(1)

(amounts in millions, except for per share data)

| Three Months Ended | Year Ended | ||||||||||||||

| December 31, 2022 | December 31, 2021 | December 31, 2022 | December 31, 2021 | ||||||||||||

| Net Income Attributable to SUI Common Shareholders | $ | 4.7 | $ | 12.9 | $ | 242.0 | $ | 380.2 | |||||||

| Adjustments | |||||||||||||||

| Depreciation and amortization | 154.0 | 144.5 | 602.6 | 521.9 | |||||||||||

| Depreciation on nonconsolidated affiliates | — | — | 0.1 | 0.1 | |||||||||||

| (Gain) / loss on remeasurement of marketable securities | (20.6 | ) | 9.7 | 53.4 | (33.5 | ) | |||||||||

| Loss on remeasurement of investment in nonconsolidated affiliates | 2.8 | 0.1 | 2.7 | 0.2 | |||||||||||

| (Gain) / loss on remeasurement of notes receivable | 0.9 | (0.1 | ) | 0.8 | (0.7 | ) | |||||||||

| (Gain) / loss on dispositions of properties | 0.3 | — | (12.2 | ) | (108.1 | ) | |||||||||

| Add: Returns on preferred OP units | 0.5 | 0.8 | 9.5 | 4.0 | |||||||||||

| Add: Income / (loss) attributable to noncontrolling interests | (2.5 | ) | (1.3 | ) | 10.4 | 14.7 | |||||||||

| Gain on dispositions of assets, net | (10.7 | ) | (14.2 | ) | (54.9 | ) | (60.5 | ) | |||||||

| FFO(1)(4) | $ | 129.4 | $ | 152.4 | $ | 854.4 | $ | 718.3 | |||||||

| Adjustments | |||||||||||||||

| Business combination expense and other acquisition related costs(8) | 7.3 | 3.3 | 47.4 | 10.0 | |||||||||||

| Loss on extinguishment of debt | — | — | 4.4 | 8.1 | |||||||||||

| Catastrophic event-related charges, net | 5.2 | (0.9 | ) | 17.5 | 2.2 | ||||||||||

| Loss of earnings – catastrophic event-related charges, net | 4.6 | (0.2 | ) | 4.8 | 0.2 | ||||||||||

| (Gain) / loss on foreign currency exchanges | 16.3 | (3.4 | ) | (5.4 | ) | 3.7 | |||||||||

| Other adjustments, net(9) | 5.5 | 4.7 | 0.4 | 16.2 | |||||||||||

| Core FFO(1)(4) | $ | 168.3 | $ | 155.9 | $ | 923.5 | $ | 758.7 | |||||||

| Foreign currency translation impact(a) | 1.7 | — | 11.0 | — | |||||||||||

| Constant Currency Core FFO(1)(4) | $ | 170.0 | $ | 155.9 | $ | 934.5 | $ | 758.7 | |||||||

| Weighted Average Common Shares Outstanding – Diluted(7) | 126.5 | 119.3 | 125.6 | 116.5 | |||||||||||

| FFO(1)(4) per Share | $ | 1.02 | $ | 1.28 | $ | 6.80 | $ | 6.16 | |||||||

| Core FFO(1)(4) per Share | $ | 1.33 | $ | 1.31 | $ | 7.35 | $ | 6.51 | |||||||

| Constant Currency Core FFO(1)(4) per Share | $ | 1.34 | $ | 1.31 | $ | 7.44 | $ | 6.51 | |||||||

(a) The Company calculated the foreign currency translation impact by comparing the actual weighted average foreign currency rates with the weighted average foreign currency rates used for guidance, as follows:

| Three Months Ended | Year Ended | ||||||||||

| December 31, 2022 | December 31, 2022 | ||||||||||

| Actual | Guidance | Actual | Guidance | ||||||||

| U.S. Dollars per Pounds Sterling | $ | 1.1452 | $ | 1.330 | $ | 1.2041 | $ | 1.330 | |||

| U.S. Dollars per Canadian Dollars | $ | 0.7380 | $ | 0.770 | $ | 0.7692 | $ | 0.770 | |||

| U.S. Dollars per Australian Dollars | $ | 0.6463 | $ | 0.756 | $ | 0.7282 | $ | 0.756 | |||

Reconciliation of Net Income Attributable to SUI Common Shareholders to NOI(1)

(amounts in millions)

| Three Months Ended | Year Ended | ||||||||||||||

| December 31, 2022 | December 31, 2021 | December 31, 2022 | December 31, 2021 | ||||||||||||

| Net Income Attributable to SUI Common Shareholders | $ | 4.7 | $ | 12.9 | $ | 242.0 | $ | 380.2 | |||||||

| Interest income | (9.9 | ) | (4.2 | ) | (35.2 | ) | (12.2 | ) | |||||||

| Brokerage commissions and other revenues, net | (7.5 | ) | (8.5 | ) | (34.9 | ) | (30.2 | ) | |||||||

| General and administrative | 69.8 | 54.6 | 256.8 | 181.3 | |||||||||||

| Catastrophic event-related charges, net | 5.2 | (0.9 | ) | 17.5 | 2.2 | ||||||||||

| Business combination expense | 0.8 | 0.4 | 24.7 | 1.4 | |||||||||||

| Depreciation and amortization | 154.8 | 144.6 | 604.8 | 522.7 | |||||||||||

| Loss on extinguishment of debt | — | — | 4.4 | 8.1 | |||||||||||

| Interest expense | 67.6 | 42.4 | 229.8 | 158.6 | |||||||||||

| Interest on mandatorily redeemable preferred OP units / equity | 1.1 | 1.1 | 4.2 | 4.2 | |||||||||||

| (Gain) / loss on remeasurement of marketable securities | (20.6 | ) | 9.7 | 53.4 | (33.5 | ) | |||||||||

| (Gain) / loss on foreign currency exchanges | 16.3 | (3.4 | ) | (5.4 | ) | 3.7 | |||||||||

| (Gain) / loss on disposition of property | 0.3 | — | (12.2 | ) | (108.1 | ) | |||||||||

| Other expense, net(6) | 4.7 | 2.1 | 2.1 | 12.1 | |||||||||||

| (Gain) / loss on remeasurement of notes receivable | 0.9 | (0.1 | ) | 0.8 | (0.7 | ) | |||||||||

| (Income) / loss from nonconsolidated affiliates | 0.9 | (1.1 | ) | (2.9 | ) | (4.0 | ) | ||||||||

| Loss on remeasurement of investment in nonconsolidated affiliates | 2.8 | 0.1 | 2.7 | 0.2 | |||||||||||

| Current tax expense / (benefit) | (2.2 | ) | (0.2 | ) | 10.3 | 1.2 | |||||||||

| Deferred tax expense / (benefit) | (0.3 | ) | (1.0 | ) | (4.2 | ) | 0.1 | ||||||||

| Preferred return to preferred OP units / equity interests | 2.4 | 3.1 | 11.0 | 12.1 | |||||||||||

| Add: Income / (loss) attributable to noncontrolling interests | (3.1 | ) | (1.1 | ) | 10.8 | 21.5 | |||||||||

| NOI(1) | $ | 288.7 | $ | 250.5 | $ | 1,380.5 | $ | 1,120.9 | |||||||

| Three Months Ended | Year Ended | |||||||||||

| December 31, 2022 | December 31, 2021 | December 31, 2022 | December 31, 2021 | |||||||||

| Real Property NOI(1) | $ | 257.8 | $ | 234.3 | $ | 1,167.0 | $ | 1,002.6 | ||||

| Home Sales NOI(1) | 31.7 | 16.2 | 154.6 | 74.4 | ||||||||

| Service, retail, dining and entertainment NOI(1) | (0.8 | ) | — | 58.9 | 43.9 | |||||||

| NOI(1) | $ | 288.7 | $ | 250.5 | $ | 1,380.5 | $ | 1,120.9 | ||||

Reconciliation of Net Income Attributable to SUI Common Shareholders to Recurring EBITDA(1)

(amounts in millions)

| Three Months Ended | Year Ended | ||||||||||||||

| December 31, 2022 | December 31, 2021 | December 31, 2022 | December 31, 2021 | ||||||||||||

| Net Income Attributable to SUI Common Shareholders | $ | 4.7 | $ | 12.9 | $ | 242.0 | $ | 380.2 | |||||||

| Adjustments | |||||||||||||||

| Depreciation and amortization | 154.8 | 144.6 | 604.8 | 522.7 | |||||||||||

| Loss on extinguishment of debt | — | — | 4.4 | 8.1 | |||||||||||

| Interest expense | 67.6 | 42.4 | 229.8 | 158.6 | |||||||||||

| Interest on mandatorily redeemable preferred OP units / equity | 1.1 | 1.1 | 4.2 | 4.2 | |||||||||||

| Current tax (benefit) / expense | (2.2 | ) | (0.2 | ) | 10.3 | 1.2 | |||||||||

| Deferred tax (benefit) / expense | (0.3 | ) | (1.0 | ) | (4.2 | ) | 0.1 | ||||||||

| (Income) / loss from nonconsolidated affiliates | 0.9 | (1.1 | ) | (2.9 | ) | (4.0 | ) | ||||||||

| Less: (Gain) / loss on dispositions of properties | 0.3 | — | (12.2 | ) | (108.1 | ) | |||||||||

| Less: Gain on dispositions of assets, net | (10.7 | ) | (14.2 | ) | (54.9 | ) | (60.5 | ) | |||||||

| EBITDAre(1) | $ | 216.2 | $ | 184.5 | $ | 1,021.3 | $ | 902.5 | |||||||

| Adjustments | |||||||||||||||

| Catastrophic event-related charges, net | 5.2 | (0.9 | ) | 17.5 | 2.2 | ||||||||||

| Business combination expense | 0.8 | 0.4 | 24.7 | 1.4 | |||||||||||

| (Gain) / loss on remeasurement of marketable securities | (20.6 | ) | 9.7 | 53.4 | (33.5 | ) | |||||||||

| (Gain) / loss on foreign currency transactions | 16.3 | (3.4 | ) | (5.4 | ) | 3.7 | |||||||||

| Other expense, net(6) | 4.7 | 2.1 | 2.1 | 12.1 | |||||||||||

| (Gain) / loss on remeasurement of notes receivable | 0.9 | (0.1 | ) | 0.8 | (0.7 | ) | |||||||||

| Loss on remeasurement of investment in nonconsolidated affiliates | 2.8 | 0.1 | 2.7 | 0.2 | |||||||||||

| Preferred return to preferred OP units / equity interests | 2.4 | 3.1 | 11.0 | 12.1 | |||||||||||

| Add: Income / (loss) attributable to noncontrolling interests | (3.1 | ) | (1.1 | ) | 10.8 | 21.5 | |||||||||

| Add: Gain on dispositions of assets, net | 10.7 | 14.2 | 54.9 | 60.5 | |||||||||||

| Recurring EBITDA(1) | $ | 236.3 | $ | 208.6 | $ | 1,193.8 | $ | 982.0 | |||||||

Same Property Summary(2) – MH / RV

(amounts in millions)

| Three Months Ended | ||||||||||||||||||||||||||

| Total Same Property – MH / RV | MH | RV | ||||||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | % Change(a) | December 31, 2022 | December 31, 2021 | % Change(a) | December 31, 2022 | December 31, 2021 | % Change(a) | ||||||||||||||||||

| Financial Information | ||||||||||||||||||||||||||

| Revenue | ||||||||||||||||||||||||||

| Real property (excluding transient and other) | $ | 237.1 | $ | 221.7 | 7.0 | % | $ | 187.6 | $ | 178.5 | 5.1 | % | $ | 49.5 | $ | 43.1 | 14.7 | % | ||||||||

| Real property – transient | 35.9 | 37.8 | (5.1) % | 0.3 | 0.3 | 25.5 | % | 35.6 | 37.6 | (5.3) % | ||||||||||||||||

| Other | 7.9 | 8.3 | (5.6) % | 4.3 | 4.8 | (11.2) % | 3.6 | 3.6 | 1.9 | % | ||||||||||||||||

| Total Operating | 280.9 | 267.8 | 4.9 | % | 192.2 | 183.6 | 4.7 | % | 88.7 | 84.3 | 5.3 | % | ||||||||||||||

| Expense | ||||||||||||||||||||||||||

| Property Operating(10)(11) | 95.9 | 90.6 | 5.8 | % | 52.7 | 47.1 | 12.0 | % | 43.2 | 43.6 | (0.9) % | |||||||||||||||

| Real Property NOI(1) | $ | 185.0 | $ | 177.2 | 4.4 | % | $ | 139.5 | $ | 136.5 | 2.2 | % | $ | 45.5 | $ | 40.7 | 11.8 | % | ||||||||

(a) Percentages are calculated based on unrounded numbers.

| Year Ended | ||||||||||||||||||||||||||

| Total Same Property – MH / RV | MH | RV | ||||||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | % Change(a) | December 31, 2022 | December 31, 2021 | % Change(a) | December 31, 2022 | December 31, 2021 | % Change(a) | ||||||||||||||||||

| Financial Information | ||||||||||||||||||||||||||

| Revenue | ||||||||||||||||||||||||||

| Real property (excluding transient and other) | $ | 929.3 | $ | 873.0 | 6.4 | % | $ | 739.9 | $ | 707.4 | 4.6 | % | $ | 189.4 | $ | 165.6 | 14.4 | % | ||||||||

| Real property – transient | 245.0 | 237.5 | 3.1 | % | 1.2 | 1.5 | (14.8) % | 243.8 | 236.1 | 3.3 | % | |||||||||||||||

| Other | 43.5 | 41.9 | 3.9 | % | 19.8 | 19.0 | 3.7 | % | 23.7 | 22.8 | 4.0 | % | ||||||||||||||

| Total Operating | 1,217.8 | 1,152.4 | 5.7 | % | 760.9 | 727.9 | 4.5 | % | 456.9 | 424.5 | 7.6 | % | ||||||||||||||

| Expense | ||||||||||||||||||||||||||

| Property Operating(10)(11) | 398.1 | 374.9 | 6.2 | % | 202.7 | 187.5 | 8.1 | % | 195.4 | 187.4 | 4.2 | % | ||||||||||||||

| Real Property NOI(1) | $ | 819.7 | $ | 777.5 | 5.4 | % | $ | 558.2 | $ | 540.4 | 3.3 | % | $ | 261.5 | $ | 237.1 | 10.3 | % | ||||||||

(a) Percentages are calculated based on unrounded numbers.

Same Property Summary(2) – MH / RV (Continued)

(amounts in millions)

| As of | ||||||||||||||

| December 31, 2022 | December 31, 2021 | Change | % Change | |||||||||||

| Other Information | ||||||||||||||

| Number of properties(a) | 421 | 421 | — | |||||||||||

| MH occupancy | 97.1 | % | ||||||||||||

| RV occupancy | 100.0 | % | ||||||||||||

| MH & RV blended occupancy(3) | 97.8 | % | ||||||||||||

| Adjusted MH occupancy(3) | 98.2 | % | ||||||||||||

| Adjusted RV occupancy(3) | 100.0 | % | ||||||||||||

| Adjusted MH & RV blended occupancy(3) | 98.6 | % | 96.8 | % | 1.8 | % | ||||||||

| Sites available for development | 7,092 | 7,670 | (578 | ) | ||||||||||

| Monthly base rent per site – MH | $ | 635 | $ | 607 | $ | 28 | 4.6%(13) | |||||||

| Monthly base rent per site – RV(12) | $ | 555 | $ | 516 | $ | 39 | 7.6%(13) | |||||||

| Monthly base rent per site – Total(12) | $ | 617 | $ | 587 | $ | 30 | 5.0%(13) | |||||||

| Monthly base rent per site – MH Rental Program | $ | 1,225 | $ | 1,117 | $ | 108 | 9.7 | % | ||||||

(a) Financial results from properties disposed of, and the three impaired communities in the Fort Myers, Florida area related to Hurricane Ian, during the year have been removed from Same Property reporting.

Same Property Summary – Marina

(amounts in millions)

| Three Months Ended | ||||||||

| December 31, 2022 | December 31, 2021 | % Change(a) | ||||||

| Revenue | ||||||||

| Real property (excluding transient and other) | $ | 54.0 | $ | 50.0 | 8.2 | % | ||

| Real property – transient | 2.9 | 2.7 | 5.1 | % | ||||

| Other | 2.8 | 2.5 | 11.2 | % | ||||

| Total Operating | 59.7 | 55.2 | 8.2 | % | ||||

| Expense | ||||||||

| Property Operating(10) | 20.6 | 19.8 | 4.2 | % | ||||

| Real Property NOI(1) | $ | 39.1 | $ | 35.4 | 10.4 | % | ||

(a) Percentages are calculated based on unrounded numbers.

| Year Ended | ||||||||

| December 31, 2022 | December 31, 2021 | % Change(a) | ||||||

| Revenue | ||||||||

| Real property (excluding transient and other) | $ | 221.4 | $ | 205.6 | 7.7 | % | ||

| Real property – transient | 12.4 | 13.0 | (5.1) % | |||||

| Other | 12.3 | 11.4 | 8.7 | % | ||||

| Total Operating | 246.1 | 230.0 | 7.0 | % | ||||

| Expense | ||||||||

| Property Operating(10) | 84.1 | 79.5 | 5.8 | % | ||||

| Real Property NOI(1) | $ | 162.0 | $ | 150.5 | 7.7 | % | ||

(a) Percentages are calculated based on unrounded numbers.

| As of | ||||||

| December 31, 2022 | December 31, 2021 | % Change | ||||

| Other Information | ||||||

| Number of properties | 101 | 101 | — | % | ||

| Wet slip and dry storage spaces | 35,546 | 35,744 | (0.6) % | |||

Acquisitions and Other Summary (excluding UK Operations)(14)

(amounts in millions, except for statistical data)

| Three Months Ended | Year Ended | |||||

| December 31, 2022 | December 31, 2022 | |||||

| Revenues | ||||||

| Real property (excluding transient and other) | $ | 35.3 | $ | 145.8 | ||

| Real property – transient | 7.2 | 57.4 | ||||

| Other | 3.4 | 23.2 | ||||

| Total Operating | 45.9 | 226.4 | ||||

| Expenses | ||||||

| Property Operating(10) | 22.6 | 92.1 | ||||

| Real Property NOI(1) | $ | 23.3 | $ | 134.3 | ||

| Other Information | December 31, 2022 | |||||

| Number of properties | 92 | |||||

| MH and RV Developed sites | 6,961 | |||||

| MH and RV Occupied sites | 5,559 | |||||

| MH and RV Occupancy % | 79.9 | % | ||||

| Transient sites | 7,689 | |||||

| Wet slips and dry storage spaces | 12,277 | |||||

UK Operations Summary

(amounts in millions, except for statistical data)

| Three Months Ended | YTD Since Acquisition December 31, 2022 |

||||||

| December 31, 2022 | |||||||

| Revenues | |||||||

| Real property (excluding transient and other) | $ | 21.9 | $ | 60.0 | |||

| Real property – transient | 3.8 | 38.5 | |||||

| Other | 0.2 | 1.2 | |||||

| Total Operating | 25.9 | 99.7 | |||||

| Expenses | |||||||

| Property Operating(10) | 15.5 | 48.7 | |||||

| Real Property NOI(1) | 10.4 | 51.0 | |||||

| Home sales | |||||||

| Revenue | 45.7 | 190.4 | |||||

| Cost of home sales | 26.7 | 102.4 | |||||

| Home selling expenses | 1.9 | 5.5 | |||||

| NOI(1) | 17.1 | 82.5 | |||||

| Retail, dining and entertainment | |||||||

| Revenue | 5.0 | 32.8 | |||||

| Expense | 9.2 | 38.0 | |||||

| Net Operating Loss | (4.2 | ) | (5.2 | ) | |||

| UK Operations NOI(1) | $ | 23.3 | $ | 128.3 | |||

| Adjustment | |||||||

| Foreign currency translation impact | 3.7 | 15.6 | |||||

| UK Operations NOI(1) – Constant Currency | $ | 27.0 | $ | 143.9 | |||

| Other information | |||||||

| Number of properties | 55 | ||||||

| Developed sites | 18,227 | ||||||

| Occupied sites | 16,223 | ||||||

| Occupancy % | 89.0 | % | |||||

| Transient sites | 3,143 | ||||||

| Sites available for development | 1,888 | ||||||

| Home Sales | |||||||

| New home sales volume | 212 | 1,158 | |||||

| Pre-owned home sales volume | 345 | 1,019 | |||||

| Total home sales volume</span. | 557 | 2,177 | |||||

Marina Segment Summary

(amounts in millions, except for statistical data)

| Three Months Ended | Year Ended | |||||||||||||||||

| December 31, 2022 | December 31, 2021 | % Change | December 31, 2022 | December 31, 2021 | % Change | |||||||||||||

| Financial Information | ||||||||||||||||||

| Revenues | ||||||||||||||||||

| Real property (excluding transient and other) | $ | 81.7 | $ | 70.1 | 16.5 | % | $ | 321.8 | $ | 251.0 | 28.2 | % | ||||||

| Real property – transient | 4.2 | 3.4 | 23.5 | % | 18.9 | 14.8 | 27.7 | % | ||||||||||

| Other | 4.5 | 2.6 | 73.1 | % | 23.8 | 12.4 | 91.9 | % | ||||||||||

| Total Operating | 90.4 | 76.1 | 18.8 | % | 364.5 | 278.2 | 31.0 | % | ||||||||||

| Expenses | ||||||||||||||||||

| Property Operating(10) | 32.1 | 26.3 | 22.1 | % | 121.4 | 95.6 | 27.0 | % | ||||||||||

| Real Property NOI(1) | 58.3 | 49.8 | 17.1 | % | 243.1 | 182.6 | 33.1 | % | ||||||||||

| Service, retail, dining and entertainment | ||||||||||||||||||

| Revenue | 91.4 | 68.8 | 32.8 | % | 402.3 | 270.8 | 48.6 | % | ||||||||||

| Expense | 84.8 | 65.0 | 30.5 | % | 356.9 | 241.1 | 48.0 | % | ||||||||||

| NOI(1) | 6.6 | 3.8 | 73.7 | % | 45.4 | 29.7 | 52.9 | % | ||||||||||

| Marina NOI(1) | $ | 64.9 | $ | 53.6 | 21.1 | % | $ | 288.5 | $ | 212.3 | 35.9 | % | ||||||

| Other information | ||||||||||||||||||

| Number of properties | 134 | 125 | 7.2 | % | ||||||||||||||

| Total wet slips and dry storage spaces | 47,823 | 45,155 | 5.9 | % | ||||||||||||||

Home Sales Summary (excluding UK home sales)

(amounts in millions, except for *)

| Three Months Ended | Year Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | % Change | December 31, 2022 | December 31, 2021 | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Information | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Homes (amounts in millions, except for *)

Operating Statistics for MH and Annual RVs (excluding UK Operations)

Acquisitions and Dispositions

(a) Combined with an existing property. (b) Contains one development property. Capital Expenditures and Investments

The Company classifies its investments in properties into the following categories: Recurring Capital Expenditures – Property recurring capital expenditures are necessary to maintain asset quality, including purchasing and replacing assets used to operate the communities and marinas. Recurring capital expenditures at the Company’s MH and RV properties include items such as: major road, driveway, pool improvements; clubhouse renovations; adding or replacing streetlights; playground equipment; signage; maintenance facilities; manager housing and property vehicles. Recurring capital expenditures at its marinas include items such as: dredging, dock repairs and improvements, and equipment maintenance and upgrades. The minimum capitalized amount is five hundred dollars. Non-Recurring Capital Expenditures Lot Modifications – Lot modification capital expenditures are incurred to modify the foundational structures required to set a new home after a previous home has been removed. These expenditures are necessary to create a revenue stream from a new site renter and often improve the quality of the community. Other lot modification expenditures include land improvements added to annual RV sites to aid in the conversion of transient RV guests to annual contracts. Growth Projects – Growth projects consist of revenue generating or expense reducing activities at MH and RV communities, and marinas. This includes, but is not limited to, utility efficiency and renewable energy projects, site, slip or amenity upgrades such as the addition of a garage, shed or boat lift, and other special capital projects that substantiate an incremental rental increase. Rebranding – Rebranding includes new signage at the Company’s RV communities and costs of building an RV mobile application and updated website. Acquisitions – Capital expenditures related to acquisitions represent the purchase price of existing operating properties and land parcels to develop expansions or new properties. Expenditures consist of capital improvements identified during due diligence that are necessary to bring the properties to the Company’s operating standards. These costs for the year ended December 31, 2022, include $114.0 million at its MH and RV properties and $166.3 million at its marina properties. For the years ended December 31, 2021 and 2020, these costs were $75.8 million at its MH and RV properties and $100.7 million at its marina properties, and $40.6 million at its MH and RV properties, respectively. These include items such as: upgrading clubhouses; landscaping; new street light systems; new mail delivery systems; pool renovation including larger decks, heaters and furniture; new maintenance facilities; lot modifications; and new signage including main signs and internal road signs. These are considered acquisition costs and although identified during due diligence, often require 24 to 36 months after closing to complete. Expansions and Developments – Expansion and development expenditures consist primarily of construction costs such as roads, activities and amenities, and costs necessary to complete home and RV site improvements, such as driveways, sidewalks and landscaping at the Company’s MH and RV communities. Expenditures also include costs to rebuild after damage has been incurred at MH, RV or marina properties, and research and development. Recurring Capex per Site / Slip / Dry Storage Space – Average based on actual number of MH / RV sites and Marina wet slips and dry storage spaces associated with the recurring capital expenditures in each period. Outstanding Securities and Capitalization

^ Annual distribution is based on the last quarterly distribution annualized. (a) Calculation may yield minor differences due to fractional shares paid in cash to the shareholder at conversion.

Debt Analysis (amounts in millions, except for *)

(a) As of December 31, 2022, £400.0 million ($483.6 million) was swapped to fix the floating rate, resulting in an interest rate of 3.66%. (b) Percentages include the impact of hedge activity. (c) Weighted average interest rate includes the impact of derivative transactions. Endnotes, Reconciliations and Definitions (1) Investors in and analysts following the real estate industry utilize funds from operations (“FFO”), net operating income (“NOI”), and earnings before interest, tax, depreciation and amortization (“EBITDA”) as supplemental performance measures. The Company believes that FFO, NOI and EBITDA are appropriate measures given their wide use by and relevance to investors and analysts. Additionally, FFO, NOI and EBITDA are commonly used in various ratios, pricing multiples, yields and returns and valuation calculations used to measure financial position, performance and value.

FFO FFO is defined by the National Association of Real Estate Investment Trusts (“NAREIT”) as GAAP net income (loss), excluding gains (or losses) from sales of depreciable operating property, plus real estate related depreciation and amortization, real estate related impairments, and after adjustments for nonconsolidated partnerships and joint ventures. FFO is a non-GAAP financial measure that management believes is a useful supplemental measure of the Company’s operating performance. By excluding gains and losses related to sales of previously depreciated operating real estate assets, real estate related impairment and real estate asset depreciation and amortization (which can vary among owners of identical assets in similar condition based on historical cost accounting and useful life estimates), FFO provides a performance measure that, when compared period-over-period, reflects the impact to operations from trends in occupancy rates, rental rates and operating costs, providing perspective not readily apparent from GAAP net income (loss). Management believes the use of FFO has been beneficial in improving the understanding of operating results of REITs among the investing public and making comparisons of REIT operating results more meaningful. The Company also uses FFO excluding certain gain and loss items that management considers unrelated to the operational and financial performance of the Company’s core business (“Core FFO”). In addition, the Company calculates Constant Currency Core FFO by translating the operating results from the UK, Canada and Australia at the foreign currency exchange rates used for guidance. The Company believes that Core FFO and Constant Currency Core FFO provide enhanced comparability for investor evaluations of period-over-period results. The Company believes that GAAP net income (loss) is the most directly comparable measure to FFO. The principal limitation of FFO is that it does not replace GAAP net income (loss) as a financial performance measure or GAAP cash flow from operating activities as a measure of the Company’s liquidity. Because FFO excludes significant economic components of GAAP net income (loss) including depreciation and amortization, FFO should be used as a supplement to GAAP net income (loss) and not as an alternative to it. Furthermore, FFO is not intended as a measure of a REIT’s ability to meet debt principal repayments and other cash requirements, nor as a measure of working capital. FFO is calculated in accordance with the Company’s interpretation of standards established by Nareit, which may not be comparable to FFO reported by other REITs that interpret the Nareit definition differently. NOI NOI is derived from revenues minus property operating expenses and real estate taxes. NOI is a non-GAAP financial measure that the Company believes is helpful to investors as a supplemental measure of operating performance because it is an indicator of the return on property investment and provides a method of comparing property performance over time. The Company uses NOI as a key measure when evaluating performance and growth of particular properties and / or groups of properties. The principal limitation of NOI is that it excludes depreciation, amortization, interest expense and non-property specific expenses such as general and administrative expenses, all of which are significant costs. Therefore, NOI is a measure of the operating performance of the properties of the Company rather than of the Company overall. In addition, the Company calculates Constant Currency NOI for its UK Operations by translating the operating results from the UK at the foreign currency exchange rate used for guidance. The Company believes that NOI and Constant Currency NOI provide enhanced comparability for investor evaluation of properties performance and growth over time. The Company believes that GAAP net income (loss) is the most directly comparable measure to NOI. NOI should not be considered to be an alternative to GAAP net income (loss) as an indication of the Company’s financial performance or GAAP cash flow from operating activities as a measure of the Company’s liquidity; nor is it indicative of funds available for the Company’s cash needs, including its ability to make cash distributions. Because of the inclusion of items such as interest, depreciation and amortization, the use of GAAP net income (loss) as a performance measure is limited as these items may not accurately reflect the actual change in market value of a property, in the case of depreciation and in the case of interest, may not necessarily be linked to the operating performance of a real estate asset, as it is often incurred at a parent company level and not at a property level. In addition, the Company calculates Constant Currency NOI for its UK Operations by translating the operating results at the foreign currency exchange rate used for guidance. The Company believes that NOI and Constant Currency NOI provide enhanced comparability for investor evaluations of period-over-period results. Same Property NOI – A key management tool used when evaluating performance and growth of the Company’s properties is a comparison of the Same Property portfolio. The Company defines same properties as those the Company has owned and operated continuously since January 1, 2021. Same properties exclude ground-up development properties, acquired properties and properties sold after December 31, 2020. The Company believes that Same Property NOI is helpful to investors as a supplemental comparative performance measure of the income generated from the Same property portfolio from one period to the next. The Same Property data may change from time-to-time depending on acquisitions, dispositions, management discretion, significant transactions or unique situations. Same Property NOI does not include the revenues and expenses related to home sales, service, retail, dining and entertainment activities at the properties. EBITDA EBITDA as defined by Nareit (referred to as “EBITDAre“) is calculated as GAAP net income (loss), plus interest expense, plus income tax expense, plus depreciation and amortization, plus or minus losses or gains on the disposition of depreciated property (including losses or gains on change of control), plus impairment write-downs of depreciated property and of investments in nonconsolidated affiliates caused by a decrease in value of depreciated property in the affiliate, and adjustments to reflect the entity’s share of EBITDAre of nonconsolidated affiliates. EBITDAre is a non-GAAP financial measure that the Company uses to evaluate its ability to incur and service debt, fund dividends and other cash needs and cover fixed costs. Investors utilize EBITDAre as a supplemental measure to evaluate and compare investment quality and enterprise value of REITs. The Company also uses EBITDAre excluding certain gain and loss items that management considers unrelated to measurement of the Company’s performance on a basis that is independent of capital structure (“Recurring EBITDA”). The Company believes that GAAP net income (loss) is the most directly comparable measure to EBITDAre. EBITDAre is not intended to be used as a measure of the Company’s cash generated by operations or its dividend-paying capacity, and should therefore not replace GAAP net income (loss) as an indication of the Company’s financial performance or GAAP cash flow from operating, investing and financing activities as measures of liquidity. (2) Same Property results for the Company’s MH and RV properties reflect constant currency for comparative purposes. Canadian currency figures in the prior comparative period have been translated at the 2022 average exchange rate of $0.7366 USD per Canadian dollar. (3) The Same Property MH and RV blended occupancy for 2022 is derived from 123,349 developed sites, of which 120,614 were occupied. The Same Property adjusted MH and RV blended occupancy percentage is derived from 122,351 developed sites, of which 120,614 were occupied. The number of developed sites excludes RV transient sites and nearly 1,000 recently completed but vacant MH expansion sites. The Same Property adjusted MH and RV blended occupancy percentage for 2021 has been adjusted to reflect incremental period-over-period growth from newly occupied expansion sites and the conversion of transient RV sites to annual RV sites. (4) The effect of certain anti-dilutive convertible securities is excluded from these items. (5) Revenue producing site net gains do not include occupied sites acquired during the year. (6) Other expense, net was as follows (in millions):

(7) Calculations of Diluted weighted average common shares outstanding for EPS and FFO are as follows:

(8) Other acquisition related costs represent (a) nonrecurring integration expenses associated with acquisitions during the three months and year ended December 31, 2022 and 2021, (b) costs associated with potential acquisitions that will not close, (c) costs associated with the termination of the bridge loan commitment during the three months ended March 31, 2022 related to the acquisition of Park Holidays and (d) expenses incurred to bring recently acquired properties up to the Company’s operating standards, including items such as tree trimming and painting costs that do not meet the Company’s capitalization policy. (9) Other adjustments, net was as follows (in millions):

(10) Results for the Company’s Same Property MH / RV, Same Property marina, UK Operations and Acquisitions and Other, net certain utility revenue against the related utility expense in Property Operating expense as follows (in millions):

Marina segment results (page 14) – Summary of utility revenue netted against the related utility expense in Property Operating expense (in millions). These amounts are broken out and included within Same Property Marina and Acquisition and Other in the table above.

(11) Same Property supplies and repair expense for the Company’s MH and RV properties excludes $1.2 million and $2.8 million for the three months and year ended December 31, 2021, respectively, of expenses incurred for recently acquired properties to bring the properties up to the Company’s operating standards, including items such as tree trimming and painting costs that do not meet the Company’s capitalization policy. (12) Monthly base rent per site pertains to annual RV sites and excludes transient RV sites. (13) Calculated using actual results without rounding. (14) Acquisitions and Other (excluding UK Operations) is comprised of recent acquisitions, recently opened ground-up development projects in stabilization and properties undergoing redevelopment. (15) Line of credit and other debt includes borrowings under the Company’s $4.2 billion senior credit facility and a $19.8 million unsecured term loan. Outstanding balances as of December 31, 2022 were as follows (in millions):