Comments and insights from Sun Communities Inc. (SUI) in their new 1st quarter 2021 earnings call, shown further below, correctly raised reasons to look at recent RV industry data to compare it with what is occurring in manufactured housing. The following is from the March 2021 RV Industry Association (RVIA) media release. This RVIA data will be followed by Sun Communities financial performance, including some interesting statements that will be quotable quotes, like the ones in the headlines.

Note that unlike the Manufactured Housing Institute (MHI), which in recent months have hidden their monthly data behind a members-only paywall, the RVIA wants as many people as possible to see their industry’s facts in a free and public fashion. In following that practice, the RVIA is more akin to the National Association of Home Builders (NAHB), the National Association of Realtors (NAR), or the Manufactured Housing Association for Regulatory Reform (MHARR), all of which publish data publicly. Thankfully, MHARR made public years of industry production and shipment data at the link here.

MHProNews is beginning a repository of manufactured housing data that includes expert analysis at this link here.

March 2021

Summary

RV shipments are expected to surpass 400,000 wholesale units by the end of 2020 and see continued growth in 2021 to more than 500,000 units, according to the Fall 2020 RV RoadSigns prepared by ITR Economics for the RV Industry Association.

The new projection sees total shipments ranging between 414,200 and 434,500 units with the most likely 2020 year-end total being 424,400 units. That total would represent a 4.5 percent gain over the 406,070 units shipped in 2019, overcoming a nearly two-month RV industry shutdown due to the COVID-19 pandemic. Initial estimates for 2021 have a range of 494,400 to 519,900 units with a most likely outcome of 507,200 units, a 19.5 percent increase over 2020.

The 507,200 units projected for 2021 would represent the best annual total on measurable record for the RV industry, eclipsing the 504,600 units shipped in 2017. The projected 424,400 units in 2020 would be the fourth best annual total on record.

Towable RV shipments are anticipated to reach 383,900 units in 2020 and 452,500 units in 2021. Motorhome shipments projected to finish at 40,500 units in 2020 and 54,700 units in 2021.

“The RV industry has experienced strong consumer growth over the past 10 years, but the recent soar in consumer interest in RVing driven by the COVID-19 pandemic has led to a marked increase in RV shipments to meet the incredibly strong order activity at the retail level,” said RV Industry Association President Craig Kirby. “This new forecast confirms what we have been seeing across the country as people turn to RVs as a way to have the freedom to travel and experience an active outdoor lifestyle while also controlling their environment.”

This new insight into the purchase motivations of people who bought RVs in 2020 is continued good news for an RV industry that has been experiencing forty years of long-term growth. A recent study from Go RVing echoed this growth, reporting that 11.2 million households now own an RV, up 26% over the past 10 years and 62% over the last 20 years. Even more importantly, nearly a quarter of current RV owners are now under the age of 35, and 84% of those younger owners plan to purchase a new RV in the next 5 years…” ##

The graphic below and some others can be opened to a larger size in many browsers.

Click the image once to open a new window, and then click that image

again to see the larger size.

So, as will be noted below by Sun Communities Inc (SUI) management in their quarterly earnings call, there are now over 11 million RVs in the nation. The RV industry surged past manufactured housing in the last 2 decades. In 1998, RVs trailed manufactured home shipments. RVs have surged past manufactured homes by ratio that has often hovered around 5 RVs to 1 MHs.

So, while conventional housing and RVs are surging, manufactured homes are trailing and sliding? This is the “superb” performance that industry cheerleaders are defending?

Sun’s Chairman and CEO Gary Schiffman in the quarterly report from 4.27.2021 matter of flatly notes that there is no central repository of information on land-lease manufactured home communities. MHI, are you listening?

Schiffman also says there is a dearth of manufactured home properties available, especially of an “institutional grade.” Other insights from what follows will be unpacked in a planned future report.

Sun Communities Inc (SUI) Q1 2021 Earnings Call Transcript

(MFTranscribers)

Apr 27, 2021 at 11:01PM

Sun Communities Inc (NYSE:SUI)

Q1 2021 Earnings Call

Apr 27, 2021, 11:00 a.m. ET

Contents:

- Prepared Remarks

- Questions and Answers

- Call Participants

Prepared Remarks:

Operator

Greetings. Thank you for joining us today for Sun Communities First Quarter 2021 Earnings Conference Call. [Operator Instructions]

I would now like to turn the conference over to your host, Gary Shiffman, Chairman and Chief Executive Officer. Thank you. You may begin.

Gary A. Shiffman — Chairman and Chief Executive Officer

Good morning and thank you for joining us as we discuss our first quarter 2021 results. We’re very pleased with the performance of all of our business lines as 2021 is off to a very strong start. In the first quarter, we delivered core FFO per share of $1.26, which exceeded the high end of our guidance of $1.17. Due to this outperformance and strong visibility into our second and third quarter transient RV bookings, we are raising our 2021 core FFO per share annual guidance range by $0.13 to $5.92 to $6.08 and our expected same community NOI growth for the full year by 190 basis points to a range of 7.5% to 8.5%.

The momentum we experienced in our RV resorts in 2020 has only accelerated this year as the country continues to reopen. For the quarter, same community NOI growth was 2.7% over last year, despite the continued Canadian border closure and the California stay-at-home order which dictated the closure of our California resorts through early February. We achieved total portfolio occupancy of 97.3%, a 60 basis point improvement over the first quarter of 2020 by selling 514 revenue-producing sites. We also delivered approximately 350 ground-up and expansion sites in the first quarter, which include the grand opening of our premier 250 site Sun Outdoors San Diego Bay Resort.

Since the beginning of the year, we have deployed $183 million into acquisitions, comprised of two manufactured housing communities, six RV resorts, and four marinas. Our team continues to find ways to add irreplaceable assets to our portfolio that serve to reinforce the high quality of our brand, enhance our offerings to our guests and foster continued growth of our revenues and earnings over time. In our manufactured housing business, our operations are benefiting from sustained strength and fundamentals and demand for affordable housing, evidenced by new, pre-owned, and brokered home sales. Furthermore, applications to live in a Sun community remain at record high levels, up 21% over this time last year.

Our RV business, while impacted by the closures and the travel restrictions associated with the pandemic during the quarter, is showing resilience with forward bookings well ahead of both 2020 and 2019. As we emerge from the pandemic and as the percentage of the vaccinated population rises, we anticipate our best-in-class resorts to remain a preferred vacationing option. Our assertion is supported by the RV Industry Association stating record-year unit sale expectations for 2021 as well as our strong advance bookings for the second and third quarters. A broader segment of the population rediscovered the outdoors during 2020 and we are seeing that interest carry forward. In an environment impacted by COVID, RV provides travelers with an incremental level of safety and control. Moreover, we believe that increased demand is being driven by the continued desire of consumers to get back to a degree of normalcy, resuming vacation and leisure travel after last year’s travel restrictions.

In our marina business, results continue to track ahead of our underwriting and the team is preparing for an active boating season. According to multiple industry sources, boat sales have increased in demand year-over-year. With our expanded presence in this sought-after and scarce asset class, we are well-positioned to benefit from the increased demand for slips and moorings.

We are relying on our four core investment strategies to support long-term resilience and the growth of our platform, further solidifying our position of delivering industry-leading results. An important part of these core strategies includes expansion and ground-up development. We wanted to highlight the recent opening of Sun Outdoors San Diego Bay first announced nearly four years ago. It is now open for guests and we are pleased to continue to realize meaningful accretion from our capital deployment activities. In early March, we executed a $1.1 billion equity raise to secure capital to fund our growing acquisition pipeline and other opportunities. We will match fund these growth initiatives with this equity.

Key contributors to the success of our franchise are our ongoing efforts with regard to our environment and its sustainability, our social ecosystem and careful attention to governance. With that said, we wanted to provide some important updates with regard to our ESG initiatives. This month, we launched a new partnership with the National Park Foundation in support of the foundation’s outdoor exploration program. Sun RV resorts has committed to contribute toward the National Park Foundation’s mission to connect this and future generations with the social, mental and physical health benefits of national parks and outdoor discovery.

With respect to our commitment to diversity, equity, and inclusion, Sun has engaged with a consultancy team with 30 years of experience in the field of equality and justice. This group has deep expertise in the importance of breaking through unconscious bias and social injustices in the workplace. Together, we are assessing the current state of inclusion, diversity, equity, and accessibility at Sun, and developing an organization wide strategy to create positive change.

Before handing the call over to John and Karen, I wanted to point out that we have enhanced our financial disclosures. With the addition of Safe Harbor, we took the opportunity to provide better insight into the primary drivers of our business. Karen will walk you through the changes we have implemented after John shares details about our operational performance.

I will now turn the call over to John. John?

John B. McLaren — President and Chief Operating Officer

Thank you, Gary.

Sun delivered a strong first quarter across the board, setting the stage for a solid year. Our results reflect the combination of the stability of our manufactured housing business line and our same community portfolio, as well as the incremental benefits of our growth initiatives across MH, RV, and marina business lines. For the first quarter, combined same community NOI increased 2.7%. The growth in NOI was driven by a 3.5% revenue gain, supported by a 1.9% increase in occupancy to 98.8% and a 3.5 weighted average rent increase. This was offset by a 5.5% expense increase. As part of our revised disclosures, we are now providing same community NOI for our manufactured housing and RV businesses. Same community manufactured housing NOI increased by 4.9% from 2020 and same community RV NOI declined by 4%.

RV revenues were impacted by the Canadian border closure during the first quarter which affected our snowbird season and the California shelter-in-place order that ran through early February. Combined, these two events had a $6 million impact on our transient RV same community revenue as compared to our previously communicated estimate of $8 million to $10 million. With respect to RV revenue, we anticipate a significant rebound in the second and third quarters. RV resorts are beneficiaries of the reopening trade and we are fully participating.

Our second quarter transient forecast is already ahead of our original budget by over 20% and trending 57% higher than 2019, which we believe to be a better comparable given COVID-related disruptions in 2020. Likewise, our third quarter transient RV forecast is currently ahead of the original budget by approximately 5% and this is trending ahead of 2019 by almost 40%. In addition, we have a great deal of visibility into our reservation for rest of the year through Campspot, our proprietary RV reservation of revenue management software. Today, digital reservations comprise over 60% of our total reservations for our same community portfolio as compared to 60% [Phonetic] just two years ago.

Moving onto total MH and RV portfolio, in the first quarter, we gained 514 revenue-producing sites as compared to 300 in the first quarter of 2020, bringing our total portfolio occupancy to 97.3% from 96.7% a year ago. Of our revenue-producing site gains, over 380 transient RV sites were converted to annual leases with the balance being added in our manufactured housing expansion communities.

A key component of our four core growth initiatives is the development of ground-up and expansion sites. In the first quarter, we delivered approximately 350 sites, 250 of which in the ground-up development in San Diego and 100 were in MH expansion sites at Sunset Ridge in Texas. These completed expansion and ground-up development sites will contribute to RPS gains in 2021 and beyond as they fill up and stabilize. As of the end of the quarter, we have approximately 9,700 zoned and entitled sites in our portfolio that once built will contribute to growth in the coming years.

Home sales in the quarter were particularly strong. We sold 835 homes, an increase of 9.4% versus the first quarter of 2020. Of these, 149 were new home sales, up over 25% and 686 were pre-owned home sales, up 6.5% as compared to the same period last year, respectively. Average home prices for both new and pre-owned homes rose 17.6% and 9.8%, respectively, underscoring the overall geographic market mix as well as sustained demand for our product and the strong desire to live in a Sun community.

Brokered home sales throughout Sun’s portfolio saw 36% increase year-over-year, as the resale market continues to show strength. Average brokered home prices in our communities increased by over 20%, as compared to the first quarter of 2020. We believe that a vibrant resell market for homes in our communities demonstrates the benefits of the consistent reinvestment in our properties, creating equity value for our homeowners and increasing the overall value of our portfolio.

Moving on to Safe Harbor. During the quarter, the marina portfolio contributed over $31.4 million to total NOI. The marinas are performing ahead of our underwriting, and the team continues to source acquisitions in irreplaceable locations, which for the first quarter, include two marinas on Islamorada in the Florida Keys and two marinas on Martha’s Vineyard.

We are optimistic about the underlying trends we are observing across all of our business lines. With the vaccination rate increasing across the country, we are anticipating accelerated growth in our RV and marina businesses. We are well positioned to see follow-through of this quarter’s outperformance and look forward to sharing our progress with you in the coming quarters.

Karen will now discuss our financial results in more detail. Karen?

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

Thanks, John. For the first quarter, Sun reported core FFO per share of $1.26, 3.3% above the prior year and $0.09 ahead of the top-end of our first quarter guidance range. During and subsequent to quarter-end, we acquired $183 million of operating properties comprised of two manufactured home communities, six RV resorts and four marinas. To support our growth activities, we completed a $1.1 billion equity raise, representing approximately 8 million shares of our common stock. To date, we have settled 4 million shares, receiving $538 million in net proceeds, which was used to pay down borrowings on our credit facility. We expect to settle the remaining 4 million shares no later than March 2022.

We ended the first quarter with $4.4 billion of debt outstanding at a 3.4% weighted average rate and a weighted average maturity of 9.5 years. As of March 31, we had $105 million of unrestricted cash on hand and a net debt to trailing 12-month recurring EBITDA ratio of 6.1 times. On a pro forma basis, including the estimated full year EBITDA contribution from Safe Harbor and other acquisitions, our net debt to trailing 12-month recurring EBITDA ratio is in the low-5 times.

As a result of our outperformance during the quarter, we are raising our core FFO expectations for full-year 2021 to a range of $5.92 per share to $6.08 per share. We expect core FFO for the second quarter to be in the range of $1.57 per share to $1.63 per share. We are also revising full year same community NOI growth guidance to a range of 7.5% to 8.5%. As a reminder, our guidance includes acquisitions through the date of this call, but does not include the impact of prospective acquisitions or capital markets activities, which may be included in research analyst estimates.

As Gary mentioned earlier, we enhanced our financial disclosures this quarter. The addition of the marina portfolio gave us the opportunity to reenvision how we report key aspects of our business. To provide more insight into each of our business lines, we now have a same community schedule which details performance by our MH and RV portfolio separately. Additionally, our same community revenues now include rental home program revenue and vacation rental home revenues. So the entire payment for these rentals is now included in real property revenue. Same community property operating expense now includes the related costs for these rental home programs.

We are also netting all utility income against utility expense, which provides a better view on what Sun’s direct utility costs are since the majority of these costs are passed through to our customers. We have retained our legacy disclosures for our rental program and have added a new page on the marina portfolio. Please see the 2021 summary of reporting changes document, which is contained in the Investor Relations section of our website for additional information and an illustration of these changes.

This completes our prepared remarks. We will now open up the call for questions. Operator?

Questions and Answers:

Operator

Thank you. Ladies and gentlemen, at this time, we will be conducting a question-and-answer session. [Operator Instructions] Our first question comes from the line of Nick Joseph with Citigroup. Please proceed with your question.

Nicholas Joseph — Citi Research — Analyst

Thank you. Gary, how does the current acquisition pipeline look, and where are you seeing the best opportunities?

Gary A. Shiffman — Chairman and Chief Executive Officer

Good morning, Nick. As we’ve shared recently that current pipeline across manufactured housing, RV and marinas has never been as full as it is right now. I think that we’re seeing a little bit more outreach than we even expected with some of the discussion about change in capital gains and things like that moving forward by the current administration, with obviously uncertainty as to where that’s going. But we do believe that we match fund — match funded the right amount of capital to be able to go out and utilize that capital in the relatively near-term based on the pipeline throughout all three aspects of our business.

Nicholas Joseph — Citi Research — Analyst

Thanks. I know guidance doesn’t assume any acquisitions or funding, but as you think about funding that pipeline, do you use your line and then settle the equity toward the end, or do you plan to settle the equity as you go in terms of the acquisition volume?

Gary A. Shiffman — Chairman and Chief Executive Officer

Yeah, I think that’s on a case-by-case basis. But for the foreseeable future, I think we rely on our line for certainty, quick access and the ability to close. One of the things that Sun is known for in such an acquisitive period and part of the reason why we had so many pocket listings, if you will, that don’t go to the market is the fact that through our process of underwriting, due diligence is to get through the purchase agreements and to work through tax deferred structuring, and then finally to a rapid close would lead me to believe we would be utilizing the credit facility on our first basis and then fund off the forward from there.

Nicholas Joseph — Citi Research — Analyst

Thank you.

Operator

Our next question comes from the line of Keegan Carl with Berenberg. Please proceed with your question.

Keegan Carl — Berenberg Capital Markets — Analyst

Hey, guys. Thanks for taking the questions. I think first, inflation is obviously a big talking point. So, are you guys seeing any inflation on new development and expansion projects? And if that’s the case, is that impacting your plans in any way for the year?

John B. McLaren — President and Chief Operating Officer

Maybe — this is John. Maybe a little bit, but no, it has had no impact on our plans for the year.

Keegan Carl — Berenberg Capital Markets — Analyst

Anything on labor, especially in the marina business, just given the specialization required?

Gary A. Shiffman — Chairman and Chief Executive Officer

I think that one of the things that we did take a look at going into the budgeting process with the management team over at Safe Harbor is that we did allocate properly for minimum wage and pricing pressure on labor. So, we feel pretty comfortable that all built into everything in the Safe Harbor budget, which we’re very pleased that they were able to exceed this past quarter on strong growth drivers. There is no doubt on the material side for homebuilding, lumber, steel, other products have been under pricing pressure for over 12 to 18 months now.

So, we’re seeing small incremental price increases on the homes being delivered for our manufactured housing communities. But I think they are smaller in nature than what site build is experiencing right now and perhaps might continue to give us at Sun Communities a little bit of an edge against increases in the site build housing and make the manufactured housing even more obtainable and affordable to many customers out there. So, it could be a positive trend for us.

Keegan Carl — Berenberg Capital Markets — Analyst

Got it. And just one more quick one. What were the cap rates from your two marina transactions? And are you guys seeing any further cap rate compression in the space?

Gary A. Shiffman — Chairman and Chief Executive Officer

There is no doubt there is continued competition in this space coming from private equity and even our public competitor who announced a small transaction this past quarter. But cap rates, for the time being, it’s a very unconsolidated industry, or governed by all the typical things of real estate location, demand, sometimes quality of the ability to bolt-on to existing marinas in the Safe Harbor portfolio. So it’s a range, and I would share that the manufactured housing and RV communities acquired since the beginning of the quarter, yeah, probably average right around the 4.5% cap rate and the marinas have ranged 200 basis points to 250 basis points above that. So we continue to look for the marinas in the 6% to 9% cap rate range. And then, of course, there’s always exceptions when there is a very, very difficult replacement value set on a particular marina that might come down below that.

Keegan Carl — Berenberg Capital Markets — Analyst

Alright. That’s it for me. Thanks, guys.

Gary A. Shiffman — Chairman and Chief Executive Officer

Thank you.

Operator

Our next question comes from the line of Brad Heffern with RBC Capital Markets. Please proceed with your question.

Brad Heffern — RBC Capital Markets — Analyst

Hey, good morning everyone. Thanks for taking the question. I appreciate the commentary that you had about the high level of advanced reservations that you’ve seen in the second quarter and the third quarter. I was noticing on the balance sheet that the category for advanced reservation deposits and rent is up really dramatically. So it was $188 million at the end of last year, it’s $280 million now. Is that reflective of the underlying strength? Are people reserving more in advance than they normally would be and that’s driving that number higher? I’m just trying to get a feel of whether that large delta sort of represents the strength that you’re seeing.

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

There is a bit of impact from Safe Harbor and the seasonality of their portfolio and when they do their advanced billings, so there is around about $26 million to $30 million, I think, it’s from Safe Harbor in there and the rest of it, I think, is just the seasonality of our advanced reservations and deposits on our RV portfolio. I’m sure there is some impact from advanced reservations in there that what we’re seeing. But it’s more about seasonality and Safe Harbor.

Brad Heffern — RBC Capital Markets — Analyst

Okay, got it. Thanks for that. And then just talking about the guide. You all beat the original first quarter guide by $0.11 and the guide’s up about $0.13. I’m just curious how much of the strength that you saw in the first quarter and that you’re expecting for the second quarter is really being read into the full-year guide or if the portfolio continues to perform like it has, or like it did in the first quarter if you see more upside?

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

I guess I would characterize the FFO raise, which I think is about $0.13 at the midpoint, that it reflects all the outperformance in Q1, plus additional expected outperformance in the transient RV business and if that — those offset — those increases are offset by the equity that we raised and have settled to date, which we will deploy into acquisitions as the year progresses.

Brad Heffern — RBC Capital Markets — Analyst

Okay, thank you.

Operator

Our next question comes from the line of Wes Golladay with Robert W. Baird. Please proceed with your question.

Wes Golladay — Robert W. Baird — Analyst

Hey, good morning, everyone. I just want to look at the RV business. Are you seeing incremental strength on annual conversions right now?

John B. McLaren — President and Chief Operating Officer

Yeah, [Indecipherable] I mean, we had a great first quarter with 380 plus — I think 387 was the exact number of conversions that we had, which as we’ve shared before, usually we’re in the range of about 1,100 in the year, and so that number is a little bit elevated. There is a little bit of seasonality to it, but I think the way that I’d characterize is that I see us — I see a lot of strength going into that for the rest of the year as well. It all kind of goes back to everything we’ve talked about over the last year with — I call it the rediscovery of the outdoors. We’ve taken so many new guests into our communities, they discover our communities and that’s really aiding in the conversion as well. So — and this is a reminder, every time we make, we have a conversion that’s a 40% to 60% revenue pickup that we get in that year each time we do that. So very positive and very excited about the results we’ve had thus far.

Wes Golladay — Robert W. Baird — Analyst

Got it and then maybe can you discuss Campspot? You mentioned 60% of bookings, I believe, come from that website or application. And can you give me, I guess, context of what that was maybe last year? And is that just Sun Communities or is that open to everybody?

John B. McLaren — President and Chief Operating Officer

Great question. So Campspot was originally developed by our Northgate partners and it’s jointly on the Sun and Northgate and it’s, as I said in my remarks, it’s a revenue management system coupled with its proprietary reservation system. And I think that the — the thing that’s most interesting about it is each resort in our portfolio really represents a multi-faceted occupancy and rate equation, literally each and every day of the year and at the core of Campspot is a built-in algorithm the optimizes the rate occupancy equation in the most efficient way. So that’s been some of the driving force behind aiding through 2020 and really brought us back as well as what’s happening in 2021, it’s been a big contributor. And if you go back to, I think, we said two years ago, our online reservation book, it was about 62% [Phonetic] versus 60% it is today. So there are other users of Campspot through the OTA, but it’s — certainly, our entire portfolio is on it now, just awesome.

Gary A. Shiffman — Chairman and Chief Executive Officer

That’s being marketed across the country right now. So we’re pretty excited to see how it performs for everybody.

John B. McLaren — President and Chief Operating Officer

Yeah.

Wes Golladay — Robert W. Baird — Analyst

Yeah. Got it and then, maybe just one on the development in San Diego. Is that going to deliver negative NOI this year or positive? And when will stabilization be? And when you do set a stabilized yield, does that include the benefit of selling homes?

Gary A. Shiffman — Chairman and Chief Executive Officer

Yeah. So the resort Sun Outdoors San Diego Bay, that is an RV resort. It’s got RV sites and vacation rentals. And typically on an RV ground-up development, we would see stabilization within a three-year period of time. And one of the benefits of the RV development is we can accept guests and we already are. In fact, I’m heading out there on Monday night for the official grand opening on the 4th [Phonetic], that we’ve worked with for close to four years on and it will generate positive NOI in 2021.

Wes Golladay — Robert W. Baird — Analyst

Got it. Thank you.

Operator

Our next question comes from the line of John Pawlowski with Green Street Advisors. Please proceed with your question.

John Pawlowski — Green Street Advisors — Analyst

Thanks. I wanted to follow up on the inflation conversation, but more on the demand side. John, the — as the price of other housing alternatives kind of skyrocketed in certain markets, are there any regions where you think you’d maybe second guess or pivot the typical 2% to 4% rent increase policy you’ve had? Is there — are there any markets where you’d push rents 5%, 6%, 7% in the coming years you think?

John B. McLaren — President and Chief Operating Officer

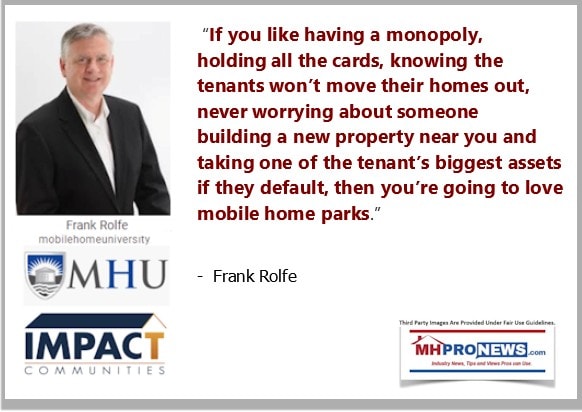

Well, for 20-plus years we’ve always, as you know, Todd, stated in that 2% to 4% range on average across the portfolio. But it’s not to say that in certain markets where a higher rent increase can be achieved. We do. We always try to keep everything from — we are in the attainable, affordable housing business and we take a very long-term view on that within the portfolio because there are so many benefits that come with sort of having the rent increases at the right level, OK, inclusive of the kind of equity growth that we’re seeing across our broker sales in our communities, which is real value to the customers, as well as real value to our portfolio overall. So to answer your question, some might be above that range and then we certainly would look to places, areas in the country that have more strength where that typically would happen.

John Pawlowski — Green Street Advisors — Analyst

Okay. Great, thanks. And then last one for me, Gary. Just in terms of the acquisition mix in recent years tilted considerably toward RV and not as active on the traditional MH side, is that more of an indication of just more RV volume hitting the market or is an indication where more times than not a traditional MH acquisition no longer pencils for you?

Gary A. Shiffman — Chairman and Chief Executive Officer

Yeah, I think it’s the former, definitely not the latter. The consolidation sequence in chronology is that manufactured housing became a prized asset way before RV resorts were really understood. So, as you may recall, there were four public companies. And now there are — actually five and now there are three, Sun, ELS and UMH [Phonetic]. And I think that it’s just a factor of the scarcity of available manufactured housing communities out there.

And then following that sequence, I’d like to give credit to the Sun team for really taking a deep dive into the RV business and understanding how it grew over the last 20 years, and then strategically determining that we were going to increase our RV Holdings in Sun’s portfolio and in doing so, kind of looked at cap rates in RV very similar to manufactured housing because we determine the revenues, the NOI growth was just a steady and, in some case, a stronger than what we saw in manufactured housing.

So as we followed and pursued aggressively acquisitions in RVs, that asset class has begun to consolidate. And then as you follow that even further into marinas, as many of you are aware, there was recapitalization and restructuring at Sunteck[Phonetic], the second largest marina holder and another portfolio — small portfolio acquired by ELS. So while there is absolutely opportunity for Sun and MH, RV, marinas right now are beginning to garner interest by other investors. And I anticipate we’ll see some pressure on cap rates, but as I indicated earlier that we are able to buy them and acquire them in a 250 basis points and above spread to MH and RV.

So, there is occasionally manufactured housing that we won’t pursue to the levels that they’re being acquired, but for the most part, what we’re seeing and what we’re acquiring isn’t broadly marketed, it’s just a phone call into our acquisitions department or personal relationship from someone on the team here reaching out.

John Pawlowski — Green Street Advisors — Analyst

Okay. Thank you for the time.

Operator

Our next question comes from the line of John Kim with BMO Capital Markets. Please proceed with your question.

John Kim — BMO Capital Markets — Analyst

Thank you, and thanks for the increased disclosure. I was wondering on the increase in RV demand you’re seeing this year. How much of that do you think is a temporary phenomenon and will receive potentially next year when people feel more comfortable flying and going increases?

John B. McLaren — President and Chief Operating Officer

Good question, John. Definitely, COVID has been a part of that, but really, the prospects for both RV and marina growth have never been stronger. I think as I said a couple of times that the notable thing is just rediscovery that’s happened[Phonetic] is really — I mean we saw particularly in the fall, OK, which was the growth like we’ve never seen in the fall. And what we saw during that time, many, many of those guests rebook, OK, into other parts of the year as well.

The other thing that provides some strength with the two is that the vast majority of our visitors and our guests that come to our resorts are coming within a 90-mile radius. So naturally, it will be some moving back to other forms of travel on vacation. But we will retain many of the new guests because of the experience they had in 2020 and the point with the radius that we have for most of our guests to come to our communities that even if they do go back to other forms of travel, it’s an easy and affordable vacation they can take, that’s something they can do on the weekend, or we can add it on. So it’s sort of it — it can be sort of an add-on even if they go back.

Gary A. Shiffman — Chairman and Chief Executive Officer

Yeah, John, I would add to John’s remarks that I think what we’re looking for is the incremental residual impact. So, we won’t retain everybody, but I can share with you that we will retain a residual portion of the increased demand as a result of the experience out there that has been positive. So I think it bodes well for incremental growth on what we would naturally expect in the RV resort business.

John Kim — BMO Capital Markets — Analyst

And what do you think is the best leading indicator for that demand? Is it RV shipment, which has increased significantly this past month? I think historically, it hasn’t really been a high correlation between shipments and your occupancy, but I’m just wondering what your thoughts were on this?

Gary A. Shiffman — Chairman and Chief Executive Officer

Okay. Well, you asked for it. So here it is. I think the best indicator is anecdotal indication of this individual myself and my family taking several COVID RV property inspections and vacations and what a great time we had. And that’s pretty much echoed by even some people on this analyst call who have shared their experiences with us. But as we continue to do our exit surveys, we’re just finding the enjoyment that John referenced as the leading indicator of why we think that it will be this residual increase post COVID to our business. And there are estimated to be around 11 million RVs registered today.

There are new options to be able to ramp existing RVs on an Airbnb model out there, so just continue to see increase in the consumer or guest pool available for a very limited amount of RV resorts. And I always like to point out to that the RV resorts are generally about being able to have the utility hookups, sewer water electric as opposed to boondocking where you don’t have those hookups and then the amenities and the features related to those RV resorts. So we just think that it’s a very, very exciting time in the RV business to be part of its growth.

John Kim — BMO Capital Markets — Analyst

I would love to ask the same question on superyacht demand. Maybe I’ll [Indecipherable] that for a separate discussion.

Gary A. Shiffman — Chairman and Chief Executive Officer

I would like to tell you, I’ve been on the superyachts, but it hasn’t [Indecipherable]. I was on electric boat, however, and it’s quite fascinating to get a glimpse of what the future might be with regard to moving from fossil fuel in the boating business to some expanded research and development and actually offerings now in electronic — electric boats battery powered.

John Kim — BMO Capital Markets — Analyst

Separate topic, with all the acquisition activity you’ve had in the past few years, can you just remind us what percentage of institutional quality image communities and RV parks you currently on?

Gary A. Shiffman — Chairman and Chief Executive Officer

Yeah, it’s Gary again, and unfortunately, there is not a national repository of information or indexes and the related items to manufactured housing communities as you’re referencing them. I would suggest that the vast majority of institutional quality manufactured housing communities have been consolidated by the public companies and what we referenced the three or four other high-quality private companies that are out there today with the best-in-class portfolios. So, I would not be able to necessarily give you a percentage, but I’ve heard from our competitors that probably represents anywhere from 10% to 15% of overall manufactured housing and RV resorts and probably closer to 50% of what we would consider institutional quality.

John Kim — BMO Capital Markets — Analyst

Okay, that’s helpful. And then my final question is on your rental home business, which had strong rental growth, but it’s coming down its proportion of your real property revenue on a year-over-year basis. Do you have any views or updated views on potentially increasing this business, given the strength of the single-family rental market?

John B. McLaren — President and Chief Operating Officer

Yeah, absolutely. I mean our rental home program, as you know, has stood the test of time. It’s an excellent tool to accelerate occupancy revenue growth. So, we will continue to use it as we share for expansions, new development and acquisitions for lease-up, ultimately, converting renters into homeowners. That would be the strategy though, John, OK to use it going forward and have and kind of align with the acquisitions and the development that we do along the way to move that forward faster.

John Kim — BMO Capital Markets — Analyst

Got it. Great. Thank you.

Operator

Our next question comes from the line of Joshua Dennerlein with Bank of America. Please proceed with your question.

Joshua Dennerlein — Bank of America Merrill Lynch — Analyst

Hey, Gary, John and Karen. Hope you’re doing well. Just wanted to touch base on John’s comments in the opening remarks about how Safe Harbor portfolios doing better than your underwriting. What’s driving that? Is it like something on the revenue side, expense side or something else, just curious?

Gary A. Shiffman — Chairman and Chief Executive Officer

That’s a great question, Josh. And what I would probably suggest what we’ve seen as we reviewed performance against budget is key first quarter drivers are revenue growth in Florida on the East Coast and in the southern portion of the portfolio. Again, strong demand, limited supply as we look what’s really taking place in the portfolio. We’re seeing rate growth pretty much in line with budget, but we’re seeing increase in demand and occupancy, and most notably, what we’re seeing is summer marina expectations that are a little bit ahead of where regions were last year.

So baked into our guidance or part of our guidance is expecting continued good solid growth in the marina business. So, it’s no one thing, just demand. I think we talked about it a lot, escaping the monotony and challenges of the COVID environment, getting out into the fresh air, enjoying being on the boats, on the water, those types of things like we’re seeing in the RV are very, very similar.

Joshua Dennerlein — Bank of America Merrill Lynch — Analyst

I hear you. I can’t wait to get back out there.

Gary A. Shiffman — Chairman and Chief Executive Officer

We know you like your boat. Question is, do you like your marina?

Joshua Dennerlein — Bank of America Merrill Lynch — Analyst

I’ll go and check out. I was at Safe Harbors for a few years, but this year, I could, just I was on the Vineyard. I tried getting into Prime, they won’t let me in. That maybe next summer. That’s it for me for questions.

Gary A. Shiffman — Chairman and Chief Executive Officer

Thanks, Josh.

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

Thanks, Josh.

Operator

Our next question comes from the line of Todd Stender with Wells Fargo. Please proceed with your question.

Todd Stender — Wells Fargo — Analyst

Hi, thanks. Just looking at new home sales, on average, they’re exceeding $150,000. What’s the highest price point that you see on new homes and what’s the square footage on something like that?

Gary A. Shiffman — Chairman and Chief Executive Officer

Yes. So our highest price point is going to be in our Colorado, our new development, River Run in Colorado as well as what we’re doing down in the [Indecipherable]. And that’s going to push above $300,000. But again, I think the important thing to note when you’re talking about $300,000 on manufactured home, that is on a relative basis very affordable in the environment, which sits in the location where…

Todd Stender — Wells Fargo — Analyst

Those price points — are buyers financing them? I guess, we’re kind of used to seeing most of cash buyers, but maybe any comments regarding the increasing financing as these price points just edge higher?

John B. McLaren — President and Chief Operating Officer

Yeah, at those price points, Todd, it’s generally a cash buyer that’s coming in for those. Usually, 90% are cash, or they go to a local bank.

Todd Stender — Wells Fargo — Analyst

Got it. Okay. Maybe for Karen, just kind of switching to the balance sheet with debt to EBITDA right around 6 times, just for modeling purposes and looking at the forward equity, is it fair to assume a 1 million shares at a clip for the next four quarters, or is that feature call for all 4 million shares at once?

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

No, the feature doesn’t call for all 4 million shares at once. And I think we’ll draw on the line as Gary suggested initially for acquisitions, and then we will shortly thereafter match fund with the acquisition volume that we’re doing.

Todd Stender — Wells Fargo — Analyst

And then so on a pro forma basis, do you have a debt to EBITDA, assuming the forward equity?

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

Without the forward equity, we are going to be at low 5 times. I think with the forward equity, we will be below.

Todd Stender — Wells Fargo — Analyst

Okay. And then on the debt side, just for modeling, what kind of debt are you looking at right now in any coupon or duration you could share?

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

We really have no maturities from a debt basis. We have been very, very active on refinancing debt. So, there’s really nothing to refinance on the debt side from — for this year and little for next year. I would say, a typical 10-year money at 65% is in the 2.5% to 3.5% for the GSEs and life companies. Also we do take a look at — we do evaluate unsecured borrowing. At this time, with the Company’s increased size and capital needs, look at that unsecured market makes more sense than what we’ve done in the past. So we are currently evaluating the unsecured market.

Todd Stender — Wells Fargo — Analyst

Got it. Last one, probably for John, the San Diego RV development. Are there more sites coming in addition to the 250 that were just completed?

John B. McLaren — President and Chief Operating Officer

Potentially. We are looking at another 90 sites that we can add to that, Todd.

Todd Stender — Wells Fargo — Analyst

Great, thank you.

John B. McLaren — President and Chief Operating Officer

Thank you.

Operator

Our next question comes from the line of Samir Khanal with Evercore. Please proceed with your question.

Samir Khanal — Evercore — Analyst

Yeah. Good morning, everyone. So I guess, John or Karen. When you look at the marina business, what’s the right NOI margin to think about? When I just did the math here, I mean, it looked a bit light in the quarter. And again, I know it’s possibly due to seasonality here, but just maybe going back, the last few years with Safe Harbor, what’s been the trend for NOI margin for marinas?

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

So, Sameer, I think your comment regarding seasonality in Q4 — I mean, Q1 is accurate and typically you’d see all-in margins on the marina business, the high-30%s, still low-40%.

Samir Khanal — Evercore — Analyst

Okay, got it. And I guess, just remind me and if I missed this, I apologize, but did you update the marina guidance for NOI, $163 million to $169 million that you provided last quarter?

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

No, we did not update the marina guidance.

Samir Khanal — Evercore — Analyst

And if you’re trending sort of in the high kind of in the $31 million, which your commentary sort of suggests that you’re kind of trending higher on the marina side, is it fair to assume that you’re tracking kind of ahead of that was $163 million to $169 million at this point?

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

I would say we’re in line with our expectations, likely into the high-end and it has been — that outperformance has been included in our FFO guidance.

Samir Khanal — Evercore — Analyst

Got it. And my final question is on the expense side. I did not see a breakdown this quarter for the various line items. I mean, how are you trending on maybe operating expenses and how are you thinking about maybe for the remainder of the year for those line items?

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

Well, that’s a tough one because of the COVID impact, right. So the comparatives for the prior year are — I’ll use a sort of technical term, very wonky. So that expense increases you will see higher on that comparative basis. But for the quarter, what we saw was an increase. I mean, lower-than-expected expenses for utilities and also for advertising and I expect some of those advertising costs to shift into future quarters.

Samir Khanal — Evercore — Analyst

Okay, got it. All right. Thanks so much.

Operator

We have a follow-up question from the line of John Pawlowski with Green Street Advisors. Please proceed with your question.

John Pawlowski — Green Street Advisors — Analyst

Hey, thanks for taking the follow-up. Maybe, Karen, could you just break out the full-year NOI growth guidance in between revenue and expense?

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

Yeah, I don’t — we haven’t — we have not presented that previously, John. So I’m going to decline to respond.

John Pawlowski — Green Street Advisors — Analyst

All right. Take care.

Operator

There are no further questions in the queue. I’d like to hand the call back to management for closing remarks.

Gary A. Shiffman — Chairman and Chief Executive Officer

Well, we thank you all for participating on the call and all of us are available for any follow-up and we look forward to getting together with everybody after second quarter is complete. Thank you, operator.

Operator

[Operator Closing Remarks]

Duration: 53 minutes

Call participants:

Gary A. Shiffman — Chairman and Chief Executive Officer

John B. McLaren — President and Chief Operating Officer

Karen J. Dearing — Executive Vice President, Chief Financial Officer, Treasurer and Secretary

Nicholas Joseph — Citi Research — Analyst

Keegan Carl — Berenberg Capital Markets — Analyst

Brad Heffern — RBC Capital Markets — Analyst

Wes Golladay — Robert W. Baird — Analyst

John Pawlowski — Green Street Advisors — Analyst

John Kim — BMO Capital Markets — Analyst

Joshua Dennerlein — Bank of America Merrill Lynch — Analyst

Todd Stender — Wells Fargo — Analyst

Samir Khanal — Evercore — Analyst

This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company’s SEC filings. Please see our Terms and Conditions for additional details, including our Obligatory Capitalized Disclaimers of Liability.

###

The graphic below and some others can be opened to a larger size in many browsers.

Click the image once to open a new window, and then click that image

again to see the larger size.

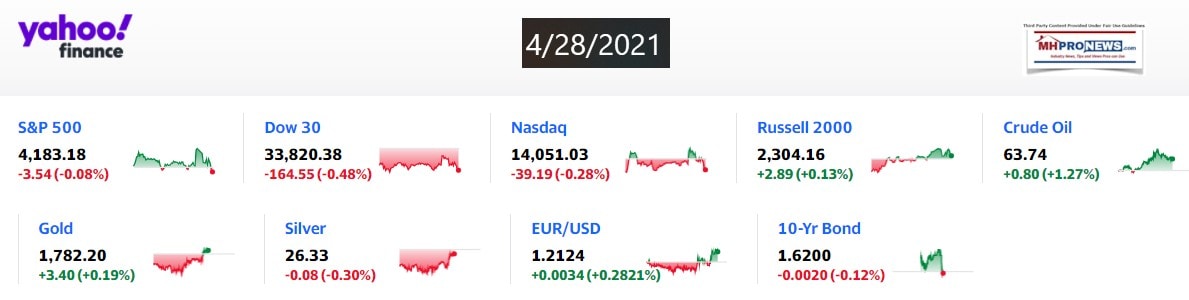

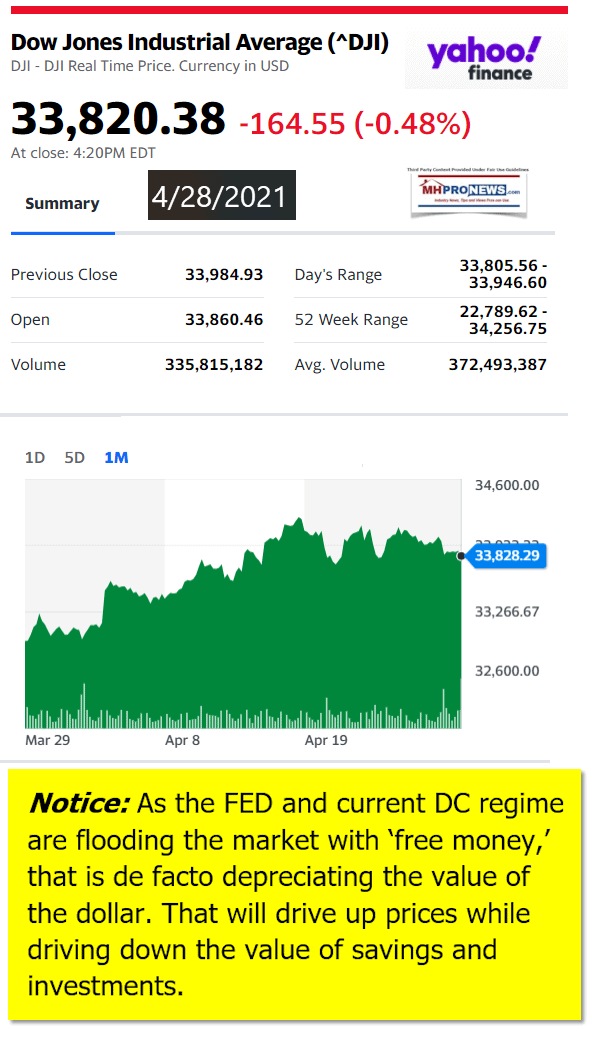

Some prior pull quotes and related information are found in the reports linked below. Following those are market and manufactured home equities snapshots at the closing bell.

##

Programming Note: the manufactured home market and stocks report for 4.27.2021 is below. We will resume our normal publishing schedule shortly.

Notice: The headlines that follow are also from 4.27.2021. While the arrangement or layout of this report has been modified, several elements of the basic concepts used before are still the same. The headlines can be reviewed at a glance to save time while providing insights across the left-right media divide. Additionally, those headlines often provide clues as to possible ‘market moving’ reports.

The manufactured home connected equities at last night’s closing bell will follow the left-right headline bullets.

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Headlines from left-of-center CNN Business

- On track

- WASHINGTON, DC – DECEMBER 01: Chairman of the Federal Reserve Jerome Powell testifies during a Senate Banking Committee hearing about the quarterly CARES Act report on Capitol Hill December 1, 2020 in Washington, DC. Treasury Secretary Steven Mnuchin also testified at the hearing.

- Fed leaves rates near zero, but says it’s ready to adjust that policy as things change

- Will Biden stick with Powell at the Fed?

- LIVE UPDATES The Fed should start tapping on the breaks: El-Erian

- Exclusive: The Declaration of Independence is the next hot IPO

- Toyota announces 1,400 jobs, new SUVs for Indiana plant

- Saudi Arabia could sell more of its crown jewel. China is a likely buyer

- Famous Indian CEO is heartbroken about his country

- A rural chain is thriving as millennials flee cities

- Uber is now letting people rent entire cars on the app

- KFC’s big challenge: People can’t get enough of its fried chicken sandwich

- Samsung unveils laptops that are ‘more like smartphones’

- Joe Rogan spread anti-vaccine misinfo. Spotify’s CEO stands behind him

- Microsoft president: This is what technology will be like in 2030

- ….And it’s retiring its default font, and wants your help choosing a new one

- Kanye West attends the 2020 Vanity Fair Oscar Party hosted by Radhika Jones at Wallis Annenberg Center for the Performing Arts on February 09, 2020 in Beverly Hills, California.

- Walmart is coming after Kanye West’s Yeezy logo

- Scene video following a crash involving a Tesla Saturday night in Spring, TX

- One of Autopilot’s features was active in fatal Tesla crash

- Taco Bell launches its first ever global ad campaign

- Taco Bell enlists ‘world’s largest influencer’ for new ad campaign

Headlines from right-of-center Newsmax

- Rudy Giuliani Raided by Feds

- Federal investigators on Wednesday searched the New York City apartment of Rudy Giuliani, the city’s former mayor and later President Donald Trump’s personal lawyer, pursuant to a search warrant, Giuliani’s lawyer said on Wednesday.

- The Biden Presidency

- Biden to Pitch Sweeping ‘Family Plan’ in Speech to Congress

- US Eyes Major Rollback in Iran Sanctions to Revive Nuke Deal

- Biden to Name Rahm Emanuel Ambassador to Japan

- WH Slams Joe Rogan For Advising Healthy Youth Not to Get Vaccine

- US, Israel Form Joint Group Focused on Iranian Missiles, UAVs

- Texas AG Paxton: White House Blocked My Facility Tour

- Hunter Biden Invited to Teach University Course on Fake News

- Poll: Declining Support For New Gun Control Legislation

- Senate Democrats Pressure Biden to Increase Refugee Cap

- More The Biden Presidency

- Newsfront

- Trump: ‘Newsmax Has Been Really Good’

- Former President Donald delivered high praise for Newsmax and the rise of conservative media, while lamenting Fox News’ daytime shift in its coverage of conservatives. “I wouldn’t say Fox has been exactly perfect,” Trump told “The Dan Bongino Show” in an interview that aired…

- Related Stories

- Trump Blasts His 3 Justices: ‘No Courage, Gutless’ on Election Cases

- Trump Slams Kerry’s Subversion of His Administration

- Blinken Admits US Afghan Withdrawal Could Result in Taliban Takeover

- Blinken Admits US Afghan Withdrawal Could Result in Taliban Takeover

- An Afghan civil war or Taliban takeover is “certainly a possible

- US Eyes Major Rollback in Iran Sanctions to Revive Nuke Deal

- The Biden administration is considering a near wholesale rollback of

- Related

- Senior US Delegation Headed to Mideast Amid Concerns About Iran Deal

- Metformin Will Kill Your Legs – Do This to Stop it

- McCaul: Allegations on Kerry, Iran Appear ‘Somewhat Treasonous’

- Allegations that former Secretary of State John Kerry gave Iran

- Related

- Lauren Boebert to Newsmax TV: John Kerry ‘Needs to Resign’

- Judge Denies Requests for Body Cam Video in North Carolina Shooting

- A judge on Wednesday denied requests to release body camera video in

- Democrats Keep Pushing PRO Act Despite Deflating Amazon Union Vote

- Democrats were dealt a crushing blow earlier this month when workers

- Democrats in Panic After Congress Takes Out Patent on Bible Secret

- SPONSOR: Ancient Biblical remedy exposed

- Texas AG Paxton: WH Blocked My Facility Tour in Donna

- Texas Attorney General Ken Paxton Wednesday accused the Biden

- Pfizer’s COVID Antiviral Pill May Be Ready by End of ’21

- A pill that can be ingested orally at home to combat COVID-19, when [Full Story]

- Related

- BioNTech Chief: Europe Will Reach Herd Immunity by August

- Republican Doctors in Congress Promote COVID-19 Vaccinations

- Poll: Seniors’ Political Leanings May Affect Vaccine Enthusiasm

- Fauci: US Should Begin Seeing COVID Turning Point in ‘A Few Weeks’

- World’s Largest Gold and Silver Shortage is Here

- SPONSOR: GoldPro offers the lowest prices, hassle free

- Actor Randy Quaid Considers Running for Governor of California

- Actor Randy Quaid is the latest celebrity considering throwing

- Eric Greitens: Biden-Harris First 100 Days Marked by Unprecedented Failure

- President Donald J. Trump proved that the America First agenda works,

- How to Empty Your Bowels Every Morning – Top Surgeon Explains How

- SPONSOR: Watch the shocking presentation [VIDEO]

- Apollo 11 Astronaut Michael Collins Dead at 90

- Astronaut Michael Collins, who flew the Apollo 11 command module

- Top Iran Diplomat Regrets Leak of Frank Comments

- Iran’s top diplomat expressed regret Wednesday that a recording

- Texas Tactical? Hunting? Ammo, Optics…We’re Your Source

- Hunter Biden Invited to Teach University Course on Fake News

- Tulane University has invited Hunter Biden to be a guest speaker as

- ‘Jeopardy!’ Contestant Under Fire Over On-Air Gesture

- A contestant on Jeopardy! Tuesday encountered controversy after

- Florida Drivers with No Recent Tickets Are Getting a Big Pay Day in April

- Smart Lifestyle Trends

- Feds Raid Rudy Giuliani’s Apartment, Seize Electronics

- Federal investigators on Wednesday searched the New York City

- Indians Rush for COVID Vaccines as Death Toll in India Passes 200K

- Indians struggled to register online for a mass vaccination drive set

- Chauvin Juror: Racial Climate, Protests Did Not Influence Guilty Verdicts

- The jury’s decision to return guilty verdicts on all three

- California Man Dies After Police Held Him, Police Video Shows

- Police in the Northern California city of Alameda released body cam

- Arizona Governor Signs Ban on Abortions Based on Genetic Abnormalities

- Arizona Governor Doug Ducey signed into law on Tuesday a measure

- GOP’s Tim Scott to Share ‘My Family’s American Dream’ in Republican Rebuttal to Biden Speech

- After President Joe Biden lays out his ambitions to reshape the U.S.

- Trump Blasts His 3 Justices: ‘No Courage, Gutless’ on Election Cases

- Despite placing 3 conservatives justices on the Supreme Court,

- Backlash Rises Over Claim NFL Prefers White Quarterbacks

- White ESPN announcer Max Kellerman is suggesting NFL teams’

- Newsom Recall Adviser: One-Third of Signers Democrats, Third-Party

- The push to recall California Gov. Gavin Newsom is a bipartisan

- US Justice Department Quietly Repeals Trump-era Limits on Grants to ‘Sanctuary Cities’

- The U.S. Justice Department has quietly repealed a controversial

- CEO of $2B Company Let Go for Taking LSD at Work

- Iterable Inc., a $2 billion company, released a board statement to

- GOP Reps Push Back on Biden’s Critical Race Theory Proposal

- President Joe Biden’s Education Department proposed a rule recently

- US Court Says ‘Ghost Gun’ Plans Can Be Posted Online

- Plans for 3D-printed, self-assembled “ghost guns” can be posted

- Company CEO Fired for Comments to Teen Boy Wearing a Dress to Prom

- CEO Sam Johnson of VisuWell was fired after videos had surfaced of

- What Will Happen at the Biden-Putin Summit?

- The agenda will likely be packed with big issues, but a potential

- Tensions Between Cheney, McCarthy Boil Over at House GOP Retreat

- House Minority Leader Kevin McCarthy, R-Calif., and Rep. Liz Cheney,

- How Dogs Cry For Help: 3 Warning Signs Your Dog Is Crying For Help

- com

- More Newsfront

- Finance

- Fed Keeps Key Rate Near Zero, Sees Inflation as ‘Transitory’

- The Federal Reserve is keeping its ultra-low interest rate policies in place, a sign that it wants to see more evidence of a strengthening economic recovery before it would consider easing its support.

- Goldman Sees Oil, Gold, Copper Rallying Over Next Six Months

- Embattled Boeing Posts Smaller Loss as More Americans Fly

- Honda to Suspend 3 Japanese Plants in May Due to Chip Shortage

- Tesla Says Bitcoin Investment Worth $2.48B

- More Finance

- Health

- Drugs used to treat hepatitis C may be valuable in the fight against COVID-19, according to a new study by researchers in Texas and New York…

- Better Sleep May Mean Better Sex for Women

- ‘Light Therapy’ Could Help Brain-Injured Veterans Struggling With PTSD

- Being Bullied Often Leads Teens to Thoughts of Violence

- Should Black Adults Take Vitamin D Supplements to Help Their Hearts?

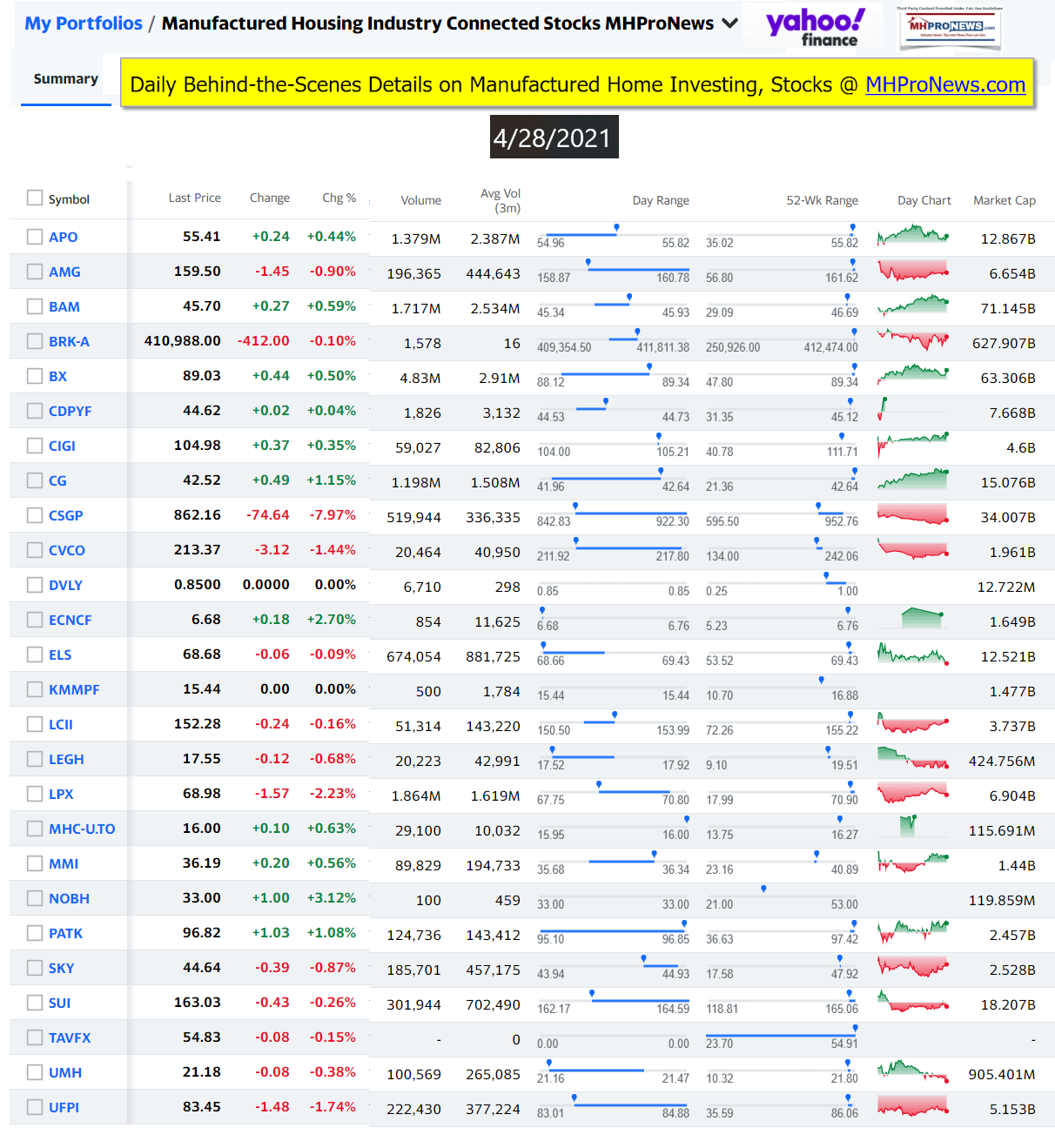

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

-

-

-

-

-

-

-

-

-

-

-

Spring 2021…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12the year of serving the industry as the runaway most-read trade media.

Sample Kudos over the years…

It is now 11+ years and counting…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.