Nobility Homes, Inc (NOBH) has released its annual report for 2022. Nobility also released on 3.20.2023 their “Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q)” via MarketScreener and other sources. While both documents obviously shed light on Nobility specifically and at some level on the broader manufactured housing industry landscape, their annual report especially does so in considerable detail. Several of their annual report remarks provide a broad level of insight into the nuts and bolts of manufactured housing that are informative for outsiders looking in who want to understand a vertically integrated operation. Those insights are useful in understanding Nobility Homes specifically or other similar vertically integrated competitors operating in MHVille. While every company’s annual report has its pluses and minuses, as a teaser for both Part I and the commentary from Part II of what follows, Nobility’s step-by-step explanation of how the world of manufactured housing looks through the lens of a vertically integrated producer of HUD Code manufactured homes is arguably widely useful. What follows from Nobility would be an insightful introduction for manufactured housing industry professional newcomers, those thinking about a management career in manufactured housing, researchers of various types, public officials, and others.

- Part 1 will be the Nobility Homes 2022 annual report. It will include as a download their recent Securities and Exchange Commission (SEC) form 10Q.

- Part 2 provides additional information with more MHProNews analysis and commentary in brief.

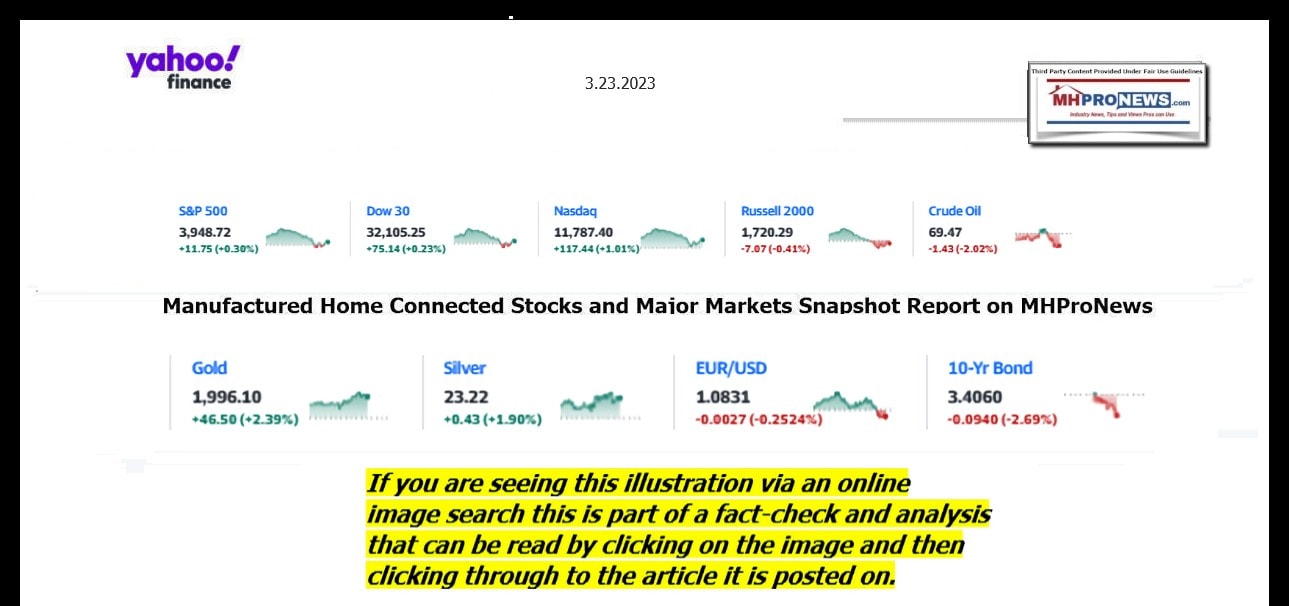

- Part 3 is our signature business Daily Business News on MHProNews graphical snapshot of the macro U.S. equities markets, plus the left-right mainstream media’s ‘market moving’ headlines snapshot.

Part 1. Nobility Homes, Inc: 3.20.2023 “Management’s Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q)” (download) and their 2022 Annual report.

(MHProNews Note – the PDF download is found at the end of this republication of their information that follows. While an effort has been made to correct spacing errors caused by converting a PDF into a Word Document, their original PDF (found linked below) is the authoritative version.

About the Company

Nobility Homes, Inc., a Florida corporation incorporated in 1967, designs, manufactures and sells a broad line of manufactured and modular homes through its own retail sales centers throughout Florida. Nobility also sells its manufactured homes on a wholesale basis to independent manufactured home retail dealers and manufactured home communities.

We pride ourselves on providing well-designed and affordably-built homes that are comfortable, pleasantly decorated, energy efficient and engineered for years of carefree living. The Company’s manufacturing plant and corporate headquarters are located in Ocala, Florida.

Our homes are available in approximately 100 active models sold under the trade names “Kingswood”, “Richwood”, “Tropic Isle”, “Regency Manor” and “Tropic Manor”. Our home sales are single and multi-section, range in size from 464 to 2,800 square feet and contain from one to five bedrooms and retail prices for our homes typically range from approximately $70,000 to $220,000.

Prestige Home Centers, Inc., our wholly owned subsidiary, operates ten retail sales centers in north and central Florida: Ocala (two), Chiefland, Auburndale, Inverness, Hudson, Tavares, Yulee, Panama City, Punta Gorda and executive offices are located at our corporate headquarters in Ocala, Florida. Each of Prestige’s retail sales centers is located within 350 miles of Nobility’s Ocala manufacturing facility.

The primary customers of Prestige are homebuyers who generally purchase manufactured or modular homes to place on their own home sites. Prestige operates its retail sales centers using a model home concept. Each of the homes displayed at its retail sales centers is furnished and decorated as a model home.

Mountain Financial, Inc., a wholly owned subsidiary of Prestige Home Centers, Inc., is an independent insurance agent and licensed loan originator. Mountain Financial provides automobile insurance, extended warranty coverage Contents and property and casualty insurance to Prestige customers in Shareholders’ Letter connection with their purchase and financing of manufactured homes.

Contents

1 Shareholders’ Letter connection with their purchase and financing of manufactured homes.

3 Directors

3 Officers

3 General Shareholders’ Letter Information

3 General Information

To Our Shareholders

Sales for fiscal year 2022 increased 14% to $51.5 million as compared to $45.1 million recorded in fiscal year 2021. Income from operations for fiscal year 2022 increased 37% to $8.4 million versus $6.1 million in the same period a year ago. Net income after taxes increased 34% to $7.2 million as compared to $5.4 million for the same period last year. Diluted earnings per share for fiscal year 2022 were $2.10 per share compared to $1.50 per share last year.

The demand for affordable manufactured housing in Florida and the U.S. is starting to reflect the increased interest rate environment by the Federal Reserve. Although net sales increased during the twelve months ended November 5, 2022, as compared to the same period last year, we continued to experience the negative impact of limitations being placed on certain key production materials from suppliers, the delay or lack of key components from vendors as well as back orders, delayed shipments, price increases and labor shortages. These supply chain issues have caused delays in the completion of the homes at the manufacturing facility and the setup process of retail homes in the field, resulting in decreased net sales due to our inability to timely deliver and setup homes to customers. We expect that these challenges will continue for the first six months of fiscal year 2023 or until the industry supply chain normalizes. According to the Florida Manufactured Housing Association, shipments for the industry in Florida for the period from November 2021 through October 2022 were up approximately 23% from the same period last year.

Nobility’s financial position during fiscal year 2022 remained very strong with cash and cash equivalents, certificates of deposit and short-term investments of $21.1 million and no outstanding debt. Working capital is $33.7 million and our ratio of current assets to current liabilities is 3.3:1. Stockholders’ equity is $47.9 million and the book value per share of common stock increased to $14.22.

Maintaining our strong financial position is vital for future growth and success. Because of very challenging business conditions during economic recessions in our market area, management will continue to evaluate all expenses and react in a manner consistent with maintaining our strong financial position, while exploring opportunities to expand our distribution and manufacturing operations.

On June 5, 2022, we celebrated our 55th anniversary in business specializing in the design and production of quality, affordable manufactured and modular homes. With multiple retail sales centers in Florida for over 30 years and an insurance agency subsidiary, we are the only vertically integrated manufactured home company headquartered in Florida.

We gratefully acknowledge the Board of Directors, officers, employees and friends of the Company and express our appreciation for their dedication. Our appreciation is also extended to our retail distribution network, customers and suppliers for their support and loyalty. We sincerely thank our stockholders for their continued investment confidence in Nobility and pledge our efforts to maintain and guard that trust. With this confidence and support, we enter fiscal year 2023 with full awareness of the challenging opportunities that lie ahead and with renewed enthusiasm and determination to achieve the goals for higher sales and operating results that have been set for your Company.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended November 5, 2022

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OF 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission file number 000-06506

NOBILITY HOMES, INC.

(Exact name of registrant as specified in its charter)

Florida 59-1166102

(State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.)

3741 S.W. 7th Street

Ocala, Florida 34474

(Address of principal executive offices) (Zip Code)

(352) 732-5157

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None Securities registered pursuant to Section 12(g) of the Act:

Name of ea/Exchange on

Title of Each Class Trading Symbol(s) Which Registered

Common Stock, $0.10 Par Value NOBH OTCQX

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer,” “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large, accelerated filer | ☐ | Accelerated filer | ☐ |

| Non -accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the registrant (650,300) shares), based on the closing price on the over-the-counter market on May 6, 2022 (the last business day of the second quarter of fiscal 2022), was approximately $19.8 million. The number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

Title of Class Shares Outstanding on February 1, 2023

Common Stock 3,370,912

DOCUMENTS INCORPORATED BY REFERENCE

Title Form 10 -K

Definitive proxy statement for Annual Meeting of Part III, Items 10-14 Shareholders to be held March 3, 2023

| TABLE OF CONTENTS | |||

|

|

PART I |

Form

10 – K |

|

| Item 1. | Business ……………………………………………………………………………………………………………………………………………….. | 2 | |

| Item 1A. | Risk Factors …………………………………………………………………………………………………………………………………………… | 4 | |

| Item 1B. | Unresolved Staff Comments ……………………………………………………………………………………………………………………. | 4 | |

| Item 2. | Properties ……………………………………………………………………………………………………………………………………………… | 4 | |

| Item 3. | Legal Proceedings ………………………………………………………………………………………………………………………………….. | 5 | |

| Item 4.

|

Mine Safety Disclosures…………………………………………………………………………………………………………………………..

PART II |

|

5 |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity | ||

| Securities ………………………………………………………………………………………………………………………………………….. | 6 | ||

| Item 6. | Reserved ……………………………………………………………………………………………………………………………………………….. | 6 | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations ……………………………… | 7 | |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk………………………………………………………………………… | 11 | |

| Item 8.

|

Financial Statements and Supplementary Data …………………………………………………………………………………………… Index to Consolidated Financial Statements ……………………………………………………………………………….. Report of Independent Registered Public Accounting Firm-Daszkal Bolton LLP ……………………………. Consolidated Balance Sheets ……………………………………………………………………………………………………. Consolidated Statements of Income …………………………………………………………………………………………..

Consolidated Statements of Changes in Stockholders’ Equity ………………………………………………………. Consolidated Statements of Cash Flows …………………………………………………………………………………….. Notes to Consolidated Financial Statements ………………………………………………………………………………. |

|

12

12 13 14 15 16 17 18 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure ……………………………… | 30 | |

| Item 9A. | Controls and Procedures………………………………………………………………………………………………………………………….. | 30 | |

| Item 9B. Other Information…………………………………………………………………………………………………… | 30 | ||

| Item 9C. Disclosure Regarding Foreign Jurisdictions that prevent Inspections …………………………………………………………….

PART III |

30

|

||

| Item 10. Directors, Executive Officers and Corporate Governance …………………………………………………………………………… | 31 | ||

| Item 11. Executive Compensation …………………………………………………………………………………………………………………………. | 31 | ||

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ……………… | 31 | ||

| Item 13. Certain Relationships and Related Transactions, and Director Independence …………………………………………………. | 31 | ||

| Item 14. Principal Accounting Fees and Services …………………………………………………………………………………………………….

PART IV |

31

|

||

| Item 15. Exhibits and Financial Statement Schedules ……………………………………………………………………………………………….

(a) Consolidated Financial Statements and Schedules ………………………………………………………………………………… (b) Exhibits ……………………………………………………………………………………………………………………………………………. |

32

32 32 |

||

| Item 16. Form 10-K Summary ……………………………………………………………………………………………………………………………… | 33 | ||

| Signatures ……………………………………………………………………………………………………………………………………………………………… | 34 | ||

PART I

Item 1. Business

Nobility Homes, Inc., a Florida corporation incorporated in 1967, designs, manufactures and sells a broad line of manufactured and modular homes through its own retail sales centers throughout Florida. Nobility also sells its manufactured homes on a wholesale basis to independent manufactured home retail dealers and manufactured home communities. All references in this annual report on Form 10-K to “Nobility,” “Company,” “we,” “us,” or “our” refer to Nobility Homes, Inc. and its consolidated subsidiaries unless the context otherwise suggests.

Manufactured Homes

Nobility’s homes are available in approximately 100 active models sold under the trade names “Kingswood,” “Richwood,” “Tropic Isle,” “Regency Manor,” and “Tropic Manor.” The homes, ranging in size from 464 to 2,800 square feet and containing from one to five bedrooms, are available in:

- Single-wide widths of 14 and 16 feet ranging from 35 to 72 feet in length.

- Double-wide widths of 20, 24, 26, 28 and 32 feet ranging from 32 to 72 feet in length.

- Triple-wide widths of 42 feet ranging from 60 to 72 feet in length.

- Quad unit with 2 sections 28 feet wide from 40 to 48 feet long and 2 sections 28 feet wide by 52 feet long.

Our floor plans can be built as an on-frame modular home. We have been approved to build A.N.S.I. (American National Standards Institute) Park models less than 400 square feet and exposure D homes.

Nobility’s homes are sold primarily as unfurnished dwellings ready for permanent occupancy. Interiors are designed and color coordinated in a range of decors. Depending on the size of the unit and quality of appliances and other appointments, retail prices for Nobility’s homes typically range from approximately $70,000 to $220,000. Most of the prices of Nobility’s homes are considered by it to be within the low to medium price range of the industry.

Nobility’s manufacturing plant utilizes assembly line techniques in manufactured home production. The plant manufactures and assembles the floors, sidewalls, end walls, roofs and interior cabinets for their homes. Nobility purchases, from outside suppliers, various other components that are built into its homes including the axles, frames, tires, doors, windows, pre-finished sidings, plywood, ceiling panels, lumber, rafters, insulation, gypsum board, appliances, lighting and plumbing fixtures, carpeting and draperies. Nobility is not dependent upon any one particular supplier for its raw materials or component parts and is not required to carry significant amounts of inventory to assure itself of a continuous allotment of goods from suppliers.

Nobility generally does not manufacture its homes to be held by it as inventory (except for model home inventory of its wholly owned retail network subsidiary, Prestige Home Centers, Inc.), but, rather, manufactures its homes after receipt of orders. Although Nobility attempts to maintain a consistent level of production of homes throughout the fiscal year, seasonal fluctuations do occur, with sales of homes generally lower during the first fiscal quarter due to the holiday season.

The sales area for a manufactured home manufacturer is limited by substantial delivery costs of the finished product. Nobility’s homes are delivered by outside trucking companies. Nobility estimates that it can compete effectively within a range of approximately 350 miles from its manufacturing plant in Ocala, Florida. Substantially all of Nobility’s sales are made in Florida.

Retail Sales

Prestige Home Centers, Inc.(“Prestige”), our wholly owned subsidiary, operates ten retail sales centers in north and central Florida. Its principal executive offices are located at Nobility’s headquarters in Ocala, Florida. Sales by Prestige accounted for 95% and 87% of Nobility’s sales during fiscal years 2022 and 2021, respectively.

Each of Prestige’s retail sales centers are located within 350 miles of Nobility’s Ocala manufacturing facility. Prestige owns the land at eight of its retail sales centers and leases the remaining two retail sales centers from unaffiliated parties.

The primary customers of Prestige are homebuyers who generally purchase manufactured homes to place on their own home sites. Prestige operates its retail sales centers with a model home concept. Each of the homes displayed at its retail sales centers is furnished and decorated as a model home. Although the model homes may be purchased from Prestige’s model home inventory, generally, customers order homes which are shipped directly from the factory to their home site. Prestige sales generally are to purchasers living within a radius of approximately 100 miles from the selling retail lot. The Company’s internet-based marketing program generates numerous leads which are directed to the Prestige retail sales centers to assist a potential buyer in purchasing a home.

The retail sale of manufactured homes is a highly competitive business. Because of the number of retail sales centers located throughout Nobility’s market area, potential customers typically can find several sales centers within a 100-mile radius of their present home. Prestige competes with over 80 other retailers in its primary market area, some of which may have greater financial resources than Prestige. In addition, manufactured homes offered by Prestige compete with site-built housing.

Prestige does not itself finance customers’ new home purchases. Financing for home purchases has historically been available from other independent sources that specialize in manufactured housing lending and banks that finance manufactured home purchases. Prestige and Nobility are not required to sign any recourse agreements with any of these retail financing sources.

Insurance and Financial Services

Mountain Financial, Inc., a wholly owned subsidiary of Prestige Home Centers, Inc., is an independent insurance agent and licensed mortgage loan originator. Its principal activity is providing retail insurance services, which involves placing various types of insurance, including property and casualty, automobile and extended home warranty coverage, with insurance underwriters on behalf of its Prestige customers in connection with their purchase and financing of manufactured homes. As agent, we solely assist our customers in obtaining various types of insurance and extended warranty coverage with insurance underwriters. As such, we have no agreements with homeowners and/or third-party insurance companies other than agency agreements with various insurance carriers. The Company provides appropriate reserves for policy cancellations based on numerous factors, including past transaction history with customers, historical experience and other information, which is periodically evaluated and adjusted as deemed necessary. In the opinion of management, no reserve was deemed necessary for policy cancellations for fiscal years 2022 and 2021.

Wholesale Sales to Manufactured Home Communities

Nobility also sells its homes on a wholesale basis through two full-time salespersons to approximately 36 manufactured home communities and independent dealers. Nobility continues to seek new opportunities in the areas in which it operates, as there is ongoing turnover in the manufactured home communities as they achieve full occupancy levels. As is common in the industry, most of Nobility’s independent dealers sell homes produced by several manufacturers.

Nobility does not generally offer consigned inventory programs or other credit terms to its independent dealers and ordinarily receives payment for its homes within 15 to 30 days of delivery. However, Nobility may offer extended terms to park dealers who do a high volume of business with Nobility. In order to stimulate sales, Nobility sells homes for display to related party manufactured home communities on extended terms and recognizes revenue when the homes are sold to the end users. The high visibility of Nobility’s homes in such communities generates additional sales of its homes through such dealers.

Regulation

The manufacture, distribution and sale of homes are subject to governmental regulation at the federal, state and local levels. The Department of Housing and Urban Development (HUD) has adopted national construction and safety standards that preempt state standards. HUD regulations require that manufactured homes be constructed to more stringent wind load and thermal standards. Compliance with these standards involves approval by a HUD approved engineering firm of engineering plans and specifications on all models. HUD has also promulgated rules requiring producers of manufactured homes to utilize wood products certified by their suppliers to meet HUD’s established limits on formaldehyde emissions. HUD’s standards also require periodic inspection by state or other third-party inspectors of plant facilities and construction procedures, as well as inspection of manufactured home units during construction. In addition, some components of manufactured homes may also be subject to Consumer Product Safety Commission standards and recall requirements. Modular homes manufactured by Nobility are required to comply with the Florida Building Code established by the Florida Department of Business and Professional Regulations.

Nobility estimates that compliance with federal, state and local environmental protection laws will have no material effect upon capital expenditures for plant or equipment modifications or earnings for the next fiscal year.

The transportation of manufactured homes is subject to state regulation. Generally, special permits must be obtained to transport the home over public highways and restrictions are imposed to promote travel safety including restrictions relating to routes, travel periods, speed limits, safety equipment and size.

Nobility homes are subject to the requirements of the Magnuson-Moss Warranty Act and Federal Trade Commission rulings which regulate warranties on consumer products. Nobility provides a limited warranty of one year on the structural components of its homes.

The government measures as well as the public reaction to COVID-19 and the various variants previously had a negative impact on customer traffic (and corresponding sales) within our centers and the operations of our business partners, which has since subsided. However, whether caused by COVID-19 or other factors, we have experienced unprecedented inflation and shortages in many material products, and difficulty in hiring additional and retaining production workers, with no immediate relief in sight that have resulted in corresponding increases to our material and labor costs. The Company is monitoring these issues and has adjusted our selling prices accordingly to help offset the higher costs.

Competition

The manufactured home industry is highly competitive. The initial investment required for entry into the business of manufacturing homes is not unduly large. State bonding requirements for entry into the business vary from state to state. The bond requirement for Florida is $50,000. Nobility competes directly with other manufacturers, some of whom are both considerably larger and possess greater financial resources than Nobility. Nobility estimates that of the 20 manufacturers selling in the state, approximately 10 manufacture homes of the same type as Nobility and compete in the same market area. Nobility believes that it is generally competitive with most of those manufacturers in terms of price, service, warranties and product performance.

Employees

As of January 7, 2023, the Company had 145 full-time employees, including 32 employed by Prestige. Approximately 89 employees are factory personnel compared to approximately 74 in such positions a year ago and 56 are in management, administrative, supervisory, sales and clerical positions compared to approximately 57 a year ago. In addition, Nobility employs part-time employees when necessary.

The Company has managerial, administrative, supervisory, sales and manufacturing employees. We have a focus on safety and being drug free in our manufacturing operations.

Historically, we have had low turnover rates with our non-manufacturing employees. It is currently difficult for us to attract long-term quality employees for our manufacturing operations. We have experienced disruption in production as a result of our inability to find labor. We are using different hiring practices such as work release programs and employment services to reduce the turnover. However, we are still experiencing a shortage of qualified factory production employees.

Nobility makes contributions toward employees’ group health and life insurance. Nobility, which is not subject to any collective bargaining agreements, has not experienced any work stoppage or labor disputes and considers its relationship with employees to be generally satisfactory.

Item 1A. Risk Factors

As a smaller reporting company, we are not required to provide the information required by this item.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties As of February 1, 2023, Nobility owned one manufacturing plant as follows:

Location Approximate Size

3741 SW 7th Street ………………………………………………………………………..

Ocala, Florida ……………………………………………………………………………… 72,000 sq. ft.

Nobility’s Ocala facility is located on approximately 35.5 acres of land on which an additional two-story structure adjoining the plant serves as Nobility’s corporate offices. The plant, which is of metal construction, is in good condition and requires little maintenance. In December 2021, the Company broke ground to build an 11,900 square foot frame shop constructed of concrete block and metal to manufacture steel frames for our homes, on our current manufacturing plant property in Ocala, Florida. It is anticipated that this project will be completed in the fiscal year 2023.

Prestige owns the properties on which it’s Ocala South, Ocala North, Auburndale, Inverness, Tavares, Panama City, Yulee and Punta Gorda, Florida retail sales centers are located. Prestige leases the property for its other two retail sales centers located in Chiefland and Hudson Florida. The Company in April 2022 sold 4.38 acres of land frontage at the Inverness location for $96,970 to the Florida Department of Transportation for SR 41 road widening project. In January 2021 the Company purchased the land for the Tavares retail sales center for $245,000, land in Ocala for a future retail sales center in February 2021 for $1,040,000 and the land for the Ocala South retail sales center in March 2021 for $500,000.

Item 3. Legal Proceedings

Certain claims and suits arising in the ordinary course of business have been filed or are pending against the Company. In the opinion of management, the ultimate outcome of these matters will not have a material adverse effect on the Company’s financial position, results of operations or cash flows.

The Company does not maintain casualty insurance on some of its property, including the inventory at its retail centers, its plant machinery and plant equipment and is at risk for those types of losses.

Item 4. Mine Safety Disclosures None.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Market Information

The Company’s common stock currently trades under the symbol NOBH on the OTCQX market. Any over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

Holders

At January 31, 2023 the approximate number of holders on record of common stock was 86 (not including individual participants in security position listings).

Dividends

The Board of Directors declared a one-time cash dividend of $1.00 per common share for fiscal year 2021 paid to stockholders of record as of March 22, 2022. Any future determination to pay dividends will be at the discretion of our Board of Directors.

Securities Authorized for Issuance under Equity Compensation Plans

The following table displays equity compensation plan information as of the end of the fiscal year ended November 5, 2022 (see Note 13 to the Company’s financial statement included herein).

Equity Compensation Plan Information

| Number of securities to be issued upon exercise

of outstanding options, warrants and rights |

Weighted-average exercise price of

outstanding options, warrants and rights |

Number of securities remaining available for issuance under equity compensation plans

(excluding securities reflected in column (a)) |

| (a) | (b) | (c) |

| Equity compensation plans approved by security

66,200 holders |

$ 27.37 | N/A |

| Equity compensation plans not approved by

N/A security holders |

N/A | 233,800 |

Total 66,200 $ 27.37 233,800

Recent Sales of Unregistered Securities None.

Issuer Repurchases of Equity Securities

The Company did not repurchase any shares of its common stock during the fourth quarter ended November 5. 2022.

In September 2022, the Company’s Board of Directors authorized the Company to repurchase up to 200,000 shares of the Company’s common stock during fiscal year 2023 on the open market.

The Company’s Board of Directors in September 2021 authorized 200,000 and in June 2022 authorized 62,300 shares to be repurchased during fiscal year 2022 on the open market. During the twelve months ended November 5, 2022, the Company repurchased an aggregate of 162,570 shares of common stock.

In April 2022, the Company repurchased 100,000 shares of common stock from its President (see note 4) to the Company’s financial statements included herein.

Item 6. Reserved

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations General

Nobility focuses on home buyers who generally purchase their manufactured homes from retail sales centers to locate on property they own. Nobility has aggressively pursued this market through its Prestige retail sales centers. While Nobility actively seeks to make wholesale sales to independent retail dealers, its presence as a competitor limits potential sales to dealers located in the same geographic areas serviced by its Prestige retail sales centers.

Nobility has aggressively targeted the retirement community market, which is made up of retirees moving to Florida and typically purchasing homes to be located on sites leased from park communities offering a variety of amenities. Sales are not limited by the presence of the Company’s Prestige retail sales centers in this type of arrangement, as the retirement community sells homes only within their community.

Nobility has a product line of approximately 100 active models. Although market demand can fluctuate on a fairly short-term basis, the manufacturing process is such that Nobility can alter its product mix relatively quickly in response to changes in the market. During fiscal years 2022 and 2021, Nobility continued to experience consumer demand for affordable manufactured homes in Florida. Our three-, four- and five-bedroom manufactured homes are favored by families, compared with the one, two and three-bedroom homes that typically appeal to the retirement buyers who reside in the manufactured housing communities.

In an effort to make manufactured homes more competitive with site-built housing, financing packages are available through thirdparty lenders to provide (1) 30-year financing, (2) an interest rate reduction program (buy-down), (3) combination land/manufactured home loans, and (4) a 5% down payment program for qualified buyers.

Prestige maintains several outside financing sources that provide financing to retail homebuyers for its manufactured homes. The Company continually tries to develop relationships with new lenders, since established lenders will occasionally leave manufactured home lending. The lack of lenders in our industry, partly as a result of an increase in government regulations, still affects our results by limiting many affordable manufactured housing buyers from purchasing homes. In addition, rising interest rates have slowed the demand for retail homebuyers.

Prestige’s wholly owned subsidiary, Mountain Financial, Inc., is an independent insurance agent and licensed loan originator. Mountain Financial provides automobile insurance, extended warranty coverage and property and casualty insurance to Prestige customers in connection with their purchase and financing of manufactured homes.

The rising interest rate environment’s future impact on the housing market as well as the continued negative impact from COVID-19 and other factors on the Company’s production work force, supply of certain building products and the operations of the Company are difficult to forecast for fiscal year 2023. These factors have had a negative impact on customer traffic (and corresponding sales) within our sales centers, operations of the manufacturing facility and our business partners through the most part of fiscal year 2022 and during the third and fourth quarters of fiscal 2021.

In fiscal year 2022 Prestige purchased from other manufacturers 153 ($12,595,593) new homes to help eliminate the large backlog from Nobility. Prestige has 99 ($8,198,040) new homes from Nobility and outside manufacturers that are included in inventory and are in the field waiting to be completed and closed.

Nobility believes that being located in Florida offers a number of advantages such as an increasing population and a low-tax and business friendly state government. However, Nobility is also aware of climate-related risks such as hurricanes, tornados, sea-level rise, flooding and wildfires which are prone to occur in Florida. To date, management does not believe these climate-related risks have adversely impacted the Company. However, management believes if such climate-related events impacted the Company’s manufacturing or sales facilities, then the Company would be adversely impacted. If such climate-related events should deter future population growth in Florida, then the Company would be adversely impacted. If climate-related disclosures are required in the future by the Securities and Exchange Commission or if customary business practices should change to require greater climate-risk mitigation, then the Company would face increased compliance costs and costs of doing business. Such costs are not currently quantifiable.

The Company’s fiscal year ends on the first Saturday on or after October 31. The year ended November 5, 2022 (fiscal year 2022) consisted of a fifty-two-week period and the year ended November 6, 2021 (fiscal year 2021) consisted of a fifty-three-week period.

Results of Operations

Total net sales in fiscal year 2022 increased 14% to $51,522,054 compared to $45,062,558 in fiscal year 2021. The Company reported net income of $7,232,029 in fiscal year 2022, an increase of 34% compared to $5,398,808 during fiscal year 2021. The demand for affordable manufactured housing in Florida and the U.S. is slowing as a result of the increased interest rate environment driven by the Federal Reserve. Although net sales increased during the twelve months ended November 5, 2022, as compared to the same period last year, we continued to experience the negative impact of limitations being placed on certain key production materials from suppliers, the delay or lack of key components from vendors as well as back orders, delayed shipments, price increases and labor shortages. These supply chain issues have caused delays in the completion of the homes at the manufacturing facility and the set-up process of retail homes in the field, resulting in decreased net sales due to our inability to timely deliver and setup homes to customers. Certainly, the COVID-19 pandemic has had an impact on each of these areas. We expect that these challenges will continue for the first six months of fiscal year 2023 or until the industry supply chain normalizes. The Company has continued to experience inflation in most building products resulting in increases to our material and labor costs which has increased the wholesale and retail selling prices of our homes. In addition, potential customers may delay or defer purchasing decisions in light of the rising interest rate environment. According to the Florida Manufactured Housing Association, shipments for the industry in Florida for the period from November 2021 through October 2022 were up approximately 23% from the same period last year.

The following table summarizes certain key sales statistics and percent of gross profit as of and for fiscal years 2022 and 2021. 2022 2021

| New homes sold through Company owned sales centers | 371 | 394 |

| Pre-owned homes sold through Company owned sales centers | 13 | 15 |

| Homes sold to independent dealers | 43 | 139 |

| Total new factory built homes produced | 423 | 557 |

| Average new manufactured home price – retail | $ 126,438 | $ 93,824 |

| Average new manufactured home price – wholesale As a percent of net sales: | $ 72,983 | $ 50,183 |

| Gross profit from the Company owned retail sales centers

Gross profit from the manufacturing facilities – including |

20% | 17% |

| intercompany sales | 16% | 15% |

Maintaining our strong financial position is vital for future growth and success. Our many years of experience in the Florida market, combined with home buyers’ increased need for more affordable housing, should serve the Company well in the coming years. Management remains convinced that our specific geographic market is one of the best long-term growth areas in the country.

On June 5, 2022, we celebrated our 55th anniversary in business specializing in the design and production of quality, affordable manufactured and modular homes. With multiple retail sales centers in Florida for over 32 years and an insurance agency subsidiary, we are the only vertically integrated manufactured home company headquartered in Florida.

Insurance agent commissions in fiscal year 2022 were $299,672 compared to $283,154 in fiscal year 2021. We have established appropriate reserves for policy cancellations based on numerous factors, including past transaction history with customers, historical experience and other information, which is periodically evaluated and adjusted as deemed necessary. In the opinion of management, no reserve was deemed necessary for policy cancellations at November 5, 2022 and November 6, 2021.

Cost of goods sold at our manufacturing facilities include materials, direct and indirect labor and manufacturing expenses (which consists of factory occupancy, salary and salary related, delivery costs, manufactured home service costs and other manufacturing expenses). Cost of goods sold at our retail sales centers include appliances, air conditioners, electrical and plumbing hook-ups, furniture, insurance, impact and permit fees, land and home fees, manufactured home, service warranty, setup contractor, interior drywall finish, setup display, skirting, steps, well, septic tank and other expenses.

Gross profit as a percentage of net sales was 29% in fiscal year 2022 compared to 25% in fiscal year 2021. Our gross profit was $14,903,438 for fiscal year 2022 compared to $11,432,196 for fiscal year 2021. The gross profit is dependent on the sales mix of wholesale and retail homes and number of pre-owned homes sold. The increase in gross profit as a percentage of net sales is primarily due to the increase in the wholesale and retail selling prices of our homes.

Selling, general and administrative expenses at our manufacturing facility include salaries, professional services, advertising and promotions, corporate expenses, employee benefits, office equipment and supplies and utilities. Selling, general and administrative expenses at our retail sales center include advertising, retail sales centers expenses, salary and salary related, professional fees, corporate expense, employee benefit, office equipment and supplies, utilities and travel. Selling, general and administrative expenses at the insurance company include advertising, professional fees and office supplies.

Selling, general and administrative expenses as a percentage of net sales was 13% in fiscal year 2022 compared to 12% in fiscal year Selling, general and administrative expenses were $6,477,988 for fiscal year 2022 compared to $5,286,172 for fiscal year 2021. The dollar increases in expenses in 2022 were due to the increase in variable expenses which were a direct result of employee benefits compensation due to the increase in sales.

The Company earned interest in the amount of $234,804 in fiscal year 2022 compared to $180,635 in fiscal year 2021. Interest income is dependent on our cash balance and available rates of return. The increase during 2022 is primarily due to the increase in the interest rates.

The Company earned $60,457 from its joint venture, Majestic 21, in fiscal year 2022 compared to $59,072 in fiscal year 2021. The earnings from Majestic 21 represent the allocation of profit and losses which are owned 50% by 21st Mortgage Corporation and 50% by the Company. The earnings from the Majestic 21 loan portfolio could vary year to year, but overall, the earnings will continue to decrease due to the amortization, maturity and payoff of the loans.

We received $364,520 in fiscal year 2022 and $246,216 in fiscal year 2021 under an escrow arrangement related to a Finance Revenue Sharing Agreement (FRSA) between 21st Mortgage Corporation and the Company. The distributions from the escrow account, related to certain loans financed by 21st Mortgage Corporation, are recorded in income by the Company as received, which has been the Company’s past practice. The increase in earnings is primarily due to the four distributions received in fiscal year 2022 compared to three distributions received fiscal year 2021. The earnings overall from the FRSA loan portfolio will continue to decrease due to the amortization and payoff of the loans.

The Company realized pre-tax income of $9,436,534 in fiscal year 2022 compared to a pre-tax income of $7,118,733 in fiscal year 2021.

The Company recorded an income tax expense of $2,204,505 in fiscal year 2022 compared to $1,719,925 in fiscal year 2021.

Net income in fiscal year 2022 was $7,232,029 or $2.10 per basic and diluted share and net income in fiscal year 2021 was $5,398,808 or $1.50 per basic and diluted share.

Liquidity and Capital Resources

Cash and cash equivalents were $16,653,449 at November 5, 2022 compared to $36,126,059 at November 6, 2021. Certificates of deposit were $3,903,888 at November 5, 2022 compared to $2,093,015 at November 6, 2021. Short-term investments were $589,071 at November 5, 2022 compared to $621,928 at November 6, 2021. Working capital was $33,667,732 at November 5, 2022 compared to $35,563,355 at November 6, 2021. A cash dividend was paid from our cash reserves in April 2022 in the amount of $1.00 per share ($3,532,976). During fiscal 2022, the Company repurchased an aggregate 162,570 shares of its common stock for an aggregate of

$5,195,267 and Prestige purchased from other manufacturers 153 ($12,595,593) new homes to help eliminate the large backlog from Nobility. Prestige new home inventory was $20,016,093 at November 5, 2022 compared to $7,140,880 at November 6, 2021. The increase in Prestige new home inventory was due to the 121 ($10,432,998) new homes in inventory that were purchased from other manufacturers. Prestige has 99 ($8,198,040) new homes from Nobility and other manufacturers that are included in inventory and are in the field waiting to be completed and closed. We own the entire inventory for our Prestige retail sales centers which includes new, pre-owned and repossessed or foreclosed homes and do not incur any third-party floor plan financing expenses. The Company incurred $1.1 million in fiscal year 2022 in building an 11,900 square foot frame shop to manufacture steel frames for our homes. In April 2022 Prestige sold 4.38 acres of land frontage at the Inverness location for $96,970 to the Florida Department of Transportation for SR 41 road widening project. A cash dividend was paid from our cash reserves in March 2021 in the amount of $1.00 per share ($3,632,100). During fiscal 2021, the Company repurchased an aggregate of 100,346 shares of its common stock for an aggregate of $3,478,553. In January 2021 the Company purchased the land for the Tavares retail sales center for $245,000, land in Ocala for a future retail sales center in February 2021 for $1,040,000 and land for the Ocala South retail sales center in March 2021 for $500,000.

The Company currently has no line of credit facility and no debt and does not believe that such a facility is currently necessary to its operations. The Company also has approximately $4.1 million of cash surrender value of life insurance which it may be able to access as an additional source of liquidity though the Company has not currently viewed this to be necessary. As of November 5, 2022, the Company continued to report a strong balance sheet which included total assets of approximately $62.4 million which was funded primarily by stockholders’ equity of approximately $47.9 million.

Looking ahead, the Company’s strong balance sheet and significant cash reserves accumulated in profitable years has allowed the Company to remain sufficiently liquid to allow the continuation of operations and should enable the Company to take advantage of any market opportunities. Management believes it has sufficient levels of liquidity as of the date of the filing of this Form 10-K to allow the Company to operate into the foreseeable future.

Critical Accounting Policies and Estimates

The Company applies judgment and estimates, which may have a material effect in the eventual outcome of assets, liabilities, revenues and expenses, accounts receivable, inventory and goodwill. The following explains the basis and the procedure where judgment and estimates are applied.

Revenue Recognition

The Company recognizes revenue from its retail sales of new manufactured homes upon the occurrence of the following:

- Its receipt of a down payment,

- Construction of the home is complete,

- Home has been delivered and set up at the retail home buyer’s site and title has been transferred to the retail home buyer,

- Remaining funds have been released by the finance company (financed sales transaction), remaining funds have been committed by the finance company by an agreement with respect to financing obtained by the customer, usually in the form of a written approval for permanent home financing received from a lending institution, (financed construction sales transaction) or cash has been received from the home buyer (cash sales transaction), and

- Completion of any other significant obligations.

The Company recognizes revenue from the sale of the repurchased homes upon transfer of title to the new purchaser.

The Company recognizes revenue from its independent dealers upon receiving wholesale floor plan financing or establishing retail credit approval for terms, shipping of the home and transferring title and risk of loss to the independent dealer. For wholesale shipments to independent dealers, the Company has no obligation to set up the home or to complete any other significant obligations.

Sales of homes to affiliated entities that are subject to contingent payment terms are considered inventory consignment arrangements. Revenue from such arrangements is recognized when the homes are sold to the end users and payment is collected by the affiliated entity.

See Note 4 “Related Party Transactions” to the Company’s financial statement included herein

The Company recognizes revenue from its wholly owned subsidiary, Mountain Financial, Inc., as follows: commission income (and fees in lieu of commissions) is recorded as of the effective date of insurance coverage or the billing date, whichever is later. Commissions on premiums billed and collected directly by insurance companies are recorded as revenue when received which, in many cases, is the Company’s first notification of amounts earned due to the lack of policy and renewal information. Contingent commissions are recorded as revenue when received. Contingent commissions are commissions paid by insurance underwriters and are based on the estimated profit and/or overall volume of business placed with the underwriter. The data necessary for the calculation of contingent commissions cannot be reasonably obtained prior to the receipt of the commission which, in many cases, is the Company’s first notification of amounts earned. The Company provides appropriate reserves for policy cancellations based on numerous factors, including past transaction history with customers, historical experience and other information, which is periodically evaluated and adjusted as deemed necessary. In the opinion of management, no reserve was deemed necessary for policy cancellations on November 5, 2022 or November 6, 2021.

Income Taxes

The Company accounts for income taxes utilizing the asset and liability method. This approach requires the recognition of deferred tax assets and liabilities for the expected future tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

Rebate Program

The Company has a rebate program for some dealers, based upon the number and type of homes purchased, which pays rebates based upon sales volume to the dealers. Volume rebates are recorded as a reduction of sales in the accompanying consolidated financial statements. The rebate liability is calculated and recognized as eligible homes are sold based upon factors surrounding the activity and prior experience of specific dealers and is included in accrued expenses in the accompanying consolidated balance sheets.

Off-Balance Sheet Arrangements

As part of our ongoing business, we generally do not participate in transactions that generate relationships with unconsolidated entities or financial partnerships, such as entities often referred to as structured finance or variable interest entities (“VIE’s”), which would have been established for the purpose of facilitating off-balance sheet arrangements or other contractually narrow or limited purposes.

As of November 5, 2022, we are not involved in any material unconsolidated entities (other than the Company’s investments in Majestic 21).

Forward Looking Statements

Certain statements in this report are forward-looking statements within the meaning of the federal securities laws. Although Nobility believes that the amounts and expectations reflected in such forward-looking statements are based on reasonable assumptions, there are risks and uncertainties that may cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to, the potential adverse impact on our business caused by the COVID-19 pandemic or other health pandemics, competitive pricing pressures at both the wholesale and retail levels, inflation, increasing material costs (including forest based products) or availability of materials due to supply chain interruptions (such as current inflation with forest products and supply issues with vinyl siding and PVC piping), changes in market demand, increase in interest rates, availability of financing for retail and wholesale purchasers, consumer confidence, adverse weather conditions that reduce sales at retail centers, the risk of manufacturing plant shutdowns due to storms or other factors, the impact of marketing and cost-management programs, reliance on the Florida economy, impact of labor shortage, impact of materials shortage, increasing labor cost, cyclical nature of the manufactured housing industry, impact of rising fuel costs, catastrophic events impacting insurance costs, availability of insurance coverage for various risks to Nobility, market demographics, management’s ability to attract and retain executive officers and key personnel, increased global tensions, market disruptions resulting from terrorist or other attack, any armed conflict involving the United States and the impact of inflation.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

As a smaller reporting company, we are not required to provide the information required by this item.

Item 8. Financial Statements and Supplementary Data

Index to Consolidated Financial Statements

Report of Independent Registered Public Accounting Firm—Daszkal Bolton LLP (Auditor ID # 229)…………………………………… 13

Consolidated Balance Sheets ………………………………………………………………………………………………………………………………………… 14

Consolidated Statements of Income ……………………………………………………………………………………………………………………………….. 15

Consolidated Statements of Changes in Stockholders’ Equity …………………………………………………………………………………………… 16

Consolidated Statements of Cash Flows …………………………………………………………………………………………………………………………. 17

Notes to Consolidated Financial Statements ……………………………………………………………………………………………………………………. 18

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of Nobility Homes, Inc.

Ocala, Florida

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheet of Nobility Homes, Inc. (the “Company”) at November 5, 2022 and

November 6, 2021, and the related consolidated statements of comprehensive income, changes in stockholders’ equity, and cash flows for each of the years in the two-year period ended November 5, 2022, and the related notes (collectively referred to as the consolidated financial statements). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

Critical audit matters are matters arising from the current-period audit of the financial statements that were communicated or required to be communicated to the audit committee and that (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. We determined that there are no critical audit matters. /s/ Daszkal Bolton LLP

We have served as the Company’s auditor since 2018.

Jupiter, Florida

February 1, 2023

PCAOB ID # 229

Nobility Homes, Inc.

Consolidated Balance Sheets

November 5, 2022 and November 6, 2021 November 5, November 6,

| Assets

Current assets: |

||

| Cash and cash equivalents | $ 16,653,449 | $ 36,126,059 |

| Certificates of deposit | 3,903,888 | 2,093,015 |

| Short-term investments | 589,071 | 621,928 |

| Accounts receivable – trade | 1,288,645 | 680,228 |

| Note receivable | 23,905 | 32,825 |

| Mortgage notes receivable | 16,191 | 22,589 |

| Inventories | 22,775,239 | 10,394,288 |

| Pre-owned homes, net | 682,254 | 542,081 |

| Prepaid expenses and other current assets | 2,172,675 | 1,821,267 |

| Total current assets | 48,105,317 | 52,334,280 |

| Property, plant and equipment, net | 7,915,695 | 6,847,780 |

| Pre-owned homes, net | – | 755,394 |

| Note receivable, less current portion | 16,599 | 38,895 |

| Mortgage notes receivable, less current portion | 131,514 | 222,459 |

| Mobile home park note receivable | – | 72,731 |

| Other investments | 1,848,893 | 1,788,436 |

| Deferred income taxes | 43,778 | – |

| Operating lease right of use assets | – | 1,597 |

| Cash surrender value of life insurance | 4,143,035 | 3,966,939 |

| Other assets | 156,287 | 156,287 |

| Total assets

Liabilities and Stockholders’ Equity Current liabilities: |

$ 62,361,118 | $ 66,184,798 |

| Accounts payable | $ 1,119,188 | $ 939,964 |

| Accrued compensation | 1,132,423 | 555,222 |

| Accrued expenses and other current liabilities | 1,742,696 | 1,513,967 |

| Income taxes payable | 229,200 | 89,083 |

| Operating lease obligation | – | 1,597 |

| Customer deposits | 10,214,078 | 13,671,092 |

| Total current liabilities | 14,437,585 | 16,770,925 |

| Deferred income taxes | – | 99,568 |

| Total liabilities

Commitments and contingencies Stockholders’ equity: Preferred stock, $.10 par value, 500,000 shares |

14,437,585 | 16,870,493 |

| authorized; none issued and outstanding Common stock, $.10 par value, 10,000,000 shares authorized; 5,364,907 shares issued; | – | – |

| 3,370,912 and 3,532,100 shares outstanding, respectively | 536,491 | 536,491 |

| Additional paid in capital | 10,849,687 | 10,766,253 |

| Retained earnings

Less treasury stock at cost, 1,993,995 and |

63,441,812 | 59,742,759 |

| 1,832,807 shares, respectively | (26,904,457) | (21,731,198) |

| Total stockholders’ equity | 47,923,533 | 49,314,305 |

| Total liabilities and stockholders’ equity | $ 62,361,118

2022 |

$ 66,184,798

2021 |

NOTE 1 Reporting Entity and Significant Accounting Policies

Description of Business and Principles of Consolidation – The consolidated financial statements include the accounts of Nobility Homes, Inc. (“Nobility”), its wholly-owned subsidiaries, Prestige Home Centers, Inc. (“Prestige”), and Prestige’s wholly-owned subsidiaries, Mountain Financial, Inc., an independent insurance agency and licensed mortgage loan originator and Majestic Homes, Inc., (collectively the “Company”). The Company is engaged in the manufacture and sale of manufactured and modular homes to various dealerships, including its own retail sales centers, and manufactured housing communities throughout Florida. The Company has a manufacturing plant in operation that is located in Ocala, Florida. At November 5, 2022, Prestige operated ten Florida retail sales centers: Ocala (2), Chiefland, Auburndale, Inverness, Hudson, Tavares, Yulee, Panama City and Punta Gorda.

All intercompany accounts and transactions have been eliminated in consolidation. The consolidated financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP).

Use of Estimates – The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying disclosures. These estimates and assumptions are based upon management’s best knowledge of current events and actions that the Company may take in the future. The Company is subject to uncertainties such as the impact of future events, economic, environmental and political factors and changes in the Company’s business environment; therefore, actual results could differ from these estimates. Accordingly, the accounting estimates used in the preparation of the Company’s consolidated financial statements will change as new events occur, as more experience is acquired, as additional information is obtained and as the Company’s operating environment changes. Changes in estimates are made when circumstances warrant. Such changes in estimates and refinements in estimation methodologies are reflected in the reported financial condition and results of operations; if material, the effects of changes in estimates are disclosed in the notes to the consolidated financial statements. Significant estimates and assumptions by management affect: valuation of pre-owned homes, the allowance for doubtful accounts, the carrying value of long-lived assets, the provision for income taxes and related deferred tax accounts, certain accrued expenses and contingencies, warranty reserve and stock-based compensation.

Fiscal Year – The Company’s fiscal year ends on the first Saturday on or after October 31. The year ended November 5, 2022 (fiscal year 2022) consisted of a fifty-two-week period and the year ended November 6, 2021 (fiscal year 2021) consisted of a fifty-threeweek period.

Revenue Recognition – The Company’s revenue comes substantially from the sale of manufactured housing, modular housing and park models, along with freight billed to customers, parts sold and aftermarket services.

The Company recognizes revenue following the comprehensive framework of Financial Accounting Standards Board ASU No. 2014-

09, “Revenue from Contracts with Customers (Topic 606)” (ASU 2014-09), which established a methodology for determining how much revenue to recognize and when it should be recognized through application of the following five-step approach:

- Identify the contract(s) with a customer.

- Identify each performance obligation in the contract.

- Determine the transaction price.

- Allocate the transaction price to each performance obligation; and

- Recognize revenue when or as each performance obligation is satisfied.

The Company recognizes revenue from its retail sales of new manufactured homes upon the occurrence of the following:

- Its receipt of a down payment,

- Construction of the home is complete,

- Home has been delivered and set up at the retail home buyer’s site, and title has been transferred to the retail home buyer,

- Remaining funds have been released by the finance company (financed sales transaction), remaining funds have been committed by the finance company by an agreement with respect to financing obtained by the customer, usually in the form of a written approval for permanent home financing received from a lending institution, (financed construction sales transaction) or cash has been received from the home buyer (cash sales transaction), and

- Completion of any other significant obligations.

The Company recognizes revenue from the sale of the repurchased homes upon transfer of title to the new purchaser.

The Company recognizes revenues from its independent dealers upon receiving wholesale floor plan financing or establishing retail credit approval for terms, shipping of the home, and transferring title and risk of loss to the independent dealer. For wholesale shipments to independent dealers, the Company has no obligation to set up the home or to complete any other significant obligations.

The Company recognizes revenues from its wholly owned subsidiary, Mountain Financial, Inc., as follows: commission income (and fees in lieu of commissions) is recorded as of the effective date of insurance coverage or the billing date, whichever is later. Commissions on premiums billed and collected directly by insurance companies are recorded as revenue when received which, in many cases, is the Company’s first notification of amounts earned due to the lack of policy and renewal information. Contingent commissions are recorded as revenue when received. Contingent commissions are commissions paid by insurance underwriters and are based on the estimated profit and/or overall volume of business placed with the underwriter. The data necessary for the calculation of contingent commissions cannot be reasonably obtained prior to the receipt of the commission which, in many cases, is the Company’s first notification of amounts earned. The Company provides appropriate reserves for policy cancellations based on numerous factors, including past transaction history with customers, historical experience, and other information, which is periodically evaluated and adjusted as deemed necessary. In the opinion of management, no reserve was deemed necessary for policy cancellations at November 5, 2022 and November 6, 2021.

Sales of homes to affiliated entities that are subject to contingent payment terms are considered inventory consignment arrangements. Revenue from such arrangements is recognized when the homes are sold to the end users and payment is collected by the affiliated entity.

See Note 4 “Related Party Transactions”.

Revenues by Products and Services – Revenues by net sales from manufactured housing, pre-owned homes, and insurance agent commissions for the years ended November 5, 2022 and November 6, 2021 are as follows:

2022 2021

| Manufactured housing | $ 50,264,637 | $ 43,963,239 |

| Pre-owned homes | 957,745 | 816,165 |

| Insurance agent commissions | 299,672 | 283,154 |

| Total net sales | $ 51,522,054 | $ 45,062,558 |

Cash and Cash Equivalents – The Company considers all money market accounts and highly liquid debt instruments purchased with an original maturity of three months or less to be cash equivalents.

Certificates of Deposit – Certificates of deposits are recorded at cost plus accrued interest and have maturities of twelve months or less.

Accounts Receivable – Accounts receivable are stated at net realizable value. An allowance for doubtful accounts is provided based on prior collection experiences and management’s analysis of specific accounts. At November 5, 2022 or November 6, 2021, in the opinion of management, no material accounts were considered uncollectible and, accordingly, no allowance was deemed necessary.

Accounts receivable fluctuate due to the number of homes sold to independent dealers. The Company recognizes revenues from its independent dealers upon receiving wholesale floor plan financing or establishing retail credit approval for terms, shipping of the home, and transferring title and risk of loss to the independent dealer.

Investments – The Company’s investments consist of equity securities of a public company. Investments with maturities of less than one year are classified as short-term investments. The Company’s equity investment in a public company is classified as “availablefor-sale” and carried at fair value. Unrealized gains on the available-for-sale securities, net of taxes, were recorded in accumulated other comprehensive income. Upon the Company’s adoption of ASU 2016-01, unrealized gains and losses on these available-for-sale securities are reflected in the statement of income and comprehensive income.

Inventories – New home inventory is carried at a lower of cost or net realizable value. The cost of finished home inventories determined on the specific identification method is removed from inventories and recorded as a component of cost of sales at the time revenue is recognized. In addition, an allocation of depreciation and amortization is included in the cost of goods sold. Under the specific identification method, if finished home inventory can be sold for a profit there is no basis to write down the inventory below the lower of cost or net realizable value.

Other pre-owned homes are acquired (Repossessions Inventory) as a convenience to the Company’s joint venture partner, 21st Mortgage Corporation. This inventory has been repossessed by 21st Mortgage Corporation or through mortgage foreclosure. The Company acquired this inventory at the amount of the uncollected balance of the financing at the time of the foreclosure/repossessions by 21st Mortgage Corporation. The Company records this inventory at a cost determined by the specific identification method. All of the refurbishment costs are paid by 21st Mortgage Corporation. This arrangement assists 21st Mortgage Corporation with liquidation of their repossessed inventory. The timing of these repurchases by the Company is unpredictable as it is based on the repossessions 21st Mortgage Corporation incurs in the portfolio. When the home is sold, the Company retains the cost of the home, an interest factor on the cost of the home and a sales commission, from the sales proceeds. Any additional proceeds are paid to 21st Mortgage. Any shortfall from the proceeds to cover these amounts is paid by 21st Mortgage to the Company. As the Company has no risk of loss on the sale, there is no valuation allowance necessary for repossessions inventory.

Inventory held at consignment locations by affiliated entities is included in the Company’s inventory on the Company’s consolidated balance sheets. Consigned inventory was $318,590 and $794,766 as of November 5, 2022 and November 6, 2021, respectively.

Pre-owned homes are also taken as trade-ins on new home sales (Trade-in Inventory). This inventory is recorded at estimated actual wholesale value, which is generally lower than market value, determined on the specific identification method, plus refurbishment costs incurred to date to bring the inventory to a more saleable state. The Trade-in Inventory amount is reduced where necessary on a unit specific basis by a valuation reserve, which management believes results in inventory being valued at net realizable value.

Other inventory costs are determined on a first-in, first-out basis.

See Note 6 “Inventories”.

Property, Plant and Equipment – Property, plant and equipment are stated at cost and depreciated over their estimated useful lives using the straight-line method. Routine maintenance and repairs are charged to expense when incurred. Major replacements and improvements are capitalized. Gains or losses are credited or charged to earnings upon disposition.

Investment in Majestic 21 – Majestic 21 was formed in 1997 as a joint venture with our joint venture partner, an unrelated entity, 21st Mortgage Corporation (“21st Mortgage”). We have been allocated our share of net income and distributions on a 50/50 basis since Majestic 21’s formation. While Majestic 21 has been deemed to be a variable interest entity, the Company only holds a 50% interest in this entity and all allocations of profit and loss are on a 50/50 basis. Since all allocations are to be made on a 50/50 basis and joint decisions with the joint venture partner are made which most significantly impact Majestic 21 economic performance therefore, the Company is not required to consolidate Majestic 21 with the accounts of Nobility Homes in accordance with the Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) No. 810, “Consolidations” (ASC 810). Management believes that the Company’s maximum exposure to loss as a result of its involvement with Majestic 21 is its investment in the joint venture. Based on management’s evaluation, there was no impairment of this investment at November 5, 2022 or November 6, 2021.

The Company entered into an arrangement in 2002 with 21st Mortgage to repurchase certain pre-owned homes. Under this arrangement or any other arrangement, the Company is not obligated to repurchase any foreclosed/repossessed units of Majestic 21 as it does not have a repurchase agreement or any other guarantees with Majestic 21. However, the Company buys from 21st Mortgage foreclosed/repossessed units from the Majestic 21 portfolio and acts as a remarketing agent. It resells those units through the

Company’s network of retail centers which management believes benefits the historical loss experience of the joint venture. The only impact on the Company’s operations from this arrangement are commissions earned on the resale of these units and interest earned for the Company’s carrying costs of the units while in inventory.

See Note 14 “Commitments and Contingent Liabilities”.

Impairment of Long-Lived Assets – In the event that facts and circumstances indicate that the carrying value of a long-lived asset may be impaired, an evaluation of recoverability is performed by comparing the estimated future undiscounted cash flows associated with the asset to the asset’s carrying amount to determine if a write-down is required. If such evaluations indicate that the future undiscounted cash flows of certain long-lived assets are not sufficient to recover the carrying value of such assets, the assets are adjusted to their fair values.

Customer Deposits – A retail customer is required to make a down payment ranging from $500 to 35% of the retail contract price based upon the creditworthiness of the customer. The retail customer receives the full down payment back when the Company is not able to obtain retail financing. If the retail customer receives retail financing and decides not to go through with the retail sale, the Company can withhold 20% of the retail contract price. The Company does not typically receive any deposits from independent dealers.

Company Owned Life Insurance – The Company has purchased life insurance policies for certain key executives. Company owned life insurance is recorded at the amount that can be realized under the insurance contract at the balance sheet date, which is the cash surrender value adjusted for other charges or other amounts due that are probable at settlement.

Warranty Costs – The Company provides a warranty as the manufactured homes are sold. Amounts related to these warranties for fiscal years 2022 and 2021 are as follows:

2022 2021

| Beginning accrued warranty expense | $ 125,000 | $ 125,000 |

| Less: reduction for payments | (428,031) | (465,549) |