Once upon a time, operating in the U.S. there was Sun Communities (SUI), Equity LifeStyle Properties (ELS), and UMH Properties (UMH) as the manufactured home communities (MHCs) real estate investment trusts (REITs). In more recent years, Flagship Communities (MHC-UN.TO) and Manufactured Housing Properties Inc. (MHProperties or OTC:MHPC) have come into being. Then there are publicly traded manufactured housing producers such as Clayton Homes (BRK), Skyline Champion (SKY), Cavco Industries (CVCO), Legacy Housing (LEGH), and Nobility Homes (NOBH). Of those 5 producers, the first 4 are said to be Manufactured Housing Institute (MHI) members. Then there are suppliers, financing, and commercial real estate brokers which are connected to manufactured housing which are publicly traded. Thus, every quarter, there is a gush of information, pages of statements, and an array of claims produced by publicly traded firms that are routinely members of the Manufactured Housing Institute (MHI). While they may not fall on the same date, they can occur in relatively proximity to each other. Naturally, there are other industry news topics occurring too. For instance, there has been the MHI-Texas Manufactured Housing Association (TMHA) legal action (U.S. District Court, Western District of Texas) Case 1:23-cv-00174-LY) against the Department of Energy and Secretary Jennifer Granholm. HUD, FHFA, the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac. Public officials make statements. Mainstream media reports on events, often negative) that can impact our industry. Then, there are macro-housing, macro-political, macro-economic issues which others in what passes for manufactured housing trade media may only mention in passing if at all, but which MHProNews periodically covers because it is deemed relevant to the industry pros, advocates, affordable housing seekers, etc. What that brief outline reveals is that editorial choices have to be made day by day on what item is of priority. Sometimes a manufactured housing story that appears to be the plan the night before is supplanted by another that seems to have a higher priority by dawn which changes the publishing plan for an array of possible reasons.

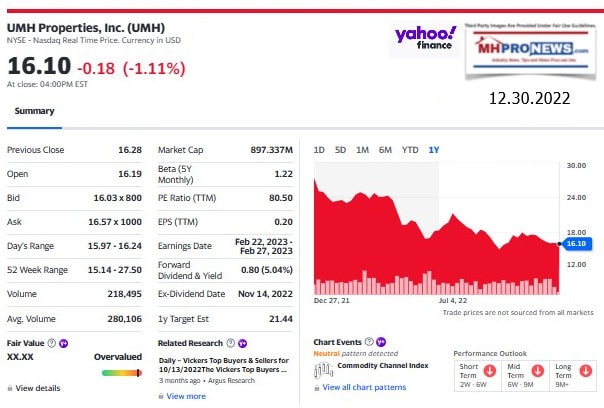

That said, today’s report is on UMH Properties fourth quarter and year end report. Knowledge is potential power = “scientia potentia est.” These facts and related remarks by the company or a specific corporate official can yield for the patient and informed manufactured housing. Experience reveals there is only so much communicating and coordinating that can occur between the various consolidators that are routinely MHI members and remarks or documents produced by MHI before disconnects occur. When the facts are laid out side by side like a giant puzzle that sheds light on manufactured housing’s historic underperformance in the 21st century, those items are apparent evidence for savvy people to consider.

Given the increased state and federal attention to antitrust and issues such as ESG (Environmental Social Governance), and with a steady beat of shareholder, resident, and other possible or actual litigation, these insights are a wealth of insights to risks, rewards, and the razzle dazzle that has marked much of what has marked the artificially smaller manufactured home industry (a.k.a. MHVille).

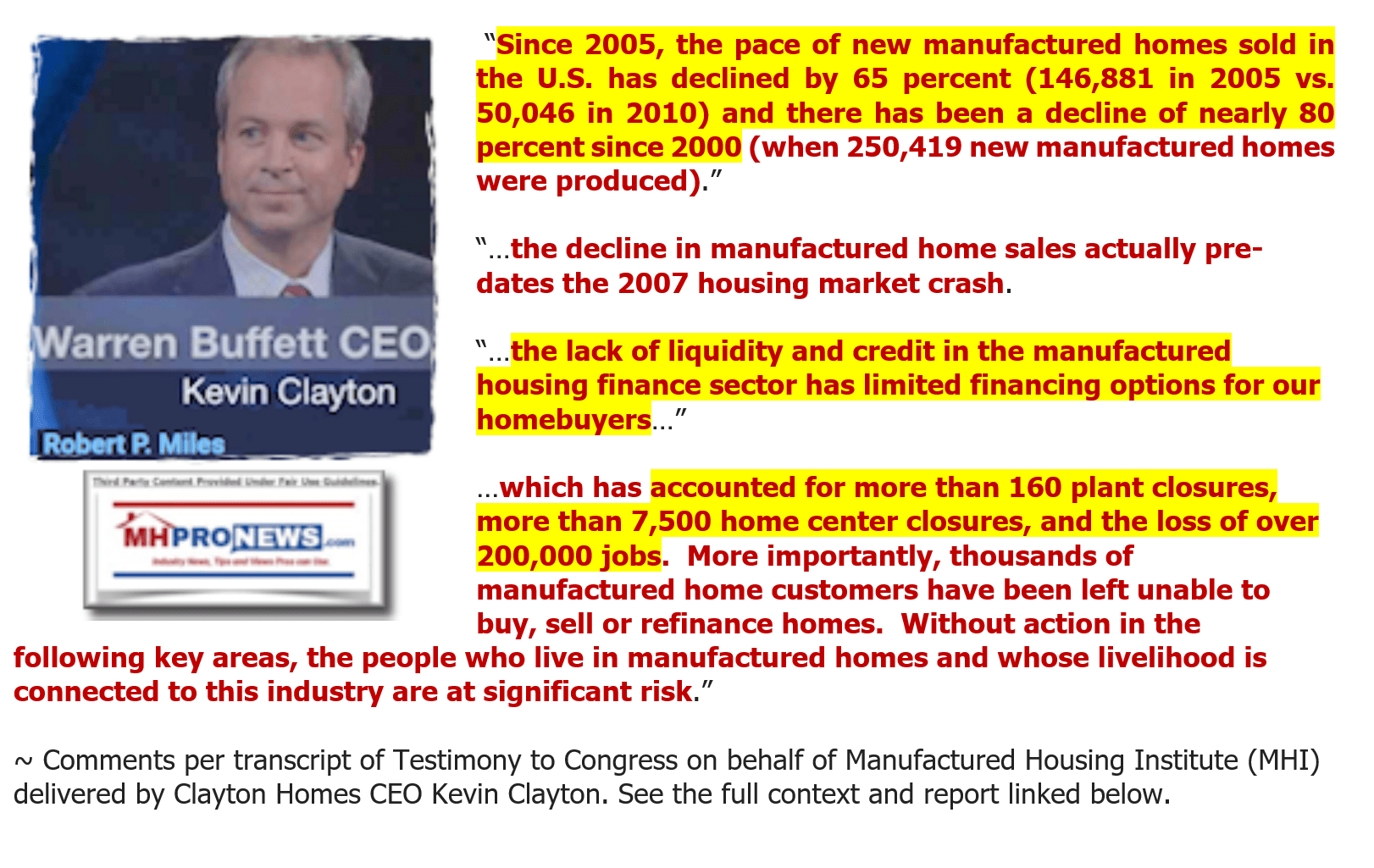

Artificially smaller? Yes. There are fewer manufactured home communities today than there were at the turn of the century. There are fewer producers of HUD Code manufactured homes than there were at the turn of the century. There are fewer ‘street retailers’ by far now then there used to be in the late 1990s or the early 2000s. Numbers of once profitable businesses, several of what had served their customers well for decades, vanished in the 21st century. Ironically, Kevin Clayton, literally speaking for MHI, made that point without pointing the finger of the role arguably played by brands with ties to Warren Buffett led Berkshire Hathaway (BRK).

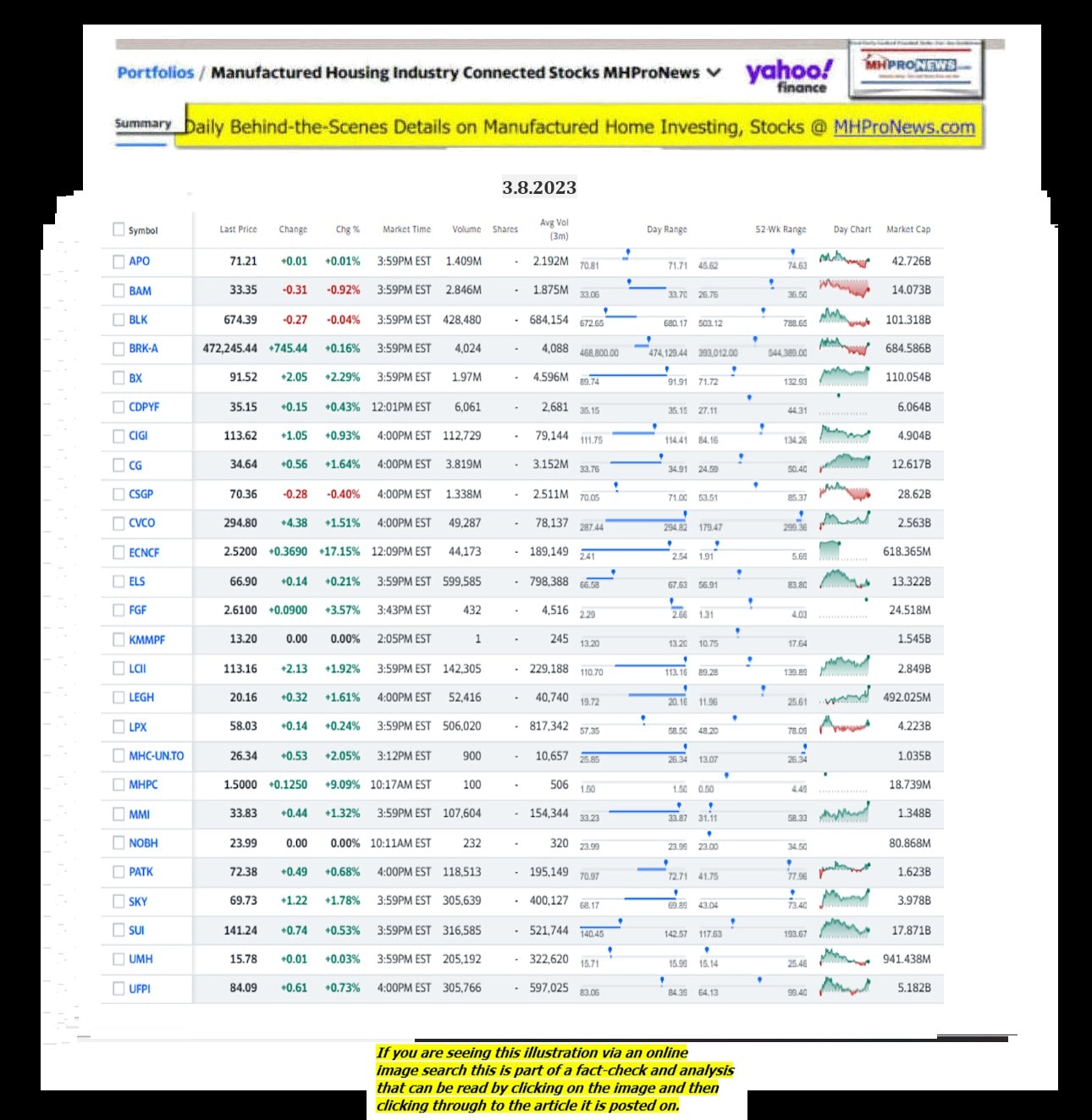

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

While a narrative has been spun that is said to explain why manufactured housing experienced a crash in 2009 and 2010, that promoted notion oddly fails to account for a range of statements, documents, evidence, and remarks that have been painstakingly gathered by MHProNews/MHLivingNews in the past several years. While some have taken pot shots (usually cheap shots) at the evidence and related thesis, often arguably by accident or design performed on behalf of MHI, none of those claims have stood up to scrutiny. Restated, there is a wealth of evidence that manufactured housing has been throttled from within, not to mention the role played by outside factors such as zoning, capital access, public officials, public opinion, media, etc. More on such matters will be found in Part II that follows Parts I A) and B) that focus on UMH Properties (UMH) ‘official’ information. Part III of today’s report will include the snapshot of the broadly sliding manufactured housing markets which have been in retreat along with much of the broader macro-equities recent drop. For those with the eyes to see — be they investors, public officials, plaintiffs or shareholders attorneys, and the like – the information gleaned from this runaway most popular trade information resource serving MHVille is apparently worth the time. Because even if someone disagrees with Warren Buffett’s methods, among the positive lessons that can be learned from the so-called “Oracle of Omaha” is the reading and understanding yields compounding benefits. On that specific point, we can concur. But look out for the devotees in MHVille of Baron Buffett and his moat methods.

With that brief introduction and plan for action in this report, let’s dive into the trove of information from UMH via the sources as noted. As usual, highlighting is added by MHProNews.

Part I A) UMH Properties 4th quarter and year end 2022 results press release via GlobeNewswire and Yahoo

GlobeNews Wire

UMH Properties, Inc.

Tue, February 28, 2023 at 4:30 PM EST

In this article:

UMH Properties, Inc.

FREEHOLD, NJ, Feb. 28, 2023 (GLOBE NEWSWIRE) — UMH Properties, Inc. (NYSE:UMH) (TASE:UMH) reported Total Income of $195.8 million for the year ended December 31, 2022 as compared to $186.1 million for the year ended December 31, 2021, representing an increase of 5%. Total Income for the quarter ended December 31, 2022 was $48.7 million as compared to $46.0 million for the quarter ended December 31, 2021, representing an increase of 6%. Net Income (Loss) Attributable to Common Shareholders amounted to a loss of $36.3 million or $0.67 per diluted share for the year ended December 31, 2022 as compared to income of $21.2 million or $0.45 per diluted share for the year ended December 31, 2021. Net Income Attributable to Common Shareholders amounted to $283,000 or $0.005 per diluted share for the quarter ended December 31, 2022 as compared to $9.4 million or $0.17 per diluted share for the quarter ended December 31, 2021.

Funds from Operations Attributable to Common Shareholders (“FFO”) was $28.5 million or $0.51 per diluted share for the year ended December 31, 2022 as compared to $39.1 million or $0.83 per diluted share for the year ended December 31, 2021. FFO was $10.0 million or $0.18 per diluted share for the quarter ended December 31, 2022 as compared to $10.1 million or $0.20 per diluted share for the quarter ended December 31, 2021. Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), was $46.8 million or $0.85 per diluted share for the year ended December 31, 2022, as compared to $41.1 million or $0.87 per diluted share for the year ended December 31, 2021. Normalized FFO was $11.3 million or $0.20 per diluted share for the quarter ended December 31, 2022, as compared to $11.0 million or $0.22 per diluted share for the quarter ended December 31, 2021.

A summary of significant financial information for the three months and year ended December 31, 2022 and 2021 is as follows (in thousands except per share amounts):

| For the Three Months Ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Total Income | $ | 48,748 | $ | 46,002 | ||||

| Total Expenses | $ | 42,582 | $ | 37,500 | ||||

| Net Income Attributable to Common Shareholders | $ | 283 | $ | 9,410 | ||||

| Net Income Attributable to Common Shareholders per Diluted Common Share | $ | 0.005 | $ | 0.17 | ||||

| FFO (1) | $ | 9,973 | $ | 10,091 | ||||

| FFO (1) per Diluted Common Share | $ | 0.18 | $ | 0.20 | ||||

| Normalized FFO (1) | $ | 11,321 | $ | 11,016 | ||||

| Normalized FFO (1) per Diluted Common Share | $ | 0.20 | $ | 0.22 | ||||

| Weighted Average Shares Outstanding | 56,755 | 51,128 | ||||||

| For the Year Ended | ||||||||

| December 31, | ||||||||

| 2022 | 2021 | |||||||

| Total Income | $ | 195,776 | $ | 186,123 | ||||

| Total Expenses | $ | 166,252 | $ | 152,163 | ||||

| Net Income (Loss) Attributable to Common Shareholders | $ | (36,265 | ) | $ | 21,249 | |||

| Net Income (Loss) Attributable to Common Shareholders per Diluted Common Share | $ | (0.67 | ) | $ | 0.45 | |||

| FFO (1) | $ | 28,489 | $ | 39,149 | ||||

| FFO (1) per Diluted Common Share | $ | 0.51 | $ | 0.83 | ||||

| Normalized FFO (1) | $ | 46,840 | $ | 41,144 | ||||

| Normalized FFO (1) per Diluted Common Share | $ | 0.85 | $ | 0.87 | ||||

| Weighted Average Shares Outstanding | 54,389 | 47,432 | ||||||

A summary of significant balance sheet information as of December 31, 2022 and 2021 is as follows (in thousands):

| December 31, 2022 |

December 31, 2021 |

|||||||

| Gross Real Estate Investments | $ | 1,391,588 | $ | 1,205,091 | ||||

| Marketable Securities at Fair Value | $ | 42,178 | $ | 113,748 | ||||

| Total Assets | $ | 1,344,596 | $ | 1,270,820 | ||||

| Mortgages Payable, net | $ | 508,938 | $ | 452,567 | ||||

| Loans Payable, net | $ | 153,531 | $ | 46,757 | ||||

| Bonds Payable, net | $ | 99,207 | $ | -0- | ||||

| Total Shareholders’ Equity | $ | 551,196 | $ | 742,140 | ||||

Samuel A. Landy, President and CEO, commented on the 2022 results.

“During 2022, UMH made substantial progress on multiple fronts – generating solid operating results, achieving strong growth and improving our financial position. We have:

- Increased Rental and Related Income by 7%;

- Increased Community Net Operating Income (“NOI”) by 4%;

- Increased our rental home portfolio by 392 homes from year end 2021 to approximately 9,100 total rental homes, representing an increase of 5% from year end 2021;

- Acquired seven communities containing 1,486 homesites for a total cost of $86.2 million;

- Issued $102.7 million of 4.72% Series A Bonds due 2027 in an offering to investors in Israel, for total proceeds of $98.7 million, net of offering expenses;

- Completed the addition of approximately 1,100 homes to our Fannie Mae credit facility, for total proceeds of approximately $25.6 million;

- Financed four communities and approximately 250 rental homes within those communities for total proceeds of approximately $34.2 million;

- Issued and sold approximately 5.0 million shares of Common Stock through an At-the-Market Sale Program at a weighted average price of $20.58 per share, generating gross proceeds of $102.6 million and net proceeds of $100.8 million, after offering expenses;

- Issued and sold approximately 406,000 shares of Series D Preferred Stock through an At-the-Market Sale Program at a weighted average price of $22.90 per share, generating gross proceeds of $9.3 million and net proceeds of $9.1 million, after offering expenses;

- Redeemed all 9.9 million issued and outstanding shares of our 6.75% Series C Preferred Stock for $247.1 million;

- Invested $8.0 million in the UMH qualified opportunity zone fund to acquire, develop and redevelop manufactured housing communities located in Qualified Opportunity Zones;

- Entered into a Second Amended and Restated Credit Agreement to expand available borrowings from $75 million to $100 million with a $400 million accordion feature, subject to certain conditions, and to extend the maturity date to November 7, 2026, with a one-year extension available at our option; and subsequent to year end, further expanded this line from $100 million to $180 million;

- Subsequent to year end, acquired our first community in Georgia, containing 118 developed homesites, for a total cost of $3.7 million through our qualified opportunity zone fund;

- Subsequent to year end, issued and sold approximately 1.9 million shares of Common Stock through an At-the-Market Sale Program at a weighted average price of $16.99 per share, generating gross proceeds of $32.7 million and net proceeds of $32.2 million, after offering expenses; and

- Subsequent to year end, issued and sold approximately 640,000 shares of Series D Preferred Stock through an At-the-Market Sale Program at a weighted average price of $22.77 per share, generating gross proceeds of $14.6 million and net proceeds of $14.4 million, after offering expenses.”

“UMH is well positioned for future earnings growth. We have invested a considerable amount of capital in existing acquisitions, expanding our communities and into our joint venture. This capital has been deployed, but value-add acquisitions and expansions take time to generate returns. The communities and expansions we have invested in are well-located and are experiencing strong demand for sales and rentals which will result in increased occupancy and revenue.”

“ The backlogs from our manufacturers are now back to pre-pandemic levels, and we have over 1,000 homes being set up and ready for occupancy. As these homes come online, we anticipate revenue growth in the 8-9% range which will more than offset the expense growth resulting in high single or low double digit NOI growth.”

“During the year, we completed the acquisition of seven communities containing approximately 1,500 developed homesites for a total purchase price of approximately $86 million. These value-add acquisitions provide a runway for long-term NOI and earnings accretion but impacted our earnings in the short term. We also completed the development of 225 expansion sites which will generate sales profits, strong yields and property appreciation in the future.”

“We are proud of the company that we have built and the mission we are on to provide the Nation with needed affordable housing. Our results and future growth prospects allowed us to raise our dividend for three consecutive years. We believe we are on track for earnings and dividend growth in the future. We look forward to continuing to execute on our business plan and building long-term value for our dedicated shareholders.”

UMH Properties, Inc. will host its Fourth Quarter and Year Ended December 31, 2022 Financial Results Webcast and Conference Call. Senior management will discuss the results, current market conditions and future outlook on Wednesday, March 1, 2023 at 10:00 a.m. Eastern Time.

The Company’s fourth quarter and year ended December 31, 2022 financial results being released herein will be available on the Company’s website at www.umh.reit in the “Financials” section.

To participate in the webcast, select the microphone icon found on the homepage www.umh.reit to access the call. Interested parties can also participate via conference call by calling toll free 877-513-1898 (domestically) or 412-902-4147 (internationally).

The replay of the conference call will be available at 12:00 p.m. Eastern Time on Wednesday, March 1, 2023 and can be accessed by dialing toll free 877-344-7529 (domestically) and 412-317-0088 (internationally) and entering the passcode 7936826. A transcript of the call and the webcast replay will be available at the Company’s website, www.umh.reit.

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 135 manufactured home communities containing approximately 25,700 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Michigan, Maryland, Alabama, South Carolina and Georgia. UMH also has an ownership interest in and operates two communities in Florida, containing 363 sites, through its joint venture with Nuveen Real Estate.

Certain statements included in this press release which are not historical facts may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements are based on the Company’s current expectations and involve various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can provide no assurance those expectations will be achieved. The risks and uncertainties that could cause actual results or events to differ materially from expectations are contained in the Company’s annual report on Form 10-K and described from time to time in the Company’s other filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

Note:

(1) Non-GAAP Information: We assess and measure our overall operating results based upon an industry performance measure referred to as Funds from Operations Attributable to Common Shareholders (“FFO”), which management believes is a useful indicator of our operating performance. FFO is used by industry analysts and investors as a supplemental operating performance measure of a REIT. FFO, as defined by The National Association of Real Estate Investment Trusts (“NAREIT”), represents net income (loss) attributable to common shareholders, as defined by accounting principles generally accepted in the United States of America (“U.S. GAAP”), excluding extraordinary items, as defined under U.S. GAAP, gains or losses from sales of previously depreciated real estate assets, impairment charges related to depreciable real estate assets, the change in the fair value of marketable securities, and the gain or loss on the sale of marketable securities plus certain non-cash items such as real estate asset depreciation and amortization. Included in the NAREIT FFO White Paper – 2018 Restatement, is an option pertaining to assets incidental to our main business in the calculation of NAREIT FFO to make an election to include or exclude gains and losses on the sale of these assets, such as marketable equity securities, and include or exclude mark-to-market changes in the value recognized on these marketable equity securities. In conjunction with the adoption of the FFO White Paper – 2018 Restatement, for all periods presented, we have elected to exclude the gains and losses realized on marketable securities investments and the change in the fair value of marketable securities from our FFO calculation. NAREIT created FFO as a non-U.S. GAAP supplemental measure of REIT operating performance. We define Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), as FFO excluding certain one-time charges. FFO and Normalized FFO should be considered as supplemental measures of operating performance used by REITs. FFO and Normalized FFO exclude historical cost depreciation as an expense and may facilitate the comparison of REITs which have a different cost basis. However, other REITs may use different methodologies to calculate FFO and Normalized FFO and, accordingly, our FFO and Normalized FFO may not be comparable to all other REITs. The items excluded from FFO and Normalized FFO are significant components in understanding the Company’s financial performance.

FFO and Normalized FFO (i) do not represent Cash Flow from Operations as defined by U.S. GAAP; (ii) should not be considered as alternatives to net income (loss) as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity.

The reconciliation of the Company’s U.S. GAAP net income (loss) to the Company’s FFO and Normalized FFO for the three months and year ended December 31, 2022 and 2021 are calculated as follows (in thousands):

| Three Months Ended | Year Ended | |||||||||||||||

| 12/31/22 | 12/31/21 | 12/31/22 | 12/31/21 | |||||||||||||

| Net Income (Loss) Attributable to Common Shareholders | $ | 283 | $ | 9,410 | $ | (36,265 | ) | $ | 21,249 | |||||||

| Depreciation Expense | 12,766 | 11,552 | 48,769 | 45,124 | ||||||||||||

| Depreciation Expense from Unconsolidated Joint Venture | 114 | -0- | 371 | -0- | ||||||||||||

| Loss on Sales of Investment Property and Equipment | 73 | 61 | 169 | 170 | ||||||||||||

| (Increase) Decrease in Fair Value of Marketable Securities | (21,185 | ) | (10,932 | ) | 21,839 | (25,052 | ) | |||||||||

| Gain on Sales of Marketable Securities, net | 17,922 | -0- | (6,394 | ) | (2,342 | ) | ||||||||||

| FFO Attributable to Common Shareholders | 9,973 | 10,091 | 28,489 | 39,149 | ||||||||||||

| Redemption of Preferred Stock (2) | -0- | -0- | 12,916 | -0- | ||||||||||||

| Amortization (3) | 511 | -0- | 1,956 | -0- | ||||||||||||

| Non-Recurring Other Expense (4) | 837 | 925 | 3,479 | 1,995 | ||||||||||||

| Normalized FFO Attributable to Common Shareholders | $ | 11,321 | $ | 11,016 | $ | 46,840 | $ | 41,144 | ||||||||

The diluted weighted shares outstanding used in the calculation of FFO per Diluted Common Share and Normalized FFO per Diluted Common Share were 56.8 million and 55.3 million shares for the three months and year ended December 31, 2022, respectively, and 51.1 million and 47.4 million shares for the three months and year ended December 31, 2021, respectively. Common stock equivalents resulting from stock options in the amount of 571,000 and 936,000 shares for the three months and year ended December 31, 2022, respectively, were excluded from the diluted weighted shares outstanding as they would have been anti-dilutive. Common stock equivalents resulting from stock options in the amount of 1.4 million and 1.1 million shares for the three months and year ended December 31, 2021, respectively, are included in the diluted weighted shares outstanding.

(2) Primarily consists of redemption charges related to the original issuance costs ($8,190) and the carrying costs of excess cash ($4,726) in 2022 from the beginning of the year through the redemption date.

(3) Due to the change in sources of capital, this non-cash expense is expected to become more significant and is therefore included as an adjustment to Normalized FFO for the year ended December 31, 2022. Had a similar adjustment been made in prior years, Normalized FFO Attributable to Common Shareholders would have been $11,293 or $0.22 and $42,145 or $0.89 for the three months and year ended December 31, 2021, respectively.

(4) Consists of special bonus and restricted stock grants for the August 2020 groundbreaking Fannie Mae financing, which are being expensed over the vesting period ($431 and $1,724, respectively) and non-recurring expenses for the joint venture with Nuveen ($210 and $264, respectively), early extinguishment of debt ($125 and $320, respectively), one-time legal fees ($10 and $197, respectively), fees related to the establishment of the Opportunity Zone Fund ($61 and $954, respectively) and costs associated with acquisition not completed ($0 and $20, respectively) for the three months and year ended December 31, 2022. Consists of special bonus and restricted stock grants for the August 2020 groundbreaking Fannie Mae financing, which are being expensed over the vesting period ($754 and $1,824, respectively) and non-recurring expenses for the joint venture ($171) for the three months and year ended December 31, 2021.

The following are the cash flows provided by (used in) operating, investing and financing activities for the year ended December 31, 2022 and 2021 (in thousands):

| 2022 | 2021 | |||||||

| Operating Activities | $ | (7,983 | ) | $ | 65,163 | |||

| Investing Activities | (124,121 | ) | (94,364 | ) | ||||

| Financing Activities | 47,954 | 125,634 | ||||||

Contact: Nelli Madden

732-577-9997

# # # #

Part I B) Q4 2022 UMH Properties Inc Earnings Call Transcript (per Yahoo, Seeking Alpha)

Q4 2022 UMH Properties Inc Earnings Call

Thu, March 2, 2023 at 12:19 AM EST

Q4 2022 UMH Properties Inc Earnings Call

Thu, March 2, 2023 at 12:19 AM EST

Participants

Anna T. Chew; Executive VP, CFO, CAO, Treasurer & Director; UMH Properties, Inc.

Brett Taft; Executive VP & COO; UMH Properties, Inc.

Eugene Landy

Nelli Madden; VP of IR; UMH Properties, Inc.

Samuel A. Landy; President, CEO & Director; UMH Properties, Inc.

Craig Gerald Kucera; Senior Research Analyst; B. Riley Securities, Inc., Research Division

Gaurav Mehta; Research Analyst; EF Hutton, Research Division

Jay McCanless; SVP of Equity Research; Wedbush Securities Inc., Research Division

Robert Chapman Stevenson; MD, Head of Real Estate Research & Senior Research Analyst; Janney Montgomery Scott LLC, Research Division

Presentation

Operator

Good morning, and welcome to UMH Properties’ Fourth Quarter and Full Year 2022 Earnings Conference Call. (Operator Instructions) Please note this event is being recorded.

It is now my pleasure to introduce your host, Ms. Nelli Madden, Vice President of Investor Relations. Thank you. Ms. Madden, you may begin.

Nelli Madden

Thank you very much, operator. In addition to the 10-K that we filed with the SEC yesterday, we have filed an unaudited annual and fourth quarter supplemental information presentation. The supplemental information presentation, along with our 10-K, are available on the company’s website at umh.reit.

I would like to remind everyone that certain statements made during this conference call which are not historical facts may be viewed as forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements that we make on this call are based on our current expectations and involve various risks and uncertainties. Although the company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the company can provide no assurance that its expectations will be achieved. The risks and uncertainties that could cause actual results to differ materially from expectations are detailed in the company’s annual 2022 earnings release and filings to the Securities and Exchange Commission. The company disclaims any obligation to update its forward-looking statements.

In addition, during today’s call, we will be discussing non-GAAP financial metrics. Reconciliations of these non-GAAP financial metrics to the comparable GAAP financial metrics, as well as explanatory and cautioning language, are included in our earnings release, our supplemental information and our historical SEC filings.

Having said that, I would like to introduce management with us today: Eugene Landy, Founder and Chairman; Samuel Landy, President and Chief Executive Officer; Anna Chew, Executive Vice President and Chief Financial Officer; Brett Taft, Executive Vice President and Chief Operating Officer; Jim Lykins, Vice President of Capital Markets; and Daniel Landy, Executive Vice President.

It is now my pleasure to turn the call over to UMH’s President and Chief Executive Officer, Samuel Landy.

Samuel A. Landy

Thank you very much, Nelli. UMH continues to make progress executing on our long-term business plan by acquiring, expanding, developing and renovating communities.

In 2022, we completed the acquisition of 7 communities containing 1,500 developed home sites for a total purchase price of approximately $86 million. And through our joint venture with Nuveen Real Estate, we acquired a community containing 144 developed home sites in Sebring, Florida for a total purchase price of $15.1 million. In addition, we completed the development of 225 expansion sites.

Normalized FFO for the fourth quarter was $0.20 per share as compared to $0.22 per share in the prior year. Our operating results were largely impacted by our investments to grow the company, inflation and rising interest rates. We have increased the number of turnaround properties we are working on, and we have increased the number of expansions and to-be-built communities. These projects will ultimately result in greater income growth, but at their current stage, they require additional capital for improvements and expenses.

Our communities continue to experience strong demand and should see increased occupancy and revenue gains as we were able to fill our inventory. The demand at the property level and our expected improvement in our operating results have given management and the Board the confidence to raise our dividend 3 consecutive years by a total of 13.9%. Effective for 2023, we increased our quarterly dividend from $0.20 per share to $0.205 per share, representing an annualized dividend of $0.82 and an increase of 2.5%. We believe that we are on track for future dividend increases as we continue to execute on our long-term business plan.

Moving on to operations. Total income for the year increased 5% to approximately $196 million. This increase was the result of a 7% increase in rental and related income and a 6% decrease in sales of manufactured homes. Rental and related income for the year was $170 million. Our operating expense ratio increased to 44.4% from 42.8% in 2021, which resulted in community NOI of approximately $94.8 million or an increase of 4% over last year.

Same-property income increased by 6% and same-property NOI increased by 3% or $2.7 million. Our same property operating results were impacted by increased expenses as a result of inflation as well as limited revenue growth due to the supply chain backlog we experienced in obtaining new rental homes. More importantly, demand is strong for both sales and rentals throughout our portfolio.

During the year, we added 392 homes to our portfolio, bringing our total portfolio to approximately 9,100 rental homes. Our rental home occupancy rates remain strong at 93.3%, and our monthly rent per home increased 5.9% to $873 per month.

New rental homes improve the appearance of the communities and demonstrate to residents, appraisers, government officials and investors that UMH continues to invest in and upgrade our assets. Our rental home portfolio consists of primarily new homes that are less than 10 years old. Our average expense per rental unit is approximately $400 per year. We turn over approximately 30% of our rental units on an annual basis with limited turnover costs.

For the first half of the year, we were unable to get homes from our manufacturers. However, we are pleased to report that the backlog has eased, and we now have over 1,000 homes that have been delivered to our communities and are in various stages of setup. We have strong demand and anticipate selling or renting the homes upon obtaining a certificate of occupancy. As we occupy these homes, revenue will increase and interest expense from floor plan financing will decrease.

We are also making progress obtaining tenant, lender and shareholder acceptance of rental units. Our rental homes improve the quality of the community which thereby increases the value of all homes and the community itself.

Fannie Mae has worked with us to lend not just on communities but also on the rental homes and the revenue generated by them. In 2020, we closed on a $106 million credit facility at a 2.62% interest rate. These communities previously did not qualify for GSE financing because of the amount of revenue generated by rental homes. In March of 2022, we completed a $25 million addition of the rental homes to this credit facility.

In September of 2022, we completed our second financing with Fannie Mae that included the rental homes as collateral. This was a $34 million loan with approximately $4 million secured by the rental units.

Our ability to obtain financing on rental homes justifies our business plan and allows us to invest this capital into additional communities and more homes, furthering our social mission of providing quality affordable housing. We are working with our other lending partners on similar lines of credit that will allow us to obtain financing on rental homes at attractive terms.

Our sales operation continues to perform very well. Although our sales for the year declined by 6%, we are very pleased with these results given that 2021 was our highest gross sales year in our company history with sales of $27.1 million, and 2022 was our second-highest gross sales year in our company’s history with sales of $25.3 million.

The inventory shortages that we experienced most of the year make these results even more impressive. Despite gross sales decreasing by $1.8 million, sales for 2022 generated income of $2 million, which is in line with the income from sales for 2021 because our gross profit percentage increased from approximately 26% last year to 31% this year.

We sold 301 total homes, of which, 144 were new homes. Our average new home sales price was $120,000 and our average used home sales price was $52,000. We are financing approximately 63% of our home sales. We have a total of $64 million in home loans on our balance sheet that earn us an average interest rate of 6.7%.

We continued to execute on our growth plan by acquiring 7 communities containing approximately 1,500 developed home sites with a blended occupancy rate of 66%. The communities were acquired for $86 million or approximately $58,000 per site. These are value-add acquisitions that should become accretive as we are able to renovate the communities, fill the vacant sites and generate sales profit.

Additionally, we launched our opportunity zone fund, which provides a source of capital to complete land development and value-add communities while limiting the negative impact to FFO during the first years of ownership.

We are optimistic that higher interest rates may result in acquisition opportunities at reasonable prices. We completed the development of 225 expansion sites, which will allow us to generate sales growth and improve the communities’ operating margins because most of the expenses at a community are fixed. In 2023, we estimate that we will receive entitlements for over 800 sites and complete the development of 400 sites.

Our greenfield development joint venture with Nuveen continues to progress nicely. At the end of 2021, we acquired Sebring Square located in Sebring, Florida. This brand-new community contains 219 sites and is highly amenitized with a clubhouse, swimming pool, bocce ball, pickleball, dog park, fitness center, shuffleboard and Tiki hut. We are making progress installing and infilling the community with a mixture of homes for sale and rent. We closed on the acquisition on Rumrunner, also in Sebring, at the end of 2022. This brand-new community contains 144 sites and is also highly amenitized.

The joint venture allows us to build first-class communities while limiting the negative impact on earnings. We have a 40% stake in the joint venture and earn assets under management fees, management fees and a promote percentage. We also have the right to and plan on purchasing these communities when the joint venture decides to sell. We have other opportunities in our pipeline and look forward to growing this joint venture in the future.

We are one of the largest operators of manufactured housing communities in the country. We own a portfolio of 135 manufactured home communities containing 25,700 developed home sites, We also own 2 communities through our joint venture with Nuveen Real Estate that contain 363 developed home sites.

Over the past few years, we have made investments in value-add communities and expansions that are beginning to see positive financial results. We have diversified our portfolio by entering the Alabama, South Carolina, Georgia and Florida markets. Of our 25,700 home sites, 84.2% are occupied, leaving us approximately 4,000 vacant sites. Additionally, we have 2,100 acres of vacant land, predominantly adjoining our communities, that can be developed into 8,400 sites.

2022 was affected by the backlogs to obtain rental homes and inventory for sale. we have 2,100 acres of vacant land, predominantly adjoining our communities, that can be developed into 8,400 sites.We have over 1,000 homes in various stages of setup. Once occupied, these homes should increase monthly revenue by $900,000 and annual revenue by $10.8 million. During 2023, we will increase our rents by 5%, which will grow revenue by an additional $8 million. At a 40% expense ratio, same-property community NOI for 2024 will increase by $11 million. Additionally, home sales are estimated to increase by 20% to $30 million with $1 million or more in increased sales profit.

Our long-term business plan provides us with the runway to generate strong income and occupancy growth for the foreseeable future. Our vacant sites and our vacant land for expansion provide the company with sites in desirable locations that should result in increased rental occupancy and increased sales.

We have positioned UMH for future earnings growth through the successful implementation of our business plan. And now Anna will provide you with greater detail on our results for the quarter and for the year.

Anna T. Chew

Thank you, Sam. Funds from operations, or FFO, was $10 million or $0.18 per diluted share for the fourth quarter of 2022 compared to $10.1 million or $0.20 per diluted share for the prior year period. Normalized FFO, which excludes nonrecurring items, was $11.3 million or $0.20 per diluted share for the fourth quarter of 2022 compared to $11 million or $0.22 per diluted share for 2021.

For the full year 2022, FFO was $28.5 million or $0.51 per diluted share compared to $39.1 million or $0.83 per diluted share for 2021. Normalized FFO was $46.8 million or $0.85 per diluted share for 2022 compared to $41.1 million or $0.87 per diluted share for 2021. Our operating results were largely impacted by our investments to grow the company through value-add acquisitions and developments, inflation and rising interest rates on our short-term borrowings.

Rental and related income for the quarter was $43.7 million compared to $40.7 million a year ago, representing an increase of 7%. For the full year, rental and related income increased from $159 million in 2021 to $170.4 million in 2022, an increase of 7%. These increases were primarily due to community acquisitions, the addition of rental homes and an increase in rental rates. Community NOI increased by 2% for the quarter from $23.7 million in 2021 to $24.3 million in 2022. For the full year, community NOI increased from $91 million in 2021 to $94.8 million in 2022, an increase of 4%.

Sales of manufactured homes for the quarter decreased 5% year-over-year from $5.3 million in 2021 to $5 million in 2022. For the full year, sales decreased 6% from $27.1 million in 2021 to $25.3 million in 2022. We sold a total of 301 homes in 2022 as compared to 370 homes in 2021. There were 144 new home sales compared to 182 homes in 2021. The company’s average sales price was approximately $84,000 in 2022 as compared to $73,000 in 2021, resulting in a 15% increase. The gross profit percentage increased by 5% from 26% in 2021 and to 31% for 2022.

As we turn to our capital structure, at year-end, we had approximately $762 million in debt, of which $509 million was community-level mortgage debt, $154 million were loans payable and $99 million was our newly issued 4.72% Series A bonds. 80% of our total debt is fixed rate. The weighted average interest rate on our mortgage debt was 3.93% at year-end compared to 3.75% at year-end last year. The weighted average maturity on our mortgage debt was 5.1 years at year-end and 5.2 years last year.

As we previously announced on July 26, 2022, we redeemed all 9.9 million shares of our 6.75% Series C perpetual preferred stock for a total of $247 million. This redemption was completed by utilizing funds raised through our common ATM, our Israeli bond offering and mortgage debt. We are very proud to have been able to complete the recapitalization of our Series C preferred in a difficult economic environment.

We opportunistically raised capital throughout the year to ensure that we had the capital available at rates and prices we were comfortable with to drive future earnings growth. At year-end, UMH had a total of $225 million in perpetual preferred equity. Our preferred stock, combined with an equity market capitalization of $927 million and our $762 million in debt, results in a total market capitalization of approximately $1.9 billion at year-end.

During 2022, we successfully completed an oversubscribed bond offering, raising $102.7 million with net proceeds of approximately $98.7 million. The transaction was completed in Israel, which afforded us some distinct advantages. Despite rates increasing during the process, we obtained a favorable rate of 4.72%, which is unsecured with a term of 5 years. Completing the offering included going through the process of obtaining a rating from S&P in Israel, which rated the bonds AA- and UMH A+ at the corporate level.

We also completed the addition of approximately 1,100 rental homes to our Fannie Mae credit facility for total proceeds of approximately $25.6 million. This is the first time that the GSEs have financed rental homes and communities that are not entirely comprised of rental homes.

Subsequently, in conjunction with a new $34 million mortgage, we added another tranche of 250 rental homes to this facility for total proceeds of $4.1 million. We have approximately $423 million of rental homes on our balance sheet that may now qualify for highly competitive financing, providing us an important source of capital going forward.

During the year, we sold 5 million shares of common stock through our common ATM programs at a weighted average price of $20.58 per share, generating gross proceeds of $102.6 million and net proceeds of $100.8 million after offering expenses. Subsequent to year-end, we sold approximately 1.9 million shares of common stock under the common ATM program for gross proceeds of $32.7 million. Additionally, we sold 406,000 shares of our Series D preferred stock through our preferred ATM program at a weighted average price of $22.90 per share, generating gross proceeds of $9.3 million and net proceeds after offering expenses of $9.1 million. Subsequent to year-end, we entered into a new $100 million ATM program and sold 640,000 shares of preferred stock under our preferred ATM programs for gross proceeds of $14.6 million.

On November 7, 2022, we entered into the second amended and restated credit agreement with BMO Capital Markets and JPMorgan Chase Bank. This amended and restated credit agreement increases our credit facility to $100 million with a $400 million accordion feature, subject to certain conditions, including obtaining commitments from additional lenders. This agreement also extends the maturity date to November 7, 2026, which may be further extended at our option for an additional year. This new agreement enhances our liquidity and financial flexibility, allowing us to continue to execute our business plan. To further increase our flexibility on February 24, 2023, we increased this facility to $180 million.

From a credit standpoint, our net debt to total market capitalization was 38.2%. Our net debt less securities to total market capitalization was 36%. Our net debt to adjusted EBITDA was 8.1x. Our net debt less securities to adjusted EBITDA was 7.7x. Our interest coverage was 3.1x and our fixed charge coverage was 1.7x.

From a liquidity standpoint, we ended the year with $29.8 million in cash and cash equivalents and $25 million available on our credit facility with an additional $400 million potentially available pursuant to an accordion feature. We also had $19.4 million available on our revolving lines of credit for the financing of home sales and the purchase of inventory and $14.9 million available on our line of credit secured by rental homes and rental home leases. Additionally, we had $42.2 million in our REIT securities portfolio unencumbered. This portfolio represents approximately 2.5% of our undepreciated assets.

During 2022, the Monmouth merger with ILPT was completed at $21 per share. UMH owned approximately 2.7 million shares of Monmouth and received approximately $55.7 million. We are committed to not increasing our investments in this REIT securities portfolio and have in fact sold certain positions. We are well positioned to continue our growth initiatives.

And now let me turn it over to Gene before we open it up for questions.

Eugene Landy

Manufactured housing and land lease communities is the best way to provide quality affordable housing for our nation. Fannie Mae estimates that there is a 4 million unit shortage of housing, and that shortage is increasing on an annual basis.

Furthermore, higher interest rates are resulting in fewer housing starts. Housing starts in 2023 are expected to be down 100,000 units or more. Additionally, most of the housing starts don’t cater to the affordable end of the market. Manufactured housing has the potential to increase our market share and help to provide the nation with much-needed affordable housing.

UMH is well positioned to execute on our mission of providing a nation with quality affordable housing. We have invested in value-add communities with deferred maintenance and made improvements that will allow us to provide desirable housing in each market we operate in. We have expanded our communities and have over 2,100 acres for the development of additional home sites. We are building new communities through our joint venture with Nuveen Real Estate and expect our new communities to be well received by municipalities, allowing us to obtain additional entitlements in the future. We have and will continue to play our role in addressing our nation’s housing shortage.

Our results in 2022 were impacted by the lack of new rental homes coming online because of supply constraints and increased costs related to inflation and value-add acquisitions. It appears that we have passed the supply constraints and are back on track to achieve our annual goal of filling at least 800 rental units. As we are able to fill these units, our revenue growth will offset our expense growth and result in higher earnings for our shareholders. Additionally, our sales profit should continue to improve.

Despite the challenges we faced in 2022, UMH had a year of many accomplishments and is well positioned for future growth.

Question and Answer Session

Operator

(Operator Instructions) Our first question comes from Gaurav Mehta with EF Hutton.

Gaurav Mehta

I wanted to ask you on your operating expenses. In your remarks, you talked about the expectations of revenue exceeding — offsetting expense growth, and you talked about revenue growth of 8% to 9%. So going forward, should we expect that your expense growth will be lower than 8% to 9%?

Brett Taft

Yes. So this year, for the full year on a same-property basis, our expenses were up 10.2%. The real drivers of that expense growth were our payroll, up about 7.5%. Waste removal was a significant item, up over 15%, tree removal insurance was a large item and real estate taxes. We do not expect the growth that we saw in those items this year, and we do expect our expense growth to normalize in that, I’ll say, 6.5% to 8.5% range.

So we should be able to drive income growth above that.

Regardless, even if we are in that 8.5% range, NOI growth will still be high single digits. But obviously, if we are able to reduce expenses further or grow revenue faster, those numbers can improve.

Gaurav Mehta

Okay. Great. Can you maybe provide some color on what you’re seeing in the transaction market for stabilized and value-add acquisitions?

Brett Taft

Yes, sure. So there really aren’t that many deals trading at the moment. There’s a lot of deals available for sale, but we’re just not seeing the pricing that you would expect to transact in this market. A lot of breakeven or negative deals — negative spreads on the table. So cap rates for anything of decent quality, you’re still seeing that 4.5% to 6% range. But obviously, the cost of debt is also about 6% and our cost of equity has gone up. So we’re out there looking for accretive opportunities but really not finding too much at the moment.

On the value-add front, there are some deals available, but we’re weighing the acquisitions we’ve completed, working on bringing them online and making those accretive. And as they are, then we can invest in additional value-add opportunities.

Operator

Our next question comes from Rob Stevenson with Janney.

Robert Chapman Stevenson

Rental occupancy was down right around 100 basis points quarter-over-quarter. Was this just a timing issue with the new deliveries? Or any notable trends that you guys saw in rental unit demand in the fourth quarter?

Brett Taft

Yes. Rental occupancy is generally seasonal, as is our sales business and everything else. And COVID did allow us to remain a little bit higher in the fourth quarter over the past 2 years, and this year, it did decrease down to 93.3%. That’s actually what we would expect for that time of year. So we are working on turning those units over, getting them occupied.

We’re through tax season and we’re coming into our peak season for rentals. So that will allow us to rent those vacant units out and also expedite the infill of our units, which are really coming online at the right time, which should allow us to grow pretty quickly here moving forward.

Robert Chapman Stevenson

Okay. And then could you talk about the pace of lease-up at the 2 Alabama assets or the 2 South Carolina assets? Looks like occupancy increased a pretty hefty 340 basis points in Alabama and 130 in South Carolina. Are you happy with those paces? Can you go faster? How should we be thinking about those assets in particular over the course of ’23?

Brett Taft

Yes. Those assets — and again, it really had to do with our inventory problem at the beginning of last year and the inability to get inventory. We closed on those acquisitions at the beginning of 2021, and that’s really when the supply constraints impacted our ability to execute our business plan.

So for the first year of ownership, we really did not have many new homes coming into those properties. But now that we have the homes, we are starting to see significant occupancy gains. We do expect the South Carolina property to be full by the end of this year. And Alabama won’t quite be full, but it should be up into that 70% to 80% range, potentially better. But it’s all based on demand.

Samuel A. Landy

Sam here. It’s an important time to note, we have 1,000 homes delivered. So that’s higher than our normal inventory we’d expect to have by far. We’re getting through supply chain issues in terms of completing setup. But as these homes are set up, we’re going to assume we continue at the 8:1 ratio of 8 rentals for every 1 home sale. And we believe we’ll fill 800 of these homes during the course of the year as rentals at better than $10,000 revenue per house, and we’ll sell the 200 homes at higher sales prices and higher sales profits.

It appears to me it’s a better time than ever to be in the business we’re in, which is manufactured housing, rehabilitating communities, because those rehabilitated communities have extremely strong demand to increase sales profits and revenue growth through the rental homes. So we think we’re in a extremely strong position going into 2023.

Robert Chapman Stevenson

Okay. And speaking of the home sales, where are you guys offering financing today on new home sales? And are very many people taking up the financing? Or is it almost all cash buyers at this point, given where rates have moved to?

Brett Taft

Our rates are currently 7.5%. And last year, we financed about 62% of our home sales. I would expect that to be about the right percentage moving forward.

Anna T. Chew

Right. That’s for new homes. And we — for used homes, our rate is 9.99%.

Robert Chapman Stevenson

Was that 62% heavily front-end weighted? Or was that ratably throughout the year? So the fourth quarter wasn’t much different than earlier in the year, when interest rates were much lower?

Brett Taft

It generally hangs around that 60% mark throughout the year.

Robert Chapman Stevenson

Okay, okay. And then Sam, I didn’t realize you were a Swiftie. Just one analyst opinion, but I have to say that trading Springsteen for Taylor Swift on the call hold music was a notable downgrade this quarter. So…

Samuel A. Landy

UMH is doing substantial work in Nashville, so we’re broadening our musical horizon.

Robert Chapman Stevenson

Well, you bought a New Jersey asset this year, so you go back to Springsteen.

Operator

Our next question comes from Craig Kucera with B. Riley Securities.

Craig Gerald Kucera

I think you mentioned last quarter you had 700 homes delivered. This quarter, we’re looking at closer to 1,000 or over 1,000. As we think about that, is there — are you anticipating that those get deployed as rentals sort of ratably throughout the year? Or is there a potential for an acceleration there, given that the inventory is there and in hand after being sort of very light for quite some time due to COVID?

Samuel A. Landy

So, the UMH team does an incredible job getting these homes set up, marketed and rented. And we view ourselves in a race, the faster we rent and sell the home, it’s the better for the 2023 year. We have no doubt the majority of them will be occupied on time for the 2024 year. But the sooner we get them occupied for 2023, the greater our revenue growth and the more we’ll reduce our expense ratios.

So there are holdups. We have to wait for electric companies, gas companies to do their part in setting up these houses. But in terms of the manufacturer’s got us the houses, we’re doing everything in our power to have them set up and ready to rent and sell. And our first 2 months of the year indicate that sales are growing and rental occupancy is growing, and that we are on target to, in fact, fill these 1,000 units.

Craig Gerald Kucera

Okay, great. Changing gears. Anna, you added amortization of debt financing costs in N-FFO this quarter. Are you planning going forward to include that? Or was this just more for ’22?

Anna T. Chew

We plan to include it because we did change the way we capitalized our company. In the past, we used primarily preferred stock, and the offering costs on the preferred stock is not added — is not subtracted from normalized FFO. But when you use debt, it is subtracted. So we just added it back just to be consistent. So we will continue to add it back.

Craig Gerald Kucera

Got it. And kind of in the same vein, I think you have about $60 million of mortgages maturing this year. I think they’re at about 3.8%. What are your expectations there? Are you looking to refinance those in the market? Or are you looking at other sources of capital? I guess, what are your thoughts there?

Anna T. Chew

Well, out of the $60 million, $44 million, I believe, has already been repaid. So we have $44 million that is additional free and clear properties. Right now, we intend to put it into our line of credit because we did increase our line of credit from $100 million to $180 million. We wanted the financial flexibility of having that, so that’s why we did it that way.

Operator

(Operator Instructions) Our next question comes from Jay McCanless with Wedbush Securities.

Jay McCanless

So for the last 4 quarters, Indiana and Pennsylvania, which I think are just under 50% of the sites that UMH has, they have underperformed in terms of same-store rent growth relative to the average that the company is putting up. Is there any thought to either trying to push rents a little harder in those markets or potentially divest some properties where you can’t get the rental growth up to where the rest of the company is?

Samuel A. Landy

Well, we see the rents going up and the occupancy going up. Go ahead, Brett.

Brett Taft

Yes. No, so Indiana and Pennsylvania, looking at them, expense growth was a little bit elevated. So that’s certainly something we’re keeping in mind. But we do believe that, that expense growth will normalize this year and come back down into that 6.5% to 8.5% range that I mentioned earlier.

Again, a big part of our portfolio now is obviously rental homes, and we did have some seasonal rental home occupancy fluctuations, and we’re working on getting those units back online. We also have a lot of new homes being delivered to those properties.

So we’ll carefully monitor the situation, and we do believe that our rental revenue growth will go back in line with our expectations, but they did have a little bit of a down year.

Samuel A. Landy

I’ll add to that. Some of our capital expenses for 2023 will include work on water and sewer lines and water and sewer plants. And we’ve seen returns on those capital improvements of as much as 20% per year as we reduce water and sewer leakage. And so those are expenses that can be reduced through capital improvements, and it will be.

And again, when we look at it, the biggest problem that we saw for 2022 was the lack of inventory. We were not able to add 800 rentals prior to 2022, so we couldn’t have the income growth we’ve become accustomed to. Had we had that income growth, it would have offset the expense increases and we still would have had high single-digit, double-digit operating income increases.

And depending on the timing of filling these 1,000 units, whether we’re going to see those type of results in 2024 or 2023 is yet to be seen. But if we can fill them quick enough, it will be 2023.

Eugene Landy

Our policy is taking a long-term view. I don’t understand why we would sell a park that’s going up in value every year and that the demand is there.

There’s a tremendous housing shortage everywhere in the United States. The Governor of New York announces that 800,000 unit shortage of affordable housing in New York, New York State requiring 80,000 homes a year to be built. Our experience with the Florida market is very, very favorable. The demand there and the future for the affordable housing, manufactured housing, is excellent everywhere in the country.

Our goal, we’re very proud of the fact that we’ve got up to 25,000 sites and we’re up to 9,000 rental homes, and we plan to grow the company and increase the size of the company over the next decade.

Jay McCanless

So where are the majority of those 1,000 homes going to be sited?

Brett Taft

Yes, hold on one second. So we’ve got 50 homes in Alabama, 100 in Florida, which is really through the joint venture so we can subtract that from the total. But 168 in Indiana, 93 in Michigan, only 5 in New Jersey because the occupancy is so high. New York, 43; Ohio, 317; Pennsylvania, 262; South Carolina, 19; and Tennessee, 94.

So as you would expect, heavily weighted towards where we own the most of our assets in Ohio, Pennsylvania and Indiana, but a good amount of homes going into our new expansions in Tennessee as well.

Jay McCanless

Got it. I guess to get in the weeds a little bit. Anna, could you talk about what you think your cost of equity is? Because the heavy reliance that you all had on the ATM last year and even to start this year is hurting kind of your headline FFO. And just wondering if the cost of this new credit facility is going to be a little more advantageous relative to where you think your cost of equity is and maybe allow UMH to be less reliant on the ATM in ’23.

Anna T. Chew

Well, on the — on our common stock, our dividend on our common stock, and I know that’s not truly the cost of capital, but our dividend on our common stock is less than 5% right now. On our preferred it’s 6.375%, which is our preferred. The mortgages are on a weighted average rate of about 3.93% and our bonds at 4.72%.

Now the new facility is that SOFR plus or minus range based on our debt to assets ratio, our liquidity ratio. And we believe that right now, I believe that is around the 6% range, it’s 5.6% and change.

So yes, because of our new BMO line, we can utilize that line. We may be able to decrease our use of the ATM. But it all depends on our stock price, it all depends on our capital needs. If we have large acquisitions coming up, we would need to fund them. It all depends, again, on our capital needs as well as our stock price.

Eugene Landy

If I can add to that, Anna. Historically, the cost of capital, you have to take into account inflation. We’ve often, in the history of this company, borrowed money at 7% or 8% and earned much substantially more than that. With a country that’s facing much more than 6% inflation, as you heard in our presentation, the way expenses have gone up, and if you listen to the presentations of almost every REIT that is in the housing business, expenses are going up 7%, 8%. There is inflation in the country.

And if you could — if you’re able to borrow at 7%, and the inflation, the real cost of capital may be 0% or 1% or 2%. As long as we’re able to take a long-term position and have no liquidity problems, your cost of capital should take into effect — into account, inflation.

Jay McCanless

Got it. And then the last question I had. Is there a case to be made for stopping the acquisitions until you can stabilize the assets that you’ve already brought onboard? I don’t know if those 2 are independent of each other.

But would seem to, at least in the near term, get some of these assets stabilized, especially if you’re trying to get 1,000 homes sited. Does it make sense to hold off on new acquisitions to get those homes and some of these newer acquisition parks up and running?

Samuel A. Landy

Well, we do always evaluate the impact acquisitions will have on FFO, and we do turn down large portfolios strictly because they would negatively impact FFO. We’re very happy with the acquisitions we did the past year. We hope that, in the next few quarters, we will be reporting to you accelerated rent growth probably beyond what people expect on both the rent and the sales income.

And if that occurs, we’re certainly going to want to do more of what we’re doing. But at this moment, we do agree we have plenty to do. We have 4,000 vacant sites. We have 1,000 homes in inventory. We have plenty of ways to grow revenue and income right at this moment and don’t necessarily need acquisitions to do that.

Eugene Landy

We will make acquisition if we can get long-term, patient capital. And we’re very proud of the joint venture we have. We’re working on getting our securities designated as social. If we can get an ESG characterization for our preferred or common stock, we think some institutions may provide us with long-term, patient capital.

We are working on the OZ fund, and we’re hoping Congress will give special tax treatment to investments in Opportunity Zones that provide affordable housing. And that will let UMH have access to long-term, patient capital. And again and again, the need is tremendous. .

So we wanted to perform our mission statement, but we will only do it if we could be successful in these major undertakings we’ve been working on for several years now. And we are making progress. So we hope that this year, we’ll have some announcements on the change in the OZ fund. We hope to get designation of our securities as social. And we hope to increase the size of our joint ventures.

Operator

This concludes our question-and-answer session. I would like to turn the conference back over to Samuel Landy for any closing remarks.

Samuel A. Landy

Thank you. I want to mention [Steve Fegley] who was with UMH for 33 years passed away suddenly in his sleep last week.

Steve was 56 years old and married for 15 years. Steve was the trusted assistant of Jeff Wolfe, our Senior Vice President of Operations.

To Steve, there was no such thing as an obsolete home because he could singlehandedly rebuild any home to better than new in less than 2 weeks. He plowed snow through the night, fixed water lines in flooded ditches in January and was a tremendous part of the UMH team.

Steve was 6-foot 4 inches tall, weighed 220 pounds of solid muscle, had a 36-inch waist and measured 48 inches shoulder to shoulder. He was big as a bear and gentle as a kitten, and he will be greatly missed by all of us.

So thank you, operator. I’d like to thank the participants on this call for their continued support and interest in our company. As always, Gene, Anna, Brett and I are available for any follow-up questions. We look forward to reporting back to you in May with our first quarter 2023 results. Thank you.

Operator

The conference has now concluded. Thank you for attending today’s presentation. The teleconference replay will be available in approximately 1 hour. To access this replay, please dial U.S. toll-free 1 (877) 344-7529 or International (412) 317-0088. The conference code — access code is 7936826. Thank you, and please disconnect your lines. ###

Note the following graphic was not part of the UMH Presentation,

it should be viewed as part of the next (Part II) segment.

Part II. Additional Information with More MHProNews Analysis and Commentary in Brief

There are several possible points, pros and cons, that could be made about the information above. The highlighting is intended to tee up some future discussions. There is no question that UMH has a profitable business model that in their view is ‘performing.’ One fair question that needs to be asked of several – perhaps most – MHI member publicly traded firms is this. Could their returns be better if different policies were in place? Some comments, plus some questions, will outline further possible analysis of UMH’s performance and business plan. In no particular order of importance are the following.

- 1) Sun (SUI) and UMH are both pushing the ESG notion. While popular among numbers on the left, they are questioned on the right. Certainly, some might think it is a defensive move to keep the left from ‘going after’ UMH. But whatever their motivations or rationales may be, it is opening them up to possible exposure from investors and state AGs, among others, who are targeting ESG as an issue that is costing shareholders potentially higher rates of return on their investments. ICYMI, see the recent reports on those topics.

- 2) Certainly, analysists on such conference calls have asked and obtained answers that are useful. That said, not as a blanket condemnation, but viewed through the ‘if the shoe fits’ lens, consider the following. Why is it that analysts don’t question the stunning low pace of new and pre-owned manufactured home sales? Per their transcript, UMH said: “We sold 301 total homes, of which, 144 were new homes” for “135 manufactured home communities containing approximately 25,700 developed homesites.” Precisely because UMH has made investments in properties that have middle class appeal, they ought to be selling at a far greater velocity. Why isn’t that explored as an area of opportunity to increase profits?

- 3) Given that UMH has been kissing the MHI ring for some years, what explains the fact that UMH didn’t get the deliveries on new homes they wanted to earlier in 2022? MHProNews has editorially noted that UMH in some ways doesn’t fit well with the business ethics of some of their peers at MHI. Looking back, there appears anecdotally to be significantly fewer complaints against UMH than say RHP, Impact, or Havenpark – among others. UMH is giving in support of MHI events, but what are the getting in return? Nearly meaningless MHI ‘awards’ that are apparently marketing for MHI, but are also going to brands that are often accused of predatory practices?

- 3) ELS’ Sam Zell said years ago that rentals should be kept marginal. Clearly, Sam and Eugene Landy don’t agree. That merits a closer look on several levels.

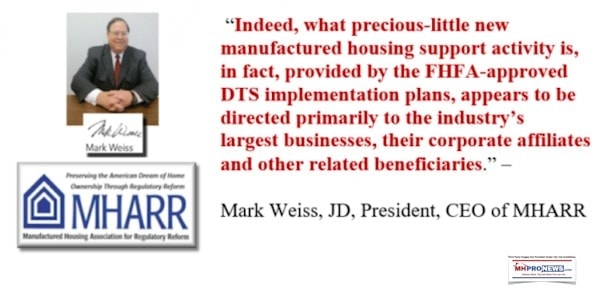

- 4) UMH boasting on GSE financing for rental housing ought to bring howls of protest from independent retailers or other community operators that sell manufactured homes. Why hasn’t the Duty to Serve Manufactured Housing (DTS) mandated by the Housing and Economic Recovery Act of 2008 (HERA) been properly implemented? Could that be among the reasons, one periodically raised by MHARR’s Mark Weiss, that DTS has been diverted by various MHI members in ways never imagined by Congress?

- 5) It is interesting to note that some of the REITs are reporting a slower pace of acquisitions.

- 6) The failure of MHI getting the Manufactured Housing Improvement Act of 2000 (MHIA) ‘enhanced preemption’ provision implemented is arguably obliquely and directly reflected in several aspects of the UMH statements and data. See “Pimple” and other linked reports to better understand those issues.

While the figures have changed, one should compare the 58K cost per site

Landy mentioned to what bipartisan researchers revealed below.

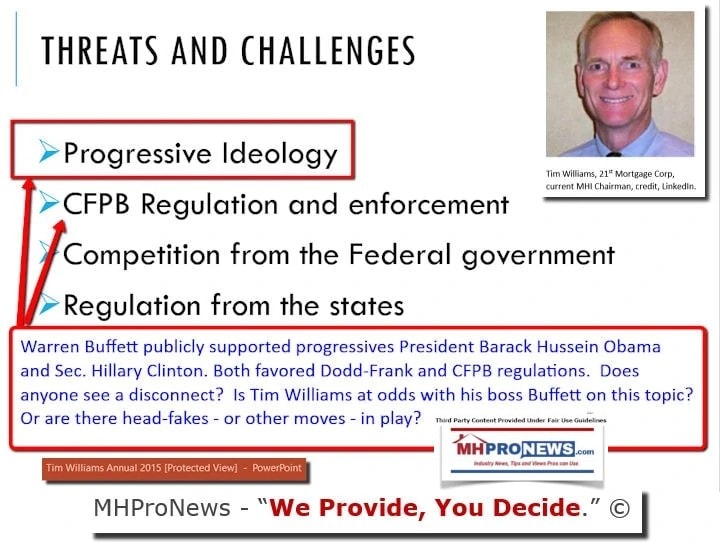

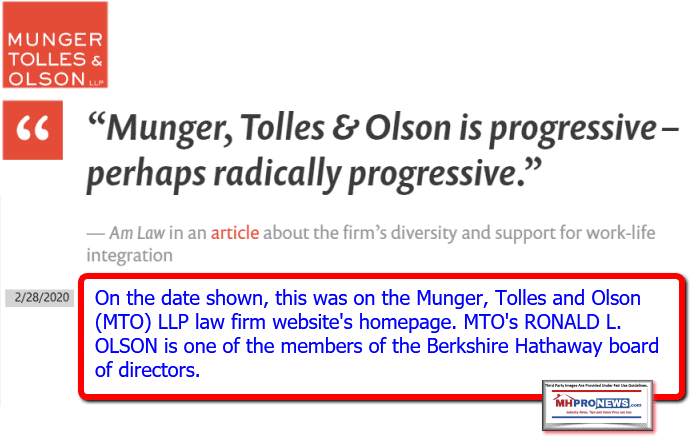

- 7) It is also odd that when Berkshire owned 21st Morgage raised problems with progressive policies that UMH wouldn’t take note of the disconnects between Williams remarks and those of Buffett.

There is more, but following the links above as well as others shown further below will begin to illustrate the concerns noted. On the lighter side, it is nice to see some humor in the form of musical tastes – but both Swift and Springsteen are apparently on the political left.

More on UMH Properties is planned for the days ahead. Stay tuned. ###

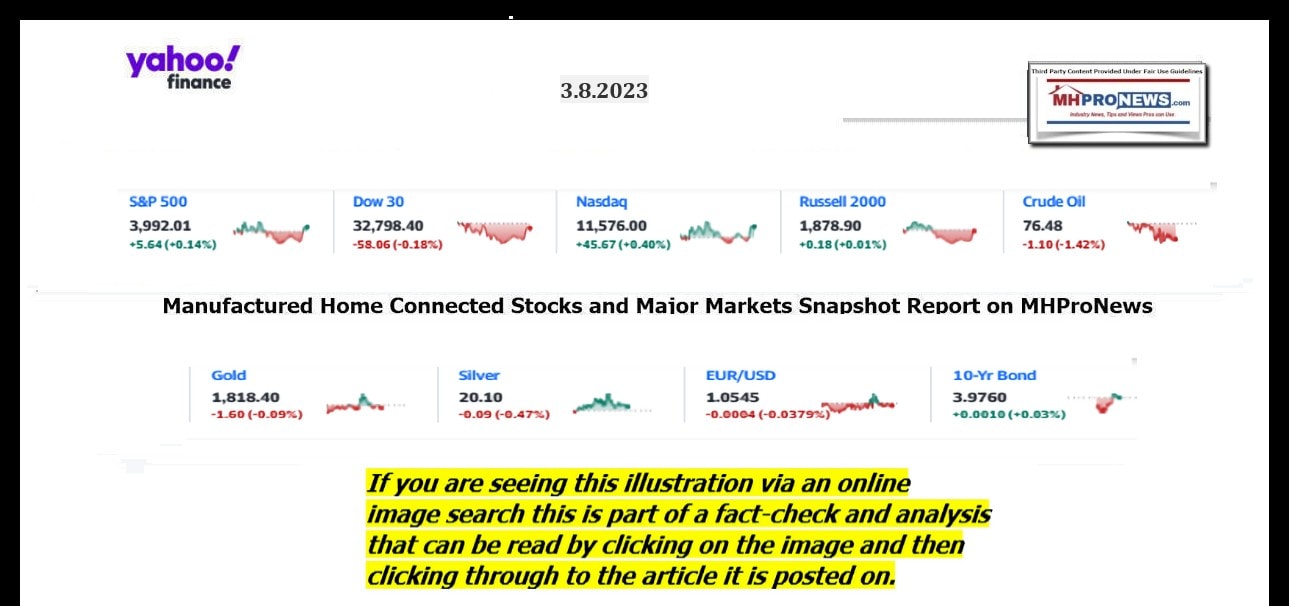

Part III. Daily Business News on MHProNews Markets Segment

The modifications of our prior Daily Business News on MHProNews format of the recap of yesterday evening’s market report are provided below. It still includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines. The macro market moves graphics will provide context and comparisons for those invested in or tracking manufactured housing connected equities.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 3.8.2023

- Food is getting cheaper…

- But not for you. Why prices aren’t falling at the grocery store

- Fox Chairman Rupert Murdoch rejected election conspiracy theories, Dominion lawsuit documents show

- Senators warn Big Tech on Section 230: ‘Reform is coming’

- The number of available jobs in the US shrank in January

- TikTok could be a valuable tool for China if it invades Taiwan, FBI director says

- The Biden administration is shifting its approach to TikTok

- US safety regulators to investigate Tesla for steering wheels that can fall off

- FTC says it’s conducting an investigation into Twitter’s privacy practices

- ChatGPT is coming to Slack

- The US housing market is short 6.5 million homes

- Federal Reserve Chair Jerome H. Powell testifies before a House Financial Services hearing on “The Federal Reserve’s Semi-Annual Monetary Policy Report” on Capitol Hill in Washington, U.S., March 8, 2023.

- Markets waver after Fed Chair Powell concludes his testimony

- Tucker Carlson ‘passionately’ hates Trump, and eight more key revelations about Fox News from new Dominion filings

- Yeezy fallout could push Adidas into its first annual loss in 31 years

- Jerome Powell’s testimony sent markets reeling. That may be a good thing

- IMF chief: Ukraine war will have ‘devastating’ consequences for Russia’s economy

- Russia says it may challenge Biden’s nominee to head the World Bank

- China censors women modeling lingerie on livestream shopping – so men are doing it

- French oil refineries blockaded as 1 million protest against pension reforms

- Buying bank stocks before a recession used to be madness. Not anymore

- Elon Musk publicly mocks Twitter worker with disability who is unsure whether he’s been laid off

- US senators unveil bipartisan bill empowering Biden to ban TikTok and other services

- China shakes up government to counter financial risks and US tech restrictions

- Elon Musk thinks he can fix Twitter’s advertising business after derailing it

- Xi Jinping hits out at US as he urges China’s private firms to ‘fight’ alongside Communist Party

- China to increase defense spending 7.2%, sets economic growth target of ‘around 5%’ for 2023

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Headlines from right-of-center Newsmax 3.8.2023

- House GOP Calls Witnesses for Probe of Biden’s Chaotic Afghanistan Exit

- DirecTV Censors Newsmax

- AG: Allow Free Speech Despite DirecTV

- Waltz: DirecTV ‘Hearings in the Works’ | video

- Kiley: ‘Disturbed’ by DirecTV Removal | video

- Self: DirecTV Must Give Reasons | video

- Tony Perkins: Axing Newsmax an ‘Abuse of Power’ | video

- Ramaswamy: DirecTV Violates ‘Existing Laws’ | video

- Murphy Decries’Blatant’ Attack on Conservatives | video

- Ruddy at CPAC: Newsmax ‘Critical’ for America’s Future

- Gaetz: House Should Hold Hearing on DirecTV Action | video

- Dean Cain: DirecTV Not for ‘Free Exchange’ of Voices | video

- Comer: Dems for Censoring Conservatives

- More Stories on AT&T DirecTV Censorship

- Gordon Chang: Put Military on High Alert Over China

- ‘Shaman’ Mom: Son Victim of 1/6 ‘Injustice’ | video

- Gordon Chang: Put US Military on High Alert Over China | video

- Waltz: Vets ‘Right to Be Outraged’ on Afghanistan | video

- Ramaswamy: I Have ‘Specific Policy Solutions’ | video

- Ohio Lt. Gov. Husted: Pushing Norfolk to Be Accountable | video

- Austin Scott: Companies Must Cut Ties With China

- Rand Paul: Fauci Had Others Drop Lab Leak Story | video

- John Bolton: China’s Hidden Intentions Now Emerge | video

- More Newsmax TV

- Newsfront

- McCarthy Appears to Reject Zelenskyy Invite to Ukraine

- As Republicans face an internal party debate over whether the United States should continue giving aid to Kyiv to fend off the Russian invasion, Ukrainian President Volodymyr Zelenskyy told CNN that he is inviting House Speaker Kevin McCarthy to visit his country…. [Full Story]

- Wagner Chief Claims Partial Control in Bakhmut

- The owner of Russia’s Wagner Group military company claimed Wednesday [Full Story]

- Related

- Germany: Nord Stream Attacks May Be ‘False Flag’ to Smear Ukraine

- IMF Mission Begins Policy Discussions With Ukraine

- Ukraine Calls for Kherson Evacuation Amid Bakhmut Focus |video

- Rice: NATO, Zelenskyy Should Win Nobel Peace Prize

- Kyiv to Send More Troops Into Bakhmut

- Bill Requires Vaccine Education for Parents

- A Democrat-sponsored bill in Pennsylvania would require parents to [Full Story]

- Tucker Carlson Texted He Hated Trump ‘Passionately’

- Tucker Carlson was so incensed with then-President Donald Trump two [Full Story]

- Miami Mayor Meeting GOP Donors Amid 2024 Rumors

- Miami Mayor Francis Suarez recently met with several high-profile [Full Story]

- Derailment Blame Falls ‘Squarely’ in Biden’s ‘Lap’

- While the freight rail industry has been under heightened scrutiny [Full Story] | Platinum Article

- UN May Cut Aid Over Taliban Stance on Women

- The U.N. envoy in Afghanistan warned on Wednesday that a Taliban [Full Story]

- Burchett Says UFO Tech ‘Reverse Engineered’

- Tim Burchett, R-Tenn., told Newsweek that he believes the U.S. [Full Story]

- New ‘M*A*S*H’ Scene Written by ChatGPT

- “M*A*S*H” stars Alan Alda and Mike Farrell sat down together for the [Full Story]

- Supreme Court Student Loan Case Perilous for Both Sides

- The Supreme Court must answer several specific legal questions raised [Full Story] | Platinum Article

- US Consumer Watchdog: Illegal Bank Fees Pervasive

- Lenders across the U.S. financial services sector continue to charge [Full Story]

- US Trade Deficit Widens Moderately

- The U.S. trade deficit widened moderately in January as both imports [Full Story]

- Amazon Hates when People From Florida Do This, But They Can’t Stop You

- Online Shopping Tools

- As Investors Buy Up Rental Homes, Cities Push Back

- Corporate investors piled into the U.S. property market during the [Full Story]

- Women More Likely to Die After Heart Bypass

- Women are more likely than men to die after coronary artery bypass [Full Story]

- Study: Keto Diet Doubles Heart Risks

- A new study showed that eat a ketogenic diet may double your risk for [Full Story]

- US Climate Change Flop Price Tag? $100 Billion

- We are the furthest thing from being climate change alarmists, but [Full Story]

- At This Rate, We Won’t Remain AI’s Masters for Long

- Are we outsmarting ourselves with the invention of artificial [Full Story]

- Half of Poisonings in Kids Under 6 Due to Opioids

- Opioids pose the greatest poison risk to children in the United [Full Story]\

- Centrist Political Party Qualifies for 2024 Arizona Ballot