Before diving into this review of Flagship Communities REIT Investor Relations (IR) pitch on the dates 2.12.2024 and 2.13.2024, the following explanations are warranted. As a periodic disclosure of a standard practice, when MHProNews publishes a report on a firm, or quotes an individual or organization, that should not be construed as an agreement with that person or entity. Indeed, there are times when MHProNews quotes a person or organization precisely to allow their perspective, their claims in their own words, which we may nevertheless editorially strongly disagree with. Having quoted the source, often at length and in full context, MHProNews can then fact-check that person or organization’s remarks, statements, or claims in the light of their own information. Additionally, this method has established in recent years perhaps the most complete record of what these various entities and leaders have said compared to their own and each other’s respective behaviors in the light of their own remarks. These business, nonprofit, or other entities which operate in manufactured housing are often members of the Manufactured Housing Institute (MHI) and/or one or more of MHI’s ‘state association affiliates.’ So, unlike perhaps any other financial or other media operation (other than MHLivingNews), as good as they might be, this approach has established an often detail record of official statements that can then be fact-checked against behaviors. This allows questions to be probed in an evidence-based and logical fashion. Are organizational behaviors consistent with their remarks? If there are disconnects, what are they? If disconnects exist, what might explain an individual professional’s or organization’s behavior in the light of known facts? Last, but not least, documented contacts with that organization directly to allow them to clarify or explain their stance, and/or respond to such fact checks are offered. Then industry expert reviews of that information are offered in virtually all articles in recent years. If an individual news report on this or that event or statement is useful, and they often are, then surely this more comprehensive approach described in this preface can give researchers probing for the truth of a question something deeper to sink their proverbial teeth into.

As longer time readers know, MHProNews has fact-checked and critiqued Flagship Communities (TSX: MHC.U) (TSX: MHC.UN) and their leadership previously. A recent example is linked here and that report links others.

Flagship Communities was co-founded by Nathan Smith, a prior Manufactured Housing Institute (MHI) chairman who still holds higher-profile roles at MHI and its National Communities Council (NCC). With this report, MHProNews will once more pull back the veil on that operation. The reasons to do so are several, including the fact that the sharp decline in 2023 total U.S. manufactured housing industry production warrants it. Where is the sense of urgency to address an array of issues that plagues and limits manufactured housing production for much of the 21st century and for all of the past 2 decades? Other than the Manufactured Housing Association for Regulatory Reform (MHARR) in reports like this one published earlier this week, who in manufactured housing is shining a spotlight on these ‘principal bottlenecks’ that have hamstrung the industry despite favorable legislation that was enacted by widely bipartisan Congressional efforts specifically designed to support more manufactured housing sales and production?

In response to an inquiry examined in Part II of this report, Bing’s AI powered Copilot said: “While I couldn’t find a specific post or document directly addressing chief bottlenecks hampering manufactured housing industry production in the 21st century on their website, MHI does provide valuable information about the industry.” That’s a keen summation that will be explored further below, following the information gathered from MHI member Flagship.

Other linked reports on MHI member firms, and a non-MHI member firm that is publicly traded will be provided herein too.

Each of these provides a piece of the puzzle that is manufactured housing industry underperformance in the 21st century. This provides a view through the lens of higher profile MHI member firm (Flagship) and their leadership, which includes Nathan Smith.

As noted above and as Part II of this report with expert analysis and commentary will reflect, quoting Flagship extensively should not be construed as an endorsement of the firm, their stock, nor their business practices. As detail-minded and longer-term readers of MHLivingNews and MHProNews may recall, at times Flagship (and/or their predecessor’s name before they rebranded, SSK Communities) has had a Better Business Bureau (BBB) rating of D- or even as low as “F.”

Much like traditional school grading systems of A-B-C-D- and F, an F is as poor a rating as the BBB offers.

Nevertheless, as those linked reports reveal, either MHI and/or an MHI state affiliate have given Flagship ‘awards’ for ‘excellence.’

If that isn’t shocking or disturbing enough, then the announced ‘induction’ of Smith into the RV MH Hall of Fame (see report linked here) is one more sign of the apparent corruption of that group’s former standards.

To truly understand ‘how the game is played’ by certain ‘insider’ brands at “the Institute” the evidence-based argument can be made that Flagship makes a reasonable case study that sheds light on how MHI claims something, but several MHI member firms’ behavior reflects something quite different.

Highlighting is added by MHProNews, but the text is that of their website or other IR information as shown on the date above.

Part I – From Flagship IR Pitch

REIT Overview

Profile

Flagship Communities Real Estate Investment Trust (“Flagship Communities REIT” or the “REIT”) is an internally managed, unincorporated and open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario. The REIT owns and operates a high-quality portfolio of 67 income-producing manufactured housing communities (“MHC”) comprising 11,876 lots, located in attractive Midwest U.S. markets. The REIT is positioned as a consolidator in the fragmented MHC industry.

Strategy

Flagship Communities REIT is positioned to accelerate its growth by executing on its proven growth strategies. Organic growth initiatives include aligning lot rents with prevailing market conditions, leasing vacant lots, converting renter-occupied lots to homeowner-occupied lots, implementing value-enhancing investments, optimizing revenue and expenses, and expanding established communities by developing excess land. External growth will come through acquisitions. The MHC industry is highly fragmented, and comprised primarily of local owner-operators. With approximately 5,300 manufactured housing communities in the REIT’s existing markets, there is a substantial opportunity for continued growth in the REIT’s own backyard.

Investment Highlights

Opportunity to Gain Exposure to a Niche Asset Class with a Track Record of Outperformance

Flagship Communities Real Estate Investment Trust is the only pure-play, publicly traded manufactured housing investment vehicle in Canada. It represents a unique opportunity to invest in U.S. manufactured housing communities (“MHCs”). The MHC industry has demonstrated a strong track record of outperformance throughout all economic cycles, having achieved 20 consecutive years of positive same community net operating income growth. The U.S. MHC industry’s net operating income has experienced an average growth rate of approximately 4% per year over this period, outperforming all other real estate sectors.

Defensive Asset Class with a Favourable Business Model that Outperforms Throughout the Economic Cycle

The MHC industry is characterized by stable and growing financial performance, with attractive investment returns and low operational volatility. Manufactured housing is predominately a land lease business model, whereby residents are owner-occupiers of their homes and rent a lot on which to place their home within a community. As a result, maintenance capital expenditures borne by MHC owners are generally minor and limited to community infrastructure. MHCs typically have a large, diverse and entrenched resident base with long tenure, low turnover, and minimal delinquency. Given the continued appreciation of single-family housing prices at a rate exceeding household income growth in the United States, management believes that demand for MHCs will remain strong from residents seeking affordable housing.

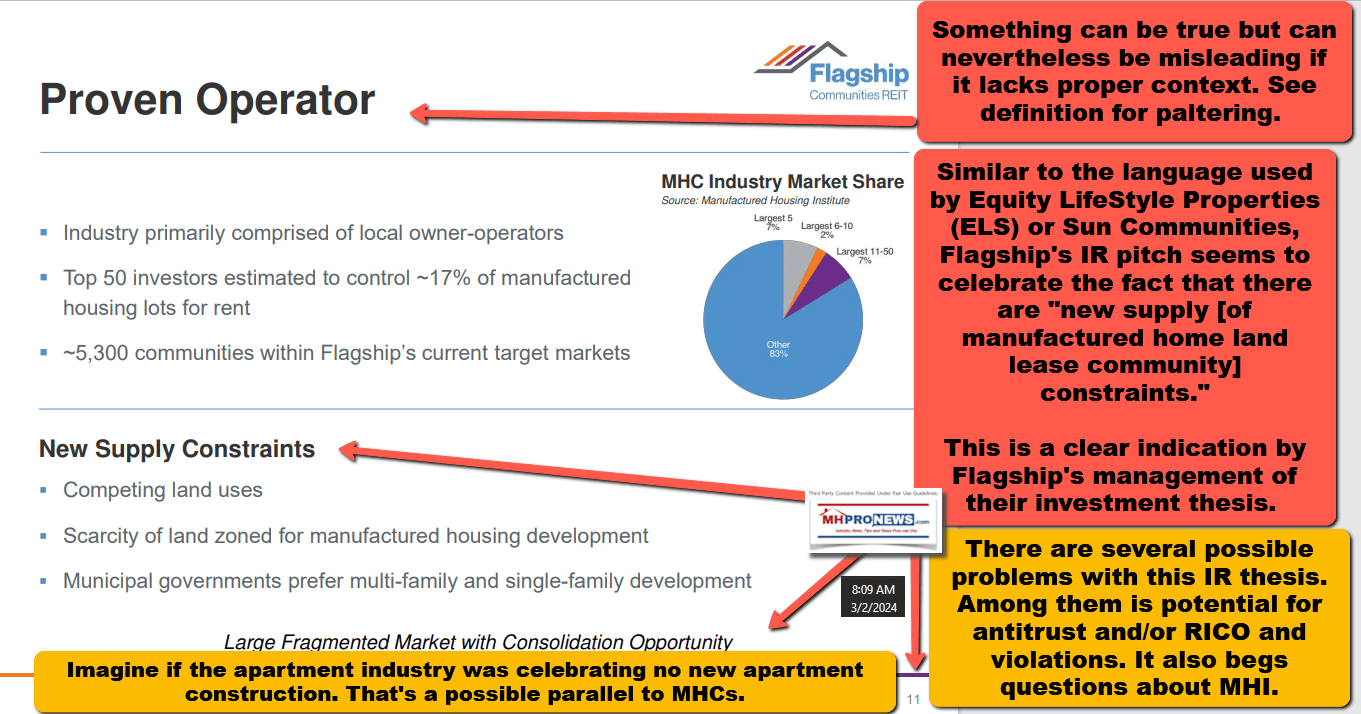

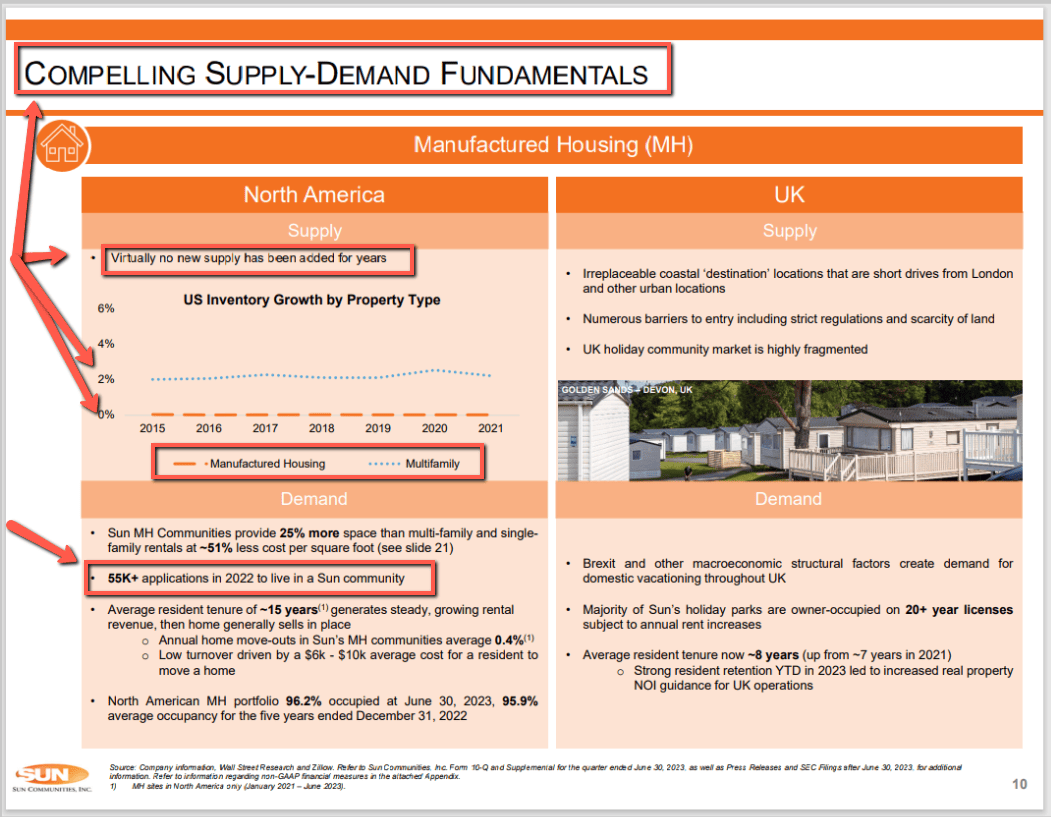

Fragmented Industry with High Barriers to Entry and Imbalanced Supply and Demand Dynamics

The MHC industry is highly fragmented and primarily consists of local owner-operators, public real estate investment trusts and institutional investors. The top 50 MHC investors are estimated to control only 17% of the 4.2 million manufactured housing lots estimated to be available for rent in the United States, presenting an opportunity for consolidation. Factors such as regulatory restrictions, competing land uses and scarcity of land zoned for manufactured housing development have limited new supply, causing an imbalance in supply and demand and creating high barriers to entry for new market participants. The REIT’s management is unaware of any new MHCs having been built within its current operational footprint during the past 15 years.

Contiguous, High Quality Portfolio with Regional Footprint in Stable Markets

The REIT’s communities are located in markets with stable population growth, stable employment trends and favourable regulatory environments. The communities are strategically concentrated within four contiguous U.S. states and are conveniently located near interstate highways, necessity-based retail centres, post-secondary institutions, healthcare facilities and major metropolitan employment centres. The regional footprint has enabled management to develop deep market insights and intelligence, build enduring relationships with market participants and establish a market-leading position. In addition, the geographic proximity of the communities allows the REIT to generate significant economies of scale and expense savings.

Well Positioned to Capitalize on Strategic Growth Opportunities

The REIT has identified four strategic avenues for growth:

- Organic cash flow growth through improving occupancy, increasing lot rents, and expense optimization initiatives;

- Targeted value-enhancing investments and community improvements;

- Third party acquisitions; and

- Expansion of certain communities through the development of excess land.

Management’s extensive relationship network, deep knowledge of local markets and regular dialogue with local owner-operators supports the execution of off-market acquisitions within the REIT’s current operational footprint and other target markets. The REIT can offer potential vendors tax-deferred Class B Units, providing them with an additional incentive to transact. The REIT can also access numerous sources of debt financing including government agency debt, commercial mortgage-backed securities and life insurance companies, providing significant flexibility to pursue acquisitions. In addition, the REIT has a preferential right to purchase MHCs offered by Empower Park, LLC, an entity controlled by the REIT’s Chief Executive Officer and Chief Investment Officer. The MHCs owned by Empower will be offered at a discount to appraised value.

Vertically Integrated Platform Led by an Experienced and Aligned Internal Management Team

The REIT’s management platform is composed of a fully integrated team of seasoned professionals with more than 50 combined years of experience across the full spectrum of the manufactured housing industry. The REIT’s vertical integration will enable it to actively control, manage and execute across all aspects of MHC investment management. The REIT’s executive officers collectively own an approximate 22.2% effective interest in the REIT, providing a significant alignment of interests with other Unitholders. …##

Part II – Additional Information with More MHProNews Analysis and Commentary

In no particular order of importance are the following.

“When you want to help people, you tell them the truth.

When you want to help yourself, you tell them what they want to hear.”

― Thomas Sowell

1)

Manufactured housing industry performance as measured by the production of new manufactured homes has underperformed for essentially all of the 21st century.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

2)

There are times that other fellow MHI members of Flagship Communities REIT Investor Relations (IR) pitches reflect that 21st century industry underperformance. So, the graphic above – while unique – is supported by information from other MHI members. More on that in a graphic further below.

But that 21st century underperformance begs questions, which is why close scrutiny of the investor information is warranted.

By law and regulations, investor information is supposed to be factually accurate at the time it was delivered. Failure to give a factually accurate information can result in various forms of liability, regulatory and/or claims made by attorneys on behalf of shareholders who have purportedly been wronged in some fashion. To illustrate that, consider the following Q&A with Bing’s artificial intelligence (AI) powered Copilot. Our stand practice is to use Bing owned Copilot’s “balanced” or blue setting in these Q&As.

> “Isn’t it true that by law and by regulation, in the U.S. investor information is supposed to be factually accurate to the best of the knowledge and belief of the corporate leadership who assert the accuracy of that information to investors?”