As just one of the eye openers, per Sun Communities (SUI) Chairman, President, and CEO Gary Shiffman in their most recent quarterly earnings call transcript is this: “The steps that we are thinking about, the fact that we have shared, we stopped new development and the acquisition, continuing converting transient to annual or when you think about those conversions in the last three years, we have actually converted about 20% of our transient sites or will have by the end of this year to annual leases and we will continue to do so. As Fernando mentioned, we sold our stock position in Ingenia, all looking to recirculate more free cash flow and capital to pay down debt and demonstrating the operational leverage, which you are referring to, is something we are very hyper focused on for 2024.” Ingenia is an investment in manufactured home communities in Australia. Changes in their United Kingdon (U.K., i.e.: British) are also on the horizon. But changes also appear to be ahead for the manufactured home, RVs, and marina slips market here in the U.S. for Sun Communities (SUI) too.

How much of these, if any, is related to the threat from national class antitrust legal actions that launched since their last earnings call remains to be seen. More on that in Part II, along with more manufactured housing investor and industry stakeholders’ insights, facts, and commentary.

Note that in Part II, some of the first official known response from Sun’s management to the national class action antitrust litigation against them and others involved in the Manufactured Housing Institute (MHI) and/or MHI linked state associations is found quoted herein. Look for it.

In Part I, the highlighting is added by MHProNews, but the text (with an edit shown in [brackets] to clarify an apparent typo and [SIC] added behind another apparent typo, etc.) is according to Insider Monkey and/or Yahoo Finance.

Part I

From Insider Monkey and Yahoo Finance Sun Communities, Inc. (NYSE:SUI) Q3 2023 Earnings Call Transcript provided under fair use guidelines for media. Highlighting below is by MHProNews which is part of our fact checking and analysis that follows.

Sun Communities, Inc. (NYSE:SUI) Q3 2023 Earnings Call Transcript

Insider Monkey Transcripts

October 27, 2023·13 min read

Sun Communities, Inc. (NYSE:SUI) Q3 2023 Earnings Call Transcript October 26, 2023

Operator: Good afternoon, ladies and gentlemen, and thank you for standing by. Welcome to the Sun Communities Third Quarter 2023 Earnings Conference Call. At this time, management would like me to inform you that certain statements made during this call, which are not historical facts, may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Although the company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the company can provide no assurance that its expectations will be achieved. Factors and risks that could cause actual results to differ materially from expectations are detailed in yesterday’s press release and from time-to-time in the company’s periodic filings with the SEC.

The company undertakes no obligation to advise or update any forward-looking statements to reflect events or circumstances after the date of this release. Having said that, I would like to introduce management with us today. Gary Shiffman, Chairman, President and Chief Executive Officer; and Fernando Castro-Caratini, Chief Financial Officer. After their remarks, there will be an opportunity to ask questions. For those who would like to participate in the question-and-answer session, management asks that you limit yourself to one question, so everyone who would like to participate has ample opportunity. As a reminder, this call is being recorded. I will now turn the call over to Gary Shiffman, Chairman, President and Chief Executive Officer.

Mr. Shiffman, you may begin.

Gary Shiffman: Good afternoon. And thank you for joining our call to discuss third quarter results and our updated 2023 guidance. We reported another strong quarter with core FFO per share of $2.57, exceeding the high end of our guidance range. Total same-property NOI growth of 6.7% meaningfully outperformed guidance, demonstrating how our properties high demand and scarce supply fundamentals generate durable growing real property income. Same-property NOI growth was fueled primarily by solid revenue growth and continued cost saving initiatives across our properties. In our manufactured housing segment, third quarter same-property NOI grew 8% as compared to 2022, supported by a 6.1% increase in monthly base rent per site and occupancy gains.

Within our RV communities, the 4.1% same-property NOI growth achieved in the quarter is a testament to continued high demand at our communities, exemplified by the successful execution of our strategy to convert transient sites to annual leases. To-date, our transient to annual conversion surpassed 1,800 sites and we are on pace to meet guidance for the year. On a combined basis, same-property adjusted occupancy for manufactured housing and RV communities increased 170 basis points this quarter compared to last year. And across the total portfolio, revenue producing sites increased by approximately 750 sites during the third quarter, an 8% increase compared to 2022. This brings year-to-date revenue-producing site gains to nearly 2,600. Marinas delivered another very strong quarter with same-property NOI growth of 8.9% over the prior year period.

Demand to join our unparalleled safe harbor network remains strong, as demonstrated by the increase in rate lift at 89% for Marinas. Our manufactured housing portfolio in the U.K. will be included in same property results starting January 1st, only reset the same community pool for 2024. For the third quarter, real property NOI in the U.K. grew 15.1% over the same period last year, in line with our expectations. Adjusting for exchange rate changes, U.K. real property NOI increased by 8.7% over the prior year quarter. Home sale activity, which supports the predictable rental income of our communities was in line with our expectations and is tracking within our guidance ranges for the year. Looking ahead to 2024, we expect rental rate growth in our same-property portfolio to exceed inflation.

At the midpoint, we expect to realize average annual rental rate increases of 5.4% for manufactured housing in North America and 7.1% in the U.K. We expect a 6.5% increase in annual ROI rates for our annual RV portfolio and 5.6% growth in annual rates across Marinas. We expect these strong rental rate increases, combined with modestly higher occupancies and our ongoing focus on expense management to produce another year of strong organic cash flow growth in 2024. And now I want to give you some perspective on Sun’s broader strategic objectives. The Sun Board and management team are laser-focused on implementing changes designed to streamline our company and position us for growth. Our goal in making such changes is to help ensure that our best-in-class, operationally resilient portfolio delivers the consistent FFO per share growth our stakeholders historically have enjoyed from Sun.

For example, we recently sold our stock position in Ingenia, generating over $100 million to pay down variable rate debt. This transaction had the added benefit of being increase the FFO. In addition, we have previously discussed, we continue to advance the process to identify select properties for potential disposition with the intent of further delevering [sic] proceeds. As we move forward, we are substantially reducing capital spending, including acquisitions and development activity, in light of the more challenging economic and capital markets environment. This year, as we have stated before, we are completing ground-up development projects that were already underway and a new external growth projects will be solely focused on the most strategic opportunities.

Our strategic positive investment activity can be seen in our U.K. operations as well. In 2021, after we announced the agreement to acquire Park Holidays, we extended a loan to RoyaleLife, a U.K. holiday park and manufactured housing developer and operator in a separate transaction. This development opportunity is distinct from our Park Holidays business. Our loan to RoyaleLife is collateralized by real estate and several other assets. We have selectively and partnered with strategic counterparts for development throughout Sun’s history. As macroeconomic conditions rapidly deteriorated in the U.K., we decided not to pursue incremental acquisitions to develop. Since that decision, RoyaleLife engaged with several lenders to repair a note, but was unable to do so.

Ultimately, at the end of September, we appointed a receiver to enforce our interest in the real estate securing our loan. We continue to assess our options as we take the note through the receivership process. Additionally, Sandy Bay is a premier manufacturing housing community in the U.K. we acquired in 2022. It has 730 operating sites and can be expanded by an additional 450 sites. As part of our broad strategic portfolio review, we decided to sell the property and headed under contract to be sold to RoyaleLife, backed by additional financial investors and lenders. While that transaction is not progressing, we are in discussions with other potential buyers and in the meantime, continue to benefit from the community’s contribution to real property NOI>.

Now Sun has 30-year history as a public company, we have demonstrated operational reliability and cash flow strength throughout economic cycles and we are continuing to see this in the solid performance of our real property business. We remain optimistic about our performance and organic cash flow generation in the near-term, supported by our anticipated rental increases in 2024. However, we recognize the headwinds from today’s challenging macro environment. And as I said, we are taking actions and steps to realign our strategy to focus on our proven, durable income streams. We are recycling capital out of non-core investments, including our operating portfolio to monetize lower-growth communities and remaining disciplined and deliberate in pursuing only the highest growth capital expenditure projects.

As we implement these rate sizing activities in the coming quarters, we are optimistic the market will recognize how these activities will decrease our leverage and target a return to the consistency of our earnings we have long enjoyed. As always, the management team and I are grateful for the hard work and accomplishments of the entire Sun team this quarter and I would like to thank all the team members for their dedication and all of our stakeholders for their support. Fernando will now discuss our results in more detail. Fernando?

Fernando Castro-Caratini: Thank you, Gary. Third quarter core FFO of $2.57 per share was $0.01 above the high end of our guidance range. Expense savings at the property and corporate level were the primary contributor to outperformance as compared to our midpoint. Sun’s total same-property NOI for the quarter increased 6.7% as compared to last year, outperforming the high end of our guidance by 220 basis points. Our performance was driven by same-property revenue growth of 5.5% and lower-than-expected property operating expense growth of 3%. For the quarter, same-property manufactured housing NOI increased 8%, driven by a rental rate increase of 6.1%, continued occupancy gains and focus on expense management. RV same-property NOI grew 4.1% due to an 8.8% increase in weighted average annual rental rate, approximately 2,100 transient to annual site conversions over the trailing 12 months and ongoing operational programs to mitigate expense growth.

These were partially offset by a 4.4% decline in transient RV revenues, as transient occupancy normalizes. Adjusting for the decrease in sites converted to annual, transient revenue grew 2.2% relative to the prior year period. Over the Labor Day holiday weekend, same-property transient RV revenue was down 1.5%, as compared to last year’s holiday weekend. Adjusting for the 5.7% decrease in transient sites converted to annual, transient RV revenue increased by 4.4%. We continue to drive the pace of transient to annual RV lease conversions to increase our percent of sticky revenues. This quarter, we converted nearly 540 sites to annual leases, for a year-to-date total of over 1,800 conversions. In Marinas, same-property NOI increased 8.9% in the third quarter as compared to 2022, an 8.4% increase in revenues highlights the strong demand to be part of our network.

Our performance was due to solid rental rate increase, longer stays by guests in our Southeastern Marinas and operating expense savings, particularly within payroll and utilities. In the U.K., real property NOI for the quarter of $29 million was in line with our guidance. Retention rates among our U.K. owners is holding steady. With an average resident tenure that approaches eight years. The increased retention over 2022 was a meaningful driver of real property income growth this year. Turning to home sales. North American home sales contribution was broadly in line with our expectations for the quarter, where lower volume was offset by higher margins. In the U.K., despite economic headwinds continuing to challenge home sales volumes, we sold 2,310 homes through the end of the third quarter.

Fourth quarter to-date, we have sold 204 homes, leaving approximately 300 homes to be sold to achieve our full year volume guidance. In terms of NOI, we are on track to achieve the midpoint of prior guidance, which approximates just over $70 million for the full year. Regarding our balance sheet, since our last call, we have focused on decreasing leverage and variable rate debt. During and subsequent to the third quarter, we entered into $150 million of SOFR swaps on our U.S. dollar line of credit at a fixed SOFR rate of 4.8% through April 2026. As Gary discussed, we sold our position in Ingenia and used the net proceeds of approximately $100 million to pay down borrowings on our line of credit. Additionally, we refinanced approximately $118 million of secured debt that was maturing this year with approximately $250 million of new secured debt.

Adjusted to include the positive impact of a $50 million SOFT swap executed in March, the new loans bear interest at a fixed rate of 6.25% and mature in 2030. Taking this activity into account, we had $7.6 billion in debt outstanding at a weighted average rate of 4.15% and had a weighted average maturity of approximately seven years. Our trailing 12-month leverage ratio was 6 times and approximately 14% of our debt is floating. Turning to guidance for the year. We are revising our full year core FFO per share guidance downward by 1% at the midpoint to a range of $7.05 to $7.13 and establishing a fourth quarter core FFO per share guidance range of $1.28 to $1.36. Our revised guidance for the year is driven primarily by, higher expected interest expense in the fourth quarter, related primarily to the U.K. note remaining outstanding, U.K. home sales NOI performing towards the midpoint of our range and lower expectations for transient revenue in the U.S. Regarding the U.K. note, through the first nine months of this year, we recognized $28 million or approximately $0.22 per share in interest income.

There is no interest income from this note in fourth quarter guidance. We previously expected to pay down debt with the notes repayment, which would have generated roughly $5 million or approximately $0.04 a share of interest expense savings in the fourth quarter. For U.K. home sales, we expect to finish the year within our prior guidance range, with home sales volume of around 500 units in the fourth quarter. We are forecasting lower margins on these home sales as U.K. consumers continue to favor pre-owned homes and part exchanges to new home. NOI margins on U.K. home sales for the first nine months averaged $26,000 and our revised guidance assumes average NOI margins of approximately $20,000 per home in the fourth quarter. Our same property portfolio is by far the largest driver of our results, representing over 90% of NOI.

Based on results to-date and our expectations for continued strong demand, bolstered by effective expense management, we are increasing total same-property NOI guidance by 50 basis points from 5.7% growth at the midpoint of the prior range to a new midpoint of 6.2%. The increase is based on higher expectations at our same-property manufactured housing and Marinas properties, partially offset by slower growth in RV addressed earlier. At the midpoint, the 5.8% to 6.1% NOI growth we now expect from MH is 45 basis points higher than the midpoint of the prior range. And our same-property RV portfolio, we now expect NOI to grow 3.5% to 4.2%, which represents a 15-basis-point decrease at the midpoint as compared to prior guidance. For same-property Marinas, we expect NOI to increase to a range of 10% to 10.3% for the year, a 165-basis-point increase from our prior assumed range of 8% to 9%.

Additionally, and as Gary discussed, we are providing guidance on preliminary rental rate increases for 2024. At the midpoint, we expect to realize average annual rental rate increases of 5.4% for manufactured housing in North America and 7.1% in the U.K. We expect a 6.5% increase in annual rental rates for our annual RV portfolio and 5.6% growth in annual rates of cost Marinas. For additional details regarding our updated full year guidance, please see our supplemental disclosures. As a reminder, our guidance includes acquisitions and dispositions and capital markets activity through October 25th. Our guidance does not include the impact of prospective acquisitions, dispositions or capital markets activities, which may be included in research anal[sys] assessments.

This concludes our prepared remarks. We will now open the call up for questions. Operator?

Q&A Session

Operator: Thank you. [Operator Instructions] Our first question comes from the line of Samir Khanal with Evercore. Please proceed with your question.

Samir Khanal: Hi. Good afternoon, everybody. Gary, maybe provide a little bit more detail on your sort of your plan to sell assets. I guess what’s the transaction market look like in the U.K. and the U.S.? Just trying to figure out your ability to sell those assets as it relates to the U.K. loan. You kind of stated about Sandy Bay. I think it was in the market, now it’s held for sale. Just want to — maybe you can provide a bit more color on the market in the U.K.? Thanks.

Gary Shiffman: I think underlying our goal to sell assets as we have shared with the market. It’s just a use of recycling capital and paying down debt. Generally, these are all high quality assets and they are performing in the portfolio. But for various reasons, we think that bringing them to market and being able to pay down higher priced debt would be favorable as we go forward. So in North America, we have shared we have done a kind of deep dive and identified some assets to bring to market. Those first group of assets are either currently or in the next week will be marketed and we will determine at that time, how the market feels in North America. As everyone is aware, there’s been very, very little transaction in the manufacturing RV market.

So it — there are no data points to point to right now. We know that rates are significantly up, but these are good high quality assets. So we look forward to being able to share with you on our next call or if we are able to execute on anything before our next call, how the market is responding to those assets. With regard to the U.K., in particular, those that are collateralized by the Royale loan — RoyaleLife assets, because we are in the receivership period, there’s really little that we can comment on. But during the receivership period, we are in dialogue with optionality on those assets and will continue to be so. And then we talked about Sandy Bay, it’s a really high quality premier asset, 730 sites with a big expansion piece to it and we are in dialogue with a number of people regarding a potential sale there as well.

So we will be very pleased to be able to share with everybody what the market is looking like as we began the first steps of marketing.

Samir Khanal: Okay. And then, I guess, just as a follow-up and maybe changing the subject here on Marinas, that continues to show strength. I would have thought you would have been able to push the rates for 2024 a little bit higher. I mean your rate was 5.6%. I understand there’s been a moderation in inflation, but I would have thought maybe the rate would have been higher. Can you provide a bit more color around that?

Gary Shiffman: Yeah. I think it speaks to how we have shared with our stakeholders over 10 years, 20 years, 30 years, 40 years of business, kind of the slow marathon over the Sprint and our approach to want to be able to really get outsized growth above inflation. When inflation is low and when inflation is high, last year, we got off 7.2%, 7.3% rental increase. So we really are enjoying heavy, heavy demand and want to continue to see it continue. So we think that we have really set the rent in a way that over a long period of time, we will be able to maintain NOI growth in excess of inflation, and at the same time, retain high occupancy. So after a couple of years of tremendous growth, we look forward to continuing that growth and set the rental rate very thoughtful for 2024.

Samir Khanal: Thank you.

Operator: Our next question comes from the line of Wes Golladay with Robert W. Baird. Please proceed with your question.

Wes Golladay: Hi, everyone. Maybe looking into next year, can we talk about some of the bigger moving parts that we should be aware of. One, in particular, I want to give more clarity on, would be home sale volume expansion and development? Will that have any impact in the U.S?

Gary Shiffman: Yeah. I will take the first part and Fernando wants to add anything. I think we have been very, very clear that with regard to use of capital and our free cash flow, the most highest priority and best use for that free capital will be to reduce leverage. As we look at this high capital cost environment that we are in right now, recognizing that we do get very, very strong IRRs on expansion usually in the 10% to 13% range. I mentioned RV and new development on the high single double-digit, those are IRRs and they do take a period of time, they are initially dilutive. So by putting those things on hold moving forward, our expectation is that in a better economic environment. We have the inventory of sites on hand and we can resume our expansion and development activities.

So as it stands right now and we will share exact numbers as we go forward in guidance for 2024. The expectation is to have a very limited capital investment in the development area and it’s just a fact from where we are sitting and see the cost of capital right now.

Fernando Castro-Caratini: And Wes, to add to Gary’s comments, we have inventory to sell on the manufactured housing side. By the end of the year we will be delivering nearly 1,000. We will have to deliver nearly 1,000 new sites across expansion and ground up development. So that would support the home sales volume or contribution to NOI here in the U.S. Where we would say, should be around what we expect to get this year.

Wes Golladay: Okay.

Gary Shiffman: And with regards to home sales volume, again, in the U.K. we have the sites, we have the homes. The U.K. Park Holidays team is doing a remarkable job. We are very, very pleased with how home sales are continuing, although they are guided down from the beginning of the year and we will be able to share those guidance post with 2024 guidance.

Wes Golladay: And then a follow-up on the balance sheet. You have taken the variable rate down. I believe you said Fernando, about 14% is floating now. Should we think the balance just being repaid off with the asset sales? Are you going to keep a certain amount of floating?

Fernando Castro-Caratini: We will continue to look to move that percentage downward. Certainly, the immediate use of proceeds of free cash flow in 2024, as well as any proceeds from dispositions or other activities would be to pay down debt. Yes.

Wes Golladay: Okay. Thanks a lot.

Operator: Our next question comes from the line of John Pawlowski with Green Street. Please proceed with your question.

John Pawlowski: Thanks. Fernando, what percentage of the roughly $360 million loan to RoyaleLife is secured by real estate versus the OpCos or the manufacturers?

Fernando Castro-Caratini: Sure. Hi, John. About 70% is secured by real estate and the other $30 million by the operating companies.

John Pawlowski: Okay. Can you just give us any sense of magnitude of the — in your guys’ minds what’s a reasonable base case for the level of impairment of the $360 million loan?

Gary Shiffman: Yeah. I think that based on what we have shared we have had third-party appraisers throughout the process at the beginning, and as recently as June 1st, provide appraisals and the overall appraisals, I think, last came out about 80%.

Fernando Castro-Caratini: At the midpoint of value. We — the loan is covered at 80%.

John Pawlowski: Okay. Back in June 1st and so it’s a lot lower now, is that fair?

Fernando Castro-Caratini: No. That’s not the assumption. The valuations do cover a wide range of scenarios in that analysis with our third-party providers and appraisers. So, no, that would not be the assumption.

John Pawlowski: Okay. Last one for me. Can you just give us, I guess, what specific expense control initiatives were rolled out to result in such a large reduction to expense growth guidance this year and should we expect these benefits to continue into 2024?

Fernando Castro-Caratini: Sure. John, I would say, the primary driver has been in response to normalizing transient revenue growth and given normalizing occupancy, any variable expenses at the property level have been managed across payroll, supply repair and utilities. As it relates to our Marina portfolio, for example, we have some of the growth capital that we have invested have been in solar projects that are driving lower utility expense year-over-year for those properties. So, yes, much of that would be sustainable and the — our expense control on the variable side is in response to topline. So we would continue to look to mitigate the impact of lower revenues, if that would be the case.

John Pawlowski: Okay. Thanks for taking all the questions.

Gary Shiffman: Thank you.

Operator: Our next question comes from the line of Brad Heffern with RBC Capital Markets. Please proceed with your question.

Brad Heffern: Hey. Thanks everybody. Thinking back to last year, you obviously gave some impressive rate indications in 3Q 2022, but we were all surprised by how that translated into FFO when the full guide came out. Obviously, you are not going to give 2024 guidance yet, but just given a similarly high set of increases, do you think we will see Sun return to a more normal level of FFO growth next year or are there other headwinds like this loan that might prevent that from happening?

Gary Shiffman: Brad, our expectation is with 90%-plus of our revenue being derived from those real property operations and with the fact that 30% to 40%, maybe by year-end close to 50%. Those rental rate increases will all be out there with good expense control, should continue to see the benefit of high occupancy, solid rental increases and expense control, as Fernando just referred to.

Fernando Castro-Caratini: Brad, you have seen operational leverage at the corporate level with more muted G&A growth and we believe any activity, as it relates to episodic capital recycling events, right, will reduce not just leverage, but then also any interest expense impact of growth, that we did see this year and was a large contributor to the flow-through from same-property growth not showing up in FFO per share growth.

Brad Heffern: Okay. Got it. Perfect. And then on the 2024 rate indications, I think, you just said, close to 50%. But I am curious if you could just talk about how locked in those are and I assume that there’s different numbers across the different businesses for how many of those rates have been fully set for 2024?

Fernando Castro-Caratini: Sure. So by the end of October, just over 40% of our manufactured housing portfolio will have been noticed and those have been at about a 5.4% increase. They will be around half of the portfolio will happen notice by the end of the year. On the RV side, about 60% of our residents have been noticed at this point. In the U.K., 100% of residents have been noticed at this point. And Marinas, essentially our Southeastern or Southern Marinas have been noticed and the rest are rolling over time.

Brad Heffern: Okay. Appreciate it.

Fernando Castro-Caratini: Thank you.

Operator: Our next question comes from the line of Eric Wolfe with Citi. Please proceed with your question.

Nick Joseph: Thanks. It’s actually Nick Joseph here with Eric. Gary, you mentioned in the press release, I think, on the call as well, implementing the select changes. It sounds like you have talked about CapEx spend and dispositions to pay off floating like debt and some other opportunities that you think will get back to earnings growth and it sounds like that earnings growth will be in 2024. But how about on the G&A side and the integration on the back end of some of these portfolio companies on the U.K. and the Marinas. What’s the opportunity there and can you frame some time in around it as well, please?

Gary Shiffman: Yeah. I think, I don’t know if that was directed to me or to Fernando, but I will start out with it. I mean, summarizing you are exactly correct. The steps that we are thinking about, the fact that we have shared, we stopped new development and the acquisition, continuing converting transient to annual or when you think about those conversions in the last three years, we have actually converted about 20% of our transient sites or will have by the end of this year to annual leases and we will continue to do so. As Fernando mentioned, we sold our stock position in Ingenia, all looking to recirculate more free cash flow and capital to pay down debt and demonstrating the operational leverage, which you are referring to, is something we are very hyper focused on for 2024.

We have continued to see a slowdown and even minor reduction in the growth that we have seen for the last five years, seven years, and certainly, for the last two years, three years as we brought these portfolios in. And Eric, we are working really hard and look forward to sharing with you the outlook for 2024. As we have owned the portfolios and will have owned the portfolios for two years to three years and I think that, that will also underscore how we are able to deliver bottom line FFO growth moving forward.

Nick Joseph: Thanks. I guess just more specific to G&A, though, right? So you have different management industry for these portfolio.

Gary Shiffman: That is what I am referencing. It is our goal to be able to share the 2024 expectations for G&A and to have created leverage moving forward.

Nick Joseph: All right. Thanks. And then just on Ingenia, obviously, you sold the stock, but you have the JV that had been extended there. Can you talk about the timing and the potential monetization of that investment?

Gary Shiffman: Yeah. Sure. First of all, I’d say that we are very pleased with our relationship with the Ingenia folks and we set out to have this JV Sungenia in 2018 and while we sold our entire investment in the Ingenia stock, they are great partners in the Sungenia development and we don’t have to — we do no longer have someone on the overall Board. We are able to allow them to focus on the day-to-day management and operations of the development and the fact of the matter is that after all that time and the investment, the work that’s now completed and the backdrop of demand in Australia for retirement housing, the near-term returns are very attractive and we are very positive about the cash flow over the next 12 months.

Again, that’s something we will be able to lay out in 2024. So, we have invested five years for what is expected in 2024 and I think that that will be pretty clearly laid out as we provide guidance and then we can talk about thoughts going forward from there.

Nick Joseph: Thanks. We will get back in the queue.

Gary Shiffman: Yeah.

Operator: Our next question comes from the line of Keegan Carl with Wolfe Research. Please proceed with your question.

Keegan Carl: Yeah. Thanks for the time guys. Maybe first, just wondering if you could walk through your reconciliation of your FFO per share guidance, where we went from negative $0.10 a share to positive $0.02 a share in the other adjustments line item?

Fernando Castro-Caratini: Hi, Keegan. Yes. There — while there are various line items that contribute to that change, the primary drivers will be the re-measurement of marketable securities, which is Ingenia on a quarter-to-quarter basis, which accounted for about $0.06 and then any unrealized gain/loss on FX changes, again, in the quarter that accounts for 5 of them — $0.05.

Keegan Carl: Got it. And then, I guess, I am struggling to with the Marinas rate increase. I was a little disappointed in the number, but I also know that there’s not good data on Marinas. So I am just curious, do you have an idea of what your hypothetical loss to lease will look like on that portfolio, given where market rents would be today if some were to come in and put their boat there?

Gary Shiffman: Yeah. I think that after two years of ownership of the Marinas and the 7.3% rental increase last year and seeing the demand, as I said, what Sun’s always focused on is the ability to give sustain — sustainable returns year-after year-on a same community basis and the fact of the matter is that a lot of thought and dialogue went into that rental increase. So that in the coming years, we will be able to look for continued long-term growth in the same way, as we had in our MH and RV portfolios. We don’t have much marked lease pickup, just because there’s very, very little turnover, well, I will say, in our MH and annual RV portfolio as well as our Marinas. So on the MH side, not to drift, but to share with you 15-year average turnover nearly 98% occupancy, less than 0.5% of the homes move out a year and the fact that we don’t have many leases that are directly tied to CPI or any long-term leases.

So our market rents or our current rents seem to be pretty close by standard to market and we feel the same is true on the Marinas side and we have always shared that an empty site or in this case, in the Marinas and empty slip is the most costly slip that we have. So as we look for providing solid performance in 2024, we arrived at the 5.6% increase and it does really not provide for very much, if any market — mark-to-mark rental increase at all as does the rest of our portfolio.

Keegan Carl: Got it. Thanks for the time guys.

Gary Shiffman: You bet.

Operator: Our next question comes from the line of Josh Dennerlein with Bank of America. Please proceed with your question.

Josh Dennerlein: Yeah. Hey, guys. Just maybe a follow-up on that marine rate growth of 5.6%. What — I guess, how should we also think about maybe occupancy increases in that line of business, like maybe it would be helpful to just hear what rate growth you sent out for last year in the occupancy uplift?

Gary Shiffman: Yeah. I don’t have the occupancy uplift for 2023. Of course, 2024 will give that thought as part of the guided range, but…

Josh Dennerlein: Yeah. I guess I am just trying to figure out of that 5.6% is like kind of static or like if there’s potential kind of upside relative to kind of where that is, as I think about rental revenue on that side?

Fernando Castro-Caratini: Hey, Josh. The — through year-to-date on non-transient income on the Marinas side has just — has been just under 10% and our rental increase in the 7.5% range. So from a back of the envelope math, roughly 200 basis points of occupancy gain in that number.

Josh Dennerlein: Okay. Okay. Awesome. And then just the U.K. sale that, I guess, it was disclosed in February, but didn’t go through. What’s, sorry if I missed it, I had to jump on late on the call. What’s the back story there?

Gary Shiffman: Well, we acquired a really high quality premier manufactured housing community in the U.K. in late 2021 and as we move forward with the RoyaleLife Group and determined that we would provide them a note for them to pay us back with that loan. They were also working with a group that was interested in acquiring Sandy Bay and we shared with the market at that time. It was an offer we were willing to accept, as we are looking to really reduce our capital commitments in the U.K. And as completely separate from RoyaleLife and completely separate from Park Holidays. We agreed and entered into a contract with that group to sell Sandy Bay. And now that, that’s not moving forward, we will continue to operate it and hold it for sale and recognize the income. It’s about 730 existing sites with expansion potential of 450 and — that’s what I had shared earlier.

Josh Dennerlein: Okay. But I guess why didn’t the sale go through? Was it related to the buyer couldn’t find financing or something else?

Gary Shiffman: Yeah. I can’t comment too much on RoyaleLife other than the same things that everyone is aware of that they have been taken under certain aspects of it have been taken under receivership and the recapitalization, as I understand it, is certainly stalled, if not terminated at this time.

Operator: And our next question comes from the line of Michael Goldsmith with UBS. Please proceed with your question.

Michael Goldsmith: Good afternoon. Thanks a lot for taking my question. My first question is on the guidance and some of the moving pieces there. I am not sure if we touched on this earlier, but it seems like the NOI guidance moves higher and then that would be kind of offset by the higher interest expense, as a result of not using the proceeds of this note to pay that down. So what were the moving pieces kind of like below the line that drove the FFO guidance lower, was that the Ingenia piece?

Fernando Castro-Caratini: Hi, Michael. No. Ingenia would have nothing to do as it relates. Only as it relates to the pay down the $9 million loss recognized is essentially marking the value of the shares at the end of the third quarter at A$4.20 to our ultimate sale price of A$3.90. So that would not impact our guidance. As it relates to the guide, certainly higher interest expense, as it relates to the note not being repaid. There’s some additional interest expense in there as well, but it’s primarily the note on the Park Holiday side from a home sales perspective, we provided guidance in July with the high end of about US$75 million. We are expecting that to be closer to the midpoint. And frankly, we give guidance and we provide ranges and some outcomes, right?

We have parts of the business that outperform and others that performs at the midpoint or to the low end. And transient mentioned in my remarks, transient revenue is down on a guide to guide standpoint where — when we spoke in July, we were expecting about a 4% decline in transient revenues and we are now expecting about a 7% on for the full year. We will look to offset and mitigate some of that impact with expense savings as we have done in the third quarter.

Michael Goldsmith: Okay. Thanks for that. My second question is a little bit more strategic in nature. What is the profile of the properties that you are looking for sale, like is there anything specific about the Sandy Bay property that made it a good candidate, was it the fact that had these development sites in like the additional capital into it? And then, finally, allowing the same line, do you have a target leverage ratio, which you are looking to move down to through the sale of some of these properties? Thank you.

Gary Shiffman: Yeah. On the Sandy Bay, I think, it — as we have shared, it just was, it’s very high quality, very high-profile property. The fact of the matter is that we determined we did not want to increase our capital exposure in the U.K., and therefore, took the offer and the opportunity to put it up for sale and we will continue to market it, and as I said during the income, as that process goes forward. So nothing particular about that. In North America, I think, what we shared before is, we did sort of a deep dive looking for where we can recycle capital. We looked at all of our properties, and the fact of the matter, we have some properties, where they are in a single location, we probably expected to be able to acquire more properties in the area, but the fact of the matter is, they are not efficient to operate without more properties in the area.

So those are the candidates. And then we have some smaller properties, that really don’t fit the size of the company right now in the way that we operate. So those are the types of things that fall in the bucket. They are all performing, they are not cats and dogs, and we just selectively bucketed those opportunities to recycle capital.

Fernando Castro-Caratini: And then, Michael, as it relates to long-term leverage targets. We stated our goal is to be at 5.5 times and below from a leverage perspective. Pro forma for the Ingenia stock sale, we are — on a trailing basis we are now at 6 times. So we will through free cash flow and then through these episodic sales we will look to get to and within that range.

Michael Goldsmith: Thank you very much. Good luck on the fourth quarter.

Operator: Our next question comes from the line of John Kim with BMO Capital Markets. Please proceed with your question.

John Kim: Thank you. In the U.K., can you just comment on, who drove the decision to move forward with 2 separate transactions with RoyaleLife? Was it the local Park Holidays team or was it your team in Michigan?

Gary Shiffman: As I said before, they are not related to Park Holidays. They are separate and distinct and it was management.

John Kim: Okay. Yes. I mean I am sure you are aware of this and you can hear this on the call, but in meetings you have had. But the performance of Sun is getting completely dominated by the U.K. business and I know you are looking to simplify and improve your balance sheet. But I am just wondering how much longer you could stomach having this much exposure to the U.K. and have you contemplated exiting the business? I know you don’t want to buy high and sell low, but looking at the forward growth prospects of all your different businesses, why not contemplate exiting the U.K.?

Gary Shiffman: Well, John, I think, it’s important to understand that, first of all, the management team is doing very well there. And the growth and reliability the real property income is achieving management’s goals, although home sales and the challenging environment aren’t and there’s been a big focus by stakeholders. Who clearly are focused on home sales and how they are lower than we originally guided to and the fact that it’s not the business or the percentage that we wanted to be able to contributing income. But we acquired the portfolio in a much different economic environment. When we took the opportunity in what was a strong economy to increase our manufactured home holdings by acquiring Park Holidays. The properties are themselves are excellent and we do believe in the business and the team.

That being said, unfortunately, the opportunity in the U.K. has been impacted by really strong economic headwinds, even though the core of the business is performing. So with that being said, in very challenging times, we continue to really review all of our options, but we are very supportive of what the team is accomplishing there and we are very aware of those people, who have shared with us their thoughts on the capital invested in the U.K. Our goal really…

John Kim: Just one more final question for me.

Gary Shiffman: Our goal really is to maximize value for that investment and as we continue to perform and view the U.K., we are happy to share any thoughts that we have moving forward.

John Kim: Just one more final question on me. On the sales that you are planning in the U.S., what kind of cap rate should we expect? You have taken out mortgage debt at 5%, obviously, the interest rate environment is not helping, but what should we be modeling in for exit cap rates?

Gary Shiffman: So I am going to suggest we are going into the market next week with the first group and it would be best if we are able to report realize market data and not interfere with the process that’s taking place as we go out to the market.

John Kim: Great. Thank you.

Gary Shiffman: Okay. Thanks.

Operator: Our next question comes from the line of James Feldman with Wells Fargo. Please proceed with your question.

James Feldman: Great. Thanks for taking my questions and I appreciate the commentary on the Board and management team focused on streamlining the company for growth. As I think about the last year, a big part of the Sun story for investors has really been just kind of surprises. Taking down U.K. Park Holiday guidance and then the loan — the U.K. loan. So as you are thinking about selling assets, deleveraging, I mean, that all makes sense. But like what can you say to like this process also making sure that there’s just not stuff that kind of catches people off guard or out of left field, that maybe you can’t see quite as clearly from the balance sheet or some of the reporting for the company?

Gary Shiffman: I am only going to suggest that there is a tremendous effort from the Board of Directors down to management to make sure that we provide as much transparency as we can. So that those type of surprises, although they weren’t economic headwinds in the U.K. came about very, very fast and had obviously dramatic impacts on these things that you are referencing. But I think what you are finding is that everything is clearly in disclosure and clearly open to discussion by the management team and we want nothing more than to be as transparent as possible. So that there aren’t any surprises going forward.

James Feldman: Okay. Thanks for that. And then as we think about — can you talk to what kind of pre-COVID run rates were for — whether it’s Marina business or even the MH business or even the U.K. business? Just to give us a sense of what we should expect in terms of longer term run rate for these businesses, once the COVID activity fade?

Gary Shiffman: I think that speaking to some communities, which has been public for 30 years. We have business lines that all have the same underlying fundamentals of high demand against very short supply and MH certainly affordable housing, which drives the high occupancies that historically performed very, very well in all economic times. And so when we share the fact that we have been able to get rental rate increases in excess of inflationary pressure throughout our history and have never delivered as a company, a fourth quarter period, where we didn’t have positive NOI growth. Our expectation and our goal with everything we are doing, with the rental increases, with the priorities that I shared with everybody, with the focus of the strategy that we have been implementing is to continue to get that same kind of same community growth and I have a drop down in an FFO per share basis to our shareholders.

So I think, historically, one has to look to how we performed and what we see as the outlook for certainly the rental rate increases that we have going forward and the high occupancies and demand is that we should be able to continue to grow and provide growth as we have historically done as a company. So we are optimistic about moving forward and we certainly have a lot of steps that we identified that we are taking to secure that kind of growth.

Operator: And our next question comes from the line of Anthony Powell with Barclays. Please proceed with your question.

Anthony Powell: Hi. Good afternoon. Thanks for taking the question. I guess in terms of RV expenses, you have done a good job of reducing expenses, when you have had lower, I guess, transient demand. Are you able to leverage these lower expenses, let’s say, next year, if you have a recovery or stabilization there or do you think you would have to add back more expenses and create some surprises on the expense growth line there?

Fernando Castro-Caratini: I think, Anthony, we are always on the lookout for efficiencies and there are certainly things we are learning as an ops team to run our properties more efficiently. But, certainly, there is flex, right, as it relates to the variable rate or the variable expenses with transient and we are looking at another very strong year of transient site conversions over to the annual side. We are already at 1,800 sites converted as of the end of the third quarter and our — would expect that elevated level of conversions to continue into 2024, which will — which does continue to reduce transient revenue as a percentage of total revenues for the portfolio.

Anthony Powell: Got it. Maybe one more expense question on insurance. I guess, so far this year, I think, it’s been a less destructive hurricane season. I know we talked about some initiatives to reducing service expense increases at NAREIT in June. So maybe update us on how you are looking at expense growth for insurance next year and will you be able to maybe have a better outcome on that line item?

Fernando Castro-Caratini: Sure. I just got back from London a couple of weeks ago with the initial meetings with the syndicate. The tone of the conversations is certainly more constructive than it was a year ago at this time and we are working through the insurance program as we speak with our broker and the syndicate itself. As we mentioned at NAREIT, we have not implemented significant changes to our historical insurance program and so that is something that we will be looking to do to mitigate the large increase that we saw this year of 40% across our MH, RV and Marinas business, but mitigating that increase year-over-year heading into 2024. As a reminder, our power program renews at the end of the year and so we will look to share with the market at that time once we have bound our coverage.

Anthony Powell: Great. Thank you.

Operator: Our next question comes from the line of Anthony Hau with Truist Securities. Please proceed with your question.

Anthony Hau: Hey, guys. Thanks for taking my question. Gary, you mentioned that you guys are focused on only pursuing the highest growth capital projects. Can you provide a little bit more color on what type of projects they are and what type of returns should you expect from these opportunities and what projects are you guys coming back?

Gary Shiffman: Yeah. I think it’s very, very limited scope. There will be certain expansions where there’s high demand in some of our MH communities and actually a backlog of potential sales. So some small expansion opportunity. And then, in Marinas, where we identify a great opportunity that provide 10% to 13% rapid returns on investments, reconfiguration of slips and other small expansions that we can do. Those are the type of areas that we will be focusing on.

Anthony Hau: Got you. I also noticed that the roof out rate year-to-date is like 3.7%, which is at least 100 bps higher than the last couple of years. What are the top reasons for the move out and where are the residents moving to home to? Is there a good difference in move-out rate for age qualifier or age?

Fernando Castro-Caratini: Anthony, that move-out rate is a combination of manufactured housing and RV. So the — what I can share is that as it relates to our manufactured housing portfolio move-out, rates are largely the same as they have been historically. We have seen some higher move-outs on the RV side. But as I shared a bit earlier, right, our 1,800 site conversions are a net number. So we are continuing to fill sites, fill vacancy as it relates to on the RV side and are implementing various strategies to look to lengthen that stay at our properties.

Anthony Hau: So the RV move out, they are not the park models that’s moving out, right? It’s mainly the wheel vehicles, right?

Fernando Castro-Caratini: That would be correct.

Anthony Hau: Okay. And like my last question is like for the assets that you guys are marketing next week, are these considered like 4 to 5 star parts and do they qualify for agency loans?

Gary Shiffman: I think they are a select small group, as I said, both small and large assets that would be high quality assets and my expectation is they would qualify for agency loans.

Fernando Castro-Caratini: Yes. Anthony, the comment would be that both Fannie and Freddie finance, manufactured housing across the quality spectrum. They also finance RV resorts that are beer mostly towards the annual side.

Operator: And our next question comes from the line of Steve Sakwa with Evercore ISI. Please proceed with your question.

Steve Sakwa: Yeah. Thanks. I just wanted to clarify maybe an answer that Fernando had given, I think, to John Pawlowski, early on about the collateral on the U.K. loan. Fernando, did you say that it was a — today it was at 80% loan to value or that the assets only were worth 80% of the loan amount? I just want to make sure I understood that correctly and I had a quick follow-up on that.

Fernando Castro-Caratini: Sure. Steve. 80% loan-to-value.

Steve Sakwa: Okay. And maybe back when the loan was originated, what was the loan-to-value when you guys work with the accounting firm to figure out what that collateral was worth?

Fernando Castro-Caratini: About 60% Steve.

Steve Sakwa: Great. Thanks very much.

Operator: And our next question comes from the line of Eric Wolfe with Citi. Please proceed with your question.

Eric Wolfe: Thanks. I guess is it possible just to provide interest expense guidance for this year, and then I guess, going forward, I mean, it would be great to get that. And then the second part of it is, is just if there’s anything considered in guidance like asset sales or something else that would reduce that interest expense later this year just so where is it?

Fernando Castro-Caratini: Sure. Eric, no perspective, acquisitions, dispositions or capital markets activities are factored into our guidance. For the full year we are expecting interest expense to be somewhere between $328 million and $330 million.

Eric Wolfe: That’s helpful. And then just a follow-up on Steve’s question there. Going from 60% to 80%, that’s mainly because the second piece, the seller financing was done at like 100% LTV. So originally, it was at 60% and then you added to the balance, I think, about $108 million, 109 million and presumably that was closer to like 100%. Is that the right way to think about it?

Fernando Castro-Caratini: Yeah. The additional the land sale that was sold in February was at 100% LTV. So that would increase the LTV and some additional accrued interest would also increase the LTV there. So it would not be a measure of the collateral itself.

Eric Wolfe: Right. And is it possible to provide the debt yield or NOI on the assets, debt yield maybe just the NOI and maybe debt [ph] or just the NOI just in general for the collateral properties?

Gary Shiffman: Yeah. I think that that’s something that is going to come out of the work that’s being done with the receivership, and at this time, there’s very little we can comment about those properties. But it is all inclusive of the third-party appraisals that we had done and so it is included to get to that value. But what I would suggest the vast majority is the value of the properties themselves and the entitlement.

Eric Wolfe: Great. Okay. All right. Thanks for taking the follow-ups.

Operator: Our next question comes from the line of John Pawlowski with Green Street. Please proceed with your question.

John Pawlowski: Yeah. Thanks for kicking the call going. Fernando, I just want to make sure I interpreted some of your comments of how NOI is going to flow through to earnings going forward. How I interpreted it was you do expect earnings growth for next year relative to calendar year 2023. Is that a fair interpretation?

Fernando Castro-Caratini: Yes.

John Pawlowski: Okay. Are there — back to Nick Joseph’s question about G&A, are there corporate cost-cutting initiatives going to lead to declines in G&A next year relative to calendar year 2023?

Gary Shiffman: Yeah. I think we would share that when we provide guidance.

John Pawlowski: Okay. All right. Thanks a lot for the time today.

Gary Shiffman: Thank you.

Operator: And we have reached the end of the question-and-answer session. I will now turn the call back over to Chairman, President and CEO, Gary Shiffman for closing remarks.

Gary Shiffman: Well, for those of you who are still on, we appreciate your patience and we really do look forward to providing full guidance for 2024 fourth quarter earnings call and I look forward to speaking to everybody then. Thank you.

Operator: This concludes today’s conference and you may disconnect your lines at this time. Thank you for your participation. ##

Part II Additional Information with More MHProNews Analysis and Commentary

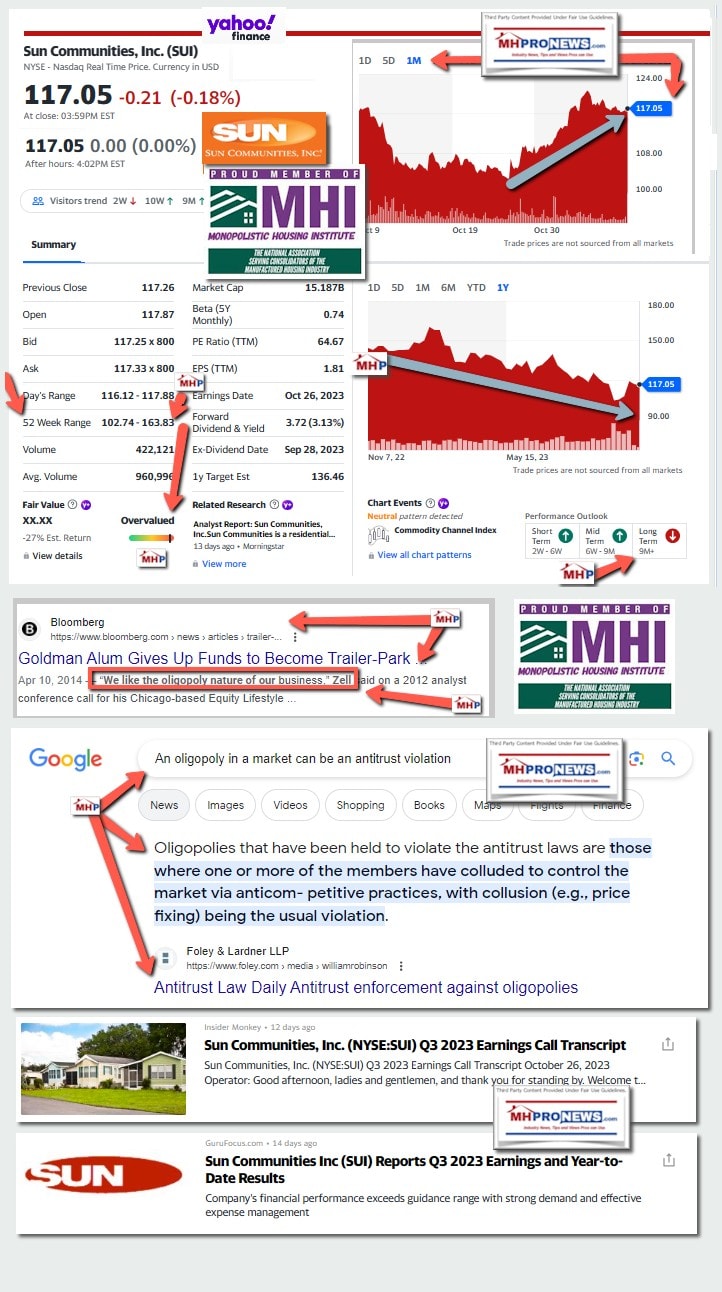

The base graphic below is from Yahoo Finance, but the Google search result on Sam Zell’s quoted remarks, arrows and collage arrangement are by MHProNews as part of this fact-check, analysis and industry-expert commentary. “We like the oligopoly nature of our industry.” – Sam Zell, per Bloomberg, citing a 2012 earnings call for Equity LifeStyle Properties (ELS). ELS and SUI both hold board positions on the main Manufactured Housing Institute (MHI) board of directors. According to the Foley and Larder law firm: “Oligopolies that have been held to violate the antitrust laws are those where one or more of the members have colluded to control the market via anticompetitive practices, with collusion (e.g., price fixing) being the usual violation.”

Price fixing is an element in the antitrust class action lawsuit that has been cited by plaintiffs’ attorneys in the cases shown and linked further below in this analysis.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Comparing the Sun Communities (SUI) earnings call insights to their previously reported press release is a worthwhile exercise for the detail minded. For instance, the press release discussed the sale of Ingenia shares.

In that same quarterly earnings press release above, Shiffman said: “Our current objectives include implementing select changes to help our best-in-class portfolio deliver the FFO per share growth Sun shareholders historically have enjoyed. These changes include selective capital recycling opportunities and using the proceeds to de-lever. With the strength of our core business, which has a positive track record throughout economic cycles, and our focus on our durable cash flow business, we remain confident in our ability to create shareholder value.”

That pull-quote from Shiffman in Sun’s quarterly earnings press release was an apparent indicator that they will put certain properties on the market, but the earnings call text above is much more explicit that then press release was. So, if an investor or potential investor read the press release but didn’t read their earning call transcript, it is a fact that might be missed.

There is more, but those two insights from the prior Sun press release should be explored with the following in mind.

In Part I, during their quarterly earnings call, the words “legal,” “suit,” “antitrust,” and “class action” are not found in this specific Sun Communities (SUI) quarterly earnings call transcript.

While one could make the observation that analysts may not have opted to ask a question about a large pending legal issue, neither did Sun’s leadership offer any verbal acknowledgement of those legal actions.

That said, per Sun’s 10Q is the following from page 40.

- Commitments and Contingencies

Since August 31, 2023, several putative class action complaints have been filed in the U.S. District Court for the Northern District of Illinois, Eastern Division, against Datacomp Appraisal Systems, Inc., us, and nine other large MH operators in the United States. The complaint alleges that the defendants have violated federal antitrust laws by sharing and receiving competitively sensitive non-public information to maintain artificially high site rents. The plaintiffs have moved to consolidate the complaints into the case captioned Carla Hajek and Gregory Hammerlund v. Datacomp Appraisal Systems, Inc., et al., No. 1:23-cv-6715.

Plaintiffs seek both injunctive and monetary damages, as well as attorneys’ fees. We are unable to estimate a range of loss, if any, that could result were there to be an adverse final decision in this litigation. If an unfavorable result were to occur, it is possible that the impact could be material to our results of operations in the periods in which any such outcome becomes probable and estimable.

We believe that the plaintiffs’ allegations are without merit and intend to defend against them vigorously. However, litigation is inherently uncertain and there can be no assurance regarding the likelihood that our defense of this litigation will be successful.

We are involved in various other legal proceedings arising in the ordinary course of business. All such proceedings, taken together, are not expected to have a material adverse impact on our results of operations or financial condition.”

With those remarks in mind, here are the linked reports that include the pleadings by the plaintiffs. Note that there are at least two known suits filed that include Sun Communities, not one, as the 10Q noted.

The signal of the possible exit from the U.K. investment is but one more example of how the automatic cheerleaders in the pro-Manufactured Housing Institute (MHI) segment of the balance of the non-MHProNews-MHLivingNews manufactured home industry trade media can fail their readers. It seems that almost whatever one reads with those sources that a leading MHI member may do, they are cheered. But Gary Shiffman has strongly suggested that they would exit the U.K. if the right deal came around.

Instead of focusing on ground up development in the U.S., which Shiffman previously said could be more lucrative than buying communities at a compressed cap rate, a big move was made into the U.K. Oops.

Analyst James Feldman’s inquiry might be seen as a solid hit too. “But like what can you say to like this process also making sure that there’s just not stuff that kind of catches people off guard or out of left field, that maybe you can’t see quite as clearly from the balance sheet or some of the reporting for the company?”

While Shiffman said: “So that there aren’t any surprises going forward…” one might make the argument that not mentioning in some form or fashion the possible threat to Sun’s bottom line from antitrust class action suits could catch some investors off guard.

There is still, in our humble view, far too much deference being given to Shiffman over the apparent embarrassment revealed last summer by the Detroit News and MHProNews. Shiffman may well be the chairman, president, and CEO of Sun Communities. But Shiffman is arguably looking more like Cavco’s Joe Stegmayer in the wake of those revelations. If he is capable of doing that – to his own mother – what is he capable of doing to his own investors? Isn’t that a fair question?

If and when a perceived scandal breaks out involving Sun – be it the New York legislation (see below), the antitrust class action suits (see above linked), another hit by an attorney general (see below), or something new – some may look back at the mounting evidence of embarrassments reported here and revealed in the linked reports and see in them evidence of apparent character and judgement flaws on the part of Shiffman. Those things matter — or should.

Evidence of Possible Warning Signs for the Broader Manufactured Home Industry?

In as much as Sun (SUI) appears to be pulling back to pay down debt and cut back on development, a fair question is how that will impact on manufactured home production.

Recall that Cavco Industries CEO William “Bill” Boor said that orders from manufactured home communities (MHC) were well off their normal pace (see his wording in the report linked below). He expected that drop from MHCs to continue through the end of the year. Boor said it would be “months” before manufactured home community owners would return in numbers.

Recall that manufactured home communities (MHC), per an MHI document that is now not available on the public side of their website, were previously reported by MHI to be about half of manufactured home placements. If that pattern holds, then there may well be an expectation that production in manufactured housing will remain at a lower ebb in the balance of 2023, and perhaps into 2024; time will tell. But it is a concern for producers and those who are counting on total national numbers.

Sun (SUI) investors ought to have someone press Sun’s board or leadership to press for policies that are focused on organic growth vs. consolidation. The fact that Sun has belatedly announced a pivot that will include selling some properties instead of acquiring and/or developing new ones ought to be another headline for investors. Recall that MHProNews has pushed this pull quote from Shiffman for some time, yet Shiffman has apparently ignored his own advice. Now, they are selling some MHCs? Is the disconnect from Sun’s leadership now somewhat more apparent?

If and when Sun spins off some of its properties, as Shiffman and company are saying that they will do, an autopsy or after action report (AAR) should be done. Would Sun have been better off doing more U.S. developing instead of doing some of their acquisitions? Would Sun have been wiser to support the use of “enhanced preemption” by the Manufactured Housing Institute of the Manufactured Housing Improvement Act of 2000? That later question arguably is certainly true for potential manufactured home buyers and possible manufactured home buyers and/or MHC residents. It should prove true for street retailers, producers, suppliers, and others too.

An Analogy in Reverse

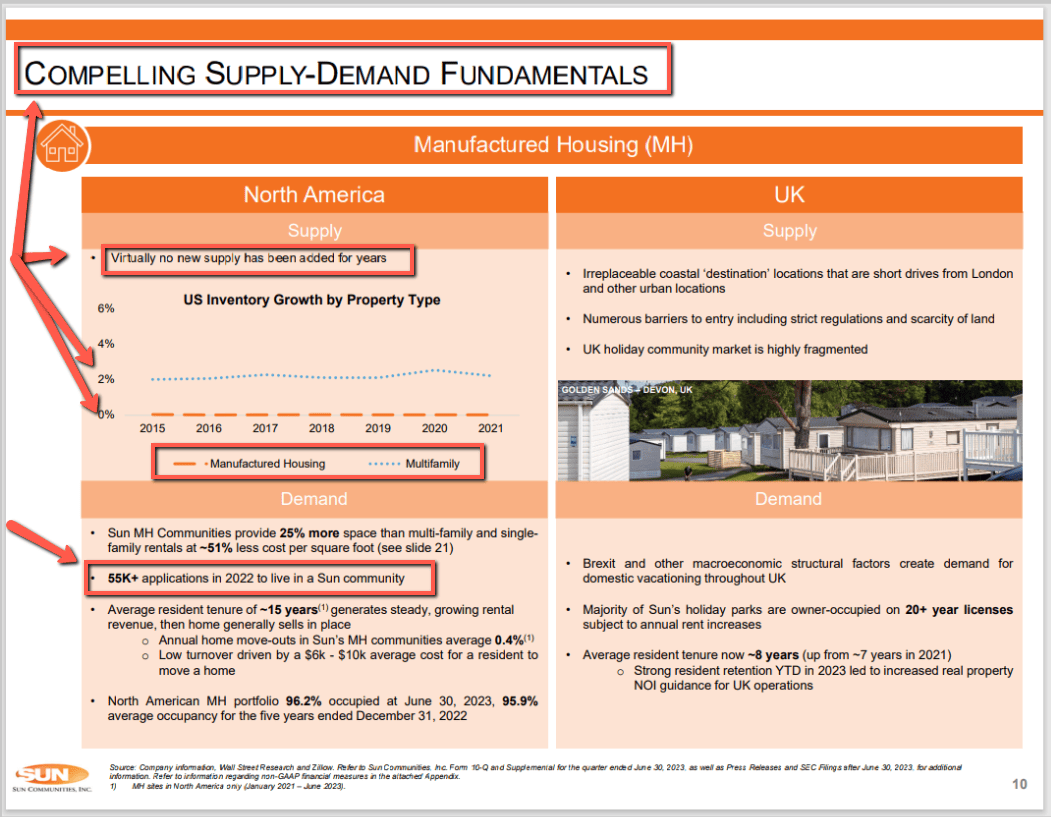

Imagine if the multifamily housing industry were bragging about the lack of new construction? It would seem bizarre, right?

But isn’t that what several prominent MHI connected community operators – Sun included – are doing?

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: depending on your browser or device, many images in this report can be clicked to expand. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

Perhaps it is time for Sun Communities (SUI) to dust off the Cavco ‘let’s change the logo!’ distraction? Or maybe they can get MHI to give them some more so-called ‘awards for excellence’? ##

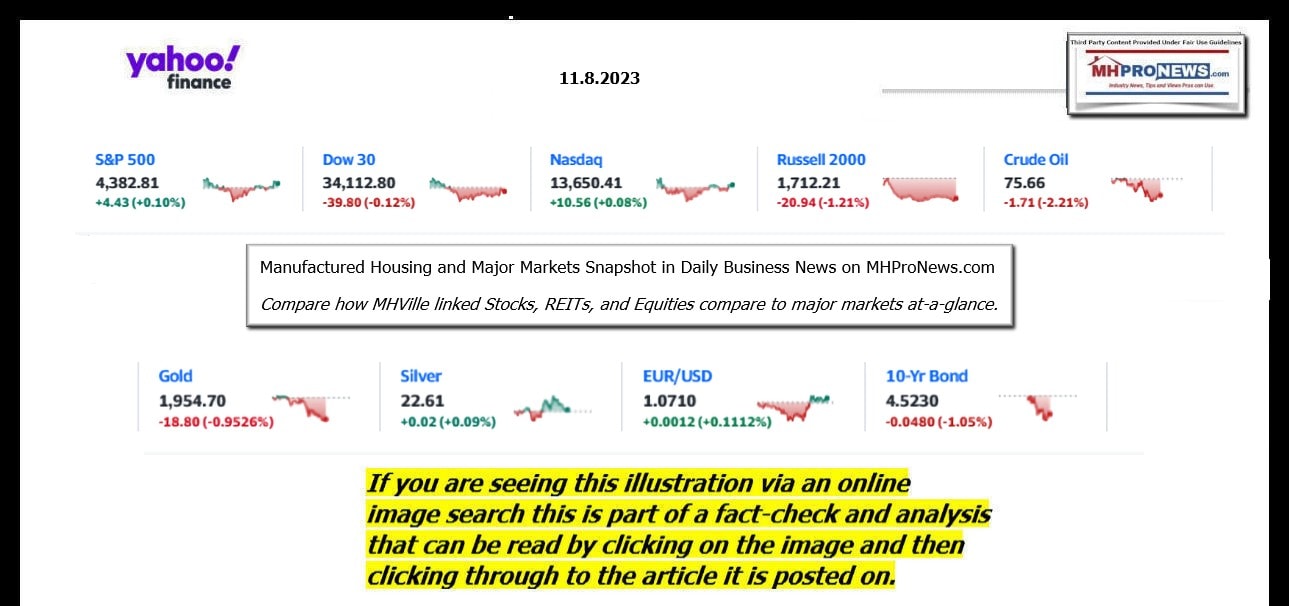

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 11.8.2023

- Mark Zuckerberg personally rejected Meta’s proposals to improve teen mental health, court documents allege

- Cleveland Fed President Loretta Mester to step down next year, adding to series of changes at the Fed

- A Citibank branch in San Francisco, California, U.S., on Friday, April 7, 2023.

- Citi targeted Armenian Americans and treated them like criminals, US regulator alleges

- Caesars Palace hotel and casino in Las Vegas, Nevada, US, on Friday, July 28, 2023.

- Tentative deal reached to avert walkouts at half of Vegas casinos set to strike

- A former Fox News correspondent is refusing to reveal a source. Her fate is now in a judge’s hands

- IAM Healthcare launches campaign to unionize retail pharmacy workers

- A self-driving GM Bolt EV is seen during a media event where Cruise, GM’s autonomous car unit, showed off its self-driving cars in San Francisco, California, U.S. November 28, 2017.

- Cruise recalls all of its self driving cars to fix their programming

- Perdue is launching Chix Mix, a snack inspired by antibiotics-free ingredients like corn, edamame and puffed wheat that Perdue’s chickens eat on a daily basis.

- Perdue made chicken feed for humans to eat

- Grove’s Theater marquee announcing the opening of “Barbie” movie is pictured in Los Angeles California, on July 20, 2023. “Oppenheimer” is facing off against “Barbie” in the biggest clash of Hollywood summer blockbusters, with both opening on the same day in a duel the media has dubbed “Barbenheimer”.

- ‘Barbie’ brought in $1.5 billion for Warner Bros. Discovery, but the company still lost money last quarter

- With big new EV motor investment, GM aims to cut reliance on China

- Facebook and Instagram will require political advertisers to disclose AI deepfakes

- Americans say the economy stinks. But they’re spending like it’s great

- The guy deciding how to spend $1.2 trillion from Biden’s infrastructure bill is expected to leave the White House

- What orange juice futures tell us about the state of our world

- Disney is in trouble. Bob Iger has 5 big problems to solve

- Outcome of Trump’s fraud trial could have ‘seismic’ impact on his business

- Beijing is ready to improve ties with US, says Chinese vice-president

- Chinese firms are increasing diversification outside of China, says HSBC CEO

- He was laid off by Elon Musk. Within hours, he had a plan to outdo Twitter

- Yet another CEO goes AWOL in China

- Optus outage affects millions of Australians, phone and internet connections still down

- S&P 500 and Nasdaq Composite notch longest streak of gains in two years

- Walmart is making noticeable changes in every store for morning shoppers. Here’s why

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.