According to Cavco Industries President and CEO William C. “Bill” Boor’s remarks during their August 5, 2023 earnings call, “…while [street] retail orders [i.e.: manufactured home ‘dealers’] are on the upswing, community orders are lagging…” Boor added that per their “…best estimates, we’ve [Cavco Industries] heard are that this issue [with lagging community orders for new manufactured homes] will start to ease up by the end of the calendar year […before] we’ll expect to see community orders improve.” The information from Cavco’s officials to analysts and investors presented during their ‘Cavco Industries First Quarter Fiscal Year 2024 Earnings Conference Call” – which covers the 2nd calendar quarter of 2023 – recounts more explanations of the asserted genesis of the sharp shift from long backlogs in early 2022 to only 60 percent plant utilization about a year later.

The steep decline in manufactured housing Boor described in his testimony last month to the U.S. Congress wasn’t asked about, nor mentioned during the August 5th earnings call. The word “Congress” is not found in the official transcript of the most recent earnings call as reported by Yahoo.

Part I of this report will be what Cavco designated as their “Q1 2024 Cavco Industries Inc Earnings Call” transcript, dated Saturday August 5, 2023. What follows has two apparent typos corrected (see [bracketed corrections]. Highlighting is added by MHProNews to draw attention to certain remarks. But that should not deter readers from absorbing all of what Cavco officials and analysts discussed. You don’t have to be a fan of Warren Buffett’s example and emphasis on reading to understand that the details matter and can prove profitable or costly. Tip: while not everyone can spend hours a day reading, think big and think priorities and find the time to read more with details and understanding in mind.

Part II will provide additional information with more MHProNews analysis and commentary. One of several items that will be spotlighted are remarks not made by Boor and Cavco that were made to Congress.

Part III is our Daily Business News on MHProNews recap of manufactured housing industry stock trends/performance, and the left-leaning CNN and right-leaning Newsmax ‘market moving’ news headlines.

Q1 2024 Cavco Industries Inc Earnings Call

[Covers 2nd Calander Quarter 2023]

Sat, August 5, 2023 at 2:45 AM EDT

In this article:

- CVCO

+3.46%

Participants

Allison K. Aden; Executive VP, CFO & Treasurer; Cavco Industries, Inc.

Mark Fusler; Director of Financial Reporting & IR; Cavco Industries, Inc.

Paul W. Bigbee; CAO; Cavco Industries, Inc.

William C. Boor; President, CEO & Director; Cavco Industries, Inc.

Daniel Joseph Moore; MD of Research; CJS Securities, Inc.

Gregory William Palm; Senior Research Analyst; Craig-Hallum Capital Group LLC, Research Division

Jay McCanless; SVP of Equity Research; Wedbush Securities Inc., Research Division

Presentation

Operator

Good day, and welcome to the Cavco Industries First Quarter Fiscal Year 2024 Earnings Conference Call. (Operator Instructions) Please be advised that today’s conference is being recorded.

I would now like to hand the conference over to your speaker today, Mark Fusler, Corporate Controller and Investor Relations. Please go ahead.

Mark Fusler

Good day, and thank you for joining us for Cavco Industries First Quarter Fiscal Year 2021 Earnings Conference Call. During this call, you’ll be hearing from Bill Boor, President and Chief Executive Officer; Allison Aden, Executive Vice President and Chief Financial Officer; and Paul Bigbee, Chief Accounting Officer.

Before we begin, we’d like to remind you that the comments made during this conference call by management may contain forward-looking statements including statements of expectations or assumptions about Cavco’s financial and operational performance, revenues, earnings per share, cash flow or use, cost savings, operational efficiencies, current or future volatility in the credit markets or future market conditions.

All forward-looking statements involve risks and uncertainties, which could affect Cavco’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of Cavco. I encourage you to review Cavco’s filings with the Securities and Exchange Commission including, without limitation, the company’s most recent Forms 10-K and 10-Q, which identify specific factors that may cause actual results or events to differ materially from those described in the forward-looking statements.

This conference call also contains time-sensitive information that is accurate, only as of the date of this live broadcast, Friday, August 4, 2023. Cavco undertakes no obligation to revise or update any forward-looking statements, whether written or oral, to reflect events or circumstances after the date of this conference call, except as required by law.

Now I’d like to turn the call over to Bill Boor, President and Chief Executive Officer. Bill?

William C. Boor

Welcome, and thank you for joining us today to review our first quarter results. While the earnings release provides year-over-year comparisons, I’d like to focus primarily on the sequential movements which I think are more relevant in understanding the current dynamics. From an operating and financial results perspective, this quarter was very consistent with Q4.

Sequential volumes were essentially flat, up about 2%.

Revenue was flat at $476 million and pretax profit was up slightly from $59 million to $61 million.

Our capacity utilization, as measured over all available days remain consistent as well at approximately 60%. So operationally, it’s been a steady quarter at the reduced pace with most of our plants remaining on a 4-day schedule, and costs are being well managed as indicated by the strong gross margins.

The most notable change this quarter was a meaningful pickup in wholesale orders. Backlogs edged lower from 7 to 8 weeks to 5 to 6 weeks, showing that production is still outpacing wholesale orders. However, the change was more modest than in the past few quarters, meaning the pace of orders did improve. Order rates were up year-over-year and up considerably over Q4. The pickup in orders is partly attributable to the improvement in retail inventories, which are now largely under control, and it’s partly due to increased home buyer activity. We need to see these trends continue in order to achieve balance with our reduced production rates and then we’d be able to start ramping capacity utilization up from there.

In our retail business and across our independent dealers and communities, there’s a continued confidence in the underlying demand, and that’s based on traffic, quotes and overall buyer activity. Interest rates and general economic confidence remain the questions for the near term. However, given the positive order trends, we believe we’ve seen the bottom of homes wholesale orders and we’re looking to return to full production schedules as soon as the market support develops.

I spoke about this last quarter, but continue to think it’s worth noting in these tougher operating times that our plants have done an outstanding job of managing margins despite reduced production rates. Factory-built gross margins remained healthy at 24.8%. This was certainly helped by lumber and OSB pricing this quarter and by continued healthy selling prices.

The business model is centered on the ability to keep controllable costs in our factories as variable as possible and our healthy profit and gross — our cash generation despite a challenging order environment as the result.

It’s been a fast 2 quarters since we closed on the Solitaire deal. The work to combine the companies continues to go well. One area of focus has been on developing new models and updating the existing lineup with a focus on high-quality lower-priced products in line with current market needs.

We’ve spoken in the past about the opportunities to round out product offerings across the combined retail operations and very good progress has been made there. As we continue to work off the purchased inventory, Solitaire’s impact on our results will develop as expected. Overall, there have been no surprises, and we’re very happy with the acquisition and the great people that have joined our Cavco family.

With that, I’d like to turn it over to Allison to discuss the financial results in more detail.

Allison K. Aden

Thank you, Bill. Net revenue for the period was $475.9 million, down $12.4 million or 19.1% compared to $588.3 million during the prior year’s first fiscal quarter. Within the factory-built housing segment, net revenue was $457.1 million, down $115.5 million or 20.2% from $572.6 million in the prior year quarter.

This decrease was primarily due to a decline in base business homes sold and a decrease in average revenue per home sold, partially offset by the Solitaire Homes acquisition which contributed $36.8 million in the quarter.

The decrease in average revenue per home was primarily due to more single wi[d]e in the mix and to a lesser extent, product pricing decreases. After utilization of Q1 of 2024 was approximately 60% when considering all available production days, but was nearly 70%, excluding scheduled downtime for marketer weather, consistent with the fourth quarter of fiscal 2023.

Financial services segment net revenue increased 19.2% to $18.8 million from $15.7 million primarily due to more insurance policies in force and higher premium rates. Consolidated gross profit in the first fiscal quarter as a percentage of net revenue was 24.8%, up 20 basis points from the 24.6% in the same period last year.

In the factory-built housing segment, the gross profit increased 40 basis points to 24.8% in Q1 of 2024 versus 24.4% in Q1 of 2023, driven primarily by lower material dollars per floor. As expected, Solitaire purchase accounting adjustments on acquired inventory continue to have a 40 basis point negative impact on our gross margins this quarter.

Under accounting rules, the inventory acquired upon purchase is recorded at fair value, which approximate the sales price. Therefore, when acquired inventory is sold, no operating income is recognized. We anticipate seeing the same impact for the next 2 quarters.

Gross margin as a percentage of revenue and financial services decreased to 24% in Q1 of 2024 from 32.6% in Q1 of 2023, resulting from higher insurance claim expenses from increased weather events, which included a very long period of daily storm activity in Texas.

Selling, general and administrative expenses were $61.7 million compared to $66.1 million during the same quarter last year. The decrease in these expenses is primarily due to lower third-party support costs and lower incentive compensation costs, partially offset by the addition of Solitaire Homes SG&A costs. Interest income for the first quarter was $4.6 million, up 251% from the prior year quarter. The increase is primarily due to higher interest rates on greater investment cash balances increased lending under our commercial loan programs.

Other income net this quarter was $0.1 million compared to $0.4 million of expense in the prior year quarter. This increase is primarily driven by unrealized gains on equity securities held in the current year compared to losses in the prior year.

Pretax profit was down $18.6 million or 23.5% to $60.7 million compared to $79.3 million for the prior year period.

The effective income tax rate was 23.5% for the first fiscal quarter compared to 24.7% in the same period last year. In the prior year period, Energy Star credits had expired and had not yet been fully extended. Therefore, the current period tax rate is more indicative of our future rate.

Net income attributable to Cavco shareholders was down $13.2 million or 22.1% from $46.4 million compared to $59.6 million in the first quarter of the prior fiscal year. Fully diluted earnings this quarter was $5.29 per share versus $6.63 per share in last year’s first quarter.

Before we discuss the balance sheet, I’d like to take a minute to talk about capital allocation. As announced with our press release, the company’s Board of Directors approved a new $100 million stock repurchase program that may be used to purchase our outstanding common stock. This increases the total availability to $135.7 million. This includes the remaining amount under the program previously announced last year.

With that, we will continue to responsibly deploy capital in keeping with our strategic priorities.

Our capital priorities remain an improvement, further acquisitions and ongoing evaluation of the opportunity in our lending operations. We will continue to utilize buybacks as a tool to responsibly manage our balance sheet.

Now I’ll turn it over to Paul to discuss the balance sheet.

Paul W. Bigbee

Thank you, Allison. When me compare the July 1, 2023, balance sheet to April 1, 2023, the cash balance was $352.2 million, up $80.8 million or 29.8% from $271.4 million at the end of the prior fiscal year. The increase is primarily due to net income adjusted for noncash items such as depreciation and stock compensation expense, and other working capital adjustments, including inventory, which decreased $9.2 million from lower raw materials at our factories and finished goods at our retail locations.

Cash also increased due to the sale of consumer loans greater than originated, partially offset by commercial loan originations exceeding payments received. Prepaid and other assets are down from lower prepaid taxes and normal amortization of prepaid expenses. Property, plant and equipment net is down from the sale of equipment acquired with Solitaire Homes. And lastly, stockholders equity exceeded $1 billion, up $47 million from $976.3 million at the end of the prior fiscal year.

This concludes the financial review. Now I’ll turn it back to Bill.

William C. Boor

Thanks, Paul. Our results this quarter highlight the ability of our organization to manage costs and generate cash even when conditions are challenging. Everyone at Cavco is ready for, what we view as an inevitable return of demand so we can help more families get the homes they need.

With that, Avigal, let’s turn it over and open up the line for questions.

Question and Answer Session

Operator

(Operator Instructions) Our first question comes from Daniel Moore with CJS Securities.

Daniel Joseph Moore

Sorry about that, muted. Thank you, Bill, Allison, Paul. Thanks for taking the time and the questions. Maybe — and Bill, very helpful color in terms of the cadence of orders and demand. Maybe if you can delineate across end markets, starting with retail, then the REIT channel and community developers what’s the cadence of order to look like throughout the quarter and thus far into fiscal Q2?

William C. Boor

So you’re just looking for kind of relative differences between those?

Daniel Joseph Moore

Yes, exactly. Exactly and the rate of improvement and whether that’s continued thus far in the current quarter.

William C. Boor

Yes, it has continued. I mean I think we talked last time about order levels and the fact that they left the fourth quarter basically not confused the time period. So March was stronger than January, right? If you would expect seasonally, but it was good to see it. And that’s what we kind of reported on last quarter. And that strength kind of continued to carry through.

And as I said, we had a pretty nice sequential increase in order rates this quarter. To take it deeper, because I think is part of your question, a lot of that strength, I think, is really coming from the dealers, the independent stores and are obviously Cavco owned stores. We’ve talked about the inventory problem. And last quarter, we said that we really thought that was going to — it’s not like it immediately is an on-off switch, but that was going to largely be behind us sometime during this first quarter.

And I think that’s the case from a total inventory perspective. And so right away, you kind of get the lift of starting to get to 1:1 orders, right? They sell a house and they need to order another home from the factory. So that’s kind of played out as we expected it to when we talked last quarter. So a lot of the uplift in order rates has really come from the dealers. The communities are lagging a little bit. I mean it’s — it’s interesting to think about. I think they’re dealing with their own form of an inventory problem.

And we’ve talked this in the past, and I think it’s hard to generalize across the thousands of communities that are out there. But I think the community inventory problem takes 2 forms. Some communities have set houses that are ready to be occupied and they’ve seen a slowdown in filling those homes. So they’re not going to be ordering. And then we’re ordering as fast, more than either or, but they’re going to be kind of on the slower side of wholesale orders.

And then other communities, when we’ve talked to this, they have unset homes. They have inventory of homes they previously ordered and that were largely delivered that they haven’t been able to get set in place due to permitting and crew problems, set-up crews. And so if they could set more quickly, they feel they do have the demand that they’re not able to get their homes ready to be occupied.

So I don’t mean to complicate this, but I think we’ve got a little of all that going on in the community side. And the total effect is that while retail orders are on the upswing, community orders are lagging a bit. We’ve talked to folks, both our people talking to the communities and also at a higher level with some of our large REITs. And best estimates, we’ve heard are that this issue will start to ease up by the end of the calendar year, and we’ll expect to see community orders improve, which will be upside from the pace of ordering we’ve seen now.

And that’s all. Every time I talk about that, looking forward, I always feel like I’ve got to say that’s all assuming macroeconomic factors kind of allow that, right? There’s — we’ve seen what happens when there’s kind of a shock or a big upswing in interest rates and things slow down. But macro factors permitting, I think the communities will pick up yet this calendar year. So that was a mouthful, Dan, did I cover the bas[e]s?

Daniel Joseph Moore

Without a doubt. No, I found that, that was extremely helpful. And in fact, maybe just delineate a little bit further between communities and REITs, any difference or delta between the factors that you just described there? And what they’re saying about their likely plans as we look to the balance of the year and next year?

William C. Boor

I’m not sure what you’re asking for delineation. I was kind of talking through collectively the REITs and therefore, the community operators.

Daniel Joseph Moore

That’s fine. We kind of finish that off-line. But maybe talk about your — as you mentioned, in order to start to see an uptick in factory utilization need to see orders continue to build. I believe I heard that correctly. What are your expectations for shipments as well as ASPs directionally for fiscal Q2 which we expect shipments to be basically flattish from here, a little — maybe a little bit of pull back? What are your thoughts?

William C. Boor

Yes. We kind of stay away from guiding because I think it’s still subject to changes in the market. So it’s I’d kind of shy away from making a prediction about it. And my comment was as you picked up, it was that — it’s not only the level of backlog that matters, it’s the direction of backlog. And we haven’t turned that around yet. We saw another bit of drop in backlog this time.

It was a much smaller drop so the pace of that drop is improving. And I guess I’m being very repetitive here, but that pace was improving because the orders were up. Our production level was pretty steady in the last 2 quarters. So we just need that trend to continue. I think it’s on the right trajectory where we’ll see backlogs first stabilize, which would be great. And then hopefully start to build with our 4-day schedule and again, hopefully return to a level that supports us starting to take plants on a local basis back up to full schedule.

So I’m not trying to make a prediction as much as you’re saying that’s — those are the trends that we’re going to keep an eye on, and we’re going to be looking forward to that time we get our utilization back up.

Daniel Joseph Moore

Understood. Maybe…

William C. Boor

Pricing — you asked about pricing as well, Dan. You asked about pricing as well, and that’s very related, right? If the supply and demand balance supports, I think the industry is shown good discipline in holding price as well as it has. So all we need is for those backlogs to stabilize and start turning the direction and then that would support prices. If something happens to disrupt demand, then I think it’s a real risk as it always is in this industry.

Operator

Our next question comes from Greg Palm with Craig-Hallum.

Gregory William Palm

Maybe starting off on following up on a couple of Dan’s. Can you maybe quantify exactly kind of what you’re seeing in terms of order rates, whether that’s a sequential or year-over-year basis? And then just specifically, what are you — what are you seeing in July? Are you seeing sort of same magnitude of what you were seeing in the quarter? Are you seeing better? Are you seeing worse? And then maybe just kind of remind us what kind of normal seasonality is in terms of order rates on a normal year?

William C. Boor

Yes, I can take a stab and then ask few other folks to correct, if I get this off or anything, I’m looking at some data here. And I’ll give you the numbers. We haven’t historically done this, but on a same plant basis, which basically what’s not included in these numbers is the Solitaire acquisition.

But on a same plant basis, we’re up about 25% year-over-year on orders. And quarter-to-quarter, we were up about 65%. So pretty big jumps. Last year — I think I’m right about this, last year, we were in a period now where we are starting to see cancellations in the orders drop off. So I really think it’s more instructive to focus on sequential. There’s the data on both. And Greg, could you remind me the second part of your question?

Gregory William Palm

Yes. What are you seeing in July specifically in terms of order rates? I mean anything that may be different relative to the quarter? And then I guess if you can just remind us kind of what normal seasonality is on — for a typical year in terms of orders?

William C. Boor

Yes. I wouldn’t note anything different in July kind of the continuation coming off of the last quarter information I just shared. So nothing of note there.

And seasonality — it’s interesting. We’ve looked at this. And kind of if you take the year, this is going to be way too simplistic, but I think if you looked at the year kind of late March time frame through October, that tends to be considerably higher, and then things drop off after October seasonally when you get into November, December and the early part of the calendar year as far as the seasonality.

But I’ll tell you the seasonal shifts in some years where you’ve got a lot of bigger things going on like we have, like the interest rate adjustments and the macroeconomic drivers kind of shifting on folks as far as confidence, the seasonal aspect can sometimes get dwarfed by that. But we should — we’re not hitting a period where we’d expect things to drop off seasonally. We should be in — from that perspective, be in a good zone through October, at least.

Gregory William Palm

In terms of the commentary on the community orders and more or less on the timing, how is your visibility? And I think what you said was expect to see some orders, I don’t know if it was by year-end or towards the end of the year, but can you give us maybe a little bit finer point on when you think — I know your crystal ball is not perfect, but just based on all the information we know today.

William C. Boor

Yes. Well, thanks for acknowledging it perfect because I was feeling that way as you’re asking the question. Yes, I think my only statement is that just about everyone we talked to internally and externally, kind of feels like this is something that will be worked through in the next couple of quarters. So that’s why I didn’t really pinpoint it. I don’t know. These things don’t happen.

I always say that they don’t have been like a on and off switch. So hopefully, we’ll be able to see this ease during the period. But even in talking to our big REIT customers, they’re kind of feeling like, hey, by the end of the year, we should be “back to normal,” meaning as I’m defining it an inventory problem that they have is kind of worked through. So it’s a little bit analogous to what we went through with the dealers and the communities just seem to be on a little different time schedule. So I can’t pinpoint it by months.

Gregory William Palm

Yes. But just to be clear, is that — does that mean they order in advance, so they’re ready to start taking more units by the end of the year? Or is your expectation that they start sort of ordering the units and then it’s another handful of weeks or months until they actually take delivery and set them up?

William C. Boor

Yes. That’s kind of fine-tuning. We do expect that we’ll see — if we have an expectation, we do expect that we’ll see orders in that time frame. And keep in mind, our backlogs are pretty short. So all of our customers know that orders turn into shipments pretty quick when backlogs are this short. So they won’t be ordering with an assumption that, that means for delivery for in the future.

But it should be really — when we have this sort of a backlog, which is a good thing in this regard, it should be pretty just in time. They make an order, we’re putting it into production and getting it to them.

So anyway, long-winded way of saying, I think the answer to your question is, yes, we’re hoping that we’ll have communities strengthening to support the order trends we’re seeing from street dealers right now.

Gregory William Palm

Understood. And last question around margins. Do you have — I think you mentioned increased claims in the financial services. Do you have sort of any visibility on whether that might impact this quarter as well? Or do you feel like that was just sort of a one quarter kind of thing?

William C. Boor

Yes. It’s weather. Everything that our insurance company is doing to run their business. They feel real good about their costs are right, they’re getting appropriate premium increases, which are — that’s the whole process to get states to approve premium increases. And it takes a little time for the premium increases to kick in. But that business is operating as we expected to. They just had high claims.

And so in my view, we had a number of storms, none of which were catastrophic so they didn’t get into the reinsurance levels. And on the kind of near-term outlook, there’s no reason to think that correlates necessarily to a continuation of storm events for the rest of the year.

So it’s kind of just from a planning perspective, that past quarters kind of isolated, and we’re looking forward to an insurance company. Over time, they’ve done real well for us economically as far as getting a good return and making profits. But a little bit of the nature of the game that periodically can get hit with a rash of storms. I’m not sure if that was a clear answer, but going forward, I don’t see that there’s any reason to expect a continuation.

Operator

(Operator Instructions) Our next question comes from James Canless — McCanless, with Wedbush.

Jay McCanless

So Bill, congrats Cavco’s unit decline was about half of the 28%, 29% decline we saw in the industry shipments. I guess could you talk about how flexible you’ve had to be on price to do better than the industry. And then also on the flip side of that, now that we’ve seen lumber prices starting to work their way up. Have you guys been tightening up on pricing just in the eventuality that higher lumber prices are going to start to flow through?

William C. Boor

Yes, I really don’t think we’ve I don’t think we’ve maintained or gained any market share through pricing through being more aggressive on pricing. I really don’t believe that’s the case. Just as we talk to all of our plants, we’re in constant touch with them and have focus calls every month. We go through them kind of sensing what’s right to do in their market.

And for the most part, when they’re kind of looking and talking to their own customers, the dealers, they feel like we’re priced right with the other manufacturers. So I think we — I’d like to think that we’ve got really good relationships with our dealers. I think that pays off over time. And I attribute any strength there to us focusing on the independents and doing a good job for them, but I don’t think it comes from pricing. The question about lumber coming up. We always talk about our gross margins and kind of an obvious way that partly driven by those costs, and it’s partly driven by price.

But I’ve also said that for the last couple of years now, I think the price we charge as an industry, but us as well for our homes is a little bit disassociated with the cost. It’s been driven by the supply and demand of our homes. So I don’t — I guess, that’s a way of saying given where we are now, I’m not sure I believe that we’re going to necessarily be kind of correlating pricing uptick in lumber and OSB prices, if that makes sense. We’ll be kind of looking at it more from the standpoint of our competitive position and the supply and demand of homes and all those local markets.

Jay McCanless

Could you talk about where chattel mortgage rates are now versus maybe last quarter and last year?

Mark Fusler

Yes, Jay, this is Mark. I can take that one. So they’ve been pretty consistent sequentially. So right now, they’re still about 9.15% to about 9.4%.

Jay McCanless

And then, I guess, the other question I had, just thinking again about capital allocation, the new authorization. Could you maybe talk about whether you do more stock repurchase first? Or does it make sense to expand on the floor plan side? Maybe just some general thoughts about that.

Allison K. Aden

James, let me help with that. Yes. I think if you take a step back, we’ve been very diligent since our first authorization, which was a couple of years ago. In using the repurchase authorizations, and we do have $35 million on our previous authorization. And the Board just gave us another $100 million. So we really use these stock buybacks as a balance sheet management tool that remains available to us as something that we do plan to execute upon.

We recognize that this creates maybe too much attention to when we are and are in the market in a given quarter. We’ve had markets in the quarters in the past when we didn’t repurchase and there’s a variety of considerations. And I wouldn’t read too much into the fact that we were in the market except to say that we’re not generally speculating our stock price when we make these decisions.

We’re really managing the balance sheet and making sure we’re conservative about position of any nonpublic information. And we still invest around our strategic priorities, which are expansion of plant operations and ongoing evaluation of opportunities and lending operations that are right down the center of manufactured housing. So just taken as a whole, it’s just our continued focus on using stock buybacks as a responsible way to manage the balance sheet.

Operator

Thank you. That concludes the question-and-answer session. At this time, I would like to turn it back to Bill Boor, President and CEO, for closing remarks.

William C. Boor

Thank you. I apologize for that. Despite our reduced production schedules and our plants are still operating efficiently. And our retail organization continues to proactively drive lead generation and sales, and we’re providing valuable tools to our retailers and prospective homebuyers with our digital marketing advances. And all of this, combined with our strong balance sheet, puts us in a great position to take what the market offers at the moment and be ready to ramp up when the inevitable release of demand occurs.

The housing affordability problem continues to worsen. And while near-term economic drivers can slow orders, the underlying need and demand is only increasing. So with that, I want to thank you, as always, for your interest in Cavco, and we look forward to keeping you updated on our progress.

Operator

Thank you for your participation in today’s conference. This does conclude the program. You may now disconnect.

Part II – Additional Information with More MHProNews Analysis and Commentary – Featuring What Boor Didn’t Say to Investors and Topics Raised with Congress

Information that is ‘material’ to investors is supposed to be disclosed, per the Securities and Exchange Commission (SEC). Some investors may watch, listen to, and/or read Bill Boor’s remarks to Congress, but others won’t. There are no known surveys of investors that identify what percentage read earnings calls vs. those who might read statements by corporate officials like Boor to lawmakers.

To illustrate that point, MHProNews asked Bing’s AI function: “Is there polling on what percentage of Cavco Investors read Bill Boor’s remarks to Congress in July 2023?”

Learn more:

- manufacturedhomepronews.com 2. congress.gov” Note that Bing provided MHProNews’ official remarks as prepared by Boor to Congress in the linked footnoted remark above, and another reference on MHProNews as the #1 linked response under their “Learn more” category. In that short quoted section of Bing’s results above, MHProNews rated two distinct but related linked results.

That said, Boor should be thinking that every time he speaks publicly on issues impacting manufactured housing, he is potentially sending signals to current or potential stockholders. Consider the following search results of the Cavco earnings call transcript with the following hot topics in MHVille, many of which were raised in his remarks to Congress.

- 1) Boor didn’t mention the DOE energy rule suit to analysts and investors (zero mentions, per MS WORD’s search tool of the Cavco Earnings Call transcript).

- 2) Boor didn’t mention zoning barriers (zero mentions).

- 3) Boor didn’t mention the Duty to Serve (DTS) – zero mentions in the above.

- 4) Boor didn’t mention FHA Title I lending (zero mention).

- 5) As noted above the word Congress is not mentioned by anyone during the earnings call, all per the Yahoo transcript and an MS WORD search of those bold key words (phrases) in these bullets.

To illustrate the issue, MHProNews asked Bing AI: “When a president or CEO of a publicly traded company speaks publicly on issues relating to his business, does the SEC consider those remarks material from an investor’s viewpoint?” MHProNews has added highlighting to part of the Bing response. MHProNews has turned the hot-linked sentence after the yellow highlighting to bold red to illustrate the potential legal liabilities concern being illustrated by this segment of our fact check, analysis, and commentary.

MHProNews asked Bing AI: is there potential liability for a publicly traded company when a material issue is omitted or not discussed by the president or CEO of a company? The first part of the reply had to do with ESG, which wasn’t specifically the issue at hand, but the balance of the reply illustrates the concern about possible liability or other legal exposure for Cavco and/or its leader(s).

- 1) Boor didn’t mention the DOE energy rule suit to analysts and investors (zero mentions, per MS WORD’s search tool of the Cavco Earnings Call transcript).

- 2) Boor didn’t mention zoning barriers (zero mentions).

- 3) Boor didn’t mention the Duty to Serve (DTS) – zero mentions in the above.

- 4) Boor didn’t mention FHA Title I lending (zero mention).

- 5) As noted above the word Congress is not mentioned by anyone during the earnings call, all per the Yahoo transcript and an MS WORD search of those bold key words (phrases) in these bullets.

A MHEC industry insider speculated to MHProNews that Boor could be preparing a pivot at MHI. That would likely mean he would be doing so for his firm too (hard to justify doing something for ‘the industry’ and not do it for your own company). While a positive pivot by Boor would be welcomed, there is no known apparent evidence MHProNews is aware of for such a speculated pivot. The four MS WORD search results above illustrate that point.

MHProNews put this question to Bing’s AI chat function. “Is there any evidence that Bill Boor is about to shift policies at the Manufactured Housing Institute on zoning and finance?”

I hope this helps.

Learn more:

Note that last May, Gregory Palm put Boor on the spot with respect to the general underperformance of manufactured housing.

3 months later, there was no such similarly pointed question by Palm or other analysts to Cavco’s officials.

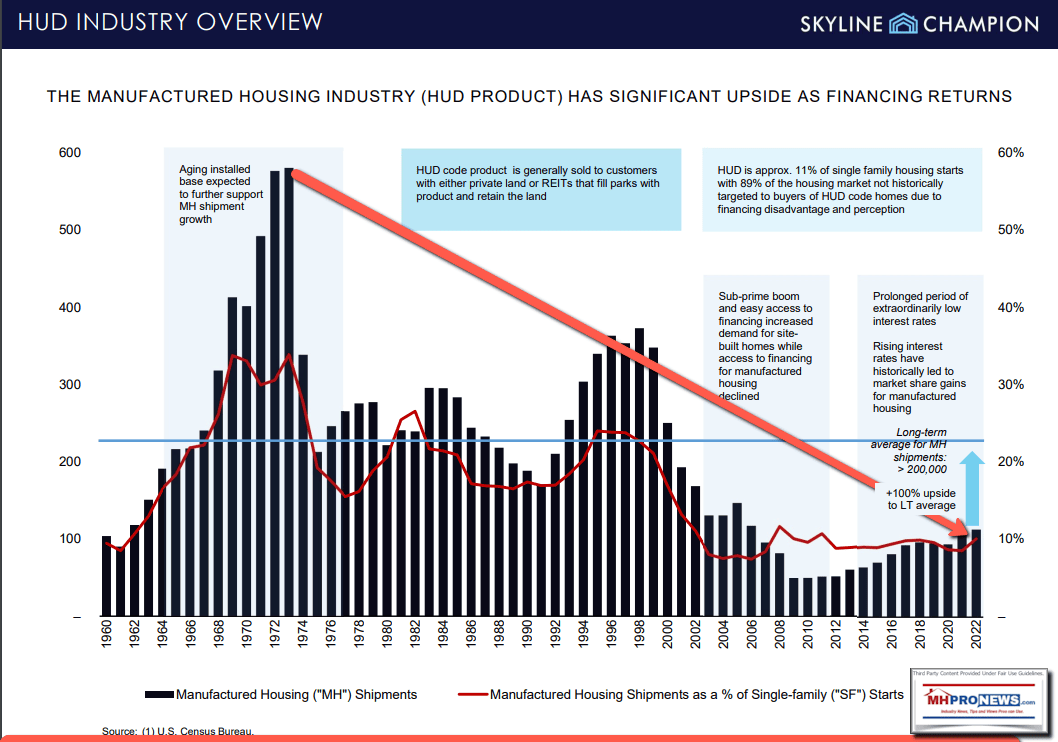

Yet, despite ongoing happy talk about the industry’s (or Cavco’s) production improving, the evidence is that manufactured housing industry production is still in retreat year over year, per the latest data. Indeed, when Boor admits that orders from communities are likely to lag through the balance of 2023, that’s a signal that manufactured housing’s recovery is going to continue to lag.

Additionally, doesn’t it seem odd that their big REIT customers (plural) are all having the same issues? All of them, after years of buying homes and setting them up are suddenly far behind? After years of working with local officials on installations, they are suddenly backed up? Why the analysts didn’t ask about such issues is baffling. It is entirely questionable to strain an analogy with street retailers than to manufactured home communities (MHCs), because there are obvious and distinctive differences. Retailers are routinely encountering a range of different installation scenarios, unless they are tied to a specific community(ies) or development(s). By contrast, with MHC operators, be the MHC a giant REIT or a mom-and-pop owned community, there are routines that ought to be in place if they have been selling for years. At a minimum, such remarks logically ought to raise questions, especially for a firm that just emerged from a multi-year cloud and legal controversies involving the Securities and Exchange Commission (SEC). For those who think that collusion is at play at various levels among certain Manufactured Housing Institute (MHI) members, the Boor remarks on communities is worthy of questioning too – did all agree to a certain narrative? And if so, why? While what Boor said might be innocent and accurate, given the kind of stunning game-playing Cavco was alleged and documented to be involved in by the SEC, it is up to inquiring minds to raise the questions and see what emerges.

These remarks spotlight concerns raised by MHProNews some years ago, that are routinely missed by others in MHVille trade media.

Boor led Cavco is arguably correct in saying that the opportunities in affordable housing – and thus manufactured housing – are tremendous. Quoting Boor above: “The housing affordability problem continues to worsen. And while near-term economic drivers can slow orders, the underlying need and demand is only increasing.” All of that has elements of truth. But aren’t they truths that are incomplete, and perhaps paltering? To broadly illustrate the concern in the business world, the left-leaning Washington Post said on December 29, 2016 — “A common type of deception known as ‘paltering‘ — one many have witnessed but probably didn’t know what to call — turns up in business …” Harvard University published a paper in 2017 called: “Artful Paltering: The Risks and Rewards of Using Truthful Statements to

Mislead Others” which said in part that: “Our findings reveal that paltering is common in negotiations and that many negotiators prefer to palter than to lie by commission.” Given indicators that clever or other forms of deception appear to be common with some business leaders, per those who have researched it, and given Cavco’s recent history, it could be foolish not to consider the possibility that paltering or other forms of deception are at play.

Recall that Boor said during a prior earnings call that: “we’ve got a great opportunity here, I think as an industry to catch up with [conventional] building.” That too was true enough. But it has been true for decades, as Eric Belsky’s remarks turn of the century remarks once touted by MHI demonstrated.

When Cavco tells investors that the opportunities in manufactured housing are tremendous, and editorially MHProNews agrees on that narrow remark, it begs the question. Why has the industry failed to fully and robustly tap into those opportunities that have existed for decades? Yesterday’s flashback-fast-forward report illustrates the sometimes stunning disconnects (and equally revealing similarities) between what MHI leaders were saying during Gail Cardwell’s term as president and CEO vs. what is occurring during Lesli Gooch’s tenure as CEO.

If manufactured home industry professionals can be successfully deceived by the thousands and it cost many their businesses, then that stark 21st century lesson can’t be forgotten by the survivors in the industry. Note that for a time this writer admits to also being partially misled by the gameplayers at MHI who have been credibly accused with evidence of manipulating the market, so there is no shame in being a victim of deception (that shame aptly belongs to those who deceive and palter, etc.). And who are MHI’s defenders? Among them are those who are rewarded or capitalizing on their own brands of paltering. As a possible parallel to make the point, whatever side of the Biden-Trump debates one happens to be on, each of those camps believe that the other is a crooked and possibly traitorous criminal. If that is occurring at the highest levels of the U.S. government, why would it be a surprise if a more modest version of it is at work in manufactured housing?

Cavco’s $135.7 Million Dollar Opportunity

There are numerous possible points in the above that could be picked apart by someone that actually understands manufactured housing. But let’s focus on the dollars that are being set aside by the Cavco board for possible stock buybacks.

One key problem for Boor and Cavco appears to be that they are saying several of the right things.

- Yes, the opportunities in manufactured housing are tremendous.

- Yes, the industry could be building potentially millions of units to help close the gap between what Cavco asserted is a 6-million-unit shortage of affordable housing.

But that being so, it begs the question. Then why isn’t Cavco operating a full capacity and building more plants with that $135.7 million dollars that they have instead made available for stock buybacks? Aren’t there several logical disconnects?

Which is going to give investors a potentially better return on investment and return of investment? Stock buybacks during an affordable housing crisis? Or successfully navigating the challenges that Boor told Congress that it faces? Restated, why are remarks to Congress and remarks to investors not 100 percent in alignment?

that the industry ought to expect this current downturn because more expensive site-built housing is also in a downturn? MHI’s research and reasoning are arguably a classic example of PALTERING and the use of a RED HERRING logical fallacy. Note: depending on your browser or device, many images in this report and others on MHProNews can be clicked to expand. Click the image and follow the prompts. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

A “What If” Illustration with that $137 Million Dollars

Litigation can be costly. An attorney was contacted by MHProNews to ask, what might the cost be to litigate the issues that researchers and Boor himself have said are holding manufactured housing back? What would it cost to press the case for the Manufactured Housing Improvement Act (MHIA) of 2000 and its so-called “enhanced preemption” clause? What would it cost to litigate the Duty to Serve issue? What would it cost to not just slow or stop the DOE energy rule, but defeat it legally in court? The answer was interesting. ‘It depends.’ It could be fairly inexpensive, depending on how the legal issues are approached. But it could cost millions of dollars. Fair enough.

So, if several million dollars were set aside by a firm like Cavco – perhaps in concert with others (more on that further below) – to litigate those issues the potential result could be that the industry may achieve it long awaited breakthrough. What seems a given is that doing more of the same is only going to result in the same outcome. Manufactured housing hasn’t won the proverbial lottery – ever. The industry has always had to work hard and fight to get what it wanted.

If, for example, hypothetically $25 million dollars was set aside to robustly lobby and litigate the industry’s key issues – all with the goal of total success – and if the industry was successful, then the potential to do hundreds of thousands of new manufactured home sales every year could be achieved. As the university law professor/legal researcher Ann Burkhart, J.D., examined in the report above and linked here pointed out in her paper on manufactured housing, it only took the industry some 3 years to double production previously in its history. The industry was at 112,882 homes per MHARR to close out 2022. That means in 3 years, the industry could be at a quarter million homes annually. In another 3 years, based on historical evidence, the industry could double again. Meaning, by 2029, the industry could be producing 500,000 new homes annually.

But that is based upon history. Manufactured housing production professionals have told MHProNews that such a ramp up could be accomplished much more quickly.

Evidence for that was the parallel claim by S2A modulars. Whatever they actually did is almost irrelevant. The fact that factory builders had a plausible plan is itself encouraging. Per S2A at the time: “The site outlines the company’s prospects for rapid expansion, including the construction of 35 such factories in three to five years.” Where is that thinking in MHVille?

Manufactured housing professionals ought to have a similar zest as visionaries in tech get when they think that are onto something BIG. There are few things more demonstrably needed than more affordable housing. Boor and Cavco are correct about that point. It is simply that they are not behaving in a manner that seems to put their money where their mouth is.

MHProNews outlined the potential in a prior somewhat lighthearted post, linked below.

The problem, in part, is that there are too many who have become enamored with Buffett-Moat thinking. While William “Bill” Gates III was arguably paltering too, his point in the insightful quotation about Buffett below is eye opening.

![DidntWantToMeetWarren[Buffett]BecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2020/07/DidntWantToMeetWarrenBuffettBecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews.jpg)

Institutional investors may well grasp and play the game of dangling promises without delivering on the big picture. But more modest ‘retail’ investors have a case that they are being robbed of opportunities by firms that know what the potential is and are failing to act accordingly. Again, see the report linked above or here to learn more.

There are apparent reasons why thousands of manufactured housing professionals at firms like Cavco and other ‘top’ MHI member brands appear to be frustrated and unhappy. That’s the obvious takeaway from the facts uncovered in the report linked below.

The Counter Argument

Marty Lavin, J.D., in the context of remarks about manufactured housing industry corporate leaders said that larger firms are not willing to invest in projects that might benefit smaller firms. His specific example was the Roper Report. Given some 15 plus years of such talk, Lavin has a point. However…

…just because that is how ‘the big boys,’ as Lavin calls them, have behaved in the past, doesn’t mean that some larger or deeper pocketed firm can’t break out of that parasitic, small-minded mode. Nor does it have to be just one firm.

What if Cavco took that hypothetical $25 million and approached a coalition of independents, including MHARR members, and said, ‘match this and we’ll create a new post-production trade group and break free of the MHI trap?’ Just the effort could result in a kind of insurance policy for Cavco against shareholders or other stakeholders’ legal action for failing to do their fiduciary and other duties properly.

The point is simple and ought to be clear. Manufactured housing does have tremendous potential. That potential was proven in the mobile home era. It was demonstrated again in the 1990s.

But it has not been actualized at the same rate as it was during the mobile home era, nor has the 21st century proven to be all that it could be based on existing laws that are not being properly enforced. Moat thinking may be a proven tool to hobble your competitors. But Gates – despite apparently paltering – was correct in implying that the Buffett-moat methods are not value added. They don’t help society or a range of potential stakeholders.

MHProNews will explore such profitable breakout possibilities in planned upcoming reports.

On a personal note, having sold, co-owned, and managed manufactured home operations in retail and then later managed in communities, there is significant firsthand experience on doing high volume out of a given location. Good goal- and career-oriented employees are attracted to that mindset. Many yearn to be achieve more and earn more.

That said, the future of the industry is being set in far too many cases by people who are more interested in building their respective and collective moats. Consolidation is a demonstrable part of that pattern. That strategy arguably has risks, as that Harvard paper mentioned above also suggested. Once the gaslighting of industry pros has lost its luster, serious people will want to achieve all that they can, rather than hunker down into comfortable ruts and survive.

Boor’s remarks to Congress, remarks to investors, and their pitch that the industry can do so much more have obvious points of appeal but also apparent disconnects, as the above has outlined. The time for tread worn ‘tall talk’ without matching action ought to be behind those of us in MHVille that want a glorious and honorable future. There is every reason to believe that some corporations – perhaps Cavco? – will be embroiled in lawsuits as shareholders and stakeholders turn on them for not doing what they should be doing. Why not invest those legal dollars to litigate and lobby, as attorney Daniel Mandelker suggested? The dollars appear that they will be spent. Why not spend it for growth instead of defense?

Bill, people often love a good mea culpa when it is followed by appropriate corrective actions. Pay the attorneys now, or pay them later, but it appears that they are going to get paid either way. Why not make it a strategy for corporate and industry victory and more profits rather than to defend against failures to do the most for investors? You and your wordsmiths can figure out how to finesse it. ##

Part III. Daily Business News on MHProNews Markets and Headline News Segment

Headlines from left-of-center CNN Business – from the evening of 8.9.2023

- Disney shares slip

- Chairman and Chief Executive Officer of The Walt Disney Company Robert Iger attends the Television Academy’s 25th Hall Of Fame Induction Ceremony at Saban Media Center on January 28, 2020 in North Hollywood, California.

- At the House of Mouse, almost everything is shrinking except international parks

- Orange juice futures are hitting record highs. Here’s why, and what it means for consumers

- Why cell phone service is down in Maui — and when it could be restored

- Taylor Swift, ‘Barbie’ and Beyoncé are unleashing the spending power of women

- How we’re buying perfume could signal how we’re feeling about the economy

- Even ‘Barbie’ may not be able to rescue AMC Theaters

- Under Biden, US oil production is poised to break Trump-era records

- Justice Kagan order: Apple doesn’t have to change app store terms while battling Epic in court

- Why Taco Bell’s free taco giveaway is happening everywhere but New Jersey

- There’s only one state left where it’s illegal to pump your own gas

- New electric Cadillac Escalade has 750 horsepower, space for your handbag, and a heck of a price tag

- Striking hotel workers file complaint over alleged violence on picket line

- Pope Francis warns about AI’s dangers

- European bank stocks bounce as Italy softens windfall tax blow

- What does Moody’s downgrade mean for markets?

- Bob Iger is supposed to save Disney. It’s not going according to plan

- The world’s biggest law firm is splitting off its business in China

- China’s property crisis deepens as another huge developer risks default

- China slips into deflation as consumer prices fall for the first time in more than two years

- Germany spends big to win $11 billion TSMC chip plant

- ESPN is jumping into sports gambling in a $2 billion deal

- UAW angrily tosses Stellantis contract offer in trash

- Smartmatic accuses Rudy Giuliani of ‘dog ate my homework’-style excuses to avoid turning over documents in defamation suit

Notice: the graphic below can be expanded to a larger size.

Headlines from right-of-center Newsmax 8.9.2023

- Bank Records Show $20M to Biden-Tied Businesses

- House Oversight Committee Chair James Comer, R-Ky., delivered a third round of bank records, bringing the official paper trail of payments to more than $20 million from Russia, Ukraine, and Kazakhstan during Joe Biden’s vice presidency. The revelation of Biden family payments has been fueling discussion of a potential impeachment inquiry. [Full Story]

- Related Stories

- Gingrich to GOP: Go Slowly With Impeachment Inquiry

- WH Denies Bank Records Show Payments to Joe Biden

- New Trump Indictment

- Trump Bashes DOJ, Biden for Obtaining Twitter Records

- Atlanta Braces for Potential New Trump Indictment

- Trump Says House Destroyed Jan. 6 Documents

- Gaetz: Testifying in House Could Give Trump Immunity | video

- Trump Docs Judge Denies Cameras in Courtroom

- Lindsey Graham: Dems Break Rules to Get Trump | video

- Poll: Most Republicans, Independents Oppose Indictment

- Judge Sets Protective Order Hearing for Friday | video

- Trump: I’ll Keep Talking About Criminal Cases

- CNN: Security Upped for D.C. Judge in Trump Case

- More New Trump Indictment

- Newsmax TV

- Dershowitz: ‘No Such Thing as a False Idea or False Opinion’

- Tuberville: Military Holds Are Schumer’s, Not Mine | video

- NFL’s Michael Oher: Setting ‘Footprint’ With New Book

- Perry Johnson: Ready, Qualified for Debate Stage | video

- Rep: Pat Fallon: Biden Border Policies Make ‘No Sense’ | video

- Geraldo Rivera: Biden at Fault for Afghan Debacle | video

- Sheriff: Biden Border Policies Hurt County | video

- Mayor Suarez: Trump Consistent in 2020 Beliefs | video

- Van Duyne: Senate Dems Blocking Border Reform | video

- Lawyer: Dems Not Even Hiding Their Hypocrisy | video

- More Newsmax TV

- Newsfront

- House Judiciary: FBI Field Offices Wrote Anti-Catholic Memo

- Multiple FBI field offices worked to produce the memo targeting traditional Catholics as potential domestic terrorists, the House Judiciary Committee says…. [Full Story] | video

- FBI Kills Utah Man in Morning Raid Who Threatened Biden

- ABC News reported that FBI agents shot and killed a Provo, Utah, man [Full Story]

- Poll: Most Voters Support Texas’ Floating Barriers

- A new poll conducted by TIPP Insights for the Daily Mail found that [Full Story]

- Bank Records Show $20 Million to Biden-Tied Businesses

- House Oversight Committee Chair James Comer, R-Ky., delivered athird [Full Story]

- Related

- WH Denies Bank Records Show Payments to Joe Biden |video

- Court to Hear Biden Appeal to Restore Big Tech Coordination

- The U.S. court’s block of the Biden administration from coordinating [Full Story]

- Newsmax Beats CNN Friday in Prime Ratings

- Newsmax did it again, beating CNN’s prime-time offerings in key [Full Story]

- Kosovo Moves to Deny Serbs Internet, Communication

- Kosovo has become a crisis “hot spot” in recent months, with ethnic [Full Story]

- China’s Food Stockpiling Indicates Preparations for War

- Beijing’s renewed focus on stockpiling enough food to ensure it can [Full Story] | Platinum Article

- Pence’s Former Aides Trade Barbs Over Trump Endorsement

- Marc Short, the former chief of staff to then-Vice President Mike [Full Story] | video

- Russia Shoots Down 2 Drones Headed for Moscow

- Russian air defenses shot down two drones aimed at Moscow overnight, [Full Story]

- Related

- Russia to Boost Forces in West to Counter NATO: Defense Minister

- Report: Russia Forced Ukrainian Kids Into Cadet Corps

- Ukraine: Talks in Saudi Arabia a Huge Blow to Russia

- Biden Order Bans Certain Tech Investments in China

- President Joe Biden on Wednesday signed an executive order that will [Full Story]

- 7 Keys to Rebooting a Presidential Campaign

- Political campaigns, like frozen computers and flagging film [Full Story] | Platinum Article

- RNC Chooses Fox for Second Primary Debate

- The Republican National Committee (RNC) has chosen Fox Business to [Full Story]

- Gingrich to GOP: Go Slowly With Impeachment Inquiry

- Former House Speaker Newt Gingrich said Republicans should “go very [Full Story]

- Wall St Closes Lower as Investors Wait on Inflation Data

- S stocks ended lower Wednesday, the day after a report showed [Full Story]

- Trump Bashes DOJ, Biden for Getting Twitter Records

- Former President Donald Trump on Wednesday lashed out at “crooked Joe [Full Story]

- Judge Rules Jack Nicklaus Can’t Reclaim Name, Likeness

- A federal judge recently ruled that golf legend Jack Nicklaus cannot [Full Story]

- Judge Denies Motion to Stop DeSantis’ Immigration Law

- Civil rights groups asked a federal judge Tuesday to stop Florida [Full Story]

- Biden Incorrect on Declaring National Climate Emergency

- President Joe Biden claimed incorrectly in his interview with The [Full Story]

- People Flee Into Ocean to Escape Hawaii Wildfire

- Wind-whipped wildfires raced through parts of Hawaii on Wednesday, [Full Story]

- Premise Poll: Trump Beats Biden But DeSantis Will Lose

- A Premise poll of registered voters conducted Aug.2-7 shows former [Full Story]

- Related

- GOP Women Behind Trump’s Large Primary Lead

- DeSantis Wants His Shot at Trump in First Debate |video

- Pence Meets Donor Threshold for First Debate

- Oddsmakers: DeSantis in 5th Place in Presidential Bid

- Perry Johnson to Newsmax: Ready, Qualified for Debate Stage |video

- Arizona Universities Drop DEI Wording in Job Posts

- Public universities in Arizona dropped the use of diversity, equity, [Full Story]

- Catholics Decry Addition of Abortion to Protection Law

- Roman Catholic bishops condemned the Biden administration’s proposed [Full Story]

- More Americans Raiding Their 401(k)s

- Americans are pulling money out of their 401(k)s at a worrisome rate, [Full Story]

- Blue Origin to Launch New Rocket Next Year

- Aerospace company Blue Origin is planning to launch its New Glenn [Full Story]

- Just 4,000 Daily Steps Can Lengthen Your Life

- If you’re one of the millions of folks bent on racking up at least [Full Story]

- Former AG Gonzales: DOJ Not Biased Against Trump, GOP

- Former Attorney General Alberto Gonzales in a brusque opinion piece [Full Story]

- FAA Refers 22 More Unruly Passenger Cases to FBI

- The Federal Aviation Administration revealed Tuesday that it referred [Full Story] | video

- DeSantis Suspends Orlando’s Top Prosecutor

- Florida Gov. Ron DeSantis suspended the state attorney for the [Full Story]

- Feinstein Hospitalized Briefly After Fall at Home

- Dianne Feinstein was hospitalized briefly Tuesday night after [Full Story]

- American Nurse, Young Daughter Freed After Abduction in Haiti

- American nurse Alix Dorsainvil and her daughter were freed Wednesday, [Full Story]

- Wall Street Insider: “I Believe Elon Musk’s ‘Project Omega’ Could Be Bigger T…

- EFIR Project Omega

- More Newsfront

- Finance

- NYC Mayor Urges Biden to Declare State of Emergency on Migrant Crisis

- New York City Mayor Eric Adams urged President Joe Biden to declare a state of emergency over the migrant crisis on Wednesday, the Daily Mail reported. “We are facing an unprecedented state of emergency,” Adams declared at a news conference. “The immigration system…… [Full Story]

- China’s Tech Giants Order $5B of Nvidia Chips for AI

- Disney Revenue Misses But $5.5B Cost Cuts on Track

- Will FTC Ever STOP Demonizing Mergers?

- Tesla CFO Leaving With a $590M Net Worth

- More Finance

- Health

- Exposure to Scents During Sleep Boosts Memory

- A new study found that older adults who were exposed to specific scents as they slept performed better on verbal memory tests. They also experienced improved function in the brain pathway that supports memory formation. The study, published in Frontiers in Neuroscience,…… [Full Story]

- CDC: Vaccine Effective Against Dominant Strain EG.5

- Your Vacation in the Sun Damages the Skin’s Microbiome

- Study: Stress, Depression Don’t Raise Cancer Risk

- Air Pollution Linked to Several Different Cancers