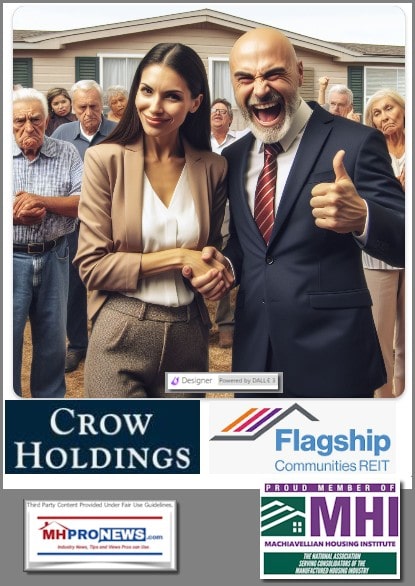

It has been almost exactly a year since left-leaning NBC News issued their “Trapped” report on manufactured home communities (MHCs), which despite terminology standards numbers in and beyond the industry’s professional ranks often errantly call ‘trailer parks’ or ‘mobile home parks.’ According to NBC, in a statement by Legacy Communities chief operating officer Andrew Fells: “The harsh economic realities of the past year have been particularly challenging.” Fells elaborated by saying that: “The interest on our loan has more than doubled as a result of the dramatic rise in interest rates. We are also facing a regional (consumer price index) above 8%, cost increases for labor, insurance, taxes, utilities, supplies, and vendors who pass through their own cost increases.” If the sharply higher cost of debt, compressed cap rates, and other factors slowed the cadence of acquisitions for a time, two big deals recently announced by Crow Holdings (see Part I) and Flagship Communities REIT (see Part II) may signal a change. Those deals and broader details about the consolidating manufactured home community (MHC) sector and more will be explored in Part III of this report with facts and analysis beyond those respective firms’ press releases.

As a reminder to new readers and current longtime ones, quoting a source should not be considered an endorsement of that source and/or of a given investment opportunity. It is our editorial position on MHProNews that providing more details is often useful for those doing research of whatever kind into the manufactured housing industry. “We Provide, You Decide” © is a longstanding motto that compliments the tagline found under our logo on virtually every page of this website. Namely, manufactured home “Industry News, Tips, and Views Pros Can Use.” ©

What follows are the bulk of the Crows and Flagship’s respective press releases, which will be complimented in Part III with additional information, more facts and a broad analysis. Hot links in the Crow and Flagship statements may have been removed, we are not plugging them and they are not our clients. Highlighting is added by MHProNews for our own purposes, which should not cause readers to lose sight of the rest of the remarks made by each firm.

Part I

Crow Holdings Announces Manufactured Housing Portfolio Acquisition

The 46-property portfolio comprises nearly 10,000 homesites across six U.S. states, building on an established platform that emphasizes the benefit to community residents

Crow Holdings, a leading national real estate investment and development firm, announced today the acquisition of a privately owned 46-property, 9,838-pad, all-age manufactured housing portfolio across Ohio, Missouri, Illinois, Indiana, Montana, and Florida.

The acquisition was made through Crow Holdings’ investment management company Crow Holdings Capital (“CHC”) and acquired on behalf of investors in Crow Holdings Realty Partners X, L.P. (“The Fund”), which closed in February 2024 with $3.1 billion of commitments. Within the first 12 months, CHC plans to invest more than $30 million to improve the manufactured housing communities with meaningful renovations of park infrastructure such as playgrounds, clubhouses, and other amenities through the commitment of significant capital.

“Given the high cost of homeownership driven by increasing home prices and mortgage rates, manufactured housing communities are extremely attractive options for residents,” said Bob McClain, CEO of Crow Holdings Capital. “Crow Holdings’ depth of experience in the sector has provided us with the relationships and capabilities to build a market-leading, nationwide manufactured housing platform. This investment strategy allows us to add to the quality housing stock of the communities where we operate and to provide residents a better place to call home.”

CHC brings more than half a decade of experience in the manufactured housing sector – not only investing in the asset class but also improving the residents’ living environment with thoughtful value-add programs. In addition, CHC is completing three ground-up developments of manufactured housing communities in North Texas that will bring more than 1,000 new homes to that market, each with large, Class A amenity centers, pool, playground, bus stops, dog parks, and basketball and pickleball courts.

“The planned investment of over $30 million in capital improvements should provide a meaningful uplift in resident experience,” said Dustin Viktorin, Managing Director in the Manufactured Housing group of Crow Holdings Capital. “These improvements are tailored to the needs of the communities, from improved safety – roads, lighting, fencing – to amenity renovations and additions based on resident feedback.”

“The large demand for quality housing at attainable price points, coupled with the highly fragmented manufactured housing market, gives us the opportunity to add value to these properties and bring professional management to the communities,” said Kristin Millington, Managing Director in the Manufactured Housing and Self-Storage groups of Crow Holdings Capital. “This portfolio is just one example of the attractive investments we’re identifying across this underserved asset class, which has seen negative net new supply in the past decade. As we continue to build our platform, we will provide meaningful improvements for residents and create more housing options in the places that need them most.”

This 46-property acquisition builds on CHC’s longstanding investment in the manufactured housing space, with over 20,000 homesites across 114 communities and 16 states since 2018.

About Crow Holdings

Crow Holdings is a leading real estate investment and development firm founded in 1948 and based in Dallas, Texas. With 20 offices across the U.S., Crow Holdings’ local, on-the-ground presence amplifies its hands-on capabilities across a broad range of investment strategies, product types, and ventures in partnership with institutional investors. Crow Holdings has $31 billion in assets under management, one of the largest multifamily and industrial development platforms in the nation, investments across the energy sector including solar and battery storage projects, and a broad, diversified investment portfolio, pursuing compelling investment opportunities to capitalize on evolving, secular growth potential. For 75 years, Crow Holdings’ success has been rooted in its founding principles of partnership, collaboration, and alignment of interests. …” ##

Note that the Crow press release page also linked to a report by Bisnow that was reported on by MHProNews and is found at this link here.

Part II

Flagship Communities Real Estate Investment Trust Announces Largest Acquisition in the REIT’s History

April 17, 2024 16:27 ET| Source: Flagship Communities Real Estate Investment Trust

TORONTO, April 17, 2024 (GLOBE NEWSWIRE) — Flagship Communities Real Estate Investment Trust (“Flagship” or the “REIT”) (TSX: MHC.U; MHC.UN) today announced that it has entered into agreements to acquire (the “Acquisitions”) a total of seven manufactured housing communities (“MHCs”), comprising 1,253 lots, for an aggregate purchase price of approximately US$93.0 million (the “Purchase Price”). The Acquisitions are expected to close on or about May 15, 2024, subject to customary closing conditions.

The Purchase Price, along with approximately US$10 million of upfront capital expenditures, will be funded with the net proceeds from the REIT’s US$60 million offering of trust units (“Units”) (see “Equity Financing” below) and the remainder funded with new debt financing. The Purchase Price represents an attractive capitalization rate of 5.6% on Year 1 forecasted net operating income (“NOI”), and is expected to be accretive to the REIT’s adjusted funds from operations per Unit (diluted) (“AFFO”, see “Non-IFRS Financial Measures” below) on a leverage neutral and stabilized basis.

“These acquisitions are the largest in the REIT’s history to date and represent a milestone for our business as we continue to execute on our stated growth strategy,” said Kurt Keeney, President and CEO. “This is a generational opportunity to strategically expand our footprint into the adjacent Nashville market, as well as establish a presence in West Virginia, both markets that enable us to maximize existing synergies and leverage economies of scale.”

Transaction Highlights

- Increased Size and Scale: Enhances Flagship’s scale, with the REIT’s pro forma portfolio consisting of 82 communities comprising 15,033 lots

- Expansion into New Markets: The Acquisitions strengthen the REIT’s presence in Tennessee while entering the core Nashville market, which is one of the fastest growing markets in the U.S. The Acquisitions also expand the REIT’s operations into West Virginia, which represents the REIT’s eighth contiguous U.S. state, and provide significant growth opportunities to become a market leading owner in these markets

- Organic Growth Potential: Organic cash flow growth generated by the REIT’s active lot leasing and home sales strategy, along with the implementation of expense optimization initiatives, are expected to generate stable, recurring and above market organic growth

- Attractive Cost Basis: The Purchase Price represents a 5.6% capitalization rate based on year 1 NOI and a price per lot of approximately US$74,000

- Operating Platform Synergies & Economies of Scale: The REIT continues to expand its portfolio without material incremental corporate level expenses and is well-positioned to further benefit from its scalable platform going forward. The REIT intends to continue its growth by sourcing acquisitions in existing and adjacent markets which are expected to generate economies of scale and operational synergies

- Accretion & Leverage Profile: The completion of the Acquisitions is expected to be accretive on a stabilized and leverage neutral basis to the REIT’s long-term leverage target. Additionally, following the completion of the Acquisitions and the Offering, the REIT’s Debt to Gross Book Value Ratio (see “Other Real Estate Industry Metrics” below) is expected to be 39.4% (prior to any exercise of the over-allotment option) compared to 49.6% following completion of the IPO.

“We are excited to have sourced more off-market acquisitions through our long-standing industry relationships, providing the ability to establish a presence in Nashville, as well as West Virginia,” said Nathan Smith, Chief Investment Officer. “The Acquisitions are comprised of high-quality properties that adhere to our acquisition criteria and also provide the opportunity to expand our presence into Nashville, one of the fastest growing cities in the U.S., strategically located along the I-40 and I-65 Interstate corridors, within easy driving distance to employment opportunities, hospitals, schools, shopping and recreational facilities.”

Overview of Acquisitions

Nashville MSA

The Madison, Tennessee acquisition comprises 300 lots across approximately 38 acres and is located 13 miles north of downtown Nashville. It is within close proximity to malls, sports and medical facilities, golf courses, schools and entertainment, and is situated along the Cumberland River. The community is 67% occupied, including 6 rental homes. Community amenities include a playground, basketball court, clubhouse, and a community center. Nearby employers include Epic Systems, American Family Insurance, American Girl, Sub-Zero, Trek Bicycle, Lands’ End, Shopbop, Colony Brands and John Deere. The community sits near the interchange of Interstate 40 and 65 and is approximately a 20-minute drive to downtown Nashville.

The Murfreesboro, Tennessee acquisition comprises 173 lots across approximately 26 acres and is located 35 miles south of downtown Nashville. It is within close proximity to local supermarkets, restaurants, the municipal airport, universities and athletic centers. The community is approximately 99% occupied. Community amenities include a basketball court, clubhouse and greenery surrounded gazebo. Major employers in the community include Nissan Automotive, National Healthcare Corporation, State Farm Insurance, Amazon and St. Thomas Rutherford Hospital. The community sits near the interchange of Interstate 24 and is approximately a 30-minute drive to downtown Nashville.

Morgantown, West Virginia (2 Communities)

The Morgantown, West Virginia acquisitions comprise 2 communities. The first community comprises 187 lots across approximately 33 acres and is 88% occupied including 4 rental homes. The second community comprises 203 lots across approximately 41 acres and is 81% occupied including 102 rental homes. Both communities are centrally located in Morgantown along the Monongahela River, near Morgantown Municipal Airport, as well as nearby attractions including several golf courses, West Virginia University campus and Art Museum, Hazel Ruby McQuain Riverfront Park, Mountaineer Field, and West Virginia Coliseum. The communities are located adjacent to Interstates 79 and 68, providing excellent access to major transportation routes. Major employers include West Virginia University, Target, WVU Medicine, Mylan INC, IBM, Viatris, US Army, AT&T and Wipro.

Milton, West Virginia (Huntington MSA)

The Milton, West Virginia acquisition comprises 213 lots across approximately 33 acres. It is located 15 miles east of Huntington, West Virginia, within a quiet, well-maintained neighborhood near schools, shopping centers, hospitals, entertainment and more. The community is 66% occupied, including 21 rental homes. This community offers residents many amenities including a new playground, a clubhouse equipped with a full kitchen and billiards. The community is located adjacent to Interstate 64, providing excellent access to major transportation routes. Nearby employers include Mountain Health Network, Marshall University, Cabell County Board of Education, University Physicians & Surgeons, Walmart, Huntington Alloys Corp., Alcon Research LLC and Steel of West Virginia Inc.

Beckley, West Virginia (2 Communities)

The Beckley, West Virginia acquisitions comprise 2 communities. The first community comprises 120 lots across approximately 15 acres and is 87% occupied including 12 rental homes. The second community comprises 57 lots across approximately 14 acres and is 68% occupied including 7 rental homes. Both communities are well-maintained offering residents well-lit, paved streets and are centrally located, with easy access to schools, hospitals, post offices, doctors’ offices, shopping malls, movie theaters, restaurants and outdoor activities. The communities are located adjacent to Interstates 64 and 77, providing excellent access to major transportation routes. Nearby employers include Filter Companies, Lowe’s Home Improvement, McDonald’s, US Army, Enterprise, IBEX Global, AT&T and UPS.

Pro Forma Portfolio

The Acquisitions are a targeted and strategic expansion of the REIT’s portfolio, increasing the number of Flagship’s MHCs to 82 from 75 and the number of manufactured housing lots to 15,033 from 13,780. The table below provides a summary of the pending Acquisitions as of April 17, 2024.

| Acquisitions Portfolio | ||

| # of Communities | (#) | 7 |

| # of Lots | (#) | 1,253 |

| Average Lot Occupancy | (%) | 78 |

Equity Financing

The REIT also announced today that it has entered into an agreement with a syndicate of underwriters co-led by BMO Capital Markets and Canaccord Genuity Corp. (together, the “Lead Underwriters”) to sell, on a bought deal basis, 3,910,000 Units at a price of US$15.35 per Unit for gross proceeds of approximately US$60 million (the “Offering”). The REIT has also granted the underwriters an over-allotment option to purchase up to an additional 15% of the Offering on the same terms and conditions, exercisable at any time, in whole or in part, up to 30 days after the closing of the Offering. The Offering is expected to close on or about April 24, 2024 and is subject to customary conditions, including the approval of the Toronto Stock Exchange. The Offering is not conditional upon closing of either of the Acquisitions.

The REIT intends to use the net proceeds from the Offering to fund (i) the Purchase Price (ii) capital expenditures, which are expected to be approximately US$10 million, in connection with the Acquisitions and (iii) for general business purposes. In the event the REIT is unable to consummate one or both of the Acquisitions and the Offering is completed, the REIT intends to use the net proceeds of the Offering to fund future acquisitions and for general business purposes.

The Offering is being made pursuant to the REIT’s base shelf prospectus dated June 7, 2023. The terms of the Offering will be described in a prospectus supplement to be filed with Canadian securities regulators.

The Units have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, (the “1933 Act”) and may not be offered, sold or delivered, directly or indirectly, in the United States, except pursuant to an exemption from the registration requirements of the 1933 Act. This press release does not constitute an offer to sell or a solicitation of an offer to buy any Units in the United States.

Forward-Looking Statements

This press release contains statements that include forward-looking information (within the meaning of applicable Canadian securities laws). Forward-looking statements are identified by words such as “believe”, “anticipate”, “project”, “expect”, “intend”, “plan”, “will”, “may”, “can”, “could”, “would”, “must”, “estimate”, “target”, “objective”, and other similar expressions, or negative versions thereof, and include statements herein concerning: the terms of, timing for completion of and source of funding for the Acquisitions, the expected synergies from the Acquisitions, the expected impact of the Acquisitions and the Offering on the REIT’s Debt-to-Gross Book Value Ratio, the expected impact of the Acquisitions on the REIT’s AFFO per Unit (diluted), the expected impact of the Acquisitions on the REIT’s long-term leverage target, the REIT’s pro forma portfolio, the REIT’s growth opportunities (including organic growth potential), the scalability of the REIT’s platform, the REIT’s acquisitions strategy and expectations regarding economies of scale and operational synergies, the terms of and timing for completion of the Offering and the intended use of the net proceeds of the Offering.

These statements are based on the REIT’s expectations, estimates, forecasts, and projections, as well as assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies that could cause actual results to differ materially from those that are disclosed in such forward-looking statements. While considered reasonable by management of the REIT as at the date of this news release, any of these expectations, estimates, forecasts, projections, or assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those expectations, estimates, forecasts, projections, or assumptions could be incorrect. Material factors and assumptions used by management of the REIT to develop the forward-looking information in this news release include, but are not limited to, that the conditions to closing of the Acquisitions will be met or waived in a timely manner and that both of the Acquisitions will be completed on the current agreed upon terms. When relying on forward-looking statements to make decisions, the REIT cautions readers not to place undue reliance on these statements, as they are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, such as the risks identified in the REIT’s management’s discussion and analysis for the year ended December 31, 2023 available on the REIT’s profile on SEDAR+ at www.sedarplus.com, including, but not limited to, the factors discussed under the heading “Risks and Uncertainties” therein and the risk of the REIT’s plans with respect to debt bridge financing for the Acquisitions not being achieved as anticipated. There can be no assurance that forward-looking statements will prove to be accurate as actual outcomes and results may differ materially from those expressed in these forward-looking statements. Readers, therefore, should not place undue reliance on any such forward-looking statements. Forward-looking statements are made as of the date of this press release and, except as expressly required by applicable Canadian securities laws, the REIT assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Non-IFRS Financial Measures

In this press release, the REIT uses certain financial measures that are not defined under International Financial Reporting Standards (“IFRS”) including certain non-IFRS ratios. These measures are commonly used by entities in the real estate industry as useful metrics for measuring performance. However, they do not have any standardized meaning prescribed by IFRS and are not necessarily comparable to similar measures presented by other publicly traded entities. These measures should be considered as supplemental in nature and not as a substitute for related financial information prepared in accordance with IFRS. The REIT believes these non-IFRS financial measures and ratios provide useful supplemental information to both management and investors in measuring the operating performance, financial performance and financial condition of the REIT.

Adjusted Funds from Operations

Adjusted funds from operations (“AFFO”) is calculated in accordance with the definition provided by the Real Property Association of Canada (“REALPAC”). AFFO is defined as Funds From Operations (being IFRS consolidated net income (loss) adjusted for items such as distributions on redeemable or exchangeable units (including distributions on class B units of the REIT’s subsidiary, Flagship Operating, LLC (“Class B Units”)), unrealized fair value adjustments to Class B Units, unrealized fair value adjustments to investment properties, unrealized fair value adjustments to unit based compensation, loss on extinguishment of acquired mortgages payable, gain on disposition of investment properties, and depreciation) adjusted for items such as maintenance capital expenditures, and certain non-cash items such as amortization of intangible assets, and premiums and discounts on debt and investments. AFFO should not be construed as an alternative to consolidated net income (loss) or consolidated cash flows provided by (used in) operating activities determined in accordance with IFRS. The REIT’s method of calculating AFFO is substantially in accordance with REALPAC’s recommendations. The REIT uses a capital expenditure reserve of $60 per lot per year and $1,000 per rental home per year in the AFFO calculation. This reserve is based on management’s best estimate of the cost that the REIT may incur, related to maintaining the investment properties. This may differ from other issuers ’methods and, accordingly, may not be comparable to AFFO reported by other issuers. The REIT uses AFFO in assessing its distribution paying capacity.

“AFFO per Unit (diluted)” is defined as AFFO for the applicable period divided by the diluted weighted average Unit count (including Class B Units, vested restricted units and vested deferred trust units) during the period.

Please refer to the REIT’s management’s discussion and analysis for the year ended December 31, 2023 at “Non-IFRS Financial Measures – Funds from Operations and Adjusted Funds from Operations” for further detail on this non-IFRS financial measure and at “Reconciliation of FFO, FFO per Unit, AFFO and AFFO per Unit” for a reconciliation of historical AFFO to consolidated net income (loss), which disclosures are incorporated by reference into this press release.

Other Real Estate Industry Metrics

Debt to Gross Book Value Ratio

Debt to Gross Book Value Ratio is calculated by dividing indebtedness, which consists of the total principal amounts outstanding under mortgages payable and credit facilities, by Gross Book Value (being, at any time, the greater of: (a) the value of the assets of the REIT and its consolidated subsidiaries, as shown on its then most recent consolidated statement of financial position prepared in accordance with IFRS, less the amount of any receivable reflecting interest rate subsidies on any debt assumed by the REIT; and (b) the historical cost of the investment properties, plus (i) the carrying value of cash and cash equivalents, (ii) the carrying value of mortgages receivable, and (iii) the historical cost of other assets and investments used in operations).

About Flagship Communities Real Estate Investment Trust

Flagship Communities Real Estate Investment Trust is a leading operator of affordable residential Manufactured Housing Communities primarily serving working families seeking affordable home ownership. The REIT owns and operates exceptional residential living experiences and investment opportunities in family-oriented communities in Kentucky, Indiana, Ohio, Tennessee, Arkansas, Missouri, and Illinois. …” ##

Part III – Additional Information with More MHProNews Analysis and Commentary

1) That NBC News “Trapped” report included remarks by Paul Bradley of ROC USA. ROC USA has been a multi-year member of the Manufactured Housing Institute (MHI). As MHProNews has routinely stressed, while several MHI members appear to be engaged in so-called “predatory” behavior that is ironically (or in blatantly hypocritical) fashion seems to contradict their so-called “Code of Ethical Conduct,” there is no known example of MHI removing someone from membership for a violation of their “code.” Supposedly Havenpark, per a source, is no longer an MHI member, but the reason for that is unclear. If Havenpark was booted, why are others who engage in similar behavior to theirs tolerated? Or did Havenpark’s corporate leaders, after fact checks like this one, figure out that it simply didn’t make sense to stay a member of MHI and they just left on their own and saved those membership fees?

2) Be that as it may, Bradley said this to NBC. “Fannie and Freddie have added fuel to the fire. There’s just no question,” said Bradley, president of ROC USA, which helps residents finance the purchase of their communities. “This competition to provide the lowest cost loans to park investors and their grab for market share helped fuel this.”

3) Bradley’s remarks are similar to the statements from the Lincoln Institute’s George “Mac” McCarthy.

4) It is interesting to note Kristin Millington, Managing Director in the Manufactured Housing and Self-Storage groups of Crow Holdings Capital’s remark: “The large demand for quality housing at attainable price points, coupled with the highly fragmented manufactured housing market, gives us the opportunity to add value to these properties and bring professional management to the communities.” That is quite similar to the phrasing used by Flagship Communities in their investor pitch. See the deep dive into Flagship, linked below.

5) Millington’s use of the word “attainable” vs. “affordable” may be a nod of sorts to the phrase being used by the periodic embarrassments and scandal-plagued MHI. Per their homepage, instead of using the traditional and highly useful phrase “affordable,” MHI’s updated website uses the term that implies less affordable, but still “attainable” phrasing expressed as follows: “Elevating Housing Innovation; Expanding Attainable Homeownership.”

6) Ironically, if MHI was truly “elevating manufactured housing innovation,” as their new image and statement project and proclaim, then why is it that some $2 billion dollars have been invested in other factory building technologies that are potential competitors for HUD Code manufactured housing?

7) If MHI’s claim “Elevating Housing Innovation; Expanding Attainable Homeownership” is authentic and sincere, then why has the industry struggled to return to its former glory in production? Why, for instance, did an analyst from B. Riley ask MHI member Legacy Housing (LEGH) why industry production is so soft?

8) Or why did analyst Greg Palm ask Cavco’s William Bill Boor: ‘Why is manufactured housing industry production so weak?’ Boor at the time was MHI’s Vice Chairman and currently is the MHI chairman.

9) Not unrelated was a statement made by prominent MHI member Sun Communities that aptly observed that accurate information on this sector of the industry is made more difficult because there is no national repository of information. Similarly, when the stated business model of several prominent MHI community members relies upon the “scarcity” of manufactured housing communities, that ought to be a red flag for regulators and consumer advocates. This is especially so when Nathan Smith, Flagship’s CIO and longtime MHI board member brags: ““We are excited to have sourced more off-market acquisitions through our long-standing industry relationships…” Taken in conjunction with what the late Sam Zell said, there is growing evidence that warrants potential criminal antitrust probes, not just multiple civil antitrust litigation as is currently the case.

10) To the point about scandals made above, among of the most popular articles on the MHProNews website for months has been the one linked below about Gary Shiffman and Sun Communities (SUI). Sun has held an MHI board position for some time.

11) Those points noted, in a previous earnings call, Sun said they’ve stopped new developments and acquisitions.

12) So, there is anecdotal evidence that suggests that prior to this announcement by Flagship, several of the publicly traded firms have slowed the cadence of their acquisitions in 2023. With that in mind, consider this Q&A with left-leaning Bing’s artificial intelligence powered Copilot.

Compared to purchases of manufactured home communities and so-called mobile home parks by publicly traded firms and private equity recorded in 2023, how did the pace of transactions compare to 2022 or 2021? How does that pace compare with transactions reported so far year to date in 2024?

- 2021:

- In 2021, the transaction volume for manufactured housing communities was around $4.2 billion1.

- This marked a substantial increase compared to previous years.

- 2022:

- In 2022, there was a notable spike in acquisitions of mobile home parks, affecting 60,000 units. The total spending on these acquisitions amounted to $4.3 billion2.

- Large corporate investors, including private equity firms and real estate investment trusts, played a significant role in these transactions.

- Residents across the country reported challenges due to rent increases and limited mobility options for their mobile homes3.

- 2023:

- The trend of institutional investors, particularly private equity firms, acquiring mobile home parks continued in 2023.

- These investors are drawn by the strong returns in real estate and the potential for steady income through rent increases.

- However, critics argue that this trend is exacerbating affordability issues for residents, as mobile homes are not easily movable, and owners face difficult choices when confronted with unaffordable rent hikes3.

- 2024 (Year to Date):

- As of the current year, the pace of transactions in 2024 has not been explicitly mentioned in the available data.

- However, given the ongoing interest from institutional investors, it’s likely that the trend of acquisitions and capital inflow into mobile home parks continues.

In summary, the mobile home park industry has experienced increased attention from institutional investors, leading to changes in ownership and rent dynamics. While these transactions can bring capital improvements, they also pose challenges for residents who rely on affordable housing options13…”

13) The first linked source is an article authored by Andrew Keel, who was featured in a deep, deep dive in the interview he did with Frank Rolfe. See that linked below as it sheds possible light on the reliability of Keel as a source for information. That report linked below was and remains a highly read item on MHProNews, though it is lengthy, even by our fact-packed and longer form trade journalism standards.

14) Among the topics Keel and Rolfe discussed was the value of getting debt via Fannie or Freddie. While unhappy about the tenant lease protections, they were not so upset about it that it would deter them from using them for financing any time that it was available at a rate that beat other options. With that in mind, NBC cited a letter from various Democratic Senators, Congressional Representatives, and self-declared Democratic Socialist Bernard “Bernie” Sanders (who caucuses with Democrats and ran as a Democrat for president) to Sandra Thompson at the Federal Housing Finance Agency (FHFA). That letter said the following. What ought to be carefully pondered in what follows is this. Democratic lawmakers, in their oversight capacity, are writing a footnoted letter to a Democratic appointee of a federal agency that progressive minded people like Bradley, McCarthy, and others are saying is contributing to housing unaffordability. Clearly, these lawmakers see to some degree what is occurring in the manufactured housing community sector and the broader manufactured housing industry market. Others that are largely on the political left have made similar appeals to Thompson at the FHFA too. Flagship’s Smith is a self-proclaimed Trump resistance leader and a well-documented higher profile Democrat too. Yet Thompson is apparently going along with what Fannie Mae and Freddie Mac want to do? This ties into a “Corporate Democrats” remark by leftist Michael Weinstein recently reported in an article linked here. More on that further below, after the body of the letter by those Democratic lawmakers to FHFA’s Thompson posted below.

Director

Federal Housing Finance Agency 400 7th Street, S.W.

Washington, D.C. 20024

Dear Director Thompson,

As you know, when Congress originally chartered Fannie Mae and Freddie Mac (the Enterprises or GSEs) they designed them to facilitate access to affordable housing by providing increased liquidity to the secondary mortgage market. Manufactured housing communities are one of the last bastions of naturally-occurring affordable housing[1], but the GSEs are failing them. As we all work to ensure every American has a safe and affordable roof over their head, we urge the Federal Housing Finance Agency (FHFA) to improve protections for residents in manufactured housing communities (MHCs) financed by the Enterprises.

Across the country, outside investors are purchasing MHCs using GSE financing, and proceeding to significantly increase rents, add fees, or push residents out to replace existing units with new higher-cost homes.[2] This is happening to Americans up and down the income ladder. [3][4] Since manufactured housing residents tend to be older and have lower incomes, these are often the people who are least able to afford these increases. Those that own their home, but rent the land underneath, often cannot afford the $1015,000 it costs to relocate.[5]

Not only are some investors benefiting from federal backing while taking advantage of our constituents, these purchases are actually getting credit towards obligations that Fannie Mae and Freddie Mac have to serve underserved communities.[6] We ask that you better support MHC residents, and ensure the Enterprises are not simply financing investment firms’ efforts to buy properties and extract maximum profit from those who have less.

Current Protections

As you know, both Fannie and Freddie offer a financial incentive for MHC purchasers willing to offer a set of Tenant Site Lease Protections (TSLPs). We appreciate recent steps taken by both Enterprises to require that all MHC loans they purchase finance MHCs that will be covered by these TSLPs. Those loan purchases currently count for credit towards the Enterprises’ Duty to Serve (DTS) obligations, as do loans to resident-, government-, or nonprofit-owned MHCs. While the TSLP program has made progress in some ways, we feel the FHFA and the GSEs, both through this program and DTS obligations generally, could do far more to protect people living in MHCs.

The FHFA defined the current set of minimum pad lease protections in the 2016 Duty to Serve Rule.[7] These have since been implemented by both Fannie and Freddie, with loan purchases of MHCs protected by the TSLPs beginning in 2019, and more than 20,000 pad leases now covered. While we’re encouraged that more residents currently have some basic level of protections, we believe the existing TSLP offerings are just that – basic – and that the Enterprises should do a better job of protecting the residents in covered MHCs.

Public disclosure of MHCs backed by the Enterprises

First, we are concerned by a lack of public information about which MHCs are covered. This can leave some residents unsure if they are covered or not, a problem that is exacerbated by MHCs where TSLPs only cover some of the tenants. We appreciate the recent changes made at both Enterprises to ensure that all residents in newly purchased parks covered by TSLPs will have those protections, but prior purchases of MHC loans that received TSLP financing benefits did not require that all residents had these protections. Prior TSLPs from Freddie did not clearly include residents who rented both the pad and home in those parks, and, prior to 2022, Fannie Mae only required some of the homes in an MHC to be covered by the TSLPs in order for the owner to receive a pricing benefit for the entire community. In addition to creating confusion and doing less to protect residents in MHCs backed by the Enterprises, disparate treatment for neighbors within a community makes oversight of the program by either Congress or the FHFA far more difficult.

Requiring a full public list of the covered MHCs, including the date at which those TSLPs went into effect and the units covered, would greatly improve our ability to assess the effectiveness of the TSLPs in protecting renters. Service to the manufactured housing market could also be enhanced by earlier disclosure when a community is being purchased by an owner using GSE financing. This will have three primary impacts. First, it can improve resident awareness of a change in ownership of the park, where all too often they first find out when they’re notified of a rent increase.[8] Second, it could increase the chances for a resident-owned group or nonprofit to work to purchase the park. And finally, it will increase public information about what can be an opaque market.

We have heard disturbing reports of MHC owners in parks that should be covered by the TSLPs that have not offered lease renewals or may have otherwise violated the TSLPs. However, it can be difficult for the public or a member of Congress to easily ascertain whether a given MHC or tenant is covered by the protections. This hurts our ability to protect our constituents or evaluate whether more needs to be done to ensure compliance with the existing TSLPs. Further, the current penalties for violating the TSLPs may not be sufficient to incentivize the park owner to comply, and we would urge you to evaluate those penalties in that light.

Improvements to the existing tenant protections

Second, while the current TSLPs provide some basic rights, we believe these protections could do more to protect tenants. For example, the current TSLPs do not include protection from eviction. Eviction has long lasting impacts on renters because the cost of moving their home may be prohibitively high. In addition, a 60 day notice of the closure of a park can significantly impact the many residents that have put tens or hundreds of thousands of dollars into their homes. Further, and perhaps most importantly, there are no protections from increases in rent or fees, which can have the effect of pricing tenants out of an MHC.

Investors buying MHCs have raised rents and added fees in order to maximize profit from a captive audience. Those increases can be extreme; in Iowa we have seen the total cost at one park financed by Fannie Mae increase by 60% in just two years.[9] These types of extreme increases can mean a resident may be forced to sell their home, or lose it entirely (often allowing the MHC owner to sell that home, or sell a newer replacement home). In addition, in the event the tenant is able to sell the home, they will often get less for it, as the new buyer knows their ongoing costs of renting the pad site will be higher. That leaves these communities in a difficult situation where a rent increase actually decreases the value of homes in the MHC – which can have the effect of transferring value from the homeowner to the park owner.

Longer term leases for pad rentals could also help protect residents from predatory increases in cost, and serve an additional benefit. Multi-year leases will give more certainty for homeowners, which will in turn make it easier for the Enterprises and others to support more traditional mortgages for people buying manufactured homes, a long-term goal to provide better protections and lower costs for homebuyers that is consistent with Fannie Mae’s most recent Duty to Serve plan.[10]

Right of First Refusal

Finally, FHFA should work to protect our constituents by requiring that residents have the opportunity to buy their MHC for any property that receives Duty to Serve credit. Resident ownership and control over the land under their homes will give them long term security and ensure any rent increases go towards benefits they want. For example, a MHC in Durango, Colorado was recently bought by its residents, who were able to avoid a projected $350 rent increase from the corporate offer in favor of one for less than $100.[11] Other groups of resident ownership could be supported in one of two ways – first, requiring evidence that the residents were offered the chance to purchase the property for any MHC that would receive DTS credit, or, second, including this protection going forward in the loan agreement for any property covered by the TSLPs (and thus receiving DTS credit).

Properly aligning Duty to Serve credit with the protections for residents

We also ask that you work to focus more of the Enterprises’ support for MHCs on those properties that do protect tenants, and to align the level of DTS credit with the level of protections for the residents. For example, additional credit for sales to resident groups could encourage the Enterprises to do more to support those purchases. DTS credit should also be reserved for loans which actually protect residents from eviction and major cost increases.

We urge you to strengthen existing protections like TSLPs, to better protect residents from eviction and major price increases. These protections should include efforts to ensure long term affordability for tenants, and protect MHC residents from predatory landlords. Some additional possible protections can also be found in legislation like the Manufactured Housing Tenants’ Bill of Rights.[12] Over the long run, FHFA should be working to ensure that all homeowners, regardless of the type of home they purchase or where they site it, have the protections and stability that homeowners with site-built homes enjoy today.

We thank you for your work to ensure all Americans will be stably housed and for your attention to the steps FHFA and the GSEs can take to better protect the people living in manufactured housing communities. We hope to work with you further to ensure the Enterprises are fulfilling their intended purpose, and that MHCs they finance are benefiting the residents.

Sincerely, [the letter was signed by the Democratic lawmakers and Democratic Socialist Bernie Sanders listed below.]

| Cynthia Axne Member of Congress |

John Hickenlooper United States Senator |

| Sherrod Brown

United States Senator |

Tina Smith

United States Senator |

| Suzanne Bonamici Member of Congress |

Earl Blumenauer

Member of Congress |

| Raúl M. Grijalva

Member of Congress |

Bernard Sanders

United States Senator |

| Jennifer Wexton

Member of Congress |

Richard Blumenthal

United States Senator |

| Jimmy Panetta

Member of Congress Ron Wyden United States Senator Amy Klobuchar United States Senator |

Tim Kaine

United States Senator Madeleine Dean Member of Congress |

Footnotes to that letter are as follows.

[1] https://www.manufacturedhousing.org/wp-content/uploads/2017/10/Understanding-Manuactured-Housing.pdf

[2] https://www.nytimes.com/2022/03/27/us/mobile-home-park-ownership-costs.html

[3] https://www.washingtonpost.com/business/2022/06/06/mobile-manufactured-home-rents-rising/

[4] https://www.newyorker.com/magazine/2021/03/15/what-happens-when-investment-firms-acquire-trailer-parks

[5] https://www.npr.org/2021/12/18/1034784494/how-the-government-helps-investors-buy-mobile-home-parks-raise-rent-andevict-pe

[6] https://docs.house.gov/meetings/AP/AP20/20220526/114841/HHRG-117-AP20-Wstate-McCarthyG-20220526.pdf

[7] https://www.fhfa.gov/SupervisionRegulation/Rules/RuleDocuments/2016%20Duty%20to%20Serve%20Final%20Rule_For %20Web.pdf

[8] https://www.desmoinesregister.com/story/news/local/waukee/2019/03/27/waukee-midwest-country-estates-mobile-homepark-havenpark-capital-utah-rent-increase-rates-iowa/3267410002/

[9] https://www.desmoinesregister.com/story/news/local/waukee/2019/03/27/waukee-midwest-country-estates-mobile-homepark-havenpark-capital-utah-rent-increase-rates-iowa/3267410002/

[10] https://www.fhfa.gov/PolicyProgramsResearch/Programs/Documents/FannieMae2022-24DTSPlan-April2022.pdf

[11] https://www.durangoherald.com/articles/renters-become-owners-of-durango-mobile-home-park/

[12] https://www.congress.gov/bill/117th-congress/house-bill/3333/text? r=12&s=2#idF7247B5F531841EFA2BB5733C36B57EB

15) Those leftist lawmakers were writing a fellow Democrat during a Democrats Biden-Harris administration to say:

But as other leftists have pointed out, including the routinely left-leaning owned and editorial stance media outlets they cited, the reality is that affordability under the Biden-Harris term of office has eroded. A prominent Democrat said they knew their policies would fuel inflation. The tenant protections discussed in the letter above have not meaningfully increased, as MHC consolidators Keel and Rolfe essentially said.

16) Is it any wonder that leftist Michael Weinstein recently ripped “Corporate Democrats” for their failure to protect the interests of their own voting base? This is a prime example of a ‘circle fest’ of Democrats pointing the finger, often citing each other, yet they gleefully allow this charade of undermining the interests of potentially millions living in manufactured home communities to continue.

17) Billions are being spent (wasted, cronyism, corruption) on homeless and affordable housing programs, as Weinstein pointed out (see the item above), while housing affordability has been collapsing at a record pace with Democrats in charge of the federal government, and with Democrats still holding great sway over the Congress as the recent vote in the House on foreign aid funding measures desired by Democrats illustrates. Conservatives and so-called “MAGA” or “America First” Republicans (as opposed to RINOs who in a pinch will reliably vote as their donors who support Corporate Democrats want them to do) may or may not have put together these puzzle pieces precisely in this fashion. but they have pointed out the tragic consequences of Democratic policies in the past 3 years. Longtime and detail minded MHProNews readers may recall that it was a HUD investigator that told MHProNews that much of the federal budget is a funnel that is pouring money into private businesses hands. A further look reveals that government largesse also flows into the coffers of some nonprofit groups and platforms such as left-leaning NPR too. Because of the complexity of federal spending, it takes time to sort through such details. But as this bullet #17 and several other items in Part III of this report more broadly reveals, the money has been flowing for years.

Meanwhile, housing affordability has worsened during a Democratic administration.

18) Ironically, some Democratic lawmakers were in Congress when the House probed the failure of HUD to properly implement the Manufactured Housing Improvement Act of 2000 (MHIA, 2000 Reform Law, 2000 Reform Act), which was passed by a widely bipartisan margin and signed into law by then President William Jefferson “Bill” Clinton (D).

19) It isn’t just millions of Americans who have voted Democratic, some for years or decades, who are being ‘screwed over.’ Smaller and potentially emerging businesses are being harmed too.

20) There are several updates pending for the land-lease manufactured home community (MHCs) sector and also for the manufactured home production and retail sectors. That said, for now, the following items are the most extensive, fact-packed, and detailed looks at authentic information vs. faux ‘trends’ or head fakes by others. Those others are routinely pushing their own, sponsors, or dominating member agendas.

21) There are plenty of head fakes going on at the governmental, political, association/nonprofits, and corporate levels. That’s not to say that all in those roles are evil or corrupt. Facts are whatever they are. But what is clear is that despite happy talk by Biden-Harris, “Corporate Democrats,” and MHI, the vision for MHC growth that the Landys have advanced is being thwarted by Democrats and their corporate cronies. Democrats have the clear financial edge in campaign season. They arguably have a clear media and big-tech edge too. Democrats could be advancing policies that boost wages instead of undermining them. Democrats could be advancing policies that secure the border instead of opening the border. Democratic policies could be causing energy costs to drop instead of rise. Democrats could allow the free market to do its job by unleashing manufactured housing production for real, instead of talking about manufactured housing while undermining it on a practical level in ways that benefits consolidators.

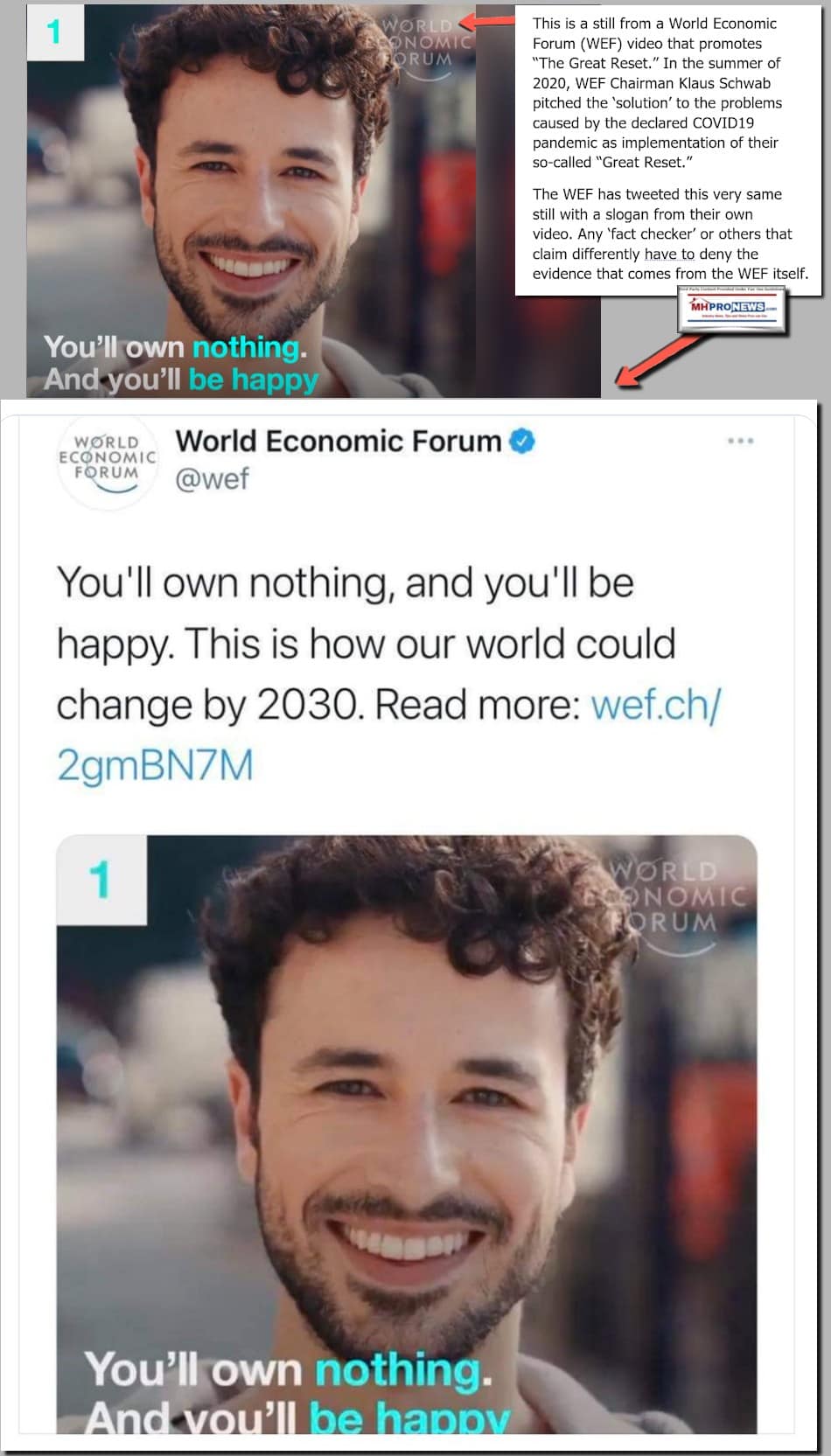

22) The list of MHI and MHI-linked state-association member brands that are arguably getting screwed over is lengthy. Some of those brands may have ‘gentlemen’s agreements’ to sell out to this or that consolidator ‘at the right time.’ But what some of those brands may not realize is that they are routinely vulnerable to whatever the latest scam is where ‘weaknesses in markets’ allows a well-connected firm to exploit smaller ones. Buffett said it. You can’t make a good deal with a bad person. The fact that some got to exit with what may look like a good deal begs the question, what might that business have been worth absent market manipulation?

23) The laugh isn’t on big corporations. Those corporate interests are the ones who demonstrably helped put Biden and scores of Democrats (and some RINOs) into positions of power. MHProNews documented that years ago using their own statements.

24) Manufactured housing is underperforming precisely because the powers that be that de facto run the government in their own perceived best interests want the industry to underperform. When manufactured housing underperforms, they may reason, their other conventional housing investments by comparison do better. To be clear, their own conventional housing interests are underperforming too. The desire for more renters has been a touted feature of ‘the “Build Back Better” agenda that corporatists have supported at the World Economic Forum (WEF) and other events for some years. Transferring wealth from the working- and middle-class or retirees to the wealthiest among us is a demonstrable feature of the new globalist economy too. These are NOT conspiracy theories. These are stated programs, produced videos, books, and articles by the WEF and others whose plan was embraced by Biden-Harris early on. This is in your face propaganda that utilizes the techniques of paltering and the Big Lie.

There are some on the right and left that have caught onto diabolically sinister nature of these behaviors.

25) There are people at the level of tens of millions of dollars in wealth who may think that they are ‘secure.’ They may think that they are protected. That is historically nonsense and utter folly. History is packed with examples of violent or sly revolutions where the allies of the insiders were eliminated after the coup was complete. The routine losers are always the working and middle classes. The very people that the Democratic party claims to champion are the ones who are often being harmed the most by the real-world outcomes of the policies of the last several years. The good news? There are an array of resources, often from leftists or former leftists, that demonstrate what some have called ‘a great awakening.’

26) The working class, retirees, the middle class, and even some in the so-called 1 percent are going to suffer immeasurably if Biden (or whoever the elites want to replace him) Harris get another term. If what leftist Weinstein aptly called “Corporate Democrats” can pummel a billionaire like deposed President Trump, how much easier will they be able to prevail against someone with tens of millions of dollars? When left-leaning CNBC star and wealthy Kevin O’Leary is telling people doing business in New York (as an example of a ‘blue state’) should beware due to the troubling example of lawfare aimed at Trump, that’s a sobering warning.

a) To illustrate that, note the following Q&A with left-leaning Bing’s AI powered Copilot.

Kevin O’Leary has made repeated warnings to other wealthy people, small to mid-sized business owners, due to the lawfare being used to target Trump’s business interests. He has essentially said that if it can happen to Trump, it can happen to others, right? Give some examples of the kinds of reports and sources for O’Leary’s remarks about the threat to smaller businesses and investors in New York or so called “blue states.”

28) Millions are being ‘screwed’ (to put it politely) in real time. It is not hard to see, once someone understands paltering, projection, preening, etc.

29) MHProNews has several pending reports that will update specific aspects of the manufactured home industry and/or specific brands in MHVille. Stay tuned. Until then, the linked reports represent the what Copilot and other sources indicate is the runaway most popular source for information in the manufactured home industry. We’ll provide information on Crow, Flagship, and other players with context and background that others won’t. Stay tuned.

30) There are sources in D.C. that indicate that serious antitrust action and real growth could occur if a Trump 2.0 occurs. See the linked reports to learn more. Watch for those planned reports on fresh details from various aspects of MHVille. Because it isn’t just residents that are “trapped” – as NBC said – in predatory MHI member communities. There are smaller to even mid-sized businesses and investors that may not yet fully realize it, but they also have a bullseye on their backs too. As that government insider told MHProNews, “Elections have consequences.” ###

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’