Per left-leaning Wikipedia: “The Center Square, formerly Watchdog.org, is an American news website that features reporting on state and local government.” Ballotpedia stated: “Watchdog.org is a network of state-based watchdog reporters keeping an eye on government corruption and transparency that was begun in September 2009.” On 3.14.2024 the Daily Signal and The Center Square published a featured article under “Economy News” by Bethany Blankley entitled “Inflation woes: Home buyers need 80% more income to buy than 4 years ago.” While the report doesn’t mention manufactured housing, it has broad implications for the U.S. housing market, including for the manufactured home industry.

- Part I of this report will be Blankley’s article.

- Part II will provide additional information with more MHProNews analysis and commentary.

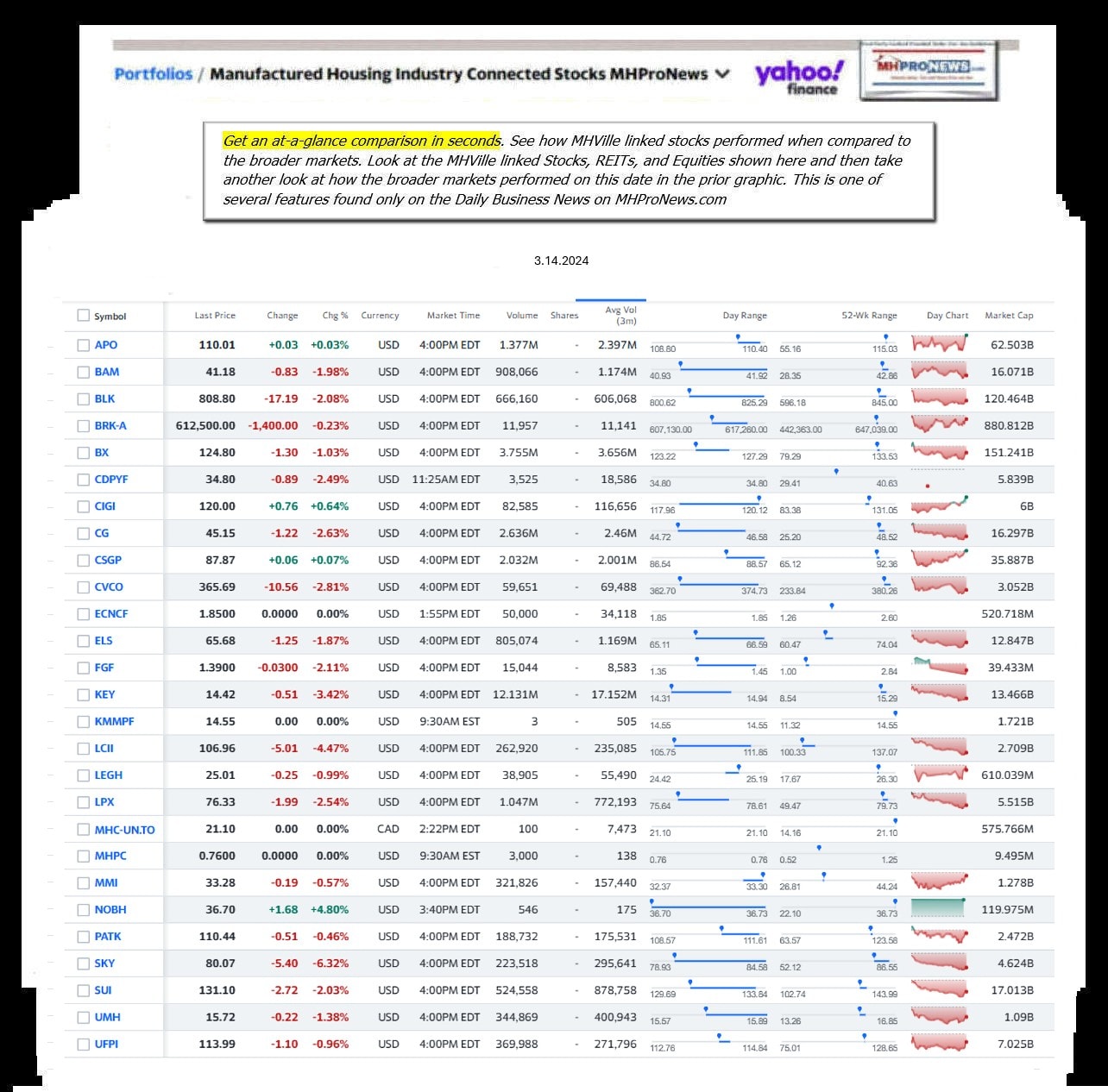

- Part III is our Daily Business News on MHProNews manufactured housing industry connected equities report. Most of those stocks fell on 3.14.2024.

Part I

Would-Be Homeowners Need 80% More Income to Buy Than 4 Years Ago, Study Finds

Bethany Blankley / @BethanyBlankley / March 14, 2024

The housing market is not immune from inflationary woes as buyers’ purchasing power has significantly diminished in four years. Homebuyers in 2024 need 80% more income to purchase a home than they did in 2020, according to a new report by Zillow.

“The income needed to comfortably afford a home is up 80% since 2020, while median income has risen 23% in that time,” the report states. That equates to $47,000 more than four years ago.

“Home shoppers today need to make more than $106,000 to comfortably afford a home,” according to the report. “That is 80% more than in January 2020.”

A monthly mortgage payment for a typical U.S. home has nearly doubled since January 2020, the report notes, up 96.4% to $2,188. The calculations are based on a 10% down payment.

Home values also increased more than 42% in the past four years, with the typical home nationwide worth roughly $343,000, according to Zillow’s January market report. Mortgage rates in January 2020 were 3%, the report notes. By February 2024, they are closer to 7%.

While costs have increased, wages have not. In 2020, a household income of $59,000 a year “could comfortably afford the monthly mortgage on a typical U.S. home, spending no more than 30% of its income with a 10% down payment,” the report notes. “That was below the U.S. median income of about $66,000, meaning more than half of American households had the financial means to afford homeownership.”

Four years later, that analysis no longer holds true. Today, roughly $106,500 is needed to comfortably afford a mortgage payment, the report states, “well above what a typical U.S. household earns each year, estimated at about $81,000.”

In seven major housing markets, a minimum household income of $200,000 is needed to comfortably afford a typical home, the report notes.

The report’s analysis was based on quarterly median household income from the American Community Survey, Moody’s Analytics, and the Bureau of Labor Statistics’ Employment Cost Index.

The findings were announced as total household debt reached a record $17.5 trillion in the fourth quarter of 2023, according to a Federal Reserve Bank of New York report. Mortgage debt increased by $112 billion in Q4 2023 to reach $12.25 trillion. Balances on home equity lines of credit increased by $11 billion, the seventh consecutive quarterly increase after Q1 2022. There are currently $360 billion in aggregate outstanding balances, the Fed states.

Credit card debt reached a record $1.13 trillion in 2023, increasing by $50 billion, or 4.6% over the year, the report notes. Other personal debt, including retail cards and consumer loans, grew by $25 billion.

Auto loan debt increased by $12 billion to $1.61 trillion, “continuing an upward trajectory seen since 2011.” At the same time, car insurance rates surged 26% nationwide over the past year and are expected to remain elevated until 2025, according to a Bankrate report. ##

Originally published at TheCenterSquare.com

Part II – Additional Information with More MHProNews Analysis and Commentary

As the new deep dive into Biden-Harris era housing policies, as implemented by figures such as HUD Secretary Marcia Fudge linked here reveals, claims have been made by Team Biden that Bing’s AI powered Copilot confirmed are simply not true. Biden recently claimed, for example, that more houses are under construction than at any time in U.S. history. Not so.

1) The data regarding skyrocketing monthly payments revealed from research by Zillow and as reported in Part I above which was featured by The Center Square and right-leaning Daily Signal obviously will result in fewer homes being purchased, and thus fewer homes being built. During an affordable housing crisis, this is a recipe for throttling construction, rather than more new single-family home building.

> “Copilot, let’s pivot to a new report from the Center Square and the Daily Signal yesterday entitled: “Would-Be Homeowners Need 80% More Income to Buy Than 4 Years Ago, Study Finds” can you scan that and see if the data looks accurate? If so, doesn’t that tend to undermine Biden-Harris claims that their policies are going to result in closing the housing shortage gap? Doesn’t it also tend to demonstrate what HUD PD&R researchers Pamela Blumenthal and Regina Gray said that for 50 years Democratic and Republican administrations have made promises on housing policies but have failed to deliver, due in part to zoning and regulatory barriers? And then doesn’t the data at this link here https://www.manufacturedhomepronews.com/masthead/affordable-housing-crisis-solution-made-easy-9-minutes-of-facts-with-applied-common-sense/ demonstrate that without millions of more affordable manufactured homes being sold, the housing shortage gap can’t be closed by single family housing builders, based on remarks made by Jerry Howard on behalf of the National Association of Home Builders? Confirm or clarify and then link results.”

- Data Accuracy:

- According to the report by Zillow, homebuyers in 2024 need 80% more income to purchase a home than they did in 2020.

- The income needed to comfortably afford a home has increased significantly, while median income has risen at a slower rate.

- Specifically, home shoppers today need to make more than $106,000 to comfortably afford a home, which is 80% more than in January 2020.

- Impact on Housing Policies:

- The data tends to undermine the claims made by the Biden-Harris administration that their policies will close the housing shortage gap.

- Despite their promises, the reality is that housing affordability remains a significant challenge for many Americans.

- HUD PD&R Researchers’ Insights:

- Pamela Blumenthal and Regina Gray, researchers from HUD PD&R, have highlighted that both Democratic and Republican administrations have struggled to address housing affordability.

- Zoning and regulatory barriers have been persistent obstacles to achieving meaningful progress in housing policy.

- Role of Manufactured Homes:

- The link you provided demonstrates that without millions of more affordable manufactured homes being sold, the housing shortage gap cannot be closed solely by single-family housing builders.

- Jerry Howard, on behalf of the National Association of Home Builders, acknowledges the importance of manufactured homes in addressing the affordability crisis.

In summary, the data underscores the urgency of addressing housing affordability, and it highlights the need for comprehensive solutions that consider various housing types, including manufactured homes. 🏡📊

For further context, you can explore the provided links:

- Report on Would-Be Homeowners Needing 80% More Income1

- Affordable Housing Crisis Solution: Facts with Applied Common Sense 2 🌐🔍…”

Let’s note for accuracy’s sake that the statement by Copilot about Jerry Howard (#4 bullet two above) may be an error. Howard led NAHB has co-sponsored with HUD the Innovative Housing Showcase (IHS), which featured manufactured homes. So, there is some apparent indirect support that could be claimed. But when pressed on that point in a follow up, Copilot said in part: “While I couldn’t find specific quotes directly from Jerry Howard specifically mentioning manufactured housing,…” and “his overall advocacy for the housing industry and his focus on addressing challenges related to supply, affordability, and regulations have been consistent themes throughout his tenure.” Howard retired in 2023 and “James W. Tobin III succeeded him as the new president and chief executive officer of NAHB, effective June 1, 20235.”

2)

> “Marty Lavin, J.D., is a multi-decade manufactured housing industry professional and a Manufactured Housing Institute award winner. Unlike several more recent “Institute” award winners, Lavin has been a periodic critic of Manufactured Housing Institute stances. He has observed, for example, that industry professionals should ‘pay more attention to what people do rather than what they say,’ and that thinkers should ‘follow the money’ trail to see what motivates actual behaviors, correct? That noted, even though on the surface it may seem that the Institute and the Manufactured Housing Association for Regulatory Reform (MHARR) are both advocating for similar things, the behavior of Institute leaders seems to contradict their formal stances. For example, zoning can be overcome by a robust use of the “enhanced preemption” provision of the Manufactured Housing Improvement Act of 2000 (MHIA, 2000 Reform Act, or 2000 Reform Law), which MHI and MHARR teamed up to get enacted into law along with the Texas Manufactured Housing Association (TMHA) in the closing years of the 20th century. But in recent years, MHI has been openly collaborating with conventional housing trade groups. They essentially behave as if MHARR doesn’t exist. They have no mention of “enhanced preemption” on the Institute’s own website, while MHARR has dozens of times that phrase is used on their website. And in the last day or so, MHI appears to have back-dated a new post praising HUD Secretary Marcia Fudge without noting that she specifically refused to enforce the enhanced preemption provision of the 2000 Reform Act. MHI even produced a video of their favorite moments with Secretary Fudge, thanking her. But isn’t the stated job of MHI to work for all segments of the manufactured housing industry, not just for the consolidators of the industry, as their critics have claimed with solid evidence? Doesn’t Lavin’s principle jump to life with respect to the stark disconnect between MHI’s claims and behavior?”

- “Follow the Money” Principle:

- Lavin’s principle suggests that understanding motivations requires looking beyond public statements and examining actual behaviors.

- By tracing financial interests and incentives, we can often uncover the true drivers behind decisions.

- MHI vs. MHARR:

- While both the Manufactured Housing Institute (MHI) and the Manufactured Housing Association for Regulatory Reform (MHARR) ostensibly advocate for similar goals, their behavior sometimes diverges.

- Enhanced preemption, a critical provision in the Manufactured Housing Improvement Act of 2000 (MHIA), is a prime example.

- MHARR consistently emphasizes this provision, while MHI’s website lacks any mention of it.

- Collaboration with Conventional Housing Trade Groups:

- Recent years have seen MHI openly collaborating with conventional housing trade groups.

- This behavior raises questions about MHI’s commitment to all segments of the manufactured housing industry.

- HUD Secretary Marcia Fudge and Enhanced Preemption:

- MHI’s recent post praising Secretary Fudge without acknowledging her refusal to enforce enhanced preemption highlights a disconnect.

- Lavin’s principle underscores the importance of actions aligning with stated goals.

In summary, Marty Lavin’s principle indeed comes to life when examining the stark contrast between MHI’s claims and behavior. The industry deserves transparency and consistency in advocacy efforts. 🏡💡

For further context, you can explore the provided links:

- Exposé on MHI CEO Lesli Gooch and Duty to Serve Controversies1

- Manufactured Home Financing and Prosperity Now2 🌐🔍

Learn more

> “Well said. Similarly, Lavin’s principle seems to apply to what the Biden-Harris-Fudge era of housing policy has produced, right? Former House Majority Whip, James Clyburn (SC-D) told MSNBC circa October 2022 – and thus weeks before that midterm election which cost Democrats their House majority – that Democrats knew their spending policies would result in inflation. Clyburn is a student and teacher of history. He better than many would know, as he himself indicated, that the lessons of history are clear on defictis and borrowing resulting in spikes in inflation, which is what occurred. So, applying Lavin’s principles, it seems that Democrats clearly knew that their policies would harm housing production, not help it, despite campaign promises. Isn’t all that logically accurate? Confirm, clarify, and provide the specific quote by Clyburn on the importance of knowing history and its lessons. Link results.”

Learn more

“Useful, but the specific quote I had in mind about Clyburn was this one: “We study history in order to understand the present and prepare for the future. Because anything that’s happened before can happen again.” That was on 2.29.2020 per a televised remark. One may or may not agree with Rep. James “Jim” Clyburn’s politics. But the wisdom of this statement by Clyburn is demonstrably true. Confirm or clarify as needed and link the results.”

“We study history in order to understand the present and prepare for the future. Because anything that’s happened before can happen again.”

Clyburn’s wisdom underscores the importance of learning from historical events and applying those lessons to navigate the complexities of the present and anticipate future challenges. Regardless of one’s political views, this principle remains universally relevant.

For further context, you can explore the provided link:

5)

> “It seems that there is an evidence-based case to be made that paltering, posturing, and faux promises that are unlikely or clearly not intended to be kept, have been in evidence at the Manufactured Housing Institute (MHI) for much of the 21st century. By providing a video of MHI leaders with Secretary Fudge, they have demonstrated their access. That access could have been used to press for the enforcement of the “enhanced preemption” provision of the Manufactured Housing Improvement Act of 2000. MHARR has a letter on their website, which is also found on MHProNews.com and MHLivingNews.com, written by Democratic lawmakers asking Republican appointed HUD Secretary Mel Martinez to enforce the law on enhanced preemption. Fudge served in Congress for years. She knows the importance of overcoming zoning barriers for the advancement of black, other minorities, and low-income people of all backgrounds to have access to affordable manufactured housing. Fudge claims to support more manufactured homes, as various Biden-Harris era White House statements reflect. But if the Biden-Harris-Fudge era of housing policy has made clear, despite promises of more manufactured housing, production dropped sharply in 2023 vs. 2022. This seems to fit what MHARR president and CEO, Mark Weiss, J.D., called a shell game in in interview with MHProNews. It seems that government and associations alike have to be held to account for their failures to perform as promised. See if there are any logical or factual errs in that and provide the links to relevant results.”

Learn more

6)

> “As a political independent myself, it seems that a close reading of U.S. history in most of the 20th and all of the 21st centuries reveals the following. To oversimplify, for over a century so-called “progressives” have talked about how big problems could be solved by more government, more regulations, and technocratic expertise could solve problems like housing shortages. HUD is now over 50 years old, right? Are we any closer to solving the U.S. housing crisis? Their own researchers Blumenthal and Gray have said “no.” That noted, prior Trump era HUD Secretary Ben Carson praised manufactured homes, said that demand was assured because the needs were so great in a speech saved on the HUD website and also on MHLivingNews and MHProNews. I can’t find that speech on the MHI website, even though that address was made to MHI members. Carson promised a new era of cooperation between the industry and HUD. It is not known if MHI used its access to Sec Carson, but I’m not aware of any mention at any time by Dr. Carson of “enhanced preemption” as a way of overcoming zoning barriers. It seems that those who are critics of big government, big business, big media, and big tech as often failing to keep their promises have a point. And it also seems that some associations in manufactured housing have made promises to dues paying members that they have failed to keep. Scan the web as needed, confirm, correct, or clarify as needed and link the results.”

a) Statistics similar to those from Watchdog.org and the Daily Signal’s report (Part I above) have been previously reported by MHProNews/MHLivingNews. So, this research confirms or ‘vindicates’ prior ones. Rates dropped somewhat since the item below, but the principle and data is otherwise much the same as is shown above.

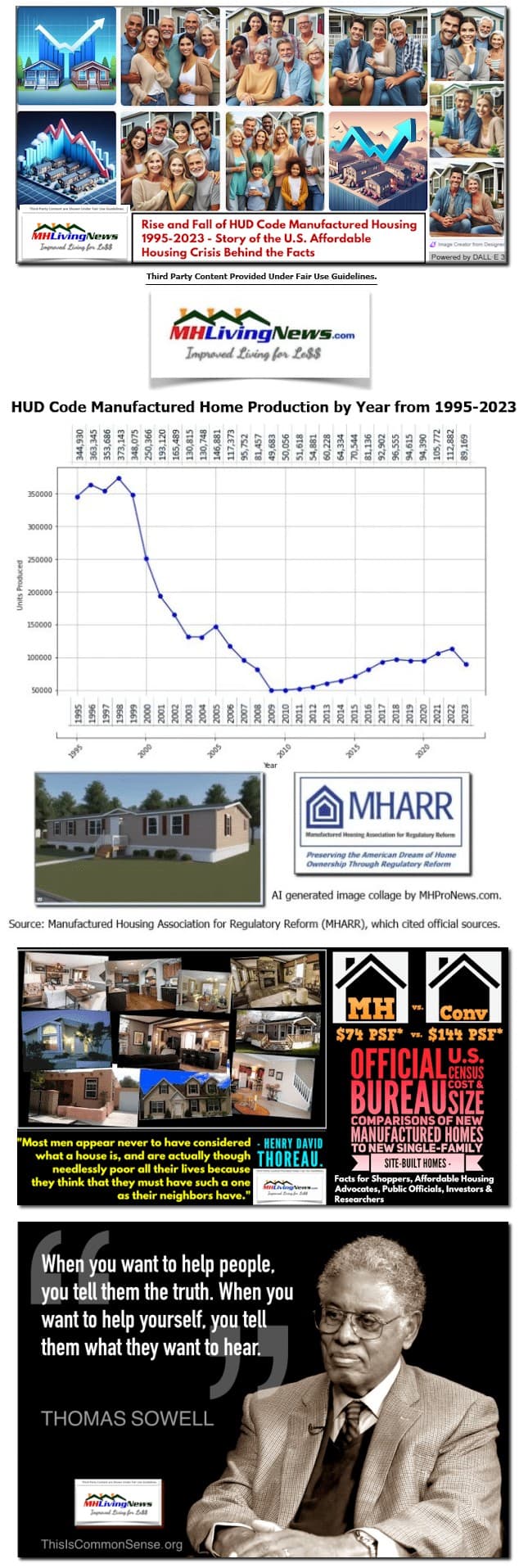

b) When Congress passed the widely bipartisan Manufactured Housing Improvement Act of 2000 (MHIA, 2000 Reform Act, or 2000 Reform Law) they first studied the manufactured home industry. The 2000 Reform Act provided additional safeguards for consumers. Those consumer safeguards were stronger in many cases than are found for far more costly conventional housing. Yet, manufactured homes are about half the cost of conventional construction, per U.S. Census Bureau data. It is therefore an obvious, multi-decades proven, and necessary part of an ‘all of the above’ type of solution to the U.S. affordable housing crisis. The report linked below covers that in under 10 minutes of reading in a fact-packed analysis.

c) Despite the 2000 Reform Act legislation, manufactured housing production has declined instead of grown. As the analysis above reflects, some of that may be attributed to consolidators operating in the industry, essentially colluding with industry competitors. That’s not mere conjecture but rather is based on research by outsiders looking in as well as observers inside manufactured housing.

d) The open or de facto critics of MHI are arguably being vindicated on a monthly if not more frequent basis, as reports like the one linked below reflect.

e) MHARR and others have long called for new probes by Congress and other public officials for apparently failed and potential corrupt practices within manufactured housing that seem to benefit a few consolidators but are harmful to the many.

f) MHI leaders, once quick to respond to inquiries by MHProNews, have in recent years gone silent. As evidence mounts, and antitrust suits and other announced investigations grow in number, it may only be a question of time before public officials are forced to ‘do their job’ and properly probe the industry too.

MHProNews Programming note: stay tuned for related reports to these items above, which will further expose decades of oddities and troubling realities based on facts, evidence, and applied common sense. ##

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – 3.14.2024

- FCC cracks down on cable ‘junk fees’

- This dip in rates is welcomed by homebuyers, as rates are expected to stay higher for longer this year.

- Mortgage rates tumble for the second week in a row

- Pi Day means pizza deals

- TikTok’s headquarters in Culver City, California

- If the US bans TikTok, China will be getting a taste of its own medicine

- A Tesla dealership is seen on December 13, 2023 in Austin, Texas.

- Tesla is the worst performing stock in the S&P 500. Analysts say it has further to fall

- An aerial photo shows Boeing 737 MAX airplanes parked on the tarmac at the Boeing Factory in Renton, Washington, U.S. March 21, 2019.

- Boeing’s got serious problems. The solution has baffled everyone

- This is United States Steel Mon Valley Works Clairton Plant in Clairton, Pa., on Monday, Feb. 26, 2024.

- Biden says it’s ‘vital’ US Steel remain American owned and operated

- Yet another inflation gauge came in hot for February

- TikTok application seen on an iPhone in L’Aquila, Italy, in January 2021.

- Italy fines TikTok $11 million for failing to protect minors

- Boeing CEO Dave Calhoun, pictured in January.

- Dave Calhoun was hired to fix Boeing. Instead, ‘it’s become an embarrassment’

- Retail sales rebounded in February amid higher gas prices

- Former Treasury Secretary Steven Mnuchin is interested in buying TikTok

- Europe investigates Big Tech’s use of generative AI

- This investor predicted the dot-com bust. He thinks AI is a bubble that will ‘deflate’

- A wrinkle in lawmakers’ plans for TikTok: Finding a willing buyer

- Alabama state and city governments grapple with pair of cyber incidents

- China says US TikTok ban ‘an act of bullying’ that would backfire

- Addicted to TikTok? Here’s what the House vote to effectively ban it could mean for you

- Investigators have removed black boxes from LATAM’s plane that dropped suddenly

- Don Lemon says Elon Musk canceled his deal with X after ‘tense’ interview

- EV maker Fisker’s stock dives after company reportedly explores bankruptcy

- What’s behind the rapid increase in car insurance rates

- Boeing is unable to provide key information in door plug blowout investigation, NTSB chair says