More financing that is competitive has long been sought by manufactured housing. Is it attainable or an illusion? To set the table for one of the hottest topics in manufactured housing, namely, getting more affordable lending and finance and the role that Lesli Gooch or others play in that realm, an overview will be useful for new readers, researchers, and industry veterans alike. To accomplish that, there is a need to understand a 35,000-foot view of the various professional trade groups that are HUD Code manufactured home focused.

A brief review of the manufactured home industry trade group structure will be followed by new and historic insights and revelations that reflect upon recent public statements and actions that are rippling through the manufactured housing industry. Because a quiet revolt is reportedly underway among some MHI connected affiliates.

More on that following this initial overview of the industry’s trade groups.

A) The manufactured housing industry effectively has two national trade associations that state they represent the views of their respective memberships.

- The Manufactured Housing Institute (MHI) clearly states that their claim to reflect the views of “all segments” of manufactured housing.

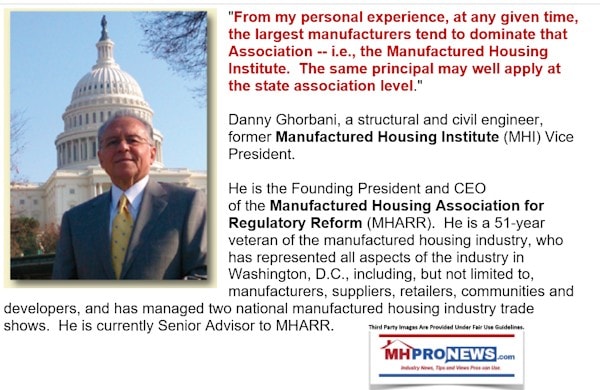

- By contrast, MHARR equally clearly says that the “Manufactured Housing Association for Regulatory Reform [MHARR] is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.”

- To clarify and stress, MHARR represents producers – i.e. independently owned factories that make HUD Code manufactured homes.

- By contrast MHI says they represent both production – factories – and post-production interests.

- “Post-production” in this context would be manufactured home retailers, land-lease communities, lenders, and others not directly involved in the production of manufactured housing.

- To clarify that further, think of the distinction between production and post-production like the National Association of Home Builders (NAHB) – producers of conventional housing – and the National Association of Realtors (NAR), which deal with issues involving the sale of existing (post-production) of primarily mainstream conventional housing.

- The RV and automotive industries also have production and post-production trade groups. That is a common arrangement in numerous industries.

- Manufactured housing professionals – by contrast to RVs, autos or mainstream housing – has no pure and active post-production representation at this time. MHI is an ‘umbrella’ trade group, which is unusual compared to other industries or professions.

B) On paper, there is also National Association of Manufactured Housing Community Owners (NAMHCO). NAMHCO launched about 2 years ago as a post-production trade group focused on land-lease community owner interest. NAMHCO did so having clearly stated that they broke with MHI due to what NAMHCO leadership said was MHI’s years of failure to advance their interests. Part of those interests NAMHCO referenced specifically included lending on HUD Code manufactured homes.

New NAMHCO Association Challenges Manufactured Housing Institute on DTS, Financing, and More

So, had NAMHCO pursued their stated aims, they would have been a post-production trade group representing community operators. That said, NAMHCO and their lobbyist have reportedly formally broken ties. NAMHCO have been quiet for months. They seem to be dormant at this time. For more details on that, see the reports linked above and below and those references which flow from them.

C) Then there is the Manufactured Housing Executives Council or MHEC. The MHEC group includes dozens of state association members, as well as representatives of MHI and MHARR. MHEC members routinely are MHI members, but some MHEC executives are dual members with MHARR, per sources. While they discuss issues and are involved in education and information sharing between themselves that routinely relate to state-based concerns, they are not per-se a lobbying group in the same fashion as MHI or MHARR operate.

D). Manufactured housing professional state associations are routinely umbrella trade groups – i.e. production and post-production – in manufactured housing. Some of them include other interests, such as RVs. By definition, state associations focus on state issues, but are routinely called upon to weigh in on national topics.

With that simple ABCD overview, let’s pivot to the latest on the red-hot topic of manufactured housing industry finance. Why now?

- Because there are fresh MHI statements and actions, along with a pattern of MHI statements and follow up.

- New comments from MHARR that take careful aim and make pointed allegations involving FHFA, the GSEs, and others.

- A relevant document by a GSE is in hand that was crafted in conjunction with an MHI member.

- A related on-the-record statement by MHI that many industry professionals have no doubt missed or are otherwise unaware of or forgotten.

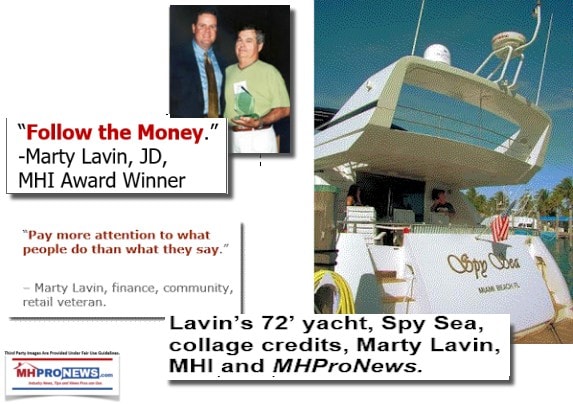

- Last and not least, there is the keen and exclusive revelation by a long-time MHI member to Namely, on the record comments from Marty Lavin, J.D., an MHI award winner.

Properly understood in the broad and specific contexts, Lavin’s comments – along with that of others referenced – may resound for months to come on this critical topic necessary for manufactured housing industry growth.

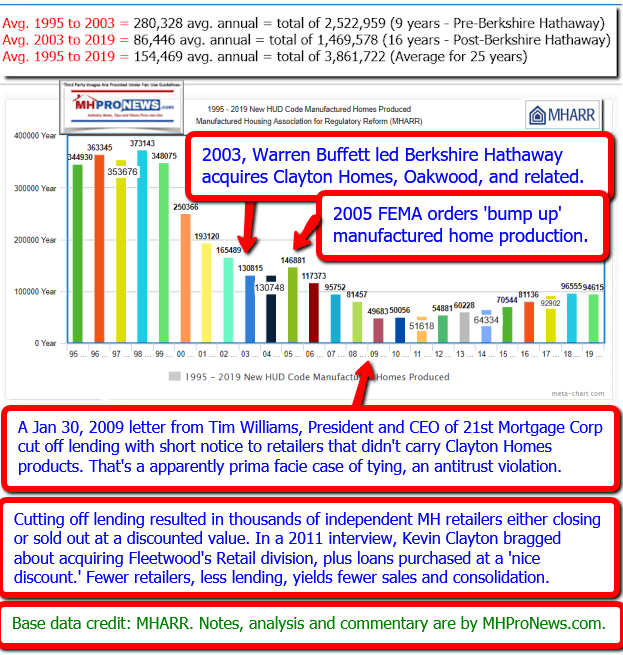

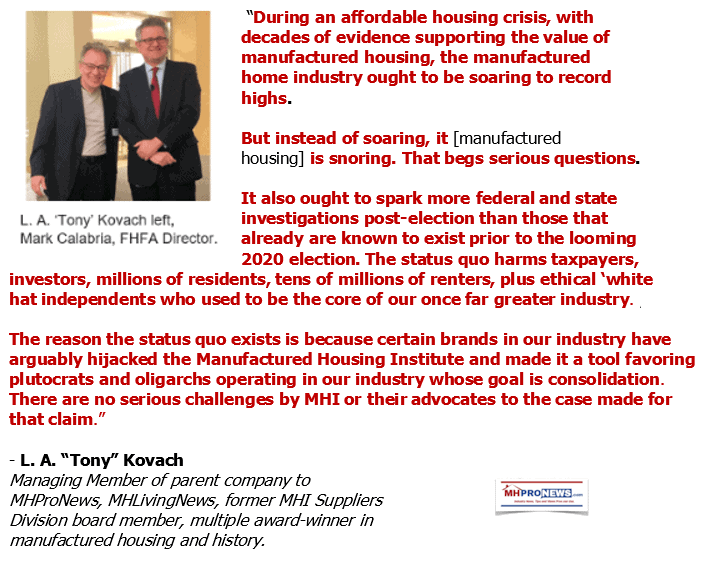

A broad consensus exists that financing, zoning and placement are issues that have held manufactured housing back for well over 15 years. MHProNews has previously reported that some in the state association – i.e: in the MHEC ranks – have made public as well as private grumblings about the deteriorating state of the industry during an affordable housing crisis which is seeing conventional housing soaring while manufactured housing is snoring.

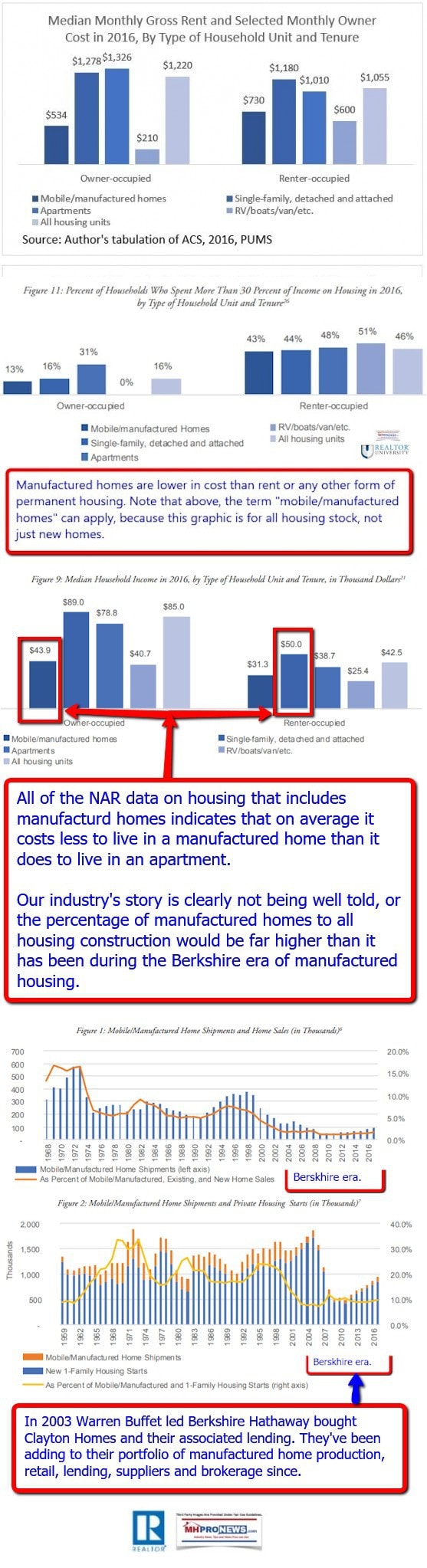

In that 15+ year timespan, the industry is actually selling fewer new manufactured homes now than then. That’s simply a sad but factual statement, based upon production and shipment evidence collected by HUD and the U.S. Census Bureau. The graphic below is from the National Association of Realtors seminal 2018 research into manufactured housing. It indicates at a glance several reasons why the industry should be doing well during an affordable housing crisis.

In order for the manufactured housing industry to avoid making the same mistakes in the same way perhaps wishfully thinking that there may be a different result – which fits a popular definition for insanity – new insights and a fresh look at the facts and evidence must occur.

That is what this factual and evidence-based report will do.

By gathering together relevant information from a range of each of the named sources, this report will probe the issues that impact thousands of professionals and millions of consumers.

This article that includes several exposé elements will thereby shed new light with information that is both fresh and historic.

This report will follow the following steps.

I. MHI’s emailed teaser to their members and related linked information.

II. A Government Sponsored Enterprise (GSE) and MHI formal documents and statements.

III. MHARR’s press release to MHProNews and formal statement to the FHFA/GSE Listening Session.

IV. MHI award-winner Marty Lavin, J.D., who provided a blunt and insightful expert assessment. Note that Lavin performed services for a GSE, so he knows this issue from a range of perspectives.

V. Based upon the above, an MHProNews analysis and commentary in brief.

VI. Conclusion and related resources.

With that outline, and the introduction above, let’s dive in.

I. MHI’s Email to Members and their Related Linked Information

On October 14, 2020, MHI emailed the following to their members. Note that MHI failed to mention Mark Weiss, President and CEO of MHARR, in the list of those who would address the listening session.

MHI to Deliver Comments During FHFA Duty to Serve Listening Session Friday

|

##

Note: MHProNews repeatedly requested from Lesli Gooch, MHI Chairman Tom Hodges, and others at MHI a copy of her remarks to the Listening Session. Each time, they declined to provide them. Why?

II) A Government Sponsored Enterprise (GSE) and MHI formal documents and statements.

The first screen capture is a snippet created by MHI’s own website that reflects a troubling statement by MHI. MHI said “However, Congress did not require chattel loans to be included under this statutory duty.”

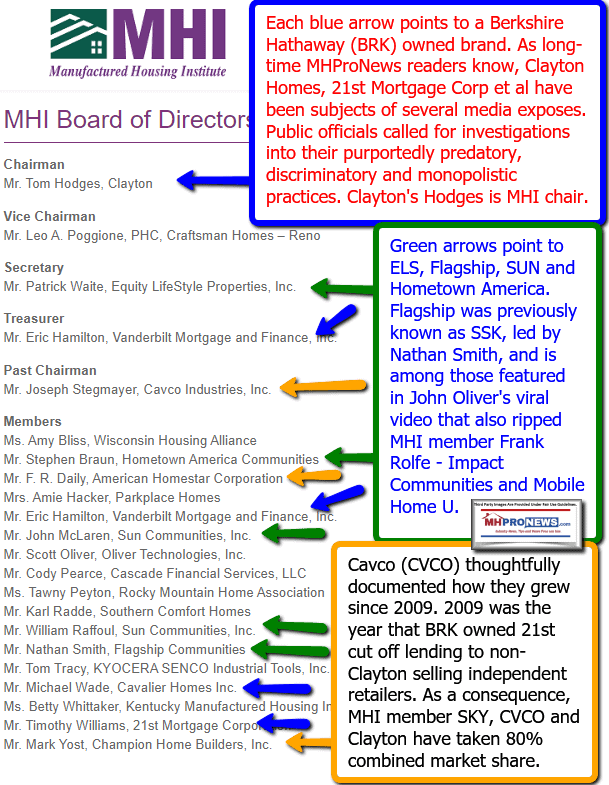

Note that the same press release, found at this link here, includes the following comment from then MHI Chairman, Tim Williams, President and CEO of Berkshire Hathaway owned 21st Mortgage Corporation. “The bottom line: done right, this [DTS on chattel and other loans] could make becoming a manufactured home owner more affordable.” That is a widely agreed upon point.

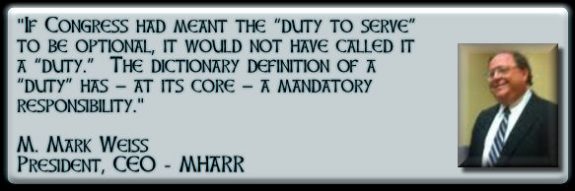

But if MHI’s Lesli Gooch, who was also quoted in that press release, and Williams were sincere in their desire to see chattel lending by the GSEs, why did the quote by Williams include these word: “However, Congress did not require chattel loans to be included under this statutory duty.” That’s at best a misleading statement, because the law clearly says that the GSEs may include chattel loans, which makes up some 76 percent of the manufactured home market today.

Rephrased, why would MHI undermine their own claimed argument? Is this the behavior of a Ph.D. or other educated professionals?

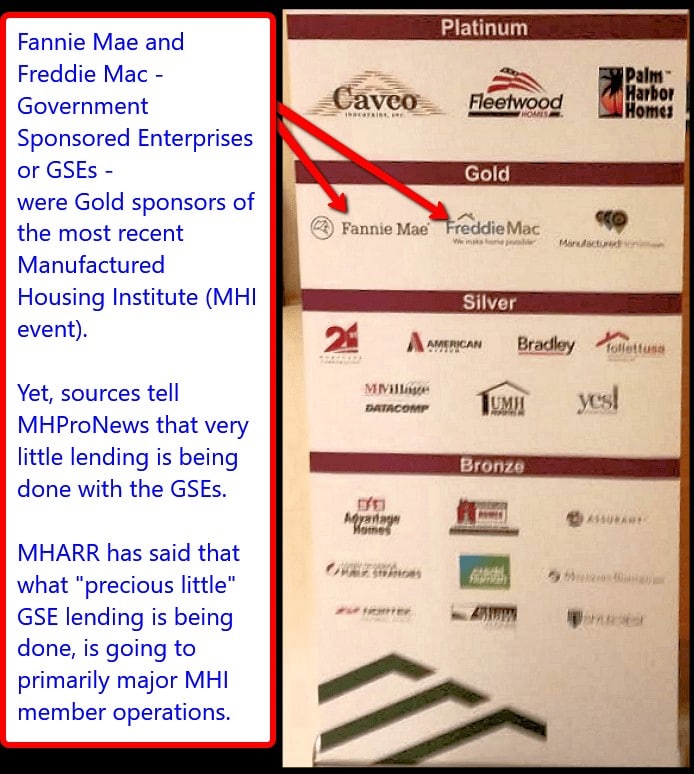

Then, note that Fannie Mae, made this statement from a detailed document on chattel and DTS lending found at this link here that is dated June 29, 2018. “This Paper is provided in connection with Fannie Mae’s January 1, 2018 Duty to Serve (“DTS”) Underserved Markets Plan for the Manufactured Housing Market (“MH Plan”). It satisfies (in part) Objective #1 under Regulatory Activity B of the MH Plan relating to manufactured housing titled as personal property (typically termed “chattel”). As the MH Plan notes, the majority of manufactured homes in the United States today are titled as personal property. Fannie Mae is considering whether to develop a chattel loan pilot under its MH Plan. This Paper is limited in scope to the fifty (50) states and to the District of Columbia. Substantial technical assistance in preparing this Paper was provided by the law firm of McGlinchey Stafford PLLC.”

As MHProNews has recently noted, the McGlinchey Stafford law firm is an MHI member. Fannie Mae notes a point that MHARR has often made. Namely, that Congress in passing DTS had a clear intent that the GSEs “may” do such loans, because that was the bulk of the market. That “may” arguably didn’t mean ‘can or can not at their own whim.’ To ignore personal property or chattel loans would have meant ignoring over 3/4ths of all manufactured housing lending, which would have made DTS support moot for the millions living in land-lease communities.

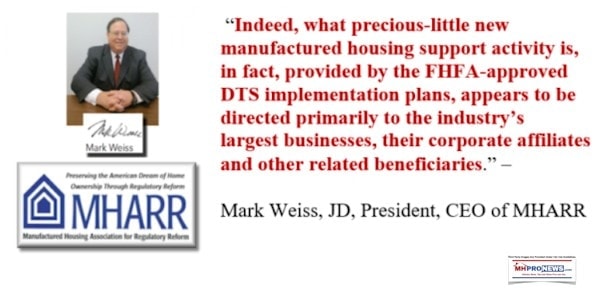

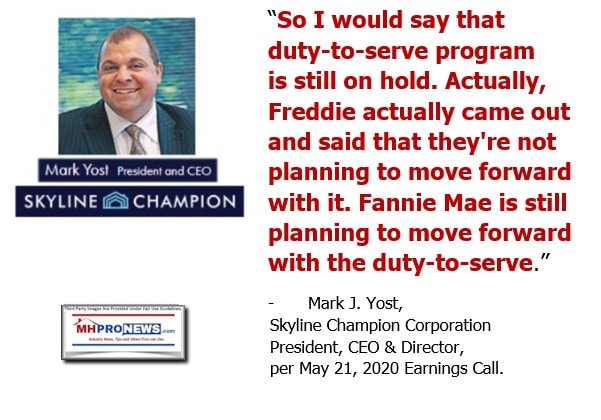

So, MHI weakened their own argument. Then, an MHI member worked with Fannie Mae to develop a plan that years later has still failed to provide any meaningful support for chattel lending. Ironically, Freddie Mac made a far less limiting statement as the screen capture below reflects.

So, MHI – for whatever reasons – and MHI members have worked with the GSEs in a fashion that minimized the need to do chattel lending with DTS. Their own papers, statements, and work products – objectively viewed – make that clear.

III) MHARR’s press release to MHProNews and their formal statement to the FHFA/GSEs Listening Session.

MHARR Exposes FHFA Duty to Serve Manufactured Housing Failures and Distortions to Congress

FOR IMMEDIATE RELEASE Contact: MHARR

(202) 783-4087

Washington, D.C., October 16, 2020 – The Manufactured Housing Association for Regulatory Reform (MHARR) in verbal and written comments presented at an October 16, 2020 Federal Housing Finance Agency (FHFA) “Listening Session” concerning implementation of the statutory Duty to Serve Underserved Markets (DTS) mandate (see, copy attached), has rebuked FHFA, as well as Fannie Mae and Freddie Mac, for their continuing failure to fully and faithfully implement the remedial DTS directive within the mainstream manufactured housing market, to the profound detriment of both consumers and the industry.

Citing public evidence from FHFA and other sources, MHARR pointed out that some twelve years after the enactment of DTS as a remedy for Fannie Mae and Freddie Mac’s long-term failure to serve the mainstream manufactured housing market and the lower and moderate-income American consumers who rely on inherently affordable manufactured homes, only 5-6% of the total market for new manufactured homes is being “served” under DTS, while the industry’s single largest and most affordable segment – comprised of homes financed as personal property – has been left totally unserved. Worse yet, FHFA, in various reports to Congress, has falsely certified that both Enterprises are in compliance with the DTS mandate, when they clearly are not. Thus, notwithstanding Congress’ clear directive, and FHFA’s legal responsibility to carry out and implement that directive in a market-significant manner, fully 94-95% of the current-day manufactured housing market remains completely unserved under DTS.

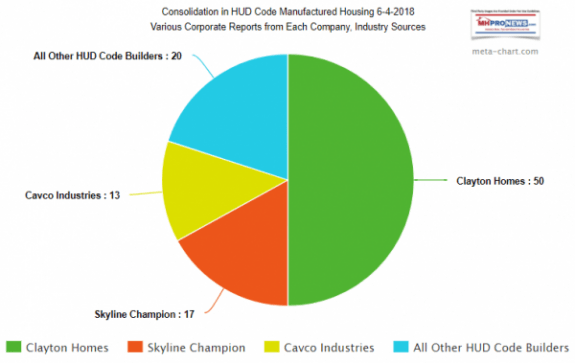

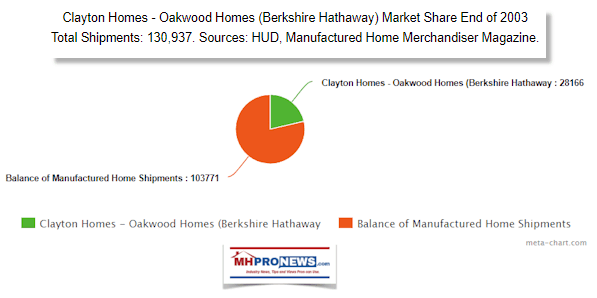

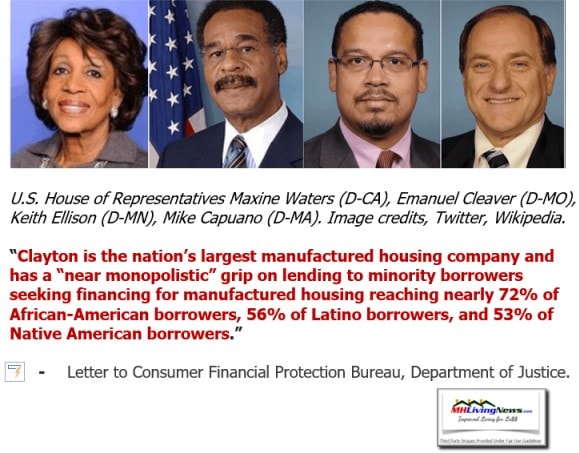

This failure to properly serve the mainstream HUD Code manufactured housing market under DTS, moreover, has resulted in significant harm for American consumers of affordable housing, subjecting “more than 90%” of manufactured housing personal property borrowers to “higher-rate” loans, according to federal data, within a less-than-fully-competitive lending market dominated by a relative handful of “portfolio” lenders, most of which are directly affiliated with the industry’s largest corporate conglomerates. This discrimination in the implementation of DTS not only subjects millions of lower and moderate-income Americans to needlessly high borrowing rates for mainstream, personal property manufactured home loans, but also needlessly excludes many more families from the American Dream of homeownership altogether.

In its presentation, MHARR emphasized that this failure to implement the direct statutory mandate of DTS is totally unacceptable, and must be remedied by FHFA. Accordingly, FHFA: (1) must conduct a thorough internal investigation into its failure to faithfully implement DTS within the manufactured housing market for twelve years – i.e., what has gone wrong for well over a decade; (2) must demand and ensure, as the federal regulator of Fannie Mae and Freddie Mac, that the two Enterprises terminate their diversionary tactics under DTS and scrap their current non-complying “plans” and programs; and (3) demand and ensure that Fannie and Freddie immediately implement effective, market-significant and fully compliant DTS programs within all segments of the mainstream HUD Code manufactured housing industry, given the fact that all relevant information, data and other predicates are already in place to do so, as advanced by MHARR.

Given the significant and growing need for affordable housing and homeownership in the United States, manufactured home production and sales should be experiencing strong growth, as is the case currently with other segments of the housing industry. Instead, though, manufactured housing production has lagged far behind historical norms for more than a decade now, and has actually declined, year-over-year, in both 2019 and 2020 due, in substantial part, to the lack of readily available, market-competitive consumer financing for the vast bulk of the industry’s consumers and especially consumers of the industry’s most affordable homes, financed as personal property. Congress, in its wisdom, sought to remedy this glaring inequality and discrimination through the DTS mandate in 2008, and it is FHFA’s legal obligation and responsibility to enforce and implement that mandate, as designed, now – not another decade or more in the future.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 —

Here are the linked comments from MHARR to the FHFA/GSE “listening session” as prepared for delivery. They plow significant ground and provide several facts that support their stated and consistent positions taken both privately and publicly over the course of a dozen years. Note too that MHARR’s prior and founding president, Danny Ghorbani, was involved in the drafting of the DTS law. Also worth mention is that Ghorbani was previously an MHI vice president for several years, before he left and soon helped form what became MHARR.

IV) MHI Totaro Award-Winner Marty Lavin, J.D. Statement to MHProNews. Note that the MHI Totaro award is financing specific and reflected a kind of ‘lifetime achievement” honor in manufactured home lending. Note too that Lavin performed extensive services for GSE Fannie Mae, the larger of the two Enterprises by loan volume, and has done years of lending and consulting with others in the industry.

Lavin told MHProNews earlier today – 10.17.2020 – the following.

“Regarding the DTS question; “Don’t pay attention to what they [MHI, the GSEs, or others] are saying, watch what they are doing…”

Let’s not mince words here. Any thought the GSEs will ever provide the type of lending the industry desires meets insurmountable reality in their halls of their decision making. The industry continues its self-congratulatory emphasis on building inexpensive homes to go into the generous lair of giant home site owners, and the shuck and jive begins. The predictable, increasingly high rents for the home site combined with the financial fragility of many of the homeowners creates quite a witch’s brew of possible poor outcomes. And the non-profits, the GSEs, lenders, and yes, the entire HUD Code industry know it. I am not sure why the clear message being sent to by the GSEs to the industry falls on such noisy but uncomprehending ears.”

Note that former MHI Chairman Nathan Smith also used the phrase “the industry,” which are often verbal shorthand by MHI members for “MHI” which claims to represent all segments of the industry.

Lavin’s statement was part of a longer on-the-record exclusive message to MHProNews, which can be explored in full at a future time. But briefly, what Lavin has said is that the GSEs are mindful of the past fiascos of the late 1990s and they have no intention whatsoever of supporting manufactured home chattel lending.

V) Additional Information, plus an MHProNews Analysis and Commentary

MHARR called it the “Illusion of Motion.” Others in MHEC have said this is the old “Razzle Dazzle.” Similar comments have been smokes screens, “Deception and Misdirection,” head-fakes, paltering, posturing, Kabuki theater, and so on. There are a range of terms that have been or could be applied.

But what is clear is this. After a dozen years, there has been no meaningful progress in getting the Duty to Serve as it was written and intended implemented.

12 years. No meaningful progress.

That begs the question, how is that possible? If MHI’s CEO Lesli Gooch, who came from the congressional side before going into lobbying, were serious about advancing the interests of “all segments” of manufactured housing, why has there been no meaningful progress?

MHARR, NAMHCO, and Marty Lavin have laid out the reasons, each in their own way.

Let’s sum up in a fair and balance fashion.

- In defense of Ms. Gooch, a Ph.D. who as a prior congressional staffer was used to making nice with all she professionally encountered in those days. But now as a lobbyist and CEO of a lobbying organization, Gooch has a different role as an advocate. Her job as a lobbyist is not to ‘make nice.’ It is to get results for her members. The DTS part of the HERA 2008 law expressly favors making the GSEs serve manufactured housing, and specifically names chattel lending as an option that some 76 percent of consumers select. As the Federal Reserve Board said, HERA 2008 gave the “FHFA director broad new authority” to regulate the GSEs and implement policies. Why does Gooch continue to give FHFA and the GSEs a pass?

- In defense of Ms. Gooch, she obviously has to keep her MHI board members happy. Almost all of them are big businesses. That speaks volumes. That said, MHI nevertheless still claims to represent “all segments” of manufactured housing. While it may be in the interests of big business to slow walk or entirely stall DTS for their own reasons and selfish motivations, it is NOT in the interests of consumers and smaller businesses. MHARR, NAMHCO and numerous consumer groups formally make it clear that they want more and more competitive lending. If MHI insists on reflecting the interests of only big businesses that want to consolidate or otherwise thwart more lending for whatever reasons, then MHI by law can’t say the reflect “all segments” without arguably crossing the legal lines into deceptive trade practices. Note that legal sources previously cited in other reports indicate that Gooch may be legally liable personally for purported , as well as MHI may be liable as a trade group if they are intentionally misleading numbers of their members.

- Sources inside MHEC have said that there is growing unrest – exhibited in part by periodic ‘leaks’ and ‘tips’ to MHProNews – that reflect the frustration that certain MHEC execs feel. That is coming, per sources, from pressure from their members – who are often industry independents.

- Those sources say that there are largely two groups inside MHEC. Those that are fine with what MHI is doing under Gooch and her ‘leadership.’ But there are others who go along publicly, but are not happy privately. But given that some of the same large companies often dominate the state associations too, there are pressures that keep the status quo in place.

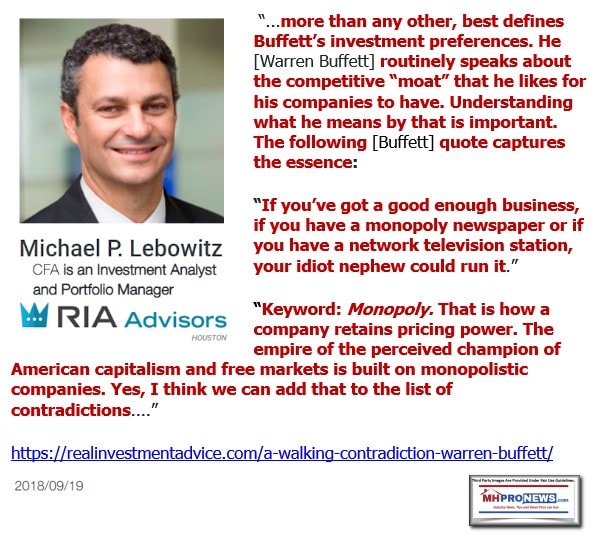

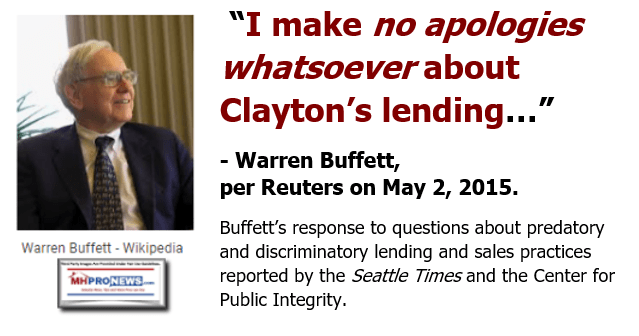

These Mark Weiss, J.D., quotes and the video of Warren Buffett and Charlie Munger – Berkshire Hathaway’s chair and vice chair, and the parent companies to Clayton Homes, 21st Mortgage and other manufactured housing industry brands, shed additional light on this issue. That Buffett/Munger video is found a bit further below.

Per sources, Gooch postured on DTS, but glowed on the topic of the “new class of manufactured homes” known as “CrossModTM” homes. But the program has no traction, per an MHI-only member producer.

Rephrased, MHI keeps pushing a program that makes no sense, which arguably undermines mainstream manufactured housing. Additionally, they have failed to promote mainstream manufactured housing, which pre-dated the MHI and Clayton backed CrossModTM homes by about a decade. Rephrased, Congress didn’t have a hybrid home in mind, they had the kind of HUD Code manufactured homes in mind that existed when DTS was enacted.

Early this morning, a message was sent by MHProNews to Gooch, Tom Hodges, other MHI leadership, as well as federal officials, various industry and other attorneys, and both of the GSEs. It said in part the following.

We are also once more asking for a production of all the minutes of meetings between Fannie Mae, Freddie Mac, and key people involved at MHI in the development of what eventually became MH Advantage ®, ChoiceHomes®, and CrossModTM styled manufactured homes, which sources connected to the GSEs tell MHProNews were developed in an “unusual” fashion out of the norms typically followed by the GSEs. If so, that may shed light on or help explain why those programs have failed in the marketplace. It may also explain why MHI and the GSEs have repeatedly failed to provide those meeting minutes, or the complete MHI “focus group” and other “research” that supposedly spawned those programs.”

MHI has repeatedly and for years declined to do this simple disclosure. So have the GSEs, which it should be noted, have replied to other MHProNews requests for information. Why has there been stonewalling on disclosing those closed-door meetings?

Drawing to a close, not the least important piece of evidence is this video of Warren Buffett and Charlie Munger speaking about manufactured housing and DTS.

Buffett too postures support for DTS. If taken at face value, are we to believe that Berkshire Hathaway lacks the sway to get an existing law fully and properly implemented?

The alternative is to think that Buffett, Munger and their surrogates in manufactured housing have been posturing support. After all, it was 21st CEO Tim Williams – who de facto works for Buffett and Munger, as a Berkshire owned brand – who at one point told MHProNews that pursing DTS was ‘a waste of time.’

MHProNews has previously reported that others in the GSEs and/or performing services for them said that there is no interest in actually doing what their various videos and statements claim.

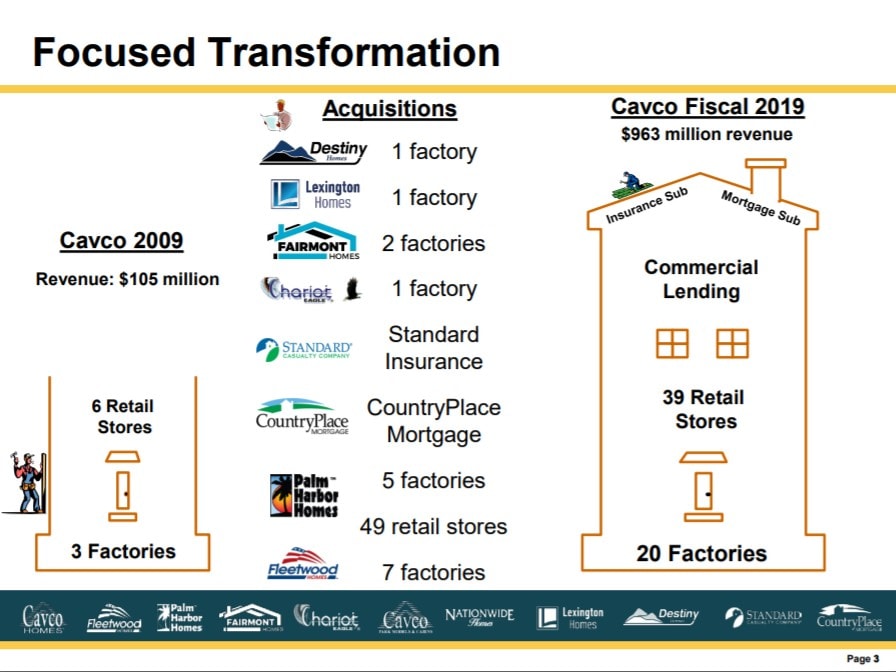

MHI publicly traded firms have at times made statements that underscore that point too – that there is no traction on DTS. By contrast, what has traction is consolidation. Coincidence?

Which could logically lead someone to conclude that the MHI is posturing with their independence and consumers. And that those closed doors meetings may have been where the scheme to posture effort while producing no results over the course of years was hatched.

Congress and other investigators need to explore that evidence-based possibility. Because Lavin would and other sources to MHProNews know from firsthand knowledge that there is no serious effort to make DTS on chattel loans a reality.

If so, that means the dollars paid by the GSEs to MHI for “sponsoring” or “listening session” are just ways of mollifying and posturing for those that they hope to keep in the dark.

This all supports MHARR’s call for Congress and the Trump Administration to investigate the failure to enforce a law that could benefit millions of potential affordable housing seekers.

VI) Conclusion and Finance Topic Related Resources.

Zoning and placement issue are boiling too, but that will be dealt with in a separate, planned report in the near term. It may or may not be ready before the November 3, 2020 general election, but that will be our goal. Stay tuned.

MHProNews and our MHLivingNews sister site have repeatedly noted that image and public perception very much connects to these topics.

But on this finance-specific topic leads to the following evidence and logical conclusions. It could be boiled down to what Lavin and Williams – both with current and long ties – to MHI said, which only buttresses the years of arguments made by MHARR, or our trade media sites for that matter.

It is this. There is no desire on the part of the GSEs. There are industry lenders who reportedly make loans similar to what 21st does at lower rates that perform well. If 21st and other lenders can make such loans perform, then so can the GSEs.

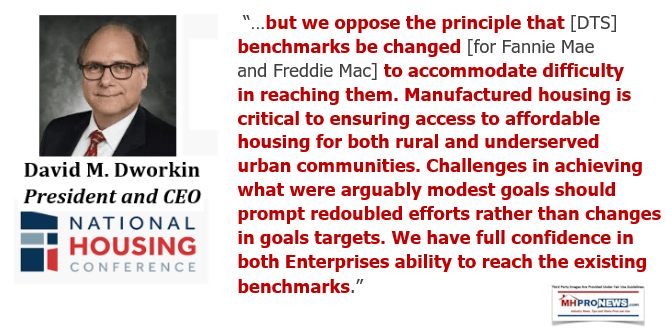

Dworkin’s statement makes it seem that he too agrees with such and assessment. Note once more that MHProNews has heard from sources inside the GSEs and/or who do contract work for them that they could be doing these loans if they so desired. They have studied the matter for years. They have bought pools of chattel loans as tests. They have experts available and willing to help as needed. Rephrased, there is no good excuse.

MHI and their overlords are either unable or unwilling to get FHFA and the GSEs to comply with the clear meaning and intent of the law.

This is why MHARR has pushed for years for the establishment of a new post-production trade association that would work with them to get good laws like DTS fully implemented.

Gooch can’t have it both ways. She is either truly working for all segments of the industry, or Gooch is working for the powers on and behind the MHI board of directors.

The fact that 12 years after DTS was made law that it hasn’t been implemented speaks volumes.

Because it isn’t words that should be examined, it is what has actually occurred. And follow the money trail to see who has benefited during that 12 years and who has been harmed.

To learn more, see the linked downloads – but more important – the related reports that are linked herein and that follow the byline and notices.

“More Punitive Regulatory” Regime Looms Warns New Manufactured Housing Industry Insider

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.