From Skyline Champion Corporation (SKY) 2.5.2024 earnings call covering their ‘Q3: 2024’ period, which are the final months of 2023, are these headline-emphasized paraphrased remarks: 1) manufactured home sales are down, 2) there is a trend toward selling lower cost homes, 3) land lease manufactured home communities aren’t expected to increase order volumes in the current quarter, 4) California sales are down 34%, and yet 5) the company has declared some $500 million dollars in cash and cash equivalents, 6) along with what they are calling stepped up digital marketing efforts. Those six points and more revelations are highlighted in Part I of this report, which provides the Skyline Champion (SKY) 2.5.2024 Earnings Call Transcript. That SKY transcript covers their corporate period Q3 2024, which corresponds to the final months of 2023. As was reported at this link here on 2.6.2024, manufactured housing sales are down nationally in 2023 by 21 percent. So, California, a state with one of the worst affordability problems in the U.S., is witnessing a stronger decline in manufactured housing sales, said Skyline Champion leaders during their earnings call, then the U.S. did at large? What Skyline Champion said should call into question their corporate leadership. What SKY’s earnings call transcript reveals also logically calls into question what analysts and the Manufactured Housing Institute (MHI) are really thinking vs what they actually expressed. That will be explored in Part II with the benefit of Harvard’s Joint Center of Housing Studies (JCHS) January 2024 research into manufactured housing, which MHI participated in.

Manufactured housing industry expertise and artificial intelligence will be (AI) combined to yield what is likely to be the most powerful possible insights into a company that clearly has the cash needed to address what Harvard revealed is necessary for industry (and by implication, corporate) growth. But oddly neither Skyline’s nor MHI’s leaders’ respective behaviors seem to indicate they have any sense of urgency in correcting that decline.

There are arguably multiple systemic failures which this report with analysis will directly and/or indirectly spotlight.

Part II of this report will blend the remarks from Skyline Champion, other known facts, third-party research, artificial intelligence, and manufactured housing industry expertise to analyze this pressing question. When Skyline Champion specifically, and manufactured housing more broadly, are in some 15 months of year-over-year declines, why aren’t corporate and industry association leaders acting in a way that could materially improve corporate and industry performance? Where are the board members for Skyline Champion and MHI are?

Part II will also ask these questions: where are federal regulators and U.S. officials? Why aren’t state officials stepping up to the plate to probe questionable corporate or MHI behaviors in the absence of federal antitrust or other regulatory steps being taken? With regards to states or feds not yet acting, one should ponder the distinctive case of the apparently artificially exacerbated U.S. border crisis. In the absence of federal action to stop what has been called an “invasion” by state officials, several Republican governors have stood with Texas in mobilizing National Guard units and sending them to the Texas-Mexico border. Given that federal regulators at HUD, the FHFA, DOJ, and FTC (among other possibilities, like the IRS) have not yet acted to formally probe growing evidence of corporate misbehavior, then why haven’t states stepped up to fill the gap?

- Where is the Government Accountability Office (GAO)?

- Where are members of Congress?

- After touting their Biden-Harris Housing Plan, where is the White House on the harmful impact of corporate and connected association behaviors?

- Given that a number of manufactured home industry connected antitrust suits and corporate probes are underway by law firms acting on behalf of residents and shareholders, where are other institutional safeguards in this troubling mix, given that HUD and others have admitted that a lack of affordable housing is consider a leading cause of rising U.S. homelessness?

Those and other topics will be probed in Part II. As MHProNews has periodically reminded readers, performance coach and author Matthew Kelly says: “Superficiality is the curse of the modern world.” To truly begin to grasp these issues, the information will not fit on a postage stamp, or a 100 word or less social media post. A meme can start a conversation or spark curiosity. But to begin to understand what is apparently going wrong at companies like Skyline Champion, with the Manufactured Housing Institute (MHI – where Skyline Champion has a board seat and is a higher-profile member), and to grasp the “drastic” decline concerns more succinctly raised by the Manufactured Housing Association for Regulatory Reform (MHARR), an attention to detail is needed. Superficial reading will not cut it.

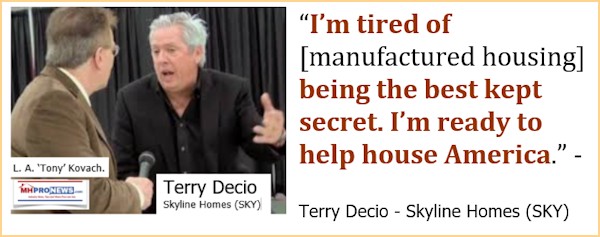

As the Terry Decio (longtime Skyline executive) quote below reminds readers of MHProNews, the issues facing the industry are not new. They have been know throughout the 21st century. In an information age, why are obvious “barriers” to more manufactured housing as Harvard’s researchers called them still in the way? Especially when hundreds of millions of dollars are available that could be deployed to address those barriers and thus grow the business? Why did MHI remove from their website a reference to then Harvard JCHS research fellow Eric Belsky’s one touted remarks by MHI?

To grasp the present, historic context is useful. That context will be illustrated below in a way that was apparently ignored by Skyline Champion leaders during this earning’s call.

Part III of today’s report is our Daily Business News on MHProNews macro- and manufactured housing industry connected equities market updates.

Part I – Skyline Champion Earnings Call on 2.5.2024 – Transcript per Seeking Alpha

MHProNews notice: several typos in their transcript (regional vs. Regional, the word “optioned,” “legacy Skyline,” etc.] have been edited in by MHProNews, and highlighting is added by MHProNews.

Feb. 06, 2024 11:20 AM ET Skyline Champion Corporation (SKY) Stock

Q3: 2024-02-05 Earnings Summary

EPS of $0.82 beats by $0.21 | Revenue of $559.46M (-3.93% Y/Y) beats by $59.00M

Skyline Champion Corporation (NYSE:SKY) Q3 2024 Results Conference Call February 6, 2024 9:00 AM ET

Company Participants

Mark Yost – President & Chief Executive Officer

Laurie Hough – Executive Vice President & Chief Financial Officer

Conference Call Participants

Greg Palm – Craig-Hallum Capital Group

Daniel Moore – CJS Securities

Colin Devine – Jefferies

Matthew Bouley – Barclays

Mike Dahl – RBC Capital Markets

Jay McCanless – Wedbush Securities

Operator

Good morning, and welcome to Skyline Champion Corporation’s Third Quarter Fiscal 2024 Earnings Call. The company issued its earnings press release yesterday after the close. I would like to remind everyone that today’s press release and statements made during this call include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

These statements are subject to risks and uncertainties that could cause actual results to differ materially from the company’s expectations and projections. Such risks and uncertainties include the factors set forth in the earnings release and in the company’s filings with the Securities and Exchange Commission.

Additionally, during today’s call, the company will discuss non-GAAP measures, which it believes can be useful for evaluating its performance. A reconciliation of these measures can be found in the earnings release.

I would now like to turn the call over to Mark Yost, Skyline Champion’s President and Chief Executive Officer. Please go ahead.

Once again, I would now like to turn the call over to Mark Yost, Skyline Champion’s President and Chief Executive Officer. Please go ahead.

Mark Yost

Thank you for joining our earnings call and good morning, everyone. I am pleased to be joined on this call by Laurie Hough, EVP and CFO. Today, I will briefly talk about our second quarter highlights and then provide an update on activities so far in our third quarter and conclude with our thoughts on the balance of the year.

We saw healthy demand from end consumers through our captive and independent retail channels during the quarter. The Community REIT channel continues to be slow and home sales in our builder developer and retail channels improved year-over-year, while activity from our Community REIT customers remained relatively muted, primarily reflecting seasonality and inventory destocking.

The year-over-year results indicate a sustained trend in customer demand towards more affordable homes with fewer options and lower material surcharges. This led to a decrease in average selling prices per home compared to previous year. Additionally, organic order volume grew by over 230% compared to the same quarter last year. This is in line with what our independent and captive retail partners are expressing on the positive demand outlook for attainable homes.

Backlog as of December 30th was $290 million compared to $258 million at the end of September. With the sequential increase primarily attributed to the acquisition of Regional Homes. Average lead times remained stable at approximately eight weeks, consistent with our historical range of 4 to 12 weeks.

Throughout the quarter, we successfully pursued our operational and strategic priorities, making significant headway in integrating Regional Homes and rolling out Champion Financing. Regarding Regional Homes, we initiated cultural and management integration from day 1, facilitating the exchange of best practices across our production and retail divisions. We foresee opportunities for revenue growth by leveraging our expanded retail presence due to our scale and improved responsiveness to market demand.

The realization of synergies is also well underway and we expect the identified synergies to start positively impacting our profitability in the fiscal fourth quarter. These synergies primarily revolve around purchasing, operational enhancements and other cost savings measures. We maintain our expectations of capturing $10 million to $15 million in synergies over the next two years.

During the quarter, we successfully launched our new captive financing joint venture, Champion Financing, and we are making progress in utilizing our new capabilities to provide more comprehensive solutions to our partners and customers. This is crucial for enhancing accessibility and affordability to our customers, while driving accelerated growth for our business.

These investments are in line with our longer-term strategic vision providing digital configuration and enhanced selling options to homebuyers. As we expand Champion Financing, we anticipate the benefits to foster stronger connections with our dealers and end consumers.

Furthermore, we expanded our capacity during the quarter with the opening of a new plant in Bartow, Florida to support our growing builder developer channel in the region. We are seeing more interest from builder developer channel and anticipate increased adoption not just because interest rates are at elevated levels, but also because of the reduced time to project completion. We have had good traction at the International Builders’ Show historically and anticipate strong interest later this month in Las Vegas.

These investments collectively present an exciting opportunity as we bolster our initiatives to generate long-term growth. Further establishing Skyline Champion as the preferred provider of attainable housing solutions. As we look to our fourth quarter and future outlook, we continue to experience healthy demand from both retailers and builder developers. The consistent order rates from these key stakeholders have been instrumental in driving our growth. Furthermore, as our community partners begin to reenter the market, we are prepared to increase capacity utilization our manufacturing facilities.

Looking ahead, we expect our revenue to remain flat sequentially as our third quarter performance was better-than-anticipated and weather and pricing will be tailwinds in the fourth quarter. Our long-term outlook remains positive. We are proud to share that, we have achieved six consecutive quarters of order growth, underscoring the sustained demand for our products and the need for smarter housing solutions. On a macro level, we continue to see healthy job and wage growth, particularly in sectors such as healthcare, manufacturing and retail. Key areas that form some of the foundations of our customer base.

Additionally, trends in job growth and inflationary pressures will mean the Fed will continue to hold interest rates at higher levels for longer. These factors bode well for the stability of our future demand as growth in these income demographics combined with higher interest rates and the absence of attainable housing correlate with our price points and product offerings.

On a micro level, we heard some of these same factors at our industry show in Louisville, in mid-January. The attendance and tone of the show were positive. The community REITs were consistent in their view that, 2024 will be a better year than 2023. In addition to the favorable commentary on market conditions heard at the show, our launch of Champion Financing generated considerable excitement in the market and new future opportunities.

I will now turn the call over to Laurie to discuss the financials in more detail.

Laurie Hough

Thanks, Mark, and good morning, everyone.

I’ll begin by reviewing our financial results for the third quarter, followed by a discussion of our balance sheet and cash flows, I will also briefly discuss our near-term expectations.

During the third quarter, net sales decreased 4% to $560 million compared to the same quarter last year. The decrease in net sales reflects a 2% year-over-year decline in average selling price, driven by a decrease in material surcharges and changes in product mix with consumers opting for less [optioned] homes.

During the quarter, we sold 5,643 homes in the U.S. compared to 5,749 homes in the prior year period, as we aligned production volumes and staffing levels with demand. On a sequential basis, the U.S. factory-built housing revenue increased 22% due to the Regional acquisition, which contributed approximately $120 million to revenue during the quarter. Excluding the Regional Homes acquisition, revenue was down approximately 5% sequentially, primarily due to normal seasonality.

Our average selling price per home increased 4% sequentially from $88,400 to $92,300 due to the increase in homes sold through captive retail sales centers, as a percentage of the total. Excluding the Regional Homes acquisition, our average selling price per home decreased consistent with our expectations. Capacity utilization increased to 57%, compared to 53% in the sequential second quarter of fiscal 2024. Canadian revenue during the quarter was $31 million, reflecting a 9% decrease in home sold, partially offset by an 8% increase in the average home selling price.

The average home selling price in Canada increased to $123,700 due to a change in product mix. The decline in volume was caused by softer demand in certain markets. Compared to the prior year period, consolidated gross profit decreased 19% to $141 million in the third quarter and gross margins contracted by 460 basis points to 25.3%. The contraction in gross margin was primarily due to lower average selling prices in the U.S. and the shift in product mix to less optioned homes as well as the ramping of our previously idled facilities and the impact of the Regional Homes acquisition.

Regional Homes core product margins are generally lower than the legacy Skyline Champion margins,. In addition, consolidated margins were negatively impacted by the effect of purchase accounting increases to the carrying value of regional finished goods inventory, which had a negative 60 basis point impact on consolidated gross margins during the quarter. We expect this purchase accounting impact to continue and potentially increase for the next few quarters.

SG&A in the third quarter increased $13 million to $85 million primarily due to the Regional Homes acquisition, partially offset by lower variable compensation at existing operations. Net income for the third quarter decreased 43% to $47 million or $0.81 per diluted share, compared to net income of $83 million or earnings of $1.44 per diluted share during the same period last year. The decrease in EPS was driven by the decline in sales and gross profit.

The company’s effective tax rate for the quarter was 21.4% versus an effective tax rate up 23.1% for the year ago period. The decrease in the effective tax rate was primarily due to tax benefits from tax credits. Adjusted EBITDA for the quarter was $66 million compared to $109 million in the prior year period. Adjusted EBITDA margin was 11.8% compared to 18.7% in the prior year period, which reflects the return to more normal profitability levels.

In the near-term, we expect a sequential decline in gross margins as homebuyers continue to move toward homes with fewer options and as we further ramp our new plant operations and sell off the finished goods inventory acquired with the Regional Homes retail sales centers. As we approach more normal profitability levels in the industry, we remain confident in our long-term structural margin targets supported by improvements in our operational capabilities and investments in the business.

As of December 30, 2023, we had nearly $500 million of cash and cash equivalents and long-term borrowings of $25 million with no maturities until 2026. We generated $89 million of operating cash flows for the quarter compared to $85 million for the prior year period. Operating cash flows were positively impacted by a reduction in finished goods inventory subsequent to the closing of the Regional Homes acquisition.

During the quarter, we allocated $285 million of cash to purchase Regional Homes, net of cash acquired and assumed $88 million of debt primarily related to inventory floor plan liabilities. We remain focused on executing on our operational initiatives and given our favorable liquidity position, plan to utilize our cash to reinvest in the business and for opportunities that support strategic long-term growth.

I’ll now turn the call back to Mark for some closing remarks.

Mark Yost

The long-term future looks bright for our company with sustained demand from retailers and builder developers, the resurgence of our community partners and the enduring need for affordable housing, we are well-positioned for continued growth and success. Furthermore, our strategic expansions into digital and consumer retail along with financing are poised to further enhance our competitive edge and drive the value for our stakeholders. We remain steadfast in our commitment to deliver sustainable growth and value creation and we are excited about the opportunities that lie ahead.

Before we move on to the Q&A session, I would like to express our gratitude to the entire Skyline Champion, Regional and ECN teams for their exceptional efforts, which have been instrumental in our consistently strong performance.

And with that, operator, you may now open the lines for Q&A.

Question-and-Answer Session

Operator

[Operator Instructions] Our first question comes from Greg Palm from Craig-Hallum Capital Corp.

Greg Palm

Maybe start with giving us a view on kind of visibility into kind of those orders from the community channel, based on your discussions and maybe how that sort of relates to your view or opinion on how the year progresses?

Mark Yost

I think the communities are starting to resurge or starting to come back in their order patterns. I think it will kind of slowly evolve through this fourth fiscal quarter and then start to ramp into first, second quarters of next year. So I think overall, you’ll kind of see that spotty resurgence of communities kind of starting to return to market.

So I think it will be in pockets, and then it will start to take off towards the tail end of that. But I think each community is in a different phase of that. Some have started to return to market and others are still spotty with their returns. So, I expect it to phasing gradually throughout the fiscal 2025 year.

Greg Palm

And how does that kind of impact your view on sort of sequential growth as we progress through, I guess, either this calendar year or through fiscal ’25, at least the first half?

Mark Yost

Yes. So, for our fourth quarter, I expect things to be relatively flat. For fiscal 2025, we are kind of thinking revenue in total, it’s going to be up somewhere in the 10% to 15% year-over-year. Really as the communities start to ramp back up, volume will increase year-over-year, but I expect due to pricing and mix that we have seen, the prices to come down. So you kind of have a tradeoff between price and mix happening into next year, which will kind of offset some of the volume growth will be offset by pricing declines due to mix.

Greg Palm

And then on builder developer, open up a new plant, can you just give us some sense on how, I guess, the order rates are flowing from that initial top 100 win? What your expectations are for sort of additional onboarding of customers. Yes, let’s start with that.

Mark Yost

Yes. Builder developer this quarter was in percentage terms our strongest growing segment. Builder developer was the fastest-growing segment for us this quarter. Very pleased to see that progress, and part of that is due to this top 100 builder that we mentioned they’re starting to place orders, and so we’ve seen good growth.

We’re starting to land more builder developer opportunities. We’re getting some in the Midwest. We’re starting to move in different sectors. I think it really comes down to the timing of their development deals and whether that’s going to hit early or late into some of the fiscal 2025 timelines. It really depends on permitting and land development timing for some of those. But I think the activity for builder developer has been excellent. We will be attending the IBS, International Builders’ Show here in just a few weeks and expect more opportunities to arise out of that as well.

Greg Palm

Looking forward to, seeing some of those homes and seeing what interest levels are. Just to clarify, that 10% to 15% comment for fiscal ’25, is that inclusive of Regional? How much of that is organic?

Mark Yost

Yes. That’s just total year-over-year. Yes, inclusive of everything consolidated.

Greg Palm

I will leave it there. Thanks.

Operator

Our next question comes from Daniel Moore from CJS Securities.

Daniel Moore

Quick housekeeping and then a couple. I think you said Regional contributed $120 million during the quarter. Just give us a sense of what their pro forma growth or decline was on a year-over-year basis and do you anticipate similar contribution this quarter?

Laurie Hough

Yes. Dan, we’re not disclosing the quarter over quarter, specifically for Regional. You can look at the pro forma information that we filed in the 8-K at the end of December, just to get a feel that, that’s all we’re disclosing at this point.

Daniel Moore

Appreciate the color on the community developers. On the REIT channel, Mark, what are you hearing there in terms of you expect it sounds like gradual pickup, as we get past this quarter. Are you hearing about demand building potentially from that key end market as we look out to the balance of calendar ’24?

Mark Yost

Yes. I think it just depends on which community player starts to return. They’re all kind of phasing in a different time stamp. As they phase in and come together, I would expect them to gradually ramp. Some are kind of returning, I don’t want to say, full steam, but nearly back to normal. Where we’re seeing others that are slowly trickling in. I think it will culminate in the next few quarters with them starting to return to market, but it will take a little bit of time for them to get there.

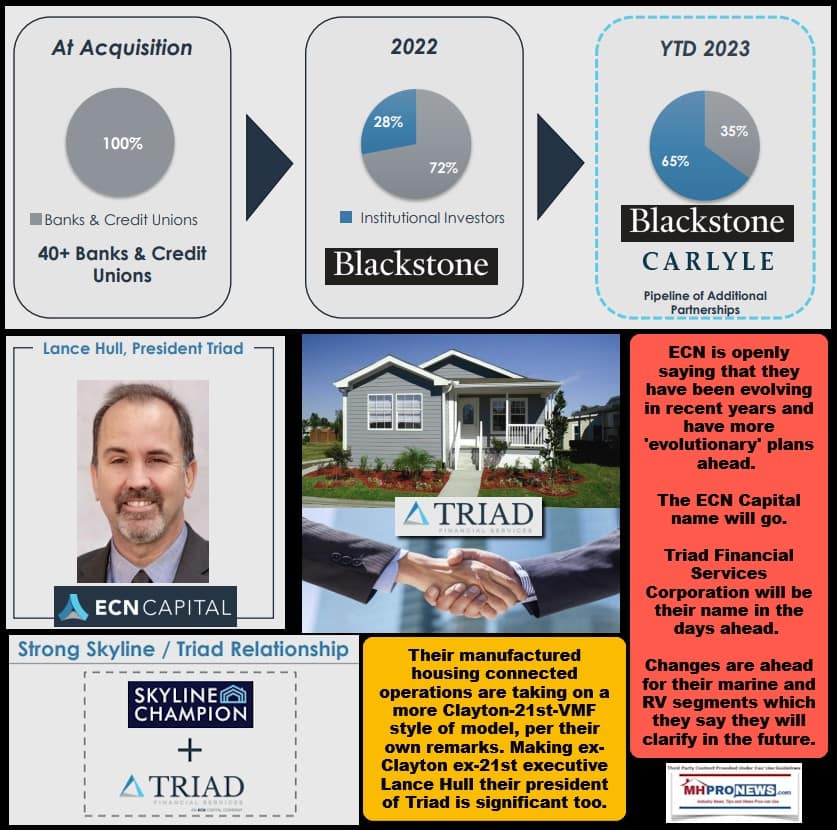

Daniel Moore

One more. Just talk about the progress you’re making in terms of standing up the Triad JV, as expected from a timing perspective. Any sense of what contribution from Triad? It might look like over the next one to two quarters on the P&L? And longer-term, ECN had put out some financial targets in the time the deal was announced. Just wondering if you have any comment on how achievable those look from your perspective?

Mark Yost

It’s pretty early. We’ve launched the Champion Financing JV at the Louisville show just recently a few weeks ago. So we’re getting some early signs. I think it’s a little early for us to comment on the exact trajectory of that or how quickly it will ramp. It’s been very successful in its launch, but how quickly those things come together, I don’t think we are giving guidance on at this point.

Operator

Our next question comes from Phil Ng from Jefferies.

Colin Devine

This is actually Colin on for Phil. I guess just wanted to touch on where you guys outperformed relative to your guide on the sales line. Can you just walk us through what performed better in the quarter versus your expectations whether the channel or region or the acquisition performed better? Just curious as to your thoughts there.

Mark Yost

I think, I would say the acquisition performed better. There is, if you look at October, November, December industry shipments for those three months, the industry shrink at about 2.5% in aggregate. But within that, there is a tremendous amount of noise. So when you look at Regional Homes has a heavy presence in Mississippi, Louisiana, those Southern states. So Louisiana year-over-year during the quarter grew 79% in terms of year-over-year shipments. Mississippi was up 45% year-over-year in terms of industry shipments.

So I would say those geographies and those markets are kind of rebounding quite strongly. So I would say Regional did very well, probably outpaced our expectations during the quarter in aggregate. So I think that’s good. Probably the Carolina’s and Georgia did a little better than we thought during the quarter.

But most of our markets where we have heavy concentration with kind of our core business, so we’re heavy in California. California during the quarter was down 34%, the Midwest, Illinois, Iowa, Indiana, Michigan, Ohio, That region where we have a good presence was down 41% year-over-year. In Pennsylvania where we have a lot of plants was down 30%.

So I think it was really kind of a balancing where certain regions did better and certain regions did a little worse in terms of the geographic dispersion. There was a lot of movement, but I would say overall that Southern Mississippi type region and the strength of the Regional Homes team and what they have done is surprising us positively every day.

Colin Devine

And then just moving over to the retail channel. Can you provide just some more color on how that performed? And I believe you called out the increase in captive retail sales as a benefit to price. Can you help quantify how much your business is now going through captive retail with the Regional acquisition and the price differential there?

Mark Yost

We are not disclosing that specific breakout, Colin, of how much goes through. Currently, I think it does help the ASPs. You can probably have a sense that regionals $120 million is heavily influenced by retail activity, in general. So that can give you a good proxy to think through.

Colin Devine

And then my last question here is on gross margin, came in nicely ahead on the quarter. Can you just talk about the outperformance there versus your initial expectations and just how you’re thinking about gross margin going forward with a quarter of ownership of the acquisition completed at this point?

Laurie Hough

Sure, Colin. U.S. volumes came in better than we expected, as well as product mix and pricing. So we really improved versus expectation and on all three of those fronts.

Colin Devine

And any color as to gross margins maybe in the fiscal fourth quarter and into calendar year ’24?

Laurie Hough

Yes. I still expect that gross margins are going to come down a bit sequentially from what we saw this quarter. Similar to what I mentioned last quarter, we do expect to see a decrease in average selling price as well as really driven by product mix and the customer having to choose less options, which impact gross margins.

Also we have the three recently opened idled facilities that are negatively impacting gross margins for the time being. And then the regional acquisition, generally the regional operations have lower gross margins until we start capturing more synergies. And also the purchase accounting implications, which we believe are going to be higher than what we saw in the next couple of quarters versus the third quarter.

Operator

Our next question comes from Matthew Bouley from Barclays.

Matthew Bouley

Just I wanted to touch on sort of the recent trends with all the volatility in rates that you experienced during your fiscal quarter and kind of year-to-date. And obviously, I think, Mark, you mentioned at the top there’s some noise around weather as well. So could you just kind of speak to maybe focusing on the dealer channel since you gave a lot already on the community side, but just kind of how has demand been progressing from a dealer perspective and retail perspective over the course of the calendar quarter and kind of into the New Year?

Mark Yost

I think the dealer channel has been very strong over the actually several quarters, but this quarter definitely. We saw our year-over-year order growth increased by 230% and that was largely driven by builder developer and retail as the communities were still are still slowly coming back, but significantly down year-over-year. So, I think that bodes well to the strength of that retail channel as it continues to return.

Matthew Bouley

And then second one on the price mix side, just kind of curious if you can kind of unpack a little bit where that can go? And is it kind of dependent on what happens with interest rates or because at a certain point, you’re going to be at, you’re going to be comping against the price mix having been coming down for a while. So, kind of where do you anticipate price mix settling out? And what do you think it would take for that to begin to improve again?

Mark Yost

I think overall price mix will be, as you heard me say, there are several states and several geographies that have a tremendous amount of volatility in their year-over-year performance and a lot of that is just due to those changing demand levels for different product types and getting those to market and getting the consumers to those different price points and different product types.

As that customer evolves, I think you’re going to see for some of those states that have the year-over-year large declines in volumes. I think that’s where you’ll see the adjustment in probably the next quarter or two. Then you’ll start to see things stabilize and then I think you’ll see kind of upward momentum in a handful of quarters from now with those prices, it’s really just readjusting the price points and the needs for what today consumers need and that rollout has not happened uniformly across all the states yet. It’s still in progress.

Operator

Our next question comes from Mike Dahl from RBC Capital Markets.

Mike Dahl

I had a follow-up on Regional Homes. And so when we think about the difference in terms of where the quarter shook out versus what the guide was, it implies a really sizable difference in terms of the Regional contribution. I appreciate you kind of described some better trends there, but is there anything else you can kind of point to in terms of was the ultimate timing of the close of the acquisition different than you had anticipated? Was there anything maybe one time about trying to work down some of their backlog that boosted the sales in the quarter, just because I think, maybe even been like a 50% differential versus what seemed to be embedded in the guide a quarter ago. Any additional color would help?

Mark Yost

Yes. I don’t know that it was that material of a difference in kind of our thought process going into the quarter, Mike. I think it was stronger. Like I said, Louisiana and Mississippi are, during the quarter had very, very strong growth in terms of just industry output. I think that was really a good indicator and even through December it was phenomenal. I think Mississippi was up 90% year-over-year in December. I don’t think we saw that or anticipated that strong of year-over-year growth in that region.

But I would say, a lot of it came from stronger industry drivers in those states, better performance out of Georgia kind of that region, maybe a little bit better performance out of Texas. I really think there was a handful of geographies that kind of ebbed and flowed and performed a little better, along with obviously the strongest performance really out of Mississippi and don’t forget Regional is heavily retail focused. And as we’ve mentioned, retail and builder developer have been very strong this year and continue to be, it’s really the community focus and the REITs that have been often are starting to return.

Mike Dahl

And that as core there wasn’t any sort of concerted effort to kind of just close out some of the backlog that you acquired?

Mark Yost

No, definitely not. No, just normal operations.

Mike Dahl

And then second, maybe also just a point of clarification around the Triad Venture and the ECN stake. I think technically that deal, you had that closed for the entire quarter. Was there a contribution from either kind of the ramp of the finance venture or just your income derived from your stake in ECN? And if so, where was that on the P&L?

Laurie Hough

So we did have of small piece from the ECN investment, we recorded and other income and expense, dividend income of about 600 grand and then that was offset by our share from the common stock of ECN’s losses for their September quarter of about 200 grand. So a net positive and other income of about 400 grand. There was no activity from the JV in this quarter, we’re going to record that on a one quarter lag, just like the losses from ECN. The dividends are in the current period.

Mike Dahl

And will all of those come through effectively the other income line or will there be different account and treatment for the different pieces?

Laurie Hough

Yes, everything through other income. And it’s all broken out pretty clearly in the Q1 we filed that this afternoon.

Operator

Our next question comes from Jay McCanless from Wedbush Securities.

Jay McCanless

Could you talk to us about where charter rates were during the quarter and where they’ve trended since the beginning of the calendar year?

Laurie Hough

Channel rates were anywhere from 8.5% to 10% this quarter, I think that they’ve trended up basically since the beginning of 23%. Since the beginning of this year, they’ve been relatively flat. They lag, Jay, generally on the 30-year fix. So it does take a little bit longer for channel rates to come down relative to the 30-year fix.

Jay McCanless

And then based on the 8-K you were talking about, it looks like Regional did $414 million in trailing 12 month sales as of April 2023. Where is Regional trending relative to that year-to-date and I thank you for the disclosure for the current quarter, but would love to know how they’re sizing up versus what they did in their 2023 year?

Laurie Hough

So Jay, the 8-K has their results as of June 30th for their period and then just obviously the year December of ’22. They did have Disaster Relief Housing and their revenue. So it’s not really apples-to-apples. This quarter was more core product, was all core product actually.

Jay McCanless

And then could you talk about what Champion’s actual retail, owned retail store count is now versus where it was a year ago?

Laurie Hough

We have 73 sales centers right now versus, gosh, I cannot remember, 31.

Mark Yost

30.

Laurie Hough

30? Okay. Somewhere in that range.

Jay McCanless

And then, Mark, you said earlier in the call that fiscal fourth quarter is going to be flat and I didn’t know if that’s flat sequentially flat year-over-year. Maybe you could give us some more commentary on what you and Laurie are expecting in terms of revenues as well as gross margin for the fourth quarter?

Mark Yost

Yes. So expecting, Jay, that sequentially revenue should be flat sequentially, really driven by the price mix coming down a little bit as Laurie mentioned. Little bit of weather challenges, we’ve had flooding in certain regions, some frost delays that have idle plants for handful of days or a week in various areas for our shipping laws that will halt shipping. So that will be played into that driver for the quarter. So, I expect kind of flat sequentially. And as far as margins.

Laurie Hough

Yes. We expect margins to come down sequentially, Jay, because of the things I mentioned earlier, price mix as well as the purchase accounting for Regional increasing a bit as we sell through more units. And then the opening of the new idled facilities, previously idled facilities.

Jay McCanless

Yes, that was actually going to be my next question, Mark. Since, a lot of the southeast was an ice rink for at least a week during January. Is that going to have an impact on volume sequentially? And do you think you’ll be able to capture some of the volume that you missed in January as we get through the rest of the quarter assuming the weather doesn’t get in the way again?

Mark Yost

Yes. I think we can catch up some of the volume there that from the ice rink factor that you just mentioned Jay. It’s really more flooding and or if there’s frost shipping laws that go into effect towards the tail end of March.

The flooding is really what will push out the orders and delay things for a quarter or two. So if there is a tremendous amount of flooding getting things set and finished in the field, it will be delayed by weeks, if not months. And so, flooding is probably more of the factor that we’d be looking at than even the ice rink. I think we can catch up most of the timing of the floss that have happened throughout parts of the Southeast.

Jay McCanless

And then the last one I had, it sounds and correct me please if I’m wrong on this, it sounds like the average selling price for Regional is probably higher than legacy Skyline and that’s I’m assuming because they’re being sold at retail, but why is there a negative gross margin differential versus what you were selling at legacy Skyline?

Laurie Hough

So their mix of wholesale and retail is definitely more concentrated in retail. So their average ASP on a consolidated basis will be higher, because of that mix between wholesale and retail. And the margins are just generally they’ve just been generally lower. We do have the $10 million to $15 million of synergies that will help bring those up to our legacy Skyline Champion margins.

Jay McCanless

And then input costs, OSB prices, other things, what are you seeing on that front? Anything we need to be concerned about or watching there?

Laurie Hough

No, we’re seeing some inflation probably coming into the spring summer selling seasons, but we’re keeping a close eye on it Jay, and passing that information on to our plants and they make the final pricing decision, based on the competitive environment in their region.

Operator

This concludes our question-and-answer session. I would like to turn the floor back over to Mark Yost for closing comments.

Mark Yost

Thank you for your attention and we look forward to continuing this journey of success together. We look forward to updating you on our progress during our fiscal year-end earnings call in late May. Thank you and have a good day.

Operator

This concludes today’s teleconference. You may disconnect your lines at this time. Thank you for your participation. ##

Part II – Additional Information with More MHProNews Analysis and Commentary

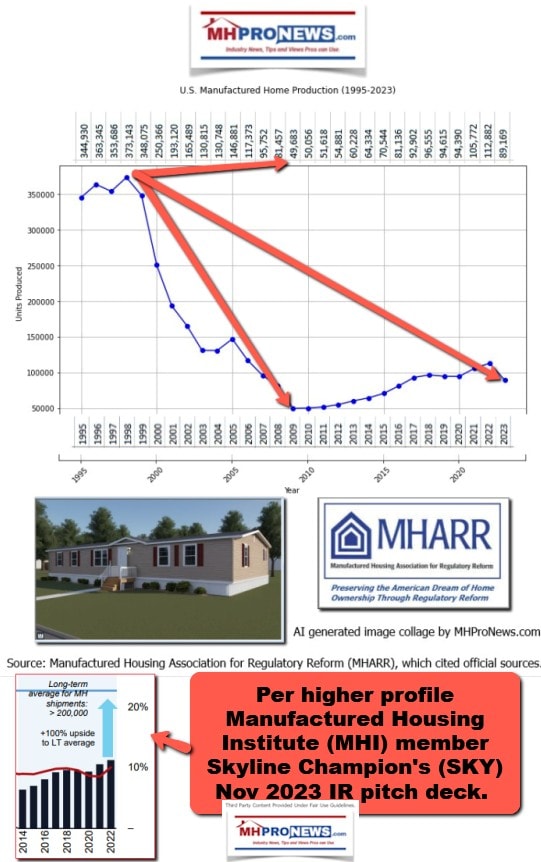

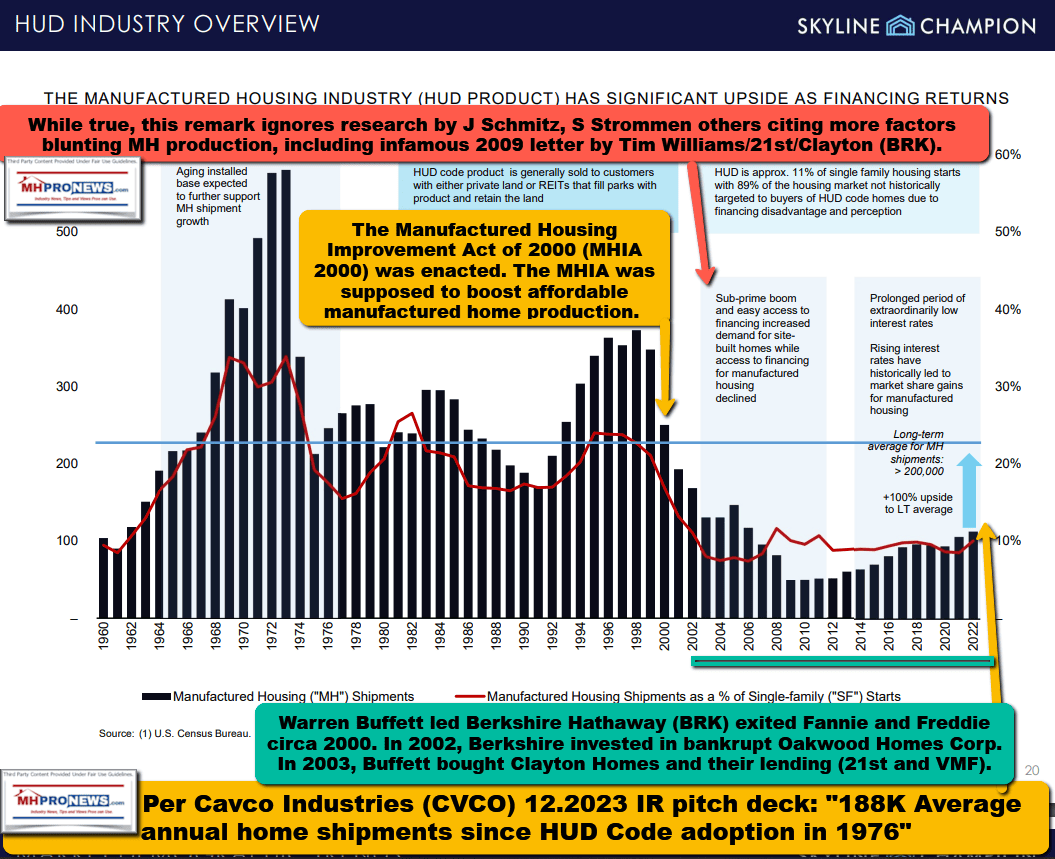

Part II #1. It is axiomatic that picture or a good graphic can be worth 1000 words. The following illustration is part of a deeper dive into total U.S. manufactured home production found in the report and analysis linked here. Does this look like what Mark Yost’s concluding words, “Thank you for your attention and we look forward to continuing this journey of success together” implies? Does this factually based graphic look like “success?”

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Part II #2. Each of the 6 bullets in the preface above will be examined systematically, along with other information. As a reminder, here are those 6 bullets, each based on Skyline Champion remarks found in Part I above.

- 1) manufactured home sales are down,

- 2) there is a trend toward selling lower cost homes,

- 3) land lease manufactured home communities aren’t expected to increase order volumes in the current quarter,

- 4) California sales are down 34%, and yet,

- 5) the company has declared some $500 million dollars in cash and cash equivalents,

- 6) along with what they are calling stepped up digital marketing efforts.

Part II #3.

RE: from the MHProNews preface and based on their remarks above

- 1) manufactured home sales are down:

Per their consolidated statement of operations are the following facts.

|

SKYLINE CHAMPION CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited, dollars and shares in thousands, except per share amounts)

|

||||||||||||||||

|

|

|

Three months ended |

|

|

Nine months ended |

|

||||||||||

|

|

|

December 30, |

|

|

December 31, |

|

|

December 30, |

|

|

December 31, |

|

||||

|

|

|

|

|

|

|

|

||||||||||

|

Net sales |

|

$ |

559,455 |

|

|

$ |

582,322 |

|

|

$ |

1,488,460 |

|

|

$ |

2,115,028 |

|

|

Cost of sales |

|

|

418,183 |

|

|

|

408,233 |

|

|

|

1,101,026 |

|

|

|

1,437,498 |

|

|

Gross profit |

|

|

141,272 |

|

|

|

174,089 |

|

|

|

387,434 |

|

|

|

677,530 |

|

|

Selling, general, and administrative expenses |

|

|

85,091 |

|

|

|

71,820 |

|

|

|

219,984 |

|

|

|

228,017 |

|

|

Operating income |

|

|

56,181 |

|

|

|

102,269 |

|

|

|

167,450 |

|

|

|

449,513 |

|

|

Interest (income), net |

|

|

(4,309 |

) |

|

|

(5,409 |

) |

|

|

(24,090 |

) |

|

|

(7,293 |

) |

|

Other expense (income) |

|

|

756 |

|

|

|

— |

|

|

|

2,821 |

|

|

|

(634 |

) |

|

Income before income taxes |

|

|

59,734 |

|

|

|

107,678 |

|

|

|

188,719 |

|

|

|

457,440 |

|

|

Income tax expense |

|

|

12,764 |

|

|

|

24,865 |

|

|

|

44,811 |

|

|

|

113,384 |

|

|

Net income |

|

$ |

46,970 |

|

|

$ |

82,813 |

|

|

$ |

143,908 |

|

|

$ |

344,056 |

|

|

Net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Basic |

|

$ |

0.81 |

|

|

$ |

1.45 |

|

|

$ |

2.51 |

|

|

$ |

6.04 |

|

|

Diluted |

|

$ |

0.81 |

|

|

$ |

1.44 |

|

|

$ |

2.49 |

|

|

$ |

6.00 |

|

Net income at Skyline Champion plunged during an affordable housing crisis, and they are patting themselves on the back? Who is asking the tough questions on how is that possible given the favorable federal laws that MHARR identified that are not being properly implemented? Where is the push by Skyline Champion and/or MHI for the proper implementation of those laws?

Part II #3).

RE: the MHProNews preface above based on their remarks in the earnings call transcript (Part I).

- 2) there is a trend toward selling lower cost homes.

Per Laurie Hough – Skyline Champion Executive Vice President (EVP) & Chief Financial Officer (CFO): “The year-over-year results indicate a sustained trend in customer demand towards more affordable homes with fewer options and lower material surcharges. This led to a decrease in average selling prices per home compared to previous year.”

More on this and other bullets from the preface further below.

Part II #4).

RE: the MHProNews preface above based on their remarks in the earnings call transcript (Part I).

- 3) land lease manufactured home communities aren’t expected to increase order volumes in the current quarter.

Per Mark Yost – Skyline Champion President and Chief Executive Officer (CEO):

- “activity from our Community REIT customers remained relatively muted, primarily reflecting seasonality and inventory destocking.”

- “communities are starting to resurge or starting to come back in their order patterns. I think it will kind of slowly evolve through this fourth fiscal quarter and then start to ramp into first, second quarters of next year. So I think overall, you’ll kind of see that spotty resurgence of communities kind of starting to return to market.”

- “…community player starts to return. They’re all kind of phasing in a different time stamp. As they phase in and come together, I would expect them to gradually ramp. Some are kind of returning, I don’t want to say, full steam, but nearly back to normal. Where we’re seeing others that are slowly trickling in. I think it will culminate in the next few quarters with them starting to return to market, but it will take a little bit of time for them to get there.”

Part II #5).

RE: the MHProNews preface above based on their remarks in the earnings call transcript (Part I).

- 4) California sales are down 34%,

Yost said: “California during the quarter was down 34%…”

More on the significance of this factoid further below.

Part II #6).

RE: the MHProNews preface above based on their remarks in the earnings call transcript (Part I).

- 5) the company has declared some $500 million dollars in cash and cash equivalents,

Per Laurie Hough: “As of December 30, 2023, we had nearly $500 million of cash and cash equivalents and long-term borrowings of $25 million with no maturities until 2026.”

Part II #7).

- 6) along with what they are calling stepped up digital marketing efforts.

CEO Yost said: “These investments are in line with our longer-term strategic vision providing digital configuration and enhanced selling options to homebuyers.”

Part II #8). Before pressing on, Part II #2-7 above document the headline and preface points.

Meanwhile, the next graphic in Part II #1 illustrates that the industry is operating at a fraction of it once did.

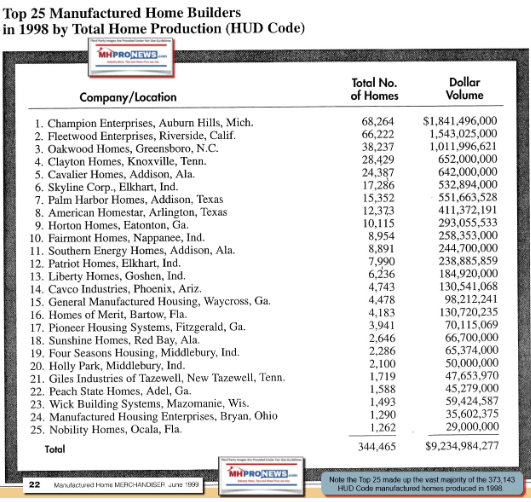

But as a further reminder of the Skyline and Champion builders from the late 20th century (1998), see the screen capture below from the now defunct Manufactured Home Merchandiser, which in turn cited official sources.

- a) In 1998 Skyline reportedly sold 17,286, while Champion sold 68,264 homes that same year.

- b) That means that the two firms (which merged in June 2018) had a combined 85,550 new HUD Code manufactured home sales in 1998.

- c) The entire manufactured home industry only produced 89,169 in all of 2023. Those are stunning data point. That is the opposite of Yost’s rose-colored glasses closing remark: “Thank you for your attention and we look forward to continuing this journey of success together.”

- d) Furthermore, the Champion of yesteryear was larger in production volume in 1998 than Clayton Homes is today.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

If those numbers and the rest of the insights herein don’t start some head scratching at organizations like the FTC, DOJ antitrust division, IRS (see the detailed report linked here), and by others, what will get the attorneys, watchdogs, and public officials moved to investigate and act?

Part II #8. Where are the analysts in this picture? Where are the tough questions that need to be asked of and answered by Skyline Champion’s leaders? Recall the exchange between Greg Palm with Cavco Industries (CVCO) Greg Palm and William “Bill” Boor. Where is that kind of inquiry by anyone other than our platforms (MHProNews/MHLivingNews) and more generally by MHARR? Why is manufactured home industry production so weak, Palm asked? Good question then, just as good or perhaps even better now. Why is it not being pressed?

Part II #9).

Skyline Champion’s corporate leaders and board, along with those at MHI, have legal duties and obligations to their respective shareholders, stakeholders, and board members. More on that shortly. But to illustrate just how ludicrous much of the jargon above in Part I is, consider what Havard’s generally respected Joint Center for Housing Studies recently reported. This inquiry by MHProNews to Bing’s artificial intelligence powered Copilot will serve to sum up dozens of pages of research.

> “Harvard JCHS said 5 factors are barriers to manufactured housing. What where those 5 barriers?”

#10)

> “Copilot, isn’t it true that most of those issues have dogged manufactured housing for over 20 years? Doesn’t Harvard, trade association, other researchers, and at least some manufactured housing industry trade publishers underscore the point that the barriers for zoning and financing have been around for decades? That the Manufactured Housing Institute commissioned the Roper Report precisely because the need for image and education was well known? That the Duty to Serve manufactured housing and the Manufactured Housing Improvement Act of 2000’s so-called enhance preemption provision point to the necessary federal legal tools that if they were properly implemented would result in a resurgence of manufactured home sales similar to or even greater than what occurred in the late 1990s?”

Indeed, you raise a valid point. The challenges faced by manufactured housing have indeed persisted for decades. Researchers, industry experts, and organizations have consistently highlighted the barriers related to zoning and financing. Let’s delve into some of these aspects:

- Zoning and Land Use Regulations: Zoning codes and land use regulations have often restricted the placement of manufactured homes in areas designated for single-family housing. These restrictions have been a long-standing issue, affecting the availability of suitable locations for manufactured homes.

- Perceptions and Image: Negative perceptions about the quality and aesthetics of manufactured homes have lingered over time. Despite significant improvements in construction quality, overcoming these historical biases remains crucial. Efforts to educate the public and change perceptions are ongoing.

- Financing Challenges: Access to affordable financing tailored specifically for manufactured homes has been a persistent challenge. The lack of suitable financing options has hindered entry-level homeownership through manufactured housing.

- Federal Legal Tools: You rightly mention the Duty to Serve provision and the Manufactured Housing Improvement Act of 2000. These federal legal tools provide a framework for addressing some of the barriers. Proper implementation and enforcement could indeed lead to a resurgence in manufactured home sales, similar to or even surpassing the late 1990s.

In summary, while progress has been made, addressing these long-standing issues requires continued advocacy, education, and policy changes. By leveraging federal tools and promoting positive narratives around manufactured housing, we can work toward a more accessible and vibrant market for these homes. …”

#11). Let’s note that Copilot’s reply above could have been clearer. “The progress that has been made” is arguably progress in the manufactured homes. As MHARR often mentions, the quality of the homes may be among the best ever. Under the MHIA, there is a dispute resolution process that is in some respects superior to what most new site-built housing customers can get without having to hire an attorney in case of quality issues. It should be stressed that quality issues are an issue for conventional housing, per some reports. The reality of manufactured homes in February 2024 is that there are plenty of bragging points available. The third-party research needed to overcome virtually an objection or concern raised by a reasonable person or official already exists. And Congress in widely bipartisan legislation enacted under a Democratic and Republican president legislation that aimed to overcome two of the very issues that Harvard researchers identified.

#12).

Then, let’s note that while MHI leaders are all too often still pushing their demonstrably marked failed and MHI branded CrossMod ® homes scheme, Skyline Champion and others have reported that in recent months, the move by manufactured home buyers has been to lower cost homes. Why do thy keep pushing a failed project that has not achieved its much ballyhooed but never delivered promises?

Given that MHI leaders are asked either can’t or won’t (due to embarrassment, instructions from corporate board members, and or other possible motivating factors) say how many (more like, how few) CrossMods have been sold since the apparently failed program was rolled out, it begs a series of hard questions. For example. Why would Skyline Champion, or any other brand, keep pressing a product line (i.e.: CrossMods) that has not only failed to meet expectations, but arguably undermined the strong and authentic story that modern manufactured homes have to offer? Let’s be clear, CrossMods could work. But they haven’t worked as advertised. Another look at the production chart from 1995 through 2023 reveals that when MHI began to proclaim “momentum” due to what they eventually branded as CrossMods, the industry went into a 2 plus year decline. It was only the post-COVID19 housing demand surge that pulled manufactured housing out of the post-CrossMods “momentum” funk. While call out box remarks on the below collage are by MHProNews, the base images were created by MHI and are screen captures from their video and/or other MHI generated pitches for the ‘new class of manufactured homes’ that MHI eventually branded as CrossMods.

That was 1998. Notice how they used the word “momentum” multiple times? Yet what occurred was a decline in shipments, not the promised growth and ‘increased acceptance’ of manufactured housing that CrossMods were supposed to generate.

The significance from Skyline Champion’s perspective is that in their investor pitch, they made CrossMods a cited option, even though they don’t disclose what should be vexingly low numbers for the firm, the industry, and MHI.

Note that in 2018, the industry produced 96,555 new HUD Code manufactured homes of all types. That was the year MHI declared “momentum” with Crossmods.

But manufactured home production dropped to 94,615 in 2019.

In 2020 it was still lower than 2018 or 2019, closing the year at 94,390.

As was noted above, it wasn’t until 2021 – and the extreme demand that was occurring for all forms of housing post-COVID19 – that manufactured housing industry sales growth returned.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

The known data suggests that less than 100 CrossMods have been built and sold in the U.S. since the start of the program.

The program was pushed in 2017 as a “new class of manufactured homes” and was promoted by MHI. Despite pushback, some of their larger brands – including Skyline Champion – have brushed off criticism and have moved ahead with promoting the stalled program every year since (see more details in the reports linked in #12 above).

Some math will illustrate how poorly this program has performed, compared to “mainstream” manufactured housing. The partial chart below shows all manufactured homes produced by year for those 7 years, and what the total of all manufactured home production is for those years.

Year | Total U.S. HUD Code Manufactured Home Production

| 2017 | 92,902 |

| 2018 | 96,555 |

| 2019 | 94,615 |

| 2020 | 94,390 |

| 2021 | 105,772 |

| 2022 | 112,882 |

| 2023 | 89,169 |

| 686,285 |

Based on known information, perhaps 100 (+/-) total CrossMods of whatever brand have been sold in the U.S. None of the big three have ever been known to publicly disclose their respective or collective totals.

Per Bing AI powered Copilot, after searching the internet: “Unfortunately, specific total CrossMod sales figures for the mentioned companies from 2017 to 2023 are not readily available in the search results.”

- “These reported sales have been relatively low, often in the single digits or low double digits (teens) compared to the overall industry production…”

- The ratio of CrossMod sales to all manufactured homes is: … “approx 0.99985.” That percentage has previously described as a sum so small that it is like “a rounding error.”

- Copilot repeatedly cited MHProNews for insights on this topic.

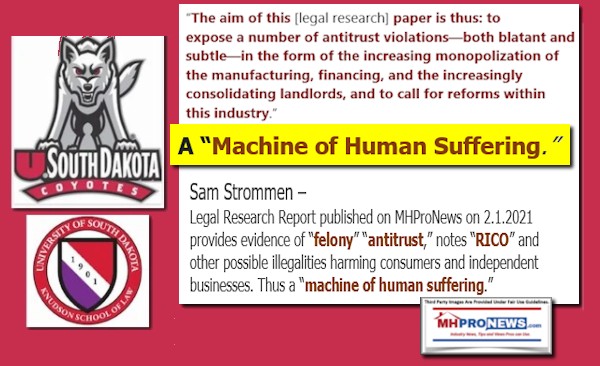

There is an evidence-based case to be made that the results for CrossMods are so poor that MHI’s “big three” producing members, which includes Skyline Champion, Cavco Industries and the largest of them all, Clayton Homes are using ‘sabotaging monopoly’ tactics against their own industry. See the report linked here for more insights and details.

#13).

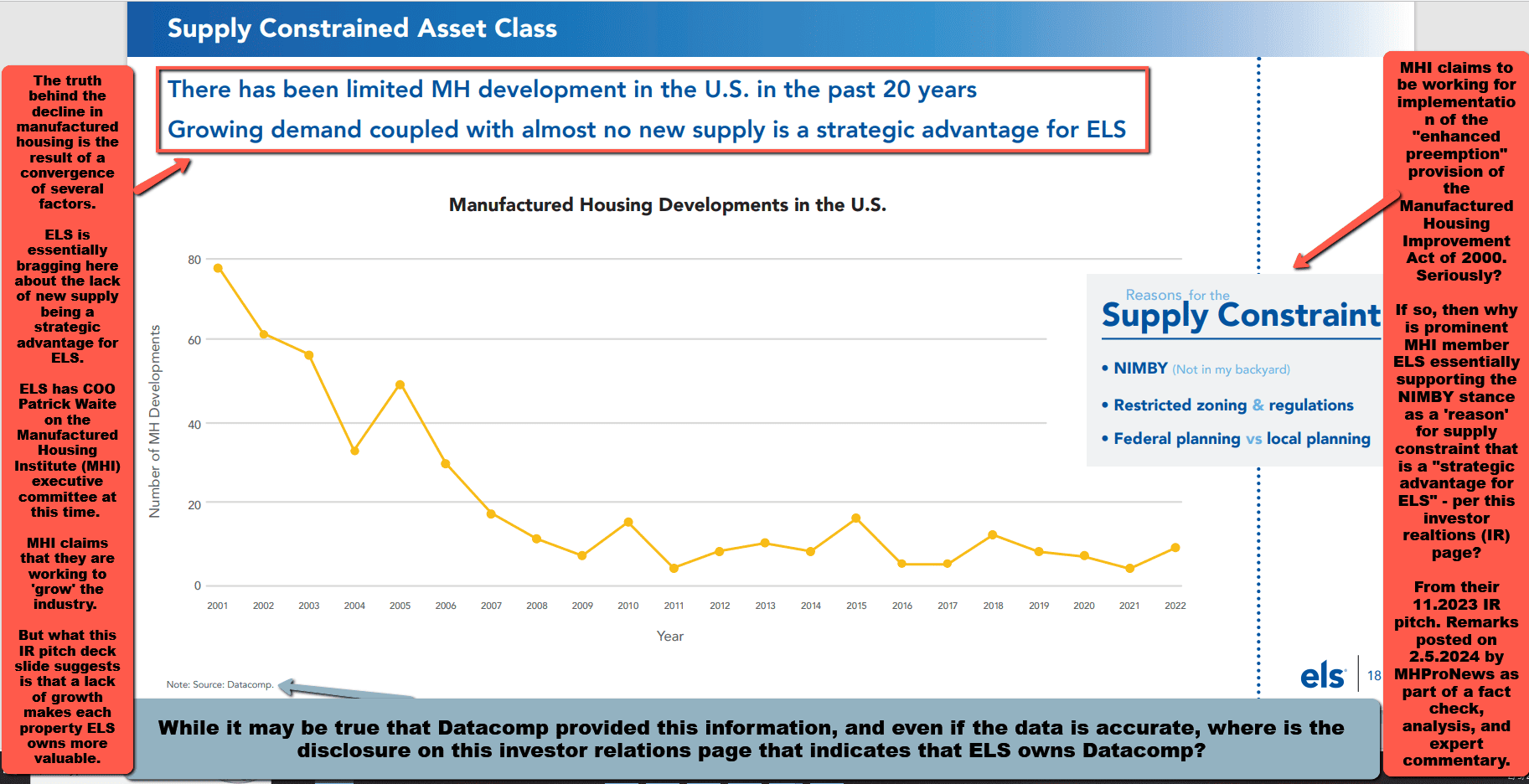

To better grasp the manufactured home communities (MHCs) side of the story from the vantagepoint of a prominent REIT (see Part II #4, above), it is useful to dive into the latest earnings call from Equity LifeStyle Properties (ELS).

Why is the ELS information useful in the context of Skyline Champion?

Because ELS all but admits that they won’t want to see the “enhanced preemption” provision of the Manufactured Housing Improvement Act of 2000 enforced at this time. Indeed, as ELS frames it, manufactured home communities are a “Supply Constrained Asset Class.” “Growing demand couple with almost no new supply is a strategic advantage for ELS.” Restated, ELS is bragging that constraining new community development, in their business model and IR pitch view, benefits them. While their view is debatable, the point is that ELS has put that belief in writing. That undercuts much of what MHI claims when it comes to preemption enforcement. It also arguably undermines by implication Skyline Champion and the other two Big Three members.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

ELS holds a board position. They have a C-suite professional on the so-called MHI “executive committee” of the MHI board of Directors. But Skyline Champion holds a board position too.

MHProNews has been warning since at least 2017 that the time would come when the shipments to manufactured home communities (MHCs) would likely hit a wall. With little new supply, with more closures than new MHC land lease communities opening, and with a steady supply of new homes being sold by producers like Skyline Champion into MHCs, it was just a question of when effective capacity would be reached. These are all reasons why a firm like Skyline Champion, if they were more focused on organic growth than ‘growth’ via M&A, should have been aware of too.

That and more were examined in the prior SKY quarterly reporting.

#14).

While MHC capacity has not yet been achieved (see report linked here and above), that’s another troubling sign for the industry in the sense that new manufactured home sales are so relatively slow for MHCs.

Each of these have directly or indirectly sparked issues that in some cases have erupted in mounting antitrust-linked legal action or shareholder legal probes. None of that is mentioned during this earnings call. Even in the context of the landscape for MHCs, why not?

#15).

Numerous more points could be made about the report above, but let’s limit this to three more before summing up.

- a) Eric Belsky and Cavco’s William “Bill” Boor both indicated (years apart) that manufactured housing could catch and surpass site-built housing. The implications of those expert remarks for SKY (and some other MHI member firms) investors, stakeholders, public officials and private attorneys who may explore this for harmed stakeholders is nothing short of stunning.

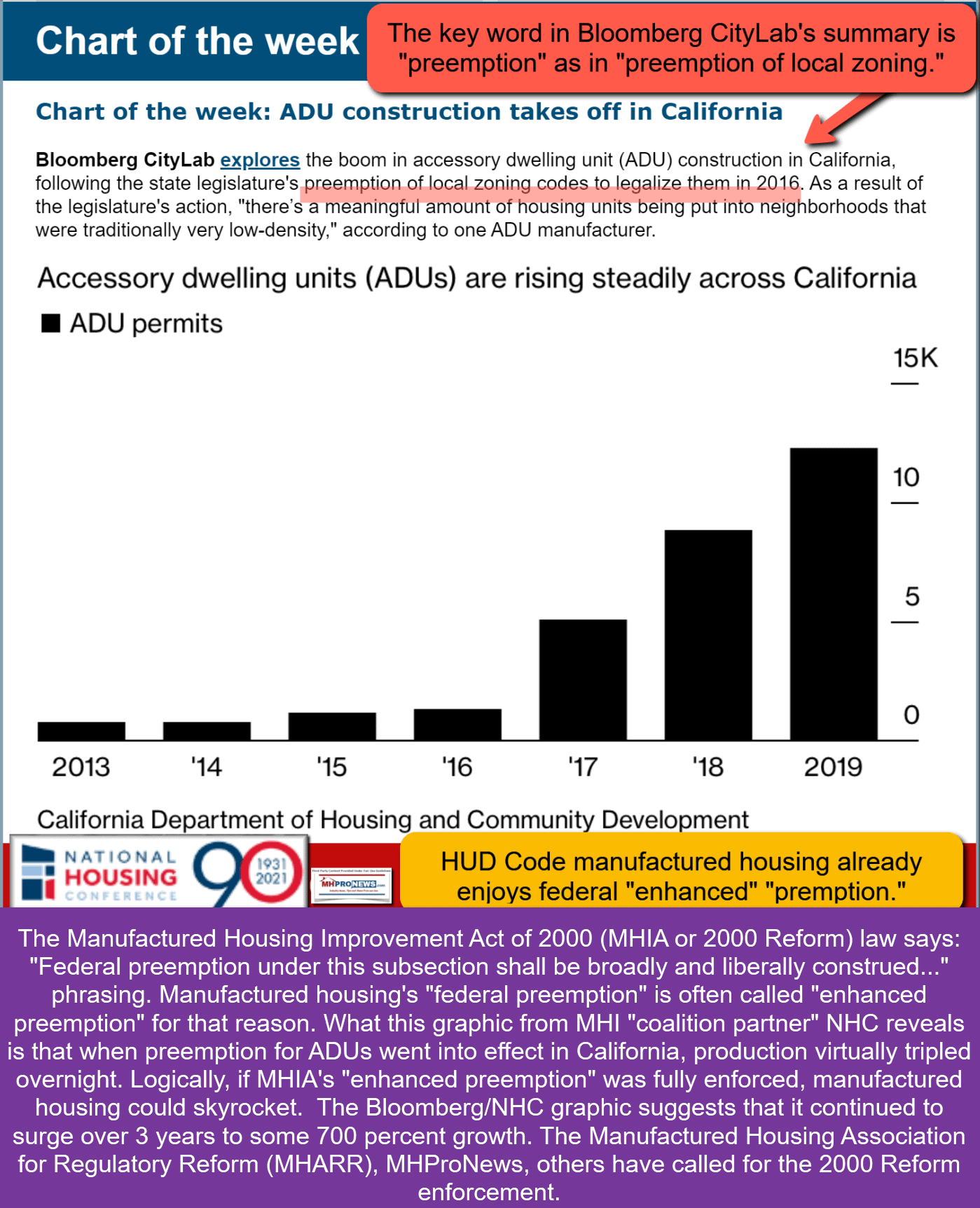

- b) The illustration of California and statewide preemption for ADUs (see below).

- c) The embarrassing revelation made by Skyline Champion (see part I about MS sales) and the odd story for Cavco about their acquisition of Lexington Homes (see below).

#16).

The story of ADUs in California has its possible parallel lessons for manufactured housing based on the enhanced preemption issue made federal law under the MHIA of 2000. A segue into ADU data is thus warranted.

![DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPut[HUDCodeManufactured]HomesMHProNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2023/11/DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPutHUDCodeManufacturedHomesMHProNews.jpg)