The claims made by Freddie Mac in the headline about financing nearly 29,000 manufactured home community (MHC) sites, over 423,000 rental units and others found in their press release below begs the question for thinking professionals. Has Freddie Mac been caught paltering? Before diving into that question and their recent press release provided below regarding their headline claims, quick insights into academic research on paltering and how it may apply to the U.S. housing industry and manufactured housing more specifically is appropriate.

Despite some psychologists who have claimed that those who are caught paltering are viewed dimly by the population, it seems that paltering is alive and well in America in general and in the diminished manufactured home industry (a.k.a. MHVille) too.

In one Harvard Scholar research paper, it was noted under “Penalizing Paltering” on page 46: “Although neither the law of perjury nor the traditional law of fraud penalizes paltering, the [legal] situation is changing. The securities laws, for example, penalize “material” omissions,18 and in modern times civil penalties for deceit or fraudulent misrepresentation (see Harrington, this volume) cover conduct as well as words and encompass a wide range of nondisclosures, passive acts, half-truths, and evasions.19 So, too, with crimes of larceny.”

MHProNews has previously noted several times a similar point to those quoted above from Penalizing Paltering by citing guidance published by the Securities and Exchange Commission (SEC) on what constitutes material omissions. There are legal, as well as reputational risks, to the practice of deception when an organization or person engages in paltering.

In a separate and more recent research paper published by Harvard: “Paltering is the active use of truthful statements to convey a misleading impression. Across 2 pilot studies and 6 experiments, we identify paltering as a distinct form of deception.” “Our findings reveal that paltering is common in negotiations and that many negotiators prefer to palter than to lie by commission.” “We also find that targets perceive palters to be especially unethical…Taken together, we show that paltering is a common, but risky, negotiation tactic. Compared with negotiators who tell the truth, negotiators who palter are likely to claim additional value, but increase the likelihood of impasse and harm to their reputations.”

With manufactured housing demonstrably underperforming for over 2 decades and in decline for over a year, and with the questions around the Duty to Serve (DTS) Manufactured Housing raised by Freddie Mac and fact-focused and credible sources in MHVille, this report will examine the good, bad, ugly, and meh about Freddie Mac’s remarks in their press release and what they have done (or failed to do) with and for manufactured housing financing, land-lease community residents, affordable housing seekers, and the broader U.S. housing market.

Part I – The Freddie Mac Press Release

(Note: publishing a press release or any other third-party content should not be construed as an agreement with those contents. Their remarks are their views, not those of MHProNews.)

Freddie Mac Multifamily Supports Over 423,000 Affordable Rental Units in 2023, on Track to Exceed Affordable Housing Goals

by Freddie Mac

Mon, January 22, 2024 at 2:00 PM EST

MCLEAN, Va., Jan. 22, 2024 (GLOBE NEWSWIRE) — Freddie Mac (OTCQB: FMCC) Multifamily today announced its 2023 volume totaled over $49 billion, including $48.3 billion in multifamily financing and over $883 million in Low-Income Housing Tax Credit (LIHTC) equity investments. The company met its mission-driven affordable housing targets, supporting 423,177 affordable rental units across the United States. The Freddie Mac data released today indicates that the company will achieve all of its 2023 Multifamily affordable housing goals set by the Federal Housing Finance Agency (FHFA).

A total of 66% of 2023 production volume qualified as “mission-driven affordable housing,” far exceeding the 50% goal set by FHFA. More than 67% of goal-eligible units financed through loan acquisitions were affordable to low-income residents earning less than 80% of area median income (AMI) and more than 20% were affordable to very low-income residents with incomes no greater than 50% of AMI, surpassing both goals. In total, 92% of all units financed in 2023 were affordable at or below 120% of AMI.

“In 2023, Freddie Mac Multifamily was proud to again surpass our ambitious affordable housing goals, despite significant headwinds facing the overall market,” said Kevin Palmer, head of Multifamily for Freddie Mac. “That is a credit to our team, our Optigo® lenders and their borrowers. We continue to be focused on and driven by all aspects of our mission. In addition to supporting affordability, in a difficult market like this one, when other liquidity providers step back, Freddie Mac Multifamily remains a steady provider of market rate loans, helping to support liquidity and stability in all market conditions.”

With more than $883 million in LIHTC equity investments in 2023, Freddie Mac achieved its LIHTC equity Duty to Serve target, aligning with FHFA’s decision to increase the LIHTC equity cap for 2024. Since 2018, Freddie Mac Multifamily has committed over $4 billion in LIHTC equity, ensuring nearly 30,000 units of affordable housing were created or preserved.

In 2023, Freddie Mac Multifamily helped to create and preserve affordable rental housing by funding a record $2.6 billion in forward conversions, which supported more than 21,000 newly constructed or rehabilitated affordable units. In addition, Freddie Mac Multifamily issued new commitments to fund $2.3 billion in future years, supporting over 22,000 units that will be constructed or rehabilitated. The forward program enhances the supply of new and rehabilitated affordable housing by providing certainty of permanent financing, even in volatile markets.

In addition, Freddie Mac Multifamily financed more than $13 billion in Targeted Affordable Housing in 2023, supporting nearly 108,000 rent-restricted affordable units. As Freddie Mac Multifamily works to advance resident-centered housing, 2023 marked a milestone in financing nearly 29,000 manufactured housing community pads with tenant protections that met or exceeded the standards laid out in its Duty to Serve Plan.

Palmer added, “In a housing market where affordability continues to be a major impediment for consumers, our team financed more than 423,000 affordable rental units. We are proud of our ability to help hundreds of thousands of families live in a place they can call home.”

About Us

Freddie Mac Multifamily is a national multifamily housing finance leader. Historically, more than 90% of the eligible rental units we fund are affordable to families with low-to-moderate incomes earning up to 120% of area median income. Freddie Mac securitizes more than 90% of the multifamily loans it purchases, transferring interest-rate risk, liquidity risk, and the majority of expected credit risk away from U.S. taxpayers to private investors.

Freddie Mac’s mission is to make home possible for families across the nation. We promote liquidity, stability, affordability and equity in the housing market throughout all economic cycles. Since 1970, we have helped tens of millions of families buy, rent or keep their home. …##

Part II – Additional Information with More MHProNews Analysis and Commentary

Some facts will help frame the analysis which follows further below for the statements made by Freddie Mac in Part I above.

- Per a response from Bing Copilot, with the bracketed remarks edited in for accuracy.

Learn more

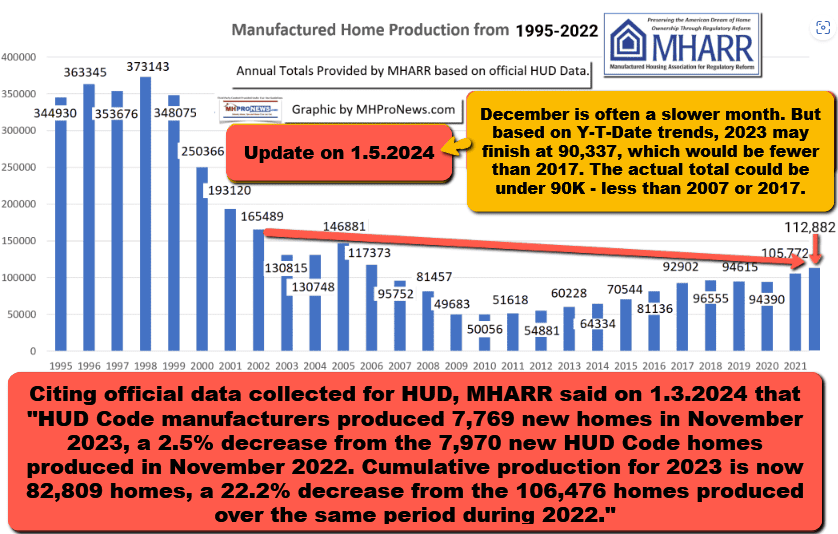

That combination of data from the table above and from MHARR at this link here looks like this in a graphic.

4. Next, citing Redfin, National Association of Realtors, others, Markets Insider said:

> In recent months, the US housing market has seen mortgage rates fall while inventory stays tight.

> New home sales are down 27%, and existing home sales have declined 40% since January 2022.

> Meanwhile, homebuilder stocks notched a banner year in 2023.

“US housing market is facing historic unaffordability and it’s kept countless Americans sidelined or forced to face hefty monthly home payments.”

5. In response to inquiries by MHProNews, Bing’s AI powered search function, Copilot, said the following.

In a separate Q&As, Copilot made these statements.

However, according to Fannie Mae, they provide liquidity to the mortgage market primarily by acquiring single-family loans from lenders and securitizing those loans into Fannie Mae MBS 4.”

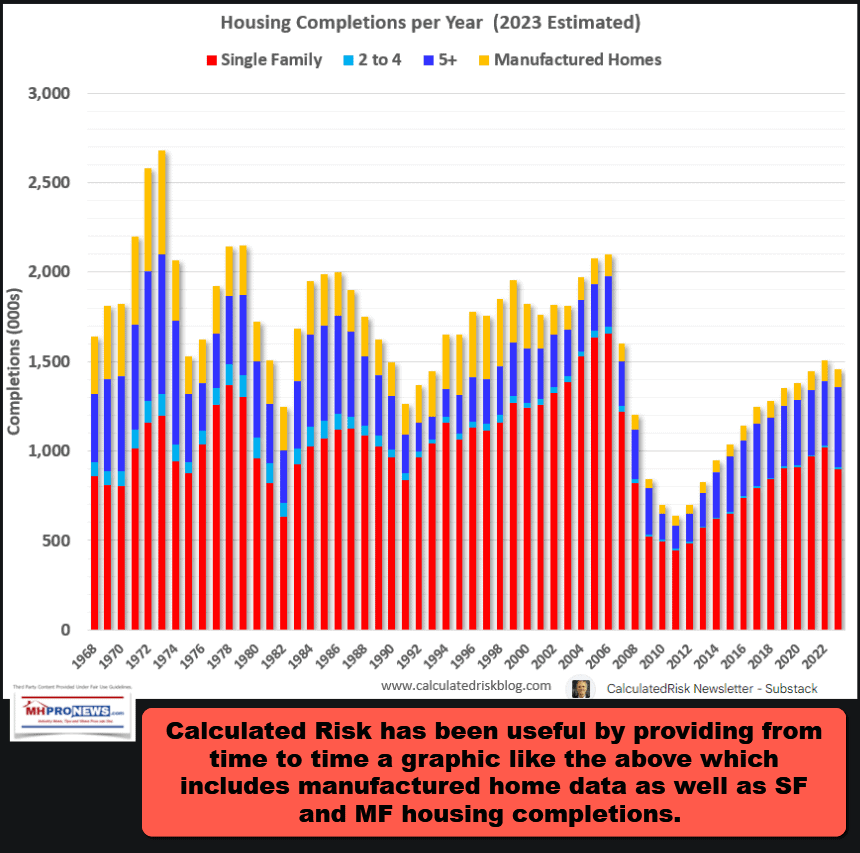

6. According to Statista: “After a peak in 2021, it is expected that there will be less than a million homes started in 2023. Housing starts are the number of new residential housing units where construction has begun.”

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

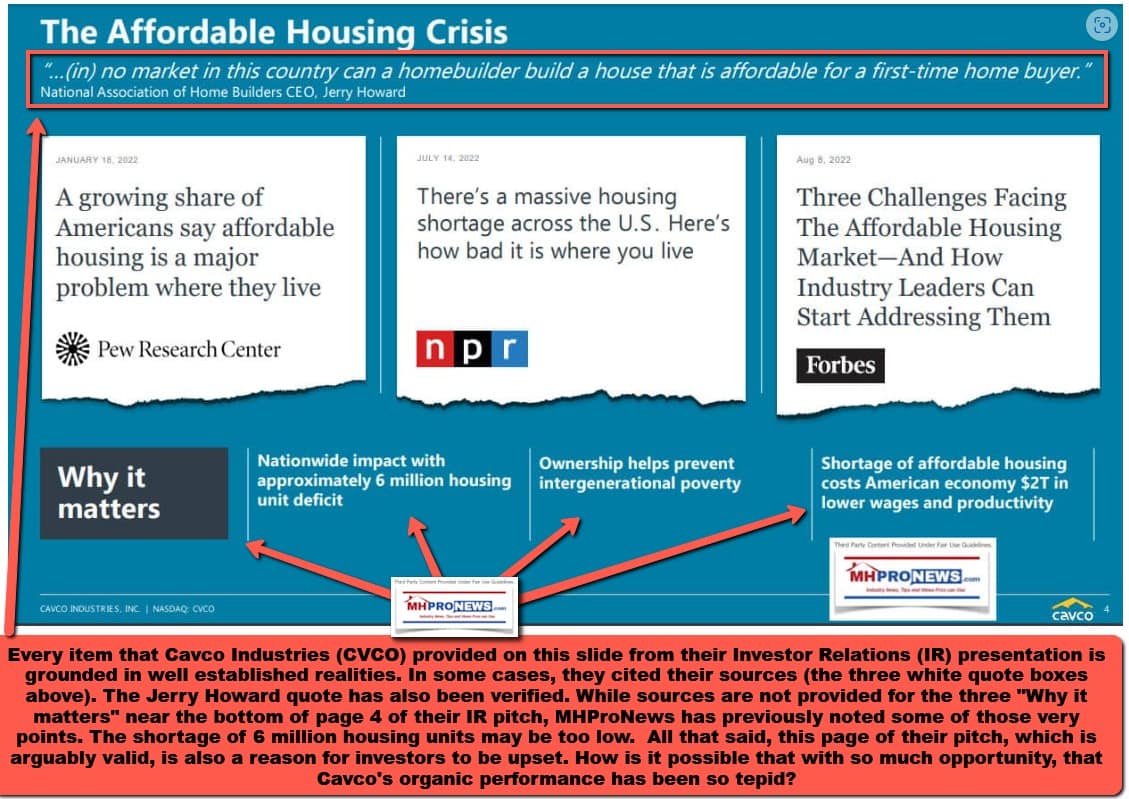

9. “The United States needs more housing, and more varied types of housing, to meet households’ needs throughout the country.” So said HUD’s Regina Gray and Pamela Blumenthal. “The consequences of inadequate supply are higher housing costs for both renting and buying a home.” “Without significant new supply, cost burdens are likely to increase as current home prices reach all-time highs,” Blumenthal and Gray wrote. MHProNews has explored those remarks in depth in the reports linked below. Both are relevant to the painfully low production of manufactured housing, which appears likely to finish 2024 with less than 30 percent of the new manufactured home production achieved in 1998 (see the graphics above in Part II #3 and #6).

10. Note that per Copilot, which cited Yahoo: “According to Yahoo Finance, as of January 23, 2024, the market capitalization of Freddie Mac is $617.557 million1.” Freddie Mac is capable of funding research. In fact, they have done quite a bit of research which has been spotlighted by our MHLivingNews sister site. Some examples since 2022 are as shown below.

11. The research linked above in Part II #10 clearly indicates that Freddie Mac can’t be ignorant of the fine nuances of the manufactured home industry. Precisely because Freddie Mac has done multiple research projects that demonstrate that they have a solid grasp of manufactured housing as a quality and affordable product, manufactured home communities (MHCs) as a business model within the manufactured home industry, and while outdated notions and myths about the industry persist, that ‘most consumers’ would consider buying a manufactured home. Those points made, and per the analysis of each of those reports above, Freddie Mac certainly have provided useful insights that if MHI were doing its job well, that umbrella trade group ought to be shouting Freddie Mac’s findings from the proverbial rooftops. The apparent and sobering fact that MHI fails to properly promote the industry it claims to serve all segments of is another story. That noted, the Lincoln Institute for Land Policy is among the organizations that along with several consumer-focused groups has pointed their fingers at Fannie Mae and Freddie Mac alike in saying that lending into the manufactured home community space has made MHCs less affordable for their residents.

12. As a relevant disclosure, this writer has addressed so-called “listening sessions” with the Federal Housing Finance Agency (FHFA), Fannie Mae and Freddie Mac officials in attendance to discuss the problematic implementation of their respect Duty to Serve (DTS) mandates several times in person and virtually starting in 2019.

There has been no known public questioning by Freddie Mac of any of those remarks. To illustrate, per Bing Copilot.

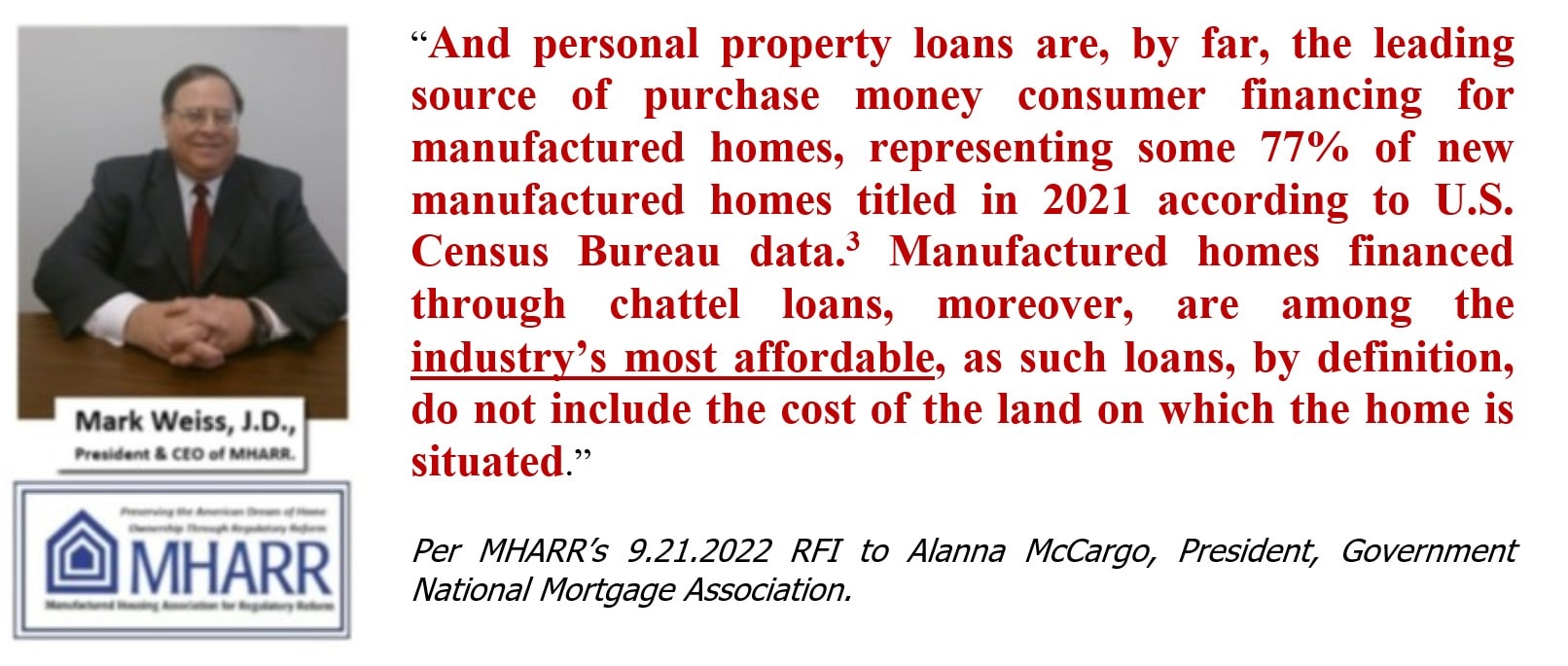

13. With the above facts noted, let’s pivot to commentary from the Manufactured Housing Association for Regulatory Reform (MHARR). Under an all caps headline, Mark Weiss, J.D., President and CEO of MHARR said: “FREDDIE MAC UNWITTINGLY PROVES ITS OWN FAILURE.”

Per Weiss’ MHARR Issues and Perspectives linked above are the following remarks.

Subsequently, during the 2010s, average entry-level housing supply according to Freddie Mac, declined even further, to an average of 55,000 units per year. “In the span of five decades,” then, the report concludes, “entry-level home construction fell from 418,000 units per year in the late 1970s to 65,000 in 2020.””

Weiss then metaphorically clubs Freddie with their own words from their own report.

With biting satire, Weiss said this.

14. Consider this Q&A with Copilot.

> Is there any known pushback by Freddie Mac or Fannie Mae to the commentary and analysis by Mark Weiss, J.D., President and CEO of MHARR to their purported failures with the Duty to Serve Manufactured Housing mandated by HERA 2008? See that commentary at the link here: https://manufacturedhousingassociationregulatoryreform.org/freddie-mac-unwittingly-proves-its-own-failure-mharr-issues-and-perspectives-may-2021/ What can you find in the way of a response by Freddie or Fannie to that analysis?”

Learn more

16. The role that CrossMods has played in this purported failure by Freddie Mac and Fannie Mae in how DTS has been implemented is explored in the reports linked below, and from others crosslinked from them.

- “Paltering is the active use of selective truthful statements to mislead,” per left-leaning Wikipedia.

- Per Merriam Webster, paltering is “to act insincerely or deceitfully” and “It comes from the Latin word paltrus, meaning “to lie or deceive” 1.”

- Paltering is not a lie in the conventional sense, in as much as the palterer does include truthful statements. That is what, per Harvard researchers and others, makes paltering cleverly deceptive, but nevertheless still deceptive. Because a palterer leaves certain facts out, what the SEC might call “material” omissions, the source engaged in paltering hasn’t out and out lied, which is defined as false statements or claims.

- Much of what Freddie Mac said may well be true. But when they said in the press release above: “We continue to be focused on and driven by all aspects of our mission. In addition to supporting affordability, in a difficult market like this one, when other liquidity providers step back, Freddie Mac Multifamily remains a steady provider of market rate loans, helping to support liquidity and stability in all market conditions” – that and more are arguably problematic. The Lincoln Institute’s George McCarthy said it aptly. Their so-called pad protection claims notwithstanding, Freddie and Fannie lending to so-called predatory consolidating brands are demonstrably making manufactured home communities less affordable.

- The launch of several antitrust lawsuits alleging illegal price rigging by several MHI member brands is further reason for concern for and about the GSEs.

19. Bing suggests in a disclaimer that their AI responses merits monitoring for possible glitches, something that longtime and detail-minded MHProNews readers know that this platform has demonstrably done since we began our tests with Bing’s AI in May 2023. That said, note this Q&A with top rated-Bing AI powered Copilot.

> “Does Freddie Mac employ lobbyists and use staff to advocate for various positions? Does that lobbying, research, and advocacy include manufactured housing related issues? Has Freddie Mac ever been known in the 21st century to issue any statements and remarks regarding the lack of enforcement of the Manufactured Housing Improvement Act of 2000 and its enhanced preemption provision? Also explain and define what enhanced preemption of HUD Code manufactured homes could signify if it were being properly implemented.”

Learn more

In response to a follow up to the above, Copilot added the following.

Regarding the Consumer Financial Protection Bureau’s (CFPB) findings, a report by the CFPB found that manufactured-home owners typically pay higher interest rates for their loans than borrowers whose homes were built onsite. The report also found that manufactured-home owners are more likely to be older, live in a rural area, or have lower net worth…When they do get a loan, these borrowers pay higher interest rates than their MH mortgage and site-built counterparts and are also less likely to refinance. Analysis shows that Black, Hispanic, and American Indian and Alaska Native borrowers are more likely to get chattel loans than their non-Hispanic white counterparts, even when controlling for land ownership 2345.

20.

> “Before or since the last time you were asked, is there any mention on the Manufactured Housing Institute website of the phrase “enhanced preemption” with respect to the Manufactured Housing Improvement Act of 2000? Or has the Manufactured Housing Institute used the phrase “enhanced preemption” in any of its social media posts?”

Learn more

21. So, while Freddie and Fannie have demonstrably supported MHI events by paying to be a sponsor for them, MHI has apparently returned the favor through the remarks made by MHI CEO Lesli Gooch. Freddie (and Fannie) have provided financial support oddly given DTS ‘credits’ by the FHFA, when the Lincoln Institute and others have complained that in doing so, the GSEs are making living in those communities less affordable (see evidence in the linked items in the analysis above). Despite launching announced plans to do pilot lending in the chattel loan space, neither Fannie or Freddie made such loans — and former MHI Chairman and longtime MHI board member — Tim Williams, president and CEO of Berkshire Hathaway owned 21st Mortgage Corporation (sister brand to Clayton Homes) said during an MHI meeting that he was glad that their respective manufactured home chattel loan pilots failed.

22. When so-called pro-consumer advocacy groups encouraged FHFA’s Sandra Thompson to move Fannie and Freddie to do chattel lending, MHI failed to sign onto their joint letter.

With those items (preface, Part I, and Part II #1-21) in mind, MHARR’s Mark Weiss seemingly aptly remark comes into sharper focus.

23. So, much of Freddie Mac’s research into manufactured housing is quite useful, as MHLivingNews has reported. That research often merits praise and appreciation. However, Freddie Mac on a practical level is only toe in the water for single family manufactured home lending. They and Fannie Mae are far more focused, in terms of dollars loaned, on the land-lease community space. In that arena, several organizations and individuals have complained that their lending and practices have allowed consolidators to dramatically hike their site fees, making their living there less affordable. As Weiss pointed out (Part II #13 and other), Freddie Mac research has demonstrated their own failures. Or as Freddie Mac’s PR above said: Palmer added, “In a housing market where affordability continues to be a major impediment for consumers…” what they have demonstrated is their apparent favoritism for the corporate consolidators in manufactured housing. These arguably appear to be instances of what the Capital Research Center has called “Deception and Misdirection,” or what some might aptly call paltering. MHProNews plans to offer an opportunity for Freddie Mac to respond to these and other linked concerns. Stay tuned. ##

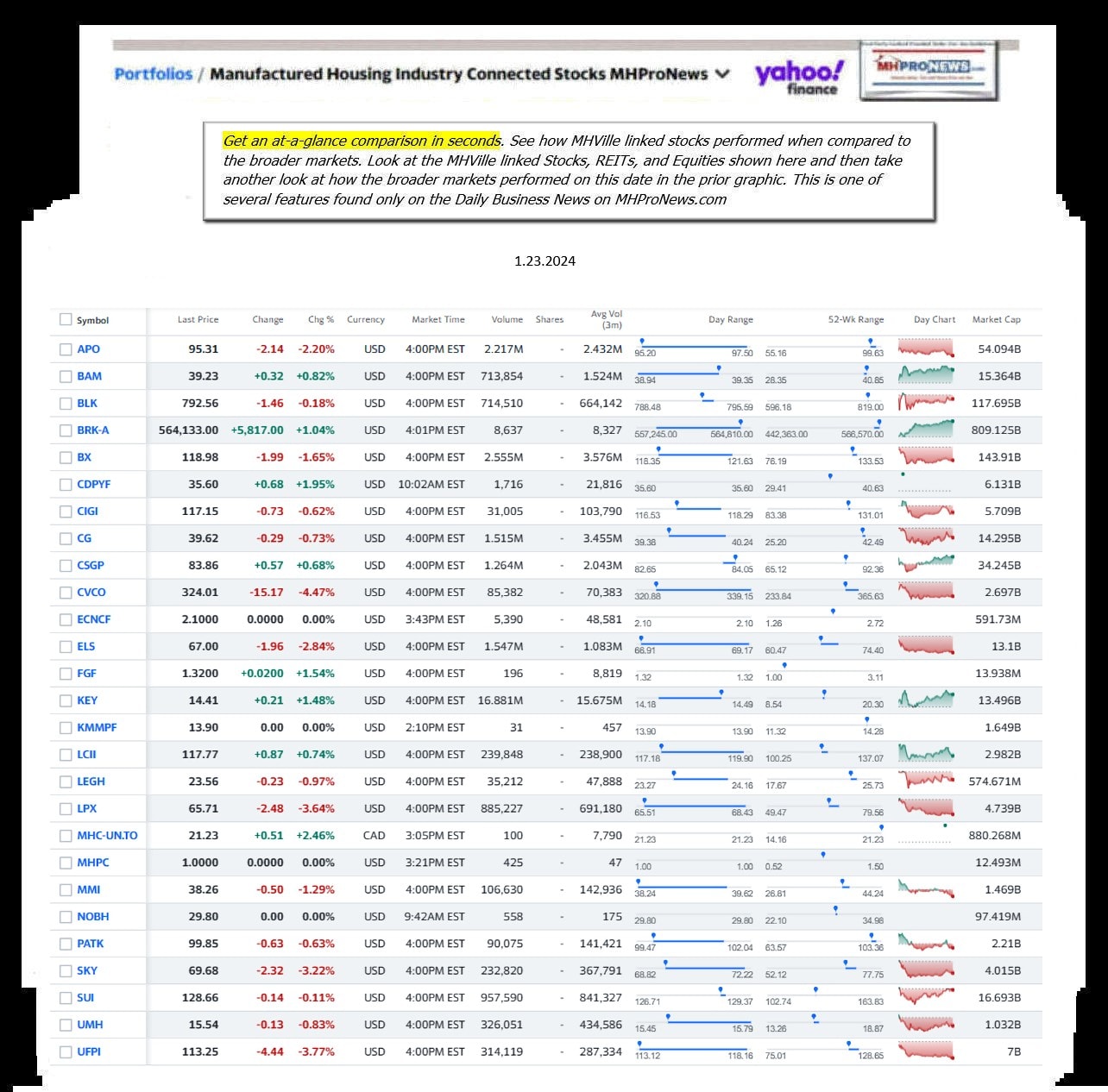

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from 1.23.2024

- Alaska Airlines CEO says company found loose bolts on ‘many’ Boeing Max 9s

- Netflix gains more than 13 million subscribers in the fourth quarter

- Venmo and other payment app theft is ‘skyrocketing,’ Manhattan DA warns

- In-N-Out has never closed a location, until now. It cites crime as the problem

- The Los Angeles Times newspaper headquarters in El Segundo, California on January 18, 2024.

- Los Angeles Times slashes more than 20% of newsroom staff as the paper confronts a ‘financial crisis’

- Sunglass Hut International Inc. signage is displayed outside of a store at the Third Street Promenade outdoor mall in Santa Monica, California., U.S., on Monday, Dec. 5, 2011.

- Texas man sues Macy’s and Sunglass Hut parent over wrongful arrest linked to facial recognition

- Republican presidential candidate and former U.S. President Donald Trump holds a campaign rally ahead of the New Hampshire primary election, in Atkinson, New Hampshire, U.S. January 16, 2024.

- Trump SPAC has tripled since the Iowa caucuses

- James Stephen Donaldson, known professionally as Mr Beast, is an American YouTuber, enjoys his time on the field before the regular season game between the Atlanta Falcons and the Tampa Bay Buccaneers on October 22, 2023 at Raymond James Stadium in Tampa, Florida.

- MrBeast tested Elon Musk’s theory and took home $250,000

- Harvard University sits as leaders of various universities, including Harvard President Claudine Gay, have taken heat from both Jewish communities, which have said they are tolerating antisemitism, and Pro-Palestinian groups, which have accused schools of being neutral or antagonistic towards their cause, in Cambridge, Massachusetts, U.S., December 12, 2023.

- Israeli hostage posters at Harvard vandalized with antisemitic messages

- Unionized staff at Condé Nast walk the picket line during a 24 hour walk out amid layoff announcement in front of the Condé Nast offices at One World Trade Center in New York City on January 23, 2024. Conde Nast is merging the popular digital music publication Pitchfork with the men’s magazine GQ, a decision that has triggered anger over resulting layoffs and concern for the outlet’s future.

- More than 400 Condé Nast staffers stage one-day walkout to protest layoffs

- Customers have soured on self-checkout, and a new study says there’s proof

- ‘The straw that broke the camel’s back’: United CEO’s frustration with Boeing’s problems

- The crisis at Kyte Baby might not have happened if the US had a mandated paid leave policy for new parents

- Amazon tracks its French warehouse workers to the second, regulator finds

- Dwayne ‘The Rock’ Johnson scores mega payday to join the WWE’s board

- Chinese stocks have lost $6 trillion in 3 years. Here’s what you need to know

- The world is a mess and Wall Street isn’t paying attention

- Police arrest California woman for allegedly stealing 65 Stanley cups

- Why companies like Kyte Baby keep screwing up, virally

- The Los Angeles Times plunges into ‘chaos’ as brutal layoffs loom and senior editors call it quits

- How New Hampshire’s economy compares to the rest of the US

- 3 burning questions Netflix faces at the start of 2024

- Boeing faces new safety alert over earlier generation of 737s