“A Cruelly-Unfulfilled Promise and Mandate” is how Mark Weiss, J.D., President and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR) has described “The Duty to Serve” manufactured housing. The article is part of their regular “MHARR Issues and Perspectives” Series. Unlike the Manufactured Housing Institute (MHI) which emails out items that may not appear on the public side of their website, when MHARR sends out an email to their members and list on an issue it is routinely found on their website that day or soon thereafter. MHProNews has observed that apparent phenomenon for some years. More on that in Part II below.

Part I

MHARR – ISSUES AND PERSPECTIVES

By Mark Weiss

AUGUST 2023

“THE DUTY TO SERVE — A CRUELLY-UNFULFILLED PROMISE AND MANDATE”

The June 2023 edition of “MHARR – Issues and Perspectives,” addressed one of the two major post-production factors – discriminatory and exclusionary zoning mandates — underlying both the HUD Code manufactured housing industry’s failure to achieve significantly higher levels of production in the face of an ongoing affordable housing crisis and the consistent failure of federal government “affordable housing” grants, funding and other programs to “reach the ground” with respect to HUD Code manufactured housing. The latter phenomenon was examined and documented in MHARR’s July 2022 White Paper, “The Exploitation of Federal Housing Finance and Mortgage Funding Assistance Programs and Potential Solutions.”

With this column, we will address a second major factor which continues to suppress industry growth and the real-world availability of government funding and programs within the HUD Code market (notwithstanding ample growth opportunities for affordable housing) – i.e., the failure of Fannie Mae, Freddie Mac and the Federal Housing Finance Agency (FHFA) to implement the statutory Duty to Serve Underserved Markets (DTS) directive with respect to the nearly 80% of the HUD Code manufactured housing finance market represented by personal property or “chattel” loans.

It is important to recall that the Duty to Serve mandate was included in the Housing and Economic Recovery Act of 2008 (HERA) as a remedy. Specifically, it was made part of HERA and adopted by Congress to remedy the miserable track record of Fannie Mae and Freddie Mac when it came to providing secondary market and securitization support for loans on certain types of affordable homes — including HUD Code manufactured homes — even though their respective charters obligate the Enterprises to promote and provide homeownership opportunities for very low, low and moderate-income American families. DTS thus directs Fannie Mae and Freddie Mac to provide such support for consumer loans within three specified affordable housing markets, one of which is HUD Code manufactured homes. It also designates the Federal Housing Finance Agency (FHFA), the federal regulator for Fannie Mae and Freddie Mac, as the federal agency responsible for ensuring compliance with the DTS mandate – i.e., DTS’ “enforcer.”

It is also important to recall that Congress, when it enacted the DTS mandate, was well aware of the contours of the manufactured housing market and the important role that chattel loans play within that market to provide consumer financing for the industry’s most affordable homes. Based, then, on specific input from MHARR as well as the Manufactured Housing Institute (MHI), Congress included a proviso in the DTS mandate which specifically authorized the inclusion of manufactured home chattel loans within the DTS programs required to be developed and adopted by the two mortgage giants. The statutory DTS mandate, accordingly, embraces, encompasses and includes both manufactured home real estate financing and personal property financing which, again, constitutes the vast bulk of all current-day manufactured housing consumer loans.

So, what have Fannie Mae and Freddie Mac – with FHFA looking on – done with manufactured home chattel loans under DTS? The answer is as succinct as it is devastating. Quite simply, the mortgage giants, with FHFA’s acquiescence, have done exactly nothing under DTS with respect to chattel loans since the mandate’s enactment 15 years ago. Despite false starts, promises and proposals spanning much of the past decade-plus, neither Fannie nor Freddie have ever supported or securitized manufactured home chattel loans under DTS. To be certain, there have been references to chattel loan “pilot programs” in DTS plans proposed by the mortgage entities over that time. And some have even made it to the “approved plan” stage, having been blessed by FHFA, like the Freddie Mac chattel pilot scheduled for the final year of its 2022-2024 DTS “implementation” plan. But, somehow, so far, all of those proposed chattel programs have managed to wash-out prior to implementation.

The odds, therefore, do not favor the current Freddie Mac proposed chattel pilot. Even if it somehow manages to go forward, though, the 1,500 to 2,500 loans currently slated for DTS support (i.e., purchase) would only amount to a marginal fraction (i.e., 1.7% to 2.8%) of the approximately 88,000 manufactured home chattel loans that could be originated in 2023 based on 2022 production levels and the 10-year-plus historical proportion of consumer chattel loans within the manufactured housing market (i.e., 78%) based on U.S. Census Bureau data. Meanwhile, consumers would lose out because roughly 98% of manufactured home consumer chattel loans would still be made at unnecessarily high interest rates (with the lack of DTS support meaning greater retained risk for lenders, combined with a less-than-fully-competitive market), while the industry (and consumers) would continue to suffer from suppressed production levels due to the unavailability or unnecessarily limited availability of fully-competitive, lower interest rate personal property loans. And that is even if the proposed Freddie Mac chattel pilot goes forward. If it does not, 100% of the chattel consumer financing market would continue to be totally unserved.

And how do those real-world impacts play out? For consumers (and potential consumers) it means that chattel loan interest rates for manufactured homes – currently ranging as high as 10.8% for qualified borrowers with lower credit scores (according to publicly available data) –will continue to far exceed mortgage rates for site-built homes, which currently average 7% (again, according to publicly available data). This differential represents a number of factors, including, but not limited to the risk that manufactured home chattel lenders must retain on portfolio because of the lack of any secondary market or securitization for such loans. But it also reflects the market distortion that necessarily flows from a lack of full, or even adequate competition within the chattel financing market (as was acknowledged by Freddie Mac itself in its 2022-2024 DTS Plan). The absence of a functioning secondary market or securitization structure, accordingly, keeps new and additional loan originators out of the market, leaving Berkshire-Hathaway-affiliated 21st Mortgage Corporation (21st) and Vanderbilt Mortgage Corporation (VMC) as the dominant lenders for manufactured home consumer financing in general and chattel loan financing in particular – albeit at unnecessarily high interest rates – thanks to their access to a virtually unlimited supply of capital via the Berkshire Hathaway megalopoly.

For consumers, then, the failure to implement DTS within the manufactured housing chattel market means higher-than-necessary interest rates on purchase loans, fewer potential sources for that financing and, therefore, fewer purchasers who can qualify for the more limited and costly financing that is available. Fannie and Freddie, accordingly, by their failure to implement market-significant chattel market support, are: (1) keeping lower-income qualified consumers out of the manufactured housing market altogether; while (2) driving those that do remain in the market into what some have termed “predatory” loans at needlessly high interest rates. For the HUD Code industry, it means fewer customers and fewer homes produced and sold.

None of this is what Congress intended when it enacted DTS. In fact, Congress’ objective was just the opposite.

Meanwhile, as the affordable housing opportunities provided by HUD Code manufactured housing (documented most recently by a 2023 Harvard University Joint Center for Housing Studies analysis) go underutilized in the midst of an affordable housing crisis, the most damaging effects are being felt by American minority groups. Despite the Biden Administration’s supposed policy emphasis on “equity” in housing and home financing, the homeownership rate among African-Americans (as of 2022) stands at 45.0%, some 4.1% lower than its previous peak in 2004. Similarly, the homeownership rate for Hispanic-Americans remains more than a percentage point below its previous peak of 49.7% in 2007. All of this confirms, again, the findings of MHARR’s July 2022 White Paper, indicating that notwithstanding the billions of dollars in housing programs promoted by the Biden Administration, such funds still fail to “reach the ground” with respect to HUD Code manufactured housing.

So, while HUD wastes billions on affordable housing programs that simply do not work, the answer to the affordable housing crisis (or at least a large part of it) sits right under HUD’s nose in the form of manufactured housing which HUD itself regulates. Why then, does HUD itself not press for the full implementation of DTS? And why is HUD — through the Federal Housing Administration (FHA) — dragging its feet on critically-needed reforms to the FHA Title I manufactured housing program, a program that Ginnie Mae has itself admitted is producing negligible levels of loan originations?

The “problem,” then, is straightforward. There is a lack of housing that is inherently affordable and available to Americans at lower and moderate-income levels. The “solution” to that problem is similarly straightforward. Federally-regulated manufactured housing is the nation’s most affordable source of housing and homeownership, as determined by HUD research. Yet, the “solution” to this national problem is not as broadly available to Americans as it should be or needs to be because of exclusionary zoning, as addressed previously, and because of the failure and outright refusal of Fannie Mae and Freddie Mac to implement DTS within the HUD Code chattel lending sector in defiance of Congress and the law.

So, what can – and should – be done to remedy this defiance? There are many industry organizations and entities which claim to represent and speak on behalf of the individuals, groups and interests that are most directly and grievously harmed by Fannie and Freddie’s blatant refusal to serve the vasty bulk of the manufactured housing consumer lending market under DTS. All of those organizations and entities have a central role to play in bringing maximum pressure on Fannie and Freddie for the full, market-significant implementation of DTS. Unfortunately, as of now, they all have failed. For the sake of the industry and its consumers, this must change and change soon.

MHARR — despite the fact that it does not receive any funding from the industry’s post-production sector – is on record as having done more than any other national group to keep these post-production issues (i.e., discriminatory zoning exclusion and lack of full, market-significant DTS implementation within the consumer chattel financing market) alive and a key public policy focus since the enactment of their relevant enabling laws.

MHI, by contrast, claims to represent the industry’s post-production sector, including finance companies, retailers, suppliers and others. As such – and again, unlike MHARR — MHI collects hefty dues from these businesses in order to effectively address matters impacting the post-production sector, specifically including the availability of consumer financing. Furthermore, MHI, with industry members’ hard-earned dollars, boasts a well-funded Political Action Committee (PAC), as well as funding levels that can support litigation when and if needed.

So, what has MHI done with that funding – particularly with respect to DTS and the lack of consumer loan support within the predominate chattel lending sector? The sad answer is, not much. Much of MHI’s funding appears to be wasted on dead-end show-projects, such as proposed legislation that is likely to go nowhere in the current political environment in Washington, D.C. A good example is MHI’s current “energy” bill (H.R. 3327), that stands a scant chance of going anywhere any time soon. Worse yet, corrective legislation would not even have been necessary had MHI joined with MHARR years ago to force DOE to work with HUD and the Manufactured Housing Consensus Committee (MHCC) on energy standards as required by the original legislation on that subject. Instead, MHI – joining with energy and “climate” special interests – sought and then cooperated with the disastrous DOE “negotiated rulemaking” that helped bring DOE’s egregious energy standards to fruition. MHARR, by contrast, stood alone, casting the only “no” vote on that horrendous proposal.

Instead of such misdirected and most-likely meaningless projects, MHI should demand congressional hearings (as MHARR has already done) regarding the failure of Fannie Mae and Freddie Mac (and in certain respects, FHFA) to fully implement the DTS mandate. As part of such hearings, Fannie and Freddie should be forced to testify and explain, among other things, why they are thumbing their nose at Congress by not implementing the DTS mandate with respect to the vast bulk of the HUD Code manufactured housing financing market.

And what of the self-proclaimed manufactured housing “consumer” groups and organizations, such as MH Action, CFED, turned Prosperity Now, Next Step and others? These groups know full well that Fannie and Freddie have failed to implement DTS for the vast bulk of the manufactured housing consumer finance market and, therefore, for the vast bulk of actual and manufactured housing consumers. Yet, other than paying occasional lip service to the need for DTS chattel lending support, they have done more to: (1) push Fannie and Freddie toward the comparatively small manufactured housing land-home sector; (2) promote more costly manufactured housing real estate hybrids with virtually no market share; and (3) focus on DTS community-related mandates which have little to no positive impact on the availability of affordable manufactured homes, in part because of discriminatory and exclusionary zoning laws as detailed in the June 2023 MHARR Issues and Perspectives.

Instead of such emotionally pleasing yet largely market-inconsequential efforts, these groups – to truly benefit their supposed constituents – should rather join with MHARR and the industry in demanding complete congressional oversight hearings on the failure of Fannie and Freddie to implement DTS for the benefit of the vast bulk of manufactured housing consumers.

Further, what of the individuals and entities that claim to have an interest in the manufactured housing industry, such as MHInsider and ManufacturedHomes.com? While producing written (and other) content related to industry issues, these entities (and others) have largely failed to expose Fannie and Freddie’s defiance of the DTS mandate with regard to consumer chattel loans. Indeed, both have given Fannie and Freddie a platform to tout their purported efforts under DTS, while failing to emphasize that after 15 years, some 80% (or more) of the HUD Code market remains completely unserved.

And what about those who ostensibly stand for the interests of land-lease community owners and operators? Indeed, of the nearly 80% of manufactured home purchasers relying on chattel financing, most make use of the often-cost-efficient ownership model offered by land-lease communities. But where are these supposed representatives, supporters, stalwarts, or others? Who among them have taken HUD, Fannie, Freddie and the others to task for their never-ending failures? Who among them have taken concrete action to demand and pursue actual remedies? At the very least, they must press their national association (MHI) to do much better than it has to date.

The time for standing on the sidelines for all of these groups, organizations and entities, is – and should be – over. After more than a decade and a half, it is time for DTS to be fully implemented. And all should be focused on demanding congressional oversight hearings to stop the defiance of the law by Fannie and Freddie (and others) that has lasted far too long.

Mark Weiss

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

Part II – Additional Information with More MHProNews Analysis and Commentary

Accuracy Notice and Disclosure: the above was an advanced draft provided by MHARR to MHProNews. MHARR advised MHProNews late yesterday afternoon that minor tweaks may have been made since the above was provided. During a BUSY week for our platform, this post may be modified in the days ahead accordingly, once compared, reviewed, and refined.

That said, as was noted in the preface, MHProNews has periodically observed for some time that remarks made by MHI and/or their staff or corporate leaders often do not routinely appear on their own website. Emails, unless posted, don’t normally appear in a web search. So, MHI – or others that engage in a similar practice – can posture to their heart’s content for their readers in emails while sending a different signal to public officials or others on their website.

By contrast, what MHARR emails they routine post on their own website. That is not only a matter of consistency. It is a matter of transparency and accountability too. MHARR ‘puts it all out there’ for others to see, track, and monitor events as they unfold.

Why doesn’t MHI do the same? The apparent answer is that if MHI were following the same procedures news, updates, and notices steps that MHARR did, they could have been found out to be duplicitous years before tipsters, some in MHI, informed MHProNews what was occurring vs. what was being said. MHI can claim, per those sources, to be doing similar efforts as MHARR.

But when the statements by publicly traded companies and/or their corporate leaders that are MHI members are compared to MHI’s formal remarks, a clear disconnect becomes apparent. Examples of that pattern are linked below.

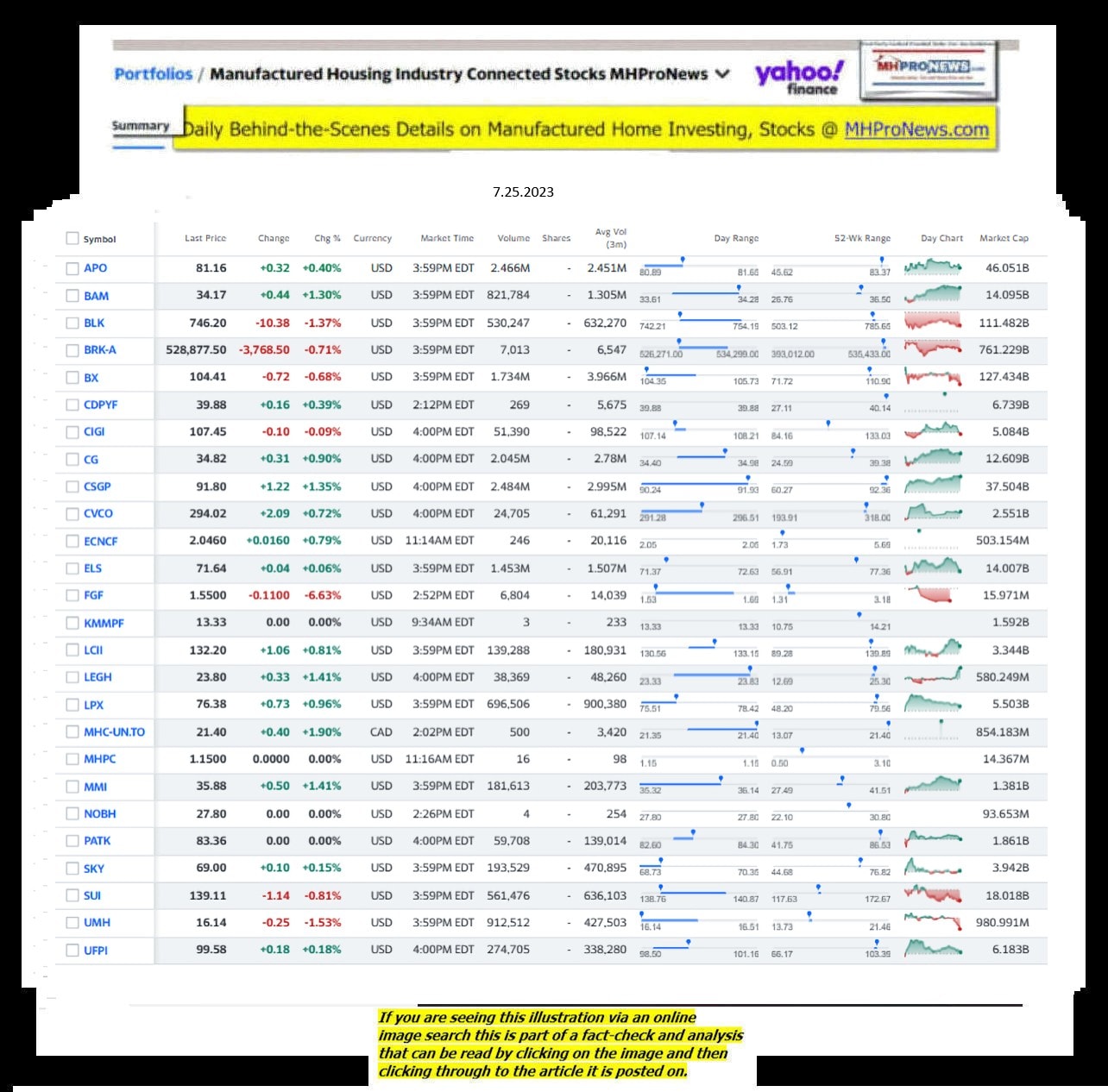

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

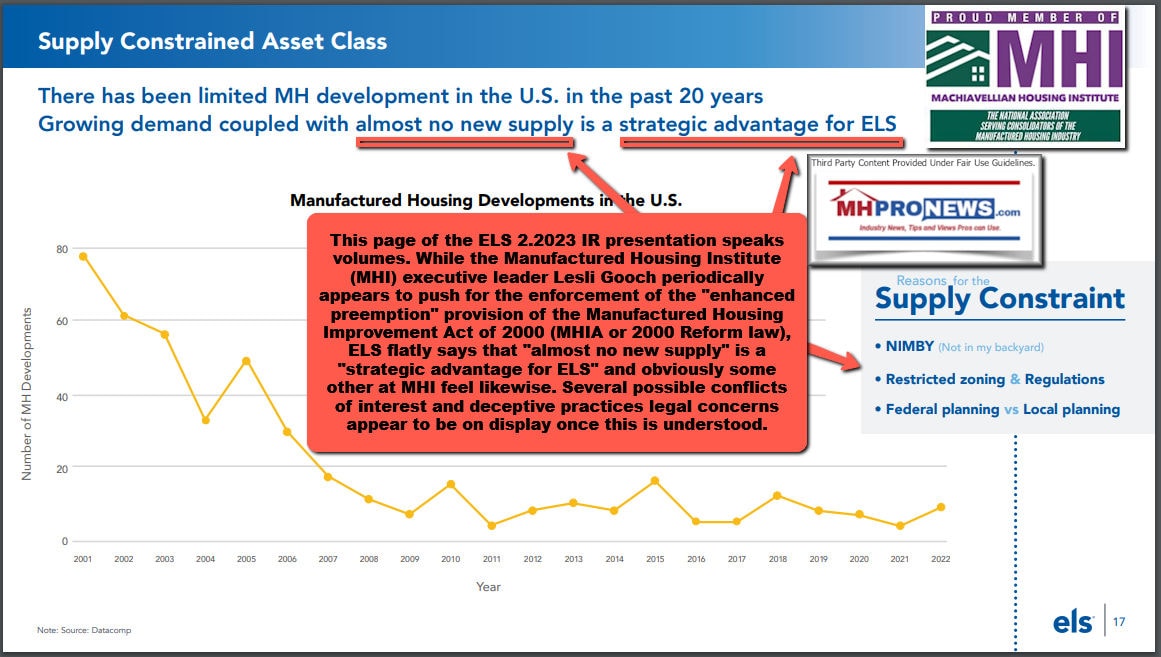

Flagship, “Frank and Dave” (Rolfe and Reynolds) led Impact Communities, and others have made similar remarks that support that evidence-based contention. Something similar applies in finance. When capital access is more difficult for a smaller firm to accomplish, then larger firms get an edge. That in turn penalizes consumers who are seeking the most home for their monthly payment. Some will be completely “priced out,” using the formula provided by the National Association of Home Builders (NAHB) when their income and debt ratio no longer leaves enough money to qualify for the lender’s approval formula.

In the above, MHARR takes a clear swipe at those beyond MHI who ought to be working with them for the authentic implementation of existing federal laws like DTS, or the Manufactured Housing Improvement Act (MHIA) of 2ooo and its “enhanced preemption” provision. Those federal laws are supposed to be supporting manufactured housing industry growth. Widely bipartisan Congressional passage was supposed to support a free enterprise solution to the affordable housing crisis. But because those good existing laws are being thwarted manufactured housing production and shipments are falling instead of rising. The facts on that speak loudly for those with the ‘eyes to see’ the truth.

To the point raised by MHARR’s Weiss on naming MHInsider and ManufacturedHomes.com, that may represent a significant and timely nuance to their long-stated positions on MHI.

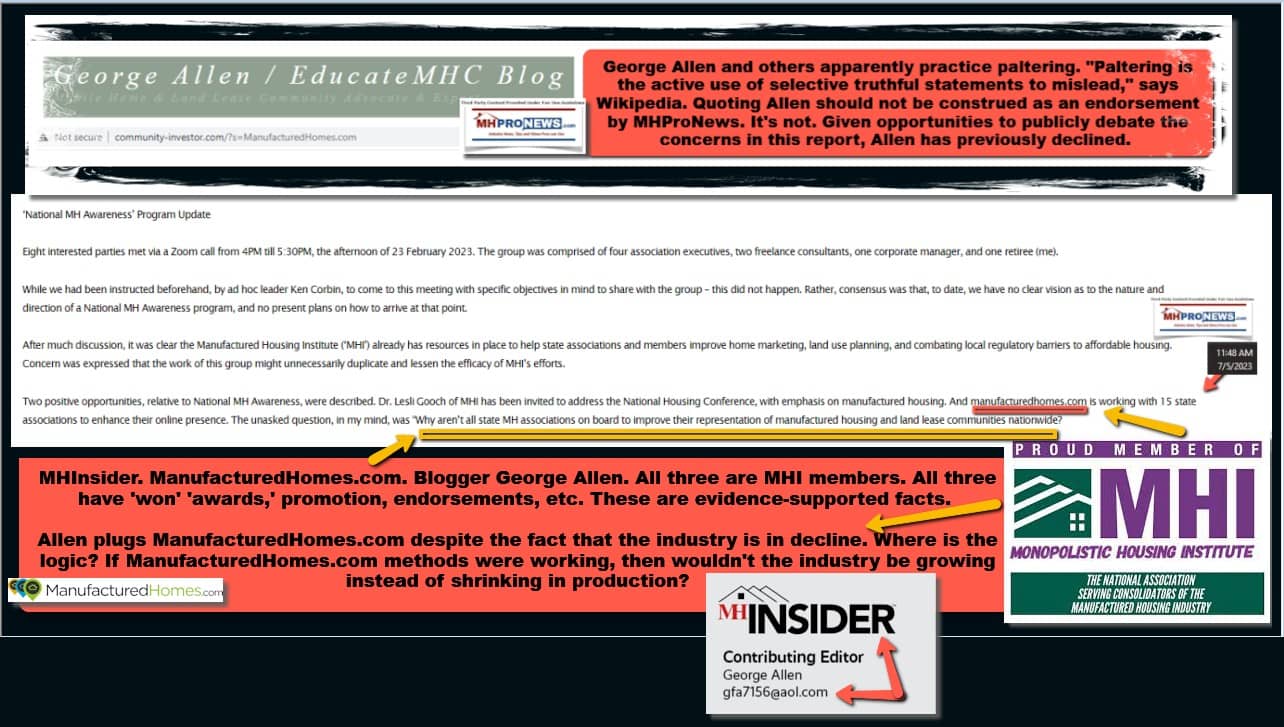

For instance, on DTS, both MHInsider and ManufacturedHomes.com have run articles and/or ads that promote the failed MHI branded CrossMods scheme in some form or fashion. Is it any wonder that those platforms don’t expose CrossMods for what they have been? Or for what MHProNews has from early on projected that they would be? For example. When it comes to picking sides, so to speak, between the independents that have largely funded ManufacturedHomes.com from early on and chasing the MHI-Fannie Mae-Freddie Mac variations of the CrossMods narrative, there is evidence that ManufacturedHomes.com have landed on the MHI side. No wonder MHI gave them ‘an award’ for their ‘service’ in the supplier’s sector. They are de facto carrying MHI’s water on their unstated support for limiting the industry from within.

If there was any question of the (willful?) ignorance and/or duplicity of George Allen, who ought to know the facts he claims to report on better, is this example of him encouraging more support for ManufacturedHomes.com DESPITE the fact that the industry has been sliding for over half a year. In the snippet from ‘AAA – All About Allen’s’ blog, Allen is pushing the industry’s other MHI state affiliates to engage ManufacturedHomes.com to do for others what they are doing for 15 states. Pardon me? By way of analogy, do you want to hire a truck driver with a history of accidents to haul critical loads? If the industry is in decline, and ManufacturedHomes.com isn’t pointing to the underlying causes for that problem, then aren’t they obviously part of the problem instead of part of the solution?

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

During the same timeframe that manufactured housing has been sliding, far more costly conventional housing has risen.

Thus, as the above illustrated, MHARR is now on record calling out by name several organizations beyond MHI that ought to be working with them to cause the full and properly enforcement of DTS and the MHIA of 2000.

Among those MHARR is challenging to step up to the plate?

- Firms such as MHInsider and ManufacturedHomes.com.

- Nonprofits such as MHAction, Prosperity Now, Next Step and others.

For whatever reasons, Weiss for MHARR doesn’t mention Frank Rolfe, Dave Reynolds, and George Allen by name. While MHARR is a sponsor, it should be noted that MHProNews does not speak for MHARR, nor vice versa, though we often have similar views.

Those disclosures made, when MHARR said “what about those who ostensibly stand for the interests of land-lease community owners and operators?” Weiss may well have had one or more of those individuals (Allen, Rolfe) in mind. Rolfe clearly has ‘more credibility’ (such as it is) in most manufactured home community (MHC) circles.

In the case of Allen, who postures a type of independence, it should be apparent that he is de facto on the side of MHI.

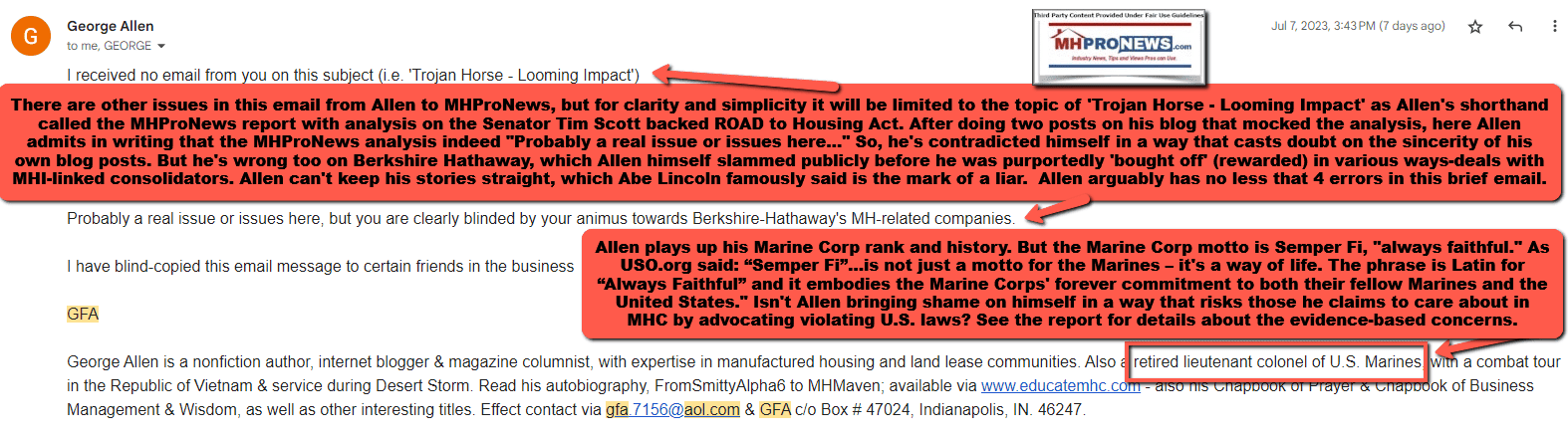

Allen made demonstrably false allegations in a recent post, apparently as a way of digging at MHARR and those who hold similar views to MHARR’s. In so doing, he reflects his routine benefit to MHI and the consolidators that Allen claims to disdain. If Allen was truly opposed to those MHC consolidators, then why has he accepted at his various events several such firm’s sponsorship?

Instead of making public corrections when his obvious errors were pointed out, Allen oddly made an on-the-record response (see below) that ironically demonstrated that his attacks were apparently pure hypocrisy. Expand the graphic below, a screen capture of Allen’s email and Allen’s own words where he admits “Probably a real issue or issues here…” on something he attempted to slam on his blog. Apparently, Allen seems to fall into the trap that Abraham Lincoln mentioned in this insightful quote.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Paltering, posturing, “deception and misdirection” in the form of various types of head-fake theatrics are arguably all too common among such MHI-insiders. So, is it any wonder that mainstream media can publish remarks that downplay or ignore what should be obvious problems to those who are supposed to reveal the truth to readers?

To sum up, MHARR has apparently been systematically laying the groundwork for potential future probes of various organizations, federal and others, when Congress or an Administration is in office that cares about such matters. MHARR’s Issues and Perspectives and other reports and commentaries keep a level of pressure on MHI and their consolidating insiders. The status quo in manufactured housing might be much worse in the absence of MHARR. It is a fair question how few independent producers of HUD Code manufactured homes would remain if MHARR didn’t exist in the 21st century? After all, MHI’s Kevin Clayton admitted in remarks to Congress how a lack of financing is one of the factors that have contributed to the loss of so many independent producers.

Similarly, in the absence of the apparently industry-leading audience here at MHProNews, MHI’s consolidators may be further along as well than they are. Careful step-by-step exposes like this one are apparently among the reason that audiences flock here for fact- and evidence-packed reports that are routinely not found elsewhere in what passes for MHVille trade media and bloggers.

MHI’s eclectic collection of ‘amen corner’ and ‘deception and misdirection’ mouthpieces are arguably part of the problem rather than stepping up to the plate and consistently being part of the solution.

Similarly, when it comes to MHAction, and others that MHARR named in the nonprofit world, why haven’t they reached out to MHARR to team up with on enforcement of the MHIA of 2000 and DTS?

The trends, behavior patterns, facts, evidence, and money trail have always been part of authentic investigative work, be it by law enforcement agencies or media.

Despite the relatively low level of general respect for media in general in the U.S. (or in many countries abroad), the growing traffic on MHProNews in the second quarter of 2023 compared to the prior quarter (or prior year) would suggest that the fact-packed, evidence-based and common-sense commentary and analysis are gaining in popularity. It has not always been easy, especially early on. But sticking to the facts, evidence, and that pesky (for deceivers) truth has its own rewards.

Until the corruption is rooted out of manufactured housing the industry will not achieve its potential. What is the potential? See what Cavco and their CEO Bill Boor had to say about that topic in the report linked below.

Part III. Daily Business News on MHProNews Markets and Headline News Segment

Headlines from left-of-center CNN Business – from the evening of 7.25.2023

- The struggle to buy a home is real

- A “For Sale” outside a home at Di Lido Island in Miami Beach, Florida, US, on Wednesday, Feb. 1, 2023.

- Eva Marie Uzcategui/Bloomberg/Getty Images

- High interest rates, low inventory and more: There’s a lot working against anyone shopping in this housing market

- The rise of gig workers is changing the face of the US economy

- UPS and Teamsters reach a labor deal, potentially avoiding a crippling strike

- LIVE UPDATES

- Microsoft, Google and Snap set to report earnings

- White House condemns Fox News over ‘dangerous and extreme’ Holocaust comments from top host

- ChatGPT creator pulls AI detection tool due to ‘low rate of accuracy’

- The Fed has paused before. Here’s what happened next

- Gas prices just saw their biggest one-day increase in a year

- Billionaire Leon Black made a $158 million payment to Jeffrey Epstein. Senators want to know why

- Meta’s Threads gets a highly requested ‘following feed’

- Meta, Microsoft, hundreds more own trademarks to new Twitter name

- Moody’s warns Israel faces ‘significant risk’ of political and social tensions that will harm its economy, security

- Skittles’ newest flavor will make your nose hairs curl

- US consumer confidence jumps to highest level since July 2021

- ‘Sound of Freedom’ is a box office hit. It has an unusual ticket strategy

- Here’s why home prices stayed high in May

- Lowe’s rehires employee who tried to stop shoplifters

- Countries could lose $4.7 trillion over the next decade to tax havens, tax group estimates

- Barbenheimer could be the one-two movie punch that blasts away the superhero smash

- GM earnings soar

- The world’s biggest ice cream company says heat waves may not help sales

- IMF: Global economy is improving but inflation is still enemy No. 1

- The stock market is dominated by just a handful of companies. The Biden administration is worried

Headlines from right-of-center Newsmax 7.25.2023

- US Judge Blocks Limits on Asylum at US-Mexico Border

- A federal judge on Tuesday blocked a rule that allows immigration authorities to deny asylum to migrants who arrive at the U.S.-Mexico border without first applying online or seeking protection in a country they passed through. [Full Story]

- Steil: ESG Dem Workaround for Losing Policies

- Alford: Biden ‘Black Widow’ in ‘Web of Lies’ | video

- Jesse Binnall: Who Wanted to Cover Up Biden Evidence?

- Satanic Temple Head: Fox Held to Unreasonable Standard | video

- Eric Trump: Justice System Not Respected Anymore | video

- Taibbi: ‘New Genre of Misinformation’ | video

- Alina Habba: Left Wanted Trump Indictment for ‘Shock Factor’ | video

- Perry: Devon Archer Not Too Happy With Bidens | video

- Kerik: ‘No One Holding FBI, DOJ Accountable’ | video

- Trump Has Plan to Return Drug Production to US

- Former President Donald Trump, who is seeking the 2024 Republican presidential nomination, announced his plan to return the manufacturing of pharmaceutical drugs to the U.S. in a new video released Monday on Rumble…. [Full Story]

- AI Mania Drives Wall Street to Higher Close

- The tech-heavy Nasdaq closed higher, leading gains on Wall Street [Full Story]

- Abortion Rights Amendment Cleared for Ohio’s Nov. Ballot

- Ohio voters will have the opportunity this fall to decide whether to [Full Story]

- As US Runs ‘Low’ on Munitions, Shortfalls Addressed Slowly

- President Joe Biden may have revealed classified information and [Full Story] | Platinum Article

- Monmouth Poll: GOP Majority Sees Trump Best to Top Biden

- Most Republican voters say former President Donald Trump is the best [Full Story]

- Related

- Rasmussen Poll: Trump Leads DeSantis by 44 Points

- Morning Consult Poll: Trump Leads DeSantis by 43 Points

- WSJ: Newsmax Ratings Jump After Tucker Leaves Fox News

- The prime-time viewership for Newsmax more than doubled in the second [Full Story]

- Russia Attacks Kyiv in New Air Strikes

- Russia launched new drone strikes on Kyiv and parts of central and [Full Story]

- Related

- Ukraine Reports Small Advances Against Russian Forces

- Anger Grows as Russia Hits Odesa Historic Sites

- UN Watchdog: Nuke Plant Occupied by Russia Is Surrounded by Land Mines

- Putin Aims to Bolster Africa Ties Despite Ukraine Conflict

- Kremlin Denies Russia Hit Odesa Cathedral, Blames Ukraine

- Russia Accuses Ukraine of ‘Terrorism’ After Drone Attacks

- Russia Widens Strikes on Ukraine, Hits Danube Export Route

- US Judge Blocks Limits on Asylum at US-Mexico Border

- A federal judge on Tuesday blocked a rule that allows immigration [Full Story]

- Related

- Gaetz Intros Bill Ending ‘Unqualified’ Birthright Citizenship |video

- Report: Fox Halts Satanic Temple Donation Matches

- If Fox News employees wish to donate to The Satanic Temple through a [Full Story]

- Education Department Opens Investigation into Harvard’s Legacy Admissions

- FBI ‘Crying Wolf’ With Claims About Biden Document

- FBI complaints regarding the release of an internal, unclassified [Full Story] | Platinum Article

- Department Opens Probe Into Harvard’s Legacy Admissions

- Opening a new front in legal battles over college admissions, the [Full Story]

- Trump Hits Senate GOP as Less Critical of Biden Than House

- Former President Donald Trump on Monday lashed out at Senate [Full Story] | video

- Related

- DOJ to Make Prosecutor in Hunter Biden Case Available to Testify, but How Soon?

- Dems Target FBI Form Detailing Biden-Burisma Allegations

- NY Post: Joe Biden Joined Hunter Business Calls

- Jill Biden Marks US Reentry Into UNESCO at Flag-Raising in Paris

- First lady Jill Biden attended a flag-raising ceremony at UNESCO in [Full Story]

- Biden Taps No. 3 Pentagon Job Nominee Amid Senate Approval Stall

- The Biden administration is nominating a new Pentagon policy chief [Full Story] | video

- Poll: McCarthy Gets Highest ‘Favorability’ in Congress

- House Speaker Kevin McCarthy, R-Calif., is the most “favorably [Full Story]

- Related

- McCarthy Raises Possible ‘Impeachment Inquiry’ Into Biden

- Consumer Confidence Hits 2-Year High

- S. consumer confidence increased to a two-year high in July amid a [Full Story]

- UPS Reaches Contract Agreement With Union, Averting Strike

- UPS has reached a contract agreement with its 340,000-person strong [Full Story]

- Russian Fighter Jet Fires Flares at US Drone Over Syria

- A Russian fighter jet flew within a few meters of a U.S. drone over [Full Story]

- Biden Cancels $130M in CollegeAmerica Student Debt

- S. President Joe Biden said Tuesday his administration was [Full Story]

- Emmett Till Monument Is Promise Kept

- As President Joe Biden signed a proclamation on Tuesday establishing [Full Story]

- Gaetz Intros Bill Ending ‘Unqualified’ Birthright Citizenship

- Matt Gaetz, R-Fla., introduced a bill to Congress on Tuesday to [Full Story] | video

- Russia Building Drone-Making Facility With Iran’s Help

- U.S. intelligence officials say Russia is building a [Full Story]

- NatWest Board Backs CEO Over Farage Account Row

- NatWest CEO Alison Rose has admitted a “serious error of judgment” in [Full Story]

- Records Reveal 10 Attacks by Biden’s Dog Commander

- President Joe Biden’s nearly 2-year-old German Shepherd dog Commander [Full Story]

- GOP Targets Abortions, Gender Surgery in VA Spending Bill

- House Republicans are taking aim at contentious Biden administration [Full Story]

- Harvard Poll: 57 Percent Say ‘Bidenomics’ Wrong Direction

- According to the results of the July Harvard CAPS/Harris Poll,57% of [Full Story]

- LeBron James’ Son Stable After Suffering Cardiac Arrest at USC

- Bronny James, the 18-year-old son of NBA basketball icon LeBron [Full Story]

- Late RBG’s ‘Pegasus’ Collar Set for Auction

- One of late Supreme Court Justice Ruth Bader Ginsburg’s celebrated [Full Story]

- Florida Supreme Court Rebukes Parkland Post-trial Judge

- The Florida Supreme Court on Monday issued a public reprimand to the [Full Story]

- Biden Associate Worked for Delaware U.S. Attorney Office

- A close associate of the Biden family, Alexander Mackler, appears to [Full Story]

- For People Who Don’t Wait Helplessly for 911

- 66% Want Congress to Cut Unnecessary Govt Spending

- Two-thirds (66%) of voters favor a proposal to create a joint Congressional committee to recommend unnecessary programs and spending to be cut. Congress would then be required to vote on whether to keep each identified program. … [Full Story]

- Senators Want Fed’s Inspector General Salary Info

- The Math Behind Why Democrats May Lose in 2024

- Banc of California in Talks to Buy PacWest Bancorp

- Meme Stocks Surge as Tech Rally Gets Too Pricey

- More Finance

- Health

- Omega-3s May Protect Against Age-Related Hearing Loss

- More omega-3 fatty acids in your diet might prevent hearing loss as you age, researchers report. Low levels of the omega-3 fatty acid docosahexaenoic acid (DHA) are linked to hearing loss in middle and old age, according to findings slated for presentation Monday at a…… [Full Story]

- Vitamin D Might Ease the Severity of Psoriasis

- Don’t Drink Borax: The Latest Dangerous TikTok Trend

- Arthritis Drug Biosimilars Increase Pricing Pressure

- 1 in 6 Kids Do Not Have All of Their Vaccines