Writer Sheelah Kolhatkar’s New Yorker “What Happens When Investment Firms Acquire Trailer Parks” does not necessarily plow new ground. Kolhatkar uses incorrect terminology in a fluid fashion. There are specific items that will be addressed as correct or erroneous in this Manufactured Home Pro News (MHProNews) fact check and analysis following the text of her “What Happens When Investment Firms Acquire Trailer Parks” article. There are arguably several missteps. That said, why read her report in the first place? Because Kolhatkar has woven together several issues into a single article – that when properly understood in a transformative manner – shed light on what is going wrong with many housing programs in general and how that relates to mobile and manufactured home living in particular.

Note that this is part of a planned two stage examination of her article. Note too that MHProNews reached out a few days ago to Kolhatkar with specific questions and items of concern. We received no response. Typos are in the original.

What Happens When Investment Firms Acquire Trailer Parks

The financial industry’s pursuit of profits from mobile-home communities is undermining one of the country’s largest sources of affordable housing.

Sheelah Kolhatkar March 08, 2021

Hikes in lot rent are forcing out people who’ve saved for years to buy their homes.

One day in October, 2016, Carrie Presley was visiting her boyfriend, Ken Mills, when she received a phone call from a neighbor informing her that someone had just been shot outside her home. Presley lived with her seventeen-year-old daughter, Cheyenne, in a two-story clapboard house on Jackson Street, in the northern part of Dubuque, Iowa. The neighborhood was notorious for its street crime, and Presley, who was, as she put it, in “the housing community”—she received Section 8 housing vouchers—had grown used to the shootings and break-ins that punctuated life there. After talking to Cheyenne, who was in tears, Presley rode with Mills back to her house, where police were sweeping the perimeter of the property. As Presley recalled, Mills looked at her and said, “We’re not doing this anymore.” It was decided that Presley and Cheyenne would move in with Mills and his son Austin.

Mills, a long-haul truck driver and the father of four grown children, lived in a three-bedroom single-wide in the Table Mound Mobile Home Park, a quiet community of more than four hundred mobile homes arranged in a tidy grid. The homes in the park are not as portable as its name implies; they’ve been placed on foundations, and their hitches have been removed. From afar, they look a little like shipping containers sitting next to small rectangular lawns. In Iowa, park owners can choose whether to accept Section 8 vouchers—which are distributed to 5.2 million Americans—and many, including the owner of Table Mound, do not, citing the administrative burden. By moving, Presley would lose her government subsidy, and she and Cheyenne would have less space, but, as Presley told me, “I was sacrificing material goods for a sense of safety.” She and Cheyenne held a garage sale, and watched as their neighbors walked away with the kitchen table, a dresser, armoires, and most of their clothes.

In the U.S., approximately twenty million people—many of them senior citizens, veterans, and people with disabilities—live in mobile homes, which are also known as manufactured housing. Esther Sullivan, a sociologist at the University of Colorado Denver, and the author of the book “Manufactured Insecurity: Mobile Home Parks and Americans’ Tenuous Right to Place,” told me that mobile-home parks now compose one of the largest sources of nonsubsidized low-income housing in the country. “How important are they to our national housing stock? Unbelievably important,” Sullivan said. “At a time when we’ve cut federal support for affordable housing, manufactured housing has risen to fill that gap.” According to a report by the National Low Income Housing Coalition, there isn’t a single American state in which a person working full time for minimum wage can afford a one-bedroom apartment at the fair-market rent. Demand for subsidized housing far exceeds supply, and in many parts of the country mobile-home parks offer the most affordable private-market options.

In the past decade, as income inequality has risen, sophisticated investors have turned to mobile-home parks as a growing market. They see the parks as reliable sources of passive income—assets that generate steady returns and require little effort to maintain. Several of the world’s largest investment-services firms, such as the Blackstone Group, Apollo Global Management, and Stockbridge Capital Group, or the funds that they manage, have spent billions of dollars to buy mobile-home communities from independent owners. (A Blackstone spokesperson said, “We take great pride in operating our communities at the highest standard,” adding that Blackstone offers “leading hardship programs to support residents through challenging times.”) Some of these firms are eligible for subsidized loans, through the government entities Fannie Mae and Freddie Mac. In 2013, the Carlyle Group, a private-equity firm that’s now worth two hundred and forty-six billion dollars, began buying mobile-home parks, first in Florida and later in California, focussing on areas where technology companies had pushed up the cost of living. In 2016, Brookfield Asset Management, a Toronto-based real-estate investment conglomerate, acquired a hundred and thirty-five communities in thirteen states.

Residents of such parks can buy their mobile homes, but often they must rent the land that their homes sit on, and in many states they are excluded from the basic legal protections that cover tenants in rented houses or apartments, such as mandatory notice periods for rent increases and evictions. One sign that a large investment firm has taken over a neighborhood is a dramatic spike in lot rent. Once a home is stationed on a lot, it is not always possible to move it; if it is possible, doing so can cost as much as ten thousand dollars. Most buyers aren’t eligible for fifteen- or thirty-year fixed-rate mortgages, so many of them finance their homes with high-interest “chattel loans,” made against personal property. “The vulnerability of these residents is part of the business model,” Sullivan said. “This is a captive class of tenant.” A leader of an association for mobile-home owners in Washington State has compared life in a mobile-home park to “a feudal system.”

When I visited Table Mound, in February of 2020, Presley welcomed me into the cluttered kitchen of her home—her third in the park. The home, where she has lived since September, 2019, has two modest bedrooms, wall-to-wall beige carpeting, and a “God Bless America” sign on the kitchen wall. Presley is forty-nine, with a strong build, curly auburn hair, and black-framed glasses. She and Mills attended the same high school in Dubuque, but Presley, who said that she was a “troubled” teen-ager, didn’t graduate; in her twenties, she spent time in a women’s shelter, then moved into transitional housing, where she had her first child, Keenan. In 1994, she got married, and a few years later Cheyenne was born. Soon afterward, Presley and her husband attempted to set up a transportation company, but the marriage fell apart. “I lost and regained everything,” she said. Her relief on moving into the park had been immediate. On weekdays, Mills was usually away, but she no longer feared the walk to her door when she returned early in the morning from a shift at the bar where she worked. On weekends, she and Mills would play video games, cook, and go fishing. In the summer, residents barbecued while kids rode their bikes around. “You could sit outside and see the stars,” she told me. “You knew who your neighbors were.”

Whereas traditional homeownership can form the basis for intergenerational wealth, mobile homes depreciate in value, like cars or motorboats. Still, many of Presley’s neighbors had saved for years or used inheritances to buy their homes. Karla Krapfl, Presley’s second cousin, has lived in Table Mound for three decades with her husband, Dennis, an Army veteran. In 1993, they bought their current home new, and had it fitted with large windows, so that Krapfl could watch from the kitchen as their three boys played outside. Their sons are now grown; two served in the armed forces and the third is a controller at a local company. When I stopped by, Krapfl showed me around the house, which was decorated with quilts, porcelain animals, and silk flowers. Princess Diana plates from the Franklin Mint hung in a triangle in the master bedroom. Krapfl had enjoyed raising a family in Table Mound, and compared living in the park in those years to being on a military base. “Everybody knew everybody’s kids,” she said. “It was all very friendly.”

Table Mound’s owner, Michael Friederick, was from Dubuque, and had made typical investments in the park, plowing the roads in the winter and repairing the curbs. He raised the rent by no more than two per cent a year. During the summer of 2017, less than a year after Presley moved to Table Mound, she and the other residents learned that Friederick had sold the park. It had gone for more than six million dollars, and was now being managed by RV Horizons. As it later emerged, according to court documents, RV Horizons is one of several foreign limited-liability companies controlled by another L.L.C., Impact MHC Management. RV Horizons announced that it would be charging residents for water and trash removal, which had previously been included in the rent. It installed new digital water meters on each property, billing residents five dollars a month for the meters. It also raised the rent on lots: Mills’s lot rent rose from two hundred and seventy dollars a month to three hundred and ten. According to Jim Baker, the executive director of the Private Equity Stakeholder Project, a think tank that monitors the effects of private-equity firms’ investments, extracting profits by increasing lot rents and decreasing expenditure on upkeep is common. “In many cases, residents have invested forty, fifty, sixty thousand dollars into the homes,” he said. “There is such a strong incentive to pay, because are you going to walk away from this home that you put your retirement into?”

A year later, RV Horizons raised the lot rent again. By then, Presley had moved out of Mills’s single-wide and was living with Cheyenne in her own home, a dilapidated trailer built in 1974 that she acquired for twelve hundred dollars. Her brother, Buddy, who worked at a company that sold and installed building supplies, delivered flooring, drywall, and insulation. Presley suffers from spinal stenosis, which sometimes leaves her hobbling in pain. The condition entitles her to federal disability benefits, provided that she works only part time—a situation that requires a delicate financial balancing act. At the time, she was employed as a substitute cafeteria worker for the Dubuque Community School District, in addition to bartending. She immediately started worrying about how she was going to make the new lot rent.

RV Horizons had sent all the residents a new lease, forty-seven pages long and full of addenda, which contained some provisions that struck Presley as unfair and potentially illegal, including an eight-hour limit on street parking for guests, a requirement for a hundred-thousand-dollar-minimum insurance policy to cover accidents related to pets, and the institution of quiet hours. Despite the fact that the land belonged to the park, residents were now responsible for repairs to the water pipes connected to their homes. Clotheslines were no longer permitted. There would also be a fifty-dollar late fee for any rents received after the monthly deadline. RV Horizons claimed that the money from the rent increases would be spent on repairing the roads and installing satellite-television service.

As Presley discussed the complexities of the lease with Mills and their neighbors, she felt a surge of fury. “I was pissed,” she said. “I thought people were being played with.” The next day, she and Mills printed flyers inviting residents to a meeting the following Sunday afternoon in the yard outside the community storm shelter. A hundred and fifty people showed up. Presley and Mills handed out yellow stickers that read “No to illegal lease.” Presley used the bed of Mills’s white pickup truck as a stage, announcing that the two of them were collecting names for a petition, and gave an impromptu speech. When I asked Presley whether she had ever been involved in activism before, she said no. “I was a rowdy teen-ager,” she told me. “My friends and family are very surprised that I took this on.”

Trailer parks first sprang up in the nineteen-twenties, as campgrounds designed to attract wealthy tourists. As the country entered the Great Depression, some unemployed Americans, known as “hobo-tourists,” took to compact travel trailers, migrating in search of work. Soon, local governments began to pass zoning restrictions that dictated the size of the lots on which mobile homes could be placed, forcing them into less dense areas of town, and limited how long trailers could be stationed. In the fifties, manufacturers started producing trailers that were more like small bungalows. Trailer parks began to serve largely as housing communities for lower-income and working-class families; many had amenities like clubhouses and swimming pools, and fanciful names like Shangri-La. By the time Table Mound was established, in 1963, there were at least three million Americans living in mobile homes; during the next two decades, the structures became more elaborate and harder to move.

Frank Rolfe, a co-founder of several corporations that invest in, manage, or are linked to mobile-home parks, grew up in Dallas and graduated from Stanford with an economics degree. In 1983, he founded a company that rented billboards to advertisers; before long, it owned more than three hundred billboards, mostly around the Dallas-Fort Worth area and in Los Angeles. He also offered a class called Billboard Boot Camp for aspiring investors. Rolfe sold the billboard company in 1996 for $5.8 million, and used the proceeds to buy his first mobile-home park, Glenhaven, in Dallas, for four hundred thousand dollars. In a 2016 interview, he recalled that he had assumed that almost anyone who lived in a mobile home was a “drug addict, a hooker, and just the scum of the earth,” and claimed to have felt so unsafe walking around Glenhaven that he applied for a concealed-weapon permit. But, he went on, he came to realize that just because tenants were poor didn’t mean that they were “dangerous” or “stupid.” It was possible to provide clean, safe housing for working people who were “just like you and me,” but who had very little money.

Rolfe met Dave Reynolds, an accountant whose parents owned a mobile-home park in Colorado, at a mobile-home-investing conference in 2006, where both of them were speaking. Soon afterward, they created Mobile Home University, a program for potential park owners which offered, among other things, three-day seminars in Southern California and Denver, for almost two thousand dollars a ticket. (The program is currently being offered virtually.) Later, they established a partnership that invests in mobile-home parks. In 2017, Rolfe was reported to have compared a typical mobile-home park to “a Waffle House where customers are chained to their booths.” (He has said that the quote was taken out of context, and was meant to refer only to the “incredibly consistent revenue” of mobile-home parks.)

Esther Sullivan, who attended one of Rolfe and Reynolds’s Mobile Home University seminars in California while researching her book, summarized the advice that they offered participants: “Look for a park that’s got high occupancy and that doesn’t need a lot of investment. Take out any possible amenity you’d ever need to invest in, such as a playground or a pool that’s going to need insurance. Make sure it’s got a nice sign, and pawn off any maintenance costs onto your tenants.”

Rolfe and Reynolds recommended that owners regularly raise rents, but not so much that it would drive out desirable tenants. They also told investors to avoid “tenant-friendly” states such as California and New York, where evictions can take months, and urged them to concentrate on areas where there is a shortage of reasonably priced rental apartments. The Mobile Home University Web site states, “Mobile home parks are the hottest sector of real estate right now, due to the endless decline in the U.S. economy.” The site points out that thousands of baby boomers are retiring each day, and that they will receive around fourteen thousand dollars a year in Social Security income: “Mobile home parks are the only segment of real estate that grows stronger as the economy weakens.”

Reynolds and his wife, Terri, own Impact Communities, which controls Table Mound. Rolfe and Reynolds claim that their companies constitute the fifth-largest operator of mobile-home parks in the country, with properties in twenty-five states. (They declined to comment for this article.) When I called Michael Friederick, the former owner of Table Mound, he told me that he hadn’t been planning to sell the park, but that Rolfe and Reynolds’s company had approached him many times, increasing its offer each time. “They drive you nuts until you cave,” he said. Not long after RV Horizons took over the park, Stephanie Small, who had lived in Table Mound for twenty-six years, became the property manager, collecting rent checks and issuing citations for rule violations. On the day the rent was due, the mailbox outside Small’s office was taped shut at 5 p.m.

After the meeting at the storm shelter, Small and her husband followed Presley and Mills to Presley’s yard, where, according to Mills, Small told them that their campaign was hopeless, saying, “This is a big corporation—there’s nothing you can do.” (Small declined to comment for this article.)

Around this time, Presley was contacted by Lindsay James, a Democratic state representative. James, who had been hearing from distraught constituents who lived in the park, put Presley in touch with two Legal Aid lawyers, Alex Kornya and Todd Schmidt, who agreed to analyze the new lease, and with Tom Townsend, a business manager from the local chapter of the International Brotherhood of Electrical Workers, who offered the use of his organization’s union hall for the residents’ meetings.

Impact, which had taken over operations from RV Horizons, invited all the residents of Table Mound to a buffet dinner with the company’s regional manager, Mike Willis, in the storm shelter. As residents ate fried chicken off paper plates, Willis assured them that the company was fixing the roads and upgrading the television service. “They basically got up there and bragged about what a great company they were and how philanthropic the owner is and all this wonderful stuff they’re doing,” Townsend recalled. One resident, a retiree who was undergoing treatment for cancer, told Willis that the rising costs had forced him to choose between buying medication and paying his rent. (An attorney representing the company said that it operates a philanthropic arm, Impact Cares, which repairs some homes in the community for free.)

In August, 2019, Presley and Mills formed the Voices for Table Mound Neighborhood Association. Presley became the president, and she usually took the microphone in meetings. She spent much of her free time making phone calls, writing e-mails, and knocking on doors. Soon, the Dubuque Telegraph Herald and the local ABC news affiliate were covering the association’s meetings. Karla Krapfl printed purple T-shirts that read “Table Mound Strong.” In the weeks that followed, Presley, Mills, and other residents began to attend city-council meetings, wearing their purple T-shirts. In November, the council passed an ordinance allowing residents of mobile-home parks to use federal housing vouchers to help pay their rent—a lifeline to several residents of Table Mound who were close to being evicted. Impact refused to accept the vouchers.

One Saturday in April, 2019, Zach Wahls, a Democratic state senator who represents Iowa’s Thirty-seventh District, read a news article about rent increases at mobile-home parks in his district. Wahls is twenty-nine years old and six feet five, with brush-cut brown hair, rosy cheeks, and dimples. When the legislature is not in session, he works as a vice-president for community investment and development at GreenState Credit Union, in Iowa City. In 2011, when Wahls was an engineering student at the University of Iowa, he made an impassioned speech before the Iowa House of Representatives, which was considering outlawing same-sex marriage; in the speech, he described growing up with his two moms, Terry and Jackie. A video of the speech went viral, prompting an Australian writer, Chloe Angyal, to publish a piece for the Web site Feministing titled “Marry Me, Zach Wahls.” In 2013, Angyal and Wahls met in New York; they are now engaged.

Two parks near Wahls’s district had just been acquired by Havenpark Communities, an investment company based in Utah. The company was increasing the rent at Golfview Mobile Home Park, in North Liberty, by fifty-eight per cent, and at Midwest Country Estates, in Waukee, by sixty-nine per cent. (Havenpark said in a statement that it “publicly acknowledged they had made a mistake after hearing from residents and subsequently lowered lot rents by a third,” and that the company has since made more than two million dollars in improvements to both communities.) Residents at Golfview had started organizing and had enlisted help from tenants’-rights groups and from Legal Aid. In interviews with the local press, Barbara Hames, the president of Hames Homes, a family business that had previously owned two other communities that were purchased by Havenpark, said that, before selling, she’d been getting two to three calls a week from investors looking to buy parks. She’d finally decided to sell because the parks needed a million dollars in upgrades to the wastewater-treatment systems.

As Wahls learned, Iowa’s tenant laws pertaining to residents of mobile-home parks are extremely weak. Residents can be evicted for no reason, provided that park owners give them sixty days’ notice. A staffer in the Iowa Senate who has worked at the statehouse for fourteen years told me that, when she started researching the housing code, she was shocked. “The entire chapter on manufactured-housing tenant law is absolutely obscene,” she said. “People who own their manufactured homes have little to no rights once they put them on rental property.”

There were only a few weeks left before the Iowa legislative session adjourned for the year. Wahls knew that there wasn’t time to get any ambitious new legislation through the state’s House and Senate, which are Republican-controlled, so he rushed to introduce an amendment to an existing bill, first proposed by a Republican colleague, that would extend some basic tenants’ rights to residents of mobile-home parks. The legislation was unanimously passed by the Senate. Such strong bipartisan support was rare for legislation that would certainly be opposed by a powerful industry, but, Wahls told me, many Republican lawmakers had mobile-home parks in their districts, and having angry and desperate constituents was clearly a campaign liability. Wahls said, “Even free-market people can see this is predatory behavior.”

The amendment was more controversial in the House of Representatives, and the legislative session ended before the bill could be passed. But momentum was gathering behind Wahls’s cause. That spring, John Oliver delved into the mobile-home industry on his TV show, “Last Week Tonight,” and described Rolfe and Reynolds’s Mobile Home University as “a crash course in how to be an asshole.” In May, dramatic rent increases at several parks in Iowa started to receive national attention. Senator Elizabeth Warren, of Massachusetts, wrote letters to eight owners and managers of Iowa mobile-home parks, including Havenpark and RV Horizons, asking them to provide an accounting of their profits. Soon afterward, during one of Warren’s Presidential-campaign trips, she visited the Golfview mobile-home community.

In December, Wahls and other supporters of the proposed reforms scheduled a public hearing at the state capitol. Presley and several dozen other residents of various Iowa communities filed into the former Supreme Court chamber, a majestic room with vaulted ceilings and a mahogany judge’s bench. Five residents’ associations, including Voices for Table Mound, had requested time to speak, and nearly every seat in the room was filled. Wahls sat at the head of a conference table, flanked by half a dozen other lawmakers, including Lindsay James. Wahls thanked everyone. “I know a lot of people have come a long way,” he said. “We’re going to try to hear as many voices as we can.”

Candi Evans, the vice-president of the Golfview residents’ association, was among the first to speak. An elegantly dressed woman, she put on a pair of reading glasses as she sat down at the table. Evans had bought a double-wide mobile home in Golfview with her husband in 1998. “This was where we were going to grow old together,” she said. She had planned her life so that she “would never be a financial burden to our children or society.” After her husband died, in 2002, she took over the roofing company he had been running. She was financially stable until 2019, when Havenpark attempted to raise her rent by sixty-six per cent. She and other residents fought the increase, and Havenpark lowered the new rate slightly. “When we told them that some of the residents couldn’t afford that, they said we should turn to the government to subsidize our rent,” she said.

Later, Presley spoke. Clasping her hands nervously between her knees and leaning toward the microphone, she said that she had finally been able to get out of subsidized housing when she moved into Table Mound, and was now faced with the prospect of going back on government assistance, because “this Frank Rolfe character says it’s not his problem whether or not these people can afford their homes.” Then Mills came forward. “I’m a father of four,” he said. “I’ve been a truck driver for twenty-eight years.” His voice started to crack. “They’re counting on you guys just to lay down and let them roll all of us over.”

Two hours into the meeting, Wahls asked if anyone else wanted to speak. A woman named Margaret Clark said that she and her husband had owned two mobile-home parks near Des Moines since the seventies. She begged the lawmakers not to penalize responsible park owners with overly harsh new laws. “As you’re crafting legislation to restrict abuse, make sure you use a scalpel and not a butcher knife,” she said. “We’re supposed to be on the same team.”

On February 15, 2020, thirty sponsors, evenly split between both parties, introduced a twenty-seven-page bill called Senate File 2238. A companion bill was introduced in the House. The legislation mandated “good cause” for evictions and a hundred and eighty days’ notice before rent increases went into effect. Rent increases would not be allowed to exceed the local inflation rate unless there was a legitimate reason. Wahls, aware that the term “rent control” tended to evoke strong responses, framed the issue instead as “rent justification.”

For the past four decades, the Iowa Manufactured Housing Association, a trade group promoting the interests of mobile-home manufacturers, park owners, and park operators in the state, has successfully courted Iowa Republicans. In the summer of 2019, the I.M.H.A. brought in Timothy Coonan, a lobbyist with the Des Moines law firm Davis Brown, who also worked with the electrical-utility and insurance industries. His profile on Davis Brown’s Web site notes that he has “annually defeated multiple mandates on behalf of clients.” Brian Lohse, a Republican member of the state House of Representatives and a supporter of the legislation, told me that he and his colleagues had sent the proposed wording of the bills to the I.M.H.A. to get its feedback, but that, despite an initial friendly response from Coonan, who said that the I.M.H.A. would get back to them with suggestions, they had heard nothing. Wahls told me, “Through this whole process, we were desperate for the association to give us ideas of things we could do to help residents without screwing over landlords who are doing the right thing. They gave us nothing.”

It later emerged that Coonan had been meeting with other senators and House members, criticizing the legislation’s sponsors for including rent-control provisions. That summer, the I.M.H.A. pac had also made thousands of dollars in contributions to Republicans in the Iowa statehouse, including thirty thousand dollars to the thirty-six-year-old speaker of the House, Pat Grassley, a grandson of the U.S. senator Chuck Grassley and one of the most powerful people in state politics. Gradually, Republican members of the House and the Senate who had previously supported the idea of tenant protections started to waver.

The House bill was approved unanimously by the three-member judiciary subcommittee, but there was speculation that Speaker Grassley would not allow it to advance to a full committee vote. (Grassley did not respond to requests for comment.) On the evening of Tuesday, February 18th, Wahls was at a reception for the Iowa Biotechnical Association, hosted by Coonan, at the Marriott Hotel in Des Moines, when he received a text message from James, who was at a reception at a hotel nearby. Wahls grabbed his coat and rushed down the street to meet her. She had just learned that the bill had been pulled from the schedule, which, for procedural reasons, meant that it couldn’t be taken up again for the rest of the session. Wahls was devastated.

Presley and several other Table Mound residents found out the next day that the bill had died. That afternoon, Presley, James, and a few others cornered Coonan in a hall of the capitol. Presley told him that he, Grassley, and the other lawmakers who had helped kill the bill didn’t have to worry about whether they were going to lose their homes. “We don’t have that luxury,” she said. Then she went into the bathroom and wept.

On March 17, 2020, the governor of Iowa, Kim Reynolds, declared a public-health emergency in response to the coronavirus, outlining restrictions on gatherings in restaurants, bars, gyms, and places of worship. Three days later, she declared a moratorium on evictions, as recommended by the Centers for Disease Control, until May. Presley had recently started a new job, at Tobacco Outlet Plus. In February, she had been given a diagnosis of kidney disease. Worried about exposure to the coronavirus, she sheltered at home for three weeks in March and April, then returned to work. Since then, she has covered several times for co-workers who have tested positive for the coronavirus, or who have missed work because a family member was sick.

Before and after her shifts, Presley sits on her couch with her laptop on a TV tray, doing research and making phone calls. In spite of the moratorium, twenty-four residents of Table Mound received eviction notices in April. Presley posted the news on Facebook, called reporters, and contacted the Legal Aid attorneys. Two days later, Impact retracted the notices, saying that they had been issued by mistake. (The company’s lawyer stated that it had reversed $4,650 in late fees for residents during the pandemic.) Mills told me that, over the summer, dozens of people had moved from Table Mound to Spring Valley, a park just south of Dubuque that is owned by Michael Friederick; his lot rents were significantly cheaper. After someone Mills knew offered to buy his trailer, Mills also moved, into a rented house in town. He seemed ambivalent about the decision. “Do you just walk away and keep your sanity?” he said. “Or do you go down fighting for God knows what?”

Residents of parks across the country controlled by Impact have contacted Presley for advice. One afternoon in July, she received a phone call from Carol Johnson, a sixty-year-old resident of Midwest Mobile Home Community, in Independence, Missouri, which Impact had bought in 2018. Johnson, a former bus driver for the local hospital system, who was taking care of her eleven-year-old granddaughter, told Presley that she had been thrilled to move to the park that year, after the landlords of several apartment buildings had rejected her because of a poor credit score. After Johnson had rented her home for five months, she said, the community manager told her that she qualified for a financing program that would allow her to purchase her home over fifteen years. “I talked to my husband and we decided to do it,” she said. Nine months later, after making every payment on time, Johnson and her husband received an eviction notice. “I started reading my lease agreements, and I started seeing things that I didn’t know were there,” Johnson said. The financing, which had an annual interest rate of almost twelve per cent, would have resulted in her paying sixty thousand dollars on a twenty-eight-thousand-dollar home. After researching Impact’s operations online, she learned that, according to the contract she had signed, her lease could be terminated with no cause. To keep her mobile home, she would have to continue making payments for an extra four years.

“Do you remember the old eighties game Mouse Trap?” Presley asked. “That’s exactly what this is like.” Johnson’s lease stipulated, among other things, that Impact could sell the land beneath her home. Presley advised Johnson to contact Legal Aid. She also suggested that the residents form their own neighborhood association. Johnson followed her advice, naming the group the Voices for Midwest Mobile Home Community Association. Later, she told me that she had tried to organize a residents’ meeting, but that, after speaking with twenty residents who seemed enthusiastic about attending, only one had shown up. “Everyone’s just scared,” Johnson said. (She has since been evicted, and she and her family have been living in hotels.)

Presley has also heard from mobile-home residents in Wisconsin, Minnesota, and North Dakota. On September 8th, Legal Aid filed a lawsuit against Impact, charging it with violating the Fair Housing Act by discriminating against a disabled sixty-year-old Table Mound resident named Suellen Klossner. According to the suit, Impact tried to compel Klossner to sign a lease with illegal provisions, such as one that said that, if any rule in the lease was breached, Impact could evict residents after giving just three days’ written notice. Impact had also increased Klossner’s rent and utility charges by about eighty-seven per cent since buying the park. (Impact denies all the allegations in the suit.)

When I spoke to Presley recently, she was worried that she, too, would have to find a cheaper place to live. The stimulus payments she had received in April and December had quickly disappeared; she had been putting groceries and car repairs on credit cards. Still, she said, she would keep fighting, even if she had to move out. On December 23rd, a new player had entered the Dubuque mobile-home-park market: RHP Properties, a real-estate investment company based in Michigan, and one of the nation’s largest privately held owners and operators of mobile-home parks, had bought the Alpine Park Manufactured Home Community, eight miles north of Table Mound. “We take great care of your community and its residents during the transfer to new ownership,” RHP’s Web site read, addressing independent park owners. “Best of all, you will finally have the time and money to do the things you want to do.” ♦

Illustrations and the original article are found at this link here.

##

MHProNews Analysis, Fact Check, and Commentary

In no specific order of importance, and generally, though not always in the order that it appears in her New Yorker piece, are the following elements that merit consideration.

- A) Section 8 not enough money in program, waiting list. It bears mention that it has been like that since early on in the program. There is never enough money in the program. That is a flag that relates to our NIMBY vs YIMBY report and the Manufactured Home Insanity report.

- B) Crime and violence in section 8 housing.

- C) Manufactured homes are the most affordable form on non-subsidized housing.

- D) Some 22 million living in mobile or manufactured homes, per research third-party studies, not 20 million as Kolhatkar said.

- E) Terminology is a problem, because “trailer” house has a problematic image. Plus, that era of the evolution from trailer houses to mobile homes into manufactured homes ended decades ago. But mostly, because it is simply factually wrong.

- F) Quite correct is her statement that the homes are not as “mobile” as the phrase “mobile home,” implies. That noted, it also ironically points out one of several reasons not to use that terminology. Beyond that, it is legally and by construction standards an improper term. See Donald Tye Jr.’s apt comment. As manufactured home community residents such as Jim Splaine, poet Lois Requist, Fred Neil or others have said, the nomenclature is hurtful to many. Out of respect, writers and publishers should consider what MHProNews does with such report. Use the problematic phrase, but then correct it.

- G) While Professor Sullivan is a popular academic to cite in such reports, and she too has done some useful analysis, Sullivan arguably makes a similarly problematic use of terminology and sometimes incorrect data, cited above.

- H) “Income inequality” can often be unpacked as a system rigged to keep the status quo that made a few wealthy in place, while keeping many in the lower or middle class from obtaining their part of the American Dream. The system Kolhatkar describes benefits the wealthy and their corporate interests, while keeping the lower and middle class from advancing through legislation that was enacted more than one or two decades ago. By accident or design, Kolhatkar’s piece connects income inequality with feudalism. Specifically, she wrote: “A leader of an association for mobile-home owners in Washington State has compared life in a mobile-home park to “a feudal system.”” The solution? First, proper understanding, followed by law enforcement. Good existing laws are being thwarted. So, to properly address the pragmatic issues she has described, good existing laws should be fully and robustly enforced. More on that further below.

- I) Kolhatkar cites several sources that MHProNews and MHLivingNews have previously referenced and explored too. One example that merits mention is the routine connection, exemplified by the Mobile and Manufactured Home Living News (MHLivingNews) analysis of the viral John Oliver “Mobile Homes” video. Oliver’s HBO Last Week Tonight satirical hit-piece names numerous corporate interests that all happen to have ties to the Manufactured Housing Institute (MHI). Yet Oliver never mentioned that significant insight. Kolhatkar overlooks the same substantial point.

- J) Nor does Kolhatkar connect-the-dots to the “dark money” or direct-funding and more visible paths to various nonprofits that aim to influence manufactured housing. Berkshire Hathaway Chairman Warren Buffett’s money reportedly flows to MHAction. Repeatedly asked, MHAction leadership does not deny that dark money connection. Meanwhile Berkshire dollars flow into MHI. The two operations seem to be at odds with each other. But upon closer examination, each performs a function that is arguably useful to Berkshire and their allies in a dark or sinister way.

- K) Among the useful finds in her New Yorker piece that has not already noted is this attributed to Blackstone: ““We take great pride in operating our communities at the highest standard,” adding that Blackstone offers “leading hardship programs to support residents through challenging times.”” Why is that useful? Because it goes to the point made in the Impact Cares report. Her piece mentions Impact Cares too. The large firms can establish a nonprofit wing, shelter income, and use that nonprofit in a manner that may obscure the larger harms being created by factors such as aggressive site fee (i.e.: lot rent) hikes.

- L) This is not a new insight, as noted at the top, but is nevertheless a significant acknowledgement. “One sign that a large investment firm has taken over a neighborhood is a dramatic spike in lot rent.” Once more, Kolhatkar does not mention it, but this arguably belies the claim on the MHI website that the average site fee (lot rent) hike is about 3 percent annually. That may be more true for non-corporate owned communities. But as MHProNews has referenced, per research by Marcus and Millichap and certain publicly traded firm’s own statements, that MHI claim is belied by their own members.

- M) Kolhatkar notes the ability of large firms to access Fannie Mae and Freddie Mac funding. What about the Duty to Serve program that mandated in the Housing and Economic Recovery Act (HERA) 2008 should be providing competitive financing for manufactured home buyers? See the report linked here to answer that vexing problem.

- N) Without mentioning the Pride and Prejudice report, her article paints the picture of how much safer one of her subjects felt after leaving subsidized housing and moving into a manufactured home community.

- O) One of her misses is this statement: “Whereas traditional homeownership can form the basis for intergenerational wealth, mobile homes depreciate in value, like cars or motorboats.” While it is true that some mobile or manufactured homes might depreciate in value, third-party research reflects appreciation too. Who says? The Urban Institute, the FHFA, and former HUD Secretary Ben Carson, among others. Additionally, a Ken Johnson, Ph.D., Florida Atlantic University researcher told MHLivingNews that manufactured home living could be a superior financial choice. Johnson explained how.

- P) Despite the arguably accurate citation of a statement made by Frank Rolfe about his ‘first mobile home park:’ “In a 2016 interview, he recalled that he had assumed that almost anyone who lived in a mobile home was a “drug addict, a hooker, and just the scum of the earth,” and claimed to have felt so unsafe walking around Glenhaven that he applied for a concealed-weapon permit.” – as was noted by university level research, that would be exceptional rather than a rule.

- Q) Wahls said, “Even free-market people can see this is predatory behavior.” Once more, this is not new. But it is an import point. Havenpark and “Frank and Dave” are MHI members, which as noted above, is a significant point.

- R) “A woman named Margaret Clark said that she and her husband had owned two mobile-home parks near Des Moines since the seventies. She begged the lawmakers not to penalize responsible park owners with overly harsh new laws. “As you’re crafting legislation to restrict abuse, make sure you use a scalpel and not a butcher knife,” she said. “We’re supposed to be on the same team.”” Clark is someone MHProNews has previously referenced, most recently, in a report linked here. Clark has essentially made the argument that subsidized housing was an unjust competitor to free market manufactured homes.

- S) Another not new, but significant pull quote, is this: “…who said that the I.M.H.A. would get back to them with suggestions, they had heard nothing. Wahls told me, “Through this whole process, we were desperate for the association to give us ideas of things we could do to help residents without screwing over landlords who are doing the right thing. They gave us nothing.””

- T) “Everyone’s just scared,” Johnson said. (She has since been evicted, and she and her family have been living in hotels.) MHProNews has previously raised the notion in reports that the Hobbs Act, and/or a state equivalent, might be applied. Another example is linked here.

- U) Once more – not new, but sadly illustrative. “Legal Aid filed a lawsuit against Impact, charging it with violating the Fair Housing Act by discriminating against a disabled sixty-year-old Table Mound resident named Suellen Klossner. According to the suit, Impact tried to compel Klossner to sign a lease with illegal provisions, such as one that said that, if any rule in the lease was breached, Impact could evict residents after giving just three days’ written notice.”

- V) Kolhatkar closes on this note, with RHP Properties buying a community nearby: “We take great care of your community and its residents during the transfer to new ownership,” RHP’s Web site read, addressing independent park owners. “Best of all, you will finally have the time and money to do the things you want to do.” ## MHProNews and our MHLivingNews sister site has reported on RHP several times. Another MHI connected firm, some RHP related reports with analysis are linked here, here, and here.

Kolhatkar is doing journalism, perhaps with a tinge of advocacy weaved in, but much in the manner that mainstream reporters and writers might do. It is not, in a sense, her ‘job’ to provide analysis or commentary; much less to have to point out possible solutions to the problems she has woven into our piece New Yorker piece.

As it stands, while noting that it usefully illustrates several issues and topics that have been previously publicized by MHProNews and MHLivingNews, it nevertheless falls short in ways our bullets above reflect.

But let’s be more specific in this closing summary, analysis, and commentary. In no specific order of importance.

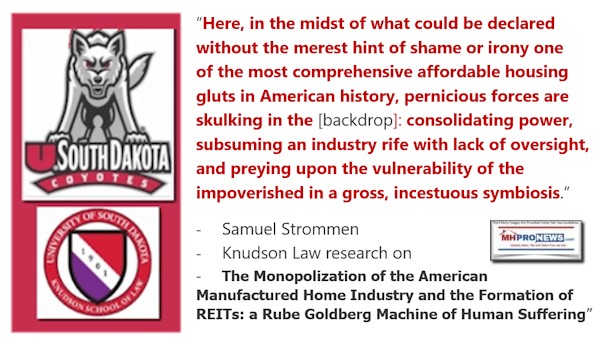

- The New Yorker article could have pointed out the connections between several of the problematic or predatory players and the Manufactured Housing Institute (MHI). Has MHI ever invoked their so-called antitrust or code of ethical conduct provisions? If so, there is no known example of that having occurred.

- What this points to, though Kolhatkar does not say it, is how the Warren Buffett “Castle and Moat” program is at work in manufactured housing, including the community sector. Frank and Dave have essentially said as much.

- The case can be made that the underlying solution to these problems is to restore the arguably manipulated free market. Resident leaders, in their own words, have said as much. It is “stiff competition” that is necessary. But the Buffett declared Class Warfare is arguably designed to thwart and kill off competition. Regulations alone that do not address that need are likely doomed to fail.

What is likely not going to work long term is any solution that fails to address the need to create more new communities, more options for the siting of manufactured homes, via free market options that are supported by existing laws that are not being properly enforced.

4) Kolhatkar notes the problems that lobbying dollars can cause. The answer is not per se to end lobbying. Rather, the answer is to clearly reveal how sinister and problematic these issues are, and that the solutions are routinely found in the robust enforcement of existing laws. Those laws that need proper enforcement include, but are not limited to: antitrust laws, RICO, Hobbs Act, the Manufactured Housing Improvement Act of 2000, and the Duty to Serve Manufactured Housing mandated by HERA 2008. Certainly, others should be explored too.

As it stands, ironically, such reports as her’s may arguably benefit Frank, Dave and those who relish news media coverage – even if it is negative. Why? Because bad publicity is better than no publicity.

Additionally, since what Bob Van Cleef called the “Vampire King.” Blood suckers, vultures, predatory, castle and moat, creating a feudal society — the metaphors are many. The solutions are understanding, proper exposure, and enforcing existing current laws. As MHProNews has reported, Van Cleef says there should be a transition period of rent stabilization, akin to what a state may due to keep price gouging from occurring after a disaster.

Understanding and law enforcement. It may be a mistake for perhaps well intended public officials and others to seek new laws, when existing laws could be far more swiftly applied.

Last but not least. There are reasons to believe that the wink-and-a-nod world of MHI and their meeting are a hub for arguably problematic if not illegal professional practices. They and their big boy backers should be subpoenaed and probed from top-to-bottom. The odds are likely better than good that a forensic audit of their spending, meeting minutes, and emails would reveal a rats nest of corrupt and possible illegal practices.

Ironically, the solution to wealth inequality is to make existing laws work. The research has been done.

The time to move beyond the endless loop of the same old same old is upon us.

The ability to protect and restore the American Dream, as the Manufactured Housing Association for Regulatory Reform (MHARR) mantra suggests, is upon us. The rigged system must be exposed and legally dismantled. Those responsible should be held to account.

###

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in-your-face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.