You do not take years to design and build a looping ramp onto a bridge for an elevated highway that will circle a city when all you have to do is walk across the street.

Hold that principle in mind as it will be revisited further below and sheds light on the problematic handling of the Duty To Serve manufactured home lending.

Preface. A variety of comments from those involved in manufactured housing, lawmaking, regulation, and capital will be woven together to create a fresh look at the dynamics at play in the hot button issues involving affordable housing in general, but manufactured homes and lending in particular.

I.

“Dear Director Calabria and Ms. Cohen,

“The definition of insanity is doing the same thing over and over and expecting different results.” Quora says the attribution of that to Albert Einstein is disputed. But the wisdom of the observation – regardless of who first said it – should be undisputed.”

So opens the formal comments letter of this writer to the Federal Housing Finance Agency (FHFA) Director Mark Calabria and Rebecca Cohen, Senior Policy Analyst at FHFA.

During an affordable housing crisis, a comments letter to the FHFA said in part: “Next Step agrees with Fannie Mae’s proposed modification that would eliminate loan purchase volume requirements for the remainder of 2020 as they instead focus on expanded education and outreach.”

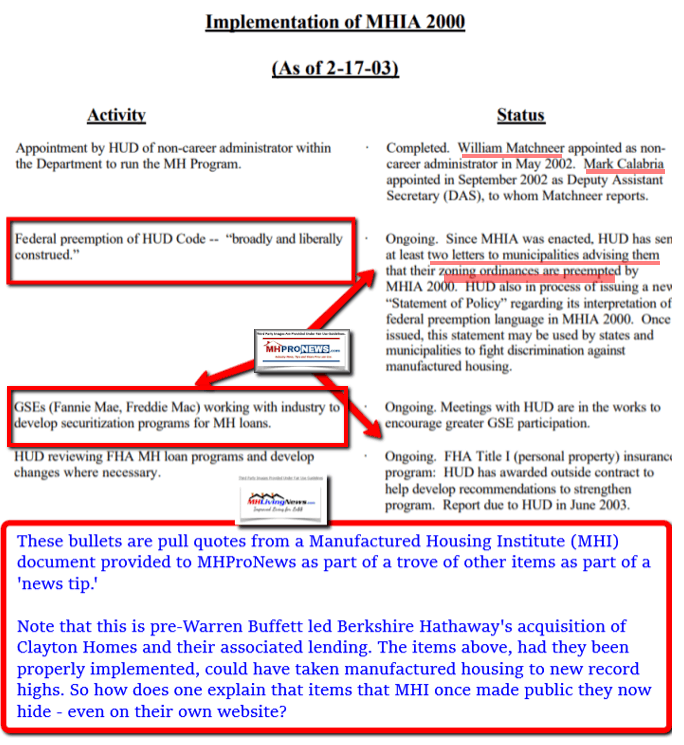

So said Stacey Epperson, President & Founder Next Step Network, Inc. Next Step is significantly involved with the Manufactured Housing Institute (MHI) and Clayton Homes, among others. Epperson’s quoted comments continued “As we assess the market landscape for manufactured homes, Next Step realizes the critical importance of conducting education and outreach initiatives with stakeholders (e.g. home builders and developers, lenders, local government entities) that have traditionally not operated in the manufactured housing space.” Her full comments letter is linked here. Note that citing a source should not be construed to imply endorsing all that a source has said or done. References – quotations – are accurately provided to illustrate a specific point.

Now with all due respect to Epperson, who is an intelligent person, ponder for a moment the absurdity of stopping the loan purchase requirements in order to focus on education and outreach. Once the outreach and education process are completed, a prospective home buyer’s ‘next step’ is to apply for a loan and then buy a home. Epperson knows this, because she’s been involved in such education. Restated, there is an apparent lack of logic to her statement. To further illustrate the odd notion, would Epperson agree stop the sale of all manufactured homes at Next Step network retailers while they begin the process of educating the public on manufactured housing? Once the education and the marketing are completed, at what stage – in this through-the-looking glass hypothetical – would Next Step start home sales again? Of course, she wouldn’t do that, its absurd. Thus, nor should FHFA allow Fannie or Freddie to do it.

After all, there is a law that mandates that the GSEs make loans under DTS, and the FHFA is supposed to see to it that the law is enforced.

FHFA’s website says: “The Duty to Serve (DTS) requires Fannie Mae and Freddie Mac (Enterprises) to facilitate a secondary market for mortgages on housing for very low-, low-, and moderate-income families in: Manufactured housing…” Note the word “requires.” As Mark Weiss, J.D., President and CEO of the independent producers trade group, the Manufactured Housing Association for Regulatory Reform (MHARR) has put it, the law used the word “Duty” which is a mandate.

Keep that example of Epperson’s in mind, as we briefly segue to note a tip to MHProNews regarding comments made by Tim Williams, prior Manufactured Housing Institute Chairman, and current President and CEO of Berkshire Hathaway owned 21st Mortgage Corporation, a sister firm to Clayton Homes. Those comments made by Williams during a recent MHI meeting will be addressed another time — but related to the topic of lending.

That noted, some history by Williams on the lending topic is useful to the DTS and broader lending discussion.

Specifically, why is there such limited lending available in manufactured housing today? Equally relevant, why are there so few manufactured homes being sold in the last ten plus years?

In 2013, in an exclusive interview with MHProNews, Williams said that pursing the Duty to Serve was a “complete waste of time.”

Yet previously, Williams said this in a letter to industry members.

“Finally, I urge you to contact your U.S. Congressman and Senator[s] to ask them to [1] demand FHA immediately increase the maximum loan limits for manufactured homes and [2] insist that Fannie [Mae] and Freddie [Mac] immediately provide funding programs for home only and land/home manufactured homes.”

That comment in the pull quote from Williams is a reference to the Duty to Serve (DTS) mandate passed by Congress as part of the Housing and Economic Recovery Act of 2008 (HERA) “Duty to Serve” manufactured housing and other underserved or rural markets. That infamous letter by Williams is linked here. Why infamous?

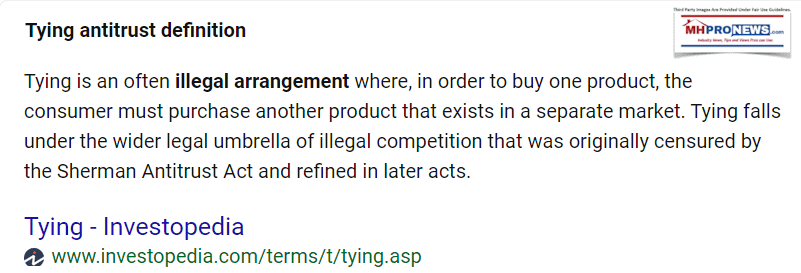

Because some legal minds believe Williams’ letter was part of an antitrust violating scheme to limit lending in manufactured housing, as it included what’s called a “tying” provision. That historic letter on 21st Mortgage Corporation letterhead by Williams is dated 1.29.2009. It was reportedly delivered to thousands of 21st sellers and loan brokers by a variety of means, including, but not limited to, the U.S. Mail, fax, and email.

- Why the flip flop by Williams on DTS between 2009 and 2013?

- Why was Williams seemingly to support DTS at times but against it at others?

These are reasonable questions for curious minds, particularly when a dozen years have elapsed since the “DUTY” to serve manufactured housing was “mandated.”

To explain the possible violations of law at play, the Department of Justice (DOJ) website says in part about antitrust law and that practice, “Tying under U.S. law has been defined as “an agreement by a party to sell one product but only on the condition that the buyer also purchases a different (or tied) product, or at least agrees that he will not purchase that product from any other supplier.”

That same Williams letter quoted above cut off lending to manufactured home brokers and sellers “effective March 1, 2009” – a mere month away from the date that the letter was dated. It included this longer quotation.

“3. All other financing plans will only be offered for sales on the following homes:

- 21st Mortgage repossessions.

- New homes built by Clayton Homes, Karsten Homes, Southern Energy or any other Clayton Homes subsidiary. The dealership must be a 21st Mortgage approved retailer.

- For any brand home floor planned with 21st prior to March 1 2009.

- For any brand home sold from a retailer’s inventory provided the retailer replaces the inventory with a home built by a Clayton Homes subsidiary.”

Those types of requirements, per legally sources, purportedly fits the definition of tying that is a violation of antitrust law. That’s not a mere technicality.

Reportedly thousands of retailers, and numbers of manufactured home industry producers, ended up failing in the wake of the impact of that letter. As antitrust activity is heating up under the Trump Administration, that may or may not be an issue depending on the outcome of the 2020 general election. Keep in mind that for lending to be profitable, several factors must be involved, among which are:

- are good loan performance,

- sufficient loan volume,

- along with reasonable regulatory and legal risks.

In the absence of all of those 3 factors in the bullets above, the interest of lenders to enter the manufactured home market dwindles.

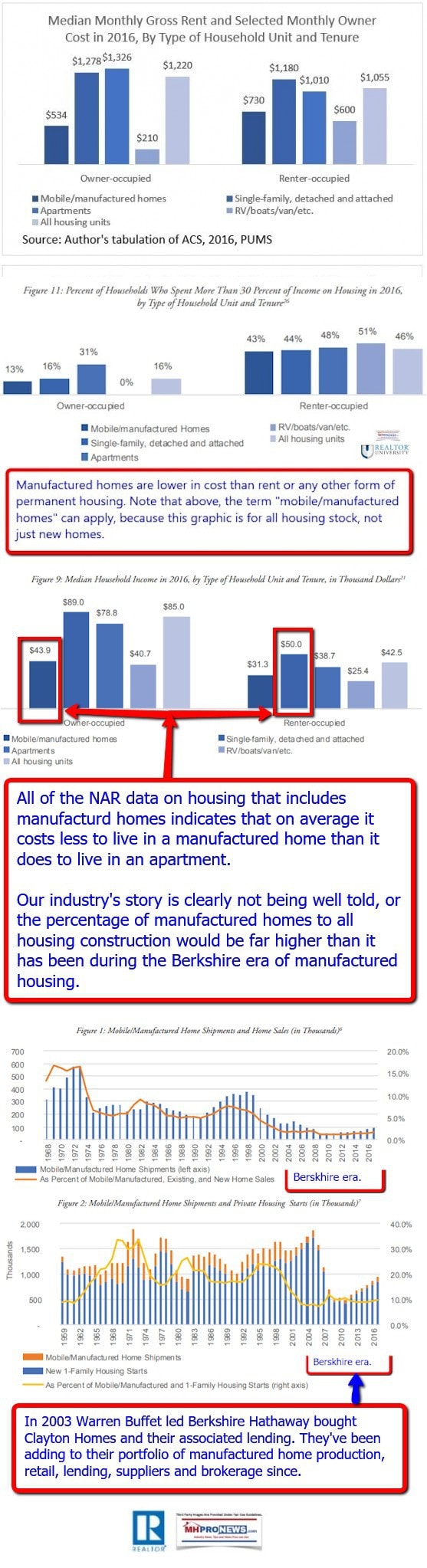

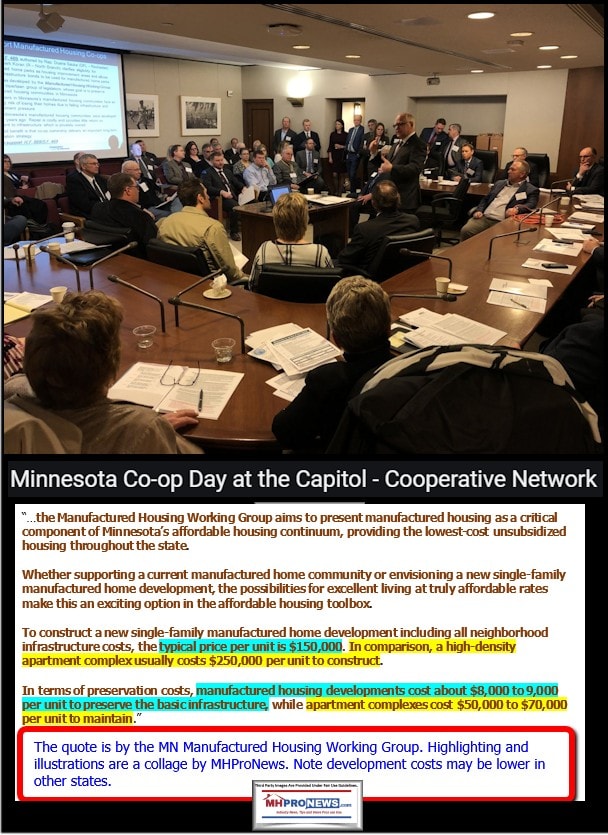

Yet, Congress recognized that manufactured housing was important for providing a free enterprise solution to the affordable housing crisis. Isn’t it better to provide a path of home ownership at a lower cost than to provide subsidies for rental housing at higher cost?

That logic aside, business professionals such as Carol Roth have made the point that regulatory hurdles may be protested by big business publicly, but are quietly embraced by larger firms. She explains why.

Barriers to Entry, Persistence, and Exiting in Business, Affordable Housing, and Manufactured Homes

In the context of antitrust and other legal concerns, the following should be noted. MHProNews has been contacted recently by a sizable plaintiff’s attorney law firm, an assistant state attorney general, and a legal researcher for a law school on antitrust and other manufactured housing related issues. Those legal contacts were due in part to published reports they found here on MHProNews and/or on our MHLivingNews sister site. One of those recent contacts specifically referenced the report below.

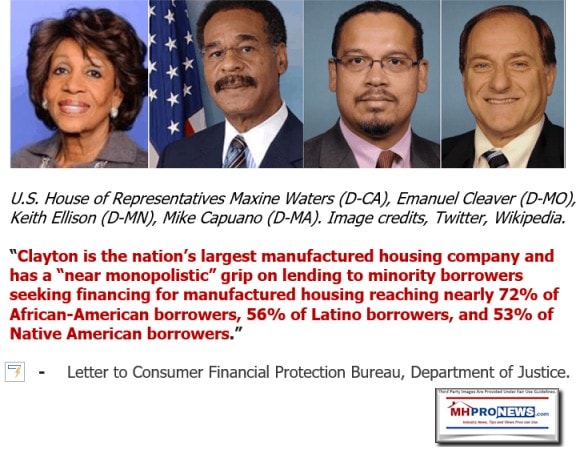

A university legal researcher commenting in part on the report above told MHProNews just days ago that “you [MHProNews] are 100% correct…” and began to outline that persons contention which included this pull quote from that writer’s email: “The vertically integrated oligopoly Clayton Homes has in the manufacturing and financing sectors of the industry (although I have noticed figures for how much of the sector 21st and Vanderbilt specifically occupy tend to fluctuate drastically)

-

- Potential violations of §§1-2 of the Sherman Act

- Potential violations of §3 of the Clayton Act…”

Other contacts by state and federal officials have occurred previously, or have been reported in mainstream media, as has been noted in reports published here such as the one linked below.

Returning to Williams’ letter, he mentioned Fannie Mae and Freddie Mac in that same infamous January 30, 2009 letter. The first few paragraphs will help set the stage.

“All Manufactured home Retailers and Mortgage Brokers

It is with regret I announce the current economic environment and the capital markets in particular have taken a toll on our ability to continue serving the entire industry. The mandate to banks and Wall Street to deleverage their balance sheets coupled with institutional investors’ fear of the uncertain times ahead has created a scarcity of capital for corporate America. Institutional investors are restricting their investment to the security of US treasuries.

Since November we have explored alternative funding source to enable us to continue funding retail home sales at the level we did in 2008. We have met with large financial institution including both Fannie Mae and Freddie Mac. Those talks are continuing but at this time we are not optimistic the government sponsored enterprises will be providing immediate relief for the industry.

Because we are unable to obtain reliable and adequate sources of funding effective March 1, 2009 we must limit our financing programs to the following:”

The case can be made that the above was paltering designed to deceive those getting the letter into thinking that 21st had done all that it could to obtain more money for funding loans. The full letter is linked here. Williams, Clayton Homes General Counsel Tom Hodges – who is currently MHI’s chairman – MHI, an outside attorney for MHI, and an attorney that sits on the board of Berkshire Hathaway have all been asked for comment about the antitrust implication of that letter previously.

Each have declined comment or reaction.

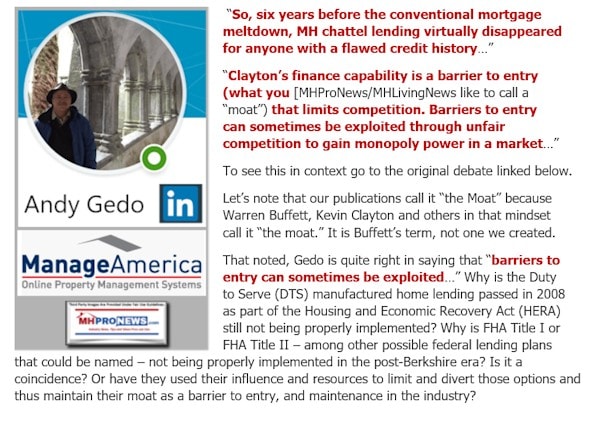

Note that Williams told those who received that letter that 21st met with Fannie Mae and Freddie Mac. An informed source has told MHProNews that 21st had shown the GSEs at that time their loan performance data and that the GSEs were “appalled.” Keep in mind that more recently, 21st declined providing information to the GSEs, as Paul Barretto, then with Fannie Mae said publicly, and which others have since corroborated. What’s going on? Why provide 21st lending data that results in no action by the GSEs, and then later decline to provide data that the GSEs also used to decline or delay home only lending on manufactured homes?

Restated, through the lens of history, the case can be made that

- 21st “poisoned the well” during the financial crisis with the GSEs,

- and then dragged their feet more recently with the GSEs on giving loan performance data.

- In each case, 21st gave the GSEs ‘an excuse’ not to enter into robust lending on HUD Code manufactured homes, particularly when those loans were personal property “home only” or chattel loans.

“We study history in order to understand the present and prepare for the future,” aptly said House Majority Whip James “Jim” Clyburn (SC-D), albeit on a different topic. “Because anything that’s happened before can happen again.”

In fairness to 21st, the argument can be made that the GSEs didn’t want to lend on manufactured housing anyway for their own reasons. The purported 2008-2009 discussions between the GSEs and 21st gave each cover.

The purported treachery of the 21st letter is more fully explored in the report linked below. It goes step-by-step in documenting the point that Warren Buffett’s annual letter contradicted Williams’ claim.

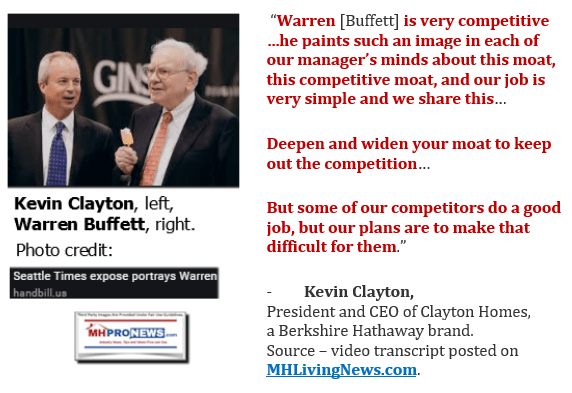

Berkshire had plenty of money to lend. Who said? Kevin Clayton, president and CEO of Clayton Homes in the video posted below the transcript of which is found in the report linked below. So too did Warren Buffett, as was noted. So the claim made by 21st has been undermined by his boss Buffett and his colleague, Kevin Clayton.

The prima facie argument can be made that:

- the proverbial well to more financing via the Duty to Serve mandated for the GSEs had been poisoned.

- The numbers of retailers and producers of HUD Code manufactured housing dropped sharply in the wake of curtailed lending by 21st and other lenders.

- Also, with the establishment of the so-called 10/10 rule on FHA Title I lending, that further restricted access to competitive financing for manufactured homes.

- The system had been rigged.

Who logically benefited from what Warren Buffett and Kevin Clayton both described as this moat?

One apparent answer is the Berkshire Hathaway brands and in time their allies at MHI. Their ‘moat’ grew, while others in manufactured housing shrank or vanished.

There are any number of reasons why a dozen years after the enactment of DTS merits various parts of the Trump Administration to investigate market rigging and corruption, or why Congress in its oversight capacity should probe such issues too. Some of those reasons are explored in the remarks by Danny Ghorbani to MHProNews referenced in the report linked below.

II. Additional Information, MHProNews Analysis and Commentary

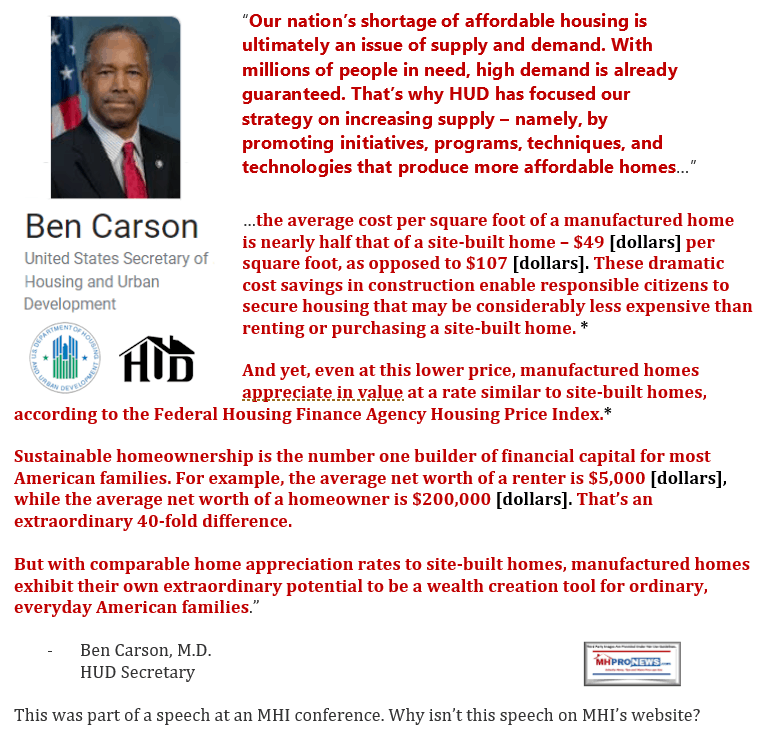

“We want people to be able to have choice [about housing],” HUD Secretary Ben Carson, M.D. said during an interview on Fox News. “They can stay where they are, they can move, but let the people be the ones who make the decisions. That doesn’t mean we are backing off of civil rights. We have a strong record in civil rights.”

Secretary Carson during that interview acknowledged that while his communication style drastically differs from that of President Donald J. Trump, “we need to be talking about the message and not the messenger.”

“Look at the big picture. Look at the future of our children and our grandchildren and what kind of country we want to live in. What are the principles we espouse?” Carson said. “Forget about who is saying it.” While Dr. Carson was clearly trying to appeal to those who may like certain policies, but don’t like the personality of the messenger, emails to MHProNews or comments that are publicly available indicate that Carson too is a politically charged figure for numbers of individuals in or out of affordable housing or the more specific real of manufactured homes.

Philip W. Schulte issued a detailed letter to FHFA which includes this noteworthy pull quote.

“The lack of progress in standardizing loan origination, underwriting and servicing procedures [by the GSEs] for manufactured home chattel loans has done nothing to increase investor confidence for whole loans or securities backed by chattel loans.” Schulte’s letter, which will be explored at another time, has numerous charts and data. That letter by Schulte is linked here.

In an email to MHProNews Schulte described his background in manufactured housing as “a former manager with the Department of Housing and Urban Development. During the 1980s, he was the senior loan specialist for the Title I program where he dealt with manufactured home lenders and served as the Title I representative to GNMA. In the early 1990s, he became the Chief of Compliance in the Manufactured Home Construction and Safety Standards Division where he was responsible for the regulatory system for about 240,000 manufactured homes being produced each year.”

Put differently, Schulte is in a position to know what he’s talking about with respect to DTS or FHA Title I, for that matter. Schulte says the GSEs have “done nothing to increase investor confidence for whole loans or securities backed by chattel loans…” Which begs the question. Is that accidental or intentional?

There is a generation of manufactured home professionals who have never personally experienced high-volume manufactured home sales. The last industry high of 1998 may as well be ancient history to them. For those who don’t have a keen appreciation for the non-partisan application of Majority Whip’s Clyburn’s words, meaning having a deep appreciation for the value of history in understanding the present and preparing for the future, the data from the past may seem surreal.

There are manufactured home industry professionals who not only experienced a period when “about 240,000 manufactured homes being produced each year” was occurring, but also personally recall when the pre-HUD Code mobile home era was producing well over 500,000 new mobile homes annually.

Put differently, the history for manufactured housing producing high volumes of safe, durable, greener homes exists. There is no need for speculation that it could happen. It already has occurred, which means it could happen again.

Schulte’s email to MHProNews said that he was “was also Acting Director of the Manufactured Home Construction and Safety Standards Division and worked on the energy and ventilation standards and the joint DOT_HUD regulation on the transportation of homes. He is an advocate for affordable manufactured housing and for the formation of a secondary market for personal property manufactured home loans.”

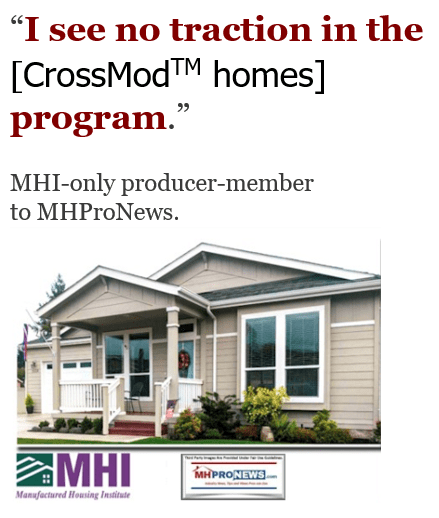

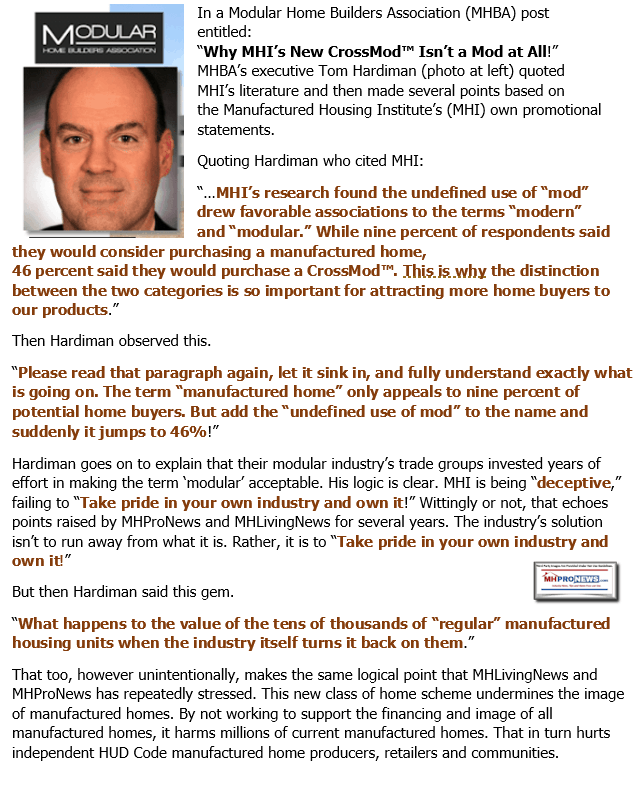

III. The So-called New Class of Manufactured Homes dubbed “CrossModTM” Homes

Pages of digital ink, photo ops, videos, and numerous statements by letter or in person by MHI have praised their so called their far more costly CrossModTM model of manufactured homes. Or at times MHI has had an industry spokesperson such as Mark Yost, President and CEO of publicly traded Skyline Champion Homes (SKY), has extolled the virtues of a so-called New Class of Manufactured Homes dubbed “CrossModTM” Homes.

But on-the-record statements of an actual retailer of “CrossModTM” homes to MHProNews belies the merits or logic of the program, as will be explored below. Additionally, a more prominent member of MHI told MHProNews off the record that the numbers behind the “CrossModTM” doesn’t make financial sense. Per that source, when the costs of meeting the Fannie Mae MH Advantage™ or the Freddie Mac CHOICEHome® installation and other standards are factored in, any advantage in the lower interest rate is wiped out.

The argument can be made that the entire program was designed to fail. Time and again, claims made by MHI, Clayton or others about how focus groups found this to be appealing have proven to be elusive in the actual marketplace. Meanwhile, what modest growth manufactured housing was experiencing since the 21st-Berkshire induced depression of the industry was engineered by the episode from 2009 noted above has resulted in a decline. It is with sadness that MHProNews must stress that our report in 2018 that the MHI scheme for a new class of manufactured homes would prove to be a Trojan Horse. That’s precisely what’s occurred.

In 2020, “I don’t think cross mod will get traction in the regular retailer model. I think the extra work that it takes and the client that is attracted to this product will be more comfortable with a sales model more similar to what we are doing. It is going to take a developer to sell them, not a retailer.” So said Dustin Arp, President of Spark Homes in New Braunfels TX in an email on April 29, 2020. Arp said then that “Our sales model is being structured more similarly to a production homebuilder than a Manufactured Home retailer.”

On October 22, 2020 Arp told MHProNews that “We do have a couple of [CrossModTM ] models just finishing up in the subdivision. Those haven’t been listed for sale as they are the show models.”

Arp added that “I have two executed contracts on homes scheduled to get here next month.” Arp noted in April that they weren’t yet advertising them.

But the Texas Manufactured Housing Association (TMHA) in an article on their blog said ”Mr. Arp was kind enough to invite DJ Pendleton and Rob Ripperda down to his massive unveiling where he also gathered over 100 local Realtors to tour all of his new home projects.” That was on November 19, 2019.

So, almost a year after that open house for realtors was reported by TMHA, Arp says that there are 2 contracts. Time will tell if the pace of their sales picks up.

No doubt, there were development and other items for Arp to navigate. But that only underscores Arp’s own point that this new type of manufactured home isn’t a product that street retailers can readily sell. So doesn’t all of that belie MHI and Clayton’s push for retailers and the industry to embrace a CrossModTM product that has no appreciable traction in the marketplace, especially considering the big claims MHI has made about their scheme, err, plan?

Another MHI-member producer source recently told MHProNews that to his knowledge, only about a dozen homes total had been sold nationally. Yet another MHI member producer said once more that there is “no traction” to the much ballyhooed program.

So, why does MHI, Clayton Homes, and their larger members keep pushing this product which even its backers indicate has been very slow to start? The Clayton video above on this date has only had 3778 views since January 16, 2020.

FHFA’s website says: “The Duty to Serve (DTS) requires Fannie Mae and Freddie Mac (Enterprises) to facilitate a secondary market for mortgages on housing for very low-, low-, and moderate-income families in: Manufactured housing…”

As a matter of law, HERA 2008 was passed about a decade before this ‘new class’ of “CrossModTM homes” was created and DTS thus obviously envisaged the loans applying to all manufactured homes, without exception.

DTS didn’t ask the GSEs to create a not yet created new class of manufactured homes. Rather, they were mandated to provide financing support for the manufactured homes that already existed.

Additionally, there has been push back from modular producers, as MHProNews has previously reported.

For all of the calls for more lending and the implementation of the DTS program, for all of the FHFA/GSE/Stakeholders “Listening Sessions,” what exists in fact is an utter lack of progress on the very thing that the law was supposed to accomplish.

When the history and the facts are carefully examined, what becomes clear is that this was either a massively bone-headed flop, or this was a program designed to fail. Why? Perhaps to undermine existing manufactured homes and the remaining independent producers. At best, after a dozen years, it is insanity.

It can’t be stressed enough that MHProNews interviewed off-the-record one of the individuals who helped advise a GSE on establishing this program, which the GSEs themselves have not been successful with. As a longtime retailer and someone who still does consulting in marketing, training and sales, that GSE consultant was asked, what will happen if this hampers or undercuts the sales of other manufactured homes? The response was stunning. Well, they can always look at that later, after the fact. Where they willing to risk undermining the sales of existing manufactured homes for what was then the ‘new class’ of homes being developed? Yes.

Another consultant to a GSE confirmed to MHProNews that the entire methodology that was used to develop the new class of manufactured homes now called CrossModTM homes was totally different than how financing programs are normally created by a GSE.

MHARR President and CEO Mark Weiss, J.D., has often noted that the language used by the GSEs, and tacitly accepted by MHI, Clayton Homes and others, is that they are promoting these as “quality” manufactured homes. That, says Weiss, implies that the other HUD Code homes “are somehow not “quality” homes…”

Here is his observation in context of his letter to the GSEs, which is linked here and their report on the matter is linked here.

Weiss is not a marketer, but as an attorney, he learned to think analytically and logically. His point about the use of the term “quality” is spot on. There was no need to spend hundreds of thousands of dollars by MHI – and who knows how much by Fannie Mae, Freddie Mac, or the FHFA – to create a program that would undermine all other manufactured homes by implying that they are somehow not “quality.”

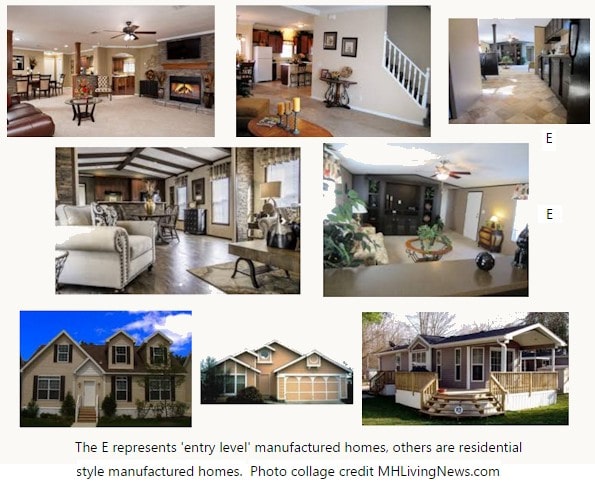

For those not familiar with manufactured housing on the granular level, it bears mention that there has long been two broad types of manufactured homes. One type could be dubbed ‘entry level’ manufactured homes. The other is more residential style housing. But both types were built to meet or exceed the HUD Code. Part of the logic of HUD Code manufactured housing was to simplify regulations and shipping while insuring durable, safe and greener homes for all price points of buyers.

Thus the very premise of such terminology and behavior as “quality” manufactured homes was never imagined by Congress when DTS was passed. It is absurd on its face. All manufactured homes met the “quality” standards set by the federal government as primarily administered by HUD.

To further illustrate the point, a top official at yet another MHI member producer said that they looked closely at the Clayton-backed CrossModTM plan. When they ran the numbers, the decided not to do them. Why? Because, said that official to MHProNews by the time the ground set and additional costs were figured in, any financing advantage that GSE lending provided was negated.

Put differently, the math did work. If so, is it any wonder that so few have sold?

What it has done instead is undermine the already multi-decade established value of manufactured homes that spanned several price points and delivered the same value at a lower cost.

Given that the leaders at MHI, Clayton Homes, 21st Mortgage Corporation and others involved in the CrossModTM homes scheme knew such facts, the entire program enacted behind closed doors between the GSEs and MHI leaders must be called into question. Does that shed light on why neither MHI, Clayton, or the GSEs will produce meeting minutes for those closed door discussions?

Thus the very premise of such terminology and behavior as “quality” manufactured homes was never imagined by Congress when DTS was passed. It is absurd on its face. All manufactured homes met the “quality” standards set by the federal government as primarily administered by HUD.

Given that the leaders at MHI, Clayton Homes, 21st Mortgage Corporation and others involved in the CrossModTM homes scheme knew such facts, the entire program enacted behind closed doors between the GSEs and MHI leaders must be called into question.

Those involved that MHProNews has interviewed or reported on regarding odd and clearly failed “implementation” of the DTS via CrossModTM homes are routinely educated and experienced professionals. Once the facts are understood, the plan obviously had no sound reason to take this circuitous path – only to arrive at a dead end destination years later.

That is, unless the long journey to a dead end was precisely the point.

IV. “You do not take years to design and build a looping ramp onto a bridge for an elevated highway that circles a city when all you have to do is walk across the street.”

The stubborn facts speak loudly.

Super Choice is one of several credit unions, banks, or other providers of manufactured home loans that have entered the market before or after DTS and did so successfully. If others can do it, what serious excuse do the GSEs have? Which begs the question, is FHFA blind to these realities? Or has their been collusion between certain government officials, private enterprises such as Berkshire Hathaway owned brands, nonprofits such as MHI, and the GSEs?

Rather than add more length to continue to prove the same point, MHProNews will link up several articles comments letters and reports through the years that demonstrate that DTS has been turned into a sham.

The losers or victims of this scheme are:

- Public coffers at the local, state, and federal level, as billions are spent annually on subsidized housing.

- Taxpayers, who end up footing the bill for more subsidized housing.

- Manufactured homeowners, who would have more appreciation on their homes, if DTS was properly implemented.

- Potentially millions of renters anxious to become homeowners, who don’t see reality due to the obscurities created by forces with their own agendas inside or outside manufactured housing.

- Owners of conventional housing who might upsize or downsize to a manufactured home given the right dynamics in the marketplace.

- Smaller businesses and investors who could be getting a good return if the system weren’t so obviously rigged against them.

People are free to buy into a lie or allow themselves to be deceived if they want to do so, after all, it is America.

But for those who look carefully at the history, evidence, and money trail, who understand the principle of Occam’s Razor, the foot dragging can readily be seen as a rigged system. There is no intention on certain parties to make DTS a reality.

That said, the law is still the law. It is up to FHFA or public officials to correct the wrongs that a dozen years have revealed.

What is certain is that it is insanity to keep claiming that listening sessions or GSE plans are sincere. They are self-evidently window dressing on a costly scam. The writers of the screenplay The Sting would be jealous.

See the related reports linked above, below and that follow the byline and notices.

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Hopeful News! Builder Confidence Grows, Views from Mainstream and Manufactured Housing

“More Punitive Regulatory” Regime Looms Warns New Manufactured Housing Industry Insider