As tens of thousands of industry professionals and investors know, among the hottest topics in manufactured housing is routinely the topic of financing.

In this third Q&A with Danny Ghorbani, who worked for years for the Manufactured Housing Institute (MHI) before leaving and launching what today is known as the Manufactured Housing Association for Regulatory Reform (MHARR), Ghorbani sheds light on solutions to the vexing problems in the Duty to Serve controversy.

This 3rd Q&A will be followed by the first two with Ghorbani, along with other additional related information and an MHProNews Analysis and Commentary.

MHProNews QUESTION

Danny, let’s pick up with Fannie Mae & Freddie Mac’s ongoing evasion of the full and proper implementation of the Duty to Serve Underserved Markets (DTS), at the conclusion of your answer to MHProNews’ second question on April 23, 2020, you indicated that Fannie & Freddie’s regulators, the Federal Housing Finance Agency (FHFA) and more specifically its Director, Mark Calabria, are the key to correcting this situation and putting the implementation of DTS back on the right track. Will you please expand on this for our readers, including how Director Calabria can accomplish this, given the fact that Fannie & Freddie have gotten away with the status quo all these years?

Danny Ghorbani ANSWER

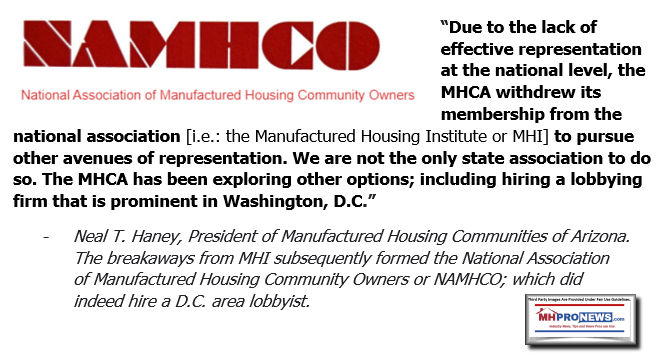

Unfortunately, this simple concept has been totally absent as the centerpiece of conversation, debate, decisions and policies by the industry’s post-production sector, ever since that group abandoned and dismantled its collective, independent, national association, the National Manufactured Housing Federation (NMHF) in early 1990s, with ensuing disastrous results.

Needless to say, among the most damaging of all the disastrous results for the industry and consumers of affordable housing is the scarcity of affordable consumer financing for our homes. I am convinced that had there been such a national, independent, post-production association in place when the Duty to Serve (DTS) law was enacted, Fannie Mae and Freddie Mac would not have dared, let alone succeeded in avoiding the securitization of mainstream manufactured home loans in market-significant numbers.

But that is hindsight. Going forward now, the question is — given the absence of such a post-production representation to speak out for retailers, communities and finance companies, how can the huge mess that Fannie and Freddie have created with respect to the DTS law be corrected? This will build upon the first two Q&As we did with your publication on March 9 and April 23, 2020. Because the goal should be to put DTS back on the right track for the benefit of low, lower and moderate-income American families. That benefits consumers and independent businesses alike, and that was the Congressional mandate that DTS was meant to solve.

My answer, is that if we carefully and comprehensively apply my above-stated concept to this question, we would realize that as bad as the current situation is, it can be corrected, if (and that is a big “if”) the entire industry and consumers are willing to fight for it, because they hold all the cards…they have everything going for them.

My optimism is based on two factors. First, the big “if” that I referred to above, is a “must,” because participation by the entire industry is necessary in order to fully comply with the elements for success described in the above concept. This must include the industry’s conglomerates, the couple or so finance companies and their association, the Manufactured Housing Institute (MHI), all of which are currently going along to get along with Fannie and Freddie, giving those two entities a free hand to continue the shenanigans which richly benefit them.

Second, I say this situation can be corrected because based on everything that we know to date (nearly all of which we have addressed with the first two Q&As in your March 9 and April 23, 2020, articles), it is my opinion that Fannie and Freddie, in their haste to avoid the securitization of mainstream manufactured home loans in market-significant numbers, have become careless, have outsmarted themselves, have made too many mistakes, have made many in-your-face, wrong decisions and painted themselves in a corner…antics that the industry and consumers can and must expose, uncover and correct. What they have done is a bureaucratic nightmare that only people who deal with the manufactured housing industry would dare to undertake, because they can always count on the go-along-to-get-along crowd in the industry to undermine anything that might help the small industry businesses and consumers of affordable housing.

And this brings us to your main question about FHFA Director Mark Calabria, who is the only person than can truly initiate the sorely-needed reform of the mess that Fannie and Freddie have created.

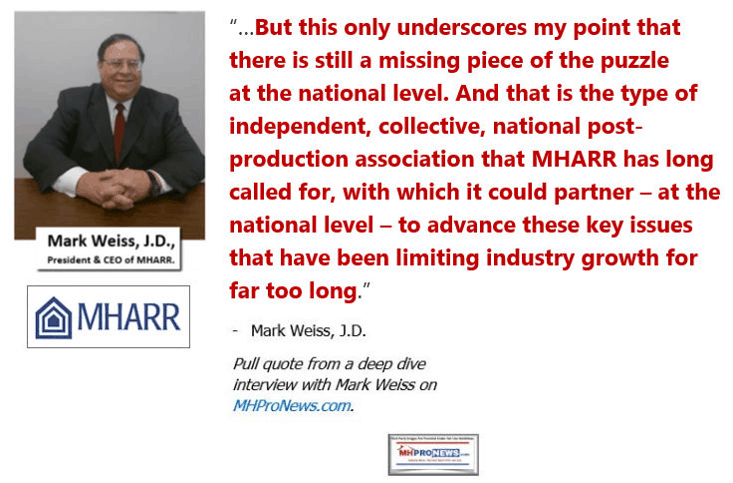

Fortunately, the Manufactured Housing Association for Regulatory Reform (MHARR) which represents the views and interests of the industry’s smaller businesses, has done just that. MHARR has, once again, taken the lead in an effort to stop Fannie and Freddie’s runaway train wreck with the DTS law, while seeking to put it back on the right track.

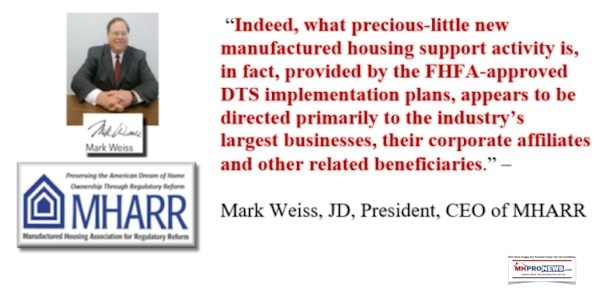

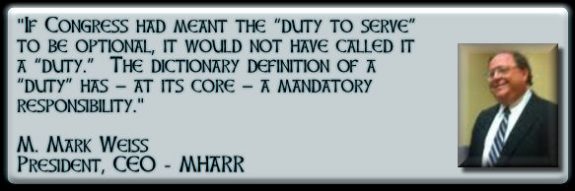

In a May 11, 2020 must-read letter to Mark Calabria, MHARR’s President & CEO, Mark Weiss, exposes the continuing ruse that Fannie and Freddie are forcing on the industry and consumers of affordable housing under the guise of “implementation” of DTS law. In essence, Weiss challenges Director Calabria to come clean with what is going on and the steps that must be taken in order to clean-up the mess. Furthermore, in that letter, Weiss methodically documents all the relevant facts — accurate and undeniable information, common sense, historic trends and other evidence — to build a solid foundation that blows away Fannie and Freddie’s ongoing schemes and excuses, and provides Director Calabria with a good structure, framework and chronological order to act.

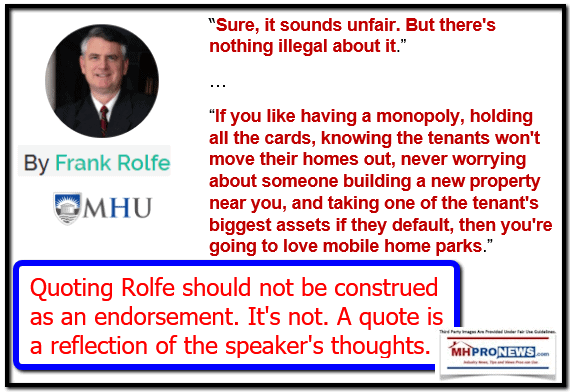

In addition, it exposes the green light that Fannie and Freddie have routinely received from the industry’s usual suspects, led by Warren Buffet’s Berkshire Hathaway subsidiary, Clayton Homes, Inc. and Clayton’s own financing affiliates. These business – and ultimately Buffet – stand at the apex of the problems that exist for the industry and consumers with respect to both production and financing. Clayton, on the one hand, dominates industry production. On the other hand, through its financing subsidiaries, it dominates the manufactured housing consumer finance market. With this double-edged market power, it is able to push consumers – with no other or better options due to the subversion of DTS — into higher-rate manufactured housing purchase loans for the homes that they produce. And, in fact, Berkshire Hathaway in one of its recent annual reports, notes that it makes more money from manufactured housing finance than from the production and sale of manufactured homes per se. So why change?

Then there are the FHFA “regulators” who have been their collective thumb on the proverbial scale of justice in favor of Fannie and Freddie’s evasions and against the industry’s small businesses and consumers of affordable, mainstream manufactured housing.

MHARR’s May 11, 2020 letter is thus must-read correspondence for anybody and everybody with an interest in manufactured housing, in order to understand what the Enterprises have been getting away with in hurting the industry and, more importantly, the low, lower and moderate-income Americans who depend on manufactured housing as their main source for affordable homeownership.

More importantly, the correction to the fiasco that Fannie Mae and Freddie Mac have engineered with the DTS law is right there…in black and white and step by step in MHARR’s May 11, 2020 letter. The proverbial ball now is in Director Calabria’s court, as he not only has a duty, but an obligation to take meaningful corrective action. And while all this began prior to Director Calabria’s arrival at FHFA, its continuation and, indeed, worsening, is now occurring on his watch.

Director Calabria must initiate an internal investigation to get to the bottom of this mess, and specifically, how and why FHFA regulators have allowed Fannie and Freddie to twist a legitimate public law into a sweetheart deal with a couple of the industry’s conglomerates, producing expensive non-affordable homes, while American families that the DTS law is meant to help, are driven (more like forced) into higher rate, predatory-like loans which are dominated by a couple of finance companies — all under the collective nose of FHFA regulators. And then, he must take concrete, specific action. That means implementing, without further baseless delay, DTS – in a market significant manner – for all mainstream HUD Code manufactured housing. If, for some reason, he feels that the DTS law needs to be expanded or “tweaked,” he has an obligation to go to Congress to seek any such corrections in order to fully effectuate Congress’ clear objectives in enacting DTS in the first place. Otherwise, he has one single, unequivocal and undeniable duty – and that is to fully implement and enforce DTS.

The current situation is outrageous and totally unacceptable. Director Calabria must put an end to this travesty. Indeed, Director Calabria, in full compliance with President Trump’s regulatory, housing and finance policies, must take meaningful and effective remedial action now.

##

MHProNews Question 2:

“In our Q&A of March 9, 2020, you indicated that Fannie Mae and Freddie Mac are using various schemes to cover-up and get away with their ongoing evasion of the Duty to Serve (DTS) mandate established by the Housing and Economic Recovery Act of 2008 (HERA) which instructed them in specified ways to serve the HUD Code manufactured housing industry and its consumers. Can you elaborate on the “how and why” of what Fannie and Freddie are doing with respect to DTS?”

Danny Ghorbani Answer:

With this background, the basic question you now are asking is: “how and why Fannie and Freddie continue to get away with skirting this federal law and its clear mandate?” The “why” part of your question was mostly answered in our Q& A of March 9, 2020, although there are additional relevant observations later in this Q & A response. But the “how” part of your question is something different and new, which warrants further explanation and elaboration.

Having watched, studied and analyzed the Enterprises’ actions for nearly four decades, and having been involved, engaged-in and instrumental in the drafting and passage of the DTS law, it is my personal opinion that Fannie and Freddie, whether by chance or by design, or a combination of both, have initiated, perfected and ultimately exploited a three-pronged approach to their interpretation, implementation and handling of the DTS law. And when these three approaches overlap, as they have since 2008, they create a platform-of-operation and a comfort zone which allows them to defy the law and its mandate to satisfy their own view of manufactured housing (see, Q & A of March 9, 2020) while, at the same time, richly benefiting their favored clients at the expense of the industry’s small businesses and the moderate and lower income American consumers that they are supposed to serve.

And what are the three prongs of this approach? They are:

1-The Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac continuing home-financing (particularly chattel financing) discrimination against a class of American consumers who depend on today’s federally regulated manufactured housing (MH) as their principal and, in some cases, only source of homeownership;

2-Fannie’s and Freddie’s utter disregard for the well-established parity between the construction/manufacturing of today’s MH and all other types of single- family dwellings; and

3-The GSEs unholy alliance with — and green lights given to them by — unexpected quarters, which provide them with just enough cover to continue the unacceptable status quo.

Now, let’s delve a bit more into each of these three factors.

1- It is a well-known and long-established fact that the large majority of manufactured home (MH) purchasers are young couples, moderate and lower income consumers and elderly Americans. Fannie and Freddie have and continue to routinely question the credit-worthiness of these groups as an excuse for not securitizing MH loans. And their biggest excuse, of course, is that they do not have any relevant data available to justify their risk-taking in securitizing such loans – and particularly chattel loans. But this is nothing more than a bogus excuse, because they have had twelve years with the best available tools and an army of home-financing experts at their disposal to actually develop such data themselves. For them, this should be an easy task and something that would not take twelve years, with no end in sight. For example, in one of its countless number of comments on the implementation of DTS, the Manufactured Housing Association for Regulatory Reform (MHARR) provided Fannie, Freddie and FHFA with a suggested program that would start with a small but market-significant number of chattel loans which would vigorously be reviewed and evaluated periodically. If the results were satisfactory, they would then gradually increase the number of loans and continue with their close monitoring. Now, if MHARR could formulate a workable approach like this, why can’t Fannie Mae and Freddie Mac? Instead, Fannie and Freddie have wasted twelve years and all they have to show for it are meaningless, miniscule, dead-end “pilot programs” that have discouraged and driven away industry participation, and forced the consumers into very high-rate private chattel loans … something that DTS was supposed to change for the better, but has instead become worse. And if these private companies can earn profits on such high-rate loans, why can’t Fannie and Freddie, at the very least, start one lower-rate loan program, while still earning a profit? For the Enterprises, whose careless and unimaginative programs (remember sub-prime loan programs?) cost American taxpayers trillions of dollars and brought the world economy to near-collapse to worry about high risks and potential defaults on a miniscule number of manufactured housing loans is hypocrisy at best and pure discrimination against some 80% of manufactured home consumers at worst. Given Fannie and Freddie’s checkered history with the manufactured housing industry, one would have to conclude that it is the latter.

2- The DTS law and its mandate are clear, unambiguous and unwavering. Simply stated, with the DTS law Congress told Fannie and Freddie that they have miserably failed to serve the federally-regulated manufactured housing industry and consumers of affordable housing since they were created, and with the DTS mandate, they now have to start serving both — i.e., not site-built, or modular, or sectional, or any other type of single-family dwelling built in compliance with other types of building codes, but today’s quality, well-built and affordable manufactured homes constructed in full compliance with the HUD Code and regulated by the federal government. They must provide securitization programs that would enable finance companies to offer lower-rate loans for manufactured housing AS IS WHEN IT LEAVES THE FACTORY AND IS PURCHASED BY A HOME BUYER…as simple as that. But that is not good enough for Fannie and Freddie as they have decided to re-invent the wheel by demanding that the code and materials be substantially upgraded to the point that the bottom-line price of the home would make it prohibitively costly to the average consumer who would otherwise depend on a manufactured home for his or her homeownership. A very clever way of avoiding the securitization of mainstream manufactured housing loans, right? And to make matters worse, as if they are ashamed of the name “manufactured home,” or in an effort to look down at the product, or in an attempt to confuse homebuyers (or, possibly, a combination of all the above) they, with the help from some within the industry, have invented meaningless and unrelated names such as “High-End Initiative,” “MH Select,” “New Type” of home, “New Generation” of home, “New Class” of home, “Advantage Home,” “Choice Home” and the worst name of all, “Cross-ModTM home!!” (As an aside, the CrossModTM name appears to have been invented by a wannabe individual totally devoid of any and all knowledge, and without the slightest understanding of the rich heritage and history of this great industry…not to mention the difficult and cumbersome evolution that it has endured to get where it is today.) So, Fannie and Freddie must be educated to understand that when a manufactured home leaves the factory with that federal-seal-of-approval affixed to it, it is on par and in full parity with — and, in many cases superior to — any and all other single-family dwellings built to any other building code in the United States of America.

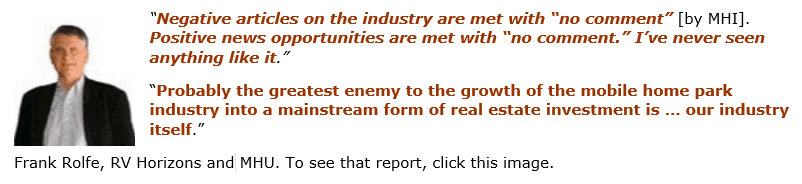

3- One of the main reasons that Fannie and Freddie have been able to yank-around the manufactured housing industry and consumers with a perceived legitimacy for their dodging and evading all these years, is due to their alliance with — and a green light given to them by — a segment of the industry and their regulators (i.e., the Manufactured Housing Institute (MHI) and FHFA).While MHI was a loyal and integral partner with MHARR and the rest of the industry and consumer coalition during the drafting and passage of the DTS law, it went off the reservation (as it did with the landmark Manufactured Housing Improvement Act of 2000 reform law) when it came to the full and proper implementation of the DTS law. I have been around this industry and Washington, DC long enough to know for a fact that Fannie and Freddie would have not been able to do what they have done with this industry and its consumers all these years had it not been for the wink and nod given to Fannie Mae and Freddie Mac by MHI, and their half-hearted support for DTS.

To be sure, and according to the available information, MHI has had its limitations and shortcomings in pulling their punches, often saying one thing publicly, but doing something different privately, going along to get along, as one, or two, or possibly three of their largest conglomerate members are the only companies utilizing Fannie and Freddie’s wild-goose-chase securitization programs — or should I say “pilot programs” or whatever is the name of the latest program that they offer these days.

I am not aware of any small businesses in this industry using a Fannie or Freddie program. Furthermore, MHI’s membership includes two of the largest finance conglomerates that provide higher-rate chattel loans and have no incentive at all to support the full and proper implementation of DTS that would attract competition from smaller companies which would utilize DTS to support lower-rate chattel loans. (Incidentally, here is another major set-back for the post-production sector of the industry when there is no independent, national collective association to represent their views and interests on critical matters such as this.)

As for the green light that FHFA has given to Fannie and Freddie to continue their evasion of and failure to fully and properly implement the DTS law, there are several words that would perfectly describe FHFA’s action or lack thereof prior to the arrival of its current Director, Mark Calabria and his team. Unfortunately, none of those words are pleasant enough to be listed here, thus we’ll spare them. Since Director Calabria’s arrival at FHFA, though, and given the fact that I personally have known and worked with this gentleman for nearly three decades with positive results, I use the word “disappointing” to describe FHFA’s efforts to regulate and fully and properly implement the DTS law. I say this because Director Calabria is a trusted and serious federal government regulator. He and his team have a large reservoir of credibility with our industry, and with me, personally. They were quite helpful and indeed instrumental in the passage of the landmark 2000 reform law. They respect and admire this industry for the quality homes that it builds and the affordable homeownership opportunities it offers to moderate and lower-income consumers. They, along with other relevant agencies, have an aggressive mandate and the full protection of President Trump and Congress to increase and expand the supply of affordable housing for American consumers — a huge undertaking that rightfully must start with affordable HUD Code manufactured housing. Why is it, then, that after nearly two years in charge of FHFA he has not been able to reign-in the renegade Fannie Mae and Freddie Mac, and fully and properly implement the DTS law for the benefit of consumers and the industry’s small businesses? Thus, my disappointment at the continuing green light that FHFA is seemingly providing to these Enterprises along with the perceived legitimacy that allows them to continue with their evasion. Although I don’t hold my breath, it is obvious that drastic decisions must be made by FHFA to end the unacceptable status quo and put the vital DTS mandate back on track.

The proverbial ball is clearly in FHFA’s court, to use its full power and authority to put an end to the nonsense and evasion that Fannie and Freddie have gotten away with for 12-plus years (and counting) regarding DTS.

##

MHProNews Question 1.

It’s now been roughly 12 years since the “Duty to Serve” (DTS) mandate was passed by Congress as part of the Housing and Economic Recovery Act (HERA) of 2008. HERA’s DTS mandate required that Fannie Mae and Freddie Mac make financing affordable housing preservation, rural, and for HUD Code manufactured homes. Can you provide our readers some insight into the history of this matter and specifically how it relates to the ongoing failure of the GSEs to fully implement that law in accordance with its terms. In framing your reply, let’s set aside community financing and FHFA’s role in this for now, and focus on the what some call posturing and confusion which we’ve seen from the GSEs instead?

Ghorbani: This may or may not come as a surprise to you and your readers, but in my opinion, the two Government Sponsored Enterprises (GSEs) i.e., Fannie Mae and Freddie Mac, don’t have very much interest in the Manufactured Housing industry, and I doubt they would ever get involved in manufactured housing in a market-significant way (i.e., large volume), securitizing loans for mainstream affordable HUD code manufactured homes. And, more specifically, they are even less interested in securitizing the industry’s most affordable homes that are financed through personal property (chattel) loans and represent nearly 80% of our industry’s homebuyers — mostly moderate and lower income American families.

Ghorbani: This may or may not come as a surprise to you and your readers, but in my opinion, the two Government Sponsored Enterprises (GSEs) i.e., Fannie Mae and Freddie Mac, don’t have very much interest in the Manufactured Housing industry, and I doubt they would ever get involved in manufactured housing in a market-significant way (i.e., large volume), securitizing loans for mainstream affordable HUD code manufactured homes. And, more specifically, they are even less interested in securitizing the industry’s most affordable homes that are financed through personal property (chattel) loans and represent nearly 80% of our industry’s homebuyers — mostly moderate and lower income American families.

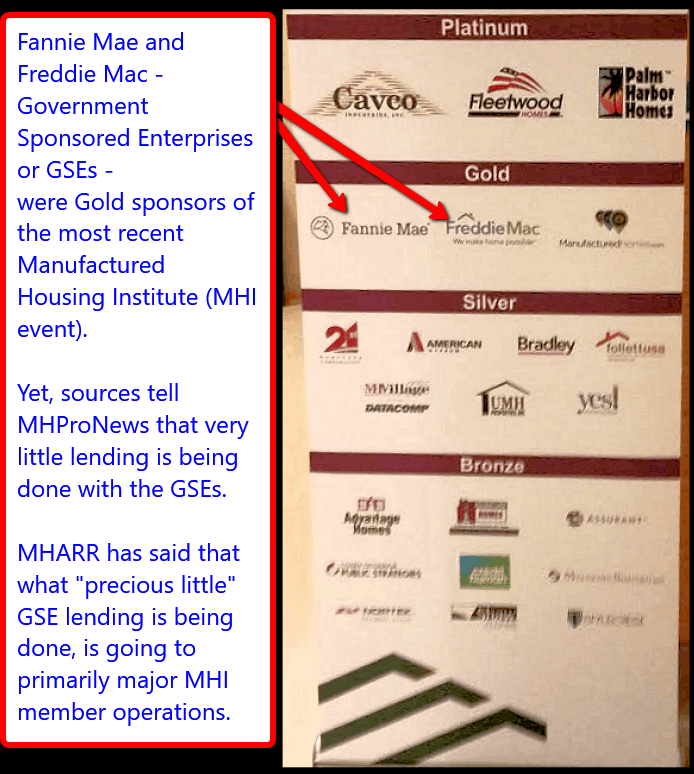

To be sure, they continue to go through the motions. They’ve “engaged” with the industry, attending and sponsoring industry events, shows, seminars and meetings on top of meetings, sweet-talking the industry and even some consumer organizations. They’ve provided targeted programs for the high-end/expensive homes built by the industry’s largest conglomerates. They’ve done endless public relations, pushing all the right buttons, etc., etc., etc. — anything and everything except securitizing loans (be it mortgage type, but more importantly chattel) for mainstream, affordable HUD Code manufactured homes in a market-significant way for moderate and lower American homebuyers — which, incidentally, is the main reason for their (i.e., Fannie and Freddie) existence…as stated in their respective charters.

My long held belief and opinion regarding their outlook and lack of interest in manufactured housing is based on personal observations and experience in dealing with them going back nearly forty years. There is a history here that not very many stakeholders (especially the newcomers and “wanna-be”-experts) are aware of, and cannot be ignored going forward if Fannie and Freddie are to be held accountable in full and complete compliance with their statutorily-mandated duty to serve the manufactured housing industry and the moderate and lower income families who rely on manufactured housing as the only means to own a home of their own. This history goes way back before we formed the Manufactured Housing Association for Regulatory Reform (MHARR) in 1985, when I was with Manufactured Housing Institute (MHI) for nearly two decades, and my many responsibilities included the management of the industry’s Annual National Show and Exposition in Louisville, KY every January. We used to bring GSE personnel to the show to see the new model homes, attend meetings and seminars, talk to industry folks, answer their questions…any and all relevant matters that would engage them with the industry in the hope that they would initiate some type of market-significant securitization of manufactured home loans. Again, and as usual, they did all the right things, as noted earlier, but nothing substantive ever happened.

Now, fast forward to the mid-2000s when the lack of an aggressive, independent National Post Production Association resulted in major set-backs for the industry in consumer financing for its homes (not to mention failures on such critical matters as SAFE Act and Dodd-Frank, which continue to haunt the industry to date), thus drawing MHARR into the consumer finance arena. The Association’s collective knowledge of the relevant consumer finance history, institutional memory and experience with Fannie and Freddie became quite effective in demonstrating to both Houses of Congress that they had to mandate an end to Fannie Mae and Freddie Mac’s discrimination against the Manufactured Housing Industry and its consumers, and start serving this industry as a “DUTY” — thus the enactment of “Duty to Serve Underserved Markets” (DTS) as part of the Housing and Economic Recovery Act of 2008 (HERA).

Unfortunately, though, nearly twelve years after the passage of DTS, because of the continuing absence of an aggressive, dedicated and independent national association representing the interests of retailers, communities and finance entities, coupled with the deployment of multiple schemes, excuses and creative methods of dodging by Fannie and Freddie, and given their very weak and ineffective regulator, the Federal Housing and Finance Agency (FHFA), the two GSEs have been able to stymie the full and proper implementation of the law, thus, once again, depriving moderate and lower American families of homeownership, while forcing them into what former Congressman Barney Frank used to refer to as “predatory lending.”

Based on all of this, do Fannie Mae and Freddie Mac really look like two organizations that are truly interested in securitizing market-significant volumes of affordable loans for moderate and lower income American homebuyers in accordance with their own charters and the mandate handed to them by DTS law? The simple answer is a resounding “no.”

Fannie Mae’s and Freddie Mac’s ongoing behavior vis-a-vis the Manufactured Housing Industry and consumers of affordable housing is a disgrace. Their unreasonable and expensive proposals that are only favorable to the largest conglomerates in this industry is a ruse and an insult to the hardworking Americans who cannot afford to purchase those more expensive homes. All of this is unacceptable and must be rejected not only by the industry and consumers, but by the Administration, Congress and FHFA…and the sooner the better.”

— End of Q &A —

Supporting Evidence for Ghorbani’s Points?

The reply to the questions above that were posed by MHProNews are those of Danny Ghorbani.

Objective thinkers should ask themselves, is the evidence for Ghorbani’s assertions?

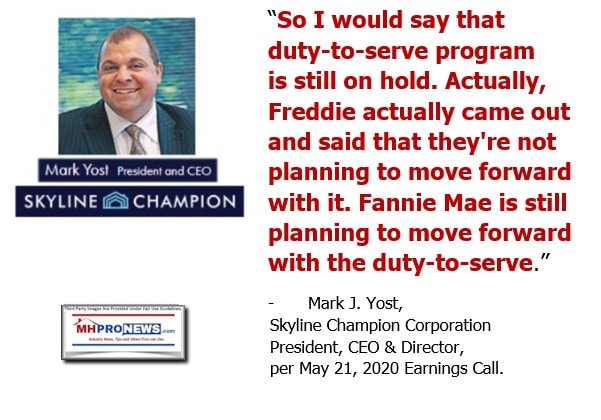

The short answer is yes. The following points are facts provided by MHProNews, not MHARR or Ghorbani. Just a few examples will serve to prove that point. Let’s begin with a statement from a prominent MHI member.

- Fannie, Freddie, MHI and a others involved have refused to release the minutes of closed door discussions that resulted in the “new class of homes” that was dubbed in 2019 as “CrossModTMhomes” by MHI.

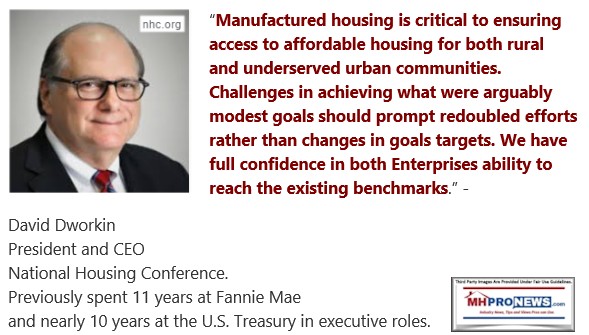

- David Dworkin, President and CEO of the National Housing Conference said in formal comments to the federal government the following, which was quite in keeping with Ghorbani’s assertion. It should be noted that Dworkin served as a vice president for a GSE, so one might presume that he knew what he was talking about. Furthermore, Dworkin arguably did a better job of arguing for more from the GSEs than MHI’s Lesli Gooch did, see that comparison of their respective remarks at the link here.

- MHI has had as event sponsors Fannie Mae and Freddie Mac. That smacks of collusion that points to the very concerns raised by Ghorbani in his response. After all, why would Fannie and Freddie need to sponsor MHI to curry favor, if the GSEs were sincere in their intention of robustly supporting all HUD Code manufactured homes?

- MHProNewsand MHLivingNews has done several reports that all tend to support the concerns raised by Ghorbani.

- Donna Feir, Ph.D., and research economist studied this issue and was troubled by what she found, citing the Seattle Timesexpose that pointed a finger at Clayton Homes and their associated Berkshire Hathaway lenders of Vanderbilt Mortgage and Finance (VMF) and 21st Mortgage Corporation.

Donna Feir’s report included a footnoted reference to Clayton Homes and their affiliated lenders.

- There is a prima facie case to be made that since Triad Financial Services, Credit Human and other lower rate manufactured housing “home only,” personal property or chattel loan lenders are successfully making such loans at lower rates that 21stor VMF. Years of sustained lending by Triad and Credit Human – who have reportedly provided the GSEs with their data – is sufficient evidence for Fannie and Freddie to issue and securitize the loans that DTS mandates.

Those are sufficient examples to make Ghorbani’s statements come to life. It should be noted that Ghorbani – as is true of others quoted, interviewed or otherwise cited here and on MHProNews – had no idea of what our analysis of his comments would be. He’ll be reading these words for the first time along with thousands of other industry professionals.

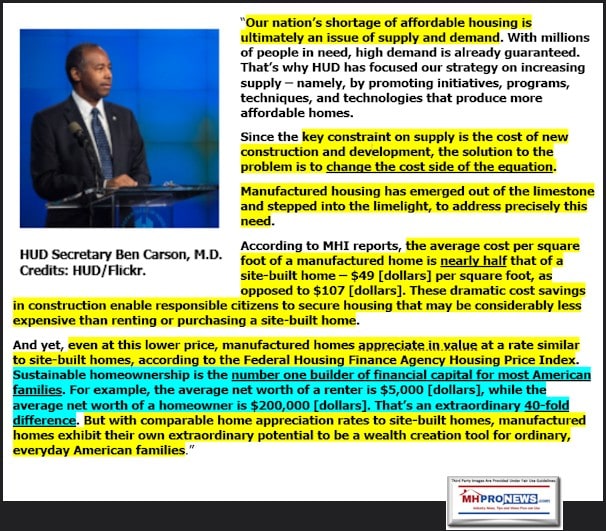

The above supports the statements made by HUD Secretary Carson as well.

The industry is struggling from what several sources say are forces inside manufactured housing that have thwarted good laws that already exist. More on that is found in the linked reports that follow the byline and notices. Ghorbani and the Manufactured Housing Association for Regulatory Reform has been a consistent leader in that fight for the full and proper implementation of good laws that exist in good measure to the work he and his colleagues have done over the years.

Consumers who have experienced manufactured homes routinely like or love their homes. It is tragic that so much evidence exists that much of the industry’s problems arguably originate from corrupt practices within the industry.

Ghorbani and MHARR frame their arguments in a distinct and independent fashion than how MHProNews does. The same observation can be made about those who are MHI members.

We strive to seek the truth and sift through the chaff to find the wheat from all sources.

MHProNews uniquely provides the mix of news, fact-checks and analysis that has resulted in our being the runaway most-read and largest industry trade publication.

That’s a wrap on this installment of manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Recent and Related Reports:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

https://www.manufacturedhomelivingnews.com/fhfa-gses-high-cost-to-minorities-all-americans-due-to-asserted-failures-to-follow-duty-to-serve-affordable-housing-existing-federal-laws/

State AG Files Suit Against, Manufactured Home Community, Rent to Own, Lease Purchase Option Warning

“Never Let a Good Crisis Go To Waste” – COVID19 Pandemic – Problems and Solutions

“MHI Lies, Independent Businesses Die” © – True or False? – Berkshire’s Joanne Stevens Strikes Again