“Where the hell have you been?”

Outside of a big box store on Sunday 5.3.2020 was a black man was talking on his cell phone, wearing personal protective gear. “Where the hell have you been?” was what he said to the person on the other end of his call. “When you go outside, you have to suit up. You need gloves and a mask.”

Whatever the medical realities of the risk factors are, that is a common view held by millions of people, based upon public opinion surveys conducted by Gallup polls in early April. Given weeks of what some see as exaggerated fears over the health risks of the pandemic commonly called COVID19 but known by other monikers such as the Wuhan Virus, China Virus, Communist Chinese Party Virus (CCP Virus) or the novel coronavirus, the views of that man are not uncommon at all.

A well established retailer told MHProNews that a good percentage of his customers are wearing PPE (personal protective equipment), most commonly a mask. Fear is a factor, not only for those who are scared of catching COVID19, but also are the serious worries by those who say that they are concerned that there businesses and the jobs that they support will vanish due to the CCP Virus outbreak.

That sets the stage for those in manufactured housing and other sectors who see silver or gold linings to the dark clouds of what President Donald J. Trump called the “plague” in his televised town hall on Fox News last night. There is talk of another round of “stimulus” money to small businesses. More on that in a different report another time.

On Equity LifeStyle Properties (ELS) most recent investor call, the official transcript for which follows below, the following remark was made.

“Yes. It’s interesting that one of the things that’s happened during this pandemic is there has been a lot of discussion with operators. We’ve kind of gotten together to talk about what’s happening, so that we have an appreciation, since we are kind of all in this together. And from that and certainly some of the smaller operators, I think there may be an opportunity, but right now it’s more about kind of exchanging best practices and really being just good community stewards at this point. And should there be something that comes out as a result of that because people are interested in selling that, that could be interesting.” – Marguerite Nader, President and Chief Executive Officer, ELS.

A week before their Q12020 earnings call occurred, Seeking Alpha labeled ELS on April 14, 2020 as a “Equity LifeStyle Properties: A Wildly Overvalued And Overleveraged REIT.” Ouch. But they are not alone as the screen capture from Yahoo Finance on 5.1.2020 below reflects. More on that in our analysis segment further below.

With that predicate, MHProNews will now present the official transcript of the call as presented by the Motley Fool’s transcription.

Equity Lifestyle Properties Inc (ELS) Q1 2020 Earnings Call Transcript

ELS earnings call for the period ending March 31, 2020.

Equity Lifestyle Properties Inc (NYSE:ELS)

Q1 2020 Earnings Call

Apr 21, 2020, 11:00 a.m. ET

Contents:

Prepared Remarks

Questions and Answers

Call Participants

Prepared Remarks:

Operator

Good day, everyone, and thank you all for joining us to discuss Equity Lifestyle Properties’ First Quarter 2020 Results. Our featured speakers today are Marguerite Nader, our President and CEO; Paul Seavey, our Executive Vice President and CFO; and Patrick Waite, our Executive Vice President and COO. In advance of today’s call, management released earnings. Today’s call will consist of opening remarks and a question-and-answer session with management relating to the company’s earnings release. As a reminder, this call is being recorded.

Certain matters discussed during this conference call may contain forward-looking statements in the meaning of the federal securities laws. All forward-looking statements are subject to certain economic risk and uncertainty. The company assumes no obligation to update or supplement any statements that become untrue because of subsequent events. In addition, during today’s call, we will discuss non-GAAP financial measures as defined by SEC Regulation G. Reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures are included in our earnings release, our supplemental information and our historical SEC filings.

At this time, I would like to turn the call over to Marguerite Nader, our President and CEO.

Marguerite Nader — President and Chief Executive Officer

Good morning and thank you for joining us today. To begin, I wish everyone on the call the best in these challenging times. Before we discuss our results, I want to say thank you to the entire ELS team for the work they have done and continue to do since the COVID-19 crisis began. We have adapted procedures with the safety of our employees and customers in mind, while also continuing to serve our residents and customers in a difficult environment. We have seamlessly transitioned to work-from-home in our corporate and regional offices. The effort and dedication that our teams have shown during these past five weeks is admirable. We have successfully navigated through new regulatory protocols and operating environments at an impressive pace, while maintaining our high quality standards. I am proud of our team.

Our first quarter was strong with an NOI growth rate of 5.2%. We saw strong demand on the MH side of the business, with a 4.9% increase in rental revenue. We wrapped up our snowbird season and have a total RV revenue growth rate of 4.8%. The drivers in that revenue were a 7.4% growth rate in annual revenue, a 7% growth rate in seasonal revenue and a 7.6% decline in transient revenue.

Let me first address our MH business. Since the middle of March, we have taken steps to increase social distancing, include closing the common area amenities and opening our offices by appointment only. We have been and remain focused on ensuring the health and well-being of our employees, residents, members and guests. Our customers have appreciated the importance of these steps and have followed the new guidelines. We have an occupancy rate of 95% in our core portfolio. We have often focused on the occupancy rate, but at this time, I think it’s important to focus on the quality of our resident base. Our residents are homeowners who have generally paid cash for their home. Our residents are committed to their communities, they care about the community and they actively display a pride of ownership in their homes. Our overall occupancy consists of less than 6% renters. We see our renters as future owners. In 2019, 33% of all home sales were the result of a renter conversion. In April, we saw continued strength in MH platform, with 96% of our residents paying us timely. We have a deferral plan in place for April rental payments for those residents facing financial hardship due to the impact of COVID-19.

Moving to our RV business, we have had an acquisition strategy over the years of buying RV resorts that are heavily focused on annual and seasonal revenue streams. 80% of our RV revenue is longer term in nature and 20% come from our Transient customers. Our properties have been impacted by local shelter and place orders which call for reduced or eliminated travel activity inside a jurisdiction. Our RV annual customer generally has developed roots at the community. The annual customer tends to own a park model, resort cottage or has an RV on the site that has add-ons that create a more permanent footprint. For the first quarter, the annual revenue grew by 7.4%, comprised of 5.8% rate and 1.6% occupancy. Our northern RV resorts generally open in April. Our annual customers at these locations pay a deposit in advance and then complete their payment when they arrive for the season. These are summer homes and weekend getaways for our customers. This year the opening of 46 of our RV resorts has been delayed until at least the end of April. While we have begun collecting the annual rent due, the delay in opening has caused a change in the normal payment pattern for these customers.

Our seasonal revenue stream comes from customers who have a reservation of 30 days or more. Our seasonal revenue primarily comes from our sunbelt locations with 70% of the revenue generated between November and March. The first quarter, which represents half of the full year anticipated seasonal revenue grew by 7%. The second quarter seasonal revenue is generally our slowest quarter with approximately 15% of the overall seasonal revenue in 2019, occurring in the second quarter. For April, we have seen a decline in seasonal revenue as described in our press release.

Our transient business represents under 6% of our total revenue. We have always said that this piece is the most difficult to forecast. Our transient customer stays with us an average of three nights. The transient business serves an important role for us as we seek to convert that transient customer to a seasonal or annual customer. Most of our RV resorts have a small portion of their overall revenue stream focused on the transient business, which becomes a lead generator for the rest of the business. Towards the end of March, we stopped accepting transient reservations for the remainder of March and all of April. As a result, the following shelter-in-place orders, we reduced activity to protect our employees and residents from any potential risks associated with transient traffic. At this point, the shelter-in-place orders are limiting our ability to accept transient reservation.

With respect to our membership business, we have seen strong demand from the members during this pandemic. As shown in our supplemental, cash receipts are similar to this year to last year at this time. We made the decision to withdraw guidance because we are operating under unprecedented conditions and thought it would be more meaningful for us to provide an outlook when there are updates to regulatory protocol.

Our business has held up extremely well during these circumstances. We are seeing the best of humanity from our employees, residents, guests and members. We have often described a sense of community at our properties and we have seen these in full display over the past month. We see neighbors caring for neighbors, working together to support the greater community. The demand is high for our property that is seen by our April results. Based on feedback that we have received, our customers are very much looking forward to enjoying the outdoors lifestyle at our properties this season.

I would like to close, by again thanking our employees, residents and customers. The ELS team has reacted to an evolving climate in an impressive manner, and for that I’m grateful.

I will now turn it over to Paul to walk through the numbers in detail.

Paul Seavey — Executive Vice President and Chief Financial Officer

Thank you, Marguerite, and good morning everyone. I will provide an overview of our first quarter results, highlight operating performance in April, including the results of our recent annual property and casualty insurance renewal and discuss our balance sheet and liquidity position.

For the first quarter we reported $0.59 normalized FFO per share. Our results reflect the initial impact of COVID-19, which primarily affected our transient RV business. Core MH rent growth of 4.9% includes 4.4% rate growth and approximately 50 basis points related to occupancy gains. Core RV rental income from annuals and seasonals outperformed expectations for the quarter. Our transient revenues, which were pacing ahead of guidance through February ended the quarter down 7.6% compared to last year. As Marguerite mentioned, we began closing our reservation grid to incoming customers in mid-March. First quarter membership dues revenue, as well as the net contribution from upgrade sales were higher than guidance. Dues revenues increased 6.1% as a result of rate increases and an increase in our paid member count of 4.3%.

During the quarter we sold approximately 3,200 Thousand Trails camping passes. We upgraded 727 members during the quarter, 15% more than the first quarter last year. Core utility and other income was in line with guidance for the quarter and includes the year-over-year increase in real-estate tax pass-throughs resulting from the Florida reassessments we discussed in January.

First quarter core property operating maintenance and real-estate tax expenses were unfavorable to forecast, mainly as a result of higher than expected R&M expenses. We incurred expenses to recover from storms in California and certain northern properties.

In summary, first quarter core property operating revenues were up 5.4% and core NOI before property management increased 5.2%. Property operating income from the non-core portfolio, which includes our Marina portfolio, as well as assets acquired during 2019 was $2.8 million in the quarter. Overall, the acquisition properties continue to perform in line with expectations.

Property management and corporate G&A were higher than guidance in the quarter because of the timing of expenses related to certain administrative matters. Other income and expenses generated the net contribution of $1.4 million for the quarter. Ancillary, retail and restaurant operations were impacted by COVID-19 and were lower than expected. Interest and related amortization was $26.1 million and includes the impact of the refinancing we completed during the quarter. I’ll provide some detail on this transaction shortly when I discuss our balance sheet.

We included a COVID-19 update with our earnings release and supplemental financial information. In addition to describing our operational response to the pandemic, the update highlights cash collections and liquidity as indicators of April performance. In our MH properties, we’ve collected 96% of April rent. The collection rate is net of approximately $180,000 of rent deferral requests we’ve approved. Our largest population within the MH portfolio age qualified properties have the highest collection rate at 97% collected. Our renter population, while a very small portion of our portfolio, has the lowest rate of collection with approximately 91% collected.

At this time of the year, our RV collection efforts are focused on the northern resorts, annual customers as they typically are returning to begin their season of camping. As detailed in the update, 46 of these properties have delayed openings, which has affected typical payment patterns. To-date, we have collected approximately 61% of the April and May annual RV renewals as compared to 71% collected at this time last year. Our seasonal revenue in April was impacted by cancellations as certain customers chose to leave early. However, we also saw customers extend their stays and are currently showing a revenue decline of 12% in April.

Our last update relates to our recent property and casualty insurance renewal. On April 1st, we completed the renewal of our property general liability, workers comp and other ancillary insurance programs. While terms and conditions are substantially similar to the expiring policies, adverse market conditions resulted in a higher than expected premium increase of 27%. The resulting insurance expense for the remainder of the year is approximately $1.1 million higher than our expectation.

Now, I’ll discuss our refinancing activity in the first quarter, highlight current secured debt market conditions and provide some comments on our balance sheet, including our current liquidity position. During the quarter, we closed a $275.4 million secured facility with Fannie Mae. The loan is a fixed interest rate of 2.69%. which is the lowest coupon we’ve seen on a secured 10-year deal in the MH, RV space. With the proceeds, we’ve repaid our secured debt maturing in 2020, which carried a weighted average interest rate of 5.2% and the outstanding balance in our line of credit. The remaining proceeds funded working capital, primarily our expansion activity.

As I provide an update on the secure debt market, bear in mind that the current environment is quite volatile. Conditions have been changing rapidly and we anticipate they’ll continue to do so for some time. That said, current secured financing terms available for MH and RV assets range from 55% to 75% LTV, with rates from 3% to 3.75% for 10-year money. As we’ve seen in challenging times in the past, sponsor strength is highly valued by lenders and ELS continues to be highly regarded. High quality aged qualified MH will command preferred terms from participating lenders.

As mentioned in our earnings release, subsequent to quarter-end, we borrowed $100 million from our line of credit. In these uncertain times, we decided it was prudent to increase our available cash balance. As noted on our COVID-19 update page, we have a current available cash balance of $126 million with no debt maturing in 2020. We continue to place high importance on balance sheet flexibility and we believe we have multiple sources of capital available to us. Our debt to EBITDA and our interest coverage are both around 4.9 times. The weighted average maturity of our outstanding secured debt is almost 13 years.

Now, we would like to open it up for questions.

Questions and Answers:

Operator

[Operator Instructions] Our first question comes from Nicholas Joseph with Citi. Your line is now open.

Nicholas Joseph — Citigroup Inc — Analyst

Thank you. Just on the transient RV revenue, I was wondering if you could break out the percentage of the total year; that’s Memorial Day and then July 4, and then Labor Day weekends.

Paul Seavey — Executive Vice President and Chief Financial Officer

I think Nick as we laid it out, in the supplemental you can see the contribution from prior year. But at this point I think that — you know I think that you would look to those numbers as the indicator of the amounts.

Marguerite Nader — President and Chief Executive Officer

And I think as we said in the past, so not talking about the future here, as we said in the past, May Memorial Day represents about a third of our overall Memorial Day traffic, our overall May transient traffic.

Nicholas Joseph — Citigroup Inc — Analyst

Okay, so Memorial Day, the 3rd of May and then that’s in the supplemental in terms of each of the months in the second quarter.

Marguerite Nader — President and Chief Executive Officer

Right.

Nicholas Joseph — Citigroup Inc — Analyst

Great, thanks. And I’m just wondering you know if you have a sense on the private side of — if your experience so far both on the MH and the RV. It’s similar to what you expect on the private side or do you expect additional stress there that may ultimately lead to different acquisition opportunities on the other side of this.

Marguerite Nader — President and Chief Executive Officer

Yes. It’s interesting that one of the things that’s happened during this pandemic is there has been a lot of discussion with operators. We’ve kind of gotten together to talk about what’s happening, so that we have an appreciation, since we are kind of all in this together. And from that and certainly some of the smaller operators, I think there may be an opportunity, but right now it’s more about kind of exchanging best practices and really being just good community stewards at this point. And should there be something that comes out as a result of that because people are interested in selling that, that could be interesting.

Nicholas Joseph — Citigroup Inc — Analyst

Thanks.

Marguerite Nader — President and Chief Executive Officer

Thanks Nick.

Operator

Thank you. And our next question comes from Joshua Dennerlein with Bank of America. Your line is now open.

Joshua Dennerlein — Bank of America Merrill Lynch — Analyst

Hey Marguerite, hey Paul. Hope you’re doing well?

Marguerite Nader — President and Chief Executive Officer

Hello Josh.

Joshua Dennerlein — Bank of America Merrill Lynch — Analyst

Curious, on the — looks like we canceled the April notice for the MH increase. What percent of the portfolio is subject to that kind of April notice, and kind of do you have any expectations on going forward, if that’s something like as the pandemic passes, you’d be able to push through.

Paul Seavey — Executive Vice President and Chief Financial Officer

Yeah. So the suspension took place in April. When you think about our rent increase process overall, those notices are generally sent 90 days prior to the effective date. So the April notice is generally suspended increases that would have been effective August 1st and just keep in mind, that rent increase calendar therefore, it’s kind of a fiscal calendar, so September through August are the notice dates for increases that would be effective January through December. We had sent notices to more than 70% of our MH residents by the time we got to April and April, the month itself is a relatively small percentage, kind of single digits type percentage. The notices that we had sent prior to April were consistent with the 4% rate growth that we had expected. So when you think about math, if you want to kind of figure out what it might translate into, just the math would suggest maybe 50 basis points on our expected rate growth.

Joshua Dennerlein — Bank of America Merrill Lynch — Analyst

Okay, thank you, I appreciate that. And then, you enacted a rent deferral program. Was that for MH and RV or just the MH side and has anyone at this point requested to defer April rent?

Patrick Waite — Executive Vice President and Chief Operating Officer

Yeah, its Patrick. The deferral program was rolled out for April rent and it provided the opportunity initially in MH for a resident to request a deferral of part of all of April rent to be repaid over the following three months. We had a small number of requests from our RV annual base across the portfolio. But that said, it’s a small number relative to the total which on the MH side is in the neighborhood of $180,000, $200,000, which represents a few basis points, 30 basis points, 40 basis points total collections.

Marguerite Nader — President and Chief Executive Officer

And the way we kind of got to that policy was in really, harkening back to my answer in the last question was just having conversations with owners and operators and trying to have an understanding of what others were doing, how we thought it was going to impact our properties and we think it’s worked out very well and it is for those who have been impacted by COVID-19, which were you know — those were the results of what we’ve seen so far.

Joshua Dennerlein — Bank of America Merrill Lynch — Analyst

Okay, thank you. Just one follow-up on that. Have you guys thought about having the same program for May or is it too early at this point?

Marguerite Nader — President and Chief Executive Officer

Yeah, I think it’s a little bit early. You know as we thought about coming out with that — probably wanted to come out at the same time we normally do, but we’ll certainly provide updates as we have updates.

Joshua Dennerlein — Bank of America Merrill Lynch — Analyst

Okay, thank you everyone. Appreciate it.

Marguerite Nader — President and Chief Executive Officer

Thanks Josh.

Paul Seavey — Executive Vice President and Chief Financial Officer

Thanks Josh.

Operator

Thank you. And our next question comes from John Kim with BMO Capital Markets. Your line is now open.

John Kim — BMO Capital Markets — Analyst

Thank you. Can you just clarify your decision to open the northern RV resort and also take steps to transient RV reservation? Would that be based solely on the state and local shelter-in-place regulations or will this be in any case more of a companywide decision?

Marguerite Nader — President and Chief Executive Officer

No, I mean the state shelter-in-place orders were really the large part of the impetus for the decisions we’ve made regarding reducing traffic at our RV parts of the transient traffic, and we’re working with local counties on their particular order, because in some cases, they may be more restrictive than the state, so it’s all regulatory protocol. So we are working with states and local counties for them to allow that activity. We’re ready to go once that happens, and then in instances like I said, some are pushed to the end of April, which is only 10 days away or nine days away, whatever that is.

John Kim — BMO Capital Markets — Analyst

So you didn’t anticipate potentially being more conservative than the state regulations, opening later than the recommendation.

Marguerite Nader — President and Chief Executive Officer

No, we would anticipate going along with regulatory protocol, similar to what we’ve done in every aspect of this during those last five weeks in terms of our systems that we put in place and we’re operating under the guidelines that we’ve been given and we would continue to do that, but we would see that they would be opening as soon as there is daylight for that to happen from the standpoint of the states or those counties.

John Kim — BMO Capital Markets — Analyst

Okay. The 7.6% decline in transient revenue that you experienced in the first quarter, how much of that was demand driven versus your decision to halt reservations?

Marguerite Nader — President and Chief Executive Officer

It was primarily our decision in that. It was toward — Patrick, correct me, I think it’s toward the middle of March or March 18th or something, where we just said that this seems like an opportunity for us that we would prefer to kind of stop the traffic going in and out and then we made that decision and I think it proved to be the absolute right decision for our customers and for our employees and then it was also couple of weeks after that, that decision was made, the shelter-in-place orders were put in place across the state.

John Kim — BMO Capital Markets — Analyst

Once we start accepting reservations again in transient, do you anticipate demand being there or I’m just wondering if there’s any way that you could track customer demand or leads in transient RV?

Marguerite Nader — President and Chief Executive Officer

I mean, we are seeing a real desire to get out and camp. We’re seeing a desire for people to be outdoors. What’s holding them back is the shelter-in-place. So we don’t see any decrease in demand. If anything, an increase and an excitement of getting outside, getting out of the four walls of their home.

John Kim — BMO Capital Markets — Analyst

Marguerite, you mentioned the strong demand in Thousand Trails during the pandemic. Can you remind us what the customer experience is like today? Are members allowed to go physically into your camping ground?

Marguerite Nader — President and Chief Executive Officer

Sure. So there’s many TT members right now who have been able to use the system and they are actually currently sheltering in place at our property, so that — I think that’s been positive and they’ve been very pleased about being able to do that. In some instances, in all instances we’ve actually reduced the regulation or rules around the amount of time that one can spend in a particular property and that has been very well received, so that we — that was just another way for us to reduce the movement around the system and around the country.

John Kim — BMO Capital Markets — Analyst

Okay, thank you.

Marguerite Nader — President and Chief Executive Officer

Thanks John.

Operator

Thank you. And our next question comes from Todd Stender with Wells Fargo. Your line is now open.

Todd Stender — Wells Fargo Securities — Analyst

Hi, thanks. I hope you guys are all well?

Marguerite Nader — President and Chief Executive Officer

Yes, thank you. You too. Good morning.

Todd Stender — Wells Fargo Securities — Analyst

Good morning, thanks. I guess kind of moving toward home sales, Q1 numbers especially with new homes were pretty solid, but can you maybe speak to March as the COVID news certainly took hold and maybe looking back at rental conversions, how do you think that looks going forward?

Paul Seavey — Executive Vice President and Chief Financial Officer

Let me just comment on the quarter first. It was a solid quarter for new home sales, up 70% year-over-year and we saw broad strength across the portfolio. Florida had a very good quarter as did Arizona, Nevada and really across all of our northern markets as well. So from a demand perspective coming out of the quarter, it’s been very favorable. From a renter conversion perspective, and keep in mind we also look at existing residents either upsizing to a new home or downsizing to a smaller home. Total conversions were 27% for the quarter. That’s kind of in the range that’s been consistent over the last several quarters, up 25% to 30% and three quarters of those were conversions, renters who were either renting an ELS home or renting another home on site. So still a very sticky customer and very much interested in buying homes and setting up long term residency at our communities. You know how that’s going to translate into you know shelter-in-place and moving out of shelter-in-place, it’s difficult to say. You know reduced contingency, that’s our demand profile coming out of the quarter.

Marguerite Nader — President and Chief Executive Officer

And yeah Todd, we were pretty excited originally to talk about the new home sales, because I think our team did a great job in new home sales in the quarter, but obviously there were other things that took precedent to discussing, but the team did a great job on new home sales in the quarter.

Todd Stender — Wells Fargo Securities — Analyst

Great. Okay, that’s helpful. And then Paul, on just with the rent deferral, how are you accounting for that? We certainly see it with retail. We covered the triple net lease space. So with a certain level of certainty, do you think you can collect rent, you certainly book it in FFO? How do you look at that from a resident standpoint and their cash?

Paul Seavey — Executive Vice President and Chief Financial Officer

Right. I mean that’s certainly a relevant question. I’d say for us Todd it is an extremely small number as we’ve talked about, so we’re evaluating it just in the ordinary course as we take a look at collectability and would otherwise offset our revenues if and when we determine it’s not collectible, but again, its 30 basis points to 40 basis points.

Marguerite Nader — President and Chief Executive Officer

And I think it will be important as we turn the calendar to May, certainly each one of these deferrals signed an agreement and so as we turn the calendar to May to see how the May payments are coming in, that will inform our views as well.

Todd Stender — Wells Fargo Securities — Analyst

Okay, got it. Just last one, when it comes to business interruption insurance, certainly we see this with you guys when hurricanes hit and events like that, but policies generally don’t cover or they only apply to property damage and they don’t apply to maybe pandemics. Do you have any context there with how this applies to you guys?

Paul Seavey — Executive Vice President and Chief Financial Officer

Yeah, I think generally speaking your comments are accurate. I do think this is an area that had been the subject of quite a bit of discussion, so it remains to be seen. With respect to the policies bound April 1st, I think there was clarification in the language, but as to policies in place prior to the pandemic, it’ll probably continue to be a topic of discussion.

Todd Stender — Wells Fargo Securities — Analyst

Got it. Thank you.

Marguerite Nader — President and Chief Executive Officer

Thanks Todd.

Operator

Thank you. And the next question comes from John Pawlowski with Green Street. Your line is now open.

John Pawlowski — Green Street Advisors — Analyst

Thanks, good morning. Paul, just maybe a follow-up question on the impact of the suspension of the MH rent increases. Is it 50 bips on total portfolio MH rate growth for 2020? Did I interpret that correctly?

Paul Seavey — Executive Vice President and Chief Financial Officer

Yeah, that’s what the math — again, you’re right. I’m trying to be careful with respect to guidance since we withdrew it, but just the math, based on the number of notices remaining and the timing of their effectiveness in 2020, it’s about 50 basis points from our expected growth of 4%.

John Pawlowski — Green Street Advisors — Analyst

Got it. Okay. And then Patrick, curious for some commentary on what you’re seeing on the occupancy side on the MH and split between age-restricted and family. Are you seeing any markets in either segments in April? Is occupancy declining anywhere in any sense of magnitude, if so?

Patrick Waite — Executive Vice President and Chief Operating Officer

I think it’s early to say with respect to April, but maybe just going up a level and just looking at the composition of our all-age and our age-qualified portfolio, overall we’re 70% age qualified. The average age of that resident is in the early 70s. It’s a baby boomer, they’re retired. The average age in our all age portfolio is in their late 50s. It skews a little higher because of the locations that we have in retirement destinations and just the amenities and activities of our properties overall. So even in the age qualified, we tend to skew toward baby boomers and retirees, whose income is really based on retirement savings, social security and less so in employment and paychecks. So they tend to be very resilient in periods of job disruptions. I did in my previous company run a large all-age portfolios and the job disruption in the great recession ended up resulting in an increasing vacancy over a period of time that was then replenished over-time as the economy stabilized and we had residency that are relocating to different markets or different states in order to seek employment and we also saw people kind of moving down to a more affordable housing choice. But for our portfolio, again 70% each qualified properties and for all-age properties behaving in many ways similar to age qualified. I don’t see the driver of the job disruption having as greater impact.

John Pawlowski — Green Street Advisors — Analyst

Okay. Understood. But I guess the quick — or just maybe the succinct question is, just given the sheer number of layoffs you see today, is it reasonable to expect that your family communities see some diminution in occupancy? Or you really wouldn’t underwrite that at — from what you see on the ground today?

Marguerite Nader — President and Chief Executive Officer

I mean, I think that what you’re seeing on our family community skewed toward the older, as Patrick mentioned, but certainly when you look at, you look at Nevada for instance, I mean you are seeing currently high unemployment rates there and we have property there. So I’d say by region you would look at it, but I think that there certainly will be some impact in those locations, but we do skew toward the older demographic even on the family side. So I think that’s what will decrease the impact.

Paul Seavey — Executive Vice President and Chief Financial Officer

And just to frame that John, I mean Nevada as an example is right around 5% delinquent for April. So as Patrick says, its early and we are trying to read tea leaves here but there’s a lot to watch.

Marguerite Nader — President and Chief Executive Officer

And then the timing with — I mean Nevada is a function of the casinos, etc coming back and when that happens and that type of thing. So we’re focused on all of it, but it’s a relatively small piece of our business.

John Pawlowski — Green Street Advisors — Analyst

Okay. No, understood. Maybe one last one from me. Paul, I know the expense savings are probably going to be minimal, at least in the first half of the year. What does — can you give us a sense of magnitude, what does the playbook look like in the second half of ’20 and 2021? If demand remains low in the RV business, like, what kind of expense levers are there to pull in the second half? And can you give — humor us with a rough dollar number of cost savings that you’re proactively looking to grab in the back half of this year or early 2021?

Paul Seavey — Executive Vice President and Chief Financial Officer

Well, I can focus on the first part of your question. The last part of your question I’ll probably set aside for another day, but just broadly when you think about our overall property operating and maintenance expenses, when you exclude the real-estate taxes, that’s about 80% of our expense base. Inside of that, about 10% are fixed. So insurance premiums, software and other expenses that support the business, so when you think about the remaining 90% that have some level of variability, and I think you’ve focused on the RV, which I think is right, because to the extent the MH portfolio maintains a consistent level of occupancy, we wouldn’t see much variability there. But inside RV, depending on the date when the normal operations resume, there’s something of a built-in hedge in expense line items like payroll and utilities and then R&M and admin, they could see reductions as well that could be just lower spend on supplies and other items that are needed for run rate operations. So that’s how I’d frame it, but I’m going to stop before I try to suggest a dollar amount or impact.

Marguerite Nader — President and Chief Executive Officer

And I think John, to just — and I think we talked about this before just from considering an example, a highly transient property, a highly transient RV property comes with it a higher level of payroll just because there’s generally more activities, there’s more people checking in and checking out, you need more people to do that, so there’s a direct correlation. If you’re not seeing that — I wouldn’t say as not seeing, because the demand I think is definitely there. If we’re not able, OK, then you have that kind of immediate adjustment to payroll just because there’s just not the activity level there. So that’s where I would see it, being able to impact with the staffing.

John Pawlowski — Green Street Advisors — Analyst

Okay, great. Thank you for the time.

Marguerite Nader — President and Chief Executive Officer

All right, thanks John.

Paul Seavey — Executive Vice President and Chief Financial Officer

Thanks John.

Operator

Thank you. And our next question comes from Samir Khanal with Evercore ISI. Your line is now open.

Samir Khanal — Evercore ISI — Analyst

Good morning, Marguerite. I guess just a clarification. I got on the call a little bit late, so I apologize. On the RV annuals, I think in the press release you said for the April and May lease renewals you’ve collected 61% of certain installment rent payments that you were 10% below the same time last year. I mean, I’m just trying to clarify, does that mean you’re sort of losing customers here; does that mean collections are coming in — you anticipate collections to come in sort of at a later date here?

Paul Seavey — Executive Vice President and Chief Financial Officer

I think what it highlights is the payment schedules for the RV annual customers that differ based on their renewal date. So the focus at this time of the year Samir is those April and May renewals, mainly consists to the northern RV resorts, and those customers tend to make their installment payments when they arrive at the beginning of the summer season. So the closures that we’ve noted have affected the timing of those payments, but we are pleased to be in a place where we’ve collected more than 85% of what we had collected last year at this time.

Marguerite Nader — President and Chief Executive Officer

And just to follow-up, this was — I had kind of touched on this in the beginning, but when our customers leave after the summer, they provide a deposit as Paul has mentioned, but they leave their park model, the resort cotter, the RV onsite at the property and return for the following season. And the first few weeks of every season are really generally a time for our customer to prepare their second home for the summer season. The activity of the property really starts to accelerate as the summer weather moves in, and so that’s kind of what we’re seeing as we’re making calls to our customers, we are seeing a lot of people very anxious to come and get out of their locations where they are and come to our properties.

Samir Khanal — Evercore ISI — Analyst

Okay, thanks for that.

Marguerite Nader — President and Chief Executive Officer

Okay, thanks Samir.

Operator

Thank you. At this time, I’d like to turn it back over to Marguerite Nader for closing comments.

Marguerite Nader — President and Chief Executive Officer

Thank you for joining us on the call today. I look forward to providing further updates about our business. Thanks and stay well.

Operator

[Operator Closing Remarks]

Duration: 39 minutes

Call participants:

Marguerite Nader — President and Chief Executive Officer

Paul Seavey — Executive Vice President and Chief Financial Officer

Patrick Waite — Executive Vice President and Chief Operating Officer

Nicholas Joseph — Citigroup Inc — Analyst

Joshua Dennerlein — Bank of America Merrill Lynch — Analyst

John Kim — BMO Capital Markets — Analyst

Todd Stender — Wells Fargo Securities — Analyst

John Pawlowski — Green Street Advisors — Analyst

Samir Khanal — Evercore ISI – Analyst

End of Motley Fool Transcript, found at this link here.

##

MHProNews Analysis and Commentary

First, MHProNews is not going to specifically weigh in at this time on the claim in Seeking Alpha that ELS is overleveraged and purportedly overpriced.

However, tangentially, one can noted that their sales numbers are unimpressive. That’s a point that MHProNews – well acquainted on the consulting side of our operation with market and sales in communities and ‘street retailers’ – can make with confidence.

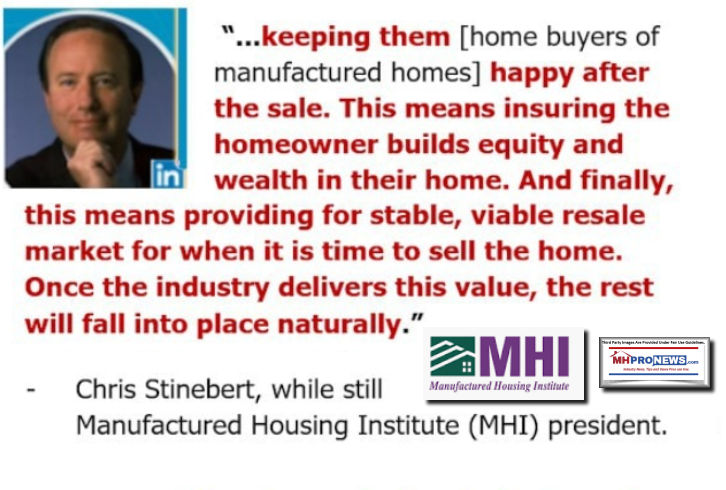

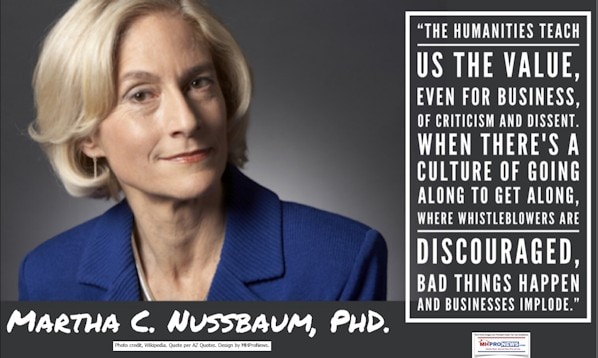

Marguerite Nader’s comments are not necessarily sinister, but they underscore an observation advanced by MHProNews for some time. Specifically, MHI ‘networking events’ are designed in part to create a ‘social attraction’ and ‘social glue’ that yields business acquisitions and other opportunities. There may well be an entirely valid and mutually beneficial exchange of ideas in what Nader described or what an MHI event accomplishes.

But it is precisely because the industry is underperforming in general and has for some twenty years that the impetus to sell out – often at discounted valuations – occurs.

Put differently, Nader unintentionally validated part of the thesis for the Buffett’s Buffett report linked below.

Investors might perceive this as ‘smart business.’ But upon closer inspection, the argument can and should be made that it is counterproductive to investor interests. Affordable housing is in high demand, that’s easy to establish from a simple search on platforms such as Google, Bing, Yahoo or Duck Duck Go.

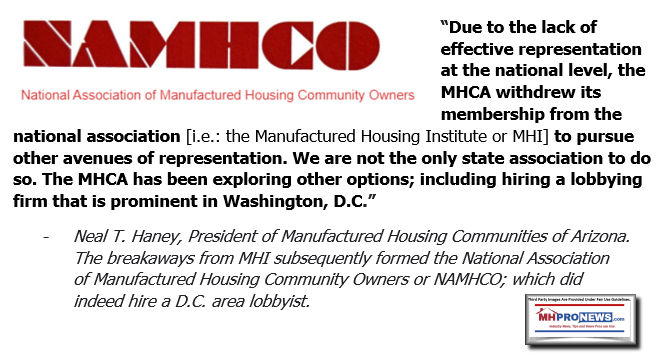

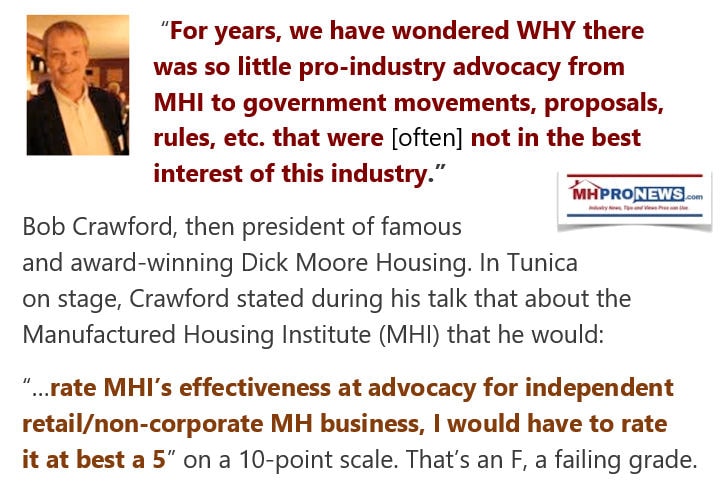

Then if the industry is underperforming – due in some part to ‘moat building’ schemes arguably deployed by Clayton Homes, affiliated Berkshire Hathaway manufactured home lenders and other ‘big boys’ at the Manufactured Housing Institute (MHI), the reality becomes clear that the industry could be doing several times more volume than is currently occurring.

It boils down to an argument that MHI is either incompetent or deviously deceptive in a fashion that benefits their ‘big boy’ members. Take your pick, which case is better for MHI? Either one is problematic, isn’t it?

“MHI Lies, Independent Businesses Die” © – True or False? – Berkshire’s Joanne Stevens Strikes Again

The fact that the ‘big boys’ tolerate apparent conflicts of interest and underperformance are among the prima facie proofs that one could offer in support of the simple notion that MHI is a tool used by a few to consolidate the many. Part of that tool is to foster overall underperformance so that consolidation occurs.

The argument has been suggested that something similar occurred in the automotive industry in the U.S. years ago.

The points to wrap this report on are these.

- There are more insights planned about ELS and their arguable underperformance.

- Whether Seeking Alpha is right or wrong about ELS being ‘overleveraged and overpriced,’ might miss the bigger point that the firm ought to be doing far better on terms of sales, occupancy, expansion of existing communities where possible and the development of new sites.

- More broadly, this is a reminder of key takeaways from the Danny Ghorbani interview linked below.

- The bottom line is that this ELS earnings call arguably demonstrates anew that this specific firm, but others as well, may be performing a fine job in certain aspects of their business plans, but that doesn’t mean that they are doing the best possible job with respect to addressing the affordable housing crisis, taking the best care of resident interests, or providing the highest possible ROI for ethically-minded investors.

- Even investors that embrace the flawed notion of Buffett and his moat-building methods should question if there is more money to make doing things forthrightly than by doing things in a purportedly devious and market-limiting manner.

MHProNews reported that the behaviors of some of the industry giants not only puts smaller businesses at risk, but it also puts larger ones in a more precarious scenario when upheavals occur. Yes, ELS may ride this CCP Virus pandemic out. But they and others will only do so at a serious cost to themselves, to investors, and Americans in general.

Doing what’s right is always the right thing to do.

For those who have not yet come to realize that the system in manufactured housing has purportedly been ‘rigged,’ the question that African American gentlemen poised to that caller applies. “Where the hell have you been?” Industry pros and investors need to “suit up” and get protection. The links below the byline are relevant to this topic. That’s a wrap on your runaway #1 source of manufactured home “Industry News, Tips and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

February 2020, Latest National Manufactured Housing Production Data, MHI and MHARR Comparisons

Are Manufactured Housing Supply Chains in China Threatened by Coronavirus?