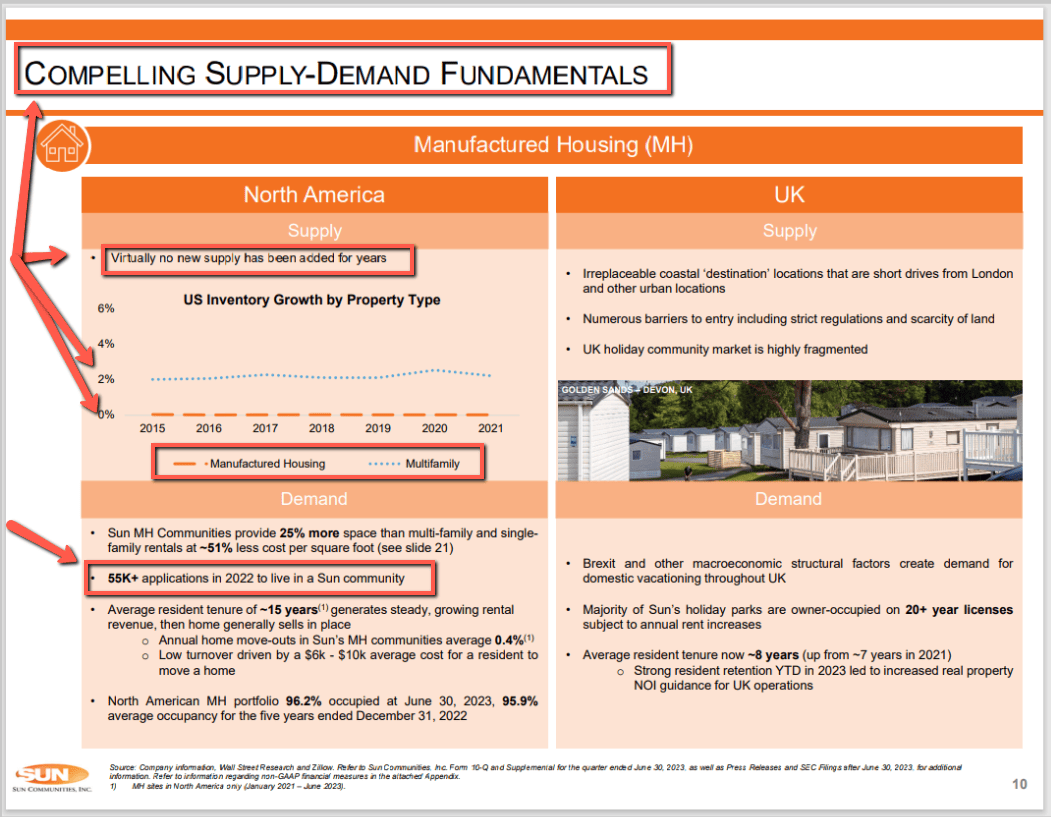

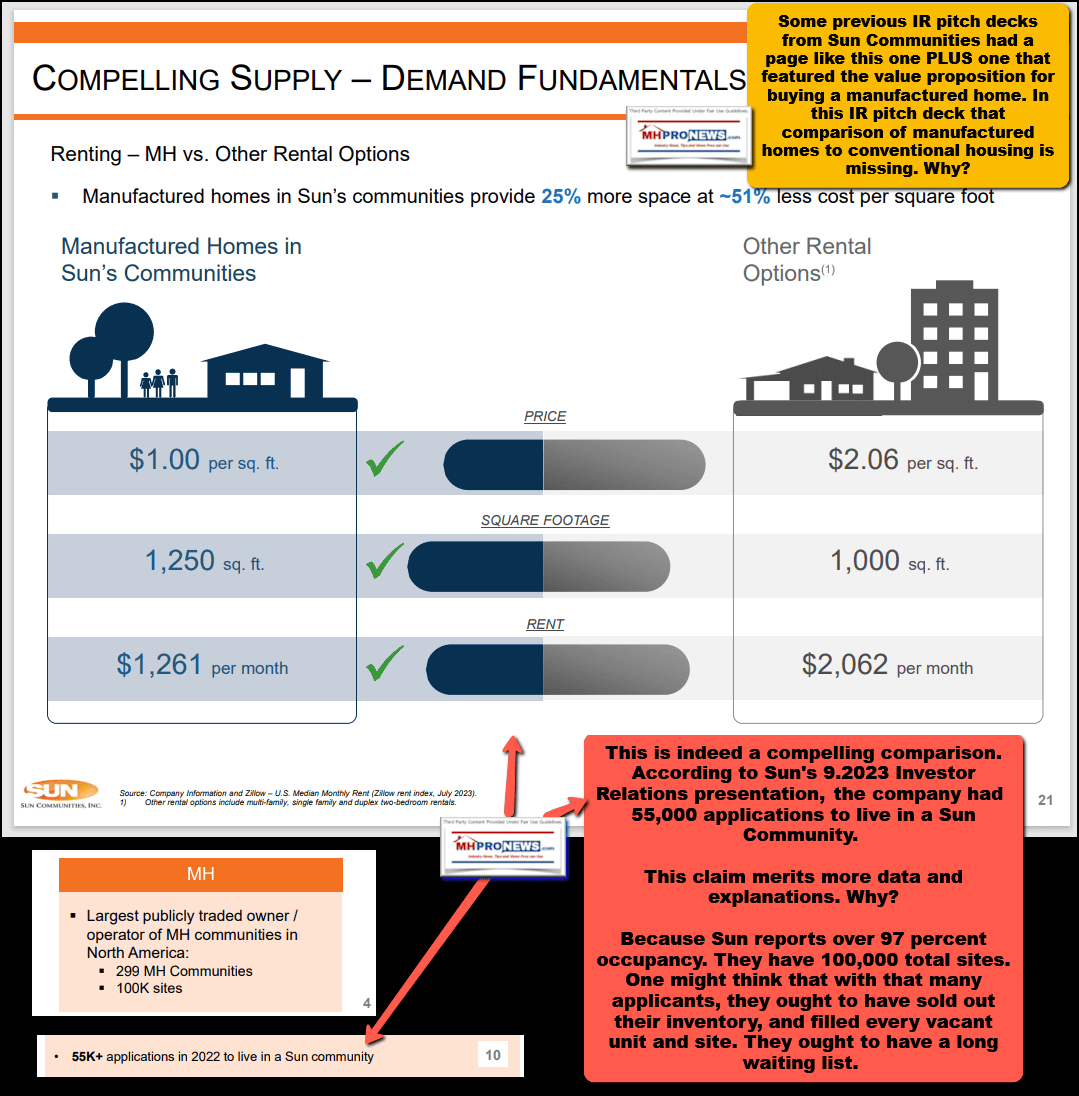

From the most recent Sun Communities (SUI) investor presentations (linked further below) are two of the headline statements. ‘Compelling Supply – Demand Fundamentals’ said SUI’s IR pitch with ‘Virtually No New Supply Has Been Added for Years.’ Those remarks are by a prominent Manufactured Housing Institute (MHI) member with a board position (Sun Communities-SUI) saying the quiet part out loud.

It appears that whatever MHI has said in recent years about their desire to see the Manufactured Housing Improvement Act of 2000 (MHIA) and its enhanced preemption clause should get robust and consistent enforcement by HUD, the apparently unstated MHI agenda at MHI is in alignment with what MHI-NCC members Sun Communities (SUI), Equity LifeStyle Properties (ELS), Flagship Communities, and others in that trade group say that actually holds sway.

Who says?

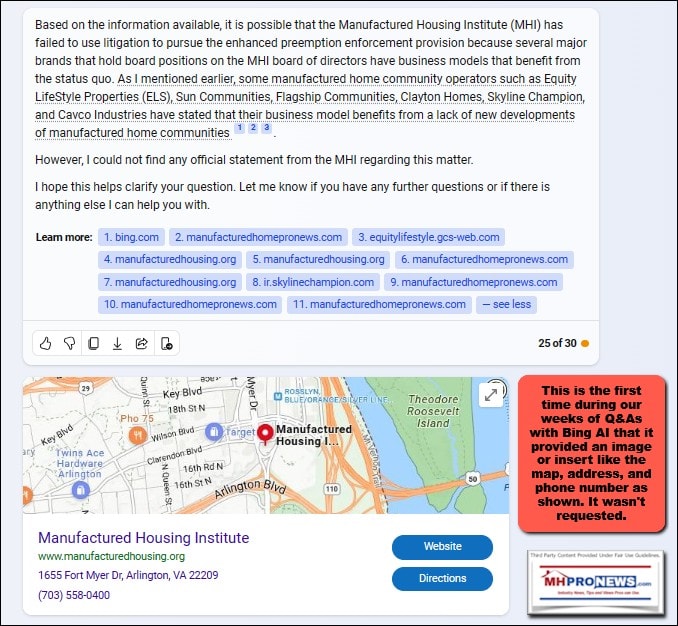

Consider this summary from Bing AI (set in context in Part II, further below). Earlier in this Q&A with Bing AI, Sun Communities (SUI) and others were specifically named. Highlighting, bold, and spacing in what follows are added by MHProNews, but the text/remarks are per Bing AI.

However, there are several MHI members whose publicly stated investor or other information makes clear that enforcing federal preemption could undermine their business model 34.

Additionally, there are no articles or press releases by the MHI on their website that mention enhanced preemption under the Manufactured Housing Improvement Act 1.

By contrast, there are multiple articles on the MHARR website that mention enhanced preemption 24.

Similarly, some Manufactured Housing Institute linked trade media also routinely fail to mention the enhanced preemption provision of the Manufactured Housing Improvement Act of 2000 1.

By contrast, both the Manufactured Home Pro News and Manufactured Home Living News websites have multiple articles that specifically mention enhanced preemption as a tool for opening up more opportunities to sell more affordable manufactured housing 5 6”

So, by de facto allowing restrictions on new development, that dynamic yields a ‘Compelling Supply – Demand Fundamentals’ with ‘Virtually No New Supply Has Been Added for Years.’ In fact, per the known data, there are perhaps thousands of fewer manufactured home communities in existence nationally in 2023 than there were in 2000 (see that linked further below in the Q&A in Part II). All that follows can be framed with those insights and others that follow in mind.

The following (Part I) is Sun’s official press release with investor information for their quarterly and year to date (Y2D) information. It will reflect Sun’s admission that their manufactured home sales are down, among other financial insights.

Part II is additional information with more MHProNews analysis and commentary. It will provide the Sun IR presentation items referenced in the headline and above. It will also provided the full and wide-ranging context for the Bing AI Q&A by MHProNews. In our expert view, it could be one of the most important Q&A’s using Bing AI software to date from the perspective of thousands in the manufactured home industry pros and potentially millions of souls who want access to more affordable housing.

Part III is our Daily Business News on MHProNews macro-markets and manufactured housing connected equities updates.

Notice: unpacking the Sun Communities (SUI) report below should not be construed as an MHProNews endorsement or plug for that investment. Indeed, as a pull quote from Sun’s CEO Gary Shiffman herein will reflect, the case can be made that Sun has acknowledged that it could be perusing a business strategy that could be more rewarding to investors. That alternative Shiffman mentioned may also be less risky in terms of liability, could be better for their residents, and would offer a more genuine and scalable ‘solution’ to the U.S. affordable housing crisis. More on that in Part II.

Part I

Sun Communities, Inc.

Earnings Press Release & Supplemental Operating and Financial Data

For the Quarter and Nine Months Ended September 30, 2023 and 2022

| Forward-Looking Statements | i |

| Earnings Press Release and Guidance | ii |

| Overview | |

| Company Overview and Investor Information | 1 |

| Financial and Operating Highlights | 2 |

| Portfolio Overview | 3 |

| Financial Statements and Reconciliations to Non-GAAP Financial Measures | |

| Consolidated Balance Sheets | 4 |

| Consolidated Statements of Operations | 5 |

| Reconciliation of Net Income Attributable to SUI Common Shareholders to Core FFO | 6 |

| Reconciliation of Net Income Attributable to SUI Common Shareholders to NOI | 7 |

| Reconciliation of Net Income Attributable to SUI Common Shareholders to Recurring EBITDA | 8 |

| Supplemental Disclosure | |

| Real Property Operations – Total Portfolio | 9 |

| Real Property Operations – Same Property Portfolio | 10 |

| Other Operating Information | |

| Home Sales Summary | 13 |

| Operating Statistics for MH and Annual RVs (excluding UK Operations) | 13 |

| Investment Activity | |

| Acquisitions and Dispositions | 14 |

| Capital Expenditures and Investments | 15 |

| Capitalization | |

| Capitalization Overview | 16 |

| Summary of Outstanding Debt | 17 |

| Debt Analysis | 18 |

| Definitions and Notes | |

| Define and provide additional notes related to Non-GAAP financial measures and other capitalized terms | 19 |

Sun Communities, Inc.

Earnings Press Release & Supplemental Operating and Financial Data For the Quarter and Nine Months Ended September 30, 2023 and 2022 Forward-Looking Statements:

This supplemental package contains various “forward-looking statements” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Sun Communities, Inc. (the “Company”) intends that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this document that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical facts are deemed to be forwardlooking statements. Words such as “forecasts,” “intends,” “intend,” “intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” “guidance,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. These forward-looking statements reflect the Company’s current views with respect to future events and financial performance, but involve known and unknown risks and uncertainties, both general and specific to the matters discussed in this document some of which are beyond the Company’s control. These risks and uncertainties may cause the Company’s actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks described under “Risk Factors” contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and in the Company’s other filings with the Securities and Exchange Commission from time to time, such risks, uncertainties and other factors include those described under the heading “Cautionary Statement Regarding Forward-Looking Statements” in the accompanying press release.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. The Company undertakes no obligation to publicly update or revise any forward-looking statements included or incorporated by reference into this document, whether as a result of new information, future events, changes in the Company’s expectations or otherwise, except as required by law.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to the Company or persons acting on the Company’s behalf are qualified in their entirety by these cautionary statements.

Note on Non-GAAP Measures:

This document includes information regarding various non-GAAP supplemental performance measures, including funds from operations (“FFO”), Core FFO, net operating income (“NOI”), earnings before interest, tax, depreciation and amortization (“EBITDA”) and Recurring EBITDA. For information on these non-GAAP measures, please refer to “Reconciliation of Net Income Attributable to SUI Common Shareholders to Core FFO,” “Reconciliation of Net Income Attributable to SUI Common Shareholders to NOI,” “Reconciliation of

Net Income Attributable to SUI Common Shareholders to Recurring EBITDA,” and “Definitions and Notes.”

EARNINGS PRESS RELEASE

October 25, 2023

Sun Communities, Inc. Reports 2023 Third Quarter and Year-to-Date Results

Net Earnings per Diluted Share of $1.31 for the Quarter

Core FFO per Share of $2.57 for the Quarter Exceeded the High-End of Guidance Range

Total Same Property NOI Grew by 6.7% for the Quarter over the 2022 Period, Exceeding the High-End of Guidance Range by 220 Basis Points

Strong Demand and Effective Expense Management Continue to Drive Outperformance

Same Property Adjusted Occupancy for MH and RV Increased by 170 Basis Points, Year-over-Year

Transient-to-Annual RV Site Conversions of nearly 537 Sites for the Quarter and 1,815 for the Year-to-Date

Revising Full-Year Core FFO per Share Guidance for 2023 to $7.05 – $7.13

Increasing Guidance Range for Full-Year Total Same Property NOI Growth to 6.0% – 6.4%

Establishing Preliminary Guidance for 2024 Rental Rate Increases of 5.4% for MH, 6.5% for Annual RV, and 5.6% for Marina in North America, and 7.1% for UK

Southfield, Michigan, October 25, 2023 – Sun Communities, Inc. (NYSE: SUI) (the “Company” or “SUI”), a real estate investment trust (“REIT”) that owns and operates, or has an interest in, manufactured housing (“MH”) and recreational vehicle (“RV”) communities and marinas (collectively, the “properties”), today reported its third quarter results for 2023.

Financial Results for the Quarter and Nine Months Ended September 30, 2023

- For the quarter ended September 30, 2023, net income attributable to common shareholders was $163.1 million, or $1.31 per diluted share, compared to net income attributable to common shareholders of $162.6 million, or $1.32 per diluted share for the same period in 2022.

- For the nine months ended September 30, 2023, net income attributable to common shareholders was $222.8 million, or $1.79 per diluted share, compared to net income attributable to common shareholders of $237.3 million, or $1.97 per diluted share, for the same period in 2022.

Non-GAAP Financial Measures

- Core Funds from Operations (“Core FFO”) for the quarter and nine months ended September 30, 2023, were $2.57 per common share and dilutive convertible securities (“Share”) and $5.76 per Share, respectively.

- Same Property Net Operating Income (“NOI”) increased by 6.7% and 6.6% for the quarter and nine months ended September 30, 2023, respectively, as compared to the corresponding periods in 2022.

“In the third quarter, we again delivered strong performance in our core real property portfolio, with Same Property NOI growth and Core FFO exceeding our expectations,” said Gary A. Shiffman, Chairman, President and CEO. “This strength was exhibited across Manufactured Housing, RV and Marinas, all of which demonstrate the continued favorable backdrop of high demand and limited supply. Furthermore, we are positioned for ongoing organic growth with 2024 expected rental rate increases of approximately 5.4% for MH, 6.5% for RV, and 5.6% for Marina in North America and 7.1% for UK.” He continued, “Our current objectives include implementing select changes to help our best-in-class portfolio deliver the FFO per share growth Sun shareholders historically have enjoyed. These changes include selective capital recycling opportunities and using the proceeds to de-lever. With the strength of our core business, which has a positive track record throughout economic cycles, and our focus on our durable cash flow business, we remain confident in our ability to create shareholder value.”

OPERATING HIGHLIGHTS

North America Portfolio Occupancy

- Total MH and annual RV occupancy was 97.2% at September 30, 2023, as compared to 97.1% at September 30, 2022.

- During the quarter ended September 30, 2023, the number of MH and annual RV revenue producing sites increased by 744 sites, as compared to an increase of 689 sites during the corresponding period in 2022, an 8.0% increase.

- Transient-to-annual RV site conversions totaled 537 sites during the third quarter of 2023 and account for 72.2% of the revenue producing site gains. Total transient-to-annual RV site conversions totaled 1,815 for the nine months ended September 30, 2023.

Same Property Results

For the properties owned and operated by the Company since at least January 1, 2022, the following table reflects the percentage changes for the quarter and nine months ended September 30, 2023:

Quarter Ended September 30, 2023

MH RV Marina Total

| Revenue | 7.4 % | 2.2 % | 8.4 % | 5.5 % |

| Expense | 5.7 % | (0.8) % | 7.4 % | 3.0 % |

| NOI | 8.0 % | 4.1 % | 8.9 % | 6.7 % |

Nine Months Ended September 30, 2023

MH RV Marina Total

| Revenue | 6.8 % | 3.6 % | 9.4 % | 6.2 % |

| Expense | 8.5 % | 3.1 % | 5.1 % | 5.5 % |

| NOI | 6.2 % | 3.9 % | 11.5 % | 6.6 % |

| Number of Properties | 288 | 161 | 119 | 568 |

Same Property adjusted blended occupancy for MH and RV increased by 170 basis points to 98.8% at September 30, 2023, from 97.1% at September 30, 2022.

INVESTMENT ACTIVITY

During the quarter ended September 30, 2023, the Company:

- Expanded its existing communities by nearly 170 sites.

- Delivered over 70 sites at one ground-up development property.

BALANCE SHEET, CAPITAL MARKETS ACTIVITY AND OTHER ITEMS

As of September 30, 2023, the Company had $7.7 billion in debt outstanding with a weighted average interest rate of 4.1% and a weighted average maturity of 6.8 years. At September 30, 2023, the Company’s net debt to trailing twelve-month Recurring EBITDA ratio was 6.1 times.

During the quarter, the Company entered into interest rate swap contracts to hedge variable rate borrowings of $125.0 million in aggregate under its senior credit facility. The interest rate swaps lock in a weighted average SOFR rate of 4.771%, and inclusive of spread, an all-in rate of 5.681% through the maturity date of April 7, 2026.

Subsequent to the quarter, the Company:

- Entered into an interest rate swap contract to hedge variable rate borrowings of $25.0 million under its senior credit facility. The interest rate swap lock in a weighted average SOFR rate of 4.684%, and inclusive of spread, an all-in rate of 5.594% through the term loan maturity date of April 7, 2026.

- Terminated one SOFR interest rate swap hedging variable rate borrowings of $50.0 million under its senior credit facility and received a cash settlement payment of $6.0 million. The net accumulated gain is included in Accumulated other comprehensive income on the Company’s Consolidated Balance Sheets, and will be amortized as a reduction to Interest expense over the term of the hedged transaction.

- Entered into a new mortgage term loan for $252.8 million that matures in November 2030 and bears interest at a fixed rate of 6.49%. The proceeds were used to repay $117.8 million of mortgage term loans that mature in 2023 and pay down amounts drawn under the Company’s senior credit facility.

- Sold its 41.8 million share position in Ingenia Communities Group (ASX: INA), generating $102.5 million of proceeds, net of underwriting and other estimated fees, with an estimated realized loss of $9.0 million. The proceeds were used to pay down amounts drawn under the Company’s senior credit facility.

UK Notes Receivable from Real Estate Operators

From time to time, the Company extends loans to third party real estate developers and operators to facilitate the Company’s potential acquisition and development pipeline. At September 30, 2023, the Company had a $361.1 million note receivable due from Royale Holdings Group HoldCo Limited, a real estate development owner / operator in the UK, and certain other parties (the “Note”). As of the same date, the borrowings under the Note bear interest at a weighted average rate of 12.4%. The Note is not related to the Company’s manufactured housing portfolio in the UK that operates under the Park Holidays brand.

Since inception, the Company has elected to measure the Note at fair value, using pricing models with the assistance of third-party valuation specialists, in accordance with Accounting Standards Codification Topic 820, “Fair Value Measurements and Disclosures.” The Company has also periodically engaged third party valuation specialists to appraise the collateral in order to assess the fair value of the Note.

The Note is collateralized by a first-priority security interest in three real estate properties and three MH manufacturers in the UK. The real estate collateral consists of MH development properties that comprised a significant majority of the total appraised value of all collateral securing the Note at September 30, 2023.

The Note matured on July 31, 2023, and remained due at September 30, 2023. On September 29, 2023, the Company appointed receivers over the real estate collateral and is assessing courses of action with respect to the other collateral.

The Company expects the receivers to start to market the real estate collateral for sale during the fourth quarter of 2023. Upon completion of the marketing process, the Company may elect to credit bid certain amounts due under the Note for the real estate collateral. If that were to occur and no third-party bid is received that exceeds the Company’s credit bid, the Company may elect to receive the real estate collateral in satisfaction of related amounts due under the Note. If a third-party bid is received that exceeds the Company’s bid, the Company will receive the cash proceeds of that bid up to the outstanding loan amount including interest, fees, and penalties, as applicable.

UK Contemplated Asset Sale

As previously disclosed, the Company had agreed to sell an operating MH community in the UK, Sandy Bay, in February 2023, which was expected to close in the third quarter. While the sale contract is no longer in effect, the asset remained classified as held for sale at September 30, 2023.

2023 GUIDANCE UPDATE

The Company is updating full-year 2023 and establishing fourth quarter 2023 guidance for diluted EPS and Core FFO per Share as follows:

Fourth Quarter

Full-Year Ending December 31, 2023 Ending

Reconciliation of Diluted EPS to Core FFO per Share Prior FY Guidance Revised FY Range December 31, 2023

| Diluted EPS | $ | 2.11 $ | 2.25 $ | 1.92 $ | 2.00 $ | 0.12 $ | 0.20 |

| Depreciation and amortization | 5.07 | 5.07 | 5.06 | 5.06 | 1.26 | 1.26 | |

| Distributions on preferred OP units | 0.09 | 0.09 | 0.09 | 0.09 | 0.02 | 0.02 | |

| Noncontrolling interest | 0.11 | 0.11 | 0.09 | 0.09 | (0.01) | (0.01) | |

| Gain on sale of assets | (0.28) | (0.28) | (0.25) | (0.25) | (0.07) | (0.07) | |

| Business combination expense and other acquisition related costs | 0.09 | 0.09 | 0.12 | 0.12 | 0.01 | 0.01 | |

| Other adjustments(a) | (0.10) | (0.10) | 0.02 | 0.02 | (0.05) | (0.05) | |

| Core FFO(b) per Share | $ | 7.09 $ | 7.23 $ | 7.05 $ | 7.13 $ | 1.28 $ | 1.36 |

- Other adjustments consist primarily of deferred taxes, changes in remeasurement (gains) / losses, contingent legal and insurance gains and other items presented in the table that reconciles Net income attributable to SUI common shareholders to Core FFO on page 6.

- The Company’s updated guidance translates forecasted results from operations in the UK using the relevant exchange rate in effect provided in the 2023 Guidance Assumptions table presented below. The impact of fluctuations in Canadian and Australian foreign currency rates on revised and initial guidance are not material.

The $7.09 per Share midpoint of the revised full-year guidance range is 1.0% lower than the prior range provided in July, primarily reflecting higher interest expense related to the UK Note remaining outstanding and lower expected transient RV revenues.

For the fourth quarter ending December 31, 2023, the Company’s guidance ranges assume Total Same Property NOI growth of 4.4% – 5.9%. The midpoints of Same Property NOI growth for the fourth quarter ending December 31, 2023 are 5.1% for Manufactured Housing, 3.6% for RV and 6.2% for Marina.

The assumptions underlying the Company’s revised 2023 full-year guidance are as follows:

FY 2022 Expected Change in 2023

2023 Guidance Assumptions (dollars in millions) Results Prior FY Guidance Revised FY Range

| Consolidated Portfolio: | |||

| Total real property NOI | 6.1% – 6.9% | 6.9% – 7.1% | |

| Service, retail, dining and entertainment NOI | $50.4 – $52.9 | $51.2 – $52.2 | |

| North America home sales contribution to Core FFO(a) | $18.9 – $21.7 | $19.4 – $20.5 | |

| Interest income(b) | N/A | $44.8 – $45.1 | |

| Brokerage commissions and other, net(c) | N/A | $50.9 – $51.4 | |

| General and administrative expenses | ($255.4) – ($249.9) | ($253.6) – ($252.1) | |

| UK | |||

| UK real property NOI(d) | $63.6 – $65.6 | $64.1 – $65.1 | |

| UK home sales NOI | $65.7 – $75.4 | $68.2 – $72.2 | |

| UK NOI | $129.3 – $141.0 | $132.3 – $137.3 | |

| Same Property Portfolio(e) | |||

| MH NOI (288 properties) | $569.2 | 5.2% – 5.8% | 5.8% – 6.1% |

| RV NOI (161 properties) | $281.8 | 3.4% – 4.6% | 3.5% – 4.2% |

| Marina NOI (119 properties) | $210.8 | 8.0% – 9.0% | 10.0% – 10.3% |

| Total Same Property Pool (568 Properties): | |||

| Revenue from real property | $1,600.4 | 6.2% – 6.5% | 5.8% – 6.0% |

| Property operating expenses(f)(g) | $538.6 | 7.2% – 7.9% | 5.2% – 5.4% |

| Same Property NOI | $1,061.8 | 5.3% – 6.1% | 6.0% – 6.4% |

| Exchange rates in effect at: | December 31, 2022 | June 30, 2023 | September 30, 2023 |

| U.S. Dollar (“USD”) / Pound Sterling (“GBP”) | 1.21 | 1.27 | 1.22 |

| USD / Canadian Dollar (“CAD”) | 0.74 | 0.75 | 0.74 |

| USD / Australian Dollar (“AUS”) | 0.68 | 0.66 | 0.64 |

Footnotes to 2023 Guidance Assumptions

| (a) | FFO from home sales in North America is net of home selling expenses and includes the gross profit from new and certain pre-owned home sales. Gross profit from pre-owned home sales of depreciated homes is excluded. |

| (b) | Interest income recognized from the UK Note during the first nine months ended September 30, 2023, totaled $27.9 million, or $0.22 per Share. No interest income from the UK Note is included in the Company’s fourth quarter guidance. The following table summarizes the interest income contribution inclusive of fourth quarter guidance: |

| (c) | For the third quarter and nine months ended September 30, 2023, Brokerage commissions and other, net includes recognition of $12.9 million of business interruption proceeds, which nets against accrued ‘Loss of earnings – catastrophic event-related charges, net’ in the Reconciliation of Net Income Attributable to SUI Common Shareholders to Core FFO table. |

| (d) | UK Real Property NOI is included in the Total Real Property NOI forecast and the properties are excluded from the 2023 Same Property pool. |

| (e) | The amounts in the table reflect constant currency, as currency figures included within the 2022 actual amounts have been translated at the assumed exchange rate used for 2023 guidance. |

| (f) | Total Same Property results net $101.1 million of utility revenue for 2022 actual results and $109.7 million for 2023 guidance against the related utility expense in property operating expenses. |

| (g) | 2022 actual results exclude $1.3 million of expenses incurred at recently acquired properties to bring them up to the Company’s standards. The improvements included items such as tree trimming and painting costs that do not meet the Company’s capitalization policy. |

Seasonality (Updated as of October 25, 2023) 1Q23 2Q23 3Q23 4Q23

| Same Property NOI: | ||||

| MH | 25% | 25% | 25% | 25% |

| RV | 16% | 25% | 42% | 17% |

| Marina | 20% | 27% | 30% | 23% |

| Total Same Property | 21% | 26% | 30% | 23% |

| UK NOI: | ||||

| Real property | 10% | 27% | 44% | 19% |

| Home sales | 18% | 35% | 33% | 14% |

| Total NOI from UK Operations | 14% | 31% | 38% | 17% |

| Consolidated Service, Retail, Dining and Entertainment NOI | 5% | 36% | 49% | 10% |

| Consolidated EBITDA | 19% | 27% | 34% | 20% |

| Core FFO per Share | 17% | 28% | 36% | 19% |

Preliminary 2024 Rental Rate Increases

The Company expects to realize the following rental rate increases, on average, during 2024:

Average 2024 Rental Rate Increases Expected

| Manufactured Housing: | |

| North America | 5.4% |

| UK | 7.1% |

| Annual RV | 6.5% |

| Marina | 5.6% |

The estimates and assumptions presented above represent a range of possible outcomes and may differ materially from actual results. These estimates include contributions from all acquisitions, dispositions and capital markets activity completed through October 25, 2023. These estimates exclude all other prospective acquisitions, dispositions and capital markets activity. The estimates and assumptions are forward-looking based on the Company’s current assessment of economic and market conditions and are subject to the other risks outlined below under the caption Cautionary Statement Regarding Forward-Looking Statements.

EARNINGS CONFERENCE CALL

A conference call to discuss third quarter results will be held on Thursday, October 26, 2023 at 2:00 P.M. (ET).

To participate, call toll-free at (877) 407-9039. Callers outside the U.S. or Canada can access the call at (201) 689-8470. A replay will be available following the call through November 9, 2023 and can be accessed toll-free by calling (844) 512-2921 or (412) 317-6671. The Conference ID number for the call and the replay is 13739128. The conference call will be available live on the Company’s website located at www.suncommunities.com. The replay will also be available on the website.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release contains various “forward-looking statements” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Company intends that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this document that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intends,” “intend,” “intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” “guidance,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. These forward-looking statements reflect the Company’s current views with respect to future events and financial performance, but involve known and unknown risks and uncertainties, both general and specific to the matters discussed in this document, some of which are beyond the Company’s control. These risks and uncertainties and other factors may cause the Company’s actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks described under “Risk Factors” contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and in the Company’s other filings with the Securities and Exchange Commission, from time to time, such risks, uncertainties and other factors include, but are not limited to:

∙ Outbreaks of disease and related restrictions on business operations;

∙ Changes in general economic conditions, including inflation, deflation and energy costs, the real estate industry and the markets within which the Company operates;

∙ Difficulties in the Company’s ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully;

∙ The Company’s liquidity and refinancing demands;

∙ The Company’s ability to obtain or refinance maturing debt;

∙ The Company’s ability to maintain compliance with covenants contained in its debt facilities and its unsecured notes;

∙ Availability of capital;

∙ Changes in foreign currency exchange rates, including between the U.S. dollar and each of the Canadian dollar, Australian dollar and

Pound sterling;

∙ The Company’s ability to maintain rental rates and occupancy levels;

∙ The Company’s ability to maintain effective internal control over financial reporting and disclosure controls and procedures;

∙ Increases in interest rates and operating costs, including insurance premiums and real estate taxes;

∙ Risks related to natural disasters such as hurricanes, earthquakes, floods, droughts and wildfires;

∙ General volatility of the capital markets and the market price of shares of the Company’s capital stock;

∙ The Company’s ability to maintain its status as a REIT;

∙ Changes in real estate and zoning laws and regulations;

∙ Legislative or regulatory changes, including changes to laws governing the taxation of REITs;

∙ Litigation, judgments or settlements, including costs associated with prosecuting or defending claims and any adverse outcomes;

∙ Competitive market forces;

∙ The ability of purchasers of manufactured homes and boats to obtain financing; and

∙ The level of repossessions by manufactured home and boat lenders;

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. The Company undertakes no obligation to publicly update or revise any forward-looking statements included or incorporated by reference into this document, whether as a result of new information, future events, changes in the Company’s expectations or otherwise, except as required by law.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to the Company or persons acting on the Company’s behalf are qualified in their entirety by these cautionary statements.

Company Overview and Investor Information

The Company

Established in 1975, Sun Communities, Inc. became a publicly owned corporation in December 1993. The Company is a fully integrated REIT listed on the New York Stock Exchange under the symbol: SUI. As of September 30, 2023, the Company owned, operated, or had an interest in a portfolio of 670 developed MH, RV and Marina properties comprising approximately 180,170 developed sites and approximately 48,030 wet slips and dry storage spaces in the U.S., the UK and Canada.

For more information about the Company, please visit www.suncommunities.com.

Company Contacts

| Management | Investor Relations |

| • Gary A. Shiffman, Chairman, President and CEO | Sara Ismail, Vice President |

| • Fernando Castro-Caratini, EVP and CFO | (248) 208-2500 |

- Bruce D. Thelen, EVP and COO investorrelations@suncommunities.com

Corporate Debt Ratings

| Moody’s | S&P | |

| Baa3 | Stable | BBB | Stable | |

| Equity Research Coverage | ||

| Bank of America Merrill Lynch | Joshua Dennerlein | joshua.dennerlein@bofa.com |

| Barclays | Anthony Powell | anthony.powell@barclays.com |

| BMO Capital Markets | John Kim | jp.kim@bmo.com |

| Citi Research | Eric Wolfe | eric.wolfe@citi.com |

| Nicholas Joseph | nicholas.joseph@citi.com | |

| Evercore ISI | Samir Khanal | samir.khanal@evercoreisi.com |

| Steve Sakwa | steve.sakwa@evercoreisi.com | |

| Green Street Advisors | John Pawlowski | jpawlowski@greenstreetadvisors.com |

| JMP Securities | Aaron Hecht | ahecht@jmpsecurities.com |

| RBC Capital Markets | Brad Heffern | brad.heffern@rbccm.com |

| Robert W. Baird & Co. | Wesley Golladay | wgolladay@rwbaird.com |

| Truist Securities | Anthony Hau | anthony.hau@truist.com |

| UBS | Michael Goldsmith | michael.goldsmith@ubs.com |

| Wells Fargo | James Feldman | james.feldman@wellsfargo.com |

| Wolfe Research | Andrew Rosivach | arosivach@wolferesearch.com |

| Keegan Carl | kcarl@wolferesearch.com |

Financial and Operating Highlights

(amounts in millions, except for *)

Quarters Ended

9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022

| Financial Information | ||||||

| Basic earnings / (loss) per share* | $ | 1.31 | $ 0.72 | $ (0.24) | $ 0.04 | $ 1.32 |

| Diluted earnings / (loss) per share* | $ | 1.31 | $ 0.72 | $ (0.24) | $ 0.04 | $ 1.32 |

| Cash distributions declared per common share* | $ | 0.93 | $ 0.93 | $ 0.93 | $ 0.88 | $ 0.88 |

| FFO per Share(a)* | $ | 2.55 | $ 1.95 | $ 1.14 | $ 1.02 | $ 2.54 |

| Core FFO per Share(a)* | $ | 2.57 | $ 1.96 | $ 1.23 | $ 1.33 | $ 2.65 |

| Real Property NOI | ||||||

| MH | $ | 182.5 | $ 168.7 | $ 156.9 | $ 153.5 | $ 166.8 |

| RV | 128.4 | 76.5 | 45.8 | 46.1 | 127.0 | |

| Marinas | 83.1 | 72.4 | 52.0 | 58.3 | 77.8 | |

| Total | $ | 394.0 | $ 317.6 | $ 254.7 | $ 257.9 | $ 371.6 |

| Recurring EBITDA | $ | 433.0 | $ 339.7 | $ 237.4 | $ 236.3 | $ 408.1 |

| TTM Recurring EBITDA / Interest* | 4.0 x | 4.3 x | 4.6 x | 5.2 x | 5.7 x | |

| Net Debt / TTM Recurring EBITDA | 6.1 x | 6.2 x | 6.1 x | 6.0 x | 5.7 x | |

| Balance Sheet | ||||||

| Total assets | $ 17,605.3 | $ 17,561.4 | $ 17,363.8 | $ 17,084.2 | $ 16,484.6 | |

| Total debt | $ 7,665.0 | $ 7,614.0 | $ 7,462.0 | $ 7,197.2 | $ 6,711.0 | |

| Total liabilities | $ 9,465.0 | $ 9,474.8 | $ 9,294.8 | $ 8,992.8 | $ 8,354.6 | |

| Operating Information* | ||||||

| Properties | ||||||

| MH | 353 | 354 | 354 | 353 | 350 | |

| RV | 182 | 182 | 182 | 182 | 181 | |

| Marina | 135 | 135 | 135 | 134 | 131 | |

| Total | 670 | 671 | 671 | 669 | 662 | |

| Sites, Wet Slips and Dry Storage Spaces* | ||||||

| Manufactured homes | 118,250 | 118,170 | 117,970 | 118,020 | 116,910 | |

| Annual RV | 32,150 | 31,620 | 30,860 | 30,330 | 32,030 | |

| Transient site | 29,770 | 30,270 | 30,870 | 31,180 | 31,150 | |

| Total sites | 180,170 | 180,060 | 179,700 | 179,530 | 180,090 | |

| Marina wet slips and dry storage spaces(b) | 48,030 | 48,180 | 47,990 | 47,820 | 46,190 | |

| Occupancy* | ||||||

| MH occupancy (including UK) | 95.4 % | 95.3 % | 95.1 % | 95.0 % | 95.5 % | |

| Annual RV occupancy | 100.0 % | 100.0 % | 100.0 % | 100.0 % | 100.0 % | |

| Blended MH and annual RV occupancy | 96.4 % | 96.3 % | 96.1 % | 96.0 % | 96.5 % | |

| MH and RV Revenue Producing Site Net Gains(c) (excluding UK Operations)* | ||||||

| MH leased sites, net | 207 | 285 | 278 | 346 | 122 | |

| RV leased sites, net | 537 | 754 | 524 | 267 | 567 | |

| Total leased sites, net | 744 | 1,039 | 802 | 613 | 689 | |

- Excludes the effects of certain anti-dilutive convertible securities.

- Total wet slips and dry storage spaces are adjusted each quarter based on site configuration and usability.

- Revenue producing site net gains do not include occupied sites acquired during the year.

Portfolio Overview as of September 30, 2023

MH & RV Properties

Total MH and Sites for

Location Properties Sites Occupancy % Sites RV Sites Development

| North America | |||||||||||

| Florida | 129 | 40,460 | 97.5 % | 3,950 | 44,410 | 3,400 | |||||

| Michigan | 85 | 32,850 | 96.7 % | 630 | 33,480 | 1,300 | |||||

| California | 37 | 6,920 | 98.8 % | 1,880 | 8,800 | 850 | |||||

| Texas | 31 | 8,950 | 95.2 % | 2,580 | 11,530 | 4,000 | |||||

| Ontario, Canada | 16 | 4,680 | 100.0 % | 500 | 5,180 | 1,450 | |||||

| Connecticut | 16 | 1,930 | 94.8 % | 80 | 2,010 | — | |||||

| Maine | 15 | 2,470 | 95.6 % | 1,070 | 3,540 | 200 | |||||

| Arizona | 13 | 4,570 | 94.4 % | 940 | 5,510 | — | |||||

| Indiana | 12 | 3,160 | 97.2 % | 1,020 | 4,180 | 180 | |||||

| New Jersey | 11 | 3,000 | 100.0 % | 1,050 | 4,050 | 260 | |||||

| Colorado | 11 | 2,810 | 89.1 % | 990 | 3,800 | 1,490 | |||||

| Virginia | 10 | 1,480 | 99.9 % | 1,970 | 3,450 | 750 | |||||

| New York | 10 | 1,520 | 99.1 % | 1,420 | 2,940 | 780 | |||||

| New Hampshire | 10 | 1,740 | 99.9 % | 680 | 2,420 | 80 | |||||

| Other | 74 | 15,810 | 98.5 % | 7,730 | 23,540 | 940 | |||||

| North America Total | 480 | 132,350 | 97.2 % | 26,490 | 158,840 | 15,680 | |||||

| United Kingdom | 55 | 18,050 | 90.6 % | 3,280 | 21,330 | 2,290 | |||||

| Total | 535 | 150,400 | 96.4 % | 29,770 | 180,170 | 17,970 |

Marina

Wet Slips and

Dry Storage

Location Properties Spaces

| Florida | 21 | 5,200 | |||||||

| Rhode Island | 12 | 3,460 | |||||||

| California | 11 | 5,710 | |||||||

| Connecticut | 11 | 3,330 | |||||||

| New York | 9 | 3,020 | |||||||

| Maryland | 9 | 2,480 | |||||||

| Massachusetts | 9 | 2,520 | |||||||

| Other | 53 | 22,310 | |||||||

| Total | 135 | 48,030 |

Sites, Wet Slips and Dry Storage

Properties Spaces

| Total Portfolio | 670 | 228,200 |

Consolidated Balance Sheets

(amounts in millions)

September 30, 2023 December 31, 2022

| Assets | ||||

| Land | $ | 3,996.4 | $ | 4,322.3 |

| Land improvements and buildings | 11,418.4 | 10,903.4 | ||

| Rental homes and improvements | 725.6 | 645.2 | ||

| Furniture, fixtures and equipment | 995.1 | 839.0 | ||

| Investment property | 17,135.5 | 16,709.9 | ||

| Accumulated depreciation | (3,144.8) | (2,738.9) | ||

| Investment property, net | 13,990.7 | 13,971.0 | ||

| Cash, cash equivalents and restricted cash | 62.0 | 90.4 | ||

| Marketable securities | 112.8 | 127.3 | ||

| Inventory of manufactured homes | 219.8 | 202.7 | ||

| Notes and other receivables, net | 832.2 | 617.3 | ||

| Goodwill | 1,084.1 | 1,018.4 | ||

| Other intangible assets, net | 374.7 | 402.0 | ||

| Other assets, net | 929.0 | 655.1 | ||

| Total Assets | $ | 17,605.3 | $ | 17,084.2 |

| Liabilities | ||||

| Secured debt | $ | 3,359.5 | $ | 3,217.8 |

| Unsecured debt | 4,305.5 | 3,979.4 | ||

| Distributions payable | 118.2 | 111.3 | ||

| Advanced reservation deposits and rent | 372.7 | 352.1 | ||

| Accrued expenses and accounts payable | 380.2 | 396.3 | ||

| Other liabilities | 928.9 | 935.9 | ||

| Total Liabilities | 9,465.0 | 8,992.8 | ||

| Commitments and contingencies | ||||

| Temporary equity | 304.5 | 202.9 | ||

| Shareholders’ Equity | ||||

| Common stock | 1.2 | 1.2 | ||

| Additional paid-in capital | 9,581.6 | 9,549.7 | ||

| Accumulated other comprehensive income / (loss) | 5.2 | (9.9) | ||

| Distributions in excess of accumulated earnings | (1,848.2) | (1,731.2) | ||

| Total SUI shareholders’ equity | 7,739.8 | 7,809.8 | ||

| Noncontrolling interests | ||||

| Common and preferred OP units | 96.0 | 78.7 | ||

| Total noncontrolling interests | 96.0 | 78.7 | ||

| Total Shareholders’ Equity | 7,835.8 | 7,888.5 | ||

| Total Liabilities, Temporary Equity and Shareholders’ Equity | $ | 17,605.3 | $ | 17,084.2 |

Consolidated Statements of Operations

(amounts in millions, except for per share amounts)

Quarter Ended

September 30, September 30, % September 30, %

2023 2022 Change 2023 2022 Change

| Revenues | ||||||||||

| Real property (excluding transient) | $ | 457.2 | $ | 425.3 | 7.5 % | $ | 1,285.5 | $ | 1,158.1 | 11.0 % |

| Real property – transient | 161.6 | 160.4 | 0.7 % | 300.9 | 303.5 | (0.9) % | ||||

| Home sales | 117.8 | 150.7 | (21.8) % | 326.7 | 358.1 | (8.8) % | ||||

| Service, retail, dining and entertainment | 205.4 | 174.2 | 17.9 % | 498.9 | 423.0 | 17.9 % | ||||

| Interest | 15.2 | 11.2 | 35.7 % | 40.6 | 25.3 | 60.5 % | ||||

| Brokerage commissions and other, net | 26.0 | 10.8 | 140.7 % | 45.3 | 27.4 | 65.3 % | ||||

| Total Revenues | 983.2 | 932.6 | 5.4 % | 2,497.9 | 2,295.4 | 8.8 % | ||||

| Expenses | ||||||||||

| Property operating and maintenance | 195.5 | 184.7 | 5.8 % | 530.7 | 469.2 | 13.1 % | ||||

| Real estate tax | 29.3 | 29.4 | (0.3) % | 89.4 | 83.2 | 7.5 % | ||||

| Home costs and selling | 80.5 | 96.4 | (16.5) % | 224.9 | 235.2 | (4.4) % | ||||

| Service, retail, dining and entertainment | 178.7 | 144.9 | 23.3 % | 450.4 | 363.3 | 24.0 % | ||||

| General and administrative | 66.2 | 69.1 | (4.2) % | 192.4 | 187.0 | 2.9 % | ||||

| Catastrophic event-related charges, net | (3.1) | 12.2 | (125.4) % | (2.2) | 12.3 | (117.9) % | ||||

| Business combinations | — | 8.4 | (100.0) % | 3.0 | 23.9 | (87.4) % | ||||

| Depreciation and amortization | 162.6 | 149.7 | 8.6 % | 482.3 | 447.7 | 7.7 % | ||||

| Asset impairments | 1.2 | 1.6 | (25.0) % | 10.1 | 2.3 | N/M | ||||

| Loss on extinguishment of debt | — | 4.0 | (100.0) % | — | 4.4 | (100.0) % | ||||

| Interest | 84.1 | 61.7 | 36.3 % | 239.9 | 162.2 | 47.9 % | ||||

| Interest on mandatorily redeemable preferred OP units / equity | 0.8 | 1.0 | (20.0) % | 2.7 | 3.1 | (12.9) % | ||||

| Total Expenses | 795.8 | 763.1 | 4.3 % | 2,223.6 | 1,993.8 | 11.5 % | ||||

| Income Before Other Items | 187.4 | 169.5 | 10.6 % | 274.3 | 301.6 | (9.1) % | ||||

| Gain / (loss) on remeasurement of marketable securities | 6.1 | (7.2) | N/M | (8.0) | (74.0) | (89.2) % | ||||

| Gain / (loss) on foreign currency exchanges | (6.5) | 14.9 | N/M | (6.5) | 21.7 | N/M | ||||

| Gain / (loss) on dispositions of properties | (0.7) | (0.8) | (12.5) % | (2.9) | 12.5 | N/M | ||||

| Other income / (expense), net(a) | (3.7) | 2.8 | N/M | (5.5) | 2.6 | N/M | ||||

| Gain / (loss) on remeasurement of notes receivable | (1.3) | (0.1) | N/M | (3.1) | 0.1 | N/M | ||||

| Income from nonconsolidated affiliates | 1.4 | 2.0 | (30.0) % | 0.5 | 3.8 | (86.8) % | ||||

| Gain / (loss) on remeasurement of investment in nonconsolidated affiliates | — | (0.4) (100.0) % | (4.5) | 0.1 | N/M | |||||

| Current tax expense | (4.6) | (7.3) (37.0) % | (13.9) | (12.5) | 11.2 % | |||||

| Deferred tax benefit | 2.3 | 3.6 (36.1) % | 14.6 | 3.9 | 274.4 % | |||||

| Net Income | 180.4 | 177.0 1.9 % | 245.0 | 259.8 | (5.7) % | |||||

| Less: Preferred return to preferred OP units / equity interests | 3.3 | 2.5 32.0 % | 9.0 | 8.6 | 4.7 % | |||||

| Less: Income attributable to noncontrolling interests | 14.0 | 11.9 17.6 % | 13.2 | 13.9 | (5.0) % | |||||

| Net Income Attributable to SUI Common Shareholders | $ | 163.1 | $ | 162.6 0.3 % | $ | 222.8 | $ | 237.3 | (6.1) % | |

| Weighted average common shares outstanding – basic(a) | 123.5 | 122.4 0.9 % | 123.4 | 119.2 | 3.5 % | |||||

| Weighted average common shares outstanding – diluted(a) | 123.5 | 122.8 0.6 % | 123.4 | 121.9 | 1.2 % | |||||

| Basic earnings per share | $ | 1.31 | $ | 1.32 (0.8) % | $ | 1.79 | $ | 1.98 | (9.6) % | |

| Diluted earnings per share(b) | $ | 1.31 | $ | 1.32 (0.8) % | $ | 1.79 | $ | 1.97 | (9.1) % | |

- Refer to Definitions and Notes for additional information.

- Excludes the effect of certain anti-dilutive convertible securities.N/M = Percentage change is not meaningful.

Reconciliation of Net Income Attributable to SUI Common Shareholders to Core FFO

(amounts in millions, except for per share data)

September 30, September 30, September 30, September 30,

2023 2022 2023 2022

| Net Income Attributable to SUI Common Shareholders | $ | 163.1 | $ | 162.6 | $ | 222.8 | $ | 237.3 | |

| Adjustments | |||||||||

| Depreciation and amortization | 162.2 | 149.2 | 480.5 | 446.3 | |||||

| Depreciation on nonconsolidated affiliates | 0.1 | — | 0.2 | 0.1 | |||||

| Asset impairments | 1.2 | 1.6 | 10.1 | 2.3 | |||||

| (Gain) / loss on remeasurement of marketable securities | (6.1) | 7.2 | 8.0 | 74.0 | |||||

| (Gain) / loss on remeasurement of investment in nonconsolidated affiliates | — | 0.4 | 4.5 | (0.1) | |||||

| (Gain) / loss on remeasurement of notes receivable | 1.3 | 0.1 | 3.1 | (0.1) | |||||

| (Gain) / loss on dispositions of properties, including tax effect | 0.7 | 0.8 | 5.0 | (12.5) | |||||

| Add: Returns on preferred OP units | 1.8 | 1.3 | 6.2 | 9.5 | |||||

| Add: Income attributable to noncontrolling interests | 12.6 | 10.5 | 11.9 | 14.1 | |||||

| Gain on dispositions of assets, net | (10.5) | (11.9) | (29.0) | (44.2) | |||||

| FFO(a) | $ | 326.4 | $ | 321.8 | $ | 723.3 | $ | 726.7 | |

| Adjustments | |||||||||

| Business combination expense and other acquisition related costs(a) | 4.2 | 19.2 | 15.6 | 40.1 | |||||

| Loss on extinguishment of debt | — | 4.0 | — | 4.4 | |||||

| Catastrophic event-related charges, net | (3.1) | 12.2 | (2.2) | 12.3 | |||||

| Loss of earnings – catastrophic event-related charges, net(b) | (6.1) | 0.2 | 4.9 | 0.2 | |||||

| (Gain) / loss on foreign currency exchanges | 6.5 | (14.9) | 6.5 | (21.7) | |||||

| Other adjustments, net(a) | 1.1 | (6.5) | (9.6) | (5.1) | |||||

| Core FFO(a)(c) | $ | 329.0 | $ | 336.0 | $ | 738.5 | $ | 756.9 | |

| Weighted Average Common Shares Outstanding – Diluted | 128.0 | 126.7 | 128.3 | 125.4 | |||||

| FFO per Share(c) | $ | 2.55 | $ | 2.54 | $ | 5.64 | $ | 5.80 | |

| Core FFO per Share(c) | $ | 2.57 | $ | 2.65 | $ | 5.76 | $ | 6.04 |

- Refer to Definitions and Notes for additional information.

- Loss of earnings – catastrophic event-related charges, net include the following:

Quarter Ended Nine Months Ended

September 30, 2023 September 30, 2023

| Hurricane Ian – Three Fort Myers, Florida RV communities impaired | |||

| Estimated loss of earnings in excess of the applicable business interruption deductible | $ | 6.3 $ | 16.8 |

| Insurance recoveries received for previously estimated loss of earnings through April 30, 2023 | (11.8) | (11.8) | |

| Hurricane Irma – Three Florida Keys communities impaired | |||

| Estimated loss of earnings in excess of the applicable business interruption deductible | — | 0.5 | |

| Reversal of unpaid previously estimated loss of earnings that the Company does not expect to recover | (0.6) | (0.6) | |

| Loss of earnings – catastrophic event-related charges, net | $ | (6.1) $ | 4.9 |

- Excludes the effect of certain anti-dilutive convertible securities.

Refer to Definitions and Notes for additional information for Home sales contribution to FFO.

Reconciliation of Net Income Attributable to SUI Common Shareholders to NOI

(amounts in millions)

September 30, September 30, September 30, September 30,

2023 2022 2023 2022

| Net Income Attributable to SUI Common Shareholders | $ | 163.1 | $ | 162.6 | $ | 222.8 | $ | 237.3 | |

| Interest income | (15.2) | (11.2) | (40.6) | (25.3) | |||||

| Brokerage commissions and other revenues, net | (26.0) | (10.8) | (45.3) | (27.4) | |||||

| General and administrative | 66.2 | 69.1 | 192.4 | 187.0 | |||||

| Catastrophic event-related charges, net | (3.1) | 12.2 | (2.2) | 12.3 | |||||

| Business combination expense | — | 8.4 | 3.0 | 23.9 | |||||

| Depreciation and amortization | 162.6 | 149.7 | 482.3 | 447.7 | |||||

| Asset impairments | 1.2 | 1.6 | 10.1 | 2.3 | |||||

| Loss on extinguishment of debt | — | 4.0 | — | 4.4 | |||||

| Interest expense | 84.1 | 61.7 | 239.9 | 162.2 | |||||

| Interest on mandatorily redeemable preferred OP units / equity | 0.8 | 1.0 | 2.7 | 3.1 | |||||

| (Gain) / loss on remeasurement of marketable securities | (6.1) | 7.2 | 8.0 | 74.0 | |||||

| (Gain) / loss on foreign currency exchanges | 6.5 | (14.9) | 6.5 | (21.7) | |||||

| (Gain) / loss on disposition of properties | 0.7 | 0.8 | 2.9 | (12.5) | |||||

| Other (income) / expense, net(a) | 3.7 | (2.8) | 5.5 | (2.6) | |||||

| (Gain) / loss on remeasurement of notes receivable | 1.3 | 0.1 | 3.1 | (0.1) | |||||

| Income from nonconsolidated affiliates | (1.4) | (2.0) | (0.5) | (3.8) | |||||

| (Gain) / loss on remeasurement of investment in nonconsolidated affiliates | — | 0.4 | 4.5 | (0.1) | |||||

| Current tax expense | 4.6 | 7.3 | 13.9 | 12.5 | |||||

| Deferred tax benefit | (2.3) | (3.6) | (14.6) | (3.9) | |||||

| Add: Preferred return to preferred OP units / equity interests | 3.3 | 2.5 | 9.0 | 8.6 | |||||

| Add: Income attributable to noncontrolling interests | 14.0 | 11.9 | 13.2 | 13.9 | |||||

| NOI | $ | 458.0 | $ | 455.2 | $ | 1,116.6 | $ | 1,091.8 |

Quarter Ended Nine Months Ended

September 30, September 30, September 30, September 30,

2023 2022 2023 2022

| Real Property NOI(a) | $ | 394.0 | $ | 371.6 | $ | 966.3 | $ | 909.2 |

| Home Sales NOI(a) | 37.3 | 54.3 | 101.8 | 122.9 | ||||

| Service, retail, dining and entertainment NOI(a) | 26.7 | 29.3 | 48.5 | 59.7 | ||||

| NOI | $ | 458.0 | $ | 455.2 | $ | 1,116.6 | $ | 1,091.8 |

(a) Refer to Definitions and Notes for additional information.

Reconciliation of Net Income Attributable to SUI Common Shareholders to Recurring EBITDA

(amounts in millions)

September 30, September 30, September 30, September 30,

2023 2022 2023 2022

| Net Income Attributable to SUI Common Shareholders | $ | 163.1 | $ | 162.6 | $ | 222.8 | $ | 237.3 |

| Adjustments | ||||||||

| Depreciation and amortization | 162.6 | 149.7 | 482.3 | 447.7 | ||||

| Asset impairments | 1.2 | 1.6 | 10.1 | 2.3 | ||||

| Loss on extinguishment of debt | — | 4.0 | — | 4.4 | ||||

| Interest expense | 84.1 | 61.7 | 239.9 | 162.2 | ||||

| Interest on mandatorily redeemable preferred OP units / equity | 0.8 | 1.0 | 2.7 | 3.1 | ||||

| Current tax expense | 4.6 | 7.3 | 13.9 | 12.5 | ||||

| Deferred tax benefit | (2.3) | (3.6) | (14.6) | (3.9) | ||||

| Income from nonconsolidated affiliates | (1.4) | (2.0) | (0.5) | (3.8) | ||||

| Less: (Gain) / loss on dispositions of properties | 0.7 | 0.8 | 2.9 | (12.5) | ||||

| Less: Gain on dispositions of assets, net | (10.5) | (11.9) | (29.0) | (44.2) | ||||

| EBITDAre | $ | 402.9 | $ | 371.2 | $ | 930.5 | $ | 805.1 |

| Adjustments | ||||||||

| Catastrophic event-related charges, net | (3.1) | 12.2 | (2.2) | 12.3 | ||||

| Business combination expense | — | 8.4 | 3.0 | 23.9 | ||||

| (Gain) / loss on remeasurement of marketable securities | (6.1) | 7.2 | 8.0 | 74.0 | ||||

| (Gain) / loss on foreign currency exchanges | 6.5 | (14.9) | 6.5 | (21.7) | ||||

| Other (income) / expense, net(a) | 3.7 | (2.8) | 5.5 | (2.6) | ||||

| (Gain) / loss on remeasurement of notes receivable | 1.3 | 0.1 | 3.1 | (0.1) | ||||

| (Gain) / loss on remeasurement of investment in nonconsolidated affiliates | — | 0.4 | 4.5 | (0.1) | ||||

| Add: Preferred return to preferred OP units / equity interests | 3.3 | 2.5 | 9.0 | 8.6 | ||||

| Add: Income attributable to noncontrolling interests | 14.0 | 11.9 | 13.2 | 13.9 | ||||

| Add: Gain on dispositions of assets, net | 10.5 | 11.9 | 29.0 | 44.2 | ||||

| Recurring EBITDA | $ | 433.0 | $ | 408.1 | $ | 1,010.1 | $ | 957.5 |

(a) Refer to Definitions and Notes for additional information.

Supplemental Disclosure

Real Property Operations – Total Portfolio

(amounts in millions, except statistical information)

North North

Financial Information America UK Total RV Marinas Total America UK Total RV Marinas Total

| Revenues | ||||||||||||||||||||||

| Real property (excluding transient) | $ | 229.4 | $ | 29.3 | $ | 258.7 | $ | 82.5 | $ | 116.0 | $ | 457.2 | $ | 213.5 | $ | 24.7 | $ 238.2 | $ 78.4 | $ | 108.7 | $ | 425.3 |

| Real property – transient | 0.8 | 23.0 | 23.8 | 128.0 | 9.8 | 161.6 | 0.3 | 21.8 | 22.1 | 131.2 | 7.1 | 160.4 | ||||||||||

| Total operating revenues | 230.2 | 52.3 | 282.5 | 210.5 | 125.8 | 618.8 | 213.8 | 46.5 | 260.3 | 209.6 | 115.8 | 585.7 | ||||||||||

| Expenses | ||||||||||||||||||||||

| Property operating expenses | 76.7 | 23.3 | 100.0 | 82.1 | 42.7 | 224.8 | 72.2 | 21.3 | 93.5 | 82.6 | 38.0 | 214.1 | ||||||||||

| Real Property NOI | $ | 153.5 | $ | 29.0 | $ | 182.5 | $ | 128.4 | $ | 83.1 | $ | 394.0 | $ | 141.6 | $ | 25.2 | $ 166.8 | $ 127.0 | $ | 77.8 | $ | 371.6 |

Nine Months Ended September 30, 2023 Nine Months Ended September 30, 2022

North North

Financial Information America UK Total RV Marinas Total America UK(a) Total RV Marinas Total

| Revenues | ||||||||||||||||||||

| Real property (excluding transient) | $ | 676.9 | $ | 85.1 | $ | 762.0 | $ | 217.1 | $ | 306.4 | $ 1,285.5 | $ | 630.8 | $ | 44.7 | $ 675.5 | $ 208.2 | $ | 274.4 | $ 1,158.1 |

| Real property – transient | 1.5 | 37.9 | 39.4 | 241.3 | 20.2 | 300.9 | 1.2 | 34.7 | 35.9 | 253.0 | 14.6 | 303.5 | ||||||||

| Total operating revenues | 678.4 | 123.0 | 801.4 | 458.4 | 326.6 | 1,586.4 | 632.0 | 79.4 | 711.4 | 461.2 | 289.0 | 1,461.6 | ||||||||

| Expenses | ||||||||||||||||||||

| Property operating expenses | 223.1 | 70.3 | 293.4 | 207.6 | 119.1 | 620.1 | 204.1 | 38.8 | 242.9 | 205.3 | 104.2 | 552.4 | ||||||||

| Real Property NOI | $ | 455.3 | $ | 52.7 | $ | 508.0 | $ | 250.8 | $ | 207.5 | $ 966.3 | $ | 427.9 | $ | 40.6 | $ 468.5 | $ 255.9 | $ | 184.8 | $ 909.2 |

As of September 30, 2023 As of September 30, 2022

North North

Other information America UK Total RV Marinas Total America UK(a) Total RV Marinas Total

| Number of properties | 298 | 55 | 353 | 182 | 135 | 670 | 296 | 54 | 350 | 181 | 131 | 662 | |||||||

| Sites, wet slips and dry storage spaces | |||||||||||||||||||

| Sites, wet slips and dry storage spaces(b) | 100,200 | 18,050 | 118,250 | 32,150 | 48,030 | 198,430 | 99,430 | 17,480 | 116,910 | 32,030 | 46,190 | 195,130 | |||||||

| Transient sites | N/M | 3,280 | 3,280 | 26,490 | N/A | 29,770 | N/M | 3,200 | 3,200 | 27,950 | N/A | 31,150 | |||||||

| Total | 100,200 | 21,330 | 121,530 | 58,640 | 48,030 | 228,200 | 99,430 | 20,680 | 120,110 | 59,980 | 46,190 | 226,280 | |||||||

| MH and Annual RV Occupancy | 96.3 % | 90.6 % | 95.4 % | 100.0 % | N/A | 96.4 % | 96.2 % | 91.7 % | 95.5 % | 100.0 % | N/A | 96.5 % |

N/M = Not meaningful. N/A = Not applicable.

- UK amounts for the nine months ended September 30, 2022 cover April 8, 2022 (date of acquisition) to September 30, 2022.

- MH annual sites included 9,834 and 9,126 rental homes in the Company’s Rental Program during the quarter ended September 30, 2023 and 2022, respectively. The Company’s investment in occupied rental homes at September 30, 2023 was $655.8 million, an increase of 20.6% from $543.8 million at September 30, 2022.

Real Property Operations – Same Property Portfolio(a)

(amounts in millions, except for statistical information)

Total

MH(b) RV(b) Marina Total MH(b) RV(b) Marina Total Change MH RV Marina Total

| Financial Information | ||||||||||||||||||||||

| Same Property Revenues | ||||||||||||||||||||||

| Real property (excluding transient) | $ | 209.2 | $ | 74.4 | $ | 91.0 | $ | 374.6 | $ | 195.0 | $ | 64.7 | $ | 85.8 | $ | 345.5 | $ | 29.1 | 7.3 % | 15.0 % | 6.0 % | 8.4 % |

| Real property – transient | 0.4 | 118.4 | 7.9 | 126.7 | 0.2 | 123.9 | 5.4 | 129.5 | (2.8) | 72.6 % | (4.4) % | 47.1 % | (2.1) % | |||||||||

| Total Same Property operating revenues | 209.6 | 192.8 | 98.9 | 501.3 | 195.2 | 188.6 | 91.2 | 475.0 | 26.3 | 7.4 % | 2.2 % | 8.4 % | 5.5 % | |||||||||

| Same Property Expenses | ||||||||||||||||||||||

| Same Property operating expenses(d)(e) | 57.1 | 69.3 | 29.7 | 156.1 | 54.1 | 69.8 | 27.7 | 151.6 | 4.5 | 5.7 % | (0.8) % | 7.4 % | 3.0 % | |||||||||

| Real Property NOI(e) | $ | 152.5 | $ | 123.5 | $ | 69.2 | $ | 345.2 | $ | 141.1 | $ | 118.8 | $ | 63.5 | $ | 323.4 | $ | 21.8 | 8.0 % | 4.1 % | 8.9 % | 6.7 % |

Nine Months Ended September 30, 2023 Nine Months Ended September 30, 2022 Total % Change(c)

MH(b) RV(b) Marina Total MH(b) RV(b) Marina Total Change MH RV Marina Total

| Financial Information | ||||||||||||||||||||

| Same Property Revenues | ||||||||||||||||||||

| Real property (excluding transient) | $ | 619.5 | $ | 198.7 | $ | 244.5 | $ 1,062.7 | $ | 579.9 | $ | 171.9 | $ | 227.1 | $ 978.9 | $ | 83.8 | 6.8 % | 15.6 % | 7.7 % | 8.6 % |

| Real property – transient | 1.0 | 224.4 | 17.5 | 242.9 | 0.9 | 236.7 | 12.5 | 250.1 | (7.2) | 11.8 % | (5.2) % | 39.5 % | (2.9) % | |||||||

| Total Same Property operating revenues | 620.5 | 423.1 | 262.0 | 1,305.6 | 580.8 | 408.6 | 239.6 | 1,229.0 | 76.6 | 6.8 % | 3.6 % | 9.4 % | 6.2 % | |||||||

| Same Property Expenses | ||||||||||||||||||||

| Same Property operating expenses(d)(e) | 167.0 | 178.4 | 84.1 | 429.5 | 154.0 | 172.9 | 80.1 | 407.0 | 22.5 | 8.5 % | 3.1 % | 5.1 % | 5.5 % | |||||||

| Real Property NOI(e) | $ | 453.5 | $ | 244.7 | $ | 177.9 | $ 876.1 | $ | 426.8 | $ | 235.7 | $ | 159.5 | $ 822.0 | $ | 54.1 | 6.2 % | 3.9 % | 11.5 % | 6.6 % |

| Other Information | ||||||||||||||||||||

| Number of properties | 288 | 161 | 119 | 568 | 288 | 161 | 119 | 568 | ||||||||||||

| Sites, wet slips and dry storage spaces | 98,590 | 54,630 | 40,890 | 194,110 | 97,830 | 54,340 | 40,690 | 192,860 |

- Refer to the Definitions and Notes for additional information.

- Same Property results for the Company’s MH and RV properties reflect constant currency for comparative purposes. Canadian currency figures in the prior comparative period have been translated at the average exchange rate of $0.7453 USD and $0.7431 USD per Canadian dollar during the quarter and nine months ended September 30, 2023, respectively.

- Percentages are calculated based on unrounded numbers.

Real Property Operations – Same Property Portfolio(a) (Continued)

(amounts in millions, except for statistical information)

- The Company nets certain utility revenues (which include utility reimbursement revenues from residents) against related utility expenses in property operating expenses as follows (in millions):

Quarter Ended September 30, 2023 Quarter Ended September 30, 2022

| MH RV Marina Total | MH RV Marina Total | |||

| Utility revenue netted against related utility expense | $ | 18.2 $ 6.3 $ 5.9 $ 30.4 | $ | 17.2 $ 5.8 $ 5.2 $ 28.2 |

| Nine Months Ended September 30, 2023

MH RV Marina Total |

Nine Months Ended September 30, 2022 | |||

| MH RV Marina Total | ||||

| Utility revenue netted against related utility expense | $ | 52.1 $ 15.3 $ 16.7 $ 84.1 | $ | 48.2 $ 14.3 $ 14.1 $ 76.6 |

- Total Same Property operating expenses consist of the following components for the periods shown (in millions) and exclude amounts invested into recently acquired properties to bring them up to the Company’s standards:

Quarter Ended Nine Months Ended

September 30, September 30, September 30, September 30,

2023 2022 Change % Change 2023 2022 Change % Change

| Payroll and benefits | $ | 54.8 | $ | 51.6 | $ | 3.2 | 6.2 % | $ | 146.2 | $ | 139.5 | $ | 6.7 | 4.8 % | |

| Real estate taxes | 26.4 | 25.9 | 0.5 | 2.1 % | 81.2 | 77.7 | 3.5 | 4.6 % | |||||||

| Supplies and repairs | 22.9 | 24.4 | (1.5) | (6.2) % | 58.0 | 58.4 | (0.4) | (0.7) % | |||||||

| Utilities | 18.9 | 19.8 | (0.9) | (4.2) % | 49.5 | 50.3 | (0.8) | (1.6) % | |||||||

| Legal, state / local taxes, and insurance | 14.0 | 9.5 | 4.5 | 47.7 % | 42.0 | 28.3 | 13.7 | 48.2 % | |||||||

| Other | 19.1 | 20.4 | (1.3) | (6.7) % | 52.6 | 52.8 | (0.2) | (0.4) % | |||||||

| Total Same Property Operating Expenses | $ | 156.1 | $ | 151.6 | $ | 4.5 | 3.0 % | $ | 429.5 | $ | 407.0 | $ | 22.5 | 5.5 % |

Real Property Operations – Same Property Portfolio(a) (Continued)

As of

September 30, 2023 September 30, 2022

MH RV MH RV

| Other Information | |||||||||

| Number of properties | 288 | 161 | 288 | 161 | |||||

| Sites | |||||||||

| MH and Annual RV sites | 98,590 | 31,850 | 97,830 | 29,790 | |||||

| Transient RV sites | N/M | 22,780 | N/M | 24,550 | |||||

| Total | 98,590 | 54,630 | 97,830 | 54,340 | |||||

| MH and Annual RV Occupancy | |||||||||

| Occupancy(b) | 97.0 % | 100.0 % | 96.8 % | 100.0 % | |||||

| Monthly base rent per site | $ | 661 | $ | 580 | $ | 623 | $ | 533 | |

| % Change of monthly base rent(c) | 6.1 % | 8.8 % | N/A | N/A | |||||

| Rental Program Statistics included in MH: | |||||||||

| Number of occupied sites, end of period(d) | 9,680 | N/A | 9,110 | N/A | |||||

| Monthly rent per site – MH Rental Program | $ | 1,282 | N/A | $ | 1,193 | N/A | |||

| % Change(d) | 7.5 % | N/A | N/A | N/A |

N/M = Not meaningful. N/A = Not applicable.

- Refer to Definitions and Notes for additional information.

- Same Property adjusted blended occupancy for MH and RV combined increased to 98.8% at September 30, 2023, from 97.1% at September 30, 2022. The 170 basis point increase was driven by MH expansion fills and the conversion of transient RV sites to annual sites.

- Calculated using actual results without rounding.

- Occupied rental program sites in Same Property are included in total sites.

Other Operating Information

Home Sales Summary

(amounts in millions, except for *)

Quarter Ended Nine Months Ended

September 30, September 30, % September 30, September 30, %

Financial Information 2023 2022 Change 2023 2022 Change

| North America | ||||||||||

| Home sales | $ | 62.4 | $ | 66.6 | (6.3) % | $ | 171.9 | $ | 213.4 | (19.4) % |

| Home cost and selling expenses | 48.0 | 51.5 | (6.8) % | 130.2 | 155.9 | (16.5) % | ||||

| NOI | $ | 14.4 | $ | 15.1 | (4.6) % | $ | 41.7 | $ | 57.5 | (27.5) % |

| NOI margin %* | 23.1 % | 22.7 % | 24.3 % | 26.9 % | ||||||

| UK(a) | ||||||||||

| Home sales | $ | 55.4 | $ | 84.1 | (34.1) % | $ | 154.8 | $ | 144.7 | 7.0 % |

| Home cost and selling expenses | 32.5 | 44.9 | (27.6) % | 94.7 | 79.3 | 19.4 % | ||||

| NOI | $ | 22.9 | $ | 39.2 | (41.6) % | $ | 60.1 | $ | 65.4 | (8.1) % |

| NOI margin %* | 41.3 % | 46.6 % | 38.8 % | 45.2 % | ||||||

| Total(a) | ||||||||||

| Home sales | $ | 117.8 | $ | 150.7 | (21.8) % | $ | 326.7 | $ | 358.1 | (8.8) % |

| Home cost and selling expenses | 80.5 | 96.4 | (16.5) % | 224.9 | 235.2 | (4.4) % | ||||

| NOI | $ | 37.3 | $ | 54.3 | (31.3) % | $ | 101.8 | $ | 122.9 | (17.2) % |

| NOI margin %* | 31.7 % | 36.0 % | 31.2 % | 34.3 % | ||||||

| Other information | ||||||||||

| Units Sold:* | ||||||||||

| North America | 636 | 724 | (12.2) % | 1,909 | 2,538 | (24.8) % | ||||

| UK(a) | 884 | 1,016 | (13.0) % | 2,310 | 1,778 | 29.9 % | ||||

| Total home sales(a) | 1,520 | 1,740 | (12.6) % | 4,219 | 4,316 | (2.2) % | ||||

| Average Selling Price:* | ||||||||||

| North America | $ | 98,113 | $ | 91,989 | 6.7 % | $ | 90,047 | $ | 84,082 | 7.1 % |

| UK(a) | $ | 62,670 | $ | 82,776 | (24.3) % | $ | 67,013 | $ | 81,384 | (17.7) % |

(a) UK amounts for the nine months ended September 30, 2022 cover the period from April 8, 2022 (date of acquisition) through September 30, 2022.

Operating Statistics for MH and Annual RVs (excluding UK Operations)

Leased Sites, New Home Pre-owned Brokered % of Total Sites Number of Move-outs Net(b) Sales Home Sales Re-sales

| 2023 – YTD as of September 30 | 3.7 % (a) | 5,651 | 2,585 | 421 | 1,488 | 1,818 | |||||

| 2022 | 3.0 % | 5,170 | 2,922 | 703 | 2,509 | 2,864 | |||||

| 2021 | 2.7 % | 5,276 | 2,483 | 732 | 3,356 | 3,528 |

- Percentage calculated on a trailing 12-month basis.

- Net increase in revenue producing sites.

Investment Activity

Acquisitions and Dispositions

(amounts in millions, except for *)

Sites, Wet Slips Expansion or State, Total

Property Number of and Dry Storage Development Province Purchase / Month

Property Name Type Properties* Spaces* Sites* or Country Sale Price Acquired

| ACQUISITIONS | ||||||||||||

| Fox Run(a) | MH | 1 | 68 | 72 | MI | $ | 7.0 | January | ||||

| Savannah Yacht Center(b) | Marina | 1 | 24 | — | GA | 100.0 | March | |||||

| First Quarter 2023 | 2 | 92 | 72 | $ | 107.0 | |||||||

| Acquisitions in 2023 | 2 | 92 | 72 | $ | 107.0 | |||||||

| DISPOSITIONS | ||||||||||||

| Cedar Haven | MH | 1 | 155 | — | ME | $ | 6.8 | August | ||||

| Third Quarter 2023 | 1 | 155 | — | $ | 6.8 | |||||||

| Dispositions in 2023 | 1 | 155 | — | $ | 6.8 |

- In conjunction with the acquisition of this ground-up development project, the Company issued 31,289 Common OP units valued at $4.4 million. The Company also delivered 68 of the 140 sites during the first quarter.

- In conjunction with this acquisition, the Company issued one million Series K preferred OP units to cover the total purchase price of $100.0 million.

Investment Activity

Capital Expenditures and Investments

(amounts in millions, except for *)

Nine Months Ended Year Ended

September 30, 2023 December 31, 2022 December 31, 2021

MH / RV Marina MH / RV Marina MH / RV Marina

| Recurring Capital Expenditures(a) | $ | 36.1 | $ | 24.9 | $ | 51.0 | $ | 22.8 | $ | 45.3 | $ | 19.3 |

| Non-Recurring Capital Expenditures(a) | ||||||||||||

| Lot Modifications | $ | 41.3 | N/A | $ | 39.1 | N/A | $ | 28.8 | N/A | |||

| Growth Projects | 20.5 | 61.0 | 28.4 | 71.1 | 25.6 | 51.4 | ||||||

| Rebranding | 3.9 | N/A | 15.0 | N/A | 6.1 | N/A | ||||||

| Acquisitions | 147.2 | 172.1 | 2,788.1 | 522.5 | 944.3 | 852.9 | ||||||

| Expansion and Development | 207.1 | 24.9 | 247.9 | 13.9 | 191.8 | 9.9 | ||||||

| Total Non-Recurring Capital Expenditures | 420.0 | 258.0 | 3,118.5 | 607.5 | 1,196.6 | 914.2 | ||||||

| Total | $ | 456.1 | $ | 282.9 | $ | 3,169.5 | $ | 630.3 | $ | 1,241.9 | $ | 933.5 |

| Other Information | ||||||||||||

| Recurring Capex per Site, Slip and Dry Storage Spaces(b)* | $ | 270 | $ | 608 | $ | 397 | $ | 582 | $ | 371 | $ | 491 |

- Refer to Definitions and Notes for additional information.

- Average based on actual number of MH and RV sites and Marina wet slips and dry storage spaces associated with the recurring capital expenditures in each period.

Capitalization Overview

(Shares and units in thousands, dollar amounts in millions, except for *)

(a) Refer to “Securities” within Definitions and Notes for additional information related to our securities outstanding. (b) Refer to “Enterprise Value” and “Net Debt” within Definitions and Notes for additional information.

Summary of Outstanding Debt

(amounts in millions, except for *)

Quarter Ended

September 30, 2023

Weighted Average

Debt Outstanding Interest Rate(a)* Maturity Date*

| Secured Debt | $ | 3,359.5 | 3.81 % | Various |

| Unsecured Debt: | ||||

| Senior Credit Facility: | ||||

| Revolving credit facilities (in USD)(b) | 1,009.3 | 5.98 % | April 2026 | |

| GBP term loan (in USD)(c) | 1,066.4 | 4.83 % | April 2025 | |

| Total senior credit facility | 2,075.7 | |||

| Other unsecured term loan | 9.2 | 6.36 % | October 2025 | |

| Senior credit facility and other term loan | 2,084.9 | 5.39 % | ||

| Senior Unsecured Notes: | ||||

| 2028 senior unsecured notes | 446.7 | 2.30 % | November 2028 | |

| 2031 senior unsecured notes | 742.2 | 2.70 % | July 2031 | |

| 2032 senior unsecured notes | 592.4 | 3.62 % | April 2032 | |

| 2033 senior unsecured notes | 395.6 | 5.51 % | January 2033 | |

| Total Senior Unsecured Notes | 2,176.9 | 3.38 % | ||

| Mandatorily redeemable preferred equity and OP units(d) | 43.7 | 6.10 % | Various | |

| Total Unsecured Debt | 4,305.5 | 4.38 % | ||

| Total debt, per consolidated balance sheets | 7,665.0 | 4.13 % | ||

| Plus: Unamortized deferred financing costs and discounts / premiums on debt(a) | 40.1 | |||

| Total debt | $ | 7,705.1 |

- Includes the effect of amortizing deferred financing costs, loan premiums / discounts and derivatives.

- As of September 30, 2023, the Company’s revolving credit facilities consisted of:

- $464.0 million borrowed on its U.S. line of credit at the Secured Overnight Financing Rate (“SOFR”) plus 85 basis points, of which $125.0 million was swapped to a weighted average fixed SOFR rate of 4.771% for an all-in fixed rate of 5.681%.

- $473.8 million USD equivalent borrowed on its GBP line of credit at the Daily Sterling Overnight Index Average (“SONIA”) plus 85 basis points.

- $71.5 million USD equivalent borrowed on its Australian line of credit at the Bank Bill Swap Bid Rate (“BBSY”) plus 85 basis points.

- As of September 30, 2023, £500.0 million ($610.1 million) was swapped to a weighted average fixed SONIA rate of 2.924% for an all-in fixed rate, inclusive of spread, of 3.866%.

- Mandatorily redeemable preferred equity and OP unit distributions are included within the line item ‘Interest on mandatorily redeemable preferred OP units / equity’ on the Company’s Consolidated Statements of Operations.

Debt Maturities(e)

Principal Senior Senior Other

Year Secured Debt(f) Amortization Credit Facility Unsecured Notes Unsecured Debt Total

| 2023 | $ | 117.8 (g) | $ | 13.8 | $ | — | $ | — | $ | — | $ | 131.6 |

| 2024 | 128.8 | 56.5 | — | — | 51.1 | 236.4 | ||||||

| 2025 | 50.5 | 54.2 | 1,068.4 | — | 1.8 | 1,174.9 | ||||||

| 2026 | 658.4 | 46.2 | 1,009.3 | — | — | 1,713.9 | ||||||

| 2027 | 4.0 | 40.7 | — | — | — | 44.7 | ||||||

| Thereafter | 1,576.2 | 627.4 | — | 2,200.0 | — | 4,403.6 | ||||||

| Total | $ | 2,535.7 | $ | 838.8 | $ | 2,077.7 | $ | 2,200.0 | $ | 52.9 | $ | 7,705.1 |

- Debt maturities include the unamortized deferred financing costs and discount / premiums associated with outstanding debt.

- For the secured debt maturing between 2023 – 2027:

| 2023 | 2024 | 2025 | 2026 | 2027 | |

| Weighted average interest rate | 3.54 % | 4.03 % | 4.04 % | 3.97 % | 4.34 % |

- This debt was paid off with proceeds from the new secured loan that the Company entered into subsequent to the quarter ended September 30, 2023. The new $252.8 million loan matures in November 2030 and bears interest at a fixed rate of 6.49%.

Debt Analysis

As of September 30, 2023

| Select Credit Ratios | |||

| Net debt / TTM recurring EBITDA(a) | 6.1 x | ||

| Net debt / enterprise value | 33.2 % | ||

| Net debt / gross assets | 36.7 % | ||

| Unencumbered assets / total assets | 77.0 % | ||

| Floating rate debt / total debt(b) | 17.5 % | ||

| Coverage Ratios | |||

| TTM Recurring EBITDA(a) / interest | 4.0 x | ||

| TTM Recurring EBITDA(a) / interest + preferred distributions + preferred stock distribution | 4.0 x | ||

| Senior Credit Facility Covenants | Requirement | ||

| Maximum leverage ratio | <65.0 % | 33.9 % | |

| Minimum fixed charge coverage ratio | >1.40 x | 3.23 x | |

| Maximum secured leverage ratio | <40.0 % | 12.5 % | |

| Senior Unsecured Note Covenants | Requirement | ||

| Total debt / total assets | ≤60.0 % | 41.0 % | |

| Secured debt / total assets | ≤40.0 % | 17.9 % | |

| Consolidated income available for debt service / debt service | ≥1.50 x | 3.99 x | |

| Unencumbered total asset value / total unsecured debt | ≥150.0 % | 334.0 % |

- Refer to page 8 for additional detail on the Company’s TTM Recurring EBITDA.

- Percentage includes the impact of hedge activities.

Debt Maturities ($ in millions)^

^ Excludes the Company’s borrowings under its senior credit facility.

Definitions and Notes

Capital Expenditures and Investment Activity – The Company classifies its investments in properties into the following categories:

- Recurring Capital Expenditures – Property recurring capital expenditures are necessary to maintain asset quality, including purchasing and replacing items used to operate the communities and marinas. Recurring capital expenditures at the Company’s MH and RV properties include major road, driveway and pool improvements; clubhouse renovations; adding or replacing streetlights; playground equipment; signage; maintenance facilities; manager housing and property vehicles. Recurring capital expenditures at the Company’s marinas include dredging, dock repairs and improvements, and equipment maintenance and upgrades. The minimum capitalized amount is five hundred dollars.

- Non-Recurring Capital Expenditures – The following investment and reinvestment activities are non-recurring in nature:

- Lot Modifications – Lot modification capital expenditures are incurred to modify the foundational structures required to set a new home after a previous home has been removed. These expenditures are necessary to create a revenue stream from a new site renter and often improve the quality of the community. Other lot modification expenditures include land improvements added to annual RV sites to aid in the conversion of transient RV guests to annual contracts. See page 13 for move-out rates.

- Growth Projects – Growth projects consist of revenue-generating or expense-reducing activities at the properties. These include, but are not limited to, utility efficiency and renewable energy projects, site, slip or amenity upgrades, such as the addition of a garage, shed or boat lift, and other special capital projects that substantiate an incremental rental increase.

- Rebranding – Rebranding includes new signage at the Company’s RV communities and costs of building an RV mobile application and updated website.

- Acquisitions – Total acquisition investments represent the purchase price paid for operating properties and land parcels for future ground-up development and expansions activities (detailed for the current calendar year on page 14), plus any capital improvements identified during due diligence needed to bring acquired properties up to the Company’s operating standards.

Capital improvements subsequent to acquisition often require 24 to 36 months to complete after closing and include upgrading clubhouses; landscaping; new street light systems; new mail delivery systems; pool renovations including larger decks, heaters and furniture; new maintenance facilities; lot modifications; and new signage including main signs and internal road signs.

For the nine months ended September 30, 2023, the components of total acquisition investment are as follows (in millions):

Nine Months Ended September 30, 2023

MH and RV Marina Total

| Purchase price of property acquisitions | $ | 7.2 | $ | 100.6 | $ | 107.8 |

| Capitalized transaction costs for property acquisitions | 5.0 | 1.6 | 6.6 | |||

| Purchase price of land acquisitions (including capitalized transaction costs)(a) | 36.7 | — | 36.7 | |||

| Capital improvements to recent property acquisitions | 98.3 | 69.9 | 168.2 | |||

| Total Acquisition Investments | $ | 147.2 | $ | 172.1 | $ | 319.3 |

(a) Includes the value allocated to infrastructure improvements associated with acquired land, when applicable.

- Expansions and Developments – Expansion and development expenditures consist primarily of construction costs such as roads, activities, and amenities, and costs necessary to complete site improvements, such as driveways, sidewalks and landscaping at the Company’s MH and RV communities. Expenditures also include costs to rebuild after damage has been incurred at MH, RV or marina properties, and research and development.

Enterprise Value – Equals total equity market capitalization, plus total indebtedness reported on the Company’s balance sheet and less cash and cash equivalents (excluding restricted cash).

GAAP – U.S. Generally Accepted Accounting Principles.

Home Sales Contribution to FFO – The reconciliation of NOI from home sales to FFO from home sales for the quarter and nine months ended September 30, 2023 is as follows (in millions):

Quarter Ended September 30, 2023 Nine Months Ended September 30, 2023

North America UK Total North America UK Total

| Home Sales NOI | $ | 14.4 | $ | 22.9 | $ | 37.3 | $ | 41.7 | $ | 60.1 | $ | 101.8 | |

| Gain on dispositions of assets, net | (9.6) | (0.9) | (10.5) | (28.2) | (0.8) | (29.0) | |||||||

| FFO Contribution from home sales | $ | 4.8 | $ | 22.0 | $ | 26.8 | $ | 13.5 | $ | 59.3 | $ | 72.8 |