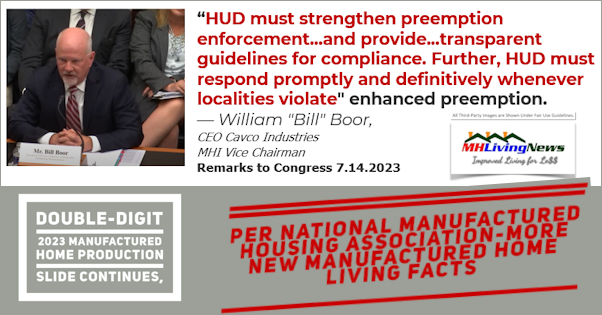

Evoking, says Oxford Languages, is the act of “bring[ing] or recall[ing] to the conscious mind.” Under the logo of the Manufactured Housing Institute (MHI), which F.R. “Jayar” Daily has served for years on their Board of Directors, is the testimony provided below by the longtime c-suite executive for American HomeStar Corporation. As MHProNews noted in a communique with a MHI board member recently, when this flashback testimony by “Jayar” Daily is compared to the more recent testimony of Cavco Industries (CVCO) CEO William “Bill” Boor, and other recent MHI actions, there are several topical similarities while noting distinctions too. For those with a keen memory to Boor’s testimony to Congress in July 2023, and for those who haven’t seen it yet or need a reminder, the CVCO leader’s complete formal remarks on behalf of MHI are at this link here. The document the below text was obtained from by MHProNews was from official Congressional sources. The footnotes for the following testimony by Daily for MHI are linked here. The reference to the Consumer Financial Protection Bureau (CFPB) White Paper on manufactured housing is linked further below in Part II.

There are several timely reasons – meaning, current events related motives – to look back at these comments by Daily now. Those insights and related analysis will be explored in Part II of this report.

Part I

Written Testimony

By

F.R. Jayar Daily

Chief Operations Officer, American Homestar Corporation

Director, Board of Directors of the Manufactured Housing Institute

Chairman, National Modular Housing Council

Immediate Past Chairman, the Manufactured Housing Division of the

Manufactured Housing Institute

Before the

Subcommittee on Housing and Insurance

House Financial Services Committee

U.S. House of Representatives

Hearing On

FUTURE OF HOUSING IN AMERICA: GOVERNMENT REGULATIONS AND

THE HIGH COST OF HOUSING

March 22, 2016

Washington, DC

Thank you, Chairman Luetkemeyer, Ranking Member Cleaver and members of the Subcommittee for the opportunity to testify this afternoon about the future of housing in America and the impact of government regulations on the high cost of housing. My name is Jayar (Francis) Daily and I am the Chief Operations Officer of American Homestar Corporation, a producer of manufactured and modular housing. I am appearing before you today on behalf of the Manufactured Housing Institute (MHI), where I serve on the Board of Directors, serve as Chairman of the National Modular Housing Council, and am the immediate past chairman of the Manufactured Housing Division.

American Homestar Corporation is headquartered in Houston, Texas, and was founded 45 years ago. Our company designs and produces factory built housing and is the nation’s fourth largest vertically integrated company in the industry. Our homes are marketed under the brand names of Oak Creek and Platinum Homes. We also build modular housing and various types of commercial structures. American Homestar Corporation also offers financing and insurance for our customers. Our manufacturing facilities are located in Texas and Alabama and we employ 750 people.

MHI is the only national trade organization representing all segments of the factory-built housing industry. MHI members include home builders, lenders, home retailers, community owners and managers, suppliers and others affiliated with the industry. MHI’s membership includes 50 affiliated state organizations. In 2015, the industry produced over 70,000 homes, approximately 9% of new single family home starts.

A robust manufactured housing market is critical to increasing the availability of affordable housing, which is, in so many parts of the country, in short supply. Manufactured home owners generally have low and moderate incomes, and commonly live in rural areas. My testimony is focused on three critical barriers to the development of manufactured housing: 1) a housing finance system that does not adequately meet the market’s needs; 2) a regulatory structure that, while solicitous of industry feedback, ultimately passes along costly and burdensome regulations; and 3) an authorizing statute that after over 40 years is in need of critical revisions.

Manufactured Housing is a Critical Source of Affordable Housing for Millions of Americans

Manufactured housing provides quality, affordable housing for more than 22 million very low-, low- and moderate-income Americans. The median annual income of manufactured homeowners is slightly more than $26,000 per year, nearly 50 percent less than that of all homeowners.[1] Manufactured housing represents 7.3% of all occupied housing units, and 10.3% of all occupied single-family detached housing[2].

Manufactured homes serve many housing needs in a wide range of communities—from rural areas where housing alternatives (rental or purchase) are few and construction labor is scarce and/or costly, to higher-cost metropolitan areas as in-fill applications. Manufactured housing is more prevalent in rural areas. About two-thirds of all occupied manufactured homes in the U.S. are located outside of metropolitan statistical areas (MSAs), and 14 percent of homes in non-MSA counties are manufactured homes.[1]

One of the many salient features of manufactured housing is the quality of the homes and the value to consumers achieved through technological advancements and cost savings associated with the factory-built process. Based on U.S. Census data, the cost of manufactured homes are 10 to 35 percent less than the cost of comparable site-built homes. The affordability of manufactured homes has long made these homes the preferred housing choice for many families, including first-time homebuyers, retirees and families in rural areas.

Unlike site-built homes, manufactured homes are built almost entirely in a controlled manufacturing environment in accordance with federal building codes administered by the Department of Housing and Urban Development (commonly referred to as the “HUD Code”). Homes are transported to the home-sites where they are installed in compliance with federal and state laws.

The HUD Code is the only federal residential building code. It regulates home design and construction, installation, durability, resistance to natural hazards, fire safety, electrical systems, energy efficiency, and other aspects of the home. Homes are inspected by a HUD approved third party during the construction process and the industry adheres to HUD’s robust quality assurance program, which offers greater controls than other forms of housing in the home building industry. Federal, state or local authorities inspect each home installation.

The quality, reliability and durability of manufactured homes has improved substantially since the enactment of the Manufactured Housing Improvement Act of 2000, which considerably strengthened HUD’s oversight of construction and safety standards, set a national standard for installation, and required a Dispute Resolution program in every state to address disputes between consumers and manufacturers and installers. As a result, the quality of manufactured homes is much higher than it was 20 or 30 years ago.

The industry faces three strong headwinds that keeps it from achieving its full potential in addressing the affordable housing needs of the nation. The first is a housing finance regulatory system that does not adequately account for the unique way manufactured housing is financed. Because current Home Ownership and Equity Protection Act (HOEPA) regulations do not have sufficient flexibility on rates, points, and fees for small loan sizes, the pace of lending for manufactured homes has declined. With respect to the Federal Housing Administration (FHA), because of outdated rules, FHA’s Title I mortgage insurance program for chattel loans is of minimal utility. In addition, because there is not a secondary market for chattel lending, financing costs are higher for chattel loans than for mortgages on site-built homes. As a result, borrowers seeking to finance an affordable manufactured home have fewer options than borrowers who seek to finance site-built real estate.

The second challenge facing manufactured housing is a regulatory structure that lacks clarity, has the potential to overlap, and does not adequately incorporate industry feedback into regulations and guidelines. Regulatory uncertainty and barriers present compliance risks and costs that are ultimately passed on to the consumers. For example, often HUD does not properly take into account the economic impacts of new requirements when finalizing regulations about the construction of manufactured housing. HUD also does not take a comprehensive view on all the regulations impacting manufactured housing so that the myriad patchwork of regulations do not have unintended cost consequences. Further, because HUD does not use its preemption authority for construction standards the way it should, states and localities are able to set guidelines in contrast to HUD Code, and in some cases localities are able to “zone” out manufactured housing communities.

Third, the legislation that established the manufactured housing construction safety standards (HUD Code), was enacted in 1974 and has become antiquated. Enacted at a time when manufactured housing was in its infancy, and transitioning from a “travel trailer” industry to one that provides permanent single family residential housing, this legislation needs to be updated so that the industry can continue to drive innovations in manufacturing.

The Challenge of Financing Manufactured Housing

MHI is eager to work with the Subcommittee to reduce the regulatory burdens harming consumers seeking to achieve the American Dream of homeownership by purchasing a manufactured home. The manufactured housing industry is fully committed to protecting consumers throughout the home buying process. MHI recognizes the importance of responsible lending and improving the consumer experience. Unfortunately, current regulations and the housing finance system harms consumers of manufactured housing by inadvertently limiting financing for this affordable homeownership option.

Reducing Regulatory Burdens to Financing for Manufactured Homes

Recent federal regulations have jeopardized access to manufactured housing financing.

The rules have penalized home buyers that cannot access traditional mortgage financing needed for single-family home ownership or live in rural areas where affordable rental or site-built housing is scarce or non-existent. Additionally, many at-risk families have seen the equity they have diligently built up in their manufactured homes wiped out because lenders are not providing the financing needed for resale due to these regulations.

There are two slight revisions to Consumer Financial Protection Bureau (CFPB) regulations that can spur lending without harming the consumer protections contained in the Dodd-Frank Act.

High-Cost Mortgage Definition. The HOEPA provisions of the Dodd-Frank Act that established parameters for which mortgage loans are classified as “high cost” included more flexible annual percentage rate (APR) and points and fees provisions for small loans. This was in recognition of the simple mathematical fact that fixed costs on smaller loans translate into higher percentages of the total loan amount. Unfortunately, in practice, this flexibility has not been sufficient to address market realities. The 2014 Home Mortgage Disclosure Act (HMDA) data offers empirical evidence of the negative real world impact from the current HOEPA small loan thresholds, confirming conclusively that manufactured home lenders are not making loans with the “high-cost” HOEPA designation. The HMDA data shows that lenders made such loans before the rules went into effect, and they did not make them after. Manufactured home loans of all size categories went down by double digits, and the lower the dollar amount size the more pronounced the year-over-year decline. In comparison, overall mortgage loan data (for all homes) shows a 2013 to 2014 year-over-year increase in the number of mortgage loans. A simple adjustment to these thresholds is necessary to enable lenders to fully meet the demand for affordable financing for manufactured homes.

- Loan Originator Definition. The definition of loan originator established by the Dodd-Frank Act is based on traditional mortgage market roles that do not reflect the distinct features of the manufactured housing market. While they are only in the business of selling homes and do not originate loans, manufactured home retailers and sellers currently run the risk of being considered mortgage loan originators. Manufactured housing retailers and sellers should be excluded from the definition of a loan originator, so long as they are only receiving compensation for the sale of the home and not engaged in financing the loans. This simple change will not result in individuals receiving kickbacks for referrals, because they are barred from receiving compensation related to the loan.

These are modest modifications, but they are much needed to alleviate the challenges facing working families seeking quality affordable housing and families currently living in manufactured housing. The proposed statutory changes would more accurately take into account the price pressures unique to manufactured home lending while still maintaining significant consumer protection from predatory lending practices. The terms typically associated with manufactured home loans—namely fixed interest rates, full amortization, and the absence of alternative features (such as balloon payments, negative amortization, etc.)—allow lenders to satisfy the requirements of what the Dodd-Frank Act would consider conservative and prudent underwriting standards. In addition, existing regulatory requirements and statutory guidelines outlined in the Dodd-Frank Act provide significant consumer protections and disclosures while prohibiting many predatory loan features. These proposed revisions ensure that substantial protections are available to consumers while ensuring financing remains available for manufactured housing.

MHI commends the House Financial Services Committee for recognizing that consumers are being harmed by current regulations that limit the availability of financing for manufactured homes. In particular, MHI appreciates the Committee’s leadership in swiftly and successfully moving H.R. 650, the Preserving Access to Manufactured Housing Act, through the legislative process in the House of Representatives with bipartisan support. MHI hopes the Committee will continue to work toward its enactment in the 114th Congress.

Improving FHA’s Programs for Manufactured Housing Finance

FHA Title I Program. The FHA Title I program provides an affordable financing option for personal property manufactured homes. However, due to a number of outdated program rules, FHA only endorsed $24 million in Fiscal Year 2014. This is woefully inadequate given that manufactured homes comprise seven percent of total occupied housing units in the United States. In many areas of the country, particularly rural areas, manufactured housing is the only form of quality affordable housing available. Improvements to the FHA Title I program would help ensure families in these communities have access to financing for manufactured homes through the Title I program.

The following are administrative changes HUD should implement to make the Title I program more effective:

- Origination Fees. The low dollar principal amounts of new personal property manufactured home loans means that the existing cap of two percent of the loan amount on the fees a lender can charge is not high enough to cover the cost of underwriting these loans, particularly with increased compliance costs related to new requirements under the Dodd-Frank Act. We believe this helps to explain the lack of utilization of the Title I program. Other laws, including Qualified Mortgage (QM) and HOEPA, have provisions that take into account the impact of lower balance personal property loans. FHA already permits a minimum underwriting fee of $2,500, for example, for a reverse mortgage (HECM) loan. The FHA Title I manufactured home loan program should also adopt a reasonable minimum permissible origination fee. MHI recommends that HUD amend its current underwriting loan fee cap of two percent of the loan amount to also allow a flat dollar amount of $2,000 for all loans.

- There are a limited number of eligible appraisers (80-85 in the entire country) who are qualified to perform Title I manufactured home appraisals. In many rural areas, where the majority of manufactured homes are located, there are literally no Title I qualified manufactured home appraisers who are available to perform an appraisal. Current appraisal requirements in the Title I program have resulted in fewer qualified appraisers and limited competition in the marketplace. HUD should amend the current requirement that requires all appraisers to be certified by a single private company (NADA) to also allow inspectors trained by qualified firms to do the on-site inspection, provided the work is ultimately reviewed and approved by NADA certified individuals. This would inject more competition into the provision of these appraisal services, while maintaining overall quality standards through the NADA certification process.

- Underwriting Standards. The detailed loan underwriting standards in the Title I program need to be updated to better align with the FHA Title II loans program. In particular, Title I underwriting standards regarding DTI ratios, treatment of Chapter 7 bankruptcy and other derogatory credit items, treatment of medical collections, and treatment of total unpaid collections should be changed to match those requirements in the Title II program.

- FHA Title II Program. The FHA Title II program is commonly used for “real estate” manufactured home loans, where the mortgage covers the land and the home. MHI recommends HUD update its installation requirements to conform to the HUD Minimum Installation Standards that were established in 2009, rather than utilizing the requirements in the outdated 1994 handbook. This would align installation requirements with more recently adopted standards that were implemented under the comprehensive 2000 regulatory legislation.

Establishing a Secondary Market for Chattel Loans

The 2008 Housing and Economic Recovery Act (“HERA”)4 singled out manufactured housing as one of only three Underserved Markets. This reflected frustration with the declining volume of Enterprise manufactured housing loan purchases at the time and with the virtual exclusion of chattel loans from the types of loans they would purchase. FHFA is in the process of reviewing comments it received as part of the proposed Duty to Serve rule. Since chattel loans constitute almost 70 percent of the manufactured housing market and are the most underserved segment of that market, MHI believes the final Duty to Serve rule cannot fulfill its statutory responsibilities without a significant requirement to purchase chattel loans.

Over the past eight years, the Enterprises have done little to support manufactured housing. Outside of some pre-financial crisis efforts to create a secondary market for chattel loans, the Enterprises have made no effort to purchase chattel loans despite significant improvements in the housing market and chattel lending underwriting guidelines and sound industry risk management practices. Additionally, even when measured against conventional mortgages, the Enterprises have purchased little in the way of conventional manufactured home loans. In fact, according to a 2014 GAO report, only 7 percent of conventional manufactured home mortgages were sold to the Enterprises

To put a finer point on why a secondary market is necessary to support manufactured housing, the Consumer Financial Protection Bureau, in its September 2014 paper on manufactured housing, stated that chattel loans are approximately 50 to 500 basis points more expensive than real property loans[1]. In large part this disparity is due to the additional risks the lender takes on: a lack of a significant secondary market for chattel loans which may account for 100 to 150 basis points, concomitant interest rate risk, which combined may account for an additional 150 to 200 basis points, higher servicing costs and very limited risk sharing with lenders by either the private or government sectors, which may account for an additional 150 basis points.

A strong secondary market for chattel loans has the potential to not only ease financing costs for consumers but also expand consumer choice as more lenders enter the market. A strong secondary market will also provide refinancing opportunities to manufactured homeowners as market conditions warrant.

The Challenge of a Complex Regulatory Structure

As the only federally-regulated national building code, the HUD Code regulates manufactured home design and construction, installation requirements for strength and durability, resistance to natural hazards, fire safety, electrical systems, energy efficiency, and all other aspects of the home. Homes are inspected every step of the way and our industry adheres to a robust quality assurance program which offers far greater controls than anyone else in the home building industry. As a result, the industry has achieved economies of scale that have brought high quality affordable homes to millions of working American families and retirees.

While the HUD Code has brought standardization to the industry, in order for manufactured housing to achieve its full potential in addressing the affordable housing needs of the nation, the administration of the HUD Code should be improved to better account for cost impacts and industry practices. We believe improvements in this area fall into three categories: 1.) improving the way HUD develops and implements regulatory changes to the HUD Code, including properly taking into account the economic impacts of new requirements when finalizing regulations about the construction of manufactured housing; 2.) enforcing its federal preemption authority for construction standards and aggressively weighing-in on local construction standards used to “zone” out manufactured housing; and 3.) taking a comprehensive view on all the regulations impacting manufactured housing so that the myriad patchwork of regulations do not have unintended cost consequences.

1.) MHI recommends improving the way HUD develops and implements regulatory changes to the HUD Code, including properly taking into account the economic impacts of new requirements when finalizing regulations about the construction of manufactured housing.

The ability to utilize new technologies and materials, and to maintain the integrity of the uniform single building code is dependent on a construction code that is current. Recognizing this, in 2000 Congress passed the Manufactured Housing and Improvement Act (MHIA), which expanded HUD’s mission with regard to manufactured housing and improved the process for establishing, revising, enforcing, and updating the HUD Code. The law created the Manufactured Housing Consensus Committee (MHCC), an advisory committee comprised of industry, consumer and other stakeholders to recommend revisions and interpretations of the HUD Code.

While HUD has recently made strides in reducing backlog of MHCC recommendations, updates to the code continue to be hindered by the cumbersome rulemaking constraints of the Administrative Procedures Act, lengthy internal reviews, and low staffing levels/prioritization of the manufactured housing program at HUD. MHI recommends that HUD utilize the interim final rule process to more expeditiously implement MHCC recommendations. The process would allow HUD to publish the MHCC recommendations as interim final rules that could take effect immediately upon publication in the Federal Register. The public would still have an opportunity to comment, but in the meantime, an updated standard could be utilized.

MHI is increasingly concerned about HUD’s use of “Guidance Memorandum” to enforce and interpret the HUD Code, without seeking input from stakeholders. While there might be legitimate circumstances that necessitate the use of “Guidance Memorandum,” this is being used more and more frequently. HUD should follow its statutory mandate and seek approval from the MHCC prior to issuing guidance changing manufactured housing regulations. In the rare cases a guidance must be utilized, necessary input must be solicited from stakeholders to ensure housing affordability is maintained.

While an updated and current code is essential, MHI does not believe this should diminish efforts to ensure the benefits to consumers outweigh the additional costs resulting from new regulations. To maintain housing affordability, it is absolutely imperative that HUD conduct adequate cost-benefit analyses of all potential new regulations. As it stands, HUD does not undertake the appropriate cost analysis, testing and research required to update the HUD Code. This results in changes to the code that push up costs without a clear justification that the new regulations will lead to improvements to the code that are in the best interest of consumers.

A recent example of the negative impact of not conducting a cost-benefit analysis is with respect to the “On-site Completion” Rule. This final rule, which was published on September 8, 2015, establishes extensive new requirements for the on-site completion of construction of manufactured homes. In its final rule, HUD failed to assess the costs associated with the expanded requirements for homes that are substantially complete when they leave the factory. Because of this significant oversight, the Rule was “determined to not be a significant regulatory action under Section 3(f) of Executive Order 12866, Regulatory Planning and Review,” and therefore was not reviewed by the Office of Management and Budget.

MHI strongly believes the “On-site Completion” Rule adds significant planning, review, reporting, and paperwork burdens. According to a survey of manufacturers, retailers, and third parties, MHI estimates that the new Rule could impact as many as ten to fifteen percent of all new homes. The cost impact could be as much as $7 to $10.5 million. This cost does not include one-time design reviews for each site-construction labeled home, nor does it include increased costs to track inspections and keep records.

- MHI Recommends HUD Enforce its Federal Preemption Authority for Construction Standards and Aggressively Weigh-in on Local Construction Standards Used to “Zone” Out Manufactured Housing.

MHI has been working to address zoning and land use issues impacting the placement of manufactured homes in communities across America. These policies take affordable homeownership out of reach for those consumers who would choose a manufactured home. HUD has proactively pursued individual cases where local jurisdictions have sought to legislate construction and safety standards that are not identical to the HUD standards, or which exclude HUD- compliant manufactured homes on that basis. However, we believe that HUD can play a greater role in this effort, and in fact, has a Congressional mandate to do so.

The Manufactured Housing Improvement Act of 2000 (MHIA) significantly strengthened the preemptive language originally contained in the National Manufactured Housing Construction and Safety Standards Act of 1974 (MHCSS). MHI believes HUD has jurisdictional authority to move beyond a case-by-case analysis and affirmatively state a policy opposing local regulatory schemes that are in conflict with HUD’s mission and with its requirements under MHCSS Act and MHIA.

- MHI Recommends HUD Take a Comprehensive View of All the Regulations Impacting Manufactured Housing

While manufactured housing is insulated from disparate local requirements for building construction, it is still subject to zoning, land use, environmental, and permitting regulations as well as regulations of federal agencies, including the Department of Energy, Occupational Safety and Health Administration, Department of Transportation and the Environmental Protection Agency. Although these state, local and federal regulations serve legitimate purposes, they can present excessive burdens when they are applied—particularly when considering their cumulative effect— slowing down construction and driving up cost. We recommend that HUD, when establishing its own regulations for manufactured housing, take a close look at these crosscutting federal requirements to determine whether they might be simplified and made more flexible while still meeting the policy objectives Congress and the Federal Agencies initially sought by instituting them. HUD, in its role as the administrator of the Manufactured Housing Programs, has a statutory responsibility to protect the affordability of manufactured homes, as well as the safety, durability and quality.

In particular, MHI believes that HUD needs to maintain full authority for the enforcement of energy efficiency standards for manufactured housing. In 2007, Congress enacted legislation, the Energy Independence and Security Act (EISA), which contained a provision requiring the Department of Energy (DOE) to implement energy efficiency standards for manufactured housing. This had the result of creating dual administrative enforcement and regulatory authority over manufactured homes.

Last year, DOE’s Appliance Standard Rulemaking Advisory Committee (ASRAC) conducted negotiated rulemaking and developed a consensus recommendation for affordable, updated energy efficiency standards. DOE plans to publish a proposed rule based on the ASRAC recommendations in the very near future. While DOE has the expertise to develop energy efficiency standards, HUD should administer the standards through its existing regulatory framework. This will ensure that manufactured homes have updated energy efficiency standards, preserve affordability and minimize duplicative compliance and enforcement regulations. This is one of the key reasons why MHI supports H.R. 3135, which would preserve HUD’s exclusive jurisdiction over all manufactured housing construction standards.

The Challenge of Outdated Manufactured Housing Construction and Safety Standards

The Manufactured Housing Construction and Safety Standards Act of 1974 (MHCSS Act) provides the statutory basis for federal construction and safety standards, which apply to all manufactured homes nationwide. The law, last amended in 2000, needs a number of updates to ensure it is effectively preserving this affordable home ownership option. For example, the manufactured housing industry operates under an outdated law that in some instances treats homes like automobiles – by requiring, for example, a steel chassis and subjecting the industry to federal lemon laws. Adhering to these outdated standards incurs costs on both the construction side and the risk management side.

Thus, changes to the 1974 Act would enhance affordability by allowing more design options under the HUD Code and moving the regulations away from non-applicable automotive laws. Changes would eliminate the need for the industry to build on a steel chassis, which would give manufacturers and homebuyers more affordable housing options, while not impacting the safety and soundness warranties that are administered at the state level.

Amend the Definition of “Manufactured Home” (42. U.S.C. 5406).

The current definition of a manufactured home is outdated, as it was developed when the manufactured housing industry was in its infancy, and was transitioning from a “travel trailer” industry to an industry that provides permanent single family residential housing. The definition contains size, length and width requirements that are more appropriate for vehicles traveling down a highway. More importantly, the definition specifies that a manufactured home be built on a permanent chassis.

This outdated definition has constrained the ability for homes to be designed and permanently sited utilizing traditional methods of foundation design and construction comparable to site-built and modular housing. It adds unnecessary costs to homebuyers and can make it difficult, if not impossible, for manufactured homes to be aesthetically compatible with other forms of single family housing. It is also a barrier to more favorable zoning.

Updating the definition of a manufactured home would eliminate confusion between all types of recreational vehicles which are designed for recreational, temporary use, and are not designed for permanent residential use.

Eliminate Current Requirements for Notification and Correction of Defects (42 U.S.C 5414).

The MHCSS Act sets forth a complex system of notification and repair of manufactured homes for non-compliances, defects, and serious defects or imminent safety standards for the entire life of the home. The system is based on federal and state laws that address warranty issues more common to automobiles and other consumer products. Residential housing is not covered by the Magnusson-Moss Warranty Act, which is the federal “lemon law.”

Manufactured homebuilding is very competitive, and manufacturers take consumer satisfaction very seriously. The HUD Code provides for a robust quality control system and stringent compliance and enforcement requirements that are sufficient to protect consumers from serious safety hazards.

Replace the Notification and Correction of Defects Provisions with an Extended Warranty Requirement (42 U.S.C. 5414).

Under current law and regulation, a one-year warranty for all defects is required. In lieu of the burdensome, lifetime requirements of “Subpart I –Notification and Correction,” Congress should consider requiring an extended warranty for major structural, plumbing, electrical and mechanical systems in the home. The Subpart I regulations authorized under 42 U.S.C. 5414 were never intended to resolve complaints concerning defects and workmanship. Nor is it practical or cost effective to divert the attention of the code enforcement system to workmanship issues. Home defects and consumer complaints are more appropriately handled through a long-term warranty program that complements market realities of total quality assurance and consumer satisfaction.

Other Proposed Changes to the MHCSS Act

Other changes to the MHCSS Act that should be considered include: establish a formula for setting label fees based on production levels; authorize HUD to circumvent requirements under the Administrative Procedures Act (APA) for non-controversial updates and changes to the HUD Code that have been recommended by the MHCC; direct HUD to update its 1997 directives on zoning and preemption to reflect changes made to the MHCCS Act in 2000, in order to prevent local communities from discriminating against the siting of manufactured homes through the establishment of construction and safety standards and requirements which exceed those in the HUD Code.

Conclusion

Manufactured homes are the most affordable homeownership option in the market today and MHI appreciates the opportunity to offer our ideas to the Subcommittee about how to improve access to credit for families buying these homes, to streamline regulations and remove regulatory barriers to affordability, and to update outdated construction standards that impact cost and innovation.

MHI believes that manufactured housing can help address America’s affordable and workforce housing challenges into the future. MHI stands ready to work with the Subcommittee to develop appropriate legislative language and identify specific regulatory changes, to implement these recommendations to alleviate the challenges facing working families, seniors, and young professionals seeking quality affordable homeownership opportunities. ##

Part II – Additional Information with More MHProNews Analysis and Commentary

As a housekeeping item promised in the preface above, the CFPB White Paper on Manufactured Housing referenced above is linked here. Note that one of the footnoted sources cited by the CFPB was the MHProNews sister site, MHLivingNews.

Relevant to the above and what follows is this X (formerly “Twitter”) post by Cavco Industries from MHI Winter Meeting in New Orleans discussion “Industry Outlook” Now is our Time.” Compare and contrast that from 2022 with the title of the above testimony “FUTURE OF HOUSING IN AMERICA: GOVERNMENT REGULATIONS AND THE HIGH COST OF HOUSING” in 2016.

Shown engaging in a panel discussion (“Industry Outlook: Now Is Our Time”) at the 2022 @MHIupdate Winter Meeting in New Orleans are Leo Poggione, Craftsman Homes (MHI Chair); Bill Boor, Cavco Industries (MHI Vice Chair); and Lance Hull, 21st Mortgage. #manufacturedhousing #events pic.twitter.com/j4BCu2Gimm

— Cavco Industries (@cavcoindustries) February 11, 2022

Among the pull quotes from Daily’s remarks to Congress cited in Part I above worth exploring, in no particular order of importance, are the following.

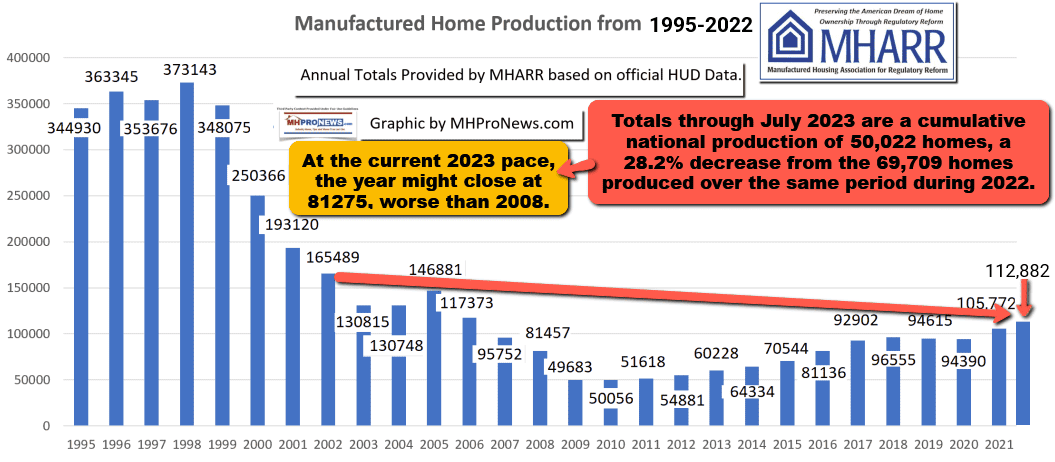

“Manufactured housing represents 7.3% of all occupied housing units, and 10.3% of all occupied single-family detached housing[2].” (MHProNews note: what that remark, compared to what William “Bill” Boor told Congress just a couple of months ago, means is that manufactured housing’s share of occupied housing is in decline. Meaning that data point is one more indication that manufactured housing is underperforming as an industry.)

“The industry faces three strong headwinds that keeps it from achieving its full potential in addressing the affordable housing needs of the nation. The first is a housing finance regulatory system that does not adequately account for the unique way manufactured housing is financed.”

“A strong secondary market for chattel loans has the potential to not only ease financing costs for consumers but also expand consumer choice as more lenders enter the market. A strong secondary market will also provide refinancing opportunities to manufactured homeowners as market conditions warrant.” (MHProNews note: These two quoted remarks by Daily remind us that similar wording have been standard fodder for MHI statements for years. Is there any substantial progress on this issue notable from the data? In a word, ‘no.’)

“Regulatory uncertainty and barriers present compliance risks and costs that are ultimately passed on to the consumers. For example, often HUD does not properly take into account the economic impacts of new requirements when finalizing regulations about the construction of manufactured housing. HUD also does not take a comprehensive view on all the regulations impacting manufactured housing…”

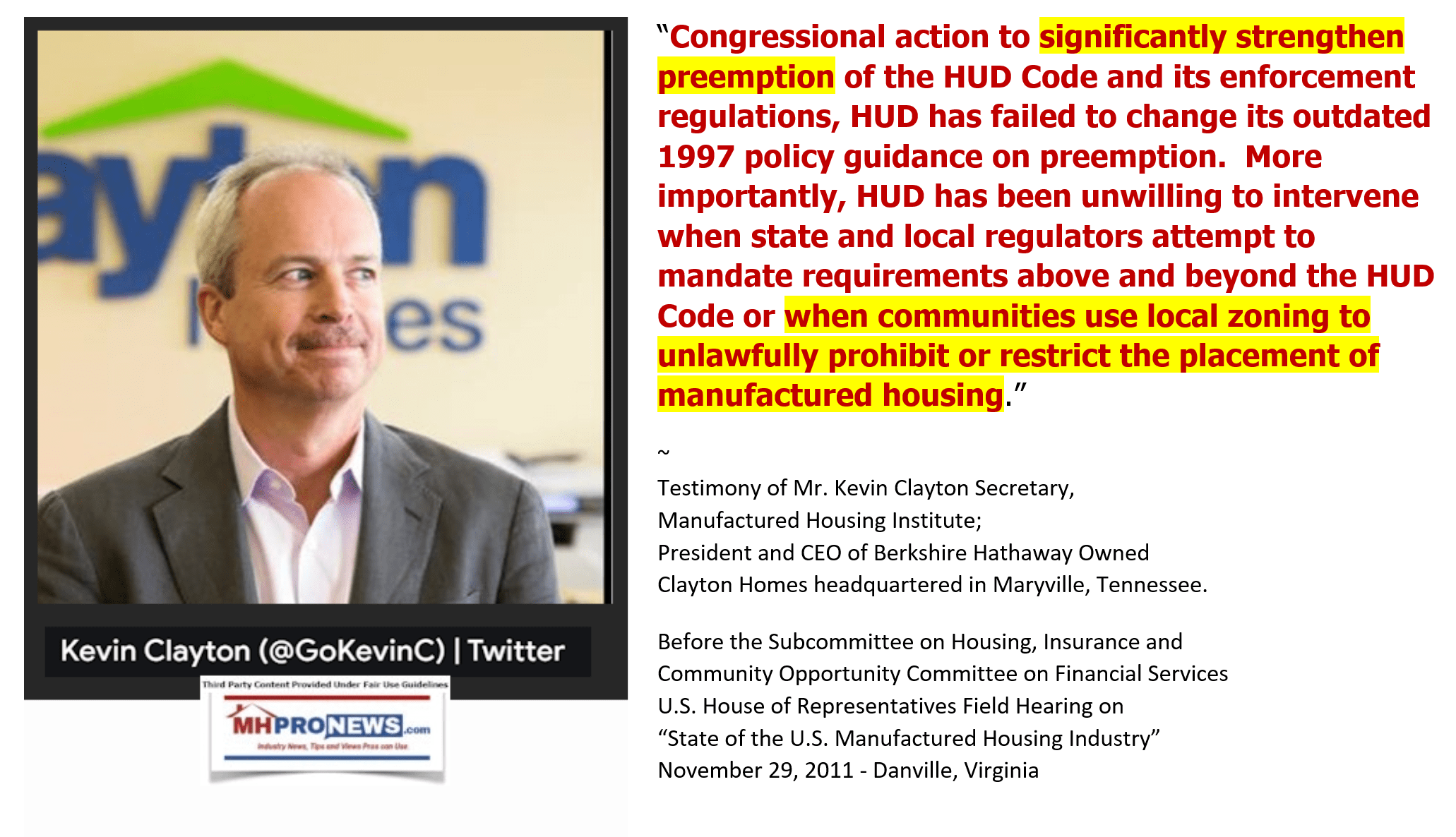

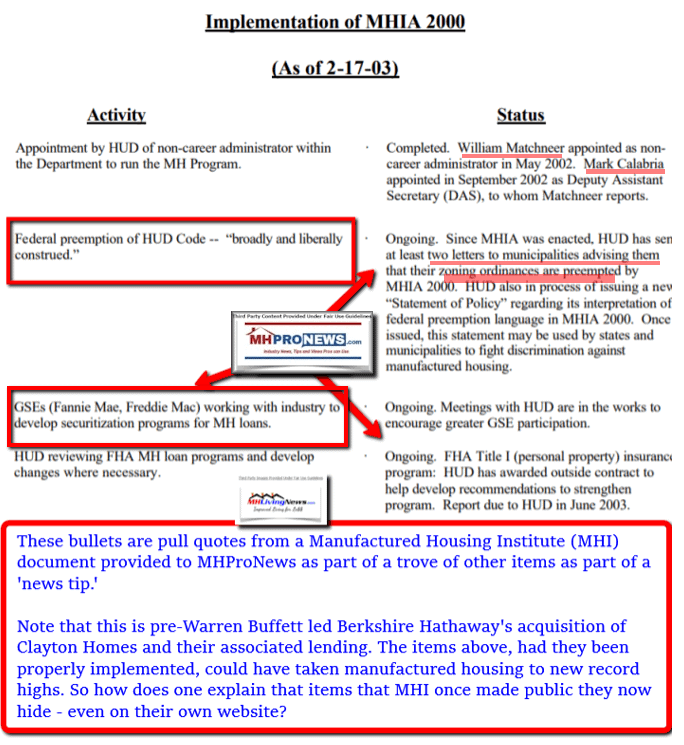

“Further, because HUD does not use its preemption authority for construction standards the way it should, states and localities are able to set guidelines in contrast to HUD Code, and in some cases localities are able to “zone” out manufactured housing communities.” (MHProNews note: Bill Boor made similar comments in July 2023. Prior remarks on behalf of MHI years before these remarks by F.R. “Jayar” Daily reflect the point that the Manufactured Housing Improvement Act (MHIA) of 2000 and its “enhanced preemption” provision remain sore spots nearly 23 years after the legislation was enacted. How is that not a failure on the part of MHI, which claims to represent “all segments” of the manufactured housing industry? What is that failure tolerated by MHI board leadership? That will be explored further below.)

“MHI is eager to work with the Subcommittee to reduce the regulatory burdens harming consumers seeking to achieve the American Dream of homeownership by purchasing a manufactured home. The manufactured housing industry is fully committed to protecting consumers throughout the home buying process. MHI recognizes the importance of responsible lending and improving the consumer experience. Unfortunately, current regulations and the housing finance system harms consumers of manufactured housing by inadvertently limiting financing for this affordable homeownership option.” (MHProNews note: those remarks are a wink and a nod form of stated contrition for the industry’s ‘liar loan’ period in the late 1990s which resulted in the industry’s financing meltdown with the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac. But who expects that of the site-built housing industry for the liar loan period in early part of the 21st century run-up to the housing and financial markets collapse of 2008? As the FHFA reflected in their featuring the remarks of this writer for MHProNews on their website, the losses of the manufactured home industry versus those of the site-built housing industry are but a “pimple on an elephant’s ass” by comparison. When will manufactured housing’s contrition be sufficient to placate those who sided with conventional housing where the losses were many times greater and far more harmful?)

Referring to updates requested to the HUD Code for manufactured housing: “Changes would eliminate the need for the industry to build on a steel chassis, which would give manufacturers and homebuyers more affordable housing options, while not impacting the safety and soundness warranties that are administered at the state level.” Note that MHI recently supported the notion of a removable chassis in Senator Tim Scott (SC-R) draft for housing legislation. So, some 7 years later, the talk then is the talk now.

“In particular, MHI believes that HUD needs to maintain full authority for the enforcement of energy efficiency standards for manufactured housing. In 2007, Congress enacted legislation, the Energy Independence and Security Act (EISA), which contained a provision requiring the Department of Energy (DOE) to implement energy efficiency standards for manufactured housing.” (MHProNews note: it wasn’t until 2022 that MHI introduced legislation that claimed to aim to fix this problem. Why didn’t MHI introduce that legislation years ago?)

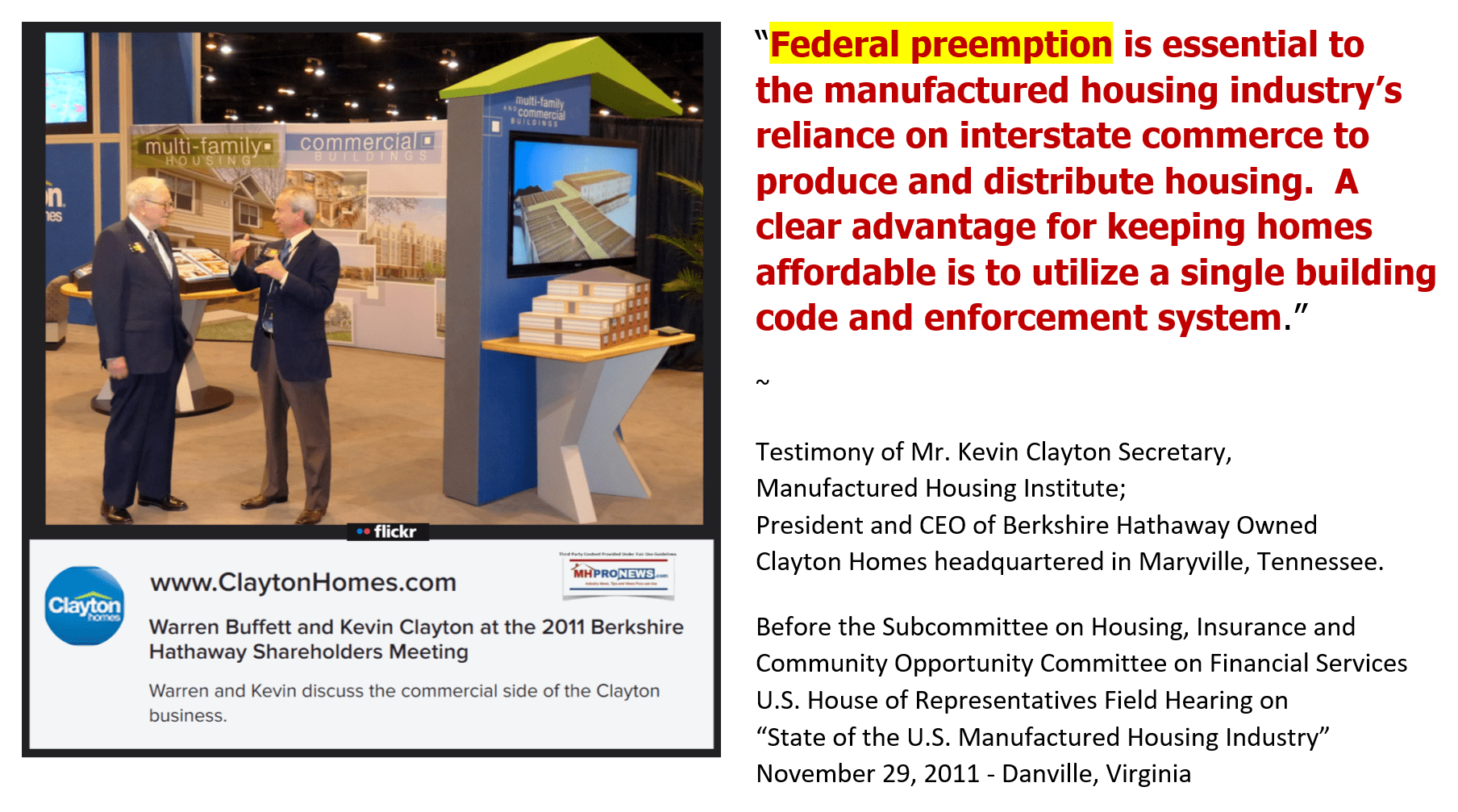

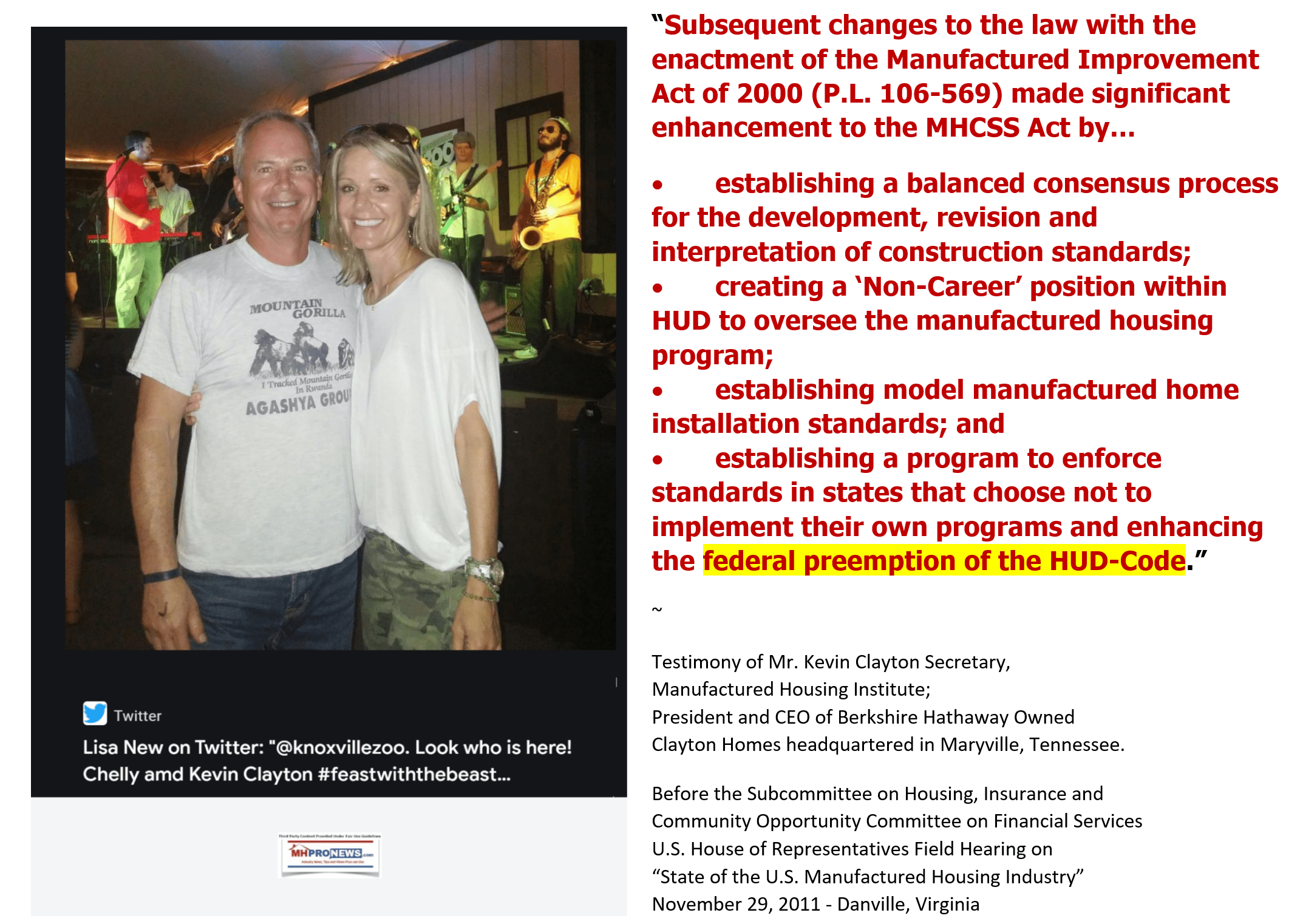

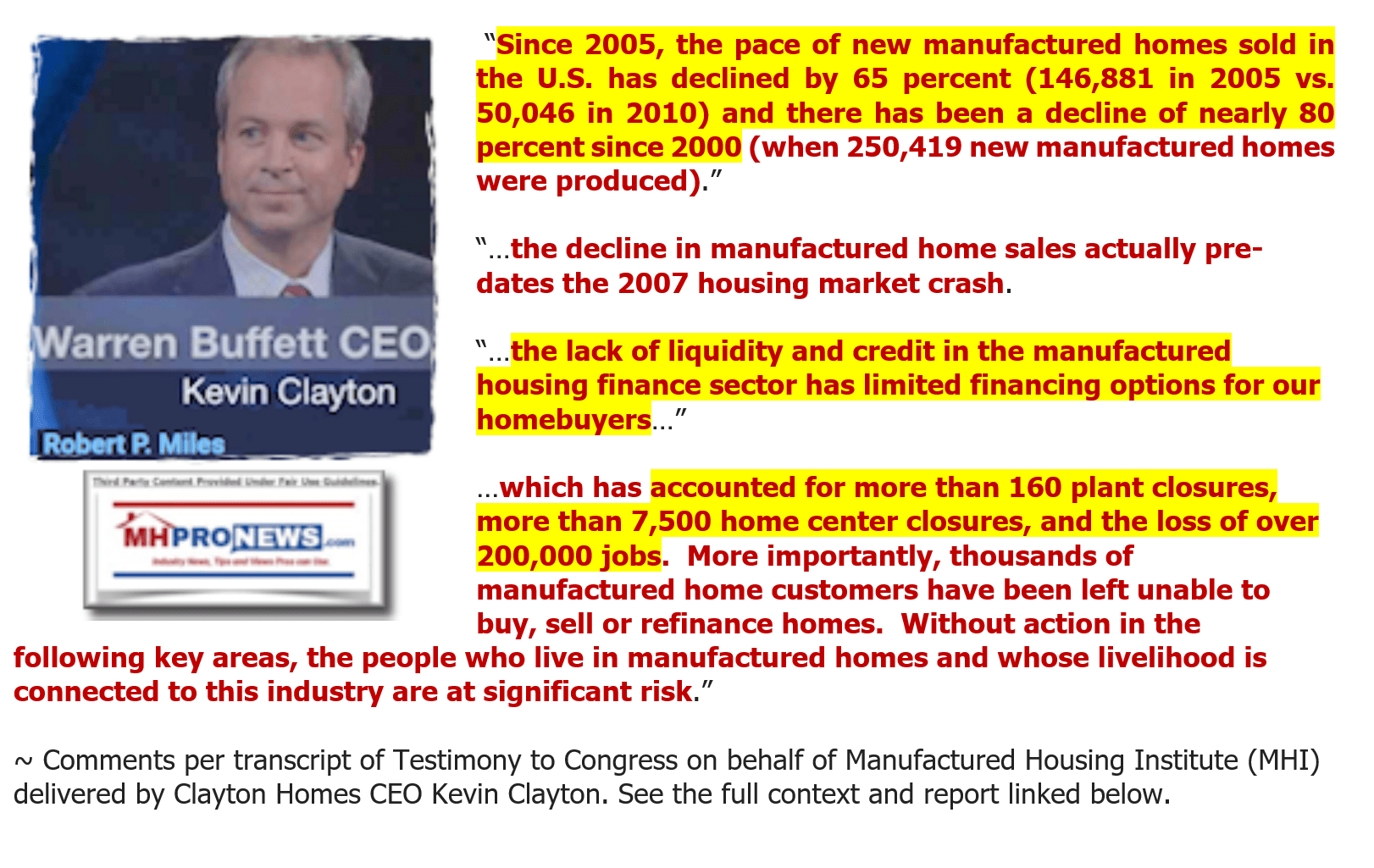

Now, flashback to remarks by Kevin Clayton to Congress in 2011.

Then, compare statements and remarks to those made by Cavco CEO Bill Boor to Congress on July 14, 2023.

The Boilerplate

What a close look at these various remarks reveal is this.

There is a template, or what some call a boilerplate, that MHI has used for a dozen years or more.

The same or similar remarks are rolled out for comments to lawmakers and regulators.

When the remarks from 2011 by Clayton are compared to those in 2016 by Daily and those are read to those made by Cavco’s Bill Boor in 2023, there are several obviously similar remarks. There are a few distinctions, based upon the year, production levels at that time, or some other ‘current event.’

What that should clearly mean is that MHI has obviously talked about the same issues over and over again without actually accomplishing what they claim to want to achieve. They have checked a box that the industry’s informed professionals should want to hear.

But the ineffective nature of that boilerplate pattern was potently summed up by former MHI Vice President Danny Ghorbani when he said the following about MHI.

No offense to those pithy insights by Ghorbani, but this pattern of MHI’s is not limited to zoning/placement and consumer finance woes. Rather, they include the long run-up to the DOE energy rule (see Daily’s remarks above and Boor’s too). They also include the pitch for a removable chassis on a HUD Code manufactured home and other topics too.

Ghorbani knows this, because he went in depth with MHProNews in Q&A remarks later republished on the Manufactured Housing Association for Regulatory Reform (MHARR) website that lays out the vexing history of the DOE energy rule, and what he asserts is MHI’s part in bringing that rule about.

Investopedia defines boilerplate as follows. “The term boilerplate refers to standardized text, copy, documents, methods, or procedures that may be used over again without making major changes to the original.”

A boilerplate method is not per se wrong, misguided, or evil. But the Cambridge Dictionary’s definition points to an apparent weakness in the boilerplate: “a way of writing or thinking that is not special and does not show any imagination.”

At best, the 21st century Berkshire era of MHI apparently lack’s imagination. The same old boilerplate remarks are rolled out for regulators, legislators, or at times even to the industry’s – and MHI’s – members themselves.

But when those boilerplate remarks are brought forth and examined, as this article has done, it arguably reveals just how pathetically ineffective MHI has become in the Berkshire era (2002 and since). That ineffectiveness can be measured several ways, including:

- How often has MHI achieved its stated objective?

- How is manufactured housing as an industry performing when measured by the acid test of production? Of how many new HUD Code manufactured homes leave one of over 140 plants and go to a retail center, to a manufactured home community, into a development, or perhaps taken directly by a seller to a residential site when the home has been pre-sold. The next two graphics shed light on #2. Note that each of these graphics can be either downloaded or expanded to reveal a larger size for easier reading viewing.

The Whole Point…

A new article in the left-leaning Boston Globe used a phrase that will be paraphrased here, because it is apt. ‘The whole point is to discuss how we got here, where here is, and how we get out.’ Manufactured housing has been stuck in a rut. MHProNews has used that theme for well over a decade.

The case can be made that Buffett keenly grasps several aspects of human nature and has turned those insights to he and his allies’ advantage. One is the challenge of habits. Habits can be good, bad, or meh. But like the boilerplate, when a habit is not periodically examined, it can result in unexpected and negative consequences.

As the report linked above explored, citing Marcel Schwantes, there is a time when breaking habits that no longer serve you comes.

Those bullets courtesy of the Boston Globe could be rephrased as:

- How did we get here?

- Where is here?

- How do we get out of here – i.e.: the current problematic and limiting rut?

1a) The testimony from Daily, Clayton, and Boor are all part of ‘how we got here.’

2a) Where is here? In a message to MHProNews about notoriously high profile MHI members, Frank Rolfe and Dave Reynolds, an industry professional mused: “Frank and Dave are the gift that keeps on giving to critics of our industry.”

That may be true, but Frank and Dave are hardly alone, as this linked report that cites MHI’s so-called Code of Ethical Conduct reflected.

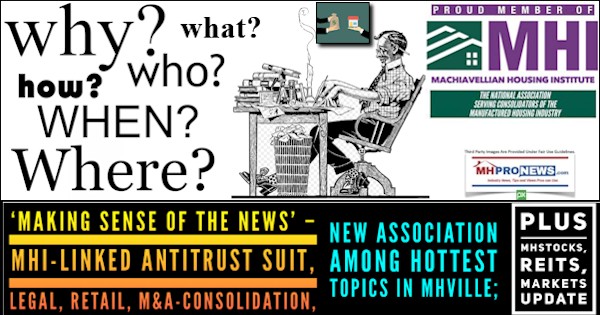

Several MHI members, and/or members of MHI state affiliates. The antitrust lawsuit filed against several current (or in the case of Havenpark, past) members of MHI are also often a dark gift to the industry’s critics. Despite the nation’s overwhelming need for more manufactured housing, there is negative growth in 2023 compared to 2022. Excuses made for that, when they are carefully examined, reveal only more troubling concerns.

2b) Indeed, several MHI ‘features’ and documents that were previously available are now missing from their freshly revamped website. Recall that something similar happened the last time that MHI updated the look of their website. Meaning, documents and information previously available were removed from the public facing view.

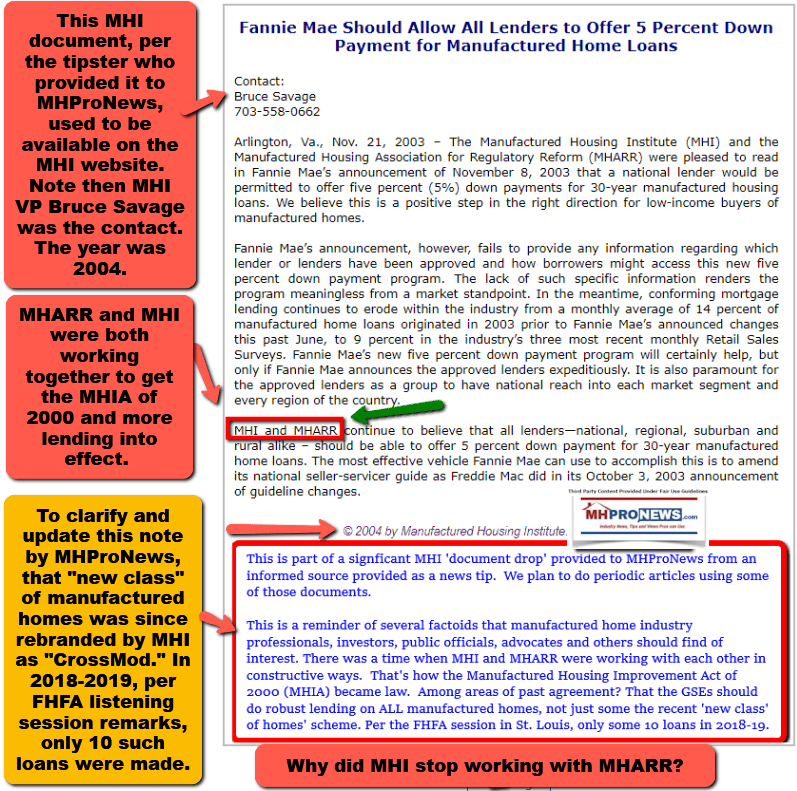

So, where we are at today is this. MHI is the largest national trade group. They seem to take stances similar to those made by MHARR on a range of issues. But in their prior version of the MHI website, publicly available documents that referenced MHARR were dropped from their website. An example is shown along with an example of just how long MHI says it has been working on the proper implementation of the MHIA 2000 and its enhanced preemption clause.

2c) MHI has teamed up with the competitors of the industry in lieu of working with MHARR. When MHI had the opportunity to work with consumers to get more financing via DTS, MHI failed to do so. Why is that, if they are sincere in their desire to get more competitive lending?

2d) Virtually every segment of the industry has dramatically consolidated since 2000. Production/builders. Street retailers (a.k.a. “dealers”). Land lease manufactured home communities. Lending. There are significantly fewer in each of these categories. While this may be waved off as the effect of lower sales and production, the causes of that lower sales and production are – as MHI leaders have said – constrained lending and constrained financing. MHI member Legacy Housing co-founder, Curt Hodgson put some of this pattern concisely as follows. Hodgson, Kevin Shipley, and Legacy have made financing for their homes a priority. Their result? A record year despite the hurdles.

2e) Manufactured home lending, some say, is once more being consolidated and constrained.

Be that as it may, for all the posturing by MHI for ‘more competitive financing,’ there is little or nothing to show for it that is related to their lobbying as opposed to the free market at work.

2f) So, in manufactured housing segment after segment, there is evidence that MHI has repeatedly failed to take timely, logical, consistent, and effective actions.

2g) They have teamed up with industry competitors instead of MHARR and possibly pro-manufactured home consumer groups. The result? Manufactured housing production has been in full retreat for approaching a year.

3) The solution? Public officials, private litigation, proper information/image promotion, and concerted efforts by pro-growth by white hat brands should all be part of the remedy or cure. So, while some bemoan the suit brought against MHI members, MHProNews editorially notes that it may be important as part of the remedial process. That said, MHProNews will bring perspectives from defenders as well as those who are prosecuting that case.

Perhaps as important is the need to forge a new post-production trade group that will earnestly do what MHI has failed to accomplish. There are indications, previously reported by MHProNews, that progress may be underway on that score.

Some public officials have taken remedial steps, but the case can be made that more needs to be done.

Summing Up and Conclusion

Thanks to MHI’s apparent boilerplate in testimony, when that testimony is compared to other remarks in the 21st century, what is revealed is that MHI keeps talking about the same issues over and over again, with little to no actual accomplishment of their stated goals. Who benefits from this pattern? Consolidators. What is a referenced part of the antitrust big antitrust suit that is underway? Consolidation. What did MHProNews say about 9 months ago was apparently looming for MHVille? More litigation. Why? Because the troubling business practices of some – who are often MHI members – are apparent violations of several federal/state statutes. Those laws may include, antitrust, collusion, RICO, failure by executives and board members to properly fulfill their fiduciary duties, and Hobbs Act violations. It would sound like a wild-eyed fictional plot in a dime novel, if not for the fact that outsiders looking in – including attorneys – have made similar points in their research into MHVille.

Here on MHProNews, we fight excuses and smokescreens with facts, details, evidence, and applied common sense. As a result, readers like you have made us the runaway number one resource of its kind. No one else in MHVille even comes close. Thanks to all who make that statement possible.

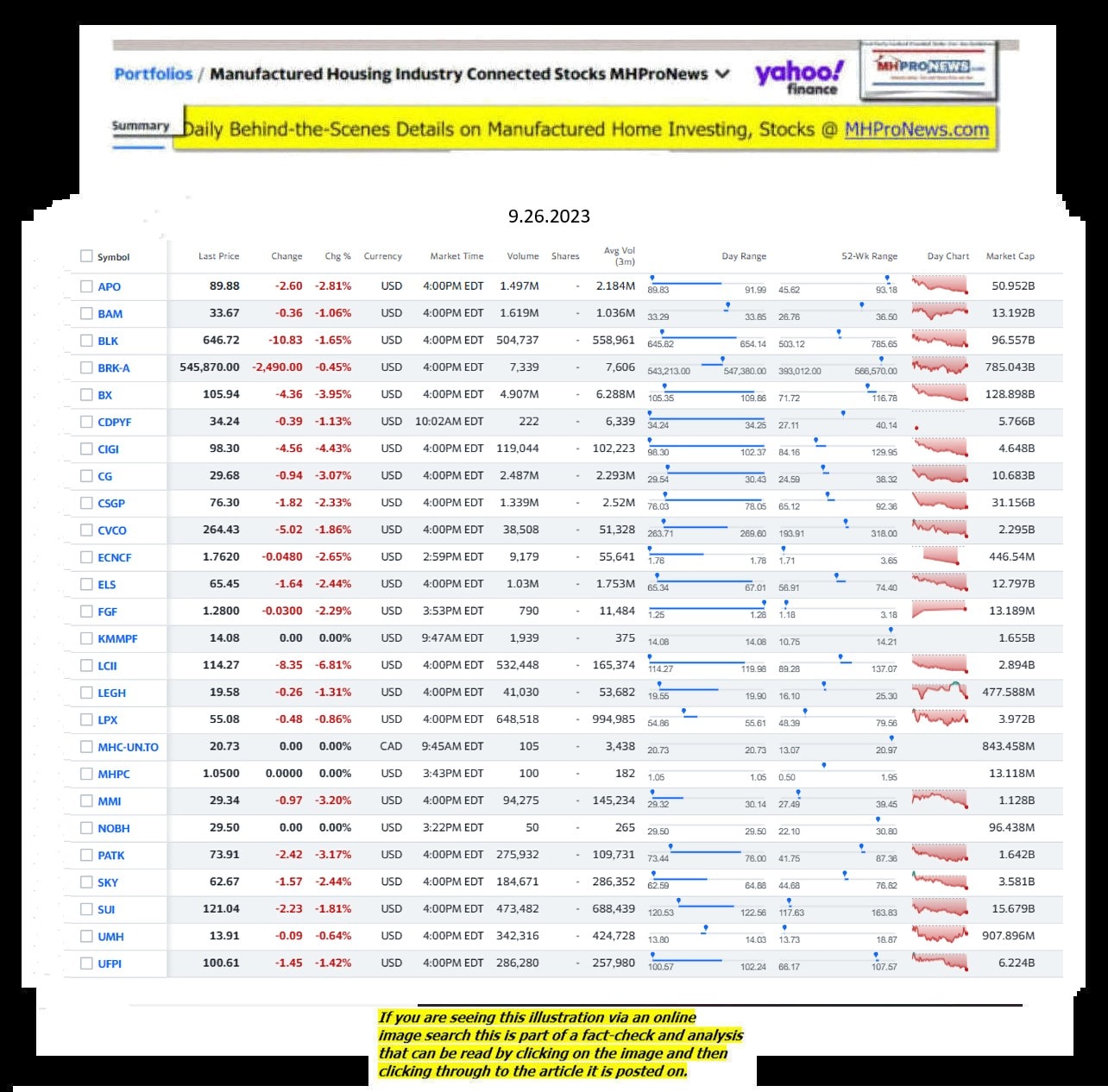

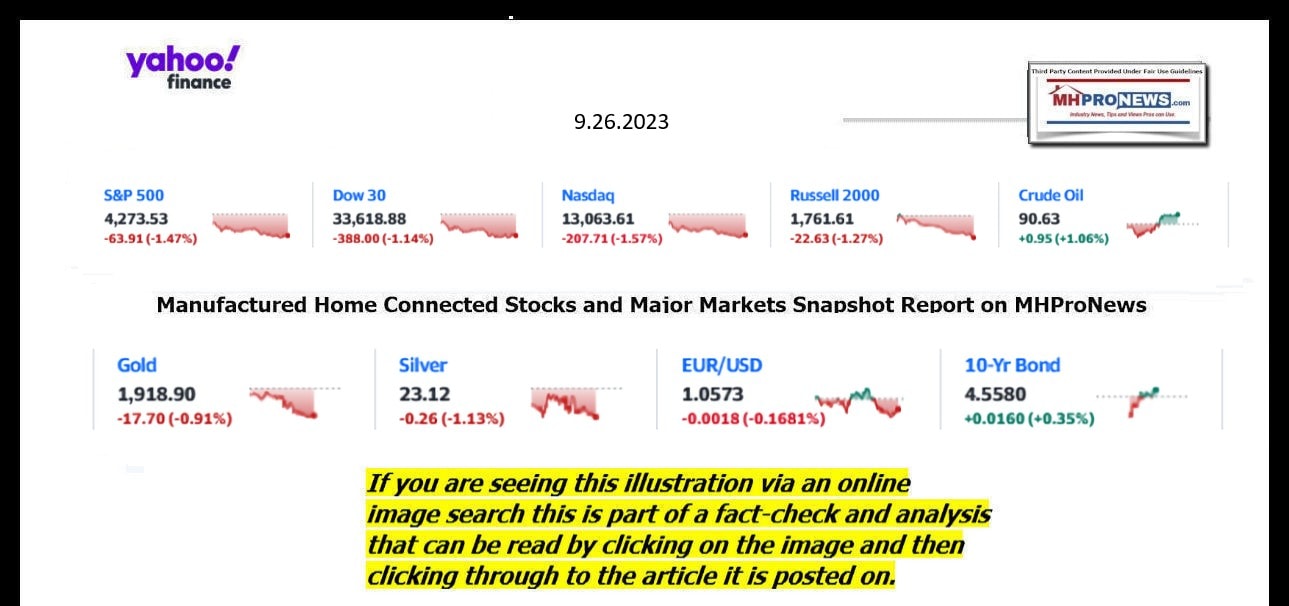

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 9.26.2023

- Target says it will close nine stores in four states due to theft and organized retail crime

- Traders work on the floor of the New York Stock Exchange on Wall Street in New York City on Tuesday, September 26, 2023.

- Dow tumbles by more than 400 points, on pace for biggest one-day decline since March

- A fast-moving conveyor moves packages to delivery trucks during operations on Cyber Monday at Amazon’s fulfillment center in Robbinsville, New Jersey, U.S., November 29, 2021.

- US government and 17 states sue Amazon in landmark monopoly case

- Panera, on a new TikTok fad-inspired menu, argues macaroni and cheese is iconic — much like the Roman Empire.

- Panera jumps on a TikTok trend, adds ‘Roman Empire’ inspired menu

- A new home is built at a housing development in Fairfax, Virginia, on August 22, 2023. Sales of homes in the United States ticked down in July, according to industry data released on August 22, 2023, as elevated mortgage rates and limited housing supply held buyers back. The housing market in the world’s biggest economy has been reeling as interest rates climbed, making home owners reluctant to put their properties up for sale — having earlier locked in lower rates on their mortgages.

- New home sales dropped in August as mortgage rates climbed

- Jamie Dimon, chairman and chief executive officer of JPMorgan Chase & Co., speaks during the Institute of International Finance (IIF) annual membership meeting in Washington, DC, US, on Thursday, Oct. 13, 2022. This year’s conference theme is “The Search for Stability in an Era of Uncertainty, Realignment and Transformation.” Photographer: Ting Shen/Bloomberg via Getty Images

- JPMorgan CEO Jamie Dimon warns the world isn’t ready for 7% interest rate

- The JPMorgan Chase headquarters building is seen on May 26, 2023 in New York City.

- JPMorgan pays $75 million to settle sex-trafficking lawsuit

- US home prices rose in July to record-high levels

- European Commission Vice-president in charge of Values and Transparency, Vera Jourova speaks during a press conference in Brussels, Belgium on September 26, 2023.

- Alibaba’s logistics business will go public in first IPO from the new-look tech giant

- New York Fed: Many Buy Now, Pay Later users are financially fragile

- US consumer confidence is the lowest it’s been in four months

- 3M agrees to pay almost $10 million to settle apparent Iran sanctions violations

- McDonald’s is adding two new sauces

- FCC to reintroduce rules protecting net neutrality

- ‘Not nearly enough.’ IEA says fossil fuel demand will peak soon but urges faster action

- AI deals give investment banks a glimmer of hope

- Crisis at Evergrande deepens as it misses another bond payment

- China and Europe try to dial down trade tension

- Longtime Amazon executive to take over Jeff Bezos’ rocket company

- Taylor Swift’s attendance at Chiefs game brings a spike in Travis Kelce jersey sales

- Costco members now have access to $29 online health care visits

- Ford pausing work on $3.5 billion Michigan electric vehicle battery plant

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Headlines from right-of-center Newsmax 9.26.2023

- Abbott: Texas Continuing to Bus Migrants to Sanctuary Cities

- Mike Pence: Americans Want President Who Protects Life

- Pence: Biden Opened the Border; I’ll Close It | video

- Pence: ‘Real Debate’ Hinges on GOP Following Reagan’s Brand

- Matthew Whitaker: Impeach Witnesses ‘Set the Tone’ | video

- Ron DeSantis: Polls Push to Get Trump In, Biden Out

- Navarro: ‘Great Chance’ to Win on Appeal | video

- Hakes, Town: Trump Gag Order ‘Tactical Mistake’ | video

- Steube: McCarthy Complicating GOP Deliverables | video

- Flawed Research May Exaggerate Long COVID Risk

- A new study reveals that the true risks of developing long COVID may be exaggerated due to flawed research. Scientists from the U.S., U.K., and Denmark say that the “overly broad case definitions and a striking absence of control groups” in studies of long COVID have led to…… [Full Story]

- Related Stories

- Rasmussen Poll: 72 Percent of Dems Fear Another Pandemic

- Gaetz Asks House to Withhold Pay During Shutdown

- Conservative Rep. Matt Gaetz, R-Fla., on Tuesday requested that his [Full Story]

- Related

- Biden Warns Shutdown Will Leave Millions Hungry |video

- Target Closing 9 Stores Due to Rampant Theft

- Target will close nine store in four states, including one in East [Full Story]

- US Blocks Imports From 3 More Chinese Companies Using Forced Labor

- The United State restricted goods from three more Chinese companies [Full Story]

- Gary Sinise to Be Honored for Work With Military, First Responders

- Gary Sinise will receive an honorary AARP Award for his work through [Full Story]

- Study: Buying Marijuana Online Easy for Minors

- The lax enforcement of age limits by many online marijuana [Full Story]

- N.J. Sen. Booker: Menendez Should Step Down

- Cory Booker on Tuesday said fellow New Jersey Democrat Sen. Bob [Full Story]

- Biden Blames Republicans for Potential Govt Shutdown

- President Joe Biden on Tuesday blamed House Republicans for a looming [Full Story]

- Morning Consult: Trump Has 43-Point Lead in GOP Race

- Former President Donald Trump holds a 43-point lead in the 2024 [Full Story]

- Related

- Trump Sending Surrogates to Second GOP Debate

- Russian Black Sea Commander Seen After Reported Death

- Viktor Sokolov, the commander of Russia’s Black Sea Fleet and one of [Full Story]

- Related

- Ukraine Says Russian Black Sea Fleet Commander Killed, No Comment by Moscow

- WSJ: Russian Yacht Costing Antigua, Barbuda $28K a Week

- US Sanctions New Companies Over Russian War Aid |video

- Viktor Orbán: Hungary May Withdraw Support for Ukraine

- JPMorgan CEO Dimon: World Not Ready for 7@ Rates

- JPMorgan Chase CEO Jamie Dimon thinks the war on inflation is likely [Full Story]

- CNN: Smartmatic Implicated in Bribery Scheme

- A voting technology company at the center of legal action against [Full Story]

- 10 Politicians Who Recently Ditched Democratic Party

- Popular Dallas Mayor Eric Johnson on Friday became the latest in a [Full Story] | Platinum Article

- Iran Displays ‘Long-Range Drone’ Amid Threats to Israel

- Iran presented what it claimed to be “the longest-range drone in the [Full Story]

- UPS to Hire Over 100,000 Seasonal Workers

- United Parcel Service said Tuesday it would hire more than 100,000 [Full Story]

- US New Home Sales Slump

- Sales of new U.S. single-family homes fell more than expected in [Full Story]

- Abbott: Texas Still Busing Migrants to Sanctuary Cities

- Texas continues to assist its border towns during the escalating [Full Story]

- Russia Court Rejects Navalny Appeal of 19-Year Sentence

- Russia on Tuesday rejected an appeal lodged by Kremlin critic Alexei [Full Story]

- Trump: Biden EV Mandate ‘Draconian and Indefensible’

- Former President Donald Trump took aim at President Joe Biden’s push [Full Story]

- Related

- Biden Joins UAW Picket Line

- Biden Slips on Stairs After WH Mocks ‘Don’t Trip’ Report

- President Joe Biden took an awkward step down the stairs of Air Force [Full Story] | video

- Related

- Biden Team Mocks Report on ‘Don’t Trip’ Concerns |video

- Biden Handlers Fear Slip or Fall Before ’24 Election |video

- Is Supreme Court About to Strike Blow for Religious Freedom?

- The U.S. Supreme Court may be poised to reestablish the importance of [Full Story] | Platinum Article

- Canada’s House Speaker Resigns Over Nazi Invitation

- The speaker of Canada’s House of Commons resigned Tuesday for [Full Story]

- Report: Fraud and Errors Cost SNAP Program $1B Monthly

- Iowa’s Republican Sen. Joni Ernst told the Washington Times that the [Full Story]

- Biden Botches Acronym During White House Forum

- President Joe Biden made another verbal gaffe, bungling an acronym [Full Story]

- Elon Musk Says He Is Going to the Southern Border

- Elon Musk says he will travel to Eagle Pass, Texas, this week to [Full Story]

- J. School District Permits Cellphone Searches

- After a 14-year-old girl who was cyberbullied committed suicide, a [Full Story]

- David McCallum, ‘Man From U.N.C.L.E.’ Star, Dead at 90

- Actor David McCallum, who became a teen heartthrob in the hit series [Full Story]

- Trump Admires, but Does Not Buy, ‘Trump 45’ Glock

- Former President Donald Trump admired a special edition Glock pistol [Full Story] | video

- Probe Launched Into Granholm’s Electric Car Jaunt

- House Oversight Committee Chairman James Comer, R-Ky., and Rep. Pat [Full Story]

- US Consumer Confidence Tumbles

- The confidence of American consumers slipped this month, particularly [Full Story]

- JPMorgan, Virgin Islands Settle Epstein Suit for $75M

- JPMorgan Chase reached settlements with the U.S. Virgin Islands [Full Story]

- Here Are 23 of the Coolest Gifts for This 2023

- TrendingGifts

- More Newsfront

- Finance

- FTC Sues Amazon for Wielding Monopoly Power

- The U.S. Federal Trade Commission filed a long-awaited antitrust lawsuit against Amazon.com Tuesday, charging the online retailer with harming consumers with higher prices in the latest U.S. government legal action aimed at breaking Big Tech’s dominance of the internet…. [Full Story]

- OpenAI Seeks Valuation of up to $90 Billion

- ESG Proponents Falsely Claim to Be Capitalists

- In Historic First, Biden Joins UAW Picket Line

- Retailers’ Losses Jump as Store Crime Soars to $112B

- More Finance

- Health

- Wrist Temperature Could Predict Disease Risk

- One day, it may be possible to monitor people for risk of disease through continuously measuring skin temperature. Researchers have found in a new study that wrist temperature is associated with future risk of disease. “These findings indicate the potential to marry emerging…… [Full Story]

- Flawed Research May Exaggerate Long COVID Risk

- Cough Syrup Deaths Overseas Prompt Stricter US Tests

- Common Plastics Linked to Postpartum Depression

- Yoga Improves Heart Failure Patients’ Symptoms

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.