“IF we keep doing what we’ve been doing, We will keep getting what we got!” – MHIdea

Today’s Sunday Weekly Recap (9.3.2023) details a troubling trend in manufactured housing that might have been thwarted had what follows further below from the Manufactured Housing Association for Regulatory Reform (MHARR) been heeded sooner. But it is not too late.

First, regarding broader trends, the National Federation of Independent Business (NFIB) monthly Small Business Optimism Index in July 2023 reflects “the 19th consecutive month below the 49-year average of 98.” The Obama years and the Biden years, per that NFIB survey, were significantly lower than the Trump years.

A survey by GoDaddy in June 2023 of small business owners said that 74 percent said that their expectations of the American Dream have changed since their youth.

While most believe they can still achieve that dream (62%), some 80% of those surveyed say that inflation is a significant barrier to achieving their goals. Inflation might be viewed as a stand-in for economic conditions. Earlier this year (February 2023), a law professor’s research into manufactured housing barriers suggested that the manufactured housing industry needed “A support organization is needed that can provide litigation and legislative support to help manufactured housing advocates with zoning reform.”

That quoted remark was by Professor Daniel R. Mandelker, J.D., who is seen as an expert in the zoning field. Professor Mandelker wasn’t commenting on the Manufactured Housing Institute (MHI), which went unmentioned in his research paper.

Despite have the most proven form of permanent affordable housing in modern U.S. history, manufactured housing isn’t achieving its potential. “If we keep doing what we’ve been doing, we will keep getting what we got” said the MHIdea website. The MHIdea promoted the formation of a new, post-production trade group.

- Mandelker wasn’t taking aim at MHI, but the MHIdea’s leaders were taking aim at MHI when they made their respective remarks. Note that MHARR wasn’t criticized, it is MHI that gets ripped.

- And MHI was ripped not only by independent retailers, but also by independent community operators too. MHI’s performance has been criticized by some of their own members.

- MHI has also been ripped by name by consumer advocates.

- The views from MHIdea will be addressed in Part II, further below.

The fact that manufactured housing is underperforming during an affordable housing crisis may be the only evidence needed that something must change in order to avoid further shrinkage and more consolidation, and that change ought to include the formation of a new post-production trade group.

This Masthead will examine in Part I of this report the full text of a study previously performed by the Manufactured Housing Association for Regulatory Reform (MHARR). For clear and objective thinkers, the fact that the MHARR research study is approaching 6 years old may make it more interesting, not less so. Individuals can see for themselves what has occurred since that study paper was published by MHARR during the first year of the Trump Administration.

Part II of this report will include additional information with more Masthead Manufactured Home Industry Expert Editorial Analysis on MHProNews.

With that brief tee up, here is the MHARR study, per the WORD version of their document, which was requested by MHProNews and promptly provided by MHARR.

Bracketed remarks in what follows are added by MHProNews. Note too that the “2000 Reform Law” is a term that MHARR uses to describe the Manufactured Housing Improvement Act (MHIA) of 2000. The acronym PPS below means “Post-Production Sector.”

For clarity for industry newcomers and outsiders looking into the sadly underperforming manufactured housing industry, MHARR is a producer’s trade group, meaning they represent independent builders of HUD Code manufactured homes. Technically, MHI claims to represent “all segments” of manufactured housing, both producers and post-production sectors. But as MHARR points out, the thrust of the industry’s woes like in the post-production segment of MHVille.

While every word should be read and grasped, highlighting below is added by the Masthead to particularly emphasize certain points made by MHARR.

Part I

A STUDY, ANALYSIS AND EVALUATION OF THE PAST, PRESENT AND FUTURE STATUS AND

COLLECTIVE REPRESENTATION OF THE POST-PRODUCTION SECTOR OF THE MANUFACTURED HOUSING INDUSTRY

AND

RECOMMENDATIONS FOR ITS IMPROVEMENT

Prepared By:

The Manufactured Housing Association for Regulatory Reform

[MHARR]

November 10, 2017

TABLE OF CONTENTS

I. INTRODUCTION, OBJECTIVE AND SCOPE

II. HISTORY, ANALYSIS AND EVALUATION

A. Definition of Post-Production Sector

B. History

C. Changes to Industry Regulatory Structure

D. Prevailing Status

E. Future Long-Range Prospects

III. POSSIBLE SOLUTIONS

A. Division within MHARR (Affiliate Status)

B. Existing Ad Hoc Organizations

C. An Incorporated Independent National Association

IV. OBJECTIVES OF THE ASSOCIATION

V. SUGGESTED ASSOCIATION STRUCTURE AND FUNDING

A. Name of the Association

B. Incorporation

C. Location

D. Membership

E. Board of Directors

F. Executive Committee

G. Chairman and Vice Chairman

H. Funding

VI. CONCLUSION

I. INTRODUCTION, OBJECTIVE AND SCOPE

At the Spring 2017 Membership Meeting of the Board of Directors of the Manufactured Housing Association for Regulatory Reform (MHARR), the Association was instructed by its Board of Directors to conduct a study and analysis of – and recommendations for improvements to — the collective national representation of the post-production sector (PPS) of the comprehensively federally-regulated manufactured housing industry. Such a document was deemed necessary due to increasing numbers of inquiries and requests to MHARR for assistance by post-production sector companies and individuals, that are increasingly being pressed and targeted by regulators at all levels of government, as well as industry competitors, particularly since the enactment of the Manufactured Housing Improvement Act of 2000 (2000 reform law). Thus, the objective of this document is to thoroughly analyze and evaluate the past, present and future status of the collective representation of the post-production sector, and to provide recommendations for the improvement of its collective national representation going forward. The scope of this document is strictly confined and limited to the post-production sector of the manufactured housing industry.

II. HISTORY, ANALYSIS AND EVALUATION

A. Definition of “Post-Production”

For purposes of this document, the manufactured housing industry PPS shall be defined as or shall include any and all individuals and/or entities that provide service(s) related to or for homes produced by federally-regulated manufactured housing producers, after the HUD certification label is affixed to the home and after construction of the home in the factory is completed, and the home is transported from the factory and/or completed on-site. These may include transporters, installers, retailers, communities, finance providers and insurers.

B. History

Early in the history of the manufactured housing industry, the Mobile Home Manufacturers Association (MHMA) included all sectors of the then- “trailer,” recreational vehicle (RV), and “mobile home” industries. In the late 1960s, for reasons too numerous to enumerate (and beyond the scope of this document), both the trailer/RV industry and retailers and communities within the PPS of the then-mobile home industry, separated from MHMA and formed their own independent national associations, with the former named Recreational Vehicle Institute (RVI) (later changed to Recreational Vehicle Industry Association (RVIA)) and the latter named the Mobile Home Dealers Association (later changed to the National Manufactured Housing Federation (NMHF)).

These changes resulted in the membership of MHMA being comprised of mobile home manufacturers, product suppliers, finance providers, insurance companies and transporters only. With the rapid advancement and evolution of the mobile home industry into the construction of permanent residential dwellings and the enactment of the National Manufactured Housing Construction and Safety Standards Act in the early 1970s, MHMA changed its name to the Manufactured Housing Institute (MHI).

In the early 1990s, due to several prevailing circumstances and despite significant opposition by many manufacturers, retailers and communities, NMHF merged with MHI, thus ending any independent, collective national representation for any and all segments of the PPS.

Chief among the reasons for this merger were dwindling funding (intentional or otherwise) for NMHF but, more importantly, a move by large conglomerate manufacturing entities into a vertically integrated business model, including production, consumer financing, retail sales and/or community businesses, allowing those conglomerates to exercise dominance and de facto control over the vertical structure of the industry. While this experiment in vertical integration largely failed for most producers involved, the resulting NMHF-MHI merger remained intact, thereby benefitting the sole remaining (and largest) such vertically-integrated conglomerate – i.e., Clayton Homes, Inc.

Deprived of collective, independent national representation, the merger placed the PPS into a unique, albeit, vulnerable position, within a comprehensive regulatory structure centered primarily at the federal level. This unitary or “umbrella” structure, moreover, stands in sharp contrast with the structure of other industries that most closely resemble the manufactured housing industry, including the RV industry and the site-built housing industry, which both have benefitted substantially from independent collective representation for builders/manufacturers through one organization, and independent, collective representation of their respective post-production sectors through a separate organization – e.g., RVIA and the Recreational Vehicle Dealers Association (RVDA) within the RV industry, and the National Association of Home Builders (NAHB) and the National Association of Realtors (NAR) within the site-built housing industry.

Indeed, the HUD Code manufactured housing industry may be the only industry of its kind in the nation (particularly being subject to comprehensive federal regulation) without an independent national post-production association to serve as a vital link between producers, at one end of the industry spectrum, PPS companies that directly interface with homebuyers and residents, and manufactured housing consumers at the other end of that spectrum. In fact, the inclusion of a nationwide “dispute resolution” (DR) (and installation regulation) mandate in the 2000 reform law was mainly due to this deficiency, with unresolved consumer complaints – characterized as “ping-ponging” between producers and PPS members – cited as a basis for mandatory nationwide DR by consumer groups involved in the legislative process leading to the 2000 law.

As a result, and as is explained below, the glaring deficiencies flowing from the lack of a collective, independent national representation for the PPS of the HUD Code industry, have already been – and continue to be — increasingly and alarmingly being felt by the industry and manufactured housing consumers.

C. Changes to the Industry’s Regulatory Structure

The enactment of the 2000 reform law, made the PPS a direct and major stakeholder in the national superintendence of the manufactured housing industry by the U.S. Department of Housing and Urban Development (HUD). By correcting deficiencies in the original 1974 federal manufactured housing law which had plagued the industry since its inception (i.e., nationwide installation regulation and dispute resolution), the 2000 reform law was designed and structured to make manufactured homes legitimate housing for all purposes, and fully equivalent in status and treatment with all other types of residential construction. The 2000 reform law thus instituted provisions directly impacting the PPS at the national level.

Forward-looking elements of the industry in the early-2000s, recognized (and expressed the view) that the PPS, without an independent, national, collective association, was not ready or prepared for such a fundamental change, and, in fact, needed such a national representation, but those pleas, ultimately, fell on deaf ears. As a result – and as shown below – PPS regulatory problems and issues have multiplied (particularly within the past decade and much more so since 2014), increasingly subjecting the entire industry to such issues and/or their consequences, all of which has slowed the growth of the industry while preventing it from reaching its full potential.

Ultimately, then, the failure of the post-production sector to respond to significant changes in the law with an independent, national, collective representation of its own – to protect, defend and advance its own specific interests (as well as interests that it shares with other segments of the industry), has harmed the industry – unnecessarily blunting its growth – while simultaneously harming consumers in need of greater access to affordable, non-subsidized housing.

D. Prevailing Status

As MHARR has already detailed in multiple published documents, the HUD manufactured housing program – particularly under the selected career administrator in place since 2014 – and its entrenched contractors, have targeted the PSS for expanded and more debilitating regulation on a wide range of matters, while adopting or maintaining positions contrary to the 2000 reform law that have had a sharply negative impact on both the PPS and the industry as a whole. These include, but are not limited to: (1) HUD’s failure/refusal to federally preempt local “zoning” or placement restrictions that discriminatorily exclude HUD-regulated manufactured homes and the lower and moderate-income Americans who rely on the industry’s homes as a source of affordable, non-subsidized housing and/or home ownership; (2) HUD’s ongoing effort to dictate state-law installation standards and programs to already-approved “compliant” states on a one-size-fits-all basis from Washington, D.C.; (3) HUD’s effort to substantively alter, via “interpretation,” its standards for “frost-free” foundations and its parallel effort to force that interpretation on states with state-law installation standards and programs; (4) HUD’s needlessly complex, costly and restrictive regulations for “on-site” construction; (5) HUD’s failure to object to baseless and extraordinarily costly “energy” standards developed by the U.S. Department of Energy (DOE) for manufactured homes; and (6) HUD’s baseless restrictions on attached garages and carports, just to name a few. Furthermore, and even more significant as it affects each of the foregoing issues (and many others), is the failure of the PPS to join with MHARR in publicly calling for – and demanding – the removal and replacement of the current career HUD manufactured housing program administrator who is responsible for each of the foregoing regulatory abuses.

Even worse for consumers and the industry as a whole, has been the PPS’s failure to effectively respond to attacks against the industry and its consumers in the arena of consumer financing, including but not limited to: (1) its failure to effectively oppose and prevent the targeting of HUD Code manufactured homes by the “SAFE Act;” (2) its failure to effectively oppose and prevent the inclusion of HUD Code manufactured homes within the Dodd-Frank law; (3) its failure to effectively oppose and prevent the targeting of HUD Code manufactured homes by the Government National Mortgage Association (GNMA) via its “10-10” restrictions on the approval and certification of lenders for manufactured home consumer loans under the Federal Housing Administration’s (FHA) Title I program; and (4) its failure to provide support data for the proper implementation of the Duty to Serve (DTS) provision of the Housing and Economic Recovery Act of 2008 (HERA) – and particularly for the chattel loans that represent 80% of manufactured home consumer loans, but are virtually absent from the final DTS rule and proposed implementation plans. In each such instance, had there been an independent, national, collective representation for the post-production sector, actively (and effectively) monitoring, protecting and advancing the interests of the PPS in such matters, it is highly unlikely that such failures and their the major negative consequences for both the industry and consumers, would have occurred or would have continued for such an extended period as they have.

Moreover, while MHARR has taken a leading and aggressive role in fighting for the industry and consumers on all of the foregoing matters (and others) using its own resources, the glaring absence of both public and behind-the-scenes support for these positions from the PPS, based on the “go-along-to-get-along” mindset and operational philosophy of current representation through MHI, has harmed such efforts on both a short and long-term basis.

E. Future Long-Range Prospects

If the current model for the representation of the PPS remains in place, the regulatory situation of the industry, as a whole, will continue to deteriorate over time, with the heaviest and most debilitating burdens falling on the industry’s smaller businesses, which – as shown by research conducted by the U.S. Small Business Administration (SBA) – are disproportionately affected and impacted by excessive government regulation. Moreover, given MHARR’s aggressive approach in confronting HUD and its entrenched contractors with respect to in-plant production regulations, both have begun an intensive effort to diversify into post-production regulation – to maintain and increase the power of HUD regulators and revenues for HUD contractors. As a result, the PPS needs to take more effective and concerted action to protect its interests and advance its views on regulatory matters.

This disproportionately-negative impact on the PPS and its smaller businesses, moreover, will only be exacerbated if the industry’s largest manufacturer is successful in its effort to develop, seek and obtain preferential regulatory and/or financing treatment for a “new class” of manufactured homes, based on proprietary data and potentially proprietary designs that could seek to relegate the status of homes of non-participants back to that of “trailers.” Market research and design development for such a new class of manufactured homes is already underway on a secretive basis within MHI, while MHI manufacturers have – and are – deeply involved in closed-door meetings with a Fannie Mae “contractor” (who coincidentally is a former MHI staffer) to develop an “MH Select II” preferential financing program for manufactured homes with features that “exceed” the requirements of the HUD Code, including enhanced energy features that have been heavily promoted by Clayton Homes, Inc.

Even in the absence of a “new class” of manufactured homes promoted by and authorized for the industry’s largest manufacturers on either an exclusive or semi-exclusive basis, smaller industry businesses, in particular, will continue to be harmed by excessive and/or unreasonable HUD regulation and restrictive consumer financing policies by Fannie Mae and Freddie Mac that are facilitated by the absence of an independent, collective national representation for the PPS. This potentially fatal gap in the representation, protection, defense and advancement of the industry as a whole, will allow both HUD (and other regulatory agencies) and the Government Sponsored Enterprises (GSEs) to needlessly and discriminatorily restrict the overall size and growth of the HUD Code manufactured housing market by unnecessarily increasing the cost of (and income necessary to purchase) a manufactured home, and by limiting the availability of competitive-rate financing for potential HUD Code home purchasers.

III. POSSIBLE SOLUTIONS

From the foregoing, it should be apparent that the PPS is rapidly losing ground in relation to both regulatory burdens and continuing unnecessary and discriminatory restrictions on the availability of consumer financing for potential purchasers. In the absence of significant and fundamental change, future prospects for the industry’s PPS, and particularly the thousands of small and smaller businesses that have been at its core for decades are, at best, clouded, as a one-two blow of expanded and unnecessary regulation, combined with baseless restrictions on consumer financing – both of which benefit the industry’s largest businesses, which include captive finance companies that are not dependent on secondary market support or funding, feature higher-rate interest levels and, as noted above, are better positioned to tolerate excessive regulatory burdens – continues to unnecessarily blunt industry growth.

Based on this premise, internal fact-finding and analysis, and broader-industry input to MHARR regarding possible approaches to the establishment of an independent, collective, national representation for the PPS, the following potential alternatives are presented and evaluated.

A. Division within MHARR (Affiliate Status)

Multiple inquiries from the PPS have urged the creation of an “independent” PPS association either as part of – or in affiliation with — MHARR, potentially with a status similar to the current “affiliate” membership provided to state associations under the existing MHARR bylaws. Such an approach, however, would be likely to replicate and continue the structural and policy failures that have characterized the representation of the PPS since the NMHF-MHI merger in 1992. Put differently, an “umbrella” type organizational structure, with representation of the PPS sector as an integral part of another organization charged with representing the production and other segments of the industry, has already been shown, after 25 years, to be inherently deficient and broadly ineffective, as noted above. Simply changing the “umbrella” organization – even to an organization already charged with aggressively representing smaller industry businesses, such as MHARR – will not significantly alter the fundamental flaw underlying the concept. Given the unique position and interests of the PPS, its representation must be independent, collective and national in scope and approach.

MHARR would also note in regard to the foregoing, that ever since it was first drawn into activities regarding consumer financing, it has continuously reviewed matters affecting the PPS and has provided the PPS with accurate and factual information regarding such matters. Unfortunately, under the PPS’ current representation model, this information has either been suppressed or has “fallen through the cracks,” with no real or effective follow-up.

B. Existing Ad-Hoc Organizations

The COBA-7 (Community Owners 7-Part Business Alliance) organization founded and headed by George Allen has also been cited as a potential home for an independent, national collective organization to represent the PPS. The organization, activities and focus of COBA-7, however, appear – thus far – to be too limited, too parochial, too closely-linked with MHI, and lacking in institutional accountability mechanisms, to effectively function, on a national level, as a full-time, independent, dedicated advocate for the PPS in relation to the full range of legislative, regulatory, legal and policy matters and issues at the national level. To date, COBA-7’s activities have been relatively narrow in scope, providing news reporting, opinion pieces, seminars, “networking meetings,” and educational activities for PPS interests (as well as personal participation by its principal at some government meetings and policy events) but not a full range of advocacy activities in Washington, D.C. that would be critical to the full and effective representation of the PPS. Further, with no apparent interest on the part of COBA-7 or its principal in extending the functions and role of COBA-7 to such necessary activities, COBA-7 does not appear to provide a viable foundation for the establishment and maintenance of the type of collective representation recommended by this study. That said, however, under the right circumstances, COBA-7 could become the initial nucleus for such a PPS association.

C. An Incorporated, Independent National Association

Instead, it appears that the greatest potential benefits would accrue to the PPS and to the industry as a whole (as well as consumers of HUD Code manufactured housing) through the creation of a new, incorporated association to properly and effectively represent the interests and views of the PPS. That organization, as indicated by the manifest failure of the present model, should be independent of any other group, with legitimate “firewalls” in place to ensure its independence going forward. In addition, that new organization should be led by an individual with previous knowledge of the HUD Code industry (and preferably industry experience) in order to ensure proper and effective representation of subscribing members. Fidelity to the interests and views of just one group of members – i.e., PPS member companies – should ensure that the new association is aggressive in pursuing the views and interests of that industry segment, as contrasted with such views being subject to the interests of other non-PPS industry participants under the existing “umbrella” arrangement.

IV. OBJECTIVES OF THE ASSOCIATION AND MEMBERSHIP

The fundamental purpose and objective of the new association would be to effectively and independently represent, protect, defend and advance the interests of the PPS and its participants, on a national basis, and to serve as an effective link between producers and homebuyers, so as to increase the availability, utilization and market for HUD Code manufactured homes and services provided by members in relation to those homes. Broader “objectives” of the association could include the following:

- To serve as a strong link between HUD Code housing producers and homebuyers;

- To improve relations between government at every level and industry, particularly companies engaged in [PPS activities] by promoting an environment of less and more effective regulations;

- To conduct marketing, educational and advertising programs to enhance and expand the manufactured housing industry’s share of the national housing market

- To promote and advance the mutual interests of its members engaged in the [PPS] of the manufactured housing industry;

- To stimulate the exchange of ideas between government and its members;

- To work in full cooperation with both national manufactured housing associations representing the views and interests of producers of manufactured housing – e. MHARR and MHI – to advance the overall interests of the industry in the nation’s capital; and

- Subject to the approval of the members, to carry out such other activities which may be necessary and proper for the accomplishment of the purposes set forth above, or which shall be recognized as proper and lawful objectives of trade associations.

The essential and primary function of the new association, would be carried out and effectuated in a manner decided by the association’s membership, in consultation with its Board of Directors and official leadership, would be to provide and ensure the full, aggressive and effective collective representation of the views, interests and concerns of its PPS members.

V. SUGGESTED ASSOCIATION STRUCTURE AND FUNDING

While the structure and funding of the new association must ultimately be decided by its membership, it would be advisable for a small, representative group to draft a basic package of proposals for further consideration and completion, subject to an express proviso such as the following:

“Although it is required for purposes of corporate responsibility to list officers with the state and federal government, the policy of this Association is to have a democratic, open discussion of every topic suggested by the full members. Decisions will be reached only by consensus of a majority of the full members at any meeting. Meetings for that purpose will be open, with the intent to achieve equal status for every full member without reference to any official title or position.”

Based, however, on the multiple inquiries that MHARR has received from PPS and other industry members – and requests therefor – the below is a sample/model structure that could be used for an independent, national, incorporated collective PPS representative organization.

A. Name of the Association – To be decided by the membership (TBD).

B. Incorporation – Delaware or any other state (TBD).

C. Location – Either Washington, D.C., or any other city/state (TBD).

D. Membership

- Primary Voting Members – Transporters, installers, retailers, communities, finance providers and insurers.

- Affiliate (non-voting) Members – Manufacturers, product suppliers, state associations.

E. Board of Directors – Comprised of seventeen (17) members as shown below (TBD):

- 5 communities;

- 4 retailers;

- 4 finance companies;

- 2 insurers;

- 1 transporter; and

- 1 installer

F. Executive Committee – Comprised of seven (7) members as shown below (TBD):

- 2 communities;

- 2 retailers;

- 1 finance company/insurer;

- 1 transporter; and

- 1 installer

G. President/CEO – Would be the association’s paid, full-time staff, to be selected by the association’s Board of Directors (and subordinate at all times to the association’s membership), whose qualifications shall include a knowledge and understanding of the industry, federal laws pertaining to the industry and PPS, as well as regulations and related legal issues affecting the industry and PPS.

H. Funding – Mandatory dues for Primary (voting) members based on “x”-dollars per gross annual business volume (TBD). Affiliate members (TBD).

VI. CONCLUSION

MHARR has developed this study and its proposed solutions based on input from industry members and its own formation and experience over the course of nearly four decades. While the evidence is clear and convincing that the PPS is not currently represented in an effective manner, or one that necessarily reflects, protects and advances the interests of all its members – especially the smaller business that have traditionally comprised the core of the PPS – it is ultimately up to PPS members to determine what should be done to remedy this situation, and how that remedy should be effectuated. Recognizing this, the models and proposals contained herein are offered as suggestions only, but the underlying conclusion of this report – that the PPS is urgently in need of effective, independent, collective national representation through a new incorporated entity — rests on undeniable evidence that should spur appropriate action to change the unacceptable status quo.

If the PPS establishes this badly-needed independent national association, MHARR will pledge its full assistance to the new organization for a finite period after its full incorporation in all regulatory, legislative and (possibly) legal matters.

This study and analysis is available to industry members for their private use or for re-publication in full (i.e., without alteration or substantive modification) with the permission of – and proper attribution to – MHARR.

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing. ##

Part II – Additional Information with More Masthead on MHProNews Expert Analysis and Commentary

MHProNews featured efforts by industry professionals to form a post-production trade association for well over a decade and has generally supported the notions that have been thoughtfully expressed by MHARR in their study above. Given that in the middle of next month will mark the conclusion of 14 years of publishing what is now known as MHProNews, that means that for the vast majority of our publication’s history, we have promoted – as has MHARR – the notion of a truly growth oriented post-production trade group that can represent the interests of independents.

That said, it is worth mentioning that the understanding by the Masthead of the industry’s woes has evolved over the years. It was not at all clear to our firm’s management just how the ‘game is played’ at MHI, even though this writer was an MHI member, a periodic MHI ‘educational event presenter,’ and sat on an MHI Suppliers Division board for some time. Those experiences are illuminated by increasingly 20-20 hindsight.

It is noteworthy that MHARR’s paper advocated that while they would like to ‘team up’ with such a trade group and closed by pledging support to such a group, they also said that such a group should interface with both MHI and MHARR and should be independent of each of those bodies. That is selfless from the perspective of MHARR, and thoughtful from the perspective of manufactured housing independents.

The MHARR study is arguably classy and thoughtful in most every respect.

In an era when large numbers are mostly self-centered, MHARR’s study reflects objective and experienced-based insights based on facts and evidence. For instance, if MHARR’s insights had been carefully followed by NAHMCO, their outcome may well have been more successful. MHARR advocated against too close a relationship with MHI, because that was a root issue for industry underperformance. That said, NAMHCO made a deal with an ex-MHI Vice President to ‘represent’ their interests in Washington, D.C. Is it any surprise that with an ex-MHI ‘leader’ at NAMHCO, that NAMHCO went nowhere?

That is mentioned as one of several possible examples of just how potent the insights from the MHARR study above have proven to be.

That said, NAMHCO’s Neal Haney made a telling point that illustrates the correctness of MHARR’s evidence-based study.

The MHARR study is wide-ranging, and as good as it is, there are some areas that it might have been better. For instance, there are post-production industry members that are not explicitly mentioned by MHARR, such as consultants, attorneys, and services providers. That said, the case could be made that it is implied by their very use of the term, post-production sector of the industry.

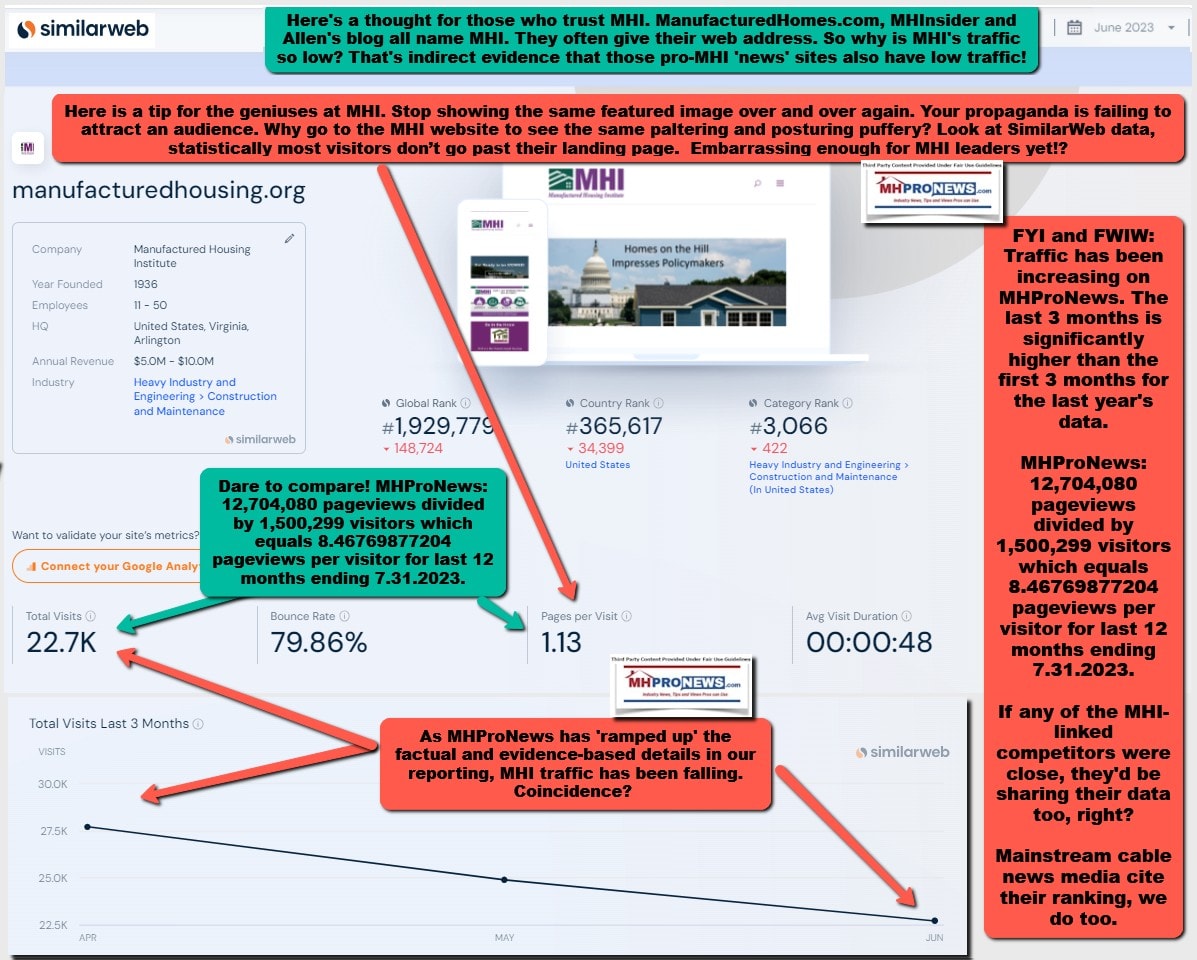

As the manufactured home industry’s demonstrably largest and most followed – #1 trade media – MHProNews has uniquely kept the potential and importance of a new post-production trade group alive, as has MHARR from an association perspective. The evidence-based case can be made that no one in MHVille – no one – has mentioned the ongoing need for a post-production trade group than MHProNews. That is said to illustrate that we are not johnny come lately to this need for a post-production trade group discussion. Just as we published MHARR news and views for the vast majority of our publication’s history, including the roughly 7 years that MHProNews was a MHI member, this publication has long provided a platform for the discussion and hoped-for formation of a post-production trade association.

There is no competition between us and others that have sincerely advocated for this apparently needed ‘next step.’ So long as a successful trade group is formed along the lines of the above and previously shared notions on this topic, with or apart from our management’s involvement, MHProNews would applaud a return to robust industry health and growth.

The irony is that while the “rising tide raises all boats,” the moat-building and apparently consolidation-focused methods witnessed among so many MHI firms might prove to be more profitable for some of them too. Again, see the Sunday recap and the insights published there.

Note that in years gone by – before MHI connected interests increasingly began to control the state associations in MHVille – J.D. Harper of the Arkansas Manufactured Home Association (AMHA) encouraged the formation of a new trade group too. Harper publicly applauded and encouraged a proper implementation of existing federal laws. His state is one of several that lost one or more producers, and lost scores of independent retailers too.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note too how MHARR’s insights contrast with MHI’s version of industry history with respect to trade associations.

MHARR’s study pointed out that George Allen was “too closely-linked with MHI.”

While Allen postures otherwise, that observation was and arguably remains true. Allen and MHI ‘battled’ for a time, but they also reconciled. Allen is essentially rewarded by key MHI members, directly and indirectly. Events, past and present, that Allen is involved in are connected to companies that are routinely in the consolidation business.

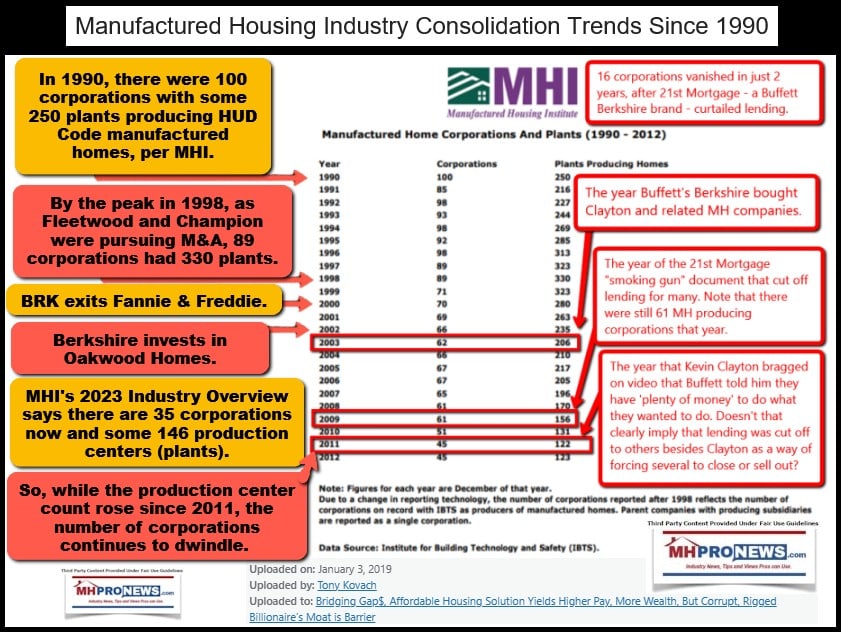

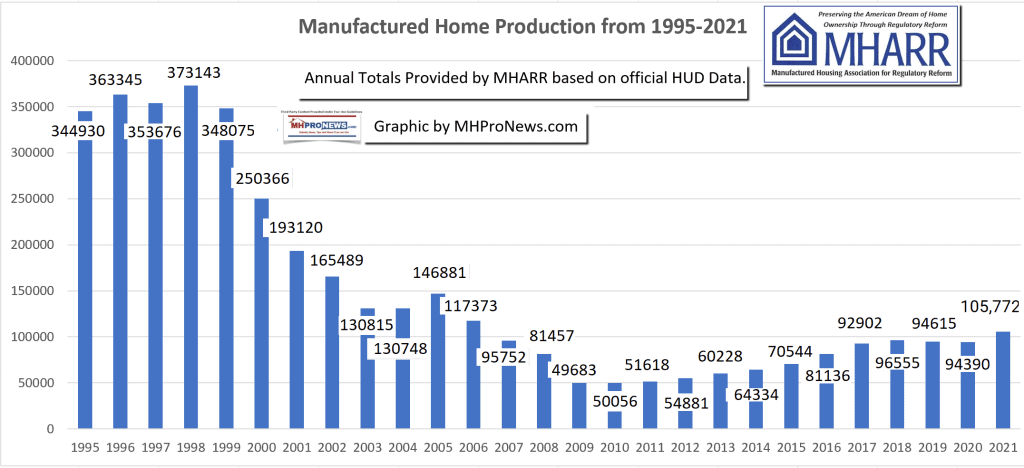

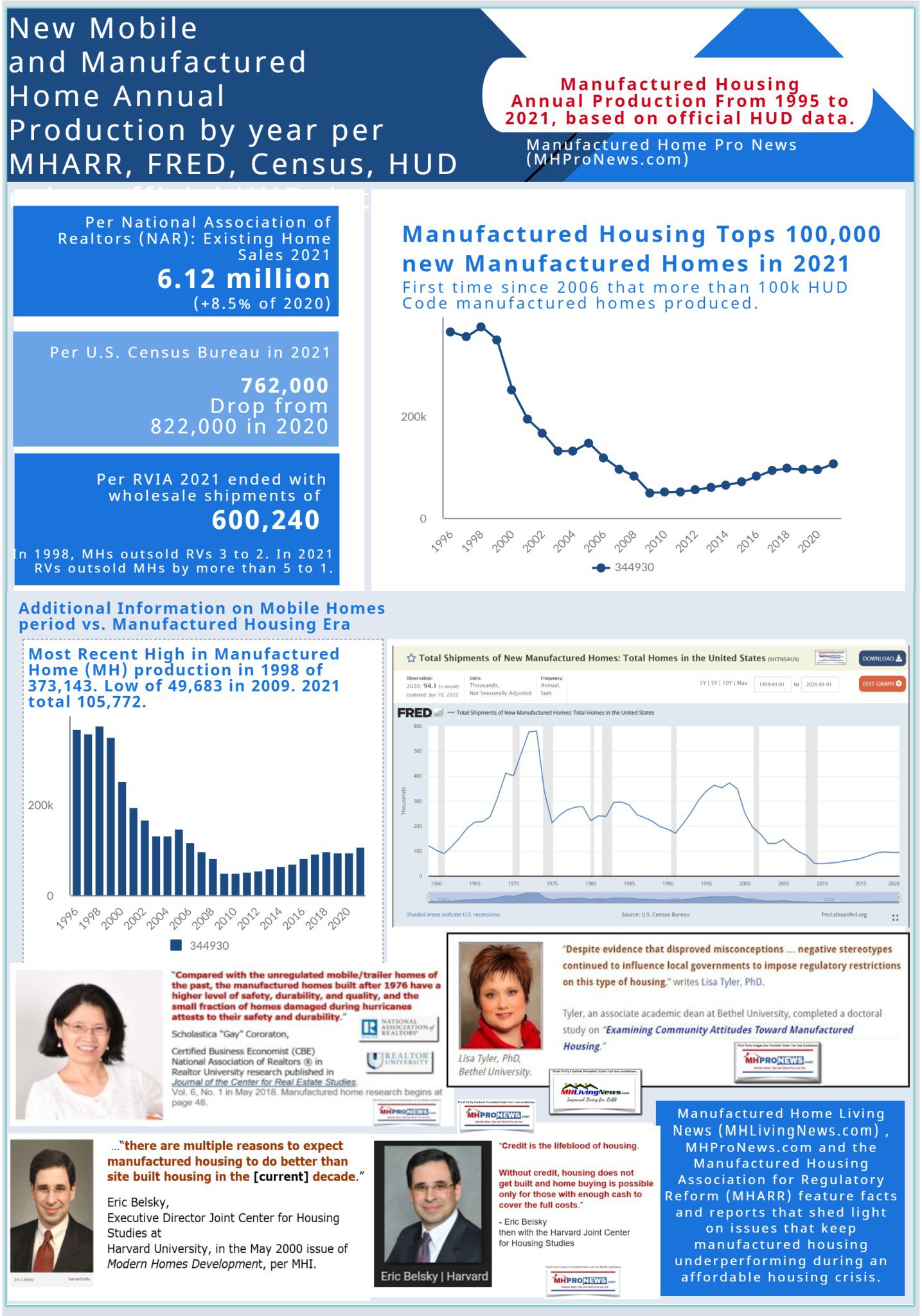

The case can be made that if there was a true and effective post-production trade group, there would have been less consolidation, and the industry’s production would have been far more robust. A glance at the graphics above reflects a period when there were dozens of more producers and over 100 more plants or production centers. More competition and producers also mean more choices for consumers, and arguably more innovation too.

The MHARR study, from our view, need not be considered as ‘exhaustive.’ They mention MHI, they mention Clayton Homes. But that doesn’t mean that others aren’t working within the MHI structure for consolidation. Again, today’s Sunday weekly headlines recap linked several examples beyond Clayton that are involved in MHI.

MHIdea

While it failed to gain traction, the MHIdea’s leaders may have been ahead of their time. MHIdea and MHARR obviously have not been alone in their evidence-based concerns and critiques.

While MHProNews does not endorse every nuance of statement made by MHIdea, the following points from their website are telling. These bullets that follow are MHIdea pull quotes. Note the site’s dates are from 2008-2010. Like the MHARR study above, they foreshadowed the trends that have only continued since then.

* Our industry faces one of the most challenging times of its history.

* Our industry faces one of the most challenging times of its history.

- The challenge concerning retail financing is further aggravated by HUD and other agencies working against the best interests of both the consumer base which could benefit from our product and industry members themselves…

- The lack of help coming from Washington, DC is glaring, with HUD boldly operating in violation of its federal mandate of the 2000 Housing Revitalization Act (i.e.: MHIA or 2000 Reform Law).

- MHI has no real incentive and apparently not much interest to work hard for the small independent retailer sales centers. Some of their recent efforts appear to be motivated by industry members’ frustration at their previous inactions.

- [MHI] …has become overloaded with members representing factions of our industry that are financially better poised to weather the regulatory storms on the horizon, almost to the point of a technical monopoly.”

Repeated Opportunities for MHI Staff, Corporate Leaders, and Attorneys to Respond

MHProNews has repeatedly asked individual corporate leaders within the MHI structure, MHI’s board/staff leaders, and attorneys for the same to respond to the evidence-based allegation that the true focus of MHI is consolidation of the industry. The case can be made that their surrogates have failed at deflecting from that reality. Neither MHI senior staff, their attorneys, nor their corporate leaders are apparently unwilling to be more embarrassed than they already are.

Thus, that core group has remained silent with respect to MHProNews’ inquiries in recent years, after years of readily responding to MHProNews’ inquiries or interview requests. Furthermore, since they are credibly accused of antitrust and other violations, they likely do not want to add to the evidence for those evidence-based concerns.

- There are reasons to believe that NAMHCO failed in part because a former MHI vice president was hired to be their lobbyist.

- Allen has been on both sides of the post-production issue, perhaps because he is rewarded for doing so. As MHARR mentioned, Allen could have expanded into a genuine trade group, but they opted not to do so. Forget what the fickle and self-serving might say, pay attention to what they do and how they make their money. The periodic ‘complaints’ against MHI or MHI connected firms appears to be part of the ruse, or Allen would consistently throw down in favor of MHARR, MHProNews and MHLivingNews.

- A case can be made that something similar to the evidence-based concerns about Allen could be said about ManufacturedHomes.com. They have on occasion used MHARR content. For years, ManufacturedHomes.com have received much, if not at various times the majority of their revenue from MHARR members. But when it comes to key road-block issues, and reporting on those, ManufacturedHomes.com are silent. They have joined MHI and ManufacturedHomes.com accepted an MHI award. Who do they think they are kidding? If the industry was growing as a result of their efforts, perhaps some of that could be forgiven. But they seem to behave more like MHVillage, which is obviously in the MHI camp too. Note, as a stating the obvious disclaimer, all of these views represent our Masthead thoughts, and may not reflect the thinking of MHARR or anyone else associated with them. That said, be it MHI “endorsed” MHVillage, ManufacturedHomes.com, blogger Allen, bloggers Frank Rolfe and Dave Reynolds, there is an apparent pattern that those who are MHI members and publish are useful to the unstated agenda of throttling manufactured housing’s growth.

- Ironically, as MHLivingNews reported some 2.5 years ago, by carefully examining what MHI has said vs. what MHI does, and comparing them to their corporate members remarks, it is clear that they have painted themselves into a corner. For instance. When a publicly traded MHI member says that manufactured housing could be doing double what the industry current is, or when they say that 6 million homes are needed and manufactured homes are the best way to achieve those goals, they are contradicting their behavior in a way that arguably violates their respective fiduciary duties. Even privately held companies or ESOPs that have shareholders could be guilty of failing to live up to their fiduciary responsibilities under various laws and regulations. Perhaps coincidentally, as MHProNews has sharpened its focus on MHI’s failures, MHI’s traffic has reportedly dropped. MHI calls to action appear to have resulted in fewer emails from industry members. Coincidences? Or are those factoids evidence that MHARR’s thinking and the often-similar stances found on MHProNews/MHLivingNews are taking a toll on MHI’s credibility?

These are just some of the reasons that the point that MHARR’s study is as valuable today as it was when it was first published some 6 years ago.

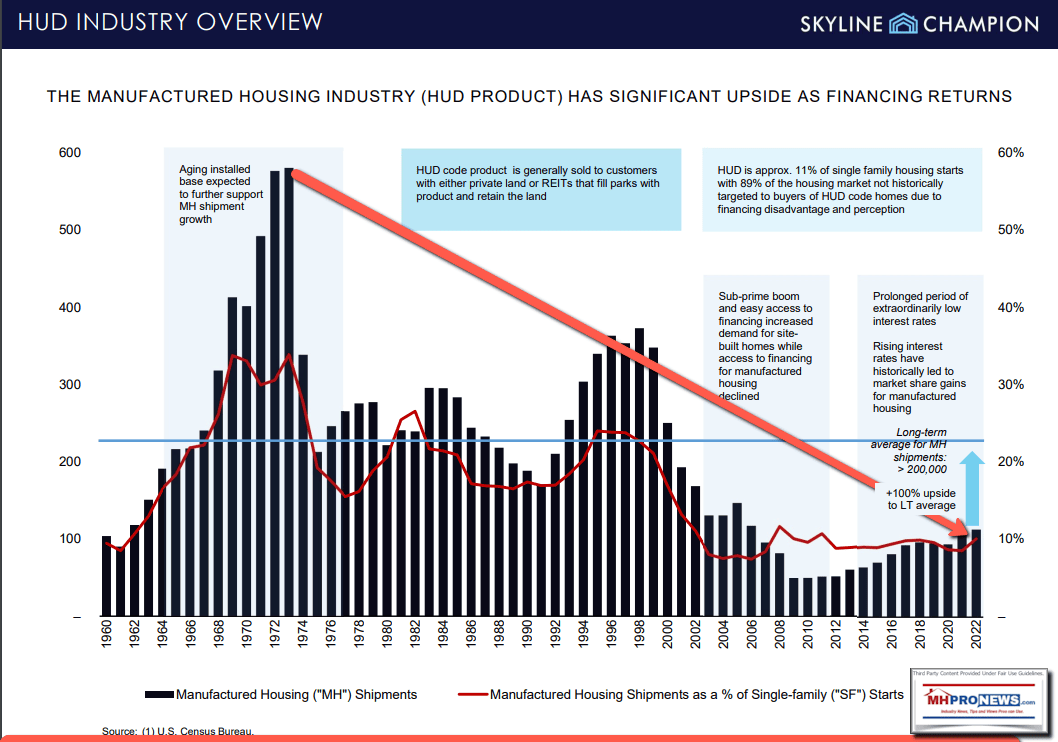

The base image is by MHI member Skyline Champion (SKY). They are making the case that the industry could be at least twice its recent production.

That being so, why aren’t they pressing MHI to sue to enforce existing laws that could spike manufactured housing to record 21st century highs?

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Lessons Learned and What’s Next?

MHIdea asked the question: what’s next? That question is as apt today as it was 15 years ago.

What is certain is that at the current pace, there may not be much left of manufactured home producers or retailers in a mere 5 years. While the large community sector may last longer, the ability for the ‘powers that be’ and their ties to conglomerates with vast political and media reach plus robust financial resources in the U.S.A. make them imposing indeed.

What neither MHIdea, nor NAMHCO did is publish and promote on a routine basis. While MHIdea praised MHARR in part, they arguably missed the mark by criticizing their most vocal ally. Quoting from their site: “Our other representative group, MHARR, is Danny Ghorbani. His writings have been steadfastly on the side of the retailers, but too often he has been the lone voice in the wilderness.” Instead of stating unequivocally that they wanted to ally with MHARR, they said instead: “The relatively small impact of his organization at the national level gives HUD no reason to seriously consider his writings. Right message, wrong forum.” Note the flawed thinking, and the stark difference between what MHARR said above and what MHIdea said? MHARR stated they would support such a group, and yet MHIdea made it into an ‘us or them’ proposition.

- NAMHCO arguably failed in part due to having embraced an ex-MHI VP as their de facto staff leader. Leaving the lion for the lion’s offspring made no sense.

- MHIdea failed in part due to failing to embrace MHARR, while as MHARR itself advocated, working with MHI when and where they can. Note that MHARR is a fierce MHI critic, but nevertheless has offered – and at times has – worked with MHI when they could properly do so.

Last April, the Masthead laid out a hypothetical case for just how successful one (or more) manufactured housing firms could be. The possible market potential and related profits are suggested by Cavco’s graphic, shown below.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

that the industry ought to expect this current downturn because more expensive site built housing is also in a downturn? MHI’s research and reasoning are arguably a classic example of PALTERING and the use of a RED HERRING logical fallacy. Note: depending on your browser or device, many images in this report and others on MHProNews can be clicked to expand. Click the image and follow the prompts. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

- Several MHI members ought to be MHARR members. Some already are.

- Several independents not aligned with MHI or MHARR ought to be MHARR members.

- Some MHARR and MHI members are vertically integrated. They and some buyer’s group connected independents could form that part of the core new post-production trade group, by whatever name its members decide to call themselves.

- Independently owned communities are still in the majority. They will need to play a robust role in the formation of a post-production trade association.

- Some suppliers logically have to keep one foot in the door with the existing powers, while doing what they can to encourage the new post-production trade association and MHARR.

MHIdea said the following.

* Multi-billion dollar manufactured housing corporations have definite advantages not available to many independent manufacturers and retailers, and MHIdea was seen as, and remains to be, an excellent opportunity for these independents to enjoy some of those benefits.

* Multi-billion dollar manufactured housing corporations have definite advantages not available to many independent manufacturers and retailers, and MHIdea was seen as, and remains to be, an excellent opportunity for these independents to enjoy some of those benefits.

- The dismal report of total shipments in 2009, the continued lack of substantive progress from the recent MHI meeting, the continued depressed condition of the economy and its effect on our customer base all weigh heavily on the future of our business. Our needs have NOT been adequately represented before Congress or the various federal regulatory agencies we are forced to deal with; our product has NOT been successfully marketed to our customer base in a time when our product is ideally suited to provide a much-needed commodity; our industry has NOT had a voice to speak with an unbiased voice for the benefit of ALL.”

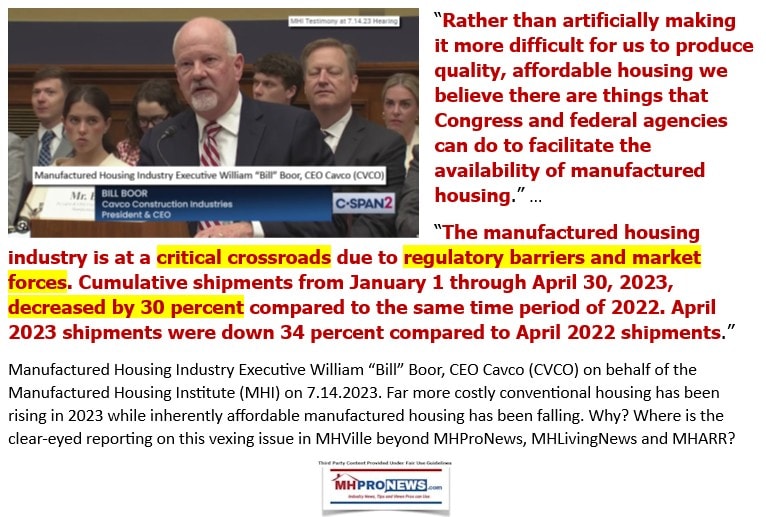

In an ironic twist, Cavco’s Bill Boor, soon to be the new chairman of MHI, used different words, by made a similar point. The industry is at critical crossroads, said Boor.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Some of the lessons learned from NAMHCO and MHIdea are outlined above. MHARR’s 2017 study is as relevant today as it was then.

A small core group of independents could launch and constantly promote a new trade group that is a MH-IDEAL (placeholder post-production trade group name).

The fact that Commodore Homes, Solitaire Homes, and now Regional Homes (among others) have/are selling out is a cautionary note to all remaining independents. Some might think they too must exit. Having spoken with independents who have and haven’t sold out suggests that in several cases, privately owned companies are not getting their best possible valuation given the limited number of possible buyers. Far better, for those who want to sell out, to support in the interim one or both independent trade groups (i.e.: MHARR and the proposed MH-IDEAL) until market conditions make their selling out the best possible valuation.

The MOAT

It must not be forgotten what the Buffett MOAT is and how it operates. At the same time, a post-production trade group that uses litigation and lobbying for litigation by public officials as a keys for growth can turn the MOAT on its head. MHI and their consolidators are arguably VULNERABLE, but only if enough consumers and professionals push for the type of legal and regulatory efforts needed to punish their so-called predatory behaviors.

Monday’s report will reveal new evidence about an issue that has gone unexplored by virtually everyone in MHVille, save MHProNews. It will arguably illustrate a recent example that there are a variety of ways that the insiders can trip up others in the industry. The industry’s upside is tremendous, as the publicly traded firms and others have sometimes allude to, but then fail to act upon.

We think the potential is far greater than Jennison said. The past (pre-21st century) could foreshadow a far more robust future for MHVille.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

A ‘MH-IDEAL’ post-production trade group can give any remaining independents potential opportunities and options that they simply don’t have now.

Some of those are ironically already spending the kind of money with service providers that could be used to fuel a post-production trade group that could GROW their businesses and PROTECT their investments.

The risks of not doing so are shown by the sudden, and often unexpected, downturns that have beset MHVille in the 21st century.

“IF we keep doing what we’ve been doing,

We will keep getting what we got!”

– MHIdea

MHIdea had some fine notions. MHARR’s study did a far more robust job. Hopefully, this report and analysis will point out why the best parts of the NAMHCO, MHIdea, and MHARR study could be combined into a program that could prove to be profitable as well as a good defense against the threats from outside and within. Take the time to read this again. Look at the evidence. There is 25 years of evidence of what’s been going wrong, and it can save time and be profitable to learn the lessons of the 21st century in manufactured housing. Because the trends are what they are. Those who already fell in the 21st century often thought it would never happen to them too, before it did. “IF we keep doing what we’ve been doing, We will keep getting what we got!” To get more, someone will have to do more. ###

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reporting that are not found anywhere else in MHVille. It is all here, which may explain why this is the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.