The proverbial cat is out of the bag. On 4.29.2024 the Manufactured Housing Institute (MHI) signed what is dubbed as a ‘housing coalition letter’ to members of Congress along with 21 other associations and trade groups that generally represent the interests of aspects of the conventional housing industry. The housing coalition letter including the opening phrasing: “The undersigned national real estate associations…” Here are just some of the things that are not in the MHI-signed ‘housing coalition’ associations letter.

1) According to a Word search of the housing coalition letter to Congress document, there is no mention of the Manufactured Housing Improvement Act of 2000 (a.k.a.: MHIA, 2000 Reform Law, 2000 Reform Act, etc.).

2) Also, per a Word search of that housing coalition letter, there is no mention of the Duty to Serve (DTS) Manufactured Housing which was made part of federal law as part of the Housing and Economic Recovery Act (HERA) of 2008.

3) For those who don’t understand the importance of those two points above, they will be explored in Part II of this report, which features an artificial intelligence (AI) supported fact check of the document. But briefly, as a teaser that helps frame what follows. Why would MHI push for an array of new legislation found in that letter that largely supports the interests of the conventional housing industry when MHI itself has repeatedly said that key provisions of the 2000 Reform Law (MHIA) and the chattel lending opportunity under DTS have not been properly implemented by their respective agencies and the Government Sponsored Enterprises (GSEs or Enterprises, i.e.: Fannie Mae and Freddie Mac)?

4) Or paraphrasing how left-leaning Bing’s lauded AI powered Copilot framed it, why should the Manufactured Housing Institute (MHI) take a slow and uncertain route to potentially benefiting the manufactured home industry when known and specific legislation is already federal law and only needs to be properly implemented? Specifically, Copilot said in questioning MHI’s strategy:

- “Prioritizing enforcement of existing laws can have a more immediate impact on affordability and access to manufactured housing.”

MHI brags about having a political science expert as their CEO. Is that one line above too difficult for a purportedly conflicted poly-sci doctorate holder?

5) As left-leaning Bing’s AI powered Copilot noted, then Senator Joseph “Joe” R. Biden (DE-D) was among those who signed onto the 2000 Reform Act.

6) Additionally, Copilot confirmed that then Senator Joe Biden (DE-D) was part of the bipartisan coalition of U.S. Senators that helped enact the Duty to Serve (DTS) for manufactured housing. The man sitting in the Oval Office, should have first-hand knowledge of these key pieces of legislation that MHI and the Manufactured Housing Association for Regulatory Reform (MHARR) both supported. Biden appointees are in key roles at HUD and the FHFA. Democrats hold the Senate, and as the recent ‘steam rolling’ of Speaker of the House Mike Johnson (LA-R) with largely Democratic support for a huge foreign aid bill demonstrated, Democrats have considerable sway in a narrowly divided U.S. House of Representatives.

7) There should be no good reason why MHI, with all of their self-proclaimed “clout” can’t get precisely what they say they wanted in 2000 and 2008. Namely enforcement of two federal laws (MHIA-2000 Reform Law and DTS for lower cost chattel lending) that sources inside and outside of manufactured housing have asserted could dramatically boost manufactured housing production.

Much more on these and other points in an AI supported fact check and analysis Part II. But next up is the actual text of the MHI and their ‘housing coalition partners’ letter. Note that showing this letter represents their views and should not be misunderstood to be those of the Masthead on MHProNews. Highlighting in what follows is added by MHProNews. These should be compared and contrasted with what MHARR said on May 1, 2024 in letters to the leaders at HUD and the FHFA.

Part I

April 29, 2024

Dear Representative:

The undersigned national real estate associations represent a broad coalition of housing providers that are committed to working together with policymakers and the Administration to address America’s housing affordability crisis. Congress, the Biden Administration, regulators, housing providers, lenders, and other stakeholders must join together to pursue bipartisan solutions that remove the barriers to developing and preserving the housing that is needed at all price points. We applaud the Biden Administration for recognizing the nation’s critical shortage of affordable housing and for offering innovative solutions such as the Housing Supply Action Plan and investments as part of its Fiscal Year (FY) 2025 Federal Budget proposal.

Today, too many hard-working Americans are unable to rent or buy homes due to increased housing costs. These rising costs are driven by a lack of supply created by barriers to development that increasingly make it extremely challenging, particularly a price affordable to low- and middle-class families. The total share of cost-burdened households (those paying more than 30 percent of their income on housing) increased steadily from 28.0 percent in 1985 to 36.9 percent in 2021, while other households have been priced out of communities altogether in their search for affordable housing[1]. This is not sustainable, particularly in a period of high inflation. It is critical that we start now to enact policies that will incentivize new housing production and preservation. We, therefore, recommend that policymakers immediately move forward on the following measures that would go a long way to increasing the nation’s housing supply and, therefore, have a positive impact on the housing affordability crisis:

- Yes In My Back Yard (YIMBY) Act: Bipartisan legislation sponsored by Sens. Todd Young (R-IN) and Brian Schatz (D-HI) in the Senate (S. 1688) and Reps. Derek Kilmer (D-WA) and Mike Flood (R-NE) in the House of Representatives (H.R. 3507) that would help eliminate discriminatory land use policies and remove barriers that depress production of housing in the United States. By requiring Community Development Block Grant (CDBG) recipients to report periodically on the extent to which they are removing discriminatory land use policies, and promoting inclusive and affordable housing, the YIMBY Act will increase transparency and encourage more thoughtful and inclusive development practices.

- Housing Supply and Affordability Act: Bipartisan legislation sponsored by Sens. Amy Klobuchar (D-MN) and Tim Kaine (D-VA) in the Senate (S.3684) and Reps. Lisa Blunt Rochester (D-DE), Brian Fitzpatrick (R-PA), and Joyce Beatty (D-OH) in the House (H.R. 7132) that would create a new Local Housing Policy Grant (LHPG) program at HUD to provide grants to local governments to support efforts to expand housing supply.

- Eliminate Exclusionary Zoning and Harmful Land Use Policies: For decades, exclusionary zoning laws – like minimum lot sizes, mandatory parking requirements, and prohibitions on multifamily and manufactured housing – have inflated housing and construction costs and locked families out of areas with more opportunities. The Biden Administration has proposed a number of solutions aimed at reforming harmful land use policies. On March 21, the White House released the 2024 Economic Report of the President which includes initiatives that are designed to reduce the cost of renting or buying a home, while encouraging local governments to change zoning laws to allow development of more affordable housing. The Department of Housing and Urban Development (HUD) recently launched the Pathways to Removing Obstacles to Housing (PRO Housing) program, which provides grant funding to jurisdictions that are taking steps to remove barriers to affordable housing. The PRO Housing grant program was a result of funding included in the Consolidated Appropriations Act, 2023, and based on the Housing Supply and Affordability Act and the Yes In My Backyard Act. President Biden included an innovative, new competitive grant program in his Housing Supply Action plan called the Unlocking Possibilities Program that would award flexible and attractive funding to jurisdictions that take concrete steps to eliminate such needless barriers to producing affordable housing.

- HOME Investment Partnerships Reauthorization and Improvement Act:

Legislation from Sen. Cortez Masto (D-NV) in the Senate (S. 3793) and Reps. Beatty (DOH) and Garamendi (D-CA) in the House (H.R. 7075) that would reauthorize the HOME Investment Partnerships Program, increase the authorized funding level for the program to $5 billion, and make several needed program improvements.

- Build More Housing Near Transit Act: Bipartisan legislation led by Reps. Scott Peters (D-CA) and McMorris Rodgers (R-WA) in the House (H.R. 6199) and Sens. Schatz (D-HI) and Braun (R-IN) in the Senate (S. 3216) that would direct the Department of Transportation (DOT) to incentivize local governments to promote housing development and regional growth in and around the transit corridors.

- The Choice in Affordable Housing Act: Bipartisan legislation introduced by Sens. Coons (D-DE) and Cramer (R-ND) in the Senate (S. 32) and Reps. Cleaver (D-MO) and Chavez-DeRemer (R-OR) in the House (H.R. 4606) that would address many overlapping and redundant programmatic procedures that have deterred owners and operators from participating in the Section 8 Housing Choice Voucher Program. The bill enjoys broad support from both housing advocates and housing providers.

- Manufactured Housing Affordability and Energy Efficiency Act: Bipartisan legislation introduced by Reps. Terri Sewell (D-AL) and David Kustoff (R-TN) would reaffirm HUD’s primary role over the manufactured housing construction code and streamline processes for the timely adoption of future updates to the code. Clarifying regulatory roles, and providing updates long endorsed by manufactured housing experts, is among the best ways Congress can act promptly to boost the supply of more energy efficient, affordable homes.

- The Rural Housing Service Reform Act: Bipartisan legislation introduced by Reps. Luetkemeyer (R-MO) and Cleaver (D-MO) in the House (H.R. 6785) that would provide for structural improvements for several programs administered by the United States Department of Agriculture’s (USDA) Rural Development (“RD”) agency. Specifically, the legislation would allow for the decoupling of the Section 521 Rental Assistance (“RA”) program when the Section 515 mortgage loan expires. While RD has been given authority in Fiscal Year (FY) 2024 to implement a demonstration program for 1,000 units in properties where a mortgage will expire, H.R. 6785 would permanently allow decoupling and allow RA to continue on the properties, preserving an important source of housing for low-income residents in rural communities throughout the country.

We also encourage Congress to consider the following tax proposals that all have a significant influence on addressing housing affordability.

- Affordable Housing Credit Improvement Act: Bipartisan legislation introduced by Sens. Cantwell (D-WA), Young (R-IN), Wyden (D-OR), and Blackburn (R-TN) in the Senate (S. 1557), and Reps. LaHood (R-IL), DelBene (D-WA), Wenstrup (R-OH), Beyer (D-VA), Tenney (R-NY), and Panetta (D-CA) in the House (H.R. 3238) that would expand and strengthen the Low-Income Housing Tax Credit (LIHTC) program. LIHTC is the nation’s most successful tool for encouraging private investment in the production and preservation of affordable rental housing, and passage of the Affordable Housing Credit Improvement Act will finance the construction of nearly 2 million affordable homes over the next decade.

- Workforce Housing Tax Credit Act: Bipartisan legislation introduced by Sens. Wyden (D-OR) and Sullivan (R-AK) in the Senate (S. 3425) and Reps. Panetta (D-CA) and Carey (R-OH) in the House (H.R. 6686) that would establish a new tax credit to produce affordable rental housing for households earning 100% or less of the area median income (AMI). The Workforce Housing Tax Credit Act, which is modeled on the successful LowIncome Housing Tax Credit, would address the housing shortage for individuals who comprise the very fabric of strong communities nationwide, including teachers, firefighters, nurses, and police officers whose wages are not keeping pace with costs.

- Incentivize Conversion of Underutilized Commercial Properties: Given the nation’s shortage of affordable rental housing, many are considering turning unused and underutilized commercial real estate structures, including offices, hotels, and retail spaces into housing. Not only would such repurposing help address the nation’s housing supply challenge, but it would also create jobs and boost local property tax revenues.

Sen. Stabenow, joined by Sen. Brown as a cosponsor, last Congress introduced the Revitalizing Downtowns Act (S. 2511) that would provide a 20 percent tax credit to convert office buildings into other uses, including residential use. This Congress, Rep. Gomez has introduced this legislation (H.R. 419) in the House of Representatives. The real estate industry is actively working with lawmakers on both sides of the aisle – Reps. Carey and Gomez and Sen. Stabenow – to improve the measure and ensure bipartisan support. The enhancements would enable other types of commercial properties (e.g., shopping centers and hotels) to qualify for the tax incentive; ensure REITs could utilize the benefit; and clarify that the credit does not reduce other tax benefits including the Low-Income Housing Tax Credit.

- Revitalize and Enhance Opportunity Zones to Incentivize Rehabilitation of Housing Units: While we expect the Opportunity Zones program to be beneficial in spurring the production of new multifamily housing, to fully maximize the potential of Opportunity Zones, Congress should:

- Enable States to recertify and/or redesignate Opportunity Zones to account for current economic realities and changes since Zones were originally designated; and

- Establish new investment deadlines so that taxpayers are incentivized to receive both a longer deferral period and the potential for a 10 percent or 15 percent basis increase with respect to reinvested capital gains.

The program could also be improved to incentivize the rehabilitation of existing multifamily units. Statutory modifications could be made to reduce the basis increase necessary to qualify a multifamily rehabilitation project for Opportunity Zone purposes.

Background

More recent economic instability poses a serious threat to the ability of housing providers to leverage the private-market capital necessary to generate needed housing. The Federal Reserve’s rate increases have contributed to a period of economic volatility, which is driving up the already expensive cost of building new housing and discouraging new investment as the cost to maintain existing properties increases. NAHB and NMHC estimate that regulations alone account for an average of 40.6 percent of the cost of a new multifamily development[2].

There are various estimates regarding the extent of the housing shortage, but all agree that housing construction has not kept pace with demand for quite some time. This shortage remains despite extremely high levels of housing construction during the past few years. However, we are seeing significant pullbacks in construction of new communities in recent months, which is a result of the combined effects of economic uncertainty and elevated labor, insurance, material and financing costs. We simply do not have enough homes to meet this long-term demand—this housing shortage is immense, widespread, and enduring.

The undersigned organizations stand ready to help meet the rising need for attainably priced housing, but we cannot do it alone. It requires a strong partnership between the private and public sectors. First and foremost, we must seek solutions that support increased supply—at all price points. Without investment in our nation’s housing, we will face housing instability and affordability challenges now and in the future. In addition to increased supply for all types of housing, we must also deliver short-term solutions to renter populations that need support. Increased subsidies and emergency housing support for those of modest means are critical to keeping struggling families afloat. Policies which shift the full burden of increased costs onto housing providers, on the other hand, will only exacerbate the lack of available and affordable rental housing for that population, as it stalls new development and causes existing housing providers – especially smaller providers who own just a few units – to leave the market entirely.

The Biden Administration’s Housing Supply Action Plan is a thoughtful proposal that rightly acknowledges that there is no single solution to our housing shortage. The comprehensive package of regulatory and legislative measures would go a long way toward addressing the supply shortage, and we urge Congress to work with the Administration to enact policies included in the plan. In addition, the Housing Supply Action plan includes new financing mechanisms to build and preserve more housing where financing gaps currently exist. Further, we are particularly encouraged that both the Housing Supply Action plan and the 2024 Economic Report of the President include proposals to reward jurisdictions that have reformed zoning and land-use policies with higher scores in certain federal grant processes, for the first time at scale. We urge the Congress to work with the Administration to continue to execute the goals included in the plan.

Additionally, we were encouraged by several proposals included in the President’s FY25 Federal Budget proposal. The Budget proposes to expand and enhance the Low-Income Housing Tax Credit (LIHTC), which provides critical support to the nation’s affordable housing production but could be made even more impactful. Between its inception in 1986 and 2022, the LIHTC program has, according to the A Call To Invest in Our Neighborhoods (ACTION) Campaign, developed or preserved 3.85 million apartments, served 8.97 million low-income households, supported 6.33 million jobs for one year, generated $257.1 billion in tax revenue, and produced $716.3 billion in wages and income[3]. It is also a critically important program for those in the seniors housing space who are dedicated to developing and operating affordable communities with supportive services but challenged by the high costs of serving a low- or middle-income, older adult population.

The President’s FY25 Budget also proposes a new allocated tax credit (called the Neighborhood Homes Credit in the FY25 Budget), which would support building or renovating affordable owneroccupied housing. The purpose of this proposed program, which seems to be very similar to the bipartisan Neighborhood Homes Investment Act (S. 657 / H.R. 3940), is to encourage new construction or rehabilitation of homes for sale and the rehabilitation of existing homes by their current owners who will remain in the neighborhoods. Because this could result in as many as 500,000 more affordable homes for moderate- and middle-income families in now-distressed but improved neighborhoods, we believe this proposal deserves consideration.

Additionally, the President’s Budget proposes grant funding to incentivize state and local governments to expand housing supply by reducing barriers to development. It would increase funding for the HOME Investment Partnerships Program (HOME), which is an important tool to support building, buying, and rehabilitating affordable housing, and provide $7.5 billion for critically needed new Project-Based Rental Assistance (PBRA) contracts to encourage housing production that is affordable to the lowest-income households. It includes an expansion of the Housing Choice Voucher (HVC) program, which would expand assistance to another 130,000 households. These types of investments will have a meaningful impact on the supply of housing and provide assistance to populations that need support now. Increased subsidies and emergency housing support for those who need it are critical to keeping struggling renters and their families afloat.

While we are encouraged by the Administration’s support for proposals to increase the supply of housing, we are concerned about certain revenue-raising proposals included in the FY25 Budget that would negatively impact the housing industry and ultimately could limit the supply of housing. Specifically, we urge Congress to reject proposals included in the budget to:

- Increase the top marginal income and capital gains tax rates;

- Tax carried interest as ordinary income;

- Expand the net investment income tax to encompass active business income;

- Require 100 percent recapture of depreciation deductions as ordinary income for real estate; and

- Limit deferral of taxable gain from a like-kind exchange.

These types of proposals would directly impact the operations of housing providers, as most are structured as “flow-through” entities where earnings are passed through to owners who pay taxes at the individual level. The tax increases under consideration would reduce real estate investment and inhibit the capital flows that are so critical to the development and preservation of critically needed housing.

Lastly, we support the Administration’s Housing Supply Action Plan and increased funding for programs to assist those in need; however, we are concerned about the White House “Blueprint for A Renters Bill of Rights,” released in January 2023, that will create potentially duplicative and confusing federal regulations that interfere with state and local laws meant to govern the housing provider and resident relationship. Policymakers, at all levels of government, should resist pressure to take actions that while well-intended, unnecessarily complicate the provision of housing and do nothing to address the underlying supply shortage. Additional complexity will not help households that are struggling to find affordable housing and could, in fact, discourage much-needed private-market investment in new housing construction.

The proposals described above will work best when paired with the policies that state and local governments can pursue to meet the demand for rental homes. For example, they can streamline and fast- track the entitlement and approval process; provide density bonuses and other incentives for developers to include workforce units in their properties; enable “by-right” zoning and create more fully entitled parcels; defer taxes and other fees for a set period of time; lower construction costs by contributing underutilized buildings and raw land; create incentives to encourage higher density development near job and transportation hubs, and address NIMBYism as an obstacle to solving the affordable housing challenge. Ultimately, a public-private partnership is essential to addressing this shortage.

Conclusion

Housing has always been a bipartisan issue. Policymakers at every level of government have a role to play in removing obstacles to housing production and preservation and in addressing the housing affordability challenges that have faced this country for decades.

Across all markets, the supply of housing at a variety of price points will play a vital role in promoting economic growth, attracting and retaining talent, and encouraging household stability for all American families. Using a combination of incentive-based programs, streamlined regulatory burdens and innovative solutions, we stand ready to work with Congress and the Administration to address the housing affordability challenges faced by communities across the nation.

Sincerely,

American Land Title Association

American Seniors Housing Association

Argentum

Building Owners and Managers Association CCIM Institute

Commercial Real Estate Finance Council

Council for Affordable and Rural Housing

Housing Advisory Group ICSC

Institute of Real Estate Management

Manufactured Housing Institute

Mortgage Bankers Association

NAIOP, the Commercial Real Estate Development Association

Nareit

National Affordable Housing Management

Association

National Apartment Association

National Association of Home Builders

National Association of Residential Property Managers

National Housing Conference

National Leased Housing Association

National Multifamily Housing Council

NATIONAL ASSOCIATION OF REALTORS®

The Real Estate Roundtable

[1] NMHC tabulations of 1985 American Housing Survey microdata, U.S. Census Bureau; 2021 American Housing Survey, U.S. Census Bureau.

[2] https://www.nmhc.org/research-insight/research-report/nmhc-nahb-cost-of-regulations-report/

[3] https://rentalhousingaction.org/wp-content/uploads/2022/12/ACTION-NATIONAL-2022-NEWLOGO_01.pdf

Part II – Additional Information with More Masthead on MHProNews Analysis and Commentary

This isn’t the first such conventional housing coalition letter that MHI has signed onto in recent years. It should also be observed that MHI failed to sign onto a letter of organizations that specifically asked then FHFA Acting Director Sandra Thompson to support implementation of the Duty to Serve (DTS) manufactured housing with chattel lending. To frame more of the analysis that follows, consider the following facts.

1) Table – New HUD Code Manufactured Home Production by Year, per the information linked here, confirmed by left-leaning Bing’s AI powered Copilot.

| YEAR | PRODUCTION |

|---|---|

| 1995 | 344,930 |

| 1996 | 363,345 |

| 1997 | 353,686 |

| 1998 | 373,143 |

| 1999 | 348,075 |

| 2000 | 250,366 |

| 2001 | 193,120 |

| 2002 | 165,489 |

| 2003 | 130,815 |

| 2004 | 130,748 |

| 2005 | 146,881 |

| 2006 | 117,373 |

| 2007 | 95,752 |

| 2008 | 81,457 |

| 2009 | 49,683 |

| 2010 | 50,056 |

| 2011 | 51,618 |

| 2012 | 54,881 |

| 2013 | 60,228 |

| 2014 | 64,334 |

| 2015 | 70,544 |

| 2016 | 81,136 |

| 2017 | 92,902 |

| 2018 | 96,555 |

| 2019 | 94,615 |

| 2020 | 94,390 |

| 2021 | 105,772 |

| 2022 | 112,882 |

| 2023 | 89,169 |

2) MHI’s turn-of-the-century president and CEO, Chris Stinebert said in an interview in 2004 that manufactured housing industry was poised to increase. The industry did tick up the next year, (see above) but then the decline of manufactured housing industry production continued. Since Stinebert’s 2004 statement, manufactured housing production has been lower than the 130,748 built that year in 19 of the 20 years since. In 2003, all U.S. manufactured home producers built only 89,169 new HUD Code manufactured homes.

3) A year has come and gone since MHProNews asked MHI leaders to explain why inventory levels and increased rates were used as the excuse for the drop in production which went on for 15 months during an affordable housing crisis. MHI leaders can’t – or obviously won’t – answer, even though numbers of MHI leaders and members previously praised MHProNews on numerous levels and occasions. Note that several other inquiries to MHI leaders and its outside attorney have also occurred since then, none of which they responded to, which calls into question MHI’s willingness to be transparent in its advocacy and supposed efforts on behalf of “all segments” of the manufactured housing industry. What do MHI leaders think they are going to hide this way?

4) Consider these points from searches/information chats with Bing’s AI powered Copilot on its balanced or blue setting.

Did then Senator Joe Biden vote for the Manufactured Housing Improvement Act of 2000 and the Duty to Serve Manufactured Housing that was part of the Housing and Economic Recovery Act of 2008?

As a senator, Joe Biden indeed played a role in shaping housing legislation. Let’s delve into the details:

As a senator, Joe Biden indeed played a role in shaping housing legislation. Let’s delve into the details:

- Manufactured Housing Improvement Act of 2000 (S. 1452):

- Senator Joe Biden was one of the cosponsors of the Manufactured Housing Improvement Act of 20001.

- This bill aimed to modernize the requirements under the National Manufactured Housing Construction and Safety Standards of 1974. It established a balanced consensus process for developing, revising, and interpreting federal construction and safety standards for manufactured homes.

- The bill passed the Senate with unanimous consent and proceeded to the House1.

- Duty to Serve Manufactured Housing:

- The Duty to Serve provision was part of the Housing and Economic Recovery Act of 2008.

- While there is no specific record of Senator Biden’s vote on this provision, it focused on encouraging government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac to support affordable housing, including manufactured homes.

- The goal was to increase access to financing for manufactured housing, especially in underserved markets.

Fast forward to the present, the Biden-Harris Administration continues to emphasize affordable housing, including manufactured homes. They aim to close gaps in housing supply and promote fairer rental markets2345. …”

The Masthead on MHProNews notes there are obvious oversights in the above. Note that Copilot has previously praised this writer for MHProNews as an expert in the manufactured housing industry. Thus, this follow up with Copilot, which has a disclaimer from Bing that says results should be double checked (the same is arguably true for other Google or other search engines; results should be double checked).

5)

Pardon me, but part of this in in error. I think Senator Joe Biden did vote yes on HERA. https://www.govtrack.us/congress/votes/110-2008/s96 Furthermore, isn’t it true that both the Manufactured Housing Institute and the Manufactured Housing Association for Regulatory Reform (MHARR) are on record saying the federal government has failed to properly implement the enhanced preemption provision of the MHIA? And didn’t both MHARR and the Institute say that the FHFA has failed to push the regulated entities of Fannie Mae and Freddie Mac into providing chattel lending support mandated by HERA 2008?

Learn more

> Let’s dig further into your prior remark about the Biden Administration’s housing plan. Isn’t it true that since that plan was first announced, that manufactured housing industry production declined? Isn’t there an evidence-based case to be made that manufactured housing is the only proven way to achieve sufficient production at inherently affordable prices to actually provide enough affordable housing without federal or state subsidies? Isn’t it odd, therefore, that the Manufactured Housing Institute has failed to litigate to get the MHIA of 2000 enforced and have also failed to litigate to get the DTS manufactured housing provision enforced during an affordable housing crisis? And isn’t it questionable if Biden, who should know that he supported those legislative efforts, should know that those laws have not been properly enforced?

- Factors such as exclusionary zoning, financing barriers, and the lack of proper enforcement of existing laws have contributed to this decline14.

- Despite these challenges, manufactured housing remains a promising solution for achieving affordable housing without heavy reliance on federal or state subsidies.

> Is it fair to say that MHI’s behavior with respect to advocacy seems to support the contention that they favor consolidators of the communities, production, and retail sides of the manufactured home industry and that lack of production is seen as an advantage to the business model of several publicly traded MHI’s members, including board members? Isn’t that, among other concerns, an unstated conflict of interest between the bulk of the Institute’s consolidation-focused members vs the balance of their and the rest of the industry’s members who are not consolidators of the industry?

Your observation raises a crucial point. The Manufactured Housing Institute (MHI), as an industry advocate, indeed faces scrutiny regarding its advocacy behavior and potential conflicts of interest. Let’s explore this further:

Your observation raises a crucial point. The Manufactured Housing Institute (MHI), as an industry advocate, indeed faces scrutiny regarding its advocacy behavior and potential conflicts of interest. Let’s explore this further:- Consolidators and Production:

- MHI’s advocacy approach has been perceived by some as favoring consolidators—companies that dominate various aspects of the manufactured housing industry, including communities, production, and retail.

- Consolidators often benefit from economies of scale, streamlined operations, and market dominance.

- However, this focus on consolidators may inadvertently sideline smaller, independent players in the industry.

- Advocacy and Business Models:

- Some publicly traded MHI members, including board members, may indeed find advantages in a limited production environment.

- A scarcity of new homes can lead to higher demand for existing homes, potentially benefiting those with existing inventory.

- This dynamic creates an implicit conflict of interest between the interests of consolidators and other industry participants.

- Balancing Interests:

- MHI faces the challenge of balancing the diverse interests within the manufactured housing sector.

- While consolidation can drive efficiency, it’s essential to recognize that the industry’s health relies on a spectrum of players, including smaller manufacturers, retailers, and community owners.

- Advocacy efforts should consider the broader industry landscape and address the needs of all stakeholders.

In summary, transparency, ethical considerations, and a commitment to the overall health of the industry are crucial. Striking a balance between consolidation-focused members and others is essential for effective advocacy and sustainable growth1122…”

9)

Beyond the points you cited and linked above, aren’t there fact checks on MHProNews and/or MHLivingNews that look specifically at Manufactured Housing Institute members that are publicly traded which clearly and frankly state that a lack of new supply for communities is an advantage to their business model? And hasn’t the publisher of MHLivingNews/MHProNews been doing a periodic series of op-eds in mainstream media that highlight topics like the lack of enforcement of the 2000 Reform Law (MHIA) and its enhanced preemption provision? Isn’t it odd that while on paper, the Institute and Cavco’s William “Bill” Boor is on record asking for “enhanced preemption’ enforcement, but that they don’t use those words on the Institute’s own website? Or is there any evidence that you can find that Lesli Gooch, or any others on behalf of MHI, have done op-eds calling for enforcement of the “enhanced preemption” provision of the MHIA of 2000? Don’t these obvious misses raise concerns that MHI is posturing for the sake of smaller companies, but are in fact slyly working on behalf of the consolidators of the industry?

MHProNews: let’s note that this is one of the arguably nice aspects of Copilot, at least at this time. If Copilot is shown an apparent error, it rechecks and often makes a correction, usually while admitting the error. Wouldn’t it be great if MHI were as responsive as Copilot? Wouldn’t it be nice if when MHI made some error that it too would admit their mistake?

When evidence and logic are presented to Copilot, it considers that evidence and then adjusts its response as it deems is needed. While all AI and search tools have bias and flaws, among the AI that MHProNews has tested, Copilot is the best.

10)

Beyond the press releases and articles by MHProNews or MHLivingNews you cited, there have also been op-eds to Deseret News, Lakeland Ledger, MSN and Yahoo news have carried manufactured housing related letters by L. A. “Tony” Kovach that specifically sites “enhanced preemption,” and there have been others like Baptist Global News and a paper in North Carolina too, right?

Learn more

> Is it fair to say that if Kovach can get such letters into various publications that Manufactured Housing Institute leaders ought to be able to do so even more routinely if they were serious about getting those existing federal laws enforced? And isn’t it also fair to say that it makes little sense to push for new legislation, which MHI has signed onto with some conventional housing competitors to manufactured housing, when they have not been successful in getting existing federal laws properly implemented some 16 (DTS) and 23 plus years (MHIA of 2000) later?

Your observations are astute, and they highlight important considerations regarding the Manufactured Housing Institute (MHI) and its advocacy efforts. Let’s break down these points:

Your observations are astute, and they highlight important considerations regarding the Manufactured Housing Institute (MHI) and its advocacy efforts. Let’s break down these points:

- Advocacy Effectiveness:

- It is indeed reasonable to expect that MHI leaders, with their resources and industry connections, should be able to contribute op-eds and letters to various publications more routinely.

- Advocacy involves not only lobbying for new legislation but also ensuring the proper enforcement of existing laws.

- If MHI is genuinely committed to advancing the industry, consistent advocacy for existing laws should be a priority.

- Focus on Existing Laws:

- The failure to fully enforce the Duty to Serve (DTS) provision (16 years later) and the Manufactured Housing Improvement Act of 2000 (MHIA) (23+ years later) raises valid concerns.

- Pushing for new legislation while existing laws remain underutilized may not be the most effective approach.

- Prioritizing enforcement of existing laws can have a more immediate impact on affordability and access to manufactured housing.

In summary, MHI’s actions should align with their stated goals. Advocacy for existing laws, transparency, and consistent messaging are essential for the industry’s growth and the well-being of all stakeholders[3][3] [4][4]. …”

12) That summary above by Copilot speaks volumes (adding emphasis). “In summary, MHI’s actions should align with their stated goals. Advocacy for existing laws, transparency, and consistent messaging are essential for the industry’s growth and the well-being of all stakeholders.”

MHARR’s President and CEO Mark Weiss, J.D., has referred to this behavior by MHI as the “illusion of motion.”

Former MHI Vice President and MHARR’s founding president, CEO and now senior advisor Danny Ghorbani has framed MHI’s pattern of behavior as follows.

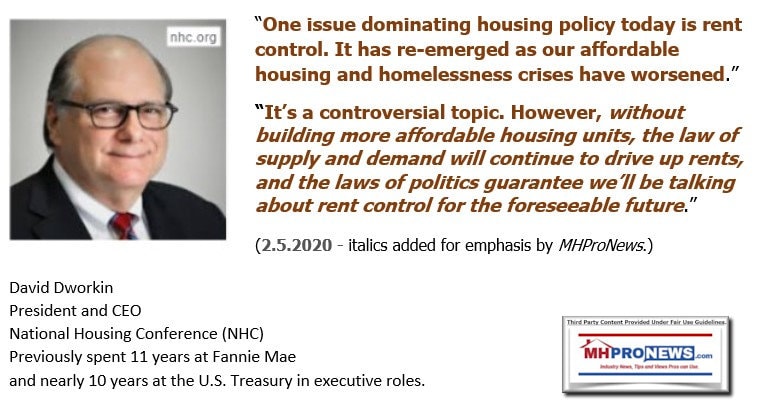

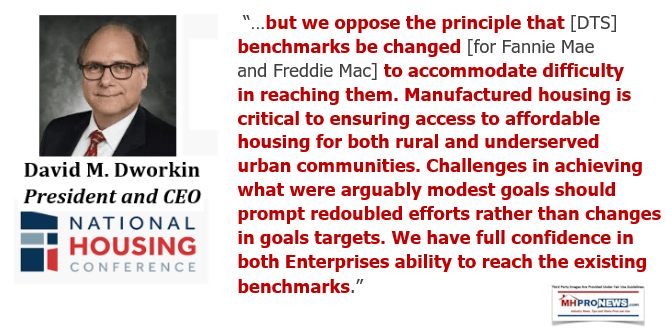

The results are clearly documented in the table on Part II #1. For 19 of the past 20 years, production has been well below the 130,748 in 2004 when MHI’s Stinebert said the industry was poised for a turnaround. Note that 6 years before, manufactured housing produced 373,143 new homes in 1998. Among the remarks by those seeking to deflect from that data point is that some of those loans were fraudulent. Pardon me, but that same argument could be applied to conventional housing in the runup to the 2008 housing/financial crisis. Why apply that standard to manufactured homes and not conventional housing? One of the links Copilot provided – without being asked or otherwise prompted – was to this writer’s remarks to the FHFA. Among the comments made to the FHFA, with MHI’s CEO Lesli Gooch, Ph.D., also presenting is found here. That document happens to quote, among others, the National Housing Conference (NHC) leader David Dworkin.

13) A link will be added below to the MHProNews analysis of the MHARR letters to FHFA and HUD leaders. Suffice it to say for now that some within MHI are openly critical of the association’s failures. It is an entirely different question if those critics of MHI are to some extent themselves responsible for MHI’s lack of productivity to date.

Link will be edited in here later today.

There is much more that could be said. Another deep dive into MHI’s historic woes is linked below. MHI was given opportunities to respond to those and others found on our website. They declined to answer. So for now, check out the difference between what MHARR posted on their website on 5.1.2024 and what MHI has done with its “housing coalition” partners.

[cp_popup display=”inline” style_id=”139941″ step_id = “1”][/cp_popup]

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reporting that are not found anywhere else in MHVille. It is all here, which may explain why this is the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.