About a week ago, independent manufactured home retailer Chad Evans with Centennial Homes and others in manufactured housing were asked to respond to an inquiry like the following. “Hey Chad, to tee up my question for you, when most were screaming long backlogs, the following remarks came in to MHProNews on Wed, Apr 27, 2022, at 7:26 AM. The following is a quote with edits, with those edited parts due in part to protect identity. It is a vertically integrated producer. The … are my edits. I’m adding highlighting for clarity on your end on what’s being quoted.

“Tony,

I think the backlogs have had a lot of fluff in them … I see signs of stress on them such as inventory at retail increasing. … they are ordering based on previous sales and line spots are being allocated.”

As you may have noted, Cavco and others later talked about high levels of inventory at retail causing sales to slow, along with higher interest rates. Beyond what producers say, you have your own experiences and know of the experiences of your colleagues in street retail.”

Here is what Evans sent to MHProNews via email in reply to the inquiry about the post-COVID19 backlogs controversy.

We get spots each week being a large exclusive with one factory dealer for 30+ years, so we have to play the internal juggle game based on customer needs, which we did during Covid much more than normal.

I heard from other dealers who would just turn in orders (with a bogus customer name on the order) just to get some production spots since many were out over a year to get a house in many cases.

We were not that far out, but we were farther out than normal for sure.

As for inventory and stock units – we bucked the trend here by design and would NOT let our staff sell our stock units during this time, knowing it was going to be months before we got it back and even longer for our crews to set it up as they were focusing on retail sets.

If we sell the stock unit that might be one sale, but not having that piece of inventory to walk someone through for months on end would cost us a lot more than 1 sale! So we didn’t allow our sales people to sell stock for over 2 years.

We did turn our inventory over finally in 2023 and are almost back to full inventory levels now. We also do not floorplan, so we have the luxury of not having to turn the inventory yearly like dealers who do floorplan everything.

Thanks, Chad [Evans]

Another retailing firm with multiple locations was contacted for this news/analysis, which provided the following insights in response to MHProNews’ inquiry.

The Skyline deal is interesting, we will see where it goes. I’m not overly concerned about it after meeting with Triad’s president this week. I am not a Skyline fan and would consider them the weakest of the big three in terms of product quality and management quality. I wouldn’t be surprised to see Cavco end up with Cascade. Reliant MH officially exited the business today. We are steadily growing at a slow pace. Off [the] record please.”

Note with respect to the remarks above ReliantMH.com that the firms is listed on their website as a “division of United Community Bank” based in Knoxville, TN (i.e.: Clayton Homes back yard) that has been doing manufactured home lending. Cascade Financial has grown since their inception in 1999, per their website, but the seller above questions if they will remain an independent or not. Time will tell.

Recall that MHProNews was told recently by a c-suite level leader of a firm that the Skyline Champion – ECN – Triad deal could put a ‘chill’ in the manufactured housing market.

Some contacted by MHProNews for insights for this news/analysis decided not to weigh in on the retailer controversy, even off the record, or felt that their remarks may not be relevant. Other remarks provided may have been similar to observations already noted above.

That said, the Texas Manufactured Housing Association (TMHA), the number one state in the nation for production and shipments of new HUD Code manufactured homes yielded some important insights.

TMHA’s Rob Ripperda Data on Retailers in #1 Texas

“Retailers sold more homes than they received during the first half of the year,” said Rob Ripperda, vice president of operations for the Texas Manufactured Housing Association, “and that trend should extend into July as manufacturing plants typically close for a week to celebrate Independence Day. Last year there wasn’t a single month when retail sales beat shipments. Solid consumer demand for affordable housing continues to drive new orders and has brought manufacturing production rates back to where they were during the last calendar quarter of 2022.”

That was per the most recent Texas Real Estate Research Center remarks provided to MHProNews. Ripperda’s remarks can be seen in their full context, via the linked report and analysis below.

MHProNews’ follow up on the Skyline Champion (SKY) ECN Capital/Triad Financial deal linked below sheds more light on the dynamics at play for manufactured home retailers, perhaps particularly so for many street retailers.

Our recent report on ZippyMH reminds/informs readers that Zippy is a “community” focused chattel lender. If there is a looming erosion of retail lending, as some in the manufactured home industry have speculated in the wake of the Skyline Champion-ECN-Triad Financial deal, would the industry see another round of lost or consolidated street retailers? That obviously could occur, but once more, time will tell.

In considering the shifting retail landscape, one must note the acquisition announced just days ago by Skyline Champion (SKY) of vertically integrated Regional Homes and their dozens of retail centers. A growing share of the remaining retailers are owned by vertically integrated producers of manufactured housing.

All of these shifts in lending and retail distribution channels have clear implications for producers of HUD Code manufactured homes. It ought to be obvious that when producers’ “backlogs” are longer than usual, it has implications for retailers as Centennial’s Chad Evans and others have noted. Changes at the retail level impact producers. Because of a sort of symbiotic relationship between producers and independent or other retailers, what impacts one routinely impacts the other too.

National Manufactured Home Distribution via Street Retail and Manufactured Home Communities

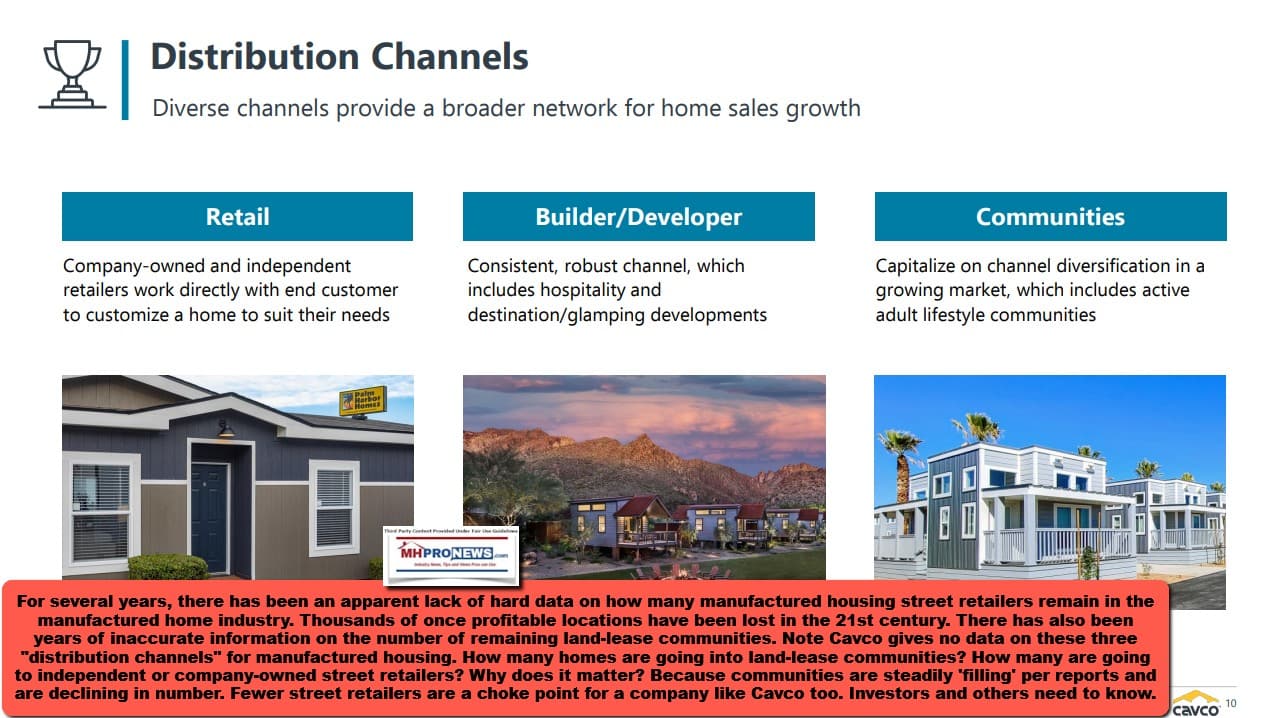

As MHProNews has previously reported, the Manufactured Housing Institute (MHI) has been reporting for some years on the percentages of homes produced by HUD Code manufactured home builders and which ‘channel’ those homes were being shipped to, i.e: where they being delivered from the factory to street retailers, or where those new manufactured homes being wholesaled to land-lease manufactured home community-based sellers?

Per MHI, the following.

- “63% of new manufactured homes are placed on private property and 37% are placed in manufactured home communities” according to MHI’s “Quick Facts” updated May 2020.

- “69% of new manufactured homes are placed on private property and 31% are placed in manufactured home communities.” So said MHI’s 2021 “Quick Facts” updated in May 2021.

- “49% of new manufactured homes are placed on private property and 51% are placed in manufactured home communities.” So said MHI’s August 2022 “Quick Facts” for 2022, which said it was updated in 5.2022.

But then comes a twist which has been under-reported and/or ignored by others in manufactured housing trade media. MHI’s 2023 version of what they previously called quick facts – now called on that document as “industry overview” – has a few odd wrinkles. Only one will be the focus of this report and analysis. It is this.

- “31% of new manufactured homes were placed in manufactured home/land-lease communities in 2021.”

What the above bullet means is that instead of updating the statistics as in prior years (2020 to 2022) on retail distribution channels: i.e. – street retailers vs. community-based sellers – MHI merely repeated part of the information for 2021. That begs questions. Why didn’t MHI update the percentages flowing to street retailers, as they had in prior years? Why that change in phrasing? And perhaps as or more important for several types of operations involved in manufactured housing, why didn’t MHI – if they weren’t going to update that data point on distribution channel percentages – return to their 2021 data claim vs. the 2022 data? MHI has not opted to clarify that point with MHProNews. Why not?

The significance could be serious for some in the industry. In essence, MHI has apparently made a conscious decision to change that part of the format for their report. The data through May 2023, as in those 3 prior years of their report, clearly stating what percentages are flowing to the retail channel is now missing in 2023.

That detail may be more significant to producer of HUD Code homes that are not part of the so-called “Big Three” of Clayton Homes (BRK), Skyline Champion (SKY), and Cavco Industries (CVCO).

As another aspect to the backlog and retail distribution channel and related issues, recall this flashback comment from a Manufactured Housing Executives Council (MHEC) member executive to MHProNews.

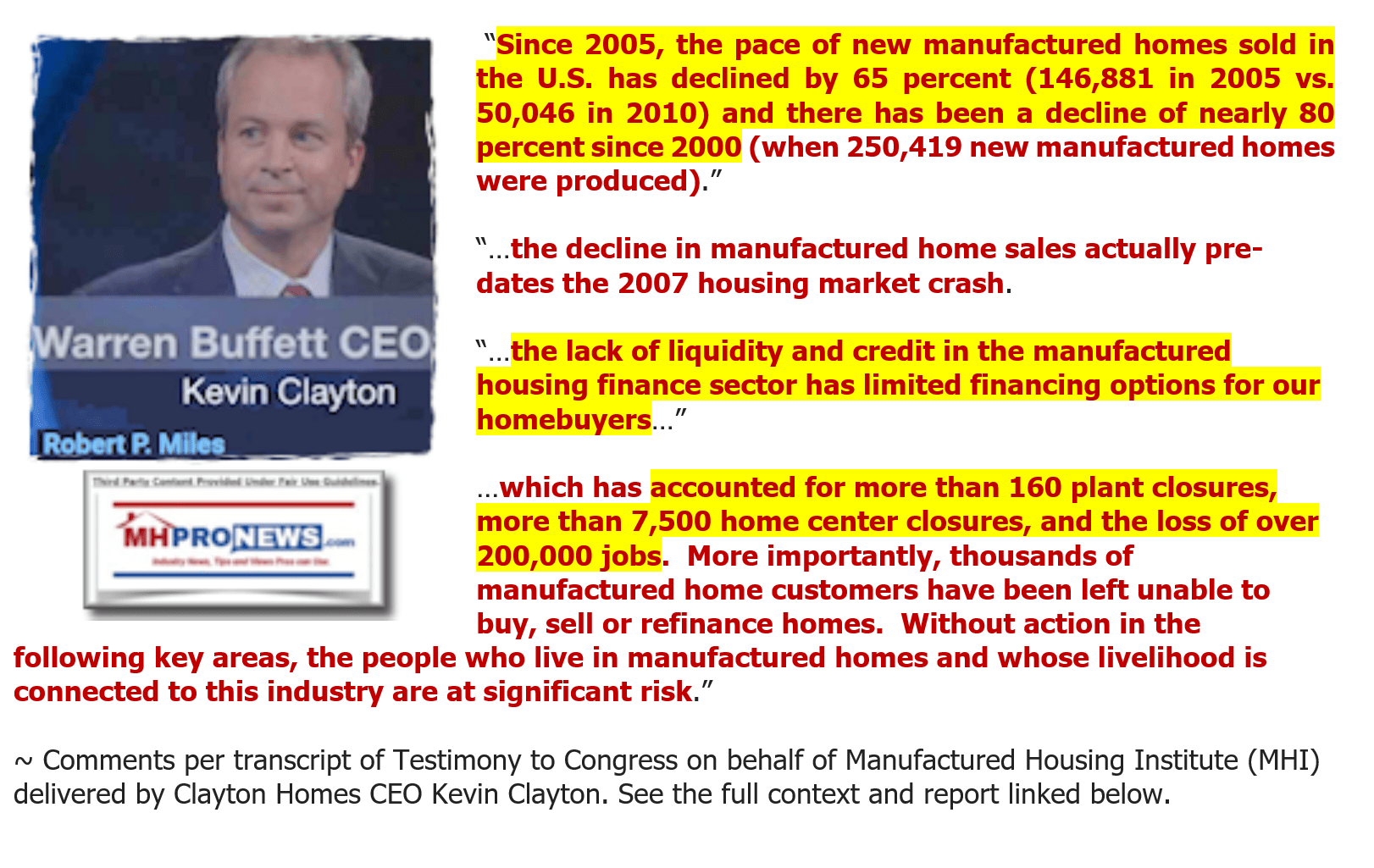

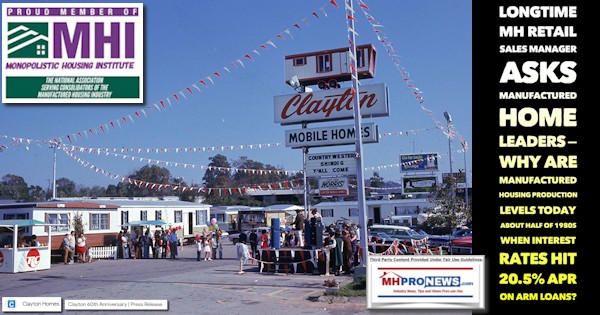

Nor should flashback remarks made by Kevin Clayton to Congress on November 29, 2011 be ignored. Again, while downplayed or ignored by others in what passes for the balance of MHVille trade media/bloggers, the loss of retail in manufactured housing in the 21st century has been stark. That loss of retail centers numbers in the thousands. Many were once profitable businesses, some of which operated for a decade or more. It is an issue that MHProNews has reported on by far more than anyone in MHVille, as this flashback to late 2017 reflects.

That loss of independent retailers has obviously been a driving factor in the lower levels of HUD Code manufactured home production. Fewer retailers has meant lower sales levels in the 21st century. Note that Clayton said there were “more than 7,500 home centers” – meaning “street” retail centers – “closures.” Note that his figure didn’t cite those acquired by someone else, those are sales centers that were closed.

Some sources in the MHI orbit have put the numbers of lost retailers as 10,000 sales centers or more.

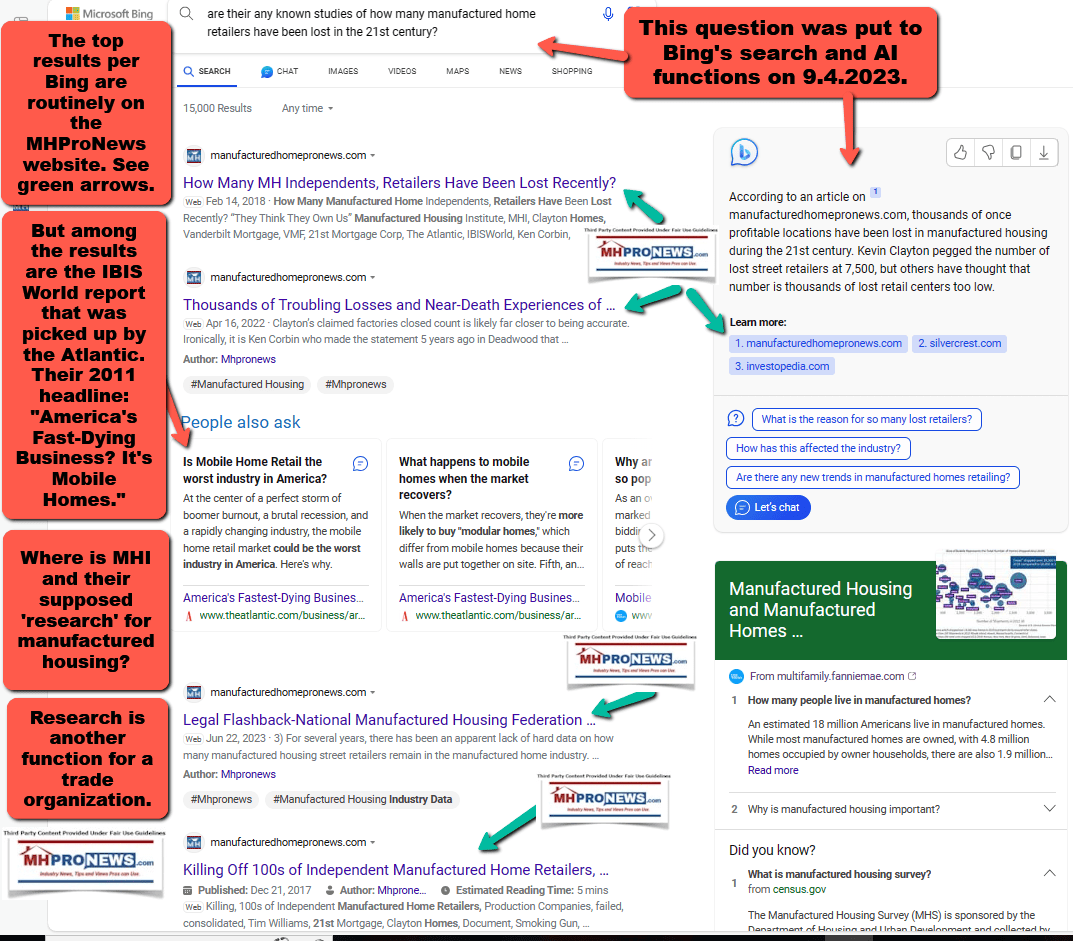

Note that the loss of “more than 7,500” home centers, as Kevin Clayton put it, was driven to a serious degree by the loss of lending in the early 21st century as compared to the 1990s. But for the purposes of this report, the numbers of street retailers is a serious issue for manufactured housing producers and affordable housing seekers. The question was put by MHProNews to Bing’s AI chat function: “are their any known studies of how many manufactured home retailers have been lost in the 21st century?” Here was the response.

The Silvercrest and Investopedia articles don’t provide any data on the question, so they are not useful for this report/analysis. The only report linked above that does mention relevant facts is the one from MHProNews (ManufacturedHomeProNews.com). That #1 linked report from Bing is the one linked below.

The screen capture for that same search shown above on Bing resulted in the following top of page 1 Bing search results on 9.4.2023 as is shown below.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Stating the Obvious Can Be Insightful

Beyond street retail, there are community retailers. Unspecified in MHI’s ‘research’ is how many communities are developments/developers of fee simple properties, vs. land lease communities. While significant, that point is beyond the scope of this specific report. That said, regarding retailing from manufactured home communities (MHCs), consider some facts from the recent UMH Properties report.

The following quoted remarks from Sam A. Landy, J.D. President, CEO & Director:

- “Our growth is dependent on the ability to have vacant lots to fill.”

- “Our goal is to continue to grow UMH into a national company by maintaining a sound balance sheet and continuing to invest in our growth initiatives.”

- “Demand for affordable housing is at an all-time high.”

UMH Properties business model for several years now has been to focus on filling vacant lots with manufactured homes purchased for rental housing purposes, supplemented by the sales of new manufactured homes.

Eugene W. Landy, Founder & Chairman of the Board, said:

Our business model reflects our aspiration that over 12 years, our assets may double in value, and if we assume 50% leverage, our equity could triple its value. These potential gains are not reflected in today’s financial results. Investing in real estate takes time to produce results, but we have a 55-year history of executing on this business plan.

During the Q&A of UMH’s earnings call, Robert Chapman Stevenson asked: “Can you talk about how the home sale business is trending?” Stevenson is listed as the “Head of Real Estate Research & Senior Research Analyst; Janney Montgomery Scott LLC, Research Division.”

Brett Taft, Executive VP & COO UMH Properties, said in response: “We’re sitting here with a $3 million pipeline of homes for sale, so we believe we are on track to put up similar results that we did in the second quarter. We’re getting the margins that we expect, which is generally a 30% gross markup. And demand appears to be strong across the portfolio.

Our internal financing is really allowing us to continue to drive these sales as we’re financing most of our home sales at a 7.5% interest rate, where most of the competition in that market is 9%, 10%, 11%.”

There is much more that could be said about the MHC distribution channel.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

See also 2023 reports from Sun Communities (SUI) and Equity LifeStyle Properties (ELS).

Industry pros and others should keep in mind that IR pitches, along with other corporate remarks, are supposed to be factually accurate in as much as investors are relying upon them to make investment decisions. Failure to provide accurate information could make a publicly traded firm subject to regulatory and shareholder liability issues.

That said, let’s pivot back to the street retail distribution channel.

Skyline Champion during the period of long backlogs had, per their own IR pitch, 8 production centers that were shuttered. SKY said earlier in 2023 that they were in the process of opening 3 of those shuttered building centers (i.e.: plants or “factories”). Note that Skyline Champion has their own Titan Factory Direct retail centers (a vertically integrated production-retail organization). They have serious assets available for investment. Which in light of the long backlogs in the post declared COVID19 period begs the question. Why didn’t they re-open those shuttered plants to reduce the backlog for their retailers and communities?

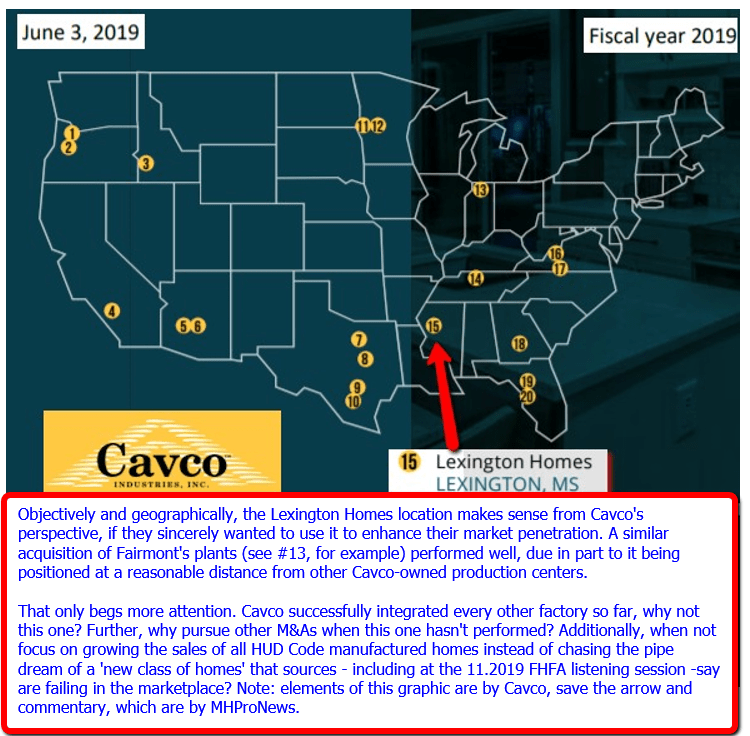

Nor is it just Skyline Champion that had a shuttered plant.

Recall that Cavco Industries bought and later closed a former Manufactured Housing Association for Regulatory Reform (MHARR) member producer, Lexington Homes. There were concerns raised following that deal that questioned if the acquisition may have been a case of buying a producer with the intent to close it. If so, that’s a possible antitrust violation. It would also be a reasonable concern for investors to wonder about the quality of decision making at Cavco, which was beset during the 2018-2022 timeframe with issues with the Securities and Exchange Commission (SEC) and also with a range of shareholder probes and lawsuits.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Some Practical and Legal Implications of Backlogs and Retail Inventory Issues

Evans and others to MHProNews made it clear that prior backlogs and their ramifications led some retailers to order more homes in advance to reserve a ‘spot’ in the production line. Something similar might be said about communities too.

If there was ‘fluff,’ as a source to MHProNews cited near the top (above) and this report, that could be a potential market manipulation, which has possible legal ramifications for the Big Three.

Recall that the industry’s performance was called into question earlier this year by market analyst Gregory Palm in a pointed question to Cavco handled by their CEO, William “Bill” Boor.

Boor said he is slated to become MHI’s chairman this month, according to his remarks to Congress in July. Those remarks by Boor to Congress are also relevant to this discussion.

With the affordable housing crisis in mind, Palm wondered: ‘why is manufactured home industry production so weak?’ A fair question, given all the facts known about the lack of affordable homes and manufactured housing’s decades of proclaiming that our profession is the most proven form of permeant affordable housing in modern U.S. history. Indeed, MHProNews editorially applauded Palm for asking such a question. There ought to be concerns raised that market analysts are properly doing their job by failing to dig into pointed enough probes of legal, performance, and other issues, focusing instead on nuances that may have merit, but may nevertheless leave several serious issues unaddressed. Among those topics largely ignored by analysts like Plam are the lack of chattel lending via the Duty to Serve (DTS) manufactured housing mandated by Congress in 2008, the lack of FHA Title I lending, zoning/placement barriers and what MHI publicly traded member/producers were doing about possible legal action on those issues, given that some 15 years and 23 years of waiting was more than enough. If ever there would be good questions asked by analysts put to producers of manufactured homes that are publicly traded, those ought to be among them. Questions also should be put Cavco, Skyline Champion and others about the apparent failure of MHI to live up to their own stated goals in most of the 21st century.

Flashing back to the report above, Palm said in part the following to get Cavco’s response.

I mean, is it just as simple as the inventory levels were just a little bit higher and it took a little bit longer to work through because I think everybody is trying to get a sense for why at least industry production data was so weak. And not just calendar Q1, but March specifically. I know that there is some sort of a lag involved, but maybe you can just tie that back out to the production, if you’re able to?”

In reply to that Boor said the following.

And then, when we look at traffic and close traffic has actually been, in my view, pretty healthy throughout, right? And I’ve always said that — what I think that indicates is the underlying need. There are people out there trying to figure out, can I afford a home? My family needs a home. They’re trying to do that work, and they were just kind of put on their heels by the interest rate increases on top of dramatic increases for our products, but the traffic has consistently been there.

The order strength over the last several months — I’m sorry, not orders, the close strength over the last several months, I view as a positive indicator. But that’s really a couple of months leading indicator to the extent it’s correlated to orders because it takes people time to make their decisions</span.. And — so it’s easy to be talking to a number of retailers and ask for quotes.

It indicates a high level of activity of shopping, trying to figure out how to make the purchase, but it won’t result in the correlation between quotes and true order is not quick. It can be a couple of months. So I’m not bothered by the fact that we’re seeing those positive indicators, but we’re not — but we haven’t seen the pickup in wholesale orders. I think, it’s very explainable by those factors. And I think it’s common.”

Recall that MHProNews asked Boor and others earlier this year some retail specific concerns. The inquiry below predated the Q&A between Palm and Boor. If it was an influencing factor for Palm’s inquiry is unknown at this time.

Summing Up

In no particular order of importance are the following claims and known facts.

- Big Three and other producers told their retail and community customers that backlogs for obtaining orders where longer than usual during the first half of 2022. As Evan’s put it, that was occurring earlier during the post-COVID19 outbreak and the surge in demand for more housing in general, and more manufactured homes.

- While Evans’ team stopped selling stock units for that reason, some other sellers may not have handled it that same way.

- Some retailers may have experienced for a time an inventory shortage.

- Other retailers had long wait times on getting product for retail sold and/or inventory.

- There are indications (see the linked reports above) that Skyline Champion and Cavco Industries had the resources and production centers available to re-open and ramp up production. That could have made a difference for several retailers. Sales that were ‘lost’ due to long delivery times could have been made. That has implications throughout the retail-production and support services chain.

- TMHA’s VP of operations, Rob Ripperda said: “Retailers sold more homes than they received during the first half of the year.” It is apparent that numbers of retailers were overstocking during 2022, perhaps due in response to ‘backlogs’ that to some extent were alleged by a well-placed source to MHProNews to be ‘fluff.’

- MHI has for some reason changed their reporting in 2023 on the retailer vs. community distribution channels.

- MHI has for too long hidden the total number of street retailers in their reports. Why is that so? For years, MHI has also mis-reported the total numbers of land-lease communities in the U.S. Why is that so? Every ‘quick facts’ report in recent years has apparent errors brought to MHI’s attention by MHProNews that have not been properly corrected. More on that another time.

- But with respect to backlogs, did some Big Three producers accidentally or intentionally create an issue that they later had to clean up with a sharp fall in production? Because while conventional housing has been recovering from the interest rate shocks that began last year, manufactured housing has continued to slide.

There are regulatory, stakeholder, and shareholder implications to all of those listed concerns, and other possible issues beyond those bulleted. To some extent, the Big Three’s behavior would have ripple effects to non-Big Three brands, both producers in MHARR, or those who are members of MHI, and also with the dwindling numbers of firms independent of either of those two national trade groups.

MHProNews has, as noted, asked MHI and Big Three leaders about some of these vexing topics. They have thus far declined to respond.

Were there honest mistakes being made in the post-COVID19 outbreak? Or where decisions made that created not so subtle stressors on some of the remaining independent retailers and producers? What, if anything, are they hiding by failing to address these questions?

And if they are hiding nothing, then why would the Big Three and MHI fail to respond to the largest known and most-read trade media in manufactured housing?

MHProNews plans to press these interrelated issues once more with corporate and MHI leaders.

Until then, the first two reports linked below, along with others linked herein, are recommended for their particular relevance to the retail topic. Because it seems that the loss of independent retail and community representation has in fact hurt manufactured housing.

Despite the fact that Leo Poggione was made chairman for a time at MHI, he himself told MHProNews that he was the first retailer in that role in many years.

Furthermore, in as much as Poggione led Craftsman Homes is essentially a subsidiary of Cavco Industries, the case can be made that Cavco has had both the chairman and the vice chairman roles at MHI in recent years.

There is an evidence-based argument that MHI has put street retailers at the back of the proverbial bus for much of the past decade. That has implications for producers and others. As noted, MHProNews plans a follow up to this report and will give the Big Three, MHI, MHARR and others an opportunity to weigh in on the facts, claims, and concerns explored herein. Watch for that exclusive follow up. ###

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’