Sarah Marx’s byline is on an article for apparently Manufactured Housing Institute (MHI) friendly HousingWire on July 14, 2023 under the headline “Manufactured housing lender Zippy secures additional funding.” The subheading for Marx’s HousingWire post was: “The company [i.e.: ZippyMH] operates in an underserved corner of housing finance.” True enough. Manufactured housing lending is underserved, as the Consumer Financial Protection Bureau (CFPB), the Urban Institute, Harvard’s Joint Center on Housing Studies (JCHS) State of the Nation’s Housing 2023, attorney Andrew Justus, and other research sources reported on by MHProNews/MHLivingNews have made clear. Marx doesn’t dive into the underlying issues of how that ‘underserved corner of the housing finance’ is related to the fact that FHA Title I loans were throttled by the so-called 10/10 rule over a decade ago. Nor does Marx go into the controversies surrounding the Government Sponsored Enterprises (GSE) of Fannie Mae and Freddie Mac obvious ongoing disinterest in doing any chattel loans under their Duty to Serve (DTS) Congressional ‘mandate.’

- In Part I of this report, analysis, and commentary will include various additional pull quotes from Marx’s article on HousingWire which will be referenced. That includes a rather awkward typo in what begins with a parenthetical remark that doesn’t end and remains uncorrected some 10 days later. For a post of less than 400 words, that’s an ‘ouch.’

- Part II of this article will feature insights confirming a funding source of ZippyMH plus Zippy’s leadership replies to the inquiries as shown by MHProNews.

- Part III will be additional information and including the need for firms like Zippy, other manufactured home lenders, and manufactured housing industry growth-minded firms of all kinds should be asking, answering, and resolving.

Part I Excerpts from HousingWire’s report, linked here.

(MHProNews Note: the “psecured by” and the missing end of that sentence are errors in Marx’s original post. Hey, it happens. But it is still embarrassing.)

Since its foundation, the company has been on a steady path to becoming one of the largest lenders in the manufactured housing industry, which has struggled to take off in part because Fannie Mae and Freddie Mac haven’t provided liquidity for loans on manufactured homes titled as personal property, and private lenders tend to charge high interest rates and offer few protections. (Borrowers of chattel loans often pay double the rate of real estate loans psecured by

It has raised a total of $26 million in venture funding and is already active in 17 markets. The company didn’t disclose the amount of the latest round. Earlier this year, Zippy announced another round of investments from Nashville-based FirstBank. …

“Zippy is providing an integral part of the equation to increase access to affordable housing by giving homebuyers more competitive financing options,” said Wesley Gottesman, partner at Brand Foundry. “We are thrilled to continue to support them in democratizing access to home ownership while pushing the entire manufactured housing industry forward.”

…A new influx of chattel houses might be one of the solutions to remedy the affordability crisis.

“This investment will fuel Zippy’s expansion in both sales and engineering capabilities and allow us to expand our footprint across the country,” said Jordan Bucy, Zippy co-founder & COO. “We’re excited to strengthen our presence and offerings to increase more opportunities for affordable housing as we march toward the immense opportunity in front of us.”

As part of its duty to serve plan, Freddie Mac aims to purchase 1,500 to 2,500 chattel loans by 2024. Fannie Mae is weighing buying chattel loans in the future as well.”

Part II – Insights from BrandFoundryVC and ZippyMH to MHProNews

Wesley Gottesman was cited by Marx in her HousingWire post, as was noted above. So, MHProNews reached out to Gottesman to confirm it was his firm (HousingWire left out the VC from BrandFoundry) that made investments for funding ZippyMH. On Monday, July 17, 4:25 PM ET Gottesman replied to an email from MHProNews on that date sent at 4:16 PM ET.

Meaning, Gottesman replied in less than 10 minutes (coy ‘award winning’ and purported MHI brownnoser George Allen and MHI insiders, take note).

Yes, Brand Foundry has led multiple founding rounds into Zippy.

Thanks,

Wesley

Gottesman’s LinkedIn profile indicates he is a partner, as HousingWire also noted.

MHProNews also reached out to a member of the ZippyMH management team. There was initially no response.

In a follow up the next day, MHProNews included ZippyMH CEO Ben Halliday plus two others. On Tuesday, July 18, 9:32 AM ET the following inquiry was sent.

A source at BrandFoundryVC.com has advised MHProNews that in the story linked below it is their firm that is being referred to in the HousingWire report. Please confirm or clarify that remark.

Next, please advise what connections, if any, your firm has with what was known as Clayton Bank?

Similarly, are there any ties between Clayton Homes, 21st Mortgage Corporation, Vanderbilt Mortgage and Finance, or Wells Fargo are your firm?

We plan a report this week. Please advise, see forward with highlighting added, and thank you.

Tony

[L.A. “Tony” Kovach for MHProNews.com]

At 9:33 PM ET, CEO Ben Halliday sent the following reply.

Thank you for your interest in Zippy!

MHProNews replied to Ben and Tierney at 9:44 PM as follows.

|

Sure. Let me know the replies to those inquiries. Thanks.

[…for MHProNews.com]

On Wednesday, July 19, 4:52 PM ET, Teirney Oakes responded on behalf of ZippyMH as follows.

Answer to your questions below. Believe I got everything. Let me know if you have any questions. Thanks!

Correct, Brand Foundry: https://brandfoundry.com/

Zippy is not affiliated with Clayton Bank.

Clayton Bank was acquired by FirstBank in 2017. FirstBank is a well-known industry partner to communities, retailers and manufactured home buyers.

Jim Clayton is not affiliated with Zippy. We have great respect for Jim, our competitors, and our industry. FirstBank made a minority investment in Zippy and is a key strategic partner. Together our combined technology, capital and industry experience represent a powerful commitment to the growth of our industry.

No. Zippy is not affiliated with Clayton Homes, 21st Mortgage Corporation, Vanderbilt Mortgage and Finance or Wells Fargo.

Tierney Oakes

ZippyMH PR and Communications

On Wednesday, July 19, 5:18 PM ET, MHProNews followed up as shown below.

Thanks for your replies. We were aware of the FirstBank buyout of Clayton.

Are there any ex-Clayton, ex-21st, Vanderbilt, or Wells Fargo team members working for Zippy? We don’t necessarily expect names, but the numb[er] with such a background would be valued.

Please advise, thank you.

Tony

[…for MHProNews.com]

On Thursday, July 20, 10:58 AM ET Oakes replied as follows.

Tierney Oakes

ZippyMH PR and Communications

On Thursday, July 20, 10:59 AM ET, MHProNews provided the following follow up to Oakes/ZippyMH.

LMK, thanks again.

Tony

[…for MHProNews.com]

On Thursday July 20, 12:21 PM ET, Oakes replied to the above as follows.

AL

KY

KS

GA

TX

VA

AZ

IN

MI

Tierney Oakes

ZippyMH PR and Communications ##

Part III – Additional Information with More MHProNews Analysis and Commentary

Per the ZippyMH website are the following remarks about their firm and co-founders.

Through their renovation project to revitalize and restore the community, the founders gained a deep respect for manufactured homes. Days of hard and rewarding work led to families and friends convening, smiling faces, kids in playgrounds, all amongst a sense of home and community. Through their journey, they also faced the challenges that come with the industry — the biggest being access to modern consumer lending solutions. How can an industry with incredible, environmental, and cost-efficient homes run on antiquated technology and lack modern financing options?”

So, ZippyMH’s leaders apparently believe that among “the challenges that come with the industry — the biggest being access to modern consumer lending solutions.”

The Zippy team are hardly alone in that type of observation.

As a relevant segue, given ZippyMH’s remarks on the topic (see email above about Clayton Bank), is the previously published flashback to the Claytonbank-FirstBank ‘merger.’

Jim Clayton Exclusive on Clayton Bank/FirstBank Merger to MHProNews

Segue aside, as was noted in the preface to this article, there have been any number of organizations and public officials researching the manufactured housing industry market that have found that a lack of competitive lending has been an inhibitor of manufactured housing industry growth. As but one example from among those linked in the preface above, or others that could be found by doing a site search on MHProNews/MHLivingNews, the Niskanen Center’s Housing Policy Analyst Andrew Justus, J.D., explained his evidence and thinking as was shown and unpacked in the report and analysis linked below.

Within the industry, the Manufactured Housing Association for Regulatory Reform (MHARR) is among those in the manufactured home profession who have long made the observation that lending is holding the manufactured home industry back. MHARR’s President and CEO, Mark Weiss, J.D., hit that theme again in his most recent FHFA Listening Session comments. More on that later this week.

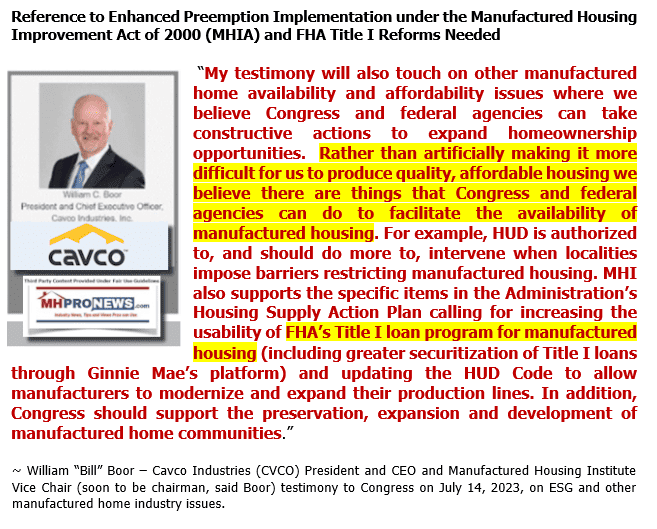

Cavco Industries (CVCO) president and CEO William “Bill” Boor has also made similar observations in his formal remarks to Congress to those made by MHARR and those outside researchers looking into manufactured housing. Meaning, there is a broad array of sources in and beyond manufactured housing that have said that a lack of competitive lending is a problem inhibiting the industry’s growth.

So, ZippyMH’s leaders can hardly be faulted for pointing out what several people in and beyond MHI have also said. For greater context on the above, Boor’s complete remarks on behalf of MHI are found below.

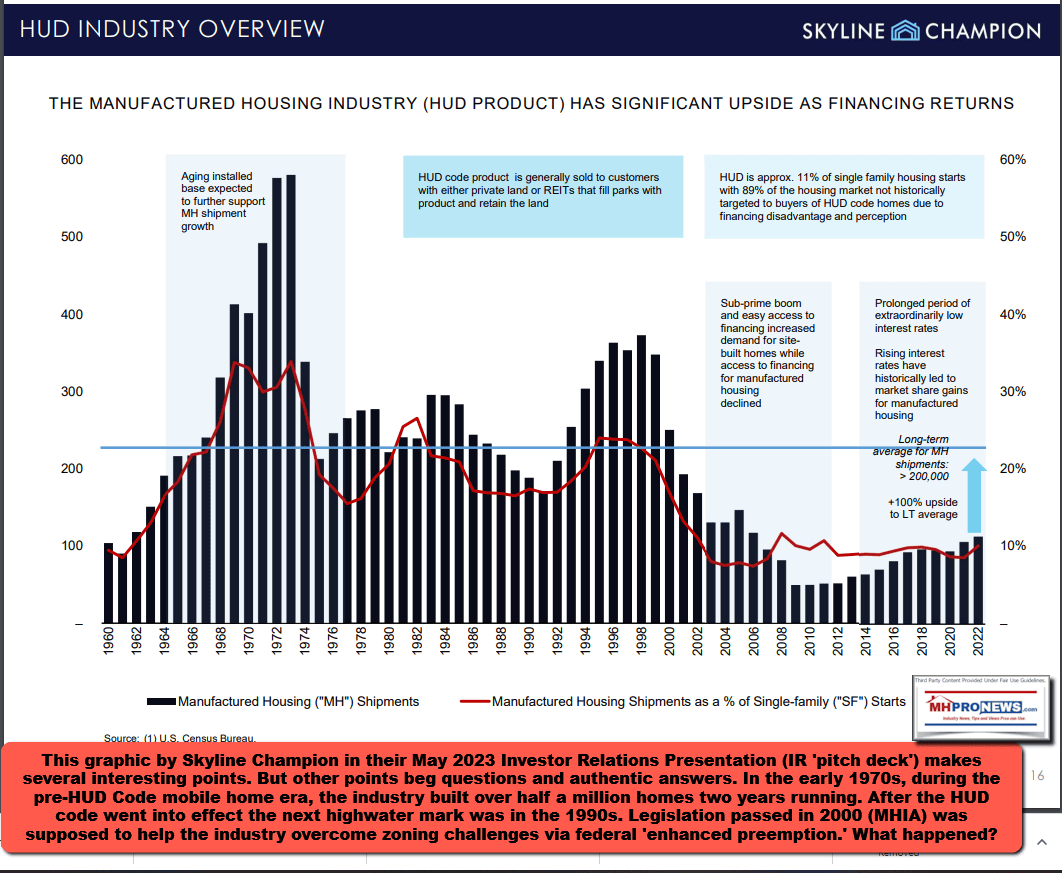

Cavco Industries also made some bold observations about the manufactured housing industry market, given the size and scope of the U.S. affordable housing crisis. This is relevant to any service provider, business, investor, and public officials with a general interest in more affordable housing or a specific interest in the role that HUD Code manufactured homes might play in the U.S. affordable housing arena.

For those on the front lines in manufactured housing, those who have the ‘view from the trenches,’ the above and below should be required reading, and even re-reading. [Programming Notice: watch for a special report this week on MHProNews planned on another ‘view from the trenches’ related topic.]

HousingWire and MHI

MHProNews previously noted that MHI appears to have a cozy relationship with HousingWire. There are any number of possible reasons that may be so.

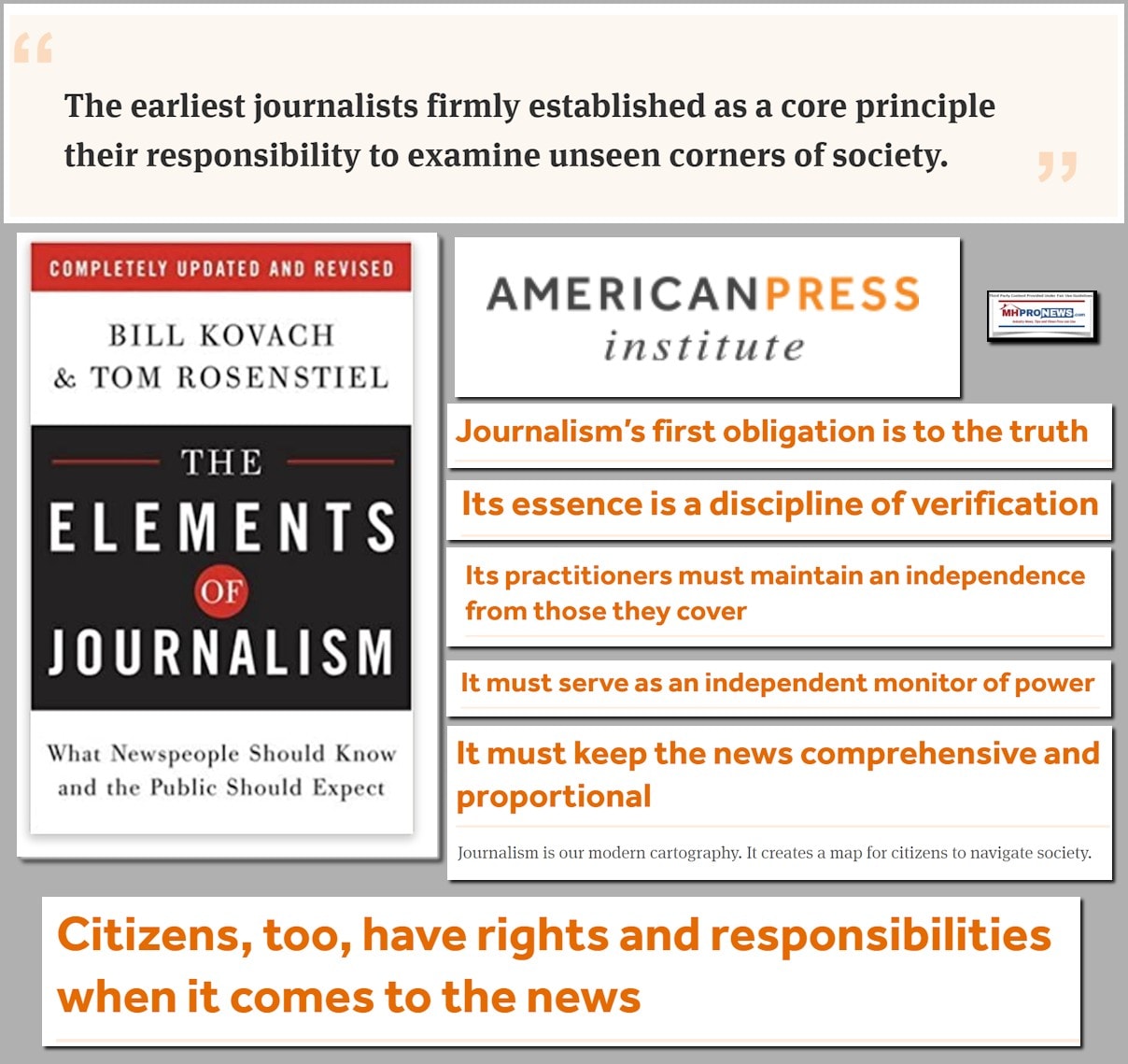

That said, the following is from the HousingWire website, which relates some of their ‘editorial standards‘ in their own words.

[revised December 2018]

Introduction

Business-to-business (B2B) media such as HousingWire exist to serve their audiences in the specialized fields they cover, while being financially successful businesses themselves.

This means that the goals of HousingWire and the industry we’ve dedicated ourselves to covering are one and the same.

The editorial staff at HousingWire best serve the industry we cover by ensuring high standards of objectivity because with high standards come the credibility that supports the industry’s long-term viability and advancement. Separately, HW’s advertising and marketing teams serve the industry by helping connect innovative and impactful companies with potential clients and partners.

These goals are accomplished through constant attention to reader needs and through a publicly expressed dedication to such journalistic principles as:

- accuracy,

- fairness,

- balance,

- full attribution to sources, and

- clear separation of reporting from analysis and opinion, and of editorial content from advertising and sponsored content.

These goals are also accomplished when editorial staff embodies the values that define all HW employees: passion, accountability, ingenuity, positivity, and integrity.

Only editors make final editorial decisions. In all ways, editorial coverage must be based primarily on reader needs in the view of the editors. Ideally, this judgment reflects both HousingWire’s corporate mission: moving markets forward – as well as a clear understanding of the professional nature of our readership in the U.S. residential mortgage finance and real estate industries.

All dealings with external, non-editorial personnel — including public relations representatives and story sources — are conducted with the clear understanding that no preferential editorial treatment should be expected from the interaction.”

The above from HousingWire is arguably both ‘clear’ but is also arguably nuanced.

HousingWire exists to serve advertisers.

They can’t move markets forward without being profitable themselves.

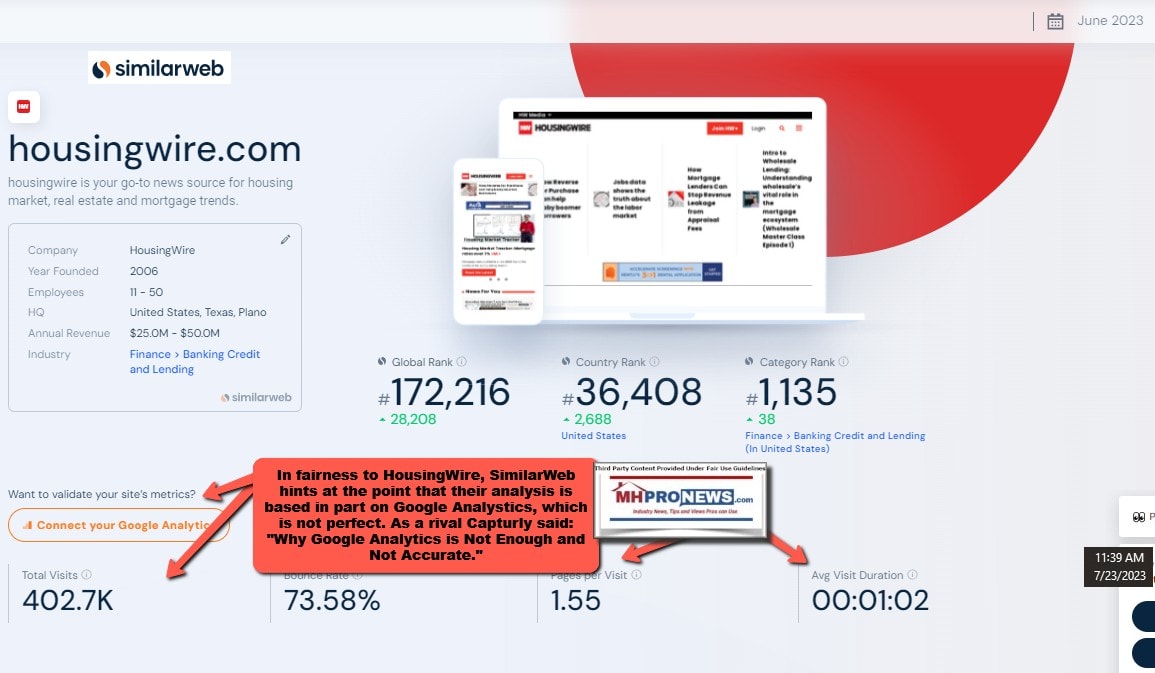

While a considerably larger organization with more traffic than MHProNews, based on their own claimed visitor count, if SimilarWeb’s data on pages per visit are accurate, their engagement is an embarrassing shadow of MHProNews’ page views per visitor.

In fairness to HousingWire, SimilarWeb hints at the point that their analysis is based in part on Google Analytics, which is decidedly imperfect, per several sources.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

That noted, continuing from HousingWire’s editorial standards are the following statements.

MHProNews has specific experience with HousingWire, which may become the focus of a follow up. Why? Because there is an evidence-based case to be made that HousingWire is decidedly not going to “Move Markets Forward” unless they are willing to expose systemic problems and how they related to reports like the one that they did on ZippyMH.

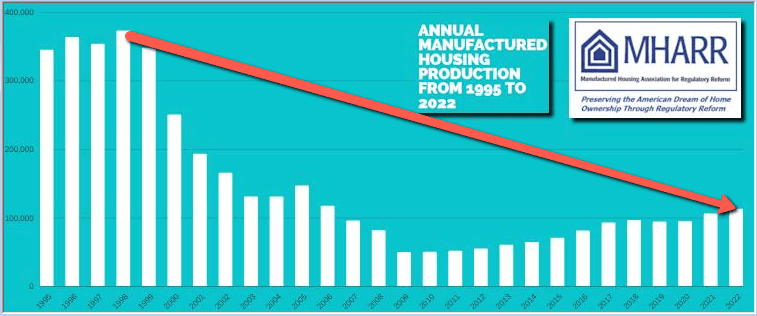

It may be no reflection on Zippy’s team if HousingWire fails to point out the obvious issues underlying the industry’s failure to recover in literally the entire 21st century from the highs that were achieved in the 1990s.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

While a lack of competitive financing is not the only contributing factor to limiting manufactured housing sales – zoning and placement barriers are another big one too, as MHARR, Boor and others even in the MHI orbit admit – it is an obvious one that is commonly mentioned, and thus relevant.

MHARR‘s mandate as a trade group is to focus on production-related issues. Lending and zoning/placement are post-production challenges. It is MHI that claims to represent “all segments” of the industry. That makes them the de facto post-production national trade group ‘leader.’ Given MHI’s mission and remarks, they can hardly then claim to be a mere observer that only mouths complaints and wrings their hands at seemingly (to them) appropriate times.

Put differently, MHI is accountable. Several legal sources have directly or indirectly said so.

HousingWire arguably failed to critique or hold MHI to account. They merely carried MHI’s talking points. As MHProNews is prepared to exemplify, HousingWire even failed to allow an evidence-packed op-ed critiquing MHI after a senior team member there said in writing that they were willing to run such a column. What happened to those HousingWire editorial standards, cited above? What about journalistic standards in general, which are supposed to shine a light on the powerful as needed when accountability is called for by repeated circumstances?

The manufactured housing market is in a well-documented decline. The previous graphic only told part of the tale.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Even Bill Boor said as much on behalf of MHI.

There is no mention of such facts by Marx.

But as HousingWire’s editorial standards stated, those decisions are apparently made in part by that firm’s editors. It is an open question if Marx wanted to go further, or if she was the one who submitted the article much as it is shown on their website.

Whatever the case may be, HousingWire is just one of a list of trade or other media that is arguably failing at some of their own claims. Manufactured housing industry shrinkage can hardly be equated with “Moving Markets Forward.”

MHProNews plans another outreach to HousingWire‘s leadership, to see if they will do a report and/or an evidence-linked op-ed that details how and why manufactured housing is struggling during an affordable housing crisis. Stay tuned, because part of the manufactured home industry’s struggles is a lack of sufficient public information and an appropriate outcry that rigged markets cannot properly serve the needs of the majority properly. Manufactured housing is an example of that. Who says? Minneapolis Federal Reserve senior economists, that include James A. “Jim” Schmitz Jr. But oh, HousingWire, MHI, and others in the MHI blogging/trade media ‘orbit’ have apparently somehow missed his seminal research, which has been referenced in testimony to Congress, by MHProNews/MHLivingNews, and numbers of others. ##

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’