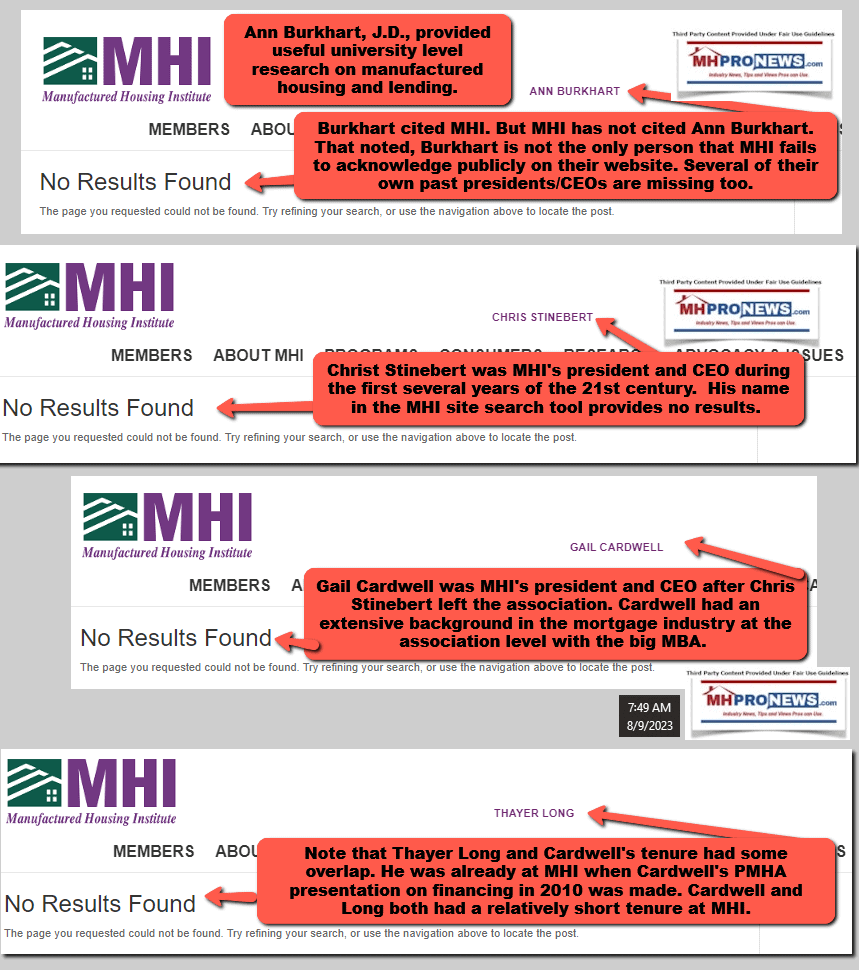

Imagine tens of thousands of additional manufactured home loans every year on existing manufactured housing loan programs that are currently effectively dormant. Hold that thought and consider the middle person among the next three names. Chris Stinebert. Gail Cardwell. Thayer Long. These are just some of the former Manufactured Housing Institute (MHI) officials – in those three cases, ex-MHI presidents and CEOs – who have apparently been culled from the public facing side of the MHI website. So, it isn’t just individuals like manufactured housing pro, ex-MHI member and periodic critic Marty Lavin, J.D., that’s been whited out on MHI’s public facing site. Several of MHI’s own prior 21st century staff leaders are missing too. There are a variety of reasons that could prove significant to manufactured housing industry professionals, stockholders, consumers, nonprofits, public officials, taxpayers, and so on. This report, analysis and expert commentary will look at one of those individuals, Gail Cardwell. Years before there was an ‘almost woman of influence‘ CEO Lesli Gooch, Ph.D., there was Cardwell. Cardwell, as veteran manufactured home community operator Barry McCabe and others involved at MHI recognized, had a strong background in the mortgage banking industry. Cardwell’s efforts on manufactured housing financing topics will be explored herein using the MHI’s teams own words. Contemporary manufactured home industry professionals and all others peering into why manufactured housing is underperforming during an affordable housing crisis can compare and contrast what MHI did previously under Cardwell vs. what MHI is doing now under Gooch’s tenure.

This evidence packed exercise will be revealing to numbers keen on seeing more manufactured housing become a reality in several respects.

Part I of this report will tee up and provide the text of a document obtained by MHProNews that bears Cardwell’s name.

In Part II of this report with analysis and commentary the question of why MHI has “memory holed” Cardwell and her historic efforts will also be spotlighted herein below. Because Cardwell-era MHI produced the document whose contents are detailed in Part I will apparently demonstrate how much additional financing could by itself mean to increased manufactured housing production. Or as Lavin periodically quips, who is going to finance those additional HUD Code manufactured home sales? The answers to that and more will become obvious.

Part III of this article will be our signature Daily Business News on MHProNews manufactured housing industry connected equities and macro-markets report, which includes a snapshot of mainstream media headlines from left-leaning CNN Business and right-leaning Newsmax. Those who invest a few minutes a day to that segment of our reporting can save time while adding to the knowledge that Warren Buffett asserts comes from plenty of daily reading.

Part I

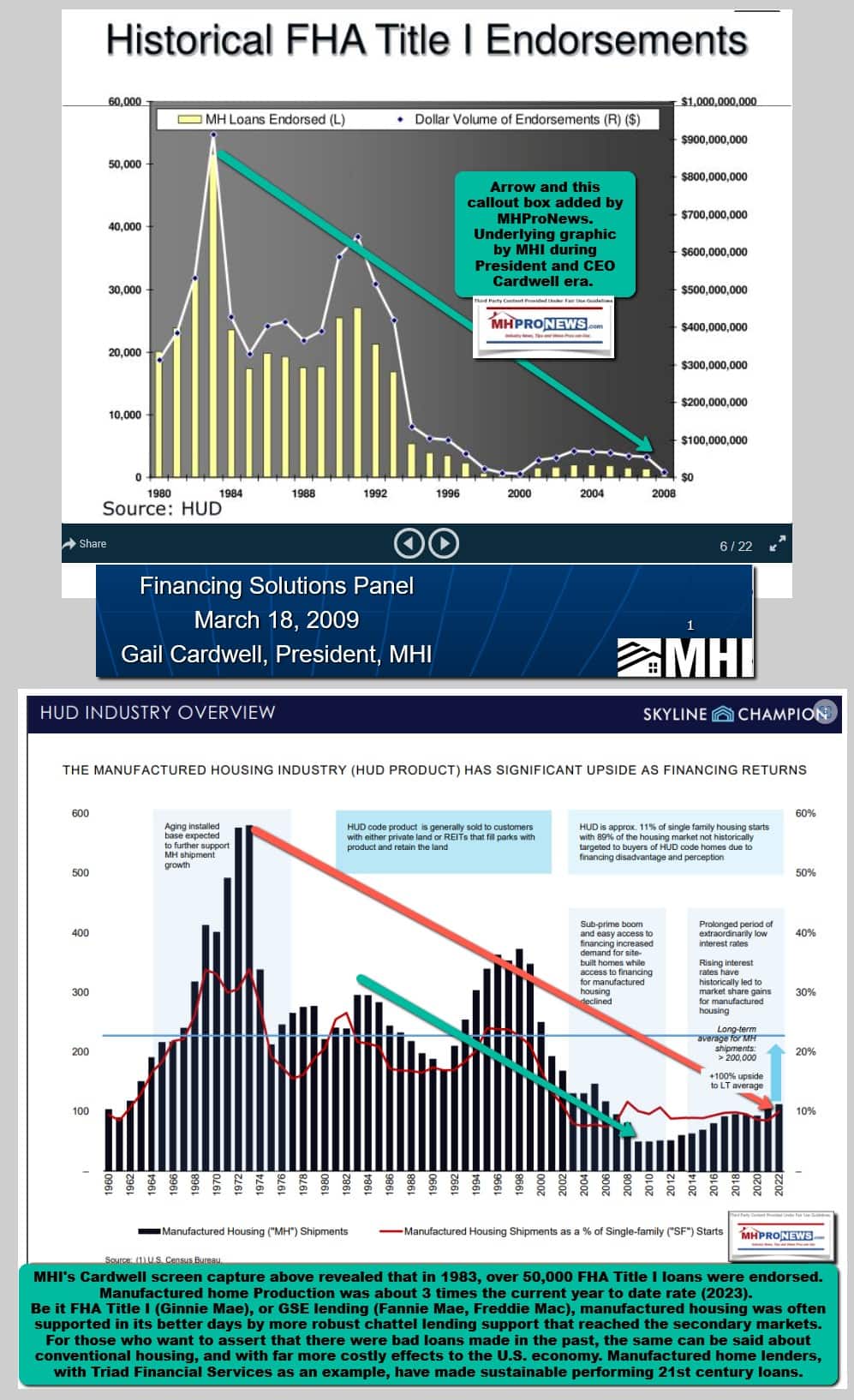

Cardwell’s stunning graphic provided below in Part II reveals at a glance how arguably ineffective and lackadaisical MHI’s staff under Gooch and so called “MHI 2.0” appear to be. In fairness to Gooch, she is essentially the pawn of MHI’s board. But she accepted the title of CEO after being an executive vice president at MHI for some years. So, Gooch could at a minimum authentically fight for the industry, instead of merely having one of her boosters claim that: “Dr. Lesli Gooch has dedicated her life’s work to ensuring that quality, affordable housing is available and attainable for all.” Those are strong words “ensuring,” through her ‘dedicated life’s work; to be available and attainable for all.”

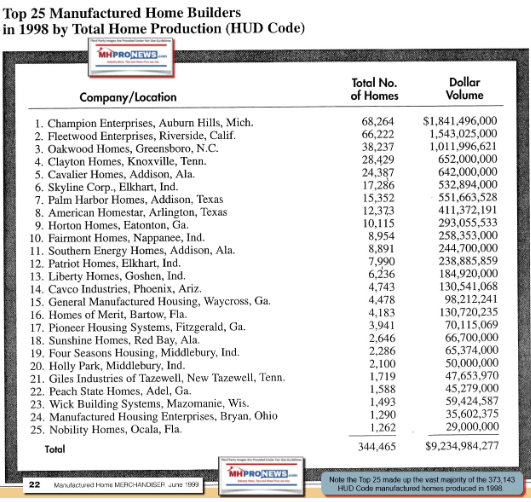

Some history and timelines are useful, since MHI fails – for whatever reasons – to provide this publicly about their own past presidents and CEOs.

Chris Stinebert, per his LinkedIn Profile, served MHI for about 7 years – from 1999 to 2006.

Gail Cardwell, per attorney and former HUD Office of Manufactured Housing Programs (OMHP) administrator Pamela Beck Danner, joined MHI in 2007. MultiHousingNews reported in April 2010 that she rejoined the powerful Mortgage Bankers Association (MBA) after she left MHI.

Per Danner, who cited MHI, stated the following in a “Washington Report.”

“According to MHI Chairman Barry McCabe, “[MHI] selected Gail primarily for her sterling track record of association management, but she brings the added benefits of over 15 years of Washington public policy experience and financial markets expertise. Gail is absolutely the perfect choice to lead MHI at this point in the history of manufactured housing.”

Cardwell came on board at MHI during the escalator ride down for manufactured housing production in the early 21st century. While zoning or image/educational issues were factors then as now, financing was arguably weighing heavily on the industry at the time.

Without financing supported by the secondary markets through Fannie Mae or Freddie Mac, manufactured home production crashed. That’s clear from MHI’s own corporate and other leadership and remarks.

In an MHI PowerPoint presentation provided for the Pennsylvania Manufactured Housing Association (PMHA) is the following that named MHI president and CEO Cardwell on page 1. This was part of a panel discussion, according to the transcript obtained by MHProNews via SlideServe and provided herein below.

Almost every word in the document with MHI-Cardwell’s fingerprints has historic significance. One of the key slides will be provided following this presentation transcript segment in Part II. It should be eye opening, especially for the thousands of industry professionals who have never experienced the manufactured housing industry’s relative ‘glory days’ in the 20th century.

This is manufactured housing history as told by MHI on March 18, 2009.

Presentation Transcript

- Pennsylvania MHA All Industry Symposium Financing Solutions Panel March 18, 2009 Gail Cardwell, President, MHI

- Update on Finance Issues • FHA Title I • Ginnie Mae Title I • GSE Program for Chattel Loans • Tax Credit for Homebuyers • Floor Plan Lending

- FHA Title I • Insures loans made by private lending institutions to finance the purchase of a new or used manufactured home (MH) • HUD has been providing loan insurance on MH under Title I since 1969. • The program insures lenders against losses of up to 90% of the value of a single loan. • The buyer must agree to make a 5% down payment and interest rate payments determined by the lender. • The maximum loan term varies from 20 to 25 years.

- Housing & Economic Recovery Act of 2008 (HERA): Title I Provisions • Adjusts the loan limits from $48,600 for home only to $69,678; manufactured home lot from $16,200 to $23,226 and manufactured home & lot from $64,800 to $92,904 • Initial upfront premium no greater than 2.25% of the original insured principal amount • Annual premium payments = no more than 1.0% of the remaining balance • The Secretary establishes underwriting criteria adequate to retain fiscal soundness of the program

- Title I HERA Provisions (con’t) • Requires Title I loans on homes to be situated in LLCs to have at least a 3-year lease, renewable upon the expiration of the original 3-year term by successive one-year terms & the lessor must provide written notice of lease termination not less than 180 days prior to expiration of the current lease term if the lessee is required to move due to a LLC closing and failure to provide notice will cause the lease term to automatically renew for one year • Replaces the former insurance mechanism that limited coverage to 10% of the lender’s Title I portfolio to a loan by loan insurance coverage • Title II: 1. eliminates requirement that MH must be taxed as real estate (applicable to homes in LLC), so long as they are permanently affixed to land that is owned or leased under a long-term leasehold arrangement. 2. FHA may insure mortgages on MH in condominium developments.

- Historical FHA Title I Endorsements Source: HUD

- FHA Title I Status • MHI conducted conference calls with FHA and Ginnie Mae Senior Staff & Lenders on 2/20/09 • FHA staff reported that Title I implementation is top priority and that Secretary Donovan and members of Congress have expressed their desire to move forward, including a recent press release from Cong. Joe Donnelly (D-IN) sponsor of the legislation • FHA confirmed they will not go through a formal rulemaking process and that OMB concurs with this approach • FHA reported that its current approach is to issue a notice in the Federal Register within 30 days announcing program changes, followed by a 60-90 day comment period • Lenders on the call and MHI repeated our request that FHA increase the loan limits ASAP • Loan limits were raised on 3/3/09 due to MHI efforts

- MHI’s Key Title I Implementation Efforts • Conduct biweekly status calls with FHA (last one conducted on 3/17/09) • In early January, HUD’s Office of General Counsel (OGC) informed FHA staff that Title I reforms must go through a formal rulemaking procedure • MHI met with counsel immediately • MHI communicated it strongly disagreed with the OGC’s views. • MHI contacted former FHA Commissioner Montgomery, who in turn, met with HUD Secretary Donovan, stressing importance of expedited implementation • MHI staff contacts Secretary Donovan’s and OGC’s staff • MHI advocates to avoid rulemaking and contacts Congressman Donnelly, House Financial Services Chairman Barney Frank, Senate Banking Chairman Chris Dodd, Ranking Members Richard Shelby and Senator Bob Corker; • MHI sends letter to Secretary Donovan, stressing importance of Title I implementation to survival of our industry • MHI provides data to Cong. Donnelly, noting plant and retail center closings, for his discussion with President Obama, during President’s visit to Elkhart the week of Feb. 9th; Donnelly conveys state of industry and urges him to expedite Title I implementation • MHI contacts FHA and key Congressional liaisons on a daily basis and provides updates on FHA in Housing Alerts and MHNewswire

- Ginnie Mae Title I Program • Ginnie Mae allows lenders to obtain a better price for their mortgage loans in the secondary market, by guaranteeing investors the timely payment of principal and interest on mortgage-backed securities (MBS) backed by federally insured or guaranteed loans, primarily FHA loans • Regardless of whether the mortgage payment is made, investors in Ginnie Mae MBS will receive full timely payment • Ginnie Mae securities are the only MBS to carry the full faith and credit guaranty of the U.S. government, which makes them a very safe investment, even in difficult times. • Each loan must be FHA Title I insured • Ginnie Mae has Eligibility Requirements to be an approved Ginnie Mae issuer • In order to qualify, an issuer must be an approved FHA mortgagee in good • standing • Ginnie Mae placed a moratorium on issuers in 1992 • MHI has called on Ginnie Mae to lift the issuer moratorium • Ginnie Mae is important because it guarantees FHA Title I loan pools which would increase liquidity to our industry, so that more homes could be financed through Title I

- MHI/Ginnie Mae Next Steps • To increase liquidity, MHI met with Ginnie Mae senior staff on 2/13/09 to: • Work Together to Identify Additional Title I issuers • Current MH Lenders • Current GNMA issuers who are not involved in Title I • Be Prepared to Lift the Moratorium on Title I Eagle-approved issuers as soon as FHA implementation of Title I is complete and have application materials available for qualified issuers • Work Together to Resolve Document Custodian Issues—call conducted yesterday. • Continue Our Productive Dialogue and Identify Marketing/Speaking Opportunities for GNMA, e.g. MHI Congress & Expo

- GSE Program for Chattel Loans • Duty to Serve • In the Housing and Economic Recovery Act of 2008, Congress provided that the GSEs have a statutory duty to serve 3 specific, underserved markets. MHI was successful in having manufactured housing included as one of the markets.

- GSE Duty to Serve Underserved Markets • (1) DUTY- To increase the liquidity of mortgage investments and improve the distribution of investment capital available for mortgage financing for underserved markets, each enterprise shall provide leadership to the market in developing loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages for very low-, low-, and moderate-income families with respect to the following underserved markets: • (A) MANUFACTURED HOUSING- The enterprise shall develop loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages on manufactured homes for very low-, low-, and moderate-income families. • MANUFACTURED HOUSING MARKET- In determining whether an enterprise has complied with the duty under subparagraph (A) of subsection (a)(1), the Director may consider loans secured by both real and personal property. FURTHER… • The Director of FHFA shall insure that the operations and activities of each regulated entity foster liquid, efficient, competitive, and resilient national housing finance markets (including activities relating to mortgages on housing for low- and moderate-income families involving a reasonable economic return that may be less than the return earned on other activities);

- GSE Affordable Housing Goals • The Act refocuses the GSE Affordable Housing Goals • Now, only loans to borrowers earning a maximum of 80% AMI qualify • According to HMDA data, in 2006, 45% of MH borrowers earned 80% AMI or less • MH loans remain very “goals rich”

- In 2007, New MH Shipments Comprised over 11% of New Home Sales…

- …but Less Than 1% of GSE Purchases Source: HMDA

- GSE Personal Property Program • MHI Key Initiatives/Activities: • Promoting a personal property loan program as a component of Duty to Serve • Met with Federal Housing Finance Agency (FHFA), GSE’s regulator to advocate Duty to Serve implementation • Wrote to Regulator calling for Duty to Serve implementation • Met with Freddie Mac and Fannie Mae in Fall 2008 • Met with Fannie Mae Task Force in New Orleans (2/2/2009) to discuss personal property MBS program • Contacted New York Federal Reserve • Met with Treasury Department last week • Petitioned Treasury to have Personal Property Loans qualify for the Home Affordable Modification Program, HomeSaver Forbearance and New Workout Hierarchy program

- American Recovery and Reinvestment Act of 2009 Refundable First-Time Home Buyer Tax Credit • Provides a tax credit of up to $8,000 for qualified first-time homebuyers • Must purchase a principal residence (either new or resale) on or after January 1, 2009 and before December 1, 2009 • A “first time homebuyer” = a buyer who has not owned a principal residence during the 3-years prior to purchase • Any home that will be used as a principal residence qualifies for the credit, including: manufactured homes placed on private land or in a land-lease community, a condominium or a cooperative • The tax credit = 10% of the home’s purchase price up to a maximum of $8,000 • The credit can be claimed even if the taxpayer has little or no federal income tax liability to offset the credit • The tax credit does not have to be repaid; however, the homebuyers must use the principal residence for at least 3 years or return a portion of the tax credit amount • The income limits for single-taxpayers are defined as under $75,000 for modified adjusted gross income (MAGI) and $150,000 for married taxpayers; over these limits, the credit is reduced proportionally; however, you may not have a MAGI of over $95,000 or $170,000 for single or married taxpayers, respectively. • The tax credit may be applied against the taxpayer’s 2008 tax return • The tax credit may be an excellent opportunity for LLC owners to turn renters into owners in 2009!

- MHI Response to Floor Plan Crisis • Outlined immediate course of action on Officers call on Nov. 14 • Contacted Independent Community Bankers Association (ICBA) and SBA to explore inventory lending programs • Distributed a Housing Alert to all MHI members on Nov. 17 that: 1. provided a list of community bank lenders; 2. furnished information on SBA’s 7(A) inventory loan guaranty program • Conducted conference call with state execs to outline course of action and provide link to state-based community bank associations • Petitioned former US Treasury Secretary Paulson in a formal letter sent on Nov. 21, calling on him to require non-bank lending institutions offering MH inventory financing who receive TARP funds to dedicate a portion of those funds to maintain this financing; a similar letter was sent to Treasury Secretary Geithner on 2/6/09 • Sent a letter to Federal Reserve Chairman Bernanke emphasizing that their Commercial Paper Funding Facility (CPFF) restricted to the highest rated issuers should go beyond the top-rated issuers, as lower-rated issuers have suspended inventory lending to retailers

- MHI Response to Floor Plan Crisis • Participating in a coalition with large, 2nd tier issuers on CPFF, e.g. Nissan, Textron, to coordinate strategy with FRB • Ongoing conversations with Federal Reserve staff who are evaluating extending the CPFF to lower-rated issuers • Met with the Equipment Leasing & Finance Association whose members have business lines that include inventory financing • Distributed survey to manufacturers to assess impact of national floor plan lending on the industry’s structure and production • Conducting webinar on January 21 with community bank lenders to brief MHI-member retailers & members on lending criteria and inventory lending programs • Drafted prototype presentation for retailers to use when approaching their local banks for inventory financing • Working with media to get the story out • Established Floor Plan Lending Resource Center on Web Site • Sent letter to Treasury Secretary Timothy Geithner requesting that floor plan loans qualify for Term Asset-backed Securities Loan Facility (TALF)

- Alternative Options to Existing National Floor Plan Lenders • Specialty Finance Companies • Local Banks • Marketing plan for sales growth • Average amount of Home Invoice • Operating expense to income ratio (5-year history) • Copy of any recourse agreement with manufacturers • Value of any real estate or other assets owned • Monthly inventory turnover • Inventory to Sales Ratio

Part II – Additional Information with More MHProNews Analysis and Commentary

While virtually every slide on Cardwell’s pitch to the PMHA is packed with facts, claims, action steps, and other insights, it should go without saying that their document is incomplete. There is no mention, for example, of the exit by Warren Buffett led Berkshire Hathaway circa 2000 long-term investments in Government Sponsored Enterprises of Fannie Mae and Freddie Mac.

Whatever motivations were involved, after Buffett-led Berkshire’s exit from Fannie Mae and Freddie Mac, the GSEs pulled support for lenders that used them in accessing the secondary market for manufactured housing loans. Hold that thought and consider the top portion of this screen shot from Cardwell’s PMHA presentation, referenced above.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Per The Pepperdine Law Review on 2-15-2010, in a 33-page document obtained by MHProNews entitled: “Bringing Manufactured Housing into the Real Estate Finance System” by law professor Ann M. Burkhart. Her University of Minnesota School of Law bio states: Professor Ann M. Burkhart is the Curtis Bradbury Kellar Professor of Law. She is a nationally recognized expert in the area of real estate law.

Burkhart’s paper on “Bringing Manufactured Housing into the Real Estate Finance System” in the Pepperdine Law Review said the following. Keep in mind that when a mortgage lender wants to make a long-term loan, the factors which follow from her paper are significant. FHFA Director Sandra Thompson and others in and out of government should take note.

After noting that manufactured homes were unfairly stereotyped, Professor Burkhart said the following. Note that while her percentage of manufactured homes moved after installation is subject to dispute, her point is nevertheless well made.

Burkhart should talk to MHI, or vice versa. She made several useful and footnoted remarks that MHI might want to emphasize themselves.

“Moreover, manufactured home residents are less transient than residents of site-built housing. Whereas the average period of ownership for a sitebuilt home is six years,” sixty percent of manufactured home residents live in their home for more than ten years. 45″

“Concerns about manufactured housing’s safety, appearance, and impact on neighboring property values are similarly misplaced. The HUD construction and installation standards have virtually eliminated the difference in construction quality and safety between manufactured homes and site-built homes. 48 As a result, the life expectancy and deterioration rate of manufactured housing are now equivalent to those for site-built housing.49”

“Contrary to popular belief, manufactured home communities do not affect neighboring property values.” Burkhart cited: “50. ASSET-BUILDING STRATEGY, supra note 7, at 8; CONSUMERS UNION, MANUFACTURED HOUSING APPRECIATION: STEREOTYPES AND DATA 12 (2003).” Note, as MHLivingNews and this platform have documented, her points then still apply now. LendingTree, FHFA, and others have continued to draw similar conclusions because manufactured housing has been appreciating at the same or sometimes a higher rate than conventional housing.

“The perception that manufactured home residents are predominantly young, noisy, and crime-prone also is false. Manufactured homes appeal to a wide range of age groups. People who are fifty years of age or older occupy almost half of all manufactured homes,” said Burkhart. The law professor then makes evidence-based points akin to those made by this writer to the FHFA listening session in 2021.

Manufactured home chattel loans should be included in the government relief programs not only because the homes are functionally equivalent to site-built homes.” They also should be included because the manufactured home finance market and, therefore, the rest of the manufactured housing industry, has been struggling to recover from a meltdown that is virtually identical to the mortgage market meltdown.72 Although the manufactured housing bubble burst several years before the mortgage market bubble, the mortgage market disastrously failed to learn from that earlier experience and repeated all the same bad practices that caused it.” Had this writer been aware of her research, it would have readily fit into the thesis then, or the more recently presented one to the FHFA last month.

Burkhart’s evidence-based points, as well as the facts presented by Cardwell-led MHI on Title I endorsements, are important lessons for policymakers and professionals alike.

“As manufactured home sales increased, the secondary market greatly increased its purchases of manufactured home loans, thereby providing much of the capital for the increased lending activity.86 As a result, securitizations of manufactured home loans also greatly increased-from $184 million in 1987 to $15 billion in 1999.” She cited: Steven Davidson, Financing Manufactured Housing, COMMUNITY BANKER 38 (1997); Lew Sichelman, Manufactured Called “Opportunity, ” NAT’L MORTGAGE NEWS, Feb. 26, 2001.

Burkhart explained the vicious cycle of problematic loans and sometimes inflated prices during the 1990s. But she also made the prudent and apt parallel to similar practices that occurred in the conventional housing market. Lending returned to conventional housing. Which begs the question: why hasn’t it returned to manufactured housing?

To give a sense of the loss of secondary market access, and what that cost manufactured housing, are the following facts cited in her paper.

“Fannie Mae bought approximately $10 billion in manufactured home loan securities before the market crash. However, it stopped buying them in 2000 after experiencing massive losses.112 Freddie Mac also incurred large losses, as did the other manufactured housing secondary market purchasers.”‘ As a result, investors, including Fannie Mae and Freddie Mac, have been slow to reenter the market, and those investors that have reentered are proceeding very cautiously.114 Manufactured home loan securitizations have plunged from $15 billion in 1999 to $307 million in 2008. As of November 2009, no

securitizations have occurred in 2009.115”

“To restore confidence in manufactured home loans, the manufactured housing industry has implemented a number of reforms to improve underwriting and servicing standards.'” 117 For example, lenders now apply more exacting standards before making a loan.’118 As a result, the default rate on manufactured home loans has declined. 119″

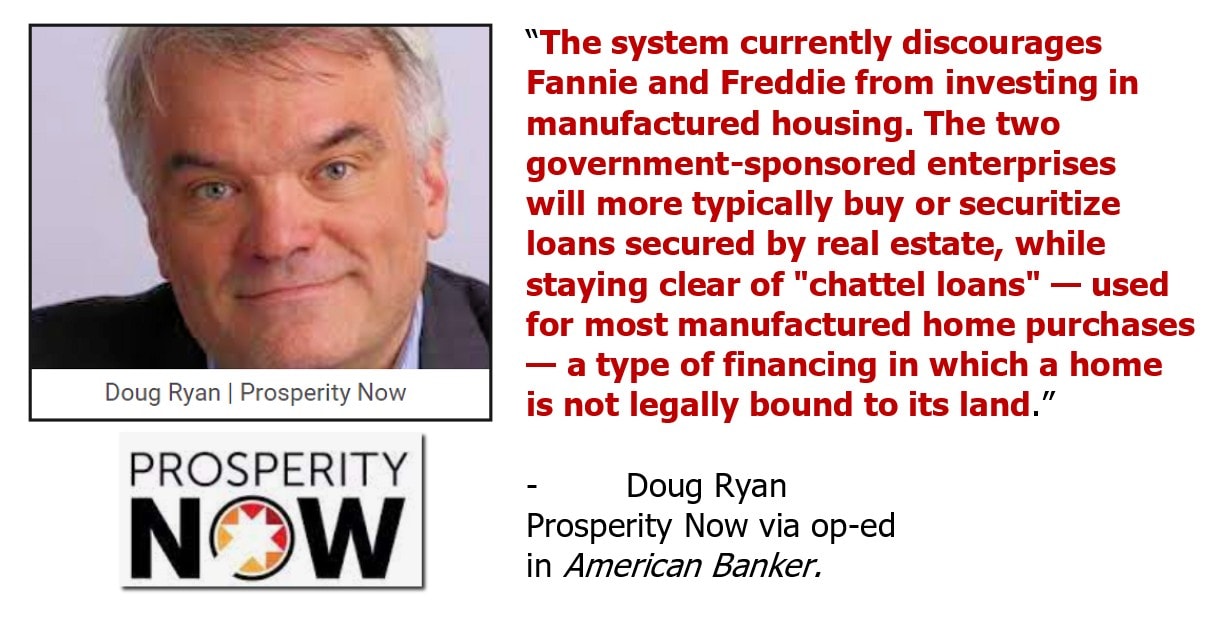

Burkhart, as some others looking into manufactured housing, makes a case for more mortgage loans for manufactured housing. That noted, she said further in: “Without the beneficial effects of competition, chattel loan terms are higher than they otherwise would be.” She said that “all manufactured home loans eligible for purchase by the secondary mortgage market…” and made these points.

“Manufactured home chattel loan terms are also less favorable because the secondary market for chattel loans is miniscule compared to the secondary market for mortgages. This difference significantly affects loan availability and affordability. By purchasing loans, the secondary market provides capital for lenders and assumes some of the loan’s risks, thereby enabling lenders to offer more affordable loan terms.152 Moreover, the mortgage market has benefited tremendously from the efficiencies that Fannie Mae and Freddie Mac have created, such as standardized loan documents and underwriting standards.153”

Blending Burkhart and Cardwell

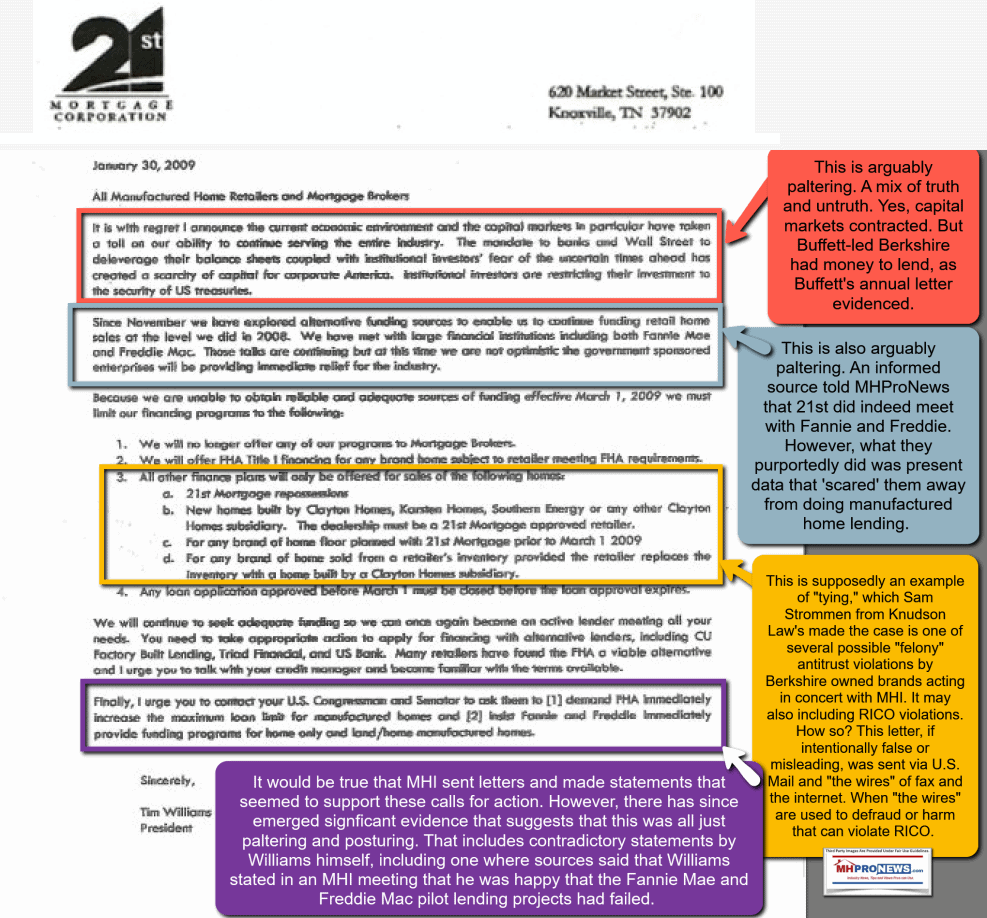

Burkhart made the case that both conventional housing and manufactured housing had meltdowns caused by predatory and problematic lending. True enough. Secondary market lending supported by Fannie Mae, Freddie Mac, FHA and other government back loan programs returned to conventional housing. But it has not done the same with manufactured housing. Burkhart said loan quality has improved and problematic practices of the past were rooted out. Marty Lavin and Tim Williams, president and CEO of Berkshire Hathaway owned 21st Mortgage Corporation are among those who previously told MHProNews/MHLivingNews something similar.

It bears mention that when a coalition of nonprofits addressed FHFA’s Sandra Thompson for the agency she leads to press Fannie Mae and Freddie Mac to restart lending on chattel loans for manufactured housing, that MHI failed to sign onto their letter. Why is that so?

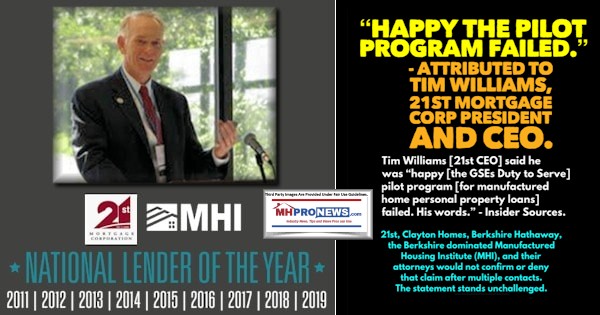

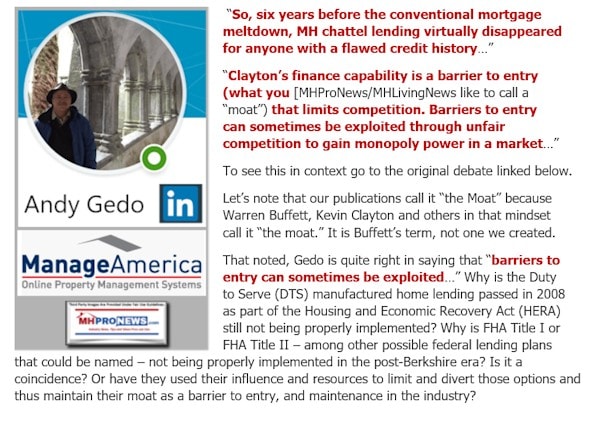

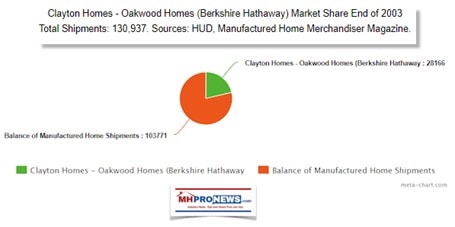

It also bears mention that when the GSEs – i.e.: Fannie Mae, Freddie Mac – failed to make any manufactured home loans in the last 3 year cycle, Berkshire owned 21st Mortgage Corporation President and CEO Tim Williams celebrated that in front of a limited number of MHI members.

While current MHI CEO, Lesli Gooch, Ph.D., denied the assertions of pro-manufactured housing advocate Doug Ryan, the evidence seems to support Ryan’s contention rather than that of Gooch. In hindsight, Ryan could have been more refined and said what type of monopolization was occurring in manufactured housing. But that said, Ryan’s basic contention has had significant evidence in support of his allegation.

Ryan’s Prosperity Now were among those that signed onto the letter to Sandra Thompson to press the FHFA to have Fannie and Freddie do manufactured home chattel lending that MHI oddly missed signing.

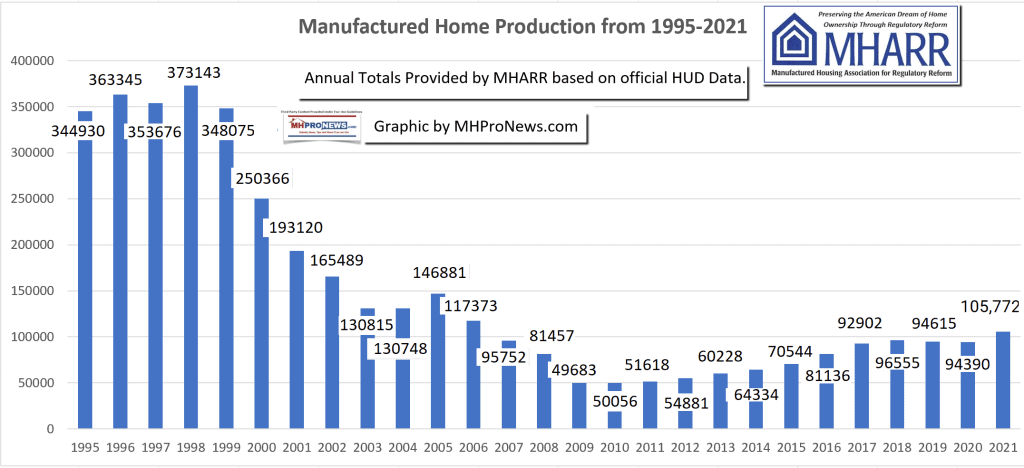

Then, someone must consider information that may or may not have been available to Cardwell and Burkhart. While the information that each provided is accurate enough, neither mentioned the devastating impact on manufactured housing sellers – and thus producers, land-lease communities, and others – of the withdrawal of lending by Williams led 21st in 2009. The date on the document obtained by MHProNews signed by Williams is January 30, 2009 (see that further below). That year and the following year represented the bottom of manufactured home production. The fall from production in 2008 to 2009 was from 81,457 manufactured homes produced to a mere 49,683 in 2009.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

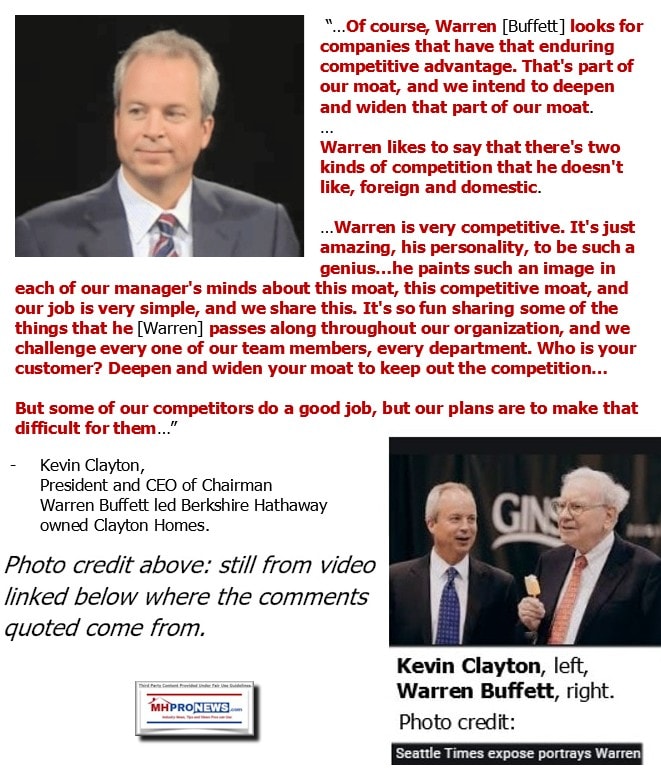

Then, the ponder anew the words of Warren Buffett and Kevin Clayton, whose sister brands of 21st and Vanderbilt Mortgage and Finance (VMF) became the leading lenders in manufactured housing in the absence of GSE (i.e.: Fannie, Freddie) and FHA Title I secondary market lending support.

Fellow Minnesotan to Professor Burkhart is James A “Jim” Schmitz Jr. with the Minneapolis Federal Reserve also teaches in Minnesota. Schmitz and his research colleagues reinvigorated the notion of ‘sabotaging monopoly’ tactics that were used to target early factory builders. Thurman Arnold in the antitrust division of the Department of Justice (DOJ) in his era pressed the notion that factory-built housing was “sabotaged” by conventional builders working in concert with others. These researchers/professionals noted that homelessness was caused in part because affordable housing – i.e.: pre-HUD Code mobile homes and post-HUD Code manufactured homes – were not available as plentifully as the market demands.

But following engagement with MHProNews/MHLivingNews and content such as what was provided by Knudson Law’s Samuel “Sam” Strommen, perhaps coincidentally, perhaps not, Schmitz observed the following.

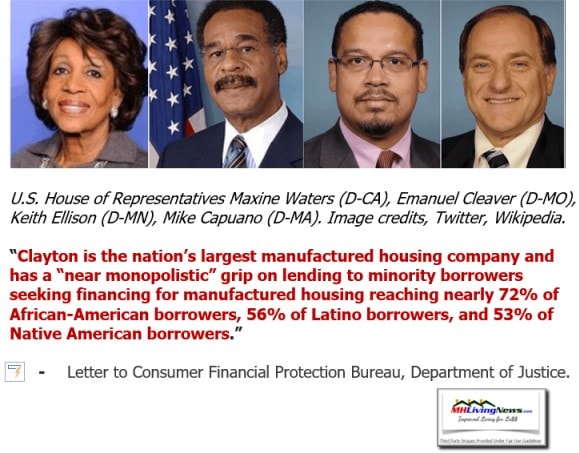

Democratic lawmakers blasted Clayton Homes, and their Berkshire owned affiliated lending by 21st and VMF. They too alleged ‘near monopoly’ conditions, but for whatever reasons did not reference the 21st letter that follows. Perhaps they were unaware of that key document’s existence? The lawmakers quoted below addressed their concerns to the Consumer Financial Protection Bureau (CFPB) and to the DOJ.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

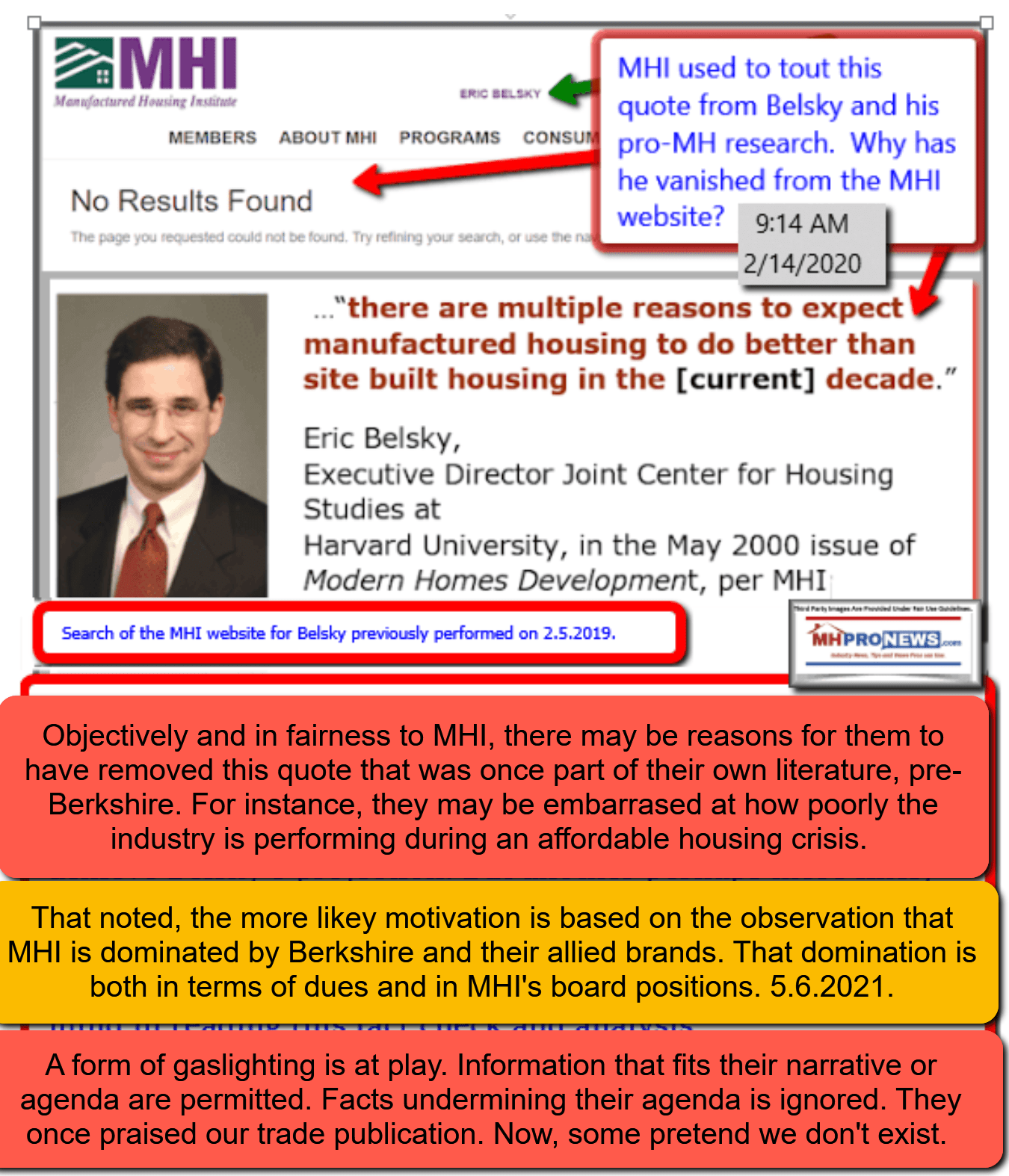

With that backdrop, note that 3 prior MHI presidents and CEO, plus Ann Burkhart, are not to be found on MHI’s public facing portion of their website. Given that MHI claims to host manufactured housing research, did they think that Burkhart’s research wasn’t worthy of their collection? Or did MHI’s leaders slyly not desire bringing to attention third-party researched evidence for why more secondary market lending support should be provided to manufactured housing?

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

If that concern sounds odd, so too is MHI CEO-Dr. Gooch’s recent unforced fumble with the FHFA during their July 2023 listening session. The full context and analysis of Gooch’s remarks to the FHFA and GSEs are found here. But three key items from it are found below. Compare and contrast what Gooch said to what the president and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR), Mark Weiss, J.D., stated at that same event. Gooch, with a doctorate in political science, appears to press Fannie Mae and Freddie Mac, but then gives them an excuse by offering the “may” vs. shall argument for the GSEs to use as they please.

The Duty to Serve statute does not require Fannie and Freddie to purchase personal property loans – but does say explicitly that they QUOTE – “may consider” such loans.

Fannie and Freddie cannot be considered to be fulfilling their Duty to Serve Manufactured Housing statutory responsibility without purchasing such loans since personal property loans constitute the vast majority of all new manufactured homes.”

Gooch demonstrated with the above Ryan’s and MHARR’s concerns.

Then, contrast what CEO Gooch had to say vs. what MHI President and CEO Gail Cardwell said, as quoted above and as is found on page 12 of the document linked here.

- GSE Duty to Serve Underserved Markets • (1) DUTY- To increase the liquidity of mortgage investments and improve the distribution of investment capital available for mortgage financing for underserved markets, each enterprise shall provide leadership to the market in developing loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages for very low-, low-, and moderate-income families with respect to the following underserved markets: • (A) MANUFACTURED HOUSING- The enterprise shall develop loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages on manufactured homes for very low-, low-, and moderate-income families. • MANUFACTURED HOUSING MARKET- In determining whether an enterprise has complied with the duty under subparagraph (A) of subsection (a)(1), the Director may consider loans secured by both real and personal property.

Note the sharp distinction between what Gooch said and what Cardwell apparently did above. Gooch essentially gave Fannie and Freddie, who have co-sponsored some MHI events, an out. “The Duty to Serve statute does not require Fannie and Freddie to purchase personal property loans – but does say explicitly that they QUOTE – “may consider” such loans. ” Cardwell framed it like this (bold emphasis added by MHProNews): “1) DUTY- To increase the liquidity of mortgage investments and improve the distribution of investment capital available for mortgage financing for underserved markets, each enterprise shall provide leadership to the market in developing loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages for very low-, low-, and moderate-income families with respect to the following underserved markets:” Shall and duty have the force of “must.” Only after the word ‘shall’ and duty are uttered (i.e.: must) did Congress via HERA 2008 say: “MANUFACTURED HOUSING MARKET- In determining whether an enterprise has complied with the duty under subparagraph (A) of subsection (a)(1), the Director may consider loans secured by both real and personal property.” Both kinds of loans may be considered under a mandated duty – a must. Why didn’t Dr. Gooch say that? Is it any wonder that a MHEC member ripped Gooch, calling for the cruel and painful form of execution practiced by ancient Romans, i.e.: crucifixion?

As noted earlier above, it is a matter of speculation why MHI would delete references to their own prior staff leaders such as Stinebert, Cardwell, and Long. It is interesting too that Lavin, an MHI award winner, is not found on the MHI website via their own search tool. There would likely be little motivation for Stinebert and Cardwell to weigh in on contemporary manufactured housing controversies. But manufactured housing pros, investors, advocates, public officials and others who authentically want a solution to the affordable housing crisis should carefully review what past and present industry leaders have done, failed to do, and who has emerged as the winners and losers from the status quo.

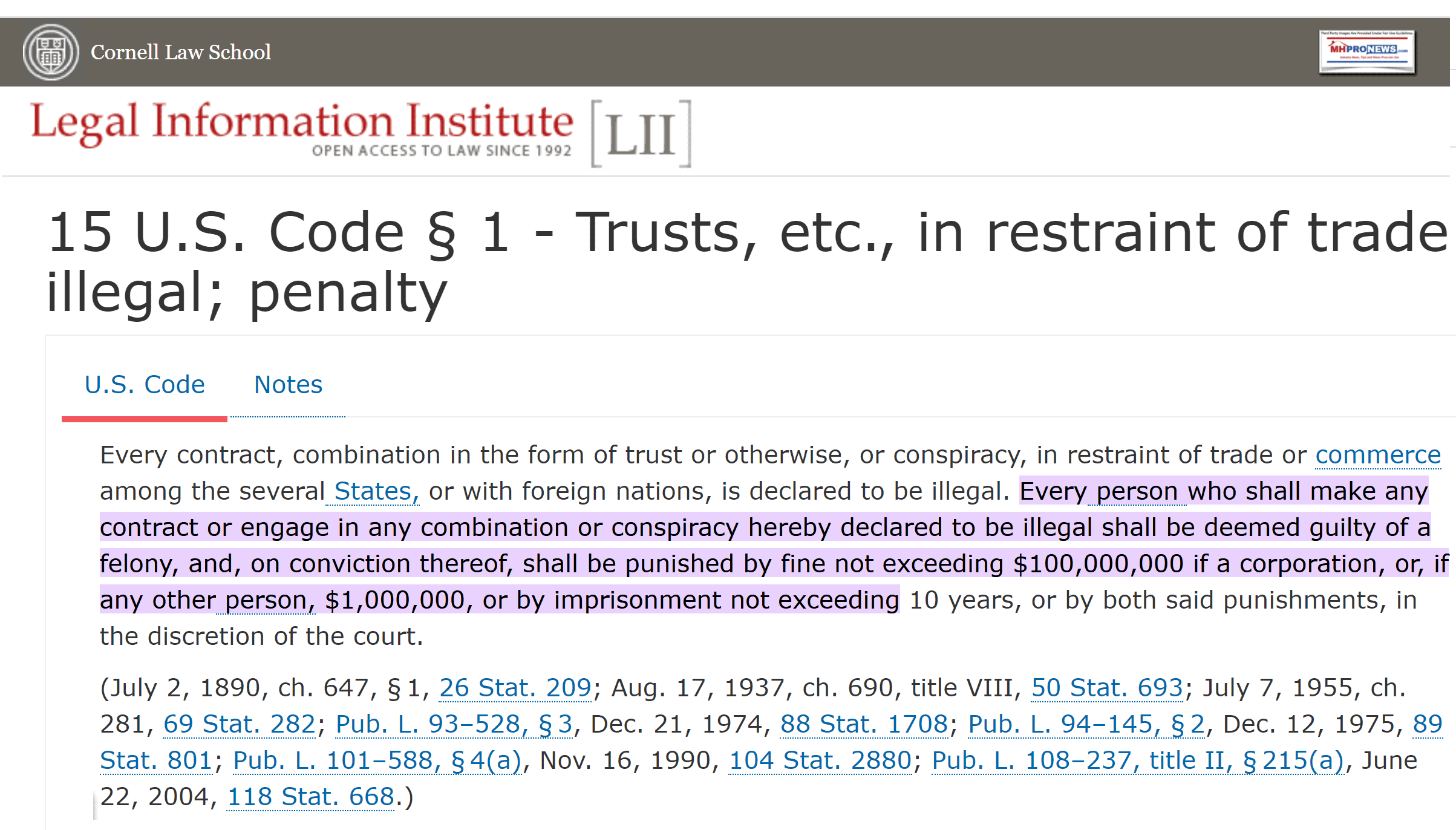

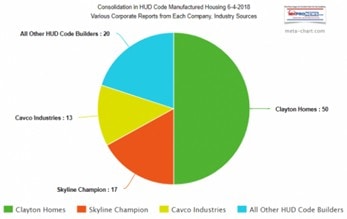

Then at Knudson Law, Sam Strommen, J.D., advanced an evidence-based and well footnoted thesis that asserted that MHI’s behavior appears to have the earmarks of antitrust violations.

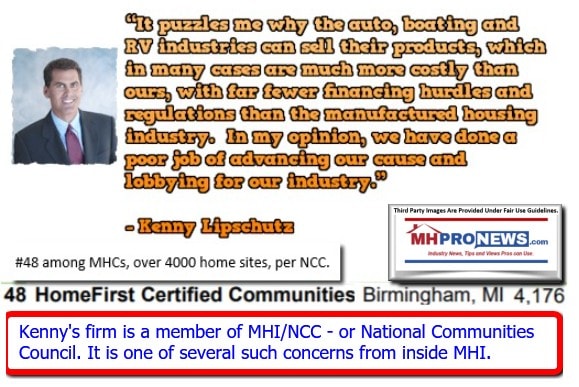

Andrew Justus, J.D., a housing policy advocate for the Niskanen Center, said just weeks ago that financing and zoning barriers are holding manufactured housing back.

Harvard’s 2023 “State of the Nation’s Housing” snapshot of the U.S. housing market mentioned manufactured housing several times. It too said that zoning and financing are holding manufactured housing back.

Law professor Daniel R. Mandelker, J.D., considered an expert on zoning, said that an organization is needed by manufactured housing to advocate for legislative support and for litigation purposes. Ouch. While Mandelker didn’t mention MHI, it is arguably a de facto slap in the face of MHI 2.0.

Back to Strommen, he made the evidence-based following observations. Strommen aptly used the phrase “consolidating.” MHProNews/MHLivingNews has said for years that consolidation appears to be the authentic agenda of MHI’s leadership, whose board of directors are largely made up of the brands that are busy consolidating the industry.

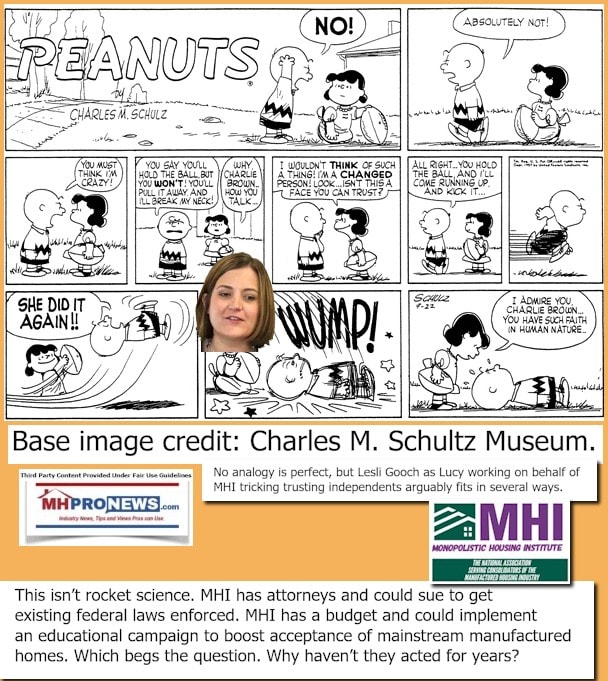

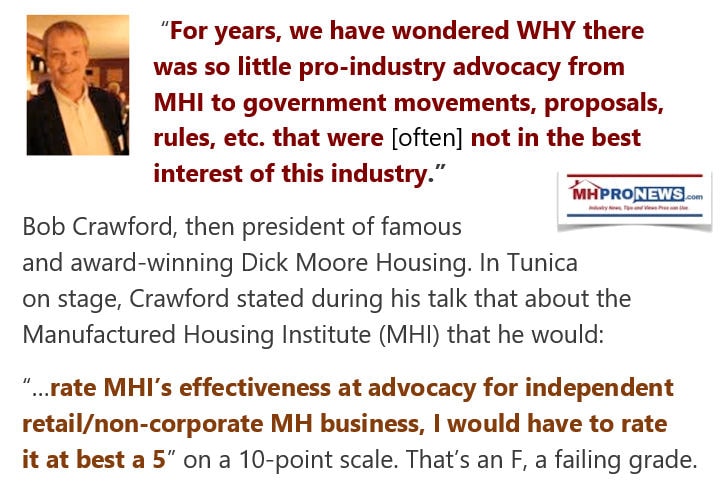

MHProNews has pointed out that there is evidence for apparent antitrust, market manipulating violations that involve MHI’s top brands. The modus operandi (“M.O.”) appears to be to palter, posture and project an image of their working for “all segments” of manufactured housing, but meanwhile they fail to take the obvious steps needed to actually accomplish their stated goals. Look again at Cardwell’s list. Her’s was apparently a far more robust effort than Gooch and company now. Are those reasons why leaders of the past are missing from MHI’s website? Is it to keep the industry’s professionals, or others looking into MHVille, from easily finding their own history? Or their own lack of success at ‘agenda’ items that are now some 15 and 22+ years old? At what point does the industry’s members who still trust MHI realize that Gooch and company are playing Lucy and Charlie Brown, with the snatch the football routine?

MHARR offered to join MHI in a suit to get existing federal laws enforced. Those are laws that MHI claims that they want to see enforced. Just last month, MHI vice chairman – and reportedly their next chairman in waiting – William C. “Bill” Boor said that they want federal preemption and FHA Title I to get enforced. MHI says they wants to see the DOE relent on rules that could further cripple the industry, said Boor.

But as attorney and author Roxanne Bland aptly noted in a generic remark: “Forget what they told you. If you want the truth, follow the money [trail].”

Strommen said the following about his research into manufactured housing.

Outsider looking in Strommen, after looking into manufactured housing, can’t buy the notion that MHI is doing its best efforts on behalf of manufactured housing independents and consumers. As MHProNews said before and since Strommen’s research, there is apparent evidence of antitrust violations, and possible RICO and Hobbs Act offenses among others too.

After spending time on MHLivingNews and MHProNews manufactured homeowner and community resident leader, Robert “Bob” Van Cleef, told MHProNews that our evidence and reasoning had convinced him. He thought what was occurring appeared to be a form of insanity.

Another Minnesotan and university affiliated professional praised the research and presentation on MHProNews.

Gooch, Boor, and their colleagues had to be pushed into litigating the DOE energy rule issues. MHI’s apparent duplicity on that topic were documented by MHARR. In a recent report, MHARR said they are uncertain that MHI intends to essentially give in – snatching defeat from the jaws of victory; if so, then was MHI’s suit with the DOE just more posturing so more consolidation could occur due to regulatory pressures? Despite the fact that the much, much smaller tiny house market have managed to get suits on behalf of their interests, why hasn’t MHI done the same? Is 22 years not long enough to wait to press the “enhanced preemption” issue? Is 15 years not long enough to wait to get FHFA and HUD/FHA Title I engaged legally since pretty talk hasn’t worked?

You can’t make this stuff up. MHI won’t answer the allegations and evidence. You can present the facts and reams of evidence, and it still seems to difficult to believe that a relatively small number of firms would dare to openly monopolize the manufactured housing industry. But the now late Sam Zell said over a decade ago what was already underway. An oligopoly is a style of monopolization that can also merit antitrust action.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

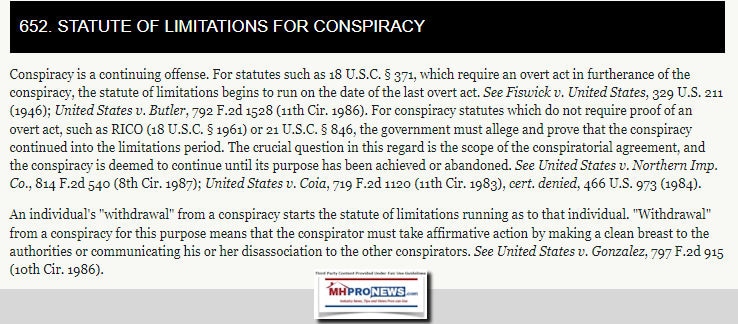

Since these behaviors appear to have been at play for most of the 21st century, there is an argument to be made that the 21st Mortgage letter cited above is just one example in a train of ongoing antitrust violations.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

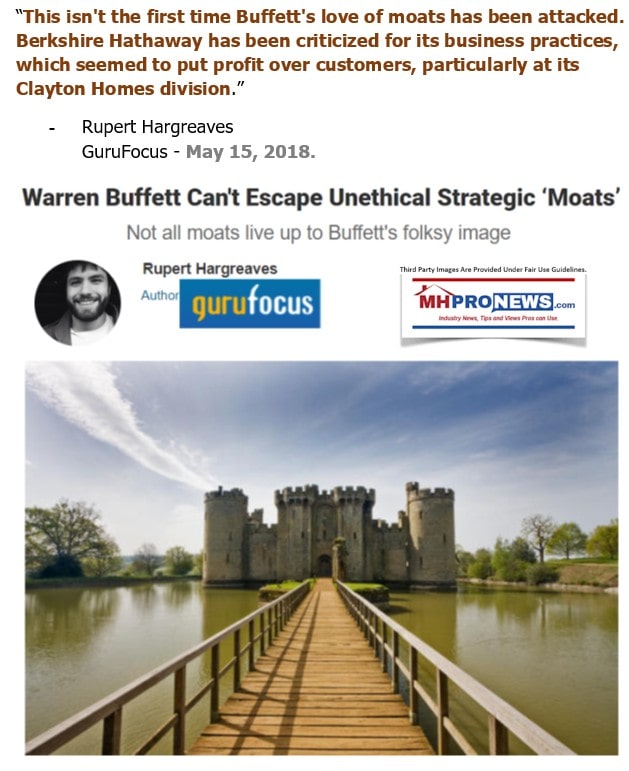

Pro-Warren Buffett author Bud Labitan spelled out what was occurring in manufactured housing over a decade ago (page 77-81). It is called the Moat or the Castle and Moat.

Pro-MHI member Andy Gedo spelled out the financing aspect of the moat.

Pro-Buffett Guru Focus noted the problems being caused by the “moat” tactics that Kevin Clayton and his general counsel at Clayton Homes, Tom Hodges, have both discussed the moat in their own words.

Self-described former Buffett admirer Robin Harding detailed the moat and mentioned manufactured housing and the need for antitrust action.

But this isn’t a guessing game. Buffett himself has spelled it out in his colloquial way.

Michael Lebowitz, a financial advisor, after studying Buffett’s methods said it was more important to observe what Buffett did than what he said. That’s a description of paltering in another fashion. That’s a description of what the Capital Research Center said has called “Deception and Misdirection.”

William “Bill” Gates, III – a long time Buffett ally, described Buffett’s methods thus.

![DidntWantToMeetWarren[Buffett]BecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2020/07/DidntWantToMeetWarrenBuffettBecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews.jpg)

The evidence is hiding in plain sight. Look at the production graphic below. Buffett led Berkshire exits the GSEs. About 2 years later, Berkshire begins its formal entry into manufactured housing. With financing of single-family manufactured home sales hobbled, the industry declined sharply. By driving manufactured housing shipments down through a loss of financing and allowing zoning barriers to persist, in sabotage monopoly fashion, Buffett’s Berkshire owned Clayton Homes and their allies were able to slowly, steadily move from smaller brands into dominating ones. They have done so profitably.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Contracting credit throttled manufactured housing. It explains why Eric Belsky’s predication circa 2000 that manufactured housing would dominate conventional housing by the end of the decade seemed to miss so badly. Perhaps in the absence of the loss of financing, if abuses were corrected and bad actors were removed, with sustainable loans.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

MHI’s leaders can’t escape the point that they have admitted that the industry could be doing a half a million new homes a year. Perhaps more. They can’t plausibly give the excuse that even if it cost a few million dollars to fund litigation/lobbying to enforce DTS, FHA Title I, the Manufactured Housing Improvement Act (MHIA) of 2000’s “enhanced preemption” clause, the DOE energy over-reach, and more. Why not? Bill Boor led Cavco explained it. The cost to the U.S. economy is in the realm of $2 trillion dollars a year. Manufactured housing’s share of that could be hundreds of billions of dollars.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Neither MHI, Berkshire Hathaway, nor their MHVille trade media surrogates, have covered these issues – or if they have, they have done so in a way that defends MHI against evidence so damning that they have to misrepresent it.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Summing Up

The hot-linked evidence and executive summary of these issues are still available.

The executive summary of relevant quotes by organization and title are linked here and are posted below.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Orwellian memory hole tactics have been used in MHVille for some years. MHI can magically vanish their own past president and CEO’s from their own website with ease. The authentic history of the industry can be obscured by paltering-laced histories that ignore relevant facts and evidence. If not for the efforts of independent producers focused MHARR, it would be a fair question if the industry’s members would be fewer than it already is. It isn’t that Kevin Clayton, or Warren Buffett, Bill Boor, or Lesli Gooch outright lie, the more apt description is that they palter with care. What is not said is often as important, sometimes more so, than what was said.

No professional could be as inept at MHI leaders have been, perhaps particularly since Stinebert and Cardwell left. What is needed isn’t rocket science.

MHProNews provided this illustration a couple of years ago to describe what is occurring in MHVille.

The federal laws needed already exist. If it is discovered that existing laws aren’t strong enough, then why not add amendments to Senator Tim Scott’s ROAD to Housing Act?

It’s going to take some work before MHVille moves past the Bruce Springsteen version of Glory Days. But perhaps with honest hard work, prayer, persistence, and more the Gabby Barrett version of Glory Days could be part of the industry’s as yet untold future. God knows, He’s not saying, so time along will tell. ###

Part III. Daily Business News on MHProNews Markets and Headline News Segment

Headlines from left-of-center CNN Business – from the evening of 8.8.2023

- Reviving the Whopper

- Burger King simply isn’t drawing enough customers. Here’s how it plans to attract more guests

- Why Taco Bell’s free taco giveaway is happening everywhere but New Jersey

- Stocks tumble as Moody’s warns it could cut credit ratings of 6 big US banks

- Here’s who is on strike in LA, and what it means for Angelenos

- Neuralink, Elon Musk’s brain implant startup, raises $280 million from Peter Thiel’s VC fund

- Oil and food prices are rising, and so are wages. Inflation isn’t beaten yet

- Thousands of flights are delayed after severe storms disrupt air travel

- Americans’ credit card debt hits a record $1 trillion

- Americans are pulling money out of their 401(k) plans at an alarming rate

- It’s not just actors: Over 11,000 city workers will strike in LA on Tuesday

- Millennials powered America’s homeownership boom

- Regulators fine Wall Street firms $549 million for using WhatsApp and other channels to discuss business

- UPS says its profit will fall after it reaches a Teamsters deal

- Italy slaps 40% one-off windfall tax on its banks

- As drinkers shift to spirits, Molson Coors acquires a bourbon maker

- Taylor Swift friendship bracelet trend has Etsy shop owners cashing in

- Here’s what CEOs are saying about consumer spending

- HSBC exec apologizes after calling the UK ‘weak’ for following US lead over China

- US small businesses feel better about the economy, but still can’t find enough skilled workers

- China’s economy suffers new blow as exports drop 14% in July

- Thousands of flights delayed as bad weather threatens Eastern US

- As writers’ strike nears 100-day mark, a potential deal with Hollywood studios is nowhere in sight

- Campbell Soup Company buys Sovos Brands, maker of Rao’s for $2.7 billion

Notice: the graphic below can be expanded to a larger size.

Headlines from right-of-center Newsmax 8.8.2023

- White House Pushes Back on McCarthy Impeachment Talk

- The White House is pushing back against Republican lawmakers’ growing conviction that President Joe Biden was an active participant in his son’s questionable foreign business dealings, which some have characterized as blatant influence peddling. Amid some calls for impeachment hearings, an administration spokesperson is claiming House Speaker Kevin McCarthy of pushing lies to appease the political right. [Full Story]

- New Trump Indictment

- Delay to Next Week Sought for Trump D.C. Hearing

- Waltz: Judge Right to Reject Smith Filings | video

- CNN: Security Upped for D.C. Judge in Trump Case

- Trump Lawyers: Proposed Protective Order Too Broad

- Trump Attorney: Indictment Wouldn’t Hold in SCOTUS | video

- Kerik Meets With Special Counsel Prosecutors | video

- AG Morrisey: Move Trump’s Trial From DC to West Virginia | video

- Could Trump Face RICO Charges in Ga.? | video

- Docs Case Judge Denies DOJ Sealing Motions | video

- Newsmax TV

- Rep: Fallon: Biden Border Policies Make ‘No Sense’

- Miklos Szantho: Hungary Rejects ‘Liberal Values’ to Protect ‘National Identity’ | video

- Hogan Gidley: ‘Good Move’ for GOP to Target VP Harris

- Mike Gallagher: China Threat ‘Right Here At Home’ | video

- Burgum: Biden WH Draining Resources at Border | video

- Actors: No End in Sight for Strike | video

- Holt: Biden Admin ‘Co-opted’ By China | video

- Cline: House Will Use ‘Power of Purse’ to Rein In DOJ | video

- Acosta: Many Companies Facing Difficulties Post-Pandemic | video

- Enes Kanter Freedom: Potential Political Run ‘The American Dream’ | video

- Newsfront

- Pentagon Tries to ‘Mitigate’ Holds by Sen. Tuberville

- The Pentagon is taking steps to “mitigate the disruption” in the promotions and confirmations of more than 300 senior military officers because of the hold Sen. Tommy Tuberville, R-Ala., has had in place for several weeks…. [Full Story]

- Poll: Most Say McConnell’s Health, Age Taking Toll

- A new poll found that most Americans believe Senate Minority Leader [Full Story]

- Biden Targets Hungary With New Visa Requirements

- The Biden administrations decision to limit visa waivers for [Full Story]

- Trump Rips Biden in First Stop Since D.C. Indictment

- Former President Donald Trump railed against the Biden administration [Full Story] | video

- House GOP Lacks Votes for Mayorkas Impeachment

- House Republicans seeking to impeach Homeland Security Secretary [Full Story]

- Newsmax Beats CNN Friday in Prime Ratings

- Newsmax did it again, beating CNN’s prime-time offerings in key [Full Story]

- Russian Missile Strikes Kill 7 in Ukrainian City

- The death toll from Russian missile strikes that hit apartment blocks [Full Story]

- Related

- Report: Russia Forced Ukrainian Kids Into Cadet Corps

- Ukraine: Talks in Saudi Arabia a Huge Blow to Russia

- Belarus Begins Military Drills Near Poland |video

- Russia Criticizes Talks in Saudi Arabia on Ending Ukraine War After Moscow’s Not Invited

- Ukrainian Woman Held in Zelenskyy Assassination Plot

- 3 Killed in Russian Shelling of Kherson, Kharkiv

- Wall Street Falls With Global Markets on Bank Worries

- Stocks closed lower on Wall Street as worries about the banking [Full Story]

- Pence’s National Security Adviser: He’s ‘Unworthy of the Presidency’

- Retired Gen. Keith Kellogg, former national security adviser to [Full Story] | video

- Related

- Pence Meets Donor Threshold for First Debate

- Trump to Attend Iowa State Fair, Likely Steal Limelight From GOP Rivals

- Vivek Ramaswamy: Juneteenth a ‘Useless’ Holiday

- DeSantis Says No to Punishing Women Who Violate Abortion Bans |video

- With Trump a Likely No Show, DeSantis Emerges as Top Target at 2024 Debate

- Perry Johnson Hits 40,000 Donors, Key for GOP Debates

- Supreme Court Reinstates Biden ATF Ghost Gun Rules

- The Supreme Court is reinstating a regulation aimed at reining in the [Full Story]

- Gov. Healey Declares Migration State of Emergency

- Massachusetts might consider itself a “sanctuary” for illegal [Full Story] | video

- ‘Woke’ Women’s Soccer Team ‘Oblivious’ to What US Fans Want

- The heavily favored U.S. Women’s National Soccer Team suffered its [Full Story] | Platinum Article

- Related

- Franklin Graham Echoes Trump on USWNT World Cup Exit

- Chip Roy Demands Biden Fire Mayorkas

- Chip Roy, R-Texas, on Tuesday demanded that President Joe Biden [Full Story] | video

- Why BlackRock Chief Larry Fink Came to Hate ESG

- Why BlackRock Chief Larry Fink Came to Hate ESG

- BlackRock CEO Larry Fink is abandoning the ESG investing push he [Full Story]

- D.C. Grand Jury Convenes Again

- The Washington, D.C., grand jury, fresh off handing down an [Full Story] | video

- Issue 1 Headed for Big Defeat in Ohio

- Even stalwart Republicans who spoke to Newsmax from Ohio on Tuesday [Full Story]

- Delay to Next Week Sought for Trump D.C. Hearing

- Special counsel Jack Smith’s office is decrying former President [Full Story] | video

- White House Pushes Back on McCarthy Impeachment Talk

- House Speaker Kevin McCarthy, R-Calif., continues to appease [Full Story]

- Fannie Mae: Homebuying Confidence at All-Time Low

- More than 80% of Americans think it is a “bad” time to buy a home, a [Full Story]

- Florida District Sends Memo on Trans Students, Employees

- Transgender employees cannot use the pronouns or bathrooms that match [Full Story]

- Rasmussen Poll: 77 Percent of Dems Back Trump Indictment

- Democratic voters overwhelmingly approve the indictment of former [Full Story]

- ‘Picklemall’ Breathes New Life Into Arizona Mall

- The pickleball craze in the United States has reached new heights [Full Story]

- Legal Fund for Marine Vet Daniel Penny Nears $3M

- A crowdfunding effort for Daniel Penny, a former Marine charged with [Full Story]

- Jim Caviezel Joins Anti-abortion Prayer Rally in Ohio

- Actor Jim Caviezel lent his support to an anti-abortion rally Sunday [Full Story]

- Related

- Ohio Special Election Indirectly Affects Abortion

- Texas Attorney General Paxton Moves to Toss Impeachment

- Texas Attorney General Ken Paxton denies he received a “bribe” or [Full Story]

- Americans’ Credit Card Debt Tops $1T for 1st Time

- Americans borrowed more than ever on their credit cards in the last [Full Story]

- Anheuser-Busch Selling 8 Beer Brands to Tilray

- Anheuser-Busch is selling eight beer brands to cannabis company [Full Story]

- DeSantis Campaign Hands Reins to James Uthmeier

- Florida GOP Gov. Ron DeSantis is elevating James Uthmeier, his [Full Story] | video

- Woman Victim to Rare NYC Shark Attack

- The first New York City shark attack in decades occurred Monday, when [Full Story]

- Uvalde Shooter’s Cousin Arrested for Similar Threat

- A 17-year-old boy, identified as a cousin to Uvalde, Texas, mass [Full Story]

- Emerson College Poll: Trump Leads Biden in Arizona

- Forty-five percent of Arizona registered voters say they support [Full Story]

- Finance

- Western Economies Desperately in Need of Change

- It should become apparent to all that the artificially low interest rates, high unproductive government spending and massive deficits are not sustainable in the long term…. [Full Story]

- ESPN, Penn Entertainment Ink $1.5B Sports Betting Deal

- Bank Stocks Sink on Moody’s Downgrades

- Y. Judge Puts Temporary Block on New Pot Shops

- Biden on Weather Channel to Discuss Climate Change

- More Finance

- Health

- Half of All People Will Develop Mental Illness

- A new study published in the scientific journal The Lancet Psychiatry found that by 75 years of age, approximately half the world’s population can expect to develop one or more of 13 mental health disorders. The two most prevalent disorders were alcohol use disorder and…… [Full Story]

- The Dangers of Drinking Too Much Water

- Sugar-Sweetened Drinks Linked to Liver Cancer

- Exposure to Scents During Sleep Boosts Memory

- Breast Cancer Over diagnosed When Screening Older Women