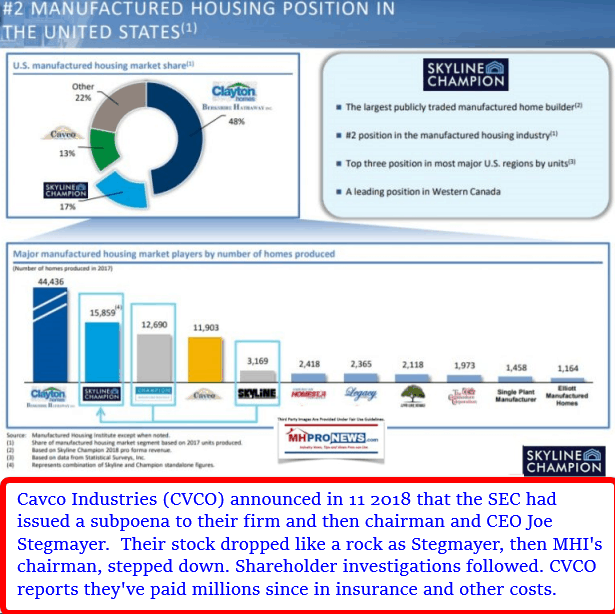

“Heath [Jenkins] not only brings years of industry retail experience, and strong leadership capabilities exemplified by the strength and tenure of the Regional Homes’ team but also exhibits an unwavering commitment to put the customer first. These are traits that perfectly align with our core operating principles.” So said Mark Yost, Skyline Champion (SKY) President, and Chief Executive Officer (CEO) according to the press release that follows in Part I of this report and analysis. Based on known data that will be explored further below (Part III), Skyline Champion is the #2 producer of HUD Code manufactured homes in the United States.

Theses document and media releases carry the typical legal disclaimers found in similar investor pitches for a publicly traded company.

Among the points not found in the first press release posted below by Skyline Champion is a reference to the deal made by Skyline Champion with ECN-Triad Financial. Note that deal was mentioned in a prior release, which is provided in Part II, below.

Restating that, potential investors, shareholders, and manufactured home industry stakeholders who are only looking at the most recent press release and are not looking at the bigger picture beyond the Regional Homes deal are arguably missing significant insights.

So, MHProNews will provide that larger context, which includes insights from others beyond or in MHVille in Part III of this report.

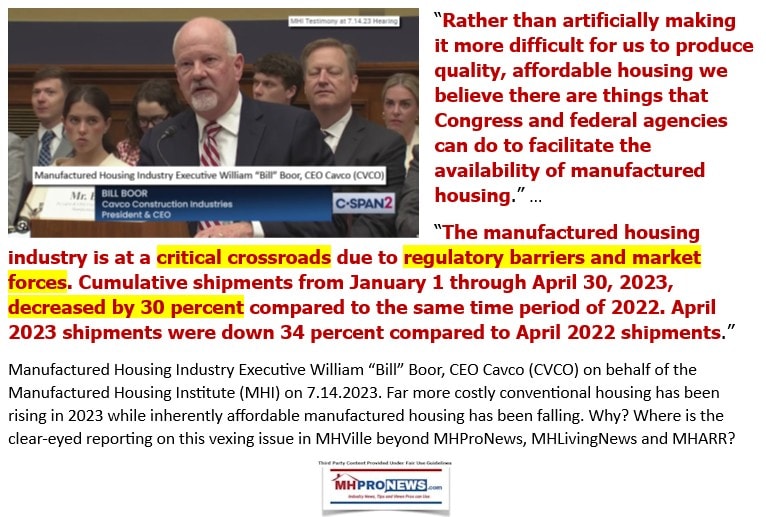

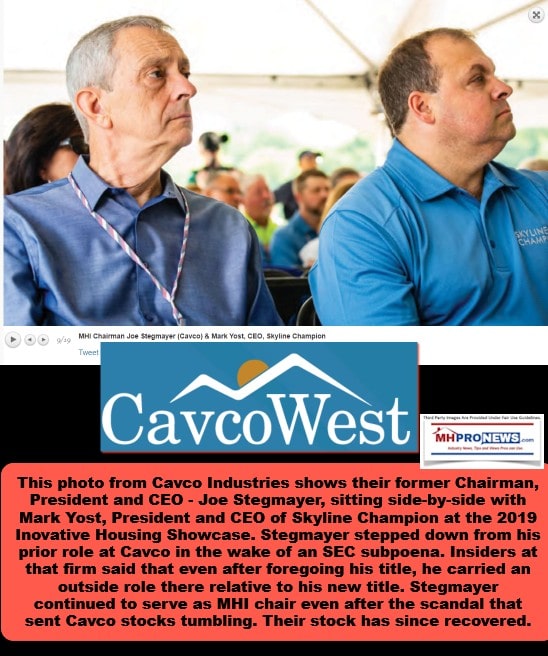

Note, for example, that these deals were announced shortly before the first of what now appears to be a series of antitrust lawsuits involving several Manufactured Housing Institute (MHI) member firms. Skyline Champion happens to be an MHI member. Skyline Champion (SKY) CEO Mark Yost has served for some time on MHI’s board of directors.

Part I Skyline Champion Announces Closing of the Acquisition of Regional Homes

October 13, 2023 at 05:22 PM Eastern Daylight Time

TROY, Mich.–(BUSINESS WIRE)–Champion Home Builders and Champion Retail Housing, subsidiaries of Skyline Champion Corporation (NYSE: SKY) (“Skyline Champion”) today announced the closing of its previously announced acquisition of Regional Enterprises LLC, and related companies (collectively, “Regional Homes”).

“We are excited to announce the closing and to welcome Regional Homes to the Skyline Champion family,” said Mark Yost, Skyline Champion’s President, and Chief Executive Officer. “We believe Regional Homes is an excellent strategic fit given their customer-centric selling approach which goes together with our on-going efforts to enhance our customers’ buying experience. Regional Homes’ strong presence in Alabama and Mississippi strengthens Skyline Champion’s market positioning as a leading provider of attainable housing solutions by expanding our captive retail and manufacturing distribution in this large region. We expect this transaction to generate solid returns over time with meaningful stakeholder value creation from day one, supported by Regional Homes’ attractive margin profile, its talented team, as well as available synergy capture.”

In coordination with the closing of the transaction, Skyline Champion is pleased to announce that Heath Jenkins will serve as the President of the Company’s captive retail operations. “We are fortunate to add Heath to the Skyline Champion team,” said Mark Yost. “Heath not only brings years of industry retail experience, and strong leadership capabilities exemplified by the strength and tenure of the Regional Homes’ team but also exhibits an unwavering commitment to put the customer first. These are traits that perfectly align with our core operating principles.”

The purchase price was approximately $313 million, net of cash acquired, plus assumed debt, primarily related to inventory floor plan liabilities, of $93 million. In addition to the purchase price, the transaction is subject to an earnout provision as well as customary net working capital adjustments. Skyline Champion funded the acquisition with cash on hand and $30 million of the Company’s common stock.

About Skyline Champion Corporation:

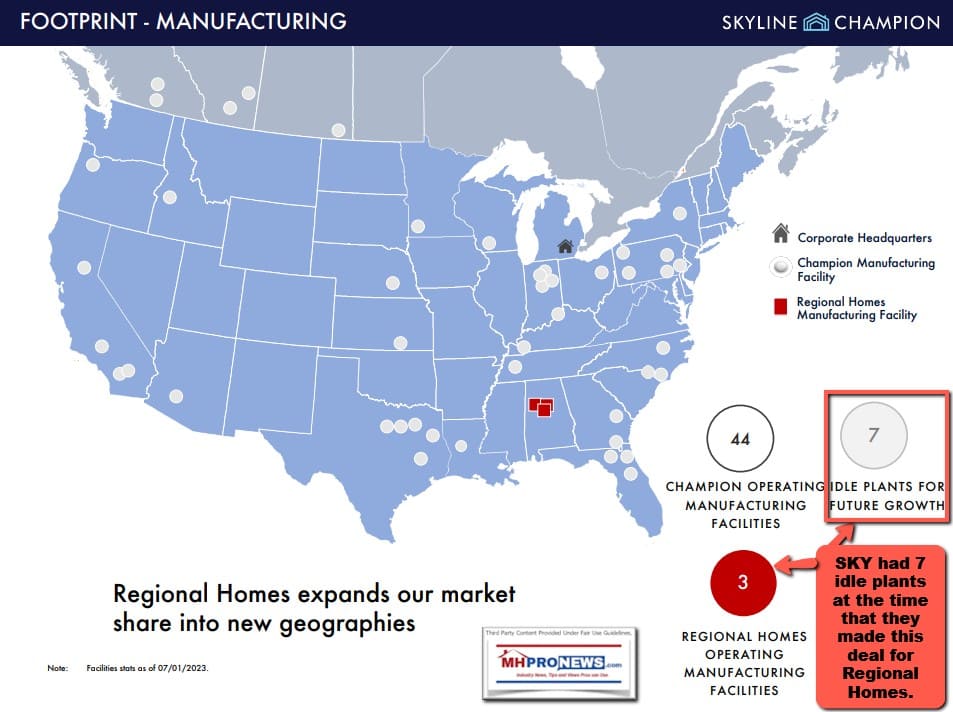

Skyline Champion Corporation (NYSE: SKY) is a leading producer of factory-built housing in North America and employs approximately 7,600 people. With more than 70 years of homebuilding experience and 44 manufacturing facilities throughout the United States and western Canada, Skyline Champion is well positioned with an innovative portfolio of manufactured and modular homes, ADUs, park-models and modular buildings for the single-family, multi-family, and hospitality sectors.

In addition to its core home building business, Skyline Champion provides construction services to install and set-up factory-built homes, operates a factory-direct retail business with 31 retail locations across the United States, and operates Star Fleet Trucking, providing transportation services to the manufactured housing and other industries from several dispatch locations across the United States.

Skyline Champion builds homes under some of the most well-known brand names in the factory-built housing industry including Skyline Homes, Champion Home Builders, Genesis Homes, Athens Park Models, Dutch Housing, Atlantic Homes, Excel Homes, Homes of Merit, New Era, Redman Homes, ScotBilt Homes, Shore Park, Silvercrest, Titan Homes in the U.S. and Moduline and SRI Homes in western Canada.

About Regional Homes:

Headquartered in Flowood, MS, Regional Homes is a manufactured and modular housing company. With over 1,200 employees, three manufacturing facilities, and 43 retail locations throughout the Southeast, Regional Homes is the fourth largest company in the industry, with the largest independent retail footprint. Since its founding in 2006, Regional Homes has sold over 30,000 manufactured homes and has built a reputation of exemplary service and customer satisfaction. In addition to manufacturing and retailing, other turnkey services provided with home purchases include site preparation, installation, furnishing, servicing, and maintenance. Regional Homes also maintains strong relationships with federal and state agencies by providing disaster relief housing programs in Texas, Mississippi, Florida, Alabama, and Louisiana.

With a distinguished company culture, Regional Homes strikes a balance of teamwork, competitiveness, and discipline that creates a cohesive and supportive environment. It is dedicated to the continued development of a collaborative and thriving environment for our staff, as well as to producing an exceptional home-buying experience for our customers.

Forward-Looking Statements

Statements in this press release, including certain statements regarding Skyline Champion’s strategic initiatives, and future market demand are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by use of words such as “believe,” “expect,” “future,” “anticipate,” “intend,” “plan,” “foresee,” “may,” “could,” “should,” “will,” “potential,” “continue,” or other similar words or phrases. Similarly, statements that describe objectives, plans, or goals also are forward-looking statements. Such forward-looking statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of Skyline Champion. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, implied, or projected by such forward-looking statements. Risks and uncertainties include regional, national and international economic, financial, public health and labor conditions, and the following: supply-related issues, including prices and availability of materials; labor-related issues; inflationary pressures in the North American economy; the cyclicality and seasonality of the housing industry and its sensitivity to changes in general economic or other business conditions; demand fluctuations in the housing industry, including as a result of actual or anticipated increases in homeowner borrowing rates; the possible unavailability of additional capital when needed; competition and competitive pressures; changes in consumer preferences for our products or our failure to gauge those preferences; quality problems, including the quality of parts sourced from suppliers and related liability and reputational issues; data security breaches, cybersecurity attacks, and other information technology disruptions; the potential disruption of operations caused by the conversion to new information systems; the extensive regulation affecting the production and sale of factory-built housing and the effects of possible changes in laws with which we must comply; the potential impact of natural disasters on sales and raw material costs; the risks associated with mergers and acquisitions, including integration of operations and information systems; periodic inventory adjustments by, and changes to relationships with, independent retailers; changes in interest and foreign exchange rates; insurance coverage and cost issues; the possibility that all or part of our intangible assets, including goodwill, might become impaired; the possibility that our risk management practices may leave us exposed to unidentified or unanticipated risks; the potential disruption to our business caused by public health issues, such as an epidemic or pandemic, and resulting government actions; and other risks set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section, and other sections, as applicable, in our Annual Reports on Form 10-K, including our Annual Report on Form 10-K for the fiscal year ended April 1, 2023 previously filed with the Securities and Exchange Commission (“SEC”), as well as in our Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, filed with or furnished to the SEC.

If any of these risks or uncertainties materializes or if any of the assumptions underlying such forward-looking statements proves to be incorrect, then the developments and future events concerning Skyline Champion set forth in this press release may differ materially from those expressed or implied by these forward-looking statements. You are cautioned not to place undue reliance on these statements, which speak only as of the date of this release. We anticipate that subsequent events and developments will cause our expectations and beliefs to change. Skyline Champion assumes no obligation to update such forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, unless obligated to do so under the federal securities laws. … ##

The IR contact info is omitted by MHProNews. This is a report and analysis of SKY’s deal, not a plug of the firm or their stock.

Note that SKY used Berkshire Hathaway owned BusinessWire for their media release.

Part II

Skyline Champion Announces Acquisition of Regional Homes

August 28, 2023

TROY, Mich.–(BUSINESS WIRE)– Champion Home Builders and Champion Retail Housing, subsidiaries of Skyline Champion Corporation (NYSE: SKY) (“Skyline Champion”) today announced a definitive agreement to acquire Regional Enterprises LLC, and related companies (collectively, “Regional Homes”). Regional Homes is the fourth largest HUD manufacturer in the United States and operates three manufacturing facilities in Alabama and 43 retail sales centers across the southeast. They sold approximately 5,000 new homes and had estimated revenue of approximately $523 million for the year ended December 31, 2022, and generated estimated EBITDA of approximately $84 million for the same period.

“We are excited to welcome Regional Homes and its 1,200 employees to the Skyline Champion family,” said Mark Yost, Skyline Champion’s President and Chief Executive Officer. “We believe Regional Homes is an excellent fit given their customer-centric selling approach which goes hand-in-hand with our on-going efforts to enhance our customers’ buying experience. The transaction is expected to accomplish several objectives within our strategic framework for profitable growth. Notably, Regional Homes’ strong presence in the large markets of Alabama and Mississippi helps expand our captive retail and manufacturing distribution in that region. We expect this transaction to generate solid returns over time with meaningful stakeholder value creation from day one, supported by Regional Homes’ attractive margin profile, its talented team, as well as available synergy capture.”

Heath Jenkins, owner of Regional Homes commented, “We couldn’t be more excited to partner with a company that not only has a reputation of excellence in our industry, but one that perfectly complements our business model and strategic goals. And with Skyline Champion’s recent announcement of their partnership with ECN Capital Corporation, our capacity to provide tangible value to our customers has increased exponentially. This transaction provides a significant opportunity to make a positive impact for our customers and employees. The team at Skyline Champion has been able to witness the unique culture we have developed at Regional Homes firsthand. Their leadership has shown tremendous support in our abilities, but most of all, our people – who are what make this company so special. I’m confident that with these alliances, we are on the path to something great.”

The purchase price will be approximately $328 million plus assumed debt, primarily related to inventory floor plan liabilities, of $130 million. In addition to the purchase price, the transaction is subject to an earnout provision as well as customary net working capital adjustments. Skyline Champion expects to fund the acquisition with cash on hand and $30 million of the Company’s common stock, which is subject to certain restrictions. The transaction is subject to regulatory approval and is expected to close during the Company’s fiscal 2024 third quarter.

Conference Call and Webcast Information:

Skyline Champion management will host a conference call on August 28, 2023, at 9:00 a.m. Eastern Time, to discuss this transaction. A slide presentation discussing the transaction has been published in the Events & Presentations section of Skyline Champion’s website.

Investors and other interested parties can listen to a webcast of the live conference call by logging onto the Investor Relations section of Skyline Champion’s website at skylinechampion.com. The online replay will be available on the same website immediately following the call.

The conference call can also be accessed by dialing (877) 407-4018 (domestic) or (201) 689-8471 (international). A telephonic replay will be available approximately two hours after the call by dialing (844) 512-2921, or for international callers, (412) 317-6671. The passcode for the live call and the replay is 13740908. The replay will be available until 11:59 P.M. Eastern Time on September 11, 2023.

About Skyline Champion Corporation:

Skyline Champion Corporation (NYSE: SKY) is a leading producer of factory-built housing in North America and employs approximately 7,600 people. With more than 70 years of homebuilding experience and 44 manufacturing facilities throughout the United States and western Canada, Skyline Champion is well positioned with an innovative portfolio of manufactured and modular homes, ADUs, park-models and modular buildings for the single-family, multi-family, and hospitality sectors.

In addition to its core home building business, Skyline Champion provides construction services to install and set-up factory-built homes, operates a factory-direct retail business with 31 retail locations across the United States, and operates Star Fleet Trucking, providing transportation services to the manufactured housing and other industries from several dispatch locations across the United States.

Skyline Champion builds homes under some of the most well-known brand names in the factory-built housing industry including Skyline Homes, Champion Home Builders, Genesis Homes, Athens Park Models, Dutch Housing, Atlantic Homes, Excel Homes, Homes of Merit, New Era, Redman Homes, ScotBilt Homes, Shore Park, Silvercrest, Titan Homes in the U.S. and Moduline and SRI Homes in western Canada.

About Regional Homes:

Headquartered in Flowood, MS, Regional Homes is a manufactured and modular housing company. With over 1,200 employees, three manufacturing facilities, and 43 retail locations throughout the Southeast, Regional Homes is the 4th largest company in the industry, with the largest independent retail footprint. Since its founding in 2006, Regional Homes has sold over 30,000 manufactured homes and has built a reputation of exemplary service and customer satisfaction. In addition to manufacturing and retailing, other turnkey services provided with home purchases include site preparation, installation, furnishing, servicing, and maintenance. Regional Homes also maintains strong relationships with federal and state agencies by providing disaster relief housing programs in Texas, Mississippi, Florida, Alabama, and Louisiana.

With a distinguished company culture, Regional Homes strikes a balance of teamwork, competitiveness, and discipline that creates a cohesive and supportive environment. It is dedicated to the continued development of a collaborative and thriving environment for our staff, as well as to producing an exceptional home-buying experience for our customers.

Forward-Looking Statements

Certain statements made in this press release and in other written or oral statements made by us or on our behalf are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). A forward-looking statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict, forecast, indicate or imply future results, performance or achievements, including without limitation, statements relating to the planned acquisition of Regional Homes and timing thereof, projected accretion to financial and production results, estimates of Regional Homes’ revenue and EBITDA, our earnings growth, and expected synergies related to the acquisition. Skyline Champion’s strategic initiatives, and future market demand are also intended to be covered by the safe harbor for “forward-looking statements” provided by the PSLRA. These forward-looking statements generally can be identified by use of words such as “believe,” “expect,” “future,” “anticipate,” “intend,” “plan,” “foresee,” “may,” “could,” “should,” “will,” “potential,” “continue,” or other similar words or phrases. Similarly, statements that describe objectives, plans, or goals also are forward-looking statements. Such forward-looking statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of Skyline Champion. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, implied, or projected by such forward-looking statements. Risks and uncertainties include regional, national and international economic, financial, public health and labor conditions, and the following: supply-related issues, including prices and availability of materials; labor-related issues; inflationary pressures in the North American economy; the cyclicality and seasonality of the housing industry and its sensitivity to changes in general economic or other business conditions; demand fluctuations in the housing industry, including as a result of actual or anticipated increases in homeowner borrowing rates; the possible unavailability of additional capital when needed; competition and competitive pressures; changes in consumer preferences for our products or our failure to gauge those preferences; quality problems, including the quality of parts sourced from suppliers and related liability and reputational issues; data security breaches, cybersecurity attacks, and other information technology disruptions; the potential disruption of operations caused by the conversion to new information systems; the extensive regulation affecting the production and sale of factory-built housing and the effects of possible changes in laws with which we must comply; the potential impact of natural disasters on sales and raw material costs; the risks associated with mergers and acquisitions, including integration of operations and information systems; periodic inventory adjustments by, and changes to relationships with, independent retailers; changes in interest and foreign exchange rates; insurance coverage and cost issues; the possibility that all or part of our intangible assets, including goodwill, might become impaired; the possibility that our risk management practices may leave us exposed to unidentified or unanticipated risks; the potential disruption to our business caused by public health issues, such as an epidemic or pandemic, and resulting government actions; and other risks set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section, and other sections, as applicable, in our Annual Reports on Form 10-K, including our Annual Report on Form 10-K for the fiscal year ended April 1, 2023 previously filed with the Securities and Exchange Commission (“SEC”), as well as in our Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, filed with or furnished to the SEC.

If any of these risks or uncertainties materializes or if any of the assumptions underlying such forward-looking statements proves to be incorrect, then the developments and future events concerning Skyline Champion set forth in this press release may differ materially from those expressed or implied by these forward-looking statements. You are cautioned not to place undue reliance on these statements, which speak only as of the date of this release. We anticipate that subsequent events and developments will cause our expectations and beliefs to change. Skyline Champion assumes no obligation to update such forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, unless obligated to do so under the federal securities laws.

Non-GAAP Financial Measures

In addition to disclosing financial measures that are determined in accordance with GAAP, we present and discuss certain non-GAAP financial measures, as supplemental measures to help investors evaluate our operational performance. EBITDA is defined as net income before taxes attributable to Regional Homes before interest income, interest expense, and depreciation and amortization. See below for a reconciliation of EBITDA of Regional Homes to the most directly comparable GAAP measure of net income before taxes. Measures related to Regional Homes’ financial results are unaudited.

|

SKYLINE CHAMPION CORPORATION RECONCILIATION OF REGIONAL HOMES NET INCOME BEFORE TAXES TO EBITDA (Unaudited, dollars in thousand) |

|||

|

|

|

For the Year Ended |

|

|

Net income before taxes |

|

$ |

70,698 |

|

Interest expense, net |

|

|

9,262 |

|

Depreciation and amortization |

|

|

3,901 |

|

EBITDA |

|

$ |

83,861 |

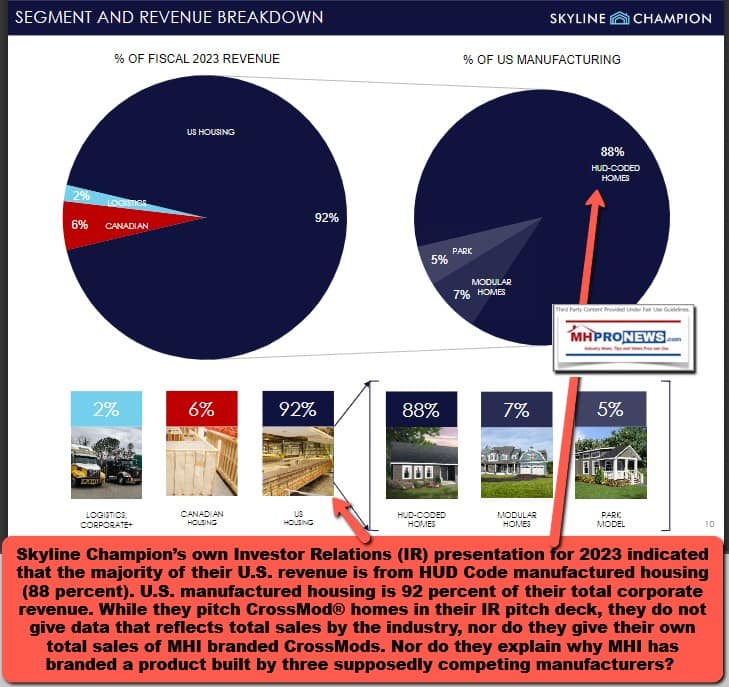

Part III – Segments Quoted from “Planned Acquisition of Regional Homes” – Skyline Champion IR Pitch Deck

HIGHLIGHTS

• Founded in 2006, now the 4th largest company in the industry, with the largest independent retail footprint

• Strong relationship with federal and state disaster relief housing programs in AL, FL, LA, MS, and TX

• Headquartered in Flowood, Mississippi

• Owned by Heath Jenkins – trusted, and well respected leader in the industry

KEY STATISTICS

- Operates 3 manufacturing facilities in Northwest Alabama

- Services low-to-high product segments with Hamilton Home Builders, Embark Home Builders, Bravo Home Builders, and Winston Home Builders brands

- 43 retail locations across the Southeastern US

- Approximately 5,000 homes sold in calendar 2022

- Approximately 1,200 employees

Transaction Rationale

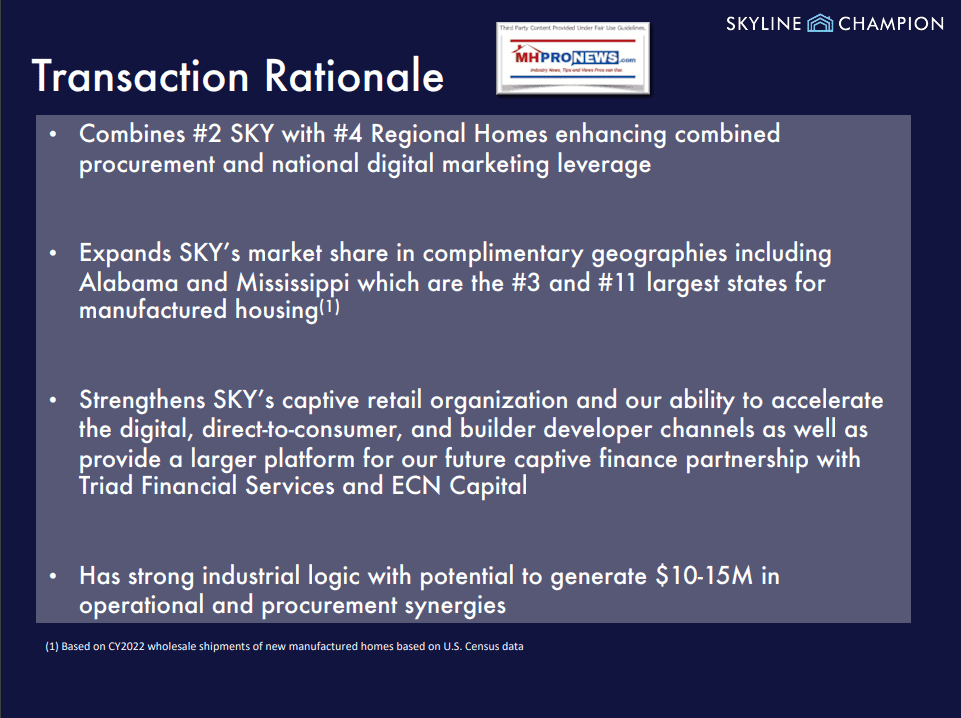

• Combines #2 SKY with #4 Regional Homes enhancing combined procurement and national digital marketing leverage

• Expands SKY’s market share in complimentary geographies including Alabama and Mississippi which are the #3 and #11 largest states for manufactured housing(1)

• Strengthens SKY’s captive retail organization and our ability to accelerate the digital, direct-to-consumer, and builder developer channels as well as provide a larger platform for our future captive finance partnership with Triad Financial Services and ECN Capital

• Has strong industrial logic with potential to generate $10-15M in operational and procurement synergies

(1) Based on CY2022 wholesale shipments of new manufactured homes based on U.S. Census data

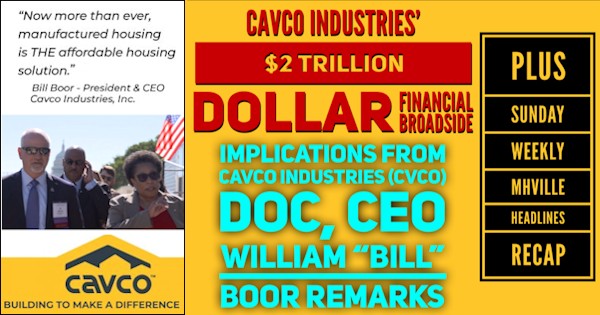

Part IV – Additional Information with More MHProNews Analysis and Commentary

To put Skyline Champions deal for Regional Homes into a broader evidence-based context, the market’s response to the deal is summed up in the graphic below. Yahoo Finance indicates that the stock is trading lower today than when the deal was announced. Closing the deal did not boost the enthusiasm among investors. Such insights are only possible by waiting a few days to see what happens. Note that since the graphic below SKY’s stock slid one more yesterday. At the close, per Yahoo Finance on October 18 04:00PM EDT 61.47-1.67 (-2.64%).

In fact, it appears that since the deal for Regional Homes was announced, there was a brief bump in SKY’s stock value, but it has fallen since. SKY’s stock fell in value again after the announced deal for Regional was closed.

Though Yahoo’s graphic shows the stock’s “fair value” as “undervalued,” most investors apparently don’t yet agree.

AI

As regular and detail minded readers know, MHProNews has been testing the use of Artificial Intelligence (AI) in the context of our reports in recent months. With that in mind, MHProNews asked Bing’s AI the following.

> “What has Manufactured Housing trade media had to say about the closing of the Skyline Champion Regional Homes Acquisition?”