“The Pew Charitable Trusts is a public charity formed in 2003 from the merger of seven foundations created by the Pew family, which made its money in the oil business. It operates the Pew Research Center as a subsidiary.” So says “Influence Watch” which says that “Capital Research Center [CRC] conceived of this [Influence Watch] project after identifying a need for more fact-based, accurate descriptions of all of the various influencers of public policy issues.” CRC’s Influence Watch has an impressive database on over 10,000 generally nonprofit organizations which includes Pew, which is the source for the research data report dated 12.7.2022 that is the source of the information that follows. After the Pew generated data and commentary there will be an additional information with more MHProNews analysis and commentary segment to this manufactured home financing focused report.

Pew Research on Manufactured Home Financing – Data Shows Lack of Enough Federal Lending Shuts Out Many Prospective Buyers, Why Hasn’t Manufactured Housing Institute Successfully Pressed Feds?

Expansion of federal loan programs could boost access to this path to homeownership

ARTICLE December 7, 2022 By: Linlin Liang, Rachel Siegel & Adam Staveski

Manufactured homes could be part of the solution. These homes are produced on a large scale in factories and cost about half per square foot compared with site-built homes. But Americans seeking to buy these homes often face higher credit standards and denial rates for loans compared with those buying site-built houses. Leading lenders for manufactured homes often keep the loans they make “in portfolio,” as opposed to selling them, a standard practice for site-built mortgages. Such companies then retain all of the financial risk and reward for each loan they make, but they tend to have the highest denial rates compared with lenders that largely sell their loans or use a federally backed program to defray losses if borrowers default.

Analysis by The Pew Charitable Trusts shows that mortgages through federal loan programs improve access to financing to purchase manufactured homes when the homes are owned as real estate—meaning the buyers also purchase or own the land and own them together just like with a site-built home. But more than 75% of new manufactured homes are purchased as personal property for which there is no functioning federal loan program. As a result, buyers have few financing options—just a handful of lenders make the majority of what are known as personal property “chattel” loans, and most loan applications are denied. Instead, those who want to buy but cannot obtain a mortgage or personal property loan are left to purchase their manufactured homes in cash or use riskier alternatives such as rent-to-own. In many instances, they may be shut out of homeownership altogether.

The Federal Housing Administration (FHA) and Ginnie Mae—government agencies that provide mortgage insurance and loan guaranty to help homebuyers to secure financing—issued a joint request for input (RFI) in July. The RFI focused on identifying hurdles to the use of their current Title I Manufactured Housing Program, which insures personal property loans but is virtually unused. In response, The Pew Charitable Trusts on Sept. 26 submitted a comment letter that suggests the government update and align Title I with FHA’s Title II program, which already provides an important source of credit to manufactured home mortgage borrowers. Updates could improve access to safe and affordable financing options for buyers who want to use a personal property loan.

More than half of manufactured home financing applications are denied

Applications for manufactured home financing are denied far more frequently than applications for site-built home financing. In 2021 lenders denied 54% of completed applications for financing—those that included all the information needed for underwriting—to purchase a manufactured home. For site-built home buyers, the rate was just 7%. These rates have remained unchanged from the previous denial rates research, when Pew and the University of North Carolina’s Center for Community Capital (UNC) completed an extensive analysis of 2018-19 manufactured home denial rates. That research demonstrated that manufactured homes are more likely to be purchased using cash than are site-built homes (37% vs. 11%), in part because of lack of financing.

This year, Pew used the same methodology as the earlier Pew-UNC study with updated 2021 national data from the Home Mortgage Disclosure Act (HMDA) database, a national repository of information on mortgages from point of application through origination or denial. For manufactured homes, personal property loans have the highest denial rates at 64%, but even traditional mortgages were denied 40% of the time. (See Figure 1.).

Manufactured home buyers are often held to higher credit standards than mortgage applicants buying a site-built unit. Consumer Financial Protection Bureau (CFPB) analysis of 2019 HMDA and credit score data found that when seeking to finance a manufactured home, buyers with strong credit—especially those applying for a personal property loan—had a higher likelihood of being denied than site-built home purchasers with lower scores.

Denials of conventional loan applications for manufactured homes drive high rates

One of the striking findings from the Pew-UNC research is the difference in denial rates between government-backed loans—that is, financing that has government insurance or backing, such as from the FHA or Department of Veterans Affairs (VA)—and conventional loans, which have no government backing.

The 2021 HMDA data shows a similar pattern. Manufactured home loan applicants fared much better when they had support from the federal government: Lenders denied FHA and VA manufactured home mortgage applications just 14% and 13% of the time, respectively. Conversely, applications for conventional financing—those without government insurances or guaranties—were denied 52% of the time for mortgages and 64% of the time for personal property loans to purchase manufactured housing. In contrast, only 6% of applications for conventional site-built home mortgages were denied. (See Figure 2.)

Reasons for differences in denial rates

The disparities in denial rates occur, at least in part, because conventional mortgages for manufactured homes are underwritten more stringently than FHA mortgages that rely more on credit history than other factors, such as home value. Pew-UNC research shows that manufactured home buyers applying for an FHA Title II mortgage were 16 percentage points less likely to be denied financing than if they had applied for a conventional mortgage. The majority of denials for conventional or personal property loans were because of credit history (59% and 65%, respectively). In comparison, just 23% of FHA denials could be attributed to borrower credit history. This shows that FHA insurance plays an important role in helping borrowers access manufactured home mortgages.

Lenders have suggested to the CFPB that personal property loans are denied so often because many prospective borrowers apply to lenders that do not offer manufactured home financing and are therefore turned down. Pew-UNC research does not support that theory. Conventional personal property loans and mortgages are rarely denied because of home type or quality “collateral” (7% and 1%, respectively). Rather, the data shows that higher credit standards for manufactured home borrowers make conventional mortgages and personal property loans more difficult to obtain than conventional mortgages for site-built homes or federally backed loans for manufactured homes.

FHA provides an important source of financing that could be expanded

In the same way that FHA’s Title II mortgage program helps expand access to manufactured home mortgages, FHA’s Title I program could be leveraged to improve access to personal property loans. Pew’s comment letter noted that the agency has an opportunity to examine the success of the Title II program and use that as a roadmap for improving the Title I program. It also could study current challenges for use by lenders and borrowers and seek to increase coordination of federal manufactured home financing programs. A successfully reworked program could improve Title I’s usefulness for lenders and borrowers and expand the availability of safe, affordable manufactured home loans.

Linlin Liang is a senior associate, Rachel Seigel is a senior officer, and Adam Staveski is a senior associate with The Pew Charitable Trusts’ home financing project ##

Note: the quotation below is not part of Pew’s post.

Additional Information with More MHProNews Analysis and Commentary

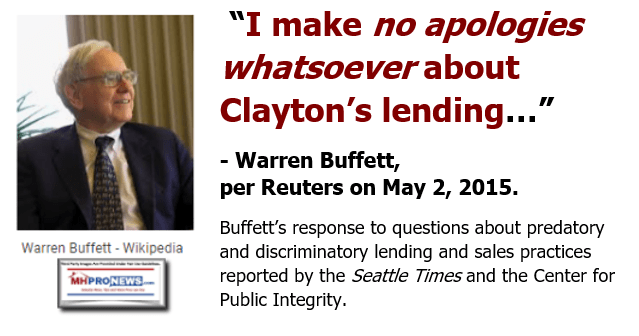

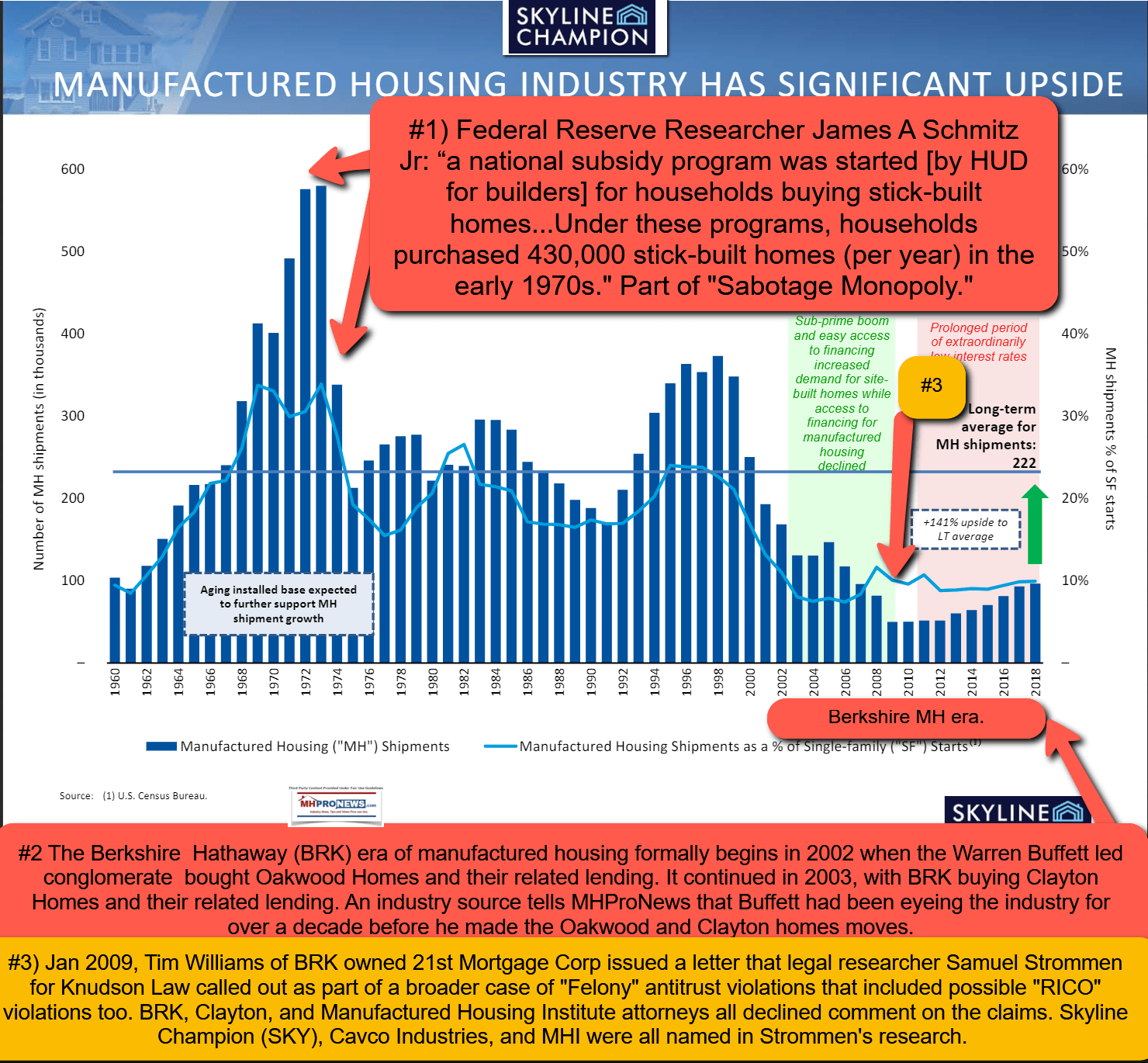

To elaborate on the background to the widely respected Pew organization, according to CRC’s Influence Watch (IW), “by 1986 liberal groups were getting three times as much money as conservative ones [from Pew], and by 1994 liberals were getting 40 times as much money from Pew as conservatives. [11]” IW also noted that “In 2003, the IRS ruled that the Pew Charitable Trusts could transform itself from seven private foundations into one public charity” and that “the action formally abolished the J. Howard Pew Freedom Trust, eliminating all the restrictions in that trust directing its grants to organizations that supported the free market.” Among the “donor organizations” listed by IW for Pew is the “Bill and Melinda Gates Foundation (Non-profit).” As longtime and detail minded readers recall, the Gates Foundation long had Warren Buffett as a trustee. Buffett is the chairman of the Berkshire Hathaway conglomerate, which includes several dominating firms in manufactured housing that are the subject matter for this Pew Research article on manufactured home financing. Berkshire-owned brands include Clayton Homes, 21st Mortgage Corporation, and Vanderbilt Mortgage and Finance (VMF).

So, while the article by Pew shown above stated that prospective manufactured home “buyers have few financing options—just a handful of lenders make the majority of what are known as personal property “chattel” loans” there is no clearly visible disclosure on the page where this cited report is posted that shed light on these possible conflicts of interest in the Pew research statement.

That noted, the report dryly referenced the Biden White House document on the Biden regime’s housing plan. As the MHProNews report and analysis below reflected, the Biden plan is an apparent failure, per the data revealed by CNN and the National Association of Realtors (NAR).

Pew’s experts further failed to mention that both Democratic and Republican administrations have for years failed to address the known causes and possible cures to the nation’s affordable housing crisis. Missing that, of course, it misses the more manufactured home specific issues that includes, but are not limited to, financing.

Several other points deserve mention in this fact check and critique. Among them, in no particular order of importance, are the following.

1). The Pew report broadly confirms statements made by Prosperity Now’s Doug Ryan on the limited number of firms operating in manufactured housing that are clearly tied to Berkshire owned brands. Ryan described their hold over the industry as a “monopoly.” While Lesli Gooch responded to Ryan’s allegation by denying that claim, the debate over that is linked below the Ryan quote. It is worth mentioning that the lock that Clayton affiliated 21st and VMF have on manufactured housing finance might best be described as the oligopoly style of monopolization.

2). The Consumer Finance Protection Bureau (CFPB) has also issued research on the manufactured housing finance market. That data is unpacked in the reports linked below, which include allegations of racial bias. Note that another Buffett-Berkshire firm was slammed earlier this year by federal action which is unpacked in the third report linked below.

3) So called ‘champions’ of leftist ideology, Buffett and Gates, are revealed upon careful scrutiny to be engaged in supporting behaviors that posture support for U.S. racial minorities, such as blacks, when upon more careful scrutiny the evidence-based case can be made that they are harming the interests of blacks. While this Buffett and Gates backed efforts includes supporting the elimination of millions of blacks while still in their mother’s wombs through the robust funding for abortion, it also has the apparent result of harming the interests of black after birth too by limiting their access to affordable housing.

While it may appear puzzling for a time, a pattern by Buffett and Gates (not to mention their affiliated organizations) of posturing support for minorities becomes evident, while simultaneously backing candidates that seem to lead the charge for defending and promoting minority rights. Genuine problems for minorities or others are allowed to fester, philanthro-feudalistic and/or government backed ‘solutions’ are offered, a modest number of souls may appear to benefit, but little or no substantive changes occur when the bigger picture is observed over time.

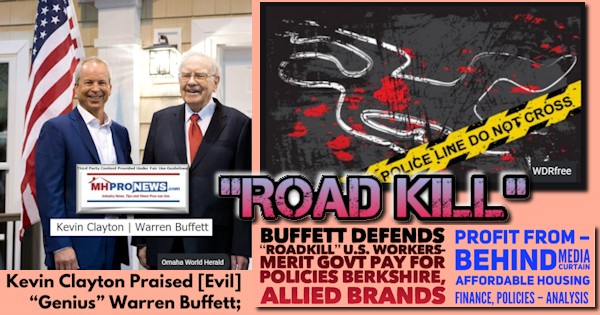

Ironically, as Warren’s son Peter Buffett admitted and the award-winning documentary drama Poverty Inc also revealed, there is a tendency for these seemingly philanthropic measures to do little or nothing to effect serious “progress” toward change. An odd paradox emerges where self-described “progressives” such as Buffett and Gates back measures, people, and policies that lock millions into dependency. Buffett has described the harm done to American employees (who some on the left describe as “workers”) by policies that ship U.S. jobs to foreign lands with fewer labor or environmental safeguards as “road kill” that merits federal support.

A pattern of serious hypocrisy begins to emerge from these facts. Support is feigned. Efforts are touted publicly by often fawning segments of the mainstream media. A lack of critical, i.e. unbiased or analytical, thinking may be evidenced. Even when genuinely useful facts – consider the evidence from Pew noted above is shown – the reports often fail in some sense to connect the dots and follow up that would be necessary to effect actual changes.

It is absurd to think that Buffett and Gates, along with others like George Soros who operate in their elite circle of ultra-wealthy philanthro-feudalists, might lack the ability to get changes to federal programs they care about. By supporting organizations from without and within the manufactured housing industry and market that they operate in through their respective investments, they create illusions that often not carefully unpacked and revealed by mainstream media who routinely bow to the advertising dollars that flow from their respective operations. Who says? That is but one of several takeaways from the award-winning Shadows of Liberty documentary drama, which is arguably as relevant today as when it was first released.

That Malcom X quote has been used more often recently by former Democrat and former CNN reporter turned WMAL satirical-news analysis pundit, Chris Plante.

While it may not apply to all cases, a common pattern could be described as follows.

- i) A genuine problem is identified – in this instance from progressive Pew, that there are few sources of manufactured home lending.

- ii) What might appear to a casual observer to be a reasonable effort toward a solution is advance – in this financing instance, the Manufactured Housing Institute (MHI) appears to take positions that support better access to FHA Title I lending. Or MHI may appear to support getting the Congressionally mandated via the Housing and Economic Recovery Act (HERA) of 2008 support for the Duty to Serve (DTS) administered by the Federal Housing and Finance Agency (FHFA), which is the primary regulator (and still conservator) of the Government Sponsored Enterprises (GSEs or Enterprises) of Fannie Mae and Freddie Mac. Note that for whatever reasons, that the Duty to Serve manufactured housing (DTS for short) was not mentioned in the Pew research memo above. MHI may posture efforts, such as letter writing, or even getting some congressional representative to read some statement in a hearing that appears to support more manufactured home personal property lending at more competitive rates.

- iii) But key pieces of information are often left out of what upon careful examination becomes an apparent case of Little or nothing changes, due in part because the full picture is not revealed. Why should this be so? Because the powers that be apparently want the status quo, for their own reasons. In the case of manufactured housing, de facto blocking more affordable lending has the result of leaving the Berkshire brands in control of wide swatches of the manufactured housing finance marketplace. Pew obliquely said as much, without naming names. Certainly, the data from the CFPB demonstrates the lock that 21st and VMF have on manufactured home lending. Because ‘gold rules,’ many will not fight whatever play Berkshire and their allies at MHI may back in the manufactured housing field. This scenario creates barriers of entry, persistence, and exit in manufactured housing.

- iv) As an investor asked MHProNews yesterday, why would Buffett et al, want to subvert the manufactured housing market? That is not only a fair inquiry, but it is also a good The reasons possible could be several, including that barriers of entry, persistence, and exit are created or enhanced by the status quo. Buffett’s Berkshire has far larger interests in conventional real estate than in manufactured housing, through Berkshire Hathaway HomeServices (BHHS), as well as through Clayton’s own growth in site-builders in recent years. Berkshire can from their own vantage point ‘grow’ in market share by limiting a market. Who says? Buffett ally William “Bill’ Gates III. See the previously quoted and insightful remark that Gates made, as cited by CNBC.

![DidntWantToMeetWarren[Buffett]BecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2020/07/DidntWantToMeetWarrenBuffettBecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews.jpg)

- v) in the way of more direct evidence is 21st Mortgage Corporation’s president and CEO, Tim Williams remarks at a meeting at MHI. Said Williams of DTS to those in the meeting room, he was glad that their pilot project failed. Note that Williams-led 21st is one of the few lenders that have the authority under the current FHA-Ginnie Mae 10/10 standards to issue an FHA Title I loan. Yet, reportedly 21st stopped making those loans a few years ago. According to MHI in a recent statement, only 5 FHA Title 1 loans were made in recent years, when some years ago, the numbers used to be in the thousands of such loans issued annually. Intentional or not, that’s a backhanded slam on Berkshire brands, not just the federal agency involved.

- vi) Restated for emphasis and clarity, there is practically nothing keeping Berkshire owned brands from making more FHA Title I loans on HUD Code manufactured homes right now. 21st and VMF don’t have to wait for a federal policy change, if they don’t want to do so. Reportedly, one or two other lenders involved in MHI also have the technical ability to issue FHA Title I loans. Nevertheless, collectively only 5 such loans were made in a year between perhaps 4 possible lenders?

So, to the very apt points that Pew raised above, lead to a startling set of facts they did not mention. There is little such competitive lending in manufactured housing due to factors that key MHI member brands, including, but not limited to those owned by Berkshire Hathaway, could almost immediately change. Additionally, they have the political, financial, and legal resources necessary to effect changes at the federal level if they sow desired.

The obvious conclusion must be that the status quo is preferred by these dominating brands. It is fine by them if others – including nonprofits like Pew, or groups such as MHAction and/or their coalition partners – make statements that seem to point a finger at Berkshire and their allies. What is apparently not okay is that any such talk or discussions about better financing options leads to a change that in fact alters the landscape that they the string pullers have themselves created.

As a relevant footnotes to this are the efforts by MHARR in recent years to press for changes that in fact would result in more competitive manufactured home lending, which would in turn result in more manufactured home sales, per Pew and others such as the Urban Institute (UI).

Subverting the manufactured housing marketplace is the de facto and largely unstated policy of Berkshire brands and MHI. While Berkshire might get away with it, so to speak, MHI has its own unique dilemma as a result of this outlined and well documented pattern.

- A) If MHI leaders sincerely wanted to see more lending, why not use their legal resource to sue to get various existing laws, such as DTS enforced?

- B) If MHI leaders sincerely wanted to see more competitive lending, why didn’t they sign onto the coalition letter to FHFA’s Sandra Thompson?

- C) If MHI sincerely wanted to see more competitive lending, why have the eschewed teaming up with MHARR in an authentic fashion? Why have MHI instead publicly embraced working with conventional housing organizations? And more to the point, why have those housing coalition allies of MHI failed to deliver any meaningful support on issues that MHI claims they care about?

Be it Pew, the Urban Institute, or others that appear to have clear ties to the philanthro-capitalistic interests of Berkshire Hathaway (e.g.: Gates owns a large block of Berkshire shares, and the Gates Foundation has a large block of Berkshire shares too), posturing and paltering appear acceptable. But why then do they fail to reveal the type of well documented insights shown herein?

That’s the nature of paltering. That’s the type of kabuki theatrics that manages to hide the truth which informed minds willing to look squarely at the facts and trends in behavior can see exists in plain view. MHI does not effectively press for more competitive financing changes, much as Doug Ryan and MHARR have each long alleged. MHI’s Clayton supported and MHI branded CrossModTM is floundering, as MHI is beginning to admit after years of exposes by MHProNews on that topic.

There is plenty of talk, talk, talk, along with words on pages in letters that get no apparent traction. But the meaningful efforts that could be obtained if MHI’s puppet masters actually wanted to see more competitive financing and more manufactured home sales are lacking.

If there is good news it is that this pattern has become so well documented that MHI corporate and staff leaders, and their outside attorneys, have declined to discuss the matter with MHProNews repeatedly. Instead, what MHI leaders and attorneys have done is duck accountability publicly.

The problem this creates for MHI is this. They apparently falsely claim to be working for “all segments” of the industry. The reality is that this pattern fosters consolidation. That consolidation in turn results in more money for the Berkshire allies at MHI. Some of that consolidation has been apparently at the expense of MHI critic, MHARR in as much as a firm may be bought that then ceases to support MHARR, or in the case of Lexington Homes, magically ceases to exist during an affordable housing crisis.

These are issues that could involve legal breaches of antitrust, RICO, or securities laws, among others. Some of those breaches may be civil as well as criminal.

Summary and Conclusion

Democrats – and the special interests behind Democrats – have held the leadership reigns in Congress for the bulk of the last two years. They have controlled the White House and the federal bureaucracy too. Despite the happy talk, routine references to the Biden (or Biden appointee led agency) Housing plans (see Pew above), and the related rosy promises, where is the progress on any of the issues that manufactured housing or affordable housing advocates claim interest in?

Indeed, what has been proven time and again is the accuracy of the reports and analysis that are linked herein. Perhaps that factual and demonstrable accuracy is why MHI and their dominating brands, that include the Berkshire lenders, 21st and VMF, duck directly engaging with MHProNews’ analysis. That said, they have on several occasions, after a period of time following MHARR or MHProNews/MHLivingNews revealtions, been forced to pivot.

With state attorneys general, treasurers, and an incoming House Republican leadership, the possibility of a different type of probe and steps with more bite could be looming. After all, when corporations increasingly threw down on the Democratic (and some Establishment Republicans) side of the aisle, that left so-called MAGA or America First Republicans increasingly embracing populist causes. Will manufactured housing be included in that? Time will tell. But the signals of meaningful changes with financial bite are revealed in the reports that follow. ##

As a postscript, these are additional reasons why there could be more legal efforts that are aimed at some key MHI member brands. See that fact-packed analysis in the report linked below.

Again, our thanks to free email subscribers, all readers like you, our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.