Facts and evidence are important for investors, affordable housing consumers, public officials, and manufactured home industry professionals. Absent accurate information, people from a variety of interest groups can make problematic or even costly decisions. This report will open with a series of direct quotes from an informed source with clear ties to the Manufactured Housing Institute (MHI). It will then pivot to data-related claims by Cavco Industries (CVCO) and MHI. In yet another segment, recently announced and already settled claims against Cavco Industries and/or their prior or current officials are explored. Linked related reports round out a robust smorgasbord of facts vs. claims that have or could once again arguably lead to harm for those invested in or otherwise relying upon Cavco Industries statement or those made by MHI.

MHProNews’ emailed inquiry and replies thread to the previously mentioned MHI insider is shown below.

Please advise, thanks.

Tony …”

The emailed reply came in swiftly.

“Definitely not on the record. What do you have in mind?”

The MHProNews reply?

MHI’s email has this:

Find Manufactured Home Communities Near You

Did you know 51% of new manufactured homes are placed in communities? Learn more about the industry by visiting MHI’s Manufactured Housing Communities in the U.S. map. Click here.

The ‘click here’ is to their [member only] info. If there is more data (I’m not so much thinking of the map), that is what is of interest at this time.

LMK, thanks…”

That MHI connected source declined further comment.

As a tip to media or researchers looking into MHVille, when fear and/or deception are all too often afoot, there are times when it pays to test out a possible new source for information about MHI, key member brands, or from within MHI, by asking a question — even if you have the requested information already in hand. As a close reading of what follows should suggest to objective minds, one must learn over time – often through trial and error – who in MHVille can be trusted and who is not a routinely trustworthy source for MHI and manufactured home industry related information.

That said, here is an example of what MHI said in a document of their published in 2020.

- “63% of new manufactured homes are placed on private property and 37%are placed in manufactured home communities.” That is per a 7.2020 post on MHI’s own website.

From a document on MHI’s website dated 4.2022 named by MHI as “Industry Quick Facts” is the following remark.

- “49% of new manufactured homes are placed on private property and 51% are placed in manufactured home communities.”

That’s a sizable swing, given that for some years MHI has indicated that placements into communities were about 1/3 of all new manufactured homes produced. Note further below, also per MHI’s own information, that the Arlington, VA based trade group have contradicted themselves on some of the statements made herein. Similarly, Cavco (CVCO) has also provided seemingly contradictory information on supposedly factual information.

Oddly, against that backdrop, just days ago MarketScreener attributed the following to Cavco Industries, a prominent MHI member. “Approximately 30% of manufactured homes go into land-lease communities where families can either rent a home or own the home they place on land that they lease from the operator.”

Cavco’s statement in that segment went on as follows: “In recent years, high-profile situations in which investors have purchased communities and then significantly raised the land-lease cost have caught the attention of policymakers. The industry’s intention has been to put the high-profile situations in context. These situations are clearly isolated and rare. MHI conducted studies showing that the average rent increases have been in the 1-4% range, and the vast majority of those living in manufactured housing communities are very happy with the lifestyle and affordability.” MHProNews has documented that concern about sharp jumps in site fees in investor acquired communities in a range of reports, including the ones linked below as examples.

That partial list of 2022 related reports on the topic of land lease communities focused controversies stands in stark contrast to the quoted claims by Cavco made to investors. Despite Cavco and MHI’s respective claims, they are apparently out-of-touch with well-publicized allegations and known facts. Nor is there clear evidence that MHI has done anything substantive, as examples linked herein reflect, repeating Cavco’s unusual claim cited above. Namely, “These situations are clearly isolated and rare. MHI conducted studies showing that the average rent increases have been in the 1-4% range, and the vast majority of those living in manufactured housing communities are very happy with the lifestyle and affordability.” MHProNews has documented that concern about sharp jumps in site fees in investor acquired communities in a range of reports, including the ones linked below as examples.”

Notice: in many devices and browsers the image below can be expanded.

Click the image and follow the prompts.

Put differently, there are several apparently contradictory claims being made. Yet SEC requirements make a publicly traded firm responsible for the accuracy – at least at the time ‘facts’ are made – regarding statements that may influence investors.

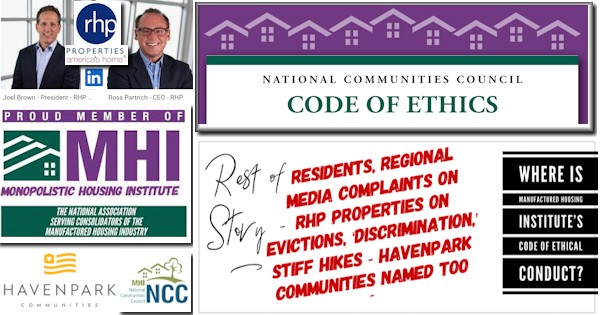

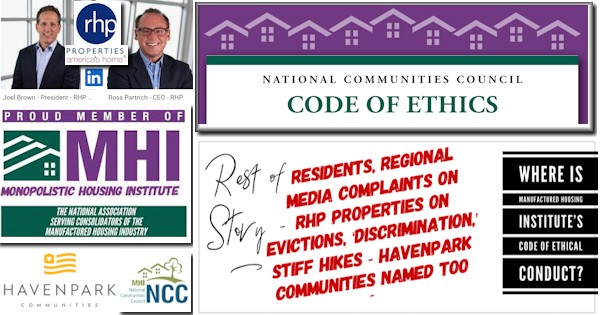

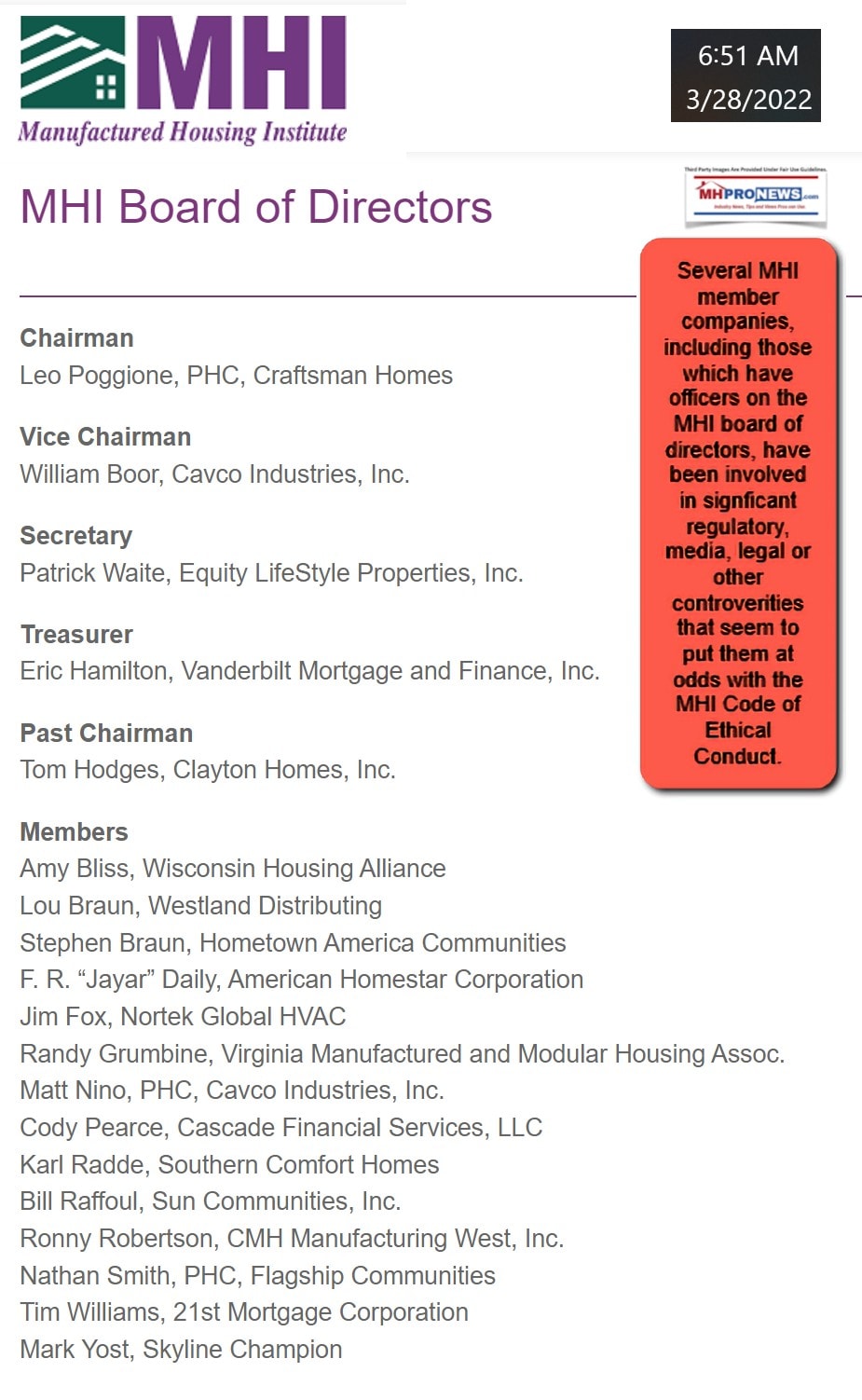

Given that Cavco has effectively at least two executive committee level positions on the main MHI board of directors and given months of reports on MHProNews that highlight months of mainstream media articles on these topics, plus Cavco’s obvious ability to read directly from the mainstream reports that appear to show a problematic patterns of behavior that violate the so-called MHI-NCC code of ethical conduct it is not only odd at best.

Note that not only does MHI have attorneys that have said they monitor our site, but per well-placed sources to MHProNews, insiders at Cavco are apparently routine readers of our websites too. Beyond those insider tips, it could arguably be a case of failure to perform their basic duties on behalf of shareholders for Cavco officials to ignore reports on this, the largest and most read trade media platform in the manufactured home industry. Put differently, it is difficult to reconcile the claims made by Cavco on some of the issues raised above or further below and the evidence-based point that they ought to know better. That raises the question, why have they put out questionable if not erroneous information that may influence investors or others?

Additionally, these self-contradictory factual claims may cross a line with SEC and other federal statutes for Cavco to say something so outrageously inaccurate to investors in mid-June. Then more recently, for whatever reason(s), the corporate claims were republished by MarketScreener in mid-September 2022. As Cavco is supposedly, per their own statements, reaching a possible deal with the SEC, is this an example of why they should be trusted by public officials and/or investors – or does it rather reflect why they are not trustworthy?

To round out the picture of just how disconnected MHI, and some of their leading members are in their public pronouncements, the MHI document that MarketScreener mentioned, but did not link to, is also found on the Cavco website for investors. That MHI document linked by Cavco oddly doesn’t say much about the apparent violations of MHI member firms of the MHI/NCC Code of Ethical Conduct. See that MHI document referenced by Cavco at this link here.

Here is part of what that MHI document said (highlighting added by MHProNews):

HUD Should Support Preservation of Land-Lease Communities

There are more than 43,000 land-lease communities in the country with almost 4.3 million homesites. Today, 27 percent of new manufactured homes are placed in land-lease communities. Land-lease communities are critically important to the availability of affordable housing in America, and we believe HUD can support increasing and preserving this attainable homeownership option for more families.

- Federal policies should encourage capital investment into land-lease communities to increase the supply of quality affordable homeownership options.

- Federal support for the preservation of communities is the right approach.

- Federal programs should allow all eligible community owners to obtain financing to preserve manufactured housing communities.

ACTION REQUESTED

Federal efforts to preserve and develop manufactured housing communities should include all eligible homeownership types. …. ##

Let’s recap point-for-point the percentage of homes, the various self-contradictory claims made by Cavco and MHI in the roughly 1700-word outline above, that directly quoted those CVCO corporate and national association sources.

Per Cavco:

- “Approximately 30% of manufactured homes go into land-lease communities where families can either rent a home or own the home they place on land that they lease from the operator.”

Cavco linking MHI’s document:

- “Today, 27 percent of new manufactured homes are placed in land-lease communities.”

MHI statement in 2020 from their own website:

- “63% of new manufactured homes are placed on private property and 37%are placed in manufactured home communities.”

Another MHI document in 2021 said the following.

- “69% of new manufactured homes are placed on private property and 31% are placed in manufactured home communities.”

Then a 2022 dated upload on the MHI website said this.

- “49% of new manufactured homes are placed on private property and 51% are placed in manufactured home communities.”

Those factual claims are ‘all over’ the proverbial map. While some of them may be true, all of them can’t be true as of the date that Cavco and/or MHI presented this information to CVCO’s potential investors and shareholders.

Why does that matter? Several reasons.

Among them, if the market share of manufactured homes going into land lease communities claimed by MHI for 2022 is accurate – meaning 49 percent of homes go on to privately owned land, but a whopping 51 percent are going into a land-lease, that may spell a near future downturn for manufactured home producers. Why? Because manufactured home communities and so called “mobile home parks’ are in many markets at or near capacity.

Given that the trend in the 21st century has been for more community closures than openings, the claimed mix of product going from factories into land lease communities vs. onto private property ought to be a warning sign for savvy investors.

If a large share of Cavco’s production is going into land-leases, and those land lease orders begin to dry up in the foreseeable future, that is information that investors arguably ought to know about.

Additionally, as noted, the Lincoln Institute for Land Policy has made their own estimates for land-lease communities that material differ from the claims made by MHI. To learn more, see the report linked below.

MHProNews has for years mentioned this disconnect between MHI claims, that of MHI member MHVillage/MHInsider, and that of others. It would be incumbent upon Cavco’s leaders to know this vital information. As an example of why this is an issue, fellow MHI member Legacy Housing’s executive chairman, Curt Hodgson, J.D., made the following statement during a quarterly report to investors.

Interestingly, this remark by Hodgson highlights another aspect of this thorny issue.

Nor is this hyperbole, which MHProNews routinely eschews in most reports, save as periodic satire. As evidence of the concerns over claims of fraud and/or violations of federal securities laws are the following.

Recently Announced Third Party Legal Investigation of Cavco Industries

Per AccessWire, is the following dated July 21,2022.

…

The investigation concerns whether Cavco and certain of its officers and/or directors have violated federal securities laws.

On November 8, 2018, Cavco disclosed in an SEC filing that it had “received a subpoena from the SEC’s Division of Enforcement requesting certain documents relating to, among other items, trading in the stock of another public company.” Following this news, Cavco stock dropped $49.48 per share, or over 23%, to close at $165.20 on November 9, 2018.

On February 4, 2019, Cavco announced that it had received requests for additional documents and that it spent, and expected to spend, millions of dollars on legal and insurance expenses in relation to the SEC’s subpoenas and its independent investigation. Following this news, Cavco stock dropped $26.92 per share, or about 16.7%, to close at $134.37 on February 5, 2019.

Then, on September 2, 2021, the SEC filed a complaint against Cavco, former CEO Joseph Stegmayer, and former CFO and Chief Compliance Officer Daniel Urness, alleging that Stegmayer and Urness caused Cavco to purchase shares of publicly traded companies on material non-public information. Following this news, Cavco stock dropped $6.59 per share, or about 2.5%, to close at $252.48 on September 3, 2021

If you are aware of any facts relating to this investigation or purchased Cavco shares, you can assist this investigation by visiting the firm’s site: www.bgandg.com/cvco. You can also contact Peretz Bronstein or his law clerk and client relations manager, Yael Nathanson of Bronstein, Gewirtz & Grossman, LLC: 212-697-6484.

Bronstein, Gewirtz & Grossman, LLC represents investors in securities fraud class actions and shareholder derivative suits. The firm has recovered hundreds of millions of dollars for investors nationwide. Attorney advertising. Prior results do not guarantee similar outcomes.

Contact:

Bronstein, Gewirtz & Grossman, LLC

Peretz Bronstein or Yael Nathanson

212-697-6484 | info@bgandg.com ##

From PR NewsWire on by Rosen Law Firm, P.A., announcing a probe of Cavco Industries, Inc. on Jul 22, 2022 is the following.

SO WHAT:If you purchased Cavco securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

WHAT TO DO NEXT: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=7555 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email pkim@rosenlegal.com or cases@rosenlegal.com for information on the class action. ##

Then, while it was from 2021, the following settlement announcements by the SEC with some of those actors who allegedly violated federal laws and/or regulations was the following.

The SEC official statement sheds further light on the apparent pattern of behavior by Cavco during and since what might be called the “Stegmayer” era of that firm. Note that Stegmayer said he was a former Clayton Homes division president in an interview linked here.

Litigation Release No. 25196 / September 3, 2021

Securities and Exchange Commission v. Cavco Industries, Inc., Joseph Stegmayer, and Daniel Urness, No. 21-cv-01507 (D. Ariz. filed September 2, 2021)

Securities and Exchange Commission v. Robert Scott Parkhurst, No. 21-cv-00657 (N.D. Ind. filed September 2, 2021)

The Securities and Exchange Commission announced insider trading charges against Arizona-based Cavco Industries, Inc., and its former CEO, Joseph Stegmayer. It also brought internal accounting control charges against Cavco, Stegmayer, and Cavco’s former CFO, Daniel Urness. The SEC also charged Stegmayer and Urness with misleading Cavco’s auditor about the trading and a related investigation.

According to the SEC’s complaint, filed in the United States District Court for the District of Arizona, Cavco, at Stegmayer’s direction, used material, non-public information obtained through merger discussions with another public company, Skyline Corp., to trade in Skyline securities. Ultimately, Skyline announced a merger with a different company, which increased Skyline’s stock price by 48% and resulted in alleged gains for Cavco of approximately $260,000. Additionally, the complaint alleges that after Cavco received an SEC subpoena concerning the Skyline trading, Stegmayer sold over 11,000 Cavco shares that he personally owned. After news of the SEC investigation and the Skyline trading came out, Cavco’s share price decreased by 23%. The complaint alleges that by selling stock in advance of this news, Stegmayer avoided losses of over $880,000.

In addition, the SEC’s complaint alleges that Cavco failed to devise a system of internal accounting controls sufficient to provide reasonable assurance that its securities trading would be executed in accordance with its board’s authorization, its corporate investment policy, and its securities trading policy, and that Stegmayer and Urness aided and abetted that failure. The complaint further alleges that Stegmayer circumvented and/or failed to implement the few controls that were in place by causing Cavco to trade in shares of Skyline and of other companies that Cavco was interested in acquiring, all without board knowledge. The SEC also alleges that Urness circumvented and/or failed to implement Cavco’s investment policy by setting up a system to fund the trades without informing the board or ensuring the trades complied with that policy. The complaint further alleges that Stegmayer and Urness knowingly misled Cavco’s auditors with respect to the Skyline trading and an ongoing Financial Industry Regulatory Authority (FINRA) investigation into those trades.

The SEC’s complaint alleges that Cavco violated Sections 10(b) and 13(b)(2)(B) of the Securities and Exchange Act of 1934 (“Exchange Act”) and Rule 10b-5 thereunder; that Stegmayer violated Section 17(a) of the Securities Act of 1933 (“Securities Act”), Sections 10(b) and 13(b)(5) of the Exchange Act, and Rules 10b-5 and 13b2-2(a) thereunder and aided and abetted Cavco’s violation of Section 13(b)(2)(B) of the Exchange Act; and that Urness violated Section 13(b)(5) of the Exchange Act and Rule 13b2-2(a) thereunder and aided and abetted Cavco’s violation of Section 13(b)(2)(B) of the Exchange Act. Without admitting or denying the allegations, Stegmayer consented to the entry of judgment, subject to court approval, that permanently enjoins him from violating the charged provisions, bars him from serving as an officer or director of a public company for 5 years, and orders him to pay a civil penalty of $1.48 million.

The Commission also announced insider trading charges against Robert Scott Parkhurst, an Indiana resident and former national sales manager at Skyline. According to the SEC’s complaint, filed in the United States District Court for the Northern District of Indiana, Parkhurst obtained material, non-public information about Skyline’s merger discussions through his role as national sales manager at Skyline. The SEC alleges that Parkhurst traded on the basis of that material, non-public information and also tipped his father and son. After the merger news was publicly released, Parkhurst had gains of approximately $4,893, and his father and son of $6,210. Without admitting or denying the allegations, Parkhurst consented to the entry of judgment, subject to court approval, that permanently enjoins him from violating the antifraud provisions of Section 10(b) of the Securities and Exchange Act of 1934 and Rule 10b-5 thereunder and orders him to pay a civil penalty of $15,995.

The SEC’s investigation was conducted by Jasmine M. Starr and Lorraine Pearson and supervised by Finola H. Manvelian and Rhoda Chang of the Los Angeles Regional Office. The SEC’s litigation will be led by Daniel O. Blau and supervised by Amy J. Longo. The SEC appreciates the assistance of FINRA in this matter. ##

Additional Information with More MHProNews Analysis and Commentary in Brief

From the so-called MHI produced 2022 “Quick Facts” are the following data claims.

| 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | |||

| New Manufactured Homes | ||||||||||

| (For Residential Use) | ||||||||||

| Located in Communities | 51% | 27% | 31% | 37% | 32% | 34% | 34% | 33% | ||

| Located on Private Property | 49% | 73% | 69% | 63% | 68% | 66% | 66% | 67% | ||

| Titled as Personal Property | 77% | 78% | 76% | 77% | 76% | 77% | 80% | 80% | ||

| Titled as Real Estate | 19% | 19% | 19% | 17% | 17% | 17% | 14% | 13% | ||

| Above Per MHI’s 2021 | ||||||||||

| Industry “Quick Facts” | ||||||||||

| MHProNews Note 1: that there are apparent contradictions between the above and MHI ‘facts’ | ||||||||||

| from the same and other so-called MHI “Quick Facts.” | ||||||||||

| MHProNews Note 2: In how homes were titled there is no explanation by MHI on why the two last columns | ||||||||||

| do not total 100 percent. | ||||||||||

MHProNews and our MHLivingNews sister site have often been essentially alone among MHVille trade media and bloggers in producing often detailed fact checks, reporting on the evidence of problematic and at times apparently erroneous information, plus evidence of seemingly corrupt behavior by the Arlington, VA based trade group.

There are obvious implications for the industry’s professionals, investors, consumers, public officials, and others of the unfolding history of events on the Cavco-Stegmayer, et al saga and the issued at MHI.

In some cases, expert eyes are useful in unpacking the disconnects between corporate and association statements for accuracy and/or apparent contradictions. But with sufficient time and objective research, others could develop the skills to spot the MHI-Cavco and “big three” and their MHC REIT allies apparent duplicity.

This article, and several linked herein, routinely look at the source documents and claims, and then compare them to other claims from the same or different sources. That’s a common-sense approach for discerning the truth from mere posturing or pretty sounding but nevertheless paltering or falsely projecting claims.

The bottom line? Federal and/or state officials, before or after the looming midterm elections, ought to announce and launch a formal probe of the Manufactured Housing Institute (MHI), and several of their higher profile member-firms, which should include Cavco Industries (CVCO). Who says such a thing, based on evidence and the law? Samuel Strommen, with Knudson Law.

Stay tuned to MHProNews and MHLivingNews for further developments. ##

Again, our thanks to free email subscribers and all readers like you, our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.