Money Made, Celebrity Net Worth and The Street each provided an estimate of Kevin O’Leary’s net worth as about $400 million dollars in 2023 reports. According to the first source: “Kevin O’Leary is a Canadian businessman, investor, and television personality with a net worth of $400 million from ventures like SoftKey and Shark Tank.” O’Leary recently made headlines with remarks about what’s ahead and his advice that included the importance of real estate – or more broadly – housing as being part of an individual’s or family’s financial plan. This writer for MHProNews asked Bing AI to digest several reports from MSN on 12.6.2023, including one featuring O’Leary.

Here is what Bing AI had to say in response.

…

- Kevin O’Leary, an investor and star of “Shark Tank,” recently made headlines based on an interview with Fox Business, stating that we should expect a “downsized America” due to the rate of inflation and the current state of the economy. He suggests that people should prepare for this by investing in assets that are not tied to the US dollar, such as gold, silver, and real estate1.

- According to Zillow, the US housing market is expected to see more homes for sale and improved affordability in 2024. However, buying a home will remain expensive, keeping pressure on the rental market to cater to families that will be renting longer than previous generations typically were. Many of those who do buy will turn to homes that need some work, and do-it-yourself upgrades and repairs will keep new homeowners busy2.

- JPMorgan’s top charts guru, Jason Hunter, predicts that the S&P 500 will plunge to around 3,500 points by next summer, and says the “odds are stacked in favor of a hard landing.” He also predicts that the US economy will sink into recession by mid-20243.

- A recent article on MSN highlights that America is no longer the land of opportunity, with a child’s life chances being more dependent on the income of his or her parents than in Europe, or any other of the advanced industrial countries for which there are data4.

- Moody’s has slashed its credit outlook for China’s battered economy, citing the country’s “weaker-than-expected economic recovery” and “rising debt levels.” This is the latest blow to China’s economy, which has been struggling with a slowdown in growth and rising debt levels5.

- Six US states saw their economies shrink in the second quarter, according to a recent report from the Bureau of Economic Analysis. The states that saw the biggest declines were Hawaii, New Mexico, New York, North Dakota, Oklahoma, and Wyoming6.

- David Malpass, former World Bank president, recently stated that the Federal Reserve has “basically become a giant hedge fund” due to its massive balance sheet and the amount of assets it has purchased. He also expressed concern about the Fed’s ability to unwind its balance sheet without causing a market crash7.

- A recent article on MSN highlights the human cost of the affordability crisis in the US housing market. The article discusses how the high cost of housing is forcing people to make difficult choices, such as living in unsafe or unhealthy conditions, or sacrificing other basic needs like food and healthcare8.

I hope this summary helps you. Let me know if you have any questions or if there is anything else I can help you with. …”

Each of these topics has potential implications for HUD Code manufactured housing. So, as 2023 winds down, and 2024 looms, what are the factors that are keeping manufactured housing from achieving its potential?

Part I – Per Bing AI – Manufactured Housing Potential is “Mixed”

In response to an inquiry by this writer, Bing AI said the following on 12.6.2023 at about 3:30 AM ET.

Learn more:

> “Congress has passed several laws over the years that were supposed to benefit HUD Code manufactured housing. Yet, the production of manufactured housing has fallen since – for example – the Manufactured Housing Improvement Act of 2000 was made law. The Housing and Economic Recovery Act of 2008 was suppossed to help restore the lending lost in the late 1990s and early 2000s to the manufactured home sector. Can you shed light on factors that kept those laws from functioning as intended by bipartisan legislation?”

The Housing and Economic Recovery Act of 2008 was intended to help restore lending to the manufactured home sector, which had been hit hard by the subprime mortgage crisis 3. However, the law did not provide enough support to the industry to help it recover fully, and many lenders remain hesitant to provide financing for manufactured homes 3. …

“Realizing that there are regional variations to consider, what percentage of the population can afford to buy a new conventional house, based on average earnings and average prices throughout the U.S.?”

Learn more:

Part II – Additional Information with More MHProNews Analysis and Commentary

For some years, Bob Crawford was the leader at historic Dick Moore Housing. Crawford remarked that ‘if we keep doing what we’ve been doing, we’ll keep getting what we’ve got.’

Among the factors that Bing AI has identified in Q&A’s this morning, and in prior sessions as well, is the ‘stigma’ or image issue. As MHProNews has periodically observed, the Manufactured Housing Institute commissioned what became the Roper Report earlier this century. Its results were sobering, but in one sense, hopeful. They pointed out the tremendous opportunities possible by addressing the image issue. But did the Manufactured Housing Institute (MHI) implement the plan that they themselves commissioned? Per Bing AI:

That confirms MHProNews’ own findings into that topic.

> “In a video with transcript linked here https://www.manufacturedhomepronews.com/warren-buffetts-pledge-to-kevin-clayton-you-can-access-plenty-of-capital-for-projects-quotes-facts-video-transcript-and-implications-for-manufactured-housing/ Kevin Clayton said that the manufactured housing industry as ready in 2011 to launch a national image and education campaign akin to the successful GoRVing campaign used by the RV industry. Can you find any evidence that the manufactured housing industry or the Manufactured Housing Institute has launched a national campaign like Kevin Clayton suggested was pending?

According to a pull quote from Bing AI: “You are correct that the Manufactured Housing Mythbusters document is available on Manufactured Home Living News1. I could not find any evidence that the document is available on the Manufactured Housing Institute’s website 1.” It seems that outside of Freddie Mac’s website, MHProNews, and MHLivingNews, that document is not to be found in the circle of sources associated with MHI.

Perhaps more encouraging is this next research document, also by Freddie Mac. Despite what MHI themselves said about this topic, that only 9 percent of those asked would consider a manufactured home, Freddie Mac has apparently contradicted MHI in a positive way. Meaning, most consumers would consider buying or purchasing a manufactured home, said Freddie Mac. The results were about 6 times higher, per Freddie Mac than MHI.

While MHI was busy creating a tool to show “members only” how many places people could be barred by zoning barriers, Freddie Mac took a more positive spin. They identified potentially millions of Americans who are “mortgage ready” and live in places that were “manufactured home ready.”

Certainly, one could look at reams of research and related remarks that indicate the headaches and heartaches that image/zoning/financing barriers are causing the manufactured home industry. Three examples follow.

But the bottom line is that there are common sense steps that could be taken to resolve these issues. Which begs the question. Then why is manufactured housing in a 1 year of month-over-month slowdowns?

Up to this point, the “Word count” in the software this post is being written in states that there are some 1800 words (1783 words) typed. That doesn’t count the images. Per a Google search: “The average reader will read 1,800 words in 6 minutes…” In 6 minutes, someone could have a sense of the reasons why manufactured housing ought to be soaring. But nevertheless, the industry is in reverse.

“The manufactured home…for tens of millions of Americans today—a great many of whom hail from the lowest socioeconomic stratum, it is a way of life, the only affordable living situation available, and the only means of achieving home ownership,” said Samuel “Sam” Strommen, now J.D., in a detailed research report linked here. “Here, in the midst of what could be declared without the merest hint of shame or irony one of the most comprehensive affordable housing gluts in American history, pernicious forces are skulking in the [backdrop]: consolidating power, subsuming an industry rife with lack of oversight, and preying upon the vulnerability of the impoverished in a gross, incestuous symbiosis.”

“The aim of this paper is thus: to expose a number of antitrust violations—both blatant and subtle—in the form of the increasing monopolization of the manufacturing, financing, and the increasingly consolidating landlords, and to call for reforms within this industry,” said Strommen in his research report for Knudson Law. “Part of the problem is that manufactured homes go by a number of different aliases: colloquially, they are known as trailers or mobile homes. This is a misnomer.” In a few dozen words, Strommen essentially identified the need that the Roper research and Kevin Clayton (see above) were talking about. There was no need for a 6-figures or more research study of consumers. Strommen, an outsider looking into the world of manufactured housing, could see the problem clearly. He elaborated as follows.

The United States today faces

Let’s pause there to observe that the odds are good that likely thousands of manufactured home professionals may not have known that Fannie Mae and Freddie Mac “two Government Sponsored Entities (GSEs)” were once active in manufactured home personal property lending, but no longer are. Unless someone is a regular and detail minded reader of MHProNews/MHLivingNews, they may never be exposed to such information from anyone in the Manufactured Housing Institute (MHI) orbit.

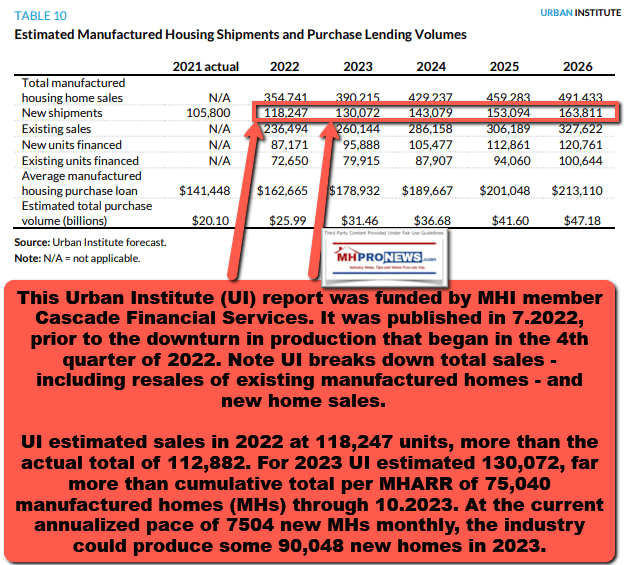

It is oddly almost as if MHI is trying to keep the history and past achievements of this industry obscured. In yesterday’s report, MHProNews referenced the graphic below. That research was funded by an MHI member. Why can that research be found on MHLivingNews and MHProNews, but not on MHI or so many other MHI affiliated websites?

Hold those thoughts, and let’s return to Strommen’s thesis.

Buffett’s own words on his business strategy provide valuable insight into Clayton Homes’ strategy in this sector: “A good business is like a strong castle with a deep moat around it,” Buffett said on a CNBC broadcast, “I want sharks in the moat. I want it to be untouchable.”37 In this analogy, the castle would be the business he has invested in, fortified and standing safe from outside attack. The shark-filled moat is representative of the litany of additional deterrents Buffett-led Berkshire Hathaway has at its disposal to ward off nascent competitors as well as regulators.

In 2002, prior to Berkshire Hathaway’s acquisition of Clayton Homes, there were 88 manufacturers scattered across the United States.38 Today, the number has fallen to less than half that.39 A report from the now-defunct Manufactured Home Merchandiser publication indicates that in 2003, Clayton was the third largest manufactured home fabricator40 in the United States, and at that time, the top twenty-five manufacturers accounted for 78% of all home production and sales.41 Today, Clayton, Skyline-Champion, and Cavco [Industries], the top three, account for some 80% market share combined.42 Clayton alone comprises about 51% of manufactured home production.43 A series of mergers and acquisitions has made this industry increasingly consolidated.”

Lori Hough, one of the vice presidents of Clayton “competitor” Skyline Champion, stated in a shareholder conference call that her company was focused principally on mergers and acquisitions as its primary method of growth.47 Moreover, since 2009, a pivotal year in the industry, Clayton itself has gone on to acquire the following companies: Schult, Crest, Karsten, Golden West, Norris, Giles, Marlette, SE, Buccaneer, A and Cavalier Homes.48 Cavco [Industries], a third member of the industry’s “Big 3” has, over the same time span, acquired Destiny, Lexington, Fairmont, Chariot Eagle, Palm Harbor, A and Fleetwood Homes.49

Clayton’s conduct here could be construed as a potential violation of Section 2 of the Sherman Antitrust Act, which states in part: “Every person who shall monopolize, or attempt to monopolize, or combine or conspire with any other person or persons, to monopolize any part of the trade or commerce among the several States, or with foreign nations, shall be deemed guilty of a felony[.]” While monopoly status has yet to be attained, Clayton’s growth over the past 17 years has been meteoric: Clayton’s market share has gone from a paltry 13.9%51 to a commanding estimated 51%.52 The number of firms they and the two other industry leaders have either acquired, merged with, or squeezed out has pushed down the total number of competitors in production-sector of the industry virtually since its inception.

In addition to potentially constituting a violation of Section 2 of the Sherman Act, this may also constitute a separate violation of Section 18 of the Clayton act, which states:

“No person engaged in commerce or in any activity affecting commerce shall acquire, directly or indirectly, the whole or any part of the stock or other share capital and no person subject to the jurisdiction of the Federal Trade Commission shall acquire the whole or any part of the assets of another person engaged also in commerce or in any activity affecting commerce, where in any line of commerce or in any activity affecting commerce in any section of the country, the effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly.”53

Here, it would appear that Clayton Homes, Cavco Industries, and Skyline Champion are doing just that: In 2003, when Berkshire Hathaway purchased Clayton Homes, Champion was the largest manufactured home builder.54 Skyline was the fifth largest, and the two companies have now merged.55 Of the top twenty-five largest manufactured home builders in 2003, Clayton itself purchased or merged with Oakwood, the fourth largest,56 Cavalier, the seventh largest,57 Southern Energy, the ninth largest,58 and Golden West, the fifteenth largest.59 Cavco at the time was the twelfth largest,60 has since merged with or acquired Fleetwood Homes, which was previously the second largest,61 Palm Harbor, the sixth largest,62 and Fairmont, the tenth largest.63 What was previously a top ten has amalgamated into a top three. What the industry has presented as apotheosis is closer to apoptosis.

While a precise history of the industry’s mergers, acquisitions, and outright failure of competition is less than perfectly discernible, it is quite clear that the year 2009 had a devastating impact on competition. It was in this year that 21st Mortgage Corporation…, a Clayton Homes sister-brand and Berkshire Hathaway subsidiary that provides financing within the industry to independent retailers, sent out a letter to its retailers indicating that it was no longer capable of finding sufficient sources to sustain their then-current levels of reliable financing. As a result, financing through 21st Mortgage was no longer going to be offered to mortgage brokers.64 Furthermore, outside of FHA-insured loans, only 21st […Mortgage] repossessions and homes built by Clayton or one of its subsidiaries would be eligible [for 21st lending]—retailers also had to be approved.65 Prior to this letter being sent, there were still 61 total manufactured housing corporations in the United States.66 Within two years, twenty-one competitors either failed, or were acquired.67 The true content of the message was made manifest not by what it said, but rather the implied consequences: capitulate to Berkshire Hathaway, or fail.68″

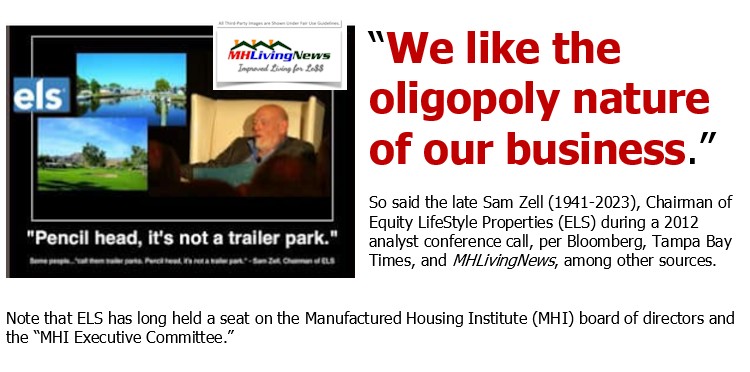

Again, keep in mind that Strommen is an outsider looking into manufactured housing, using a legal focus in that process. What Strommen is saying is that an oligopoly was steadily forming in the manufactured housing industry marketplace during the 21st century. With that in mind, consider what the late billionaire Samuel “Sam” Zell had to say about the industry that did so well for his firm.

An oligopoly can be a form of monopolization too, and oligopolies can also be illegal under antitrust laws.

That noted, let’s jump into this next segment of Strommen’s research paper. It illustrates the very point noted above.

Strommen then hits a common theme from MHARR, MHProNews, and MHLivingNews. But this theme is downplayed or often ignored by others. Why? Hold that question in mind and consider what Strommen said next.

There may be no greater indicator of collusion by the industry Big 3 through the MHI than HUD’s ongoing failure to implement enhanced preemption and for the [FHFA to compel the] GSEs to follow through on the Duty to Serve mandate. To call this ongoing failure a coincidence is a risible proposition: promotion of these runs contrary to the Big 3—and Clayton’s—interests in particular. The stated purpose of the GSEs is to securitize mortgages by purchasing them from lenders, packaging them together, and selling them as mortgage backed securities to investors. By alleviating lenders of the burden of having their capital tied up in loans that tend to amortize over periods of decades, liquidity—and thus allocable credit—is freed up, making credit cheap and lending competitive.”

Jumping ahead, while noting that almost every word Strommen wrote has significance and relevance so should be digested, consider the following.

Strommen hits Tim Williams, president and CEO of Clayton Homes’ sister brand repeatedly for examples of possible antitrust violations. Then he said this.

Strommen’s thesis noted the following.

Those remarks mirror entirely independent statements made by MHARR’s Mark Weiss or Danny Ghorbani. Recall that Ghorbani is a former MHI VP.

Strommen weaves the failures of CrossMods into the discussion several times. Consider this example.

Strommen then goes through some case law and said this.

…

The author of this paper submits that the MHI’s conduct in obfuscation judicious decision-making by the [FHFA and HUD] constitutes a conspiracy to restrain trade under Section 1 of the Sherman Act, and by virtue of the misrepresentative nature of the conduct, should not be afforded Noerr protection. The intent of the MHI to influence [FHFA and] HUD to act in a particular way, or omit to act in a certain way, would be protected—however, the chief misrepresentation is that lobbying efforts are representative of an industry and not a select few companies. The data supplied to governmental officials is likely erroneous,131 and the attempts by the MHI to obtain governmental intercession on the industry’s behalf is likely a ruse.

Under Noerr, if obtaining securitization of loans for CrossMod™ homes is in fact MHI’s desired political outcome, its lobbying efforts to support that would be protected under the First Amendment. However, this would appear to be a strategy not dissimilar to the old cup-and-ball trick: a misdirection by MHI at the behest of its principal benefactors—the Big 3—an act of skillful subterfuge to misdirect the government in one area, allowing the Big 3 to engage in anticompetitive in another area unabated. This is supported by more than simple inference: industry leaders have lauded GSEs failure,132 sales of CrossMod™ homes remain far below that of traditional manufactured homes,133 and that seemingly every time reform in the industry or intrusion by GSEs is proposed, in nearly the same breath it vanishes.”

Those insights by Strommen have stood the test of time. For example, when consumer groups asked for a more robust plan by the GSEs be mandated by the FHFA, MHI was absent in that letter and related request. That is true even though at least two of those organizations that signed onto the letter to Sandra Thompason at the FHFA were MHI members.

While Doug Ryan with CFED (later rebranded as Prosperity Now) made his own pitch that MHI was part of a scheme to monopolize manufactured housing by constraining lending, Ryan – like Strommen – pointed to the lending issue. Ryan hit MHI and Clayton Homes, not unlike Strommen.

The manufactur[ing] and lending sectors of the industry are rife with potential antitrust violations, from the Sherman Act, to the Clayton Act, to potential violations of the Noerr-Pennington Doctrine. It is clear that the Federal Trade Commission and United States Department of Justice should investigate these companies. The American consumer can ill-afford to pretermit manufactured housing as a viable option in the midst of an affordable housing crisis. Traditional site-built homes have continued to increase in price since the mid-2000s subprime mortgage crisis, and industry experts are predicting that the joblessness caused by the COVID-19 pandemic will fuel a second foreclosure crisis in America. Clayton Homes, et al. have gotten demonstrably more profitable. Why has manufacturing yet to cross the 100,000 unit threshold, much less come anywhere close to its most recent 1998 peak?”

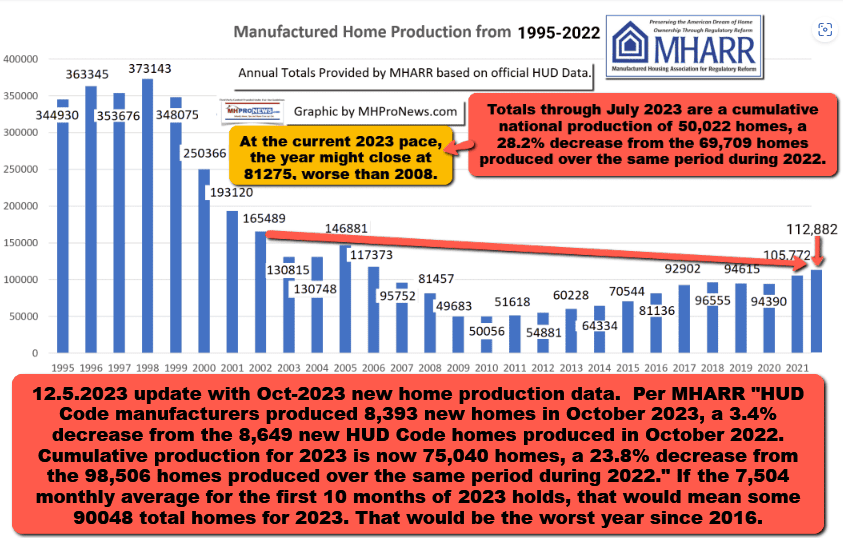

That was first published in February 1, 2021 by MHProNews before total U.S. manufactured home production finally did re-cross the 100,000 unit threshold. Allowing and adjusting for what has occurred since his thesis, Strommen’s insights as an outsider looking into manufactured housing is compelling.

The articles that MHProNews asked Bing AI to summarize in Part I touch upon topics that MHProNews – and in several cases, only MHProNews and/or MHLivingNews – has covered among manufactured housing industry publishers and bloggers.

Strommen used the word “pretermit” in that closing paragraphs before his footnotes. Pretermit means: “to leave undone : neglect. 2. : to let pass without mention or notice : omit,” according to Merriam Webster.

Agreement with MHProNews?

The leader of an MHI member organization recently emailed MHProNews to say that ‘we agree with what you’ – i.e.: MHProNews – ‘are reporting.’

Summing Up

While the future is never completely clear, it is apparent that several developments could favor manufactured housing. But despite the industry’s incredible potential, the industry is badly underperforming.

MHI, and/or is corporate/staff/legal leaders, can’t have it both ways. They can’t be claiming to represent “all segments” of the industry, if in fact they are only authentically working on behalf of the consolidators of manufactured housing, which is what Strommen and others have alleged with considerable evidence to support their concerns.

When Strommen said that these are ‘felony’ offenses, it fits the notion that this publication has argued for some years. Namely, the market manipulation that has occurred in manufactured housing are not some victimless crime. There are thousands of smaller businesses that have been harmed. There are millions of consumers, current and potential owners of manufactured homes, that have been impacted by these evidence-based monopolistic crimes. Employees working for these brands may get propagandized about how great they are, but when the reviews from Indeed are examined, what emerges is a picture that thousands upon thousands of professionals working for those dominating consolidating brands at MHI have a poor reputation with their own staffs.

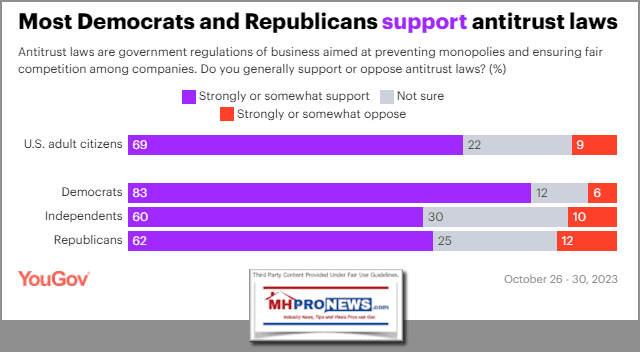

As the report linked immediately above reflected, ‘most Americans oppose monopolies’ and support antitrust laws.

The way that these issues play out in different companies and organizations in manufactured housing varies. But indicators that are examples are unpacked in the reports that follow which in several cases carefully examine publicly traded firms’ formal remarks.

The most recent U.S. production and related manufactured home shipment information is linked below.

Note: featured images generated for MHProNews by DallE. ##

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the morning of 12.5.2023

- How old fishing nets could be part of the climate crisis solution

- Smoke rises from the Israeli side after Palestinian Hamas gunmen infiltrated areas of southern Israel, as seen from Gaza, October 7, 2023.

- Israeli regulator says no suspicious trading before October 7, but questions remain on US-traded securities

- Tesla’s clash with Swedish workers risks spilling over into a regional fight

- Exterior view of News Corp. Building and Fox News Headquarters, New York, NY, February 28, 2023.

- Tucker Carlson’s former top producer at Fox News accused of sexual assault

- Outside Kitchen United Mix on Monday, Sept. 14, 2020 in Pasadena, CA. Kitchen United Mix is one of many ghost kitchens facilities throughout the Los Angeles area.

- Ghost kitchens were supposed to revolutionize restaurants. They’re crashing

- Hackers access profiles of nearly 7 million 23andMe customers

- Jobseekers attend the Cape Fear Community College’s Business and IT Career Fair at Cape Fear Community College North Building in Castle Hayne, North Carolina, on Wednesday, Sept. 20, 2023.

- US job openings hit a two-year low

- A woman walks past a CVS Pharmacy in Washington, DC, on November 2, 2022.

- CVS will change the way it prices prescription drugs

- Jeffrey Goldberg, editor-in-chief of The Atlantic, left, and Former President Donald Trump

- A second Trump term ‘poses a threat to the existence of America as we know it,’ says The Atlantic’s top editor

- Nvidia is the stock of the year. Can it last?

- Moody’s warns it may downgrade China

- Wanxiang Trust: Another Chinese ‘shadow bank’ faces major financial trouble

- Media groups raise concerns following report of ‘missing’ Hong Kong journalist in China

- Former Harvard disinformation scholar says she was pushed out of her job after college faced pressure from Facebook

- GTA 6 leak: ‘Grand Theft Auto’ trailer reveals game’s release date

- Unknown traders appear to have anticipated October 7 Hamas attack, research finds

- US Supreme Court scrutinizes controversial opioid crisis settlement that would give Sackler family immunity

- Sheryl Sandberg on Hamas attack: Rape should never be used as an act of war

- Alaska Air to buy Hawaiian Airlines for $1.9 billion

- Electric cars are having more problems, but not because they’re electric

- Richard Branson sends Virgin Galactic shares plunging after he says he’s not putting any more money in

- Gold has never been this expensive

- The wealth of middle-class and lower-income Americans grew at a faster rate than high earners early in the pandemic