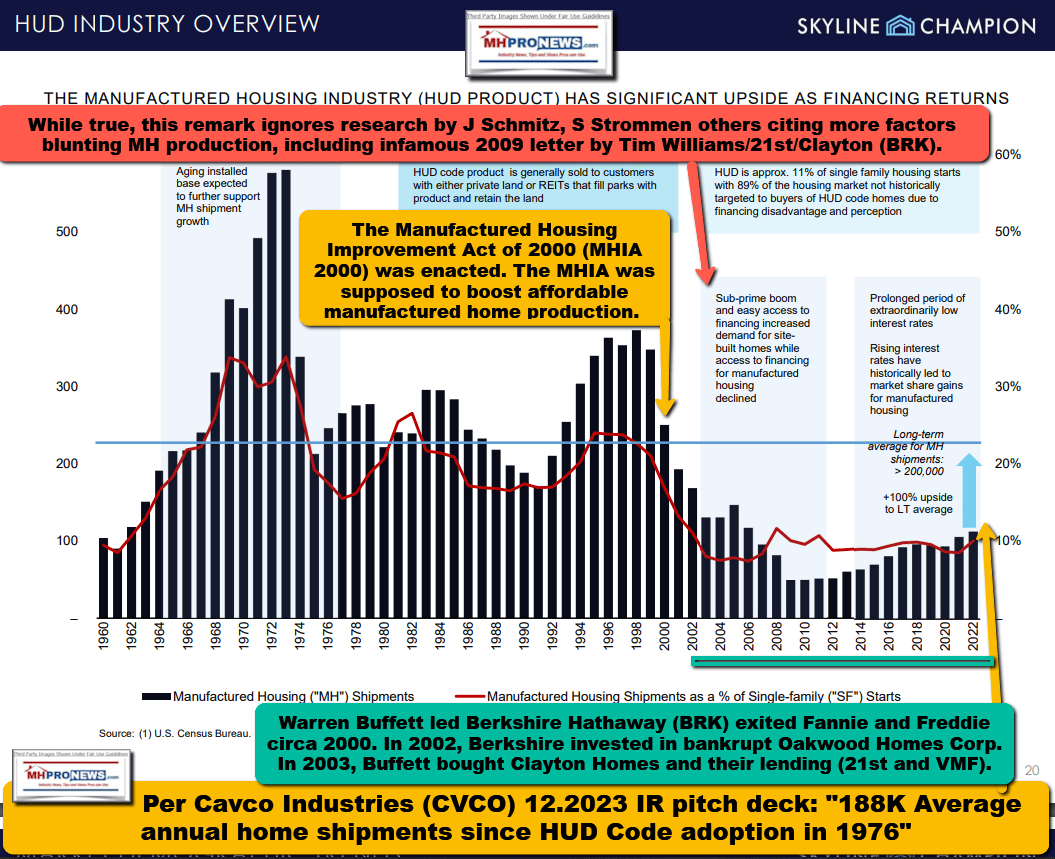

The ECN Capital website on 3.26.2024 said that manufactured home industry lender Triad Financial Services is an “ECN Capital Company.” “About Triad,” ECN stated: “Secured consumer loan portfolios – Manufactured Housing Loans” “Pioneer in the [manufactured home loan] industry, 60+ years in business.” All that might be demonstrably true, but it failed to point to something not mentioned. Manufactured housing 50, 60 or 25 years ago was a bigger industry than it is today as measured by the important metric of new home production. MHProNews recently reported on the tough hit on Legacy Housing (LEGH) by an analyst at B.Riley. Despite previously reporting solid financial performance, Legacy’s stock slid on what was termed “industry softness” as reported by financial news sites such as MarketBeat and Defense World. Fast forward a few days to now. ECN Capital is making admissions and perhaps it is no surprise that their stock is taking a hit on valuation too. While there may be apparent differences, let’s consider briefly some similarities between ECN/Triad and Legacy. Both ECN/Triad and Legacy are Manufactured Housing Institute (MHI) members. MHI says they represent “all segments” of the industry. Industry performance as measured by the key metric of production was markedly down in 2023 vs. 2022. The question must be asked. Would the same hits on the share value of ECN and Legacy have occurred if manufactured housing was perceived by investors as growing instead of shrinking in 2023? To what extent have arguably significant actions/inactions by board members and other leaders at the Manufactured Housing Institute (MHI) contributed to the slide in valuations at MHI members ECN/Triad and Legacy?

As a modestly relevant aside to frame their reports below, according to Bing’s AI powered Copilot: “Interestingly, Defense World is a publication of MarketBeat Media, LLC, a South Dakota Limited Liability Company.” That may help explain why the reports by Defense World and MarketBeat on ECN Capital, or previously in a fact check and analysis of those two financial news platforms on Legacy Housing (LEGH), are so similar.

That noted and disclosed, as Part III of this article will explore, the reporting on ECN will arguably underscore the points made Sunday in the MHProNews report on MHI and Legacy.

Part I of this report with analysis will be a press release from ECN Capital on their “strategic simplification” process.

Part II will be information from MarketBeat and DefenseWorld on ECN Capital.

Part III is additional information with more MHProNews Analysis and Commentary, Including from Triad Parent ECN Capital which advised investors that “2023 was a difficult year” and the headline (of this report) admission of “Material Implementation Mistakes.”

Part III will also ask the question from Sunday 3.24.2024 again – to what extent have actions/inactions by corporate and staff leaders at MHI contributed to millions to billions in lost revenues for companies and/or the manufactured housing industry more broadly? At what point will investors, attorneys, stakeholders, and/or public officials step in, formally investigate and take corrective action?

New readers and longer-time followers of this platform should recall that MHProNews issued a cautionary report in late 2022 that manufactured housing was a ‘target rich environment’ for attorneys. Some months later, the first of a series of legal actions was launched against several prominent MHI member brands and/or against companies that are members of MHI-linked state association affiliates. While the windshield of the future is not as clear as the proverbial rearview mirror, there are evidence-based reasons to believe that multiple manufactured housing industry firms are at risk of significant legal actions. Will MHI be directly involved at some point in current or future litigation due to their purported role in market manipulation that has limited manufactured housing to the benefit of industry consolidators? Based on the research of Samuel Strommen and others, that is not as far fetched as it may have seemed just 2 years ago.

Part IV is our Daily Business News on MHProNews manufactured housing connected markets recap.

Part I – According to ECN Capital Press Release on 3.21.2024

Strategic Execution and Corporate Simplification Continues – ECN Capital Announces Completion of the Sale of Red Oak Inventory Finance to BharCap Partners

| Source: ECN Capital Corp.

TORONTO, March 21, 2024 (GLOBE NEWSWIRE) — ECN Capital Corp. (TSX: ECN) (“ECN Capital” or the “Company”) today announced the sale of Red Oak Inventory Finance (“Red Oak”) to BharCap Partners. The transaction closed on February 21, 2024.

This transaction is another milestone in ECN Capital’s corporate simplification plan and strategic review process for the Company’s RV & Marine platform. The net proceeds from the transaction were initially used to pay down debt under the Company’s credit facility and are expected to be available to be redeployed into ECN’s manufactured housing and RV & Marine origination platforms.

RBC Capital Markets acted as sole financial advisor to the Company, and Cravath, Swaine & Moore LLP acted as legal advisor to the Company in connection with the transaction.

About ECN Capital Corp.

With managed assets of US$4.8 billion, ECN Capital Corp. (TSX: ECN) is a leading provider of business services to North American based banks, credit unions, life insurance companies, pension funds and institutional investors (collectively our “Partners”). ECN Capital originates, manages and advises on credit assets on behalf of its Partners, specifically consumer (manufactured housing and recreational vehicle and marine) loans and commercial (inventory finance or floorplan) loans. Our Partners are seeking high quality assets to match with their deposits, term insurance or other liabilities. These services are offered through two operating segments: (i) Manufactured Housing Finance, and (ii) Recreational Vehicles and Marine Finance. For more information about ECN Capital, visit www.ecncapitalcorp.com.

About Bharcap Partners

BharCap Partners, LLC is a private investment firm investing in businesses across the financial services industry including insurance distribution and insurance services; asset and wealth management; financial technology and tech-enabled business services. BharCap is a minority-owned and controlled firm and manages over $2.2 billion of capital across 11 investments since inception. For more information, visit www.bharcap.com. …”##

Part II – Financial News Sites Reports on ECN Capital, Parent to Triad Financial Services

According to Defense World: “ECN Capital (TSE:ECN) Hits New 52-Week Low After Analyst Downgrade.” Similarly but rephrased, the financial news site MarketBeat reported: “ECN Capital (TSE:ECN) Reaches New 12-Month Low After Analyst Downgrade.” As they are traded on the Toronto Stock Exchange (TSE), the figures are denominated in Canadian dollars.

Other equities analysts have also issued research reports about the stock. TD Securities dropped their target price on shares of ECN Capital from C$3.00 to C$2.75 and set a “hold” rating on the stock in a report on Friday. Royal Bank of Canada dropped their target price on shares of ECN Capital from C$3.00 to C$2.25 and set a “sector perform” rating on the stock in a report on Friday. Finally, National Bankshares dropped their price objective on shares of ECN Capital from C$2.75 to C$2.00 and set a “sector perform” rating on the stock in a report on Friday. Six investment analysts have rated the stock with a hold rating and one has issued a buy rating to the company’s stock. Based on data from MarketBeat, the stock currently has an average rating of “Hold” and a consensus target price of C$2.54.

In other ECN Capital news, Director William Wayne Lovatt bought 200,000 shares of the stock in a transaction that occurred on Monday, March 25th. The shares were bought at an average price of C$1.71 per share, for a total transaction of C$342,000.00. Company insiders own 17.99% of the company’s stock.”

MarketBeat said the following.

This transaction is another milestone in ECN Capital’s corporate simplification plan and strategic review process for the Company’s RV & Marine platform. The net proceeds from the transaction were initially used to pay down debt under the Company’s credit facility and are expected to be available to be redeployed into ECN’s manufactured housing and RV & Marine origination platforms.”

Also, from MarketBeat.

Several other analysts have also recently commented on ECN. Royal Bank of Canada dropped their target price on shares of ECN Capital from C$3.00 to C$2.25 and set a “sector perform” rating for the company in a research report on Friday. National Bankshares decreased their price target on shares of ECN Capital from C$2.75 to C$2.00 and set a “sector perform” rating for the company in a report on Friday. Finally, TD Securities decreased their price target on shares of ECN Capital from C$3.00 to C$2.75 and set a “hold” rating for the company in a report on Friday. Six analysts have rated the stock with a hold rating and one has issued a buy rating to the company. According to data from MarketBeat, the company has an average rating of “Hold” and an average target price of C$2.54. …”

Part III – Additional Information, Including from Triad Parent ECN Capital, Along with More MHProNews Analysis and Commentary

A) The screen capture below is from Yahoo Finance, with the call out boxes, arrows, logos and other additions by MHProNews.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

From ECN Capital’s most recent investor relations (IR) pitch deck are the following remarks.

Strategic Review – Completion of process establishes a streamlined & improved ECN coming into better operating environment, but at materially higher cost than anticipated

- Land Home (“LH”) – LH challenges were worse than we anticipated as late as Q3 2023; even though loan rates improved in Q4 bids didn’t follow resulting in higher than anticipated losses to clear portfolio issues. Well positioned now to grow again under new management and LH pricing in 2024

- Funding – While ECN smartly moved to diversify funding prior to 2023, bank and credit unions pulled back more than anticipated resulting in elevated balance sheet use in a rising rate environment and a reduced margin profile from new buyers. Banks and credit unions have returned in 2024 and we have diversified funding sources to grow again

- Originations – Economic uncertainty resulted in slower originations in 2023 than expected. However, we have great end markets that have originations rebounding in early 2024

ECN has great businesses that are well positioned in attractive markets and can now resume a growth path following a difficult 2023 (Page 6) …”

From page 7 of the same ECN IR document are the following remarks.

Strategic review launched in response to external interest in the company in early 2023; ECN engaged CIBC, BMO Capital Markets and Goldman Sachs as strategic advisors

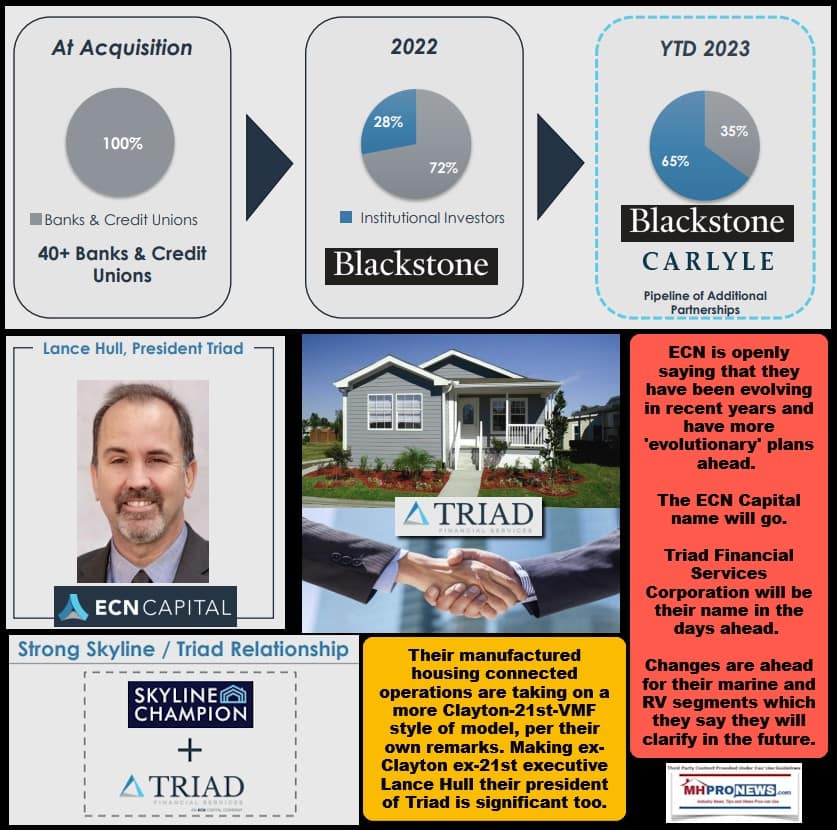

1. Determined an industry partnership was the best path forward for Triad

• Skyline Champion (SKY – NYSE) acquired a 19.9% interest in ECN for C$185 million (US$138 million) or an implied value of $3.04 per share.

• Separately, ECN & Skyline formed Champion Financing, a captive finance company, owned 51% by Skyline and 49% by ECN. Champion Financing, which launched in 2024

• Discussions on expanding strategic partnership continue

2. Completed the RV & Marine strategic review in Q1; determined that the best path to maximize shareholder value for now is to continue to execute its business plan and commitment to grow:

• Significantly enhanced funding prospects in 2024

• Improving originations & industry outlook

• Servicing build-out or acquisition is a strategic necessity…”

MHProNews notes that it is entirely debatable that the “best path forward for Triad” was to create an “industry partnership” which was revealed as Skyline Champion (SKY).

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

The ECN Capital name will go.

Triad Financial Services Corporation will be their name in the days ahead.

Their manufactured housing connected operations are taking on a more Clayton-21st-VMF style of model, per their own remarks. Making ex-Clayton ex-21st executive Lance Hull their president of Triad is significant too. Reading their entire presentation is recommended. MHProNews plans a follow up to unpack more.

There are items potentially hiding in plain sight based on ECN’s remarks. MHProNews will withhold comment at this time, beyond what is being said, to see how events further unfold. But we will editorially note apparent reasons for concern, which the hit on the firm’s stock apparently reflects. That noted, more from Triad parent ECN’s investor pitch follows.

From page 9 of ECN’s investor pitch.

2023 Strategic Review costs

Transaction & Strategic Review Costs – $11.5 million

Assets sale & Restructuring Costs – $24.0 million

Red Oak Sale related expenses – $4 million

• Includes expenses from several M&A transactions that included substantial due diligence but did not move forward; and the ECN, Triad & RV Marine Strategic Reviews

• Includes personnel expense for senior management and headcount reductions, office closure & corporate asset disposal

From Page 10 of Triad parent ECN’s presentation.

1. Land Home business launched in August 2022 under former Triad management

2. Material implementation mistakes were made on product design, pricing and risk management

3. Industry Backlogs extended throughout 2022 & 2023

4. Federal Reserve began raising rates aggressively

5. Major credit union LH funding partner unexpectedly reduced capacity

6. Early approved production was not priced properly resulting in an underwater construction book that sold at a material loss

7. Hedge Ineffectiveness

$47.5 million in 2023 realized losses

✓ New management team including Lance Hull, President & James Barry, CFO

✓ Replaced entire LH team from launch with experienced mortgage and LH professionals

✓ Process changes implemented to reduce cycle times and improve construction loan turnover

✓ Pricing – significant rate increases implemented across LH business & rate committee established

✓ Dealer portal in progress to digitize documents and streamline underwriting & monitoring

✓ Improved funding pipeline – incremental funding capacity for 2024

✓ Chris Johnson named SVP head of Capital Markets – hedging responsibility

There is more to know, and MHProNews plans a follow up on these items in the near term. But for now, in no particular order of importance, let’s note the following items.

B) Per ECN’s own remarks: “Industry Backlogs extended throughout 2022 & 2023” MHProNews reported on the ripple effects of this on several occasions. See the reports linked below as examples.

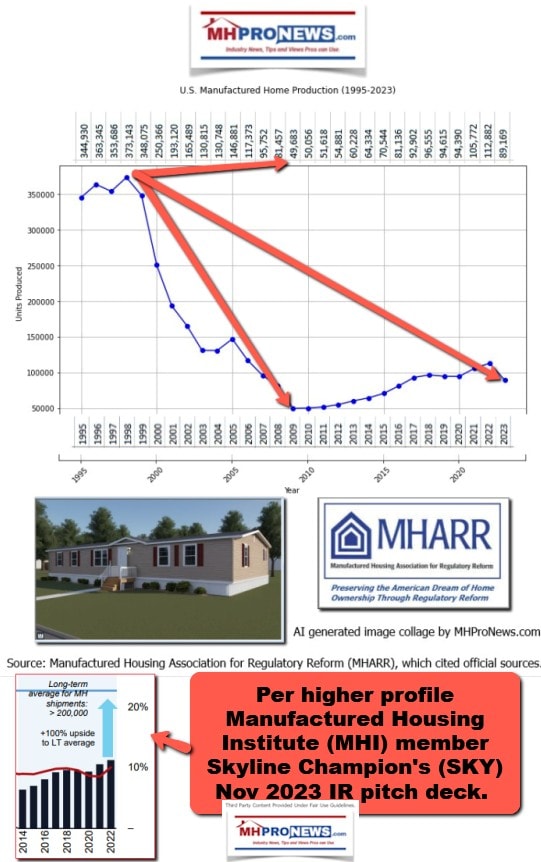

C) Had manufactured housing continued to rise, even modestly, as it had been for some years in the last part of 2022 and on into 2023 instead of falling, that difference in trajectory may well have mitigated some of the impacts on ECN (and other manufactured home industry firms).

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

D) As MHProNews noted on Sunday, obviously a company’s management has some measure of responsibility for its own outcomes. That ‘stating the obvious’ noted, there are serious concerns that should be explored involving the level of responsibility that the Manufactured Housing Institute (MHI) corporate-board and staff leaders have in the harm caused to industry companies when MHI leaders fail to take the obvious steps needed to advance manufactured housing in a robust fashion. A careful review of MHI’s own statements, followed by a careful review of MHI’s behaviors in the wake of those statements lead to a commonsense concern that MHI’s supposedly seasoned and educated leaders have routinely failed the industry for much of the 21st century. For instance, MHI’s praising the New Dems plan (see report linked below) is illogical at best, for reasons that report details.

E) MHARR, as well as MHProNews and MHLivingNews, have each laid out facts and evidence that ought to point to steps that MHI should be taking if in fact industry growth was the goal. If manufactured housing was several times its current production levels, and ECN/Triad was generating far more volume, some costly mistakes might be spread out over a larger financial basis. But either way, if significantly more production was the rule, then opportunities obviously grow.

F) If there is something remarkable about the MarketBeat reports and ECN stock downgrade, it may be this. How rarely this is occurring, given the manufactured housing industry’s own pitch, as articulated by MHI and by several MHI member firms. It has been approaching a year since Cavco was politely whacked by analyst Greg Palm who asked the obvious. Why is the industry production so weak?

G) For Legacy a B. Riley analyst’s remark was about manufactured housing “industry softness.” Soft, weak, are similar and OBVIOUS observations.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

H) It should be apparent that manufactured housing industry leaders involved in MHI are for whatever reasons failing to hold MHI accountable. That has ramifications and ripple effects. See the related reports to learn more.

Part IV – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Headlines from left-of-center CNN Business – 3.26.2024

- Cars, sugar and cruises: How the Port of Baltimore closure could hurt the economy

- Apple announces its annual developers conference is set for June 10

- Visa and Mastercard agree to $30 billion settlement that will lower merchant fees

- Tesla and SpaceX’s CEO Elon Musk pauses during an in-conversation event with British Prime Minister Rishi Sunak in London, Britain, Thursday, Nov. 2, 2023.

- Judge’s stern rebuke of Elon Musk’s X gives researchers fresh hope

- BYD’s profit soared 80% in the year the Chinese EV giant overtook Tesla

- A house is for sale in Arlington, Virginia, July 13, 2023.

- There’s more bad news for potential homebuyers: Prices just hit another record

- The skyrocketing share price comes despite the fact that Trump Media is burning through cash, piling up losses and its main product – Truth Social – is losing users.

- Trump’s Truth Social is now a public company. Experts warn its multibillion-dollar valuation defies logic

- Is America at risk of a bond market meltdown? This watchdog thinks so

- Republican National Committee Chair Ronna McDaniel speaks to the audience before the start of the second Republican presidential primary debate hosted by Fox News at Ronald Reagan Presidential Library in Simi Valley, California, on September 27, 2023.

- NBC News boss Cesar Conde faces backlash from his network’s anchors over ‘inexplicable’ decision to hire ex-RNC chair Ronna McDaniel

- America’s largest companies are fueling inequality, says new study

- 3 ways Apple’s monopoly lawsuit could change the iPhone experience for fans

- Fed officials are now considering fewer rate cuts this year

- The winning numbers for an $800 million Powerball jackpot have been drawn – and a bigger Mega Millions prize is up Tuesday

- Donald Trump’s estimated net worth just doubled as Truth Social owner closes deal to go public

- Fisker shares halted as EV company navigates uncertain future

- The last time Trump took a ‘DJT’ business public, it ended up in bankruptcy

- Trader Joe’s just increased the price of a banana for the first time in more than 20 years

- Boeing timeline: Inside the air giant’s turbulent journey in recent years

- Boeing CEO Dave Calhoun to step down in wake of ongoing safety problems

- Florida governor signs law restricting social media access for children

- Trump is about to get $3 billion richer after deal is approved to take his company public. But it won’t solve his cash crunch

- Judge tosses Elon Musk’s case against hate speech watchdog in excoriating rebuke