Few things are more important to frontline manufactured home retail sellers than access to more competitive chattel lending. With that in mind, according to their press release: “Persistent efforts by the Manufactured Housing Association for Regulatory Reform (MHARR) to reform the draconian “10-10” rule imposed by Ginnie Mae in 2010 to limit lender eligibility under the Federal Housing Administration’s Title I manufactured home federal loan insurance program, have finally paid dividends.” That media release and more are provided below in its entirety, including attached and related federal items which reflect increases in FHA Title I loan limits. Those are found on the MHARR website since 3.5.2024. Meanwhile, on the Manufactured Housing Institute (MHI) website on the morning of 3.7.2024 (2:04 AM ET) there is no mention of these developments on their website. Indeed, there is no new ‘news’ on the MHI website since its apparently still flawed teaser of the Newsweek story dealing with manufactured housing which was unpacked in the report and analysis linked here.

HousingWire said about Ginnie Mae and its role in FHA lending: “Ginnie guarantees investors the timely payment of principal and interest on mortgage-backed securities containing federally insured loans, mainly FHA.”

But more specifically, the following Q&A from Copilot explains the role played by Ginnie Mae in more detail and in a fashion that could prove useful to those who may benefit from this announcement as it gets implemented.

> “Explain the role played by Ginnie Mae in manufactured home FHA Title 1 Lending.”

- Part I of this article will provide the entire MHARR news release, carried in full by MHProNews.

- Part II – Memo from Ginnie Mae on 10/10 Rule Change

- Part III – Federal Register official notice of 10/10 Rule Change and increases in FHA Title I loan limits

- Part IV – Additional Information with More MHProNews Analysis and Commentary

- Part V is our Daily Business News on MHProNews MHVille markets report.

Part I

PERSISTENT MHARR EFFORTS PAY DIVIDENDS

ON REFORMING DESTRUCTIVE GINNIE MAE RULE

Washington, D.C., March 5, 2024 – Persistent efforts by the Manufactured Housing Association for Regulatory Reform (MHARR) to reform the draconian “10-10” rule imposed by Ginnie Mae in 2010 to limit lender eligibility under the Federal Housing Administration’s Title I manufactured home federal loan insurance program, have finally paid dividends.

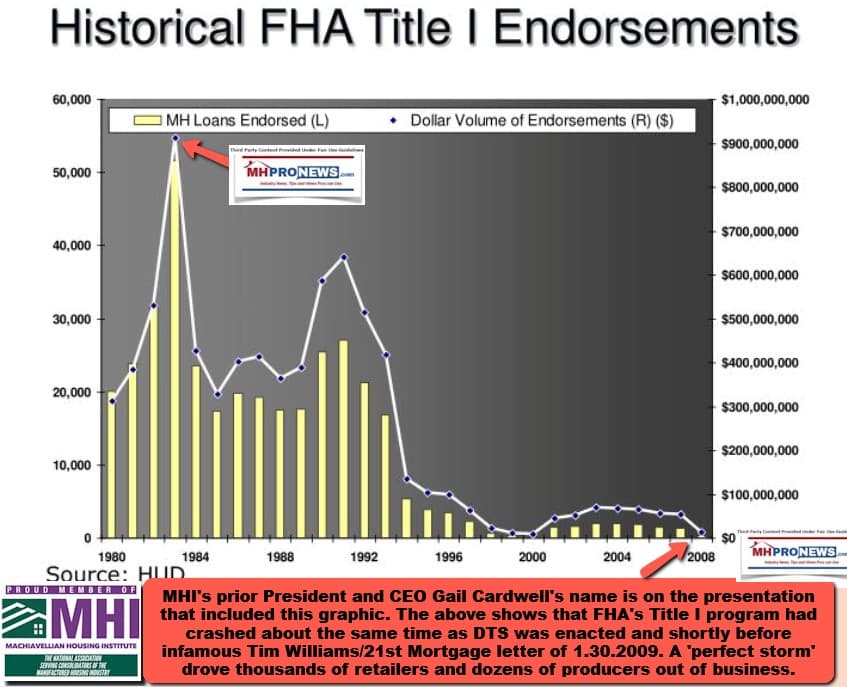

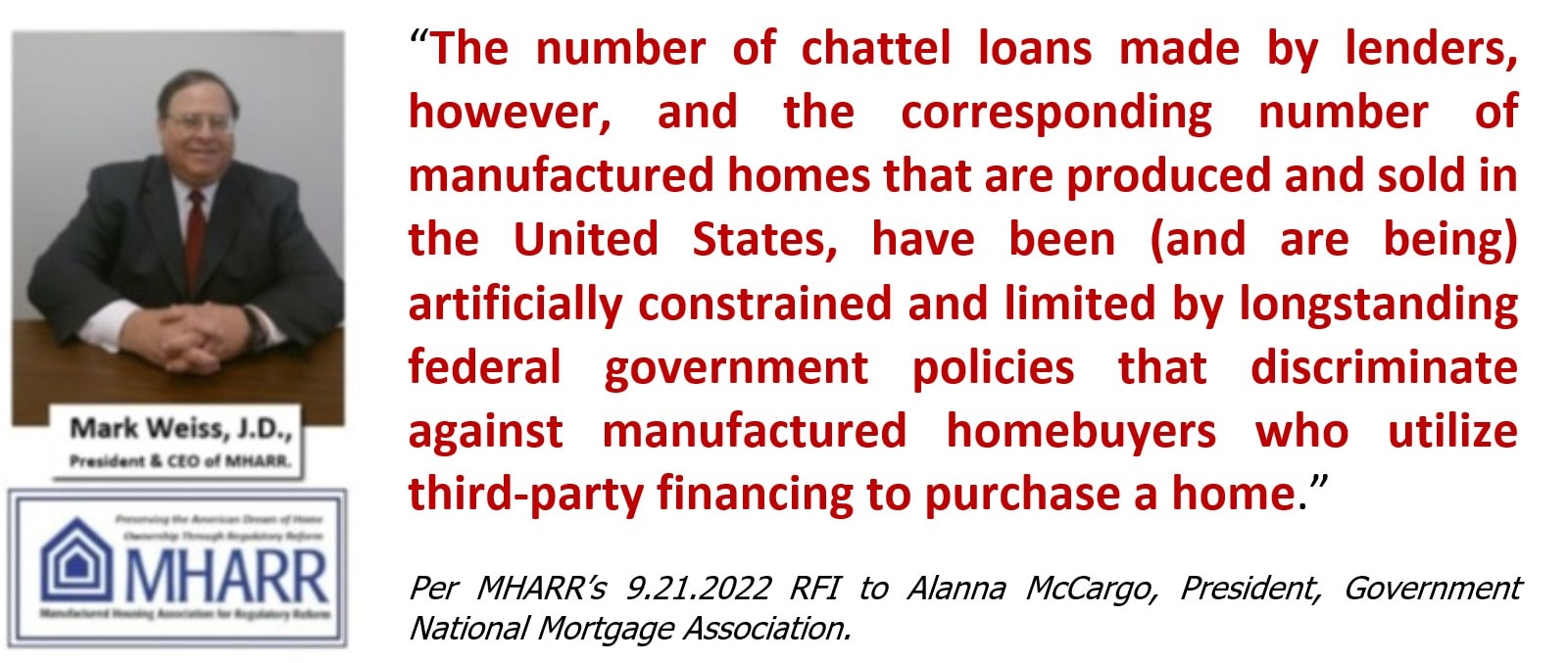

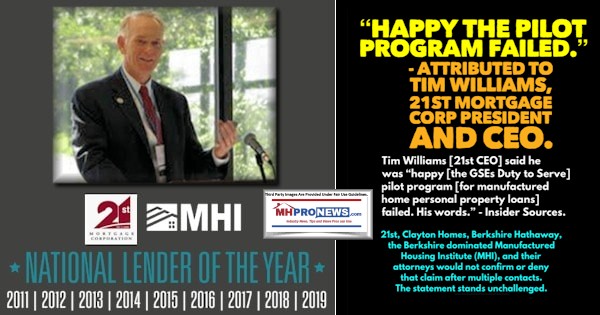

While the Title I program had formerly been an important source of consumer financing for manufactured home purchases – providing government-backed support for the personal property or chattel loans that comprise some 70-80% of all manufactured home purchase loans – the program had shriveled to insignificance under the “10-10” rule. That rule, by imposing large net worth and related requirements for authorized Title I lenders, limited eligibility to only a few companies — most notably the Berkshire-Hathaway/Clayton Homes, Inc.-affiliated lenders, Vanderbilt Mortgage and Finance, Inc. and 21st Mortgage – leading to negligible origination levels.

A more than decade-long MHARR effort to eliminate and modify the destructive 10-10 rule culminated in a 2022 meeting with senior Ginnie Mae officials where MHARR reasserted its call for the adoption of reasonable and appropriate criteria for Title I originators. Soon thereafter, Ginnie Mae issued a Request for Input (RFI) on Title I eligibility, in response to which MHARR submitted comprehensive comments, on September 21, 2022, seeking the substantial modification of the 10-10 rule, in order to revitalize Title I.

Now, in an “All Participants Memorandum,” issued on February 28, 2024 (copy attached), Ginnie Mae has eliminated the 10-10 rule and replaced it with an eligibility rule requiring $2.5 million in net worth for eligible Title I originator applicants, a 75% reduction. By reducing the draconian 10-10 criteria, the Title I program can potentially attract a larger number of smaller lenders and increase both participation and competition to the ultimate benefit of consumers. An increase in loan volume under the Title I public lending program is even more important now, in light of the continuing failure of both Fannie Mae and Freddie Mac to implement the “Duty to Serve Underserved Markets” (DTS) with respect to the dominant manufactured home consumer chattel lending sector – which has created a major bottleneck impacting the industry and consumers as explained in MHARR’s March 1, 2024 News Release packet.

Contemporaneously with the Federal Housing Administration (FHA) Title I APM, the U.S. Department of Housing and Urban Development (HUD) also published a Federal Register notice amending regulations for Title I-insured loan limits in accordance with the Housing and Economic Recovery Act of 2008 (HERA). Among other things, HUD announced that as of March 29, 2024, the index for adjusting future Title I loan limits will be based on “sales prices, unit sizes and property data collected by the [U.S.] Census Bureau.” Such information will be supplemented with two additional metrics as set forth in the final rule. First, HUD “will set loan limits at 15% above the average home price according to the Census data for the given type of loan.” Second, HUD will also “utilize an inflation factor” to account for inflation that occurs after collection of the Census data. As an example, Title I loan limits for home-only loans on single-section homes under these metrics would increase from $69,678, the HERA limit, to $106,405. Meanwhile the limit for home only multi-section loans will increase to $195,322 (copy attached).

While these actions are positive, they do not alter the unavoidable fact that HUD still is not doing enough to promote and advance the utilization and acceptance of HUD-regulated manufactured homes as required by Congress in the Manufactured Housing Improvement Act of 2000 (2000 Reform Law). In part, this is because HUD, for more than two decades, has dodged its responsibility to utilize the enhanced federal preemption of the 2000 Reform Law – as specifically envisioned by both houses of Congress and as expressed in 2003 correspondence from key congressional proponents of that law to the Secretary of HUD – to invalidate discriminatory zoning edicts that exclude affordable manufactured homes, regulated by HUD itself, from jurisdictions across the United States. This continuing failure by HUD not only deprives Americans of the nation’s most affordable homeownership resource at a time of unprecedented affordable housing scarcity and need, but also works in a discriminatory fashion to most harmfully affect members of minority groups as documented by the Consumer Financial Protection Bureau.

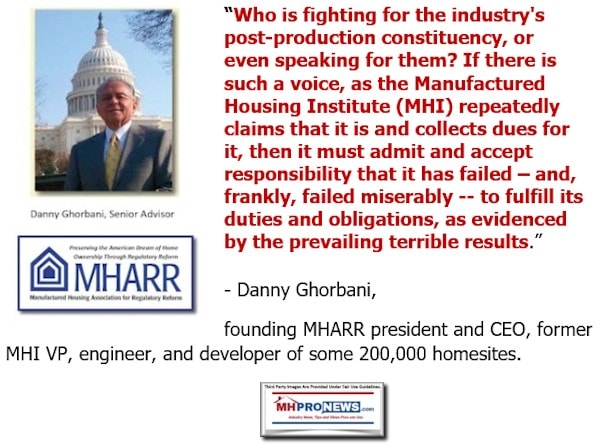

Finally, and most importantly, in addition to changing lending regulations and authorizing billions of dollars in federal spending that never “reach the ground” in a meaningful manner, as documented in MHARR’s July 2022 White Paper – “The Exploitation of Federal Housing Finance and Mortgage Funding Assistance Programs and Potential Solutions” — HUD needs to act now, under existing federal statutory and regulatory authority, to make affordable manufactured housing an available resource and option for all Americans, regardless of where they reside. Moreover, the Manufactured Housing Institute (MHI), as the national representative for the industry’s post-production sector, must aggressively begin to press HUD to fully and properly implement the enhanced federal preemption of the 2000 Reform Law in order to open all such areas for affordable HUD Code manufactured homes.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.- based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 —

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARRDG@AOL.COM

Website: www.manufacturedhousingassociation.org

Attachments

MHARR-attachment1ToGinnieMae10-10ruleChangeAPM_24-01MHProNews

Part II – Memo from Ginnie Mae on 10/10 Rule Change

| February 28, 2024 | APM 24-01 |

| MEMORANDUM FOR: | All Participants in Ginnie Mae Programs |

| FROM: | Alanna McCargo, President |

| SUBJECT: | Manufactured Housing Applicant and Issuer Financial Eligibility

Requirements

|

In support of the Department of Housing and Urban Development’s (HUD) Strategic Plan to address the important role of Manufactured Housing, the Federal Housing Administration (FHA) and Ginnie Mae have jointly prioritized and committed to updating their respective programs for Title I Manufactured Housing to provide greater affordable financing and securitization opportunities for personal property manufactured housing.

Following extensive industry outreach and the completion of a 2022 RFI, Ginnie Mae has embarked on a comprehensive review of the data and feedback received from industry stakeholders and RFI respondents. Particular focus has been placed on the evolving risks encountered by the Manufactured Housing Mortgage-Backed Securities (MH MBS) Program since the last major program update in 2010 following the Housing and Economic Recovery Act of 2008, (Public Law 110-289) (HERA). Drawing from the results of the review and in conjunction with FHA’s proposed policy changes, Ginnie Mae is announcing the first of a series of modernizations to the MH MBS Program. In support of housing finance system stability as well as Ginnie Mae manufactured housing Issuer financial consistency across economic cycles, Ginnie Mae is revising its financial eligibility requirements in the Mortgage-Backed Securities Guide 5500.3 Rev-1 (“MBS Guide”) for institutions seeking approval as Ginnie Mae Manufactured Housing Issuers (“MH Applicants”) and existing, approved Ginnie Mae MH Issuers. Additionally, MH Issuers that are non-depository mortgage companies will be required to maintain a Risk-Based Capital Ratio (“RBCR”). The financial eligibility requirements are detailed below.

Ginnie Mae monitors performance and assesses risk on an on-going basis, and reserves the right to revise the financial requirements, in its sole discretion, at any time.

Chapter 2, Chapter 3, Chapter 30, and Appendix IV-24 (MH Prospectus) of the MBS Guide have been updated accordingly. The MH MBS Program financial eligibility requirements announced in this APM will be effective immediately as of March 1, 2024 for MH MBS Applicants and will be effective June 1, 2024 for MH Issuers with the exception of Issuer RBCR requirements. RBCR requirements for MH MBS Issuers will be effective December 31, 2024.

Revised Net Worth Requirements

For all MH MBS Applicants, the minimum Net Worth requirement is $2,500,000 plus 250 basis points (2.5%) of the Applicant’s total effective MH MBS non-agency securities outstanding obligations. For more information, please see revised portions of Chapter 2, Part 9, § A(2) included with this APM.

The minimum Net Worth requirement for all MH MBS Issuers is $2,500,000, plus 250 basis points (2.5%) of the Issuer’s total effective MH MBS outstanding obligations. The total effective MH MBS outstanding obligations are the sum of 1). all MH MBS securities outstanding, 2). available commitment authority to issue new MH MBS pools, and 3). Total MH MBS pools funded. For more information, please see revised portions of Chapter 3, Part 8, § D(1) included with this APM.

Liquidity Requirements

In addition to the list of liquid assets that are eligible to meet Ginnie Mae’s liquidity requirement as stated in Chapter 2, Part 9 § B(1) and Chapter 3, Part 8 § D(2), Ginnie Mae requires MH MBS Program Applicants and MH MBS Issuers to maintain appropriate levels of liquidity to meet and sustain financial obligations under the MH MBS Program. As stated in Chapter 2, Part 8, § D(2), MH Applicants are required to have liquid assets, equal to at least $1,000,000. MH Issuers are required to maintain liquid assets of the greater of at least $1,000,000 which may be comprised of cash, cash equivalents as defined under FAS95, and AAA rated government securities marked to market, as defined under FAS95 or 50 basis points of the Issuer’s total effective MH outstanding obligations.

Institution-wide Capital Requirements for Certain Manufactured Housing Applicants and Issuers

Ginnie Mae’s Institution-wide Capital Requirements for certain Manufactured Housing Applicants and Issuers will continue to be applied to measure the entity’s ability to sustain the volatility of market disruptions and reflect the varying risk among different asset types. MH Issuers that are not covered by the requirements for financial institutions in the MBS Guide Chapter 3, Part 8, § D(3)(a) and (b) must maintain a Risk-Based Capital Ratio (“RBCR”) of at least 6% in addition to continuing to maintain a Leverage Ratio of at least 6%. RBCR is Adjusted Net Worth (as defined by Ginnie Mae) divided by Total Risk-based Assets. For more information and details regarding Institution-wide Capital Requirements, please see Chapter 2, Part 9, § B(2)(c) for MH Applicants, and Chapter 3, Part 8 § D(3)(c) and (d) for MH Issuers.

Chapter 6 of the HUD Consolidated Audit Guide (“Audit Guide”) will be updated to direct independent auditors to the MBS Guide for the current Institution-wide Capital Requirements for Applicants and Issuers. Until the Audit Guide update takes place, the requirements in the MBS Guide supersede the requirements in the Audit Guide if the requirements in these two guidance documents conflict.

If you have questions, please contact your Account Executive in the Office of Issuer and Portfolio Management directly. ##

MHProNews Notes: in the above and below, the PDF of the items linked as attachments to the MHARR release are copies of the official published statements. It is possible that spacing or other errors can occur when a PDF is converted into WORD and then cut and paste into this article. That said, a reasonable effort has been made to ‘get it right,’ but if total precision matters, look at the PDFs.

Part III – Federal Register/Vol. 89, No. 40/Wednesday, February 28, 2024/Rules and Regulations

DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT

24 CFR Part 201

[Docket No. FR–6207–F–02]

RIN 2502–AJ52

Indexing Methodology for Title I

Manufactured Home Loan Limits

AGENCY: Office of the Assistant Secretary for Housing—Federal Housing Commissioner, Department of Housing and Urban Development (HUD).

ACTION: Final rule.

SUMMARY: Section 2145 of the Housing and Economic Recovery Act of 2008 (HERA) amended the maximum loan limits for manufactured home loans insured under Title I of the National Housing Act and required regulations to implement future indexing of the loan limit amounts for manufactured homes originated under the Manufactured Home Loan program. This rule establishes indexing methodologies using data from the United States Census Bureau (‘‘Census’’) to annually calculate the loan limits for Manufactured Home Loans,

Manufactured Home Lot Loans, and

Manufactured Home and Lot

Combination Loans (‘‘Combination

Loans’’) insured under Title I of the National Housing Act for the Manufactured Home Loan program.

This final rule adopts HUD’s October

18, 2022, proposed rule with changes. DATES: Effective March 29, 2024.

FOR FURTHER INFORMATION CONTACT: Mary Jo Houton, Acting Director,

Department of Housing and Urban

Development, 451 7th St. SW, Room 9266, Washington, DC 20410–4000; telephone number 202–402–2378 (this is not a toll-free number). HUD welcomes and is prepared to receive calls from individuals who are deaf or hard of hearing, as well as individuals with speech or communication disabilities. To learn more about how to make an accessible telephone call, please visit https://www.fcc.gov/ consumers/guides/telecommunications- relay-service-trs.

SUPPLEMENTARY INFORMATION:

I. Background

Title I of the National Housing Act authorizes the Secretary of HUD to insure, through the Federal Housing Administration (FHA), loans made by FHA-approved lenders to eligible borrowers to finance property improvement and purchase, or refinance, of a manufactured home, with or without the lot. HUD insures these loans under HUD’s Property Improvement Loan program and HUD’s Manufactured Home Loan program. FHA insures the lender against loss if the borrower defaults. A Title I Manufactured Home Loan may be used for the purchase or refinancing of a manufactured home, a lot on which to place a manufactured home, or a manufactured home and lot in combination. The manufactured home must be used as the principal residence of the borrower. Applicable loan limits and requirements are codified in 24 CFR part 201.

Section 2117 of HERA1 added the definition of real estate to include all natural resources and structures permanently affixed to the land, amended the maximum loan limits for manufactured home loans and certain property improvement loans insured under Title I of the National Housing Act, and required future changes to the amounts for manufactured home loans to be made through regulation. HERA also stipulated that the Secretary develop a metric that uses U.S. Census Bureau (‘‘Census’’) data2 on manufactured home prices to calculate an index for adjusting loan limits in the future.

In compliance with HERA, on March 3, 2009, HUD published Title I Letter TI–4803 notifying lenders of the new statutory loan limits. HUD also noted in that Title I Letter the need for the Secretary to develop an indexing method that would determine future loan limits. HUD regulations still reflect the outdated, pre-HERA Loan Limits. Initially after HERA’s enactment, Census data showed a decline in home prices. However, for compliance with HERA, HUD did not lower loan limits and the limits were kept at the threshold set under HERA. The outdated Loan Limits, and the 2008 Loan Limits currently in effect for manufactured homes as described in the Title I letter are outlined below:

TABLE 1—LOAN LIMITS UNDER HERA COMPARED TO PRE-HERA LOAN LIMITS

| Title I loan program name | Eligible loan name for property type | Loan limits prior to HERA | 2008 loan limit basis per HERA currently in effect |

| Property Improvement Loan Program …………… | Manufactured Home Improvement Loan for units classified as real estate. | $7,500 ………………….. | $25,090. |

| Manufactured Home Loan Program ……………… | Manufactured Home Loan (unit only) …………… | $48,600 ………………… | $69,678. |

Manufactured Home Lot Loan (lot only) ……….. $16,200 ………………… $23,226.

TABLE 1—LOAN LIMITS UNDER HERA COMPARED TO PRE-HERA LOAN LIMITS—Continued

| Title I loan program name | Eligible loan name for property type | Loan limits prior to

HERA |

2008 loan limit basis per HERA currently

in effect |

| Manufactured Home and Lot (Combination Loan). | $64,800 ($48,600 + $16,200). | $92,904 ($69,678 + $23,226). |

II. The Proposed Rule

On October 18, 2022, as required by HERA, HUD published for public comment a proposed rule (87 FR 63018) (‘‘the proposed rule’’) to update the loan limits in §201.10 and to establish an index for which future loan limits would be revised through notice. HUD also proposed to amend the definition of ‘‘manufactured home’’ in §201.2 to conform to the loan limit change. HUD proposed to index loan limits based on sale prices, unit sizes, and property data collected by the Census Bureau.

HUD proposed to establish separate indexing methodologies to annually calculate future loan limits for manufactured home loans, manufactured home lot loans, and manufactured home and lot combination loans under the Manufactured Home Loan program.

HUD proposed to create a dual index based on purchase prices of manufactured homes, which are collected by the US Census Bureau (Census): an index for single-section manufactured homes using only single- section home sale data and a separate index for multi-section manufactured homes using only double-section home sale data.[4]

HUD also proposed to adjust loan limits for single-section and double or greater-section manufactured home loans annually based on changes to indexes for the average price of single-section and double-section manufactured homes, respectively. HUD proposed to set each loan limit at the average price data for the most recent 12

months available at the time HUD calculates the adjustment, weighted according to the number of manufactured units shipped during that same period.

HUD also proposed creating an index for Manufactured Home Lot Loans based on median home prices in Census’s New Residential Sales data.5

Finally, HUD proposed that the loan limit for manufactured home and lot Combination Loans would be determined by adding the manufactured home lot loan limit to either the single- or double-section loan limit, depending on the home.

III. This Final Rule

HUD adopts the proposed rule with changes to the indices and changes to the regulatory text.

Changes to the Indexing Methodology

As further discussed in the public comment summary, HUD received several comments suggesting that the loan limits set by the proposed indexing methodology would be too low to accurately reflect current manufactured housing prices and that, if adopted, the proposed indexing methodology would frustrate the purpose of section 2145 of HERA which is to make FHA housing programs more widely available for low-income homebuyers.

In consideration of these comments, HUD has decided to adjust the proposed indexing methodology to more accurately reflect real-world manufactured housing costs, improving the viability of the Title I Manufactured Housing program and fulfilling HERA’s purpose of making FHA housing programs available to more homebuyers. In addition to using the average manufactured housing prices for single- and multi-section homes, HUD will use two additional factors in calculating the manufactured home loan limits. First, HUD will set loan limits at 15% above the average home price according to the Census data for the given type of loan.

This is consistent with the initial loan limits set by HERA, which were set to about 15% over the average manufactured home price at the time.

This is also consistent with how HUD calculates loan limits under Title II, where FHA limits loans to 115% of the median home price.

Second, to account for the time between when the Manufactured Housing Survey data was collected and when the limits will be effective, HUD will utilize an inflation factor. To calculate this inflation factor, HUD will use an inflation forecast such as the CPI–U forecast in the President’s Economic Assumptions 6 to increase loan limits to account for inflation that has occurred since the relevant Census data were collected. This will address the maintenance or increase of the sales price from year-to-year according to the Census data and intends to more accurately represent current prices for manufactured homes.

HUD’s updated indexing methodology is demonstrated in the below chart:

TABLE 2—PROPOSED INDEX METHODOLOGIES FOR TITLE I MANUFACTURED HOME LOAN LIMITS

| Eligible loan types | Proposed methodology/index |

| 1. Manufactured Home Loan (Home only) ……… | • For single-section homes, the loan limit will be set each year at 115% of the average single- section home price with an adjustment for inflation.

• For homes composed of two or more sections (multi-section homes), the loan limit will be set each year at 115% of the average double-section home price with an adjustment for inflation.* |

| 2. Manufactured Home Lot Loan (Lot only) …….. | Manufactured Home Lot Loan limit established by HERA, indexed using changes in the me- |

TABLE 2—PROPOSED INDEX METHODOLOGIES FOR TITLE I MANUFACTURED HOME LOAN LIMITS—Continued

| Eligible loan types | Proposed methodology/index |

| 3. Manufactured Home and Lot Loan (Combination Loan). | The indexed Manufactured Home Lot Loan limit, plus the applicable Manufactured Home Loan limit. |

*Utilizing single- and double-section price averages based on the most recent data from the Manufactured Housing Survey from the Census Bureau, adjusted for the effective year of the limit using an inflation forecast (such as the CPI–U forecast in the President’s Economic Assumptions or similar replacement data set or report as may be specified by the Secretary). See MHS Latest Data Average Sales Price by Region and by Size of Home https://www2.census.gov/programs-surveys/mhs/tables/time-series/mhstabavgsls.xlsx.

**Utilizing median new home price based on the most recent data from the Survey of Construction from the Census Bureau. See Median and Average Sales Price of Homes Sold https://www.census.gov/construction/nrs/xls/usprice_cust.xls.

| HUD will make changes to the indexing methodology through notice where HUD determines that revisions are necessary to enhance or maintain the accuracy of the index. HUD | anticipates any such change(s) would likely be technical in nature, but if a change were more than technical, HUD would provide notice to the public with

TABLE 3—EXAMPLE LOAN LIMITS |

the opportunity for comment prior to changing the index.

Table 3 below shows examples of the loan limits, based on recent data from Census. |

||||

| Description of property | Loan limit methodology | Current limits (per HERA) | Example 2024 loan limits

(based on 2022 Census data) |

|||

| Single-section Manufactured Home (unit only) | Set to average of 115% of single-section home prices. Note 1. | $69,678 ………………… | $106,405. | |||

| Multi-section Manufactured Home (unit only) …. | Set to 115% of average double-section home prices. Note 1. | $69,678 ………………… | $195,322. | |||

| Manufactured Home Lot (lot only) ………………… | Set to median sales price for new single-family homes. Note 2. | $23,226 ………………… | $43,377. | |||

| Single-section Manufactured Home and Lot (Combination Loan). | Limit for Single-Section + Limit for Lot Loan …. | $92,904 (69,678 + 23,226). | $149,782 (106,405 + 43,377). | |||

| Multi-section Manufactured Home and Lot (Combination Loan). | Limit for Multi-Section + Limit for Lot Loan ……. | $92,904 (69,678 + 23,226). | $238,699 (195,322 + 43,377). | |||

Table 3 Notes:

- Indexing to occur at the beginning of each year, based on the weighted average price data for the most recent 12 months available from the Manufactured Housing Survey.

- Indexing to occur at the beginning of each year, based on the median sales price of the most recent 12 months available from the New

Residential Sales data.

Changes to the Regulatory Text

HUD is making only technical changes at the final rule stage. HUD is removing references to ‘‘double-section’’ homes as they are already covered by ‘‘multi-section’’ homes. HUD is also revising §201.10(h)(1) and (2) to remove the reference to changes to the ‘‘average’’ price of single-section manufactured home sales as superfluous. HUD is also revising §201.10(h)(2) to change a reference to data published by HUD because the data HUD will be using is published by the Census Bureau. HUD is also revising 201.10(h)(1) through (3) to clarify that HUD will not lower loan limits from previous years.

IV. Summary of Public Comments

The public comment period for the proposed rule closed on December 19, 2022. HUD received five distinct comments relating to the proposed rule. Comments were submitted by an individual, associations representing housing industry stakeholders (i.e., community banks, manufactured housing, realtors), a lender, and anonymously. The full text of each public comment can be found at: https://www.regulations.gov/document/ HUD-2022-0078-0001.

A. Support for the Proposed Rule

Multiple commenters expressed their support for the proposed rule. One commenter said they support the proposed rule because of the significant cost increase in modular homes since 2008 and because the Housing and Economic Recovery Act of 2008’s (HERA) current limits are too low to allow low-income Americans to afford housing. Commenters expressed support for the proposed rule because they said updated loan limits would help address the declining trend in loans that qualify for the Title I loan program. Another commenter expressed support for the proposed rule because it would establish separate loan limits for single- section and multi-section manufactured homes. The commenter stated that home size has a significant impact on home cost and separate loan limits help account for the different cost components between single- and multi- section homes.

A commenter expressed their support for the proposed rule, stating it would benefit low to moderate-income and first-time home buyers to take advantage of financing through the Federal Housing Administration (FHA) and begin to build wealth through homeownership. Another commenter said the proposed rule would create opportunities for creditworthy borrowers to access manufactured homes, and this is a crucial bridge to address the housing supply gap allowing low to moderate-income Americans to afford a home.

A commenter stated that the proposed rule creates a unique indexing methodology that increases loan limits through annual adjustments that would ensure the limits remain current with the housing market. Another commenter stated that they are encouraged by the potential effect of the proposed rule’s indexing methodology because it will update statutory loan limits established in 2008 and allow for annual adjustments.

HUD Response: HUD appreciates these comments and the broad support for this rule; these commenters identified many of the reasons why HUD undertook this effort. HUD agrees that increased loan limits will provide additional opportunities for low-to- moderate income borrowers to access homeownership now and in the future.

B. Suggested Revision to the Proposed Rule’s Loan Cap and the 130 Percent Home Invoice Limitation

A commenter stated they are supportive of the proposed rule’s attempt at increasing loan limits for FHA’s Title I program and believed that the index would capture the movement of manufactured home pricing. However, the commenter believes that loan limits should be increased further than described in the proposed rule. The commenter stated that community banks typically choose to portfolio loans that may otherwise be eligible for FHA’s Title I program because the maximum FHA loan amounts often fail to cover the cost of the unit. The commenter, a lender, calculated the percentage of its own loans in 2022 that would have qualified under the proposed rule’s example loan limits for 2022 to be 22.7 percent of all single-section loans; 47 percent of all multi-section loans; 46 percent of all single-section, land loans; and 54.6 percent of all multi-section, land loans.

The commenter encouraged HUD to further increase the proposed loan limits because the commenter was discouraged that a higher percentage of its loans would not have qualified for the Title I program.

The commenter also stated that its figures do not account for the advance structure limitations that accompany the Title I loan limits, such as the 130 percent of home invoice limitation (including itemized options and freight). The commenter estimated that only 3.4 percent of its originated new home only loans in the last 12 months had a home sales price under the 130 percent limitation.

The commenter stated that, in the commenter’s experience, most manufactured home retailers sell homes significantly above 130 percent of the manufactured home invoice. To address this, the commenter suggested that HUD either improve or remove the limitation altogether. The commenter stated that annually adjusted loan limits can be a sufficient ‘‘check’’ to ensure that home prices stay true to recent market trends and, therefore, the 130 percent cap is an unnecessary limitation that undercuts the effectiveness of the increased loan limits. The commenter stated that, as an alternative to eliminating the 130 percent cap, HUD could increase the limitation to 160 percent. The commenter stated that the 160 percent adjustment would represent a more practical and realistic percentage that would not require retailers to significantly cut sales prices for a home to qualify for a Title I loan. The commenter stated that over the last 12 months, 44 percent of its loans have involved homes sold under the 160 percent cap, compared to only 3.4 percent under the 130 percent cap.

HUD Response: HUD appreciates the comment that the proposed limits should be further increased. Section 2145 of the Housing and Economic Recovery Act (HERA) of 2008 amended

Title I, Section 2 of the National Housing Act (12 U.S.C. 1703) to increase the maximum loan limits for manufactured home loans insured under Title I and requires the Secretary to develop an index to annually adjust the loan limits based on U.S. Census Bureau (Census) data on manufactured home prices. The indices adopted by the Secretary for manufactured homes in this rulemaking to annually adjust the loan limits are based on the average of the year-over-year changes in the all- units price series published by Census, at the national level, and for a defined look-back period. These indices are based on data from Census-collected surveys of firms that sell new manufactured housing to individuals for residential use. HUD will also adjust the average sales price, as determined by the Census Bureau data, by 115% and apply an inflation factor, which more accurately reflects the prices of manufactured homes since the publication of the most recent Census Bureau report.

HUD includes the 130 percent cap on new manufactured homes to protect FHA borrowers and in keeping with FHA’s fiduciary responsibility to taxpayers. The 130 percent cap is not the focus of this rulemaking. Nevertheless, HUD will continue to consider this issue in regard to the Title I manufactured housing program.

- Alternate Method of Calculating the

Lot Loan Index

A commenter stated that the proposed indexing methodology is not sufficient to capture the reality of land and improvements costs for manufactured homes. The commenter stated that the National Housing Act requires HUD to base the index on manufactured housing price data collected by the Census Bureau; however, the proposed rule seeks to create an index based on median home prices in the Census Bureau’s New Residential Sales data. The commenter stated that the average total costs of options (e.g., well, septic, driveway) is $30,000 across all of its funded loans. When considering the example loan limit of $37,205 for 2022, the commenter stated that there is essentially no additional room to purchase a parcel of property under the FHA Title I program after the cost of options alone. Similarly, the commenter stated that the average appraisal value for a parcel of real estate is roughly $34,028, which leaves virtually no room for improvements to the land.

The commenter stated that improvements on purchased land are usually vital with the purchase of a manufactured home with land because each land site is typically developed individually, unlike single-family homes built by a developer with the appropriate infrastructure scaled across hundreds of lots.

To more accurately reflect the actual costs of purchasing a manufactured housing lot, the commenter suggested the use of Census Bureau MHS Annual Data, Cost & Size Comparison: New Manufactured Homes and New Single- Family Site Build Homes that derives the average land price for site-built homes, which, while not connected to manufactured housing pricing data, at least accounts for the actual cost of land, according to the commenter. The commenter stated that the derived average land price in the Census Bureau data vastly exceeds the example 2022 loan limit and is directly related to the cost of land alone.

HUD Response: HUD appreciates the comment and the commenter’s opinion that the proposed limits should be further increased. HUD’s loan limits and indexing are dictated by the Housing and Economic Recovery Act of 2008 (HERA). Section 2145 of the Housing and Economic Recovery Act (HERA) of 2008 amended the maximum loan limits for manufactured home loans insured under Title I and stipulated that the Secretary develop a metric that uses U.S. Census Bureau (Census) data on average manufactured home prices to calculate an index for adjusting loan limits in the future. The index is based on data from the Census’ site, which is derived from surveys that were collected from firms that sell new manufactured homes to individuals for residential use. HUD has determined that the New Residential Sales index provides an accurate assessment of the manufactured housing market. This index is defined as the average of the year-over-year changes in the all-units (total) price series published by Census, at the national level, and for a defined look-back period. Furthermore, HUD has determined that it is appropriate to include additional factors to the indexing methodology, accounting for inflation and resulting in adjustments that more closely reflect current manufactured home loan values.

D. Establish New Loan Base Limits Using Current Data

A commenter suggested that loan limits be initially brought up to the following values, which the commenter stated were based on the commenter’s current origination volume for manufactured home lending: home only loans, single-section homes to $200,000, multi-section homes to $300,000; loans secured by land, single-section homes to $325,000, multi-section homes to $350,000. The commenter suggested that the new manufactured homes sales price data then be used as the index for year-over-year loan limit adjustments to this new baseline. The commenter stated that if the loan limits were adjusted in the described manner, nearly all manufactured home loans could qualify for the Title I program, making the program truly viable.

HUD Response: HUD appreciates the comment that the proposed baseline loan limits be further increased and the commenter’s interest in improving the viability of the Title I Manufactured Home loan program. Section 2145 of the

Housing and Economic Recovery Act (HERA) of 2008, established the baseline loan limits and amended the maximum loan limits for manufactured home loans insured under Title I. HERA stipulated that the Secretary develop a metric that uses U.S. Census Bureau (Census) data on average manufactured home prices to calculate an index for adjusting loan limits in the future.

E. Additional Suggested Revisions to FHA’s Title I Program

A commenter provided the following suggestions for changes to FHA’s Title I program: (1) The origination cap fee should be updated from 2 percent to the greater of $2,000 or 2 percent because the cost to originate a lower balance Title I loan is effectively the same as that to originate a larger mortgage; (2) Permit Title I closing-related fees and other customary home loan fees (e.g., closing fee, title insurance, title search) to be financed in the loan because customers currently have to contribute an additional $3,000–$6,000 to cover these fees and costs; (3) Allow the seller to pay closing costs up to 6 percent, like the Title II program; (4) Revise the collections policy to match the Title II policies applicable to medical collections, bankruptcies and judgments—currently the Title I program has a blanket limit on collections of $1000; (5) Adjust the debt ratio guidelines in Title I to match that available for Title II; and (6) Do not require a park/community agreement for 3 years because it has a negative impact on adoptions as community owners already have their own rental agreements, the current length of commitment is too long for some owners, and a timeline of six months should be acceptable if the community is being shut down.

Another commenter recommended that FHA update its fee structure to incentivize lenders to offer loans through the Title I program.

Another commenter stated that a significant reason that community banks are not FHA-approved lenders is because the FHA lender approval process is overly complicated and burdensome. The commenter recommended that HUD work with community bank stakeholders to determine the best way to simplify the FHA lender approval process, thus expanding community bank participation in FHA’s Title I program. This commenter also recommended that HUD create a secondary market facility that allowed community banks to sell manufactured home loans, which the commenter stated would incentivize lenders to make these loans because it would allow lenders to quickly free up capital to further invest in the lenders’ communities.

HUD Response: HUD appreciates these suggestions, which the commenter believes would improve lender participation in the Title I program. These suggestions are outside the scope of this rulemaking which is focused on establishing an indexing methodology for calculating Title I manufactured home loans. HUD will consider these suggestions for future rulemaking or policy changes. F. Other Comments

A commenter stated that they found the proposed rule to be an interesting proposal to address rising home prices and that using indexing methodology and census data on manufactured homes may create a fair or unfair opportunity to take out loans on manufactured homes due to the potential limitation on loan amounts based on this methodology.

HUD Response: HUD appreciates this comment. HUD believes the changes in this rule will provide additional opportunities for low-to moderate income borrowers to participate in the Title I Manufactured Housing program.

- Findings and Certifications

Regulatory Review—Executive Orders 12866, 13563 and 14094

Pursuant to Executive Order 12866 (Regulatory Planning and Review), a determination must be made whether a regulatory action is significant and therefore, subject to review by the Office of Management and Budget (OMB) in accordance with the requirements of the order. Executive Order 13563 (Improving Regulations and Regulatory Review) directs executive agencies to analyze regulations that are ‘‘outmoded, ineffective, insufficient, or excessively burdensome, and to modify, streamline, expand, or repeal them in accordance with what has been learned.’’ Executive Order 13563 also directs that, where relevant, feasible, and consistent with regulatory objectives, and to the extent permitted by law, agencies are to identify and consider regulatory approaches that reduce burdens and maintain flexibility and freedom of choice for the public. Executive Order 14094 (Modernizing Regulatory Review) amends section 3(f) of Executive Order 12866 (Regulatory Planning and Review), among other things.

This rule has been determined to be a ‘‘significant regulatory action,’’ as defined in section 3(f) of Executive Order 12866, as amended by Executive Order 14094, and therefore was reviewed by OMB. However, this final rule was not deemed to be significant under section 3(f)(1) of the Order. The docket file is available for public inspection in the Regulations Division, Office of General Counsel, Department of Housing and Urban Development, 451 7th Street SW, Room 10276, Washington, DC 20410–0500. Due to security measures at the HUD Headquarters building, please schedule an appointment to review the docket file by calling the Regulations Division at 202–402–3055 (this is not a toll-free number). HUD welcomes and is prepared to receive calls from individuals who are deaf or hard of hearing, as well as individuals with speech or communication disabilities. To learn more about how to make an accessible telephone call, please visit: https://www.fcc.gov/consumers/guides/ telecommunications-relay-service-trs.

Regulatory Flexibility Act

The Regulatory Flexibility Act (RFA) (5 U.S.C. 601 et seq.) generally requires an agency to conduct a regulatory

flexibility analysis of any rule subject to notice and comment rulemaking requirements, unless the agency certifies that the rule will not have a significant economic impact on a substantial number of small entities. Accordingly, the undersigned certifies that this rule does not have a significant economic impact on a substantial number of small entities.

Environmental Impact

This rule establishes and reviews loan limits. Accordingly, under 24 CFR 50.19(c)(6) this rule is categorically excluded from environmental review under the National Environmental Policy Act of 1969 (42 U.S.C. 4321).

Executive Order 13132, Federalism

Executive Order 13132 (entitled ‘‘Federalism’’) prohibits an agency from publishing any rule that has federalism implications if the rule either: (i) imposes substantial direct compliance costs on state and local governments and is not required by statute, or (ii) preempts state law, unless the agency meets the consultation and funding requirements of section 6 of the Executive order. This rule does not have federalism implications and does not impose substantial direct compliance costs on state and local governments or preempt state law within the meaning of the Executive order.

Unfunded Mandates Reform Act

Title II of the Unfunded Mandates

Reform Act of 1995 (2 U.S.C. 1531– 1538) (UMRA) establishes requirements for federal agencies to assess the effects of their regulatory actions on state, local, and tribal governments, and on the private sector. This rule does not impose any federal mandates on any state, local, or tribal governments, or on the private sector, within the meaning of the UMRA.

List of Subjects in 24 CFR Part 201

Claims, Health facilities, Historic preservation, Home improvement, Loan programs—housing and community development, Manufactured homes, Mortgage insurance, Reporting and recordkeeping requirements.

For the reasons discussed in the preamble, HUD amends 24 CFR part 201 as follows:

PART 201—TITLE I PROPERTY

IMPROVEMENT AND MANUFACTURED HOME LOANS

■ 1. The authority for 24 CFR part 201 continues to read as follows:

Authority: 12 U.S.C. 1703; 15 U.S.C. 1639c; 42 U.S.C. 3535(d).

■ 2. Amend §201.2 by revising the definition of ‘‘Manufactured Home’’ to read as follows:

- 201.2 Definitions.

- * * * *

Manufactured home means a transportable structure, comprised of one or more modules, each built on a permanent chassis, with or without a permanent foundation, designed for occupancy as a principal residence by a single family. For purposes of the annual adjustments to loan limits under this part, a manufactured home may be a single-section home comprised of one module or a multi-section home comprised of two or more modules. A new manufactured home shall comply with the minimum property standards prescribed by the Secretary to assure its livability and durability that are published as the Manufactured Home Construction and Safety Standards implementing the National Manufactured Housing Construction and Safety Standards Act of 1974, 42 U.S.C. 5401–5426, at 24 CFR part 3280. To qualify for a manufactured home loan insured under this part, an existing manufactured home must have been constructed in accordance with standards published at 24 CFR part 3280 and must meet standards similar to the minimum property standards applicable to existing homes insured under title II of the Act, as prescribed by the Secretary.

- * * * *

■ 3. Amend §201.10 by revising the introductory texts of paragraphs (b)(1) and (2), paragraph (c), and paragraphs (d)(1) and (2), and adding paragraph (h) to read as follows:

- 201.10 Loan amounts.

(b) * * *

(1) The total principal obligation for a loan to purchase a new manufactured home shall not exceed the sum of the following itemized amounts, up to a maximum set according to an index established by HUD in paragraph (h)(1) of this section and updated through notice which shall establish separate loan limits for single-section homes and multi-section homes:

* * * * *

(2) The total principal obligation for a loan to purchase an existing manufactured home shall not exceed the lesser of the following amounts, up to a maximum set according to an index established by HUD in paragraph (h)(1) of this section and updated through notice which shall establish separate loan limits for single-section homes and multi-section homes:

* * * * *

- Manufactured home lot loans. The total principal obligation for a loan to purchase and, if necessary, develop a lot suitable for a manufactured home, including on-site water and utility connections, sanitary facilities, site improvements and landscaping, shall not exceed 95 percent of either the appraised value of the developed lot (as determined by a HUD-approved appraisal) or the total of the purchase price and development costs, whichever is less, up to a maximum set according to an index established by HUD in paragraph (h)(2) of this section and updated through notice.

- * * *

- The total principal obligation for a loan to purchase a new manufactured home and a lot on which to place the home shall not exceed the sum of the following itemized amounts, up to a maximum set according to an index established by HUD in paragraph (h)(3) of this section and updated through notice which shall establish separate loan limits for single-section homes and multi-section homes:

- The total principal obligation for a Combination Loan, to purchase an existing manufactured home and lot, shall not exceed the lesser of the following amounts, up to a maximum set according to an index established by HUD in paragraph (h)(3) of this section and updated through notice which shall establish separate loan limits for single- section homes and multi-section homes:

* * * * *

(h) Annual Adjustments. HUD shall adjust the following loan limits annually through notice:

- In paragraphs (b)(1) and (2) of this section, the single-section manufactured home loan limit shall be adjusted to reflect changes in single-section manufactured home sales prices and the multi-section manufactured home loan limit shall be increased to reflect changes in double-section manufactured home sales prices, according to data published by the Census Bureau, except that the loan limits shall not be lowered.

- In paragraph (c) of this section, the manufactured home lot loan limit shall be increased to reflect changes in single- family home sales prices according to data published by the Census Bureau, except that the loan limit shall not be lowered.

- In paragraphs (d)(1) and (2) of this section, the combination manufactured home and lot loan limits shall be increased to be the sum of the applicable loan limit for the manufactured home loan in paragraph (b)(1) and the lot loan limit in paragraph (c) of this section, except that the loan limit shall not be lowered.

Julia R. Gordon, Assistant Secretary for Housing—FHA Commissioner.

[FR Doc. 2024–04138 Filed 2–27–24; 8:45 am]

BILLING CODE 4210–67–P

DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT

24 CFR Part 401

[Docket No. FR–6122–F–02]

RIN 2502–AJ48

Rent Adjustments in the Mark-to- Market Program

AGENCY: Office of the Assistant Secretary for Housing—Federal Housing Commissioner, HUD.

ACTION: Final rule.

SUMMARY: The Mark-to-Market program preserves affordability and availability of affordable rental multifamily properties with federally insured mortgages, reducing rents to market levels by restructuring existing debt to levels supportable by these rents. This final rule revises the Mark-to-Market program regulations to clarify that annual adjustment of restructured rents under the program will be based on an operating cost adjustment factor determined by HUD and to further clarify when HUD may approve rent adjustments on a budget basis. This final rule will bring greater clarity to the Mark-to-Market program and will align HUD’s regulations with recent legislative changes that specifically allow budget-based rent adjustments for the program.

DATES: Effective: March 29, 2024.

FOR FURTHER INFORMATION CONTACT: Thomas R. Davis, Director, Office of Recapitalization, Office of Multifamily Housing Programs, Department of Housing and Urban Development, 451 Seventh Street SW, Room 6106, Washington, DC 20410; telephone number 202–402–7549. HUD welcomes and is prepared to receive calls from individuals who are deaf or hard of hearing, as well as individuals with speech or communication disabilities. To learn more about how to make an accessible telephone call please visit https://www.fcc.gov/consumers/guides/ telecommunications-relay-service-trs.

SUPPLEMENTARY INFORMATION:

I. Background

The Multifamily Assisted Housing Reform and Affordability Act of 1997 (Title V of Pub. L. 105–65, approved October 27, 1997, and codified at 42 U.S.C. 1437f note) (MAHRA) authorizes the Mark-to-Market program, which is designed to preserve low-income rental housing affordability while reducing the long-term costs of federal rental assistance. Under the program, multifamily housing projects with above-market rents that are subject to an expiring contract under section 8 of the United States Housing Act of 1937 (42 U.S.C. 1437f) (Section 8) undergo both a restructuring of the project’s HUD- insured or HUD-held debt and an initial renewal of its Section 8 Housing Assistance Payments (HAP) contract so that a new first loan is serviceable based on modified rents.

On July 16, 2020, HUD issued a proposed rule in the Federal Register, at 85 FR 43165, which proposed to revise the Mark-to-Market program regulations to clarify that all annual rent adjustments for projects subject to a restructuring plan are solely by application of an operating cost adjustment factor (OCAF) established by HUD. The current regulations, at 24 CFR 401.412(b), authorize HUD to approve a request for a budget-based rent adjustment in lieu of an OCAF. HUD proposed to remove the budget-based rent adjustment provision as discussed in detail in the proposed rule at 85 FR 43166–43167.

In addition, HUD in the proposed rule sought to revise §401.554 to remove the statement that HUD will ‘‘extend’’ Section 8 contracts in order to comport with HUD’s standard programmatic practice of renewing contracts rather than extending them and also to remove a parenthetical reference in §401.554 to multiple renewal authorities for contracts subject to a Restructuring Plan.

Subsequent to the publication of the proposed rule, Public Law 117–328, Consolidated Appropriations Act, 2023, approved on December 29, 2022, amended MAHRA section 515 to add a new subsection specifically authorizing budget-based rent adjustments for Mark- to-Market projects. As amended, the statute provides that HUD may, not more than once every 10 years, adjust rents in an amount equal to the lesser of budget-based rents or comparable market rents for the market area upon request of an owner or purchaser who meet certain criteria.

This final rule implements the statutory change enacted by the Consolidated Appropriations Act, 2023, as well as the revisions to §401.554 contemplated in the proposed rule.

II. The Public Comments

The public comment period for the proposed rule closed on September 14, 2020. HUD received five comments. The commenters included members of the public, public officials, and the assisted housing industry. Commenters were generally opposed to the contemplated regulatory changes removing the budget- based rent adjustment provision; however, this issue has been superseded and obviated by the statutory change enacted by the Consolidated Appropriations Act, 2023. The statutory change is generally aligned with the views expressed by commenters on the rent adjustment provisions. Commenters expressed no opinions with respect to the proposed revisions to §401.554.

Discretion To Allow Budget-Based Rent Adjustments

Commenters stated that HUD does retain the discretion to use a budget-based rent adjustment at the request of the property owner regardless of whether §401.412(b) is revised. One commenter noted that in enacting MAHRA, Congress did not prohibit the Secretary’s exercise of reasonable discretion to address extraordinary

[1] For an example of the latest data according to 5The New Residential Sales data come from 6Available at https://www.whitehouse.gov/omb/ Census, see ‘‘MHS Latest Data,’’ https:// Census’s Survey of Construction. More information budget/mid-session-review/.

www.census.gov/data/tables/time-series/econ/mhs/ can be found here: https://www.census.gov/ latest-data.html. construction/nrs/index.html.

Part IV – Additional Information with More MHProNews Analysis and Commentary

1) As MHARR’s memo itself indicated, this announcement is a step in the process. What now remains to be seen is this. What institutions will step up and take advantage of this opportunity for more manufactured home lending under the Title I loan program? From a potential lender’s perspective, federal guarantees against losses are potentially attractive. It is entirely possible that several categories of organizations could become interested and involved in doing more manufactured home lending.

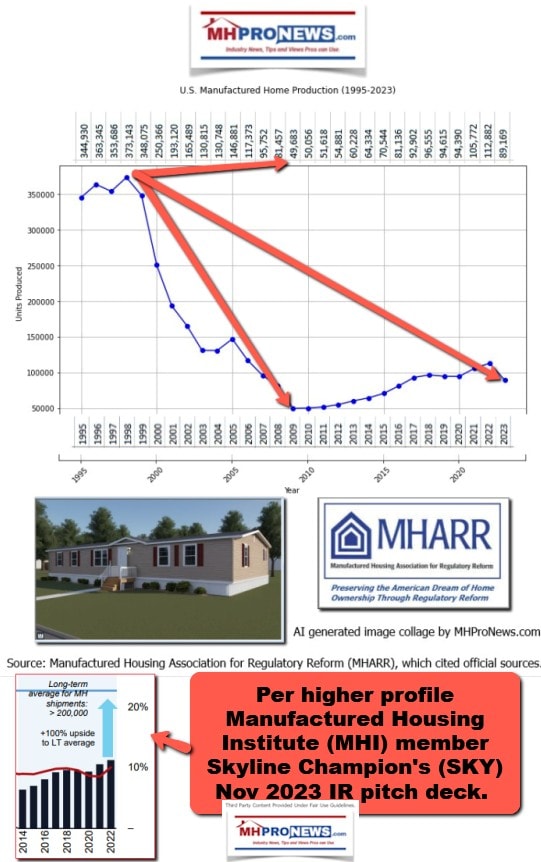

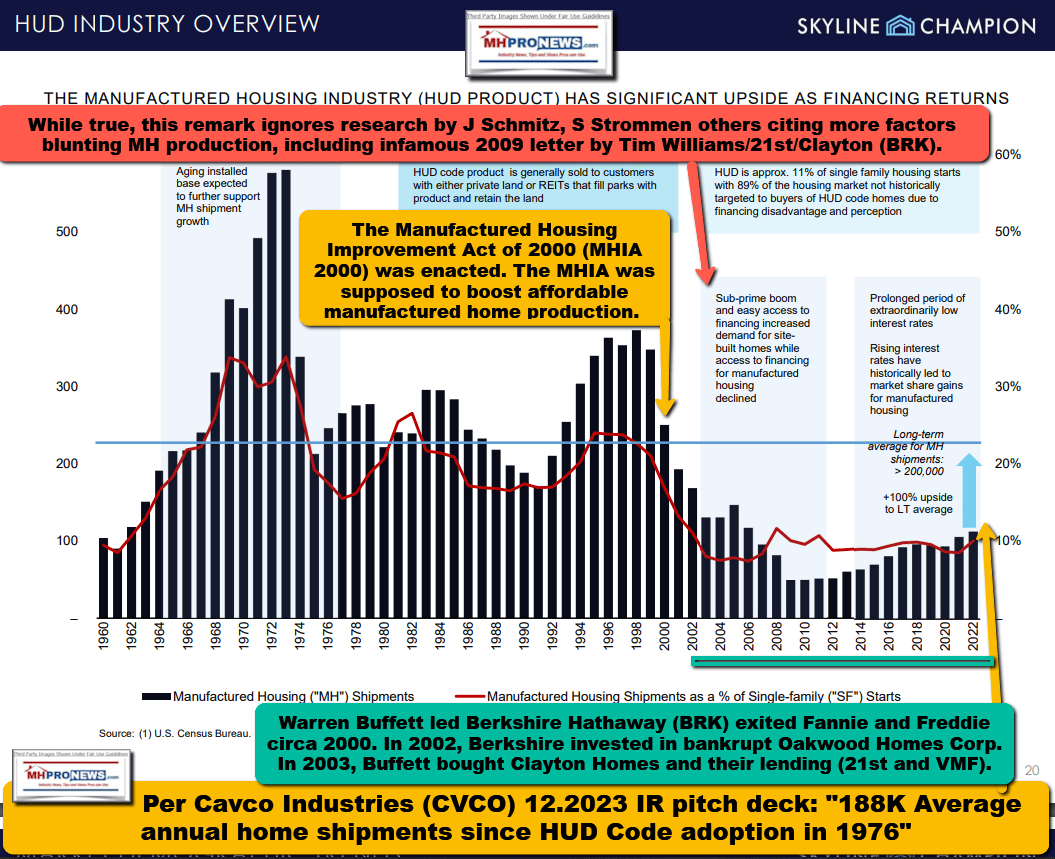

2) That noted, as MHProNews has uniquely reported, the Manufactured Housing Institute (MHI) during the tenure of their prior president and CEO Gail Cardwell produced this next graphic. It reflects how significant the FHA Title I loan program used to be for HUD Code manufactured homes in prior decades.

During its heyday, per MHI and Cardwell, tens of thousands of manufactured homes annually were financed with such Title I loans.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

3) Former MHI presidents and CEOs, Chris Stinebert, Gail Cardwell, and Thayer Long, names are no longer available on the MHI website. This was the search performed on 3.6.2024 at about 11 AM ET. Note carefully what left-leaning Copilot said about the absence of their names.

> “Can you find any mention on the Manufactured Housing Institute website on this date the following prior 21st century presidents and CEO of that trade group? Chris Stinebert, Gail Cardwell, and Thayer Long.”

4) With the three prior MHI presidents and CEOs in mind, it should be noted that Stinebert told The Wall Street Transcript (TWST) that manufactured housing was poised for a rebound. His remarks are preserved by MHProNews, but apparently not by others who are often in the MHI orbit. Why don’t others involved in MHI spotlight this same information?

5) Years ago, MHProNews reported that a Manufactured Housing Executive Committee (MHEC) member told Thayer Long at a meeting this writer was in attendance at that ‘you are not getting the job done.’ Not long after those words were uttered, Long was gone. Eventually, Richard “Dick” Jennison took Long’s place as the President and CEO of MHI.

Due in part to the lack of financing, manufactured home production continued to fall after Stinebert said circa 2004 that manufactured housing was ready for a rebound (see article linked above and here). Stinebert, Cardwell, and Long all have gone on to other association work. A surface look at their efforts appear to support the notion that they have done well. Which begs the question, what happened to them at MHI?

Then longtime readers of MHProNews should recall that Dick Jennison oddly remarked after the industry had hit bottom in 2009-2010 that manufactured housing should ‘grow slowly’ in remarks made in a video recorded and posted below.

6) Those remarks captured in the video above proved to be so embarrassing (and revealing) to Jennison and MHI at the time that when MHProNews pressed the matter with Tim Williams, president and CEO of Berkshire Hathaway owned 21st Mortgage Corporation, that Williams indicated he would see to it that Jennison would clean up those remarks in a public forum. Williams has served as MHI’s chairman. Longer story short, that is what occurred. At the next Louisville Manufactured Home Show, Jennison said that the industry’s goals should be set to achieve 500,000 manufactured homes sold annually. Instead of ‘slow growth,’ the new narrative would be robust growth was possible. So, which is it with MHI?

7) Nearly a decade has gone by since those remarks by Jennison were made that the industry could achieve 500,000 new HUD Code homes annually. Manufactured housing is still not at the levels that it was when Stinebert said the industry was ready for a rebound. Stinebert predicted the industry’s turnaround about 20 years ago. Why is it that these historical reference points are nowhere to be found on MHI’s website? Why is it that MHI linked trade media and bloggers routinely ignore such factual insights and MHI-linked information? As the graphic below reflects, and the following linked article indicate, the industry is not yet poised to return to the anemic levels that existed when Stinebert spoke with TWST as recorded above and is linked again for reader convenience at this link here.

8) MHProNews has noted several times that Bing’s AI powered Copilot is linked to Microsoft. William “Bill” Gates III has been a longtime ally of Warren Buffett, who still leads Berkshire Hathaway. Gates has a noteworthy number of shares in Berkshire Hathaway (BRK). Gates traveled with Buffett to East Tennessee to visit Berkshire owned Clayton Homes. One point from this is that AI powered Copilot is likely to favor the viewpoints of operations and organizations that are linked to interests of Gates, his investments, nonprofits, and enterprises.

9) Nevertheless, when asked the appropriate evidence-based inquiries, Copilot has repeatedly called into question the various anomalous behaviors Berkshire- and Clayton-dominated MHI. MHI for much of the 21st century, per Copilot, has not been known to have ever taken a position that goes against what Clayton, its affiliated lending, and its dominating brands have wanted. To a certain extent, Copilot’s artificial intelligence – its ‘logic’ – can be guided to spot and then identify seemingly contradictory behavior by MHI leaders which have routinely benefited consolidators in part because manufactured housing industry growth has been thwarted.

10) MHARR has championed for years the existing good federal laws which have oddly not been properly enforced through various administrations in the 21st century. Copilot has pointed to MHARR’s consistency in advocacy. Copilot has pointed to MHARR’s absence of scandals that seemingly dog several MHI connected leaders. And Copilot has explored MHARR’s logic in pushing for the enforcement of good existing laws, including this recent advancement of correcting Ginnie Mae’s onerous 10/10 rule to now being only one fourth of the capital requirements that have existed for some 15 years (see federal statements in the documents posted above).

11) MHARR has steadily pressed the case for DTS as well as the case for the reform of Ginnie Mae and the FHA Title I program. Some examples from the MHARR website are linked below.

12) As will be explored by MHProNews in a planned upcoming report in a follow up to this announcement and development, it is ludicrous for MHI-linked mouthpieces to fail to mention MHARR when it is MHARR that has been consistent in its apparently genuine pursuit of getting more affordable and competitive lending. By stark contrast, the evidence-based case can be made that Clayton-21st and MHI leaders have consistently postured one thing (the desire for more competitive lending) when their behavior clearly indicates something quite different.

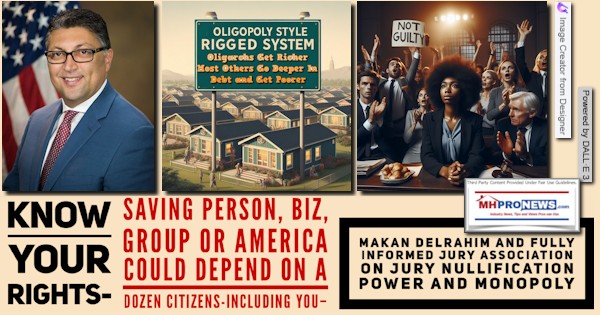

13) The truth has arguably been hiding in plain sight. It has been Clayton-linked lending, with MHI behavior as cover, that has apparently been thwarting manufactured housing in precisely the arenas that have been what MHARR called “bottlenecks” to industry growth. If it seems counterintuitive to Clayton and 21st’s interests on one level, that is almost irrelevant to the type of mindset that is described by Minneapolis Federal Reserve researchers who explain “sabotage monopoly” tactics. Sabotaging a market is how a market is minimized. When a market is minimized, it can be more readily consolidated. Consolidation of the industry is for whatever reasons an unstated by MHI staff, but demonstrably persistent goal of MHI’s managing corporate junta in the 21st century. MHI’s staff can’t be so deaf, dumb or blind to not notice the disconnects. Who says? Copilot and Samuel Strommen, consumer and antitrust legal investigator.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

14) MHI’s failure to ‘team up’ with one of its own members in the Underserved Mortgage Markets Coalition and MHARR who have been advocating for DTS is more evidence that it is slyly posturing support for more lending, when it is actually sabotaging its own market so that consolidation can continue.

15) While MHI is pointing its ‘news’ toward flawed reporting by Newsweek, it has ignored the potential that mainstream and specialized media has pointed to in the reports linked below.

16) There is still no known direct response by MHI, nor its attorneys, nor its media relations contact Molly Boyle to the evidence-based allegations above, nor many others. Instead, MHI plays the posturing game. But it consistently fails to produce measurable results, as their former vice-president and MHI critic Danny Ghorbani has said.

17) It remains to be seen if what may be the waning days of the Biden Administration will witness any launch by antitrust enforcement by the Department of Justice (DOJ) or Federal Trade Commission (FTC) of antitrust enforcement in the manufactured housing industry space. But what is known per two sources deemed reliable is that during the Trump Administration, the DOJ did meet to discuss a probe of Clayton Homes and possible antitrust violations in manufactured housing.

18) In conclusion to this review, MHARR has been consistent. MHI has been described as duplicitous, false, misleading, “lie,” and apparently engaged in paltering. Who has made those observations? MS linked Copilot.

> “Can you find any direct response by Clayton Homes, 21st Mortgage, Vanderbilt Mortgage, or the Manufactured Housing Institute, Molly Boyle, or attorneys linked to the Institute to the concerns and allegations raised in the following reports: https://manufacturedhousingassociationregulatoryreform.org/manufactured-housing-association-for-regulatory-reform-mharr-continues-to-expose-principal-bottlenecks-suppressing-manufactured-housing/ and https://www.manufacturedhomepronews.com/institute-for-justice-planetizen-yahoo-news-msn-wn-florida-trend-mharr-plug-enhanced-preemption-promoting-solution-but-what-about-manufactured-housing-institute-plus/ and https://www.manufacturedhomepronews.com/manufactured-housing-institute-hit-by-antitrust-allegations-in-op-ed-mhi-attorney-boyle-asked-to-respond-to-evidence-based-concerns-ai-fact-check-refers-to-mhis-orwellian/ ?”

After a partially glitched response, after pointing out its apparent error, Copilot provided this revised response to the inquiry above.

19) Manufactured housing is demonstrably underperforming during an affordable housing crisis. While there is plenty of self-congratulations, and mutual accolades and awards sharing by MHI’s “circle fest in a hot tub” there is no robust growth. These are facts. The evidence points to the reality of these observations. It seems apparent that MHI is unable and/or unwilling to be accountable for these behaviors. Thus, there seems to be an apparent need for public officials and/or plaintiffs’ attorneys to investigate, litigate, and demonstrate just how costly this has been to manufactured housing independents, employees, consumers and those who desire affordable housing.

20) Meanwhile, MHProNews and/or MHLivingNews will continue to report as warranted based on developments like this hard-earned advancement by MHARR of the reform of the Ginnie Mae 10/10 rule to get more FHA Title I lending. Stay tuned. ##

Part V – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from 3.6.2024

- New York Community Bank gets $1 billion ‘lifeline’ from former Treasury Secretary Steven Mnuchin’s company

- Landmark rule requires some companies to share how much they pollute. But it was scaled back

- Federal Reserve Board Chairman Jerome Powell speaks during a news conference after a Federal Open Market Committee meeting on September 20, 2023 at the Federal Reserve in Washington, DC. In the face of slowing inflation and strong consumer spending, the Federal Reserve announced that it will keep the interest rate steady, holding the benchmark borrowing rate to a range of 5.25% to 5.5%.

- Markets end the day higher after Fed Chair Powell’s testimony before Congress

- Elon Musk

- OpenAI publishes Elon Musk’s emails. ‘We’re sad that it’s come to this’

- Key takeaways from Fed Chair Powell’s testimony on Capitol Hill

- As Americans prepare to head to the polls for the 2024 Presidential election, experts in online safety are raising alarms that AI could contribute to the spread of political misinformation.

- Top AI photo generators produce misleading election-related images, study finds

- A Microsoft sign is seen at the company’s headquarters on March 19, 2023 in Seattle, Washington.

- Microsoft employee: AI tool should be removed until ‘offensive images’ can be addressed

- Jennifer Homendy, Chair of the U.S. National Transportation Safety Board (NTSB), testifies before the Senate Commerce, Science and Transportation Committee at the Russell Senate Office Building on Capitol Hill on March 06, 2024 in Washington, DC. Homendy said that Boeing has not fully cooperated with the NTSB Board’s investigation into Alaska Airlines Flight 1282 door plug incident.

- NTSB rips Boeing for failing to produce key door plug documents

- UK finance minister Jeremy Hunt delivering his Budget to the House of Commons in London in March 2024.

- Britain raids the pockets of the jet-setting super-rich to raise $3 billion

- Commuters battle strong winds on London Bridge on Monday, January 22, 2024.

- Cash-strapped Britain cuts taxes for workers as election looms

- This is Oscar Mayer’s newest hot dog

- Starbucks is laying off thousands of workers in the Middle East in response to Gaza boycotts

- Elon Musk’s X must face copyright infringement suit by music publishers, federal judge says

- Fed Chair Powell is about to get grilled by Congress. Here’s what markets want to hear

- Tesla’s Berlin plant shut after arson attack on electricity pylon. Far-left group claims responsibility

- There’s a gold rush on Wall Street

- California Panera franchisee will raise minimum wage to $20 after political firestorm over minimum wage carveout

- Taiwan wants to hire Indian workers. What’s skin color or religion got to do with it?

- Dartmouth basketball team votes to join the first college athletics union

- Harvard ‘absolutely failed’ to comply with unprecedented subpoena in antisemitism probe, House Education Committee chair says

- Credit card late fees capped at $8 as part of Biden crackdown on junk fees

- Apple iPhones sales fall 24% in China amid competition and headwinds