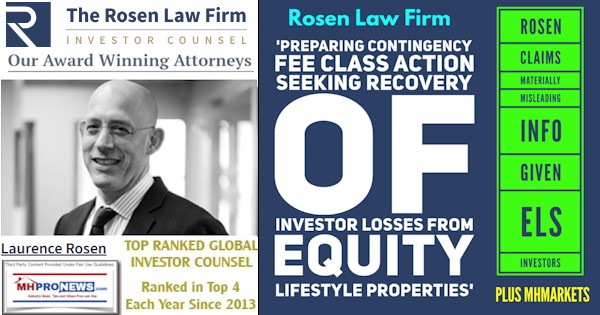

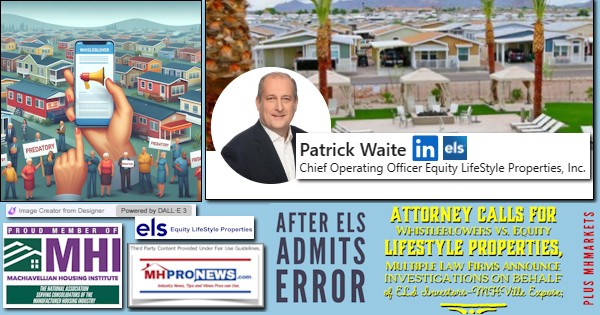

According to the firm’s website: “Equity LifeStyle Properties, Inc. is a self-administered, self-managed real estate investment trust (REIT) headquartered in Chicago.” Also per ELS: “We marked 30 years as a public company in 2023” and “We have a unique business model where we own the land which we lease to customers who own manufactured homes and cottages, RVs and/or boats either on a long-term or short-term basis.” On 5.23.2024 a press release by the Rosen Law Firm was issued under the headline: “ROSEN, NATIONAL TRIAL LAWYERS, Encourages Equity LifeStyle Properties, Inc. Investors to Inquire About Securities Class Action Investigation – ELS.” According to the Rosen media release, ELS “may have issued materially misleading business information to the investing public.” Per the Rosen website, the firm has: “Over $400 million recovered for investors in the last 2 years.” The firm asserts that “Our mission is to protect shareholders rights.”

Part I of this report provides that media release, while Part II of this report includes additional information from ELS and other sources along with more MHProNews analysis and commentary.

Part I – According to the Rosen Law Firm Press Release

New York, New York–(Newsfile Corp. – May 23, 2024) – WHY: Rosen Law Firm, a global investor rights law firm, continues to investigate potential securities claims on behalf of shareholders of Equity LifeStyle Properties, Inc. (NYSE: ELS) resulting from allegations that Equity LifeStyle Properties may have issued materially misleading business information to the investing public.

SO WHAT: If you purchased Equity LifeStyle Properties securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

WHAT TO DO NEXT: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=22421 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

WHAT IS THIS ABOUT: On January 22, 2024, after market hours, Equity LifeStyle Properties filed with the U.S. Securities and Exchange Commission (“SEC”) a current report on Form 8-K in which it announced that “[f]ollowing receipt of a further Comment Letter in which the Staff of the SEC informed the Company it disagreed with the materiality conclusion, the Company and the Audit Committee … determined that the error was material to its previously issued financial statements, as included in the Annual Report on Form 10-K for the year ended December 31, 2022 and the Quarterly Report on Form 10-Q for the quarter ended March 31, 2023 (the ‘Prior Period Financial Statements’).” Equity LifeStyle Properties further stated that it “determined that the Prior Period Financial Statements, as well as, any reports, related earnings releases, investor presentations or similar communications of the Company’s Prior Period Financial Statements, should no longer be relied upon.”

On this news, Equity LifeStyle Properties’ stock fell $1.96 per share, or 2.84%, to close at $67.00 per share on January 23, 2024. The next day, it fell $1.45 per share, or 2.16%, to close at $65.55 per share on January 24, 2024.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/210301##

Part II – Additional Information with More MHProNews Analysis and Commentary

Per the Rosen website: “The Rosen Law Firm, P.A. is dedicated to recovering damages for shareholders victimized by corporate fraud and other misconduct. Our attorneys have a wealth of knowledge and experience handling complex financial litigation and winning significant victories and settlements for our clients. By focusing exclusively on securities class actions and derivative litigation, we have risen to the forefront of plaintiffs’ firms and have recovered damages totaling hundreds of millions of dollars for our clients. Our mission is to protect shareholders rights.” Longtime and detail-minded MHProNews readers are aware of the issue of materiality detailed in the SEC document linked here.

1) MHProNews has previously reported on ELS’ statement on this specific issue where the firm admitted error, as was cited by Rosen Law firm in Part I above.

2) Copilot and the Shareholders Foundation have stated that others beyond Rosen have announced similar probes on behalf of shareholders related to this same materiality concern.

- Several law firms, including FeganScott, Kirby McInerney LLP, and Glancy Prongay & Murray LLP, have announced investigations into ELS for possible breaches of fiduciary duties. These investigations stem from ELS’s disclosure in an SEC filing that certain previously issued financial statements should no longer be relied upon due to an error related to the classification of cash outflows associated with the purchase of manufactured homes1234.

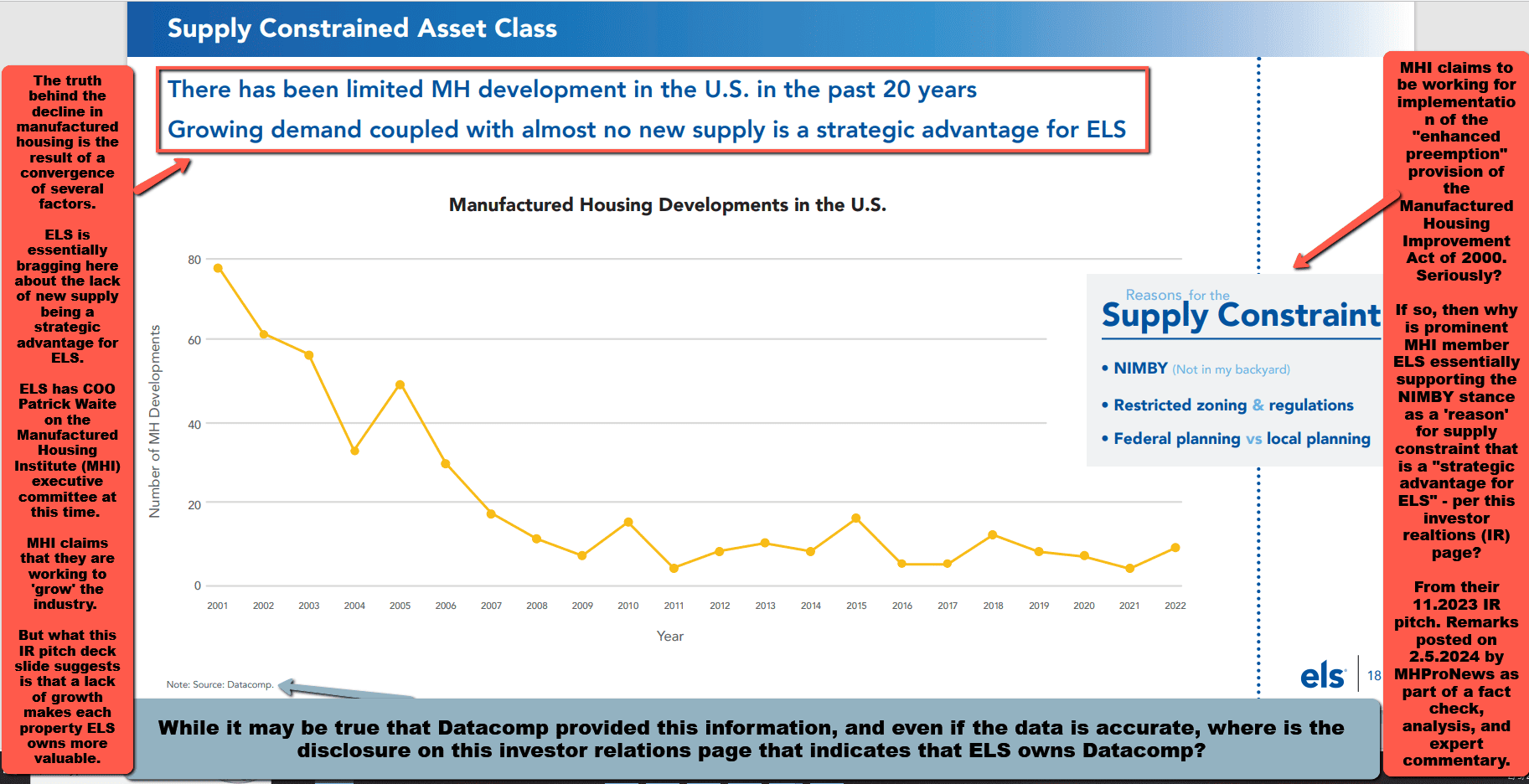

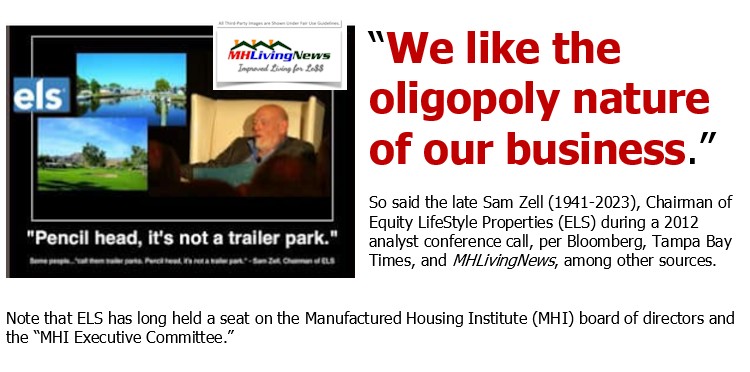

3) This issue is not directly related to the concerns by plaintiffs’ attorneys on behalf of manufactured home community residents against several Manufactured Housing Institute (MHI) members that include ELS owned Datacomp, ELS itself, and several other firms.

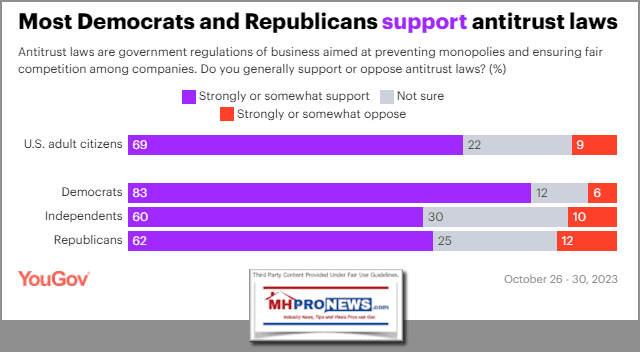

4) As will be noted in an upcoming report on multiple antitrust suits that have been announced against ELS, ELS owned Datacomp (sister brand to MHVillage and MHInsider), and multiple other MHI and MHI-linked state association affiliated firms, counsel for the defendants have mocked the claims, but the plaintiffs are persisting in their legal action.

5) ELS has faced several other cases over the years, one of which resulted in a major loss. More recently, beyond those cases and investigations already cited is the litigation noted below. Per LawEmpower: “The Equity LifeStyle Properties lawsuit in Florida is still in its early stages. The court has not yet ruled on the merits of the case.”

6) Per Copilot on 5.25.2024 using its purple or creative setting was the following.