“When others are going left, look right.”

– investing maxim of Sam Zell, Chairman, Equity Lifestyle Properties (ELS).

Preface. This report will touch upon the interests of the following.

- Manufactured home industry professionals, particularly independents, but larger players too.

- Affordable housing advocates – including, but not limited to – those who care about the growing pressures on manufactured home community residents living in properties where site fees are being dramatically hiked.

- Investors – including, but not limited to – those invested in publicly traded firms, but also those who may be seeking ‘white hat’ investments that are sustainable, provide a much-needed products/services, while earning healthy profits.

- Public officials at the local, state, and federal levels.

- Researchers, nonprofits, and others – including, but not limited to – mainstream national, regional, or local media.

- Taxpayers, renters, and housing seekers.

Newer readers should note that citing a source ‘is what it is.’ Citing some person, publication, or organization in this article or others should not be regarded as an endorsement or agreement. MHProNews and our MHLivingNews sister site apply the time-honored principle of separating the wheat from the chaff. Every source has its good and bad, and a quote is aimed to reflect someone’s perspective that may prove useful in understanding a given topic.

The predicates and disclaimer made, let’s dive in.

Investor Christopher Salazar, writing for Bigger Pockets, published a list of his favorite pull quotes from Sam Zell’s book, “Am I Being Too Subtle?” From that list are the following that to various degrees apply to the theme of this report.

- “If everyone is going left, look right”

- “There is tremendous value in being a good listener”

- “I run my company as a meritocracy with a moral compass”

- “In any negotiation I believe in leaving a little bit on the table. And in any relationship I believe in sharing the stakes.”

- “Reputation is your most important asset. Everything you do, everything you say, is part of the permanent record. Your name reflects your character”

- “The bottom line is if you’re really good at what you do, you have the freedom to be who you really are”

- “All the opportunity in the world means nothing if you don’t actually pull the trigger”

- “I grew up believing that anything is possible. And when you’re not aware there are any limitations, nothing stops your from trying”

- “Where there is scarcity, price is no object. This basic tenet of supply and demand would later become a governing principle of my investment principle”

- “I learned I was a leader. Instead of being part of the crowd, subject to directions I didn’t care for, I could set the course. And I could get others to follow me”

- “It just never occurred to me that I couldn’t do it. If you’re not aware that you’re not supposed to be able to do something, the barriers to doing it are dramatically lessened”

- “That desire to take a risk, to test my limits, to ask “Why not?” was part of my DNA, and I don’t think I’ve changed that much since.”

- “It never crossed my mind that I might be too young to start an investment business or that I couldn’t do it. I didn’t know any better, but was able to sell the banks on my ability to get it done”

- “Real estate isn’t just about buildings as inanimate objects. It often reflects the pulse of the nation.”

- “I never allow my personal feelings to interfere with my duty to the shareholders, or even with my own private investments.”

- “Taking risks is really the only way to consistently achieve above-average returns.”

- “I’m highly judicious about where I put my time- in terms of the opportunity cost of other deals I didn’t do, and because time is my most valuable resource.”

- ”Seeing potential opportunities is one thing; knowing how to take advantage of them is another.”

- “I’ve always believed in buying into in-place demand rather than trying to create it.”

- “The environment you spend most of your waking hours in reflects who you are and the type of people you want working with you and for you.”

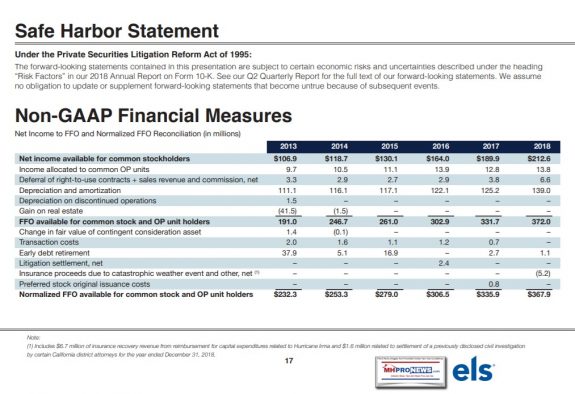

We will leave it to readers or researchers to discern the degree that those statements fit Zell’s ELS. Certainly, from a stock performance standpoint compared to the broader markets, the firm is doing well, and has done so for many years.

Among the takeaways from the above could be these fitting concepts for manufactured housing.

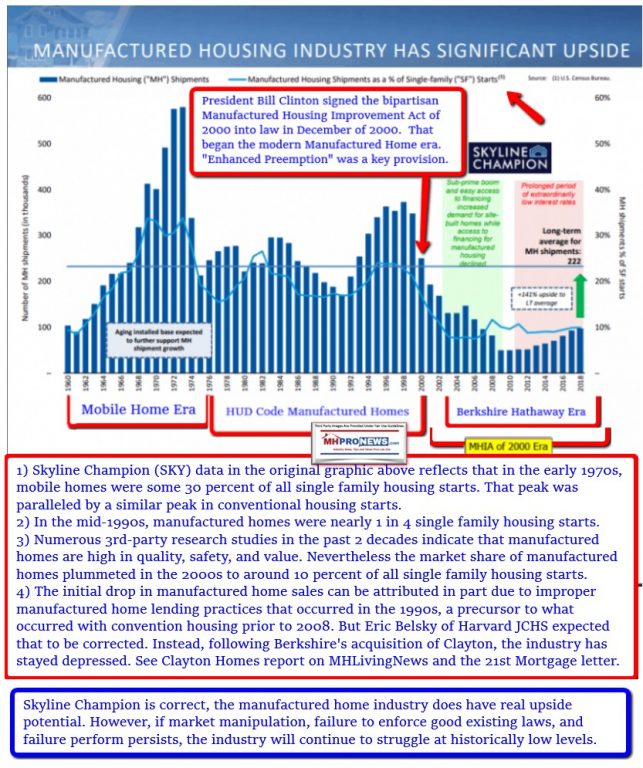

- The demand for affordable housing already exists. Manufactured homes are well positioned to serve that need.

- The proven leader is willing to take input from others (“listening”), and to look at avenues that others aren’t considering to obtain better returns. For example, it is a maxim in investing that when everyone is already into a stock that the best returns have already been obtained.

With those Zell quotes, A and B above specifically in mind, let’s ponder some statements by UMH Properties (UMH) as reported for their November 8, 2019 investor/analyst conference call.

Official Insights from UMH Properties

“The acquisition market remains challenging. Both one-off acquisitions and portfolio sales continue to trade at historically low cap rates.”

- Sam Landy, J.D.,

President and Chief Executive Officer,

UMH Properties (UMH)

From our recent report and analysis on Sun Communities (SUI) 2019 3rd quarter investor conference call at this link here are the following pull quotes. SUI’s reference relates very specifically to what Landy said in the quote above. As ELS, UMH, and SUI are all publicly traded firms, their formal comments matter. They are supposed to be accurate information.

Andrew T. Babin,

Research Division – Senior Research Analyst

Robert W. Baird & Co. Incorporated.

- – Gary A. Shiffman,

Chairman & CEO

Sun Communities, Inc. (SUI).

That is applicable to what a bipartisan group of lawmakers said in comments related below.

MHProNews Takeaway #1.

Several sources have made the observation that ‘new sites and new communities’ can often be developed for ‘a lower cost than existing communities can be acquired.’ Review that potent insight in the light of the list at the top of who this report should interest.

To that point, “54% of our properties are currently 98% to 100% occupied…Half of our vacancy is in Florida, which has got a really good demand profile in migration and has performed well for us.” So said Patrick Waite, Executive VP & COO of Equity LifeStyle Properties (ELS), during ELS’ most recent investor conference call.

Back to UMH…

To set the stage for some UMH comments that follow, is the size of their firm.

-Sam Landy, J.D.

President and Chief Executive Officer,

UMH Properties (UMH)

What will be cited below in terms of performance should not be taken as a slam on ELS, because in several respects the assertions are in keeping with Sun Communities and ELS comparable performance. Rephrased, it is rather common, not uncommon.

The gross profit percentage year-to-date was 27% versus 24% in the prior year period. Year-to-date we have sold 230 homes as compared to 204 homes in the prior year period. Our average sales price year-to-date was approximately $60000 versus $54000 in the prior year period representing an increase of 10.8%. Our sales operation continues to meet our expectations. Sales demand is strong throughout the portfolio.”

-Sam Landy, J.D.

President and Chief Executive Officer,

UMH Properties (UMH)

Let’s unpack that observation from Landy.

There is an affordable housing crisis. “Sales demand is strong,” which is as it should be, because of the need for more affordable homes. Yet ELS, Sun (SUI), and UMH all provided similarly low levels of actual home sales. Landy himself admits that sales at a property used to be about 4 units a month. Now, they are less than a single unit monthly average per location? Using 122 properties with 80 sales would yield 2/3rds of a sale per month per property.

That’s a stunning drop in sales. It is a dismally low sales level for professionals involved in affordable housing during a crisis. The margins are there, as Landy explained. They are improving their properties, as UMH’s CapX and other data reveals.

UMH’s CEO also said this.

“Part of the reason our business plan works so well is there are still so many people that cannot get financed under the existing laws that we rent 8 homes for every 1 we sell.”

-Sam Landy,

President and Chief Executive Officer,

UMH Properties (UMH)

Just a few years ago, UMH was concerned with home sales, and Landy lamented how they had to back away from lending which allowed them to sell homes instead of rent them. The regulatory environment changed that, as he explained.

Back to their recent conference call, we see this.

“We anticipate that there will be action in Congress and with the President [with respect the Duty to Serve manufactured housing lending by the Government Sponsored Enterprises of Fannie Mae and Freddie Mac, as required by the Housing and Economic Recovery Act of 2008]. And even if it is a pilot program [by the GSEs] we think there’s going to be financing available for the public so they can buy manufactured homes not paying 7%, 7.5%, 8% mortgages but more competitive rates to the 3.5% 4% rates you get on a conventional home.”

- Eugene W. Landy

Chairman of the Board, Founder

UMH Properties (UMH)

That’s an interesting comment by UMH’s chairman, which merits parsing.

Unless Congress, the Trump Administration, or other legal action occurs, there are several reasons to doubt that Fannie or Freddie will do so.

For example. Fannie Mae’s recently revised proposed plan to ‘fulfill’ their DTS requirements to the FHFA indicates they plan to reduce their already miniscule commitment to manufactured housing. Lesli Gooch, Ph.D., the CEO-elect for the Manufactured Housing Institute (MHI), indicated their trade group would be okay with a reduction so long as it isn’t as steep a reduction as what Fannie Mae proposed. Serious researchers can see how Gooch phrased that in her own words in the report linked below.

So, given that the national trade association based in Arlington, VA that UMH is part of – MHI – plans to scale back their expectations for the GSEs to do more lending for manufactured homes – unless Eugene Landy has some insider insight from Washington apart from MHI – that optimism at UMH seems to be contradicted by the plain evidence of the GSEs and MHI.

Then, consider this comment from November 2019 “listening session” in St. Louis by the Federal Housing Financing Agency (FHFA).

At that time, we emphasized the urgent need for both Government Sponsored Enterprises (GSEs) and FHFA, as their federal regulator, to ensure market-significant secondary market and securitization support under DTS not only for manufactured housing real estate loans, but also for the manufactured home personal property (i.e., “chattel”) loans which, according to U.S. Census Bureau data, are used to finance nearly 80% of the manufactured homes purchased in the United States today.

- Edward J. Hussey

Former Chairman, Manufactured Housing Association for Regulatory Reform (MHARR)

His company – Liberty Homes – was a founding member of MHARR.

MHProNews Takeaways #2

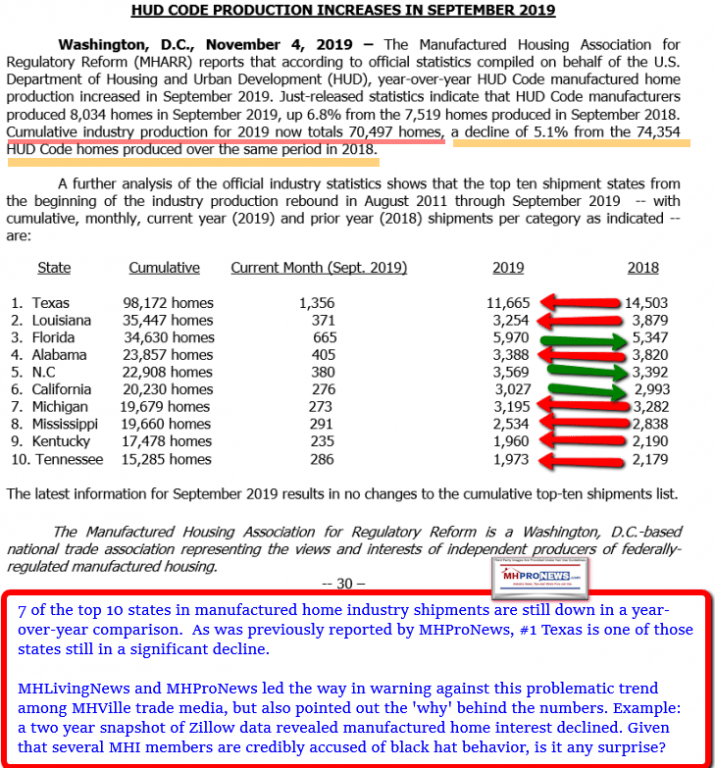

New manufactured home sales are down, while rentals are up in these larger manufactured home community portfolio operators. As has been stated in prior reports, comparing third-party Zillow’s research in 2016 to 2018 indicates that housing shopper interest in manufactured homes has declined.

- Land-lease Communities are moving toward capacity.

- Overall sales are in a year-over-year decline.

Mixed Bag in September 2019 Manufactured Home Production, Shipment Data

- Meanwhile, the demand for single family conventional housing sales are up.

U.S. Conventional Housing Starts Rise, Building Permits Hit New High, Manufactured Housing Insight

- Per third-party CoreLogic, occupancy at rental properties is up and so to are costs.

CoreLogic SFRI Reports Low Rental Inventory Levels Pushing Rent Higher

- Even though there is an opportunity to develop new communities at costs often lower than buying older, existing properties, there are clear indications that developing is being limited by argument and in practice.

MHARR, which offered earlier this year to help apply the “enhanced preemption” provision of the MHIA to local zoning issues, had no serious takers among MHI’s affiliated state associations.

Why that matters is explained by Mark Weiss, J.D., president and CEO of MHARR as follows in the statement made to MHProNews.

While MHI can point to specific letters, videos or documents that purport to advance the interests of manufactured housing and thousands of independents, they are arguably examples of paltering.

Key MHI members have used data that contradicts other data that they all draw from.

That raises several questions. Are we to think that educated and often successful professionals are not able to achieve the kinds of levels of success that the manufactured home industry previously enjoyed? Or are they failing to use good laws and useful information to promote the industry as a means of causing underperformance?

Why would some do so? Because it would allow a few bigger players to consolidate the industry at a discounted valuation.

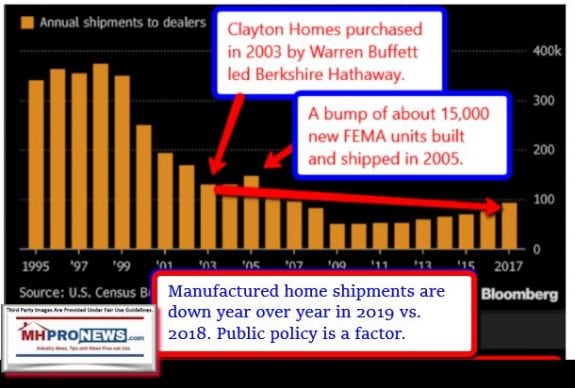

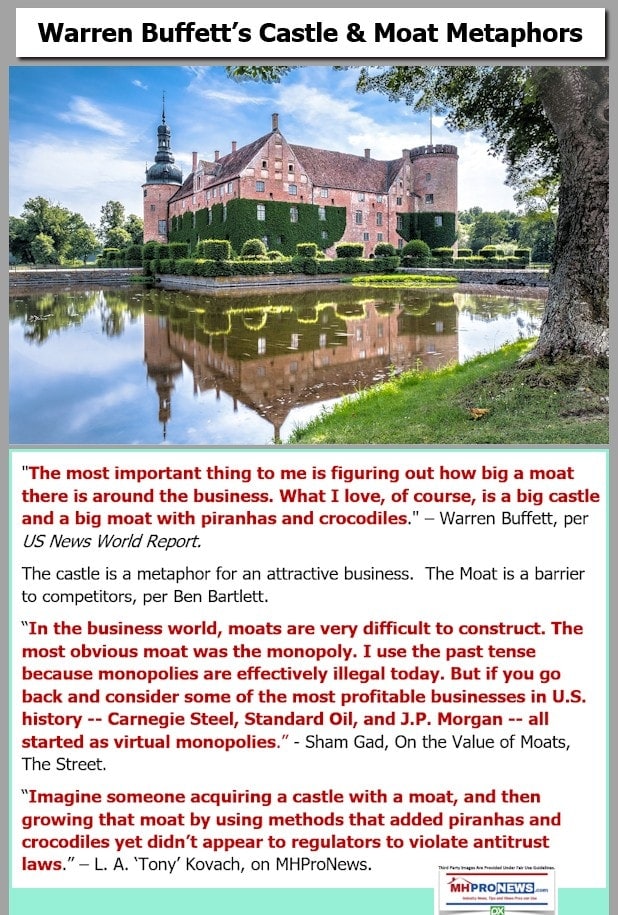

Each of these data points supports the allegation that Clayton Homes, often in conjunction with other firms, has manipulated the market in a fashion that has destroyed several thousand independent business using “the Moat.” That allegation has been made by mainstream media operations that span the left-right media divide.

- The Atlantic, without specifying how the monopolization was being accomplished, noted that the independent retailers in manufactured housing were being rapidly eliminated/consolidated, that report is linked here.

- GuruFocus said “Warren Buffett Can’t Escape Unethical Strategic Moats,” their specific points are linked here.

- The Nation called it “The Dirty Secret Behind Warren Buffett’s Billions…” and specifies Clayton Homes among those using the strategic moat in ‘dirty’ ways.

- The Jacksonville Florida Times Unionsummarized the connection between the John Oliver viral hit video dubbed “Mobile Homes,” MHI, Clayton Homes, and their related lenders. That op-ed was first fact-checked by an editor, before it was published not only in the one newspaper it was submitted, but at least in 5 Florida newspapers.

What those other media didn’t do is document the specifics of how that was accomplished, which reports like the one below by MHLivingNews did in detail.

Further, several of these same MHI member firms have sparked serious scandals, an overview of which is found in the viral Last Week Tonight video by John Oliver errantly dubbed “Mobile Homes.”

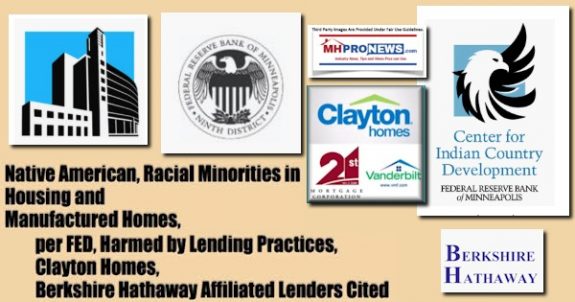

In an arguably more sinister fashion, donations by Warren Buffett – chairman of Berkshire Hathaway, which is the parent to several MHI member firms including Clayton and their affiliated lenders – oddly flowed to some of the very nonprofits, such as MHAction or the Center for Public Integrity, that in turn goes to undermining the industry in general.

Prosperity Now, Nonprofits Sustain John Oliver’s “Mobile Homes” Video in Their Reports

When given repeated opportunities to reply to these concerns, those in the Omaha-Knoxville-Arlington axis, outside attorney, and their surrogates have opted to remain silent.

Clayton Homes, 21st Mortgage, MHVillage, Manufactured Housing Institute Leaders Challenged

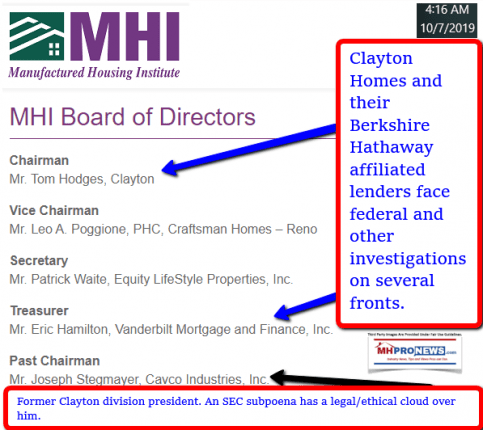

When a close look is made at MHI, many of their executive committee’s board of directors and/or their firms are involved in known legal/media/federal investigations scandals.

There is no lack of evidence to indicate serious concerns that point to the notion that the industry is being manipulated by a relative small group of power players. There are also examples of good publicity that goes with little or no promotion to the public at large.

They may well have allies in key places in the federal government, for reasons that the article linked below reflects.

Takeaway #3 For Investors?

So long as investors are willing to challenge the powers that be in the market, the opportunities to invest, or outperform in the marketplace are many. See a related report linked here.

The flip side is that investors in publicly traded firms tasted a year ago the scandalous drop of Cavco Industries stock, when an SEC subpoena caused their firm’s prior chair and CEO – Joe Stegmayer, a former Clayton Homes division president – to step down.

The problematic information – some accurate, some not, some contradictory – that flows from MHI and some of their larger member companies should cause investors to prudently dig deeper into competing claims by the industry’s two largest trade groups.

Publicly Traded Manufactured Housing Firms – Which Source Do You Trust More? Why? MHI, MHARR, Others

Several lawmakers have asked for federal agencies to investigate issues that relate to these concerns.

Making Eugene Landy’s point about affordable lending, but contradicting his thought that it might be over the horizon is research by the Minneapolis Federal Reserve regarding the flawed implementation of DTS.

MHARR and resident leaders are among those who think that federal officials need to investigate these concerns.

Summing Up and Conclusion

Using the available facts and applying basic business logic, what the above should arguably tell thinking professionals, advocates, and others are the following.

- During an affordable housing crisis, the manufactured home industry is underperforming.

- There are reasons to suspect market manipulation that may violate antitrust, RICO, and other laws – such as deceptive trade practices.

- There are several known federal and other legal investigations underway.

- There seems to be a clear pattern of corrupt behavior. Real people, millions of manufactured homeowners, affordable housing seekers, smaller businesses, and investors are arguably harmed as a result.

That’s your reality-based second episode of “News through the lens of manufactured homes and factory-built housing,” © your #1 biggest and most-read professional information resource, where “We Provide, You Decide.” © (News, fact-checks, analysis, and commentary.)

Soheyla is a co-founder and managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

Related Reports:

Click the image/text box below to access relevant, related information.

Barriers to Entry, Persistence, and Exiting in Business, Affordable Housing, and Manufactured Homes

Unique Opportunities for More Competitive Lending for All HUD Code Manufactured Homes

https://www.manufacturedhomepronews.com/saturday-satire-and-executive-summaries-for-manufactured-housing-professionals-investors-advocates-researchers-public-of