Following an email to a limited number of manufactured housing professionals this morning, one of them posted the following to the Federal Housing Finance Agency (FHFA) request for input.

The core of the message from our publisher to encourage the FHFA to hold Fannie Mae and Freddie Mac to fully support financing for manufactured homes read as follows:

—- emailed message —-

Feedback welcome. FYI, I know each of you, and I’m hoping you will do this if you are serious about white hat industry growth and benefits to consumers and homeowners.”

—- end of message —-

The article reference is linked below. Note that the still is from a video posted near the end of this report.

Unique Opportunities for More Competitive Lending for All HUD Code Manufactured Homes

Perhaps in response, the most recent check of the FHFA website included comments from two of those addressed.

One is from Jody Anderson, of Lufkin, TX. Anderson gave the FHFA a statement and his background as follows.

“I have been a manufactured housing retailer for over 35 years and served 1 term on the Manufactured Housing Consensus Committee. I have seen countless product improvements and production innovations during my time in the industry. Today’s manufactured homes can compete with other forms of housing in every way in terms of design and materials. The only remaining barrier to a market place that is completely fair for all participants that will ultimately benefit American consumers is equal access to lending. That access is the one thing that has not changed in my time in this industry. The discriminatory policies and practices of government agencies and lenders directed at the manufactured housing industry and its consumers continues to bar people from the possibility of home ownership. I am part of the most regulated form of housing in the United States and yet I have the least amount of practical finance options to offer potential home owners. You have the opportunity to help level the financial playing field so that more consumers have more opportunity to get a piece of the American Dream of owning a home. Removing these discriminatory practices and allowing equal access to financial opportunities for all consumers (regardless of their home choice) will more create jobs, more local tax payers and more happy families. Please don’t let more time pass before you completely fulfill your duty to serve all potential homeowner choices equally.”

Next, there is this from Brian Gallagher, the Chief Operating and Financial Officer of Santefort Real Estate Group, LLC, in Westmont, IL.

Those comments are linked here as a PDF, which includes the firm’s letterhead. It will also be part of the submitters planned comments at: FHFA Listening Session, Federal Reserve, Chicago IL, on November 15, 2019.

The remarks are as follows. It stresses that residents and industry alike benefit when the law is fully enforced, but the details that support the argument are noteworthy. Gallagher’s background is cited, which makes the items all the more compelling.

Summary of Remarks from Brian Gallagher, Santefort Real Estate Group, LLC, Westmont, IL 630-327-6908

- Recognizing FHFA’s Duty to Serve would be a win/win/win for the Residents, the MHC industry, and Investors

- For Residents –

- Most importantly, it would increase the value of Used Homes. Imagine if you could only sell your home to a cash buyer – what would the impact on your home value be? That is the challenge facing many MH owners today. If we could finance third party, owner to owner sales, because there was a market for the paper, the Residents would instantly realize greater value in their homes.

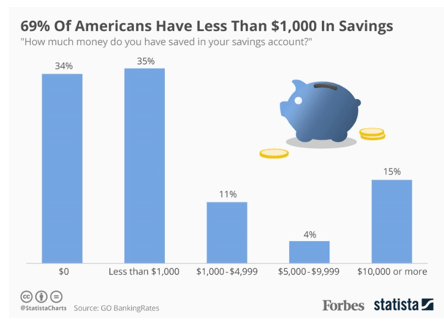

- Our industry is often the subject of criticism in media – such as the HBO “Last Week Tonight” with John Oliver. The stinging criticism was “a $50,000 house is only worth $10,000 in three years” (direct quote from the show). I assure you, that we would never sell a $50,000 home for $10,000 in any of our communities, because we would likely finance the buyer, if they could not obtain outside financing. HOWEVER, if someone purchased a $50,000 home, and needed to sell it in three years, AND they were limited to the CASH the buyer had because the Buyer did not have a financing option, it is no wonder they might be selling for $10,000 in an economy where 58% of the country doesn’t have more than $1,000 in the bank. The US Government recognizing its DUTY TO SERVE to chattel home owners would unlock millions if not billions in homeowner value – increasing wealth in this very challenged lower half of the economy.

- Could lower rates and payments by providing greater market liquidity.

- Our standard $40,000, 8%, 15-year loan yields a $382 monthly payment

- A secondary $40,000, 7%, 25-year loan reduces monthly to $282, or $100 less (reduces required wages by $1.75/hour to meet the 33% front end threshold.)

- Allows a citizen to relocate with enough money to purchase a home in a new location (where a better job might await) instead of causing them to feel locked into their current community.

- With PMI, we could allow more borrowers to qualify with lower down payments, reflecting the 80% of the country with no significant savings.

- I very much appreciate the fact that you are recognizing the Duty to Serve millions of manufactured home community residents by supporting a secondary market for chattel loans, and I thank you for this opportunity to provide our perspective on this important matter.

- By way of introduction, my background includes practice as a CPA with KPMG, and a real estate attorney with Mayer Brown and Platt. I’ve earned an MBA from Kellogg/Northwestern, and am currently the COO/CFO of the Santefort Real Estate Group of companies, a family owned organization with no outside investors.

- Santefort owns and operates 3,000 home sites in 11 MH Communities in Illinois and Indiana – which ranks us about 50th in the Nation. We also recognize our Duty to Serve, and are committed to providing Quality Affordable Housing to our diverse pool of residents – millennials starting their first household, families, and retirees. A wonderful cross section of middle America clearly in need of the Quality Affordable Housing alternatives which we are proud to offer. Our communities already comply with the Resident Protection Standards enumerated in the Duty to Serve.

- Because of the severe economic consequences of the Great Recession, which continue to disproportionately impact our core residents – blue collar workers and retirees, the chances of a resident

- It was clear that the residents in our target market suffering from stagnant wages and Social Security payments and almost no savings for a down payment, would have difficulty qualifying for the few remaining manufactured home chattel lenders. Therefore, we obtained an MLO in Illinois and Indiana to be able to lend our money to our residents to buy our homes. Earning an MLO is no easy task, as you may be aware. We require $150,000 in the bank at all times (which alone is enough to preclude many comparable MHC operators from obtaining a license), and had to satisfy significant additional education, testing, bonding, financial reporting and servicing requirements, which we have done and continue to do.

- Over the course of 2 1/2 years, we’ve funded over 270 loans for an aggregate $7.7 million original principal balance (average $28,500 each). Our underwriting complies with Dodd Frank, 33/43 ratios, though we must necessarily work with lower FICO score borrowers who struggle to put 10% down. Our interest rates have ranged from a very special 0% fixed program, to a typical 8% fixed rate for a 15-year term. We also offer a special “Neighborhood Heroes” rate to Veterans, Nurses, Teachers, Police and Fire personnel of 5% down and a fixed 5%, 15-year term. We charge minimal fees ($285 per loan), and avoid the red flags of the past – all fixed rate, fully amortizing, fully underwritten, documented and verified loans.

- This deal structure allows a two-income family earning $9/hour to build equity and live in a brand new 1,280 foot 3 bed, two bath home for about $1,000 month, depending on the site rent of $370-$599 in our portfolio. Others purchasing rehabbed used homes would be significantly less. This is what we mean by quality affordable housing in communities which may also offer swimming pools, clubhouses, new playgrounds and basketball courts.

- We consider residents who do not qualify for even these loans may then apply for a lease of the same home, with an option to purchase and partial credit for their payments in the meantime.

- Our applicants have the opportunity to apply to other industry lenders in addition to our related party financing. Those who do not qualify for these “pure” lenders – Triad, 21st, and Oxford, for example, apply to us. Our borrower’s FICO scores are generally between 540-590, so we believe we are providing financing and quality affordable housing options to those who do not have many other alternatives.

- Our experience has been about what we’ve expected. Our residents’ significant financial stress with generally minimal savings means that it doesn’t take too much – a major car repair, a few weeks out of work, a boyfriend/girlfriend leaving what was once a two-income household – for our borrowers to fall behind. Of our 273 original loans, 60 (22%) have required some level of workout. We have been willing to work carefully with them, in good faith, to accommodate their needs. In general, we have avoided any material lending loss, or charged any borrower with a deficiency if their financial situation was beyond restructuring.

- We have approximately 500 more empty lots to fill in our portfolio. At $50,000/lot for site prep, home, and install, we will have capital needs of $25,000,000 to provide as much Quality Affordable Housing as our portfolio will allow. However, we don’t have the capital to do that, so long as we are unable to liquidate our growing loan portfolio as many single family home lenders do. Therefore, our markets will be underserved. Further, Manufactured Home construction is generally local to the markets to minimize transport costs. Therefore, our ability to buy more homes manufactured in our geographic region will support our local economies. If we had a secondary market for our chattel loans, we could continue to provide Quality Affordable Housing and stimulate local job markets.

- As an example of how we might develop a model for the secondary market, I’d like to describe our particularly successful relationship with a chattel lender who is focused on MH lending. This relationship is completely separate from our own Loan Originations. We agree with this Lender, at the community level, that if this lender makes a loan in our community which defaults, we support the lender to mitigate their risk as follows (per our written agreement):

- We will rehab the home (at lender’s cost), if necessary.

- We will not charge the lender site rent during the vacancy of the home.

- We will actively use our community sales team to prioritize reselling the unit, for a commission paid by lender, to preserve the home’s value and essentially eliminate lender’s losses.

We have found this to be very successful, though rarely necessary to be implemented. Still, it could serve as a model for the secondary market to reduce the lenders’ risk in this housing niche.

To this list, I imagine we could add

- Creation of a PMI pool for chattel loans with accompanying lump sum or monthly premiums.

- Bonds for Community, to provide recovery in the very unlikely event that a home is removed from the site.

- Standardized, Uniform loan documents, Community standards and limits on the age of homes in the collateral pool.

- If the Enterprises were to support a secondary market of our loan portfolio (obviously, the 8% loans, not the 0% or 5% interest rates), it would allow us to recapitalize our home acquisition efforts and make more quality homes available to our core market of lower economic class millennials, families and downsizing retirees while driving employment opportunities for our manufacturers …….

- This would be a win/win/win for the Residents, the MHC industry, and Investors

- For Residents –

- Most importantly, it would increase the value of Used Homes. Imagine if you could only sell your home to a cash buyer – what would the impact on your home value be? That is the challenge facing many MH owners today. If we could finance third party, owner to owner sales, because there was a market for the paper, the Residents would instantly realize greater value in their homes.

- Our industry is often the subject of criticism in media – such as the HBO “Last Week Tonight” with John Oliver. The stinging criticism was “a $50,000 house is only worth $10,000 in three years” (direct quote from the show). I assure you, that we would never sell a $50,000 home for $10,000 in any of our communities, because we would likely finance the buyer, if they could not obtain outside financing. HOWEVER, if someone purchased a $50,000 home, and needed to sell it in three years, AND they were limited to the CASH the buyer had, it is no wonder they might be selling for $10,000 in an economy where 58% of the country doesn’t have more than $1,000 in the bank. The US Government recognizing its DUTY TO SERVE to chattel home owners would unlock millions if not billions in homeowner value – increasing wealth in this very challenged lower half of the economy.

- Could lower rates and payments by providing greater market liquidity.

- Our standard $40,000, 8%, 15-year loan yields a $382 monthly payment

- A secondary $40,000, 7%, 25-year loan reduces monthly to $282, or $100 less (reduces required wages by $1.75/hour to meet the 33% front end threshold.)

- Allows a citizen to relocate with enough money to purchase a home in a new location (where a better job might await) instead of causing them to feel locked into their current community.

- With PMI, we could allow more borrowers to qualify with lower down payments, reflecting the 80% of the country with no significant savings.

- For the Industry

- Greater liquidity means more MHC owners could become MLO’s, and originate loans and liquidate them in the secondary market, to repeat the cycle.

- More capital means more new homes are acquired, driving more jobs in the manufacturing, concrete, site prep, management and maintenance fields.

- For Investors

- Chattel loans would almost certainly yield higher rates than real estate loans, but the safeguards described above could disproportionately reduce the risk.

In summary, we respectfully request that the Enterprises honor their Duty to Serve this significant component of the lower middle class of our economy, allowing them to participate in the American Dream

of building Equity in Quality, Affordable Home Ownership, by supporting a secondary market in chattel homes placed in qualified manufactured home communities.

###

The prior 4 comments before dawn today were:

- Robert ‘Bob’ Van Cleef

- L. A. ‘Tony’ Kovach

- Mark Weiss, Manufactured Housing Association for Regulatory Reform (MHARR)

- Emily Thaden, Grounded Solutions

MHProNews Takeaways from Anderson and Gallagher’s FHFA Comments

The above are two compelling, yet very different styles of comments, from Anderson and Gallagher. Each one presents important information from industry veterans who manifest concern for their customers and residents. They both present, in their own words, why the Duty to Serve (DTS) from the Housing and Economic Recovery Act (HERA) 2008 law should be fully enforced.

Let’s conclude how we did earlier this morning.

Do You Want More Competitive Lending for Manufactured Housing?

If you want more competitive lending for manufactured housing, ponder these three options.

You can:

- Submit a letter than can say whatever you’d like (look closely at Bob Van Cleef’s folksy and fact-based, but essentially simple core message), but open and close with this following simple point. The existing plans by Fannie and Freddie are clearly favoring a few big companies, not the millions of Americans that the DTS plan is supposed to support by federal law. Reject the plans by Fannie and Freddie. Make Fannie and Freddie fully comply with the law by supplying lending on manufactured housing with both personal property and mortgage lending.

- You could skip the comments entirely but write your congressional Representative and 2 Senators. We’ll look at that soon, perhaps next week. When you write your Senators and Representative, make that simple and folksy too. Enforce the law. Say why you want to enforce the law. But enforce the law.

The video below makes it clear that Superior Choice credit union was able to successfully enter the manufactured housing market by partnering with Triad Financial Services. As a disclosure, Triad has previously done some business with our publication. But that fact doesn’t change the realities of what those lenders who sat down with our publisher had to say on camera. They weren’t paid to do a video interview, nor did Triad pay for this video. It is a genuine, unscripted video.

What isn’t in that video is where one of the officials from Superior said they thought the GSEs were missing out, and they lauded Triad’s program. Triad has had a successful lending platform in manufactured housing for some 50 years.

The GSEs have no good excuses, as our publisher L. A. ‘Tony’ Kovach said in his letter. The GSEs of Fannie and Freddie don’t have a good excuse. But keep it simple. Bob Van Cleef in his message linked other items, which is certainly permitted. You could link other letters, or link this article or others if you wanted to do so.

But the bottom line is this. Ask the FHFA – which has the authority to do this – to mandate that Fannie and Freddie supply full support for all HUD Code manufactured homes. And/or wait until later, and write your congressional representative and your 2 senators. Make them ask the FHFA to force the Fannie and Freddie to fully enforce the law.

That’s your second installment today from the largest and #1 most read manufactured home “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” © ## (News, fact-checks, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and and here.

Related Reports:

Click the image/text box below to access relevant, related information.

Smaller, Independent Businesses, Property Ownership, Manufactured Housing Risks and Opportunities

Rent Controls and Manufactured Housing Restrictions Targeted in New Presidential Executive Order

Senator Elizabeth Warren Takes Aim, Blasting Again MHI Member Company in 2020 Campaign Stop

A Tale of Two Cities, Affordable Housing, Manufactured Homes, and You

https://www.manufacturedhomepronews.com/masthead/manufactured-housing-industrys-opportunities-and-obstacles-executive-summary/