In a release to MHProNews is the following from the Minneapolis Fed. Manufactured homes are part of their new research, and in the full documentation provided further below, Berkshire Hathaway lenders and Clayton Homes are referenced in an unfavorable light.

First, the Minneapolis Fed news media release which will be followed by MHProNews’ analysis.

From the Center for Indian Country Development:

New study shows Native Americans face higher-priced mortgage rates

“Native Americans living on reservations who want to buy homes are significantly more likely to have high-priced mortgages, and those mortgage rates average nearly 2 percentage points higher than for non-Native Americans outside reservations.

The bottom line? A Native American family purchasing a $140,000 home on a reservation could pay $107,000 more over the course of a 30-year loan than a non-Native American purchasing a home outside a reservation would pay.

That’s according to a new study from the Federal Reserve Bank of Minneapolis’ Center for Indian Country Development (CICD).

“This report should serve as notice to policymakers, lenders, and housing advocates that there is an urgent and deeply troubling issue around housing and mortgage costs across Indian Country,” said Minneapolis Fed Assistant Vice President and CICD Director Patrice Kunesh.

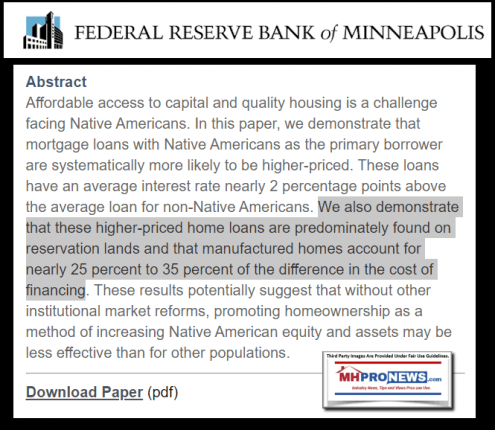

Written by CICD research economist Donna Feir and data analyst Laura Catteneo, a new working paper, “The Higher Cost of Mortgage Financing for Native Americans,” confirms that affordable access to capital and quality housing is a daunting challenge facing Native Americans, particularly those who live on or near reservations.

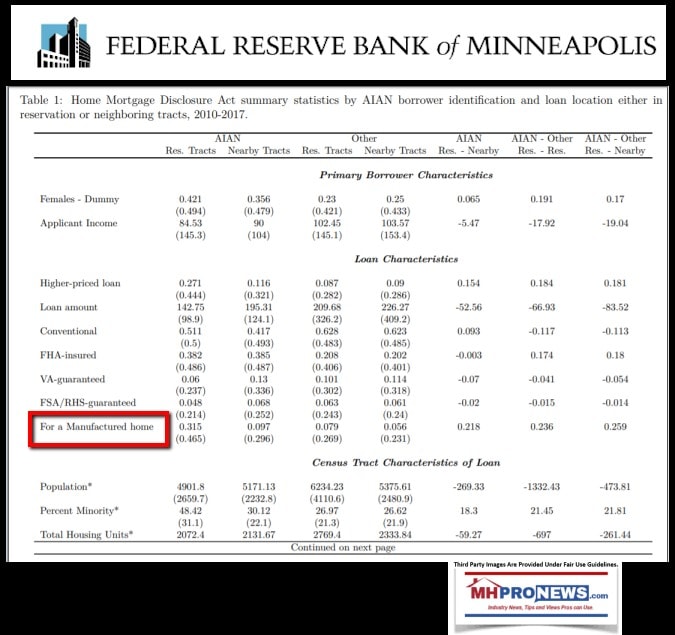

Feir and Catteneo’s research finds:

- Almost 30 percent of loans made to American Indian and Alaska Natives (AIAN) for reservation properties were higher cost—that is, costing more in interest rates than those available to non-Native Americans.

- Only 10 percent of loans in the same time period made to non-Native borrowers for properties near reservations were higher cost; thus, three times the proportion of Native borrowers faced higher-cost loans than did non-Native borrowers.

- While these higher-cost home loans are predominately found on reservation lands, manufactured homes account for 25 percent to 35 percent of the difference in the cost of financing.

“We believe further investigation around the manufactured home financing market structure might be necessary if home loans are going to be made equally affordable for AIAN

borrowers,” said Feir.

The report concludes: “These results potentially suggest that without other institutional market reforms, promoting homeownership as a method of increasing Native American equity and assets may be less effective than for other populations.”

###

Their full research by the Minneapolis Fed is found here or from the graphic below as a download. In their footnotes is a specific mention of the Seattle Times research that named Clayton Homes, 21st Mortgage Corporation, and Vanderbilt Mortgage and Finance (VMF).

MHProNews Analysis and Takeaways?

First, let’s note that MHLivingNews reported on a related issue some weeks prior to the FED’s new research. Senator Tina Smith (MN-D) raised similar concerns. She asked her Senate colleagues to do bipartisan efforts to get the Government Sponsored Enterprises (GSEs) to fully enforce the Duty to Serve manufactured housing, rural and underserved markets and Native Americans.

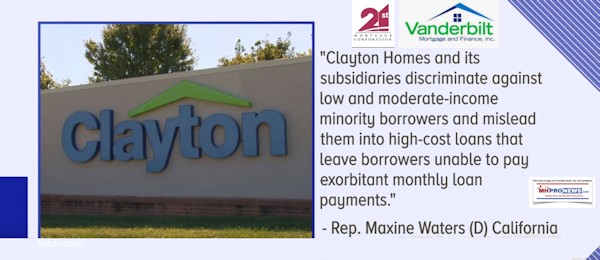

Second, then ranking member, but now Chair Maxine Waters (CA-D) of the House Financial Services Committee has in a letter with some of her colleagues previously ripped Clayton Homes, 21st and VMF for apparent racial bias in lending practices.

Third, MHProNews and our MHLivingNews sister site have alone spotlighted in manufactured housing trade media the Knoxville news media’s spotlight of similar concerns. Why are the others not willing to show mainstream concerns akin to those that have been raised here?

This problem has spanned Democratic and Republican administrations. It isn’t partisan to say that it is passed due time for public officials to react in a more decisive manner.

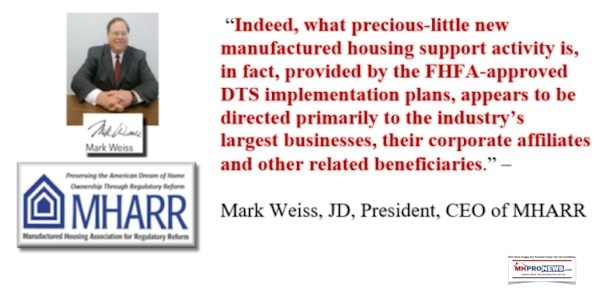

Last and not least before wrapping this analysis up, is this reminder to longer-time readers and newer ones alike. Clayton and their affiliated lenders have a history of being involved in racial and other controversies. One must wonder, is it accidental or is it part of a broader effort to cast a cloud over the entire industry? Or was Mark Weiss, J.D., president and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR) onto something in his comments below? See the related report immediately below, and other further below the byline, offers, and notices.

Prosperity Now, Nonprofits Sustain John Oliver’s “Mobile Homes” Video in Their Reports

There will be some special report planned before the end of this week that relate as well. Stay tuned to your only source for investigations in MHVille trade media that pull back the veil on purported ‘black hat’ behavior, MHProNews and MHLivingNews. If you aren’t already part of our growing list of readers, sign up in seconds for free below.

Thanks for checking in this morning on the runaway most read resource for manufactured home “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” © ## (News, analysis, periodic entertainment, inspiration, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and and here.

Related Reports:

Click the image/text box below to access relevant, related information.

Clayton Homes, 21st Mortgage, MHVillage, Manufactured Housing Institute Leaders Challenged

Progressive “Nation” Reports on Monopolies Cites Buffett, Clayton, Others – MH Industry Impact?