Looking at facts on long-festering issues as if they are being seen for the first time can bring clarity. So long time MHProNews readers, as well as newcomers, should digest these facts that have been spotlighted by recent and prior reports from an array of sources.

Lending has long been one of the top issues that manufactured home retailers, be they ‘street dealers’ or community sellers. Public officials, lenders, and policy advocates have been reexamining this issue in 2020, including these recent examples.

- On September 23, 2020, the Manufactured Housing Institute (MHI) issued a new emailed memo to their members, affiliates, and readers. The topic was one of the most important ones to our industry. Namely, the retail financing of manufactured homes and other opportunities possible based upon current federal law.

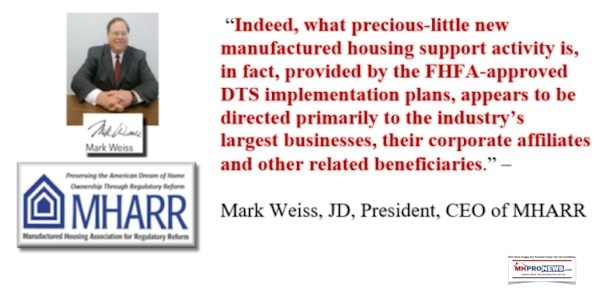

- On September 9th, the Manufactured Housing Association for Regulatory Reform (MHARR) published an Issues and Perspectives by Mark Weiss, J.D., on the issue of a federal law that aimed to establish more manufactured home lending. Weiss is the president and CEO of MHARR.

In the MHARR Issues and Perspectives, Weiss pointed to data that was presented to the Federal Housing Finance Agency (FHFA). Citing that research, he said that for the recent time frame reflected in their data, some ’94-95% of the total manufactured housing market for new homes and consumer loans for new homes, remains completely unserved’ by the Duty to Serve mandates passed into law in 2008, including the entire manufactured home chattel loan segment of the market.

As manufactured home sellers and other close observers know, some 75 percent of all HUD-Code manufactured homes are sold using “chattel” or personal property “home only” loans vs. real estate-style mortgage loans that are ‘land-home deals.’ Which means that what little lending is being done by the Government Sponsored Enterprises (GSEs or Enterprises) of Fannie Mae and Freddie Mac, those single family housing loans are focused on real estate mortgage-style lending, which has been the minority of the manufactured home market for years.

In MHI’s September 23 message, there was no similar reference to MHARR’s point of how little Fannie Mae or Freddie Mac – both still under the FHFA’s regulation and conservatorship – has adhered to the 2008 Duty to Serve (DTS) provision to provide lending to manufactured homes, rural housing and other ‘underserved’ markets.

MHI has access to the same data that MHARR does. Additionally, MHI has access to – and reportedly reads – what MHARR or the MHProNews trade news publishes too. Since MHProNews published MHARR’s September 9 Issues and Perspectives, and MHI has hired a law firm to read what we publish, there are numerous reasons to believe that MHI is fully aware of these factual points.

Which begs the question. Why isn’t MHI pressing FHFA – or Fannie and Freddie directly – to fully comply with the DTS provisions of the HERA law?

For those who might think there is room for interpretation, a careful look at more information reveals that such is not so. This should be a rather clear-cut, proverbial ‘black and white’ issue. Why? Because Jim Gray, admitted in his departure from FHFA message that DTS remains largely unrealized.

Gray served as the FHFA Duty to Serve (DTS) Manager. In an August 31, 2020 farewell message to DTS stakeholders, Gray candidly acknowledged: “[W]e have not made as much progress [under DTS] as many of us would have liked; so much remains to be done to reach these [DTS] markets.” That certainly reads like an admission of what MHARR and other critics of the implementation of the nearly invisible to most manufactured home sellers lending program have said for years.

But there is more than Gray’s statement, or MHARR’s analysis of the data.

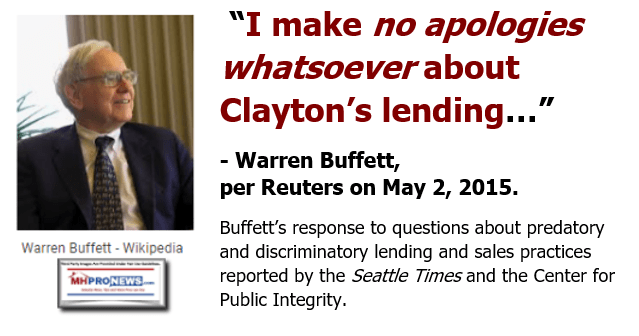

In 2019 research for the Minneapolis Federal Reserve, Donna Feir criticized the manufactured home lending market. She cited her own findings, but also noted what the Seattle Times reports that ripped MHI member Clayton Homes, 21st Mortgage Corporation, and Vanderbilt Mortgage and Finance. This pull quote is insightful.

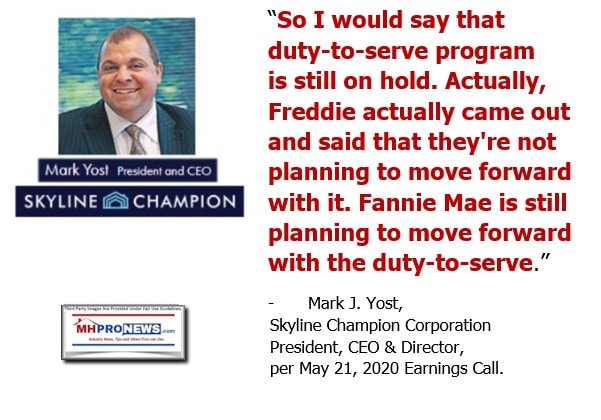

Then, consider what MHI board member Mark Yost, who is president and CEO of Skyline Champion Homes, said the following.

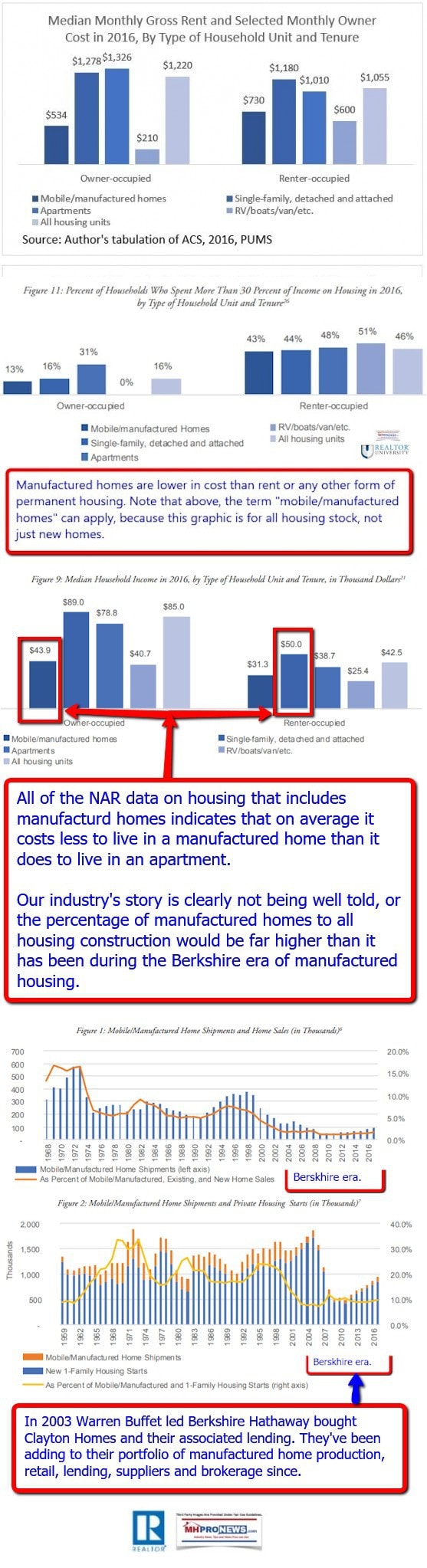

Summing the survey above up, there are numerous voices – plus factual evidence – from an array of sources that are saying similar things. That could be summed up like this.

A dozen years after the DTS program was passed into law through HERA 2008, the lending mandated by law that the GSEs are supposed to be providing to manufactured homes are still largely going unenforced.

Which begs this question. Why isn’t MHI seriously pressing alongside MHARR for the full and proper implementation of DTS mandated lending by Fannie and Freddie?

When asked by MHProNews, MHI doesn’t directly answer such questions. Which leaves only their behavior and the money trail to examine.

Despite MHI routinely posturing a desire – via their emailed messages, letters, comments, or statements in various meetings – they have not achieved a core function that their association is supposed to be seeking. Namely, the implementation of an existing law that serves the post-production sector of the industry – i.e.: retailers, communities, developers – that are part of the “all segments” of the industry that MHI routinely claims verbally and in writing that they are representing.

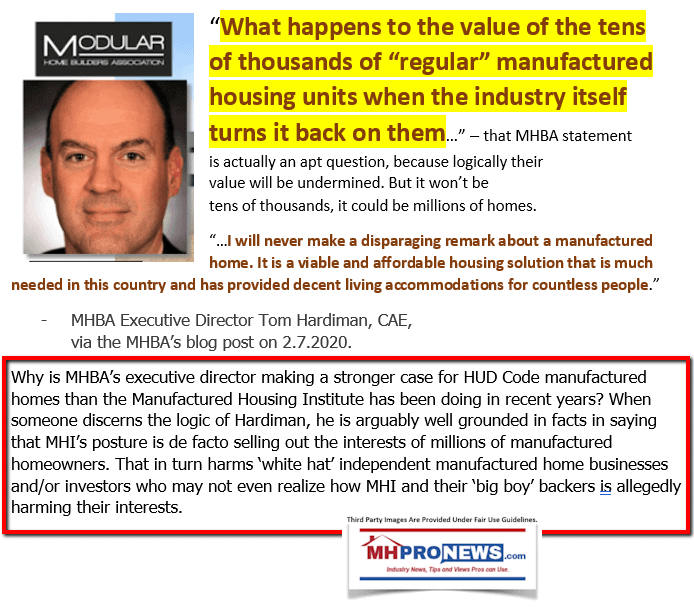

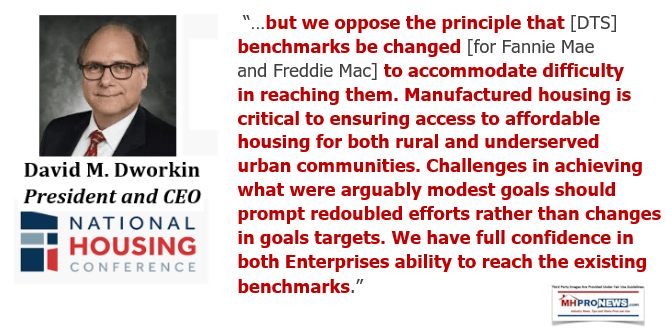

While MHI for years has postured effort to get more lending by their independents, in their own letter regarding the planned modifications of the DTS plan, they acquiesced to a reduction in that already minimal lending. By contrast, the National Housing Conference (NHC) clearly stated that the GSEs had no excuse not to fulfill the mandates of the law. The NHC president used to work for a GSE. MHI is a member of the NHC. MHI routinely touts being in a “coalition” with the NHC and other housing associations.

Rephrased, what the above outlines is that MHI postures but doesn’t perform. It is what Mark Weiss dubbed “The Illusion of Motion” in February of 2019. It was one of his most read “Issues and Perspectives” reports.

To the same point, it is what longtime MHI member Marty Lavin told MHProNews was the need to pay more attention to what is done, not what is said. Lavin is now retired, but who still keeps his finger on the pulse of the industry. Lavin has advocated as well for the notion of following the money trail to understand why certain behaviors occur, or not. That point by Lavin is in keeping with principles that others in business, investigations, reporting, and politics have said over the years.

Why doesn’t MHI actively push for full implementation of this potentially highly useful law? As Weiss puts it, by not doing so, and by diverting what lending does occur to certain corporate interests that happen to align with larger MHI members, there is a veneer of effort while the actual indented beneficiaries – consumers and those who serve them – are largely left out.

With that backdrop, A MHEC affiliate told MHProNews the following. MHEC is the Manufactured Housing Executives Committee, made up of the various state manufactured housing associations. Some of those affiliates are MHARR members, but all are claimed under the MHI umbrella.

“MHARR and others, with specific facts and data presented to FHFA, has proven that the Duty to Serve (DTS) mandate, with respect to the manufactured housing market, has effectively been “hijacked” by Fannie Mae and Freddie Mac (with the blessing of FHFA) for the primary benefit of the industry’s largest corporate conglomerates that routinely are MHI members.

MHARR says that some 94-95% of the total manufactured housing market for new homes and consumer loans for new homes, remains completely unserved. Their September 9, 2020 issues and perspectives pointed out that the entire chattel lending segment was essentially unserved.

Now, in their 2020 DTS Plan modifications, and proposed Plan “extensions” for 2021, both Fannie and Freddie are pulling back even further from their already minimal proposals regarding the chattel lending market.

Against that backdrop, when has MHI ever said, or maintained that what Fannie and Freddie are doing with regard to DTS – ignoring the bulk of the market in favor of a “sweetheart” arrangement with the largest conglomerates regarding higher-priced, non-affordable homes — is deceitful, untruthful, harmful to consumers and the industry, and clearly contrary to what Congress designed DTS to accomplish for lower and moderate-income purchasers of mainstream, HUD Code manufactured homes?

Instead, MHI continues to give industry members the false and misleading impression that everything is going well with the implementation of DTS. But after twelve wasted years, it clearly is not.

Why doesn’t MHI publicly acknowledge and address the obvious failure to implement DTS, as exposed by MHARR, your publications, and others?

Why hasn’t MHI objected, publicly, to the sweetheart deal that Fannie and Freddie Have seemingly made with the largest industry conglomerates (at the expense of smaller, independent producers and consumers)?

Without any such objection, or even acknowledgment of the flat-out failure that is DTS implementation within the manufactured housing market, the only possible conclusion is that MHI, at least implicitly, supports this “hijacking.””

MHARR was asked about the comments above. They briefly indicated that they largely concurred. Of course they would, since much of that research and advocacy has come from MHARR.

Without revealing the source of that specific comment, there are several MHEC affiliates that have provided nuanced support for MHARR’s positions in their comment letters on various topics, including DTS.

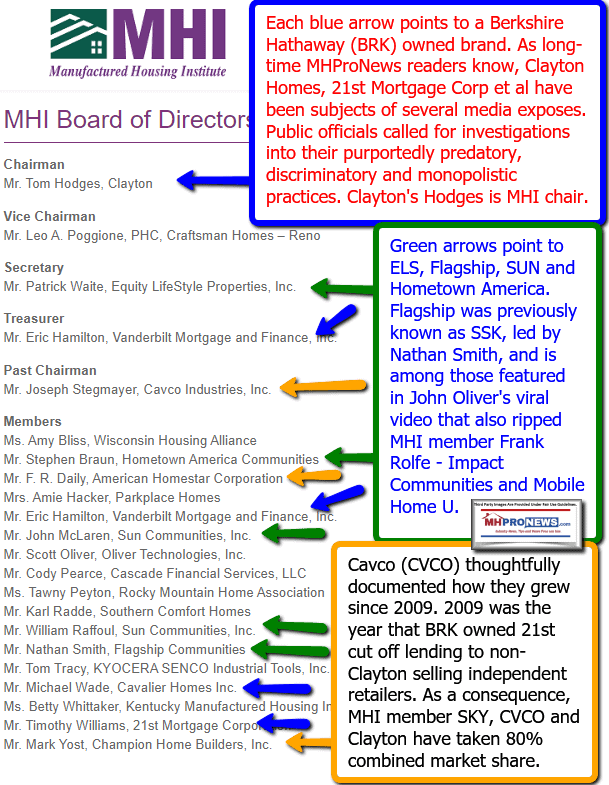

As MHProNews has previously reported, based on input from MHEC state affiliates, during the Dodd-Frank/Consumer Financial Protection Bureau (CFPB) battles, 21st Mortgage Corporation President and CEO Tim Williams strong-armed reluctant states into pushing what became the years of failed Clayton-21st-MHI backed initiatives to reform regulations that limited lending.

Even MHI’s former government affairs vice president Jason Boehlert admitted that the plan was going to go nowhere. Nevertheless, MHI continued to press ahead, with millions being spent with no result.

What the above does is paint a picture for objective minded observers and industry professionals. That picture is one of MHI posturing efforts that routinely lead nowhere. Meanwhile, year after year of failed “advocacy” by MHI – coupled with occasional nice statements by someone in Congress, a public official, or MHI photo opportunities – result in only one significantly measurable trend.

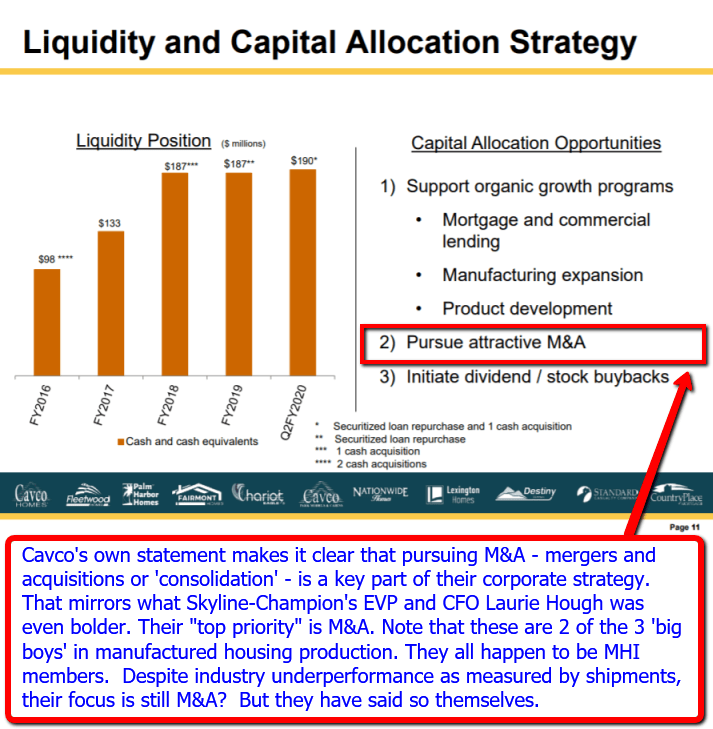

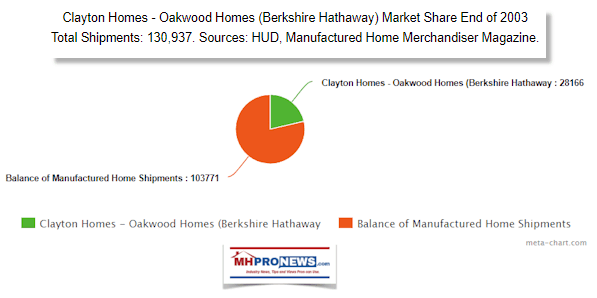

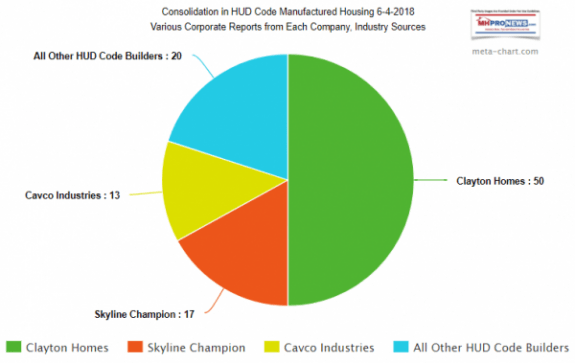

That trend is toward increased industry consolidation. While MHI’s essentially compensated cheerleaders who blog or publish point to rising shipment levels since the bottom was hit, they routinely fail to note that after 2018, that trend also reversed. 2019 saw fewer manufactured home sales than 2018. Year to date in 2020 – while mainstream housing is roaring, see the report linked here and another below – manufactured housing year-to-date through July is behind 2019, and thus behind 2018 too.

The View From Consumers and Other Advocates

Beyond manufactured home industry perspectives, last December at the Washington, D.C. FHFA “Listening Session,” scores of attendees, which included consumers, sounded off on various aspects of the DTS program.

Among those consumers were those who made the argument that DTS was being used by Fannie and Freddie to do loans on manufactured home land-lease communities. Those GSE loans were often being given to consolidators who in turn would acquire and/or refinance communities. Those communities in turn often hiked their site fees significantly over what prior “mom and pop” independent community owners charged.

Numbers of residents living in those communities bluntly complained to the GSEs and FHFA that DTS had made living in manufactured home communities less affordable.

This writer in his presentation at that event, which is found in a 5 page PowerPoint linked above, called DTS’ implementation a disgrace.

The MHEC sender of that lengthy comment above included this statement. “The intent with this [message to MHProNews] is to highlight and expose MHI’s deceit.”

Be that as it may, that implies that there is also deceit occurring among the GSEs and at the FHFA. See the detailed thinking of former MHI VP and MHARR founding president and CEO Danny Ghorbani in the report linked below.

Why this Matters Now? Proposed DTS Plan Modifications Pending

Additional Facts, MHProNews Analysis and Commentary

MHI is calling on their members to once more sound off on the DTS program. But after a dozen years of what a MHEC member calls the need to “highlight and expose MHI’s deceit,” the pattern of behavior should be clear.

Even absent that MHEC comment, the bulk of the evidence points to these possible conclusions.

- MHI staff are incompetent. There is a federal law, its purpose is clearly to provide lending on all manufactured homes, not just the Clayton/MHI back “CrossModTM” homes.

- MHI’s controlling corporate powers want the status quo for their own reasons.

- The GSEs and FHFA are okay with the status quo.

Let’s briefly examine each of those. Let’s start with bullet 1, above.

- First, in fairness, MHI’s staff do what the MHI executive committee tells them to do.

- Second, MHI’s staff are educated and some have useful experience at lobbying and advocacy.

- Third, the conflicts of interest that were documented by an apparent MHI whistleblower to MHProNews were ignored by MHI’s executive committee. Why would MHI corporate execs ignore such clear cut evidence of conflicts of interest that are arguably harmful to manufactured housing, unless they are okay with it?

Summing up those three bullets above, it still comes down to the MHI Executive Committee and other board members.

That the responsibility falls on the MHI board and executive committee doesn’t mean that MHI staff have no culpability. If the MHI staff truly cared about their members, they would do more to warn the industry about how the status quo harms independents and consumers alike. While there are periodic tips from MHI insiders or MHEC members to MHProNews, frankly, there can and should be far more.

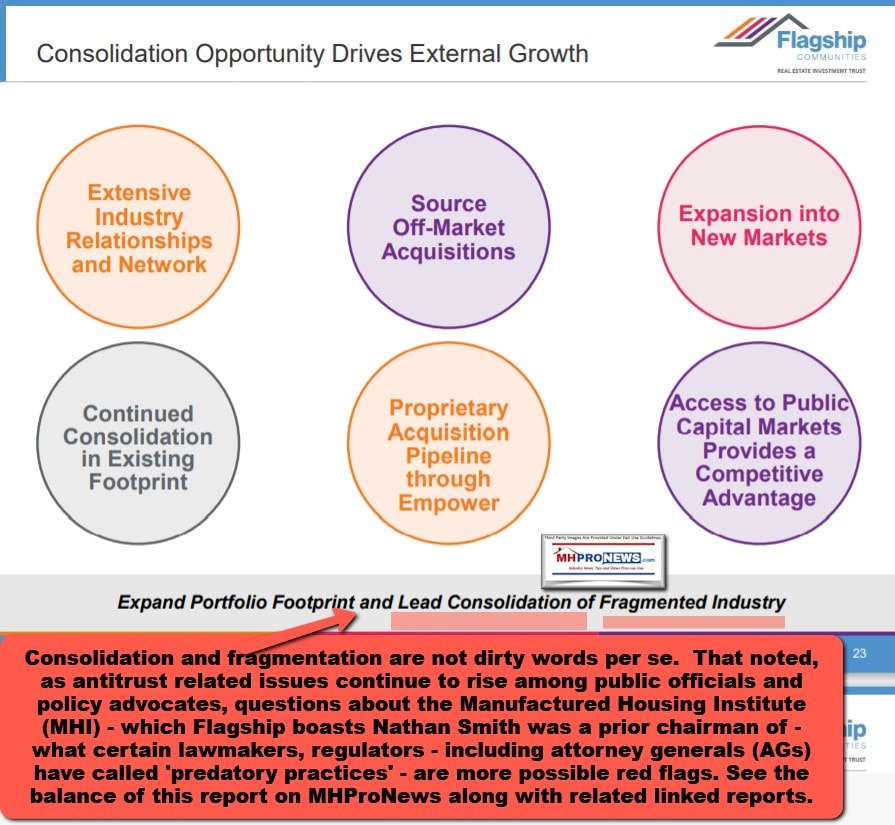

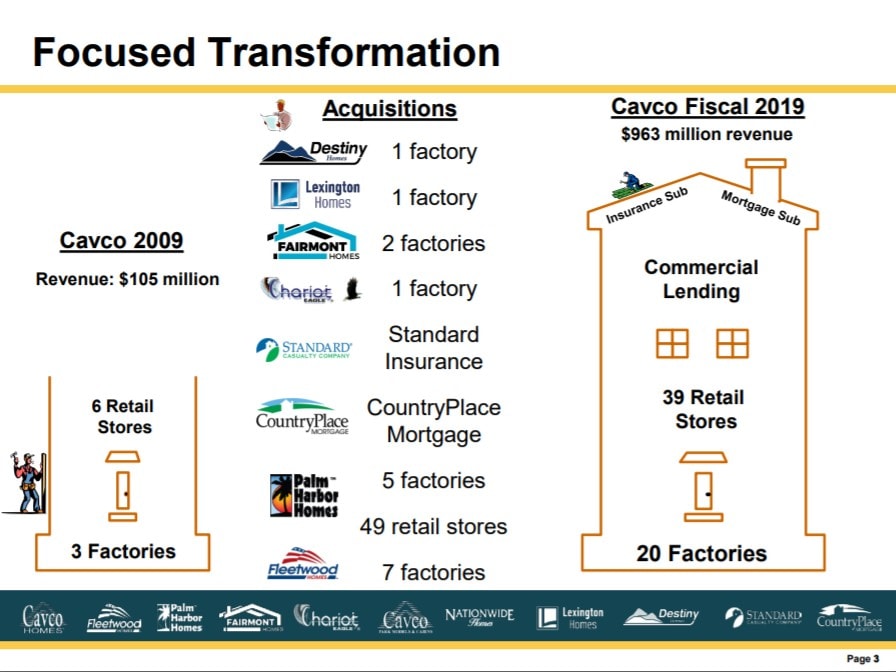

2) When MHI’s corporate members that are publicly-traded make statements that they are focused on consolidation, that should be taken at face value.

The only MHI member that has seriously attempted to defend MHI’s behavior and track record is Andy Gedo, a partner in ManageAmerica, an MHI member firm. After a thoughtful public online debate, Gedo ended up tossing in the towel, but not before making some arguably useful admissions. One of those is the comment he made below. Gedo’s reasoning goes back to the heart of Eric Belsky’s point, noted further below, about the critical role that credit plays in manufactured housing.

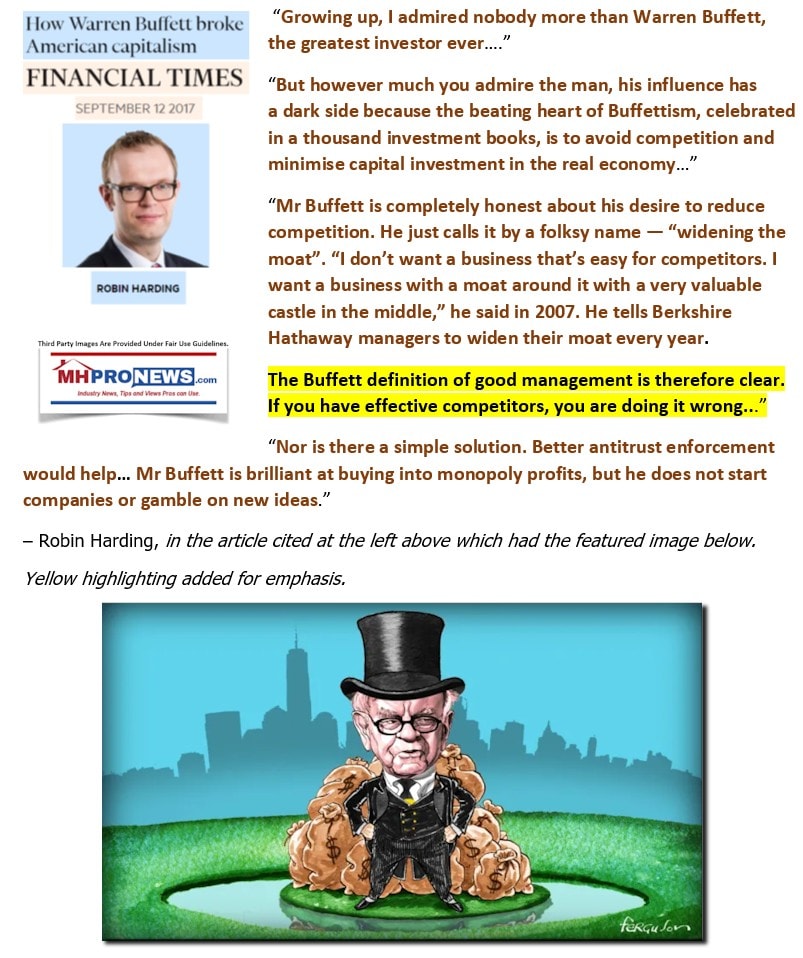

That “moat” principle that Kevin Clayton says Warren Buffett hammers home on his unit managers is important to keep in mind for public officials, lawyers or investors researching the industry for various reasons, policy advocates, and most others.

![DidntWantToMeetWarren[Buffett]BecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2020/07/DidntWantToMeetWarrenBuffettBecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews.jpg)

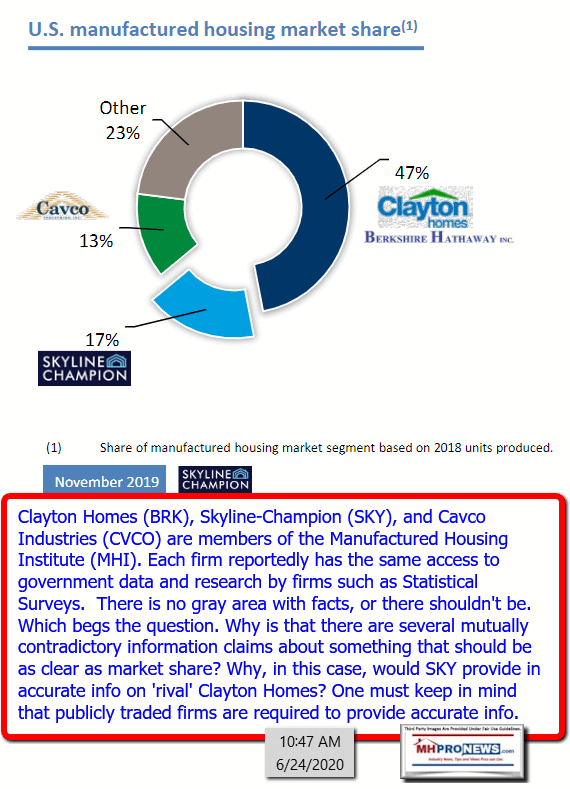

When Clayton Homes, apparently with the tactic support of at least Skyline Champion, has attempted to mask their market share, that points to possible collusion between those larger MHI corporate players.

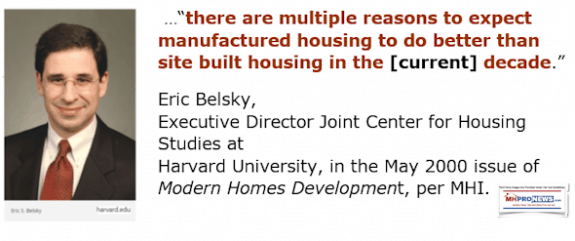

Then Harvard Joint Center for Housing Studies (JCHS) researcher Eric Belsky, who has since moved onto the Federal Reserve board of governors, said two things during his tenure at JCHS that should be red-letter insights for objective thinkers.

- Lending is the lifeblood of housing.

- Manufactured homes, thought Belsky and others, were destined to overtake conventional housing.

Belsky used to be quoted by MHI in the pre-Berkshire era. But sometime after Clayton Homes and their affiliated Berkshire-Hathaway owned lending was acquired by Clayton, Belsky’s name was scrubbed from the MHI website and no longer was produced as part of MHI literature. Why not? Why not tout third party praise of manufactured homes? Why not point to Belsky’s logic that credit is the lifeblood of housing and use that as part of their arguments to move FHFA and the GSEs into full compliance with the HERA law?

When one steps back and looks carefully, not only are the two largest lenders both owned by Berkshire Hathaway – i.e. 21st Mortgage Corporation, which serves “independents,” and Vanderbilt Mortgage and Finance (VMF), which serves Clayton retailers – but the #3 lender in manufactured housing also has clear ties to Berkshire Hathaway.

Wells Fargo has as one of its biggest shareholders Berkshire. Are thinking people to believe that there is no influence from Warren Buffett’s team there at Wells Fargo?

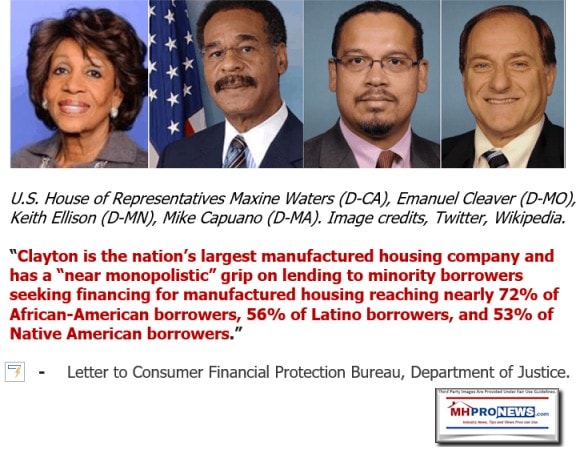

Hearings in Congress and letters by various Senate and House members on the manufactured home lending market over the years have pointed to the problems associated with Buffett-led Berkshire brands. An independent, non-Berkshire-owned lender, has told MHProNews that they can and do originate loans much like those of 21st, but do them at a lower interest rate.

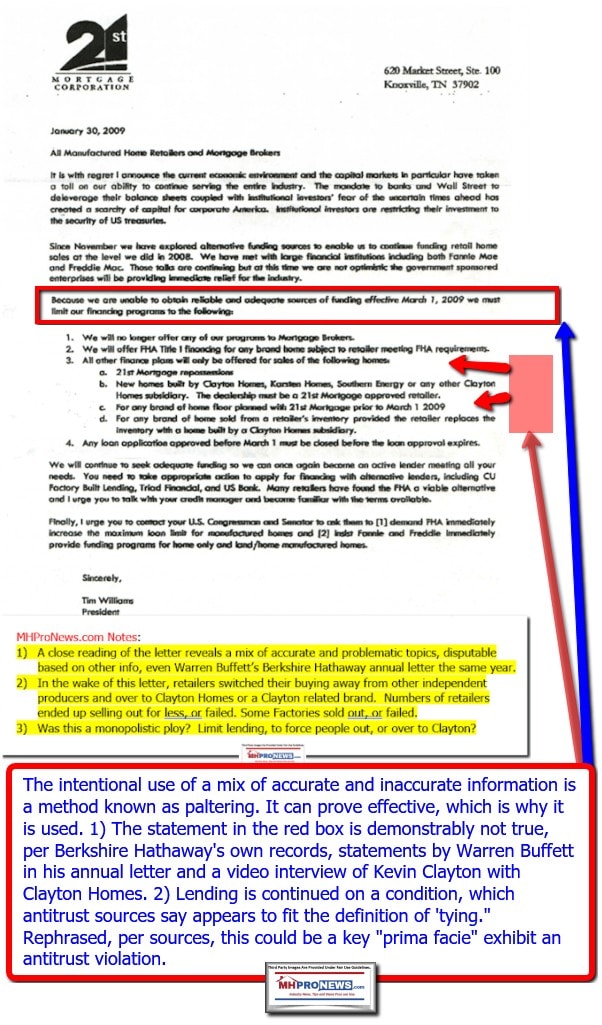

The higher rates that Buffett’s brands can charge are protected by the lack of GSE lending in the manufactured housing marketplace. While there are one or more state and federal public officials looking into allegations of antitrust violations by Clayton, 21st and their allies, this letter below – note the date and when the industry hit bottom on lending – is prima facie evidence to that point. It includes “tying,” and cutting off lending to those who didn’t buy Clayton product. Note too the cover given in the letter, suggesting that DTS should be part of the proposed solution. But over a decade later, DTS is as elusive now as it was then.

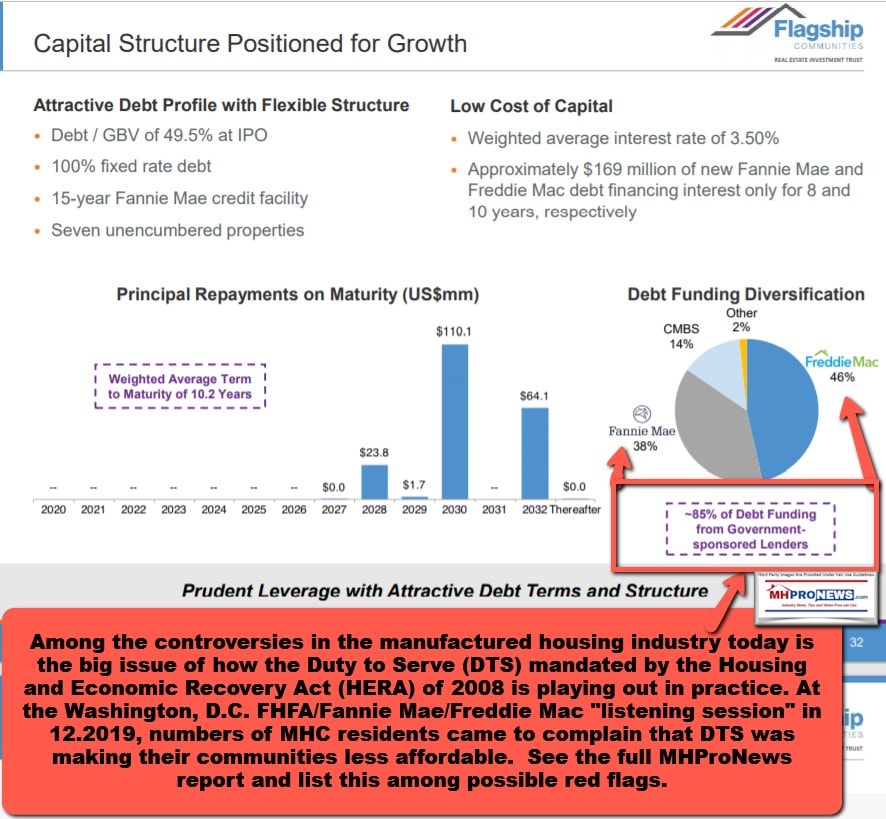

Then, there is the lending edge that the larger community operators – all MHI members – are getting from the GSEs on their commercial real estate. When publicly traded firms, or the new Flagship Communities proposed IPO are referenced, they periodically point to the benefit of having lower cost GSE lending on their properties.

Summing up point two, the largest players in manufactured housing all have selfish motivation to keep the GSEs engaged much at the same levels that they currently are. Is there any reason to be surprised that the GSEs feel no pressure to comply with MHARR or others, given the money and market markers?

3: The GSEs and FHFA are okay with the status quo.

It must also be kept in mind that the GSEs, if the Trump Administration gets its way, will at some point in time be re-capitalized by outside investors and set free from FHFA conservatorship.

While there will still be a regulatory role for the FHFA to play, the GSEs know that they have to play the long game. CNN recently reported that Berkshire is sitting on some $150 billion in cash or liquid assets. Buffett has been looking for an “elephant sized” acquisition for some time. Aren’t rational people who follow Buffett and Berkshire’s keen interest in banking and financial services going to ponder the possibility that one or both of the GSEs might be thinking that Berkshire might buy a big stake in them?

Given Berkshire’s real estate services, Clayton Homes increasing moves into conventional housing, wouldn’t controlling or having a serious influence over one or both of the Enterprises give Berkshire brands a serious edge in the multi-trillion-dollar housing market?

Additionally, the GSEs have paid MHI to sponsor events. Why are they sponsoring when they are doing so little lending?

Sources in and connected to the GSEs have told MHProNews repeatedly that the DTS program is not being done like any other normal lending program. The program makes no sense as it is being implemented.

The GSEs, per sources, really doesn’t want to lend on manufactured homes.

Those points all tend to confirm what MHARR and other DTS implementation critics have claimed.

With those thoughts in mind, one must not lose sight of the fact that there is a revolving door between federal positions and working in private industry or nonprofits.

- The Buffett-Gates impact on nonprofits can’t be overlooked. If someone is serving in the federal government and wants a post-federal gig, who will they be looking to make happy?

- Ditto the same point on the Buffett-Berkshire impact on possible post-federal employment for corporate interests.

The Official View on DTS from MHI…

“MHI’s letter emphasized the increased importance of access to financing for manufactured housing through Fannie Mae and Freddie Mac. As part of this process, MHI also participated in a recent FHFA Listening Session where the Association stressed the importance of maintaining access to credit as the economy recovers and that maintaining accountability for the GSE’s statutory Duty to Serve manufactured housing is crucial.” So said part of MHI’s 9.23.2020 message to their followers.

That MHI letter, linked here, includes this line. “The nation continues to navigate an affordable housing shortage, exacerbated by the Coronavirus crisis. Ensuring that the Enterprises support the availability of financing for manufactured homes has never been more important.” Quite so. But that only begs the question, that MHARR and other MHI critics have been pressing for years. Why is it that MHI postures the right words, but fails to take the proper behaviors?

Said MHI’s CEO Lesli Gooch, credibly charged by a tipster who provided reams of documents reflecting her purported conflicts of interest, said this in her letter to the FHFA. “Since manufactured housing is the most affordable source of single family homeownership in America, MHI believes that it is critically important that: (1) the Enterprises continue to press forward on their Duty to Serve Plans with respect to manufactured housing, and (2) FHFA hold the Enterprises strictly accountable for their performance relative to the promises made in their Duty to Serve Plans.”

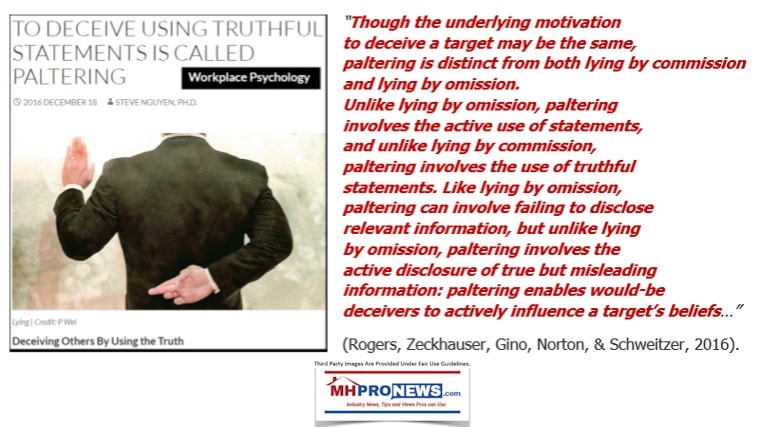

That is arguably classic paltering. MHI and their ‘big boy members,’ as the record reflects, has repeatedly failed to press for what those words claim that they want. In 2019, as the previously referenced statement by Gooch linked above and here made plain, MHI agreed to allow the GSEs to pare back their lending.

MHI admits the same thing that MHARR and other critics point to, after saying that some 77 percent of the market in manufactured housing is personal property or “chattel” loans, Gooch said “However, there is effectively virtually no secondary market for chattel loans.”

Gooch goes on to mention FHA Title I lending, “The volume of FHA Title I manufactured home chattel loans is miniscule and falling – only 526 Title I loans in 2018, which fell to 204 loans in 2019.”

What Gooch failed to say is that 21st Mortgage stopped making such loans, and the VMF will make them for Clayton Homes retailers.

Put differently, such letters from MHI – when understood in a historic context – are a pack of clever lies mixed in with window dressing to make the underinformed feel good.

But Gooch presses on, saying that the Fannie Mae committed to 1,000 chattel loans per year as part of their DTS plan. She ironically making the point that MHARR’s Mark Weiss and other critics noted above have said.

“To date, almost 2/3 of the way through the second of these two years, we are not aware of any chattel loans that Fannie Mae has purchased, participated in a debt structure, or guaranteed.” Gooch then went on to say that Freddie Mac, which only committed to 250 loans per year “To date, almost 2/3 of the way through the second of these two years, we are not aware of any chattel loans that Freddie Mac has purchased.”

The evidence suggests that such a ‘complaint’ by MHI, which accepted GSE sponsorship dollars, is “Kabuki theater” for the uninformed. It is what a periodic MHEC tipster tells MHProNews is MHI’s pattern of “Razzle Dazzle.” These are purported ‘con artists’ tricks which are being carried by the wires in possible violation of various federal laws. As Dictionary defines it, “The phrases Kabuki theater, kabuki dance, or kabuki play are sometimes used in political discourse to describe an event characterized more by showmanship than by content.”

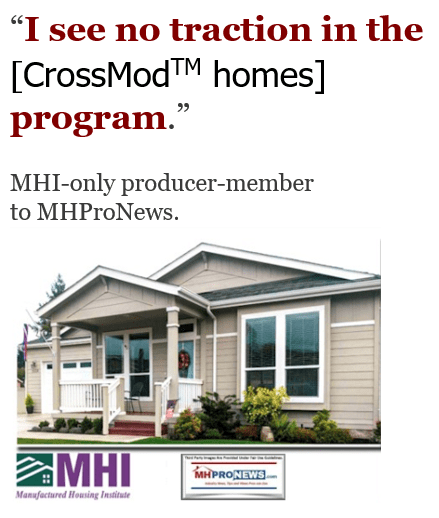

Gooch’s letter doesn’t mention the Clayton Homes-backed “new class” of manufactured homes that MHI trademarked as “CrossModTM” homes. But she does mention the names Fannie and Freddie gave to those housing types. “Fannie Mae’s MH Advantage® – in the form of Freddie Mac’s CHOICEHome®.” Gooch and MHI spokespeople routinely tout the “CrossModTM”, “MH Advantage®” and “CHOICEHome®.” While she took pains to say that the GSEs had done no chattel lending, what she failed to say is that virtually no loans took place on the highly touted MHI program either.

As MHProNews previously cited an MHI source, these programs have no traction in the marketplace. But that point begs the question. How good could MHI’s so-called research and focus group have been if these programs have witnessed a contraction in the industry instead of an advancement in sales, as it was sold to their members?

Thus, is the game played that drew this complaint from a MHEC member: “Without any such [serious] objection, or even acknowledgment of the flat-out failure that is DTS implementation within the manufactured housing market, the only possible conclusion is that MHI, at least implicitly, supports this “hijacking.” of DTS by the GSEs, and tactically tolerated by FHFA.

The “CrossModTM” program made no sense since it was first announced as a “new class of manufactured homes.” MHProNews some 18 months ago said it could prove to be a Trojan Horse, and so it has come to pass.

But that wasn’t just a crystal ball look into the future. It was based upon insights from various sources inside MHI and with insider ties to the GSEs.

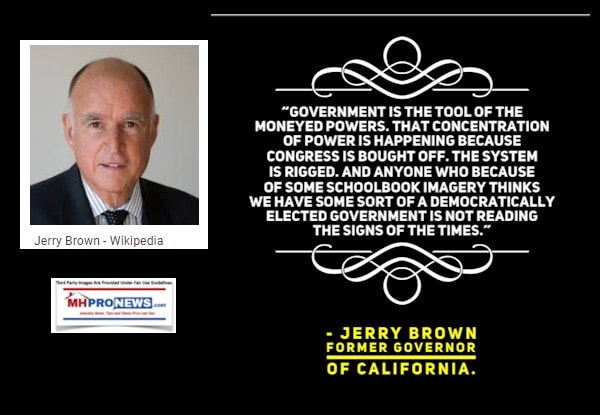

The Rigged System?

In hindsight, after years of so-called “deep state” resistance to the Trump Administration’s “drain the swamp” pledge, it was naïve to think it could be accomplished in a single term in office. When “deep state” actors in various federal agencies, including law enforcement and so-called ‘spy agencies,’ were bold enough to attempt to unseat a duly elected president, that’s so big that collusion and corruption between crony capitalists and government bureaucrats in positions that impact manufactured housing pales in comparison.

Early voting in the upcoming general election set for November 3, 2020 is underway. MHARR, which has no PAC and makes no endorsement of candidates, nevertheless raised the concern that the deep state was working at HUD to thwart the Trump regulatory reform agenda there.

There are plenty of reasons to believe that a similar “deep state” foot dragging is occurring at FHFA. The law regarding DTS is clear. The exiting DTS program manager admits that there has not been much done.

Understanding these issues will be useful no matter who wins the 2020 general election, and which party controls the two chambers of the U.S. Congress.

But from the MHProNews vantagepoint, the logic should be to educate others on what has occurred. And then long-term thinkers must act and vote accordingly.

There is always more to know. Stay tuned with the runaway largest and documented number one most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Manufactured Housing Institute Warns Members – Pondering Legal Action, Insider Insights

Frank Rolfe, MHU/RV Horizons Protest by MHAction; Nathan Smith/SSK/MHI Flashbacks?

Nathan & Mary Lee Chance Smith, Leaders in ‘Anti-Trump Resistance,’ Manufactured Housing Impact?

Barriers to Entry, Persistence, and Exiting in Business, Affordable Housing, and Manufactured Homes