On August 5, 2021 Cavco Industries (CVCO) provided the following media release on what they say are historic levels of gross earnings and net income. Of course, as is routinely true of this and other stocks, there are too few references to the effect of inflation on this corporate ‘record.’ Another macro-market insight will follow Cavco’s official statements, which are provided. That will be framed against the 5 year stock graphic shown below, which was not part of their release. Additional information and linked reports not found in their statement will be provided that yield a rich tapestry of insights from behind the curtain that press releases and most mainstream reports miss. Then, this report will conclude with our business-daily market report and related ‘headline’ news feature.

MHProNews has no position in this or other reported firms. Per Cavco, the following.

Thu, August 5, 2021, 4:05 PM

PHOENIX, Aug. 05, 2021 (GLOBE NEWSWIRE) — Cavco Industries, Inc. (Nasdaq: CVCO) today announced financial results for the first fiscal quarter ended July 3, 2021 and provides updates on other business items.

Highlights

- Recorded highest quarterly Net revenue and Net income in the Company’s history at $330 million and $27 million, respectively

- Gross profit as a percentage of Net revenue increased to 22.4% and factory-built housing gross profit to 21.2%

- Earnings per diluted share was $2.92 compared to $1.80 for the same quarter last year

- Home order rates improved nearly 50% over last year’s quarter

- Backlogs increased $189 million during the quarter

- Released first ever Corporate Responsibility Report

- Announced major expansion of the Fort Worth, Texas production facility and continued progress on new park model facility in Glendale, Arizona

- Announced agreement to acquire manufactured and modular home builder The Commodore Corporation

- Returned over $12.8 million to shareholders through stock repurchases

Commenting on the quarter, Bill Boor, President and Chief Executive Officer said, “Our first quarter results demonstrate the strength of our company, with record quarterly revenue and strong gross margins. The demand for our homes also remains healthy with seasonally strong order rates. We remain focused on innovation and increasing home production while navigating continuing labor and building supply challenges.”

Mr. Boor continued, “We have stated that our capital allocation priorities include investing in our facilities, strategic acquisitions and returning money to our shareholders. This quarter, we have executed on all three of these through the expansion of our Fort Worth facility, our planned acquisition of The Commodore Corporation and our stock repurchase activity. Our strong balance sheet has allowed us the flexibility to move quickly with these opportunities and we will continue to explore other prospects for growth and return on capital.”

Financial Results

| Three Months Ended | ||||||||||||||

| ($ in thousands, except revenue per home sold) | July 3, 2021 |

June 27, 2020 |

Change | |||||||||||

| Net revenue | ||||||||||||||

| Factory-built housing | $ | 312,283 | $ | 238,090 | $ | 74,193 | 31.2 | % | ||||||

| Financial services | 18,139 | 16,711 | 1,428 | 8.5 | % | |||||||||

| $ | 330,422 | $ | 254,801 | $ | 75,621 | 29.7 | % | |||||||

| Factory-built modules sold | 6,318 | 5,616 | 702 | 12.5 | % | |||||||||

| Factory-built homes sold (consisting of one or more modules) | 3,700 | 3,349 | 351 | 10.5 | % | |||||||||

| Net factory-built housing revenue per home sold | $ | 84,401 | $ | 71,093 | $ | 13,308 | 18.7 | % | ||||||

- In the factory-built housing segment, the increase in Net revenue was primarily due to 18.7% higher home selling prices and 10.5% higher home sales volume. The higher home prices were driven by product price increases and a shift toward more multi-section homes. Home sales volume increased from higher factory capacity utilization. On a sequential basis, adjusting for the extra week of production in the fourth quarter of fiscal year 2021, home sales volume also increased from slightly higher factory capacity utilization.

- Financial services segment Net revenue increased primarily due to higher volume in home loan sales and more insurance policies in force in the current year compared to the prior year, partially offset by lower interest income earned on the acquired consumer loan portfolios that continue to amortize and lower unrealized gains on marketable equity securities in the insurance subsidiary’s portfolio.

| Three Months Ended | |||||||||||||||

| ($ in thousands) | July 3, 2021 |

June 27, 2020 |

Change | ||||||||||||

| Gross Profit | |||||||||||||||

| Factory-built housing | $ | 66,273 | $ | 46,992 | $ | 19,281 | 41.0 | % | |||||||

| Financial services | 7,740 | 8,331 | (591 | ) | (7.1 | ) | % | ||||||||

| $ | 74,013 | $ | 55,323 | $ | 18,690 | 33.8 | % | ||||||||

| Consolidated gross profit as % of Net revenue | 22.4 | % | 21.7 | % | N/A | 0.7 | % | ||||||||

| Income from Operations | |||||||||||||||

| Factory-built housing | $ | 30,776 | $ | 16,255 | $ | 14,521 | 89.3 | % | |||||||

| Financial services | 2,405 | 3,745 | (1,340 | ) | (35.8 | ) | % | ||||||||

| $ | 33,181 | $ | 20,000 | $ | 13,181 | 65.9 | % | ||||||||

- In the factory-built housing segment, Income from operations increased from the higher home sales prices and the higher home sales volume, partially offset by higher salary and incentive compensation expense on improved earnings. Net expense of $0.1 million related to the Securities and Exchange Commission (“SEC”) inquiry was recorded for both periods presented. There was no additional Director and Officer (“D&O”) insurance premium amortization in the current period versus $2.1 million in the prior year period.

- In the financial services segment, Income from operations decreased from lower unrealized gains on marketable equity securities, higher weather-related claims during the period and lower interest income earned on the acquired consumer loan portfolios that continue to amortize.

| Three Months Ended | ||||||||||||||

| ($ in thousands, except per share amounts) | July 3, 2021 |

June 27, 2020 |

Change | |||||||||||

| Net Income | $ | 27,046 | $ | 16,674 | $ | 10,372 | 62.2 | % | ||||||

| Diluted net income per share | $ | 2.92 | $ | 1.80 | $ | 1.12 | 62.2 | % | ||||||

Items ancillary to our core operations had the following impact on the results of operations:

| Three Months Ended | ||||||||

| ($ in millions) | July 3, 2021 |

June 27, 2020 |

||||||

| Net revenue | ||||||||

| Unrealized gains recognized during the period on securities held in the financial services segment |

$ | 0.4 | $ | 1.0 | ||||

| Selling, general and administrative expenses | ||||||||

| Amortization of additional D&O insurance premiums | — | (2.1 | ) | |||||

| Legal and other expense related to the SEC inquiry, net of recovery | (0.1 | ) | (0.1 | ) | ||||

| Other income, net | ||||||||

| Corporate unrealized gains recognized during the period on securities held | 1.2 | 1.0 | ||||||

| Income tax expense | ||||||||

| Tax benefits from stock option exercises | 0.2 | 0.3 | ||||||

Housing Demand and Production Updates

Home order rates remained strong during the first fiscal quarter of 2022, being nearly 50% higher than the comparable prior year quarter. This increased order volume is the result of more well-qualified home buyers making purchase decisions, supported by reduced home loan interest rates.

We continue to experience hiring challenges, higher and largely unpredictable factory employee absenteeism and other inefficiencies from building material supply disruptions. Accordingly, our total average plant capacity utilization rate was approximately 75% during the first fiscal quarter of 2022. Orders outpaced the challenging production environment during the quarter, raising order backlogs to $792 million at July 3, 2021, up 31.3% compared to $603 million at April 3, 2021, and up 404.5% compared to $157 million at June 27, 2020.

Planned Acquisition of The Commodore Corporation

As discussed in our July 26, 2021 press release, we entered into an agreement to acquire the business and certain assets and liabilities of The Commodore Corporation (“Commodore”), including its six manufacturing and two retail locations. Commodore is the largest private independent builder of manufactured and modular housing in the United States, operating under a variety of well-known brand names. Commodore has over 1,200 employees and operates across the Northeast, Midwest and Mid-Atlantic regions. In addition to manufacturing, Commodore also has a commercial lending portfolio with its dealers that we will acquire and continue. For the last 12 months ended March 31, 2021, Commodore generated net sales of approximately $258 million and sold over 6,600 modules, equating to over 3,700 homes.

The purchase price totals $153 million, before certain adjustments that will be determined upon close of the transaction. The estimated cash outlay is $140 million after adjustments and including transaction fees. We expect to fund the acquisition entirely with cash on hand. The transaction is expected to close in our third quarter of fiscal year 2022, subject to applicable regulatory approvals and satisfaction of certain customary conditions.

Release of Corporate Responsibility Report

The release of our first Corporate Responsibility Report represents a great milestone. In the report, we present a framework for how we think about our impact across the spectrum of stakeholders in our business. The report is divided into several focus areas: our employees, our community, our environment and corporate governance. The content of this first Corporate Responsibility Report demonstrates that, in addition to having opportunities for improvement, we have a lot to be proud of as a team of people working to make a difference. This report can be accessed in the General Documents section at https://investor.cavco.com.

Conference Call Details

Cavco’s management will hold a conference call to review these results tomorrow, August 6, 2021, at 1:00 p.m. (Eastern Time). Interested parties can access a live webcast of the conference call on the Internet at https://investor.cavco.com or via telephone at + 1 (844) 348-1686 (domestic) or + 1 (213) 358-0891 (international). An archive of the webcast and presentation will be available for 90 days at https://investor.cavco.com.

About Cavco

Cavco Industries, Inc., headquartered in Phoenix, Arizona, designs and produces factory-built housing products primarily distributed through a network of independent and Company-owned retailers. We are one of the largest producers of manufactured homes in the United States, based on reported wholesale shipments and marketed under a variety of brand names including Cavco, Fleetwood, Palm Harbor, Fairmont, Friendship, Chariot Eagle and Destiny. We are also a leading producer of park model RVs, vacation cabins and systems-built commercial structures, as well as modular homes. Cavco’s finance subsidiary, CountryPlace Mortgage, is an approved Fannie Mae and Freddie Mac seller/servicer and a Ginnie Mae mortgage-backed securities issuer that offers conforming mortgages, non-conforming mortgages and home-only loans to purchasers of factory-built homes. Our insurance subsidiary, Standard Casualty, provides property and casualty insurance to owners of manufactured homes.

Forward-Looking Statements

Certain statements contained in this release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. In general, all statements that are not historical in nature are forward-looking. Forward-looking statements are typically included, for example, in discussions regarding the manufactured housing industry; our financial performance and operating results; and the expected effect of certain risks and uncertainties on our business, financial condition and results of operations. All forward-looking statements are subject to risks and uncertainties, many of which are beyond our control. As a result, our actual results or performance may differ materially from anticipated results or performance. Factors that could cause such differences to occur include, but are not limited to: the impact of local or national emergencies including the COVID-19 pandemic, including such impacts from state and federal regulatory action that restricts our ability to operate our business in the ordinary course and impacts on (i) customer demand and the availability of financing for our products, (ii) our supply chain and the availability of raw materials for the manufacture of our products, (iii) the availability of labor and the health and safety of our workforce and (iv) our liquidity and access to the capital markets; labor shortages and the pricing and availability of raw materials; our ability to successfully integrate past acquisitions or future acquisitions and the ability to attain the anticipated benefits of such acquisitions; involvement in vertically integrated lines of business, including manufactured housing consumer finance, commercial finance and insurance; information technology failures or cyber incidents; our participation in certain financing programs for the purchase of our products by industry distributors and consumers, which may expose us to additional risk of credit loss; significant warranty and construction defect claims; our contingent repurchase obligations related to wholesale financing; a write-off of all or part of our goodwill; our ability to maintain relationships with independent distributors; our business and operations being concentrated in certain geographic regions; governmental and regulatory disruption, including prolonged delays by Congress and the President to approve budgets or continuing appropriations resolutions to facilitate the operation of the federal government; curtailment of available financing from home-only lenders and increased lending regulations; availability of wholesale financing and limited floor plan lenders; market forces and housing demand fluctuations; the cyclical and seasonal nature of our business; competition; general deterioration in economic conditions and turmoil in the financial markets; unfavorable zoning ordinances; extensive regulation affecting the production and sale of manufactured housing; potential financial impact on the Company from the subpoenas we received from the SEC and its ongoing investigation, including the risk of potential litigation or regulatory action, and costs and expenses arising from the SEC subpoenas and investigation and the events described in or covered by the SEC subpoenas and investigation, which include the Company’s indemnification obligations and insurance costs regarding such matters, and potential reputational damage that the Company may suffer; losses not covered by our director and officer insurance, which may be large, adversely impacting financial performance; loss of any of our executive officers; our ability to generate income in the future; liquidity and ability to raise capital may be limited; organizational document provisions delaying or making a change in control more difficult; and volatility of stock price; together with all of the other risks described in our filings with the SEC. Readers are specifically referred to the Risk Factors described in Item 1A of the Company’s Annual Report on Form 10-K for the year ended April 3, 2021 as may be amended from time to time, which identify important risks that could cause actual results to differ from those contained in the forward-looking statements. Cavco expressly disclaims any obligation to update any forward-looking statements contained in this release, whether as a result of new information, future events or otherwise. Investors should not place undue reliance on any such forward-looking statements.

CAVCO INDUSTRIES, INC.

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except per share amounts)

| July 3, 2021 |

April 3, 2021 |

||||||

| ASSETS | (Unaudited) | ||||||

| Current assets | |||||||

| Cash and cash equivalents | $ | 329,753 | $ | 322,279 | |||

| Restricted cash, current | 16,728 | 16,693 | |||||

| Accounts receivable, net | 51,054 | 47,396 | |||||

| Short-term investments | 19,749 | 19,496 | |||||

| Current portion of consumer loans receivable, net | 32,429 | 37,690 | |||||

| Current portion of commercial loans receivable, net | 16,500 | 14,568 | |||||

| Current portion of commercial loans receivable from affiliates, net | 2,113 | 4,664 | |||||

| Inventories | 150,917 | 131,234 | |||||

| Prepaid expenses and other current assets | 48,621 | 57,779 | |||||

| Total current assets | 667,864 | 651,799 | |||||

| Restricted cash | 335 | 335 | |||||

| Investments | 38,192 | 35,010 | |||||

| Consumer loans receivable, net | 35,095 | 37,108 | |||||

| Commercial loans receivable, net | 21,245 | 20,281 | |||||

| Commercial loans receivable from affiliates, net | 4,730 | 4,801 | |||||

| Property, plant and equipment, net | 97,981 | 96,794 | |||||

| Goodwill | 75,090 | 75,090 | |||||

| Other intangibles, net | 14,190 | 14,363 | |||||

| Operating lease right-of-use assets | 16,150 | 16,252 | |||||

| Total assets | $ | 970,872 | $ | 951,833 | |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

| Current liabilities | |||||||

| Accounts payable | $ | 30,175 | $ | 32,120 | |||

| Accrued expenses and other current liabilities | 210,190 | 203,133 | |||||

| Current portion of secured financings and other | 1,822 | 1,851 | |||||

| Total current liabilities | 242,187 | 237,104 | |||||

| Operating lease liabilities | 13,085 | 13,361 | |||||

| Secured financings and other | 9,927 | 10,335 | |||||

| Deferred income taxes | 6,606 | 7,393 | |||||

| Stockholders’ equity | |||||||

| Preferred stock, $0.01 par value; 1,000,000 shares authorized; No shares issued or outstanding |

— | — | |||||

| Common stock, $0.01 par value; 40,000,000 shares authorized; Issued 9,245,721 and 9,241,256 shares, respectively |

92 | 92 | |||||

| Treasury stock, at cost; 67,901 and 6,600 shares, respectively | (14,283 | ) | (1,441 | ) | |||

| Additional paid-in capital | 255,071 | 253,835 | |||||

| Retained earnings | 458,103 | 431,057 | |||||

| Accumulated other comprehensive income | 84 | 97 | |||||

| Total stockholders’ equity | 699,067 | 683,640 | |||||

| Total liabilities and stockholders’ equity | $ | 970,872 | $ | 951,833 | |||

CAVCO INDUSTRIES, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per share amounts)

(Unaudited)

| Three Months Ended | |||||||

| July 3, 2021 |

June 27, 2020 |

||||||

| Net revenue | $ | 330,422 | $ | 254,801 | |||

| Cost of sales | 256,409 | 199,478 | |||||

| Gross profit | 74,013 | 55,323 | |||||

| Selling, general and administrative expenses | 40,832 | 35,323 | |||||

| Income from operations | 33,181 | 20,000 | |||||

| Interest expense | (164 | ) | (196 | ) | |||

| Other income, net | 2,461 | 1,876 | |||||

| Income before income taxes | 35,478 | 21,680 | |||||

| Income tax expense | (8,432 | ) | (5,006 | ) | |||

| Net income | $ | 27,046 | $ | 16,674 | |||

| Net income per share | |||||||

| Basic | $ | 2.94 | $ | 1.82 | |||

| Diluted | $ | 2.92 | $ | 1.80 | |||

| Weighted average shares outstanding | |||||||

| Basic | 9,198,229 | 9,174,182 | |||||

| Diluted | 9,276,529 | 9,264,661 | |||||

CAVCO INDUSTRIES, INC.

OTHER OPERATING DATA

(Dollars in thousands)

(Unaudited)

| Three Months Ended | |||||||

| July 3, 2021 |

June 27, 2020 |

||||||

| Capital expenditures | $ | 2,593 | $ | 1,856 | |||

| Depreciation | $ | 1,403 | $ | 1,426 | |||

| Amortization of other intangibles | $ | 173 | $ | 187 | |||

For additional information, contact:

Mark Fusler

Director of Financial Reporting and Investor Relations… ##

###

Additional Information, MHProNews Analysis and Commentary

Per an emailed update from financial source Zacks to MHProNews on 8.7.2021, the following.

In the first half of 2021, investors across the globe poured over $900 billion into U.S.-based mutual funds and exchange-traded funds (ETFs). It was a record-setting start for fund flows in the first six months, and the U.S. was by far the biggest beneficiary. In a world still beset by the pandemic and uneven responses and recoveries, the U.S. has been a refuge of sorts for global investors. Foreign investors alone added $712 billion into U.S. equities in 2020 and are expected to add another $200 billion this year.1

Similar trends are playing out in the bond markets. According to Bloomberg data, close to $16 trillion of global debt had a negative yield as of the end of July, which means investors would have to pay money to hold the bonds (assuming they held to maturity). At the end of 2019, there was $11 trillion in negative-yielding debt, which underscores how global central banks pushed rates lower in response to the pandemic.

The picture in the United States looks different. U.S. Treasury bond yields are positive, and we expect them to move higher over time as the Federal Reserve eventually pulls back QE and as the economy continues to grow. When global investors are looking for positive yielding, safe debt, the U.S. is the place to go – approximately 70% of positive-yielding bonds from G10 countries were U.S. Treasuries.”

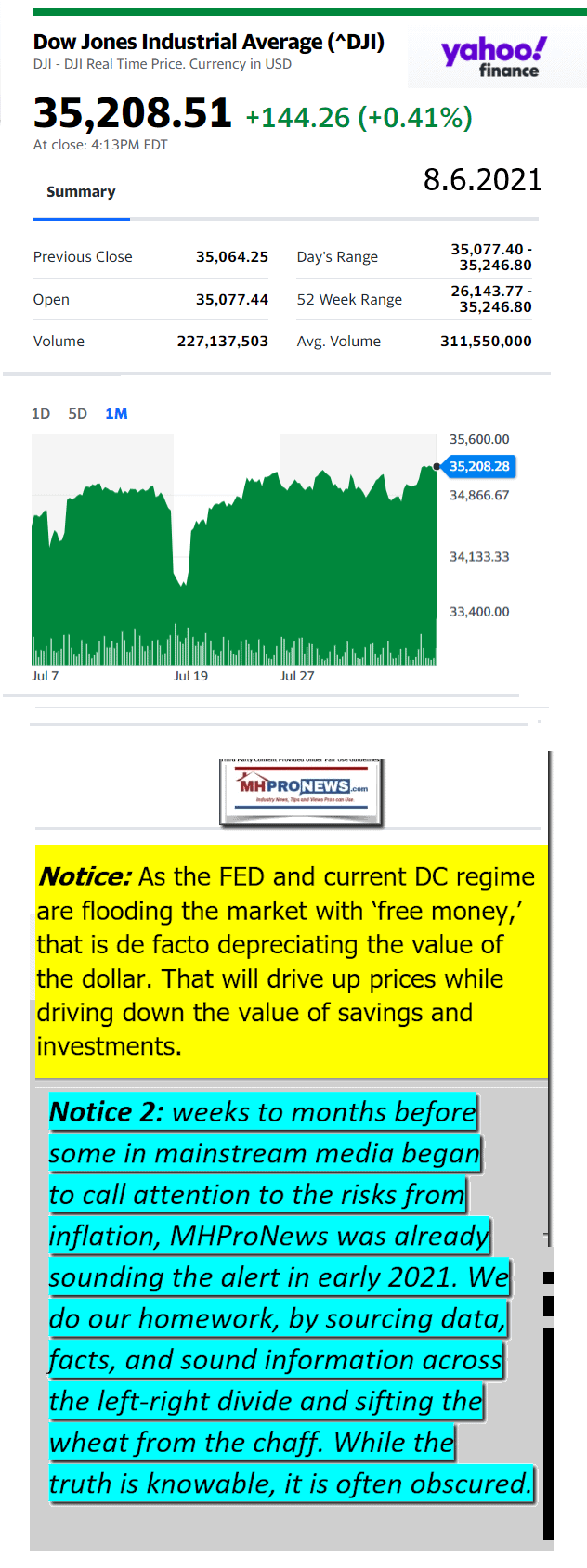

That, plus inflation (more precisely, more printed money causing a devaluation of U.S. currency’s worth) are not to be overlooked items in discerning what may seem to be a ‘rising’ stock.

Additionally, it is worth mentioning that the Trump tax cuts are still in place. Those tax cuts were a capital inflow into the U.S. magnet.

There is a curious mix of smaller owners – fearful of Biden’s proposed tax cuts, that are selling hoping to avoid higher taxes. But there are also those consolidators who are gladly buying and have the capital access and/or cash to do so.

Note: MHProNews will plan to unpack the Cavco earnings call in a special report planned in the near term. Stay tuned.

Until then, a few quick bullets and linked reports will prove insightful. From the above, Cavco said:

- “Net expense of $0.1 million related to the Securities and Exchange Commission (“SEC”) inquiry was recorded for both periods presented. There was no additional Director and Officer (“D&O”) insurance premium amortization in the current period versus $2.1 million in the prior year period.”

- “…potential financial impact on the Company from the subpoenas we received from the SEC and its ongoing investigation, including the risk of potential litigation or regulatory action, and costs and expenses arising from the SEC subpoenas and investigation and the events described in or covered by the SEC subpoenas and investigation,…”

MHProNews has been covering what a Cavco insider called a “debacle” for approaching 3 years. Some sample linked reports paints the picture at-a-glance. More details are available by clicking on a given report.

There has been several shareholders related probes and pending suits related to manufactured housing. These firms routinely appear to have ties to the Manufactured Housing Institute (MHI), of which Cavco is a board-level member.

The announcement of the deal between Cavco and The Commodore Corporation (TCC) shown below has been a leading report in terms of readership on MHProNews since shortly after it was published. It provides additional information not found in their original release. When you hit the top 5 reports on a this site of some 20,000 (+/-) articles and posts – the runaway most-read in our industry – that is a sign that the topic is of keen interest with professionals.

Cavco’s former Chairman and former MHI chair Joe Stegmayer has a seat at the table with the Manufactured Housing Institute (MHI). The industry’s various maneuvers, purported schemes, slippery politics and related can not be properly understood absent an understanding of the linked items. For certain investors, some of this may seem appealing. For others, it may appear to be a warning sign.

Either way, knowledge is potential power. The industry’s sales are up. But the performance relative to the glory days gone by are still evident. These are causes for concern, because it speaks to what researchers say are market manipulations that are routinely NOT found in financial or other or other news reports. ##

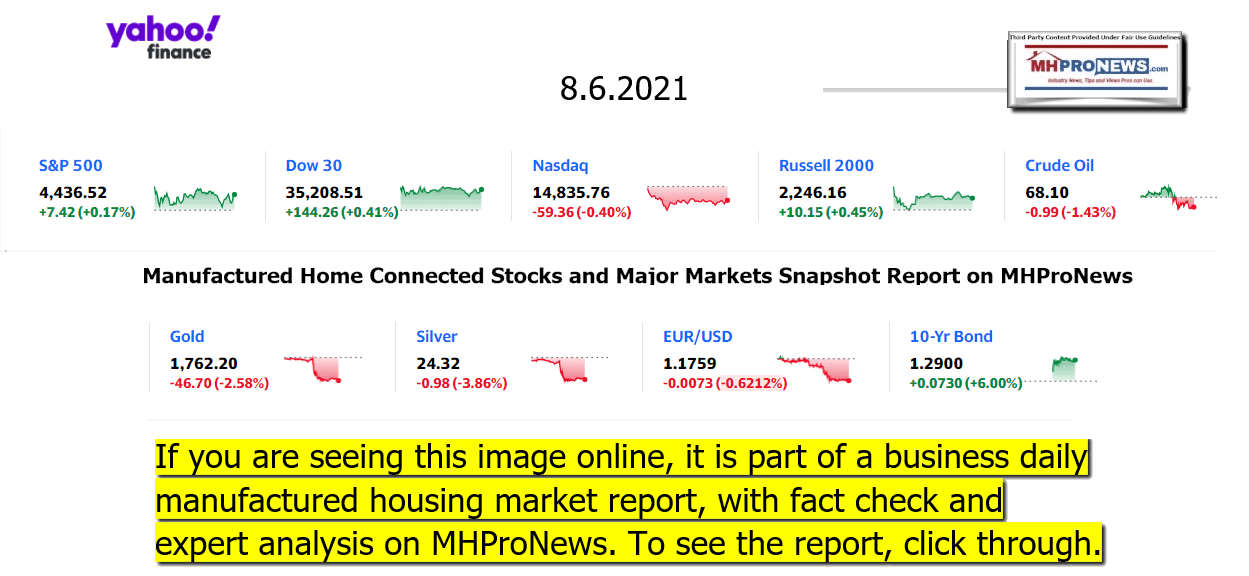

Next up is our business daily recap of yesterday evening’s market report and related left-right headlines.

The Business Daily Manufactured Home Industry Connected Stock Market Updates. Plus, Market Moving Left (CNN) – Right (Newsmax) Headlines Snapshot. While the layout of this daily business report has recently been modified, several elements of the basic concepts used previously are still the same. The headlines that follow below can be reviewed at a glance to save time while providing insights across the left-right media divide. Additionally, those headlines often provide clues as to possible ‘market-moving’ items.

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Headlines from left-of-center CNN Business = evening of 8.6.2021

-

-

- ‘Increasingly alarmed’

- Joe Manchin, D-W.Va., arrives to chair the Senate Energy and Natural Resources Committee, as lawmakers work to advance the $1 trillion bipartisan bill, at the Capitol in Washington, Thursday, Aug. 5, 2021.

- Democratic Senator Joe Manchin goes after the Federal Reserve on inflation

- The US added 943,000 jobs, the biggest gain since August 2020

- The big picture on jobs is still grim

- Opinion: It may look like a bubble, but the US isn’t heading for another housing crisis

- United Airlines mandates Covid-19 vaccines for all employees

- Ethan Allen changes stock symbol from ETH to avoid confusion with ethereum

- How to handle a pandemic-related gap on your resume

- Apple to start checking iPhone and iCloud photos for child abuse imagery

- Watch these robots clean up a beach

- Tesla just got snubbed by Biden’s electric vehicle summit

- ‘We are failing one another:’ USA Today front page implores people to pay attention to Covid surge

- How Jeopardy’s producer ended up as the front-runner to replace Alex Trebek

- An Applebee's with dining room open sign after being shutdown for months due to the coronavirus pandemic, in Roseville, Minnesota on September 05, 2020.

- People are flocking to Applebee’s. This popular song is one reason why

- Pallets of Coke-Cola Zero cans wait to the filled at a Coco-Cola bottling plant on February 10, 2017 in Salt Lake City, Utah.

- Coke is changing the recipe of a popular drink. A lot could go wrong

- How a Tom Cruise doppelganger on TikTok led to a new AI company

- MARKETS

- The Virgin Galactic SpaceShipTwo space plane Unity returns to earth after the mothership separated at Spaceport America, near Truth and Consequences, New Mexico on July 11, 2021.

- Virgin Galactic reopens ticket sales — for $450,000 per seat

- These reality shows are sending regular people to space

- Boeing set to retry test flight to take on SpaceX

- Space tourism won’t be affordable any time soon

- An exclusive look into how Space Force is defending America

- CLIMATE CONCERNS

- Electric vehicles are displayed before a news conference with White House Climate Adviser Gina McCarthy and U.S. Secretary of Transportation Pete Buttigieg about the American Jobs Plan and to highlight electric vehicles at Union Station near Capitol Hill on April 22, 2021 in Washington, DC. The Biden administration has proposed over $170 billion in spending to boost the production of zero-emission buses and cars and increase the number of EV charging stations.

- Biden’s electric vehicle sales goal won’t be too hard to reach by 2030

- Europe aims to kill gasoline and diesel cars by 2035

- Heart Aerospace plans to fly electric planes by 2026

- Pro-fossil fuel Facebook ads had millions of views

- Oil prices are rebounding, but investors have climate concerns

-

Headlines from right-of-center Newsmax – evening of 8.6.2021

-

-

- Justice Dept Urges Federal Judge to Keep CDC Eviction Moratorium in Place

- Newsmax TV

- Danny Danon: US Shouldn’t Negotiate With ‘Butcher of Tehran’

- Ron Johnson: Pelosi, Capitol Police Leaders Failed Jan. 6 Officers |

- Gimenez: Ambassador Pick Shows WH Errs on Cuba |

- Curtis Sliwa: Taxpayers Will Foot ‘Hypocrite’ Cuomo’s Legal Bills |

- Spartz: Biden’s ‘Lack of Leadership’ on Display With Cuba |

- Ricketts: Hard for Govs to Learn of Feds Shuttling Migrants |

- Tenney, Pete King: Cuomo Facing Bleak Future |

- More Newsmax TV

- Newsfront

- Republican Issues Subpoenas for Wisconsin Election Info

- The leader of the state Assembly’s elections committee issued subpoenas Friday demanding extensive election materials, including all ballots and voting machines, from two Wisconsin counties in what she called a “top-to-bottom” investigation of the state’s 2020 presidential…… [Full Story]

- Related Stories

- Marjorie Taylor Greene: Fulton County Audit Will Expose ‘Big Lie’

- Students Ask Supreme Court to Block College Vaccine Mandate

- WASHINGTON (AP) – The Supreme Court is being asked to block a plan by [Full Story]

- Commerce Secretary: COVID Shot Resistance ‘Incredibly Frustrating’

- Commerce Secretary Gina Raimondo said Friday it’s ”incredibly [Full Story]

- Judge Refuses to Block Construction of Obama Center in Chicago

- A federal judge has rejected a request by activists to block [Full Story]

- Twitter Suspends Podcaster After She Says Transgender Weightlifter Is A Man

- Twitter temporarily suspended podcaster Allie Beth Stuckey after she [Full Story]

- Cuomo Flooded With Sex Harassment, Nursing Home, COVID-19 Probes

- New York Gov. Andrew Cuomo faces an extraordinary number of [Full Story] |

- US Central Command: Evidence Shows Iran Attacked Tanker

- The U.S. cited evidence for the first time Friday to back up its [Full Story]

- Cori Bush Part of ‘Class System of Justice’ for Elites

- The push from Rep. Cori Bush, D-Mo., to defund the police – all while [Full Story] |

- White House: 50 Percent of Americans Fully Vaccinated

- The White House announced Friday that half of the U.S. population is [Full Story]

- Accuser Files Criminal Complaint Against Gov. Cuomo

- An assistant to Gov. Andrew Cuomo, D-N.Y., filed a criminal complaint [Full Story]

- Mike Lindell Sets Off Firestorm With Symposium, New Ad

- MyPillow founder Mike Lindell has declared all-out war on Fox News [Full Story]

- US Intelligence Helped Cause 2011 Massacre in Mexico

- S. authorities inadvertently helped to cause the deaths of [Full Story]

- Eddie Murphy Has the Most Kids of Any Celebrity in the World

- Definition

- Arkansas Judge Blocks State Enforcement Of Ban On Mask Mandates

- An Arkansas judge Friday temporarily blocked the state from enforcing [Full Story]

- Texas House Democrats Mull Next Move Ahead of 2nd Special Session

- Texas House Democrat lawmakers are mulling their next move as a [Full Story]

- Nearly $500M Spent Fighting Homelessness in Denver

- About $481 million is annually spent on various services for the [Full Story]

- Dem Sen. Joe Manchin Urges Fed to Begin Trimming Bond Buys

- A prominent Senate Democrat, saying he is concerned about inflation, [Full Story]

- Felix Sets Record, Wins Bronze for 10th Olympic Medal

- Allyson Felix finished third in the 400 meters Friday to win her 10th [Full Story]

- NBC’s Olympics Coverage Continues to Suffer Poor Ratings

- The Tokyo Olympics have been a ratings disaster for NBC, which on [Full Story]

- Report: UPS Wants Changes to Postal Service Reform Bill

- United Parcel Service is pushing for changes to the United States [Full Story]

- Glock Manufacturing Set to Grow in US

- The U.S. manufacturing of Glock pistols is expected to increase as [Full Story]

- US Added 943,000 Jobs in July; Unemployment Rate Drops to 5.4 Percent

- Hiring surged in July as American employers added 943,000 jobs. The [Full Story]

- 9/11 Families Don’t Want Biden at Memorial Events

- About 1,800 Americans directly impacted by the Sept. 11, 2001, [Full Story]

- Ashli Babbitt Family Lawyear Preparing $10M Wrongful Death Suit Against Officer

- A police officer “ambushed” Ashli Babbitt and fatally shot her during [Full Story]

- Google Founder Gets New Zealand Residency, Raising Questions

- Google co-founder Larry Page has gained New Zealand residency, [Full Story]

- Biden Attacks on Ron DeSantis ‘Woefully Misguided’

- President Joe Biden is “woefully misguided” in blaming Florida Gov. [Full Story] |

- Impending Vaccination Rules Prompt Concern in NYC

- Michael Musto can’t bring himself to ask his regulars at his Staten [Full Story]

- Appeals Court Upholds Murder Conviction of Ex-Dallas Officer

- A Texas appeals court on Thursday upheld the murder conviction of a [Full Story]

- Arrest in Hit-and-Run Death of ‘Gone Girl’ Actor Lisa Banes

- An arrest was announced early Friday in the hit-and-run death of [Full Story]

- CNN Fires 3 Employees Who Came to Office Unvaccinated

- CNN has terminated three of its employees for coming to the office [Full Story]

- Town Burns to Ashes in Raging Northern California Wildfire

- Eva Gorman says the little California mountain town of Greenville was [Full Story]

- More Newsfront

- Finance

- US Added 943,000 Jobs in July; Unemployment Rate Drops to 5.4%

- Hiring surged in July as American employers added 943,000 jobs. The unemployment rate dropped to 5.4% another sign that the U.S. economy continues to bounce back with surprising vigor from last year’s coronavirus shutdown. [Full Story]

- Google Founder Gets New Zealand Residency, Raising Questions

- Bayer’s Latest Roundup Trial Offers Better Chance of Winning

- Retail Coffee Prices to Climb as Frost and Freight Costs Bite

- CBO Sees Infrastructure Bill Widening Budget Gap by $256 Billion

- More Finance

- Health

- What Vaccinated People Need to Know to Keep Safe from Delta

- The highly contagious Delta variant is threatening even fully vaccinated people. According to a new study by researchers at Imperial College London, people who received both doses of a COVID-19 vaccine are half as likely to be infected with the Delta variant than… [Full Story]

- 8 Delicious Ways to Boost Your Immune System

- Where You Live Could Predict Your Survival After Heart Attack

- Brain ‘Zap’ Treatment Might Curb Smoking

- Two-Thirds of Mild COVID Cases Leave Long-Term Symptoms

-

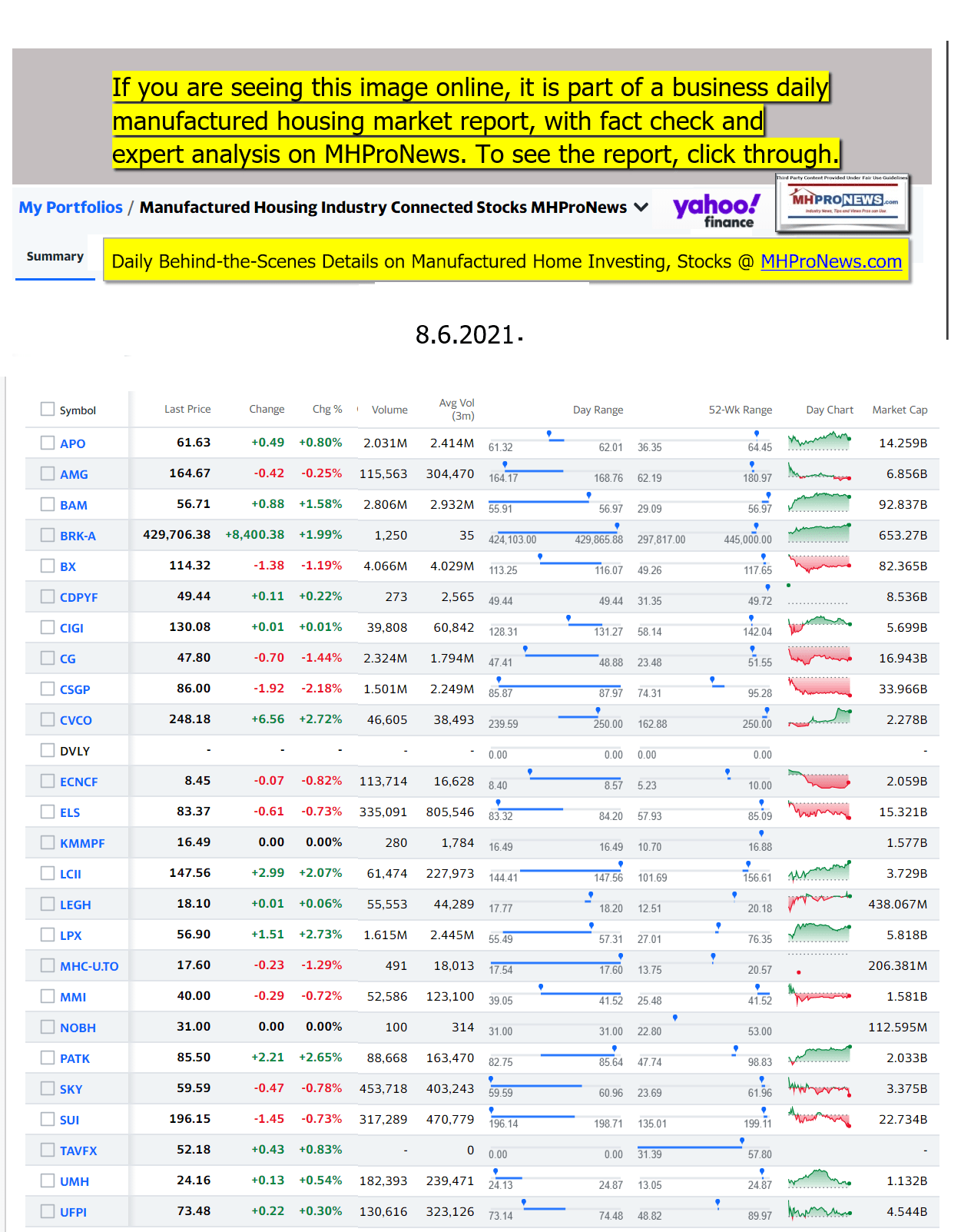

Manufactured Housing Industry Investments Connected Equities Closing Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

-

-

-

-

-

-

-

-

-

-

-

Summer 2021…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12th year of serving the industry as the runaway most-read trade media.

Sample Kudos over the years…

It is now 11+ years and counting…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.