In an email from Matt Stoller and his “Big” newsletter and on his Substack page, Stoller on 8.17.2022 introduced his topic by saying “Today’s issue is written by an anonymous guest-author. It’s about the emergence of the financial model currently ruling America, which is known as private equity, and why there’s finally a regulator at the Securities and Exchange Commission willing to crack down on the industry.”

This issue of Stoller’s “Big” will be followed by some additional related insights and commentary. Note that Stoller arguably leans left politically, but is known to be willing to raise issues with Democratic as well as Republican connected officials. That said, it is not unusual for Stoller to seemingly be optimistic when it comes to what the Biden Administration may be ‘trying’ to do on the antitrust front. Time will tell how accurate Stoller’s “Big” and their collective insights will prove to be. With that brief background, here is the 8.17.2022 sans the emailed opening graphic and verbiage that preceded this commentary. Highlighting is added by MHProNews.

Closing Down the Billionaire Factory

The private equity industry has been running America for four decades. This is how the ‘billionaire factory’ emerged, and why the public has had enough.

| Matt Stoller | Aug 17 |

Today’s issue is written by an anonymous guest-author. It’s about the emergence of the financial model currently ruling America, which is known as private equity, and why there’s finally a regulator at the Securities and Exchange Commission willing to crack down on the industry

Securities and Exchange Commissioner Gary Gensler testifies on exactly how much thought he gives to the opinion of billionaire Stephen Schwarzman.

Where Are the Customers’ Yachts?

In a memoir with the cringeworthy title What It Takes: Lessons in the Pursuit of Excellence, Stephen Schwarzman, the co-founder of Blackstone explains how his private equity giant came to control money from the nation’s largest public pension funds. In 1992, Blackstone hired a former top official from the Oregon state pension fund with a salary far in excess of what he had previously earned and used him to open doors nationwide. “When the pension managers saw him, they saw one of their own, from the smallest fund to the biggest of all,” Schwarzman writes.

Today, Schwarzman has a net worth around $33 billion. And it’s not because private equity, or what Wall Street used to call leveraged buyouts (LBO), is particularly good at buying and growing companies. It’s because private equity can extract lots of hidden fees from pension funds. Large private equity firms have market power over the funds they raise from and can set terms that make it very hard to figure out what they are being charged. Schwartzman’s net worth is the result.

Over the last five years, the public has noticed private equity. If you mentioned that word to a doctor a few years ago, some would say they had heard the term. Today, it’s likely that fire comes out of their ears; even the stodgy American Medical Association warns of the perils of private equity. People are angry that rents are skyrocketing, as private investors from large investment shops buy up housing en masse. More broadly, the public is noticing that while their pensions seem to be empty, the people who manage them – like Schwarzman – throw multimillion-dollar parties with acrobats, camels and pretend Mongolian soldiers.

(Indeed, the wealth of private equity barons, when contrasted with the poverty of their clients, brings to mind an old finance joke about a visitor to Wall Street admiring the various yachts owned by bankers, and then naively asking ‘Where are the customers’ yachts?’ The joke is that the bankers make the money, not the customers.)

One result of anger from voters is that there’s increasing interest by politicians in addressing how out of control private equity has become, from eliminating tax concessions like the ‘carried interest loophole’ that let financiers get taxed at a lower rate, to legislation like the Stop Wall Street Looting Act that would force them to assume liability for the debt they put on companies and protect worker pensions in bankruptcy. But ground zero in the attack on corrupt forms of private equity, is now an agency that has been sleepy and corrupt for decades, until a serious regulator named Gary Gensler took it over last year: the Securities and Exchange Commission.

The fight Gensler picked is a multi-trillion-dollar battle, the kind of dispute that reshapes societies. So, let’s start at the beginning. First, what is private equity?

Unlike a mutual fund, in which a manager collects money from investors and buys publicly traded stocks and bonds, private equity is private because it raises its money behind closed doors, instead of selling shares or floating bonds that can be traded on exchanges. (An LBO of an exchange-listed company is referred to as “going private.”) Investors put the money into funds administered by private equity firms, which then buy companies, under the pretense that they are fixing them up (not impossible, but not demonstrably the norm either), then selling them. The stated goal is to deliver returns to their investors. Private equity firms take fees and expenses, plus a percentage of the profits when companies are sold. That’s really all it is, a kind of finance that channels retirement savings into the purchase of real assets, the way a bank uses money in savings accounts to lend to companies.

So how did this significant industry come to be? In the 1970s, Americans saved for retirement in different ways. They had some personal savings, they used Social Security, but mostly had pensions through their corporate or government employer. Pension fund administration used to be straightforward. Pension managers took a pool of employee money and invested it in fixed-income products (mostly bonds, both government and corporate) or held in cash, with maturities calculated to meet the fund’s obligations as people retired. It wasn’t sexy, or particularly complicated. But it helped ensure a comfortable retirement for tens of millions of people. The country’s deregulatory turn in the 1980s changed all that.

Tighter budgets meant that states, which came under intense fiscal pressure in the 1982 recession even as Washington dialed back revenue-sharing, were less able to make contributions to pension funds on behalf of their employees. The declining power of unions played a role as well; they were less able (or willing) to force states to keep up contributions to pension funds. So, states began giving their pension fund managers more leeway to invest in publicly traded equities (stocks), a trend that the bull market of the 1980s only hastened. The Dow Jones looked like an easy ticket to greater pension fund assets.

Meanwhile, private equity – known as leveraged buyouts (LBOs) before a very conscious rebranding – was taking shape as a new form of financial engineering, in part because of legal changes in the 1970s and 1980s to deregulate finance. One episode in particular caught the attention of Wall Street. William Simon, a former Treasury secretary, bought Gibson Greeting Cards by putting up (with a partner and a few others) $1 million and borrowing the rest of the $80 million purchase price, then selling into a rising market 18 months later for $270 million. Suddenly, Simon was worth $100 million. (Schwarzman was one of the bankers on the sale; he described it as “the perfect case study” of what he wanted to do later at Blackstone.)

In the 1980s, the LBO industry really took off thanks to the emerging junk bond empire created by Michael Milken. Private equity firms raised money from banks, insurance companies, and wealthy individuals, and put up a small share of a target company’s purchase price; the rest was debt, with which the company, not the private equity firm, was saddled. The real force behind the rise of high finance was a set of regulatory changes, occurring either through wholesale shifts in laws – like the 1982 deregulation of savings and loan banks that let S&L’s buy Milken’s junk debt – or the refusal of Reagan-era enforcers to enforce securities rules.

The peak of the 1980s frenzy came when Kohlberg Kravis & Roberts (KKR) purchased RJR Nabisco in 1988 for $25 billion, and put up only 0.06 percent (!) of its own money. By then, LBOs were about 30 percent of the overall market for mergers and acquisitions. The recession of the early 1990s, the bankruptcy of Drexel Burnham Lambert, and Milken’s conviction for illegal securities trading, took the steam out of the LBO market. But KKR had already taken the step that would draw public pension funds into Wall Street’s orbit.

By the mid-1980s, KKR was raising money from state pension funds, a step facilitated by a friendship between George Roberts, a KKR founder, and Roger Meier, the chairman of the Oregon Investment Council, which manages state pension funds. Roberts had persuaded Meier, a local business magnate and sophisticated financier, to give KKR stewardship of state pension money early on after KKR was founded in 1976. KKR also funneled campaign contributions to Oregon’s treasurer, who in 1984 vanquished a challenger who opposed putting state pension money into LBO funds like KKR, and to gubernatorial candidates, since the governor appoints investment council members.

As KKR harvested profits from LBOs in the 1980s, and seemed to deliver solid returns, other states – and private equity firms – sought a piece of the action. The staff of the Oregon Investment Council became sought-after door-openers; one of them, Jim George, was the one hired by Schwarzman in 1992 to open doors in all 50 states for his firm, seven-year-old Blackstone.

The 1990s saw a slow rise in private equity funds designed for LBOs, even though the overall activity remained less than in the 1980s since junk-bond financing had vanished, as the industry won over pension funds. Importantly, while there had been limits on how private pools of capital could fundraise and use debt, these limits were removed by the National Securities Markets Improvement Act in 1996. Schwarzman credits Oregon’s George with raising a $1.27 billion fund in the mid-1990s, at the time the largest ever. While the SEC took a stab at increasing basic oversight of private funds – a category that sweeps in hedge funds along with private equity and a few other lesser types – in the wake of the collapse of Long-Term Capital Management in 1998, it was beaten back in court by hedge fund manager Philip Goldstein.

In early 2000s private equity raised ever-greater piles of money from public pension funds. Congress encouraged this financing channel when it passed overwhelmingly (93-5 in the Senate) the Pension Protection Act in 2005. That law loosened restrictions on pension funds, which are regulated by the Department of Labor under the Employee Retirement Security Act, that sought to allocate money to private equity. In 2000, 3.6 percent of pension fund money went to private equity funds; by 2021 the number was 11 percent. If that seems small, consider that the nation’s 6,000 public pension funds and retirement systems currently hold $4.5 trillion in assets, which means private equity has $495 billion of the people’s money to play with. And that’s before they borrow any money – the “leveraged” in LBO – at all.

Along the way, key Democrats-turned-lobbyists facilitated the rise of private equity in the 2000s, lending a center-left credibility to the industry. Private equity’s management of pension fund money gave rise to the talking point – its lobbyists can barely utter anything else publicly – that they are doing well by doing good, making money for retirees current and present, and created useful links with organized labor. Having union friends paid off for private equity, since some public pension fund trustees are also union members, and because unions sometimes run their own pension funds, giving Wall Street more money to play with.

Richard Gephardt, the onetime House Democratic leader who had been an ally of unions, used that credibility extensively to make private equity seem reasonable. In 2007, Gephardt helped KKR overcome union opposition to its takeover of Texas Utilities Corporation, and also helped a private equity firm hive off part of Boeing that manufactured aerostructures.

David Marchick, a Clinton administration appointee, worked at The Carlyle Group, a Washington-based private equity giant, and set about persuading unions that their pension savings would do well in the hands of leveraged buyout firms. Working under CEO Glenn Youngkin, now governor of Virginia, Marchick pursued that angle to the point where Leo Gerard, president of the United Steelworkers of America, praised Marchick in 2019 for “strengthen[ing] the ties between investors and labor.”

The dramatic growth in the early 2000s reflected a peculiar dynamic in which pension funds relied on data about the eye-popping returns private equity at precisely the time when they were bound to fall. KKR, for example, returned 35 percent to Oregon’s pension funds. That’s alluring if you’re a pension manager trying to ensure your liabilities – the cost of supporting future retirees – are fully funded. But a basic law of economics also made itself felt, for as pension funds pumped more money into private equity, overall returns were bound to fall, since there are a finite number of target companies. Finance is an industry of copycats; one Wall Streeter like Simon gets rich doing LBOs, others take notice and try to do the same thing.

Competition for Capital

The post-2000 explosion in pension fund allocations to private equity meant Wall Street no longer needed to persuade pension managers to allocate funds. Instead, managers desperately needed higher returns, thanks to low interest rates, fiscal pressure, and lagging contributions that have left many pension funds wary of their ability to support future retirees. Wall Street had begged pension funds for cash 20 years earlier; now pension funds begged for the chance to kick money into the latest hot fund.

Put simply, Wall Street’s private equity no longer had to compete for capital. It was there for the taking, from the retirement savings of Americans lucky enough to have a pension. Predictably, as competition waned in the battle for funds, private equity firms started upping the fees they charged pension funds. As one report documented, pension funds doubled the money they allocated to “alternatives,” the category that included private equity, between 2006 and 2012. And “these changes in investment practice have coincided with an increase in fees as well as uncertainty about future realized returns, both of which may have significant implications for public pension funds’ costs and long-term sustainability.” In plain English: at a time when the outlook for fully funded pensions was darkening, Wall Street was harvesting higher fees from them.

There are now more private equity-owned companies than there are companies listed on public stock exchanges like NYSE and Nasdaq. Last year, they bought up $1.2 trillion worth of companies in the United States, smashing the previous record of less than a trillion, set before the 2008 financial crisis, which marked but a brief interruption in the rise of private equity. The pandemic-induced economic contraction in 2021 was a boon to private equity because the Federal Reserve’s interventions in financial markets lowered the cost of debt.

Small steps like these – there were many others over the last 40 years – gave us the situation we have now, in which the nation’s public pension funds provide the bulk of the money for private equity. There are a lot of reasons to criticize private equity, as it is responsible for many abuses, including the looting of the retail industry, fraying of vital services such as health care, and defense-related profiteering. And private equity loves to assemble monopolies (like in cheerleading!) because they are very good at extracting money. And read this Buzzfeed blockbuster for a horrifying story of what happens when private equity buys care facilities for people with severe developmental disabilities. But its rise would be unimaginable without the money provided by pension funds.

Ludovic Phalippou, the University of Oxford scholar who coined the term “billionaire factory” to describe private equity, estimates that the industry harvested $370 billion in fees and expenses since 2015. A recent investigation by Bloomberg found that major public pension funds do not or cannot keep track of the fees and expenses they pay to private equity titans like Blackstone, Apollo, and the like. The common denominator is that private equity firms report data in scattershot ways, allowing for no comparability across companies. And they are notorious for padding expenses, such as charging their clients when they fly on private jets. SEC probes have resulted in warnings to this effect.

And that’s where SEC Chair Gensler, a white-collar sheriff type who knows finance well, comes in. In broad strokes, Gensler has proposed reviving the market for capital, in which those who would use the money actually compete for it. Under the plan, which is now the subject of public comment, private funds (private equity, hedge, and others) would be required to provided information to potential investors (like pension funds) about their fees and expenses, and their track records, in a standardized format. And it would prevent private funds from using their existing market power to force investors to surrender their rights to clear information, or to force them into sweetheart deals for the private equity firm.

Gensler is aiming at fees on the theory that transparency can result in more competition for money from pension funds, lower fees for private equity barons, and better capital allocation, as investors realize their money would work better elsewhere. (You can actually have an impact here, by offering your thoughts to the SEC. If you’d like to offer comments, email rule-comments@sec.gov and indicate file S7-03-22 or go to https://www.sec.gov/rules/proposed.shtml and click through the link on S7-03-22. Or follow instructions here.)

Imagine pension funds using the greater transparency to comparison-shop on fees and returns and demanding better terms. There’s a case to be made that the changes might even generate momentum toward structural change. If transparency were to expose the illusory promises of private equity for pension funds and other investors, it could reduce opportunities for leveraged buyouts, and reinvigorate more transparent public markets – the centerpiece of the New Deal reforms that created the SEC in the first place. That change, spurred by abuses of Blackstone and others, won’t win any praise in Stephen Schwarzman’s next opus. But it might appear in his obituaries. …##

Additional Information with More MHProNews Analysis and Commentary in Brief

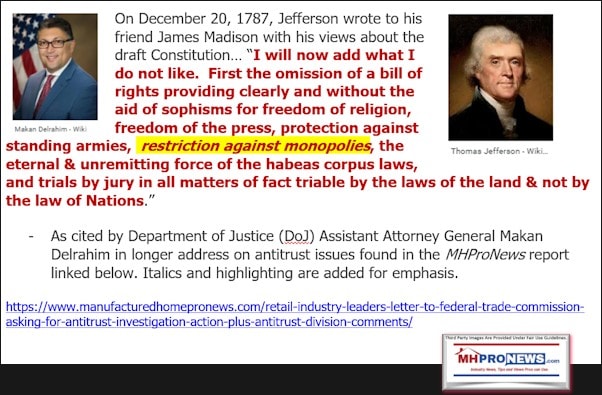

The history in the U.S. of concerns over monopoly power go back to the earliest days of what became the American Revolution against Britain.

Stoller is the author of Goliath, which Google book’s website said: “Every thinking American must read” (The Washington Book Review) this startling and “insightful” (The New York Times) look at how concentrated financial power and consumerism has transformed American politics, and business. MHProNews has periodically reported on left-leaning Stoller’s take on monopoly power in the U.S. for several years.

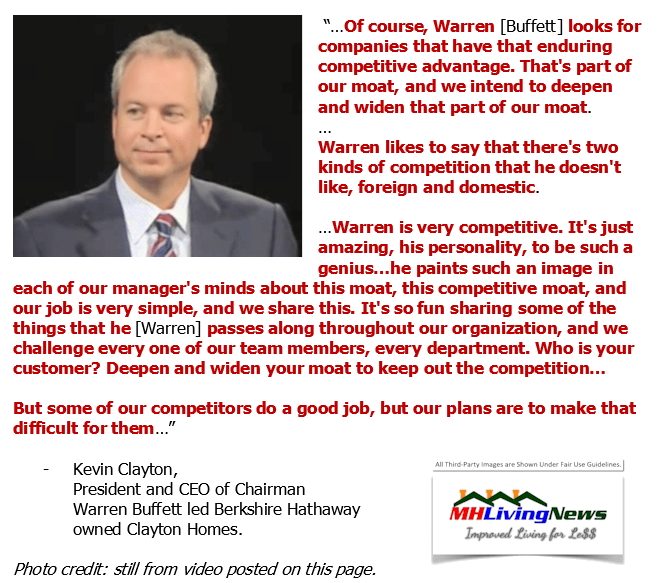

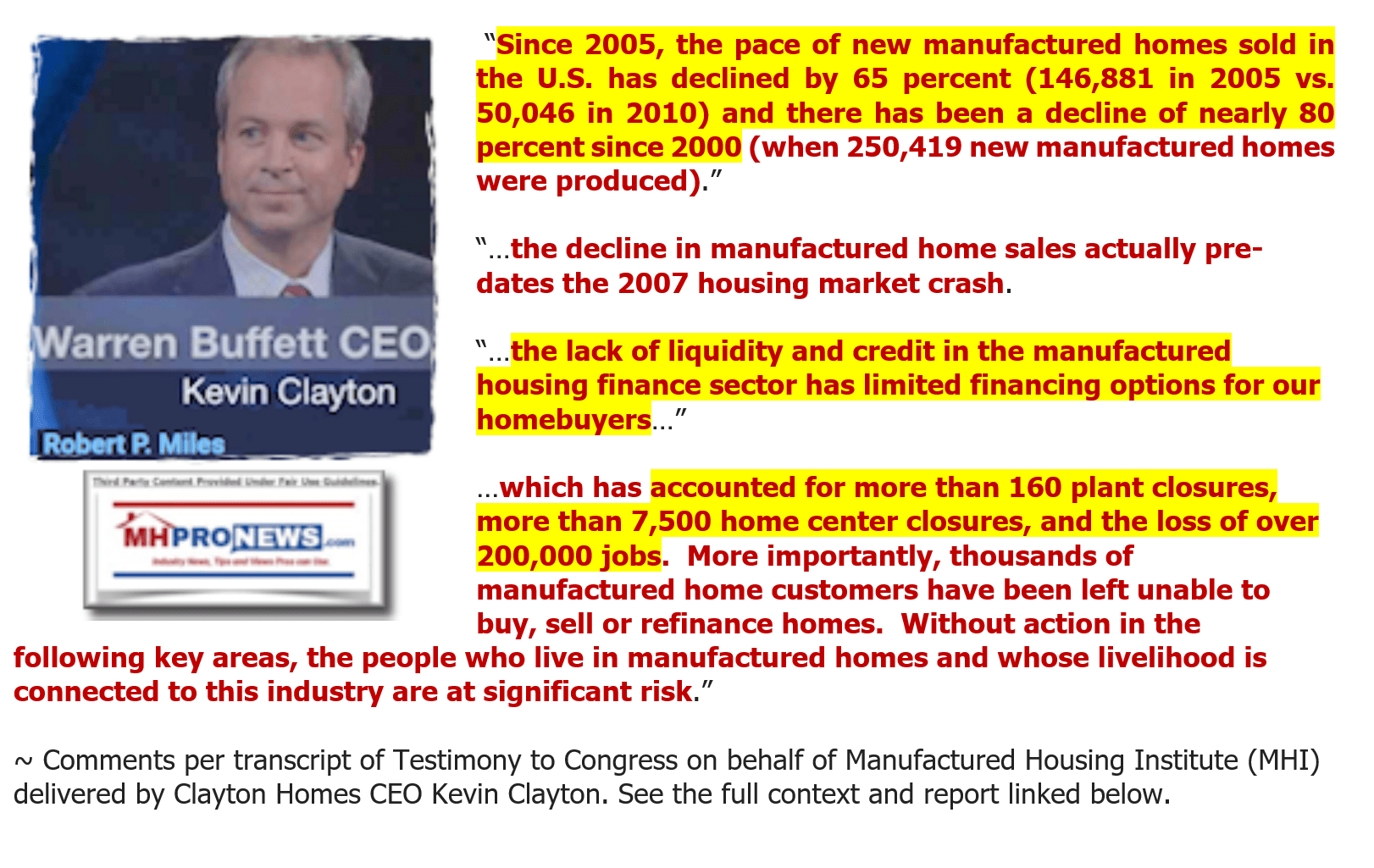

While Berkshire Hathaway unit leader Kevin Clayton was arguably diverting attention for his parent company and sister firm’s potential roles in the collapse of manufactured housing in the 21st century, he ironically helped establish just how many businesses have been harmed by the flexing of monopoly power.

Reports like the ones that follow dive deeper into the issues raised by Stoller and his anonymous author on the item above, including how monopoly plays out in manufactured housing. This is a problem hiding in plain sight, as Warren Buffett has periodically spoken out on this in politics as well as in business. It is a fair question if Stoller and that unnamed author are correct in thinking that there is a sincere push for antitrust by the Biden-regime, given it is some of those same corporate dollars that helped put him into the Oval Office. That said, his voice is useful on several levels, because he is keeping the issue’s importance in the mix of problems that ought to be tackled.

Next up is our daily business news recap of yesterday evening’s market report, related left-right headlines, and manufactured housing connected equities.

The Business Daily Manufactured Home Industry Connected Stock Market Updates. Plus, Market Moving Left leaning CNN and Right-leaning (Newsmax) Headlines Snapshot. While the layout of this daily business report has been evolving over time, several elements of the basic concepts used previously are still the same. For instance. The headlines that follow below can be reviewed at a glance to save time while providing insights across the left-right media divide. Additionally, those headlines often provide clues as to possible ‘market-moving’ news items.

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Headlines from left-of-center CNN Business – from the evening of 8.17.2022

- New tax breaks

- EV tax credits just got totally revamped. Here’s what car buyers need to know

- Greed is back on Wall Street

- Workers file for union vote at another Amazon facility

- US natural gas prices spike to 14-year high. Here’s why

- Lose big on crypto? Here’s how to reduce the sting

- Target profit plunges 90% as inflation-weary shoppers pull back

- Spacewalk interrupted by issue with Russian’s spacesuit

- More Americans are relying on credit cards. That could be very costly

- Liz Cheney was a Fox hero 10 years ago. Today she is the network’s top villain

- The 9 p.m. cable news hour is primed for reinvention

- Girl Scouts add a new raspberry cookie to the lineup

- Exclusive: Buffalo Wild Wings is adding pizza to its menu

- Farmers harvest tomatoes in Winters, California, US, on Friday, Aug. 12, 2022. Drought and water shortages are hurting processing tomato production in a region responsible for a quarter of the worlds output, with the squeeze set to exacerbate already elevated prices for tomato-based goods.

- Farmers are killing their own crops and selling cows because of extreme drought

- Airbnb rolls out ‘anti-party technology’ to help enforce its global ban

- The Papa Bowls are all topping, no crust.

- See Papa Johns new pizza bowls: Just toppings, no crust

- RETAIL

- An employee works the lumber section at a Home Depot store in Alhambra, California on May 4, 2022. – The US central bank announced its biggest interest rate hike in over twenty years as it deals with fast rising home, gas and food prices in the US economy.

- Record Home Depot sales show strong US housing market

- Walmart vs. Target: A tale of two retail results

- Why Bed Bath & Beyond’s shares are skyrocketing

- How these retailers use smell to get you to spend more

- Is anyone buying couches and beds from Wayfair?

- CRYPTO

- Report: $1.9 billion stolen in crypto hacks so far this year

- This high risk investment craze isn’t going away

- Coinbase may have a savior in BlackRock

- US sanctions crypto service allegedly used for laundering

- How common are Ponzi schemes in crypto?

Headlines from right-of-center Newsmax 8.17.2022

- Trump Slams Media’s Embrace of Liz Cheney’s Future

- Raid on Trump’s Mar-a-Lago

- Diaz-Balart to Newsmax: FBI Leaks Could Be ‘Fake Reporting’ | video

- Pence Tells GOP to Stop Lashing Out at FBI Over Trump Search

- Trump Attorney to Newsmax: Quick Ruling on Search Affidavit Sought | video

- Trump Lawyer: ‘Shocked’ if Biden Didn’t Know of Trump Raid | video

- Trump: FBI Raid ‘Grabbed Everything’ Like a ‘Common Criminal’

- Trump Attorney Bobb: FBI, DOJ Quiet on Raid Intent | video

- Manafort: Affidavit Will ‘Expose the Corruption’ of DOJ

- Cammack: CDC Overhaul a ‘Long Time Coming’ | video

- Biggs: IRS Shouldn’t Be Taught to Use ‘Deadly Force’ | video

- Oz: ‘Crudité’ Video Shows He Relates to ‘Everyday’ People | video

- Higgins: GOP Will Defund ‘Inflation Reduction Act’ | video

- Clyde: Chinese Drone Buys Endanger US Security | video

- Fallon: ‘Law-Abiding Citizens’ Will Be ‘Harassed by Armed IRS | video

- Tenney: Cheney ‘Joined Right in’ With Democrats | video

- Newsfront

- RNC Chair: Parents Waking up to ‘Woke’ School Initiatives

- In her Wednesday op-ed for the Washington Examiner, Republican Party chair Ronna McDaniel praised parents throughout the United States for becoming wise to the “woke” initiatives being implemented by school districts…. [Full Story]

- Judge: Pharmacies Owe 2 Ohio Counties $650M in Opioids Suit

- A federal judge in Cleveland awarded $650 million in damages [Full Story]

- Report: CBP Head Warns of Extremist Domestic Violence at US-Mexico Border

- S. Customs and Border Protection commissioner Chris Magnus recently [Full Story]

- Palin Advances in Alaska House Race; Murkowski Survives Senate Challenge

- Alaska Republican Sen. Lisa Murkowski advanced from her primary along [Full Story]

- Wyoming to Cheney: You’re Fired! Trump-Backed Hageman Wins Easily

- Gizzi: John Bolton Mourns Defeat of Liz Cheney

- Wyoming GOP Gov. Mark Gordon Wins Primary

- Trump to Fundraise for Zeldin in N.Y. Gov Race

- Pence Says He’d Consider Testifying Before Jan. 6 Panel

- Former Vice President Mike Pence said on Wednesday he would consider [Full Story]

- Pence Tells GOP to Stop Lashing Out at FBI Over Trump Search

- Catholics Slam ‘Shameful, Bigoted Attack’ on Rosary

- Catholic leaders are blasting a recent opinion piece that essentially [Full Story] | Platinum Article

- CDC Director Announces Organization Changes for Faster Response to Health Threats

- The head of nation’s top public health agency on Wednesday announced [Full Story]

- Blasts Hit Russian Base in Crimea, Ukraine Targets Supply Lines

- Russia blamed saboteurs for explosions at one of its military bases [Full Story]

- Crimea ‘Sabotage’ Highlights Russia’s Woes in Ukraine

- Catholic Group Slams Biden’s ‘Notable Silence’ on Church Attacks

- Conservative advocacy group CatholicVote launched a $1 million ad [Full Story]

- Afghanistan Withdrawal an ‘Inflection Point’ for Biden’s Decline

- As President Joe Biden rides a string of legislative wins to see his [Full Story] | Platinum Article

- Poll: Biden Approval Up Three Points in Past Week

- A new poll released Wednesday shows that President Joe Biden has [Full Story]

- Stocks Slip on Wall St, Erasing S&P 500’s Weekly Gains

- Stocks closed lower on Wall Street, led by drops in big technology [Full Story]

- WHO: Number of Monkeypox Cases Jumped 20 Percent in Last Week

- The number of monkeypox cases jumped 20% in the last week to more [Full Story]

- Weisselberg Plea Includes No Cooperation in Trump Org. Probe

- Former Trump Organization CFO Allen Weisselberg is agreeing to [Full Story]

- BofA CEO: Struggling Americans Feel They Are in a Recession

- The CEO of Bank of America said the recent debate over whether the [Full Story]

- Giuliani Testifies in Georgia Criminal Probe Into 2020 US Election

- Rudy Giuliani, Donald Trump’s onetime personal lawyer, testified [Full Story]

- Germany, Israel Condemn Palestinian President’s Holocaust Remarks

- German Chancellor Olaf Scholz voiced disgust on Wednesday at remarks [Full Story]

- NY Dems Urge Biden to Use Defense Production Act for Monkeypox Vaccine

- Some New York Democrats are urging President Joe Biden to invoke the [Full Story]

- Ron DeSantis: IRS Expansion Is ‘Middle Finger’ to Americans

- Florida Gov. Ron DeSantis said that expanding the IRS was the Biden [Full Story]

- Fed Saw Evidence of a Slowing Economy at Its Last Meeting

- Federal Reserve officials saw signs that the U.S. economy was [Full Story]

- Attacker Says He Didn’t Think Rushdie Would Survive

- Hadi Matar, who stabbed Salman Rushdie multiple times in western New [Full Story]

- Trump Slams Media’s Embrace of Liz Cheney’s Future

- Former President Donald Trump on Wednesday released a statement [Full Story]

- Trump: Cheney’s Defeat a ‘Referendum’ on ‘Witch Hunt’

- Defeated Cheney to Launch Anti-Trump Effort, Mulls Presidential Run

- Gizzi: After Defeat, Cheney Has Resources for Presidential Run

- Appeals Court Allows Biden to Pause Oil and Gas Drilling on Federal Lands

- A federal appeals court has allowed the Biden administration to [Full Story]

- Video Report: Hearing Set Regarding Unsealing of Mar-a-Lago Raid Affidavit

- Judge Bruce Reinhart has scheduled a hearing regarding the unsealing [Full Story] | video

- Pilot Program Aims to Provide Child Care for National Guardsmen

- A pilot program beginning next month will provide free child care to [Full Story]

- Palin Advances in Alaska House Race; Murkowski Survives Senate Challenge

- Alaska Republican Sen. Lisa Murkowski advanced from her primary along [Full Story]

- Georgia ‘Fake Electors’ Ask Judge to Disqualify Atlanta DA From 2020 Election Probe

- Progressives Roiled by Sen. Kaine’s Role in Abortion Bill

- Progressive Democrats are increasingly frustrated about having Sen. [Full Story]

- Dem Super PAC Spends $2M to Motivate Young Voters

- Leading Democrat super PAC Priorities USA Action is spending $2 [Full Story]

- Florida Prosecutor Sues DeSantis for Removing Him Over Abortion

- An elected Florida prosecutor who was removed from office by Gov. Ron [Full Story]

- TikTok to Clamp Down on Paid Political Posts by Influencers Ahead of US Midterms

- TikTok will work to prevent content creators from posting paid [Full Story]

- Japan Makes Arrests on Bribery Suspicions in Tokyo Olympics

- A former Tokyo Olympic organizing committee board member and three [Full Story]

- Finance

- Companies Plan $2.6B Investment in Major Alaska Oil Project

- Two oil and gas companies have announced plans to invest $2.6 billion into developing a major oil field on Alaska’s North Slope…. [Full Story]

- Bluebird’s Gene Therapy Approved, Becomes Most Expensive Drug

- Bank of America’s Overdraft Fees Down 90% Under New Policy

- Peter Morici: Going Far Left, Biden Has Left Many Voters Behind

- Railroads Back Plan Calling for 24% Raises but Workers Wary

- Health

- CDC Director Announces Organization Changes for Faster Response to Health Threats

- The head of nation’s top public health agency on Wednesday announced a shake-up of the organization, intended to make it more nimble. The planned changes at the Centers for Disease Control and Prevention – CDC leaders call it a “reset”- come amid ongoing criticism of the…… [Full Story]

- Dispensary Staff, Doctors, Not Qualified to Give Advice on Medical Pot

- Bluebird’s Gene Therapy Approved, Becomes Most Expensive Drug

- US Traffic Deaths Hit 20-Year-High

- Study: Half of People Infected With Omicron Did Not Know It

MHProNews has pioneered in our profession several reporting elements that keep our regular and attentive readers as arguably the best informed in the manufactured housing industry. Among the items shared after ‘every business day’ (when markets are open) is our left-right headline recap summary. At a glance in two to three minutes, key ‘market moving’ news items are covered from left-of-center CNN Business and right-of-center Newsmax. “We Provide, You Decide.” © Additionally, MHProNews provides expert commentary and analysis on the issues that others can’t or won’t cover that help explain why manufactured housing has been underperforming during the Berkshire era while an affordable housing crisis and hundreds of thousands of homeless in America rages on. These are “Industry News, Tips, and Views Pros Can Use” © features and others made and kept us the runaway #1 in manufactured housing trade publisher for a dozen years and counting.

Manufactured Housing Industry Investments Connected Equities Closing Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

-

-

-

-

-

-

-

-

-

-

-

-

-

- 2022 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments. MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing and have completed over a dozen years of serving the industry as the runaway most-read trade media.

- 2022 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

Sample Kudos over the years…

It is now 12+ years and counting…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.