You can’t make it up. But you can read or watch Warren Buffett and his longtime Berkshire Hathaway partner Charlie Munger’s thoughts carefully to better understand how the truth can be hiding in plain sight. During his interview with Munger on CNBC, Warren Buffett said: “Politicians in this country want more power. The rich want more power.” True enough. Much of what Buffett and attorney-turned-investor Munger have said and done over the years must have the duo laughing all the way to the proverbial bank. How so? Several reasons. One example is because when their comments are properly understood, several things that they claim they are against, they have been involved in themselves. They have boldly admitted certain things that manufactured home industry professionals and affordable housing advocates should become keenly aware of, because they are potentially useful. The Buffett-Munger interview takeaways are a mix of the good, bad, and ugly. Through the context of other reports and research produced here on MHProNews or on MHLivingNews, their words could – for instance – be a useable legal cudgel with whatever ethical public officials you or others can find. Cudgel for what? The kind of ‘reparations’ and justice they and Berkshire are uniquely positioned to pay for systemic harm they and their colleagues deliberately caused.

But there is much more, ranging from fluffy to serious in Becky Quick’s and CNBC’s news release of the transcript of the June 29, 2021 interview with Buffett and Munger, dressed up under the title – “A Wealth of Wisdom.“ There is wisdom to be found there, to be sure, but only if someone knows the history of companies like Clayton Homes, which CNBC listed in their interview as one of the holdings of the Berkshire Hathaway (BRK) conglomerate.

Among the numerous quotable pull quotes the pair oddly admitted to: “All the early businesses that we owned together have disappeared.” The textile business, for instance, in the U.S., is gone. The trading stamp business in the U.S. is largely history. Bill Gates’ and Robin Harding’s insights must be considered: that Buffett led Berkshire is “parasitic.” Why does this ‘early’ pattern matter to affordable housing professionals and advocates?

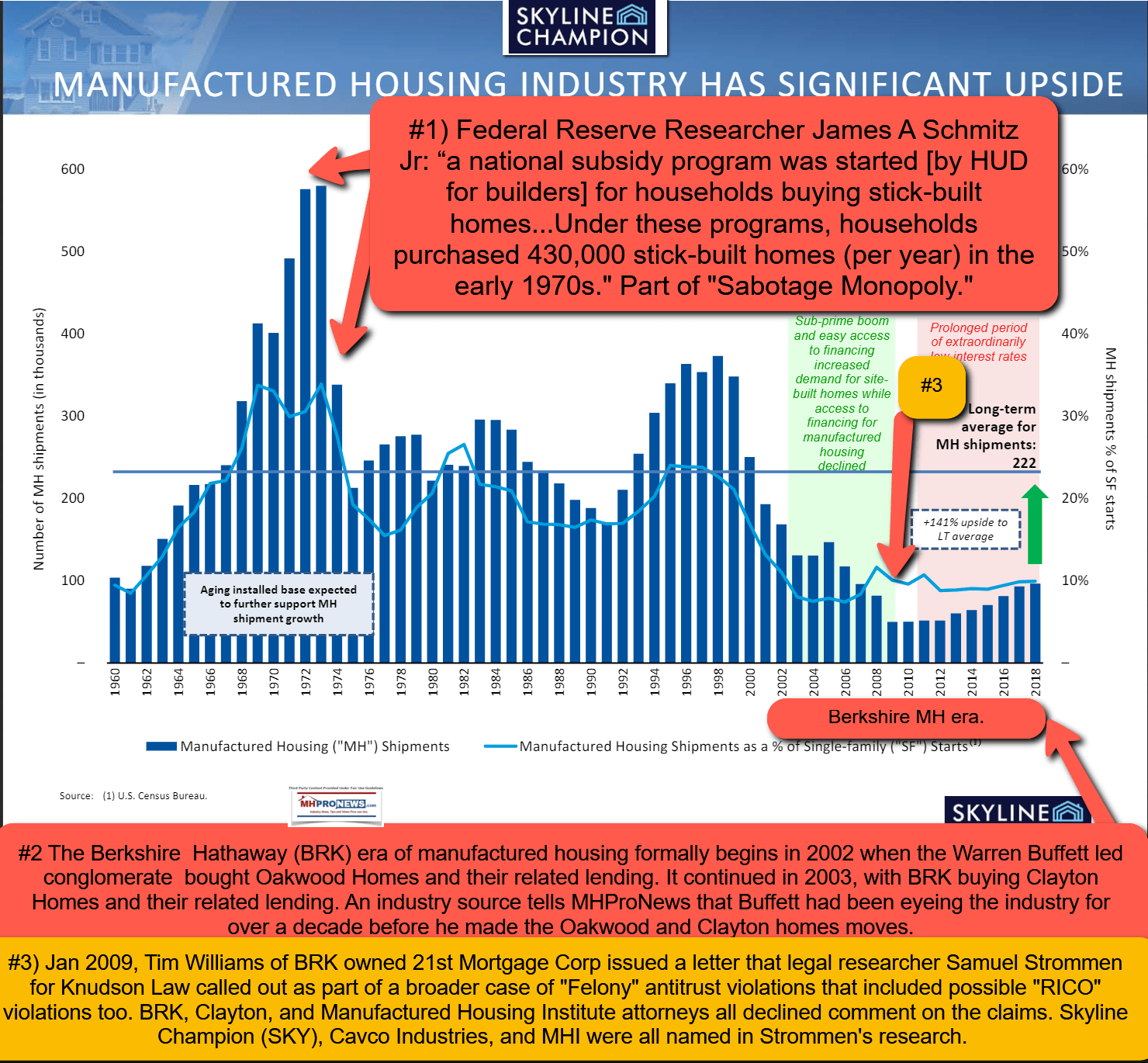

Because manufactured homes has yet to recover to the level the industry operated at in 2002 or 2003, much less the last high of 1998. Buffett-led Berkshire was reported by Business Insider to have “a record” $137 billion in cash to invest on May 8, 2020. Buffett and Berkshire’s wealth reportedly swelled during the COVID19 outbreak. He and Berkshire clearly has the money to invest in affordable manufactured homes, if they wanted to do so. He has told Kevin Clayton that they have ‘plenty of money‘ for whatever Clayton Homes may need, Clayton’s CEO has said. Given the vast sums available, the statements made, the known trends and facts, the obvious conclusion is that Buffett and Clayton like the historically low level that the industry is operating at. Longtime Buffett fan Harding’s thesis on how Buffett broke American Capitalism with the Financial Times supports that notion.

About the businesses that are now gone, Buffett stated: “They didn’t disappear, they failed.” Added Munger: “But, but we took so much out of them before they failed that we, it still worked out fine for us.”

To any manufactured home industry professionals that may still be tempted to believe the Clayton Homes/MHI talking points, smell the coffee and listen up. What follows is the truth hiding in plain sight. Because some of what they said is directly true, and other parts are best understood indirectly as dark lessons.

Listen to this part of Munger’s advice: “One thing we’ve learned is, if it’s clear that something is a mistake, is to fix it quickly. It doesn’t get better while you wait.” Quite so. What ails manufactured housing is not going to fix itself. CNBC interviewer Becky Quick spoke about transparency. That’s precisely the need in manufactured housing now — for transparency by the dominating brands of the Manufactured Housing Institute (MHI), which is not the focus of this report.

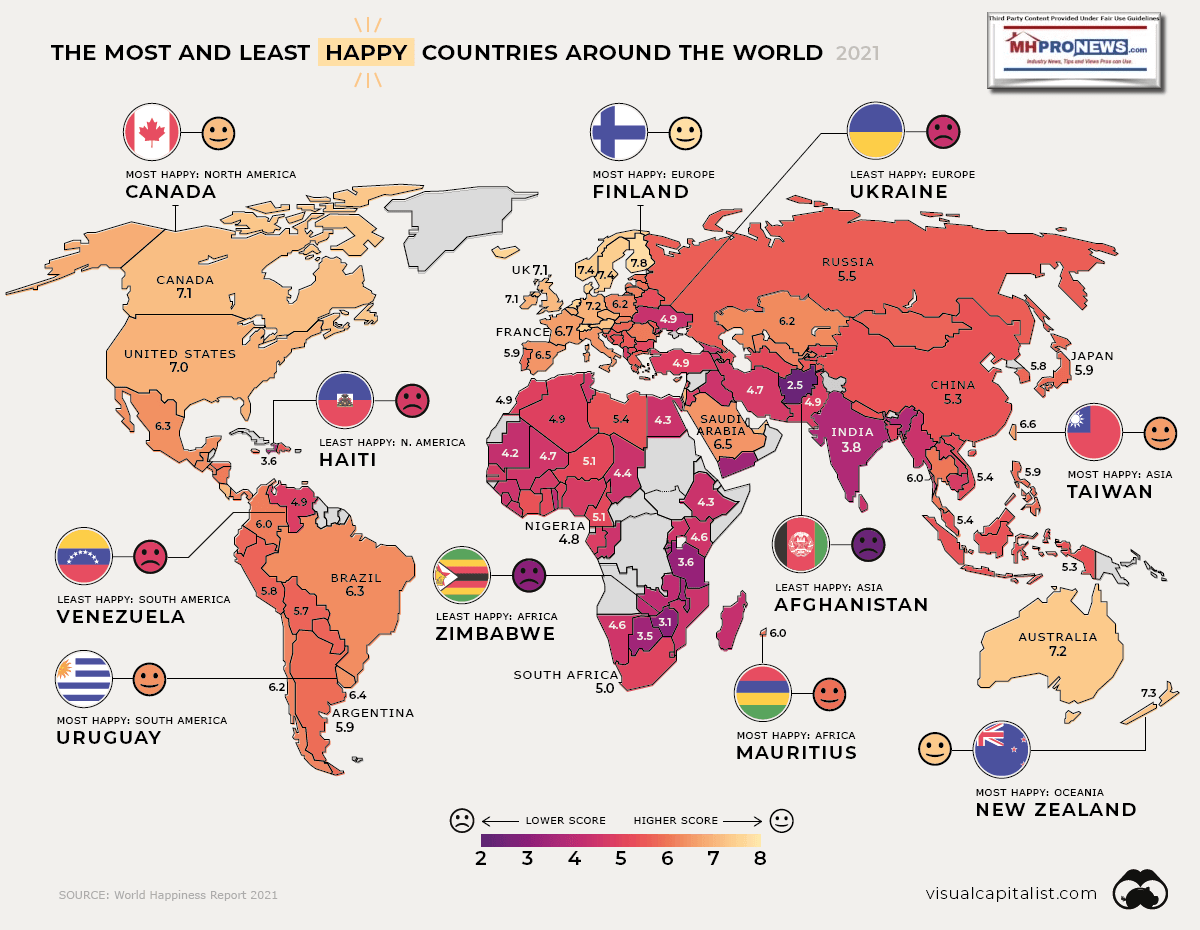

Another noteworthy example is this. Buffett and Munger had praise for elements of China’s system vs. the U.S. As someone chews on that, a recent Visual Capitalist infographic usefully documents that public ‘happiness’ in the U.S. and Canada are almost 50 percent higher than it is in Communist China. The very example Munger uses below of China slapping down Chinese billionaire Jack Ma is precisely why competitors of Berkshire and Clayton should lean into these lessons. This duo can be patient in their apparent vengeance. Left-leaning Deal Maker noted on October 21, 2020 – just before the election – that “Trump hating” Warren Buffett wants “Trump to Lose.” Deal Maker cited a $4.1 million dollar settlement between Berkshire and the Trump DOJ on an Iran Sanctions violation in Turkey. One paper, the Trump tax cut seemingly benefited Buffett, Munger, Berkshire and others. Why would Buffett hate Trump? That too is another topic for another time, but such insights should be kept in mind.

Without specifically mentioning Clayton’s affiliated lending, another topic raised in the interview/transcript is relative to fintech. Per Investopedia, “Fintech, the word, is a combination of “financial technology,” adding that “Financial technology (Fintech) is used to describe new tech that seeks to improve and automate the delivery and use of financial services. At its core, fintech is utilized to help companies, business owners and consumers better manage their financial operations…” Rephrased, while neither Berkshire leader said so, the term fintech could be applied to 21st Mortgage Corporation and Vanderbilt Mortgage and Finance. Both apply financial technology to better manage financial operations with business owners and consumers.

While ripping “swingers“ in fintech, Buffett and Munger aptly ripped regulators. Recently, the CFPB officials frankly admitted to MHProNews that Berkshire’s Clayton affiliated financing brands have been increasingly growing their market share. That has occurred despite well publicized probes over their business practices. That growth occurred while the FHFA, FHA, HUD, FTC, DOJ, et al failed to properly implement good laws that would have limited their profits while their business practices arguably harmfully impacted manufactured home industry industry independents and numerous consumers.

The Financial Times’ Robin Harding and GuruFocus aren’t the only financial reporting that has ripped the duplicitous method of Buffett’s communications. Financial analyst Michael Lebowitz is another example of a third-party source that has spotlighted the slippery, sometimes self-contradictory, method of communications by Berkshire’s chairman. The routine topic this comes up with is the moat.

With that brief introduction, let’s pivot to the video and transcript, provided by CNBC to MHProNews. Highlighting is added by MHProNews, but the text is otherwise as provided.

CNBC Transcript: Billionaire Investors Warren Buffett & Charlie Munger Sit Down with CNBC’s Becky Quick for CNBC’s “Buffett & Munger: A Wealth of Wisdom”

PUBLISHED TUE, JUN 29 20219:17 PM EDT UPDATED THU, JUL 1 20219:10 AM EDT

WHEN: Tuesday, June 29th at 8pm ET

WHERE: CNBC’s “Buffett & Munger: A Wealth of Wisdom”

Following is the unofficial transcript of CNBC’s hour-long special, “Buffett & Munger: A Wealth of Wisdom,” with billionaire investors Warren Buffett and Charlie Munger and CNBC’s Becky Quick, which premiered tonight, Tuesday, June 29th. [MHProNews Note: the following is the transcript from the full video above, per provided by CNBC. Note too that while these open with some flashback quotes, but then pivots to their June 29, 2021 interview.]

PART I

[MAY 2015] WARREN BUFFETT: I’m Warren, this is Charlie. He can hear and I can see. We work together.

[MAY 2016] CHARLIE MUNGER: I constantly quote Warren and everybody always loves it, you take the high road and its uncrowded.

[FEBRUARY 2018] BUFFETT: We knew we were sort of made for each other and we

[MAY 2016] BUFFETT: The way to get a good partner is to be a good partner and these are very old-fashioned ideas and they just work so fabulously well.

BECKY QUICK: Warren Buffett and Charlie Munger, friends for more than six decades, business partners for more than five, together sitting atop one of the country’s biggest companies, Berkshire Hathaway. Buffett, the Chairman and CEO, known as the oracle of Omaha, amassed a more than $100 billion fortune running the conglomerate, acquiring stocks and companies from his office in Omaha, Nebraska and Vice Chairman Munger, who grew up less than a mile from Buffett, a lawyer by training but an investor by practice. They met as adults after Munger had moved to his current home, Los Angeles. From 1,500 miles apart, the duo built Berkshire Hathaway from a single textile mill to a $650 billion powerhouse, running companies from railroad operator Burlington Northern Santa Fe and insurance company Geico to Fruit of the Loom, Dairy Queen and Clayton Homes and managing a portfolio of $300 billion in shares of companies like Apple, Bank of America and Coca Cola Tonight, we bring you the story of perhaps their greatest accomplishment, sixty years of friendship and the lessons they’ve learned from each other along the way in business and life. 90-year-old Buffett, a man of many words, and 97-year-old Munger, a man of fewer, but his are more pointed.

[MAY 2004] MUNGER: I would rather throw a viper down my shirt front than hire a compensation consultant.

[MAY 2006] MUNGER: Yeah, well, I think he’s demented

[MAY 2015] MUNGER: You can’t form a business partnership with your shriftless drunken brother in law.

QUICK: Buffett and Munger’s outspoken nature and their refusal to chase hot market fads that stray from fundamental market analysis don’t always win them friends, like their take on Bitcoin.

[MAY 2019] MUNGER: Bitcoin is worthless, artificial gold.

[FEBRUARY 2019] BUFFETT: Bitcoin its ingenious and blockchain is important but bitcoin has no unique value at all it doesn’t produce anything. You can stare at it all day and no little bitcoins come out or anything like that. It’s a delusion basically.

[MAY 2021] MUNGER: I think I should say modestly that I think the whole damn development is disgusting and contrary to the interest of civilization

QUICK: And while the pair delivered market beating performances with the Berkshire portfolio for four and a half decades, they have lagged the S&P 500 for the last 5 and 10 years leading some to question whether they .

[MAY 2021] MUNGER: I’m quite comfortable holding Berkshire. I think our businesses are better than the average on the market.

QUICK: We asked Munger and Buffett their thoughts on some of the latest headlines in the business world, those that could have lasting impact on how markets operate beginning with Credit Suisse.

MUNGER: Think of how massively stupid that was. And of course, it was the lure of the really easy money that the idiot was paying you, being the prime broker for a jerk. But he was a convicted insider trader that came out of the craziest part of the hedge fund industry. And they were getting unusual profits by extending unusual credit. I mean, it was just, the world was shouting at them, “Crook. Fool.” And they didn’t listen. They thought, “This is where the easy money is, crooks and fools.”

BUFFETT: There’s one rule–

MUNGER: We don’t like either of–

BUFFETT: That, that we learned a long time ago is that you can’t make a good deal with a bad person. Just forget it. Now, if you think you can draw up a contract that, that is going to work against a bad person, they’re gonna win. But one thing, they, they probably enjoy litigation but ah, Berkshire Hathaway as an entity, or me personally, or anything, we don’t wanna spend our life, you know, doing that sort of thing. And, and besides, the bad guys win. They know more games. They may lose eventually in the but, but it’s no way to spend your life.

QUICK: Charlie, it wasn’t just Credit Suisse that got pulled in by that. There were a lotta firms that were doing business with Archegos and–

MUNGER: Yes. Yes. They were all foolish. But, but Credit Suisse has managed to be the biggest fool of all.

BUFFETT: Well, Becky, if you look back–

MUNGER: A lot of competition for that order–

BUFFETT: In nineteen–

MUNGER: Honor.

BUFFETT: In 1934, after the great crash well, 1932 and ’33 they held these hearings. And they decided that unusual amounts of leverage were one cause of the problem in the 1929 . And that, that it posed, it could pose dangers even to the economy. So, they gave the Federal Reserve Board the right to establish how much people could borrow against stocks, margin requirements. Like when–

MUNGER: Which was a very good idea.

BUFFETT: It was a terrific idea. And they–

MUNGER: Totally sound.

BUFFETT: The Federal Reserve, between 1934 and 1973, used that power I think 23 or 24 times. They even raised margins to 100%. But they were the regulators of determining whether excess leverage might have systemic problems associated with. And then and, and the rule in 1973 or ’4 was 50%; the rule today is 50%. It has in the last, you know, 40+ years, first 40-some years, it, it had 23 changes. It went to 100%; it went down to, you know, all kinds. And it was the signal to the economy and all kinds of things. And essentially, Wall Street figured out how to get around that.

MUNGER: They lobbied through changes in the law.

BUFFETT: Yeah.

MUNGER: So, they could have unlimited leverage, and keep the transactions off the books and subject to murky accounting.

QUICK: The, the banks would say, “We made it through this. We absorbed all the problems ourselves and, and many of us, you know, won’t even take a substantial hit on the, on the balance sheet for it.” What would—

MUNGER: Well, there’s an old story about the all these banks that think they’ve done so well. These two guys are fighting with razors. One takes a big swipe and the other guy says, “You missed me.” And the guy says, “Wait until you shake your head.”

QUICK: So, what would you tell regulators today? What would you do–

MUNGER: Well, the regulators aren’t, they need to change laws now. But of course, if you’re running a gambling parlor, you want the big players to gamble more furiously. And that’s what the securities business allowed people to do. It was a big mistake. It created a lot of misery all this we don’t wanna suck people into gambling for way more than they can afford. And you get into clearance, there were clearance risks in the thing. The whole market was in chaos. The people who are making money out of this unreasonable extension of credit argue for it, and nobody’s speaking against it. And l, last time around, we got the correct regulation that came and stayed for a long time on margin debt only because we had the worst depression in the history of the English-speaking world. That’s what it took to get a little sense into the politicians. This time around, it just total return swap.

QUICK: So what fixes it though. I mean, there have been suggestions that there needs to be more–

BUFFETT: Well, we fixed it–

QUICK: Transparency, there needs to be really a crackdown on allowing people to lever up like this. What, what’s–

MUNGER: The correct–

QUICK: The answer?

MUNGER: Answer was never to have allowed most of this stuff to start.

BUFFETT: But I think–

—

BUFFETT: And but it’s, it is tough to be very, very, very tough to it’s a regulator. It’s easy to, you know, to really go after the big stuff, you’re attacking the profit center of institution after institution after institution.

MUNGER: The, the prime brokerage things, by very nature, means you’re, you’re specializing at lending, lending to the big swingers. And of course, it’s dangerous. And rules they violated, the same guy was hitting up four or five brokers at once. And of course, he was buying stocks to keep them up to prevent margin calls. Once you start doing that, you’re headed for a ugly ending, and of course it happened.

QUICK: But do you think that it would take a systemic breakdown before changes would actually get implemented again, like you reference with the Great Depression?

MUNGER: Well, I, the last time, it took the worst depression in the English-speaking world in all history. That’s what it took to get the last correction. I certainly don’t want that.

BUFFETT: Now, it–

MUNGER: A wise regulator–

BUFFETT: We could just start–

BUFFETT: It’s very hard to stop though–

QUICK: Charlie, you said communist China is doing all the things that we should be doing right now, and I, I can’t help but think of what they’re–

MUNGER: Well, I have a–

QUICK: What they’ve done to Jack Ma.

MUNGER: That amuses me, you know —

QUICK: What about what they’ve done to Jack Ma? He’s kind of disappeared as—

MUNGER: Well, yes, but Jack Ma is one of the swingers. So, they just cut his, they said, “To hell with you.” He basically gave a speech when he said to a, to a one-party state, “Well, you guys are a buncha jerks, don’t know what you’re doing. And I know what I’m doing, and I’m gonna do it better.” And he was gonna wade into banking and no rules and just do whatever he pleased.

QUICK: He also brought–

MUNGER: The Chinese, the Chinese–

QUICK: Banking to a lot of people—

QUICK: Although Ant Financial was bringing banking to a huge un-banked population before. I mean, there were things that they were doing that–

MUNGER: I know, but you don’t want a swinger to run. The banks have the implicit guarantee of the government, and you don

QUICK: Who are the swingers here in this country?

MUNGER: Well, I don’t wanna start naming swingers.

BUFFETT: They’ll, they’ll appear.

QUICK: You know, the way the story’s kinda been painted is that it’s the Chinese communists who don’t wanna lose power. And some of the capitalists who have maybe gained too much power under, under at least what the communists might like to see.

MUNGER: But he, but–

MUNGER: Yes, yes. No, what’s so, what Yeah. And, and but, but the banking system take shadow banking, which we have in this country. People say, “Well, it’s a young bank.” But, well, whole leverage buyout lending practically left the banks and went to shadow banks in our own country. And it hasn’t caused any big trouble yet. But I’ll be amazed if it doesn’t.

QUICK: Well, Jamie Dimon has said that. Like, “Look out for the, some of the fintech areas,” that they’re not–

QUICK: Which maybe we should talk about Robinhood and some of the areas that–

MUNGER: Well, Robinhood is beneath contempt.

QUICK: Why?

MUNGER: Well, it’s a gambling parlor masquerading as a respectable business.

QUICK: And the pushback on that is always, “This is a way of getting average people into the markets,” people–

MUNGER: Well, of course you don’t want–

QUICK: Who didn’t have access–

MUNGER: To say you’re a, it’s a gambling parlor, but it is a gambling parlor.

BUFFETT: It’s not encouraging people to buy a very, very, very low-cost index fund and hold it for 50 years. I will guarantee you that you will not walk in there, get that advice.

MUNGER: No.

BUFFETT: Instead, you’ll get advice on how you can trade options and, and, and, and, and they’ll tell you that–

MUNGER: And it’s telling people they aren’t paying commissions when the commissions are simply disguised in the trading. It’s basically a sleazy, disreputable operation. And the interesting thing about it is that some good people you would be glad to have marry into your family and have backed it.

PART II

QUICK: Before Ben and Jerry, Oprah and Gayle, or Sergey Brin and Larry Page, there was Warren Buffett and Charlie Munger. Born and raised in Omaha, Nebraska, both worked at Buffett’s grandfather’s grocery store, but their paths didn’t cross until Buffett was 29 years old and Munger was 35. To understand the most successful couple in business, it’s best to start at the beginning and how they first met.

BUFFETT: Well, want to tell the story?

MUNGER: Go ahead.

BUFFETT: There was a doctor couple, very prominent in Omaha, and his name was Eddie Davis, her name was Dorothy Davis. And it was Mrs. Davis that called me, actually. She did everything. She said, “We’ve heard that you manage money and, and we’d be kind of interested in listening to your story about how ya, how you do it, and what we might do with you.” So I went over and I talked to ‘em. And I was all full of myself and like that’s, you know, I couldn’t talk fast enough about stocks in those days. And, and Dorothy Davis, very smart, and she listened to every word. And the doctor was kind of over in the corner, submitting a yoyo or something, and really not paying much attention. And, and I got all through and the wife looked over at the doctor and said, “I’m gonna give him $100,000.” And I was managing about $500,000 at the time, so it was a big deal. And in a very nice way, I said, “Dr. Davis,” I said “you know, you really haven’t been paying much attention to what I’ve been saying and everything. I, I’d kinda like to know why you’re giving me this $100,000,” I said. But it was much more modest than that way I edged into it. And Dr. Davis looked at me and he said, “Well,” he says, “you remind me of Charlie Munger.” And I said, “Well, I don’t know who Charlie Munger is, but I like him.” And he gave me $100,000 and, and then they told me about Charlie and what young kid, how he would be over there asking ‘em questions on medicine and giving ’em lectures or I mean, they, they clearly loved him. And it sorta became their mission that, that sometime they wanted to get me and Charlie together. So, so Charlie, in, in 1959, his dad died and he came back to Omaha. His mother lived there and the Davises really got us together. So they arranged the dinner. And about five minutes into it, Charlie was sort of rolling on the floor laughing at his own jokes, which is exactly the same thing I did. So I thought, “This, I’m not gonna find another guy like this.” And we just hit it off.

QUICK: Charlie, what did they first tell you about Warren? How did they describe him to you?

MUNGER: Well, the Davises were like second parents to me. There were two sets of three children, my father’s best friend was Eddie Davis and my mother’s best friend was Mrs. Davis. I lived in that house back and forth as though it were an alternate house of the Mungers. And Mrs. Davis gave me the honor of switching my legs when I misbehaved, just as if I were one of her own.

BUFFETT: You probably gave her plenty–

MUNGER: So, so, anything the Davises asked me to do, I was gonna do.

QUICK: What did you think of Warren when you first met him?

MUNGER: We got along fine. Oh, well, we–

BUFFETT: Both of our wives thought, “My god, another one.”

MUNGER: What I like about Warren is the irreverence. We don’t have automatic reverence for the pompous heads of all civilization.

QUICK: Is that something that came with age or you, you guys–

MUNGER: We were always that way.

QUICK: Were born with that–

BUFFETT: No, we were kind of always that way. We were, we’re a little more extreme. I’ve learned to behave a little bit better. Charlie really hasn’t learned much better. They, but we, you know, I, I just knew instantly Charlie was the kinda guy that I was gonna like, and I was gonna learn from. But, you know, it wasn’t anything calculated, a decision or anything like that. The, it was, it was natural. And, and we have had nothing but fun.

QUICK: Fun both as friends and business partners. A few years after meeting Munger, Buffett, who had grown his investment partnership into more than a quarter million dollars, found Berkshire Hathaway. He started buying stock in the textile mill in 1962 and took ownership of it in 1965. Around the same time, Munger had given up his career as a lawyer and had been running his own investment firm. That is, until Buffett convinced him to shutter it and join him at Berkshire.

QUICK: So how did the business relationship start?

MUNGER: Well, Warren had scorn for my way of making a living, and he was correct in that. It took me a long time to wise up that he had, had a better way of making a living than I did. But he finally convinced me that I was wasting my time.

QUICK: As a lawyer?

MUNGER: Yeah.

BUFFETT: I told him it was okay as a hobby, but not the real way to spend his time. He more or less decided to duplicate in Los Angeles what I was doing in, in Omaha, which was great. We just connected. And we, we talked a long time on, on the phone when it was expensive to talk a long time on the phone. I, I didn’t sit there with an hourglass or, but with Charlie, I mean, my family could tell when Charlie was calling. I mean, and then I would, we’d go on for a long, long time.

MUNGER: And we had fun in the early days ’cause it was like hunting expeditions. And we had a lot of fun.

PART III

QUICK: Over the sixty-six years Warren Buffett has run Berkshire Hathaway, he has made hundreds of deals. But believe it or not, he calls acquiring Berkshire Hathaway itself was his worst trade ever.

[CNBC, 2010] BUFFETT: Truth is I had now committed a major amount of money to a terrible business. And Berkshire Hathaway became the base for everything pretty much that I’ve done since. So in 1967, when a good insurance company came along, I bought it for Berkshire Hathaway. I really should, should have bought it for a new entity. Because Berkshire Hathaway was carrying this anchor, all these textile assets. So initially, it was all textile assets that weren’t any good. And then, gradually, we built more things onto it. But always, we were carrying this anchor. And for 20 years, I fought the textile business before I gave up. And instead of putting that money into the textile business originally, we just started out with the insurance company, Berkshire would be worth twice as much as it is now.

QUICK: From that first deal, Buffett, soon joined by Charlie Munger, continued to buy stock in undervalued companies. The two say they often learned more from their mistakes, as was the case from one of Buffett and Munger’s first deals together, Blue Chip Stamps.

MUNGER: Well, we bought into Blue Chip Stamps together with a third, we had a third friend there, Rick Guerin. And pretty soon, the three of us together had most of the stock. And, and one thing led to another. And, and Blue Chip Stamps is now a part of Berkshire. And of course, the trading stamp business has disappeared. All the early businesses that we owned together have disappeared.

BUFFETT: They didn’t disappear, they failed.

MUNGER: They failed, yeah.

BUFFETT: Yeah, right.

MUNGER: But, but we took so much out of them before they failed that we, it still worked out fine for us.

BUFFETT: We evolved them. I mean, but, but literally, the, the three base businesses all ended up disappearing. They, you know, they went outta business. They did, they no longer fit into the society, in a sense. And actually, the, the first, the very first deal that, that we joined in on was something called diversified retailing which was in Baltimore. We bought a department store there. And we had Sandy Gottesman had 10%, Charlie had 10%, and, and in his partnership, he had 10%, and I had 80% in our partnership, the three of us. And we always treated as, you know, we may have had 80, but we were equal partners. And, and we put $6 million into that. We called it diversified retailing, but we only had one department store chain. But we had, and we had a lotta fun with that. But we also saw, after we were in a little while, department this department store was–

MUNGER: As the ink dried, we dried, we realized we had made a big mistake. It didn’t take very long.

BUFFETT: Yeah.

QUICK: Why? What happened?

MUNGER: Well, you heard the old story, “Let me outta this trap. I’ve decided I don’t like the cheese.” We just wised up to the fact that it was one tough business we’d bought into, and that the sellers had made the good decision and we’d made a bad one.

BUFFETT: We had, we had some terrific people who were running it for us that were actually related to Sandy’s wife. And–

MUNGER: Exceptionally honorable people.

BUFFETT: Really honorable people. The smart. If you’re losing–

MUNGER: Yes.

BUFFETT: Money in a business with a smart, decent person, you know, it, we got a problem. I mean, that’s the business. Use the smart, decent person and move ’em over some other place and move the capital some other place.

MUNGER: The, the company was not yet losing money, but we could see, we soon realized it was about to lose money.

BUFFETT: Yeah. And, and so we, we sold the department store. It went outta business in 1983, but Hutzler’s, which was the silk-stocking department store, they went outta business in, I don’t know, 1985 or ’6. They’re, they’re gone. And, and the people there, quite understandably, wanted to build more branch stores. But you don’t wanna put more money into a business that’s destined for failure. Now, we put $6 million of capital in that, and it was a dumb decision and everything. But that $6 million, what would it be worth now, Charlie? At, they got four-tenths of a share.

MUNGER: Great many billions.

BUFFETT: Oh, it’s, tens of billions.

MUNGER: Yeah.

BUFFETT: Now, if the department store had succeeded, we’d have a nice little business then. Send us a nice little check, but because it failed, we’ve made 25, well, we made more than $25 billion in that, didn’t look like it at the time, though.

QUICK: So, when you realized it was a mistake, what did you do? How, how did you address it?

BUFFETT: We asked Sandy, who was the best salesman among us, to go sell it. And, and we sold it. And we put the money into Berkshire.

MUNGER: We got about 95% of our money back.

BUFFETT: Yeah. And we’d borrowed $6 million in there, so now we had, so we bought Berkshire stock and we bought Blue Chip Stamp stock and eventually put it all together. It looked like a plate of spaghetti at one time, which was not good, as it was complicated. And so, we, we put ’em all together. And, you know, I’ve still got stock and Charlie’s still got stock that came out of retailing, as do a number of my partners. But from the old days. Best thing that happened to us was that this place failed obviously was a failure.

QUICK: Why? What did you learn?

BUFFETT: Pardon me–

MUNGER: To leave quickly.

BUFFETT: Yeah. And, and move the capital someplace else.

MUNGER: One thing we’ve learned is, if it’s clear that something is a mistake, is to fix it quickly. It doesn’t get better while you wait.

PART IV

[MAY 2016] MUNGER: I learned how hard it is to work for 10 hours for $2.

[MAY 2016] BUFFETT: We shoveled wet, deep, heavy snow from these driveways around the store. I looked at my grandfather who said, “What should I pay you boys? A dime is too little and a dollar is too much. The main thing we learned from the grocery store is we didn’t want to work in a grocery store.

QUICK: Warren Buffett and Charlie Munger agree, a lot of their outlook on life comes from their midwestern upbringing. They credit their success to a deep sense of values, which have kept them grounded throughout their careers, associating with good people, in business and in life, and to taking the high road in business transactions.

MUNGER: If the high road is way more profitable, do you deserve a lotta credit for choosing it? People who get the credit are the people that take it even when it’s painful.

QUICK: Both say these values were instilled at a young age thanks to a key figure in each of their lives.

BUFFETT: Long, long ago, people don’t even know about this, but we owned two small insurance companies at Berkshire that both went broke except we didn’t let ‘em go broke. I mean, in other words, we coulda walked away from ’em and left the money because they were separate companies. And we didn’t walk away. And we haven’t spent our lifetime, you know, working at things to try and figure out ways to walk away from debts, or have things in indentures then play games like they have, you know, with, with credit default swaps and, you know, figure out ways to take advantage of the, the lenders. I, it’s just not our game. If we owe money, we’re gonna pay it back.

QUICK: You, you said that it’s, it would occur to both that it was the more profitable way. But that’s certainly not necessarily how the majority of people in business think.

BUFFETT: It’s the way our dads thought, in both cases. Who the hell knows where you get your values from exactly, but basically, you know, you have a few people that are teachers to you in life and are not formal teachers. And the most important people are your, definitely are your parents. And, and, you know, I never, I never heard my dad say to me in my life, you know, that, “Be sure you pay all your debts.” But I just watched how he lived and, and you wanna have certain people in life that you don’t want to disappoint. You’ll behave, you know, you wanna have people that, that make you a better person than you otherwise would be. And Charlie does that for me now, but my dad did it for me early on. And, and I think I didn’t know his dad, but from everything I’ve heard about his dad, you know, he had the same experience.

QUICK: Charlie, tell me more about your dad.

MUNGER: Well, my father was a lawyer and he was the son of the, another lawyer who became the only federal judge in Lincoln, Nebraska, was is Nebraska’s capital city. And grandfather Munger was a marvelous guy and, and a great family man too. I was surrounded by high-grade people, and my parents had good friends who are high-grade people. So, I had a very privileged life in terms of my associations. In fact, I had terrible trouble by coming out to Los Angeles and succeeding in life. I frequently thought I couldn’t ever get, group of friends that were any as good as my father had gotten in little Omaha. And I finally realized that they had a very unusual bunch of friends in Omaha. And it was just a peculiar accident of history so I was surrounded by a buncha high-grade people. I deserve no credit at all for, I was just forced to imitate the right people.

BUFFETT: Both Charlie and I, we, we like talking to older people all our lives. I mean, I liked when I was seven or eight years old talking to older people. And now of course the problem is there aren’t any older people. So, I’ve run outta that constituency. But, but I, you know, if I would go over to the Dundee Presbyterian Church to sing in the kids’ choir or something like that, walking home, I’d drop in at four or five houses where I’d talk to housewives. So, I’d sit and talk to ’em. I’ve always enjoyed talking to older people and I think Charlie was the same way.

MUNGER: ’Course. When I married the woman that helped me build this house, one of her relatives said, after meeting me, she said, “That is the oldest young man I’ve ever, man I’ve even known.”

BUFFETT: But I think the same–

MUNGER: I always behaved like I was 100 years old, even when I was young.

BUFFETT: But now we’re the youngest old men that you’ll–

QUICK: Charlie, just the relationship that you had with your dad too.

MUNGER: Oh, a marvelous relationship. And, and that, that’s a great blessing, to have a wonderful mother and a wonderful father and they have a bunch of wonderful friends. It was just it’s, I was very lucky.

BUFFETT: We’ve been able to associate with people that we really like in life. Well, that’s one of the luxuries of life.

MUNGER: And we’re still doing it.

BUFFETT: And we’re still doing it, yeah. We made a lot of money. But what we really wanted was independence. And we have had the ability since pretty much a little after we met financially we could associate with people who we wanted to associate with. And if we had, if we associated with jerks, that was our problem. But we didn’t have to. We’ve had that luxury now for, you know, 60 years or close to it. And, and that beats 25-room houses and, you know, six cars or that stuff is, what really is great is if you can do what you want to do in life and associate with the people you want to associate with in life. And, now, it, it’s and, and we both had that, that spirit all the way through.

QUICK: How quickly can you figure out if somebody is someone you want to associate with?

MUNGER: It’s amazing how quickly we do it, and how few bad mistakes we’ve made.

QUICK: So, what do you look for? What do you know?

MUNGER: I don’t know exactly.

BUFFETT: Yeah, how did I know Charlie? You know, I knew when I met Charlie, you know, after a few minutes in the restaurant that, that you know, this guy was gonna be in my life forever, you know. I mean it, it, we were gonna have fun together. We were gonna make money together. We were gonna get ideas from each other. We were gonna both behave better than if we didn’t know each other.

PART V

QUICK: On the first Saturday in May, from the 1970s to 2019, Warren Buffett and Charlie Munger could be found here, on stage in Omaha, Nebraska.

[MAY 2019] BUFFETT: Good morning and welcome to Berkshire Hathaway!

QUICK: Dubbed Woodstock for capitalists, the Berkshire Hathaway Annual Meeting grew in size from about 20 people in the National Indemnity Lunchroom to more than 40,000 crowing into Omaha’s biggest convention center until the COVID-19 pandemic forced the meeting, like everything else, to go virtual. In 2020, that meant Buffett ran the meeting without Munger.

[MAY 2020] BUFFETT: This is the annual meeting of Berkshire Hathaway. It doesn’t look like an annual meeting, it doesn’t feel exactly like an annual meeting.

QUICK: But this year, the two were back together on stage at a virtual meeting held in Munger’s hometown of Los Angeles. We sat down with them after the meeting in Munger’s backyard. They reflected on the pandemic’s impact on business and on their own experiences working remotely.

QUICK: The last year, you both had your lives change pretty dramatically from the pandemic. Charlie, I hear you’re, you’re pretty adept at Zoom.

MUNGER: Oh, well, I have fallen in love with Zoom.

QUICK: How often do you talk to people on Zoom?

MUNGER: At least three times a day. I made a deal in Australia. I, I think Zoom is here to stay. It’s, it just adds so much convenience.

BUFFETT: Well, particularly if you’re 97, it, and getting around. But Charlie and I have talked a lot obviously, since the pandemic started. We haven’t talked on Zoom yet. I mean, it, it–

MUNGER: Well, but it’s not because–

BUFFETT: I’m, I’m just not a Zoom guy.

QUICK: Why don’t you like Zoom?

BUFFETT: Well, I don’t see any plus to it, particularly, I like to I did it once or twice, and they had a whole screen of people that, that it, I just didn’t figure it was adding to the experience. I’d rather have my, you know, feet on the desk, and, and I, I find the telephone a very satisfactory instrument, I mean.

QUICK: So how does life change post-pandemic? How does work change? And, and how does it’s, go back to normal? I guess, what, what do you think happens—

MUNGER: Well, I think a lot of business travel will never come back. Just corporation after corporation deciding one meeting a year, two meetings a year in person, and the rest Zoom. And I think that’s here to stay. And, of course, what’s happened to office demand is just think of the agonies in that field now. And a lot of people have found they don’t need to be there. I think all kinds of things are gonna happen that, that we’ll be, we don’t go back to what we did before.

BUFFETT: Some, some, some of our businesses will change a lot, and some of ’em won’t change hardly at all. But it’ll be interesting. I, I would say this, in terms of the, the whole pandemic, in terms of predicting both the economic and how the wires should behave, you know, it, it surprised us in a lot of ways. It surprised our, you know, at the end, we still don’t know. We know a lot about this, but there’s a lot of things we don’t know yet. And, and, and, if you look at the graphs of, of how it’s hit different countries and everything, it, it, it just shows you how a very advanced economically world can get disrupted by something that in, in ways that, even when you’re in it, you can’t predict. And the economic impact has been this extremely uneven thing where I don’t know how many but many hundreds of thousands or millions of small businesses have been hurt in a terrible way, but most of the big, big companies have overwhelmingly have done fine, unless they happen to be in cruise lines or, you know, or hotels or something.

MUNGER: But, but some people did better than we. Again, the Chinese simply totalitarian state, they simply shut down the country for six weeks. And that turned out to be exactly the right thing to do. And they didn’t allow any contact. You picked up your groceries in a box in the apartment and that’s all the contact you had with anybody for six weeks. And, when it was all over, they kind of went back to work. It happened they did it exactly right.

BUFFETT: But a lot about, but, in other cases, they’re shutdowns, and the shutdowns really they’d, they thought they were model examples, and then, now, they’re experiencing problems. And then you had other countries, you know, like–

MUNGER: Yeah. No, it’s just–

BUFFETT: You had other countries like Sweden, Sweden says, “We’re not gonna do it.” And that seemed to be working fine for a while. And then it, this has been very, very, very unpredictable–

MUNGER: Yeah, very difficult. Yeah.

BUFFETT: And it’s not over. I mean, in, in terms of the unpredictability. And in terms of the economic, it’s been very unpredictable, but it’s worked out better than people anticipated for most people and most businesses. And it’s just, for no fault of their own, it’s just decimated all kinds of people in their hopes. And that, and, and those we want to, you know, the government should be helping–

MUNGER: But, for some businesses—

BUFFETT: We’re prosperous.

MUNGER: It didn’t create just a return to normal. It created fabulous success they didn’t anticipate. The auto dealers are coining money that they wouldn’t have had except for the pandemic.

BUFFETT: And all of the dealers that we have partners in each dealership, they very sincerely felt that, that they were gonna have one helluva problem in, in March and April. And some might have wanted to go in for the assistance from the government, but we wouldn’t let ’em, because they had a rich parent. But, they honestly believed it. We honestly believed it. We, we didn’t know what was gonna happen with NetJets in terms of the demand. And it has been, you know, it’s been, just been different than a lot of people thought. The banks were scared stiff in the middle of March. I mean, they, they saw everybody taking down their lines of credit. But why do people take down their lines of credit when they don’t need it? Because they’re afraid it won’t be there next week, you know. And, if you get enough people believing something won’t be there next week in banking, it won’t be there next week absent the Federal Reserve.

QUICK: One thing that maybe surprised you most? Something you learned the last year?

BUFFETT: Well, I learned that people don’t know as much as they think they know. But the biggest thing you learn is that the pandemic was bound to occur, and this isn’t the worst one that’s imaginable at all. And, we all, society has a terrible time preparing for things that are remote but are possible and will occur sooner or later. There’ll be another pandemic, we know that, we know there’s a nuclear, chemical, biological, and now cyber threat. And we, you know, it has, each one of those has terrible possibilities. And we do some things about it, but it’s just not something that society seems particularly capable in fully coming to grips with. The cyber threat, it, you know, it, we’ve just started, and, and look at the damage that’s already been done. Charlie and I have been ungodly lucky in many ways. But the luckiest thing was actually being around at this time and place. And we also have these problems in how 200 countries with over seven-and-a-half billion people, and a lot of tensions between them and all sorts of things, and different systems, and selected governments, and all that. And how do we actually do this so that mankind, 50 and 100 and 200 years from now, should enjoy the incredibly better life that could be enjoyed while not screwing it up?

PART VI

QUICK: It’s one of the 10 biggest companies in the world, by market capitalization. It’s 360,000 employees work in offices around the globe. But Berkshire Hathaway’s sprawling operations are headquartered here, from two floors leased in a building in Omaha, managed by a staff of just two dozen people. It’s different because of the two men at the top, Warren Buffett and Charlie Munger.

MUNGER: We have accidentally created a very interesting experiment in how well a really big place can be run on a very non bureaucratic basis with extreme decentralization. We’re like a test case for how extreme you can make it. And I would say so far, that it’s worked better. We get more advantages than disadvantages out of our hands-off management.

BUFFETT: That’s true.

MUNGER: Don’t, don’t you agree with that?

BUFFETT: That’s true. We get very few people who wanna copy us, but–

MUNGER: No, nobody wants to copy us, and, and yet, if–

BUFFETT: It works.

MUNGER: People, people study us, they’d find it at least the way we’re doing it, it works way better.

BUFFETT: Yeah. It has certain disadvantages–

MUNGER: Yes.

BUFFETT: That we want to trust people. Occasionally trust is misused. But net, it’s worked.

MUNGER: It’s a useful experiment that we’ve done, and I confidently predict that someday, well, somebody will find out that some of this dumb bureaucracy could be eliminated, we’ll be better off. Just as we found we can eliminate some business travel, we’re gonna find we can get rid of some dumb bureaucracy. In American corporations.

BUFFETT: It works at large scale, but it doesn’t work to produce the kind of returns that, that it is like we’ve got something that produces extraordinary returns, but, but it can be a very decent business at scale, operating that way.

MUNGER: Don’t you think we’ve done better than we woulda been if we’d copied the centralized management system?

BUFFETT: Well, I wouldn’t have been, I wouldn’t have wanted to work there. I mean, would you?

MUNGER: I know no, no, of course not.

BUFFETT: I’d resign. Or been fired. No, I would, I’d rather be in a jail cell with a few people who are interesting. You know, and plenty of reading material. Then, then–

MUNGER: No, what you’re saying is, we may have done it, we may have created the decentralization, ’cause it suited our nature.

BUFFETT: Absolutely.

MUNGER: But we’ve accidentally created–

BUFFETT: But it worked.

MUNGER: Created an experiment, and demonstrated can, can work on a big scale. That will eventually prove useful, I think.

QUICK: You two have been friends for over 60 years, what’s one thing that you really admire about the other?

MUNGER: Well, I like the humor, and all that, but dependable is really important.

QUICK: Warren, what do you admire about Charlie?

BUFFETT: Really, just the kinda person he’s been. I mean, he is, he has contributed given individuals, and also to society, I mean, and it, it goes well beyond buying a stock and selling it higher. He’s designed dormitories and helped build them. He’s, he’s worked at hospitals and to understand how they can be made better and serve more people and do it at less cost. You know, it’s, it’s an uphill fight all the time, but Charlie’s worked on big problems, and he’s, and he doesn’t need to. And Charlie has never shaded anything he’s told me, you know, since we met, in terms of presenting it to me in a different way than reality, or he’s never, he’s never done anything I’ve seen that’s self-serving, in terms of being a partner, or in any kind of way. He, he’s, he makes me better than I would otherwise be. I don’t wanna disappoint him.

MUNGER: But you’ve had the same thing, in reverse.

BUFFETT: Yeah, it, well, it works, it does work that way. I mean it’s better to associate with people who are better than you are. I mean–

MUNGER: It really is. It’s, it’s so, it’s, it really helps.

QUICK: Business partners more than half a century. Warren Buffett and Charlie Munger are lifelong teachers, corporate executives who lead in an unconventional manner and who will certainly be studied for generations to come. But with almost 190 years of experience between them, it’s the lessons in life they’ve shared through their friendship that may be more lasting. ##

###

Additional Information plus MHProNews Analysis and Commentary in Brief

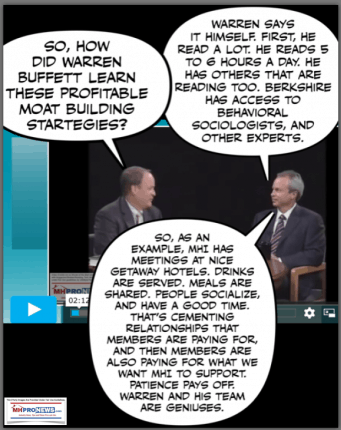

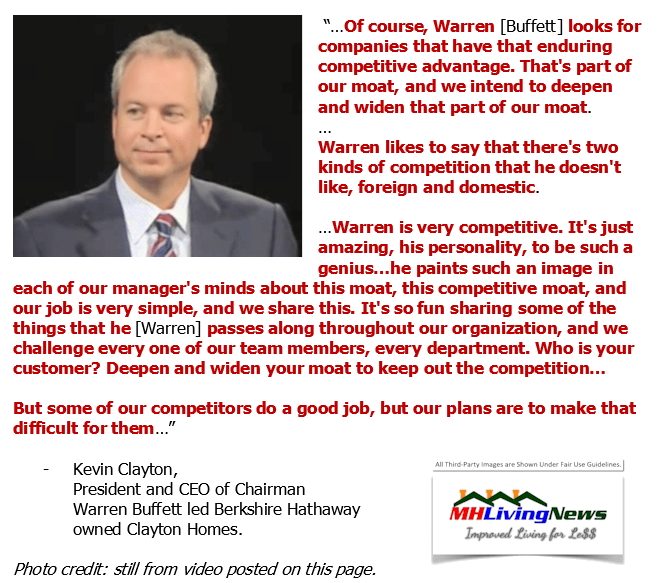

In about a 45-minute video, there are hits and misses. Absent in the above is mention of the Castle and Moat that both Buffett and Munger have bragged about is an essential part of their business model. For example, when they talked about decentralization, what they did not say is that they preach the castle and moat to their company managers, and then those company managers execute on that strategy.

For example.

So, while posturing being good guys, in the manufactured home profession alone, they were arguably complicit in destroying thousands of routinely honest smaller businesses. The numbers are provided by Kevin himself.

Buffett and Munger talk about doing good, a reference to charitable endeavors. They speak about not doing deals with bad people. That can be taken at face value. But it can also be understood in a topsy turvy sort of way. To pick a controversial example to illustrate the point, roughly half the nation believes that abortion is the taking of an innocent unborn life. Killing a baby – pre- or post-birth – for many is about as bad a deed as half of Americans can imagine. Yet, Buffett is one of the documented top funders of abortion. He can easily be understood as one of the biggest mass murders in history. That’s biblically evidenced.

Furthermore, regular and detail minded MHProNews/MHLivingNews readers know that Buffett has supported the weaponization of nonprofits. On several issues, Buffett or Berkshire bucks have been on both sides of the same issue. This should be understood as a man-eating aquatic creature in their moat. Kevin Clayton and Tim Williams have both postured wanting more financing in manufactured housing. But when carefully examined, what each has done and supported was the opposite of what they claimed.

In those battles, nonprofits that Buffett-bucks has supported said several things that became a bad reflection on the industry, but which de facto benefited Buffett/Berkshire brands. Are any of those the behaviors of a good person?

Hardly.

Since 2002-2003, and Berskhire’s entry into manufactured housing, the industry is operating at a historically low level.

The so-called COVID19 pandemic, which is a genuine virus, but whose handling is certainly up for debate, benefited the few at great harm to the many. They said as much in the video/transcript above. While they postured caring about those harmed, their answer is to let the government deal with it. In another interview, Buffett called certain people “road kill.” Let the government deal with the roadkill that the behavior of billionaires and their brands, much like themselves, have caused society. These are all deceptive machinations. The truth is hiding in plain sight, but someone must be willing to actually look to see just how disgusting and treacherous their behavior is. Even as to the choice of who they do interviews with, CNBC has obvious ties to a longtime Berkshire board member. Ally Bill Gates and Berkshire itself spends more than enough money on some networks where they can be confident that they won’t get negative media from them. “And no wonder! For Satan disguises himself as an angel of light.” (2 Cor. 11:14). Recall or know that Buffett and Munger literally funded a church that they used as cover to preach their gospel of abortion. A disproportionate number of those abortions are of minorities. The list of devious horrors goes on and on.

Given their clout with many in mainstream media, they can get dressed up as do-gooders who give away money. But when examined, that money is routinely used to advance causes that fit their beliefs and advance their perceived business interests. Thus, it is not always easy to spot at a glance what is honest or deceptive about these people, because they are behaving and speaking in a coded fashion. Those who follow their logic get it, and some celebrate it. But others see it for what it is.

See the linked and related reports to learn more. But keep in mind, that you can’t make a good deal with a bad person. Are either of these men good guys? Then, realize what was said above is true. Once a problem is spotted, it is best to deal with it as rapidly as possible. Problems do not fix themselves.

MHProNews can report the problems and patterns, but others will have to do lifting too in order to cure the ills. Absent the cures, listen to what they said. New pandemics, new cyber or other attacks are coming. They have praise for Communist China. Politicians and the billionaires both want more money and power. Those are warnings to any honest or even mildly prudential person that need to be heeded. Their power of MHI is difficult to deny. They could have fixed any ills the industry had during the Obama years, or during the Trump years. But the decided not to do so (see the report linked below). These are demonstrably deceptive and evil men. They have literally and economically destroyed untold millions of lives. They need to be exposed and prosecuted to the fullest extent of the law, because of the many demonstrable evils that they have done.

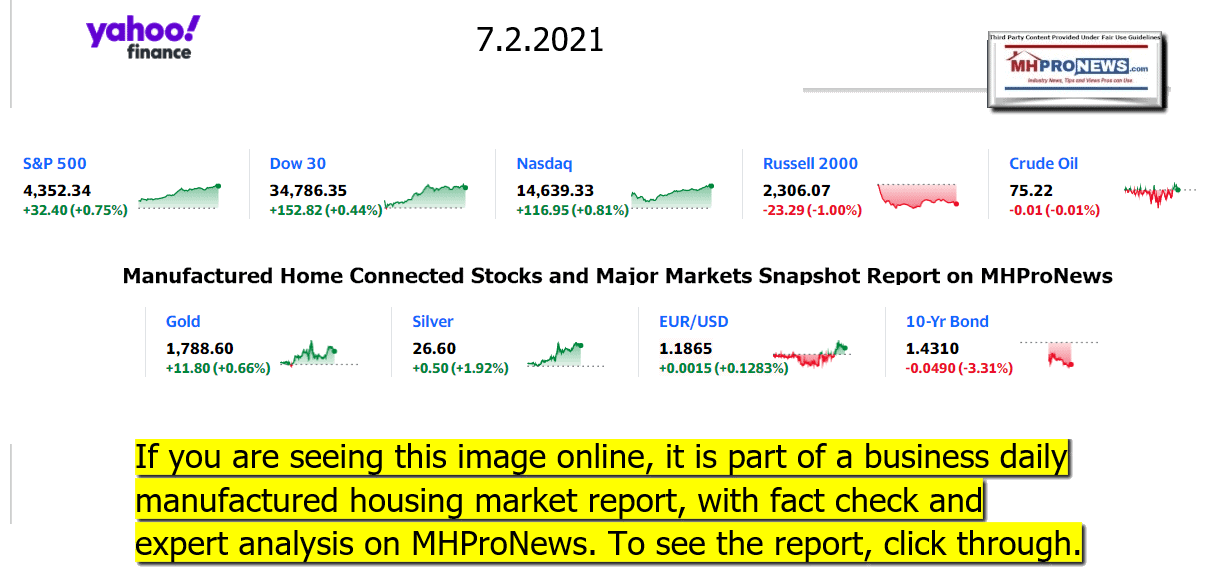

Next, is our evening market report and related left-right headlines.

The Business Daily Manufactured Home Industry Connected Stock Market Updates. Plus, Market Moving Left (CNN) – Right (Newsmax) Headlines Snapshot. While the layout of this business daily report has recently been modified, several elements of the basic concepts used previously are still the same. The headlines that follow below can be reviewed at a glance to save time while providing insights across the left-right media divide. Additionally, those headlines often provide clues as to possible ‘market moving’ items.

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

- On a roll

- Mandatory Credit: Photo by Erik Pendzich/Shutterstock (12084357f)

- Exterior view of the New York Stock Exchange (NYSE) and Wall Street in New York.

- Daily life, New York, USA – 15 Jun 2021

- The S&P 500 has had a record-breaking week, and it might keep going

- The US economy added 850,000 jobs in June

- FTC charges Broadcom with monopolizing chip industry

- Tesla sales rise despite problems with chips and China

- Didi stock tumbles just two days after going public

- Wages are rising. That might not be a good thing

- Vaccine inequality is hurting Asia’s poor and the rest of the world

- President Biden gets global support for massive tax overhaul

- Robinhood settles lawsuit over 20-year-old trader who died by suicide

- How these telemedicine companies are innovating in the pandemic

- The rental car market is back and so is Hertz

- Used vehicles for sale at a CarMax dealership in Louisville, Kentucky, U.S., on Thursday, June 24, 2021. CarMax Inc, jumps 5.8% in premarket trading after it reported revenue for the first quarter that beat the average analyst estimate.

- If you bought a car last year, it could now be worth more than you paid for it

- Those annoying robocalls aren’t going to stop today. But they could slow down soon

- A shopper wearing a protective mask walks past a sale sign at an American Eagle Outfitters Inc. clothing store at Westfield San Francisco Centre in San Francisco, California, U.S., on Thursday, June 18, 2020.

- Why you’re seeing fewer clothing sales right now

- TO-GO FOOD

- A chicken sandwich from Popeyes Louisiana Kitchen is shown on May 06, 2021 in Chicago, Illinois.

- McDonald’s and Popeyes have a plan to make customers come back more often

- Starbucks is selling these drinks on social media

- Wendy’s is testing a new plant-based burger

- Dunkin’s new menu item explodes in your mouth

- America loves to-go cocktails. This state won’t allow them anymore

- WEALTH COACH

- 5 to-do items if you want to retire within 10 years

- How to protect your nest egg from inflation

- How to retire a millionaire

- How to invest in IPOs

- What should you do when you get paid? Here’s how to create a payday routine

Headlines from right-of-center Newsmax – evening of 7.2.2021

- Trump Ally in Pennsylvania Raises

- 2020 Election Audit Plan

- Trump Ally in Pennsylvania Raises<br> 2020 Election Audit Plan

- (Getty)

- A move modeled on the audit process in Arizona, advanced amid lingering controversy over the legitimacy of the 2020 presidential vote that saw Joe Biden succeed Donald Trump. [Full Story]

- Newsmax TV

- Grover Norquist: Jobs Report Still Lags Biden Predictions

- Jason Miller to Newsmax: SCOTUS Ruling on Arizona Clear on Elections

- Fred Keller: Pentagon Continuing Trump Policy in Afghanistan |

- Nikki Haley: ‘Republicans Are Way Too Nice’ to Rep. Omar |

- Ben Carson: Critical Race Theory ‘Bunch of Garbage’ |

- Ted Cruz: ‘Considering’ 2024 White House Run |

- Steube: Pelosi’s Jan. 6 Committee ‘100 Percent Partisan’ |

- More Newsmax TV

- Newsfront

- Era Ends, War Looms as US Forces Quit Main Base in Afghanistan

- American troops pulled out of their main military base in Afghanistan on Friday, leaving behind a piece of the World Trade Center they buried 20 years ago in a country that the top U.S. commander has warned may descend into civil war without them. “All American soldiers and…… [Full Story]

- FTC Charges Broadcom With Illegal Monopolization

- The Federal Trade Commission on Friday announced monopolization [Full Story]

- Eric Trump to Newsmax: Trump Family Not Charged Because Nothing to Charge Them With

- It’s no mystery why Manhattan prosecutor’s didn’t elect to charge [Full Story]

- Related

- NY Post: Trump Indictments Like ‘Banana Republic’

- Trump Organization, CFO Plead Not Guilty to NY Fraud Charges

- Eric Trump: CFO Charges Are ‘Political Vendetta’

- Rick Scott Tells Florida Residents: Take Hurricane Elsa ‘Seriously’

- Rick Scott, R-Fla., in a Friday tweet, urged all Floridians to [Full Story]

- Facebook under Fire as U.S. Lawmakers Press for New Antitrust Complaint

- A bipartisan group of U.S. lawmakers expert in antitrust urged the [Full Story]

- The NRA is Making a Big Comeback Under Biden

- When the National Rifle Association arrives for its 150th annual [Full Story] |

- Kevin McCarthy: Dems ‘Defunding the Borders’

- House Minority Leader Kevin McCarthy, R-Calif., blasted Democrats in [Full Story]

- Trump Ally in Pennsylvania Raises 2020 Election Audit Plan

- Following in the footsteps of Arizona’s Senate Republicans, [Full Story]

- US Media Largely Ignores ‘Deteriorating’ Press Freedoms Worldwide

- Hong Kong’s Apple Daily newspaper was shuttered, and senior [Full Story] |

- Biden Looking to Encourage as Many as 9M Immigrants to Become US Citizens

- The Biden administration wants to reach out to as many as 9 million [Full Story]

- Firefighter’s 7-Year-Old Daughter Found Dead in Ruins of Florida Condo

- The death toll from last week’s condominium collapse in Florida rose [Full Story]

- Supreme Court Declines Appeal by Christian Florist Who Spurned Gay Couple

- Supreme Court Declines Appeal by Christian Florist Who Spurned Gay Couple

- The U.S. Supreme Court on Friday declined to hear an appeal by a [Full Story]

- Related

- Supreme Court to Hear Maine Dispute Over Religious Schools

- Supreme Court Refuses to Curb Government Power to Take Land

- Boeing 737 Cargo Jet Makes Emergency Landing Off Hawaii: FAA

- A Boeing Co. 737 cargo jet made an emergency landing off the Hawaii [Full Story]

- Did Tucker Carlson Vote for Kanye West?

- Tucker Carlson, who’s maintained a prickly relationship with Donald [Full Story]

- California Homicides Up 31 Percent From 2019

- California reported 2,202 homicides last year, an increase of 31% [Full Story]

- Judge Orders Minneapolis to Hire More Police

- A district court judge in Minneapolis has ordered the city to hire [Full Story]

- Poll: Nearly 80% Favor Voter Identification Requirement

- Seventy-nine percent of Americans believe voters should be required [Full Story]

- Team Trump Launches New Social Media Platform

- Former President Donald Trump’s team has launched a new social media [Full Story]

- Sprinter Sha’Carri Richardson Suspended Over Positive Cannabis Test

- American sprinter Sha’Carri Richardson has accepted a one-month [Full Story]

- US Adds 850,000 Jobs, Unemployment Ticks Up to 5.9%

- S. job growth accelerated in June, with payrolls gaining the most [Full Story]

- AG Garland Suspends Federal Executions Pending Review of DOJ Policies

- Attorney General Merrick Garland on Thursday announced a freeze on [Full Story]

- Poll: Almost Half of Americans Disapprove of How Biden Handles Crime

- Almost half of Americans disapprove of how President Joe Biden is [Full Story]

- Miami Herald: Biden’s Hand on DeSantis’ Arm Shows His ‘Humanity’

- The Miami Herald, in a Friday editorial, says a photo of President [Full Story]

- Financial Firm Asks to Withdraw From Britney Spears Conservatorship

- Bessemer Trust, a wealth management firm that had been tapped as [Full Story]

- Barrett Finds Own Voice at Center of Conservative US Supreme Court

- Justice Amy Coney Barrett blazed her own path during her rookie term [Full Story]

- Voting Rights Battles Move to States After Supreme Court Ruling

- A Supreme Court decision weakening protections for ballot access [Full Story]

- Branson Plans First Space Trip Days Before Bezos Blasts Off

- Richard Branson plans to fly to space on July 11, days before a [Full Story]

- Tokyo Olympics Won’t Insist on Allowing Spectators

- Tokyo Olympics organizers will not insist on allowing spectators “at [Full Story]

- Chicago Council Wants Meeting on Crime After Exchange Between Mayor, Newsmax

- The Chicago City Council is close to a quorum for a special meeting [Full Story]

- More Newsfront

- Finance

- US Adds 850,000 Jobs, Unemployment Ticks Up to 5.9%

- US Adds 850,000 Jobs, Unemployment Ticks Up to 5.9%

- S. job growth accelerated in June, with payrolls gaining the most in 10 months, suggesting firms are having greater success recruiting workers to keep pace with the broadening of economic activity. Nonfarm payrolls increased by 850,000 last month and the unemployment rate… [Full Story]

- US Trade Deficit Increases to $71.2B in May

- Controversial Billionaire Buys $20M Yacht as Super-Rich Thrive

- States Ending Jobless Benefits Early Hit Labor Market Milestone in March

- Porsche Recalls Electric Model Taycan to Fix Software Issue

- More Finance

- Health

- New Drug Gives Hope to Those With Celiac Disease

- An experimental drug can prevent intestinal damage caused by celiac disease, an early trial has found – raising hopes that it could become the first medication for the serious digestive disorder. With celiac disease, the immune system attacks the lining of the small… [Full Story]

- Wisdom Teeth Extraction May Enhance Smell

- Study: No Health Risks to Exercising With a Mask

- Stay Safe this 4th of July Weekend

- J&J’s Vaccine Shows Effectiveness Against Delta Variant

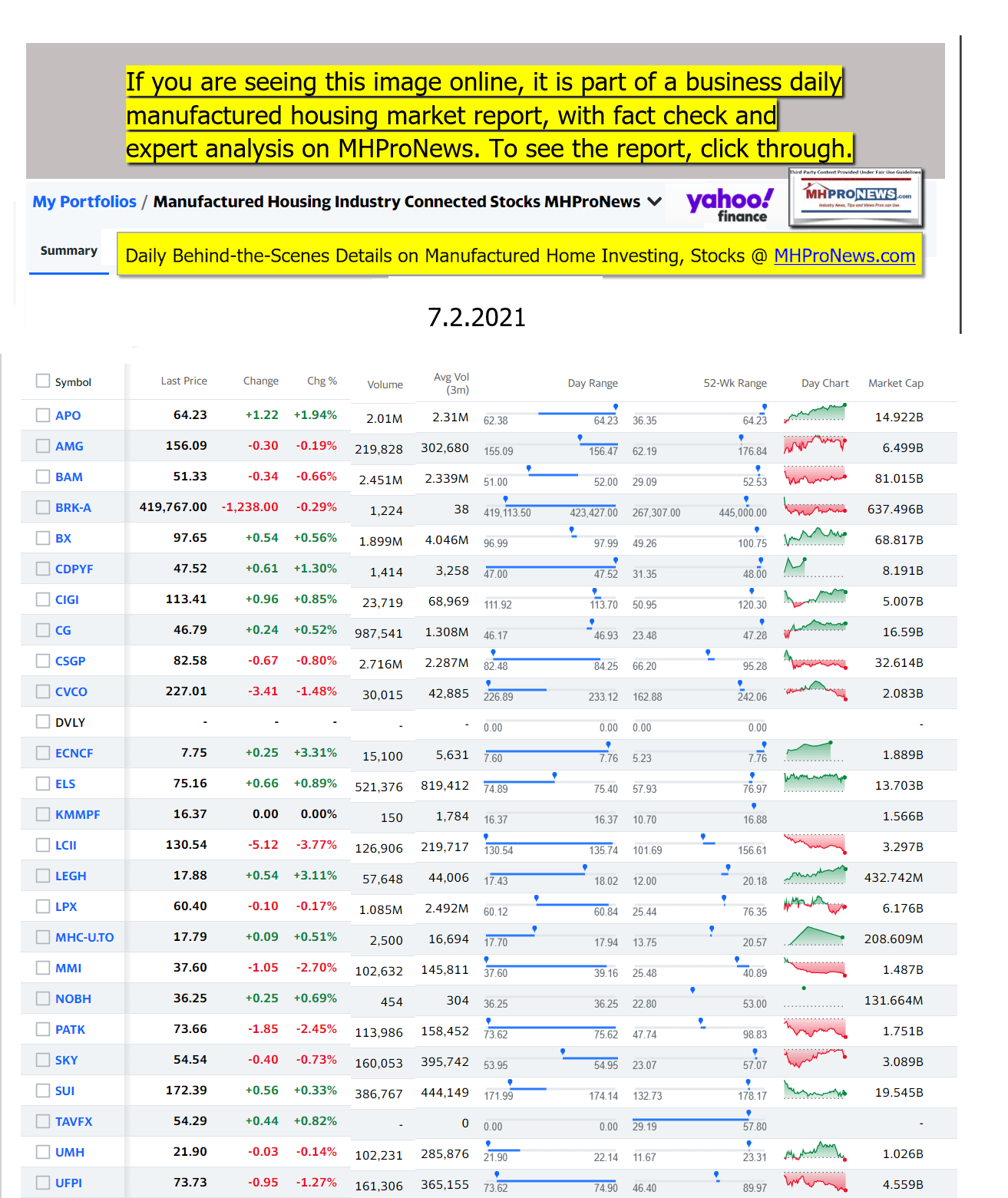

Manufactured Housing Industry Investments Connected Equities Closing Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

-

-

-

-

-

-

-

-

-

-

-

Spring 2021…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12the year of serving the industry as the runaway most-read trade media.

Sample Kudos over the years…

It is now 11+ years and counting…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.