MHProNews has been unpacking aspects of the newly-released the “Annual Report of the Council of Economic Advisers” and February 2020 “Economic Report of the President.” While there is a problematic area to their report that will be examined at another time, the focus of our article today will be on the Chapter 8 entitled “Expanding Affordable Housing.”

Manufactured housing is mentioned in this chapter. But what makes “Expanding Affordable Housing” potentially useful to manufactured housing industry professionals, investors, advocates and others is the wealth of information and research that has been synthesized. Not necessarily in the order of the report, what follows below are segments of their collective research. For those into details that shed light on obstacles as well as opportunities, this should prove to be a useful reference for some time to come.

Following the quoted sections and graphs, will be an MHProNews analysis and commentary. As a teaser, it will reflect the dichotomy between an obvious solution that is mentioned versus the stark reality of how that solution is not being deployed to its best possible advantage. That said, in fairness, there are several reasons why more manufactured homes haven’t been deployed, which are addressed in other reports that will be linked further below in our analysis.

Graphics are inserted that may not correspond to the precise same point that it appears in the original report. With that backdrop, let’s begin.

Selected Facts, Data and Insights from Chapter 8 on “Expanding Affordable Housing”

“Since 2000, real median (post-tax/post-transfer) household income has grown by 20 percent, while real home prices have grown by almost 50 percent, according to the Standard & Poor’s / Case-Shiller Index (CBO 2019). With rising home prices outpacing income gains in some areas, households are spending larger portions of their incomes on housing, and fewer people can afford to purchase their own homes.”

In that one paragraph, much is stated. As the White House report states several times, while incomes are rising more rapidly in recent years, housing prices are growing at an even faster pace. That challenge – properly understood and addresses – is an opportunity in disguise for manufactured housing deployment.

Returning to Chapter 8, page 269.

“Although the overall homeownership rate has increased since 2016, some groups lag behind. Based on the four-quarter moving average, the black homeownership rate remains 31.5 percentage points below that of non-Hispanic white households (see figure 8-1). The Hispanic homeownership rate remains 26.2 percentage points lower than that of non-Hispanic white households, despite increasing by 1.3 percentage points since the fourth quarter of 2016, when President Trump was elected. Differences in homeownership between races exacerbate the wealth gap. In 2016, white families had a median wealth of $171,000, while black families had a median wealth of $17,600, resulting in part from their lower homeownership rate (Dettling et al. 2017).”

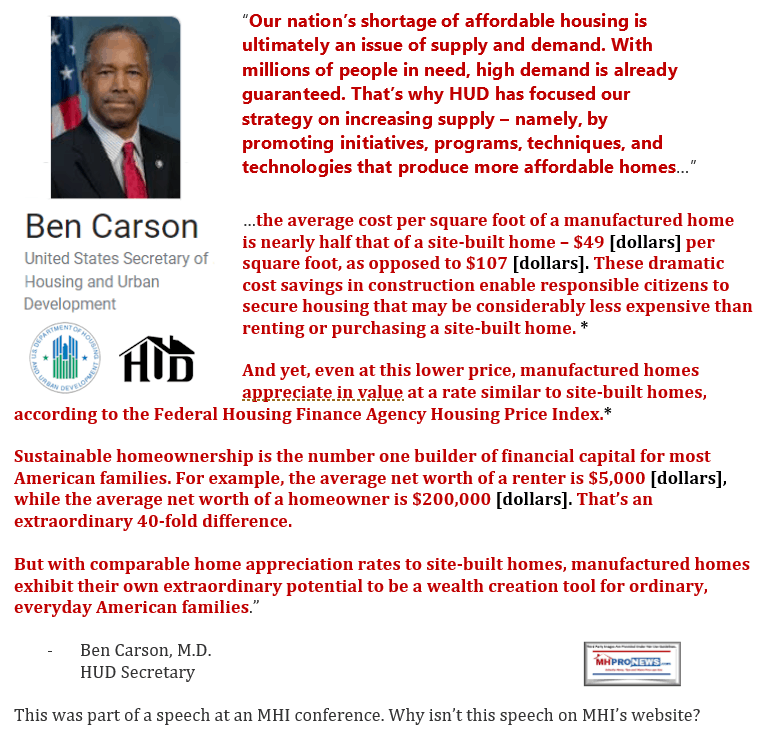

We will note in passing that this later data point is noteworthy on several levels. Among them, HUD Secretary Carson has said that the average home owning household has a net worth of some $200,000, while the average rental household has an average net worth of some $5,000. The two data points bear a measure of scrutiny, but each generally supports the other.

“Many American households, particularly low-income households, spend a large portion of their income on rent. According to the American Community Survey, out of 43 million renter households in the United States in 2017, 46 percent paid more than 30 percent of their income on housing, 31 percent paid more than 40 percent, and 23 percent paid more than 50 percent. Among renters with incomes of less than $20,000 in 2017, about 74 percent paid more than 30 percent of their income in rent. For those renters with income between $20,000 and $50,000, about 61 percent paid more than 30 percent of their income in rent.

Meanwhile, a significant number of Americans go without housing altogether, sleeping instead on the streets or in homeless shelters. Just over half a million people were homeless on a single night in January 2018, with 35 percent of those found in unsheltered locations not intended for human habitation, such as sidewalks and public parks (HUD 2018). Research has linked higher rents to higher rates of homelessness (e.g., Quigley, Raphael, and Smolensky 2001; Corinth 2017; Hanratty 2017; Nisar et al. 2019).”

Note that the above supports several reports and contentions advanced by MHProNews and MHLivingNews. For instance, housing affordability – or the lack thereof – is fueling homelessness in many areas. We’ll mention our previous analysis of the Seattle is Dying and similar mainstream media news, because that relates to manufactured housing connected issues in ways that others may have missed.

“The housing affordability problem shows no signs of subsiding, given that home construction fails to keep up with demand in some places, putting upward pressure on home prices and rents. Indeed, from 2010 to 2016, housing construction failed to keep pace with household formation, according to the Census Bureau. Home construction per capita has declined every decade since the 1970s. While an average of 8.2 homes were built for every 1,000 residents between 1970 and 1979, annual average construction fell to 3.0 homes per 1,000 residents between 2010 and 2018. Across States, there is large variation in housing construction, according to State-level data from the Bank of Tokyo–Mitsubishi. For example, from 2010 to 2018, Texas built 5.3 homes and Florida built 4.3 homes per 1,000 residents, on average. Meanwhile, over the same period, California built 2.0 homes and New York built 1.7 homes per 1,000 residents.

A key driver of the housing affordability problem is excessive regulatory barriers to building (single and multifamily) housing in a selected number of areas in the United States. In a competitive market, developers will build homes until (economic) profits fall to zero or, in other words, until the price the developer receives for the home equals the cost to produce the home.

However, overly burdensome regulations in some areas restrict housing supply and drive the price of a home above its minimum profitable production cost: the cost of construction plus the price of land to build on in a free market and a normal profit margin. In terms of the standard model of supply and demand, regulations make supply less elastic, causing prices to increase and quantity to decrease. In this way, Glaeser and Gyourko (2018) note that regulation that drives home prices above production costs acts as a “regulatory tax” on housing. Regulations that can potentially drive up home prices include, for example, overly burdensome permitting and review procedures, overly restrictive zoning and growth management controls, unreasonable maximum-density allowances, historic preservation requirements, overly burdensome environmental regulations, and undue parking requirements.

It is important to emphasize that an adequate amount of smart regulation is important to address market failures and reflect the reasonable concerns of current neighborhood residents regarding new housing development. In chapter 1 of this Report, we review evidence that gains in housing wealth contributed to the growth of total household wealth from 2016 through 2019. Many growing areas are highly successful in balancing neighborhood concerns with the need to expand housing supply to meet growing demand. In fact, housing prices are near or below the cost to produce a home in most areas of the United States, suggesting that low income levels (despite incomes rising in recent years) rather than high home prices are the reason some households struggle to cover housing costs in those areas. However, research has shown that as a result of excessive local regulatory barriers to building housing, there are 11 metropolitan areas where the inability to build enough housing to meet demand has driven home prices far higher than the cost to produce a home (Glaeser and Gyourko 2018). These 11 metropolitan areas include San Francisco, Honolulu, Oxnard, Los Angeles, San Diego, Washington, Boston, Denver, New York City, Seattle, and Baltimore. Even in these areas, it is not necessary to build high-rise apartments throughout neighborhoods currently zoned for single-family homes or to eliminate all regulations. Rather, steps to remove excessive regulatory barriers must be taken so that housing supply can expand to meet demand and alleviate extreme housing cost burdens placed on low- and middle-income families.

The excessive regulatory barriers placed on building housing in these 11 metropolitan areas cause economic distress to their current and potential residents. In addition to restricting the ability of property owners to use their property in reasonable ways, these regulations increase costs for both renters and those trying to buy a home. Based on estimates from Glaeser and Gyourko (2018), excessive regulatory barriers (defined as regulations that drive up home prices at least 25 percent above home production costs) drive up home prices by between 36 and 184 percent in each of these 11 metropolitan areas, which also leads to higher rents. These cost burdens are especially problematic for low-income Americans, who pay the largest share of their income on housing.”

There are several items that are noteworthy in the above. Among them is a point of tension with respect to property rights. Shouldn’t those who buy property have a right to use their property in “reasonable ways” – isn’t the right to make licit choices American? Despite that obviously sensible point, zoning and placement laws that bar the use of manufactured homes are de facto an attempt to abridge or deny the right of a property owner to use their property in a reasonable manner, because a federally regulated housing product deserves an opportunity for proper installation and use.

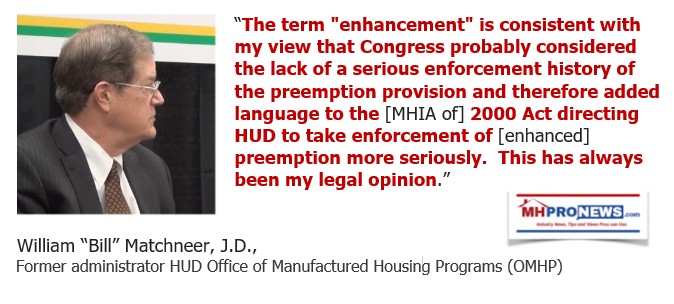

That principle is enshrined in the Manufactured Housing Improvement Act of 2000, notably in its “Enhanced Preemption” provision. To understand that, first consider what periodic MHI adviser Bill Matchneer said, and then ponder the related and more detailed quote from Mark Weiss, J.D., president and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR). Then circle back to the report linked below that quotation.

Returning to Chapter 8, “By increasing rents, overly burdensome regulatory barriers to building housing increase homelessness. As estimated by the CEA (2019), relaxing excessive regulatory barriers in these 11 metropolitan areas where housing supply is significantly constrained would reduce homelessness by an average of 31 percent in these areas. For example, homelessness would fall by 54 percent in San Francisco, 40 percent in Los Angeles, and 23 percent in New York. Because these areas contain 42 percent of the U.S. homeless population, homelessness would fall by 13 percent in the United States overall if each area adequately addressed its regulatory barriers.

Overregulation of these selected housing markets also reduces the efficiency of government housing assistance because fewer American families receive assistance for a given budget outlay. In 2019, the Department of Housing and Urban Development (HUD) was provided $42 billion for its largest rental housing assistance programs: Section 8 Housing Choice Vouchers ($23 billion), Section 8 Project-Based Rental Assistance ($12 billion), and Public Housing ($7 billion). Because HUD rental assistance is tied to market rents in an area, regulations that drive up rents also increase the costs of serving a fixed number of families. Deregulation that reduces rents in supply-constrained areas could produce savings for HUD that could be used to serve more families. For example, Federal taxpayers can pay more than $4,000 per month in rental assistance toward a three-bedroom unit in San Francisco County, California, compared with about $1,500 per month in Harris County, Texas.”

“In addition to specific harmful effects on low-income Americans, excessive regulatory barriers in selected markets have other negative consequences for all Americans. First, they reduce labor mobility across areas, which stunts aggregate economic growth and increases inequality across regions and workers. When it is more expensive for workers to live in areas where they are most productive, they are less likely to do so and their productivity falls. Hsieh and Moretti (2019), for example, estimate that gross domestic product would have been 3.7 percent higher by 2009 if housing supply restrictions in the New York, San Jose, and San Francisco areas were relaxed beginning in 1964.

Second, excessive regulatory barriers to building housing in selected markets reduces parents’ ability to access neighborhoods that advance their children’s economic opportunity. A series of papers by Raj Chetty and his colleagues have identified neighborhoods that are most likely to improve longterm outcomes of children (Chetty et al. 2018). High home prices are a common characteristic of such neighborhoods, suggesting that excessive regulation that artificially increases home prices may reduce in-migration and diminish opportunity for children. A report from the U.S. Senate Joint Economic Committee similarly found that the average U.S. zip code with the highest quality public elementary schools has a median home price that is four times as high as those zip codes with the lowest-quality public schools (JEC 2019). This is partly due to the willingness of some parents to pay more for homes located in high-quality school districts. Many of these areas have excessive regulatory barriers, however.”

Third, excessive regulatory barriers to building housing increase commuting times because housing cannot be built near where people work, increasing driving time and traffic congestion, which harm the environment. The average commuter spent 54 hours in traffic congestion in 2017, up from 20 hours in 1982 (Schrank, Eisele, and Lomax 2019). The aggregate travel delay increased from 1.8 billion hours to 8.8 billion hours over this period, and the total cost associated with congestion rose from $15 billion to $179 billion. As a result of this rise in average commuting times, an extra 3.3 billion gallons of fuel were consumed.”

What the above does is confirm the report previously cited at this link here, and which is illustrated at this below.

That linked report lays out the evidence and research based argument that having more affordable homes – specifically, manufactured homes – would boost economic activity by an estimated $2 trillion dollars a year.

“…To more successfully address the overregulation of housing markets, President Trump signed an Executive Order on June 25, 2019, establishing the White House Council on Eliminating Regulatory Barriers to Affordable Housing. Recognizing the harmful impact of these regulations on economic growth, opportunities for children, homelessness, and the cost of government programs, the council is tasked with identifying the most burdensome Federal, State, and local regulatory barriers to housing supply as well as actions that can best counter them. The Executive Order requires the council to determine how each Federal agency can curtail impediments to housing development, including in ways that “align, support, and encourage” State and local authorities to address local regulatory barriers.”

“…This chapter proceeds by first documenting the housing affordability problem in the United States. It then identifies the key role that excessive regulatory barriers play in the problem in a selected number of metropolitan areas. Next, it provides evidence of the many harmful consequences of these barriers, especially harm to low-income Americans. Finally, it concludes by discussing actions the Administration has taken to encourage the relaxation of excessive regulatory barriers in local housing markets.1”

The next section is entitled “The Role of Overregulation in the Housing Affordability Problem,” but we will circle back to the forward for this same chapter. It is the only place that manufactured housing is mentioned.

The mention of manufactured homes is near the middle of this segment. This will be followed by our MHProNews analysis.

“Incomes in the United States are rising, but home prices are rising much faster in some highly regulated markets. While overall homeownership rates have increased since 2016, some disadvantaged groups lag behind. As households turn to the rental market, moderate-income households are dedicating a large share of their incomes to rent. The housing affordability problem shows no signs of subsiding in certain markets, as housing construction fails to keep up with demand, putting upward pressure on home prices and rents.

Fortunately, the majority of areas in the United States have relatively well functioning housing markets in which regulations do not significantly drive up prices. Indeed, smart regulations that balance the need to build enough housing to meet growing demand while reflecting the reasonable concerns of neighborhood residents are achieved by many growing areas in the country. While areas with relatively moderate home prices may still suffer from some issues, such as delays for building permits, regulations do not necessarily make homes substantially less affordable.

However, research has shown that there are 11 metropolitan areas where the inability to build enough housing to meet demand has driven home prices far higher than the cost to produce a home. These 11 metropolitan areas include San Francisco, Honolulu, Oxnard, Los Angeles, San Diego, Washington, Boston, Denver, New York City, Seattle, and Baltimore.

Housing is particularly difficult to build in these 11 metropolitan areas due to excessive regulatory barriers imposed by State and local governments. Such overly restrictive regulations include zoning and growth management controls, rent controls, building and rehabilitation codes, energy and water efficiency mandates, maximum-density allowances, historic preservation requirements, wetland or environmental regulations, manufactured-housing regulations and restrictions, parking requirements, permitting and review procedures, investment or reinvestment tax policies, labor requirements, and impact or developer fees. Research has linked higher home prices and lower housing supply to many of these regulations.

Resulting higher housing prices in these 11 metropolitan areas make homeownership less attainable for otherwise-qualified borrowers, thereby constraining their ability to achieve sustainable homeownership and putting additional pressure on rental markets for lower- and middle-income households. The lowest-income households are especially burdened. Among these 11 metropolitan areas, homelessness would fall by an estimated 31 percent on average if overly burdensome regulations were relaxed. Higher rents resulting from these regulations also deprive families of Federal rental housing assistance, because higher government expenditures on households in high-rent areas, through higher Fair Market Rents, reduce the amount of funds available to serve other needy families. For example, housing a family in a three-bedroom apartment can cost the Federal Government more than $4,000 per month in San Francisco County, California, compared with about $1,500 per month in Harris County, Texas.

Excessive regulatory barriers to building more housing in these specific areas also have broader negative effects beyond those imposed on lower-income Americans. State and local housing regulations reduce labor mobility by pricing workers out of several of the Nation’s most productive cities, which stunts aggregate economic growth and increases inequality across regions and workers. Excessive regulatory barriers also reduce parents’ ability to access neighborhoods that best advance their children’s economic opportunity. And by incentivizing families to venture further from their places of work to find affordable housing, overregulation can increase commuting times to work, thus harming the environment, straining local budgets, and decreasing worker productivity.

Removing government-imposed barriers to more affordable housing is a priority for the Trump Administration. Beyond establishing the White House Council on Eliminating Regulatory Barriers to Affordable Housing, the Department of Housing and Urban Development is encouraging State and local governments to focus on increasing housing supply in areas where supply is constrained. Increasing housing choice for all Americans requires taking on regulatory barriers that place housing in large swaths of specific areas out of reach for lower-income families.”

Next, let’s jump to the conclusions section of this chapter from the federal report, all of which is found linked here.

Conclusion

“How to increase housing affordability through regulatory reform is an issue that has garnered bipartisan attention in recent years. In this chapter, we have focused on excessive regulations that substantially drive up home prices in a selected number of metropolitan areas. Relaxing these regulations would greatly benefit Americans, especially those with lower incomes, by reducing the cost of attaining homeownership and reducing rents in supply-constrained areas. Falling rents resulting from relaxing excessive regulations would reduce homelessness by 31 percent on average in these areas, and more families could be served by Federal rental housing assistance programs. Broader benefits would include increased economic growth, reduced regional disparities, expanded opportunities for children, and a cleaner environment.

We have also emphasized that addressing the problem of overregulation with more regulation would be counterproductive. Rent control can increase housing prices by reducing the incentive for developers to build new housing. Similarly, expanded government subsidies for housing do not solve the problem of overregulation. When housing supply is constrained, housing subsidies for tenants may increase market rents without increasing the quantity of housing, counteracting the goals of these programs.

The Trump Administration has taken steps to address onerous housing regulations. President Trump issued an Executive Order in 2019 to establish the White House Council on Eliminating Regulatory Barriers to Affordable Housing, which is tasked with reviewing housing regulations at all levels of government and submitting a report to the President in 2020 with recommendations on how to ameliorate these excessive regulatory burdens.

HUD has also taken action under the Trump Administration to counter regulatory barriers to building affordable housing. The Affirmatively Furthering Fair Housing rule, which was finalized during the previous Administration, is being revised to focus more clearly on increasing housing supply in areas where supply is constrained. This rule recognizes that increasing housing choice for disadvantaged groups requires taking on regulatory barriers that place housing in large swaths of specific areas out of reach for lower-income families.”

That should be juxtaposed with HUD Secretary Carson’s related comments addressed to manufactured housing professionals.

Once more, the entire White House economics report is linked here as a download, and Chapter 8 is found starting on page 267.

MHProNews Analysis and Commentary

Chapter 8 is just shy of 10,000 words, about 9,900 words. Manufactured housing is mentioned once. If someone read the report MHProNews mentioned about Manufactured Housing Institute (MHI) ‘partner’ competitor MHInsider, they would not realize the scant attention given to manufactured homes. So, this report – in passing – mentions that because other ‘sources’ for information in the industry are routinely into spin to a degree that is arguably problematic. But that may also be why there are scant readers, per their own data, to their purportedly weaponized articles. For details, see the report linked below.

That segue about MHI-connected spin aside, much of this White House document is packed with useful data, certainly in this specific chapter. As noted above, MHProNews will in the days ahead critique a chapter in the federal report that in our view has significant flaws. That teaser noted, this report should be viewed through two different perspectives.

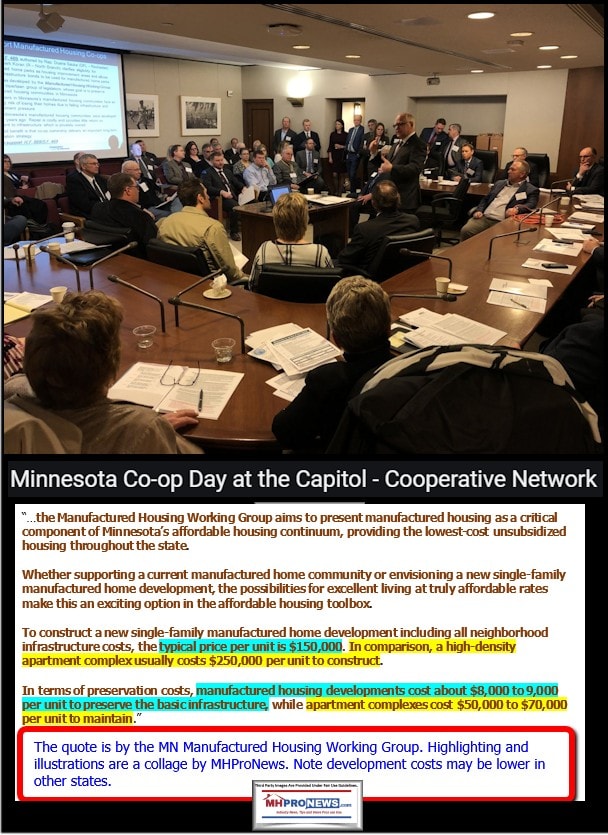

- The federal data confirms years of our research on MHLivingNews and MHProNews. What the report should be viewed at by objective thinkers is that this documented a virtual roadmap for the tremendous potential for manufactured housing. To understand that potential, the bipartisan research report linked below published on MHLivingNews spotlights how much money can be saved by using manufactured homes versus multifamily or single-family housing.

- The obvious solution to the well documented challenges of regulatory burdens impacting affordable housing is dramatically increased access to manufactured homes. Let individual Americans decide what goes on their single-family housing homesite. For millions of Americans, no other form of so-called ‘affordable’ housing will even come close. That’s been documented for decades.

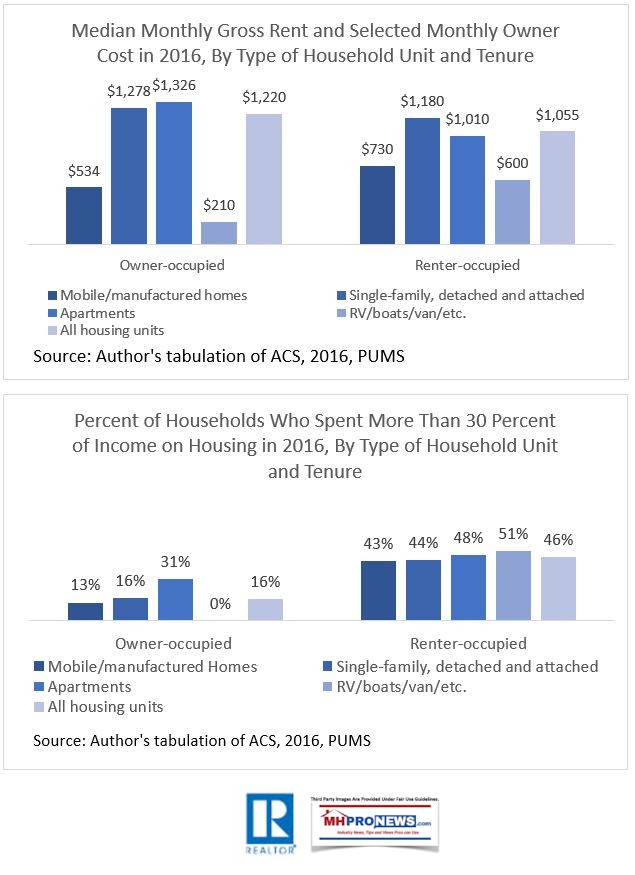

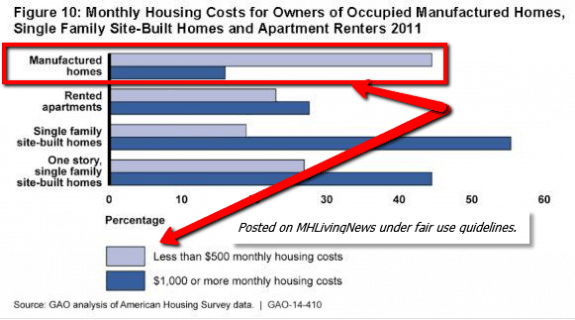

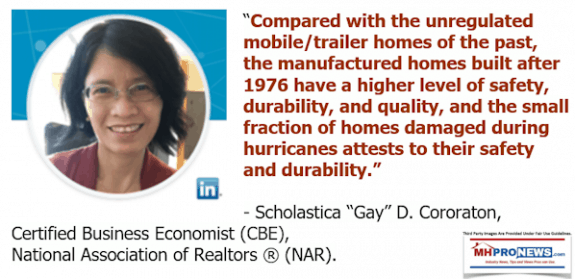

The Government Accountability Office’s 2014 research, as well as the National Association of Realtors research in 2018 underscores that manufactured homes are often less costly on a monthly payment basis than other options.

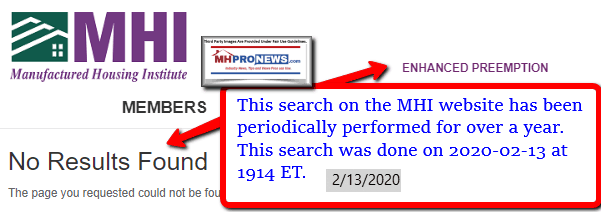

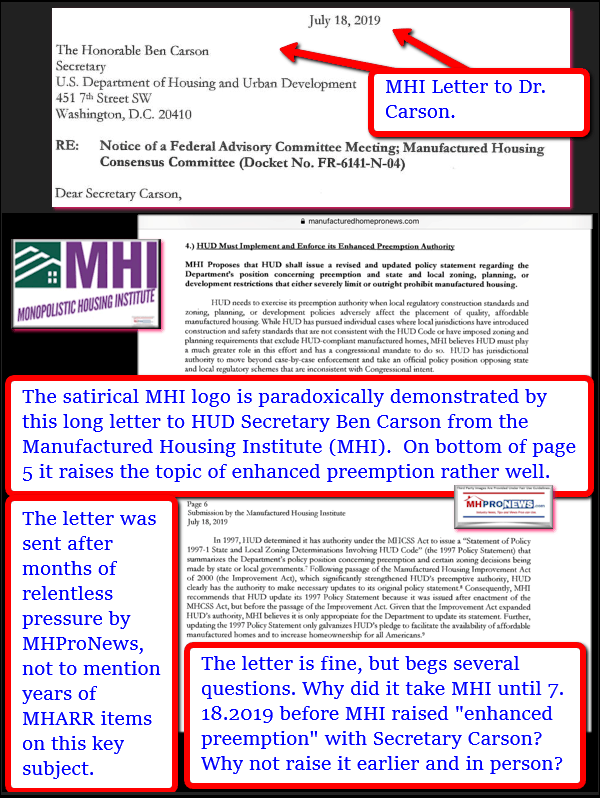

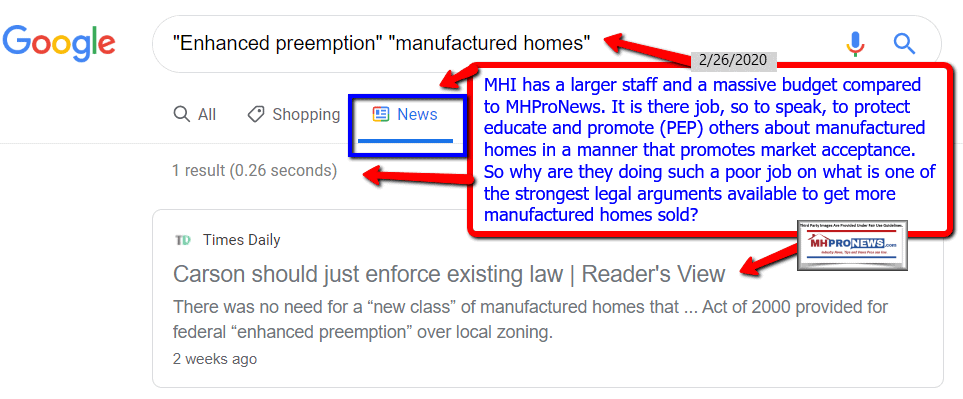

When the problem is understood, that begs the question, why isn’t the solution being deployed? That solution on a practical level is manufactured housing placements made possible by the enhanced preemption provision of the MHIA 2000. So why isn’t MHI and their reportedly rewarded surrogate-bloggers and trade publishing pushing that obvious point?

MHI clearly has the access. That’s what the photo opportunities and videos demonstrate. MHI has had Dr. Carson hosted several times. Why is there no known use of the phrase “enhanced preemption” made by Dr. Carson?

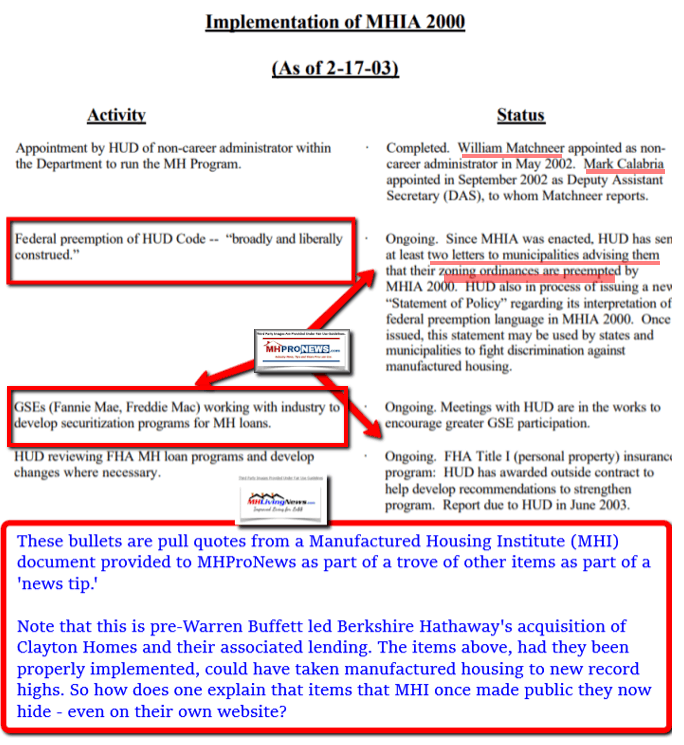

The contrast between MHI of the past on this issue and MHI in the post-Berkshire Hathaway era is revealing. The base document that is annotated by MHProNews below was provided as a news tip from a connected source, which documented that this page used to be on the MHI website.

Under Pressure, MHI Pivots “HUD Must Implement and Enforce its Enhanced Preemption Authority”

So, why is MHI not pushing enhanced preemption or a proper application of the Duty to Serve manufactured housing in the post-Berkshire era – even on their own website?

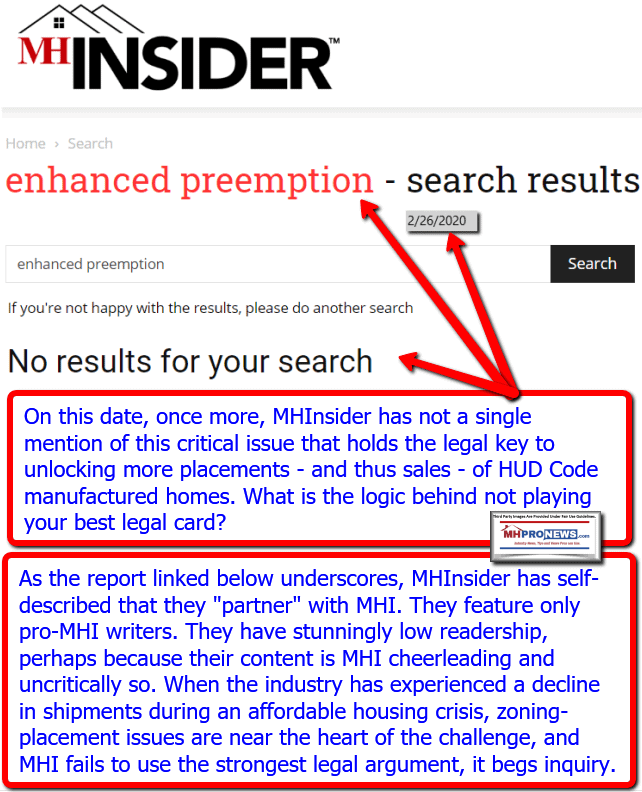

The same is true for MHI-‘partner’ media too, as the example below reflects. This is significant, as the contrast that follows will reflect.

By contrast, Washington, D.C. based MHARR dwarfs the use and mentions of enhanced preemption. Note that MHI’s website has been online for decades, MHARR for about 3 years. That makes the contrast all the more stunning.

But note that not only has MHI failed to mention enhanced preemption themselves, they have failed to use their news media resources. The only mainstream news mentions comes from MHProNews’ publisher.

Under an all categories searches, MHARR, MHProNews and MHLivingNews dominate. Which certainly creates a reasonable presumption that MHI and their ‘big boy’ backers are essentially ‘hiding’ in this useful term. That begs the question, why?

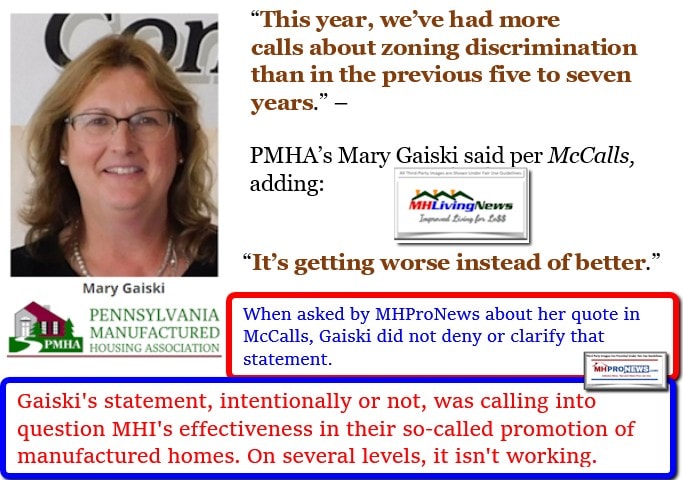

Then, consider the initiative that MHARR launched almost a year ago after the 2019 Tunica Show. They offered to team up with state associations to fight zoning problems. That zoning is an issue is underscored by Mary Gaiski’s recent comment, that only confirms what the White House research already said.

Yet, despite that growing problem, MHARR reports that they had no takers for their generous offer.

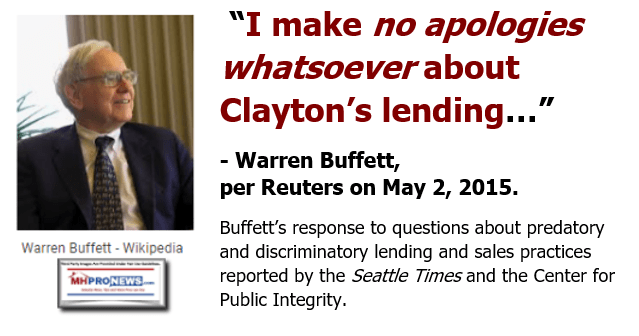

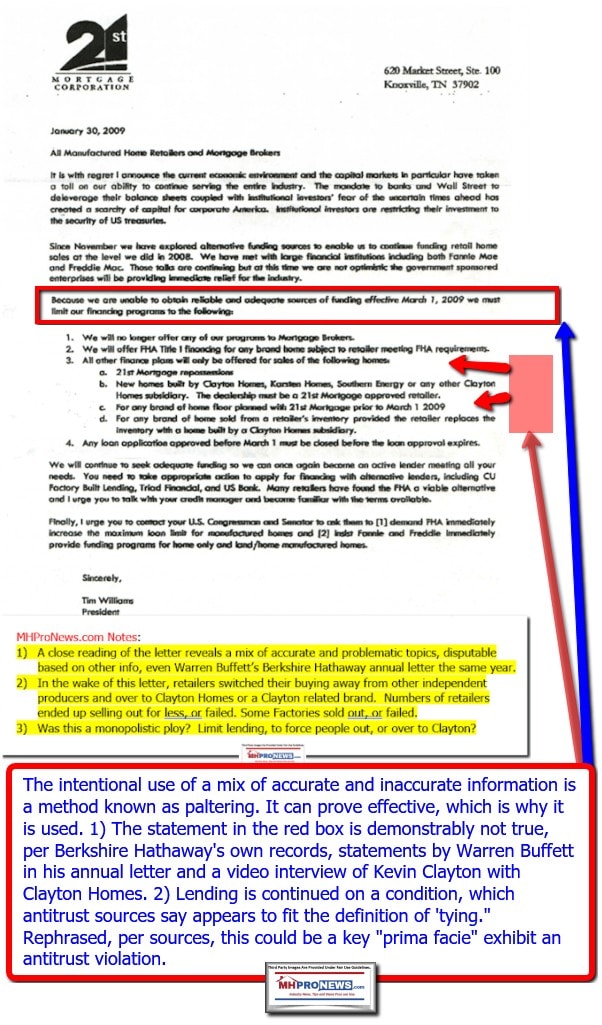

Those factoids spotlight what ought to be part of the industry’s conversation. Not only has MHI been apparently weaponized to thwart industry growth, but state associations have often been neutered too. Why? A logical deduction, based on the evidence, Warren Buffett’s, Kevin Clayton’s and Tim Williams’ (21st Mortgage and prior MHI chairman) statements is that slowing growth or thwarting it makes consolidation of the industry more likely and at more affordable prices.

That has a spillover impact on manufactured home communities and their residents too. Because when some 10,000 manufactured home retailers where lost, the decades of historic dependence of thousands of independently owned communities on independent retailers. That’s market manipulation on a stunning level that arguable is a prima facie case of antitrust violations.

The stunning lack of logic on the Clayton-supported MHI “CrossModTM homes” project is another wrinkle to this vexing pattern of MHI’s failure to behave in a normal or expected fashion.

The federal government, as well as state and local governments, are already probing Clayton Homes and their related firms. But there is more that arguably needs to be done.

Part of that more could be public hearings using subpoena powers that compels production of documents from Clayton Homes, 21st, MHI, Fannie Mae, Freddie Mac and the likelihood that some federal public officials are acting in either an inept or corrupt fashion.

In summary, this White House document has provided a very useful backdrop of research. That research should lead to a full and proper implementation of federal law.

Or as our publisher has said, Dr. Carson and other key officials should enforce the law. Enforcing the law would open up tremendous opportunities.

Enhanced Preemption for Manufactured Housing Raised on Brian Kilmeade Show

To go deeper on the growing track record of related issues that have arguably been keeping manufactured housing underperforming during an affordable housing crisis, see the timely reports further below. That’s it for this report on manufactured housing “Industry News Tips and Views Pros Can Use“ © – MHVille’s runaway #1 news source, where “We Provide, You Decide.” © (News, fact-checks, analysis, and commentary.) Notice: all third party images or content are provided under fair use guidelines for media.

Submitted by Soheyla Kovach for MHProNews.com. Soheyla is a co-founder and managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

Manufactured Home Communities Targeted by Lawmakers, AG Plans – Manufactured Housing Industry Alert

No Title

No Description

No Title

No Description

No Title

No Description

There is more than enough evidence that there is corruption, deceptive trade practices and other arguably illegal activities that are benefiting a few to the harm of the many. See the related articles below.

The bad news is that the opposition to ethical ‘white hat’ businesses, investors and other professionals have deep pockets and they are politically connected. But the good news is that Bernie Madoff could have once made that similar claim. Today, Madoff sits in a federal cell. It took persistence on the part of a few professionals with federal officials to finally topple Madoff’s multi-billion dollar empire.