What follows is further below is a Q&A interview with Dustin Arp, president of Spark Homes in New Braunfels TX. Arp, who per the Texas Manufactured Housing Association (TMHA) is “One of the first manufactured homes conforming with the requirements of the pilot programs recently launched by the Government Sponsored Entities, Freddie Mac and Fannie Mae, was placed on a lot near Canyon Lake by developer Dustin Arp…”

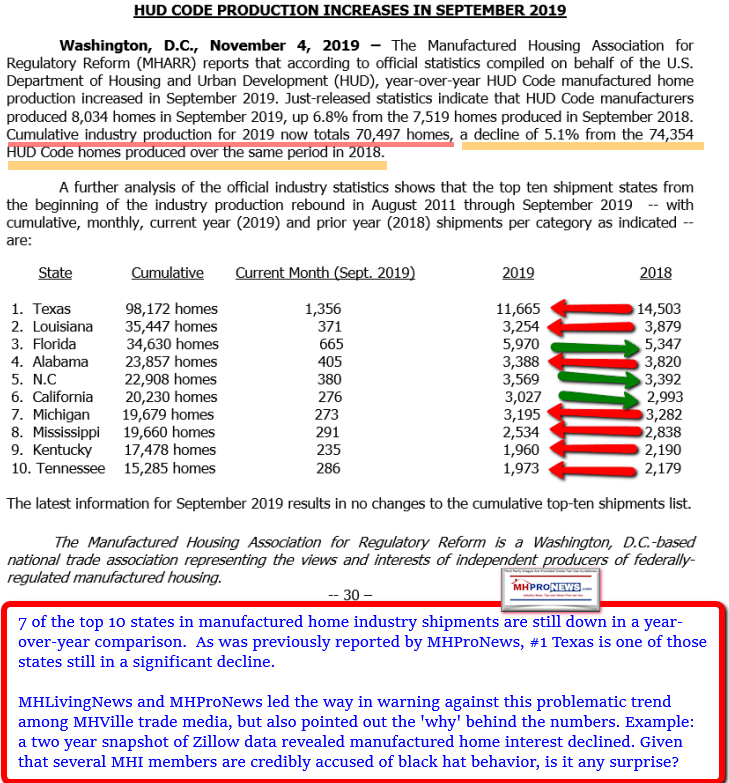

Texas, as long-time industry professionals know, is the top state in the nation for the production, shipments and sales of new HUD Code manufactured homes. The screen capture that follows tells part of the backdrop to this tale, which is that Texas is slipping.

This report will next provide the messages and interview Q&A first, followed by an MHProNews analysis.

The email that follows is from publisher L. A. ‘Tony’ Kovach to Dustin Arp, who responded to the questions in a timely and respectful fashion.

Dustin, As you may know, MHProNews.com is the largest and most read trade media serving manufactured housing professionals. The article below about your project was brought to our attention, and we plan a report today on this topic.

https://www.texasmha.com/news/featured/texas-deployment-of-mh-advantage-homechoice-homes

As a disclosure, we see the ‘new class of homes‘ dubbed “CrossModTM homes” supported by Fannie Mae’s MH AdvantageSM and Freddie Mac’s CHOICEHomeSM as problematic for the HUD Code manufactured home industry at large for reasons we’ve previously reported on several times. That said, we recognize the right of producers and retailers to sell whatever they like within the norms of the law and ethics. The issue in our view is focused more with the GSEs denying the same type of lending to all HUD Code manufactured homes, and how that came to be.

That said, we hereby request that you email us the following for our planned report. Please hit reply on this message and type your reply below each question for our mutual accuracy, clarity, and ease of handling.

Arp’s Replies –

Tony,

Please see my responses below. I welcome opposing points of view to help the industry grow – we don’t have to agree to work well together. That being said, I would ask that you use any quotes you use in their entirety so the thoughts retain their intended meaning. Good luck with your article and I hope it turns out well. Please send me a copy when you publish!

- Was the home that got the offer a modular home or was it the CrossModTM home?

“It was an 1120 square foot MH advantage home.”

- What were the price points on those homes reported in the story?

“The waterfront modular homes haven’t been listed yet but they are not representative of the volume products we are offering because of the specialty nature of the land features. The MH Advantage home is listed at $159,995.”

- What is the approximate price difference between a standard HUD Code manufactured home you sell of a similar size to the new class/ CrossModTM home?

“It would be hard for me to quantify an average here as we generally deal exclusively in the CrossMod product lines. We use all traditional conforming conventional or government financing programs so this arena is most attractive to us.”

- Finally, do you think that all HUD Code manufactured homes should have the same access to Fannie Mae and Freddie Mac lending as the ‘new class’ a.k.a. CrossModTM homes are getting?

This is a complicated question.

On why GSEs would treat the products differently:

“CrossMod homes are HUD Code manufactured homes but the nature of the site preparation and the standard features from the manufacturer make them uniquely capable of gaining share against production builder products because of the market reaction they get. Fannie Mae and Freddie Mac have identified that the traditional real estate consumer looking to purchase in the secondary market finds the transition from the current products they are considering to HUD code homes more palatable if the standard features of those homes more closely conform to what they see in the site built housing market. That increased demand represents lower collateral risk to the mortgagee so it makes sense that it would be treated differently from a financing perspective.”

On how CrossMod affects valuation in the real property market:

“By making the CrossMod (MH Advantage/CHOICEhome) designation, GSEs allow appraisers to identify a concrete difference (the label) between the volume product our industry builds and the top 5-10% of the homes from a feature standpoint. I think anyone in our industry that is operating in the real property arena can relate to ordering a high end home that a client wants only to have it compared to a older, less feature rich sale by an appraiser and ultimately losing a deal because it didn’t make value. The CrossMod product allows appraisers to hit the reset button from a comparable sale perspective to more accurately account for feature differences between our upper end products and houses that generally use chattel financing products anyway. As a result, it more accurately accounts for the costs that are incurred by performing the site work required to gain access to the better financing programs without negatively impacting the valuation of homes that do not meet the minimum criteria since those products will be valued the same way as they always have been.”

Thanks,

Dustin Arp

President / Spark Homes, LLC

###

Those replies above resulted in a set of follow up questions from MHProNews’ publisher to Arp. He once more responded in a timely manner, as shown below. Note that typos, capitalization, or spacing errors above and below are in the original. The ellipsis … reflects words edited out from our publisher’s statements for the focused purposes of this report. Arp’s replies are word for word as he provided.

Dustin…

Same Q&A guidance as before, which you did perfectly in your last response. Please type your reply below each question for our mutual clarity and accuracy. Got the video, but if you’d send stills of that home and a photo of yourself, if it comes soon enough, we will use it.

Thanks for your feedback. Your points were well made.

Regards,

Tony

Arp’s 2nd Set of Replies –

Tony,

Please see attached Photos.

See Below for my responses to your questions:

- Do you think that FHFA, Fannie and Freddie should follow the letter of the law?

“This question implies that property overlays do not conform to the letter of the law. FHA has been given a duty to serve as well but they have property specific requirements (foundation engineering, decks, steps, skirting, siding and other code related items) in order to be eligible for FHA financing and their fulfillment of the duty to serve has not been in question. Traditionally GSEs have had lower property specific requirements than government backed loan programs. That being said, risk based pricing will always be a driving factor behind loan programs.

If research shows that higher feature standards create less collateral risk and the GSEs are willing to price that lower risk into a new category of conventional financing, then the rollout of the CrossMod programs give consumers interested in HUD code housing more financing options than they previously had, not fewer. If the introduction of the CrossMod financing programs eliminated the previous GSE financing offerings then I would be concerned, but since we now have two programs available it simply shows the GSE’s have identified the lower collateral risk associated with the improved product quality our industry now has available.

By introducing these new programs, the GSE’s now have arguably fulfilled their duty to serve the affordable housing as good or better than FHA has since they offer 1. A lower (3%) down payment option, 2. The ability to eliminate mortgage insurance once the consumer has 20% equity, 3. The ability to use site built comparables to help fill in sale data gaps when good comps aren’t available, 4. Similar risk evaluation on automated findings, 5. No loan level pricing adjustments for property types, 6. Subsidized mortgage insurance and 7. The option to finance a home without an engineered foundation under the traditional conforming MH product.”

- Should all manufactured housing be able access these GSE backed loans, new or preowned?

“Homes that have been moved represent more collateral risk than homes that haven’t been moved. Additionally the requirement that a home have a permanent foundation implies that any foundation that was detached from the home was, by nature, not permanent. Because of these factors, I have no problem with this requirement when it applies to GSE backed mortgage financing.”

- Should personal property (home only, chattel) loans be given the same access as land home under DTS?

“In short, no. GSEs are tasked with creating a secondary market for mortgage backed securities. If the loan doesn’t secure real property, it isn’t a mortgage in a traditional sense. I would not have a problem with a government sponsored entity creating a secondary market for personal property loans, but it would invite oversight and regulation that I am not sure the retail body would welcome. Most investors would be incentivized to conform to the requirements set out by a secondary market maker. Anyone who has been in the mortgage industry or has been through the paperwork process of getting a mortgage would probably agree that requirements that have been implemented by GSEs are often arbitrary and exclude many situations that would otherwise make sense. It would also likely add licensing requirements and paperwork processes that could create added compliance expense and exposure for retailers. I think the chattel financing market benefits from consumers falling out of traditional mortgage financing because consumers that can’t meet the GSEs stringent documentation requirements. Those consumers often find their way to our industry to have a housing option.”

— End of Interview Q&A —

MHProNews Analysis and Commentary

The replies were useful and in several respects, revealing.

Let’s begin by noting anew that MHProNews editorially respects Arp’s or anyone else’s right to sell what he or she wants to within the norms of the law and good business ethics. We also respect the fact that he thoughtfully provided timely answers, perhaps knowing that we would see it differently, as his own comments stressed.

Takeaway # 1.

“…I welcome opposing points of view to help the industry grow – we don’t have to agree to work well together…” – Dustin Arp, Developer, Spark Homes.

That should be the most celebrated sentence in the entire article. On that focused concept that two people need not have the same starting – or ending – viewpoints in order to work effectively with each other, we 100 percent concur.

In fact, we’d stress that our reports are geared toward ethical, sustainable growth. So growth of the industry – says Arp – is his goal, and ours too.

If only more manufactured housing professionals adopt Arp’s mantra. More pros should be willing to take the questions and provide answers that can help others inside and outside of manufactured housing ponder their relevance and value. He deserves kudos for his effort.

Takeaway #2

Having given Arp credit for his timely and detailed responses, let’s focus on this portion of his last reply.

“In short, no. GSEs are tasked with creating a secondary market for mortgage backed securities. If the loan doesn’t secure real property, it isn’t a mortgage in a traditional sense…”

There might be a technical correctness in the sense that some could argued his same point. But it completely misses what the FHFA themselves have stated on their website with respect to DTS.

FHFA’s website says: “The Duty to Serve (DTS) requires Fannie Mae and Freddie Mac (Enterprises) to facilitate a secondary market for mortgages on housing for very low-, low-, and moderate-income families in: Manufactured housing…”

Note that 21st Mortgage Corporation makes thousands of chattel or personal property loans, but they use the word “mortgage” in their name. Is that misleading? Arguably, not.

Next, is the dictionary definition. It clearly allows for either a real or personal property understanding.

Further, much of the thrust of the discussion around DTS from its origins has been around chattel lending. MHARR – the Manufactured Housing Association for Regulatory Reform – carried the water on DTS during the debate of the Housing and Economic Recovery Act (HERA) of 2008. They helped write that part of the bill. They know it was meant to include home only as well as land-home.

That is relevant, both as to Congressional intent and to the purposes of the FHFA’s administration of the loans.

From the outset home-only loans were a key focus in the industry’s desire for an alternative to Berkshire Hathaway portfolio lenders. That home only loans are part of the desire even of lawmakers and others is outlined in detail in the statements of the researcher for the Minneapolis Federal Reserve’s report earlier this month. Tribal lands – and other property in various parts of the U.S. – may be easier to develop lending for with personal property vs. traditional land-home mortgages.

Simply put, on this point, however well indented, Arp is objectively mistaken. There is more proof, but that will suffice for now.

Takeaway #3

We’ll plan to look at other parts of Arp’s comments another time. But at this time, here is the final set of thoughts for today — which are collectively MHProNews’ bottom line.

While once more stressing the respect Arp – or any other retailer, producer, developer or community – should get allowing them to sell such products as they wish in a lawful and ethical fashion, his interpretation of DTS would logically continue the harm being done to millions of manufactured housing’s consumers.

That by extension harms the industry’s potential home buyers too. Consumer and manufactured homeowner Robert Van Cleef explains why this issue does and should matter to millions.

Unique Opportunities for More Competitive Lending for All HUD Code Manufactured Homes

As MHLivingNews has previously pointed out, the Warren Buffett supported Urban Institute said this in 2018, that a lack of lending likely keeps existing manufactured homes from appreciating even more than they already do.

Rephrased, what Arp and any others who take that vantagepoint or a similar view may or may not realize is this. They are undermining the long-term interests of the homeowners and thus the industry. When consumers benefit, the bulk of the industry’s independents and would be investors also win.

MHI’s former president made that case, which we’ve set in the context of the Urban Institute point referenced. Specifically note Chris Stinebert’s closing point in the report linked below, which is applicable.

The other side of the coin also applies.

Yes, making the DTS mandate for a secondary market for both mortgage and chattel lending would be good for millions, but would no doubt would cost some profits for Berkshire Hathaway lenders in the industry, perhaps a few others too. But isn’t that why the Omaha-Knoxville-Arlington axis have sought so diligently to twist DTS into something it was never meant to be?

It is thus entirely unjustified for DTS to be a specialized loan program for ONLY the CrossModTM homes. That ignores the plain meaning of what FHFA said, once again: “The Duty to Serve (DTS) requires Fannie Mae and Freddie Mac (Enterprises) to facilitate a secondary market for mortgages on housing for very low-, low-, and moderate-income families in: Manufactured housing…”

For better or worse, there was a secondary market for manufactured homes in the 1990s. It clearly suffered abuses. But so to did conventional housing in the runup to the financial crisis. There were trillions in losses on conventional housing. Are conventional housing lenders and builders still suffering over a decade after the 2008 mortgage and housing crisis? No.

Neither should manufactured home customers for ‘sins’ that date back almost 2 decades ago.

Warren Buffett has strengths and weaknesses like any person. He made this observation, per Kevin Clayton.

Perhaps Buffett better understood than most that lending and valuations were a choke point in MHVille.

To level the playing field for the 22 million who live in a manufactured or mobile home – plus the millions more stuck in rentals that could never buy either a new conventional house or this new class of more expensive manufactured homes – there must be competitive lending made available from Fannie and Freddie, among others.

Our analysis and advocacy as presented by Tony Kovach at the link below thus stands.

Notice: MHProNews will be on a Reduced Publishing

Schedule for about the next 10 days. That still

leaves us the runaway largest provider of industry

news, fact checks, analysis and reports.

Arp’s comments will add to the broader conversation that the industry should have about DTS. But the majority of industry professionals must keep in mind that decades or research have supported the value of ALL – not a select few – HUD Code manufactured homes. That value must be protected.

Here, we look clinically at subjects. We seek to separate what may benefit a few from what ought to be benefit the majority. Enforcing good existing laws fully and without exception ought to be the industry’s simple mantra.

That’s the kind of pragmatic fact checks, research and analysis that makes us the runaway number #1 manufactured home “Industry News, Tips, and Views Pros Can Use,” © source, where “We Provide, You Decide.” © (News, fact-checks, analysis, and commentary.)

Soheyla is a co-founder and managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

Related Reports:

Click the image/text box below to access relevant, related information.

White House Council Requesting Input From Manufactured Home Industry on Affordable Housing Barriers

Publicly Traded Manufactured Housing Firms – Which Source Do You Trust More? Why? MHI, MHARR, Others

Unique Opportunities for More Competitive Lending for All HUD Code Manufactured Homes