It is a legal victory being hailed by plaintiffs as a “landmark case” securing a record settlement against a community operator that attorneys said left their residents in squalor while raising site rents rapidly. Readers can decide if that claim is hyperbole, or if this now settled case should send shivers down the spines of numbers of companies in the manufactured home industry.

While this may seem to apply to communities, there are reasons to think that this could be meaningful for retailers and producers too.

Among the allegations in the case were “unfair business practices, retaliatory eviction and financial elder abuse.” The video from 2018 sets the stage and explains the litigation that was already underway at that time.

First, their press release. It is unedited, which means that the terminology errors are in the original. Then following that reslease will be some commentary and analysis by MHProNews.

LOS ANGELES–(BUSINESS WIRE)–Kabateck LLP attorneys representing hundreds of low-income mobile home residents in Long Beach, CA secured a nearly $57 million settlement, which is the largest settlement ever involving a mobile home park.

“Now I can move on with my family and don’t have to live in this crisis anymore”

350 residents of Friendly Village Mobile Home Park who live in squalor will receive monetary compensation from the owners of the park, who failed to address serious maintenance problems, ignored complaints and hiked up the rent.

“Instead of repairing the park, instead of leveling the homes, the management’s only accomplishment in its four years of owning this park was to increase the rent by 50 percent,” said lead plaintiff attorney Brian Kabateck.

A bankruptcy judge approved a $42.5 million settlement for 151 families who filed lawsuits against the defendants, Michael Scott and Lee Kort. Those plaintiffs obtained $6.9 million paid from prior settlements.

As part of the settlement agreement, the mobile home park will be sold and a substantial portion of the proceeds of that sale, at least $7 million, will be divided between many of the residents, even those who are not part of the litigation.

This landmark agreement resolves litigation that found the owners negligent of unfair business practices, retaliatory eviction and financial elder abuse.

Nearly one year ago on November 27, 2018, a Los Angeles jury awarded $34 million in punitive damages to 30 residents of the Friendly Village Mobile Home Park, which was once a trash dump site for the city of Long Beach. That verdict was in addition to a $5.5 million judgment the jury leveled a week earlier against the owners of Friendly Village.

The land beneath the mobile home units is constantly shifting, causing sewage backups, electrical problems and structural damage to the residents’ property. The residents sued the property owners for failing to fix their dilapidated community.

“Now I can move on with my family and don’t have to live in this crisis anymore,” said Leonard Camarena, the president of the Homeowner’s Association.

The settlement money will help the residents relocate to safer and better-maintained housing.

“This case is about affordable housing in Los Angeles,” said Kabateck.

The plaintiffs’ legal team included Brian S. Kabateck and Shant Karnikian with the Los Angeles law firm Kabateck LLP, and Gary

Fields with the Long Beach firm FieldsLaw.

##

Let’s note before diving into our analysis that similar issues occur in other parts of the housing industry, here in the U.S. or overseas. MHLivingNews has spotlighted examples of those parallels, but here is a more recent video that explains ‘how to spot a cheaply built condo.’

Having briefly made the point that housing problems are far from limited to the manufactured home industry, let’s unpack some of the takeaways from the plaintiffs’ press release above. Some will be generic, but others will including notions that those plaintiffs’ attorneys themselves may not have heretofore pondered.

Those takeaways could furrow brows in offices in Omaha-Knoxville-Arlington and beyond.

MHProNews Analysis and Commentary

Even if half of the settlement went for attorneys and expenses, the sum would represent an average of about $80,571.43 per household in that community. While there have been other big cases and awards for failure to maintain and related, this is certainly one of the big ones on record.

While no two cases are alike, imagine sums like that in a judgment against a different firm, for hypothetical examples, Havenpark Capital or “Frank and Dave’s.” Let’s note from the outset that the possible causes of action are not strictly apples to apples, but there are parallels, so it isn’t all apples and oranges. Indeed there may be some new causes of action that the KBK attorneys didn’t consider.

Impact Communities and Others – Who Are Often MHI Members?

Rephrased, such cases – applying as a hypothetical example – a similar settlement sum against Impact Communities would yield the following math.

- $161,142.86 x 25,000 about homesites = $4,028,571,425. That’s $4.02 billion dollars.

Or ponder what a more modest sum per site might be. Consider jury verdicts or settlements in the range of $15,000 to $45,000 per resident of those land lease communities who are MHI member companies.

- Given MHI’s purported market manipulation which has thwarted the Duty to Serve provisions of the Housing and Economic Recovery Act (HERA) of 2008,

- coupled with the Impact of limiting the use of the enhanced preemption provisions of the Manufactured Housing Improvement Act (MHIA) of 2000,

- while jacking up site fees due again to alleged market manipulation. There are several possible causes of action which amount to an unjust taking of the potential appreciated value of those homes, coupled with higher site fees that could have been mitigated had more construction come online, instead of allowing it to be tripped up by a lack of enforcement of existing laws.

- On the lower end of $15,000 per site that could cost an operation like Frank, Dave, their investment partners and those colluding with them some $375 million dollars. At the higher end it would mathematically imply $1.125 billion.

- That principle could be applied to several other firms, not just Impact Communities. Harm to seniors, unjust taking, market manipulation, antitrust, RICO, and other possible causes of action are among those that could be considered.

MH Retailers, Producers, Others?

For another possible example of a class action and/or antitrust types of actions. A similar hypothetical math game could be applied to Berkshire Hathaway who reportedly have some $128 billion in cash reserves.

How much has those thousands of retailers, dozens of independent producers or related suppliers lost as a result of the allegations reported in the link below?

If, for example, 30 producers got a reasonably modest $20,000,000 average each and 10,000 independent retailers got $2 million each, that would be $600,000,000 for HUD Code manufactured home producers and $20,000,000,000 for the manufactured home retailers. Buffett’s Berkshire has that combined $20.6 billion in essentially cash on hand.

Let’s note that sources like Bloomberg noted a couple of years ago that one of Buffett’s ongoing concerns is antitrust and possible breakup efforts. An industry source from within MHI told MHProNews that Buffett-led Berkshire shook up their antitrust legal advisors not long ago. Given the reports published here and on our sister MHLivingNews site, plus others in mainstream media, is there any surprise in that claim?

Ponder the lost value in land lease communities that are or were ethically run by mom and pop owners. $10,000 per site for some 4.2 million sites is $42,000,000,000 or $42 billion. Berkshire’s got it, and there is evidence that they arguably caused at least several thousand operations such harm through the ploys described at this link here, here, here, here, here and here among others. Eliminating thousands of independent retailers harmed ethically run communities too, which in turn harmed those residents.

Since so many of those community business models were built on independent retailers selling homes into independently operated communities. Thus, knee-capping independent producers and retailers – a claim credibly alleged against Berkshire brands – logically could mean that independents that often performed profitably for decades could have a reasonable case to bring too.

Put differently, it isn’t just residents or customers who are harmed. It is residents plus independents that treated their customers well.

Industry newcomers or researchers here must grasp that those business models worked successfully for years prior to the 21st, Clayton, Buffett and Berkshire alleged ruses. That means that the with a proper predicate, a case that could reasonably be made.

Analogies, Wag the Dog, Weapons of Mass Distraction, Executive Summaries and Chasing Bernie Madoff

Analogies are used at times to illustrate an idea that might be missed by a casual observer.

As a disclosure for what follows, Bernie Madoff and Warren Buffett at first blush may appear to be two entirely different types of people. Sure, Madoff was wealthy for a time using a confidence or ‘con’ game that involved a scheme that was hiding in plain sight. That ploy of Madoff’s was spotted by a man named Harry Markopolos, about whom a movie was made ‘based on a true story’ – Chasing Bernie Madoff.

A plot summary of the movie begins by saying that “The film [Chasing Bernie Madoff] chronicles how Harry Markopolos and his associates spent ten years trying to get the U.S. Securities and Exchange Commission (SEC) and others to acknowledge and act on their investigative proof of Bernie Madoff’s…” illegal activities, which are technically known as “Ponzi scheme.” But like any con game, a common feature is that the Ponzi scheme of Madoff operated in plain sight. The SEC was warned, but for a time didn’t act. In time, federal officials did act. Madoff sits in federal prison today.

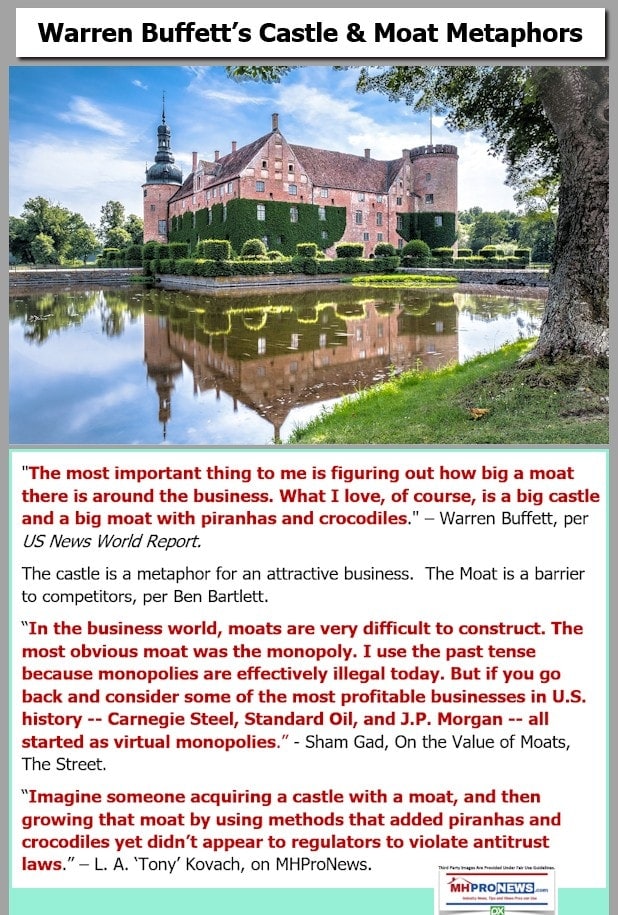

By analogy, Warren Buffett could be accused of a different kind of ploy. Several in mainstream media have reported on his strategic “Moat.” Buffett-led Berkshire’s Clayton Homes CEO, Kevin Clayton, talked about the “moat” and how Buffett preaches to his unit leaders to be ‘tough competitors’ in a video. That video is unpacked and analyzed alongside graphics, direct quotes and other evidence in a report linked here.

Berkshire-owned Clayton Homes is already the subject of several federal inquiries, and per sources, reportedly some state level ones too. Senators and Congressional Representatives are among those who have asked for investigations. An academic researcher for the Minneapolis Federal Reserve mentions them by name via a footnote in her recent report too.

What Markopolos had the advantage of having, at least in theory, was something so obvious that when he saw it he immediately suspected something was wrong. By contrast, MHProNews has not heretofore had something that was so obvious that it should cause those officials who consider it to scratch there heads and analogously say, ‘Yes, that DOES look odd. Perhaps something is there that looks illegal worth of investigation.’

Our ‘chasing’ – using the hypothetical analogy – began quite differently than Markopolos did. Richard ‘Dick’ Jennison – the exiting President and CEO of the Manufactured Housing Institute (MHI) said something during a 2014 video interview with me that was so outrageous on its face that I had to keep myself from reacting. That incident would have been meaningless to many without explanations. But it caught my attention. Over time, other incongruous items were brought to or came to my awareness. In 2015, Jennison and Lesli Gooch authorized the issuing of a statement to their own members that was clearly in hindsight to those who knew the details paltering or spin. We reported on it to our readers, and based on what was to us an obvious alleged deception, called on them to be terminated or to resign. Tim Williams, then MHI Chairman and still at this time the president and CEO of Berkshire owned 21st Mortgage Corporation defended Jennison via a vote of confidence by the MHI board.

That shifted my interest to those powers behind the curtain at MHI.

In 2017, we were given documents as a news tips that caused the report posted here to be published. Those documents were letter signed by Tim Williams, one of which is posted on that page, along with other evidence of purported antitrust violations.

Hindsight can be 2020 for a careful researcher or objective thinker. What at the time is merely odd or curious could be nothing, or it could be part of a pattern of activity. Markopolos had his diagrams and straight line charts that were his tip offs. Perhaps an analogy to Markopolos’ insight about Madoff that could be applied to Buffett-Berkshire and their manufactured housing units that evidence market manipulation can be found in the graphics and quotes below.

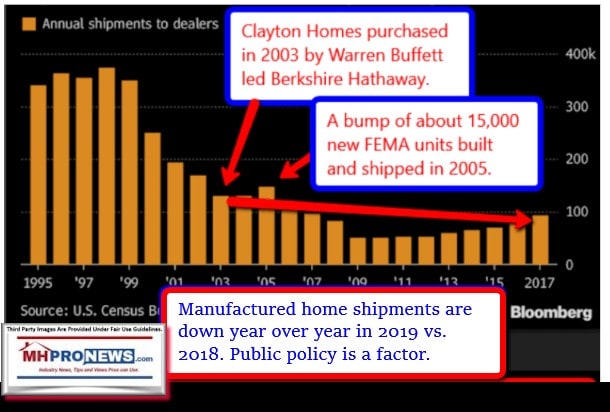

With Buffett-led Berkshire’s deep pockets, how is it possible that during an affordable housing crisis, manufactured homes could be underperforming so badly?

When there are good laws on the federal books that were passed by widely bipartisan margins that could benefit manufactured housing and the thirst for more affordable housing in America, how could the manufactured housing industry find itself struggling to get laws that already exist to be enforced?

Today, at the Federal Housing Finance Agency (FHFA) a 7-minute talk will be delivered that is found at this link below.

When You Are Over the Target, You Catch Flak

There are all sorts of tricks and tactics that have been deployed in an attempt to divert us or others from exposing a con game that arguably makes Madoff’s multiple billion dollar swindle small by comparison.

The executive summary linked above the listening session graphic/link and other materials linked from this page – if followed with care – may lead objective minds to understand why illicit tactics have been deployed to try to shake us off this trail. Distractions and dirty tactics may be a sign to a serious researcher that a confidence game – where legitimate businesses using illicit tactics do so openly hoping to escape legal scrutiny – are deployed.

States and Fed’s?

What about the sums states or the Fed’s that might sue for the economic impact of the violations of antitrust, RICO or other alleged violations by Berkshire brands alone? Again, that could easily be in the billions.

With sentiment against billionaires running high in America, juries might revel in issuing multiple billion dollar judgments.

MHProNews believes that socialism is as problematic as crony capitalism. A truly free market is something in between the crony capitalism that manipulates politicos and public officials and the socialists who would seize all private property. Free markets and small independent businesses are what the founders envisioned, rejecting the mercantilism of monopolists as well as the commonly held notions of socialists.

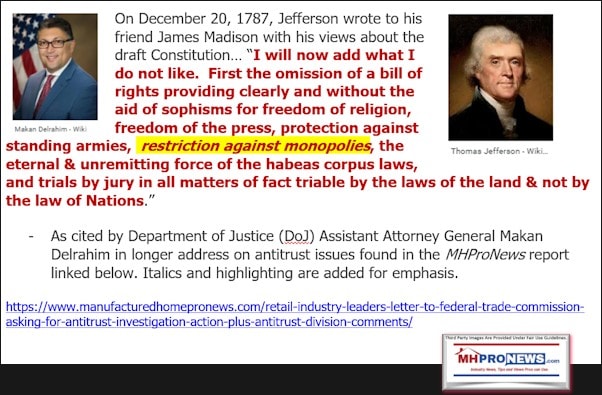

Consider anew the Department of Justice’s top antitrust cops words in citing the example of Thomas Jefferson.

MHProNews has explored similar issues in the related reports linked herein and below. “We Provide, You Decide.” © (Industry news, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.)

(See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.