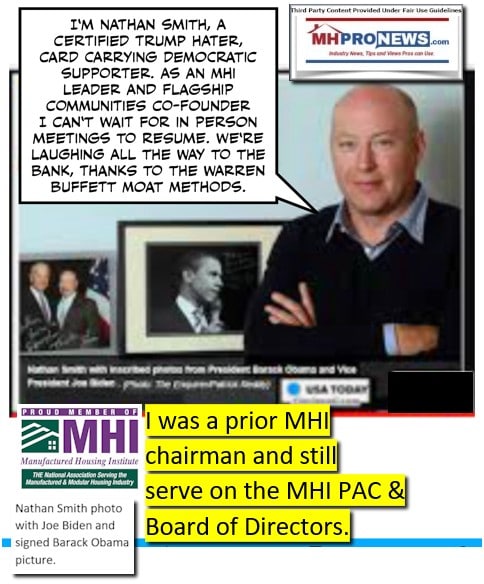

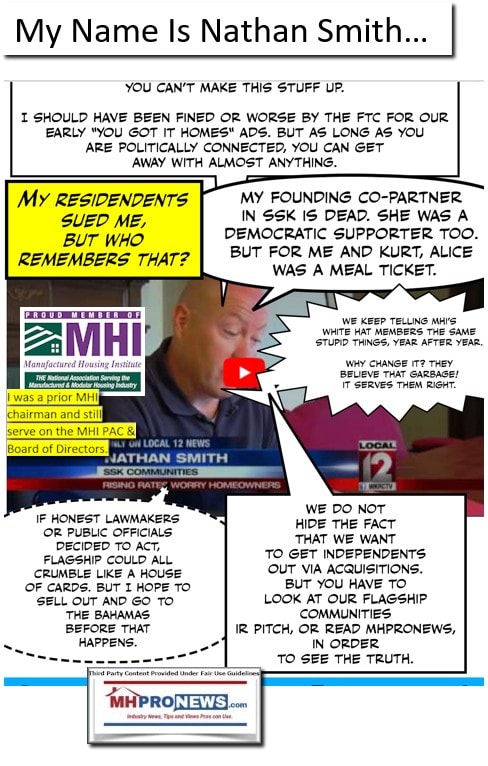

According to the Better Business Bureau (BBB) pre-dawn on 11.26.2022, Flagship Homes has a “Business Response Rate of 0%.” While Flagship Communities website boasts that they are a “Manufactured Housing Institute” (MHI) 2022 “Excellence in Manufactured Housing” “Award Winner,” 0ne must consider that source. In stark contrast to being an MHI award winner, the BBB’s rating on that date for Flagship Homes is a D-. Which ought to beg the question, which source is closer to the truth about Flagship? Nathan Smith is one of the principles who founded SSK Communities, the previous name for Flagship Communities before the operation was rebranded and taken public on the Toronto Exchange. Smith quite openly wraps himself in Democratic Party politics, where he has been a serious player for some years, as an illustration below and the right side of the featured image above attest. Smith bragged about being an anti-Trumper, which places him in a category that is controversial for some but is hardly cutting edge. Smith has fundraised for Democratic Party candidates such as former Secretary of State Hillary Clinton. As noted, Smith has been photographed proudly featuring to mainstream media his signed photos from Democrats Joe Biden and former President Barack Obama. Apparently notorious community operator Frank Rolfe mused to MHProNews in a previously referenced statement circa the time that Smith was MHI’s Chairman of the Board. Said Rolfe, “Nathan Smith is Chairman of the Board of MHI. His company is being sued in a huge class action lawsuit on several counts…SSK’s lawsuit puts all [mobile home] park owners in jeopardy.” Rolfe went on to say, “…Now what was that about me being bad for the [manufactured home] industry and MHI? Hypocrisy anyone?” Perhaps Rolfe’s remarks are an example of either a head fake, it takes one to know one, or both? Or were Rolfe’s remarks about Smith an example of the one person making an allegation while being guilty of a similar offense? As an insightful Magyar maxim goes, “As aki mondott, te mondtad, te vagy,” which roughly translated into English means the person making the allegation is the guilty party. It is perhaps akin to Democrats crying ‘racist!’ when the history of the Democratic party is rife with racism, per their historically-minded critics. But hypocritical head fakes do not appear to be limited to politics. They appear to be alive and well among manufactured housing industry professionals too.

As a disclosure, this writer and MHProNews/MHLivingNews are political independents who publicly warned readers about Flagship before that firm went public (MHC-U.TO- Toronto Stock Exchange) and since, as some of those prior linked reports from this post reflect.

Flagship has an apparently problematic history of troubling behavior toward their own residents, as the Better Business Bureau (BBB) and other sources cited in this report reflect.

That noted, in fairness, there appears to be some confusion on the part of either the BBB and/or those who have lodged complaints against Flagship Homes. There is a firm by the name “Flagship” based in Utah, which offers conventional housing. But some complaints on that firm’s BBB page appear to be focused on the Nathan Smith-connected Flagship Communities, which is the operation based in Kentucky and is involved in the manufactured housing industry. That Flagship Communities firm still has a BBB page under their prior corporate name of SSK Communities.

The BBB rating on SSK Communities page on the date shown is worse than the D- that of Flagship Homes.

Those points noted, this 2022 complaint on the Flagship Homes BBB page appears to refer to Flagship Communities, the prominent Manufactured Housing Institute (MHI) member which in recent years is a publicly traded equity. Per a BBB complaint, “Hilltop Pointe [manufactured home community] was acquired by Flagship Communities. They [Flagship] are not honoring my previous lease that was in place and sent me a Five day eviction notice if I do not pay additional fees that are not in my lease. I am abiding by my current active lease. They [Flagship Communities] are changing due dates, charging me for services that were previously included in my rent and not informing me of water bill which was paid through previous landlord.”

There are published complaints with the BBB under both SSK Communities and Flagship Homes that appear to be about Flagship Communities. They identify or describe the KY based and prominent MHI ‘award winning’ member firm. These are not the only public sources of negative views or troubling evidence about how business is done by Smith’s Flagship.

While the manufactured home operation named Flagship may have appeared to some to be ‘cleaning up their act’ before and when they went public, if so, the current evidence seems to reflect that they are back to business as usual now. Who says? Consumers who have filed complaints and who assert that they are the Flagship Communities/SSK Communities’s past or present customers.

While Flagship Communities may have appeared to some to be ‘cleaning up their act,’ if so, the current evidence from the BBB and other sources seem to reflect that they are back to their business-as-usual ‘black hat’ style of behavior now.

Per Flagship’s leadership page there are:

- Kurt Keeney – Chief Executive Officer.

- Nathan Smith – Chief Investment Officer.

- Eddie Carlisle – Chief Financial Officer.

Per LinkedIn, the firm’s attorney is Jody Gabel: “Flagship Communities LLC · Full-timeJan 2022” who was previously an attorney with “Lutz Bobo Telfair Eastman Gabel & Lee” from “May 1994 – Jul 2022” (“28 yrs 3 mos.”). Jody Gabel has responded to some, but apparently not all, complaints from the BBB per that organization’s websites complaints that related to Flagship Communities.

But as or more troubling is the cover that MHI and other state associations are giving to the arguably predatory practices exhibited by Flagship. What happened to that so-called MHI-National Communities Council (NCC) Code of Ethical Conduct?

The Nathan Smith connected operation ‘arrived’ when they made it into HBO’s viral satirical hit-piece on the industry featured on Last Week Tonight with John Oliver. That satirical snark was errantly dubbed “Mobile Homes,” when it was obvious from the context and images that Oliver was rather speaking of modern HUD Code manufactured homes. Either way, the image that Oliver’s hit painted of manufactured housing, by using examples of firms such as Clayton Homes, Rolfe’s and Smith’s communities as examples of misbehavior within the manufactured home profession.

How can someone explain the troubling slide of manufactured housing during an affordable housing crisis?

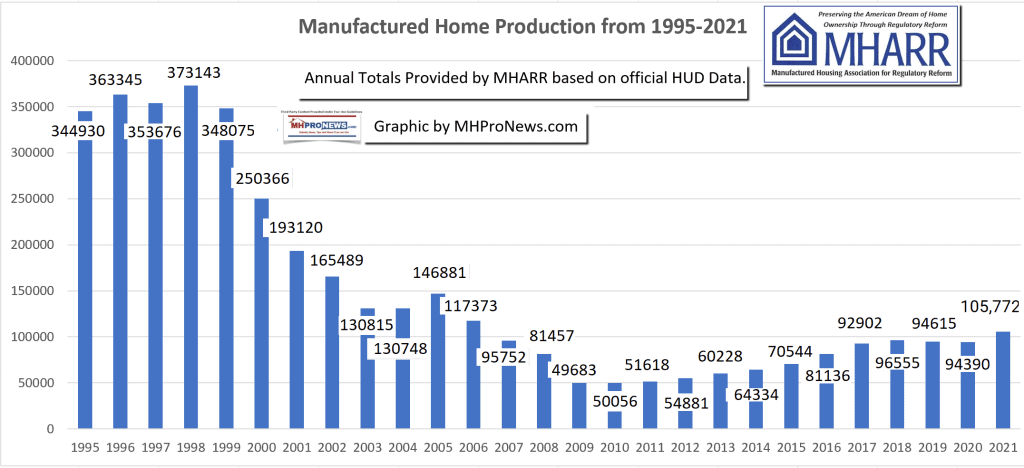

Manufactured homes achieved their most recent peak in 1998, as the graphic below reflects. Then, manufactured housing sales and production levels began to slide for years until it bottomed out in 2009-2010. It has since begun a gradual ‘recovery’ which amounts to only about 30 percent of that last highwater mark in 1998. These factoids beg questions, which ought to include – why is manufactured housing underperforming during an affordable housing crisis? What role has the business tactics of firms like SSK/Flagship and others at MHI played in that sad underperformance of the most proven form of permeant form of affordable housing in U.S. history?

While the explanations and facts involved shed light on the late 20th and early 21st century debacle for manufactured homes are numerous, certainly among them are vexing issues involving the quiet takeover of MHI and state associations by dominating firms. Those larger MHI member firms apparently include producers which have steadily grown in this 21st century era of manufactured housing underperformance. Those larger producers include Berkshire Hathaway owned Clayton Homes, Cavco Industries (CVCO), and Skyline Champion (SKY). But there are also firms in the manufactured home community sector that have been growing through consolidation in the 21st century in the manufactured housing crash that occurred. Among the prominent and publicly traded land-lease community operators are Sun Communities (SUI), Equity LifeStyle Properties (ELS), UMH Properties (UMH) and others that include Flagship Communities, which was formerly known as SSK Communities. Some of these and MHI itself may posture being ethical, altruistic, and noble businesses. But an examination of the facts and concerns raised by HBO’s report on manufactured housing, or evidence from the BBB as shown, reveal an often different, darker, and thus more troubling story of affordable manufactured housing firms that seemingly went morally astray. So, is it surprising that Smith-co-led SSK-turned Flagship Communities has a troubled history of problematic behavior toward their own residents?

Nathan Smith, MHI board members (past and present), MHI CEO Lesli Gooch, Rolfe, and others are reportedly among the longtime and routine readers of MHProNews. Why are these individuals’ readers of a publication that is often critical of their business and professional ethical practices? Are they sado-masochistic? Are they at some level wrestling with their consciences?

Or are they rather trying to prepare for what may follow when more mainstream media and certain public officials finally are moved to shout out, ‘enough of this corrupt behavior that targets affordable housing seekers!’

Today’s postscript will feature extensive statements from Flagship Communities. They are not thus being promoted, though they may indeed make money, which is reflected in the report. But that isn’t the only issue in focus. Because a key question that investors and others ought to seek answers to is this. Could more money be earned more honorably if white hat business practices replaced years of black hat, moat-building methods?

Ponder such thoughts and questions when you get to that segment of today’s headlines in review and the conclusion of today’s featured report on Flagship/SSK.

That’s a reasonable point to segue to what MHProNews lovingly refers to as MHVille’s (the artificially diminutive, manufactured home industry) weekly headlines and reports recap.

With no further adieu, here are the news, commentary, and expert analysis for the week in review in facts- and evidence-packed, and occasionally wryly humorous, reports from 11.20 to 11.27.2022.

What’s New on MHLivingNews

What’s New from Washington D.C. from MHARR

What’s the Latest on the Masthead

What’s New on the Words of Wisdom by Tim Connor, CSP

What’s New on the Daily Business News on MHProNews

Saturday 11.26.2022

Friday 11.25.2022

Thursday 11.24.2022

Wednesday 11.23.2022

Tuesday 11.22.2022

Monday 11.21.2022

Sunday 11.20.2022

Postscript

The following items are from the Flagship Communities investor segment of that firm’s website. This should NOT be misconstrued as an endorsement of the firm, nor of their customer-relations and business practices. They will be followed by a brief analysis and commentary.

Per Flagship is the following.

REIT Overview

Profile

Strategy

Flagship Communities REIT is positioned to accelerate its growth by executing on its proven growth strategies. Organic growth initiatives include aligning lot rents with prevailing market conditions, leasing vacant lots, converting renter-occupied lots to homeowner-occupied lots, implementing value-enhancing investments, optimizing revenue and expenses, and expanding established communities by developing excess land. External growth will come through acquisitions. The MHC industry is highly fragmented, and comprised primarily of local owner-operators. With approximately 5,300 manufactured housing communities in the REIT’s existing markets, there is a substantial opportunity for continued growth in the REIT’s own backyard.

Investment Highlights

Opportunity to Gain Exposure to a Niche Asset Class with a Track Record of Outperformance

Flagship Communities Real Estate Investment Trust is the only pure-play, publicly traded manufactured housing investment vehicle in Canada. It represents a unique opportunity to invest in U.S. manufactured housing communities (“MHCs”). The MHC industry has demonstrated a strong track record of outperformance throughout all economic cycles, having achieved 20 consecutive years of positive same community net operating income growth. The U.S. MHC industry’s net operating income has experienced an average growth rate of approximately 4% per year over this period, outperforming all other real estate sectors.

Defensive Asset Class with a Favourable Business Model that Outperforms Throughout the Economic Cycle

The MHC industry is characterized by stable and growing financial performance, with attractive investment returns and low operational volatility. Manufactured housing is predominately a land lease business model, whereby residents are owner-occupiers of their homes and rent a lot on which to place their home within a community. As a result, maintenance capital expenditures borne by MHC owners are generally minor and limited to community infrastructure. MHCs typically have a large, diverse and entrenched resident base with long tenure, low turnover, and minimal delinquency. Given the continued appreciation of single-family housing prices at a rate exceeding household income growth in the United States, management believes that demand for MHCs will remain strong from residents seeking affordable housing.

Fragmented Industry with High Barriers to Entry and Imbalanced Supply and Demand Dynamics

The MHC industry is highly fragmented and primarily consists of local owner-operators, public real estate investment trusts and institutional investors. The top 50 MHC investors are estimated to control only 17% of the 4.2 million manufactured housing lots estimated to be available for rent in the United States, presenting an opportunity for consolidation. Factors such as regulatory restrictions, competing land uses and scarcity of land zoned for manufactured housing development have limited new supply, causing an imbalance in supply and demand and creating high barriers to entry for new market participants. The REIT’s management is unaware of any new MHCs having been built within its current operational footprint during the past 15 years.

Contiguous, High Quality Portfolio with Regional Footprint in Stable Markets

The REIT’s communities are located in markets with stable population growth, stable employment trends and favourable regulatory environments. The communities are strategically concentrated within four contiguous U.S. states and are conveniently located near interstate highways, necessity-based retail centres, post-secondary institutions, healthcare facilities and major metropolitan employment centres. The regional footprint has enabled management to develop deep market insights and intelligence, build enduring relationships with market participants and establish a market-leading position. In addition, the geographic proximity of the communities allows the REIT to generate significant economies of scale and expense savings.

Well Positioned to Capitalize on Strategic Growth Opportunities

The REIT has identified four strategic avenues for growth:

- Organic cash flow growth through improving occupancy, increasing lot rents, and expense optimization initiatives;

- Targeted value-enhancing investments and community improvements;

- Third party acquisitions; and

- Expansion of certain communities through the development of excess land.

Management’s extensive relationship network, deep knowledge of local markets and regular dialogue with local owner-operators supports the execution of off-market acquisitions within the REIT’s current operational footprint and other target markets. The REIT can offer potential vendors tax-deferred Class B Units, providing them with an additional incentive to transact. The REIT can also access numerous sources of debt financing including government agency debt, commercial mortgage-backed securities and life insurance companies, providing significant flexibility to pursue acquisitions. In addition, the REIT has a preferential right to purchase MHCs offered by Empower Park, LLC, an entity controlled by the REIT’s Chief Executive Officer and Chief Investment Officer. The MHCs owned by Empower will be offered at a discount to appraised value.

Vertically Integrated Platform Led by an Experienced and Aligned Internal Management Team

The REIT’s management platform is composed of a fully integrated team of seasoned professionals with more than 50 combined years of experience across the full spectrum of the manufactured housing industry. The REIT’s vertical integration will enable it to actively control, manage and execute across all aspects of MHC investment management. The REIT’s executive officers collectively own an approximate 22.2% effective interest in the REIT, providing a significant alignment of interests with other Unitholders. ##

Next is the following, also per Flagship and with the same disclaimers as were previously provided.

FLAGSHIP COMMUNITIES REAL ESTATE INVESTMENT TRUST ANNOUNCES THIRD QUARTER RESULTS

November 14, 2022

Summary of Third Quarter 2022 Results:

Financial and Operating Highlights

- Strengthened portfolio with the acquisition of two manufactured housing communities (“MHCs”) in the REIT’s existing footprint of Louisville, Kentucky and Bloomington, Illinois for an aggregate purchase price of approximately $32.3 million

- Rental revenue and related income was $15.0 million, an increase of approximately $3.6 million from the third quarter of 2021

- Same Community Revenue1was $10.3 million, an increase of $0.8 million from the third quarter of 2021

- Net income and comprehensive income was $14.9 million, compared to $1.9 million during the third quarter of 2021

- Net Operating Income (“NOI”) was $9.8 million, an increase of $2.3 million from the third quarter of 2021

- Same Community NOI1was $6.8 million, compared to $6.2 million in the third quarter of 2021, an increase of $0.6 million and 9.7%

- NOI Margin1was 65.5%, compared to 66.6% in the third quarter of 2021

- Adjusted Funds from Operations2(“AFFO”) were $4.6 million or $0.235 per unit, compared to $3.8 million and $0.218 per unit in the third quarter of 2021

- Same Community Occupancy1 increased to 82.2% as at September 30, 2022, from 81.0% as of September 30, 2021

- Debt to Gross Book Value1as at September 30, 2022 was 41.3% compared to 42.0% as at September 30, 2021

- Rent Collections1for the three months ended September 30, 2022, were 98.2%, a slight decrease from 99.2% for the three months ended September 30, 2021

- Subsequent to quarter-end, Flagship’s Board of Trustees approved an approximately 5% increase to its monthly cash distribution to unitholders to $0.0468 per REIT unit or $0.562 per REIT unit on an annualized basis payable on or about December 15, 2022 to unitholders of record as of the close of business on November 30, 2022

| 1See “Other Real Estate Industry Metrics” for more information. |

| 2A non-IFRS financial measure. See “Non-IFRS Financial Measures” for more information |

“During the third quarter of 2022 we continued to demonstrate the solid fundamentals of the MHC sector, while also further strengthening our portfolio with two acquisitions in our existing footprint,” said Kurt Keeney, President and CEO. “Having established a strategy that includes long-term fixed rate debt with stacked maturities, we are in a strong financial position poised to execute on future opportunities and our next leg of growth. Our outlook for the MHC industry remains positive even in the current inflationary economic environment and rising mortgage rates in the United States. Over the past 20 years, the MHC industry has consistently outperformed other real estate classes during similar economic conditions.”

Financial Summary

| ($000s except per share amounts) | ||||||

| For the three months ended Sept. 30, 2022 |

For the three

months ended Sept. 30, 2021 |

Variance | For the nine months ended Sept. 30, 2022 |

For the nine months ended Sept. 30, 2021 |

Variance | |

| Rental revenue and related income | 15,042 | 11,399 | 3,643 | 43,098 | 30,883 | 12,215 |

| Revenue, Same Community1 | 10,283 | 9,488 | 795 | 30,371 | 28,324 | 2,047 |

| Revenue, Acquisitions1 | 4,759 | 1,911 | 2,848 | 12,727 | 2,559 | 10,168 |

| Net income and comprehensive income | 14,910 | 1,870 | 13,040 | 43,366 | 6,556 | 36,810 |

| NOI, total portfolio | 9,848 | 7,592 | 2,256 | 28,566 | 20,462 | 8,104 |

| NOI, Same Community1 | 6,812 | 6,207 | 605 | 20,318 | 18,801 | 1,517 |

| NOI, Acquisitions1 | 3,036 | 1,385 | 1,651 | 8,248 | 1,661 | 6,587 |

| NOI Margin1, Total Portfolio | 65.5 % | 66.6 % | (1.1) % | 66.3 % | 66.3 % | 0.0 % |

| NOI Margin1, Same Community1 | 66.2 % | 65.4 % | 0.8 % | 66.9 % | 66.4 % | 0.5 % |

| NOI Margin1, Acquisitions1 | 63.8 % | 72.5 % | (8.7) % | 64.8 % | 64.9 % | (0.1) % |

| FFO2 | 5,337 | 4,412 | 925 | 16,336 | 11,250 | 5,086 |

| FFO Per Unit2 | 0.272 | 0.257 | 0.015 | 0.832 | 0.778 | 0.053 |

| AFFO2 | 4,616 | 3,751 | 865 | 14,187 | 9,532 | 4,655 |

| AFFO Per Unit2 | 0.235 | 0.218 | 0.017 | 0.723 | 0.659 | 0.063 |

| AFFO Payout Ratio2 | 56.8 % | 58.5 % | (1.7) % | 55.5 % | 56.8 % | (1.4) % |

| Weighted average units (Diluted) | 19,637,962 | 17,165,547 | 2,472,415 | 19,625,617 | 14,454,621 | 5,170,996 |

| 1. See “Other Real Estate Industry Metrics” for more information.

2. A non-IFRS financial measure. See “Non-IFRS Financial Measures” for more information. |

||||||

Financial Overview

Rental revenue and related income in the third quarter of 2022 was $15.0 million, approximately $3.6 million higher compared to the same period last year primarily due to acquisitions, lot rent increases and occupancy increases across the portfolio. Rental revenue and related income for the nine months ended September 30, 2022 was $43.1 million, which was an increase of approximately $12.2 million compared to the same period last year for the same reasons.

Net income and comprehensive income for the three months ended September 30, 2022 was $14.9 million, approximately $13.0 million more compared to the same period last year, as a result of the fair value gain on Class B Units being significantly larger than in the same period in 2021. Net income and comprehensive income for the nine months ended September 30, 2022 was $43.4 million, an increase of $36.8 million from the prior period for the same reason.

NOI and NOI Margin for the third quarter of 2022 were $9.8 million and 65.5% respectively, compared to $7.6 million and 66.6% during the third quarter of 2021. NOI and NOI Margin for the nine months ended September 30, 2022 were $28.6 million and 66.3%, respectively, compared to $20.5 million and 66.3% for the nine months ended September 30, 2021. These NOI increases were primarily driven by the REIT’s accretive acquisitions, lot rent growth and cost containment efforts.

FFO and FFO Per Unit for the third quarter of 2022 were $5.3 million and $0.272 per unit, a 21.0% and 5.8% increase respectively, from the third quarter of 2021.

FFO and FFO Per Unit for the nine months ended September 30, 2022 were $16.3 million and $0.832 per unit, a 45.2% and 6.8% increase respectively, compared to the nine months ended September 30, 2021.

AFFO and AFFO per Unit for the third quarter of 2022 were $4.6 million and $0.235 per unit, a 23.1% and 7.8% increase respectively, from the third quarter of 2021. AFFO and AFFO per Unit for the nine months ended September 30, 2022 were 14.2 million and $0.723, a 48.8% and 9.6% increase, respectively, compared to the nine months ended September 30, 2021. These increases were primarily driven by the REIT’s accretive acquisitions and continued Same Community NOI growth. FFO and FFO Per Unit in any particular quarter may vary due to the scheduling of maintenance events, seasonal requirements, such as lawn maintenance and other factors.

Same Community Revenues for the three and nine months ended September 30, 2022, exceeded the three and nine months ended September 30, 2021 by $0.8 million and $2.0 million, respectively. These increases were driven by lot rent increases implemented during the period, occupancy growth throughout the year and increases in utility revenues.

Same Community NOI for the third quarter of 2022 was $6.8 million, an increase of 9.7% compared to the third quarter of 2021. Same Community NOI for the nine months ended September 30, 2022 was $20.3 million, an increase of 8.1% compared to the nine months ended September 30, 2021.

Same Community Occupancy of 82.2% increased by 1.1% as of September 30, 2022, compared to the same period last year. The consistent and growing occupancy rate reflects Flagship’s commitment to resident satisfaction and ensuring its communities are desirable locations.

Rent Collections for the third quarter of 2022 were 98.2%, a slight decrease from 99.2% from the three months ended September 30, 2021.

As of September 30, 2022, Flagship’s total cash and cash equivalents were $4.8 million with $4 million available on the REIT’s operating line of credit. Flagship also has 20 unencumbered assets with a value of approximately $50 million.

Flagship’s Weighted Average Mortgage Term to maturity was 11.7 years, with the REIT’s first maturity due in 5.5 years. Flagship’s Weighted Average Mortgage Interest Rate was 3.68% as at September 30, 2022.

Operations Overview

During the third quarter 2022, Flagship acquired two MHCs in the REIT’s existing footprint of Louisville, Kentucky and Bloomington, Illinois, which included 584 lots and 97 rental homes for $32.3 million.

Flagship manages and monitors water usage at all of its MHCs. The REIT has ongoing sub-metering and water re-capture programs to help conserve water and detect leaks. Historically, sub-metering has resulted in a 25% reduction in water consumption compared to previously un-monitored water usage. Flagship continues to implement sub-metering and water re-capture programs across all of its MHCs.

Flagship is also focused on energy conservation across all of its MHCs through a solar lighting program. The REIT’s solar lighting installation program is underway and Flagship’s goal is to transform its community street lighting into a 100% solar-powered system.

As at September 30, 2022, the REIT owned a 100% interest in a portfolio of 68 MHCs with 12,500 lots. The table below provides a summary of the REIT’s portfolio as of September 30, 2022, compared to December 30, 2021:

| As of September 30, 2022 | As of September 30, 2021 | ||

| Total communities | (#) | 68 | 58 |

| Total lots | (#) | 12,500 | 9,904 |

| Weighted Average Lot Rent1 | (US$) | 385 | 365 |

| Occupancy | ( %) | 83.1 | 81.9 |

| 1See “Other Real Estate Industry Metrics” below | |||

Outlook

Flagship believes the REIT is well positioned amidst the current inflationary economic environment, higher rental rates and rising mortgage rates that are making stick-built homes more difficult to obtain in the United States. Flagship maintains a positive outlook for the MHC industry and believes it offers significant upside potential to investors. This is primarily due to the MHC industry’s consistent track record of historical outperformance relative to other real estate classes and the lack of supply of new manufactured housing communities given the various layers of regulatory restrictions, competing land uses and scarcity of land zoned, which has created high barriers to entry for new market entrants.

Other macro and MHC industry-specific characteristics and trends that support Flagship’s positive outlook include:

- Increasing household formations;

- Lower housing and rental affordability;

- Declining single-family residential homeownership rates;

Non-IFRS Financial Measures

The REIT uses certain non-IFRS financial measures (including ratios), including FFO, FFO Per Unit, AFFO, AFFO Per Unit, AFFO Payout Ratio to measure, compare and explain the operating results, financial performance and financial condition of the REIT. The REIT also uses AFFO in assessing its distribution paying capacity. These measures are commonly used by entities in the real estate industry as useful metrics for measuring performance. However, they do not have any standardized meaning prescribed by IFRS and are not necessarily comparable to similar measures presented by other publicly traded entities. These measures should be considered as supplemental in nature and not as a substitute for related financial information prepared in accordance with IFRS.

FFO is defined as IFRS Net Income and Comprehensive Income adjusted for items such as distributions on redeemable or exchangeable units recorded as finance cost under IFRS (including distributions on the class B units of the REIT’s subsidiary, Flagship Operating, LLC (“Class B Units”), unrealized fair value adjustments to investment properties, loss on extinguishment of acquired mortgages payable, gain on disposition of investment properties and depreciation. The REIT’s method of calculating FFO is substantially in accordance with the recommendations of the Real Property Association of Canada (“REALPAC”). FFO per Unit (diluted) is defined as FFO for the applicable period divided by the diluted weighted average Unit count (including Class B Units and Deferred Trust Units (“DTUs”)) during the period. Refer to section “Reconciliation of Non-IFRS Financial Measures – FFO, FFO per Unit, AFFO and AFFO per Unit” for a reconciliation of FFO to AFFO to Net Income and Comprehensive Income.

AFFO is defined as FFO adjusted for items such as maintenance capital expenditures, and certain non-cash items such as amortization of intangible assets, premiums and discounts on debt and investments. The REIT’s method of calculating AFFO is substantially in accordance with REALPAC’s recommendations. The REIT uses a capital expenditure reserve of $60 (dollars/annual) per lot and $1,000 (dollars/annual) per rental home in the AFFO calculation. This reserve is based on management’s best estimate of the cost that the REIT may incur, related to maintaining the investment properties. This may differ from other issuers’ methods and, accordingly, may not be comparable to AFFO reported by other issuers. Refer to section “Reconciliation of Non-IFRS Financial Measures – FFO, FFO per Unit, AFFO and AFFO per Unit” for a reconciliation of AFFO to net income (loss).

AFFO Payout Ratio is defined as total cash distributions of the REIT (including distributions on Class B Units) divided by AFFO. AFFO per Unit (diluted) is defined as AFFO for the applicable period divided by the diluted weighted average Unit count (including Class B Units and DTUs) during the period.

Other Real Estate Industry Metrics

Additionally, this news release contains several other real estate industry metrics that are not disclosed in the REIT’s financial statements:

- “Acquisitions” means the REIT’s properties, excluding Same Communities (as defined below) and such measures (i.e.: Revenue, Acquisitions; NOI, Acquisitions; and NOI Margin, Acquisitions) are used by management to evaluate period-over-period performance of such investment properties throughout both respective periods. These results reflect the impact of acquisitions of investment properties.

- “NOI margin” is defined as NOI divided by total revenue. Refer to section “Calculation of Other Real Estate Industry Metrics – NOI and NOI Margin”.

- “Rent Collections” is defined as the total cash collected in a period divided by total revenue charged in that same period.

- “Same Community” means all properties which have been owned and operated continuously since January 1, 2021, by the REIT and such measures (i.e.: Same Community Revenue or Revenue, Same Community; Same Community NOI or NOI, Same Community; NOI Margin, Same Community; and Same Community Occupancy) are used by management to evaluate period-over-period.

- “Weighted Average Lot Rent” means the lot rent for each individual community multiplied by the total lots in that community summed for all communities divided by the total number of lots for all communities.

Reconciliation of Non-IFRS Financial Measures

FFO, FFO Per Unit, AFFO and AFFO per Unit

| ($000s, except per unit amounts) | For the three months ended September 30, 2022 |

For the three months ended September 30, 2021 |

For the nine months ended September 30, 2022 |

For the nine months ended September 30, 2021 |

| Net income and comprehensive income | 14,910 | 1,870 | 43,366 | 6,556 |

| Adjustments to arrive at FFO | ||||

| Depreciation | 76 | 53 | 209 | 125 |

| Fair value adjustments-Class B units | (1,915) | 10,200 | (23,552) | 24,937 |

| Distributions on Class B units | 732 | 692 | 2,194 | 2,077 |

| Fair value adjustment – investment properties | (8,458) | (8,412) | (5,796) | (22,690) |

| Fair value adjustment – unit based compensation | (8) | 9 | (85) | 9 |

| Transaction costs | – | – | – | 236 |

| Funds from Operations (“FFO”) | 5,337 | 4,412 | 16,336 | 11,250 |

| FFO per Unit (diluted) | 0.272 | 0.257 | 0.832 | 0.778 |

| Adjustments to arrive at AFFO | ||||

| Accretion of mark-to-market adjustments on mortgage payable | (257) | (257) | (772) | (771) |

| Capital Expenditure Reserves | (464) | (404) | (1,377) | (947) |

| Adjusted Funds From Operations (“AFFO”) | 4,616 | 3,751 | 14,187 | 9,532 |

| AFFO per Unit (diluted) | 0.235 | 0.218 | 0.723 | 0.659 |

Calculation of Other Real Estate Industry Metrics

NOI and NOI Margin

| ($000s) | For the three months ended September 30, 2022 |

For the three months ended September 30, 2021 |

For the nine months ended September 30, 2022 |

For the nine months ended September 30, 2021 |

| Rental revenue and related income | 15,042 | 11,399 | 43,098 | 30,883 |

| Property operating expenses | 5,194 | 3,807 | 14,532 | 10,421 |

| NOI | 9,848 | 7,592 | 28,566 | 20,462 |

| NOI Margin | 65.5 % | 66.6 % | 66.3 % | 66.3 % |

Forward-Looking Statements

This press release contains statements that include forward-looking information (within the meaning of applicable Canadian securities laws). Forward-looking statements are identified by words such as “believe”, “anticipate”, “project”, “expect”, “intend”, “plan”, “will”, “may”, “can”, “could”, “would”, “must”, “estimate”, “target”, “objective”, and other similar expressions, or negative versions thereof, and include statements herein concerning: the REIT’s investment strategy and creation of long-term value; the REIT’s intention to continue to expand, including on a clustered basis and newly-entered geographies, and to shrink its rental fleet; expected sources of funding for future acquisitions; macro characteristics and trends in the United States real estate and housing industry, as well as the manufactured housing communities (“MHC”) industry specifically; the continued ability of the REIT’s MHCs to be stable or strengthen in the foreseeable future and over the longer term and the REIT’s target indebtedness as a percentage of Gross Book Value.

These statements are based on the REIT’s expectations, estimates, forecasts, and projections, as well as assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies that could cause actual results to differ materially from those that are disclosed in such forward-looking statements. While considered reasonable by management of the REIT as at the date of this press release, any of these expectations, estimates, forecasts, projections, or assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those expectations, estimates, forecasts, projections, or assumptions could be incorrect. Material factors and assumptions used by management of the REIT to develop the forward-looking information in this press release include, but are not limited to, the REIT’s current expectations about: vacancy and rental growth rates in MHCs and the continued receipt of rental payments in line with historical collections; demographic trends in areas where the MHCs are located; the impact of COVID-19 on the MHCs; further MHC acquisitions by the REIT; the applicability of any government regulation concerning MHCs and other residential accommodations, including as a result of COVID-19; the availability of debt financing and future interest rates; expenditures and fees in connection with the ownership of MHCs; and tax laws. When relying on forward-looking statements to make decisions, the REIT cautions readers not to place undue reliance on these statements, as they are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, the factors discussed under the heading “Risks and Uncertainties” herein, as well as risk factors discussed in the Annual Information Form. There can be no assurance that forward-looking statements will prove to be accurate as actual outcomes and results may differ materially from those expressed in these forward-looking statements. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, certain forward-looking statements included in this press release may be considered a “financial outlook” for purposes of applicable Canadian securities laws, and as such, the financial outlook may not be appropriate for purposes other than to understand management’s current expectations and plans relating to the future, as disclosed in this press release. Forward-looking statements are made as of the date of this press release and, except as expressly required by applicable law, the REIT assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Third Quarter 2022 Results Conference Call and Webcast

| DATE: | Tuesday, November 15, 2022 |

| TIME: | 8:30 a.m. ET |

| DIAL-IN NUMBER: | 416-764-8650 or 1-888-664-6383 |

| INSTANT JOIN BY PHONE: | https://connectnow1.accutel.com/EventMeet/rest/users/login?password=mlt7r267l3us5

(Click the URL to join the conference call by phone) |

| CONFERENCE ID: | 87176176 |

| LIVE WEBCAST: | https://flagshipcommunities.com/investor-relations/presentations-and-events/ |

About Flagship Communities Real Estate Investment Trust

Flagship Communities Real Estate Investment Trust is an internally managed, unincorporated, open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario. The REIT owns and operates a portfolio of income-producing manufactured housing communities located in Kentucky, Indiana, Ohio, Tennessee, Arkansas, Missouri, and Illinois, including a fleet of manufactured homes for lease to residents of such housing communities.

For further information, please contact:

Eddie Carlisle, Chief Financial Officer …##

Analysis and Commentary in Brief

MHProNews strongly believes in the value of manufactured housing ‘done properly.’ In fairness, Flagship at a glance appeared to have risen from a “F” rating with the BBB to the current rating of Flagshiup Homes to the rating shown above of D-. But upon a closer look, Flagship/SSK still appears to have a rating of “F” on 11.26.2022 date. That’s from a self-proclaimed Democratic progressive, i.e.: Nathan Smith.

There is ample evidence that several of MHI’s so-called ‘leading brands’ are engaged in a ploy to steadily consolidate the manufactured home segments of the affordable housing market into ever fewer corporate hands. That cries out for serious antitrust investigations by sincere (vs. posturing) public officials at the state and national levels. Doing so may bring a measure of justice to those harmed among consumers and businesses to the tactics that have been steadily documented by our twin trade media platforms. To learn more, see the linked and related reports. ###

Again, our thanks to free email subscribers and all readers like you, our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.