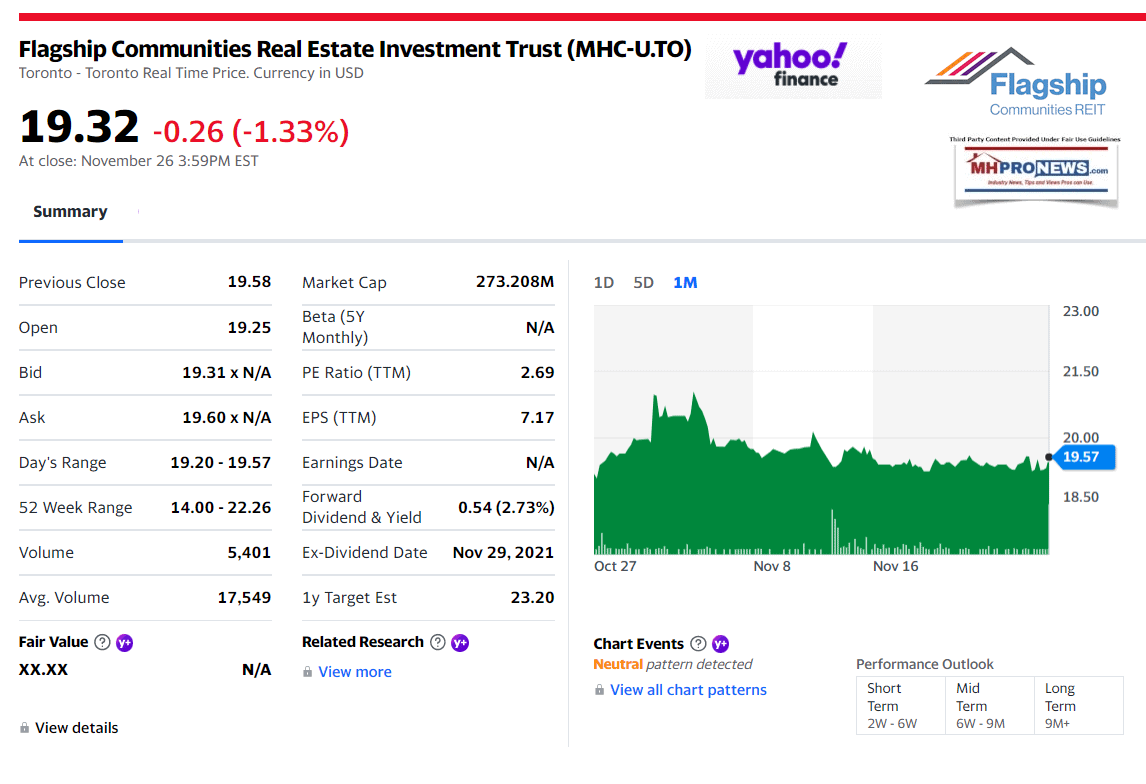

It is useful to begin this discussion of Flagship Communities REIT (MHC-U.TO), Nathan Smith, Kurt Keeney and their leadership through the lens of this exchange involving far larger and more established Sun Communities (SUI). “Obviously, manufactured housing is probably the most practical solution available for California’s affordability issues, and with the political environment the way it is, is there any more traction in potentially gaining more opportunities in that state to develop ground-up, incorporating affordable components?” So said Andrew “Drew” Babin, Research Analysis for Robert W Baird & Co during a Sun Communities (SUI) earnings call. Sun’s Chairman and CEO, Gary Shiffman responded. “Drew, it’s Gary. There certainly is and its certainly the West Coast, certainly right up to the Northwest is area of concentration where we feel, we can actually develop communities to a better return for our shareholders than buying them at the cap rates that they’re trading at currently.” That was October 29, 2019. Fast forward to late November 2021 when cap rates have compressed in most manufactured home community markets nationally. It is also important to recall the facts disclosed by the bi-partisan Manufactured Housing Working Group that documented that developing manufactured home sites and homes was considerably less costly than developing multifamily housing. Against that factual and evidentiary backdrop, MHProNews will turn to the most recent pitches, claims, and disclosures by Flagship and their management team.

Stating the obvious can bring clarity to issues, even for seasoned investors. Disclosures by publicly traded companies are required by the Securities and Exchange Commission (SEC) and are a way for a firm and its leadership to limit their liability. “Federal regulations require the disclosure of all relevant financial information by publicly-listed companies. In addition to financial data, companies are required to reveal their analysis of their strengths, weaknesses, opportunities, and threats.” So says Investopedia.

- What is the main purpose of the federal Regulation Fair Disclosure?

“Regulation Fair Disclosure (Regulation FD or Reg FD) is a rule issued by the U.S. Securities and Exchange Commission that requires publicly traded companies to disclose material, nonpublic information to all investors simultaneously.” According to the SEC, Reg FD aims to promote full and fair disclosure.

- Why are disclosures important?

“The disclosure statement can reveal negative or positive news and financial information about the company. … It also provides critical facts that investors should be aware of, such as warning-like statements. The Securities and Exchange Commission (SEC) requires that all research reports contain a disclosure statement.“

Perhaps the most onerous reading from publicly traded firms are their pages and pages of disclosures. Flagship is no different in that regard.

But their “Annual Information Form” has some interesting statements which sheds light on the manufactured home community sector in general. They bring to mind concerns raised by MHProNews and our MHLivingNews sister site regarding the Manufactured Housing Institute (MHI) and their dominating brands. Specifically, they point toward issues such as the Manufactured Housing Improvement Act of 2000, and what MHI’s CEO Lesli Gooch admits is HUD’s failure to properly enforce its so-called “enhanced preemption” provision.

- Some of Flagship’s disclosures could suggest for the informed concerns that their disclosures, as abundant as they are, may be legally inadequate.

- Certain Flagship’s disclosures, in the wake of the SEC litigation of their fellow MHI member Cavco Industries (CVCO), ought to be bright red flags for savvy investors. The reasons for that and more will be explored below. For those not familiar with that case, and for those who have not read that report recently, the stunning way that Cavco’s corporate controls were apparently circumvented, per the SEC, only makes admissions and statements by Flagship a reason to think two or three times before parking investment money with them.

Flagship Communities Real Estate Investment Trust Management Discussion and Analysis (MDA) that follows further below covers the “three and nine months ended September 30, 2021 (unaudited). It references their

“Annual Information Form” for additional disclosures. That document is 97 pages long. So, the following is not exhaustive. But it raises issues that shed light on MHI, their dominating brands, other community consolidators, and of course Flagship itself.

With the Drew Babin–Gary Shiffman SUI exchange above in mind, on page 17 of their “Annual Information Form” is this interesting statement under the Current Economic Environment subheading.

“It is possible that capitalization rates within the U.S. MHC industry could increase in the future due to external market factors, which tend to put downward pressure on the market values of publicly traded real estate entities.” That is odd at best. But let’s press on.

“(ii) rent control or rent stabilization laws or other residential landlord/tenant laws; or (iii) other governmental rules and regulations or enforcement policies affecting the development, use and operation of the REIT’s properties, including changes to building codes and fire and life safety codes.” This roughly 97 page doesn’t specifically mention the Manufactured Housing Improvement Act of 2000 (MHIA). But by mentioning “building codes,” while that can certainly mean local building codes, it could also be a subtle reference to the HUD Code for manufacutred housing and thus to the MHIA too. That is isn’t explicitly stated may be a problem for their leadership and shareholders.

Recall that Equity Lifestyle Properties (ELS), another fellow MHI/National Communities Council (NCC) member, said that rent control was something that they were accustomed to navigating.

On page 18 of the AIF is this: “landlord/ tenant laws in certain states may provide residents with the right to bring certain claims to the respective judicial or administrative body seeking an order to, among other things, compel landlords to comply with health, safety, housing and maintenance standards.” Well, duh? But that might be pondered in the light of attorney and former community owner Marty Lavin’s recent comments, linked below.

Also on page 18 of Flagship’s AIF is this.

“Changes in rules and regulations, including the U.S. Department of Housing and Urban Development’s manufactured housing rules, that result in access to affordable housing being made increasingly burdensome or excessively costly would negatively impact the tenant demand for lots, which may adversely affect the REIT’s financial condition and results of operations.” Why this is raised absent a specific mention of the MHIA is a fair question. Why this is only put in the negative is another question, because MHI is certainly in a position to impact these regulations. Indeed, Smith promised while he was MHI’s chairman that he would leave the trade association in a pro-active rather than a re-active mindset.

To the points raised and alluded to above, is this from Flagship’s AIF on page 19.

“If competing MHCs or other residential properties are built in the area where one of the REIT’s properties is located, or any such communities or residential properties located in the vicinity of one of the REIT’s properties is substantially refurbished, the net operating income derived from, and the value of, the REIT’s property could be reduced.”

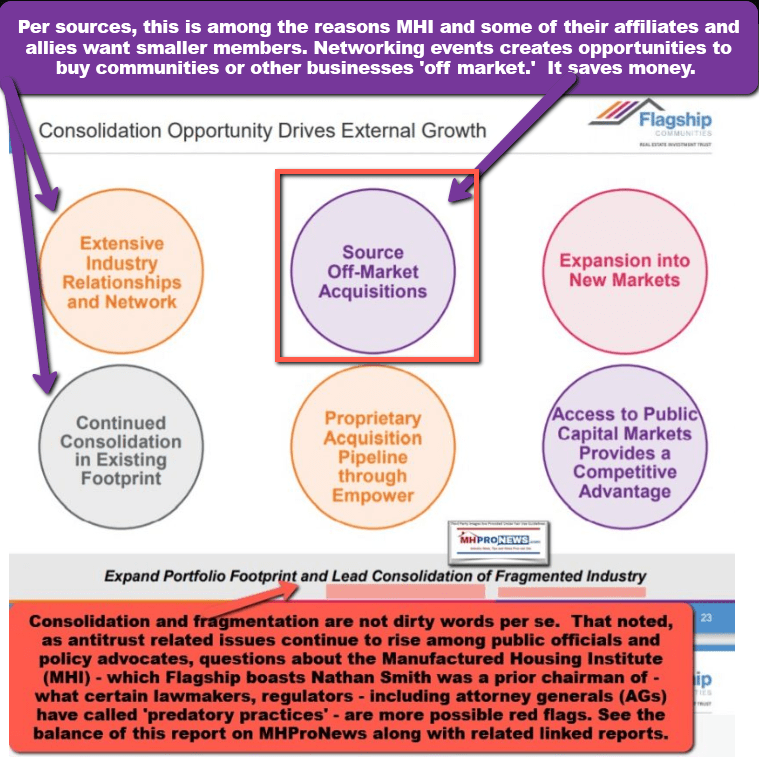

This gets to the heart of numerous issues that MHProNews, or third-party researchers such as Samuel “Sam” Strommen at Knudson Law, have raised. New communities and/or new sites in existing communities could challenge Flagship’s property valuations. But that implies that there is a perverse incentive by certain large members who are open about their goal toward consolidation, as is Flagship, to see to it that good existing laws are thwarted.

Given that more manufactured home communities are closing than opening, the supply-demand pressures on existing pads and communities is increased. While that may seem good for some time, it could also become a destabilizing factor.

This previously referenced page from the Flagship investor pitch-deck makes a related point. Given a relatively closed system, where closures outnumber openings, each existing properties values are pressed up.

Then, when Shiffman’s observations about Biden Administration tax plans are taken into account, there are reasons why the numbers of communities that are being sold has risen.

Another disclosure from Flagship’s AIF on page 23 says the following.

While that may be viewed as relatively standard language for such a document, when viewed in the light of their internal controls and other disclosures, it is one of a series of possible red-flags for investors of Flagship.

On page 24 of their AIF:

The process of obtaining zoning variances can be difficult and time consuming and there can be no assurance that the required variances would be granted in each case or, if granted, that they will be granted on terms favorable to the REIT.”

Once more, that begs a mention of the MHIA and preemption. The fact that MHI is posing support for that without taking robust legal or other action to make a good law an effective reality is a cautionary note for investors.

This comment on AIF page 26 is almost comical, given the history of Flagship in its SSK Communities days.

The use of social media could cause the REIT to suffer brand damage or information leakage. Negative posts or comments about the REIT or its MHCs on any social networking platform could damage the REIT’s reputation. In addition, employees or others might disclose non-public sensitive information relating to the REIT’s business through external media channels. The continuing evolution of social media will present the REIT with new challenges and risks.

Community residents tired of street flooding every time it rains

Each of the following items

AIF page 27. The discussion on access to capital is stating the obvious, but begs the question why MHI isn’t doing what it claims to grow that access to capital?

The real estate industry is highly capital intensive.”

Property Development, Redevelopment and Renovation Risks

P29

Legislative Requirements that Limit Affordable Financing for Potential Manufactured Home Buyers Legislation impacting third party loan originators, consumer protection laws and lender requirements to investigate a borrower’s creditworthiness may restrict access to affordable financing to potential manufactured home buyers. Restricted access to affordable financing to potential manufactured home buyers may result in a slowdown in the demand for manufactured housing, which may adversely affect the REIT’s financial condition and results of operations.”

Then, comes this. This comment could be a 5-star red flag. Read the highlighted parts carefully. When Flagship says their interests are largely aligned with that of shareholders, doesn’t this from AIF page 30 wave a cautionary flag to the contrary?

Pursuant to the Non-Competition and Non-Solicitation Agreement, unless otherwise consented to by the independent trustees of the REIT, during any period in which the Non-Competition and Non-Solicitation Agreement remains effective, Empower and its affiliates and associates are restricted from certain activities that would be competitive with the REIT. However, following the termination of the Non-Competition and Non-Solicitation Agreement, Empower, which is controlled by the REIT’s President and Chief Executive Officer and Chief Investment Officer, will not be limited or restricted in any way from owning, acquiring, constructing, developing or redeveloping properties, and may itself compete with the REIT in seeking tenants and for the purchase, development and operation of desirable properties to be used as MHCs. Such continuing business of Empower may lead to conflicts of interest between Empower and the REIT. Additionally, if a change of control or management (as defined in the Non-Competition and Non-Solicitation Agreement) of the REIT or Flagship Operating, LLC occurs, Empower will have the right to terminate the Non-Competition and Non-Solicitation Agreement upon written notice.”

Page 33

Page 65

US HOLDCO

US Holdco is a corporation incorporated under the laws of the State of Delaware. US Holdco owns all of the Class A Units of Flagship Operating, LLC. …”

The above headers and topics are hardly exhaustive. They are only some of the myriad points that merit attention, given Flagship’s history.

Last but not least, from the item below in their Management Discussion on November 10, 2021 are these cautionary notes. Again, this should be construed through the lens of the SEC pleadings against Cavco. The following are pull quotes, the full text is provided following the video.

Disclosure Controls and Internal Controls Over Financial Reporting

- Management, including the Chief Executive Officer and Chief Financial Officer, does not expect that control systems of the REIT will prevent or detect all errors and all fraud or will be effective under all potential future conditions.

- Controls can also be circumvented by individual acts of some persons, by collusion of two or more people or by management override of the controls.

For balance, the following video from Flagship on October 26, 2020.

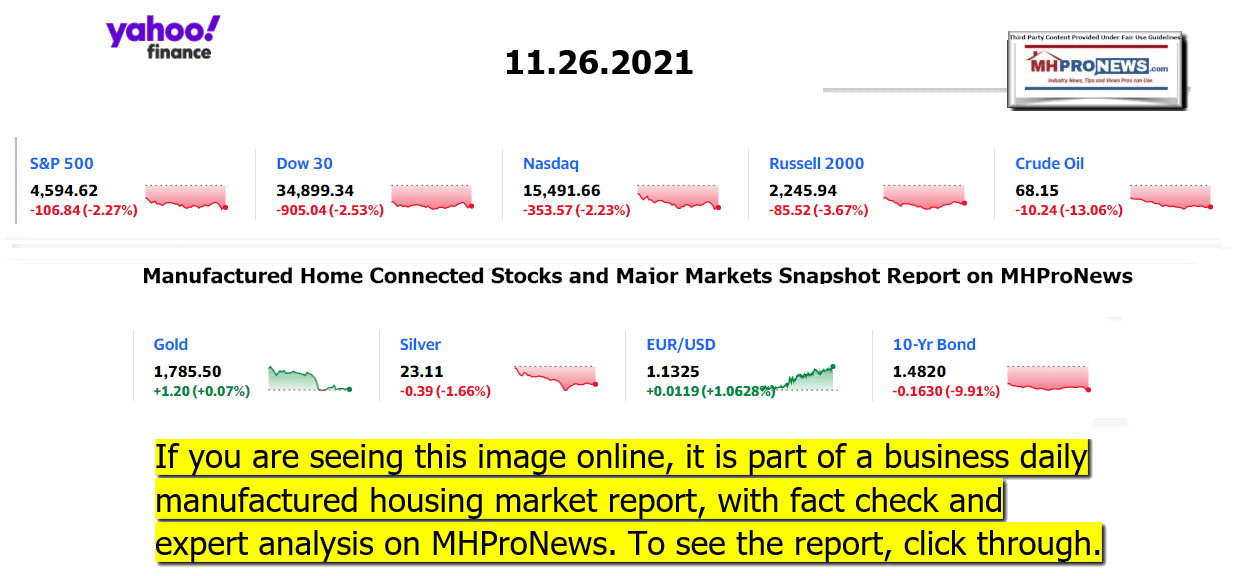

All that said, here Flagship’s November 10, 2021 management discussion. It will be followed by our left-right headlines and market snapshot graphics. For reasons noted and linked herein, publishing this information from them should not be considered an endorsement of any kind.

Flagship Communities Real Estate Investment Trust

Management Discussion and Analysis

For the three and nine months ended September 30, 2021 (unaudited) Amounts in Thousands of US Dollars (except for per unit amounts)

Table of Contents

Forward Looking Statements…………… 3

Non-IFRS Financial Measures………….. 5

Financial Highlights……………………… 10

Business Performance Measures…….. 11

Selected Quarterly Financial Information………………………………………………. 15

Review of Selected Operating Information – Q3 2021………………… 16

Reconciliation of Non-IFRS Financial Measures………………………………….. 26

Liquidity and Capital Resources……… 30

Contractual Commitments…………….. 35

Investment Property Portfolio………… 35

Transactions with Related Parties…… 37

Critical Accounting Estimates and Assumptions………………………………. 38

Future accounting changes……………. 39

Disclosure Controls and Internal Controls Over Financial Reporting………………. 39

Presentation

This Management’s Discussion and Analysis (“MD&A”) is prepared as of November 10, 2021 and outlines Flagship Communities Real Estate Investment Trust’s (the “REIT” or “Flagship”) operating strategies, risk profile considerations, business outlook and analysis of its financial performance and financial condition for the three and nine months ended September 30, 2021. The analysis provides a comparison to the REIT’s financial forecast for the same period (the “Forecast”) provided in the REIT’s final prospectus dated September 28, 2020 (the “Prospectus”).

This MD&A should be read in conjunction with the REIT’s unaudited interim condensed consolidated financial statements and accompanying notes for three and nine months ended September 30, 2021, and the REIT’s audited consolidated financial statements and accompanying notes for the period from August 12, 2020 (date of formation) to December 31, 2020. These documents, as well as additional information relating to the REIT (including the REIT’s most recently filed annual information form (the “Annual Information Form”)) can be accessed under the REIT’s SEDAR profile at www.sedar.com or on the REIT’s website at www.flagshipcommunities.com.

This MD&A is based on financial statements prepared by management in accordance with International Accounting Standards (“IAS”) 34, Interim Financial Reporting, as issued by the International Accounting Standards Board. All amounts are stated in thousands of U.S. dollars, unless otherwise noted. The trust units of the REIT (“Units”) trade on the Toronto Stock Exchange in U.S. dollars under the symbol “MHC.U”.

Forward Looking Statements

This MD&A contains statements that include forward-looking information (within the meaning of applicable

Canadian securities laws). Forward-looking statements are identified by words such as “believe”, “anticipate”,

“project”, “expect”, “intend”, “plan”, “will”, “may”, “can”, “could”, “would”, “must”, “estimate”, “target”, “objective” and other similar expressions, or negative versions thereof, and include statements herein concerning: the REIT’s investment strategy and creation of long-term value; the REIT’s intention to continue to expand, including on a clustered basis and newly-entered geographies, and to shrink its rental fleet; macro characteristics and trends in the United States real estate and housing industry, as well as the manufactured housing communities (“MHC”) industry specifically; the continued ability of the REIT’s MHCs to be stable or strengthen in the foreseeable future and over the longer term and the REIT’s target indebtedness as a percentage of Gross Book Value. These statements are based on the REIT’s expectations, estimates, forecasts and projections, as well as assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies that could cause actual results to differ materially from those that are disclosed in such forward-looking statements. While considered reasonable by management of the REIT as at the date of this MD&A, any of these expectations, estimates, forecasts, projections or assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those expectations, estimates, forecasts, projections or assumptions could be incorrect. Material factors and assumptions used by management of the REIT to develop the forward-looking information in this MD&A include, but are not limited to, the REIT’s current expectations about: vacancy and rental growth rates in MHCs and the continued receipt of rental payments in line with historical collections; demographic trends in areas where the MHCs are located; the impact of COVID-19 on the MHCs; further MHC acquisitions by the REIT; the applicability of any government regulation concerning MHCs and other residential accommodations, including as a result of COVID-19; the availability of debt financing and future interest rates; expenditures and fees in connection with the ownership of MHCs; and tax laws. When relying on forward-looking statements to make decisions, the REIT cautions readers not to place undue reliance on these statements, as they are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, the factors discussed under the heading “Risks and Uncertainties” herein and in the Annual MD&A, as well as risk factors discussed in the Annual Information Form. There can be no assurance that forwardlooking statements will prove to be accurate as actual outcomes and results may differ materially from those expressed in these forward-looking statements. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, certain forward-looking statements included in this MD&A may be considered a “financial outlook” for purposes of applicable Canadian securities laws, and as such, the financial outlook may not be appropriate for purposes other than to understand management’s current expectations and plans relating to the future, as disclosed in this MD&A. Forward-looking statements are made as of the date of this MD&A and, except as expressly required by applicable law, the REIT assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Use of Estimates

The preparation of financial statements requires management to make judgments, estimates and assumptions that affect the application of policies and reported amounts of assets and liabilities, and revenue and expenses. The estimates and associated assumptions are based on historical experience and various other factors that are believed to be reasonable under the circumstances, the results of which form the basis of making the judgments about carrying values of assets and liabilities that are not readily apparent from other sources.

Significant estimates, judgments and assumptions include the fair values assigned to investment properties. Actual results may differ from these estimates.

Non-IFRS Financial Measures

In this MD&A, the REIT uses certain financial measures that are not defined under International Financial Reporting Standards (“IFRS”), including certain real estate industry metrics, to measure, compare and explain the operating results, financial performance and cash flows of the REIT. These measures are commonly used by entities in the real estate industry as useful metrics for measuring performance. However, they do not have any standardized meaning prescribed by IFRS and are not necessarily comparable to similar measures presented by other publicly traded entities. These measures should be considered as supplemental in nature and not as a substitute for related financial information prepared in accordance with IFRS.

Funds from Operations and Adjusted Funds from Operations

In February 2019, the Real Property Association of Canada (“REALPAC”) published a white paper titled “White Paper on Funds from Operations & Adjusted Funds from Operations for IFRS”. The purpose of the white paper is to provide reporting issuers and investors with guidance on the definition of funds from operations (“FFO”) and adjusted funds from operations (“AFFO”) and to help promote more consistent disclosure from reporting issuers.

FFO is defined as IFRS consolidated net income (loss) adjusted for items such as distributions on redeemable or exchangeable units recorded as finance cost under IFRS (including distributions on the class B units of Flagship Operating, LLC (“Class B Units”), unrealized fair value adjustments to investment properties, loss on extinguishment of acquired mortgages payable, gain on disposition of investment properties and depreciation. FFO should not be construed as an alternative to net income (loss) or cash flows provided by or (used in) operating activities determined in accordance with IFRS. The REIT’s method of calculating FFO is substantially in accordance with REALPAC’s recommendations but may differ from other issuers’ methods and, accordingly, may not be comparable to FFO reported by other issuers. Refer to section “Reconciliation of Non-IFRS Financial Measures” for a reconciliation of FFO to AFFO to net income (loss).

AFFO is defined as FFO adjusted for items such as maintenance capital expenditures, and certain non-cash items such as amortization of intangible assets, premiums and discounts on debt and investments. AFFO should not be construed as an alternative to net income (loss) or cash flows provided by or (used in) operating activities determined in accordance with IFRS. The REIT’s method of calculating AFFO is substantially in accordance with REALPAC’s recommendations. The REIT uses a capital expenditure reserve of $60

(dollars/annual) per lot and $1,000 (dollars/annual) per rental home in the AFFO calculation. This reserve is based on management’s best estimate of the cost that the REIT may incur, related to maintaining the investment properties. This may differ from other issuers’ methods and, accordingly, may not be comparable to AFFO reported by other issuers. Refer to section “Reconciliation of Non-IFRS Financial Measures” for a reconciliation of AFFO to net income (loss).

The REIT believes these non-IFRS financial measures and ratios provide useful supplemental information to both management and investors in measuring the operating performance, financial performance and financial condition of the REIT. The REIT also uses AFFO in assessing its distribution paying capacity.

Net Operating Income

Net operating income (“NOI”) is defined as total revenue from properties (i.e., rental revenue and other property income) less direct property operating expenses in accordance with IFRS. NOI should not be construed as an alternative to net income determined in accordance with IFRS. The REIT’s method of calculating NOI may differ from other issuers’ methods and, accordingly, may not be comparable to NOI reported by other issuers. The REIT regards NOI as an important measure of the income generated from the income producing properties and uses NOI in evaluating the performance of the REIT’s properties. It is also a key input in determining the value of the REIT’s properties. Refer to section “Reconciliation of Non-IFRS Financial Measures” for a reconciliation of NOI to net income.

Other Real Estate Industry Metrics

Additionally, this MD&A contains several other real estate industry metrics that could be considered non-IFRS financial measures:

- “AFFO payout ratio” is defined as total cash distributions of the REIT (including distributions on Class B Units) divided by AFFO.

- “Debt to Gross Book Value Ratio” is calculated by dividing indebtedness, which consists of the total principal amounts outstanding under mortgages payable and credit facilities, by Gross Book Value (as defined below).

- “Gross Book Value” means, at any time, the greater of: (a) the value of the assets of the REIT and its consolidated subsidiaries, as shown on its then most recent consolidated balance sheet prepared in accordance with IFRS, less the amount of any receivable reflecting interest rate subsidies on any debt assumed by the REIT; and (b) the historical cost of the investment properties, plus (i) the carrying value of cash and cash equivalents, (ii) the carrying value of mortgages receivable; and (iii) the historical cost of other assets and investments used in operations.

- “NOI margin” is defined as NOI divided by total revenue.

- “Same Community” means the Initial Communities (as defined below) and such measure is used by management to evaluate period-over-period performance of investment properties throughout both respective periods. These results remove the impact of dispositions or acquisitions of investment properties.

- “Liquidity” is defined as (a) cash and cash equivalents (unrestricted), plus (b) borrowing capacity available under any existing credit facilities.

Business Overview

Flagship Communities Real Estate Investment Trust is an unincorporated, open-ended real estate investment trust established pursuant to a declaration of trust dated as of August 12, 2020 (as subsequently amended and restated, the “Declaration of Trust”) under the laws of the Province of Ontario. The registered office of the REIT is located at 199 Bay Street, Suite 4000, Toronto, Ontario, M5L 1A9, Canada. The head office of the REIT is located at 467 Erlanger Road, Erlanger, Kentucky, 41018, United States. The REIT has been formed for the purpose of owning and operating a portfolio of income-producing MHCs, and related assets, all of which are located in the United States.

The operations of the REIT commenced on October 7, 2020 when it completed its initial public offering (“IPO” of 6,250,000 Units) for gross proceeds of $93,750. Following certain reorganization transactions, upon closing of the IPO, the vendor of certain of the REIT’s initial MHCs merged with and into Flagship Operating, LLC, a limited liability company subsidiary of the REIT, and the vendor of certain further of the REIT’s initial MHCs was contributed to Flagship Operating, LLC. As a result, upon completion of the merger and contribution, and certain related transactions, some of which took place on November 2, 2020, all of the REIT’s initial MHCs and the remaining assets comprising the REIT’s initial “portfolio” are now indirectly held by the REIT through its indirect ownership of Flagship Operating, LLC. The initial portfolio was comprised of 45 MHCs with 8,255 lots located in four contiguous states in the U.S.: (i) Kentucky; (ii) Indiana; (iii) Ohio; and (iv) Tennessee (the “Initial Communities”). The Initial Communities are strategically concentrated in key markets where REIT management has comprehensive knowledge and experience, including the REIT’s largest markets of Louisville, Cincinnati and Evansville. Proceeds from the IPO were also used to repay approximately $13,600 of indebtedness and to fund transaction costs associated with the offering.

On October 22, 2020, pursuant to the exercise of the over-allotment option granted to the underwriters in connection with the IPO, the REIT issued an additional 937,500 Units at $15.00 per Unit, resulting in gross proceeds of $14,063. Total costs for underwriters’ fees were $894, resulting in net proceeds of $13,169. The net proceeds from the exercise of the over-allotment option have been used by the REIT to fund further acquisitions and for general business purposes.

On December 17, 2020, the REIT announced the acquisition (and pending acquisition) of seven MHCs consisting of 379 lots for approximately $12,900. The acquisitions were all within the REIT’s existing geographic footprint with three MHCs (197 lots) in Evansville, Indiana, two MHCs (101 lots) in Northern Kentucky, and two MHCs (81 lots) in Paducah, Kentucky.

On February 9, 2021, the REIT announced the acquisition of two new MHCs consisting of an aggregate of 151 lots and the acquisition of 8 additional lots adjacent to an already-owned community, for an aggregate purchase price of approximately $6,050. One new community is within the REIT’s existing geographic footprint with 77 lots in the Louisville, Kentucky market. The second new community, however, is Flagship’s first entry into the Bowling Green, Kentucky market. This community has 74 lots and is located approximately 60 miles north of Nashville, Tennessee.

On May 12, 2021, the REIT announced the acquisition of a new MHC consisting of 167 lots and a fleet of manufactured homes for a purchase price of approximately $5,300 (“Anderson Pointe”). This community was the first acquisition outside of the REIT’s main geographic footprint. The acquisition of Anderson Pointe, which is 76.6% occupied, is a strategic move by the REIT and represents an expansion into Little Rock, Arkansas.

On June 9, 2021, the REIT filed a supplement to its base shelf prospectus dated May 7, 2021, and entered into an underwriting agreement for the purpose of completing an equity offering (the “June 2021 Offering”) that closed on June 14, 2021. Pursuant to the June 2021 Offering, the REIT raised gross proceeds of $81,000 (including from the exercise, in part, of an over-allotment option by the underwriters of the offering) through the issuance of 4,500,000 Units at a price of $18.00 per Unit. The net proceeds from the exercise of the June 2021 Offering were used by the REIT to fund the acquisition of Anderson Pointe, as well as future acquisitions and for general business purposes.

On July 2, 2021, the REIT acquired two MHCs comprising 677 lots for an aggregate purchase price of approximately $65,100 (the “July 2021 Acquisitions”). The July 2021 Acquisitions, along with the acquisition of Anderson Pointe and other previously completed acquisitions, represent the REIT’s strategic entry into Missouri and Arkansas while further consolidating its operating footprint in existing markets.

On August 10, 2021 the REIT signed a loan commitment, for which the July 2021 Acquisitions are collateral, for $29,700. The interest rate on the note is 3.08% fixed for 20 years with the first 84 payments being interest only. These funds were used to fund future acquisitions and for general business purposes.

On August 23, 2021 the REIT acquired a 231 lot MHC located in Springfield, Illinois for a purchase price of approximately $16,300. This MHC was 94% occupied at time of acquisition and is the REIT’s first property in the state of Illinois. Consistent with the REIT’s clustering strategy, which is designed to maximize operating efficiencies and provide opportunities for rent growth, the REIT intends to continue sourcing acquisitions in Missouri, Arkansas, and Illinois as well as other adjacent markets with a focus on expanding the REIT’s contiguous portfolio.

As of September 30, 2021, the REIT owned a 100% interest in a portfolio of 58 MHCs with 9,904 lots located in seven contiguous states: (i) Arkansas; (ii) Illinois; (iii) Indiana; (iv) Kentucky; (v) Missouri; (vi) Ohio; and (vii)

Tennessee. These MHCs are strategically concentrated in key markets where management has comprehensive knowledge and experience, including the REIT’s largest markets of Louisville, Cincinnati and Evansville. The REIT also owns a fleet of approximately 1,120 manufactured homes for lease to residents. The growth in the rental home fleet is a direct result of recently acquired properties and the REIT plans to continue its strategy of shrinking the rental fleet as the market allows.

On October 22, 2021 the REIT announced that the Board of Trustees approved a 5% increase to its monthly cash distribution to unitholders to $0.0446 per REIT unit or $0.5355 per REIT unit on an annual basis. The new monthly cash distribution will commence with the November 2021 distribution when declared, to be payable in December 2021.

On October 25, 2021 the REIT announced the acquisition of two RV Resort communities for an aggregate purchase price of approximately $8,350. The RV resorts are located in Wapakoneta, Ohio and Walton, Kentucky and include 75+ acres and 467 sites.

The REIT is internally managed by a vertically integrated team of seasoned MHC professionals with expertise across the spectrum of real estate investment management, including: acquisitions, underwriting, financing, asset management, property management, operations, development and redevelopment, accounting, regulatory affairs, marketing, and human resources. Management of the REIT has extensive experience with the Initial Communities, having operated all of the Initial Communities since the date of their respective acquisition and, in the case of one Initial Community, development.

The primary objectives of the REIT are to:

- Provide holders of Units (“Unitholders”) an opportunity to invest in a portfolio of MHCs located in attractive U.S. markets;

- Provide Unitholders with predictable, sustainable and growing cash distributions;

- Enhance the value of the REIT’s portfolio and maximize the long-term value of the Units through proactive asset and property management, disciplined capital management and value-add investment opportunities; and

- Expand the asset base of the REIT in its existing operational footprint and target growth markets by leveraging management’s extensive industry experience and relationships to acquire MHCs that are expected to be accretive to the REIT’s net asset value and AFFO per Unit.

COVID-19 Update

A sizable number of Flagship REIT residents have been able to maintain their employment through the COVID19 pandemic or are on fixed incomes from retirement, pensions, or disability. The majority of Flagship REIT’s residents received a minimum of $1,400 per person, including children, from the US government in the form of stimulus checks. These stimulus checks are in addition to jobless benefits, child tax credits, health insurance subsidies and rent relief.

Flagship REIT believes COVID-19 has amplified the benefits of MHCs versus multi-family apartments. Multifamily apartments typically have smaller living spaces, fewer bedrooms and bathrooms, shared indoor walls, shared laundry facilities, common areas, and shared HVAC systems. Given the current landscape, these conditions, especially the shared facilities and common areas, are sub-optimal when everyone is mindful of social distancing requirements.

Flagship REIT will continue to closely monitor COVID-19 developments and will update health and safety policies as required to ensure the highest level of safety for the REIT’s residents and employees.

Financial Highlights

Three months ended September 30, 2021

- Revenue for the three months September 30, 2021 was $11,399, which is $2,331 higher than the Forecast.

- Same Community Revenue for the three months ended September 30, 2021 was $9,218, which is $150 higher than the Forecast.

- Net Income and Comprehensive Income for the three months ended September 30, 2021 was $1,870 which was $192 less than Forecast

- NOI for the three months ended September 30, 2021 was $7,592 which is $1,740 higher than the Forecast.

- Same Community NOI for the three months ended September 30, 2021 was $6,105, which is $253 higher than the Forecast.

- NOI Margin for the three months ended September 30, 2021 was 66.6%, which exceeded the Forecast of 64.5%

- Same Community NOI Margin for the three months ended September 30, 2021 was 66.2%, which exceeded the Forecast of 64.5%

- AFFO per unit (diluted) for the three months ended September 30, 2021 of $.218 exceeded the Forecast by 19.0%

- Same Community occupancy increased to 80.8% as of September 30, 2021 compared to 79.2% on December 31, 2020.

- Rent collections for the three months ended September 30, 2021 was 99.2%, which is slightly up from

98.8% for the three months ending June 30, 2020 and consistent with historical periods.

Nine months ended September 30, 2021

- Total portfolio and Same Community revenues exceeded the Forecast by $3,798 and $338 respectively, for the nine months ended September 30, 2021.

- Net income and comprehensive income for the nine months ended September 30, 2021 was $6,556 which was $352 more than forecast.

- Total portfolio and Same Community NOI exceeded the Forecast by $2,957 and $881, respectively, for the nine months ended September 30, 2021. This represents an increase over the Forecast of 16.9% for total portfolio and 5.0% for Same Community.

- NOI Margin for the nine months ended September 30, 2021 was 66.3% which exceeded the Forecast by

1.7% and Same Community NOI margin was 67.0% which exceeded the Forecast by 2.4%

- AFFO per unit (diluted) for the nine months ended September 30, 2021 of $.659 exceeded the Forecast by 18.1%.

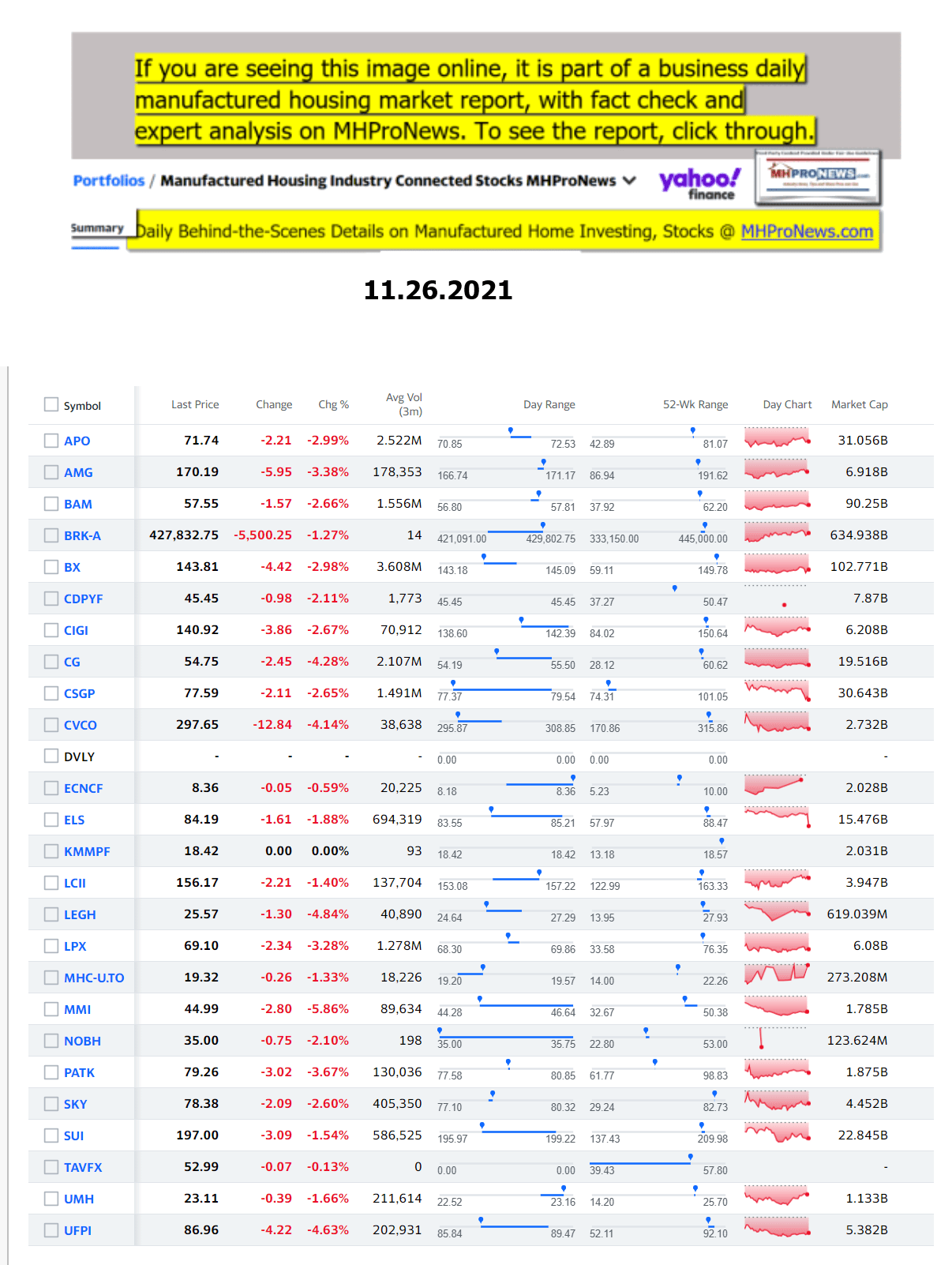

Business Performance Measures

The following table presents an overview of certain performance measures of the REIT as of September 30, 2021 and for the three months ended September 30, 2021.

| Performance measures | |

| Total communities as of September 30, 2021 | 58 |

| Total lots as of September 30, 2021 | 9,904 |

| Weighted average lot rent as of September 30, 2021 | $ 365 |

| Occupancy as of September 30, 2021 | 81.9% |

| For the three months ended September 30, 2021 Total revenues | $ 11,399 |

| Net income and comprehensive income | $ 1,870 |

| Net income and comprehensive income per unit (basic) | $ 0.16 |

| Net income and comprehensive income per unit (diluted) | $ 0.11 |

| Distribtutions Declared per unit (Units) | $ 0.128 |

| Distribtutions Declared per unit (B Units) | $ 0.128 |

| NOI* | $ 7,592 |

| NOI Margin* | 66.6% |

| FFO* | $ 4,403 |

| FFO Per Unit* (diluted) | $ 0.257 |

| AFFO* | $ 3,742 |

| AFFO Per Unit* (diluted) | $ 0.218 |

| AFFO Payout Ratio* | 58.5% |

| Weighted average units (basic) | 11,726,185 |

| Weighted average units (diluted) | 17,165,547 |

Debt to Gross Book Value as of September 30, 2021 42.0%

Weighted average mortgage Interest Rate as of September 30, 2021 3.44%

Weighted average mortage term as of September 30, 2021 10.6

*These measures are not recognized under IFRS and do not have standardized meanings prescribed by IFRS. Refer to section “Non-IFRS Financial Measures”.

Net income and comprehensive income per unit (basic) as well as net income and comprehensive income per unit (diluted) are calculated by using Net income divided by the weighted average unit count (Units only) and the diluted weighted average unit count (including Class B Units and Deferred Trust Units (“DTUs”)), respectively for the three months ended September 30, 2021. FFO per unit and AFFO per unit are calculated by using FFO and AFFO, divided by the diluted weighted average unit count (including Class B Units and DTUs) for the three months ended September 30, 2021.

The following table highlights certain information about communities as of September 30, 2021, organized by Metropolitan Statistical Area (“MSA”):

| MSA | State | Number of lots | $ Average Lot Rent | Occupancy |

| Louisville | Kentucky | 3,427 | $ 373 | 82.3% |

| Lexington | Kentucky | 326 | $ 344 | 85.6% |

| Paducah | Kentucky | 365 | $ 234 | 81.9% |

| Cincinnati | Ohio | 2,381 | $ 387 | 87.0% |

| Evansville | Indiana | 2,191 | $ 320 | 71.1% |

| St Louis | Missouri | 502 | $ 493 | 97.0% |

| Springfiled | Illinois | 232 | $ 395 | 94.4% |

| Other | 480 | $ 309 | 79.0% |

9,904 $ 365 81.9%

The charts below show the total portfolio weighted average lot rent and occupancy as well as the Same Community weighted average lot rent and occupancy growth since 2015:

The following table highlights certain financial performance measures of the REIT for the three months ended September 30, 2021.

| For the three months ended September 30, 2021

Actual results Forecast Variance |

|||

| Revenue, total portfolio | $ 11,399 | $ 9,068 | $ 2,331 |

| Revenue, Same Community* properties | $ 9,218 | $ 9,068 | $ 150 |

| Revenue, acquisitions | $ 2,181 | – | $ 2,181 |

| Net income and comprehensive income | $ 1,870 | 2,062 | $ (192) |

| NOI*, Total Portfolio | $ 7,592 | $ 5,852 | $ 1,740 |

| NOI * , Same Community* properties | $ 6,105 | $ 5,852 | $ 253 |

| NOI * , acquisitions | $ 1,487 | – | $ 1,487 |

| NOI Margin*, total portfolio | 66.6% | 64.5% | 2.1% |

| NOI margin*, Same Community* properties | 66.2% | 64.5% | 1.7% |

| NOI Margin*, acquisitions | 68.2% | – | 68.2% |

| FFO* | $ 4,403 | $ 2,789 | $ 1,614 |

| FFO Per Unit* (excluding over allotment – IPO) | N/A | $ 0.238 | N/A |

| FFO Per Unit* (including over allotment – IPO) | $ 0.257 | $ 0.220 | $ 0.037 |

| AFFO* | $ 3,742 | $ 2,319 | $ 1,423 |

| AFFO per Unit* (excluding over allotment – IPO) | N/A | $ 0.198 | N/A |

| AFFO per Unit* (including over allotment – IPO) | $ 0.218 | $ 0.183 | $ 0.035 |

| AFFO Payout Ratio* (exluding over allotment – IPO) | N/A | 64.4% | N/A |

| AFFO Payout Ratio* (including over allotment – IPO) | 58.5% | 69.6% | -11.1% |

| Weighted average units (excluding over allotment – IPO) | 15,725,374 | 11,721,625 | 4,003,749 |

| Weighted average units (Including over allotment – IPO) | 17,165,547 | 12,659,125 | 4,506,422 |

*These measures are not recognized under IFRS and do not have standardized meanings prescribed by IFRS. Refer to section “Non-IFRS Financial Measures”.

The following table highlights certain financial performance measures of the REIT for the nine months ended September 30, 2021.

| For the nine months ended September 30, 2021

Actual results Forecast Variance |

|||

| Revenue, total portfolio | $ 30,883 | $ 27,085 | $ 3,798 |

| Revenue, Same Community* properties | $ 27,423 | $ 27,085 | $ 338 |

| Revenue, acquisitions | $ 3,460 | – | $ 3,460 |

| Net income and comprehensive income | $ 6,556 | 6,204 | $ 352 |

| NOI*, Total Portfolio | $ 20,462 | $ 17,505 | $ 2,957 |

| NOI * , Same Community* properties | $ 18,386 | $ 17,505 | $ 881 |

| NOI * , acquisitions | $ 2,076 | – | $ 2,076 |

| NOI Margin*, total portfolio | 66.3% | 64.6% | 1.7% |

| NOI margin*, Same Community* properties | 67.0% | 64.6% | 2.4% |

| NOI Margin*, acquisitions | 60.0% | – | 60.0% |

| FFO* | $ 11,241 | $ 8,379 | $ 2,862 |

| FFO Per Unit* (excluding over allotment – IPO) | N/A | $ 0.715 | N/A |

| FFO Per Unit* (including over allotment – IPO) | $ 0.778 | $ 0.662 | $ 0.116 |

| AFFO* | $ 9,523 | $ 7,068 | $ 2,455 |

| AFFO per Unit* (excluding over allotment – IPO) | N/A | $ 0.603 | N/A |

| AFFO per Unit* (including over allotment – IPO) | $ 0.659 | $ 0.558 | $ 0.101 |

| AFFO Payout Ratio* (exluding over allotment – IPO) | N/A | 63.4% | N/A |

| AFFO Payout Ratio* (including over allotment – IPO) | 58.1% | 68.5% | -10.4% |

| Weighted average units (excluding over allotment – IPO) | 13,317,949 | 11,721,625 | 1,596,324 |

| Weighted average units (Including over allotment – IPO) | 14,454,621 | 12,659,125 | 1,795,496 |

*These measures are not recognized under IFRS and do not have standardized meanings prescribed by IFRS. Refer to section “Non-IFRS Financial Measures”.

On October 22, 2020, pursuant to the IPO underwriters’ exercise of an over-allotment option, the REIT issued an additional 937,500 Units. The tables above lay out FFO per unit, AFFO per unit, and AFFO payout ratio with and without the effects of the exercise of the IPO over-allotment option. The “Forecast” for AFFO and FFO per unit (excluding the exercise of the IPO over-allotment option) is calculated by dividing forecasted AFFO/FFO by the weighted average number of units for the three and nine months ended September 30, 2021 excluding the 937,500 Units issued pursuant to the exercise of the IPO over-allotment option. The “Forecast” for AFFO and FFO per unit (including the exercise of the IPO over-allotment option) is calculated by dividing AFFO/FFO by the weighted average number of units for the for the three and nine months ended September 30, 2021 including the 937,500 Units issued pursuant to the exercise of the IPO over-allotment option. All per unit measures included in the tables above are diluted (including Class B Units and DTUs.)

Selected Quarterly Financial Information

| For the three months ended | For the three months ended | For the three months ended | |

| Performance measures | September 30, 2021 | June 30, 2021 | March 31, 2021 |

| Total communities

Total lots Weighted average lot rent Occupancy |

58

9,904 $ 365 81.9% |

55

8,960 $ 359 80.7% |

54

8,793 $ 361 80.2% |

| Total revenues

Net income (loss) and comprehensive income (loss) Net income (loss) and comprehensive income (loss) per unit (basic) Net income (loss) and comprehensive income (loss) per unit (diluted) |

$ 11,399

$ 1,870 $ 0.16 $ 0.11 |

$ 9,835

$ (1,945) $ (0.25) $ (0.15) |

$ 9,649

$ 6,631 $ 0.92 $ 0.52 |

| NOI*

NOI Margin* |

$ 7,592

66.6% |

$ 6,430

65.4% |

$ 6,440

66.7% |

| FFO*

FFO Per Unit* (diluted) |

$ 4,403

$ 0.257 |

$ 3,342

$ 0.255 |

$ 3,498

$ 0.276 |

| AFFO*

AFFO Per Unit* (diluted) AFFO Payout Ratio* |

$ 3,742

$ 0.218 58.5% |

$ 2,754

$ 0.210 60.7% |

$ 3,028

$ 0.239 53.3% |

*These measures are not recognized under IFRS and do not have standardized meanings prescribed by IFRS. Refer to section “Non-IFRS Financial Measures”.

The AFFO/FFO per Unit amounts in the table above are calculated by dividing AFFO/FFO by the weighted average number of Units (diluted to include the Class B Units and DTUs) for the applicable period.

Review of Selected Operating Information – Q3 2021

The following tables highlight selected financial information of the REIT for the three and nine months ended

September 30, 2021 compared to the REIT’s Forecast provided in the REIT’s final prospectus dated September 28, 2020. This information has been compiled from the interim condensed consolidated financial statements and notes thereto and should be read in conjunction with the interim condensed consolidated financial statements and notes.

The following table highlights certain operating information of the REIT for the three months ended September 30, 2021.

| For the three months ended September 30, 2021

Actual results Forecast Variance |

|||

| Revenue

Rental Revenue |

$ 11,399 | $ 9,068 | $ 2,331 |

| Expenses (Income)

Property operating expenses |

$ 3,807 | $ 3,216 | $ 591 |

| General and administrative | $ 1,432 | $ 1,252 | $ 180 |

| Finance costs from operations | $ 2,037 | $ 2,068 | $ (31) |

| Accretion of mark-to-market adjustment on mortgage payable | $ (257) | $ (257) | $ – |

| Depreciation and amortization | $ 53 | $ 34 | $ 19 |

| Other (income) | $ (32) | $ – | $ (32) |

| Fair value adjustment – Class B units | $ 10,200 | $ – | $ 10,200 |

| Distributions on Class B units | $ 692 | $ 693 | $ (1) |

| Fair value gain on investment properties | $ (8,412) | $ – | $ (8,412) |

| Fair value adjustment – Unit Based Comp | $ 9 | $ – | $ 9 |

| Transaction Costs | $ – | $ – | $ – |

| $ 9,529 | $ 7,006 | $ 2,523 | |

| Net income and comprehensive income | $ 1,870 | $ 2,062 | $ (192) |

The following table highlights certain operating information of the REIT for the nine months ended September 30, 2021.

| For the nine months ended September 30, 2021

Actual results Forecast Variance |

|||

| Revenue

Rental Revenue |

$ 30,883 | $ 27,085 | $ 3,798 |

| Expenses (Income)

Property operating expenses General and administrative Finance costs from operations Accretion of mark-to-market adjustment on mortgage payable Depreciation and amortization Other (income) Fair value adjustment – Class B units Distributions on Class B units Fair value gain on investment properties Fair value adjustment – Unit Based Comp Transaction Costs |

$ 10,421

$ 4,120 $ 5,916 $ (771) $ 125 $ (53) $ 24,937 $ 2,077 $ (22,690) $ 9 $ 236 |

$ 9,580

$ 3,759 $ 6,142 $ (771) $ 94 $ – $ – $ 2,077 $ – $ – $ – |

$ 841

$ 361 $ (226) $ $ 31 $ (53) $ 24,937 $ – $ (22,690) $ 9 $ 236 |

| $ 24,327 | $ 20,881 | $ 3,446 | |

| Net income and comprehensive income | $ 6,556 | $ 6,204 | $ 352 |

|

Revenue |

|||

| For the three months ended

September 30, 2021 Forecast Variance |

Variance % | ||

Rental Revenue $ 11,399 $ 9,068 $ 2,331 25.7%

Rental revenue consists of lot rent, home rent, utility reimbursements, and other miscellaneous income collected at the communities. For the three months ended September 30, 2021, the higher revenue as compared to the Forecast of $2,331 was primarily driven by acquisitions not included in the Forecast. New acquisitions accounted for $2,181 of the increase versus the Forecast. Same Community revenues were approximately $150 higher than the Forecast, driven by higher than forecasted utility reimbursements and quarterly revenue sharing payments from cable contracts.

| For the nine months ended September 30, 2021 | Forecast | Variance | Variance % |

Rental Revenue $ 30,883 $ 27,085 $ 3,798 14.0%

For the nine months ended September 30, 2021, the higher revenue as compared to the Forecast of $3,798 was primarily driven by acquisitions not included in the Forecast. New acquisitions accounted for $3,460 of the increase versus the Forecast. Same Community revenues were approximately $338 higher than the Forecast, driven by higher than forecasted utility reimbursements and quarterly revenue sharing payments from cable contracts.

Property Operating Expenses

The following tables highlights property operating expenses of the REIT for the three months ended September 30, 2021.

| For the three months ended September 30, 2021 | Forecast | Variance | Variance % |

Operating expenses $ 3,807 $ 3,216 $ (591) -18.4%

Operating expenses are comprised mainly of common area and maintenance expenses, payroll, insurance, property taxes and other costs associated with the management and maintenance of the investment properties. Operating expenses for communities acquired after the IPO were $694. These costs were not included in the Forecast. Same Community operating expenses offset much of this increase primarily driven by payroll and benefits which were $124 less than Forecast. Repairs and maintenance along with other operating expenses accounted for a slight overspend. In total, Same Community operating expenses finished $253 better than the Forecast.

The table below provides a breakdown of operating expenses for the period:

| Operating Expenses | For the three months ended September 30, 2021 |

| Utilities | $ 1,241 |

| Payroll and benefits | $ 974 |

| Taxes and insurance | $ 853 |

| Repairs and maintenance | $ 378 |

| Other | $ 361 |

| Total Operating Expenses | $ 3,807 |

The following tables highlights property operating expenses of the REIT for the nine months ended September 30, 2021.

| For the nine months ended September 30, 2021 | Forecast | Variance | Variance % |

Operating expenses $ 10,421 $ 9,580 $ (841) -8.8%

Operating expenses for communities acquired after the IPO were $1,368. These costs were not included in the Forecast. Same Community operating expenses offset much of this increase primarily driven by payroll and benefits and utilities which were $471 and $143 better than Forecast respectively. Repairs and maintenance along with other operating expenses accounted for a slight overspend. In total, Same Community operating expenses finished $543 better than forecast.

The table below provides a breakdown of operating expenses for the period:

| Operating Expenses | For the nine months ended September 30, 2021 |

| Utilities

Payroll and benefits Taxes and insurance Repairs and maintenance Other |

$ 3,586

$ 2,541 $ 2,345 $ 902 $ 1,047 |

| Total Operating Expenses | $ 10,421 |

|

General and Administrative The following tables highlights general and administrative expenses of the REIT fo September 30, 2021. |

r the three months ended |

| For the three months ended

September 30, 2021 Forecast Variance Variance % |

|

General and administrative $ 1,432 $ 1,252 $ (180) -14.4%

General and administrative expenses include legal fees, audit fees, salaries and benefits for certain REIT employees, trustee fees, transfer agent fees, insurance and other administrative costs. For the three months ended September 30, 2021, the $180 higher spend compared to the Forecast is primarily the result of higher than forecasted payroll and benefits and Legal / Consulting Fees.

The table below provides a breakdown of general and administrative expenses:

| General and administrative | For the three months ended September 30, 2021 |

| Payroll and benefits | $ 847 |

| Legal / Consulting | $ 119 |

| Audit and tax fees | $ 73 |

| Taxes and insurance | $ 133 |

| Trustee fees | $ 68 |

| Travel | $ 71 |

| Other | $ 121 |

| Total General and administrative | $ 1,432 |

The following tables highlights general and administrative expenses of the REIT for the nine months ended September 30, 2021.

| For the nine months ended September 30, 2021 | Forecast | Variance | Variance % |

General and administrative $ 4,120 $ 3,759 $ (361) -9.6%

For the nine months ended September 30, 2021, the $361 higher spend compared to the Forecast is primarily the result of higher spend on consulting fees and insurance expense in the period which were partially offset by savings in audit and tax fees as well as travel.

The table below provides a breakdown of general and administrative expenses:

| General and administrative | For the nine months ended September 30, 2021 | ||

| Payroll and benefits

Legal / Consulting Audit and tax fees Taxes and insurance Trustee fees Travel Other |

$ 2,329

$ 447 $ 290 $ 336 $ 196 $ 174 $ 348 |

||

| Total General and administrative | $ 4,120 | ||

| Finance Cost from Operations | |||

| For the three months ended September 30, 2021 | Forecast | Variance Variance % |

Finance costs from operations $ 2,037 $ 2,068 $ 31 1.5%

Finance costs from operations consist of interest expense on loans and borrowings, amortization of deferred financing costs and other miscellaneous interest expense. For this period, interest expense on loans and borrowings accounted for $1,973 and miscellaneous interest expense was $60. Amortized deferred financing cost was $3 for the period versus $107 in the Forecast. This was offset by $72 of unforecasted mortgage interest expense primarily related to communities acquired post IPO.

| For the nine months ended September 30, 2021 | Forecast | Variance | Variance % |

Finance costs from operations $ 5,916 $ 6,142 $ 226 3.7%

For this period, interest expense on loans and borrowings accounted for $5,731 and miscellaneous interest expense was $180. Amortized deferred financing cost was $6 for the period versus $316 in the Forecast, accounting for the majority of the variance. This was offset by $86 of unforecasted mortgage interest expense primarily related to communities acquired post IPO.

Other (Income)

| For the three months ended

September 30, 2021 Forecast Variance Variance % |

|

| Other (income) | $ (32) $ – $ 32 – |

Other (income) is made up of property management fees, asset management fees and note receivable interest that the REIT charges to Empower Park, LLC (“Empower”) – See “Transactions with Related Parties”. For the three months ended September 30, 2021, other income was higher than the Forecast due to unforecasted note receivable interest and management fees charged to Empower in the period.

| For the nine months ended

September 30, 2021 Forecast |

Variance | Variance % | |

| Other (income) | $ (53) $ – | $ 53 | – |

For the nine months ended September 30, 2021, other income was higher than the Forecast due to unforecasted note receivable interest and management fees charged to Empower in the period. Fair Value Adjustment – Class B Units

For the three and nine months ended September 30, 2021, the REIT recognized a fair value loss on Class B Units of $10,200 and $24,937, respectively. Class B Units are measured at fair value with any changes in fair value recorded in fair value adjustment – Class B Units on the statement of net income and comprehensive income. These Class B Units carried a 12-month selling restriction from issue date which was deemed to be an attribute of the units. This attribute required that the unit value be discounted at the end of the period. The fair value at September 30, 2021 was calculated using the Unit closing price as of the end of the reporting period and applying a discount rate that took into consideration the remaining hold period along with an average volatility of comparable issuers. The hold period expired as of October 7, 2021.

Distributions on Class B Units

The Class B Units are redeemable for cash or Units, at the option of the REIT, and, therefore, the Class B Units meet the definition of a financial liability under IAS 32. The distributions paid to the holders of Class B Units are treated as interest expense and reflected on the Statement of net income and comprehensive income within the REIT’s financial statements. There was no variance in the actual distributions paid to the holders of Class B Units as compared to the Forecast for the three and nine months ended September 30, 2021.

Fair Value Gain on Investment Properties

In accordance with IFRS, management has elected to use the fair value model to account for investment properties. Overall, the fair value of investment properties increased by $8,412 and $22,690 for the three and nine months ended September 30, 2021, respectively, as compared to no change in the Forecast. Fair value adjustments were determined based on the movement of various parameters, including changes in NOI and capitalization rates. The major driver of this increased fair value for the periods was an increase in revenue across the portfolio related to the rent increases that went into place during the three months ended March 31, 2021 driving growth in the annual NOI.

Transaction Costs

Transaction costs are cost that relate to a stock market listing, or are otherwise not incremental and directly attributable to issuing new securities and are therefore recorded as an expense in the statement of comprehensive income. For the three months ending September 30, 2021 the REIT incurred no transaction cost and for the nine months ending September 30, 2021 the REIT incurred $236 related to the drafting and translating of the shelf prospectus which is included in transactions costs.

| For the nine months ended

September 30, 2021 Forecast |

Variance | Variance % | |

| Transaction costs | $ 236 $ – | $ (236) | – |

Net Income and Comprehensive Income

| For the three months ended September 30, 2021 | Forecast | Variance | Variance % |

Net income and comprehensive Income $ 1,870 $ 2,062 $ (192) -9.3%

Net income and comprehensive income for the three months ended September 30, 2021 was $192 less than the Forecast as a result of the fair value loss on B units which was slightly offset by the fair value gain on investment properties as well as the other variances discussed above.

| For the nine months ended September 30, 2021 | Forecast | Variance | Variance % |

Net income and comprehensive Income $ 6,556 $ 6,204 $ 352 5.7%

Net income and comprehensive income for the nine months ended September 30, 2021 was $352 more than the Forecast as a result of the fair value loss on B units which was slightly offset by the fair value gain on investment properties as well as the other variances discussed above. The fair value loss on B Units as well as the fair value gain on investment properties were not considered in the Forecast.

NOI, FFO, AFFO

Below is a summary of the NOI, FFO and AFFO for the three and nine months ended September 30, 2021. The weighted average unit count (diluted) for the three and nine months ended September 30, 2021 was

17,165,547 and 14,454,621, respectively. As of September 30, 2021, there were 17,165,547 Units outstanding (including the combined number of Units, Class B Units and DTUs).

In total AFFO and AFFO per unit exceeded the Forecast by 61.4% and 19.0% respectively for the three months ended September 30, 2021. The outperformance continues to be driven by the accretive acquisition strategy as well as well as Same Community margin efficiencies. Same Community revenues exceeded the Forecast by $150 for the three months ended September 30, 2021 and $338 for the nine months ended September 30, 2021. Much of this has been driven by continued focus on the water and sewer submetering program as well as cable revenue sharing.

Cost containment efforts also helped contribute to the positive results. Continued focus on labor efficiencies throughout the communities as well as water and sewer savings had a positive impact in property operating expenses.

The following table highlights a summary of the NOI, FFO and AFFO of the REIT for the three months ended September 30, 2021.

| For the three months ended September 30, 2021

Actual results Forecast Variance |

Variance % | |||

| NOI* | $ 7,592 | $ 5,852 | $ 1,740 | 29.7% |

| NOI Margin* | 66.6% | 64.5% | 2.1% | 3.3% |

| FFO* | $ 4,403 | $ 2,789 | $ 1,614 | 57.9% |

| FFO Per Unit* (excluding over allotment – IPO) | N/A | $ 0.238 | N/A | N/A |

| FFO Per Unit* (including over allotment – IPO) | $ 0.257 | $ 0.220 | $ 0.037 | 16.8% |

| AFFO* | $ 3,742 | $ 2,319 | $ 1,423 | 61.4% |

| AFFO per Unit* (excluding over allotment – IPO) | N/A | $ 0.198 | N/A | N/A |

| AFFO per Unit* (including over allotment – IPO) | $ 0.218 | $ 0.183 | $ 0.035 | 19.1% |

| AFFO Payout Ratio* (exluding over allotment- IPO) | N/A | 64.4% | N/A | N/A |

| AFFO Payout Ratio* (including over allotment- IPO) | 58.5% | 69.6% | -11.1% | -15.9% |

*These measures are not recognized under IFRS and do not have standardized meanings prescribed by IFRS. Refer to section “Non-IFRS Financial Measures”.

The following table highlights a summary of the NOI, FFO and AFFO of the REIT for the nine months ended September 30, 2021.

| For the nine months ended September 30, 2021

Actual results Forecast Variance |

Variance % | |||

| NOI* | $ 20,462 | $ 17,505 | $ 2,957 | 16.9% |

| NOI Margin* | 66.3% | 64.6% | 1.7% | 2.6% |

| FFO* | $ 11,241 | $ 8,379 | $ 2,862 | 34.2% |

| FFO Per Unit* (excluding over allotment – IPO) | N/A | $ 0.715 | N/A | N/A |

| FFO Per Unit* (including over allotment – IPO) | $ 0.778 | $ 0.662 | $ 0.116 | 17.5% |

| AFFO* | $ 9,523 | $ 7,068 | $ 2,455 | 34.7% |

| AFFO per Unit* (excluding over allotment – IPO) | N/A | $ 0.603 | N/A | N/A |

| AFFO per Unit* (including over allotment – IPO) | $ 0.659 | $ 0.558 | $ 0.101 | 18.1% |

| AFFO Payout Ratio* (exluding over allotment- IPO) | N/A | 63.4% | N/A | N/A |

| AFFO Payout Ratio* (including over allotment- IPO) | 58.1% | 68.5% | -10.4% | -15.2% |

*These measures are not recognized under IFRS and do not have standardized meanings prescribed by IFRS. Refer to section “Non-IFRS Financial Measures”.

As previously noted, on October 22, 2020, pursuant to the IPO underwriters’ exercise of an over-allotment option, the REIT issued an additional 937,500 Units. The tables above lay out FFO per unit, AFFO per unit, and AFFO payout ratio with and without the effects of the exercise of the IPO over-allotment option. The

“Forecast” for AFFO and FFO per unit (excluding the exercise of the IPO over-allotment option) is calculated by dividing forecasted AFFO/FFO by the weighted average number of units for the for the three and nine months ended September 30, 2021 excluding the 937,500 Units issued pursuant to the exercise of the IPO overallotment option. The “Forecast” for AFFO and FFO per unit (including the exercise of the IPO over-allotment option) is calculated by dividing AFFO/FFO by the weighted average number of units for the for the three and nine months ended September 30, 2021 including the 937,500 Units issued pursuant to the exercise of the IPO over-allotment option. All per unit measures included in the tables above are diluted (including Class B Units and DTUs.)

Reconciliation of Non-IFRS Financial Measures

FFO, FFO per Unit, AFFO and AFFO per Unit

The REIT uses the following non-IFRS key performance indicators: FFO, FFO Per Unit, AFFO, AFFO per Unit.

The calculations of these measures and the reconciliation to net income and comprehensive income, for the three months ended September 30, 2021 are set out in the following table:

| For the three months ended September 30, 2021 | |

| Net income and comprehensive income | $ 1,870 |

| Adjustments to arrive at FFO Depreciation | $ 53 |

| Fair value Adjustment Class B Units | $ 10,200 |

| Distributions on Class B units | $ 692 |

| Fair value adjustment investment properties | $ (8,412) |

| Transaction costs | $ – |

| Funds from Operations (“FFO”) | $ 4,403 |

| FFO Per Unit* (diluted) | $ 0.257 |

| Adjustments to arrive at AFFO

Accretion of mark-to-market adjustment on mortgage payable |

$ (257) |

| Capital Expenditure Reserves | $ (404) |

Adjusted Funds from Operations (“AFFO”) $ 3,742

AFFO Per Unit* (diluted) $ 0.218

*FFO per unit and AFFO per unit are calculated by using FFO and AFFO, divided by the diluted weighted average unit count (including Class B Units and DTUs) for the three and nine months ended September 30, 2021.

For the nine months ended September 30, 2021

| For the nine months ended September 30, 2021 | |

| Net income and comprehensive income | $ 6,556 |

| Adjustments to arrive at FFO Depreciation | $ 125 |

| Fair value Adjustment Class B Units | $ 24,937 |

| Distributions on Class B units | $ 2,077 |

| Fair value adjustment investment properties | $ (22,690) |

| Transaction costs | $ 236 |

| Funds from Operations (“FFO”) | $ 11,241 |

| FFO Per Unit* (diluted) | $ 0.778 |

| Adjustments to arrive at AFFO

Accretion of mark-to-market adjustment on mortgage payable |

$ (771) |

| Capital Expenditure Reserves | $ (947) |

Adjusted Funds from Operations (“AFFO”) $ 9,523

AFFO Per Unit* (diluted) $ 0.659

*FFO per unit and AFFO per unit are calculated by using FFO and AFFO, divided by the diluted weighted average unit count (including Class B Units and DTUs) for the three and nine months ended September 30, 2021.

In the calculation of AFFO, the REIT uses a capital expenditure reserve of $60 (dollars/annual) per lot and $1,000 (dollars/annual) per rental home. This reserve is based on management’s best estimate of the cost that the REIT may incur, related to maintaining the investment properties. For the three and nine months ended September 30, 2021, the capital expenditure reserve was $404 and $947 respectively as compared to actual spending of $739 and $1,151, respectively.

Capital expenditures for the three months ended September 30, 2021 was higher than the reserve as a result of rental home refurbishment as well as asphalt and concrete repair within the communities. Spending related to asphalt and concrete must be done during summer and fall months due to weather patterns in the REIT’s operational footprint. This results in higher capital expenditures during these months.

NOI and NOI Margin

The REIT uses the following non-IFRS key performance indicators: NOI and NOI Margin.

The calculations of these measures and the reconciliation to net income and comprehensive income for the three months ended September 30, 2021 are set out in the following table:

| For the three months ended September 30, 2021 | |

| Net income and comprehensive income | $ 1,870 |

| Adjustments to arrive at NOI General and administrative | $ 1,432 |

| Finance costs from operations | $ 2,037 |

| Accretion of mark-to-market adjustment on mortgage payable | $ (257) |

| Depreciation and amortization | $ 53 |

| Other (income) | $ (32) |

| Fair value adjustment – Class B units | $ 10,200 |

| Distributions on Class B units | $ 692 |

| Fair value gain on investment properties | $ (8,412) |

| Fair value adjustment – Unit Based Comp | $ 9 |

| Transaction Costs | $ – |

NOI $ 7,592

The table below lays out the reconciliation of the REIT’s NOI and NOI Margin for the three months ended September 30, 2021.

| For the three months ended September 30, 2021 | |

| Total revenue | $ 11,399 |

| Property operating expenses | $ 3,807 |

Net Operating Income (“NOI”) $ 7,592

NOI Margin 66.6%

The calculations of these measures and the reconciliation to net income and comprehensive income for the nine months ended September 30, 2021 are set out in the following table:

| For the nine months ended September 30, 2021 | |

| Net income and comprehensive income | $ 6,556 |

| Adjustments to arrive at NOI General and administrative | $ 4,120 |

| Finance costs from operations | $ 5,916 |

| Accretion of mark-to-market adjustment on mortgage payable | $ (771) |

| Depreciation and amortization | $ 125 |

| Other (income) | $ (53) |

| Fair value adjustment – Class B units | $ 24,937 |

| Distributions on Class B units | $ 2,077 |

| Fair value gain on investment properties | $ (22,690) |

| Fair value adjustment – Unit Based Comp | $ 9 |

| Transaction Costs | $ 236 |

NOI $ 20,462

The table below lays out the reconciliation of the REIT’s NOI and NOI Margin for the nine months ended September 30, 2021.

| For the nine months ended September 30, 2021 | ||

| Total revenue

Property operating expenses |

$ 30,883

$ 10,421 |

|

| Net Operating Income (“NOI”)

NOI Margin

Debt to Gross Book Value The following table lays out the REIT’s Debt to Gross Book Value as of September 3 |

$ 20,462

66.3% , 2021. |

|

| As of September 30, 2021 | ||

| Mortgages payable (current portion) | $ 589 | |

| Mortgages payable (non-current portion) | $ 244,758 | |

| Total mortages payable (“Debt”) | $ 245,347 | |

| Gross Book Value | $ 583,785 | |

Debt to Gross Book Value 42.0%

Liquidity and Capital Resources

As of September 30, 2021, the capital structure of the REIT was as follows:

| As of September 30, 2021 | |

| Indebtedness

Mortgages payable (current portion) |

$ 589 |

| Mortgages payable (non-current portion) | $ 244,758 |

| Class B Units | $ 98,336 |

| $ 343,683 | |

| Unitholders equity Unitholders equity | $ 226,714 |

| Total capitalization | $ 570,397 |

Liquidity and capital resources are used to fund capital investments in the investment properties, acquisition activities, servicing of debt obligations and distributions to Unitholders. The principal source of liquidity is cash flow generated from property operations. For the three months ended September 30, 2021, net cash from operating activities was $7,146. Business operations are also financed using property-specific mortgages, and equity financing.

On May 12, 2021 the REIT closed on a $5,000 working capital line of credit. The line is for three years with a floating interest rate at .5% above the Wall Street Journal Prime rate. Payments will be interest only for the full term. At September 30, 2021 the REIT had $0 outstanding on this line of credit.

As of September 30, 2021, liquidity was $32,733 consisting of cash, cash equivalents, and available capacity on lines of credit.

The REIT expects to be able to meet all obligations as they become due using some or all of the following sources of liquidity:

- cash flow generated from property operations;

- property-specific mortgages; and

- existing cash and cash equivalents on hand

In addition, subject to market conditions, the REIT may raise funding through equity financing. On May 7, 2021, the REIT filed a (final) short form base shelf prospectus, pursuant to which, for a period of 25 months thereafter, the REIT (and Unitholders) may sell up to an aggregate of $300,000 of (i) Units; (ii) senior or subordinated unsecured debt securities of the REIT; (iii) subscription receipts; (iv) warrants; and (v) securities comprised of more than one of the foregoing, or any combination thereof. Subsequently, the REIT filed a supplement to that prospectus, and entered into an underwriting agreement for the purpose of completing the June 2021 Offering. The REIT raised gross proceeds of $81,000 pursuant to the June 2021 Offering through the issuance of 4,500,000 Units at a price of $18.00 per Unit.

The REIT believes that its capital structure will provide it with financial flexibility to pursue future growth strategies. However, the REIT’s ability to fund operating expenses, capital expenditures and future debt service requirements will depend on, among other things, future operating performance, which will be affected by general economic, industry, financial and other factors, including factors beyond the REIT’s control.

The REIT currently has seventeen unencumbered investment properties with fair values of $46,240 as of September 30, 2021.

The table below sets out the upcoming principal payments due by year.

| Year | Principal payments due

during period % of Total Principal |

|

| 2021 | $ 161 | 0.1% |

| 2022 | $ 602 | 0.2% |

| 2023 | $ 735 | 0.3% |

| 2024 | $ 772 | 0.3% |

| 2025 | $ 820 | 0.3% |

| 2026 | $ 866 | 0.4% |

| Thereafter | $ 241,391 | 98.5% |

| TOTAL | $ 245,347 | |

Debt Financing

The REIT seeks to maintain a debt profile consisting of borrowings from various sources of low-cost capital, which may include debt from regional and national banks, government-sponsored entities such as Fannie Mae and Freddie Mac, insurance companies, CMBS lenders and publicly issued bonds.

The REIT’s overall borrowing philosophy is to obtain secured debt, principally on a fixed rate or effectively fixed rate basis, which will allow the REIT to: (i) achieve and maintain staggered maturities to lessen exposure to refinancing risk in any particular period; (ii) achieve and maintain fixed rates to lessen exposure to interest rate fluctuations; and (iii) extend loan terms and fixed rate periods as long as possible when borrowing conditions are favorable. Subject to market conditions and the growth of the REIT, management currently intends to target Indebtedness of approximately 45%-55% of Gross Book Value. Interest rates and loan maturities will be reviewed on a regular basis to ensure appropriate debt management strategies are implemented.

On August 10, 2021 the REIT signed a loan commitment, for which the July 2021 Acquisitions were collateral, for $29,700. The interest rate on the note is 3.08% fixed for 20 years with the first 84 payments being interest only.

As of September 30, 2021, the REIT’s Debt to Gross Book Value ratio was 42.0% (47.8% at December 31, 2020.) This decrease, as compared to December 31, 2020, is due to the June 2021 Offering, which raised $81,000 of equity capital. Management expects that the ratio of Debt to Gross Book Value may increase, at least temporarily, following an acquisition by the REIT of one or more additional properties.

As of September 30, 2021 the REIT had a weighted average interest rate of 3.44% (100% fixed rate) and a weighted average term to maturity of 10.6 years. Mortgages as of September 30, 2021 mature at various dates beginning in 2027. Outside of the regular principal amortization of existing loans and borrowings; there are no balloon payments due in the next twelve months.

As of September 30, 2021, the REIT was in compliance with all debt covenants with various lenders.