Regular readers please note there are a few tweaks to some of the standard portions of our evening market/investing report. Read carefully as some changes of the ‘standard text’ that follows before our left-right headlines and also in other features near the end of tonight’s reports.

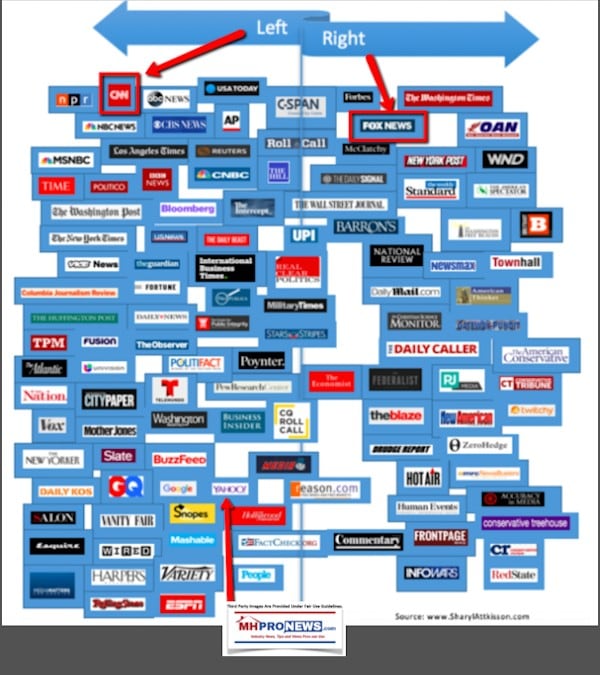

Every evening our headlines that follow provide snapshots from two major media outlets on each side of the left-right news spectrum that reflect topics that influence or move investor sentiment. In moments on this business evening report, you can get ‘insights-at-a-glance.’

This report also sets the broader context for manufactured housing markets, in keeping with our mantra, “News through the lens of manufactured homes and factory-built housing” ©.

We begin with headlines left-of-center CNN followed by right-of-center Fox Business. We share closing tickers and other related data courtesy of Yahoo Finance, and more. 5 to 10 minutes reading this MHProNews market report every business night could save you 30 minutes to an hour of similar reading or fact-gathering elsewhere.

Perhaps more important, you will get insights about the industry from experts that care, but also dare to challenge the routine narrative that arguably keeps manufactured housing underperforming during an affordable housing crisis.

Newsy, Peeling Back Media Bias, Manufactured Housing Sales, Investing, Politics, and You

Headlines from left-of-center CNN Business.

-

-

- A Hollywood premiere – WarnerMedia’s new streaming service is launching in May for $14.99 a month

- He’s running for governor to run false ads on Facebook. Now Facebook is stopping him

- How did the US economy do in the third quarter?

- Why the Fed might change its rate-cut strategy after October

- Samsung teases new ‘clamshell’ foldable smartphone

- Bankrupt Forever 21 is closing 200 stores

- Uber, Lyft, DoorDash unveil ballot to fight California gig economy law

- Fiat Chrysler reportedly in talks to merge with Peugeot owner

- GM says the strike cost it $2.9 billion

- Why GM is backing Trump in his fight against California

- America’s largest private coal miner has filed for bankruptcy

- Deadspin staff revolt after mandate to ‘stick to sports’

- GrubHub is getting crushed in the food delivery wars. The stock is nose-diving 40%

- ‘Game of Thrones’ creators exit upcoming ‘Star Wars’ films

- Amazon Fresh grocery delivery truck from the Amazon Prime service parked on a suburban street in San Ramon, California, July 5, 2018. (Photo by Smith Collection/Gado/Getty Images)

- Amazon makes grocery delivery free for Prime members

- The new 760 Horsepower Ford Shelby GT500

- Driving the Shelby GT500, the most powerful car Ford has ever made

- Your home isn’t a mansion. But you might still have to pay a ‘mansion tax’

- GrubHub is getting crushed in the food delivery wars

- Wegmans opens its 101st store. It’s in Brooklyn

- Impossible Burgers hit the grocery store

- Why robots will soon be picking soft fruits and salad

- Walmart will deliver groceries straight to your fridge

- TESLA

- Elon Musk, co-founder and chief executive officer of Tesla Inc., speaks during an unveiling event for the Tesla Model Y crossover electric vehicle in Hawthorne, California, U.S., on Friday, March 15, 2019.

- The Model Y could be a game changer for Tesla

- Elon Musk pushes ahead with Tesla’s global expansion

- Tesla shocks investors

- New Tesla feature sparks awe and mayhem

- Tesla Model 3 earns top safety award

-

Headlines from right-of-center Fox Business.

-

-

- CFO departing toymaker Mattel following whistleblower probe

- Mattel announced that Chief Financial Officer Joseph J. Euteneuer will leave the company after “a transition period of up to six months.”

- What drove Barbie doll-maker’s surprise jump in revenue

- The financial reason why some in Houston are rooting against the Astros

- You haven’t seen the last of the viral Bud Light ‘hero’

- PG&E will credit customers for blackouts, California governor says

- Forecasters warn California to brace for ‘remarkable and dangerous event’

- Wi-Fi is illegal in this US town; the reason why may be even more unbelievable

- Here’s the real danger health care poses to America

- Cops looking for man who tried to open bank account with fake $1 million bill

- Chicago mayor fires back at ‘political’ teachers union as schools stay closed

- EXCLUSIVE: Inside Delta CEO’s plan to improve airports across the US

- Bed Bath & Beyond customer data exposed in hack, company says

- JPMorgan may move workers out of New York — here’s where they could go

- This bank is handing out $1,000 bonuses and stock units

- Inside ‘ghost kitchens’: Restaurants jumping on this cost-cutting trend

- Fed expected to cut interest rates for third time before pressing pause

- Here are the tax hikes Warren could use to pay for Medicare-for-all

- Fiat Chrysler reportedly in talks to form $50B auto behemoth

- Lockheed lowers price of F-35 fighter jet

- Did GM just announce the slow death of the combustion engine?

- Johnson & Johnson reveals new test results amid asbestos fears, recall

- CEO says Amazon will turn US cities into ‘ghost towns,’ calls for ‘Internet tax’

- Facebook sues after hackers allegedly used WhatsApp flaw to target users

- Uber, Lyft, DoorDash launch $90M counterattack against gig economy law

- Why this politician wants to crack down on Martian-themed parties

- Tinder’s $2B lawsuit against parent company to proceed to jury trial

- ‘We must embrace change’: NCAA to let student athletes cash in on their names, images

- Sony to shut down PlayStation Vue

- Kushner: ‘China vs civilization’ problem tackled in Trump’s new deal

- Maryland man beaten by guards at Six Flags walks away with massive payday

- Mom’s marriage changed on a dime; she paid cheating ex the same way

- Congress shreds Boeing CEO over ‘flying coffin’ 737 Max jet

- Mnuchin open to looser bank liquidity rules after September cash crunch

- Peter Luger’s zero-star review will still lure people willing to pay

- Taylor Swift can’t shake off this legal battle

- This beverage is leading ‘exceptional’ iced coffee sales nationwide

- The most depressed states in America

- You haven’t seen the last of this Bud Light ‘hero’

- Why millennials are spending billions on Halloween

- Grubhub crashes as ‘promiscuous’ online diners flirt with competing apps

- Elizabeth Warren punches back at Zuckerberg in ongoing feud

- ‘Davos in the desert’ kicks off in dark shadow of Khashoggi’s murder

- This college is giving students millions in ‘live ammunition’ to invest

- This simple scheme could be a breakthrough in the Chicago teachers strike

- These are the best-paying cities for young people: Report

- Home purchases to remain solid in 2020, thanks to low interest rates

- US online spending for 2019 holiday season to reach record highs: What to know

- Biggest US drinkmakers pledge $100M recycling effort

- Trump: Federal Reserve holding economy back

- Juul to cut up to 500 jobs by the end of 2019

-

10 Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Focus/Featured Report – Markets/Political/Big Picture/Stock

Their media release is in hand. Their conference call from earlier today is found below. Related information is provided following the Sun Communities (SUI) data. No one else in manufactured housing trade media even begins to generate such relevant information, other than MHProNews. Perhaps that is why you are reading here at the documented #1 trade news site in all the entire manufactured home industry, bar none.

Sun Communities

Sun Communities Scores 1/3rd Billion Dollar M&A, Insights, Details Beyond Media Release

First, their information, then a brief analysis and a teaser for an upcoming special report.

Southfield, Michigan, (GLOBE NEWSWIRE) — Sun Communities, Inc. (NYSE: SUI) (the “Company”), a real estate investment trust (“REIT”) that owns and operates, or has an interest in, manufactured housing (“MH”) and recreational vehicle (“RV”) communities, today reported its third quarter results for 2019.

Financial Results for the Quarter and Nine Months Ended September 30, 2019For the quarter ended September 30, 2019, total revenues increased $39.0 million, or 12.1 percent, to $362.4 million compared to $323.4 million for the same period in 2018. Net income attributable to common stockholders was $57.0 million, or $0.63 per diluted common share, for the quarter ended September 30, 2019, as compared to net income attributable to common stockholders of $46.1 million, or $0.56 per diluted common share, for the same period in 2018.

For the nine months ended September 30, 2019, total revenues increased $109.4 million, or 12.8 percent, to $962.2 million compared to $852.8 million for the same period in 2018. Net income attributable to common stockholders was $131.7 million, or $1.50 per diluted common share, for the nine months ended September 30, 2019, as compared to net income attributable to common stockholders of $96.5 million, or $1.19 per diluted common share, for the same period in 2018.

Non-GAAP Financial Measures and Portfolio Performance

• Core Funds from Operations (“Core FFO”)(1) for the quarter ended September 30, 2019, was $1.46 per diluted share and OP unit (“Share”) as compared to $1.35 in the prior year, an increase of 8.1 percent.

• Same Community(2) Net Operating Income (“NOI”)(1) increased by 7.2 percent for the quarter ended September 30, 2019, as compared to the same period in 2018.

• Same Community(2) Occupancy increased by 210 basis points to 98.3 percent, as compared to 96.2 percent at September 30, 2018.

• Revenue Producing Sites increased by 766 sites for the quarter ended September 30, 2019, bringing total portfolio occupancy to 96.7 percent.

Gary Shiffman, Chief Executive Officer of Sun Communities stated, “During the third quarter, we continued our consistent track record of delivering strong organic growth, as portfolio-wide occupancy gains along with tight cost controls contributed to 7.2 percent same community NOI growth. These results were further enhanced by the solid performance at our recent acquisitions. Despite a competitive acquisition environment, Sun has completed over $444.0 million of transactions year to date which will strengthen our growth over time. We believe that our ability to address sellers’ needs for flexible exit and monetization strategies will continue to be a competitive advantage in our pursuit of accretive acquisitions.”

OPERATING HIGHLIGHTS

Portfolio Occupancy

Total portfolio occupancy was 96.7 percent at September 30, 2019, compared to 96.1 percent at September 30, 2018.

During the quarter ended September 30, 2019, revenue producing sites increased by 766 sites, as compared to 628 revenue producing sites gained during the third quarter of 2018, a 22.0 percent increase.

During the nine months ended September 30, 2019, revenue producing sites increased by 2,005 sites, as compared to an increase of 1,878 revenue producing sites during the nine months ended September 30, 2018, a 6.8 percent increase.

Same Community(2) Results

For the 345 communities owned and operated by the Company since January 1, 2018, NOI(1) for the quarter ended September 30, 2019, increased 7.2 percent over the same period in 2018, as a result of a 6.1 percent increase in revenues, and 3.9 percent increase in operating expenses. Same Community occupancy(3) increased to 98.3 percent at September 30, 2019 from 96.2 percent at September 30, 2018.

For the nine months ended September 30, 2019, NOI(1) increased 7.2 percent over the same period in 2018, as a result of a 6.2 percent increase in revenues, and a 3.9 percent increase in operating expenses.

Home Sales

During the quarter ended September 30, 2019, the Company sold 906 homes as compared to 971 homes sold during the same period in 2018. New home sales volume increased 14.4 percent to 167 new home sales for the quarter ended September 30, 2019, as compared to 146 homes in the same period in 2018. Rental home sales, which are included in total home sales, were 317 in 2019, as compared to 316 sold during 2018.

During the nine months ended September 30, 2019, 2,631 homes were sold compared to 2,751 for the same period in 2018. New home sales volume increased 11.7 percent to 431 new home sales for the nine months ended September 30, 2019, as compared to 386 homes during the same period in 2018. Rental home sales, which are included in total home sales, were 859 in 2019, an increase of 4.1 percent over the 825 sold during 2018.

Pending Transaction – Jensen Portfolio

On August 22, 2019, the Company entered into an agreement to acquire a 31-community manufactured housing portfolio (the “Jensen Portfolio”) for $343.6 million. The Jensen Portfolio has 5,230 operating sites and 466 additional sites available for development. The 31 communities are located in eight states across the eastern United States. The purchase price will be paid through a combination of $274.8 million shares of common stock and cash consideration. We expect to acquire the Jensen Portfolio no later than October 31, 2019. However, the closing is subject to the satisfaction of customary closing conditions, including obtaining certain third party consents. If these conditions are not satisfied or waived, or if the merger agreement is otherwise terminated in accordance with its terms, then the acquisition will not be consummated.

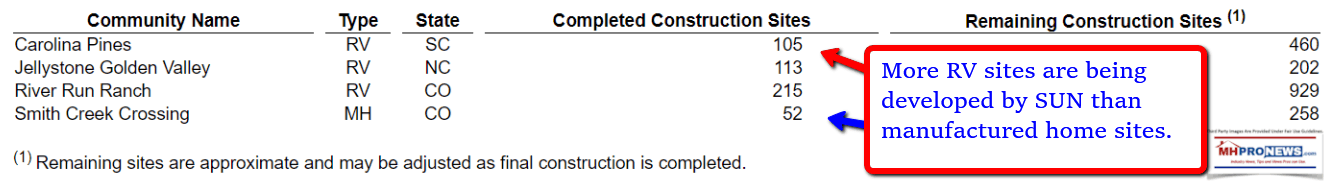

Construction Activity

During the quarter ended September 30, 2019, the Company completed the construction of 177 expansion sites in three communities. Year to date, the Company has completed the construction of 365 expansion sites in 10 communities. The Company expects to complete the construction of an additional 800 to 1,000 expansion sites by year end.

BALANCE SHEET AND CAPITAL MARKETS ACTIVITY

Series A-4 Preferred Stock and Series A-4 Preferred OP Units Conversion

The Company intends to convert 1,051,501 shares of Series A-4 preferred stock and 405,656 Series A-4 preferred OP units issued by the Operating Partnership into its common stock and common OP units. Each share of Series A-4 preferred stock is convertible into approximately 0.4444 shares of common stock and each Series A-4 preferred OP unit is convertible into approximately 0.4444 common OP units. The Company has the right under its charter and the Operating Partnership’s partnership agreement to convert these securities, if at any time after November 26, 2019, the volume weighted average of the daily volume weighted average price of a share of its common stock on the New York Stock Exchange is equal to or greater than $64.97 for at least 20 trading days in a period of 30 consecutive trading days (the “Pricing Target”). On October 17, 2019, the Company’s Board of Directors approved the conversion of all of the Series A-4 preferred stock and Series A-4 preferred OP units into common stock and common OP units, respectively, provided that the Pricing Target is satisfied on November 27, 2019. If the Pricing target is satisfied, the conversion is expected to occur on December 13, 2019.

Debt Transactions

As of September 30, 2019, the Company had $3.3 billion of debt outstanding. The weighted average interest rate was 4.3 percent and the weighted average maturity was 9.8 years. The Company had $26.2 million of unrestricted cash on hand. At period-end the Company’s net debt to trailing twelve month Recurring EBITDA(1) ratio was 5.3 times.

During the quarter ended September 30, 2019, the Company completed a $250.0 million ten-year term loan transaction which carries an interest rate of 2.925 percent. Concurrently, the Company repaid a $134.0 million term loan which was due to mature in May 2023.

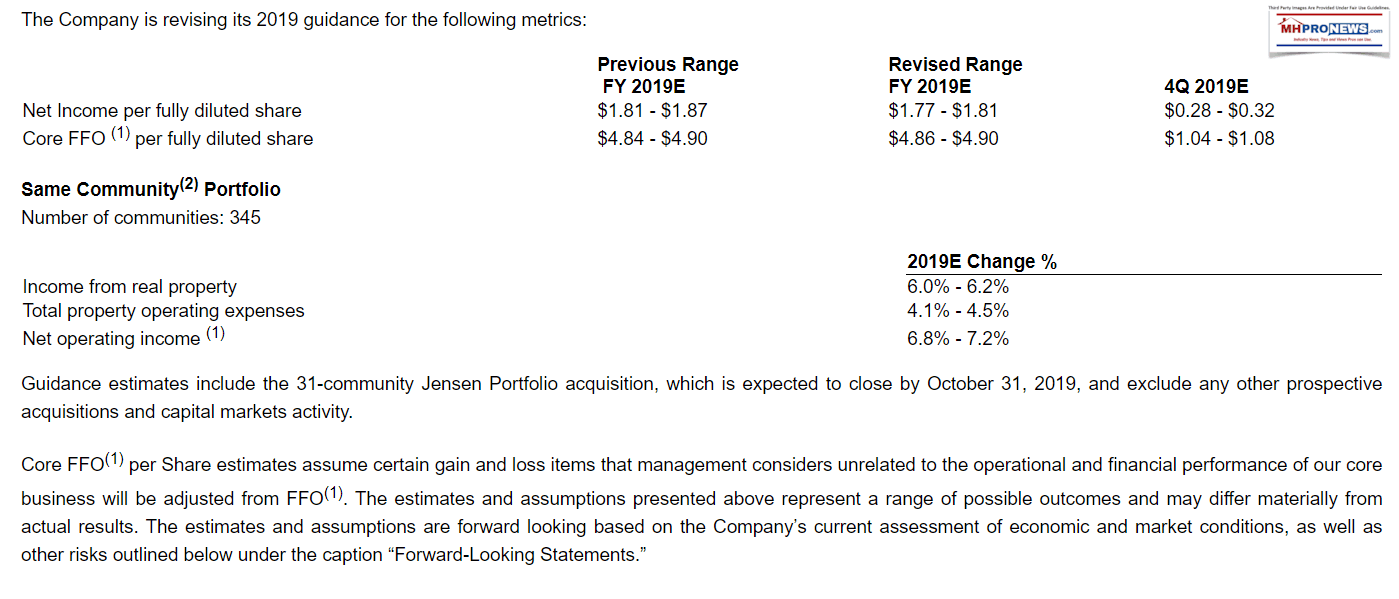

GUIDANCE 2019

The Company is revising its 2019 guidance for the following metrics:

Per Yahoo Finance, is this transcript earlier today of Sun Communities (SUI) conference call on earnings and related data.

Q3 2019 Sun Communities Inc Earnings Call

SOUTHFIELD Oct 29, 2019 (Thomson StreetEvents) — Edited Transcript of Sun Communities Inc earnings conference call or presentation Thursday, October 24, 2019 at 3:00:00pm GMT

TEXT version of Transcript

================================================================================

Corporate Participants

================================================================================

* Gary A. Shiffman

Sun Communities, Inc. – Chairman & CEO

* John Bandini McLaren

Sun Communities, Inc. – President & COO

* Karen J. Dearing

Sun Communities, Inc. – Executive VP, CFO, Treasurer & Secretary

================================================================================

Conference Call Participants

================================================================================

* Andrew T. Babin

Robert W. Baird & Co. Incorporated, Research Division – Senior Research Analyst

* John Joseph Pawlowski

Green Street Advisors, LLC, Research Division – Analyst

* Joshua Dennerlein

BofA Merrill Lynch, Research Division – Research Analyst

* Nicholas Gregory Joseph

Citigroup Inc, Research Division – Director & Senior Analyst

* Piljung Kim

BMO Capital Markets Equity Research – Senior Real Estate Analyst

* Todd Jakobsen Stender

Wells Fargo Securities, LLC, Research Division – Director & Senior Analyst

* Wesley Keith Golladay

RBC Capital Markets, LLC, Research Division – VP & Equity Research Analyst

================================================================================

Presentation

——————————————————————————–

Operator [1]

——————————————————————————–

Good morning, ladies and gentleman, and thank you for standing by. Welcome to Sun Communities Third Quarter conference call.

At this time, management would like me to inform you that certain statements made during this conference call, which are not historical facts, may be deemed forward-looking statements within the meanings of the Private Securities Litigation Reform Act of 1995. Although the company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the company can provide no assurance that its expectations will be achieved.

The factors and risks, which could cause actual results to differ materially from expectations are detailed in yesterday’s press release, from time to time the company’s periodic filings with the SEC. The company undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date of this release.

Having said that, I would like to introduce management with us today, Gary Shiffman, Chairman and Chief Executive officer; John McLaren, President and Chief Operating Officer; Karen Dearing, Chief Financial Officer. After their remarks, there will be an opportunity to ask questions.

I will now turn the call over to Gary Shiffman, Chairman and Chief Executive Officer. Mr. Shiffman, you may begin.

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [2]

——————————————————————————–

Good morning, and thank you for joining us for Sun Communities Third Quarter Earnings Conference Call.

We’re pleased to report continued strong performance for the third quarter for both our manufactured housing communities and RV Resorts. The need for affordable housing and vacationing in premier locations across North America continues to reinforce our industry-leading results.

Core funds from operations for the quarter ended September 30, 2019, was $1.46 per diluted share, at the high-end of our guidance range, and up 8.1% versus a year ago. Same community net operating income growth was similarly strong, up 7.2% for both the third quarter and the first 9 months of the year.

Given the greater visibility of our operations, as we approach the end of the year, we are once again raising core FFO guidance and updating our expectations for our Same Community NOI. Karen will provide details when she reviews our financial results.

Our continued success in delivering strong results can be attributed to Sun’s consistent organic growth as well as our ability to complement that growth with expansions, ground-up developments and accretive acquisitions. We were active across all 3 areas in the third quarter, helping to lay the foundation for continued long-term success.

On the ground-up development front, we delivered almost 500 sites at 4 locations, including Carolina Pines in Myrtle Beach South Carolina, Jellystone Golden Valley in North Carolina and River Run Ranch and Smith Creek Crossing in Granby, Colorado. Upon completion, these properties will total over 2,600 operating sites.

Additionally, during the quarter, we commenced construction on our 280-site San Diego Bay front RV Resort. Our acquisition strategy remains focused on identifying opportunities in high demand areas with limited supply. Diligently scouring the landscape for properties that meet our investment criteria is an ongoing process at Sun that helps us acquire one-off communities as well as consolidated portfolios.

During the third quarter, we announced the acquisition of the 31-property manufactured housing portfolio from the Jensen family for $344 million. The Jensen communities are approximately 75% age restricted and located in 8 states primarily across the Eastern U.S. The portfolio will add 5,230 manufactured home sites and over 460 additional expansion-ready sites to Sun’s platform. The Jensen acquisition is noteworthy, and the seller has elected to take 80% or $275 million of the consideration in Sun common stock. The transaction is expected to close by October 31.

We believe that our experience in structuring a transaction that works for both Sun and the seller enable us to win this highly sought-after portfolio.

This is a strategy that we have used in the past to secure other portfolios, including the American Land Lease and Carefree transactions.

By using our advantageous cost of capital, and in some cases issuing tailored securities to the sellers, we have captured transactions that have allowed our platform to grow, diversify and generate attractive returns for the long term. We see this as a competitive advantage, which should persist as long term manufactured housing and RV Resort property owners look for ways to monetize holdings, while simultaneously addressing their tax planning needs.

We also acquired 4 operating properties containing 948 sites in Delaware, Louisiana, New Hampshire and Virginia for a total consideration of $93.5 million.

Upon the closing of the Jensen transaction, we will have invested nearly $800 million in the acquisition of 45 operating manufactured housing and RV properties year to date.

We are confident that we will continue to execute on our acquisition pipeline. This quarter’s accomplishment are yet another example of excellent executions that contribute to our long history of sustained organic growth and accretive acquisitions.

For nearly 45 years, we have developed and maintained our reputation as a trusted provider of attractive and affordable solutions for both housing and vacationing. As a result of following the same tried-and-true strategy, we remain optimistic about our continued ability to deliver shareholder value well into the future.

Our steadfast adherence to our 4-core capital allocation initiatives supports the growth of our platform. These include the consistent reinvestment in our operating properties to support continued high occupancy rates, accretive acquisition of operating properties whose performance can be further enhanced as they are integrated onto the Sun platform, site expansion within our existing communities and resorts where we can drive highly-accretive returns for new sites and selective ground-up development of premier resorts and communities in highly desirable areas.

Let me now turn the call over to John and Karen to discuss the results in detail. John?

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [3]

——————————————————————————–

Thanks, Gary. During the third quarter, Sun once again delivered great operational results with strong contributions across portfolio. The consistent factor in our leading performance is primarily NOI growth from our same community portfolio, portfolio-wide occupancy gains and the contribution of our acquisitions year to date. This is our third consecutive quarter delivering Same Community NOI growth of 7.2% at the top end of our guidance range. The improvement was driven by a 6.1% revenue increase and a 3.9% expense increase.

Our same community revenue increases were comprised of a 6.4% increase in manufactured housing revenues, a 10.2% increase from annual RV and a 3.4% increase from our transient RV revenue. For the 9 months ended September 30, manufactured housing revenues increased 6.3%, annual RV revenues rose by 10.2% and transient RV revenue increased by 2.5% despite an almost 9% reduction in available site nights year to date given our strong site-conversion activity.

Total portfolio occupancy improved 60 basis points to 96.7%, reflecting the addition of 766 sites in the third quarter and nearly 2,730 revenue-producing sites for the last 12 months.

In our manufactured housing expansion communities, over 200 sites were filled in the third quarter and over 730 sites were filled year to date. With respect to the RV transient site conversions to annual leases, we completed 470 conversions in the third quarter and almost 900 year to date.

Home sales volume continues to demonstrate healthy demand for our communities. In the third quarter, Sun sold 906 homes, of which 167 were new, exceeding new home sales by 14.4% over the third quarter last year.

Top new home sales locations were Florida, Michigan, Ontario and Taxes [sic: i.e.: Texas], accounting for 70% of total new home sales.

Our renter-to-homeowner conversions has also been strong in 2019 with 317 renters becoming homeowners in the third quarter. Year to date, we have converted 859 renters to homeowners, a 4.1% increase over the same period last year.

In the third quarter, we completed the construction of approximately 180 vacant expansion sites across 3 operating manufacturing communities and RV Resorts, bringing our year-to-date total vacant expansion site deliveries to 365. By the end of the year, we expect to be within the previously provided range of 1,200 to 1,400 vacant site deliveries.

We also delivered almost 500 sites and 4 ground-up development projects, capping off a productive quarter. In the first 3 quarters of 2019, we have delivered over 750 sites and remain on track to deliver between 800 and 1,000 total ground-up development sites for the year.

These results are a direct reflection of the dedication and ownership mindset that our team members bring to the communities every day. We truly have the best teams in the business. We are very pleased with our performance in the third quarter as it reinforces our commitment to deliver superior service to our residents and guests.

We believe that our sustained efforts to put our customers first translates directly into shareholder value.

With that, I will turn the call over to Karen to discuss our financial results. Karen?

——————————————————————————–

Karen J. Dearing, Sun Communities, Inc. – Executive VP, CFO, Treasurer & Secretary [4]

——————————————————————————–

Thanks, John. Sun reported $1.46 of core FFO per share for the quarter ended September 30, 2019, in line with the top end of previously provided quarterly guidance, and 8.1% over the third quarter of 2018.

As we mentioned earlier, these results were driven by the consistent strength of our Same Community NOI and contributions from home sales and our recent acquisitions.

Before moving on to the discussion of our balance sheet and updated guidance, we wanted to revisit the direct share issuance related to the Jensen portfolio. As Gary mentioned earlier, we expect to close on the Jensen portfolio acquisition of 31 manufactured home communities by the end of October.

Total consideration for the portfolio is approximately $344 million comprised of the following. $274.8 million of Sun shares issued at $139.31 per share based on the trailing 20-day VWAP at the time we entered into the contract. This translates into 1.97 million incremental shares, the remainder will be paid in cash.

We would also like to note that in the fourth quarter, we will initiate the process to convert approximately 1 million shares of Series A-4 preferred stock, and approximately 400,000 Series A-4 preferred OP Units. The conversion, which has been approved by our Board, will occur in December.

Each share of the Series A-4 preferred stock and preferred operating partnership units is convertible into approximately 0.44 shares of common stock or common OP Units. This will translate into an incremental 647,000 common shares and units on the conversion date.

Conversion of these securities further simplifies our capital structure and reduces our quarterly cash distributions as the individual coupons for the Series A-4 preferred stock and OP Units were 6.5%.

With respect to other capital markets activities, we continued our efforts to incrementally reduce our funding costs.

In the quarter, we completed a $250 million 10-year term loan that carries a 2.925% interest rate. And also, repaid a $134 million term loan in advance of its May 2023 maturity date.

Our weighted average interest rate is 4.3%, and we continue to see opportunities to reduce that cost given the current interest rate environment. We ended the quarter with $3.3 billion of indebtedness and $26 million of cash on hand.

Our net debt to trailing 12 months of EBITDA on September 30 was 5.3x, well within our target leverage ratio.

Moving on to guidance, we are tightening our core FFO per share guidance by $0.02 to $4.86 to $4.90.

This reflects a $0.01 increase at the midpoint.

We’re also tightening our Same Community NOI guidance range by 20 basis points for a full year range of 6.8% to 7.2%.

As is our practice, our guidance does not include the impact of prospective acquisitions other than the announced Jensen transaction, which is expected to close in the next week or capital markets activities that may be included in analysts’ estimates.

This concludes our prepared remarks, and we’d like to open up the call to questions. Operator?

================================================================================

Questions and Answers

——————————————————————————–

Operator [1]

——————————————————————————–

(Operator Instructions) Our first question is from Drew Babin with Baird.

——————————————————————————–

Andrew T. Babin, Robert W. Baird & Co. Incorporated, Research Division – Senior Research Analyst [2]

——————————————————————————–

Quick question on the Jensen’s portfolio. As it begins to flow into your guidance in the fourth quarter, I guess can you give us any detail about year 1 yield expectations on the portfolio? And kind of, ultimately, where you hope to be when it comes to intensive management, adding CapEx, adding sites things like that to the properties? Can you just maybe give us a little more color as we model out in ’20 and beyond?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [3]

——————————————————————————–

Sure, Drew. I think while we’re cautious as things have not closed yet, but the expectation it will close shortly. We’ve underwritten to about 4.7% yield for the first year, minimal impact with what’s left in the balance of the year, I think about may be just around 0.5p. We believe much of that has been taken into account. And the analysts’ world is — it’s been known and we’ve announced this for a while. Ordinarily, we wouldn’t discuss acquisitions like this prior to them closing, but because we were issuing common currency, we did announce at the time we locked into this transaction. As far as other operating items, I’ll turn it over to John.

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [4]

——————————————————————————–

Yes. I think one of the things that I would add — or few other things that I would add with respect to the Jensen portfolio is, first off, from an operational perspective, we’re thrilled to have won these irreplaceable assets. From our perspective, from my perspective, this may be one of the sharpest looking portfolio communities I have seen. And I think it speaks very well to the high quality of the communities themselves and how closely matched the Jensen team is with Sun in terms of the care and stewardship they demonstrate every day.

With respect to sort of growth opportunities, there is really — there is approximately 400 sites in the portfolio today of organic growth based on their occupancy. In addition to that, there is 460 expansion sites that are primarily located in mid-Atlantic states like South Carolina, North Carolina, Georgia, Maryland, which lines up really well with areas that we’ve targeted for growth and expansion and even ground-up development like South Carolina. So it really fits nicely in terms of our overall strategy within the portfolio.

——————————————————————————–

Andrew T. Babin, Robert W. Baird & Co. Incorporated, Research Division – Senior Research Analyst [5]

——————————————————————————–

Thanks for the color. And one follow-up on the San Diego project. Obviously, manufactured housing is probably the most practical solution available for California’s affordability issues, and with the political environment the way it is, is there any more traction in potentially gaining more opportunities in that state to develop ground-up, incorporating affordable components? Can you maybe give us sort of an update on the temperature of those discussions?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [6]

——————————————————————————–

Drew, it’s Gary. There certainly is and it’s certainly the West Coast, certainly right up to the Northwest is area of concentration where we feel, we can actually develop communities to a better return for our shareholders than buying them at the cap rates that they’re trading at currently.

One of the outcomes of what we’ve been doing in other areas, yesterday, we had a visit by several municipalities to our new development in Granby, Colorado, to show it off, as you will, as an example of how we can address affordable housing needs. In particular, in the ski resorts, in the mountains where the cost of housing is very, very high. And as we get underway with Chula Vista, we think it’ll be another great example of working hand in hand with municipalities. Chula Vista San Diego, has already reached out to us and we are in discussions with them of expanding and being able to lease additional land for another 90 sites. So we’re thrilled about that.

To set the stage so that everybody recalls, we were selected after submitting proposals to work with the City of San Diego. And it still was over 2 years to get a shovel in the ground as being selected and not have to go through the entitlement process. So every aspect of development is got to be thought through, it is slow, it is deliberate, and that’s why we have to keep a full pipeline in order to be successful in 1 or 2 instances with the entitlement.

But we do think San Diego will be a good example of how we can work hand in hand with the municipality.

——————————————————————————–

Andrew T. Babin, Robert W. Baird & Co. Incorporated, Research Division – Senior Research Analyst [7]

——————————————————————————–

Thanks, Gary and John. And one quick one for Karen. The new term loan, I assume that was probably Fannie Mae. Please confirm that it is the case? And I guess, the one that was paid off, what type of secured debt was that? And what was the rate on what was paid off during the quarter?

——————————————————————————–

Karen J. Dearing, Sun Communities, Inc. – Executive VP, CFO, Treasurer & Secretary [8]

——————————————————————————–

Yes. That’s a great execution, we love that execution on that 10-year loan, $250 million at — below 3%. The $135 million loan that was maturing in 2023 was a CMBS debt. The new debt, you are right, that was Fannie. And the debt that we paid off carried interest rate of 4.3%. That transaction also freed up 3 assets from the collateral pool, and obviously, gave us $103 million of additional proceeds to deploy into the business, so we’re really happy with the execution on that debt.

——————————————————————————–

Operator [9]

——————————————————————————–

Our next question is from Joshua Dennerlein with Bank of America Merrill Lynch.

——————————————————————————–

Joshua Dennerlein, BofA Merrill Lynch, Research Division – Research Analyst [10]

——————————————————————————–

I just had a kind of question on your same store — or Same Community NOI growth. How much of — could you maybe break that down into components, how much of that is from kind of rate growth, occupancy growth on existing sites and then expansion sites that have been added to communities?

——————————————————————————–

Karen J. Dearing, Sun Communities, Inc. – Executive VP, CFO, Treasurer & Secretary [11]

——————————————————————————–

I’m sorry, could you — I’m sorry, would you repeat that question?

——————————————————————————–

Joshua Dennerlein, BofA Merrill Lynch, Research Division – Research Analyst [12]

——————————————————————————–

Yes. I’m just trying to figure out with your Same Community NOI growth, how much is just driven by great growth on existing sites, and then the filling up of many sites that are just vacant? So occupancy gains. And then also just a new expansions coming online in the community and contributing to the NOI.

——————————————————————————–

Karen J. Dearing, Sun Communities, Inc. – Executive VP, CFO, Treasurer & Secretary [13]

——————————————————————————–

Okay. So just to do the revenue walk on same community, 4.2% weighted average — 4.5% weighted average rent increase, 2.1% occupancy gain. There was about 30 basis points of transient income growth and another 10 basis points in other. When you think about our occupancy growth, that 2.1%, I just want to mention that it’s really — that’s — it’s a point-in-time occupancy gain at the very end of the quarter and revenues are impacted by when you gain that occupancy. So the timing of an RPS gain, if it’s gained at the very end of the quarter, has less impact on the actual revenue growth as does the transient to annual conversions that we do, where that incremental — it’s just — it’s incremental revenue growth from the transient income we had in the prior year of 40% to 60% incremental revenue growth. So that is the walk on the revenue.

As far as the impact of our expansion sites, as a general rule, our — on a — for NOI, every 500 sites we fill of expansions on a pro rata basis over the year equals about 25 to 30 basis points of NOI growth. We filled 970 expansion sites in the last 12 months, which would equate to about 48 to 58 basis points of NOI growth.

——————————————————————————–

Joshua Dennerlein, BofA Merrill Lynch, Research Division – Research Analyst [14]

——————————————————————————–

Okay. Awesome, awesome. And for the expansion sites that you expect to complete by year-end, it’s 800 to 1,000, how quickly can you build those sites?

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [15]

——————————————————————————–

Generally, on the MH site [sic; i.e: side], those are going to fill at a pace of about 6 to 8 per month on a per community basis, Josh.

——————————————————————————–

Operator [16]

——————————————————————————–

Our next question is from John Pawlowski with Green Street Advisors.

——————————————————————————–

John Joseph Pawlowski, Green Street Advisors, LLC, Research Division – Analyst [17]

——————————————————————————–

John, moving to next year, do expect a stronger, similar or weaker pricing power environment across the portfolio on the MH and RV side?

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [18]

——————————————————————————–

As far as — what — I’m not sure I follow the question?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [19]

——————————————————————————–

General increases…

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [20]

——————————————————————————–

Yes. I would expect something similar to what we’ve been doing, John.

——————————————————————————–

John Joseph Pawlowski, Green Street Advisors, LLC, Research Division – Analyst [21]

——————————————————————————–

Okay. Any markets within portfolio average behaving meaningfully better or worse than you would’ve expected at this point?

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [22]

——————————————————————————–

I think generally, everything has gone very well and as expected over the course of the year.

——————————————————————————–

John Joseph Pawlowski, Green Street Advisors, LLC, Research Division – Analyst [23]

——————————————————————————–

Okay. And last one for me, I know a lot of — maybe your Midwest portfolio is a disproportionate exposure to either direct automotive employment or indirect employment. So curious on the ground, what you’re seeing in terms of the GM strike and the problem Ford is having? Any leading indicators, worrisome indicators in terms of bad debt or potential move-outs?

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [24]

——————————————————————————–

No. We haven’t been — I mean that really hasn’t impacted us. But I would add, as I have — as we’ve described before is that we’ve described the business as being kind of recession resistant. And so when you look at that and whether it’s — wherever the economy might be, whatever might be going on locally, there always seems to be a need for our product whether it’s in the form of housing or vacationing and the affordability that goes with that. So nothing that has really indicated us any sort of change to what our expectations are, John.

——————————————————————————–

Operator [25]

——————————————————————————–

Our next question is from Nick Joseph with Citigroup.

——————————————————————————–

Nicholas Gregory Joseph, Citigroup Inc, Research Division – Director & Senior Analyst [26]

——————————————————————————–

Maybe following up on one of those questions. Can you walk through the process for setting rents next year? What percentage of next year is — rent increases have already been negotiated?

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [27]

——————————————————————————–

Sure. This is John. Well, the first step in the process is, generally, we take a look at what’s happening — what’s going on in the market around us and we look at comparable rents as well as the quality of the resorts that are — communities that are around us and just making sure that we are sort of in line with what the market will bear. That’s generally — one of the things that we do perpetually at Sun is, we update our market comparables on a quarterly basis throughout the portfolio. So we kind of know what things look and feel like, and we know our peers that are out there very well and sort of have a sense of that all the way along.

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [28]

——————————————————————————–

Yes. The other thing that I’d add, Nick, is that management here is acutely sensitive to a lot that’s going on in the rental environment, and we always talk about living within the range of 2% to 4% rental increases. And we’ve seen a little bit of expansion beyond that. But everything that management focuses on, all 4 of its core pillars of growth, if you will, we’re very cognizant to thinking out past quarter to quarter and thinking about 1, 3, 5 years. So if we can live at the high end of rental increases and sustain the kind of growth we’ve been able to sustain now for 1, 3 and 5 years, historically, and go out forward in a similar fashion. We will leave room and elasticity to be able to continue to gain similar rental increases, when one might point to the fact that on a given year, we could, perhaps, push rents a little bit more. So we’re very cognizant of that.

And then I would suggest more so I think on many of our competitors, the vast majority, at this point, of a rental increase that goes into place is what takes place as CapEx in the community. So as I mentioned in my beginning remarks, rental increases do go hand in hand with maintaining the quality and the high demand for the community. So a balance of rental increases and a balance of investment in the community is really what drives the rental increases.

With regard to what’s in place right now? By September of each year, we generally have to notify the rental increases that are taking place in Florida, 90 days in advance of January 1. That represents about 30% of the portfolio. So currently, that would be the approximate number of notified rental increases.

——————————————————————————–

Nicholas Gregory Joseph, Citigroup Inc, Research Division – Director & Senior Analyst [29]

——————————————————————————–

And for sort of portfolio, what’s the rent increase for 2020? And what were they for 2019?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [30]

——————————————————————————–

For 2020, we will include it in the guidance that we provide next quarter. And for ’19, I don’t know if we ever broken out.

——————————————————————————–

Karen J. Dearing, Sun Communities, Inc. – Executive VP, CFO, Treasurer & Secretary [31]

——————————————————————————–

I don’t have it in front of me.

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [32]

——————————————————————————–

Okay. It’s something we could get back to you with.

——————————————————————————–

Nicholas Gregory Joseph, Citigroup Inc, Research Division – Director & Senior Analyst [33]

——————————————————————————–

Thanks. And then just with the Jensen portfolio closing next week. What does the acquisition pipeline look like beyond that? And then are you currently pursuing any larger deals? Or is it more one-off acquisitions?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [34]

——————————————————————————–

I would suggest that it’s definitely more one-off acquisitions. That Jensen deal came to the market on its own, if you will, where the family determined that they were ready to exit and ran a fully shaft process. So the pipeline remains very, very full, just as it has been for the last several years.

It’s a good balance of MH and a good balance of RV Resorts, all age senior. Obviously, we’re very, very selective. We’re really focused on managing our geographic diversification now and travel patterns so that we can take advantage of a larger network across the country of people who are traveling with their RV. As I said, you’ll see more activity from us, I think in the Northwest and Western regions of the country. But most of it will be in onesies and twosies.

——————————————————————————–

Operator [35]

——————————————————————————–

Our next question is from John Kim with BMO Capital Markets.

——————————————————————————–

Piljung Kim, BMO Capital Markets Equity Research – Senior Real Estate Analyst [36]

——————————————————————————–

It looks like Jensen got an attractive price on your shares based on, I guess, a strong performance of your shares recently. But can you remind us, does the 20-day VWAP standard when you pay in consideration of a stock? And also can you comment on why the seller chose not to take all the units?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [37]

——————————————————————————–

It’s Gary, and I can’t comment on why the seller’s elected OP or common. You’d have to discuss that with them directly. There was a lot of tax consultation that went in. There are 60 family members, if you will, that are taking those common units. And I think I missed a little — the part — first part of your question, John?

——————————————————————————–

Piljung Kim, BMO Capital Markets Equity Research – Senior Real Estate Analyst [38]

——————————————————————————–

Just if it’s standard that you use the 20-day VWAP when you…

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [39]

——————————————————————————–

Yes. I would say, that’s the standard as anything, we’ve used 10 day, 20 day, 30 day. I would share with the market that when we first started getting into serious discussion as a leading candidate to acquire the property, the common was trading at about $120 a share. We were very concerned over the fact that when it closed, it had VWAP of $139, but we assumed that the Jensens are very pleased with where it’s trading at right now.

So there is no singular point where you can make a call about a stock going up and down. It could, obviously, have gone down. In this case, it went up. So the VWAP seems like a fair way for both parties to the lock into a pricing before a transaction has taken place.

——————————————————————————–

Piljung Kim, BMO Capital Markets Equity Research – Senior Real Estate Analyst [40]

——————————————————————————–

Okay. I think this quarter, you provided more disclosure on your ground-up developments, and you’ve added Smith Creek Crossing in the quarter. Is — are 4 active ground-up developments the most you’ve had in your history? And can you envision doing more than 1 to 2 new ground-up developments per year?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [41]

——————————————————————————–

So historically, and…

——————————————————————————–

Karen J. Dearing, Sun Communities, Inc. – Executive VP, CFO, Treasurer & Secretary [42]

——————————————————————————–

We go back a long time…

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [43]

——————————————————————————–

Karen, when she first came to the company as our accountant in control of new development, there were times when we would have 9 to 11 new developments going at any given time, when we were a much younger company and developing much more on our own. And the stated current goal is that we would like to have a pipeline that allowed us to develop 3 to 4 new communities each year.

We have not been able to develop the land parcel pipeline to achieve that yet. We’re getting very, very close. But again, the entitlement process is very cumbersome, takes a long period of time as well as determining the financial feasibility.

So we’re really reviewing 8, 10, 12 parcels of land at any given time with the hopes that 1 or 2 of them make it all the way through to entitlement approval. So if we could be at a level of 3 to 4 new developments a year, it would be terrific. I think this year, we’re closer to 2, although, we have overlap in any given year because of the length of time it takes to start a development and finish it.

——————————————————————————–

Piljung Kim, BMO Capital Markets Equity Research – Senior Real Estate Analyst [44]

——————————————————————————–

A couple of questions in an Ingenia. The presentation that they had when they raised capital discussed $22 million of earnings that they could achieve from development, which assumes that they expedite the right to acquire 100% of the projects, including your stake. Do you envision that, that is going to happen? And how do you think that weighs out?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [45]

——————————————————————————–

Well, there is a lot of things to take into account with regard to the joint venture. I mean at this point, we’re under construction with one new joint venture development that we hope will be completed and believe we’ll be moving homes in there by the second quarter this coming year. We closed on a second parcel, and it will start construction shortly. And we’ve identified, in the JV, a third parcel for a larger community that we’re under due diligence right now.

So I think what I would suggest, again, these are long-term projects. They are done in phases. We haven’t really opened the first phase yet. So I think Sun will continue to monitor what’s going on over the next 12 months. We’ll share with the marketplace what we’re seeing. We are very pleased at how Ingenia performed through their year-end, which was June 30. Guidance is very positive for the coming year. From every indication they are performing. And to think about what may or may not be the returns that far out would just be hard for me to speculate them. But I can assure you, we will share, in all of our calls, updates with how the performance is going as well as what additional thoughts we might have with regard to our investment in Australia.

The final thing I would share with everybody is that we did participate in our pro rata share. They did a $131 million offering at about $3.93 per share.

So Sun’s investment was an additional $13 million for about 3.3 million shares. So that’s pretty much the remarks I would have on Ingenia. I’m glad to answer any other questions.

——————————————————————————–

Piljung Kim, BMO Capital Markets Equity Research – Senior Real Estate Analyst [46]

——————————————————————————–

Can I just ask a follow-up on that. What would be the catalyst for you to increase your stake in Ingenia to 20% from 9.9% today?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [47]

——————————————————————————–

It’s a great question. And not that there is any plan, but the governing rules in Australia, if we were to ever get to 19%, it’s considered a hostile takeover. So the process becomes quite complex. I think that for right now we are in a lockup. That lockup expires sometime in May. We are very, very pleased with our relationship at Ingenia. And as I said, we’ll just take kind of one JV deal at a time and continue to look at it.

——————————————————————————–

Operator [48]

——————————————————————————–

Our next question is from Todd Stender with Wells Fargo.

——————————————————————————–

Todd Jakobsen Stender, Wells Fargo Securities, LLC, Research Division – Director & Senior Analyst [49]

——————————————————————————–

For the — back to the Jensen portfolio, Gary, I think you gave a yield expectation? Or was that 4.7% yield? Was that a trailing 12 months number?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [50]

——————————————————————————–

That’s in place.

——————————————————————————–

Todd Jakobsen Stender, Wells Fargo Securities, LLC, Research Division – Director & Senior Analyst [51]

——————————————————————————–

In place. Okay. Can you provide some occupancy and some rate numbers around the portfolio just to maybe back into a stabilized yield expectation?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [52]

——————————————————————————–

You have the occupancy…

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [53]

——————————————————————————–

Yes. The occupancy today at approximately 92.5%.

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [54]

——————————————————————————–

Average rent. Do you know?

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [55]

——————————————————————————–

I don’t have it right in front of me.

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [56]

——————————————————————————–

I don’t think we have it right off hand, but if you reach out to John, I’m sure he’d be glad to share it with you.

——————————————————————————–

Todd Jakobsen Stender, Wells Fargo Securities, LLC, Research Division – Director & Senior Analyst [57]

——————————————————————————–

Sure. And then kind of a stabilized number, this is multiyear, I guess. It’s a good size portfolio, you’ve put some money into it, maybe get a stabilized yields up around 6%, something like that?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [58]

——————————————————————————–

That would certainly be a minimal goal for us.

——————————————————————————–

Todd Jakobsen Stender, Wells Fargo Securities, LLC, Research Division – Director & Senior Analyst [59]

——————————————————————————–

Okay. Okay, just switching gears, new home sales were up, that would look like a surprise to me I guess, but preowned home sales were down. Is there any incentive differences right now for your sales force to maybe push new home sales versus preowned, any color there?

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [60]

——————————————————————————–

No. Nothing from an incentive standpoint, Todd. I mean really, I would say though, I think our sales results speak — do speak for the focus we have placed on new home sales quants or margins for the last few quarters because we’ve had a lot of really solid growth on that side. On the preowned side, we’ve placed a bit more emphasis on price and margin growth on that. And I think we’ve seen it, and you can see it in the numbers as well where the margins on preowned have grown to roughly — not roughly but 34.8% year to date on preowned versus 32.9% all of last year. Yes, we’ve also benefited from that focus on the pricing increase on preowned to — from about 35,900 to 40,600 year-over-year, which is almost 13% increase. One of the things that’s kind of added to that as well, as we’ve seen growth on our broker resident-to-resident home sales that we broker has grown along with some increase in pricing on that side of the sales business as well. So it’s really more about we took a concerted effort to just put more focus and emphasis into the new home sales, and we’re seeing it in the growth for both the quants and the margins on those and the home prices.

——————————————————————————–

Operator [61]

——————————————————————————–

(Operator Instructions) Our next question is from Wes Golladay with RBC Capital Markets.

——————————————————————————–

Wesley Keith Golladay, RBC Capital Markets, LLC, Research Division – VP & Equity Research Analyst [62]

——————————————————————————–

Just looking at the transient RV revenues, it looks like you mentioned, it still has a nice increase, the 2.5% despite having 9% less sites. What is driving that? Is that all rate driven? Or if you were look at occupancy gains adjusted for transient conversions, what would that look like?

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [63]

——————————————————————————–

Yes. This is John. It’s primarily rate driven.

——————————————————————————–

Wesley Keith Golladay, RBC Capital Markets, LLC, Research Division – VP & Equity Research Analyst [64]

——————————————————————————–

Okay. And then maybe looking at the supply, I guess, competitive supply for transient RV sites, it looks like you’re doing a lot of conversions, are others in the industry doing a lot of conversions? And what is the development? I guess maybe, are we seeing a net contraction in supply of available transient sites?

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [65]

——————————————————————————–

Well, I think that — I mean there has always been sort of an economic advantage in terms of the RV sites. There is over 9 million registered RVs in the United States and that’s like 9 or 10:1 ratio. Even before all this for sort of relevant resort sites that are available out there. I think some of our peers are doing what we’re doing, which is to make those conversions as well.

We’ve had a program to do this for well over a decade, where we’ve done these conversions and it’s a refined process. And it comes down to, if you’re a transient guest in an RV Resort and you love it, you want to be there and you sort of built your circle of friends around you, and you come back every year it’s just — it’s simple and it makes sense and it’s got a great value proposition. So it’s definitely played into and it’s one of the core tenets of our strategy of growth throughout the portfolio.

——————————————————————————–

Wesley Keith Golladay, RBC Capital Markets, LLC, Research Division – VP & Equity Research Analyst [66]

——————————————————————————–

And so I guess, would you think though — over for the industry, would you say that transient sites are contracting year-over-year? I’m not sure there’s much new developing going on.

——————————————————————————–

John Bandini McLaren, Sun Communities, Inc. – President & COO [67]

——————————————————————————–

Yes. There is some new development going on but still not a ton. I mean I think that we’re still sort of leading the pack from that perspective.

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [68]

——————————————————————————–

I don’t think we see a great deal of contraction because there are cases to be made in the transient resorts that are located in areas where the revenues will be greater and higher as a transient resort than they will be as seasonal or annuals. We do have some of those within our portfolio where we will not convert because it’s usually a loss of revenue. I think it’s a good question. I think it’s something we should continue to address as time goes on.

——————————————————————————–

Wesley Keith Golladay, RBC Capital Markets, LLC, Research Division – VP & Equity Research Analyst [69]

——————————————————————————–

Okay. And then the 4 developments, I mean with cap rates going down for acquisitions, has that impacted your willingness to develop at a lower yield for new — for your developments? Or is it just mainly an entitlement issue like you mentioned?

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [70]

——————————————————————————–

It’s a good question. I would say, the compression of cap rates have been where they’ve been for a while. I mean there are things dipping into three handles, coastal and very unique situations that have existed for the last 3, 4 years as there are a lot more entrants interested in the space right now. But there hasn’t been further contraction. So we’re seeing the same thing on the acquisitions. Although, they’re harder and harder to turn up and fewer and fewer of them as the consolidation continues.

On the development side, we underwrite to the risk associated with the development. So I wouldn’t expect to change that risk profile a lot.

——————————————————————————–

Operator [71]

——————————————————————————–

There are no more questions at this time. I would like to turn the conference back over to management for closing remarks.

——————————————————————————–

Gary A. Shiffman, Sun Communities, Inc. – Chairman & CEO [72]

——————————————————————————–

On behalf of the entire Sun company, we thank everybody for participating today. And we look forward to sharing year-end and fourth quarter results with you. Thank you.

——————————————————————————–

Operator [73]

——————————————————————————–

Thank you. This concludes today’s conference. You may disconnect your lines at this time, and thank you for your participation.

###

There is evidence to suggest that Sun Communities has a better track record in terms of resident relations than several of their peers in the Manufactured Housing Institute (MHI).

That doesn’t mean that they haven’t had controversies, they have. The report linked below makes that clear.

State AG Files Suit Against, Manufactured Home Community, Rent to Own, Lease Purchase Option Warning

That said, compared fellow MHI members such as “Frank and Dave” or Nathan Smith’s SSK Communities rebranding as Flagship Communities, Sun are choir members. While the Better Business Bureau (BBB) at various locations reports some complaints, some with NR or other ratings, they also often show an “A” BBB rating.

There will be a special report, perhaps as soon as tomorrow, featuring a fascinating aspect of this data, what was said, but also, what wasn’t. Stay tuned, and sign up for our x2 weekly email headline news updates.

Related Reports:

Sun Communities (SUI) As Viewed by Hedge Funds Data, Per Media Reports

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Updated for Fall 2019…

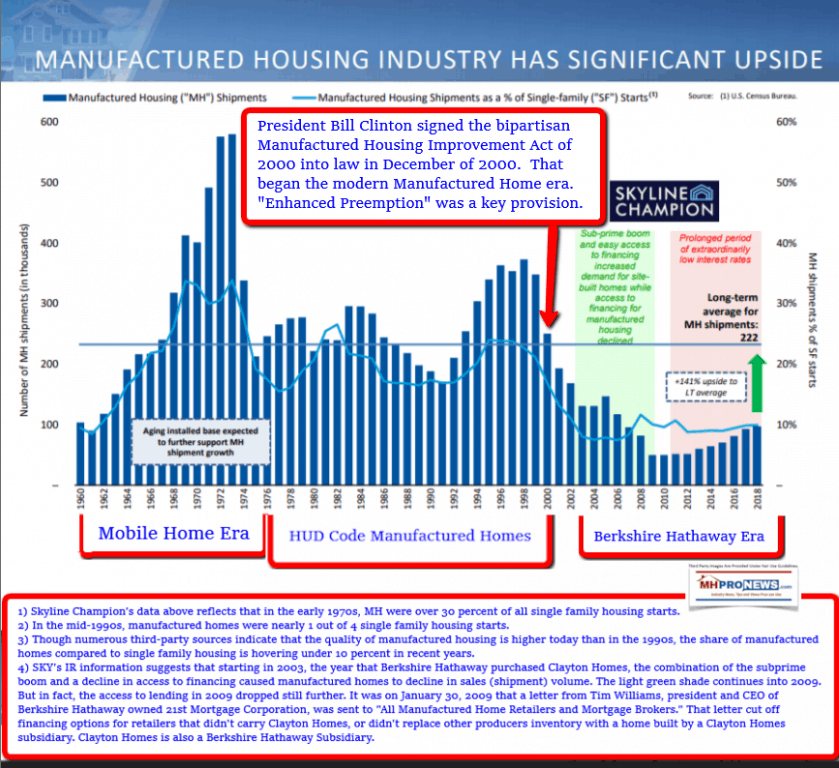

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses.

For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach, co-managing member of LifeStyle Factory Homes, LLC and co-founder for MHProNews.com, and MHLivingNews.com.