Nina Todic, writing for investor-focused Insider Monkey and Yahoo Finance news, reported as follows about manufactured home commercial real estate giant, Sun Communities (SUI).

Sun is one of the publicly traded firms tracked in our evening manufactured housing connected stock report. Last night’s closing ticker and related numbers are available at this link here.

We’ll note that this isn’t a fact-check. Nor is this an endorsement of Insider Monkey, rather, this is a report on June 18, 2019 that summarizes their findings on Sun Communities as it relates to hedge fund interest.

Let’s further note as a disclosure the mantra of Sam Zell, of Sun’s rival Equity LifeStyle Communities, famously quipped that “When others are going left, look right.” Zell told MHProNews that they have never lost confidence in the manufactured home community sector.

Those notes made, let’s dive into their data and views.

Here’s What Hedge Funds Think About Sun Communities Inc (SUI)

Hedge fund managers like David Einhorn, Bill Ackman, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Sun Communities Inc (NYSE:SUI).

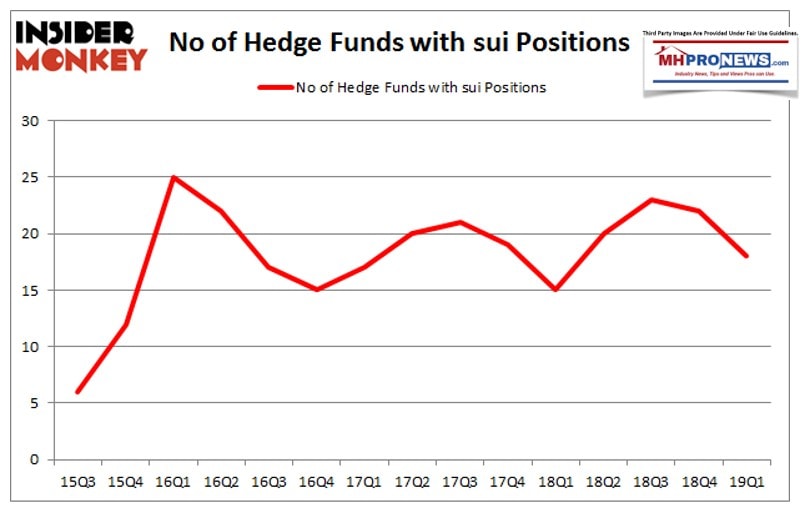

Sun Communities Inc (NYSE:SUI) was in 18 hedge funds’ portfolios at the end of March. SUI has seen a decrease in support from the world’s most elite money managers of late. There were 22 hedge funds in our database with SUI holdings at the end of the previous quarter. Our calculations also showed that sui isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to review the new hedge fund action surrounding Sun Communities Inc (NYSE:SUI).

What have hedge funds been doing with Sun Communities Inc (NYSE:SUI)?

At Q1’s end, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -18% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SUI over the last 15 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Sun Communities Inc (NYSE:SUI), with a stake worth $152.7 million reported as of the end of March. Trailing Renaissance Technologies was Citadel Investment Group, which amassed a stake valued at $79.6 million. Waratah Capital Advisors, Millennium Management, and Echo Street Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Sun Communities Inc (NYSE:SUI) has experienced falling interest from the entirety of the hedge funds we track, it’s easy to see that there exists a select few funds that slashed their full holdings heading into Q3. Intriguingly, Stuart J. Zimmer’s Zimmer Partners said goodbye to the largest stake of all the hedgies tracked by Insider Monkey, comprising an estimated $54.1 million in stock. Richard Driehaus’s fund, Driehaus Capital, also dumped its stock, about $2.3 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 4 funds heading into Q3.

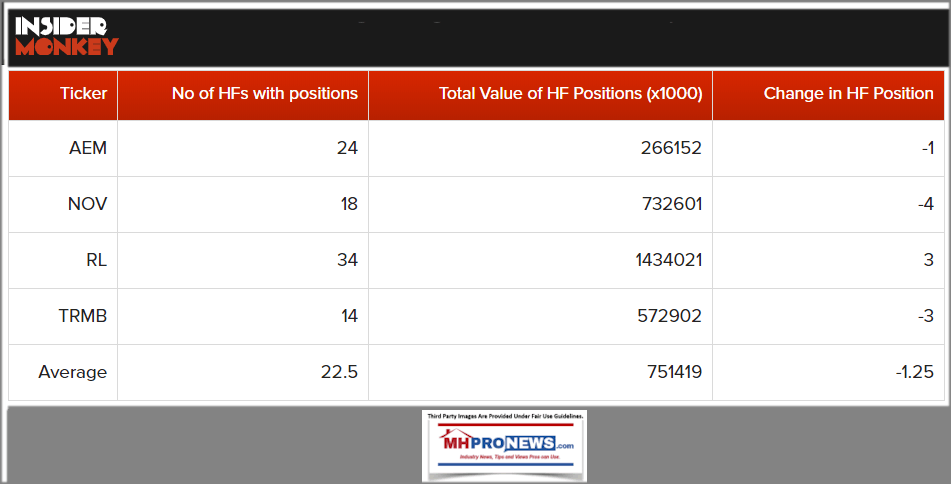

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Sun Communities Inc (NYSE:SUI) but similarly valued. We will take a look at Agnico Eagle Mines Limited (NYSE:AEM), National Oilwell Varco, Inc. (NYSE:NOV), Ralph Lauren Corporation (NYSE:RL), and Trimble Inc. (NASDAQ:TRMB). This group of stocks’ market caps are closest to SUI’s market cap.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $751 million. That figure was $413 million in SUI’s case. Ralph Lauren Corporation (NYSE:RL) is the most popular stock in this table. On the other hand Trimble Inc. (NASDAQ:TRMB) is the least popular one with only 14 bullish hedge fund positions. Sun Communities Inc (NYSE:SUI) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on SUI as the stock returned 4.2% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published on Insider Monkey at this link here.

##

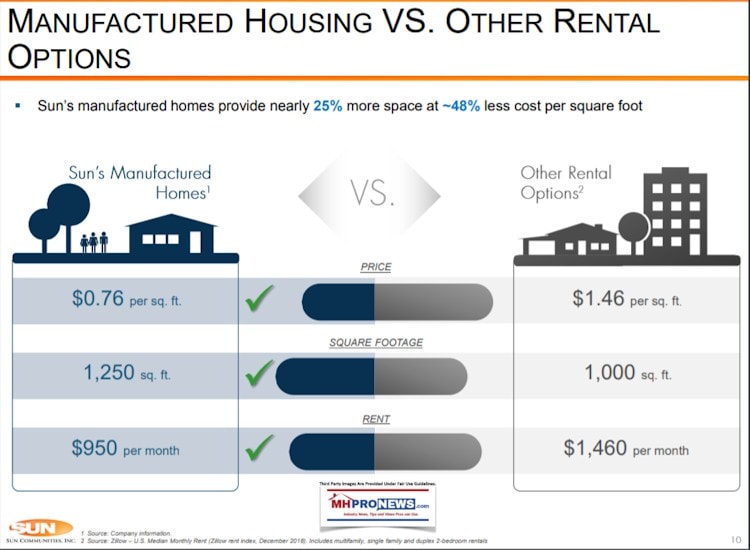

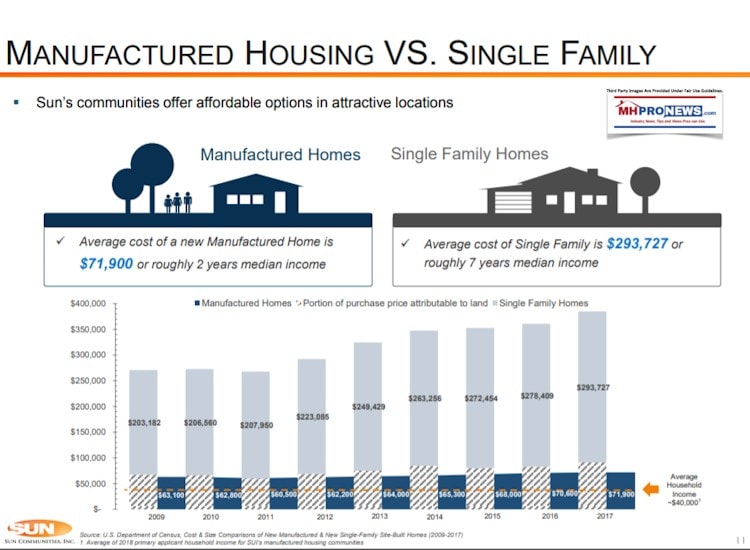

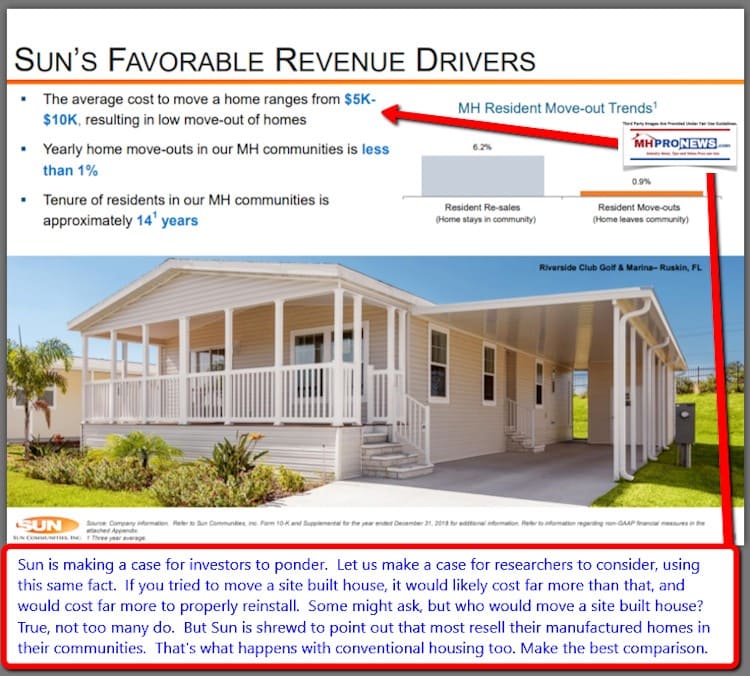

For balance, and to exemplify why Zell and other savvy investors have not lost confidence in manufactured housing (MH) and MH Communities, consider the graphics above and below from Sun Communities.

Our more robust MHProNews April 2019 data-and graphically rich dive into Sun is found at this linked text-image box below, which is the source for the sample Sun Community graphics on this page.

During an affordable housing crisis, there are reasons to pay attention to the most proven of all kinds of affordable homes.

That most proven permeant affordable housing resource would be HUD Code manufactured homes.

That’s this morning’s second installment of manufactured home “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” ©. ## (News, fact-checks, analysis, and commentary.)

1) Marketing, Web, Video, Consulting, Recruiting and Training Resources

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com. Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

Related Reports:

You can click on the image/text boxes to learn more about that topic.

Views From Trenches of Manufactured Housing – Factories, Retailers, MHCs, Others Sound Off

“Time to Investigate Fannie And Freddie’s Mishandling Of DTS” | Manufactured Housing Association Regulatory Reform

It’s been more than ten years since Congress enacted the Housing and Economic Recovery Act of 2008 (HERA) and its “Duty to Serve Underserved Markets” (DTS) mandate. DTS directs both Fannie Mae and Freddie Mac to “develop loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages on manufactured homes for very low, low and moderate-income families.”

“We as a Nation Can Solve the Affordable Housing Crisis,” Says Secretary Ben Carson, Spotlighting Manufactured Homes, Other Emerging Housing Technologies – manufacturedhomelivingnews.com

” Let’s make sure people understand what’s available,” said HUD Secretary Ben Carson about affordable housing, as he spotlighted manufactured homes as a key part of the Innovations in Housing display on the National Mall in Washington, D.C. ” You can get one of these manufactured houses, for instance, for 30 percent less, and they are very, very resilient.

HUD Secretary Ben Carson, Affordable Housing, Obscuring the Truth, Innovations in Housing, and Manufactured Homes – Masthead L. A. ‘Tony’ Kovach

Hold the headline for 125 words. Poisoning the well. Salting the fields. Those are but two of several ancient methods some enemies used to harm their opponents. The notion behind those vile tactics was if you could kill off their drinkable water or their food supply, someone could effectively destroy their enemy.