“Knowledge is potential power” is the English translation for the Latin aphorism, “Scientia potentia est.” In an email from the Capital Research Center (CRC), Tom Woods and Michael Malice have been credited with charging that rather than speaking truth to power, journalists today often serve as the lapdogs for the powerful. CRC added that “Journalists don’t just report the news, they create it. Journalists have double standards for those who support vs. those who oppose the narrative journalists are pushing.” The Media Research Center (MRC), Glenn Greenwald and others from within and across the left-right media divide have at various times made similar assertions. If the survey claims linked here – with a manufactured housing connection – is an indicator, the fact that 73 percent of Americans are “dissatisfied” with major corporations, the so-called great awakening may be approaching. This report will feature what may initially seem to be several disconnected elements that will include the bulk of the press release from publicly traded Sun Communities (SUI). Sun is one of several public firms that are members of the Manufactured Housing Institute (MHI). A letter addressed from an attorney acting on behalf of MHI is addressed to what was at that time a MHI/National Communities Council (NCC) member. Right or wrong, Spencer Roane with Pentagon Properties dared question MHI’s leadership and pushed back in public against what he expressed that was slander aimed at him. The context of that MHI attorney’s letter could be described as their reaction to their being publicly questioned, and in some sense, threatened. The MHI response could fairly be described in part as threatening Roane back. This report, analysis, and commentary will bring together several seemingly disjointed threads to reveal the context – and risk potential – for those rosy numbers being reported by MHI member Sun (SUI).

In no particular order of importance, against that backdrop, MHProNews will first look back in time at a letter from the law firm of “Webster, Chamberlain & Bean, LLP,” based in Washington, D.C. to Spencer Roane. When the Sun Communities press release is presented later below, it should not be construed as an endorsement of the firm or its stock. There will be additional information there too, which will include quotes and previous statements by Sun leadership. But there will also be references to other MHI member brands, numbers of which are part of a larger publicly traded operation.

Part I – Attorney Letter to then MHI Member Spencer Roane

Roane was at that time, as the letter below stated, president of Pentagon Properties. They were a member of MHI’s National Communities Council. The letter in good measure speaks for itself. But following this letter will be additional linked information. A PDF of the attorney’s letter on behalf of MHI is available at this link here, with the text being reproduced below.

November 30, 2012

Mr. Spencer Roane

President

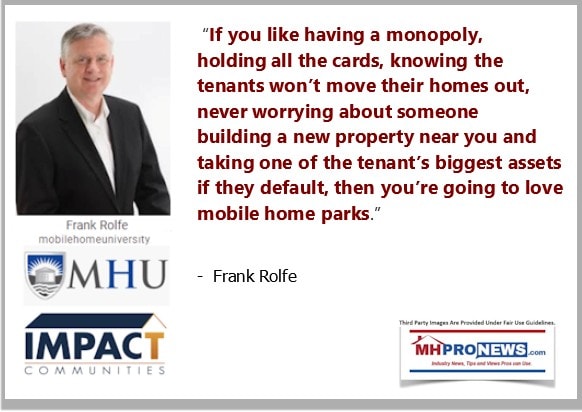

Pentagon Properties, Inc.

P.O. Box 20256

Atlanta, GA 30325

Re: MHI/NCC Matter

Dear Mr. Roane:

My firm represents the Manufactured Housing Institute (hereinafter referred to as “Institute” or “MHI”).

I have been asked to respond to your numerous communications regarding an MHI/ National Communities Council (“NCC”) meeting held on October 8, 2012 (the “Meeting”).

Without addressing each and every allegation and assertion you make individually, the most succinct summation of MHI’s position is as follows.

Based on the facts presented regarding what was stated at the Meeting we have determined that no “slanderous or defamatory” comments were made against you. To be even clearer, MHI’s position, with the Executive Committee of the Board being fully briefed on the matter, is that no laws were broken and no legal cause of action exists on your part against MHI, NCC or the Chairman of the NCC Division as a result of the proceedings at the Meeting; and MHI considers the matter closed.

As you are aware from your years of participation, MHI is the nation’s leading trade organization representing all segments of the factory built housing industry. By virtue of that definition, it is understood MHI represents a broad spectrum on business interests within the industry (e.g., business, size, geography, business models, etc.) and that this diverse membership will often express a wide range of views on issues and Institute activity. MHI, in fact, seeks out all points of view on industry issues anticipating they will contribute to the discussion and ultimately the most favorable, widely supported outcomes. While both democracy and dissension at times can be a strenuous process, every disagreement, differing point of view, or opinion asserted (whether officially on behalf of the organization or in ones own personal capacity) does not warrant legal action, apologies, or the need for point by point rebuttals (the reason why, as stated above, this letter does not attempt to address all of your allegations regarding, for example, that comments were “mean spirited”).

In conclusion, MHI/ NCC will continue to work for the best interest of the industry inviting comments, the occasional contentious debate, pursuing the goal of productive meetings and measurable success.

Notwithstanding the foregoing, however, MHI’s most valuable asset is its name and reputation. Over the years, MHI has diligently worked to serve the industry and establish significant good will within its membership, the industry at-large, as well as with the government and the consumers the membership serves. MHI actively monitors and proactively addresses any attempts by third parties who wrongfully disparage the organization. Therefore, to the extent any third party communicates (orally, in writing, electronically) untrue, false, fabricated deleterious statements regarding MHI, the Institute is firmly committed to pursue every legal remedy available to preserve the reputation it has worked so hard to establish and maintain. This includes statements made from its membership as well.

If you have any questions regarding this foregoing, please feel free to contact me.

Sincerely,

David P. Goch

cc: Richard Jennison, President & CEO, MHI

cc: Don Glisson, Jr., Chairman, MHI

##

Part II. Additional Information, More Commentary and Analysis Regarding MHI,

Attorneys Acting on Behalf of MHI, and Roane

In no particular order of importance, are the following points to be considered.

1) The letter to Roane reflects the point that MHI is obviously willing and able to hirer an outside counsel to engage in legal issues. 2) The letter itself makes various claims that beg examination. For instance. MHI has at various times claimed that it is working for “consensus.” Some voices acting on behalf of MHI interests have gone so far as to assert that there had to be consensus if manufactured housing would achieve its goals with, for example, the U.S. Department of Housing and Urban Development (HUD). That noted, HUD’s official spokesperson denied that such was necessary, expected or even reasonably achievable.

More specifically, HUD’s media relations office told MHProNews that claims by MHI that there had to be consensus “do not comport with HUD policy.” While there are several ways to frame that, one is that MHI has been misrepresenting that claim to their own members – and the industry at large – for years.

Sparks Fly – MHI, HUD Allegations Do “Not Comport with HUD Policy”

3) A few of several pull quotes from Goch’s letter to Roane on behalf of MHI that merit scrutiny are as follows. MHProNews inquired this morning with Goch if he believes that these claims are valid today? That reply from Goch is pending as this report and analysis are being produced.

4) The letter to Roane should also be considered in the light of letters by various attorneys to MHProNews, some noted and linked in the report found here, during and after our membership at MHI. Those attorneys letters either stated and/or by implication indicated they were acting on behalf of the interests of MHI. Additionally, there are numerous quite public examples that MHI and several of their dominating brands ducked public debate. Or where MHI/NCC – and its inside/outside counsels or several of their major brands – ducked input from members or others. Rephrased, Goch was either speaking in demonstrable ignorance of reality or he was spinning and manipulating reality on behalf of MHI, quite to the contrary of numerous examples and well documented history.

5) This fact check should not be construed as a defense of Roane. MHProNews has previously documented problems he and his colleague George F. Allen have been involved in. See the reports linked below to learn more. Rather, spotlighting this letter is demonstrate several key items. One, MHI is willing and able to use attorneys to achieve their desired end, be that goal right or wrong.

George Allen Blasts MHI, NCC Ignoring Own, Spencer Roane, SECO, COBA7, Tom Lackey Controversies

6) Next, MHI has demonstrably NOT employed attorneys to do what Danny Ghorbani said is necessary in the Q&A, report, fact check and analysis linked below.

7) While this troubling landscape involving MHI is painted, the evidence-based question arises. Why would should MHI staff and key board leaders fail to aggressively promote – through legal action, if necessary – the full and proper implementation of good existing laws that were designed by Congress to protect consumers and advance affordable manufactured home ownership? The only logic thesis that has stood the test of time is that an apparently stealthy form of consolidation is sought. MHI and their leaders claim something, but upon examination, it is often arguably proven not to be true. Restated, there is often a need to “invert” – see the headline – a claim by MHI and their dominating brands to see if it stands up to scrutiny. That noted, ironically MHI’s own members have made it plain that they want consolidation. Thus, it is MHI members who are in some ways the strongest evidence that Goch and MHI’s claims of working for all segments of the industry are, to put it politely, hooey. A few examples from MHI members, and linked reports that examine them in more detail, will make the point.

8) Some lies and behaviors are so big and bold that it is hard for normal people to get their minds around the level of audacity needed to make such a claim. Note that Jody Gabel, J.D., has thus far – days later – declined to respond to MHProNews’ inquires. So much for Goch’s claim that MHI – and/or their inside/outside attorneys – want engagement, debate, and input? Isn’t the claim absurd on its face when someone is informed about the issues? Thus, the value of the Latin aphorism, “Scientia potentia est.” Or “Knowledge is potential power.”

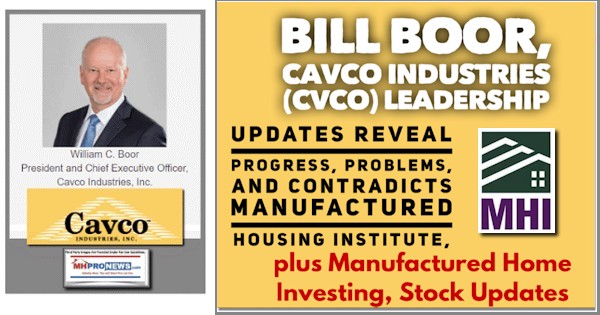

9) It is in the light of the above, plus the notion that high profile MHI member Cavco Industries is still under and SEC cloud, that the report that follows about Sun Communities should be examined.

10) Why? Because if the public mood – and manufactured housing independents’ grumblings – shifts enough, there may well be a CAVCO (CVCO) style dust-up ahead for not only Sun, but others who are apparently consolidating under the cover of MHI’s defensive mantle.

With that backdrop, let’s now proceed to Part III, the actual Sun Communities press release. If you are a Sun share holder, consider in the light of the above and what follows when the best time to sell your shares might be. Following that Sun media release will be additional information, and then the balance of our 7.26.2021 market report.

Part III. Sun Communities Press Release. (Notice: publishing this release should not be misunderstood as an endorsement of the stock or operation.)

Sun Communities, Inc. Reports 2021 Second Quarter Results

Sun Communities, Inc.

Mon, July 26, 2021, 4:35 PM

NEWS RELEASE

July 26, 2021

Sun Communities, Inc. Reports 2021 Second Quarter Results

Southfield, MI, July 26, 2021 (GLOBE NEWSWIRE) — Sun Communities, Inc. (NYSE: SUI) (the “Company”), a real estate investment trust (“REIT”) that owns and operates, or has an interest in, manufactured housing (“MH”) communities, recreational vehicle (“RV”) resorts and marinas, (collectively, the “properties”), today reported its second quarter results for 2021.

Financial Results for the Quarter and Six Months Ended June 30, 2021

For the quarter ended June 30, 2021, total revenues increased $300.6 million, or 99.1 percent, to approximately $603.9 million compared to $303.3 million for the same period in 2020. Net income attributable to common stockholders increased $51.9 million or 88.0 percent, to approximately $110.8 million, or $0.98 per diluted common share, compared to net income attributable to common stockholders of $58.9 million, or $0.61 per diluted common share, for the same period in 2020.

For the six months ended June 30, 2021, total revenues increased $432.3 million, or 70.5 percent, to $1.0 billion compared to approximately $613.6 million for the same period in 2020. Net income attributable to common stockholders increased $92.7 million or 216.5 percent, to approximately $135.6 million, or $1.22 per diluted common share, compared to net income attributable to common stockholders of $42.8 million, or $0.45 per diluted common share, for the same period in 2020.

Non-GAAP Financial Measures and Portfolio Performance

- Core Funds from Operations (“Core FFO”)(1) for the quarter ended June 30, 2021, was $1.80 per diluted share and OP unit (“Share”) as compared to $1.12 in the corresponding period in 2020, a 60.7 percent increase.

- Same Community(2) Net Operating Income (“NOI”)(1) increased by 21.6 percent for the quarter ended June 30, 2021, as compared to the corresponding period in 2020.

- Home Sales Volume increased 89.5 percent to 1,158 homes for the quarter ended June 30, 2021, as compared to 611 homes in the same period in 2020.

- Acquisitions totaled $719.4 million during and subsequent to the quarter ended June 30, 2021, including 10 MH communities, two RV resorts and six marinas.

Gary Shiffman, Chief Executive Officer stated, “Sun’s ongoing strong momentum continued through the second quarter, as we saw robust performance across RV, Manufactured Housing and Marinas. Our RV business is demonstrating the growing appeal of an RV vacation for consumers, marinas are in the midst of an active boating season and our results continue to track ahead of our underwriting, and in our manufactured housing business, we are benefiting from sustained demand for affordable housing. Furthermore, our RV forward bookings have continued to accelerate and we are pleased to again increase our guidance for the year.”

Mr. Shiffman continued, “We have remained active in terms of new site deliveries and have more than 9,400 sites available for development, representing an attractive source of growth and value creation over time. We also deployed over $719 million in acquisitions, including six marinas as we begin to realize the meaningful consolidation opportunity we have in the marina industry. To support this ongoing growth, we are pleased to have received investment grade ratings and completed our inaugural unsecured bond issuance as we issued $600 million in senior unsecured notes. This additional financing option provides Sun enhanced financial flexibility to efficiently match fund our investment activities as we continue to realize compelling growth opportunities across all of our businesses.”

OPERATING HIGHLIGHTS

Portfolio Occupancy

Total MH and annual RV occupancy was 97.4 percent at June 30, 2021, compared to 97.3 percent at June 30, 2020, an increase of 10 basis points.

During the quarter ended June 30, 2021, MH and annual RV revenue producing sites increased by 583 sites, as compared to an increase of 851 revenue producing sites during the quarter ended June 30, 2020.

During the six months ended June 30, 2021, MH and annual RV revenue producing sites increased by 1,097 sites, as compared to an increase of 1,151 revenue producing sites during the six months ended June 30, 2020.

Same Community(2) Results

For the 405 MH and RV properties owned and operated by the Company since January 1, 2020, the following table reflects the NOI(1) percentage increases, in total and by segment, for the quarter and six months ended June 30, 2021:

| Quarter Ended June 30, 2021 | ||||||||

| Total Same Community | MH | RV | ||||||

| Revenue | 22.5 | % | 6.9 | % | 64.4 | % | ||

| Expense | 24.7 | % | 11.8 | % | 41.9 | % | ||

| NOI | 21.6 | % | 5.4 | % | 85.1 | % | ||

| Six Months Ended June 30, 2021 | ||||||||

| Total Same Community | MH | RV | ||||||

| Revenue | 12.8 | % | 6.0 | % | 30.2 | % | ||

| Expense | 15.2 | % | 8.7 | % | 24.2 | % | ||

| NOI | 11.8 | % | 5.1 | % | 34.8 | % | ||

Same Community adjusted occupancy(3) increased to 98.8 percent at June 30, 2021 from 97.2 percent at June 30, 2020.

Home Sales

During the quarter ended June 30, 2021, the Company sold 1,158 homes as compared to 611 homes in the same period in 2020, an increase of 89.5 percent. The Company sold 227 and 140 new homes for the quarters ended June 30, 2021 and 2020, respectively, an increase of 62.1 percent. Pre-owned home sales were 931 in the second quarter 2021 as compared to 471 in the same period in 2020, an increase of 97.7 percent.

During the six months ended June 30, 2021, the Company sold 1,993 homes as compared to 1,374 homes in the same period in 2020, an increase of 45.1 percent. The Company sold 376 and 259 new homes for the six months ended June 30, 2021 and 2020, respectively, an increase of 45.2 percent. Pre-owned home sales were 1,617 in the six months ended June 30, 2021 as compared to 1,115 in the same period in 2020, an increase of 45.0 percent.

Marina Results

Marina NOI was $62.8 million and $94.2 million for the quarter and six months ended June 30, 2021, respectively. Refer to page 15 for additional information regarding the marina portfolio operating results.

PORTFOLIO ACTIVITY

Acquisitions and Dispositions

During and subsequent to the quarter ended June 30, 2021, the Company acquired the following communities, resorts and marinas:

| Property Name | Property Type | Sites, Wet Slips and Dry Storage Spaces |

Development Sites | State / Province | Total Purchase Price (in millions) |

Month Acquired | ||||||||||

| ThemeWorld RV Resort | RV | 148 | — | FL | $ | 25.0 | April | |||||||||

| Sylvan Glen Estates(a) | MH | 476 | — | MI | 24.0 | April | ||||||||||

| Shelter Island Boatyard | Marina | 55 | N/A | CA | 10.0 | May | ||||||||||

| Lauderdale Marine Center | Marina | 202 | N/A | FL | 340.2 | May | ||||||||||

| Apponaug Harbor(b) | Marina | 378 | N/A | RI | 6.6 | June | ||||||||||

| Cabrillo Isle(c) | Marina | 483 | N/A | CA | 46.9 | June | ||||||||||

| Marathon Marina | Marina | 147 | N/A | FL | 19.1 | June | ||||||||||

| Subtotal | 1,889 | — | 471.8 | |||||||||||||

| Acquisitions subsequent to quarter end | ||||||||||||||||

| Allen Harbor | Marina | 165 | N/A | RI | 4.0 | July | ||||||||||

| Cisco Grove Campground & RV | RV | 18 | 407 | CA | 6.6 | July | ||||||||||

| Four Leaf Portfolio(d) | MH | 2,714 | 171 | MI / IN | 215.0 | July | ||||||||||

| Harborage Yacht Club | Marina | 300 | N/A | FL | 22.0 | July | ||||||||||

| Subtotal | 3,197 | 578 | 247.6 | |||||||||||||

| Total acquisitions | 5,086 | 578 | $ | 719.4 | ||||||||||||

(a) In conjunction with the acquisition, the Company issued 240,000 Series J preferred OP units.

(b) Combined with an existing adjacent marina.

(c) Acquired in connection with Safe Harbor Marinas acquisition. Transfer of the marinas was contingent on receiving third party consent.

(d) Contains nine MH communities.

During and subsequent to the six months ended June 30, 2021 the Company acquired 28 properties totaling 7,666 sites, wet slips and dry storage spaces, and 578 sites for development for a total purchase price of $853.4 million.

Subsequent to the quarter ended June 30, 2021, the Company sold two MH communities located in Indiana and Missouri for $67.5 million. The assets and liabilities associated with the transaction were classified as held for sale on the Consolidated Balance Sheets as of June 30, 2021.

Construction Activity

During the quarter ended June 30, 2021, the Company completed the construction of over 100 sites in two ground-up developments and over 120 expansion sites in two MH communities and one RV resort.

Year to date June 30, 2021, the Company completed the construction of over 350 sites in three ground-up development and over 230 expansion sites in three MH communities and one RV resort.

BALANCE SHEET, CAPITAL MARKETS ACTIVITY AND OTHER ITEMS

Debt

As of June 30, 2021, the Company had approximately $4.3 billion in debt outstanding. The weighted average interest rate was 3.5 percent and the weighted average maturity was 10.4 years. At June 30, 2021, the Company’s net debt to trailing twelve month Recurring EBITDA(1) ratio was 5.1 times. The Company had $103.5 million of unrestricted cash on hand.

Senior Unsecured Notes

On June 14, 2021, the Company received investment grade ratings of BBB and Baa3 with a stable outlook from S&P Global and Moody’s, respectively.

On June 28, 2021, Sun Communities Operating Limited Partnership (“SCOLP”), the Company’s operating partnership, issued $600.0 million of senior unsecured notes with an interest rate of 2.7 percent and a ten-year term, due 2031. The net proceeds from the offering were $592.4 million, after deducting underwriters’ discount and estimated offering expenses.

Credit Agreement

On June 14, 2021, SCOLP, as borrower, and the Company, as guarantor, entered into a new credit agreement with certain lenders. The new credit agreement combines and replaces SCOLP’s $750.0 million credit facility which was scheduled to mature May 21, 2023, and the $1.8 billion credit facility of the Company’s marina subsidiary, Safe Harbor Marinas, LLC (the “Safe Harbor Facility”) which was scheduled to mature on October 11, 2024. The Safe Harbor Facility was terminated in connection with the execution of the new credit agreement and all amounts due and outstanding were repaid on or prior to the date of the New Credit Agreement. The Company recognized a loss on extinguishment of debt in its Consolidated Statement of Operations related to the termination of these prior credit facilities of $0.2 million and $7.9 million, respectively.

Pursuant to the New Credit Agreement, SCOLP may borrow up to $2.0 billion under a revolving loan (the “New Credit Facility”) to fund the business of SCOLP and all its subsidiaries. The New Credit Facility has a four-year term ending June 14, 2025. Subject to the satisfaction of certain conditions, the term may be extended for two additional six-month periods, and additional borrowings not to exceed $1.0 billion is permitted. However, the maturity date with respect to $500.0 million of available borrowing under the New Credit Facility is October 11, 2024, which may not be extended. The New Credit Facility bears interest at a floating rate based on the Adjusted Eurocurrency Rate or Australian Bank Bill Swap Bid Rate (BBSY), plus a margin which can range from 0.725 percent to 1.400 percent. As of June 30, 2021, the margin based on our credit ratings was 0.850 percent on the New Credit Facility. The Company had $190.3 million of borrowings on the New Credit Facility as of June 30, 2021.

Equity Transactions

Public Equity Offering

In May and June 2021, the Company completed the physical settlement of the remaining 4,050,000 shares offered under the forward sale agreement pursuant to the Company’s March 2021 equity offering of 8,050,000 shares. Net proceeds of $539.7 million after deducting expenses related to the offering, were used to acquire assets and pay down the Safe Harbor Facility.

At the Market Offering Sales Agreements

In June 2021, the Company entered into an At the Market Offering (ATM) Sales Agreement (the “Sales Agreement”) with certain sales agents, forward sellers, pursuant to which the Company may sell, from time to time, up to an aggregate gross sales price of $500.0 million of its common stock. No shares were sold during the quarter ending June 30, 2021 under the ATM program. Upon entering into the Sales Agreement, the Company simultaneously terminated its previous ATM sales agreement entered into in July 2017.

2021 GUIDANCE

The Company is providing revised or initial 2021 guidance for the following metrics:

| Previous Range | Revised Range | ||||||||||

| FY 2021E | FY 2021E | 3Q 2021E | |||||||||

| Basic earnings per share | $1.68 – $1.84 | $2.24 – $2.36 | $0.90 – $0.96 | ||||||||

| Core FFO(1) per fully diluted Share | $5.92 – $6.08 | $6.25 – $6.37 | $2.00 – $2.06 | ||||||||

| 1Q21 | 2Q21 | 3Q21 | 4Q21 | ||||||||

| Seasonality of Core FFO(1) per fully diluted Share | 20.0 | % | 28.5 | % | 32.1 | % | 19.4 | % | |||

Seasonality of Core FFO(1) per fully diluted Share is based off of the midpoint of full year guidance.

| Previous Range | Revised Range | ||||||

| FY 2021E | FY 2021E | 3Q 2021E | |||||

| Same Community NOI(1) growth | 7.5% – 8.5% | 9.9% – 10.7% | 11.2% – 12.0% |

Guidance estimates include acquisitions completed through the date of this release and exclude any prospective acquisitions or capital markets activity.

The estimates and assumptions presented above represent a range of possible outcomes and may differ materially from actual results. The estimates and assumptions are forward looking based on the Company’s current assessment of economic and market conditions, as well as other risks outlined below under the caption “Cautionary Statement Regarding Forward-Looking Statements.”

EARNINGS CONFERENCE CALL

A conference call to discuss second quarter results will be held on Tuesday, July 27, 2021 at 11:00 A.M. (ET). To participate, call toll-free (877) 407-9039. Callers outside the U.S. or Canada can access the call at (201) 689-8470. A replay will be available following the call through August 10, 2021 and can be accessed toll-free by calling (844) 512-2921 or (412) 317-6671. The Conference ID number for the call and the replay is 13720116. The conference call will be available live on Sun Communities’ website located at www.suncommunities.com. The replay will also be available on the website.

Sun Communities, Inc. is a REIT that, as of June 30, 2021, owned, operated, or had an interest in a portfolio of 569 developed MH, RV and marina properties comprising over 153,300 developed sites and nearly 41,300 wet slips and dry storage spaces in 39 states and Ontario, Canada.

For more information about Sun Communities, Inc., please visit www.suncommunities.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release contains various “forward-looking statements” within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended, and the Company intends that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this press release that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intends,” “intend,” “intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” “guidance,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward looking statements contain these words. These forward-looking statements reflect the Company’s current views with respect to future events and financial performance, but involve known and unknown risks, uncertainties and other factors, both general and specific to the matters discussed in or incorporated herein, some of which are beyond the Company’s control. These risks, uncertainties and other factors may cause the Company’s actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks disclosed under “Risk Factors” contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and in the Company’s other filings with the Securities and Exchange Commission from time to time, such risks, uncertainties and other factors include but are not limited to:

- outbreaks of disease, including the COVID-19 pandemic, and related stay-at-home orders, quarantine policies and restrictions on travel, trade and business operations;

- changes in general economic conditions, the real estate industry and the markets in which the Company operates;

- difficulties in the Company’s ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully;

- the Company’s liquidity and refinancing demands;

- the Company’s ability to obtain or refinance maturing debt;

- the Company’s ability to maintain compliance with covenants contained in its debt facilities and its senior unsecured notes;

- availability of capital;

- changes in foreign currency exchange rates, including between the U.S. dollar and each of the Canadian and Australian dollars;

- the Company’s ability to maintain rental rates and occupancy levels;

- the Company’s ability to maintain effective internal control over financial reporting and disclosure controls and procedures;

- increases in interest rates and operating costs, including insurance premiums and real property taxes;

- risks related to natural disasters such as hurricanes, earthquakes, floods and wildfires;

- general volatility of the capital markets and the market price of shares of the Company’s capital stock;

- the Company’s ability to maintain its status as a REIT;

- changes in real estate and zoning laws and regulations;

- legislative or regulatory changes, including changes to laws governing the taxation of REITs;

- litigation, judgments or settlements;

- competitive market forces;

- the ability of purchasers of manufactured homes and boats to obtain financing; and

- the level of repossessions by manufactured home lenders.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. The Company undertakes no obligation to publicly update or revise any forward-looking statements included in this press release, whether as a result of new information, future events, changes in its expectations or otherwise, except as required by law.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to the Company or persons acting on its behalf are qualified in their entirety by these cautionary statements.

Investor Information

| RESEARCH COVERAGE | ||||||

| Firm | Analyst | Phone | ||||

| Bank of America Merrill Lynch | Joshua Dennerlein | (646) 855-1681 | joshua.dennerlein@baml.com | |||

| Berenberg Capital Markets | Keegan Carl | (646) 949-9052 | keegan.carl@berenberg-us.com | |||

| BMO Capital Markets | John Kim | (212) 885-4115 | johnp.kim@bmo.com | |||

| Citi Research | Michael Bilerman | (212) 816-1383 | michael.bilerman@citi.com | |||

| Nicholas Joseph | (212) 816-1909 | nicholas.joseph@citi.com | ||||

| Evercore ISI | Steve Sakwa | (212) 446-9462 | steve.sakwa@evercoreisi.com | |||

| Samir Khanal | (212) 888-3796 | samir.khanal@evercoreisi.com | ||||

| Green Street Advisors | John Pawlowski | (949) 640-8780 | jpawlowski@greenstreetadvisors.com | |||

| Robert W. Baird & Co. | Wesley Golladay | (216) 737-7510 | wgolladay@rwbaird.com | |||

| RBC Capital Markets | Brad Heffern | (512) 708-6311 | brad.heffern@rbccm.com | |||

| UBS | Michael Goldsmith | (212) 713-2951 | michael.goldsmith@ubs.com | |||

| Wells Fargo | Todd Stender | (562) 637-1371 | todd.stender@wellsfargo.com | |||

| INQUIRIES | ||||||

| Sun Communities welcomes questions or comments from stockholders, analysts, investment managers, media, or any prospective investor. Please address all inquiries to our Investor Relations department. | ||||||

| At Our Website | www.suncommunities.com | |||||

| By Email | investorrelations@suncommunities.com | |||||

| By Phone | (248) 208-2500 | |||||

Portfolio Overview

(As of June 30, 2021)

Financial and Operating Highlights

(amounts in thousands, except for *)

| Quarter Ended | |||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | |||||||||||||||

| Financial Information | |||||||||||||||||||

| Total revenues | $ | 603,863 | $ | 442,015 | $ | 384,265 | $ | 400,514 | $ | 303,266 | |||||||||

| Net income | $ | 120,849 | $ | 27,941 | $ | 9,818 | $ | 89,756 | $ | 63,355 | |||||||||

| Net income attributable to Sun Communities Inc. common stockholders | $ | 110,770 | $ | 24,782 | $ | 7,586 | $ | 81,204 | $ | 58,910 | |||||||||

| Basic earnings per share* | $ | 0.98 | $ | 0.23 | $ | 0.07 | $ | 0.83 | $ | 0.61 | |||||||||

| Diluted earnings per share* | $ | 0.98 | $ | 0.23 | $ | 0.07 | $ | 0.83 | $ | 0.61 | |||||||||

| Cash distributions declared per common share* | $ | 0.83 | $ | 0.83 | $ | 0.79 | $ | 0.79 | $ | 0.79 | |||||||||

| Recurring EBITDA(1) | $ | 268,225 | $ | 190,830 | $ | 168,527 | $ | 199,321 | $ | 148,650 | |||||||||

| FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities(1)(4) | $ | 198,017 | $ | 135,925 | $ | 110,849 | $ | 165,209 | $ | 118,092 | |||||||||

| Core FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities(1)(4) | $ | 209,620 | $ | 141,036 | $ | 124,872 | $ | 162,624 | $ | 110,325 | |||||||||

| FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities(1)(4) per share – fully diluted* | $ | 1.70 | $ | 1.22 | $ | 1.03 | $ | 1.63 | $ | 1.20 | |||||||||

| Core FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities(1)(4) per share – fully diluted* | $ | 1.80 | $ | 1.26 | $ | 1.16 | $ | 1.60 | $ | 1.12 | |||||||||

| Balance Sheet | |||||||||||||||||||

| Total assets | $ | 12,040,990 | $ | 11,454,209 | $ | 11,206,586 | $ | 8,335,717 | $ | 8,348,659 | |||||||||

| Total debt | $ | 4,311,175 | $ | 4,417,935 | $ | 4,757,076 | $ | 3,340,613 | $ | 3,390,771 | |||||||||

| Total liabilities | $ | 5,099,563 | $ | 5,101,512 | $ | 5,314,879 | $ | 3,791,922 | $ | 3,845,308 | |||||||||

| Quarter Ended | ||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | ||||||||||

| Operating Information* | ||||||||||||||

| Properties | 569 | 562 | 552 | 432 | 426 | |||||||||

| Manufactured home sites | 97,448 | 96,876 | 96,688 | 95,209 | 94,232 | |||||||||

| Annual RV sites | 28,807 | 28,441 | 27,564 | 26,817 | 26,240 | |||||||||

| Transient RV sites | 27,032 | 26,295 | 25,043 | 23,728 | 22,360 | |||||||||

| Total sites | 153,287 | 151,612 | 149,295 | 145,754 | 142,832 | |||||||||

| Marina wet slips and dry storage spaces | 41,275 | 38,753 | 38,152 | N/A | N/A | |||||||||

| MH occupancy | 96.7 | % | 96.5 | % | 96.6 | % | 96.4 | % | 96.5 | % | ||||

| Annual RV occupancy | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||

| Blended MH and annual RV occupancy | 97.4 | % | 97.3 | % | 97.3 | % | 97.2 | % | 97.3 | % | ||||

| New home sales | 227 | 149 | 156 | 155 | 140 | |||||||||

| Pre-owned home sales | 931 | 686 | 626 | 555 | 471 | |||||||||

| Total home sales | 1,158 | 835 | 782 | 710 | 611 | |||||||||

| Quarter Ended | ||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | ||||||

| Revenue Producing Site Gains(5) | ||||||||||

| MH net leased sites | 226 | 127 | 247 | 349 | 759 | |||||

| RV net leased sites | 357 | 387 | 331 | 427 | 92 | |||||

| Total net leased sites | 583 | 514 | 578 | 776 | 851 | |||||

Consolidated Balance Sheets

(amounts in thousands)

| June 30, 2021 | December 31, 2020 | |||||||||

| Assets | ||||||||||

| Land | $ | 2,412,629 | $ | 2,119,364 | ||||||

| Land improvements and buildings | 8,995,041 | 8,480,597 | ||||||||

| Rental homes and improvements | 622,397 | 637,603 | ||||||||

| Furniture, fixtures and equipment | 529,549 | 447,039 | ||||||||

| Investment property | 12,559,616 | 11,684,603 | ||||||||

| Accumulated depreciation | (2,165,564 | ) | (1,968,812 | ) | ||||||

| Investment property, net | 10,394,052 | 9,715,791 | ||||||||

| Cash, cash equivalents and restricted cash | 119,612 | 92,641 | ||||||||

| Marketable securities | 153,049 | 124,726 | ||||||||

| Inventory of manufactured homes | 43,686 | 46,643 | ||||||||

| Notes and other receivables, net | 262,333 | 221,650 | ||||||||

| Goodwill | 448,317 | 428,833 | ||||||||

| Other intangible assets, net | 295,663 | 305,611 | ||||||||

| Other assets, net | 324,278 | 270,691 | ||||||||

| Total Assets | $ | 12,040,990 | $ | 11,206,586 | ||||||

| Liabilities | ||||||||||

| Secured debt | $ | 3,457,734 | $ | 3,489,983 | ||||||

| Unsecured debt | 853,441 | 1,267,093 | ||||||||

| Distributions payable | 98,429 | 86,988 | ||||||||

| Advanced reservation deposits and rent | 290,913 | 187,730 | ||||||||

| Accrued expenses and accounts payable | 214,200 | 148,435 | ||||||||

| Other liabilities | 184,846 | 134,650 | ||||||||

| Total Liabilities | 5,099,563 | 5,314,879 | ||||||||

| Commitments and contingencies | ||||||||||

| Temporary equity | 285,603 | 264,379 | ||||||||

| Stockholders’ Equity | ||||||||||

| Common stock | 1,159 | 1,076 | ||||||||

| Additional paid-in capital | 8,163,095 | 7,087,658 | ||||||||

| Accumulated other comprehensive income | 5,197 | 3,178 | ||||||||

| Distributions in excess of accumulated earnings | (1,614,243 | ) | (1,566,636 | ) | ||||||

| Total Sun Communities, Inc. stockholders’ equity | 6,555,208 | 5,525,276 | ||||||||

| Noncontrolling interests | ||||||||||

| Common and preferred OP units | 82,865 | 85,968 | ||||||||

| Consolidated variable interest entities | 17,751 | 16,084 | ||||||||

| Total noncontrolling interests | 100,616 | 102,052 | ||||||||

| Total Stockholders’ Equity | 6,655,824 | 5,627,328 | ||||||||

| Total Liabilities, Temporary Equity and Stockholders’ Equity | $ | 12,040,990 | $ | 11,206,586 | ||||||

Statements of Operations – Quarter to Date and Year to Date Comparison

(In thousands, except per share amounts) (Unaudited)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||

| June 30, 2021 | June 30, 2020 | Change | % Change | June 30, 2021 | June 30, 2020 | Change | % Change | ||||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||||

| Real property (excluding transient) | $ | 328,907 | $ | 225,413 | $ | 103,494 | 45.9 | % | $ | 626,984 | $ | 453,415 | $ | 173,569 | 38.3 | % | |||||||||||||||||||||

| Real property – transient | 76,998 | 25,714 | 51,284 | 199.4 | % | 109,534 | 56,061 | 53,473 | 95.4 | % | |||||||||||||||||||||||||||

| Home sales | 81,848 | 38,530 | 43,318 | 112.4 | % | 134,047 | 79,117 | 54,930 | 69.4 | % | |||||||||||||||||||||||||||

| Service, retail, dining and entertainment | 106,452 | 7,700 | 98,752 | N/M | 157,064 | 12,803 | 144,261 | N/M | |||||||||||||||||||||||||||||

| Interest | 2,719 | 2,635 | 84 | 3.2 | % | 5,350 | 4,985 | 365 | 7.3 | % | |||||||||||||||||||||||||||

| Brokerage commissions and other, net | 6,939 | 3,274 | 3,665 | 111.9 | % | 12,899 | 7,187 | 5,712 | 79.5 | % | |||||||||||||||||||||||||||

| Total Revenues | 603,863 | 303,266 | 300,597 | 99.1 | % | 1,045,878 | 613,568 | 432,310 | 70.5 | % | |||||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||||||||

| Property operating and maintenance | 129,961 | 70,804 | 59,157 | 83.6 | % | 233,514 | 140,638 | 92,876 | 66.0 | % | |||||||||||||||||||||||||||

| Real estate tax | 23,202 | 17,723 | 5,479 | 30.9 | % | 45,610 | 34,899 | 10,711 | 30.7 | % | |||||||||||||||||||||||||||

| Home costs and selling | 58,763 | 32,051 | 26,712 | 83.3 | % | 100,353 | 66,090 | 34,263 | 51.8 | % | |||||||||||||||||||||||||||

| Service, retail, dining and entertainment | 78,585 | 7,242 | 71,343 | N/M | 124,016 | 13,924 | 110,092 | N/M | |||||||||||||||||||||||||||||

| General and administrative | 45,127 | 26,527 | 18,600 | 70.1 | % | 83,330 | 51,876 | 31,454 | 60.6 | % | |||||||||||||||||||||||||||

| Catastrophic event-related charges, net | 355 | (566 | ) | 921 | 162.7 | % | 2,769 | 40 | 2,729 | N/M | |||||||||||||||||||||||||||

| Business combination, net | (201 | ) | — | (201 | ) | N/A | 1,031 | — | 1,031 | N/A | |||||||||||||||||||||||||||

| Depreciation and amortization | 126,423 | 87,265 | 39,158 | 44.9 | % | 249,727 | 170,954 | 78,773 | 46.1 | % | |||||||||||||||||||||||||||

| Loss on extinguishment of debt | 8,108 | 1,930 | 6,178 | 320.1 | % | 8,108 | 5,209 | 2,899 | 55.7 | % | |||||||||||||||||||||||||||

| Interest | 37,681 | 31,428 | 6,253 | 19.9 | % | 77,198 | 63,844 | 13,354 | 20.9 | % | |||||||||||||||||||||||||||

| Interest on mandatorily redeemable preferred OP units / equity | 1,041 | 1,042 | (1 | ) | (0.1 | ) | % | 2,077 | 2,083 | (6 | ) | (0.3 | ) | % | |||||||||||||||||||||||

| Total Expenses | 509,045 | 275,446 | 233,599 | 84.8 | % | 927,733 | 549,557 | 378,176 | 68.8 | % | |||||||||||||||||||||||||||

| Income Before Other Items | 94,818 | 27,820 | 66,998 | 240.8 | % | 118,145 | 64,011 | 54,134 | 84.6 | % | |||||||||||||||||||||||||||

| Gain / (loss) on remeasurement of marketable securities | 27,494 | 24,519 | 2,975 | 12.1 | % | 31,155 | (4,128 | ) | 35,283 | N/M | |||||||||||||||||||||||||||

| Gain / (loss) on foreign currency translation | (264 | ) | 10,374 | (10,638 | ) | (102.5 | ) | % | (239 | ) | (7,105 | ) | 6,866 | (96.6 | ) | % | |||||||||||||||||||||

| Other expense, net(6) | (660 | ) | (821 | ) | 161 | 19.6 | % | (1,759 | ) | (1,793 | ) | 34 | (1.9 | ) | % | ||||||||||||||||||||||

| Gain / (loss) on remeasurement of notes receivable | 93 | 246 | (153 | ) | (62.2 | ) | % | 469 | (1,866 | ) | 2,335 | N/M | |||||||||||||||||||||||||

| Income from nonconsolidated affiliates | 794 | 92 | 702 | N/M | 1,965 | 144 | 1,821 | N/M | |||||||||||||||||||||||||||||

| Gain / (loss) on remeasurement of investment in nonconsolidated affiliates | (115 | ) | 1,132 | (1,247 | ) | (110.2 | ) | % | (11 | ) | (1,059 | ) | 1,048 | (99.0 | ) | % | |||||||||||||||||||||

| Current tax expense | (1,245 | ) | (119 | ) | (1,126 | ) | N/M | (1,016 | ) | (569 | ) | (447 | ) | 78.6 | % | ||||||||||||||||||||||

| Deferred tax benefit / (expense) | (66 | ) | 112 | (178 | ) | N/M | 81 | 242 | (161 | ) | (66.5 | ) | % | ||||||||||||||||||||||||

| Net Income | 120,849 | 63,355 | 57,494 | 90.7 | % | 148,790 | 47,877 | 100,913 | 210.8 | % | |||||||||||||||||||||||||||

| Less: Preferred return to preferred OP units / equity | 3,035 | 1,584 | 1,451 | 91.6 | % | 5,899 | 3,154 | 2,745 | 87.0 | % | |||||||||||||||||||||||||||

| Less: Income attributable to noncontrolling interests | 7,044 | 2,861 | 4,183 | 146.2 | % | 7,339 | 1,899 | 5,440 | 286.5 | % | |||||||||||||||||||||||||||

| Net Income Attributable to Sun Communities, Inc. | $ | 110,770 | $ | 58,910 | $ | 51,860 | 88.0 | % | $ | 135,552 | $ | 42,824 | $ | 92,728 | 216.5 | % | |||||||||||||||||||||

| Weighted average common shares outstanding – basic | 112,082 | 95,859 | 16,223 | 16.9 | % | 110,007 | 94,134 | 15,873 | 16.9 | % | |||||||||||||||||||||||||||

| Weighted average common shares outstanding – diluted | 112,082 | 95,860 | 16,222 | 16.9 | % | 112,593 | 94,525 | 18,068 | 19.1 | % | |||||||||||||||||||||||||||

| Basic earnings per share | $ | 0.98 | $ | 0.61 | $ | 0.37 | 60.7 | % | $ | 1.22 | $ | 0.45 | $ | 0.77 | 171.1 | % | |||||||||||||||||||||

| Diluted earnings per share | $ | 0.98 | $ | 0.61 | $ | 0.37 | 60.7 | % | $ | 1.22 | $ | 0.45 | $ | 0.77 | 171.1 | % | |||||||||||||||||||||

N/M = Percentage change is not meaningful.

Outstanding Securities and Capitalization

(amounts in thousands except for *)

| Outstanding Securities – As of June 30, 2021 | |||||||||||

| Number of Units / Shares Outstanding | Conversion Rate* | If Converted(1) | Issuance Price Per Unit* | Annual Distribution Rate* | |||||||

| Non-convertible Securities | |||||||||||

| Common shares | 115,889 | N/A | N/A | N/A | $3.32^ | ||||||

| Convertible Securities | |||||||||||

| Common OP units | 2,569 | 1.0000 | 2,569 | N/A | Mirrors common shares distributions | ||||||

| Series A-1 preferred OP units | 288 | 2.4390 | 703 | $ | 100 | 6.00 | % | ||||

| Series A-3 preferred OP units | 40 | 1.8605 | 75 | $ | 100 | 4.50 | % | ||||

| Series C preferred OP units | 306 | 1.1100 | 340 | $ | 100 | 5.00 | % | ||||

| Series D preferred OP units | 489 | 0.8000 | 391 | $ | 100 | 4.00 | % | ||||

| Series E preferred OP units | 90 | 0.6897 | 62 | $ | 100 | 5.25 | % | ||||

| Series F preferred OP units | 90 | 0.6250 | 56 | $ | 100 | 3.00 | % | ||||

| Series G preferred OP units | 241 | 0.6452 | 155 | $ | 100 | 3.20 | % | ||||

| Series H preferred OP units | 581 | 0.6098 | 355 | $ | 100 | 3.00 | % | ||||

| Series I preferred OP units | 922 | 0.6098 | 562 | $ | 100 | 3.00 | % | ||||

| Series J preferred OP units | 240 | 0.6061 | 145 | $ | 100 | 2.85 | % | ||||

^ Annual distribution is based on the last quarterly distribution annualized.

(1) Calculation may yield minor differences due to fractional shares paid in cash to the stockholder at conversion.

| Capitalization – As of June 30, 2021 | |||||||||||

| Equity | Shares | Share Price* | Total | ||||||||

| Common shares | 115,889 | $ | 171.40 | $ | 19,863,375 | ||||||

| Common OP units | 2,569 | $ | 171.40 | 440,327 | |||||||

| Subtotal | 118,458 | $ | 20,303,702 | ||||||||

| Preferred OP units as converted | 2,844 | $ | 171.40 | 487,462 | |||||||

| Total diluted shares outstanding | 121,302 | $ | 20,791,164 | ||||||||

| Debt | |||||||||||

| Secured debt | $ | 3,457,734 | |||||||||

| Unsecured debt | 853,441 | ||||||||||

| Total debt | $ | 4,311,175 | |||||||||

| Total Capitalization | $ | 25,102,339 | |||||||||

Reconciliations to Non-GAAP Financial Measures

Reconciliation of Net Income Attributable to Sun Communities, Inc. Common Stockholders to FFO(1)

(amounts in thousands except for per share data)

| Three Months Ended | Six Months Ended | ||||||||||||||||||

| June 30, 2021 | June 30, 2020 | June 30, 2021 | June 30, 2020 | ||||||||||||||||

| Net Income Attributable to Sun Communities, Inc. Common Stockholders | $ | 110,770 | $ | 58,910 | $ | 135,552 | $ | 42,824 | |||||||||||

| Adjustments | |||||||||||||||||||

| Depreciation and amortization | 126,227 | 87,296 | 249,303 | 171,048 | |||||||||||||||

| Depreciation on nonconsolidated affiliates | 31 | 19 | 61 | 19 | |||||||||||||||

| (Gain) / loss on remeasurement of marketable securities | (27,494 | ) | (24,519 | ) | (31,155 | ) | 4,128 | ||||||||||||

| (Gain) / loss on remeasurement of investment in nonconsolidated affiliates | 115 | (1,132 | ) | 11 | 1,059 | ||||||||||||||

| (Gain) / loss on remeasurement of notes receivable | (93 | ) | (246 | ) | (469 | ) | 1,866 | ||||||||||||

| Income attributable to noncontrolling interests | 5,033 | 1,942 | 4,886 | 1,646 | |||||||||||||||

| Preferred return to preferred OP units | 478 | — | 958 | 1,000 | |||||||||||||||

| Interest expense on Aspen preferred OP units | 514 | — | 1,028 | — | |||||||||||||||

| Gain on disposition of assets, net | (17,564 | ) | (4,178 | ) | (25,719 | ) | (9,740 | ) | |||||||||||

| FFO Attributable to Sun Communities, Inc. Common Stockholders and Dilutive Convertible Securities(1)(4) | $ | 198,017 | $ | 118,092 | $ | 334,456 | $ | 213,850 | |||||||||||

| Adjustments | |||||||||||||||||||

| Business combination expense and other acquisition related costs(7) | 2,284 | 504 | 4,237 | 889 | |||||||||||||||

| Loss on extinguishment of debt | 8,108 | 1,930 | 8,108 | 5,209 | |||||||||||||||

| Catastrophic event-related charges, net | 364 | (567 | ) | 2,778 | 39 | ||||||||||||||

| Loss of earnings – catastrophic event-related | — | — | 200 | 300 | |||||||||||||||

| (Gain) / loss on foreign currency translation | 264 | (10,374 | ) | 239 | 7,105 | ||||||||||||||

| Other expense, net | 517 | 552 | 1,233 | 854 | |||||||||||||||

| Deferred tax (benefits) / expenses | 66 | 188 | (81 | ) | 58 | ||||||||||||||

| Core FFO Attributable to Sun Communities, Inc. Common Stockholders and Dilutive Convertible Securities(1)(4) | $ | 209,620 | $ | 110,325 | $ | 351,170 | $ | 228,304 | |||||||||||

| Weighted average common shares outstanding – basic | 112,082 | 95,859 | 110,007 | 94,134 | |||||||||||||||

| Add | |||||||||||||||||||

| Common stock issuable upon conversion of stock options | — | 1 | — | 1 | |||||||||||||||

| Restricted stock | 580 | 305 | 372 | 390 | |||||||||||||||

| Common OP units | 2,577 | 2,448 | 2,586 | 2,430 | |||||||||||||||

| Common stock issuable upon conversion of certain preferred OP units | 1,174 | — | 1,180 | 815 | |||||||||||||||

| Weighted Average Common Shares Outstanding – Fully Diluted | 116,413 | 98,613 | 114,145 | 97,770 | |||||||||||||||

| FFO Attributable to Sun Communities, Inc. Common Stockholders and Dilutive Convertible Securities(1)(4) Per Share – Fully Diluted | $ | 1.70 | $ | 1.20 | $ | 2.93 | $ | 2.19 | |||||||||||

| Core FFO Attributable to Sun Communities, Inc. Common Stockholders and Dilutive Convertible Securities(1)(4) Per Share – Fully Diluted | $ | 1.80 | $ | 1.12 | $ | 3.08 | $ | 2.34 | |||||||||||

Reconciliation of Net Income Attributable to Sun Communities, Inc. Common Stockholders to NOI(1)

(amounts in thousands)

| Three Months Ended | Six Months Ended | ||||||||||||||||||

| June 30, 2021 | June 30, 2020 | June 30, 2021 | June 30, 2020 | ||||||||||||||||

| Net Income Attributable to Sun Communities, Inc. Common Stockholders | $ | 110,770 | $ | 58,910 | $ | 135,552 | $ | 42,824 | |||||||||||

| Interest income | (2,719 | ) | (2,635 | ) | (5,350 | ) | (4,985 | ) | |||||||||||

| Brokerage commissions and other revenues, net | (6,939 | ) | (3,274 | ) | (12,899 | ) | (7,187 | ) | |||||||||||

| General and administrative expense | 45,127 | 26,527 | 83,330 | 51,876 | |||||||||||||||

| Catastrophic event-related charges, net | 355 | (566 | ) | 2,769 | 40 | ||||||||||||||

| Business combination expense, net | (201 | ) | — | 1,031 | — | ||||||||||||||

| Depreciation and amortization | 126,423 | 87,265 | 249,727 | 170,954 | |||||||||||||||

| Loss on extinguishment of debt | 8,108 | 1,930 | 8,108 | 5,209 | |||||||||||||||

| Interest expense | 37,681 | 31,428 | 77,198 | 63,844 | |||||||||||||||

| Interest on mandatorily redeemable preferred OP units / equity | 1,041 | 1,042 | 2,077 | 2,083 | |||||||||||||||

| (Gain) / loss on remeasurement of marketable securities | (27,494 | ) | (24,519 | ) | (31,155 | ) | 4,128 | ||||||||||||

| (Gain) / loss on foreign currency translation | 264 | (10,374 | ) | 239 | 7,105 | ||||||||||||||

| Other expense, net(6) | 660 | 821 | 1,759 | 1,793 | |||||||||||||||

| (Gain) / loss on remeasurement of notes receivable | (93 | ) | (246 | ) | (469 | ) | 1,866 | ||||||||||||

| Income from nonconsolidated affiliates | (794 | ) | (92 | ) | (1,965 | ) | (144 | ) | |||||||||||

| (Gain) / loss on remeasurement of investment in nonconsolidated affiliates | 115 | (1,132 | ) | 11 | 1,059 | ||||||||||||||

| Current tax expense | 1,245 | 119 | 1,016 | 569 | |||||||||||||||

| Deferred tax (benefit) / expense | 66 | (112 | ) | (81 | ) | (242 | ) | ||||||||||||

| Preferred return to preferred OP units / equity | 3,035 | 1,584 | 5,899 | 3,154 | |||||||||||||||

| Income attributable to noncontrolling interests | 7,044 | 2,861 | 7,339 | 1,899 | |||||||||||||||

| NOI(1) | $ | 303,694 | $ | 169,537 | $ | 524,136 | $ | 345,845 | |||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2021 | June 30, 2020 | June 30, 2021 | June 30, 2020 | |||||||||||||

| Real Property NOI(1) | $ | 252,742 | $ | 162,600 | $ | 457,394 | $ | 333,939 | ||||||||

| Home Sales NOI(1) | 23,085 | 6,479 | 33,694 | 13,027 | ||||||||||||

| Service, retail, dining and entertainment NOI(1) | 27,867 | 458 | 33,048 | (1,121 | ) | |||||||||||

| NOI(1) | $ | 303,694 | $ | 169,537 | $ | 524,136 | $ | 345,845 | ||||||||

Reconciliation of Net Income Attributable to Sun Communities, Inc. Common Stockholders to Recurring EBITDA(1)

(amounts in thousands)

| Three Months Ended | Six Months Ended | ||||||||||||||||||

| June 30, 2021 | June 30, 2020 | June 30, 2021 | June 30, 2020 | ||||||||||||||||

| Net Income Attributable to Sun Communities, Inc. Common Stockholders | $ | 110,770 | $ | 58,910 | $ | 135,552 | $ | 42,824 | |||||||||||

| Adjustments | |||||||||||||||||||

| Depreciation and amortization | 126,423 | 87,265 | 249,727 | 170,954 | |||||||||||||||

| Loss on extinguishment of debt | 8,108 | 1,930 | 8,108 | 5,209 | |||||||||||||||

| Interest expense | 37,681 | 31,428 | 77,198 | 63,844 | |||||||||||||||

| Interest on mandatorily redeemable preferred OP units / equity | 1,041 | 1,042 | 2,077 | 2,083 | |||||||||||||||

| Current tax expense | 1,245 | 119 | 1,016 | 569 | |||||||||||||||

| Deferred tax (benefit) / expense | 66 | (112 | ) | (81 | ) | (242 | ) | ||||||||||||

| Income from nonconsolidated affiliates | (794 | ) | (92 | ) | (1,965 | ) | (144 | ) | |||||||||||

| Less: Gain on dispositions of assets, net | (17,564 | ) | (4,178 | ) | (25,719 | ) | (9,740 | ) | |||||||||||

| EBITDAre(1) | $ | 266,976 | $ | 176,312 | $ | 445,913 | $ | 275,357 | |||||||||||

| Adjustments | |||||||||||||||||||

| Catastrophic event-related charges, net | 355 | (566 | ) | 2,769 | 40 | ||||||||||||||

| Business combination expense | (201 | ) | — | 1,031 | — | ||||||||||||||

| (Gain) / loss on remeasurement of marketable securities | (27,494 | ) | (24,519 | ) | (31,155 | ) | 4,128 | ||||||||||||

| (Gain) / loss on foreign currency translation | 264 | (10,374 | ) | 239 | 7,105 | ||||||||||||||

| Other expense, net(6) | 660 | 821 | 1,759 | 1,793 | |||||||||||||||

| (Gain) / loss on remeasurement of notes receivable | (93 | ) | (246 | ) | (469 | ) | 1,866 | ||||||||||||

| (Gain) / loss on remeasurement of investment in nonconsolidated affiliates | 115 | (1,132 | ) | 11 | 1,059 | ||||||||||||||

| Preferred return to preferred OP units / equity | 3,035 | 1,584 | 5,899 | 3,154 | |||||||||||||||

| Income attributable to noncontrolling interests | 7,044 | 2,861 | 7,339 | 1,899 | |||||||||||||||

| Plus: Gain on dispositions of assets, net | 17,564 | 4,178 | 25,719 | 9,740 | |||||||||||||||

| Recurring EBITDA(1) | $ | 268,225 | $ | 148,919 | $ | 459,055 | $ | 306,141 | |||||||||||

Non-GAAP and Other Financial Measures

Debt Analysis

(amounts in thousands)

| Quarter Ended | |||||||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | |||||||||||||||

| Debt Outstanding | |||||||||||||||||||

| Mortgage term loans | $ | 3,418,097 | $ | 3,430,420 | $ | 3,444,967 | $ | 3,191,380 | $ | 3,205,507 | |||||||||

| Collateralized term loan | 39,637 | 42,510 | 45,016 | 47,546 | 50,006 | ||||||||||||||

| Total secured debt | 3,457,734 | 3,472,930 | 3,489,983 | 3,238,926 | 3,255,513 | ||||||||||||||

| Senior unsecured notes | 591,688 | — | — | — | — | ||||||||||||||

| Line of credit and other debt | 191,841 | 875,093 | 1,197,181 | 31,775 | 65,346 | ||||||||||||||

| Preferred Equity – Sun NG Resorts – mandatorily redeemable | 35,249 | 35,249 | 35,249 | 35,249 | 35,249 | ||||||||||||||

| Preferred OP units – mandatorily redeemable | 34,663 | 34,663 | 34,663 | 34,663 | 34,663 | ||||||||||||||

| Total unsecured debt | 853,441 | 945,005 | 1,267,093 | 101,687 | 135,258 | ||||||||||||||

| Total debt | $ | 4,311,175 | $ | 4,417,935 | $ | 4,757,076 | $ | 3,340,613 | $ | 3,390,771 | |||||||||

| % Fixed / Floating | |||||||||||||||||||

| Fixed | 94.7 | % | 79.3 | % | 74.0 | % | 97.6 | % | 96.6 | % | |||||||||

| Floating | 5.3 | % | 20.7 | % | 26.0 | % | 2.4 | % | 3.4 | % | |||||||||

| Total | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||

| Weighted Average Interest Rates | |||||||||||||||||||

| Mortgage term loans | 3.78 | % | 3.78 | % | 3.78 | % | 3.88 | % | 3.88 | % | |||||||||

| Collateralized term loan | 1.30 | % | 1.29 | % | 1.31 | % | 1.31 | % | 1.31 | % | |||||||||

| Senior unsecured notes | 2.70 | % | — | % | — | % | — | % | — | % | |||||||||

| Line of credit and other debt(8) | 0.93 | % | 1.77 | % | 2.11 | % | 1.34 | % | 2.57 | % | |||||||||

| Preferred Equity – Sun NG Resorts – mandatorily redeemable | 6.00 | % | 6.00 | % | 6.00 | % | 6.00 | % | 6.00 | % | |||||||||

| Preferred OP units – mandatorily redeemable | 5.93 | % | 5.93 | % | 5.93 | % | 5.93 | % | 5.93 | % | |||||||||

| Total average | 3.52 | % | 3.39 | % | 3.37 | % | 3.86 | % | 3.86 | % | |||||||||

| Debt Ratios | |||||||||||||||||||

| Net Debt / Recurring EBITDA(1) (TTM) | 5.1 | 6.1 | 6.9 | 5.0 | 4.8 | ||||||||||||||

| Net Debt / Enterprise Value | 16.8 | % | 19.7 | % | 21.4 | % | 18.3 | % | 17.8 | % | |||||||||

| Net Debt / Gross Assets | 29.6 | % | 31.8 | % | 35.5 | % | 31.6 | % | 29.7 | % | |||||||||

| Coverage Ratios | |||||||||||||||||||

| Recurring EBITDA(1) (TTM) / Interest | 5.6 | 5.0 | 4.9 | 4.8 | 4.5 | ||||||||||||||

| Recurring EBITDA(1) (TTM) / Interest + Pref. Distributions + Pref. Stock Distribution | 5.5 | 4.8 | 4.8 | 4.6 | 4.4 | ||||||||||||||

| Maturities / Principal Amortization Next Five Years | 2021 | 2022 | 2023 | 2024 | 2025 | ||||||||||||||

| Mortgage term loans | |||||||||||||||||||

| Maturities | $ | — | $ | 82,155 | $ | 185,619 | $ | 315,330 | $ | 50,529 | |||||||||

| Principal amortization | 30,083 | 61,411 | 60,788 | 57,344 | 53,933 | ||||||||||||||

| Collateralized term loan | 4,621 | 10,000 | 25,016 | — | — | ||||||||||||||

| Line of credit and other debt | — | 1,509 | — | — | 190,332 | ||||||||||||||

| Preferred Equity – Sun NG Resorts – mandatorily redeemable | — | — | — | 33,428 | 1,821 | ||||||||||||||

| Preferred OP units – mandatorily redeemable | — | — | — | 27,373 | — | ||||||||||||||

| Total | $ | 34,704 | $ | 155,075 | $ | 271,423 | $ | 433,475 | $ | 296,615 | |||||||||

| Weighted average rate of maturities | — | % | 4.46 | % | 4.08 | % | 4.47 | % | 4.04 | % | |||||||||

Same Community(2)

(amounts in thousands)

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||

| Total Same Community | MH | RV | ||||||||||||||||||||||||||||||||||||||||||

| June 30, 2021 | June 30, 2020 | Change | % Change | June 30, 2021 | June 30, 2020 | Change | % Change | June 30, 2021 | June 30, 2020 | Change | % Change | |||||||||||||||||||||||||||||||||

| Financial Information | ||||||||||||||||||||||||||||||||||||||||||||

| Revenue | ||||||||||||||||||||||||||||||||||||||||||||

| Real property (excluding transient) | $ | 219,693 | $ | 205,449 | $ | 14,244 | 6.9 | % | $ | 174,158 | $ | 166,473 | $ | 7,685 | 4.6 | % | $ | 45,535 | $ | 38,976 | $ | 6,559 | 16.8 | % | ||||||||||||||||||||

| Real property – transient | 51,481 | 21,510 | 29,971 | 139.3 | % | 362 | 173 | 189 | 109.2 | % | 51,119 | 21,337 | 29,782 | 139.6 | % | |||||||||||||||||||||||||||||

| Other | 10,798 | 3,219 | 7,579 | 235.4 | % | 4,869 | 1,130 | 3,739 | 330.9 | % | 5,929 | 2,089 | 3,840 | 183.8 | % | |||||||||||||||||||||||||||||

| Total Operating | 281,972 | 230,178 | 51,794 | 22.5 | % | 179,389 | 167,776 | 11,613 | 6.9 | % | 102,583 | 62,402 | 40,181 | 64.4 | % | |||||||||||||||||||||||||||||

| Expense | ||||||||||||||||||||||||||||||||||||||||||||

| Property Operating(9)(10) | 87,459 | 70,159 | 17,300 | 24.7 | % | 44,984 | 40,226 | 4,758 | 11.8 | % | 42,475 | 29,933 | 12,542 | 41.9 | % | |||||||||||||||||||||||||||||

| Real Property NOI(1) | $ | 194,513 | $ | 160,019 | $ | 34,494 | 21.6 | % | $ | 134,405 | $ | 127,550 | $ | 6,855 | 5.4 | % | $ | 60,108 | $ | 32,469 | $ | 27,639 | 85.1 | % | ||||||||||||||||||||

| Six Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||

| Total Same Community | MH | RV | ||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2021 | June 30, 2020 | Change | % Change | June 30, 2021 | June 30, 2020 | Change | % Change | June 30, 2021 | June 30, 2020 | Change | % Change | |||||||||||||||||||||||||||||||||||

| Financial Information | ||||||||||||||||||||||||||||||||||||||||||||||

| Revenue | ||||||||||||||||||||||||||||||||||||||||||||||

| Real property (excluding Transient) | $ | 435,054 | $ | 410,667 | $ | 24,387 | 5.9 | % | $ | 346,900 | $ | 331,301 | $ | 15,599 | 4.7 | % | $ | 88,154 | $ | 79,366 | $ | 8,788 | 11.1 | % | ||||||||||||||||||||||

| Real property – transient | 76,883 | 49,869 | 27,014 | 54.2 | % | 962 | 1,101 | (139 | ) | (12.6 | ) | % | 75,921 | 48,768 | 27,153 | 55.7 | % | |||||||||||||||||||||||||||||

| Other | 17,793 | 9,071 | 8,722 | 96.2 | % | 9,695 | 4,940 | 4,755 | 96.3 | % | 8,098 | 4,131 | 3,967 | 96.0 | % | |||||||||||||||||||||||||||||||

| Total Operating | 529,730 | 469,607 | 60,123 | 12.8 | % | 357,557 | 337,342 | 20,215 | 6.0 | % | 172,173 | 132,265 | 39,908 | 30.2 | % | |||||||||||||||||||||||||||||||

| Expense | ||||||||||||||||||||||||||||||||||||||||||||||

| Property Operating(9)(10) | 159,973 | 138,879 | 21,094 | 15.2 | % | 87,989 | 80,911 | 7,078 | 8.7 | % | 71,984 | 57,968 | 14,016 | 24.2 | % | |||||||||||||||||||||||||||||||

| Real Property NOI(1) | $ | 369,757 | $ | 330,728 | $ | 39,029 | 11.8 | % | $ | 269,568 | $ | 256,431 | $ | 13,137 | 5.1 | % | $ | 100,189 | $ | 74,297 | $ | 25,892 | 34.8 | % | ||||||||||||||||||||||

Same Community(2) (continued)

| As of | ||||||||||||||

| June 30, 2021 | June 30, 2020 | Change | % Change | |||||||||||

| Other Information | ||||||||||||||

| Number of properties | 405 | 405 | — | |||||||||||

| MH occupancy | 97.4 | % | ||||||||||||

| RV occupancy | 100.0 | % | ||||||||||||

| MH & RV blended occupancy(3) | 98.0 | % | ||||||||||||

| Adjusted MH occupancy(3) | 98.5 | % | ||||||||||||

| Adjusted RV occupancy(3) | 100.0 | % | ||||||||||||

| Adjusted MH & RV blended occupancy(3) | 98.8 | % | 97.2 | % | 1.6 | % | ||||||||

| Sites available for development | 7,246 | 7,553 | (307 | ) | ||||||||||

| Monthly base rent per site – MH | $ | 601 | $ | 583 | $ | 18 | 3.1%(12) | |||||||

| Monthly base rent per site – RV(11) | $ | 527 | $ | 504 | $ | 23 | 4.7%(12) | |||||||

| Monthly base rent per site – Total(11) | $ | 584 | $ | 565 | $ | 19 | 3.3%(12) | |||||||

Marina Summary

(amounts in thousands except for statistical data)

| Three Months Ended | Six Months Ended | ||||||

| June 30, 2021 | June 30, 2021 | ||||||

| Financial Information | |||||||

| Revenues | |||||||

| Real property (excluding transient) | $ | 61,914 | $ | 108,020 | |||

| Real property – transient | 4,257 | 5,125 | |||||

| Other | 3,671 | 5,319 | |||||

| Total Operating | 69,842 | 118,464 | |||||

| Expenses | |||||||

| Property Operating(a) | 28,246 | 51,821 | |||||

| Real Property NOI | 41,596 | 66,643 | |||||

| Service, retail, dining and entertainment | |||||||

| Service, retail, dining and entertainment revenue | 82,238 | 126,592 | |||||

| Service, retail, dining and entertainment expense | 61,017 | 99,026 | |||||

| Service, Retail, Dining and Entertainment NOI | 21,221 | 27,566 | |||||

| Marina NOI | $ | 62,817 | $ | 94,209 | |||

| Other Information – Marinas | June 30, 2021 | ||||||

| Number of properties(b) | 114 | ||||||

| Total wet slips and dry storage | 41,275 | ||||||

(a) Marina results net $3.7 million and $6.3 million of certain utility revenue against the related utility expense in property operating and maintenance expense for the quarter and six months ended June 30, 2021.

(b) Marina properties comprised of eight properties acquired in 2021 and 106 properties acquired in 2020.

MH and RV Acquisitions and Other Summary(13)

(amounts in thousands except for statistical data)

| Three Months Ended | Six Months Ended | ||||||

| June 30, 2021 | June 30, 2021 | ||||||

| Financial Information | |||||||

| Revenues | |||||||

| Real property (excluding transient) | $ | 8,522 | $ | 15,820 | |||

| Real property – transient | 21,259 | 27,525 | |||||

| Other income | 2,767 | 3,122 | |||||

| Total Operating | 32,548 | 46,467 | |||||

| Expenses | |||||||

| Property Operating(a) | 15,915 | 25,475 | |||||

| Real Property NOI | $ | 16,633 | $ | 20,992 | |||

| Other Information – MH and RVs | June 30, 2021 | ||||||

| Number of properties | 50 | ||||||

| Occupied sites | 5,474 | ||||||

| Developed sites | 6,322 | ||||||

| Occupancy % | 86.6 | % | |||||

| Transient sites | 8,122 | ||||||

(a) MH and RV Acquisitions and Other results net $1.1 million and $2.3 million of certain utility revenue against the related utility expense in property operating and maintenance expense for the quarter and six months ended June 30, 2021.

Home Sales Summary

(amounts in thousands except for *)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| June 30, 2021 | June 30, 2020 | Change | % Change | June 30, 2021 | June 30, 2020 | Change | % Change | ||||||||||||||||||||||

| Financial Information | |||||||||||||||||||||||||||||

| New Homes | |||||||||||||||||||||||||||||

| New home sales | $ | 34,761 | $ | 19,206 | $ | 15,555 | 81.0 | % | $ | 57,733 | $ | 34,802 | $ | 22,931 | 65.9 | % | |||||||||||||

| New home cost of sales | 28,269 | 15,707 | 12,562 | 80.0 | % | 46,943 | 28,317 | 18,626 | 65.8 | % | |||||||||||||||||||

| Gross Profit – new homes | 6,492 | 3,499 | 2,993 | 85.5 | % | 10,790 | 6,485 | 4,305 | 66.4 | % | |||||||||||||||||||

| Gross margin % – new homes | 18.7 | % | 18.2 | % | 0.5 | % | 18.7 | % | 18.6 | % | 0.1 | % | |||||||||||||||||

| Average selling price – new homes* | $ | 153,132 | $ | 137,186 | $ | 15,946 | 11.6 | % | $ | 153,545 | $ | 134,371 | $ | 19,174 | 14.3 | % | |||||||||||||

| Pre-owned Homes | |||||||||||||||||||||||||||||

| Pre-owned home sales | $ | 47,087 | $ | 19,324 | $ | 27,763 | 143.7 | % | $ | 76,314 | $ | 44,315 | $ | 31,999 | 72.2 | % | |||||||||||||

| Pre-owned home cost of sales | 25,945 | 13,474 | 12,471 | 92.6 | % | 44,529 | 30,896 | 13,633 | 44.1 | % | |||||||||||||||||||

| Gross Profit – pre-owned homes | 21,142 | 5,850 | 15,292 | 261.4 | % | 31,785 | 13,419 | 18,366 | 136.9 | % | |||||||||||||||||||

| Gross margin % – pre-owned homes | 44.9 | % | 30.3 | % | 14.6 | % | 41.7 | % | 30.3 | % | 11.4 | % | |||||||||||||||||

| Average selling price – pre-owned homes* | $ | 50,577 | $ | 41,028 | $ | 9,549 | 23.3 | % | $ | 47,195 | $ | 39,744 | $ | 7,451 | 18.7 | % | |||||||||||||

| Total Home Sales | |||||||||||||||||||||||||||||

| Revenue from home sales | $ | 81,848 | $ | 38,530 | $ | 43,318 | 112.4 | % | $ | 134,047 | $ | 79,117 | $ | 54,930 | 69.4 | % | |||||||||||||

| Cost of home sales | 54,214 | 29,181 | 25,033 | 85.8 | % | 91,472 | 59,213 | 32,259 | 54.5 | % | |||||||||||||||||||

| Home selling expenses | 4,549 | 2,870 | 1,679 | 58.5 | % | 8,881 | 6,877 | 2,004 | 29.1 | % | |||||||||||||||||||

| Home Sales NOI(1) | $ | 23,085 | $ | 6,479 | $ | 16,606 | 256.3 | % | $ | 33,694 | $ | 13,027 | $ | 20,667 | 158.6 | % | |||||||||||||

| Statistical Information | |||||||||||||||||||||||||||||

| New home sales volume* | 227 | 140 | 87 | 62.1 | % | 376 | 259 | 117 | 45.2 | % | |||||||||||||||||||

| Pre-owned home sales volume* | 931 | 471 | 460 | 97.7 | % | 1,617 | 1,115 | 502 | 45.0 | % | |||||||||||||||||||

| Total home sales volume* | 1,158 | 611 | 547 | 89.5 | % | 1,993 | 1,374 | 619 | 45.1 | % | |||||||||||||||||||

Rental Program Summary

(amounts in thousands except for *)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||

| June 30, 2021 | June 30, 2020 | Change | % Change | June 30, 2021 | June 30, 2020 | Change | % Change | ||||||||||||||||||||||||

| Financial Information | |||||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||

| Home rent | $ | 17,060 | $ | 14,968 | $ | 2,092 | 14.0 | % | $ | 34,082 | $ | 30,436 | $ | 3,646 | 12.0 | % | |||||||||||||||

| Site rent | 18,649 | 18,591 | 58 | 0.3 | % | 37,766 | 36,598 | 1,168 | 3.2 | % | |||||||||||||||||||||

| Total | 35,709 | 33,559 | 2,150 | 6.4 | % | 71,848 | 67,034 | 4,814 | 7.2 | % | |||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||

| Rental Program operating and maintenance | 4,561 | 4,425 | 136 | 3.1 | % | 9,785 | 9,248 | 537 | 5.8 | % | |||||||||||||||||||||

| Rental Program NOI(1) | $ | 31,148 | $ | 29,134 | $ | 2,014 | 6.9 | % | $ | 62,063 | $ | 57,786 | $ | 4,277 | 7.4 | % | |||||||||||||||

| Other Information | |||||||||||||||||||||||||||||||

| Number of sold rental homes* | 281 | 122 | 159 | 130.3 | % | 492 | 356 | 136 | 38.2 | % | |||||||||||||||||||||

| Number of occupied rentals, end of period* | 10,951 | 11,785 | (834 | ) | (7.1 | ) | % | ||||||||||||||||||||||||

| Investment in occupied rental homes, end of period | $ | 601,798 | $ | 621,327 | $ | (19,529 | ) | (3.1 | ) | % | |||||||||||||||||||||

| Weighted average monthly rental rate, end of period* | $ | 1,076 | $ | 1,018 | $ | 58 | 5.7 | % | |||||||||||||||||||||||

Rental Program NOI is included in Real Property NOI. Rental Program NOI is separately reviewed to assess the overall growth and performance of the Rental Program and its financial impact on the Company’s operations.

| MH and RV Property Summary | |||||||||||||||

| 6/30/2021 | 3/31/2021 | 12/31/2020 | 9/30/2020 | 6/30/2020 | |||||||||||

| FLORIDA | |||||||||||||||

| Properties | 129 | 128 | 128 | 127 | 125 | ||||||||||

| MH & Annual RV Developed sites(14) | 40,171 | 40,011 | 39,803 | 39,517 | 39,241 | ||||||||||

| Occupied MH & Annual RV(14) | 39,402 | 39,283 | 39,063 | 38,743 | 38,453 | ||||||||||

| MH & Annual RV Occupancy %(14) | 98.1 | % | 98.2 | % | 98.1 | % | 98.0 | % | 98.0 | % | |||||

| Transient RV sites | 5,895 | 5,823 | 6,011 | 5,993 | 5,547 | ||||||||||

| Sites for development | 1,414 | 1,497 | 1,497 | 1,427 | 1,427 | ||||||||||

| MICHIGAN | |||||||||||||||

| Properties | 75 | 74 | 74 | 74 | 72 | ||||||||||

| MH & Annual RV Developed sites(14) | 29,600 | 29,092 | 29,086 | 29,086 | 27,901 | ||||||||||

| Occupied MH & Annual RV(14) | 28,671 | 28,145 | 28,109 | 28,033 | 27,191 | ||||||||||

| MH & Annual RV Occupancy %(14) | 96.9 | % | 96.7 | % | 96.6 | % | 96.4 | % | 97.5 | % | |||||

| Transient RV sites | 509 | 541 | 546 | 546 | 572 | ||||||||||

| Sites for development | 1,182 | 1,182 | 1,182 | 1,182 | 1,182 | ||||||||||

| CALIFORNIA | |||||||||||||||

| Properties | 36 | 36 | 35 | 34 | 32 | ||||||||||

| MH & Annual RV Developed sites(14) | 6,736 | 6,734 | 6,675 | 6,372 | 6,364 | ||||||||||

| Occupied MH & Annual RV(14) | 6,613 | 6,609 | 6,602 | 6,290 | 6,272 | ||||||||||

| MH & Annual RV Occupancy %(14) | 98.2 | % | 98.1 | % | 98.9 | % | 98.7 | % | 98.6 | % | |||||

| Transient RV sites | 2,416 | 2,418 | 2,231 | 2,236 | 1,978 | ||||||||||

| Sites for development | 127 | 127 | 373 | 373 | 264 | ||||||||||

| TEXAS | |||||||||||||||

| Properties | 25 | 24 | 24 | 24 | 23 | ||||||||||

| MH & Annual RV Developed sites(14) | 7,947 | 7,928 | 7,766 | 7,659 | 7,641 | ||||||||||

| Occupied MH & Annual RV(14) | 7,731 | 7,671 | 7,572 | 7,427 | 7,289 | ||||||||||

| MH & Annual RV Occupancy %(14) | 97.3 | % | 96.8 | % | 97.5 | % | 97.0 | % | 95.4 | % | |||||

| Transient RV sites | 1,835 | 1,773 | 1,810 | 1,917 | 1,590 | ||||||||||

| Sites for development | 1,194 | 1,275 | 1,378 | 1,378 | 565 | ||||||||||

| ONTARIO, CANADA | |||||||||||||||

| Properties | 16 | 16 | 15 | 15 | 15 | ||||||||||

| MH & Annual RV Developed sites(14) | 4,302 | 4,199 | 4,090 | 4,067 | 3,980 | ||||||||||

| Occupied MH & Annual RV(14) | 4,302 | 4,199 | 4,090 | 4,067 | 3,980 | ||||||||||

| MH & Annual RV Occupancy %(14) | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||

| Transient RV sites | 870 | 964 | 966 | 920 | 1,007 | ||||||||||

| Sites for development | 1,525 | 1,525 | 1,525 | 1,593 | 1,593 | ||||||||||

| CONNECTICUT | |||||||||||||||

| Properties | 16 | 16 | 16 | 16 | 16 | ||||||||||

| MH & Annual RV Developed sites(14) | 1,901 | 1,897 | 1,897 | 1,898 | 1,898 | ||||||||||

| Occupied MH & Annual RV(14) | 1,757 | 1,746 | 1,739 | 1,736 | 1,735 | ||||||||||

| MH & Annual RV Occupancy %(14) | 92.4 | % | 92.0 | % | 91.7 | % | 91.5 | % | 91.4 | % | |||||

| Transient RV sites | 104 | 108 | 108 | 107 | 107 | ||||||||||

| Sites for development | — | — | — | — | — | ||||||||||

| ARIZONA | |||||||||||||||

| Properties | 14 | 14 | 14 | 13 | 13 | ||||||||||

| MH & Annual RV Developed sites(14) | 4,401 | 4,391 | 4,323 | 4,274 | 4,259 | ||||||||||

| Occupied MH & Annual RV(14) | 4,116 | 4,101 | 4,030 | 3,957 | 3,932 | ||||||||||

| MH & Annual RV Occupancy %(14) | 93.5 | % | 93.4 | % | 93.2 | % | 92.6 | % | 92.3 | % | |||||

| Transient RV sites | 1,260 | 1,270 | 1,337 | 1,386 | 1,401 | ||||||||||

| Sites for development | — | — | — | — | — | ||||||||||

| MAINE | |||||||||||||||

| Properties | 13 | 13 | 13 | 7 | 7 | ||||||||||

| MH & Annual RV Developed sites(14) | 2,204 | 2,190 | 2,190 | 1,092 | 1,074 | ||||||||||

| Occupied MH & Annual RV(14) | 2,127 | 2,119 | 2,121 | 1,089 | 1,069 | ||||||||||

| MH & Annual RV Occupancy %(14) | 96.5 | % | 96.8 | % | 96.8 | % | 99.7 | % | 99.5 | % | |||||

| Transient RV sites | 792 | 805 | 805 | 819 | 837 | ||||||||||

| Sites for development | 30 | 30 | 30 | 30 | 30 | ||||||||||

| INDIANA | |||||||||||||||

| Properties | 12 | 12 | 12 | 11 | 11 | ||||||||||

| MH & Annual RV Developed sites(14) | 3,087 | 3,087 | 3,087 | 3,087 | 3,087 | ||||||||||

| Occupied MH & Annual RV(14) | 2,970 | 2,961 | 2,950 | 2,957 | 2,961 | ||||||||||

| MH & Annual RV Occupancy %(14) | 96.2 | % | 95.9 | % | 95.6 | % | 95.8 | % | 95.9 | % | |||||

| Transient RV sites | 1,089 | 1,089 | 1,089 | 534 | 534 | ||||||||||

| Sites for development | 277 | 277 | 277 | 277 | 277 | ||||||||||

| COLORADO | |||||||||||||||

| Properties | 10 | 10 | 10 | 10 | 10 | ||||||||||

| MH & Annual RV Developed sites(14) | 2,453 | 2,453 | 2,453 | 2,453 | 2,441 | ||||||||||

| Occupied MH & Annual RV(14) | 2,420 | 2,395 | 2,380 | 2,365 | 2,327 | ||||||||||

| MH & Annual RV Occupancy %(14) | 98.7 | % | 97.6 | % | 97.0 | % | 96.4 | % | 95.3 | % | |||||

| Transient RV sites | 987 | 962 | 962 | 930 | 574 | ||||||||||

| Sites for development | 1,225 | 1,250 | 1,250 | 1,282 | 1,566 | ||||||||||

| NEW HAMPSHIRE | |||||||||||||||

| Properties | 10 | 10 | 10 | 10 | 10 | ||||||||||

| MH & Annual RV Developed sites(14) | 1,777 | 1,776 | 1,777 | 1,833 | 1,827 | ||||||||||

| Occupied MH & Annual RV(14) | 1,769 | 1,769 | 1,767 | 1,822 | 1,816 | ||||||||||

| MH & Annual RV Occupancy %(14) | 99.5 | % | 99.6 | % | 99.4 | % | 99.4 | % | 99.4 | % | |||||

| Transient RV sites | 602 | 456 | 460 | 404 | 410 | ||||||||||

| Sites for development | 151 | 151 | 151 | 151 | 151 | ||||||||||

| NEW YORK | |||||||||||||||

| Properties | 10 | 10 | 9 | 9 | 9 | ||||||||||

| MH & Annual RV Developed sites(14) | 1,457 | 1,452 | 1,419 | 1,414 | 1,403 | ||||||||||

| Occupied MH & Annual RV(14) | 1,428 | 1,415 | 1,380 | 1,371 | 1,358 | ||||||||||

| MH & Annual RV Occupancy %(14) | 98.0 | % | 97.5 | % | 97.3 | % | 97.0 | % | 96.8 | % | |||||

| Transient RV sites | 1,684 | 1,689 | 1,422 | 900 | 911 | ||||||||||

| Sites for development | 371 | 371 | 371 | 371 | 371 | ||||||||||

| OHIO | |||||||||||||||

| Properties | 9 | 9 | 9 | 9 | 9 | ||||||||||

| MH & Annual RV Developed sites(14) | 2,797 | 2,797 | 2,790 | 2,790 | 2,778 | ||||||||||

| Occupied MH & Annual RV(14) | 2,770 | 2,760 | 2,755 | 2,758 | 2,736 | ||||||||||

| MH & Annual RV Occupancy %(14) | 99.0 | % | 98.7 | % | 98.7 | % | 98.9 | % | 98.5 | % | |||||

| Transient RV sites | 128 | 128 | 135 | 135 | 147 | ||||||||||