Prominent Manufactured Housing Institute (MHI) and National Communities Council (NCC) member UMH Properties has provided a summary of the second quarter for the publicly traded firm (NYSE:UMH) that ended June 30, 2020.

The UMH Properties media release to MHProNews and others includes financial snapshots and comments from Sam Landy, President and CEO. It will be followed by an MHProNews analysis and commentary in brief.

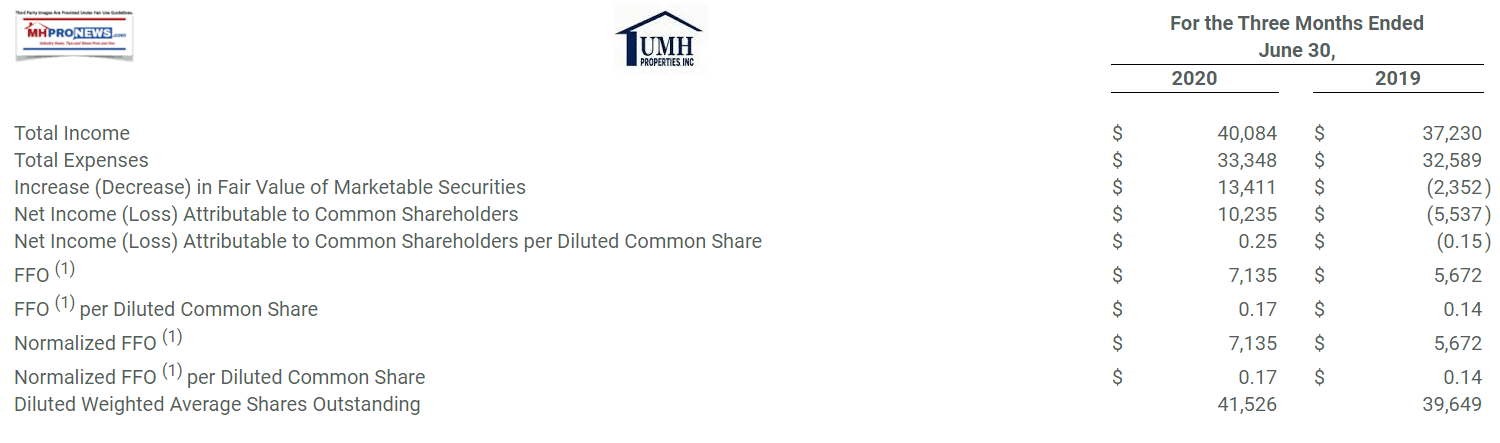

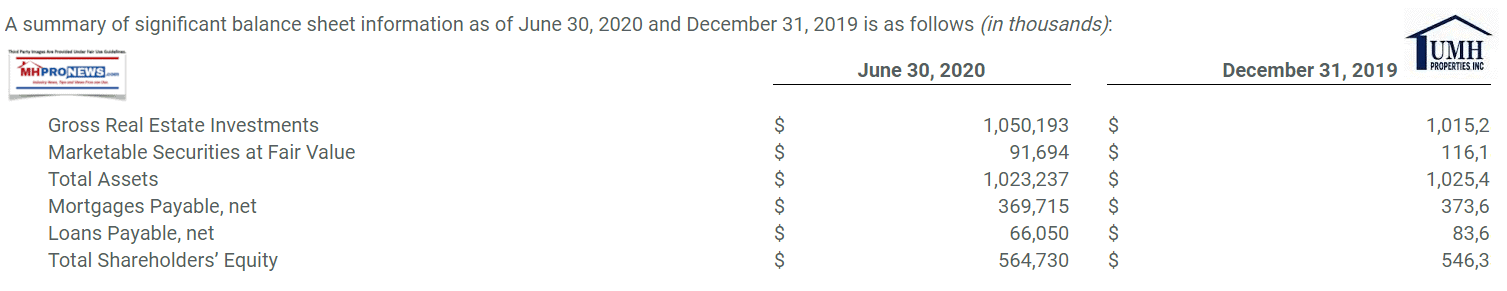

FREEHOLD, NJ, Aug. 05, 2020 (GLOBE NEWSWIRE) — UMH Properties, Inc. (NYSE:UMH) reported Total Income for the quarter ended June 30, 2020 of $40.1 million as compared to $37.2 million for the quarter ended June 30, 2019, representing an increase of 8%. Net Income Attributable to Common Shareholders amounted to $10.2 million or $0.25 per diluted share for the quarter ended June 30, 2020 as compared to a Net Loss of $5.5 million or $0.15 per diluted share for the quarter ended June 30, 2019. This increase was due to the change in fair value of our marketable securities. During the quarter, the securities portfolio experienced an unrealized gain of $13.4 million as compared to an unrealized loss of $2.4 million in the prior year period.

Funds from Operations Attributable to Common Shareholders (“FFO”), was $7.1 million or $0.17 per diluted share for the quarter ended June 30, 2020 as compared to $5.7 million or $0.14 per diluted share for the quarter ended June 30, 2019. Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), was $7.1 million or $0.17 per diluted share for the quarter ended June 30, 2020, as compared to $5.7 million or $0.14 per diluted share for the quarter ended June 30, 2019.

A summary of significant financial information for the three and six months ended June 30, 2020 and 2019 is as follows (in thousands except per share amounts):

Samuel A. Landy, President and CEO, commented on the results of the second quarter of 2020.

“We are pleased to announce another solid quarter of operating results. During the quarter, we:

- Increased Rental and Related Income by 12%;

- Increased Community Net Operating Income (“NOI”) by 19% ;

- Improved our Operating Expense ratio by 370 basis points to 44%;

- Increased Same Property NOI by 14%;

- Increased Same Property Occupancy by 550 sites from 83.3% to 85.8% or 250 basis points;

- Increased our rental home portfolio by 367 homes to approximately 7,800 total rental homes, representing an increase of 5%;

- Increased rental home occupancy by 220 basis points from 93.0% at yearend 2019 to 95.2% at quarter end;

- Amended and extended our revolving line of credit for the financing of homes, increasing total availability from $15 million to $20 million and reducing the interest rate by 25 basis points to prime, with a floor of 3.25%;

- Reduced the weighted average interest rate on our mortgages payable from 4.3% to 4.1% year over year;

- Reduced our Net Debt to Total Market Capitalization from 31.4% to 29.5% year over year;

- Reduced our Net Debt to Adjusted EBITDA from 6.6x at yearend 2019 to 5.6x at quarter end; and,

- Subsequent to quarter end, we completed the acquisition of one all-age community located in Pennsylvania containing 147 homesites situated on 27 acres with approximately 56% occupancy, for a purchase price of approximately $3.3 million.”

Mr. Landy further stated, “The COVID-19 crisis has had a negative impact on many businesses and industries throughout the nation. However, we are pleased to report it has not materially impacted the operations at UMH. Our team has done an exceptional job furthering the goals of UMH given the challenging circumstances. Our rent collection rates are in line with pre-pandemic levels and we continue to experience strong demand throughout our portfolio.”

“Our business plan of acquiring value-add communities, making the necessary improvements, and implementing a rental and sales program has proven to yield excellent results. Year over year, our same property occupancy improved by 550 sites or 3.1% resulting in revenue growth of over 7% and NOI growth of 14%. This is the third quarter in a row that we have produced double-digit same property NOI growth.”

“We continue to make progress on the financing front. As we have previously announced we are working to obtain approximately $100 million of GSE mortgage debt at rates below 3%. Assuming no unforeseen issues arising, we plan to call our $95 million of Series B Perpetual Preferred stock. This will add approximately $0.11 per share in FFO annually.”

“Our strong operating results have given us the confidence to seek acquisition opportunities in additional states. We will implement our proven business plan to further increase community value while providing affordable housing for the nation.”

UMH Properties, Inc. will host its Second Quarter 2020 Financial Results Webcast and Conference Call on Thursday, August 6, 2020 at 10:00 a.m. Eastern Time. Senior management will discuss the results, current market conditions and future outlook on the call.

The Company’s 2020 second quarter financial results being released herein will be available on the Company’s website at www.umh.reit in the “Financial Information and Filings” section.

…

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 123 manufactured home communities containing approximately 23,200 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Michigan and Maryland. In addition, the Company owns a portfolio of REIT securities.

Certain statements included in this press release which are not historical facts may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements are based on the Company’s current expectations and involve various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can provide no assurance those expectations will be achieved. The risks and uncertainties that could cause actual results or events to differ materially from expectations are contained in the Company’s annual report on Form 10-K and described from time to time in the Company’s other filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

Note:

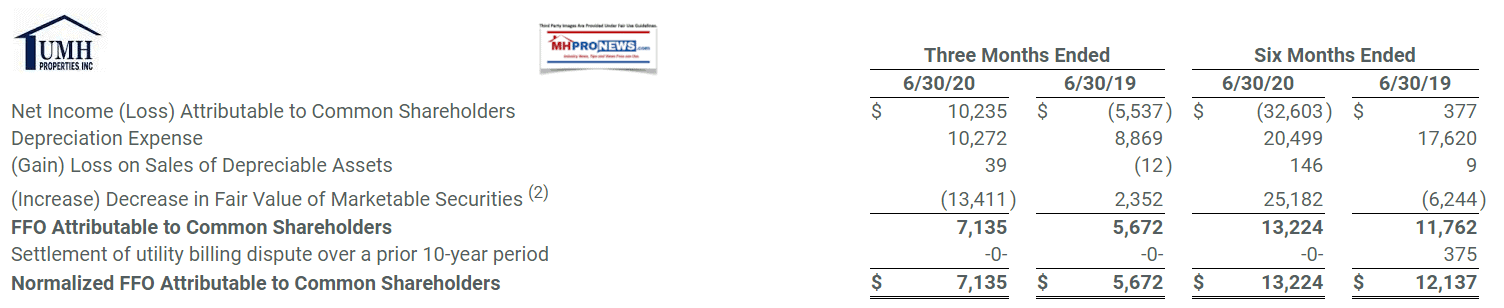

(1) Non-GAAP Information: We assess and measure our overall operating results based upon an industry performance measure referred to as Funds from Operations Attributable to Common Shareholders (“FFO”), which management believes is a useful indicator of our operating performance. FFO is used by industry analysts and investors as a supplemental operating performance measure of a REIT. FFO, as defined by The National Association of Real Estate Investment Trusts (“NAREIT”), represents net income (loss) attributable to common shareholders, as defined by accounting principles generally accepted in the United States of America (“U.S. GAAP”), excluding extraordinary items, as defined under U.S. GAAP, gains or losses from sales of previously depreciated real estate assets, impairment charges related to depreciable real estate assets, and the change in the fair value of marketable securities plus certain non-cash items such as real estate asset depreciation and amortization. Included in the NAREIT FFO White Paper – 2018 Restatement, is an option pertaining to assets incidental to our main business in the calculation of NAREIT FFO to make an election to include or exclude gains and losses on the sale of these assets, such as marketable equity securities and include or exclude mark-to-market changes in the value recognized on these marketable equity securities. In conjunction with the adoption of the FFO White Paper – 2018 Restatement, for all periods presented, we have elected to exclude the change in the fair value of marketable securities from our FFO calculation. Prior to the adoption of the FFO White Paper – 2018 Restatement, we utilized Core Funds from Operations (Core FFO), which we defined as FFO, excluding the change in the fair value of marketable securities. NAREIT created FFO as a non-U.S. GAAP supplemental measure of REIT operating performance. We define Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), as FFO, excluding gains and losses realized on marketable securities investments and certain one-time charges. FFO and Normalized FFO should be considered as supplemental measures of operating performance used by REITs. FFO and Normalized FFO exclude historical cost depreciation as an expense and may facilitate the comparison of REITs which have a different cost basis. However, other REITs may use different methodologies to calculate FFO and Normalized FFO and, accordingly, our FFO and Normalized FFO may not be comparable to all other REITs. The items excluded from FFO and Normalized FFO are significant components in understanding the Company’s financial performance.

FFO and Normalized FFO (i) do not represent Cash Flow from Operations as defined by U.S. GAAP; (ii) should not be considered as alternatives to net income (loss) as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity.

The reconciliation of the Company’s U.S. GAAP net loss to the Company’s FFO and Normalized FFO for the three and six months ended June 30, 2020 and 2019 are calculated as follows (in thousands):

The diluted weighted shares outstanding used in the calculation of FFO per Diluted Common Share and Normalized FFO per Diluted Common Share were 41.5 million and 41.6 million shares for the three and six months ended June 30, 2020, respectively, and 39.9 million and 39.4 million shares for the three and six months ended June 30, 2019, respectively. Common stock equivalents resulting from stock options in the amount of 356,000 shares for the six months ended June 30, 2020, and 282,000 shares for the three months ended June 30, 2019, were excluded from the computation of the Diluted Net Income (Loss) per Share as their effect would be anti-dilutive. Common stock equivalents resulting from stock options in the amount of 316,000 shares for the three months ended June 30, 2020, and 245,000 shares for the six months ended June 30,2019, are included in the diluted weighted shares outstanding.

The following are the cash flows provided (used) by operating, investing and financing activities for the six months ended June 30, 2020 and 2019 (in thousands):

(2) Represents change in unrealized gain (loss) in marketable securities which is included in the Consolidated Statements of Income (Loss). (Increase) Decrease in Fair Value of Marketable Securities, if any, were previously recorded in Core FFO.

# #

UMH PROPERTIES, INC.

Juniper Business Plaza

3499 Route 9 North, Suite 3-C

Freehold, NJ 07728 …

###

MHProNews Analysis and Commentary

UMH Properties has largely escaped the types of controversies that several other MHI/NCC members have encountered.

But that begs the question. Why is UMH lending their relative credibility to companies that have in several cases been a magnet for negative news?

On this date, the Better Business Bureau (BBB) gives the firm an A+ rating for what they say is a 51 year old firm. So what good does it do for UMH to be associated with other communities that often have problematic operations?

That is not to say that UMH couldn’t improve in other ways too, but that might would require going against the currents.

For instance, it takes more effort to sell then rent.

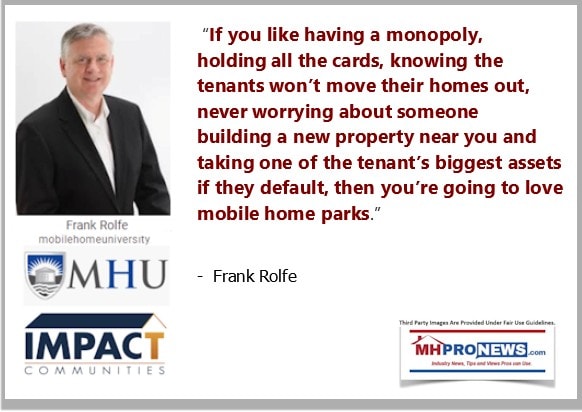

The manufactured home rental model, as Landy has said, can be profitable. But it is also quite different than the industry’s traditional model of offering affordable home ownership. Additionally, the argument can be made that UMH – by supporting MHI – is thereby supporting the undermining of the industry’s independents and potentially millions of consumers.

There is a need for an authentic independent trade association that serves communities, retail, financial services, suppliers, and brokerages. Because the current model seriously seems to be focused on throttling new growth that would create more home ownership opportunities.

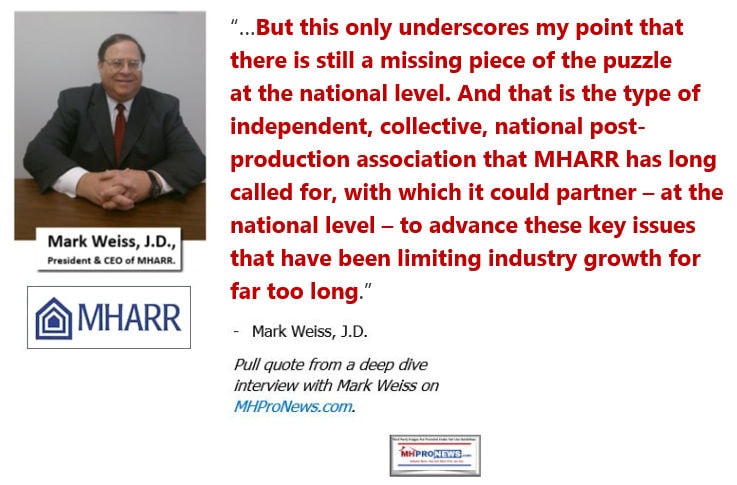

Other than MHProNews and MHLivingNews, the only other high profile public – as opposed to behind-the-scenes – effort to expose the rigged system and its solutions is MHARR.

There are reasons why state and federal officials, among others, are investigating purportedly corrupt practices in the manufactured housing industry. Once the election is concluded, it may not be a surprise to see those efforts become more public.

To learn more, see the linked reports herein and the related reports above and below.

There is always more to come, so stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

PissedConsumer.com on Clayton Homes, Growing Section 230 Legal Dispute