Periodic readers of this business-nightly feature should note there are new tweaks to some of the standard portions of our evening market/investing report. Read carefully as some changes of the ‘standard text’ that follows before our left-right headlines and also in other features near the end of tonight’s reports.

Every evening our headlines that follow provide snapshots from two major media outlets on each side of the left-right news spectrum that reflect topics that influence or move investor sentiment. In moments on this business evening report, you can get ‘insights-at-a-glance.’

This report also sets the broader context for manufactured housing markets, in keeping with our mantra, “News through the lens of manufactured homes and factory-built housing” ©.

We begin with headlines left-of-center CNN followed by right-of-center Fox Business. We share closing tickers and other related data courtesy of Yahoo Finance, and more. 5 to 10 minutes reading this MHProNews market report every business night could save you 30 minutes to an hour of similar reading or fact-gathering elsewhere.

Perhaps more important, you will get insights about the industry from experts that care, but also dare to challenge the routine narrative that arguably keeps manufactured housing underperforming during an affordable housing crisis.

Newsy, Peeling Back Media Bias, Manufactured Housing Sales, Investing, Politics, and You

Headlines from left-of-center CNN Business

- It’s not just the 737 Max – Boeing is facing some even bigger challenges

- Samsung takes second crack at a foldable smartphone with Galaxy Z Flip

- RECAP From Galaxy Buds+ to smarter cameras, everything Samsung revealed today

- FTC probing Big Tech’s past acquisitions

- Sprint’s stock soars 75% after a judge OKs merger with T-Mobile

- Britain finally admits that Brexit means the death of frictionless trade with Europe

- The coronavirus outbreak is letting the safe-haven dollar shine

- Oops! Investors thought Slack was announcing big news. It was old news

- Warner Bros. tweaks the name of its box office flop, ‘Birds of Prey’

- Flu season. Coronavirus. How managers can handle sickness and paranoia at the office

- Samsung’s Galaxy S20 lineup packs better cameras, battery life and built-in 5G

- Air Italy stops flying and goes into liquidation

- Fed chair grilled over attending Jeff Bezos party

- Facebook is lame and you should delete it, Elon Musk says

- Mark Zuckerberg: Facebook doesn’t need to be ‘liked’

- Instagram deletes the IGTV button

- The evolution of Facebook Live

- Stephen King quits Facebook

- Nanny shares are a solution to the child care dilemma. Here’s how they work

- Child care costs skyrocketed by 150% for these families

- How to pay for private school

- When child care costs more than a mortgage

- We asked 35 executives how they balance family and work. Here’s what they said

Headlines from right-of-center Fox Business

- Southwest Airlines flew 17M passengers on potentially dangerous jets

- The report said Southwest Airlines operated more than 150,000 flights carrying 17.2 million passengers on 88 used Boeing 737 jets without confirmation that required maintenance had been completed.

- As New Hampshire votes S&P, Nasdaq hit fresh records

- Lyft races toward profitability after hitting $1 billion in revenue for first time

- Coronavirus spreading in US: Where cases are and how you can protect yourself

- Coronavirus and how to stay healthy on a cruise

- Trump shreds Fed as Chairman Powell testifies before Congress

- EXCLUSIVE: Trump says Fed Chair Powell ‘let me down’

- Amazon VP, and former Obama aide, rips into reporter over safety record

- Sanders, Warren hit Amazon for ‘intolerable’ worker conditions in new letter to Bezos

- How to defuse the debt bomb and balance the federal budget

- Driver in fatal crash had reported problems with ‘Autopilot’ feature

- Philippines notifies US of intent to end major security pact

- Russian satellites trailing US spy satellite in orbit, Space Force says

- Nielsen data reveals staggering fact about online streaming services

- Trade war sends Arkansas town shopping for a new buyer

- Cruise ship returning to US as hundreds are sickened with vicious stomach virus

- Weinstein’s legal team makes bold move, seems confident they’ll win

- Vacations can save romantic relationships, survey finds

- The sneaky new way men and women ‘cheat’ on their partners

- What is Halle Berry’s net worth?

- These are the most livable cities in the US

- Is it better to buy or lease a car?

- Universal will release controversial ‘Hunt’ film in March

- Home from TV’s ‘Full House’ fights ‘Empty Nest’ syndrome

- Who is the CEO Of Kylie Cosmetics?

- Sanders, Warren hit Amazon for ‘intolerable’ worker conditions in new letter to Bezos

- Avenatti threats to tank Nike stock value caught on tape

- New Hampshire Primaries to play minor league baseball game in July

- Samsung’s Galaxy Z flip phone makes debut

- AOC challenged by former CNBC anchor Michelle Caruso-Cabrera

- Why former oil and gas chairman says she’s running for Congress

- Bloomberg News buries bombshell audio of boss defending ‘stop and frisk’

- Scientists say coronavirus symptoms may take 24 days to present, contradicting WHO

- Lyft races toward profitability after hitting $1 billion in revenue for first time

- Harvey Weinstein rape accuser recalled sex in intimate detail, ex-roommate testifies

- Once called ‘dangerous topic,’ companies embrace religion and offer faith-based support

- Looking to invest in cryptocurrency? Here’s the most popular

- Under Trump, Americans’ economic optimism hits highest level since 1999

- The staggering number of Americans who say they’ve maxed out credit cards

- Embattled Wells Fargo gets overhaul from new CEO Charles Scharf

- Officer told to ‘tone down’ gayness settles suit for $10.25M

- Border agents confiscate bag of dead birds off traveler from China

- Powell tells Congress Fed is likely to remain on sidelines in 2020, warns of coronavirus

- How much does Nicole Kidman earn?

- New Hampshire goes to the polls, but no billionaires are voting

- Bloomberg News not headlining ‘stop-and-frisk’ controversy

- Home Depot hiring 80,000 workers for busy spring season

- How New York could shut down a $26B cell service mega-merger

10 Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus – Where Business, Politics and Investing Can Meet

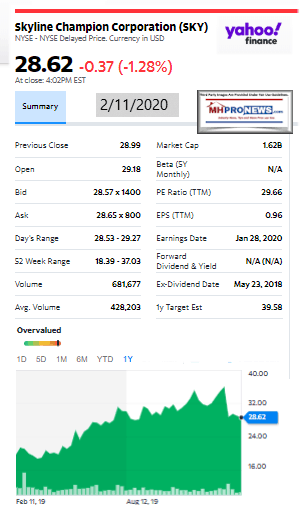

This report and analysis of Skyline Champion Corporation’s Q3 2020 Earnings Call Transcript

will use a somewhat different format than some other reviews of investor call transcripts.

Tonight, we will follow this sequence.

- Part 1. Preface – comments that tee up the conference call.

- Part 2. Conference call transcript proper, which will include highlighting by MHProNews of items of particular interest for some readers. Additionally, there will be comments in blue – which often includes links – that will relate directly to some statement just made by Skyline Champion’s leadership.

- Part 3. Closing thoughts by MHProNews.

As a positioning for this call, which goes entirely unmentioned, is what PMHA’s Mary Gaiski said to a local reporter recently. Namely, that the push back on local zoning and placement issues is getting worse, not better. That should also be considered in the light of what the Modular Home Builders Association Executive Director Tom Hardiman published late last week.

In fairness to Skyline Champion, those statements came after this earning call discussion. However, it is difficult to imagine that a company of their size is unaware of such bubbling issues.

Furthermore, what occurred with the FHFA, various industry and non-industry nonprofits on the topic of the Duty to Serve is highly relevant to this discussion.

The failure of Skyline-Champion (SKY) leadership to explain to investors what is actually occurring at the nation and state association levels is potentially legally problematic. In our view, it opens up concerns about liability that are not being addressed.

Skyline Champion Corp (SKY) Q3 2020 Earnings Call Transcript

SKY earnings call for the period ending December 28, 2019. Per Motley Fool Transcribers

(MFTranscribers) Jan 29, 2020 at 9:01PM

Skyline Champion Corp (NYSE:SKY)

Q3 2020 Earnings Call

Jan 29, 2020, 8:00 a.m. ET

Contents:

- Prepared Remarks

- Questions and Answers

- Call Participants

Prepared Remarks:

Operator

Good morning. Welcome to Skyline Champion Corporation’s Third Quarter Fiscal Year 2020 Earnings Call. The company issued an earnings press release yesterday after close.

I would now like to introduce your host for today’s call, Sarah Janowicz, the company’s Director of Investor Relations and External Reporting. Sarah, you may begin.

Sarah Janowicz — Director of Investor Relations

Good morning and thank you for participating in our earnings call to discuss our third quarter results. Joining me on today’s call is Mark Yost, President and CEO; and Laurie Hough, EVP and CFO.

I would like to remind everyone that yesterday’s press release and statements made during this call include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties that could cause actual results to differ materially from our expectations and projections. Such risks and uncertainties include the factors set forth in our earnings release and in our filings with the Securities and Exchange Commission.

Additionally, during today’s call, we will discuss non-GAAP measures, which we believe can be useful in evaluating our performance. A reconciliation of these measures can be found in the earnings release.

I would now like to turn the call over to Mark.

Mark Yost — President and Chief Executive Officer

Sarah, thank you. Good morning, everyone. I am pleased to report strong gross margin and operating income improvement this quarter compared to the same period a year ago. As we look at industry demand trends we’ve seen HUD industry shipments rebound favorably over the last few months and anticipate that trend will continue throughout the calendar year. With revenue down 3.5% to $342 million this quarter, we were able to deliver strong operating leverage with a year-over-year increase of nearly 50% in operating income. Adjusted EBITDA grew by 13% year-over-year reaching $29.7 million for the quarter. Adjusted EBITDA margin in the quarter was 8.7%, a 130 basis points improvement compared to a year ago. We saw strong gross profit improvement across all of our reporting segments, driven by merger synergies, standardization and operational improvements as we saw material inflation start to rise during the quarter. I’m particularly proud of the fact that we were able to deliver these results without the benefit of top line growth in the quarter.

During the quarter, we saw our Canadian and Star Fleet revenues down due to economic and housing conditions in Western Canada along with softer RV market in the US. We anticipate that those markets will remain soft in the short term. In US we experienced marginal unit volume increases with a shift to single section product resulting in lower average selling prices during the quarter. . HUD industry volumes for the three months ended November increased by approximately 6.7% year-over-year with strong growth in the South Central region of the country offset by declines in California and parts of the Midwest. We are seeing strong demand for affordable housing and expect HUD industry’s year-over-year volumes to continue at this mid-single-digit growth rate for the remainder of the calendar year with California rebounding toward the end of our fourth fiscal quarter and the Midwest expected to return late spring after the customer consolidation finalize. The broader housing market is also showing signs of strong growth, especially at the affordable missing middle price point. This will translate into higher levels of demand for the industry later in the year, due to a lag between single-family starts and HUD shipments. Additionally, we believe that manufactured and modular homes will play an increasingly significant role in filling the gap for new single-family homes at more affordable price points compared to other housing options. We are seeing evidence of this increasing role from recent events on the financing, regulatory in both the fronts.

On the financing front, while we are still waiting for the GSEs to rollout their secondary market for channel loan outlined in their duty to serve, we’re encouraged by the private placements that occurred late in 2019. Financing terms are starting to become more competitive as a result, which should translate into demand later this year. Zoning changes are additionally starting to happen throughout the country to help solve the housing shortage. We are seeing increased demand for alternative dwelling units or ADUs in states like California, which has lifted zoning restrictions to address the need for affordable living spaces in urban areas</span. The feedback from customers for our ADUs from the International Builders Show in Las Vegas last week was very positive. The product provides a simple solution for affordable housing in those markets.

Additionally, in Las Vegas at the International Builders Show, we showcased our Genesis home series, an affordable housing solution for builder developers. The feedback from builders on the quality and features of those homes at that price point exceeded our expectations. They were surprised at the speed to market and labor solutions that these products provide. One supplementary benefit was that these products had lower financing costs due to the support from the GSEs. In addition to the interest we received at the IBS show, we have started to experience traction in this past quarter, with a handful of models ordered for delivery to subdivisions. We’re very excited about the long term potential of this new class of homes.

[Link – Independent No More]

I will now turn the call over to Laurie to discuss our quarterly financials in more detail.

Laurie Hough — Executive Vice President and Chief Financial Officer

Thanks, Mark. Net sales decreased to $342 million in the current quarter from $355 million in the year ago quarter. We saw revenue declines of $4.7 million in the US factory built housing segment as well as declines in our Canadian factory built housing segment and transportation business revenue of $7.7 million. The number of homes sold in the US increased slightly versus the same quarter last year, while the decline in US factory built revenue was driven by a reduction in average selling price per US home sold of 2% to $60,600. The decline in average selling price was due to a shift in product mix as we sold a larger percentage of single section homes this third quarter versus the December quarter last year. Canadian revenue decreased by 16% to $23 million with corresponding decreases in the number of homes sold in the quarter. The number of Canadian units sold decreased to 276 homes, compared to 329 homes in the prior year period. Average home selling prices were stable at $82,600. We expect similar Canadian year-over-year volume shortfalls for the remainder of the fiscal 2020 compared to the same period in fiscal 2019, consistent with the broader housing market in Western Canada.

[Are these self-contradictory statements? If sales have shifted to single-sections, why are they pushing CrossModTM homes so hard? Why no mention to investors that the GSEs were by the FHFA allowed to pare back their commitments in their revised plan?]

Consolidated gross profit increased to $69 million, up 6% versus the prior year quarter. Our US housing segment gross margins were 20.1% of segment net sales, up from 18.5% last year. Sequentially, from the September 2019 quarter, US factory built housing segment gross margins were down 80 basis points from 20.9% driven by the impact of normal seasonal shutdowns as many of our facilities reduced or ceased production during the holiday season. SG&A in the third quarter decreased to $45 million versus $49 million in the same period last year. The decrease was primarily due to a reduction in non-cash equity-based compensation expense and integration costs.

Net income for the third quarter was $17 million or $0.30 per share compared to net income of $10.5 million or earnings per share of $0.19 during the same period in the prior year, driven by an increase in profitability from higher operating income, a reduction in equity compensation and other expenses and lower net interest expense. On an adjusted basis, we generated $0.32 of net income per diluted share compared to $0.27 in the year ago quarter. The company’s effective tax rate for the three months ended December 28, 2019 was 27% versus an effective tax rate of 29.7% for the fiscal 2019 third quarter. The change in the effective rate was primarily due to higher non-deductible share based compensation expense incurred in the prior year. Adjusted EBITDA for the quarter was $29.7 million, an increase of 13% over the same period a year ago. The adjusted EBITDA margin expanded a 130 basis points to 8.7%, largely due to continued margin capture from synergies related to last year’s combination reaching their run rate levels earlier this fiscal year and execution on identified operational improvements.

At the end of December, our consolidated backlog was $133 million compared to backlog last December of $181 million. Although backlog varies significantly by plant, our average US plant backlog stood at five weeks of production at the end of the quarter. Backlog remains within our optimal range of four weeks to six weeks, which allows us to effectively schedule production and manage the supply chain with our vendors. We believe backlogs have returned to more normal levels compared to the elevated levels experienced over the last year. We are focused on continuing to execute on our operational improvements and product rationalization initiatives while bringing more value to our customers by continuing to elevate opportunities to refine and strengthen our costing and pricing strategies on our products as well as prioritizing efforts on operational improvements and efficiencies leveraging our knowledgeable and capable team members. We feel that these self help initiatives will allow us to achieve a 10% adjusted EBITDA margin target at our current volume levels. We are on track to achieve this target in the next 18 months to 24 months.

As of December 28, 2019, we had $171 million of cash and cash equivalents. Cash generated from operations during the third quarter of fiscal 2020 decreased slightly to $21 million, compared to $23 million in the same period last year as cash flow generated by increased profitability was offset by cash utilization for working capital purposes.

During the quarter, we used excess cash to pay down $5 million of our revolving credit facility. As a result, the company had $44 million of unused borrowing capacity under our $100 million revolving credit facility as of December 28, 2019. We have a strong cash position with added liquidity from our credit facility that provides ample flexibility to invest in our core business and our strategic initiatives. We continue to be focused on identifying areas to utilize our strong free cash flow on opportunistic growth, which could include potential acquisitions or further organic capacity expansions.

I’ll now turn it back to Mark for some closing remarks.

Mark Yost — President and Chief Executive Officer

Laurie, thank you. As you can see from our results, we continue to achieve solid financial and operational performance. We are pleased with our continued track record of progress as we continue to achieve incremental improvements along our path to reaching our medium and long term goals.

We are encouraged by the feedback from our retail and community partners on the products and services we’re providing them as well as the future opportunities to expand our offsite construction model offerings with an evolving customer channel like builder developers.

[Again, there is history on this Genesis, Independent No More]

As we look forward, we expect our markets to remain healthy, driven by the increased demand across the country for affordable housing. Our optimism is supported by the improvements that we’ve seen in the financing environment and the attention by regulators to suggest changes that are ultimately benefit to our end customer.

With favorable long-term demand fundamentals, we continue to invest and evaluate opportunities to position Skyline Champion as a sustainable solution for the future of our customers and their families.

And with that, operator, you may now open the lines for Q&A.

Questions and Answers:

Operator

Thank you. [Operator Instructions] Our first question is from Daniel Moore with CJS Securities. Please proceed.

Daniel Moore — CJS Securities — Analyst

Mark, Laurie, good morning, thanks for taking the questions.

Mark Yost — President and Chief Executive Officer

Good morning, Dan.

Daniel Moore — CJS Securities — Analyst

Starting with I guess backlogs, obviously, now back down to as you described more normalized level of five weeks, you certainly laid out a scenario where shipments likely start to increase. Can you just maybe talk about underlying demand trends, traffic at the dealer level, expectations for backlog as we look into fiscal Q4, do you expect that to stay flat for next quarter or two, start to build again, how should we kind of think about all that over the next say 90 days to 180 days?

Mark Yost — President and Chief Executive Officer

Very good. Thanks, Dan. I think we see good traffic at the dealership level. Overall, the industry and activity across the board is very good, very healthy. So, I think everything is very positive. We have seen strong growth as we mentioned in the South Central Atlantic region recently, past few months — 77% of the increase in the industry has been in that kind of Alabama through the Carolinas, Mississippi type region. So, we’ve seen that rebound first, which was hardest hit last year by the weather. So we’re seeing other markets start to kind of comeback right now across the board, which is very good.

Backlog should build into the first or into the fourth quarter, end of the fourth quarter here, and then continue into obviously the June time period. So, very confident that we have a normal seasonal backlog dip normally, especially with our Northeastern footprint. So this is very normal. Our backlogs actually were very good for this point in time of year.

Daniel Moore — CJS Securities — Analyst

Very helpful. And then just in terms of the mix and modest decline in ASPs [Average Selling Price], you expect that to continue as far as US product is concerned in Q4 and obviously you can’t necessarily predict the impact of raw materials going out further, but what are your thoughts for trends as we get into fiscal ’21?

Mark Yost — President and Chief Executive Officer

I would expect multi-lines to pick up as we go through the season kind of into the June time period. Most of the dealers, as we talked about on the last earning, probably last two earnings calls, dealers have low inventory levels and I think this quarter particularly what they focused on is they had their sites ready for single wides. So they were able to take that product quickly because it’s easier to set up a single wide product in the field for some of the community customers and some of the retails because of — there’s less site work involved in setting those up. So during the winter period keeping inventory lean you probably tend toward those products first, but I think as the fall happens and things warm-up, you will see a more — a larger trend to multi wides as the season picks up throughout the year. So you will see a general uptick, a gradual uptick as the year goes on in ASPs into the June, July, August time period.

Daniel Moore — CJS Securities — Analyst

Perfect. Lastly for me, subject to — I know you don’t mind talking about, maybe just elaborate on Genesis and the builder developer channel, you mentioned a couple of specific orders that you have seen, any more specific tangible evidence of progress and detail that you can provide for us would be helpful? Thanks.

Mark Yost — President and Chief Executive Officer

Yeah thanks Dan. I think Genesis was well received at the International Builders Show this past week. We’ve seen a tremendous amount of inquiry and activity from that. As we mentioned earlier, we have seen a handful of orders start to be produced for subdivision to get things go on with subdivision. So they are actually in production now being produced. So that’s very encouraging that those are — those levels of activity have happened. We have already produced MH Advantage in the field, but this is kind of a main foray in going into subdivision builder developer channel and it’s actually starting. So we’re encouraged by that.

[This occurred prior to theMHBA’s Tom Hardiman publicly blasting MHI for CrossModTM homes, which could add a wrinkle into these plans.]

Daniel Moore — CJS Securities — Analyst

Okay. If I any follow-ups, I’ll jump back. Thank you.

Mark Yost — President and Chief Executive Officer

Thank you Dan.

Operator

Our next question is from Rohit Seth with SunTrust. Please proceed with your question.

Rohit Seth — SunTrust — Analyst

Thank you. I just wanted to ask, what are the kind of trends you’re seeing in January?

Mark Yost — President and Chief Executive Officer

Trends, Rohit in just the overall HUD market or what are you –?

Rohit Seth — SunTrust — Analyst

The HUD market on volumes.

Mark Yost — President and Chief Executive Officer

Yeah, I think January trends and orders are good. So I think year-over-year order activity has increased. So general trends is probably consistent with what we mentioned on the call. We’re seeing good year-over-year growth.

Rohit Seth — SunTrust — Analyst

And then just curious if you maybe could compare and contrast like the entry level stick builders are seeing very good order progression. Just curious why you think there is such a big delta between maybe manufactured housing and the stick builders are seeing entry level housing demand really, really serge right now?

Mark Yost — President and Chief Executive Officer

Yeah, I think you know we will see that type of pickup in demand, but there is a natural lag in all of that activity for manufactured housing and the HUD market. So generally speaking, as an example, a lot of the site builds, demand has been fueled by interest rate drops. If you think of our customer base, generally what will happen during a period of time where interest rates drop, the retailer partners will reach back out to their customer base and let them know there was a interest rate drop. Once that customer determines they want to buy a home, they then have to find a piece of property to place that home upon, which takes a lead time of let’s say four months to six months or something like that.

So really when you think of the site built market, an interest rate drop because it’s a land home typical deal, it can be acted upon immediately, whereas a traditional MH product to a retail distribution will not be as immediate because of the land is not tied with the home readily, number one.

[That turns the logic of manufactured housing on its head, and the reason that it does is because MHI hasn’t properly pushed for the “enhanced preemption” for HUD Code manufactured homes.]

Number two is typically there’s less of a benefit for an interest rate drop for some of our customers. An average customer for manufactured housing or a HUD code product due to its lower price point will save if the — interest rates have dropped about 1.25% over the past year or so and that will save a channel [Phonetic] loan customer about $600 a year, whereas a site, a traditional site built will save about $2,700 or maybe $3,000 a year. So there’s more impetus to fuel that. So, it’s just a timing lag. We will see that, but it takes time to work itself through the channel, because of a land piece.

Rohit Seth — SunTrust — Analyst

Understood. And then, maybe could you talk about the M&A pipeline. You got substantial cash on the balance sheet and I believe you said you would be willing to take your net debt-to-EBITDA at about 3 times. So maybe just talk about what you are seeing out there? Are there any opportunities to do some deals in the near-term or is that more of a longer term fixed story?

Mark Yost — President and Chief Executive Officer

No, I think we are always actively looking at the M&A pipeline. So, I think there is a pipeline of potential — always potential near-term and long term M&A activity.

[Consolidation, the undercurrent name of the game for ‘big boy’ MHI members.]

Rohit Seth — SunTrust — Analyst

Understood. All right, I’ll pass it on. Thank you.

Mark Yost — President and Chief Executive Officer

Thanks Rohit.

Operator

Our next question is from Greg Palm with Craig-Hallum. Please proceed with your question.

Greg Palm — Craig-Hallum — Analyst

Good morning, thanks for taking the questions here. I guess just maybe a little bit more color on kind of what you’re seeing near term. Mark, you gave some kind of qualitative I don’t know, I don’t want to call it guidance, but you gave some qualitative commentary last quarter on kind of how you thought December and March would shake out. And I’m just wondering if you could just sort of give us an update on kind of how you’re thinking about the near term? It sounds like kind of a mixed bag out there.

Mark Yost — President and Chief Executive Officer

Yeah and you are talking in terms of just outlook on revenue, Greg?

Greg Palm — Craig-Hallum — Analyst

Yeah, exactly. Thanks.

Mark Yost — President and Chief Executive Officer

Yeah, I think we will continue as we mentioned to see softness in the RV market and which drives a lot of our trucking business revenues. Canada, we continue to see single-family starts in Canada were down as you guys — in British Columbia single-family starts were down 28% year-over-year during the quarter. Saskatchewan was down 18% year-over-year for the quarter in single-family starts in Canada.

So we only dropped 16%, so I’m glad we’re gaining share in Canada in the overall housing market with our volumes, but I anticipate with the weakness in single-family and the economy in Canada, our Canadian revenues to be soften — soft in the next quarter or so just due to tying that to single-family starts and that lag that’s in there.

In the US, I think we are going to see good growth in the US. In most of the country, I think there’ll be timing lags in parts of California that, that will take time to develop and California is picking up and — but it’s a land timing and a zoning permitting timing issue that we’re seeing in California.

So expect that to rebound, but it will take probably till the first quarter to do that. And then in parts of the Midwest there’s been customer consolidation, primarily on the community front where there’s been merger and integration activity happening at multiple sites and multiple parks and the result of that is until those transactions close I think there is going to be a pause in buying in parts of the Midwest. So you’ll see a downturn in parts of the Midwest, probably until I would guess April, May time period when some of those transactions close is the anticipation. So other than that I think you’re going to continue to see strong growth in the South Central region. Texas is starting to pick back up. Texas was down about 12% in the last three months, but we will see that rebound. So I think overall kind of neutral for the quarter, net-net including Canada.

Greg Palm — Craig-Hallum — Analyst

Got you. And what’s — I mean if we’re talking specifically US HUD code, what is your expectation for calendar year ’20 industry growth? And I guess do you see yourselves as outperforming the industry in this calendar year, underperforming, neutral, how are you seeing things as of — as we sit today?

Mark Yost — President and Chief Executive Officer

Yeah and you’re talking HUD market right, Greg?

Greg Palm — Craig-Hallum — Analyst

Yeah, correct.

Mark Yost — President and Chief Executive Officer

Okay, yes so I think HUD growth as I mentioned is going to be kind of that similar to where we’ve seen in the last few months rebound. So mid-single, upper single-digit growth kind of areas for this year for the HUD industry. I think our HUD growth will be similar to the industry. We will have our normal seasonality for the winter and summer. So we will probably outpace that during the summer time and then under pace it in the winter time but net-net we’ll be neutral to that growth. I think we will see probably more activity in non-growth HUD market. So the ADU market and some of those park model markets, we should see that. So we might have different channels that we might tend to — that will change our growth trajectory with HUD a little bit. But other than that, it’s really just a trade-off on what product mix we choose to produce.

[These types of issues have as unstated and unmentioned undercurrents the failure of MHI and their big boy members to press for “enhanced preemption” enforcement and full enforcement of the Duty to Serve (DTS) by Fannie and Freddie.]

Greg Palm — Craig-Hallum — Analyst

Yeah, make sense. Shifting gears a little bit to build developer, which obviously seems like a very, very big opportunity. I am hoping you can just give us some more color here on kind of who your typical end customer might be and maybe use sort of the feedback that you got from the Vegas show. But in general is there a certain number of homes that folks are looking for and probably more importantly, how long does a typical sales cycle like this take to play out in your mind?

Mark Yost — President and Chief Executive Officer

Yeah and that’s a great question, Greg. I think we — the International Builders Show, we saw builders from that typically did anywhere between 25 houses to maybe 500 houses to 700 houses a year. So, the customers that went through the builders’ show were kind of in that range. So we have seen a tremendous amount of activity in discussions with that group of customers in that channel. We’ve also seen land developers who are not necessarily builders, but land developers who are interested in expanding into — they don’t want to get into homebuilding, but they wouldn’t mind partnering or working with a company to add value to their land and work with that company. So I think those are the two key demographics right now that we’ve seen.

The channel is really site dependent. We have some builders that are in the pipeline that really have the zoning done, the permitting done, the infrastructure in place and those are the handful of homes that we’ve started to produce and put into place. There’s others developers who have the land zoned and permitted are in the stages of putting in the infrastructure, so that will take a little longer as that infrastructure could take three months to six months to put in place at which time, the houses can be delivered and then there’s a handful of builders as well that you would look to that if they don’t have the permitting and zoning.

So, it’s really building the entire pipeline and filling the sales funnel with all of these different opportunities and some of them will start to strike and we anticipate having a handful of subdivisions going by later on this year in the June to September kind of timeframe, but really it’s all about filling that sales pipeline and taking advantage of this long-term opportunity.

[Once more, this could have an unexpected wrinkle due to the issues raised by Hardiman and the MHBA concerning CrossModTM homes and MHI.]

Greg Palm — Craig-Hallum — Analyst

Okay, great. Last one from me, I guess maybe a question for Laurie given her commentary around margins. I thought it was interesting, I think what you said was the ability to achieve 10% EBITDA margins on this level of revenue. I’m assuming you’re not thinking that revenue will be flat call it 18 months from now, but you know even if it was, I guess, what are the key levers in going from call it a mid [Indecipherable] EBITDA margin to 10%, I mean is that gross margin expansion, is it operating leverage or something to do with the cost structure. Can you just kind of walk us through how you’re thinking about that?

Laurie Hough — Executive Vice President and Chief Financial Officer

Sure, thanks for the question. Yes, it’s definitely in the gross margin line and it goes back to Greg all those things that we’ve been talking about related to our operational improvements that we’re focusing and standardization of product offerings, rationalization of base metals and options as well as material usage, product value, engineering the product, operational excellence, things like that.

Greg Palm — Craig-Hallum — Analyst

Got it. Okay, I’ll hop back in the queue thanks.

Mark Yost — President and Chief Executive Officer

Thank you.

Operator

Our next question is from Matthew Bouley with Barclays. Please proceed.

Matthew Bouley — Barclays — Analyst

Good morning. Thank you for taking my questions. I wanted to ask kind of any additional insights on that divergence between the US HUD shipments for you guys versus the industry. Is that — I think in the past you talked about perhaps passing up on some lower margin business and I think Mark, it just sounded like you were referring to some of the geographic footprint as well with the Northeast as part of that. So I guess what gives you that confidence that Sky would be able to outperform the market in the summer months as you just mentioned? Thank you.

Mark Yost — President and Chief Executive Officer

Thanks, Matt. I think two things, one is we normally it’s very typical for us to see kind of a seasonality. We have more plants in the North sector of the country, the Northern part of the country, which is more affected by weather than most other participants. So we have a Northern demographic of our plants. So we will typically see a market share ebb and flow throughout the calendar year, it’s very typical for us just given our geographic footprint. Overall though, I would say that if you look at the markets that were most impacted last year, the decline, the decline happened fastest and hardest in that kind of South Central region, Alabama, Mississippi, Tennessee, South Carolina, all of those states really when you look at declines last year that we saw, that started kind of in that October through December timeframe last year and went into the spring time of last year, we saw most of that in that rain affected area where crews could not set units and that was the hardest impacted area in year-over-year declines. So I think it’s — what we’ve seen thus far is, that area has rebounded fastest with good weather conditions this year as we expected, but we have seen strong interest and strong — strong interest in our orders and everything else. So that’s what really fuels the view that we have of — as we go through the season. So we see the orders picking up. We see the pipelines building. We see the activity. We just had our show in Louisville with our retailers, activity was very, very good. Orders were very good, activity was very good. So I think just everyone getting ready to order for the spring and so we will see that normal seasonal pick up.

Matthew Bouley — Barclays — Analyst

Okay, that’s perfect. Thanks for the color on that. And then secondly just on the gross margin side. Two part, number one, just was there any offset in there from Leesville, I know you guys had signaled there could be some temporary pressure as that ramps up?

And then secondly just given you have seen that modest uptick in lumber prices, how are you guys thinking about the ability to kind of push price a little bit going forward to offset that? Thank you.

Laurie Hough — Executive Vice President and Chief Financial Officer

Hi, Matt. Yes, I think there definitely was a bit of offset from Leesville in the numbers and will probably continue for the next couple of quarters as we continue to ramp the plant. We have about 12 more months of ramp of that plant. So the next couple of quarters for sure we will see some pressure from that.

As far as ASPs in lumber, we did see lumber kind of even out this quarter versus the same time last year. We expect lumber pricing to go up a bit just based on general housing trends and what we’re seeing in the market. So I do believe that we will be able to match that in price.

Matthew Bouley — Barclays — Analyst

Okay, perfect. I’ll leave it there. And thanks again.

Mark Yost — President and Chief Executive Officer

Thank you Matt.

Operator

[Operator Instructions] Our next question is from Mike Dahl with RBC Capital Markets. Please proceed.

Mike Dahl — RBC Capital Markets — Analyst

Good morning, thanks for taking my questions. First question, I wanted to start with the margins and Laurie you mentioned a number of things going into the success in terms of margins for the quarter and then your expectations going forward, but I wanted to ask you for a few more details there, and so a couple things that I’m curious about. On the synergy side, have you identified incremental opportunities for synergies and can you give us an update on where you’re running versus the target?

And then secondly, I think one of the bigger buckets was on this skew rationalization or standardization. So, maybe just a little more color on where you are in that process and how much incremental progress you expect over the next six months, 12 months?

Laurie Hough — Executive Vice President and Chief Financial Officer

Sure. So, I would say that the margin improvement is really coming from our operational initiatives that we have talked about more than deal synergies. Just as a reminder, we have reached the deal synergy run rate targets in the June quarter. So year-over-year the synergies are certainly helping us. But I would say sequential quarters we had some movement in the margin but definitely saw some improvement from operational synergies, the rationalization and standardization of the product offerings, simplifying the product to get the plant more quickly, helping production efficiencies.

We’re going to see kind of a steady increase in those over the next couple of quarters. I think the March quarter is going to be just generally overall more similar that to this quarter from a margin perspective. We’re going to see some pressure in Canada, we’re going to see, as I mentioned before lumber costs increasing, which will hopefully be able to offset with price. We have seen some labor inflation. So all of that inflation is getting offset with those price or operational improvements depending on the geographic locations of the plants.

Mike Dahl — RBC Capital Markets — Analyst

Okay, that’s helpful. Thank you. My second question, just shifting back to the genesis, as two questions on genesis. The first one in terms of — the question was asked on kind of type of builder that you’ve been hearing from or working with. Aside from size of builder, I was curious if there’s been any notable trend in terms of whether the builders are actually planning to put these on land as for sale homes or if these are going to build to rent community, so any dynamics there?

And then, second part, just a little more color on the ADUs and whether post the California laws and other things you’ve already seen, have taken place since there?

Mark Yost — President and Chief Executive Officer

Yeah, thanks Mike. I think as we look at genesis, we’re actually seeing activity from builder developers and land developers both frankly in the for rent market and for the for sale market. So, in the pipeline and in the sales funnel, if you will, we have seen both customer types show interest. So, it’s really dependent on that site and what that customer’s interested is. I would say just as a rule of thumb it’s probably 80/20, 80 for sale and 20 for rent, but that really changes based on geography.

As far as the ADU market, obviously, we’ve seen a tremendous amount of activity in California and we expect that to continue. Recently after the California laws were passed, we saw a — like for instance the City of Los Angeles saw a 28 times increase in the number of ADU permits that were issued. So they saw strong growth in ADU permits. Oregon now has passed the state wide legislation on ADUs along with Washington. We have seen recent developments in the cities of Austin, Minneapolis, Philadelphia and Atlanta passing zoning changes for that. And then right now we have seen Virginia, Maryland, Massachusetts, and Colorado all have proposed legislation under review to change zoning which could impact the ADU market as well.

So I think there is a good amount of activity, it’s just getting that through the pipeline, getting into the field and getting builders and others comfortable with it. But I think if you really look at the studies in California, the growth increase of the number of permits in mainly those urban pockets has been I think right now in Los Angeles 18 — about 18% of the permits — 18% to 20% of all the permits in the City of Los Angeles are all ADU permits. So it’s now major portion of all housing permits within the city.

[These data claims are a significant signal on the potential for growth for HUD Code manufactured homes if “enhanced preemption” were fully enforced nationally. If there was a 28 fold increase in CA since the ADU law was passed, what could occur if HUD Code manufactured homes were made available nationally in localized market through HUD’s strict enforcement of the “enhanced preemption” provision of the Manufactured Housing Improvement Act of 2000? If their ADU data is an indicator, then our estimates of potential may be understated. Rephrased, the opportunities are then far greater than MHProNews has previously stressed.]

Coming Epic Affordable Housing Finance Clash? Chair Maxine Waters vs. Warren Buffett – Clayton Homes – Historic Challenges Ahead

Mark Weiss, J.D., President and CEO of the Manufactured Housing Association for Regulatory Reform (MHARR). Near the epicenter of what could become a cosmic clash in the year 2020 are events that have their origin approaching 2 decades ago.

Mike Dahl — RBC Capital Markets — Analyst

Okay, that’s great, very helpful. Thanks.

Operator

Our next question is from Phil Ng with Jefferies. Please proceed with your question.

Phil Ng — Jefferies — Analyst

Good morning everyone. Mark your commentary generally has been pretty upbeat for a few quarters on the outlook, appreciating there’s a lag. When you kind of expect to see a more noticeable inflection in demand in your US business. It sounds like there could still be some mild headwinds this spring. So just kind of deliver at mid single-digit growth outlook for 2020 [Indecipherable] pretty sharp acceleration when it’s summer and fall. Are we thinking about that right and are you set properly to kind of meet that demand from a capacity and labor standpoint?

Mark Yost — President and Chief Executive Officer

Yes, thanks Phil. I think that statement is correct. I think we are going to see good growth in parts of the US, just with the exception of maybe one or two regions of the US that will just lag either due to customer timing and/or just that states growth trajectory in this period of time. So I think we’re going to see activity pickup periodically throughout the year as we go during the summer and late fall periods. That’s correct.

Phil Ng — Jefferies — Analyst

Got it. But you’re still feeling pretty good about your ability to kind of hit that mid single-digit trajectory calendar 2020. Is that the right way to think about your US business?

Mark Yost — President and Chief Executive Officer

That’s correct.

Phil Ng — Jefferies — Analyst

Okay, got it. And I guess when we think about medium to longer term manufactured home market has lagged and there is a number of catalysts that could drive growth whether it’s genesis and just better financing, can you kind of remind us how you are set up from a capacity and labor standpoint?

And what type of investments you need to scale up over time and relative to how you are like positioned versus your competitors, if I remember correctly, you may have a little more mouthful [Phonetic] of capacity. So it could be kind of help for kind of frame that up for us?

Mark Yost — President and Chief Executive Officer

Yeah, thanks Phil. I think this past quarter we operated at 67% capacity utilization. So, we definitely have some upward potential to increase our utilization and throughput. We’ve recently expanded some of our production lines, obviously at Leesville. We’ve expanded a park model ADU line in California. We have got one in our Pennsylvania operation that we have opened recently. So, I think we’re poised well to take advantage of that growth as it funnels through.

I think we have got 14 plants that are producing ADU models, right now, we’ve got 23 plants that are producing genesis series as well. So, it’s really building that funnel and pipeline. And then as that pipeline of business develops, we will look to open up additional capacity. And I think we’ve been investing in people. We’ve been investing in — like right now, we have got GM and training programs and other people as an example of that — so we have got a bunch of people who are currently actively traveling the country today, learning best practices, learning the operations, working side-by-side with their peers or their future peers I should say to have those people ready to go to fill vacancies in various management positions throughout the company as we need to expand.

Phil Ng — Jefferies — Analyst

Got it, that’s helpful. Just last one from me. From a cash flow standpoint, I mean cash flow obviously is building nicely. That’s encouraging. Laurie, that’s a nice problem to have, that you guys have kind of hinted at maybe taking a more proactive approach on M&A going forward, but these things you can’t time. So kind of help us to understand how you are thinking about capital deployment, and if there is anything in the next 12 months to 18 months, would you consider returning more of that cash back to shareholders? Thanks.

Laurie Hough — Executive Vice President and Chief Financial Officer

It’s something that we would definitely consider, but really more focused on the growth of the company through M&A. That would definitely be our top priority .

[Here out of their own mouths is confirmation of an ongoing theme on MHProNews and MHLivingNews. Namely, that consolidation – mergers and acquisitions or M&A – are a “top priority.” What is unstated is how this plays out at the state and national association levels. But it Skyline Champion, Cavco or Berkshire Hathaway brand Clayton Homes, the game-plan has been to foster consolidation. This isn’t stated in their calls, why? Because it would arguably spark regulatory concerns over market manipulation and thus various aspects of antitrust laws. Keep in mind that the big three already have some 80 percent market share. How much more can they squeeze through consolidation? It is not only arguably wrong to manipulate the market but is illogical to focus effort there. The effort should be industry growth by promoting the full and proper implementation of existing laws that are beneficial to manufactured housing.]

Phil Ng — Jefferies — Analyst

Got it. And can you help size how we should think about some of these potential opportunities in terms of magnitude? I assume it’s probably not as big a Skyline, but any color on that would be really helpful?

Mark Yost — President and Chief Executive Officer

Specifically on the M&A front Phil you are talking about?

Phil Ng — Jefferies — Analyst

Yeah, I mean in terms of targets you guys are potentially looking at, just help us size how big any of these deals could be? Are they more bolt-on in nature or are they going to be a little more sizable in general?

Mark Yost — President and Chief Executive Officer

I think there’s a wide pipeline. We’ve got active M&A focus. So, we’ve got a pipeline of projects. Frankly the range begin from something that scales as far as like $25 million in revenue upwards to things that would be more meaningful and blockbuster type.

Phil Ng — Jefferies — Analyst

Okay. Thanks a lot. Really appreciate the color.

Mark Yost — President and Chief Executive Officer

Thank you.

Operator

We now have a follow up question Greg Palm with Craig-Hallum. Please proceed.

Greg Palm — Craig-Hallum — Analyst

Yeah, thanks. Just maybe a couple of minutes on financing trends. I guess first as it relates to the GSE programs, any update there on the chattel pilot? And I guess presumably on these subdivisions in genesis, they will be utilizing some of the new GSE programs there, the land-home. So can you talk about sort of what the potential is there on that front too?

Mark Yost — President and Chief Executive Officer

Yeah, sure Greg. I think as far the GSEs, the GSEs have really not moved yet on the duty-to-serve channel program in the secondary market. So we are still waiting on that. We are not — at least I’m not just because there is been no movement anticipating anything anytime soon. So I would say best guess would be midyear this year to maybe fall time period for the GSEs, which is why I’m encouraged by seeing some activity in the secondary market for private placement. And that’s really caused several lenders to start to move. Interest rates have dropped, they are buying deeper in the FICO scores, things like that, that haven’t traditionally been there and available. So that’s all encouraging and that will start to trickle out later this year as I said.

When there’s like a FICO score change or industry change it doesn’t happen immediately because then what the retailers do is they will reach out to all the customers that were turned down because of their FICO score that came in, in the past three months, they will return those phone calls and say you can get qualified now as an example, if they were turned down. Then that customer has to find land and then go through the buying and selling process. So even if a change like that is not going to be overnight, there is a little bit of lag there.

As far as the MH Advantage, perhaps more immediately actionable, that’s really dependent on the — either the retail partners. We are seeing, a lot of retailers start to take inventory of MH Advantage and MH Choice products and then put it into subdivisions as kind of a one-off infill within the subdivisions. So we’re seeing an increasing amount of retailers take that product and get that financing through and it’s also obviously for the builder developer and kind of genesis series but I will say Fannie and Freddie are 100% behind the MH Advantage, actually 100% is probably understatement, they’re very active and the training has proceeded very well. I would say there is still probably lag in the appraisers process or appraisal process, but besides that, very encouraging.

[That’s arguably a false statement; why? Because the GSEs argued for and got a reduction in their commitment on Duty to Serve for the ‘new class of homes’ since dubbed CrossModTM homes. While that decision came after the conference call, Yost surely knew that the GSEs had asked for that reduction, and that MHI essentially went along with it.]

Greg Palm — Craig-Hallum — Analyst

Yeah, OK. And my follow up relates to how you answered that first question because one of my main takeaways from Louisville was probably an elevated amount of excitement around financing, accessibilities, you had a couple of entities announce some new programs, which you alluded to around the FICO scores. So any qualitative commentary around how many folks out there turned down because of FICO scores and how some of these new products that were just recently announced could benefit it? And I’m not sure if you could characterize in a level of importance in terms of the financing environment what we’ve seen here in the last couple of months relative to the last four, five, six, seven years, just trying to figure out how from a magnitude standpoint, how important that could be?

Mark Yost — President and Chief Executive Officer

You know it’s hard to quantify Greg. I would say that overall you’re probably talking in the order of magnitude of a few percent of shipments, something in that nature of our industry shipments of the HUD shipments. It’s probably — if you’re talking just lowering from 600 to 575, which is I think what you alluded to at Louisville, you know that drop in FICO score will probably add a few percent to the overall industry in terms of shipments is what I would anticipate the lenders would say in terms of their magnitude or expected lending into that is what they mentioned.

[All of this begs the real question. It shouldn’t be about FICO scores and buying deeper. It ought to rather be about fostering an understanding in the market of demand. Hardiman said it well, MHI – and by extension, big boy members like Skyline-Champion – should ‘own’ their product and promote it accordingly. MHI’s own research proves the opposite has occurred. Acceptance declined, as MHLivingNews documented through evidence provided by Zillow.]

Greg Palm — Craig-Hallum — Analyst

Okay. Alright, thanks and good luck going forward.

Mark Yost — President and Chief Executive Officer

Thank you.

Operator

This concludes our question-and-answer session. I would like to turn the call back over to Mark for closing remarks.

Mark Yost — President and Chief Executive Officer

Thank you very much. As we mentioned, it was a very good quarter. We see the strength of the industry, strengthening builder developer activity getting better and improving as we launched our genesis brand and look forward to the future. Thank you very much and have a great day.

Operator

[Operator Closing Remarks]

Duration: 53 minutes

Call participants:

Sarah Janowicz — Director of Investor Relations

Mark Yost — President and Chief Executive Officer

Laurie Hough — Executive Vice President and Chief Financial Officer

Daniel Moore — CJS Securities — Analyst

Rohit Seth — SunTrust — Analyst

Greg Palm — Craig-Hallum — Analyst

Matthew Bouley — Barclays — Analyst

Mike Dahl — RBC Capital Markets — Analyst

Phil Ng — Jefferies — Analyst

This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company’s SEC filings.

Part 3. MHProNews Analysis and Commentary

Informed sources tell MHProNews that when Mark Yost made his statements before Congress, it was a ‘team effort’ of Manufactured Housing Institute (MHI) members, not just his own thoughts. That’s not necessarily good or bad in and of itself. However, if the statements themselves are problematic, then that could be a different story for not only Yost, but also his company.

Statements made to public officials that are known to be false or misleading, per legal sources, can be illegal. That includes statements made to Congress during public hearings. Furthermore, a similar principle holds, per legal sources, in official statements made by officials of publicly traded firms.

It will be interesting, for instance, to see how Skyline Champion handles their next investor relations package. Will the correct the error in the last one, regarding the market share data that they previously published?

Or will they continue to give cover to Clayton Homes? And if so, why?

The industry is underperforming for reasons largely within the ability of the Manufactured Housing Institute (MHI) and ‘big boy’ member firms like Skyline Champion to influence. When they fail to do so, are they arguably short changing their investors?

There will be a planned follow up on this that will synthesis several key points. That drill down may prove potent.

Stay tuned, and dig into the related reports in the meantime.

Related Reports:

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

-

-

-

Winter 2020…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has now celebrated our tenth anniversary.

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach, co-managing member of LifeStyle Factory Homes, LLC and co-founder for MHProNews.com, and MHLivingNews.com.

Connect with us on LinkedIn here and here.